What are the different types of accounting in Odoo?

There are mainly two different types of accounting in Odoo, Anglo-Saxon Accounting and Continental Accounting. Both of these types play different roles in businesses that are maintained with Odoo. These two different types of accounting were used by different countries according to different needs and factors of a business. In this blog, we can go through Anglo-Saxon accounting and how to manage a business using Anglo-Saxon accounting.

Anglo-Saxon Accounting

Some countries need to make use of the Expense accounts instantly after the purchase of a product is just completed, and some countries may use the Expense accounts of the company only after the sale of the products is also completed. In the case where the Expense accounts are only affected after the sales procedures of a product also are completed may use the Anglo-Saxon Accountings for their businesses. Mainly those companies that follow international financial reporting standards may use Anglo-Saxon Accounting in their business.

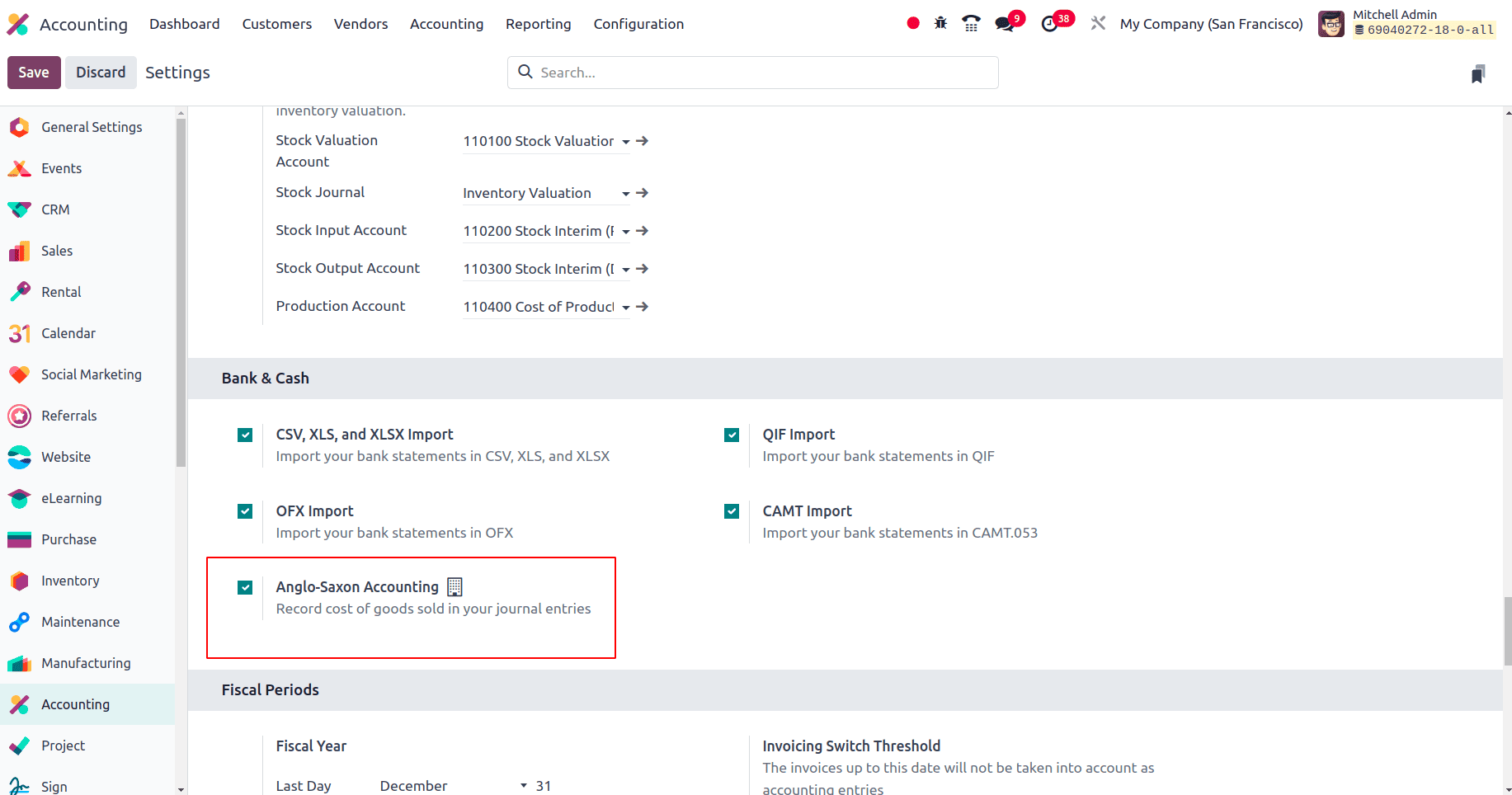

To set up the Anglo-Saxon Accounting to your business practices, you can move to the Odoo 18 Accounting application. Inside the Configuration > Settings, on activating the developer mode you can see a Bank & Cash section. The field, of Anglo-Saxon accounting, is inside the section Bank & Cash.

