A company will deal with a lot of transactions every day. The amount collected from the client through the invoice is paid. However, at the time of the transaction, the accounting department of the company may not be able to enter all of the transaction details and amounts into the bank account. The account statements are usually examined and verified once a week. The process of reconciling the data from the bank account and the cash transaction is called reconciliation. The accounting wing can more easily keep an eye out for any entry issues thanks to this process. Reconciliation guarantees transaction transparency. This allows you to ensure that transactions are accurate.

Reconciliation is made easy using Odoo Accounting's unique capabilities. Therefore, once the process is complete and any changes are identified, the system starts the reconciliation process automatically. The Odoo 18 Accounting module facilitates the development of reconciliation models to speed up the procedure. This accounting program will allow us to link bank information and customer invoicing.

When is an account reconciled? We reconcile the accounts after each bank account has been properly created and imported. Reconciliation can be used to ensure that all of your journal entries are accurately reflected on the bank statement. To finish this operation more quickly, we use a reconciliation procedure. Since we have to deal with recurring reconciliation operations, we can create and use reconciliation models to speed up the process.

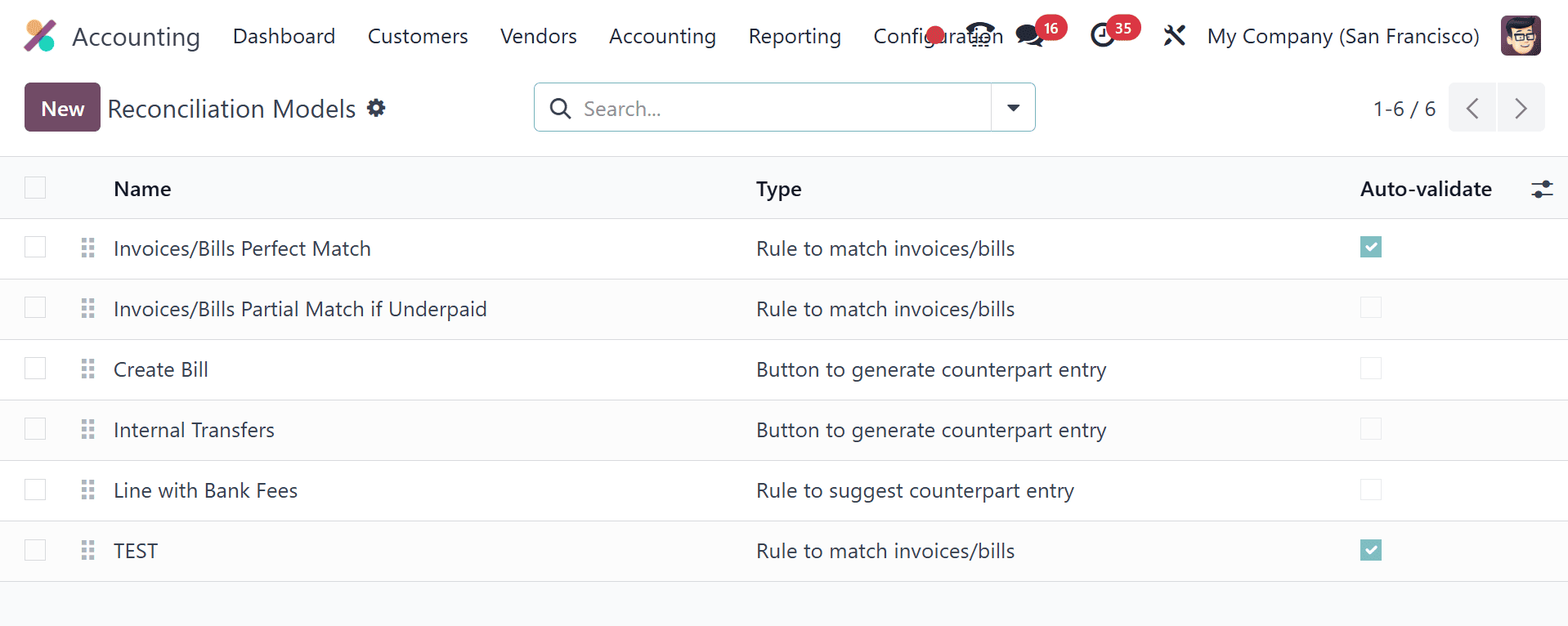

To create a reconciliation model, we can utilize the Configuration menu in Odoo 18 Accounting. You may find a reconciliation model here, in the Banks section.

Reconciliation Models

It is possible to access an existing reconciliation model here. To find out what's inside, let's open it.

