Handling small cash differences in transactions is a common scenario in many businesses, especially those operating in retail environments where payments are made using cash. Rounding adjustments become necessary when the final invoice amount includes decimals that cannot be practically settled using available currency denominations. Properly managing these adjustments ensures that both customers and businesses experience smooth and transparent transactions without inconsistencies in financial records.

Odoo 19 introduces enhanced cash rounding functionalities that simplify how businesses handle these minor discrepancies. With improved configuration settings and automation, the system ensures that rounding is applied consistently across invoices and payments. Whether a company needs to round to the nearest whole number, apply upward or downward rounding rules, or follow country-specific cash rounding regulations, Odoo 19 provides a flexible and user-friendly solution.

In this blog, we will walk you through how cash rounding works in Odoo 19 and demonstrate how to configure it step by step. From creating a rounding rule to applying it to customer invoices, you will learn how to ensure your accounting remains accurate while delivering a seamless checkout experience. Whether you’re a small business or a large organization, understanding and using cash rounding effectively can significantly improve transaction handling and financial reporting in your Odoo system.

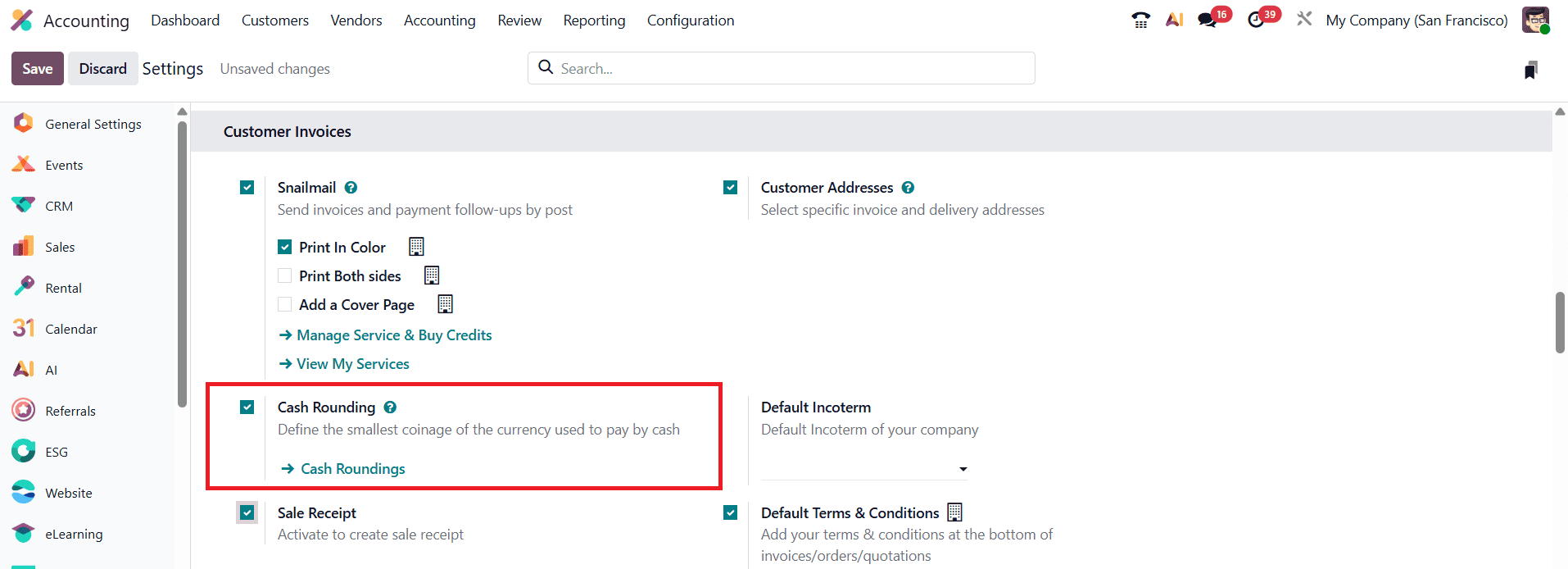

The Accounting module in Odoo 19 includes a valuable feature called Cash Rounding, which allows businesses to automatically round invoice totals to the nearest available currency denomination. This is particularly useful in cash-based transactions where certain decimal values cannot be settled using physical currency. To enable this feature, navigate to the Accounting module and open the Settings menu. Under the Customer Invoices section, activate the Cash Rounding option. Once enabled, Odoo allows you to configure how rounding should be applied to customer invoices, as illustrated in the interface shown below.

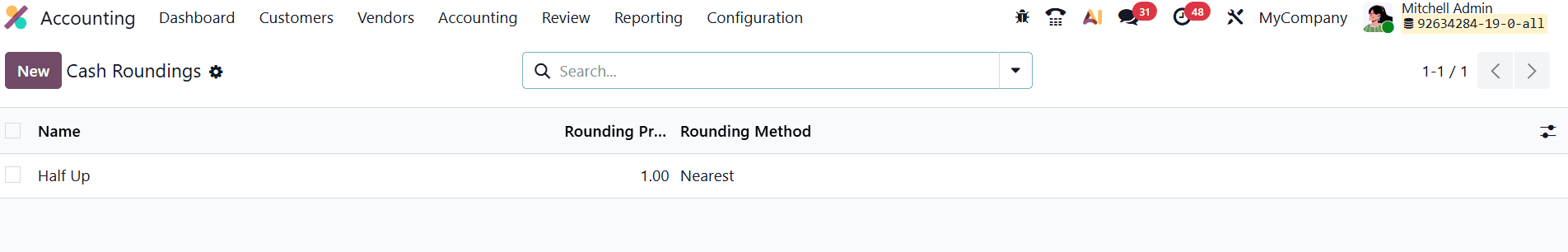

Once the feature is enabled, you can configure your rounding rules by navigating to Accounting > Configuration > Cash Rounding.

