Odoo 18's Accounting module provides a strong set of reporting options, further solidifying its standing as a complete business management solution. For monitoring financial health, guaranteeing compliance, and assisting with well-informed decision-making, these accounting reports are crucial. Odoo 18 offers real-time, adaptable insights for companies of all sizes, ranging from simple balance sheets and profit & loss statements to sophisticated analytical reports and tax filings.

Better user interfaces, quicker report production, and deeper connectivity with other modules like sales, purchase, and inventory are all features of the most recent edition. Businesses can now more accurately dive down into transactional data thanks to these improvements, which also streamline financial procedures. The structure, salient characteristics, and potential applications of Odoo 18's core accounting reports for strategic financial planning and operational effectiveness are examined in this paper.

Accounting Reports

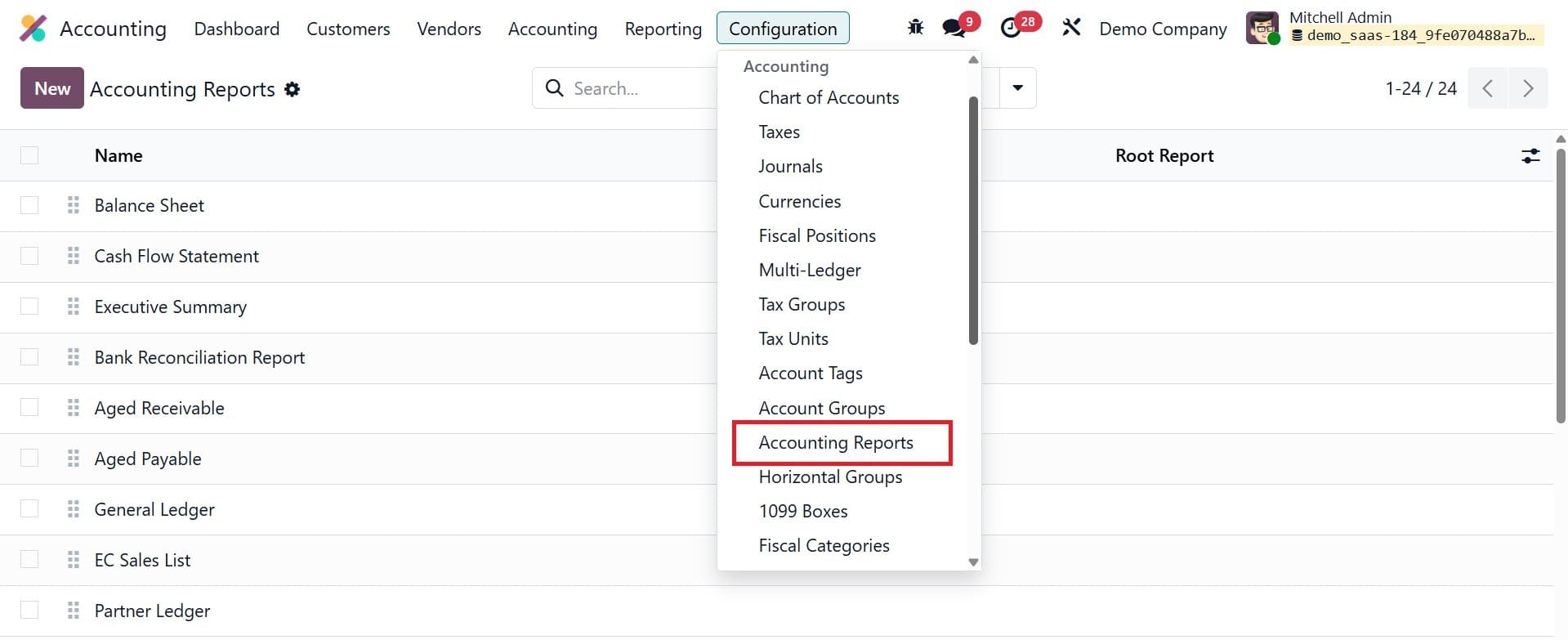

A new feature in Odoo 18 allows you to personalize your accounting reports, which will make them more informative and understandable. If you want to change your company's accounting reports to suit your needs, you can do so by selecting the Accounting Reports option from the Accounting module's Configuration menu. With this platform, you can generate reports that are customized to your requirements. You can even change the settings of reports that are already in place by selecting the relevant option from the list that is supplied, as illustrated below.

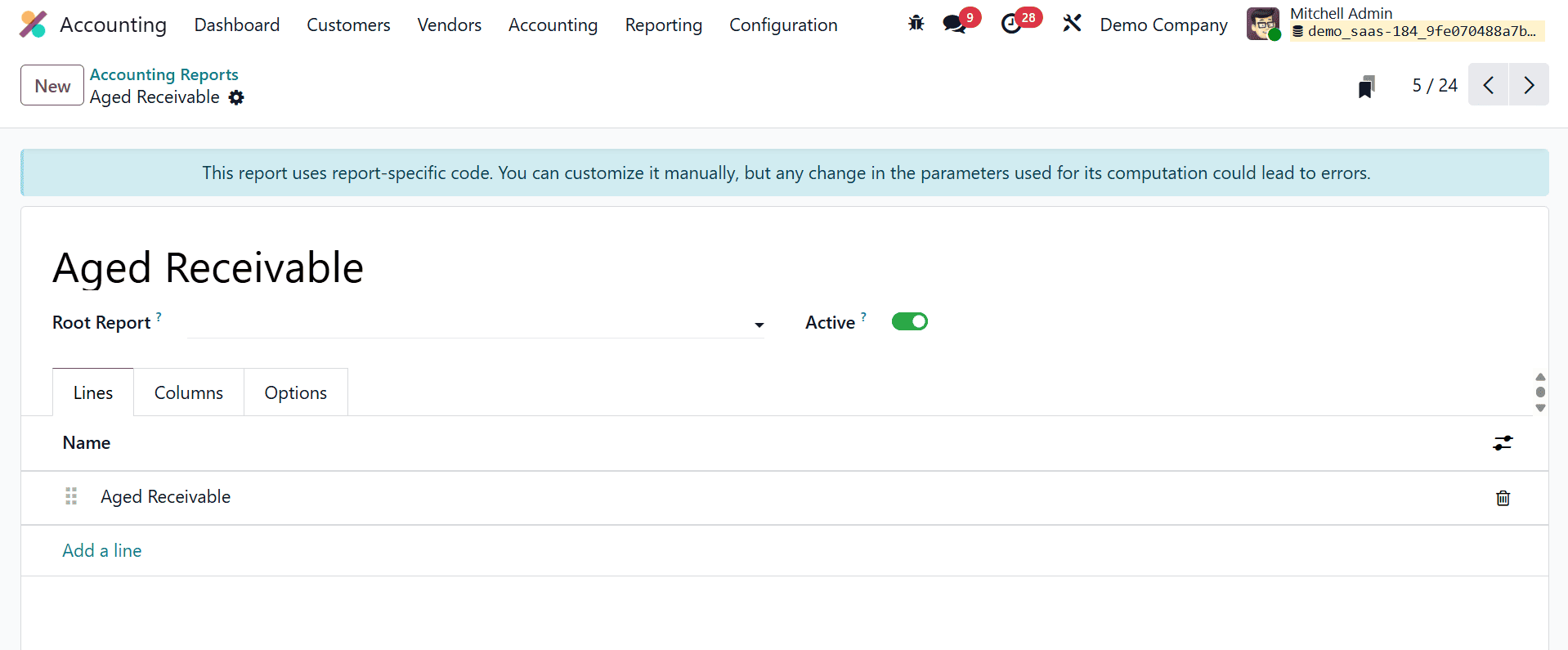

Let's demonstrate this functionality with an example. We will personalize the aged receivables report in this section. From the list, you can select the Aged Receivable for this use.