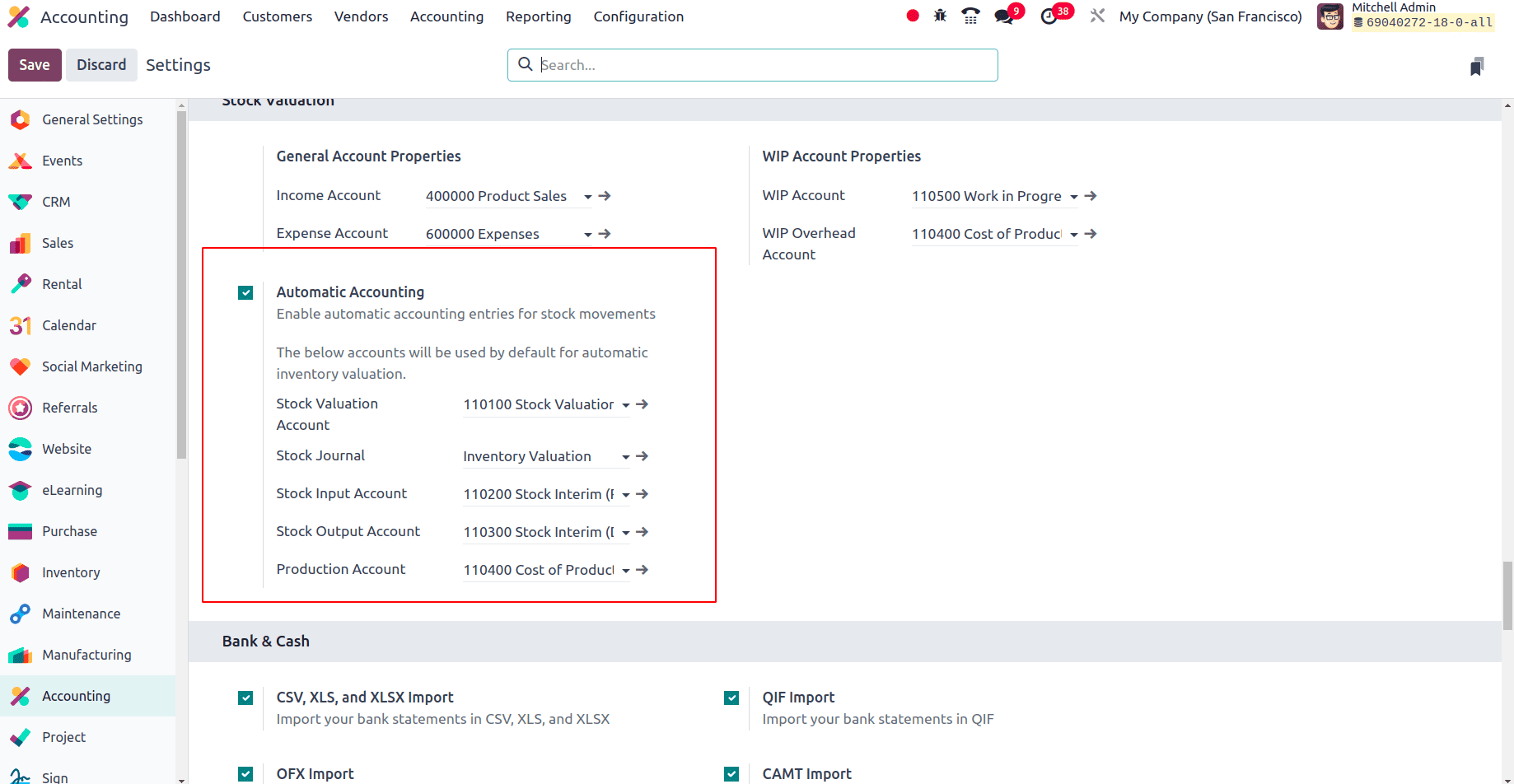

Then the next step is to set the inventory valuation of a product category as automatic. So to set up the inventory valuation as automatic we need to enable the Field ‘Automatic Accounting’ from the Configuration > Settings of the Accounting Application.