The list view displays all existing rounding configurations, and you can create a new one by clicking New.

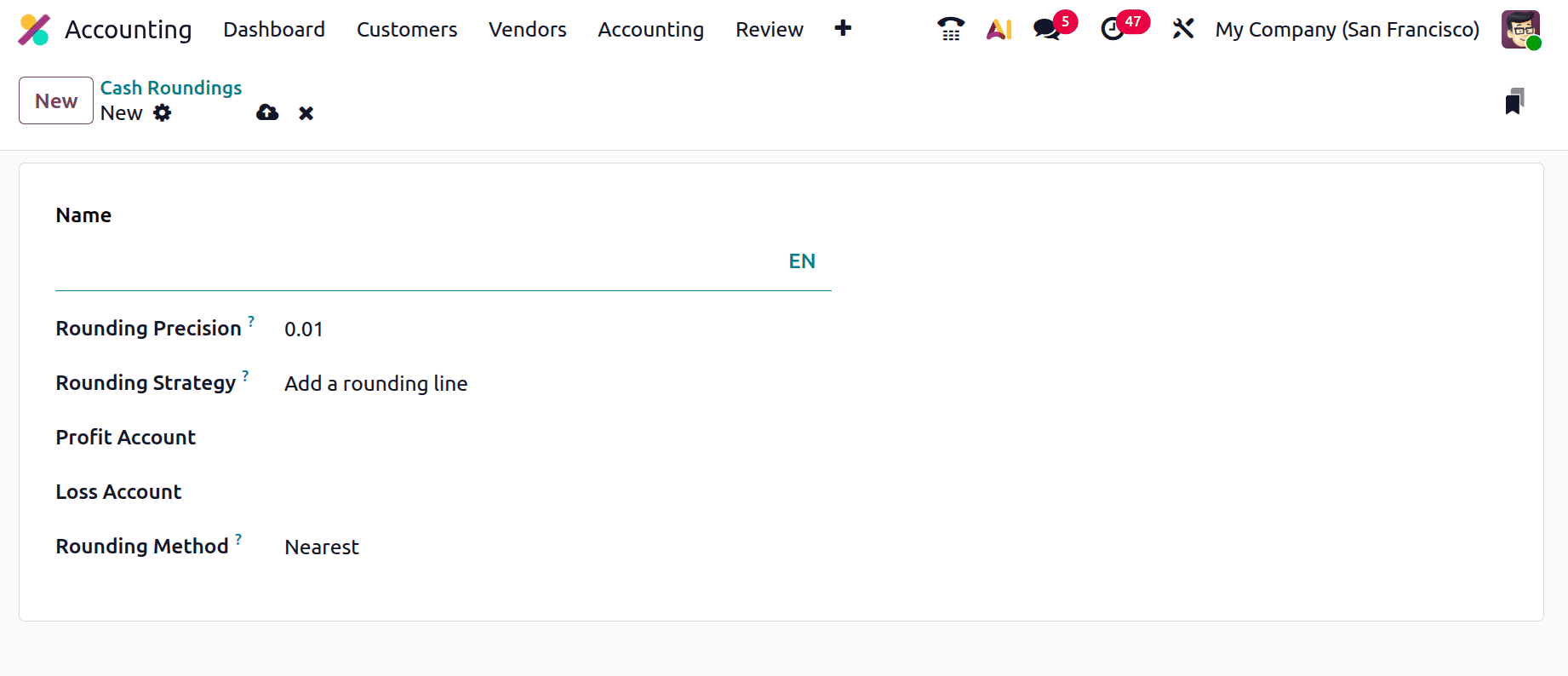

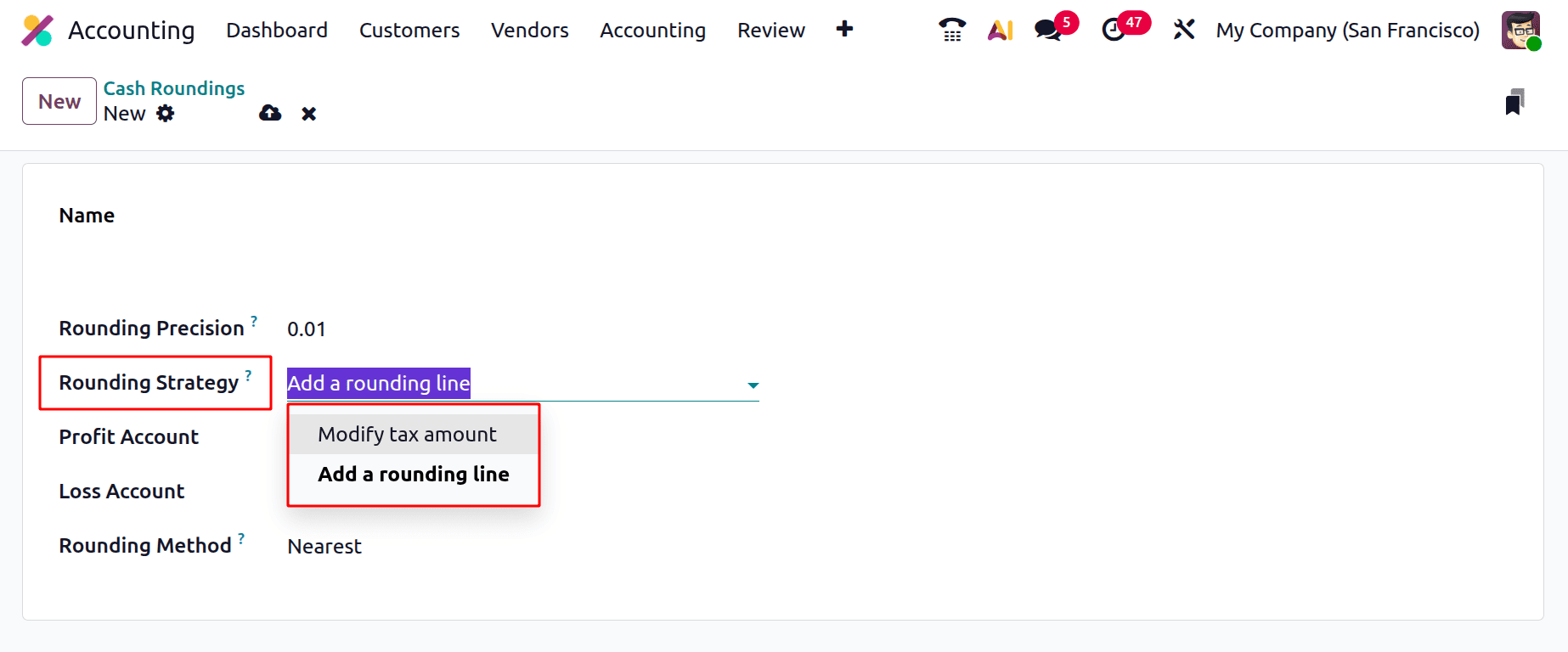

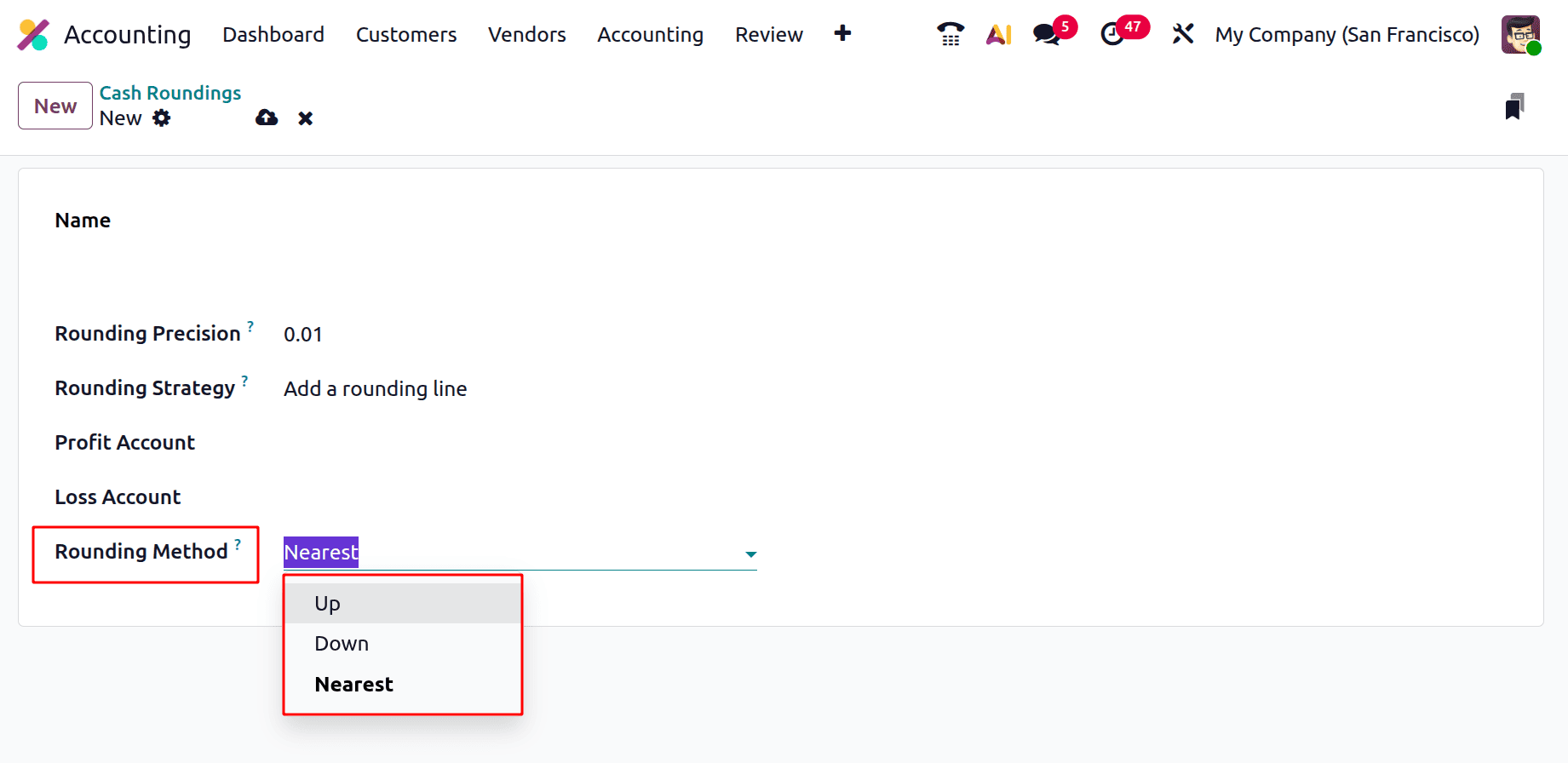

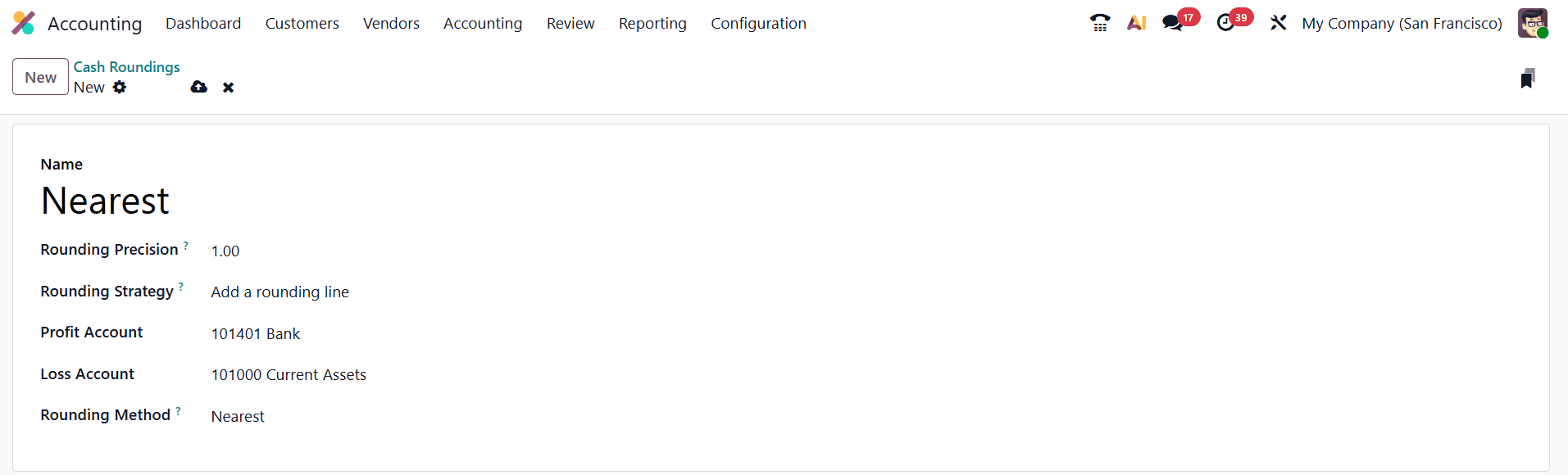

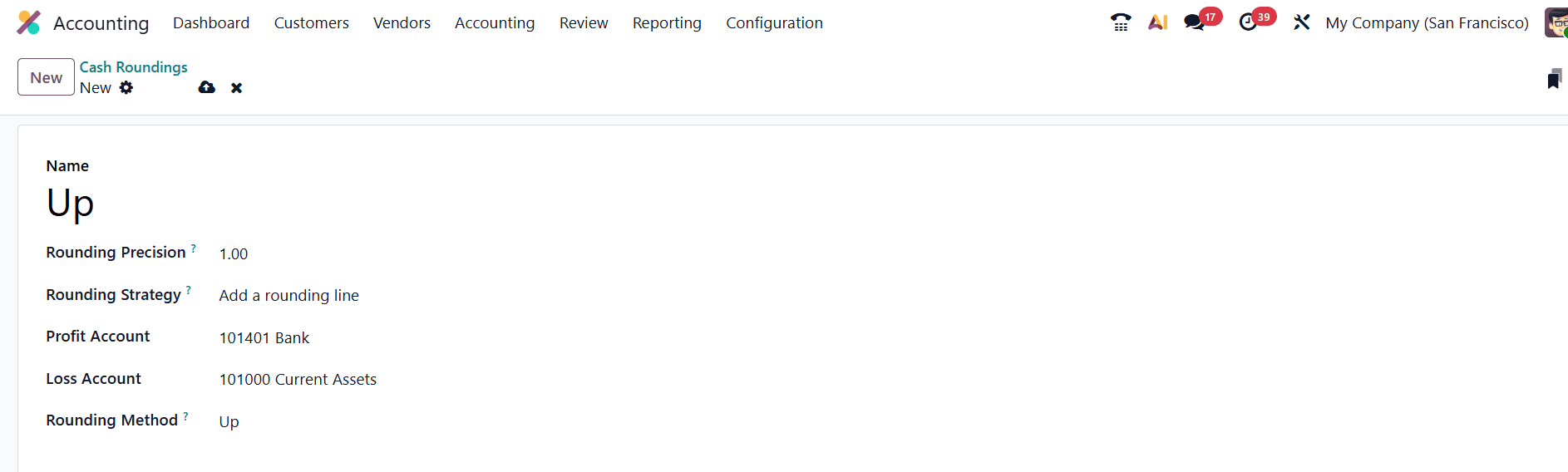

In the configuration form, start by entering a Name for the rounding method and define the Rounding Precision, which determines the smallest denomination that the invoice total should be rounded to. You can then choose a Rounding Strategy based on how you want Odoo to apply the adjustment. The Add a Rounding Line option inserts an additional line in the invoice to clearly show the rounding difference, while the Modify Tax Amount option adjusts the tax calculation so that the final invoice total aligns with the rounding precision.

You will also need to specify the corresponding Profit and Loss Accounts to correctly record any rounding gains or losses resulting from the adjustment.

Odoo 19 supports three types of rounding methods: Up, which always rounds the amount upward; Down, which always rounds downward; and Nearest, which rounds up if the decimal value is 0.5 or higher and rounds down when it is lower. This flexible rounding system ensures accurate handling of fractional values, compliance with local currency rules, and smoother reconciliation of cash payments during daily business operations.