This is where the title of the report will appear. The current report will be a variable of the root report that you select in the Root Report box. You can add new report lines by clicking the Add a Line button under the Lines tab. To configure the details of the new report line, a pop-up window will appear.

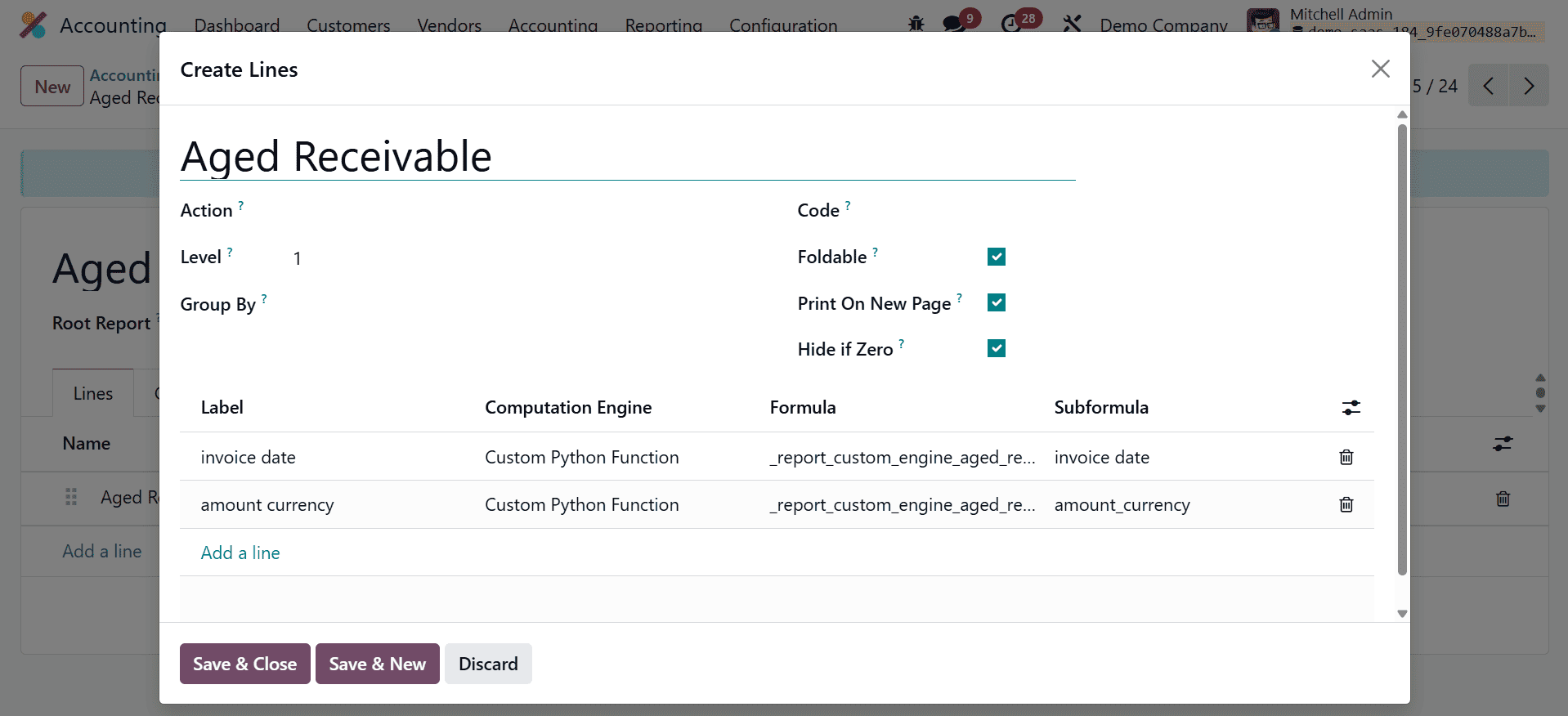

Aged Receivable is a new report line that we are introducing to our financial report. This reporting line's partner ID can be entered in the Partner Line. A separate list of fields will appear in the report line if the keys are entered in the Group By field. To turn the report line into a link, use the Action box. This report line's hierarchical level will be shown in the Level field. You can add a unique identifier to this line in the Code section. A button to fold this line will appear on the report when the Foldable field is selected. Printing will begin on a new page as soon as the Print on New Page button is activated.

If the Zero functionality is enabled, Odoo will automatically hide a line when all of its columns are 0. The Add a Line button allows you to define the Label, Formula, Subformula, and Computation Engine. Once a new line has been generated, you can view it in the Aged Receivable report as indicated below.