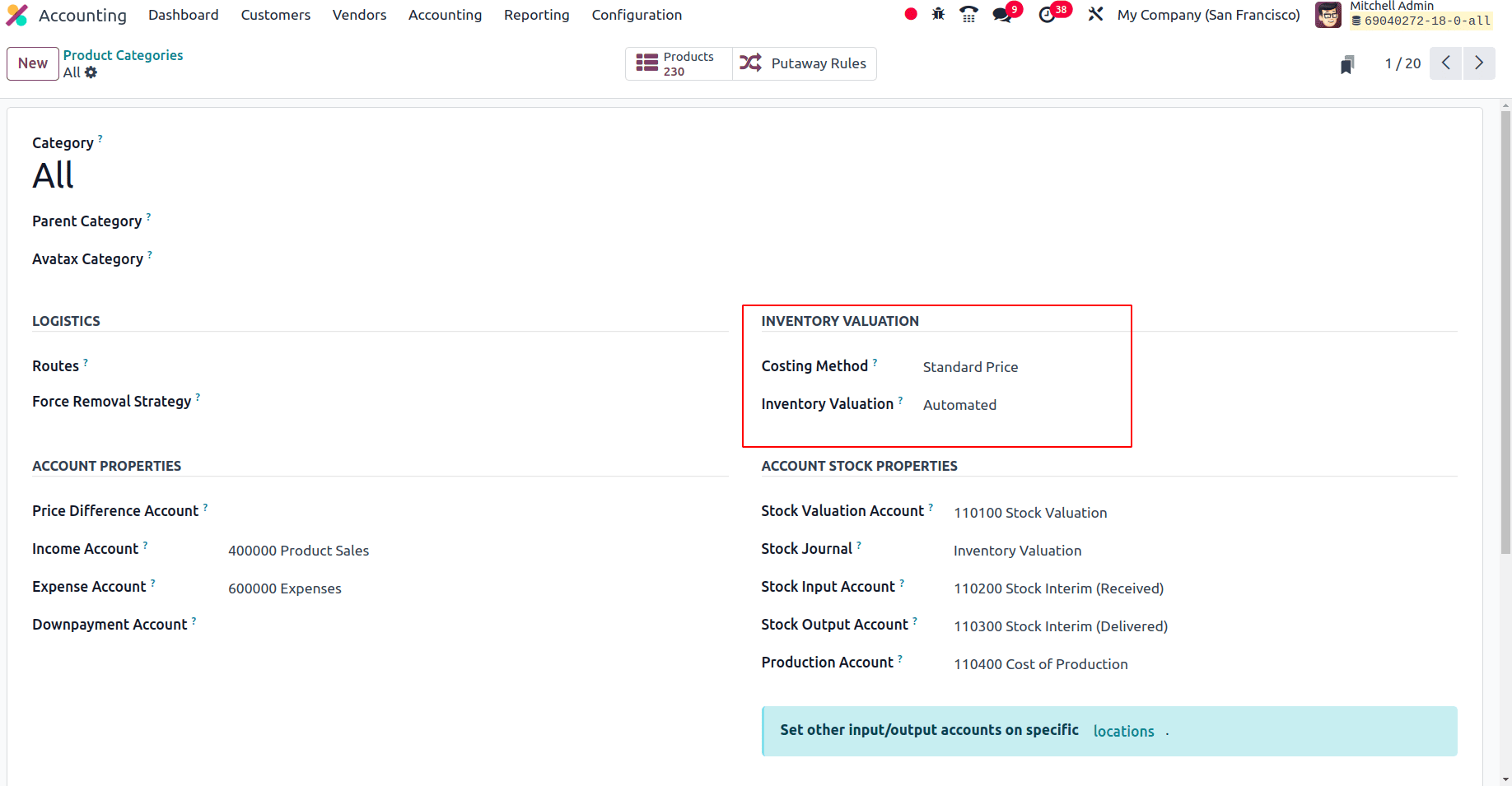

On enabling Automatic Accounting, when we move to the Product category, and on selecting the specific product category that we need we can set up the inventory valuation of that product category as Automated.

Here we can set the Inventory Valuation as Automatic for the product category ‘All’. Then the Account Stock Properties of the products from this category also will be updated here.