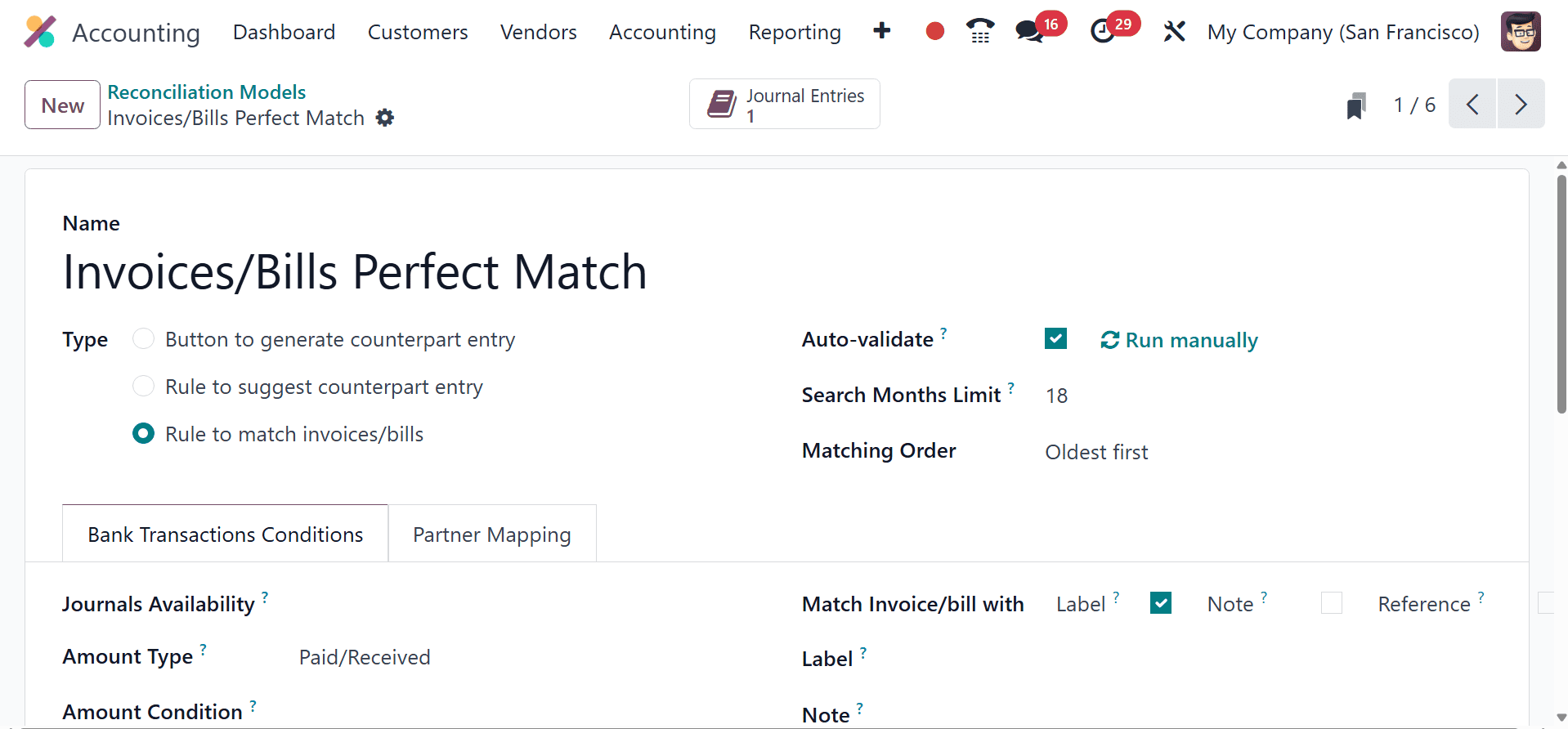

Using Odoo, the user can name the reconciliation model. We can also create a type of model for reconciliation. Using this form, we may create three different types of reconciliation models. They're

* Button to generate counterpart entry: The bank reconciliation view's resulting entry section now has a button. In accordance with the model's established principles, this button, if pressed, creates a counterpart entry to reconcile with the current transaction. The counterpart entry's account(s), amount(s), label(s), and analytical distribution are determined by the model's rules.

* Rule to suggest counterpart entry: utilized to match a recurring transaction to a new entry, depending on criteria that need to match the transaction's data.

* Rule to match invoices/bills: utilized for recurring transactions in order to match the transaction to pre-existing bills, invoices, or payments according to criteria that must coincide with the transaction's data.

To match invoices, we created a model with rules. Another option is the Auto-Validate feature. After this Auto Validation option is selected, the reconciliation will be done automatically. We currently have the criteria shown on the lines of the bank statement. In this instance, we have to decide on the journal, the amount, the type, etc. There are also the same options for currency and amount matching.

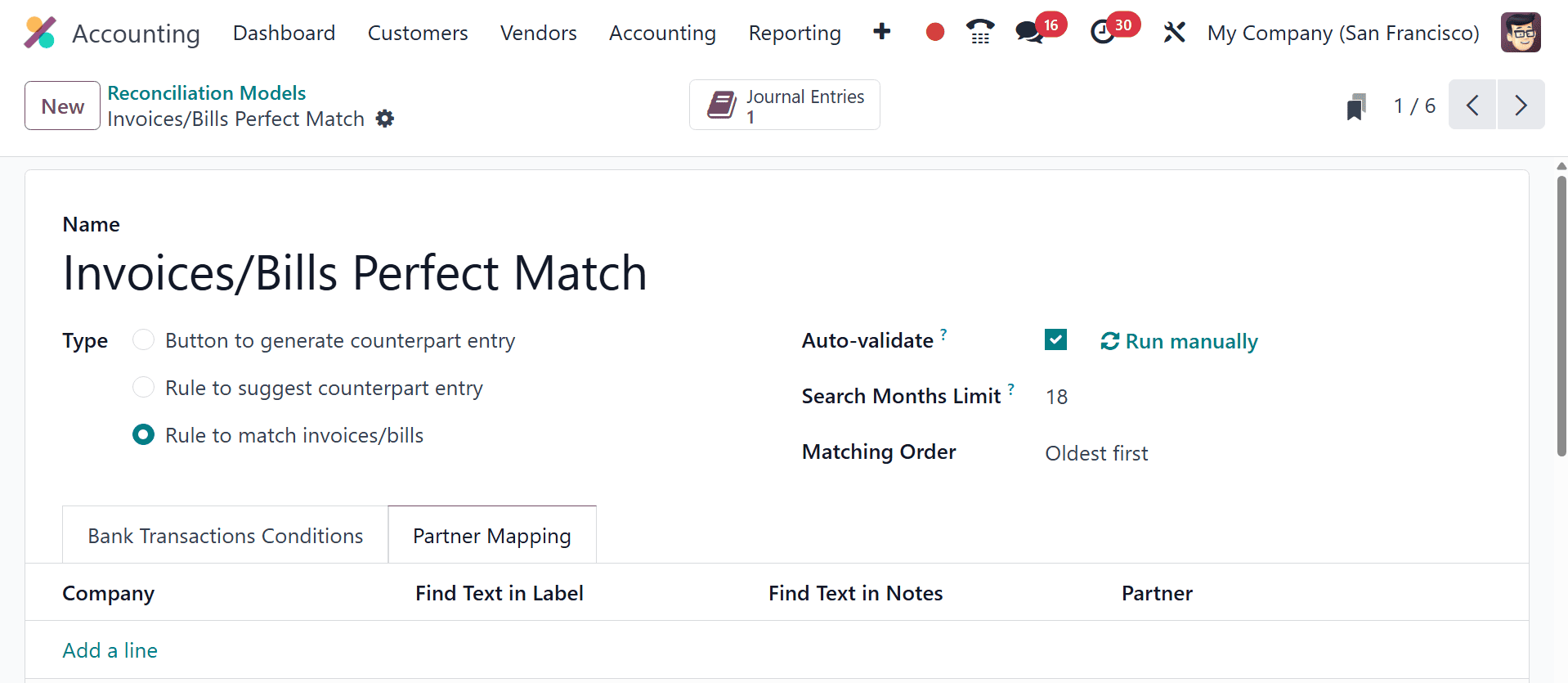

Another option we have is partner mapping. This reconciliation model can only be applied to one partner at a time. Partner restriction: With this function, you can select only particular partners, such as customers or vendors. Once we are satisfied with the configuration of the reconciliation models, we may start the reconciliation process.