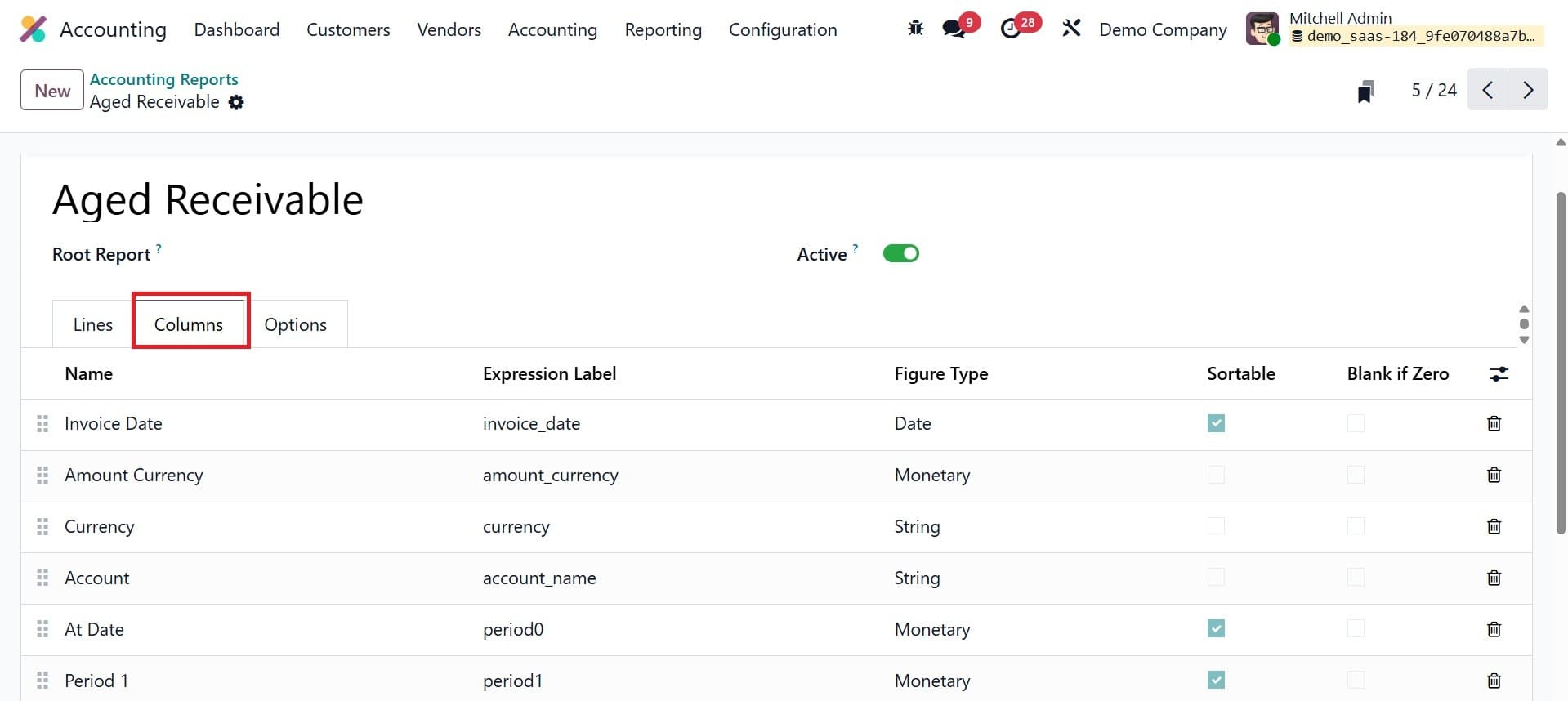

Now let's update the report with a new column. You may add new columns to the Aged Receivable report by clicking the Add a Line option on the Column page.

We are now including the Currency column in our report. In the relevant fields, you can mention the Name, Express Label, and Figure Type. If necessary, you can turn on the Sortable and Blank of Zero fields.

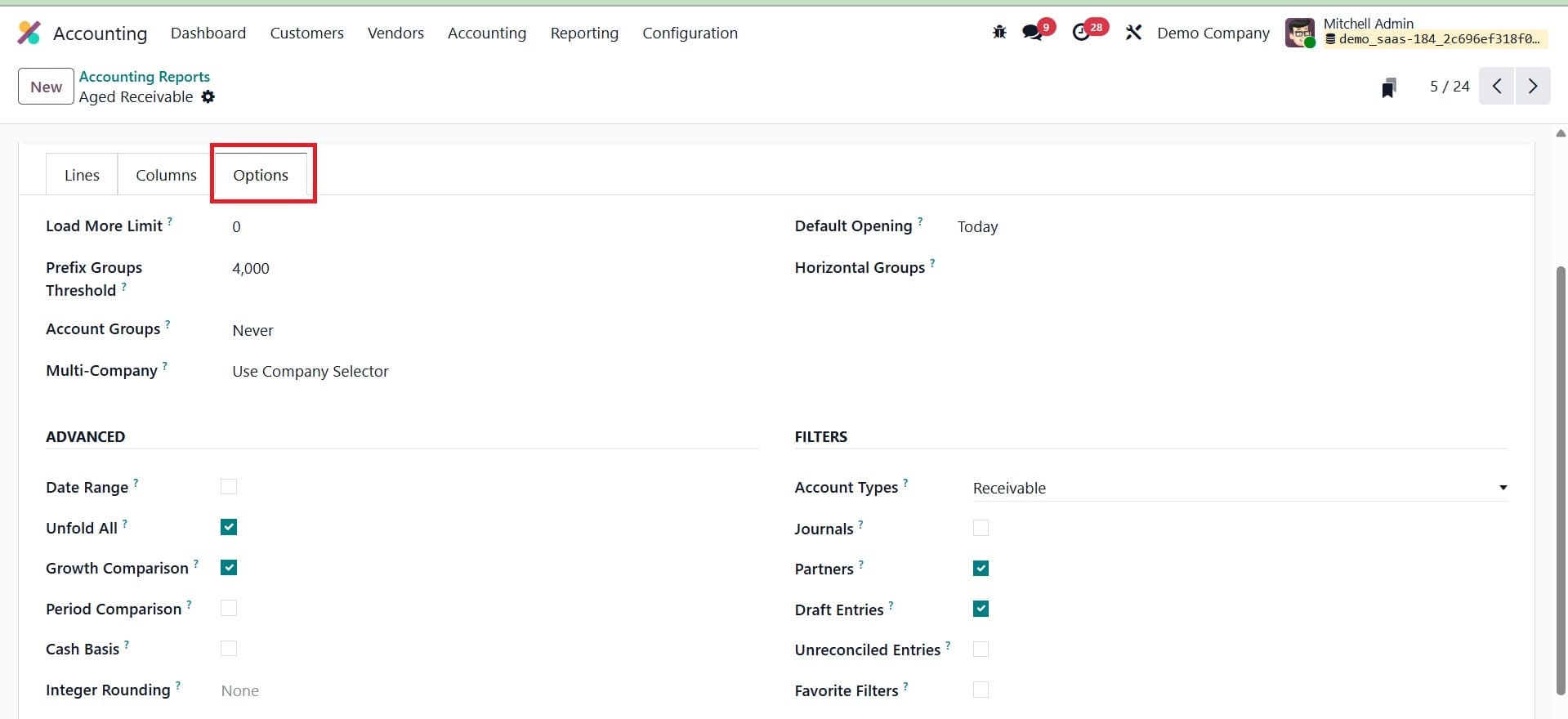

The extensive customization options on the options tab allow you to further alter the report.