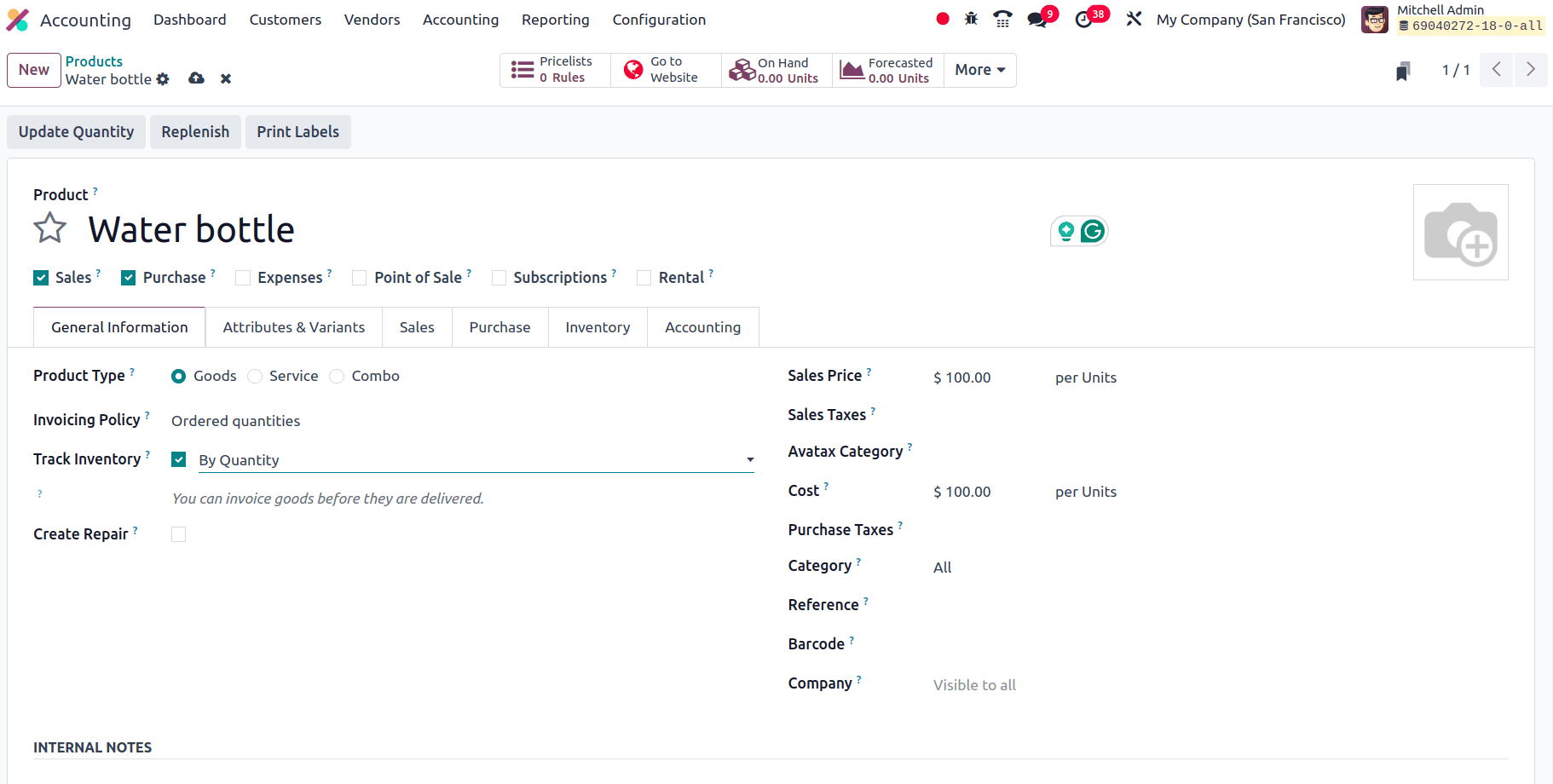

Next, we can create a new product from this category and perform different operations on this product so that we can find the action of Anglo-Saxon Accounting.