Before that, let’s talk about the payment matching.

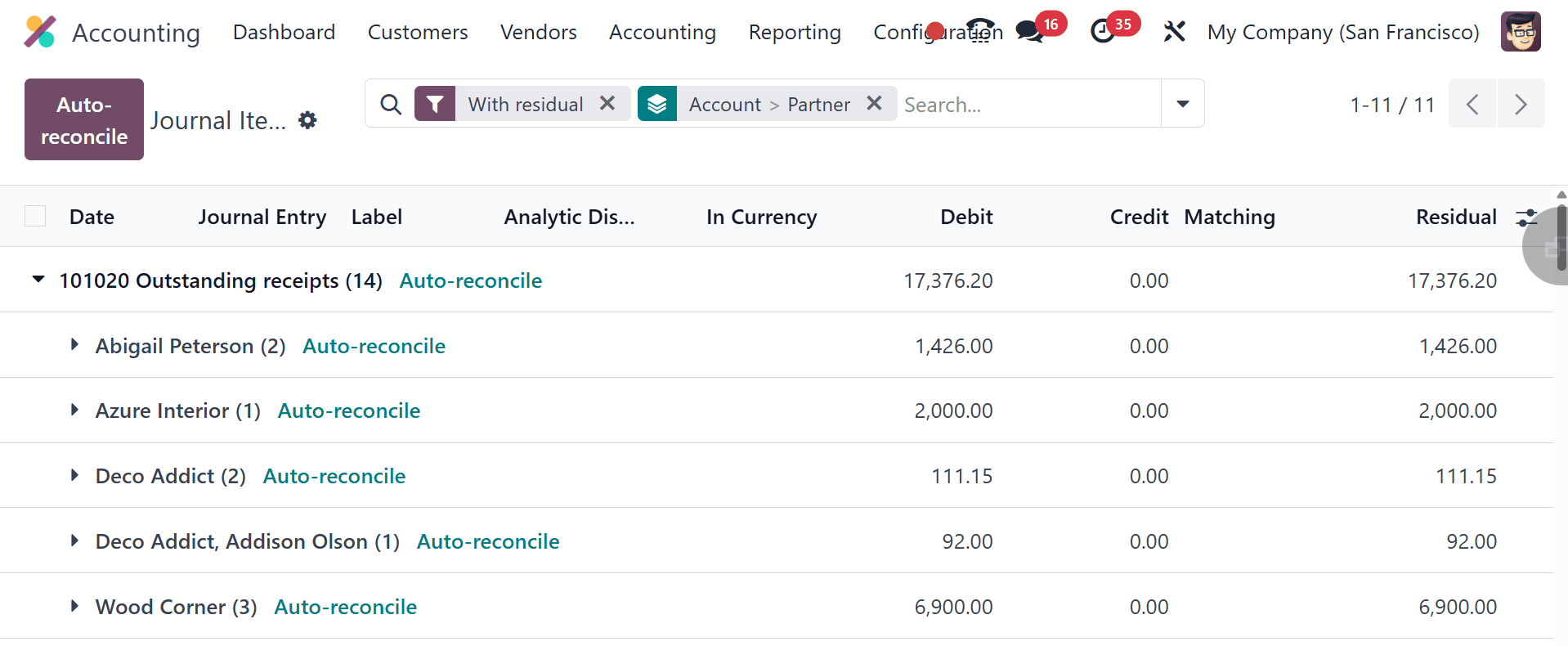

We have the ability to match the payments and invoices from the Accounting menu > Reconcile in order to do this. This form brings all the journals needed to reconcile with a filter ‘Account>Partner’. One can unfold the data and choose the required one, and click on reconcile. Or have the option to ‘auto-reconcile’ button at the top which will reconcile/match payments with respective journal entries: it can be invoices, bills or any other entries.

This procedure will enable us to reconcile the payment or invoice with the account.