Applying Cash Rounding to Invoices

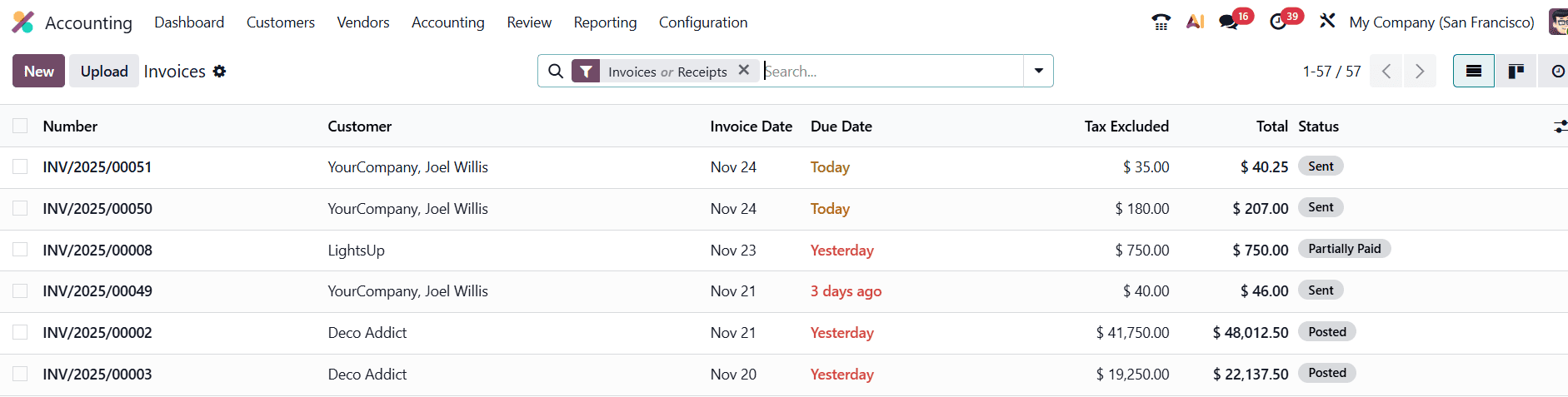

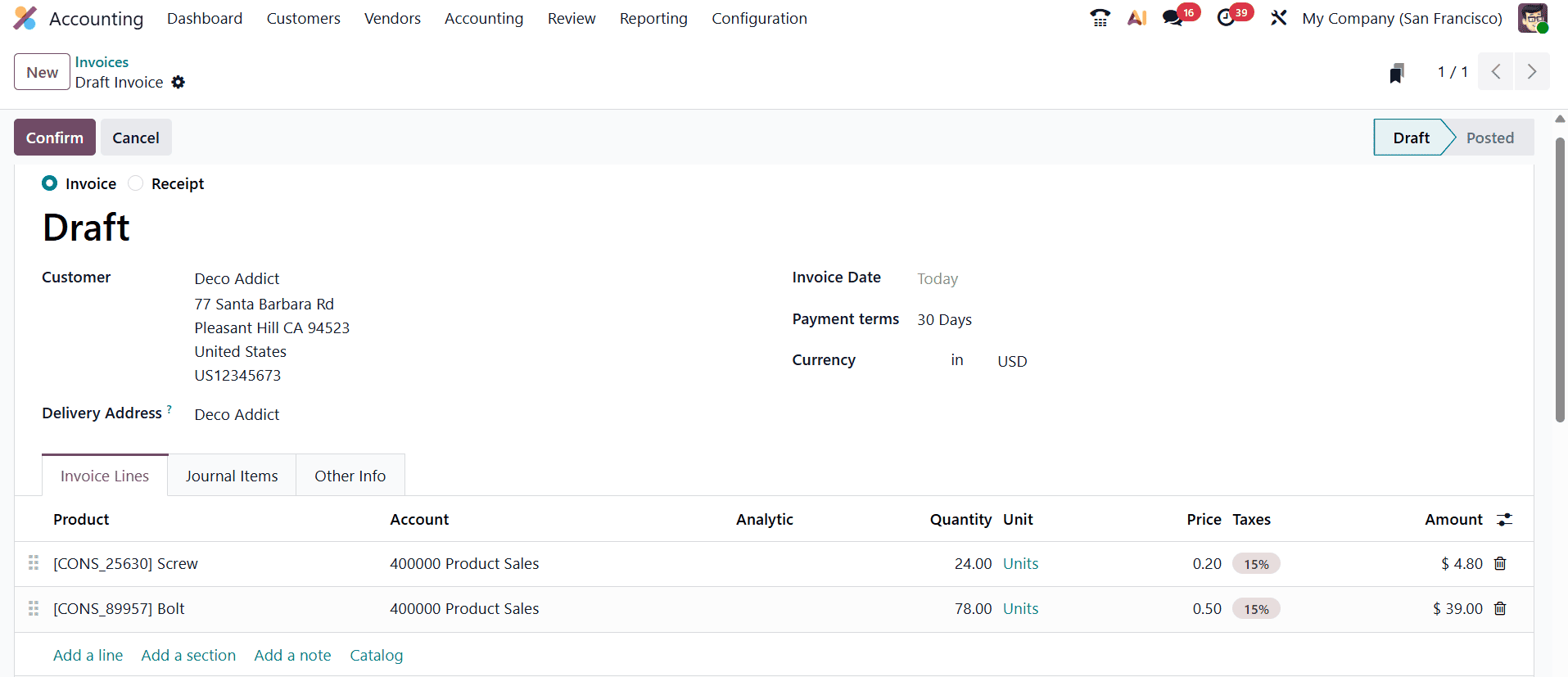

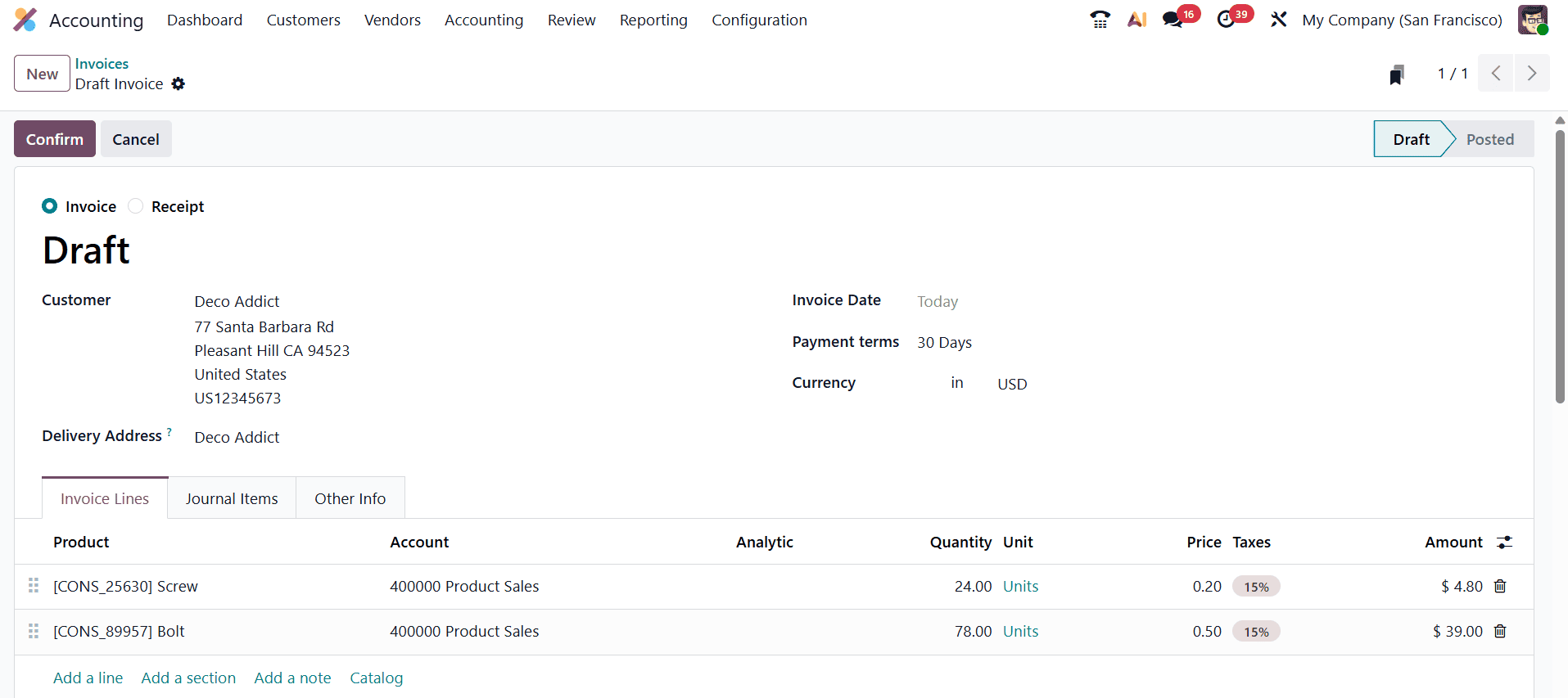

To see how cash rounding works in Odoo 19, start by creating a new invoice. Go to Customers > Invoices, where you will see a list of all existing invoices along with key details such as the invoice number, customer, date, and total amount.