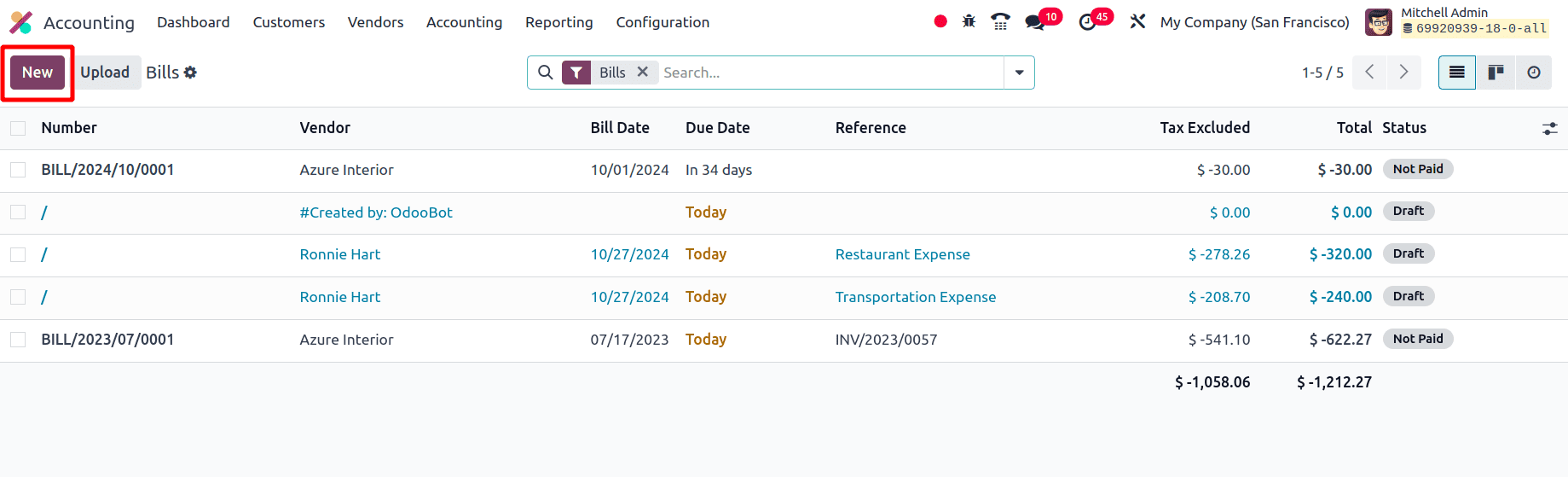

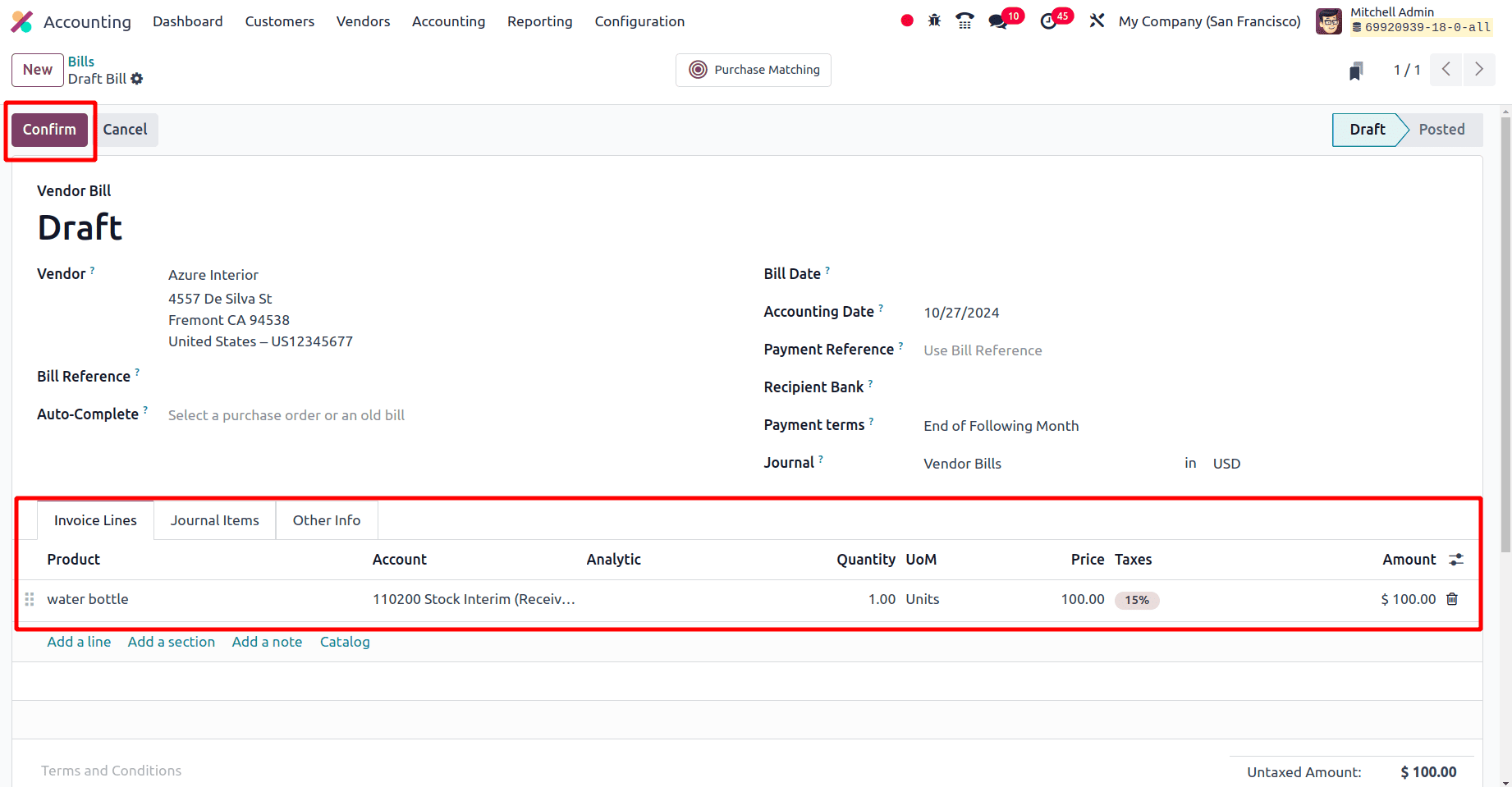

Here we have created a new product with the product type ‘Goods’ which opts for tracking inventory by quantity, under the Product Category ‘All’ and then we can create a purchase order for this product ‘Water bottle’. So to create the purchase order, move to the purchase application and create a new RFQ for this product or we can just create a bill for this product from the accounting application. So under the Vendor menu in the accounting application, we can find the Bill sub-menu, and on clicking that Bills sub-menu all the vendor bills in different statuses will be visible there. To create a new vendor bill instantly, click the new button from there.

Then we can create a new vendor bill for the newly created product ‘Water bottle’ and then confirm the vendor bill by clicking the Confirm button.