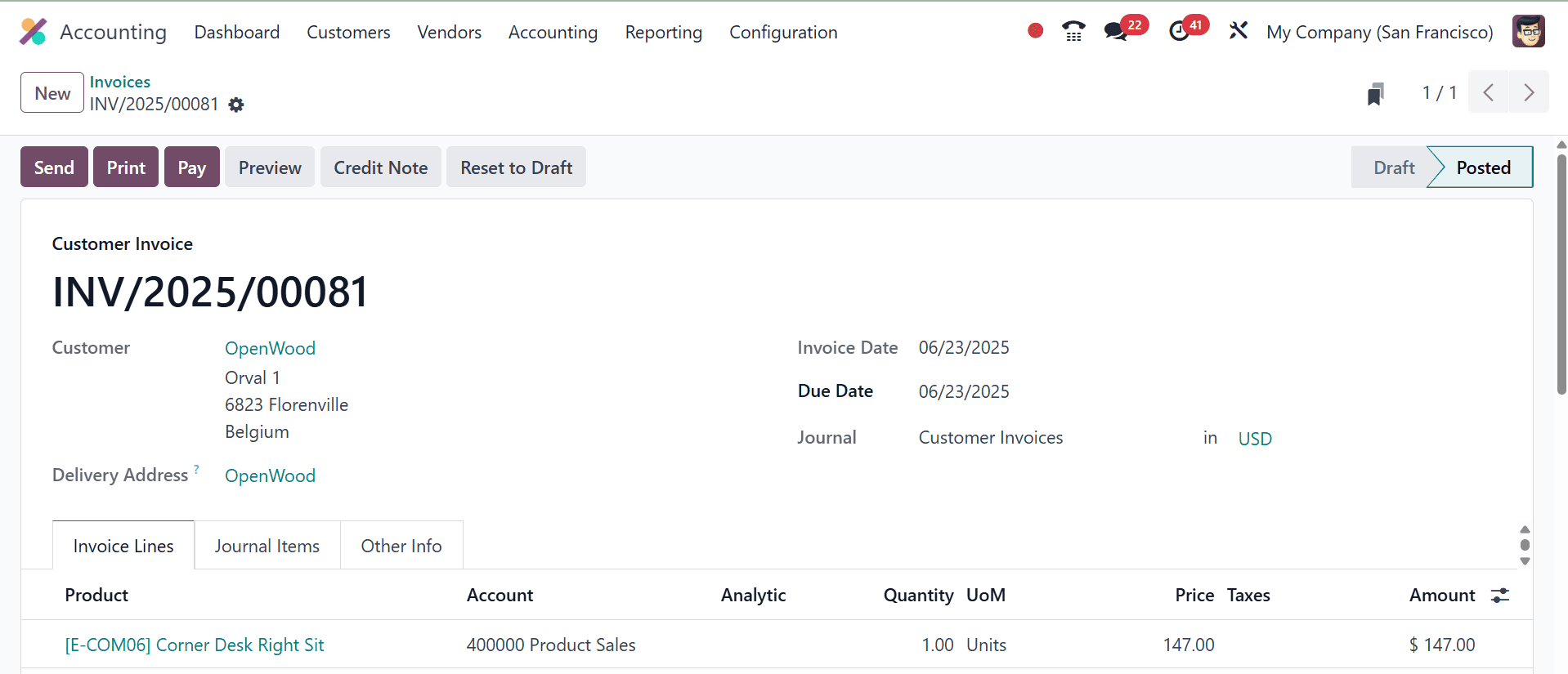

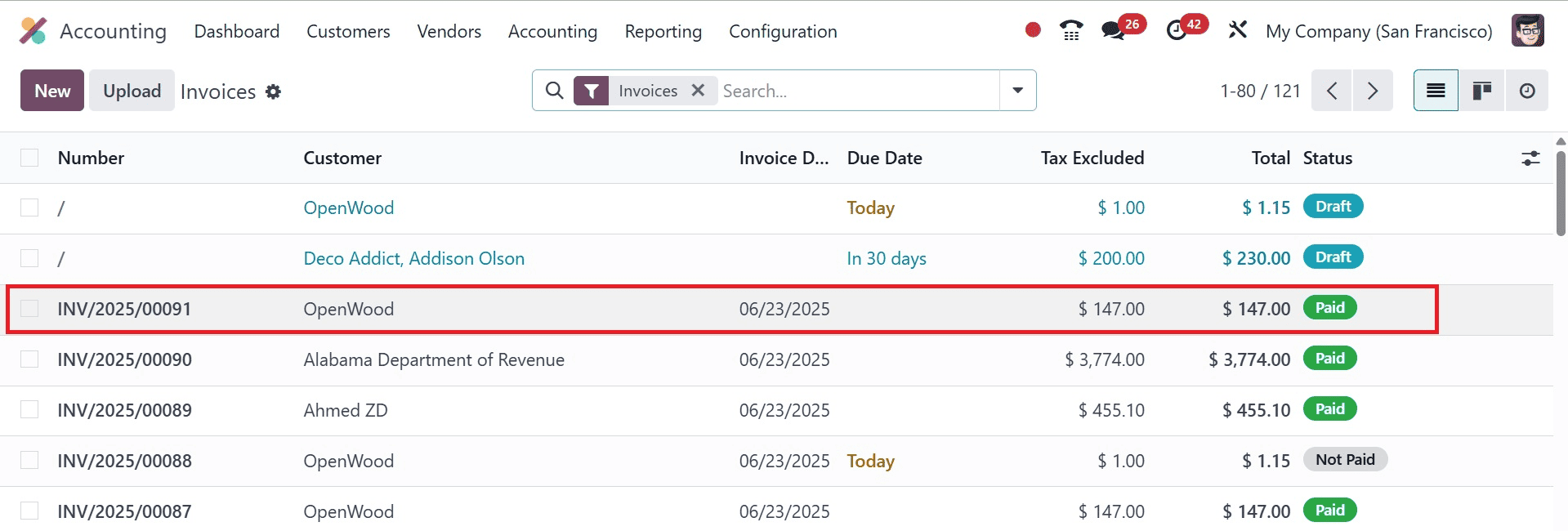

Now let’s talk about the Bank reconciliation. This will ensure that the data in the bank statement corresponds to the data in the journal, including the general ledger. We can complete the reconciliation process in two ways. We must first construct an invoice in order to reconcile it.