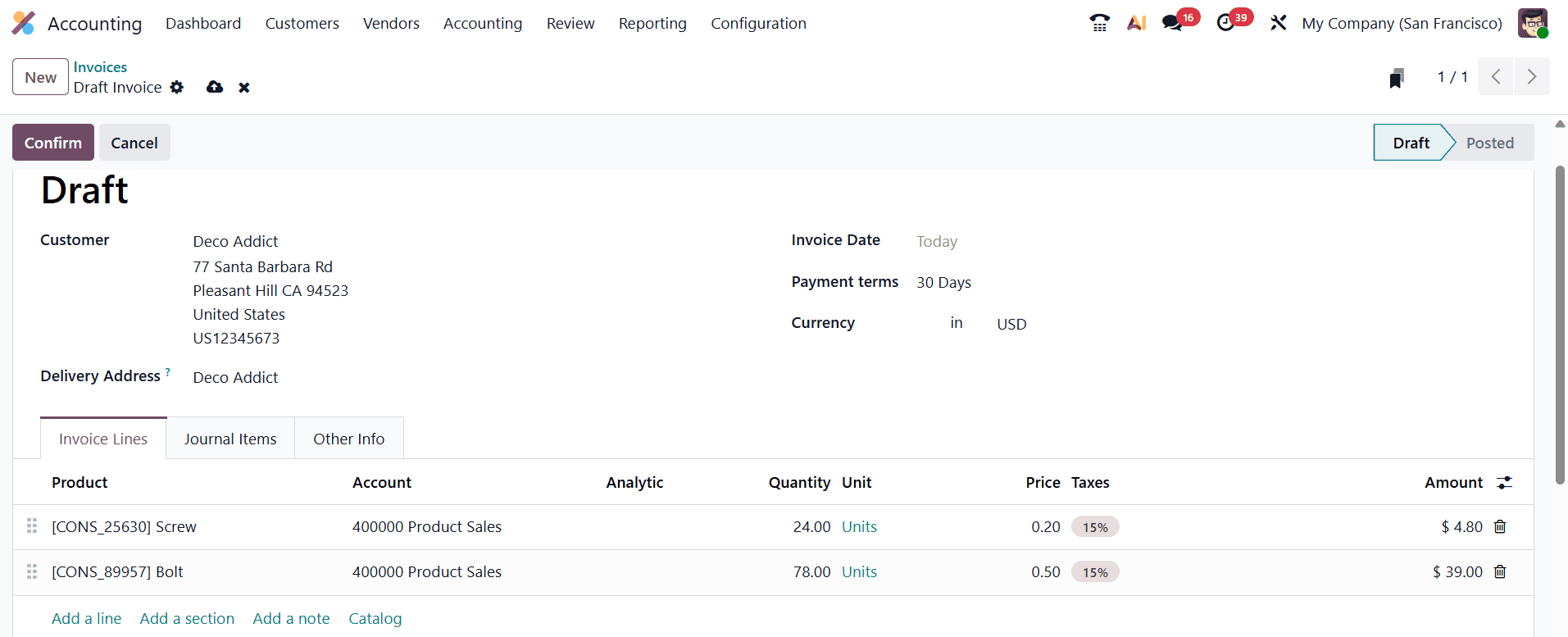

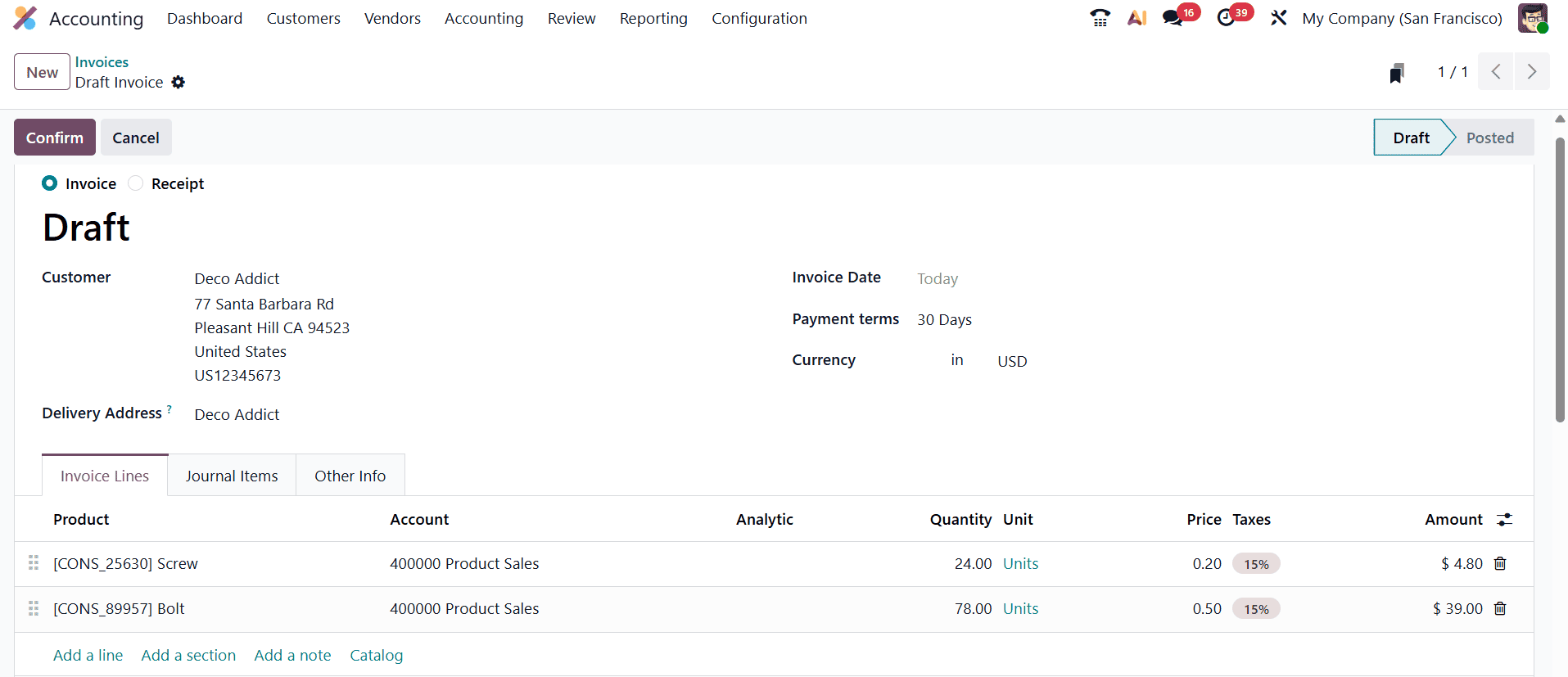

Click the New button to open a blank invoice form. Begin by selecting the customer and filling in the necessary invoice information.