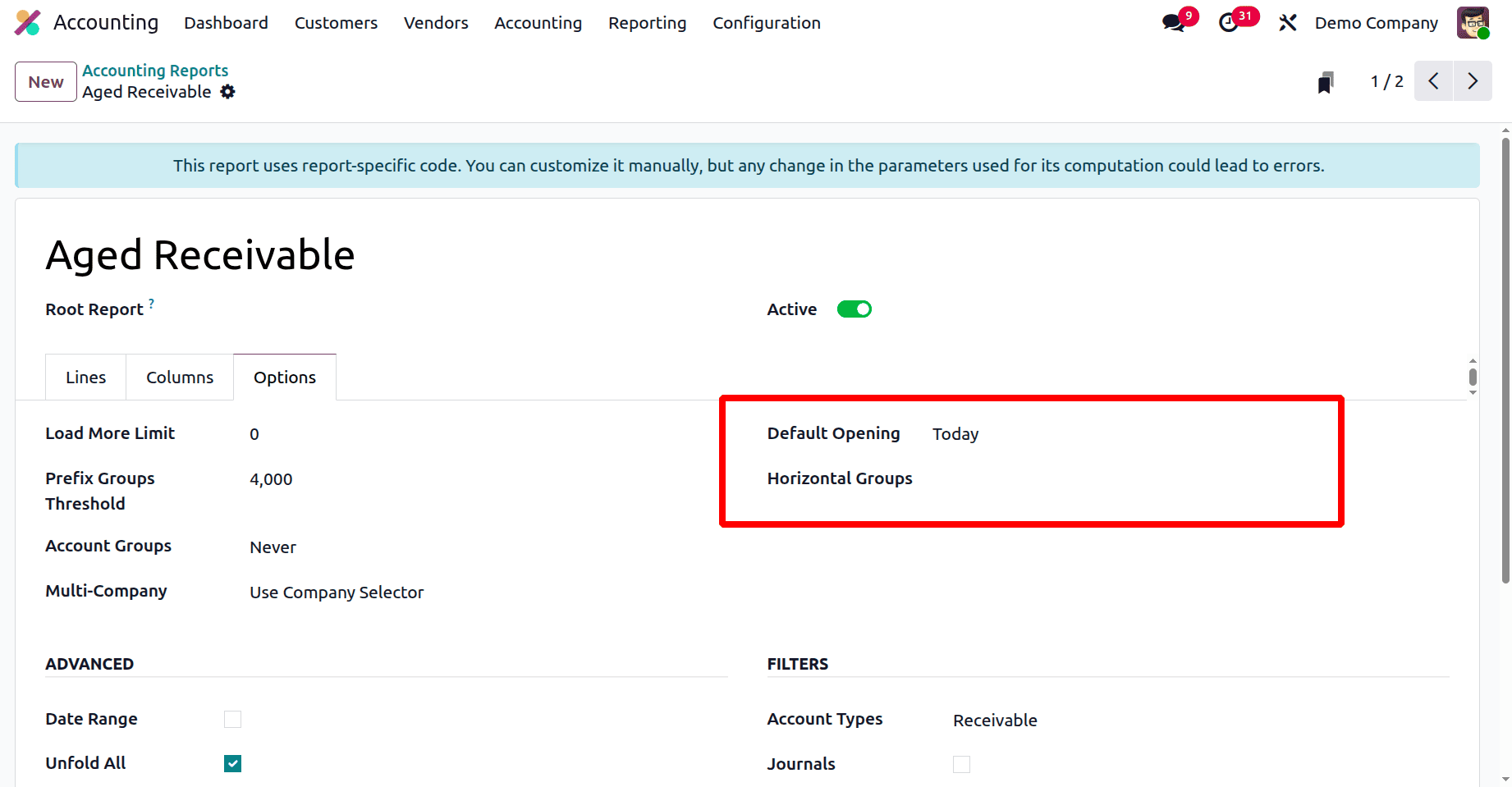

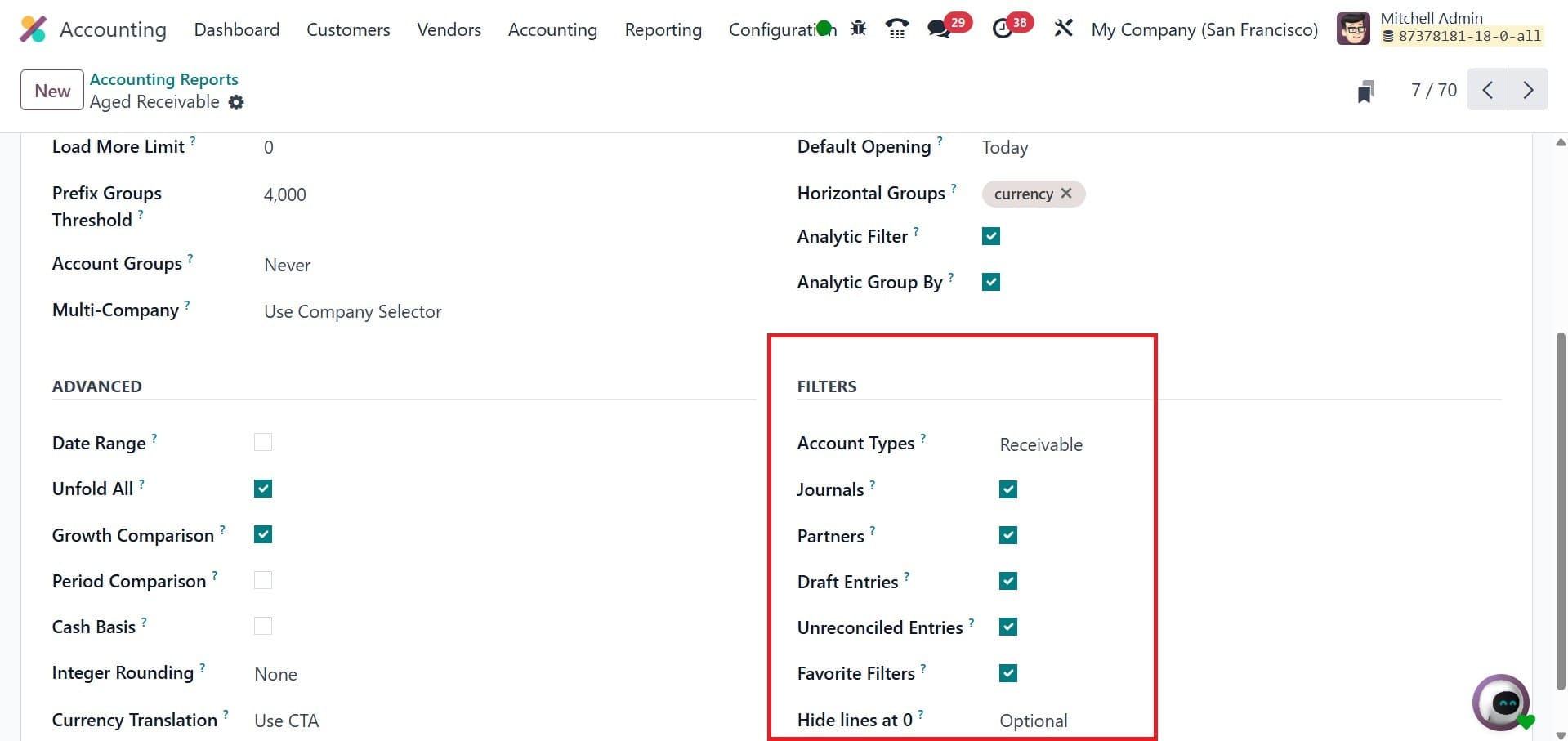

The limit value can be changed using the Load More Limit field. Three options are available for the Account Groups function: Always, Optional, and Enabled by Default. The Multi-Company filter can be changed using the Use Company Selector or Use Tax Unit. Set the field to Disabled if you want to disable the Multi-Company filter option. By specifying a time period in the Default viewing area, the Aged Receivable report for the chosen time period can be shown by default when viewing it in Odoo.