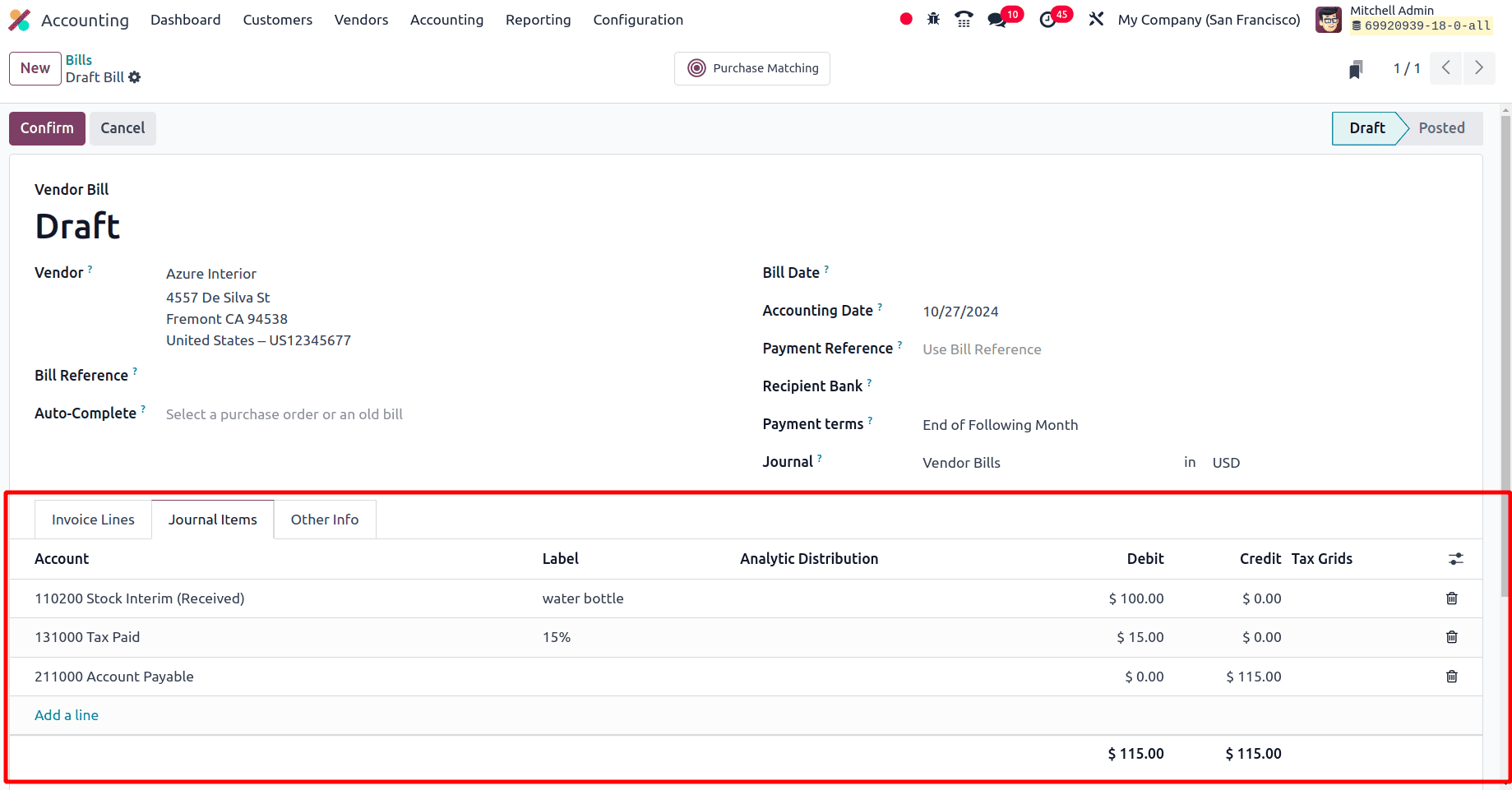

After the creation of the vendor bill, when we move to the Journal Items tab of the vendor bill, we can see the journal items created corresponding to the purchase of the product.

Here we can see that the accounts affected while purchasing the product water bottle are the 110200 Stock Interim (Received) and the 211000 Account Payable. Normally we know that the accounts affected by creating a purchase order are the ‘Account payable’ and the ‘Expense’ account. The ‘Expense’ account will be credited and the ‘Account Payable’ will be debited. We know that Account Payable is a Liability account and an increase in the liability leads to an increase in credit and moving to the second account ‘Expense Account’ and on increasing the expense, the debit will be also added.