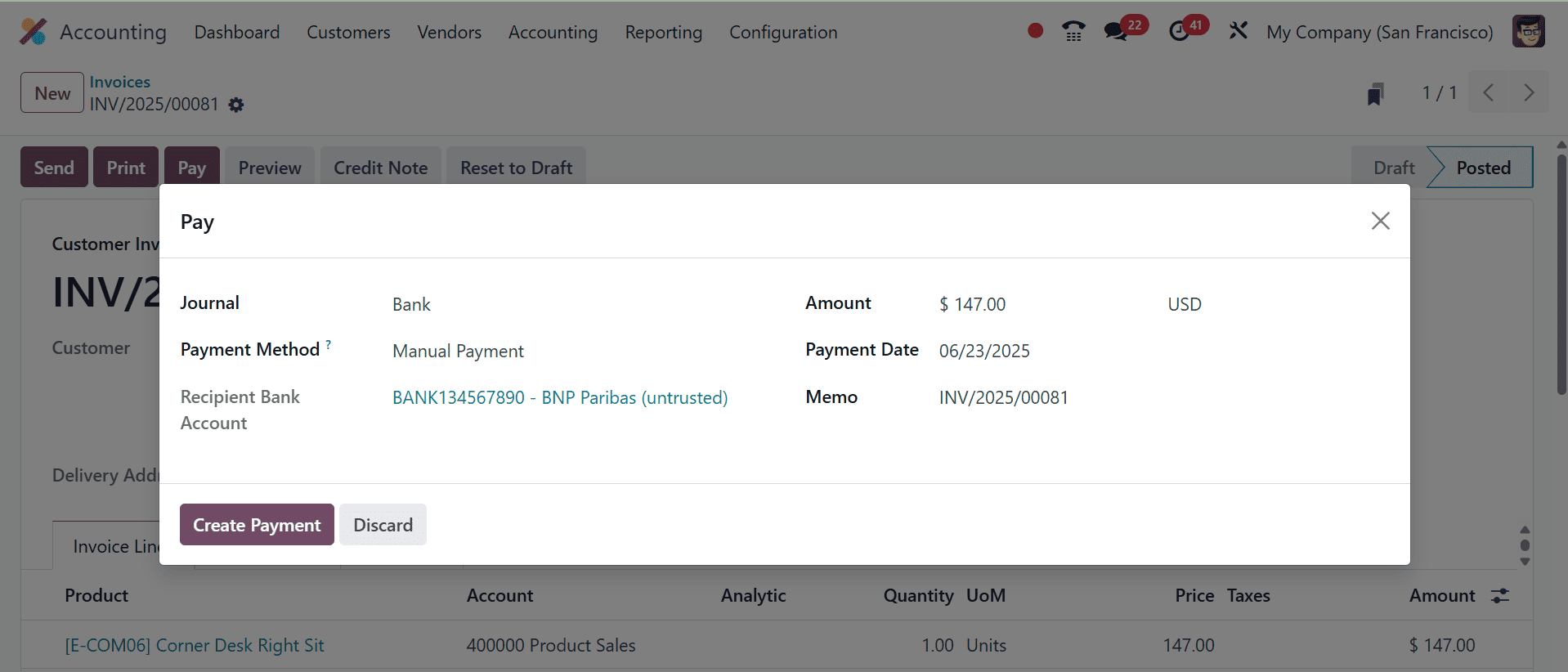

We see a new page, similar to the one below, after registering our payment.

You can provide the name of the journal. Select a payment option and add more. The date and amount of the payment can also be included here. Once the payment has been made, we will know that the process is complete.

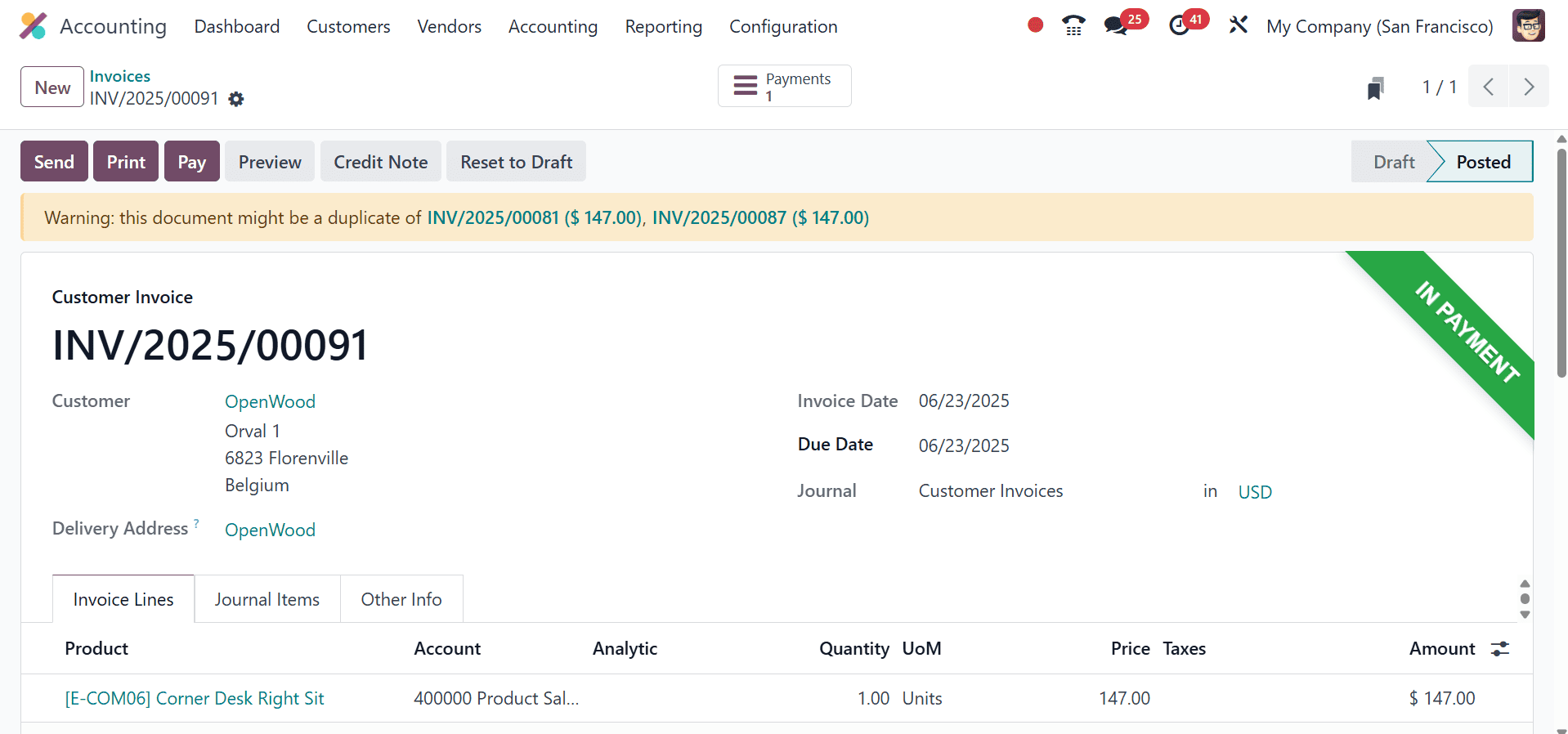

When the payment is created, this is the page that shows up. There is a ribbon on this invoice. The invoice page shows the amount due and the due date.