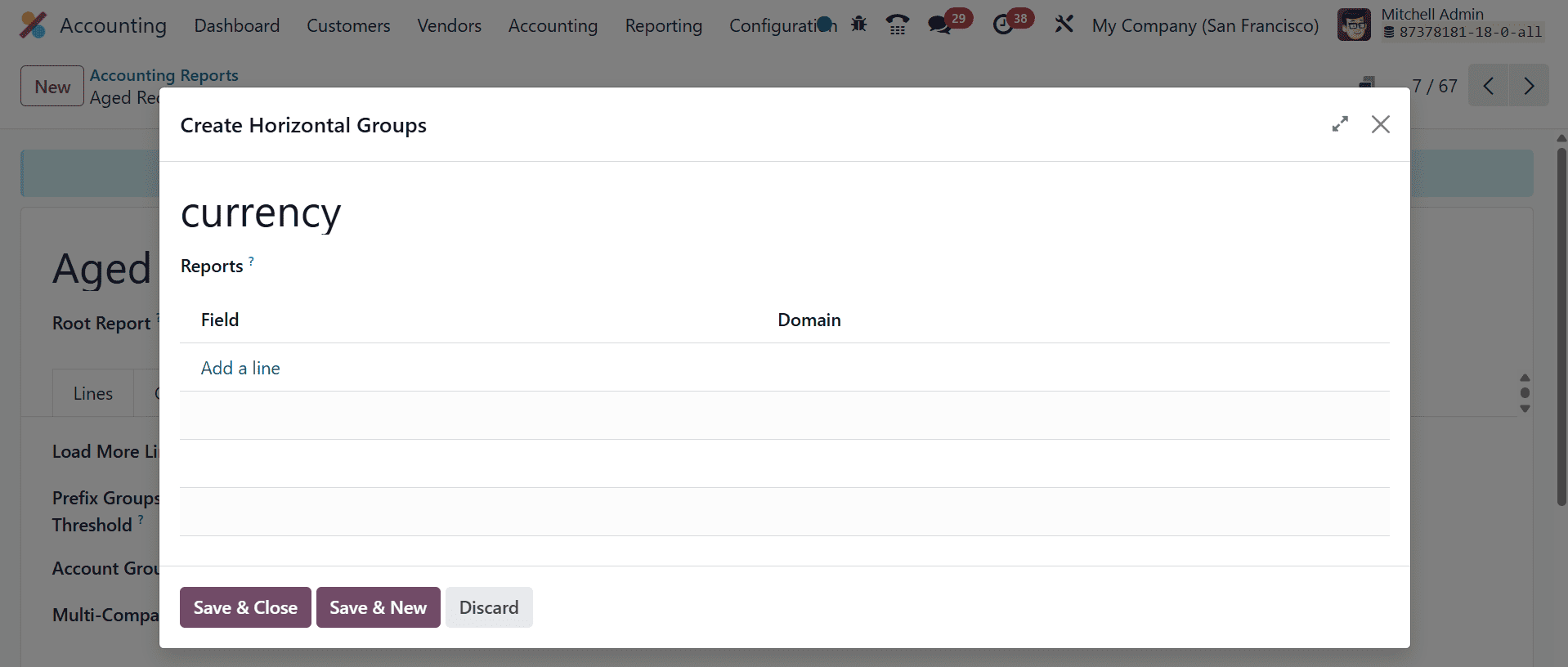

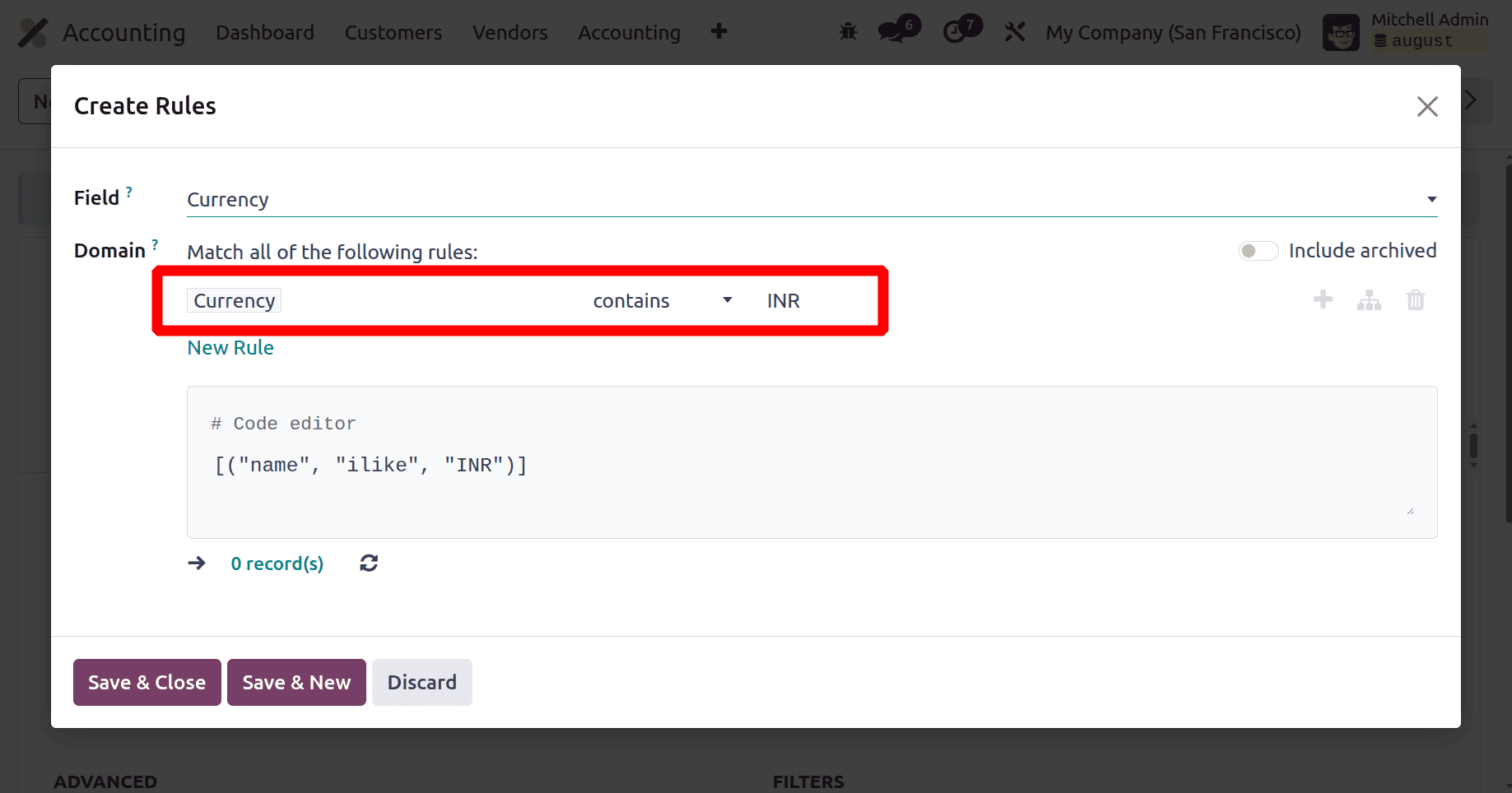

The required Horizontal Groups can be added to the available space. For that, add an horizontal group to say, currency, as in the image below.

Here, add the field using add a line option. Here the filter added is Currency Contains INR.