Here in our case, while using the Anglo-Saxon accounting system one of the accounts affected will be the Stock Interim (Received). Here all the incoming stock moves will be posted in this account. This account Stock Interim (Received) is a stock input account that is considered as an asset account. When a product enters the stock, the asset gets increased. In odoo when the asset is increased the account will be debited. There is a 15% tax on the product Water bottle. This 15% tax gets debited to the Tax paid account which is an asset account. Taxes are considered as liabilities and hence the liability gets decreased, and the account will be debited.

| Account | Nature | Increasing/Decreasing | Credit/Debit |

| Account payable | Liability | Increasing | Credit |

| Stock interim (Received) | Asset | Increasing | Debit |

| Tax Paid | Asset | Increasing | Debit |

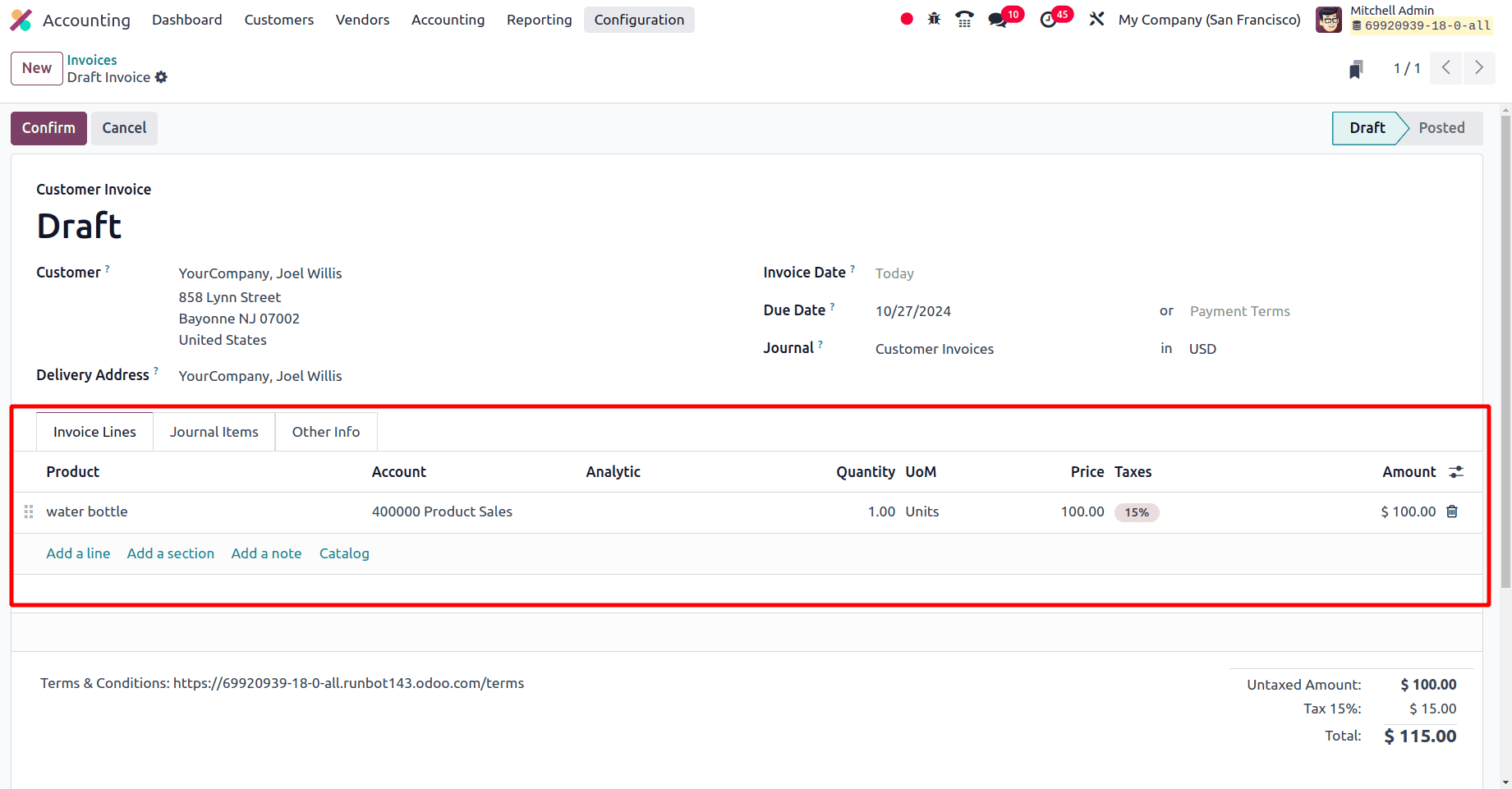

Next, we can sell the same product from our stock and only after the product has been sold from the stock the expense account will be affected. So to check that is the expense account is affected or not on selling this product, just create an invoice for this product ‘Water bottle’.

To create an invoice for this product, move to the Odoo 18 Accounting application, and under the customer's menu, we have an Invoice sub-menu. on clicking the invoice sub-menu we can see all the invoices in different statuses and to create a new invoice, click the New button.