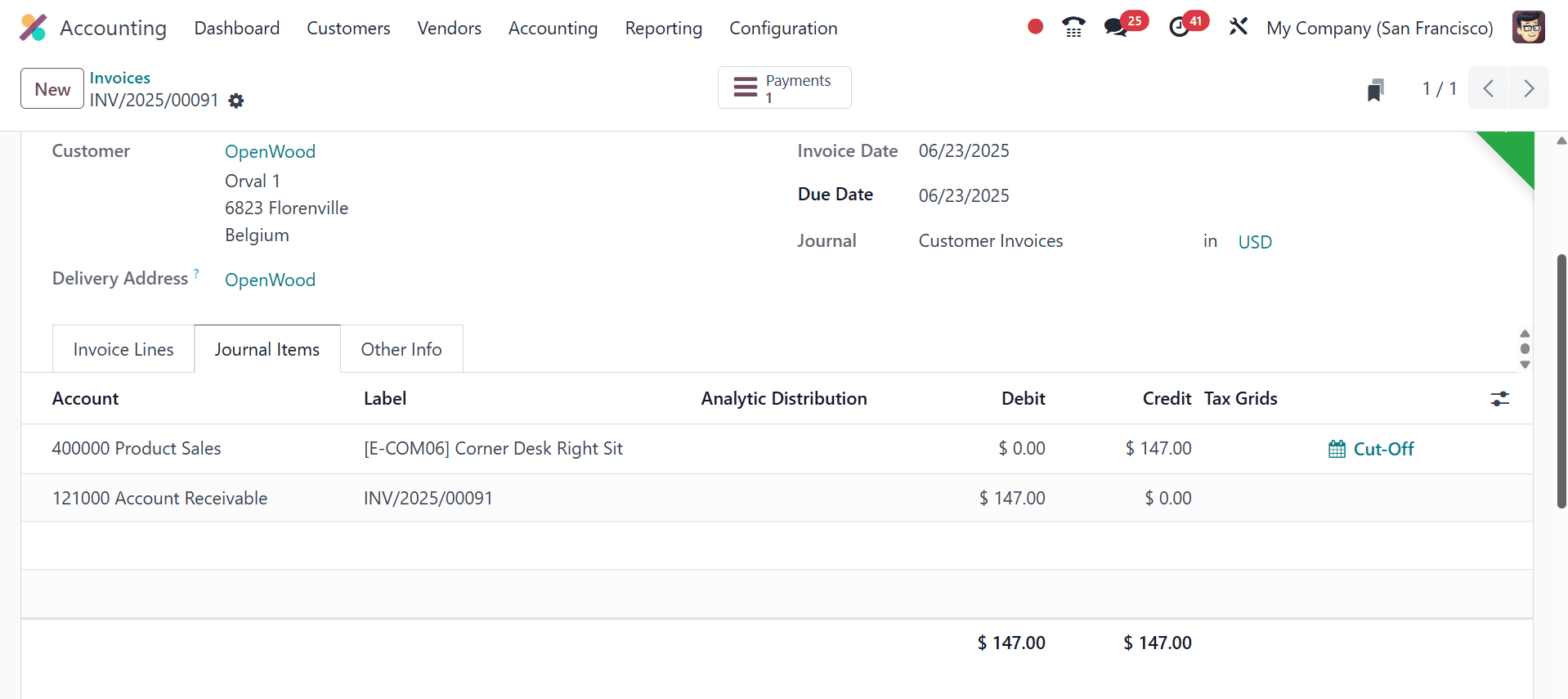

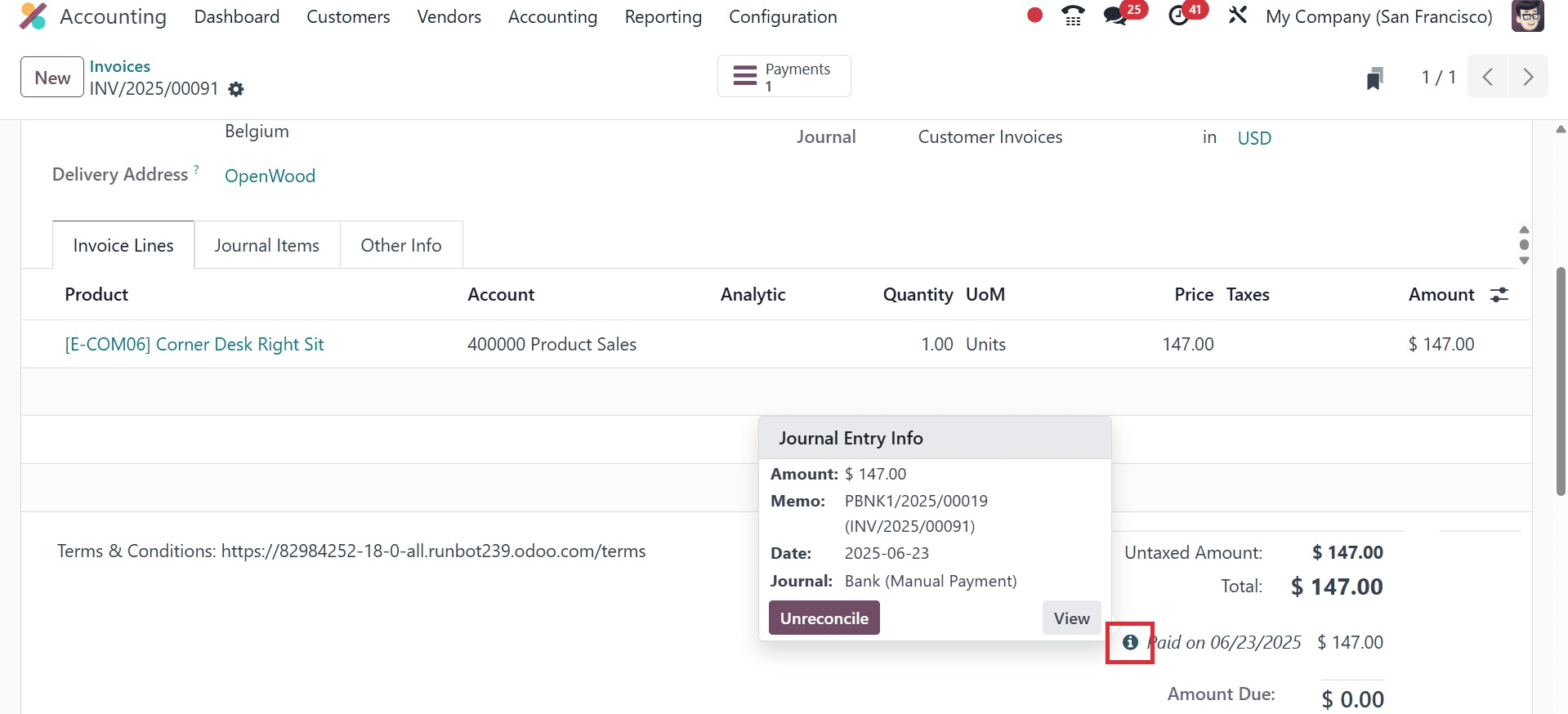

The journal items tab of the invoice defines the ledger posting to each account in debit and credit. At the bottom of the invoice untaxed amount, tax, and total including tax will be shown. Nearly an ‘i’ button provides the information regarding ‘Paid on’ the date, and the amount. This indicator helps us recognize that the invoice has been paid on that particular day and has been automatically matched (Payment matching).