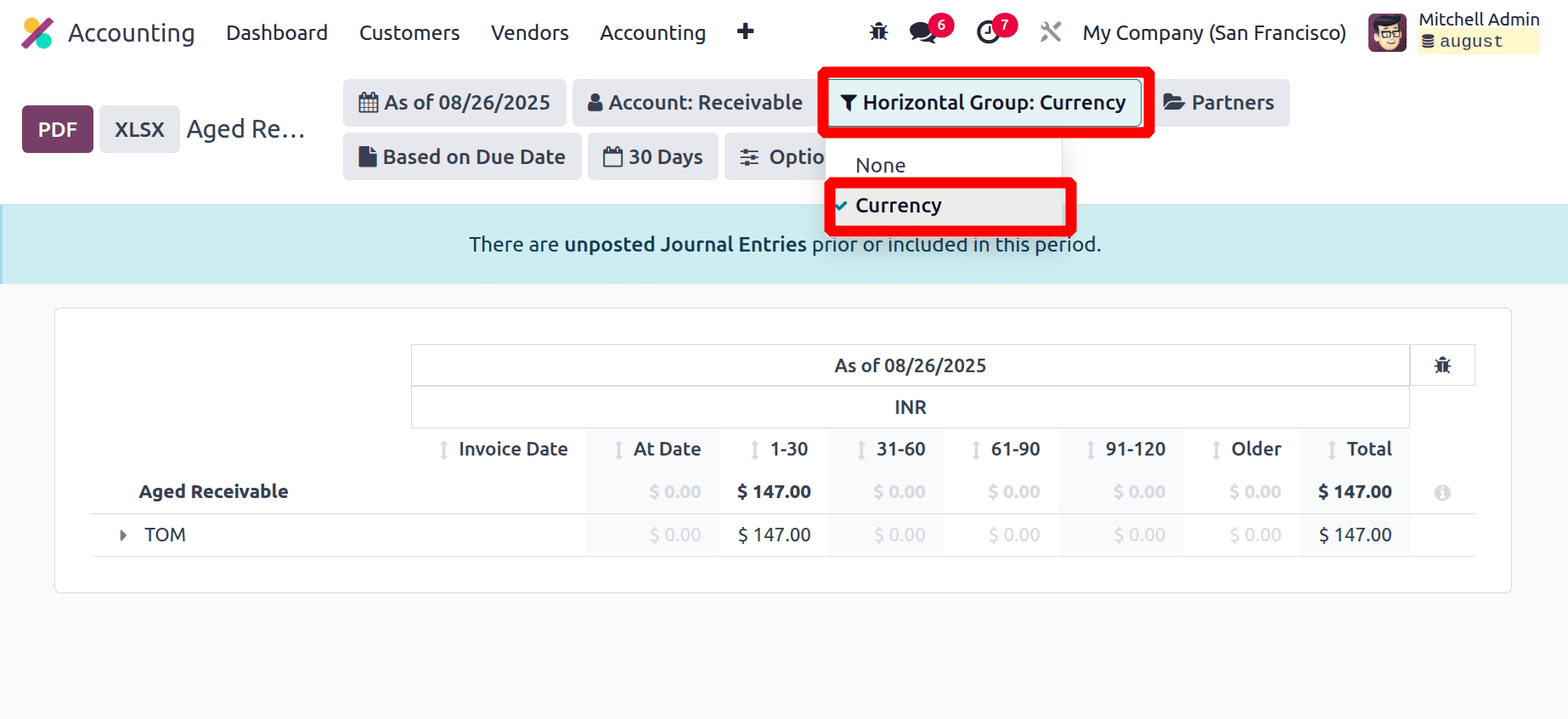

Save the data and you can see that the created currency got added to the Aged Receivable under reporting.

You can activate the Analytic Filter and Analytic Group By options to give your reports additional sorting choices.

If you want to show the Date Range, Unfold All, Growth Comparison, and Period Comparison features on the Aged Receivable report, you can activate the relevant fields from the Advanced session. Once the Cash Basis field is activated, the option to switch to cash basis mode becomes apparent. To add more filters to the report, you can activate the Account Types, Journals, Partners, Draught Entries, and Unreconciled Entries filters from the Filters session.