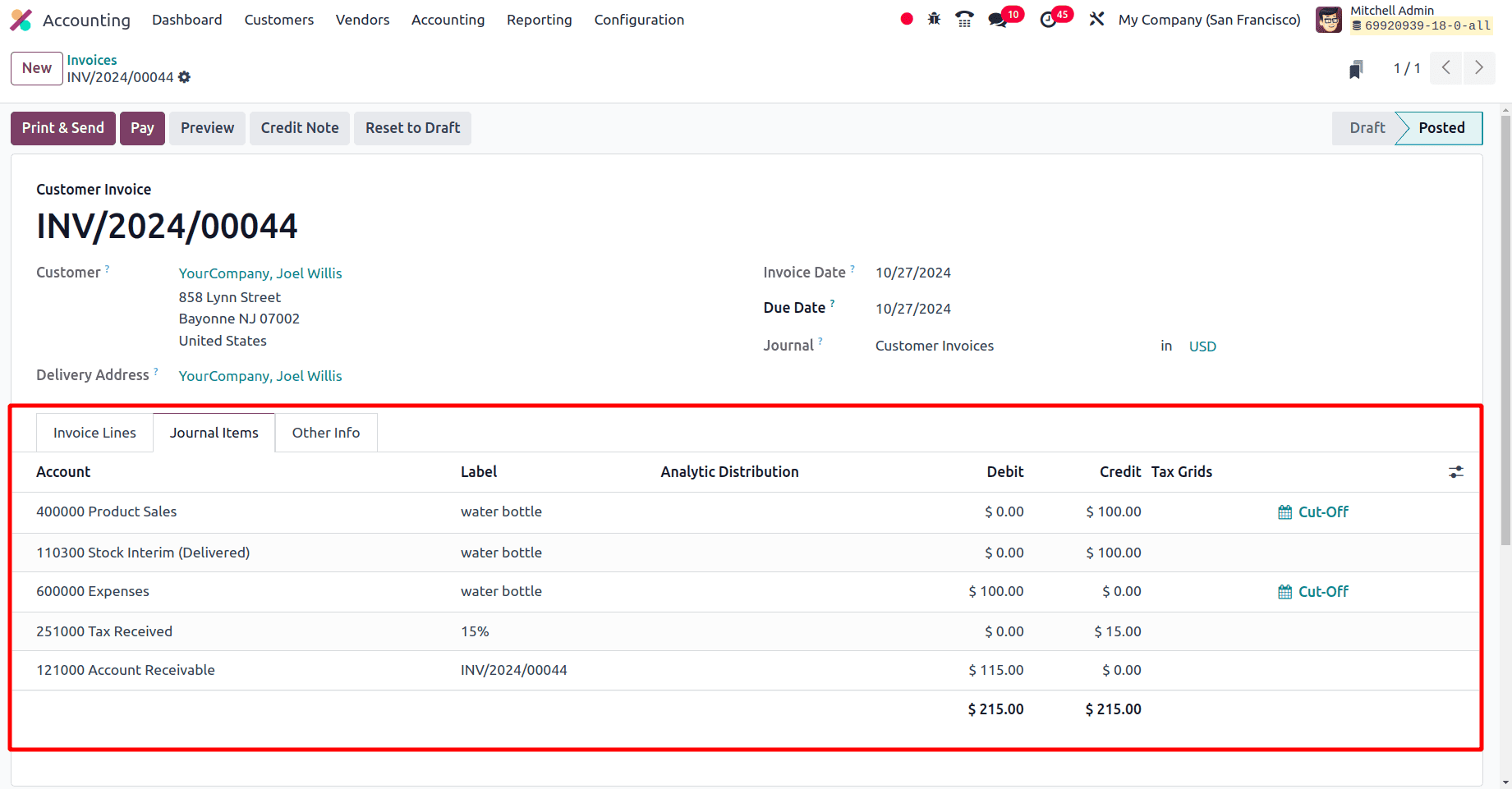

Then after the product has been added successfully click the confirm button to confirm the sale order. Then on moving to the journal items tab all of the accounts are affected by selling the product when the accounting system is set as Anglo-Saxon Accounting.

| Account | Nature | Increasing/Decreasing | Credit/Debit |

| Product Sales | Income | Increasing | Credit |

| Stock Interim(Delivered) | Expense | Decreasing | Credit |

| Expenses | Expense | Increasing | Debit |

| Account Receivable | Asset | Increasing | Debit |

| Tax Received | Liability | Increasing | Credit |

So at last the Expense account gets affected only after the sales of the product have been completed. All of these journal entries are also visible or reported properly in the Journal item sub-menu under the Accounting menu.

So in this blog, we have discussed the Anglo-Saxon accounting standards and the ledger postings that have been done while purchasing and selling items with Anglo-Saxon Accounting standards. Now we can say that Odoo 18 offers a complete and efficient solution for companies following Anglosaxon accounting rules.

To read more about How to Manage Ledger Posting in Odoo 17 Anglo-Saxon Accounting, refer to our blog How to Manage Ledger Posting in Odoo 17 Anglo-Saxon Accounting.