To undo the payment matching, we can now click the UNRECONCILE button.

Reconciliation of bank statements.

This is the method of achieving bank reconciliation. A bank statement can also be utilized to confirm reconciliation, as we have already discussed invoice reconciliation. To do this, we must create a fresh bank statement. This can also be accomplished by importing bank statements. The payment status of an invoice in Odoo changes from "In Payment" to "Paid" when a bank statement is imported and reconciled with an invoice payment. This is accomplished by the bank reconciliation procedure, in which Odoo automatically updates the invoice's status in accordance with the bank transaction and the associated invoice payment.

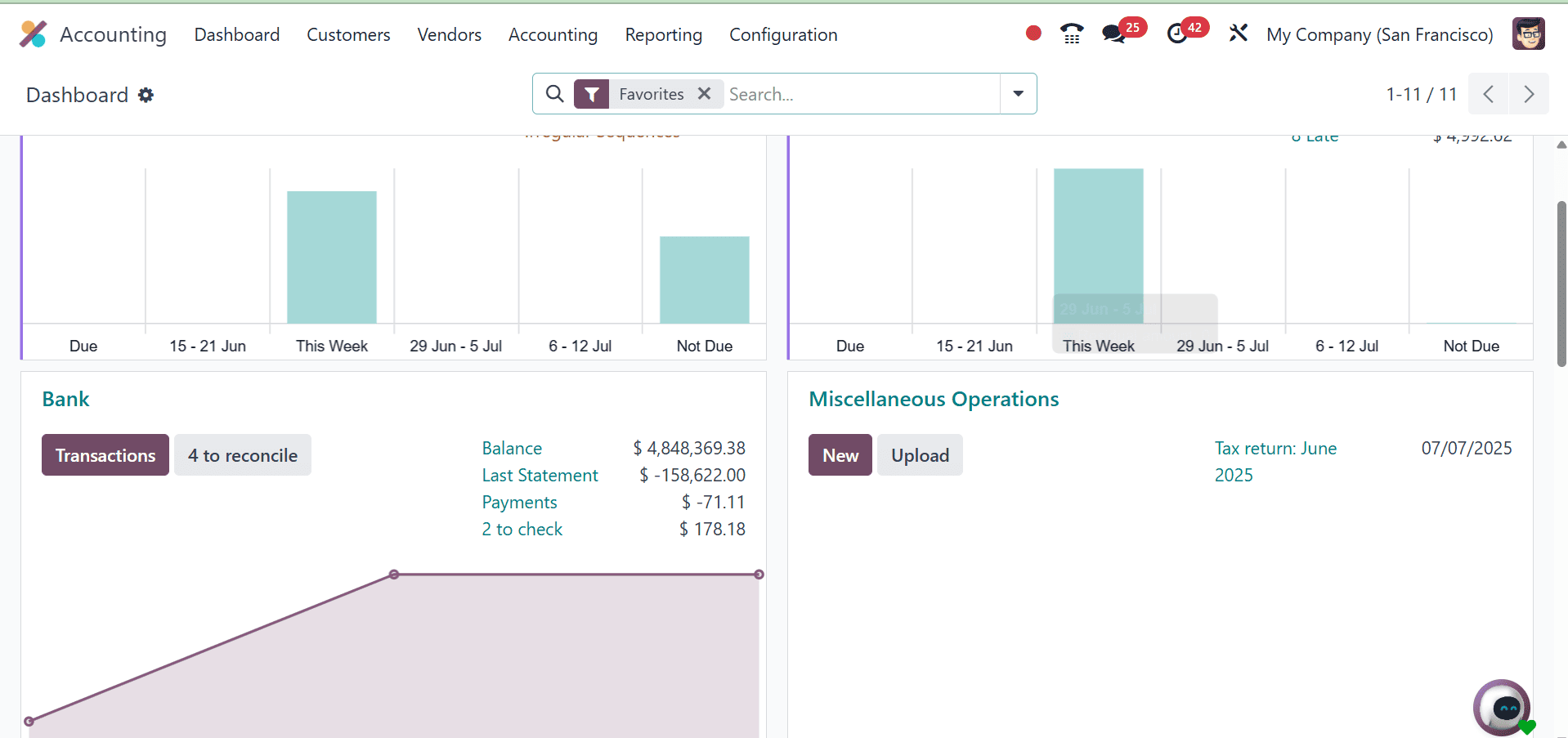

Go to the bank feed section of the Accounting dashboard to accomplish this. By selecting the Bank Reconciliation option, you can see the statements that are pending reconciliation.

Make a new statement or use the one that already exists. Here are all the assertions that need to be reconciled. We are able to confirm such statements.