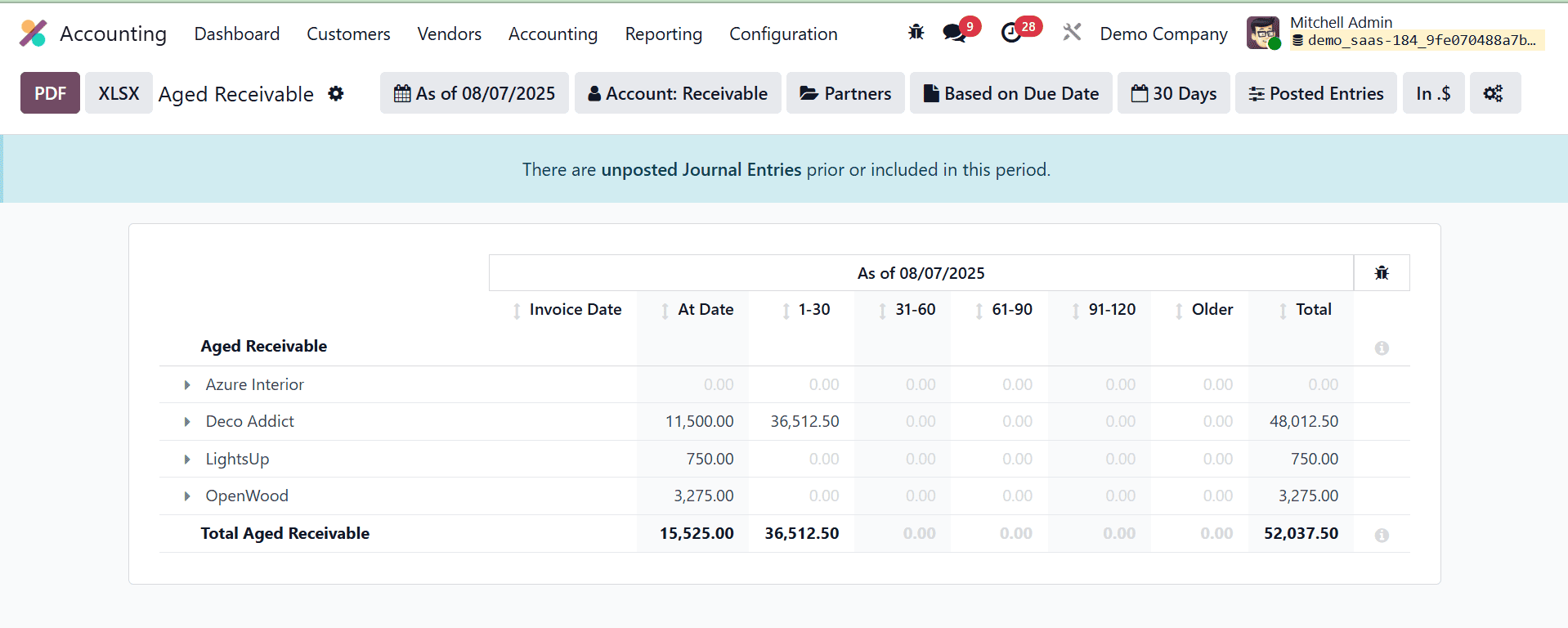

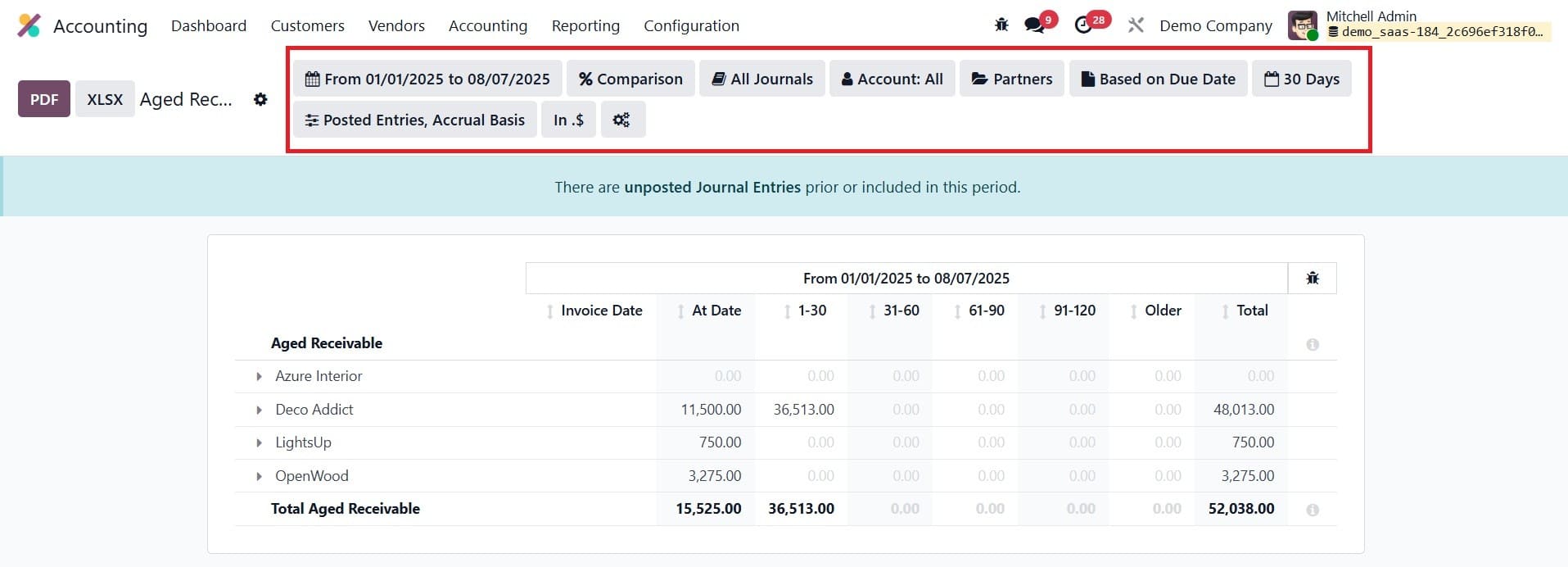

After making the required changes to the Aged Receivable report's parameters, you can observe comparable changes on the reporting platform, as shown in the image below.

With the help of the Accounting Reports function, you can alter your financial reports to make them more helpful and conduct a thorough examination of the financial operations that your business conducts.

Dynamic Reports

The Accounting Reports and Dynamic Reports in Odoo 18 provide a potent blend of organized financial summaries and adaptable, real-time insights. Standardized, audit-ready data that is necessary for compliance and financial tracking is provided by traditional accounting reports such as the Balance Sheet, Profit & Loss, and Tax Reports. Dynamic Reports, on the other hand, let users work with financial data instantly, aggregating, filtering, and diving down to find patterns, irregularities, and possibilities.

These reporting features work together to close the gap between agile business intelligence and static financial accounts. They provide decision-makers with quick, accurate information as well as views that can be customized to meet changing business requirements. To put it briefly, Odoo 18 turns accounting reports from passive records into dynamic instruments for planning, managing, and expanding.

In Odoo 18, dynamic reports are adaptable and interactive papers that offer a thorough rundown of all the different facets of a company's activities. Dynamic reports allow for real-time customization to highlight particular metrics, filter criteria, and visualizations, in contrast to static reports that provide set views of data. Because of its adaptability, users can examine data from many perspectives and derive useful insights that inform choices.

Users can rapidly generate current financial statements and performance indicators using dynamic accounting reports.

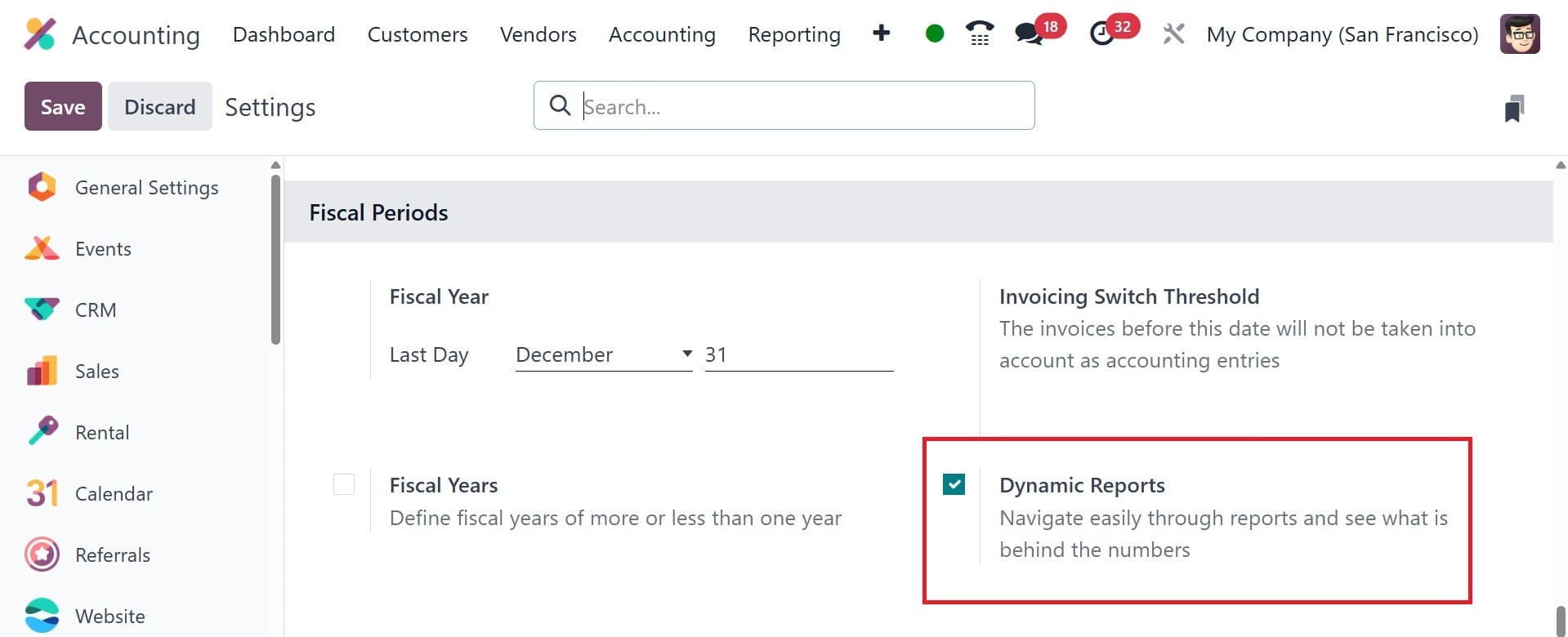

Go to Accounting > Configuration > Settings and click the 'Dynamic Reports' box to activate them.

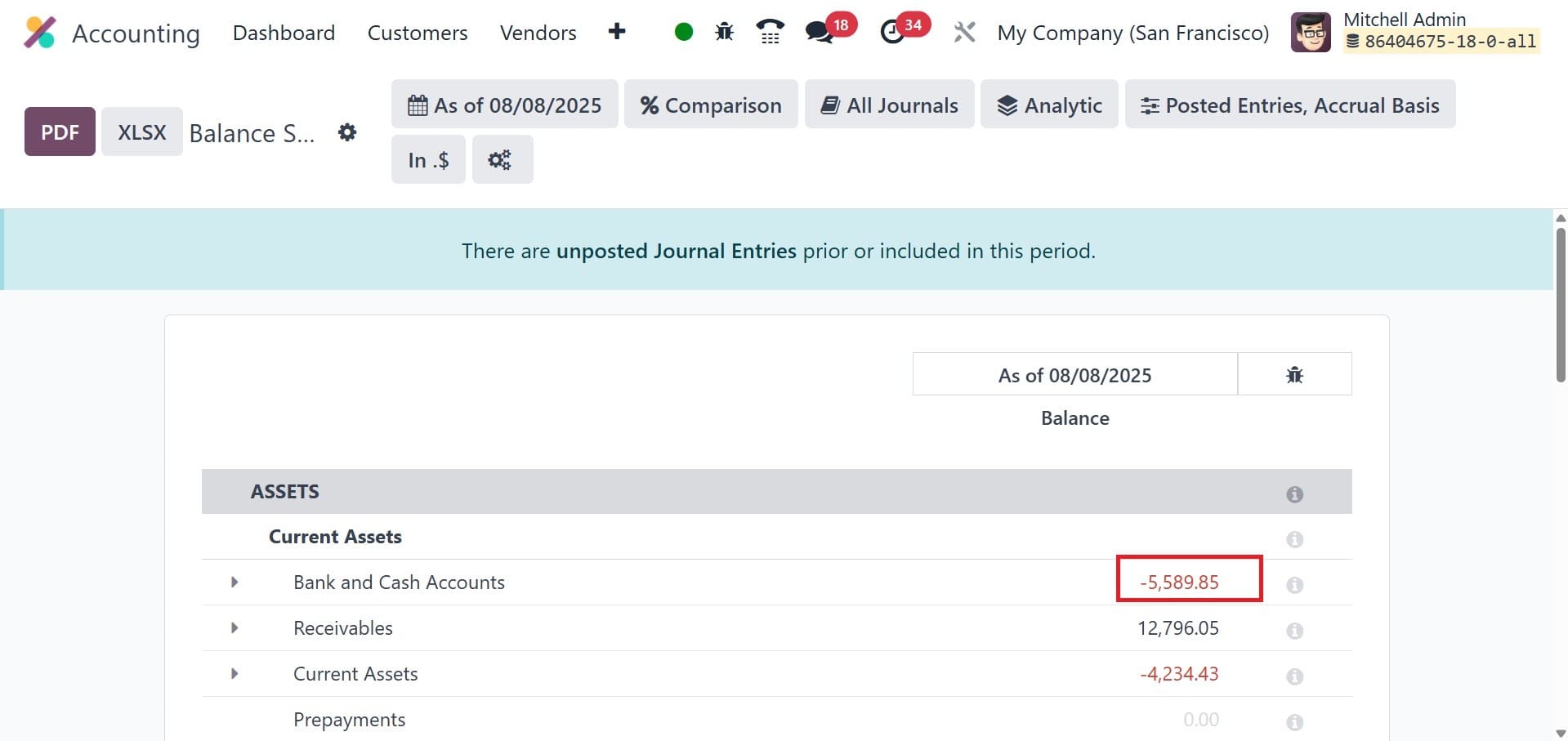

The reports won't appear here unless this checkbox is enabled. After the option is enabled, take the reports. Click the value as shown in the screenshot.

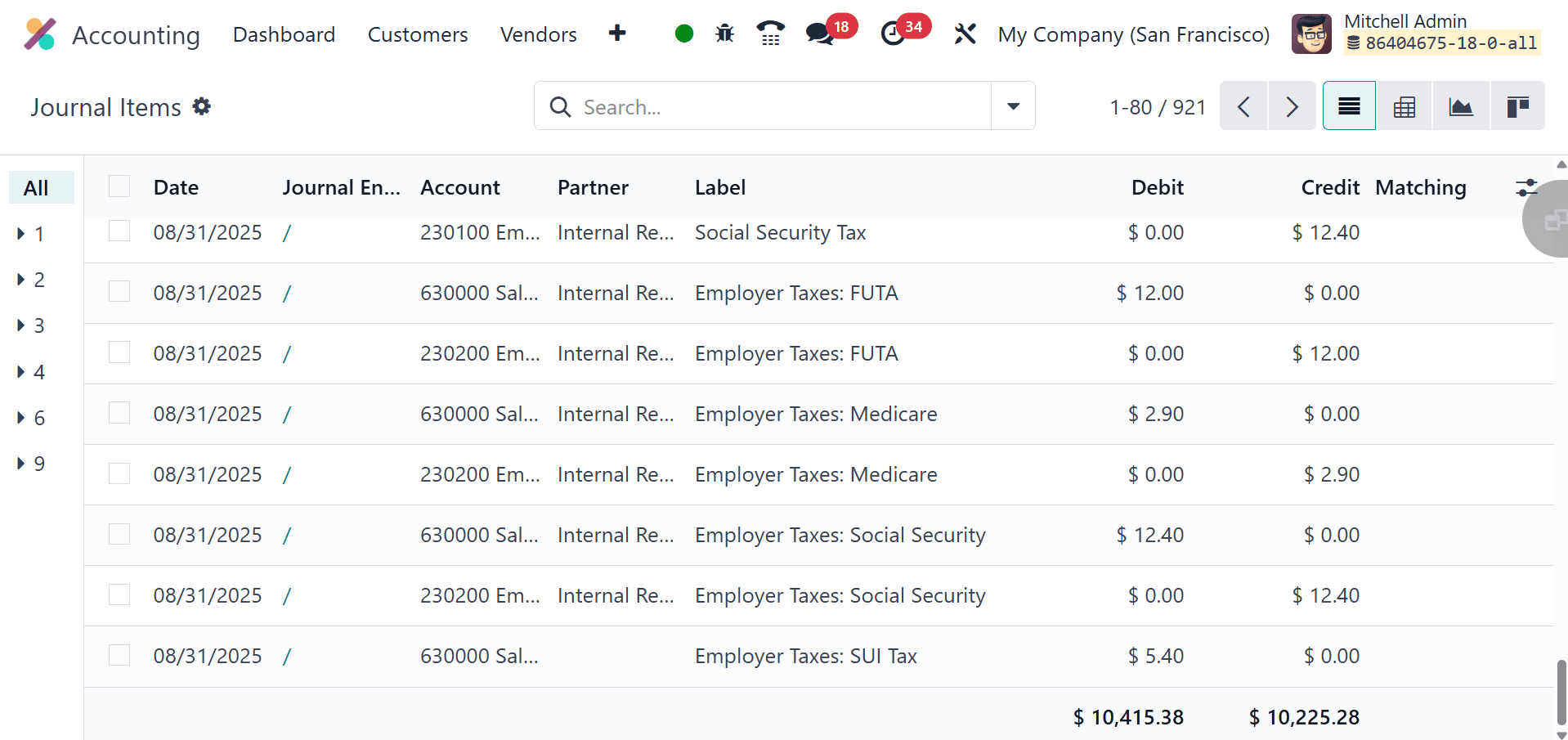

This will produce the corresponding journal entries as stated.

For contemporary firms, Odoo Accounting's reporting features—particularly its dynamic reports—offer a significant edge. Businesses may swiftly and effectively make well-informed decisions when they have real-time access to financial data. While dynamic reports like the Aged Receivables, Profit and Loss, and Balance Sheet offer drill-down analysis, exportable formats, and customized views, the accounting module's interface with other Odoo modules guarantees accuracy and consistency across all transactions. All things considered, Odoo's accounting and dynamic reporting features facilitate strategic financial management, improve transparency, and streamline intricate financial procedures.

To read more about An Overview of Odoo 17 Accounting Reports, refer to our blog An Overview of Odoo 17 Accounting Reports