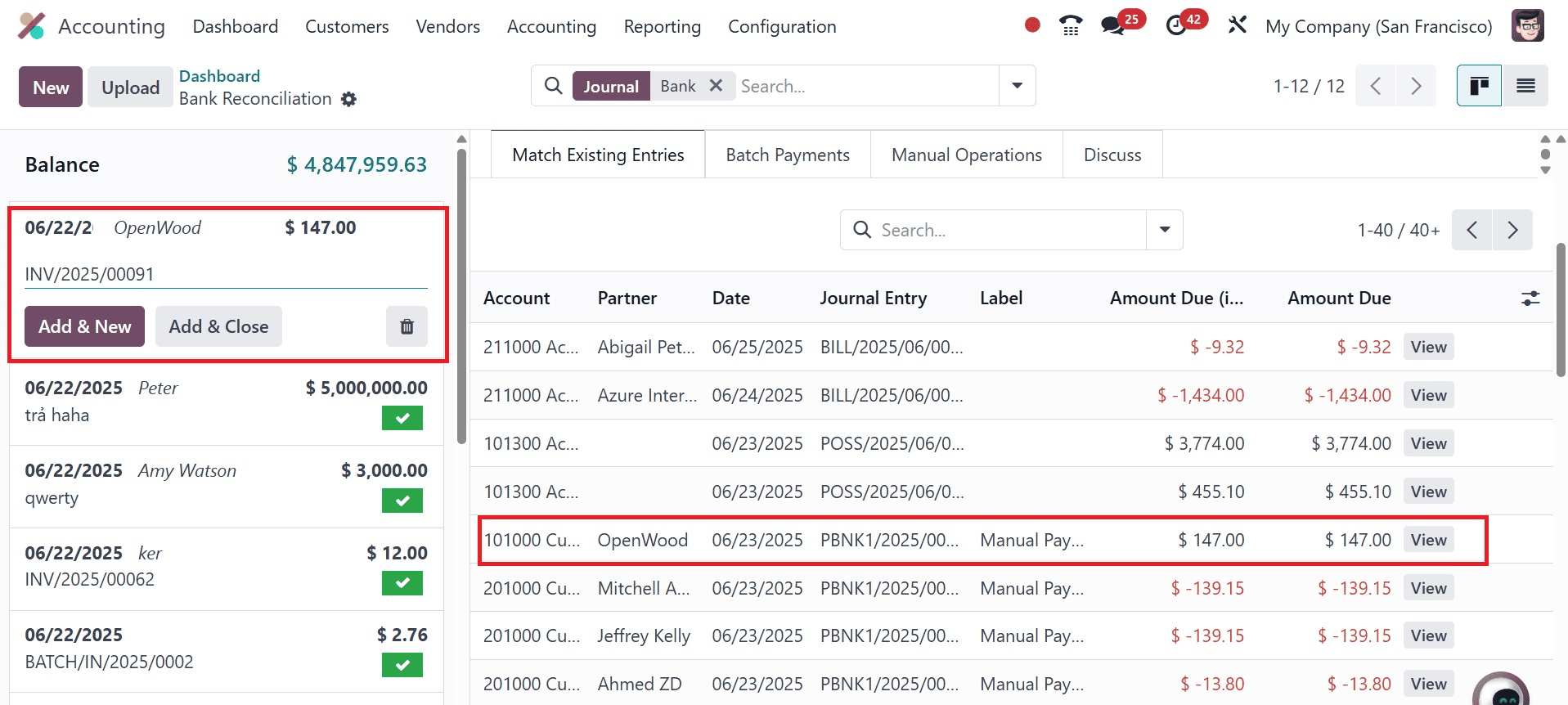

On selecting the statement, you can see the payment and statement here, as in the screenshot below.

Once you have closed the journal in the search bar, you can see that, the payment changes to paid state under the Invoice option, as in the image below.

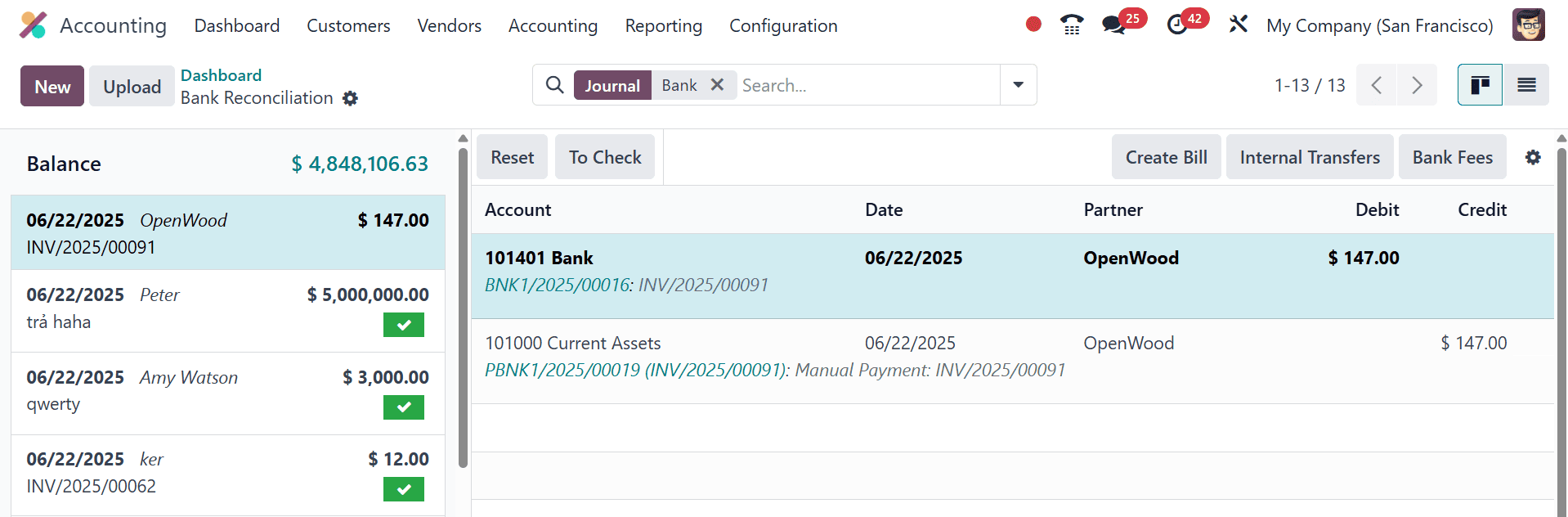

Following validation, we can observe that each transaction has been reconciled. We can then see that every transaction has been reconciled by clicking on this.

If we'd like, we can examine the bank statement by choosing GO TO BANK STATEMENTS. These are the methods for reconciliation that Odoo 18 Accounting employs. We can guarantee that our bank statements are clear and devoid of statistical irregularities by following this process.

To read more about How to Manage the Reconciliation Process in Odoo 17 Accounting, refer to our blog How to Manage the Reconciliation Process in Odoo 17 Accounting.