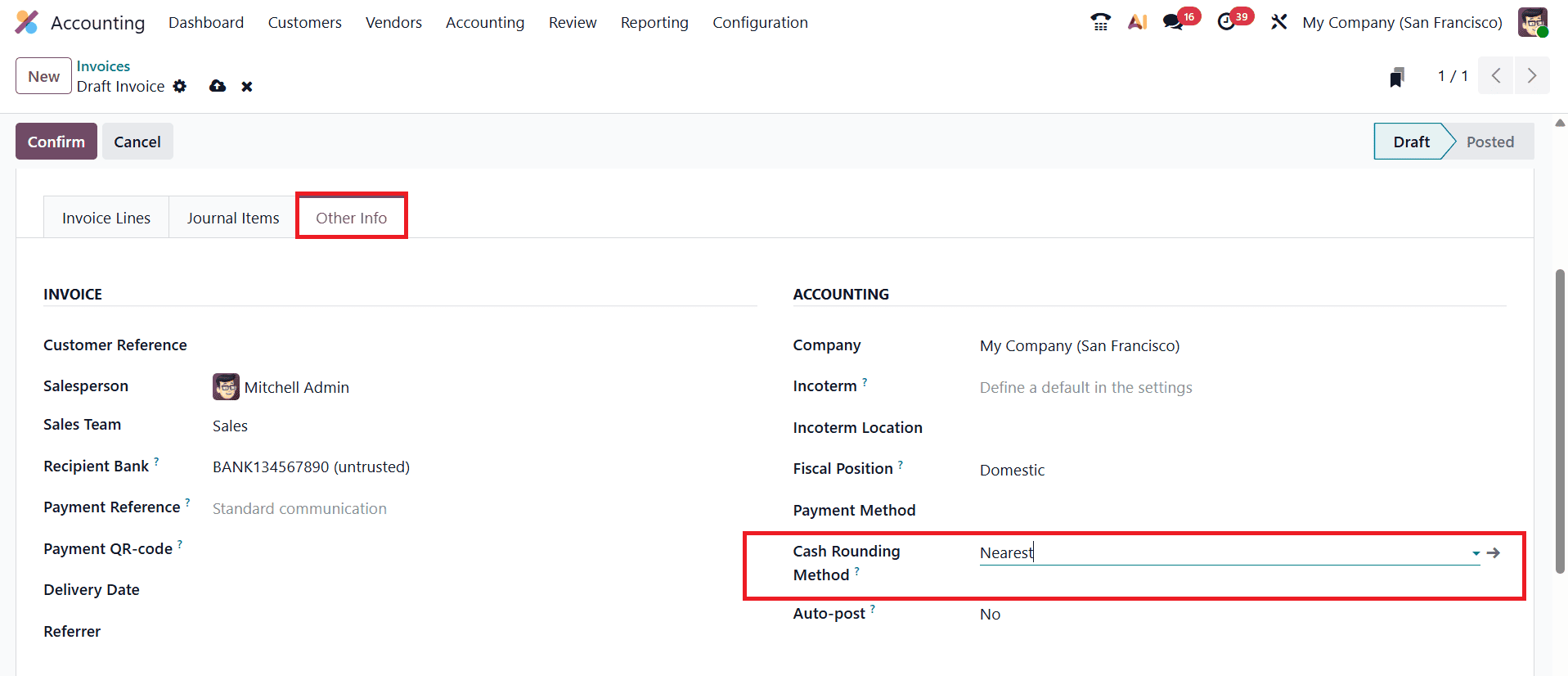

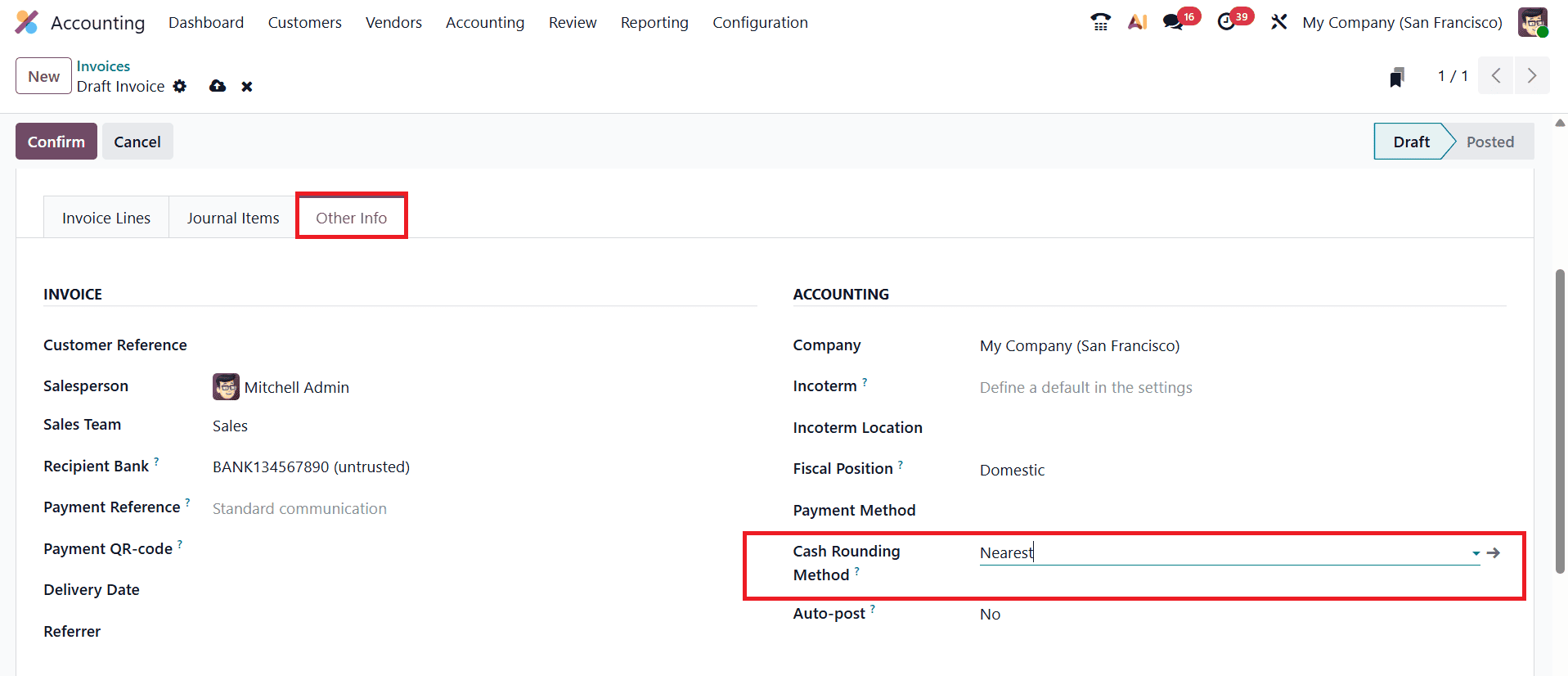

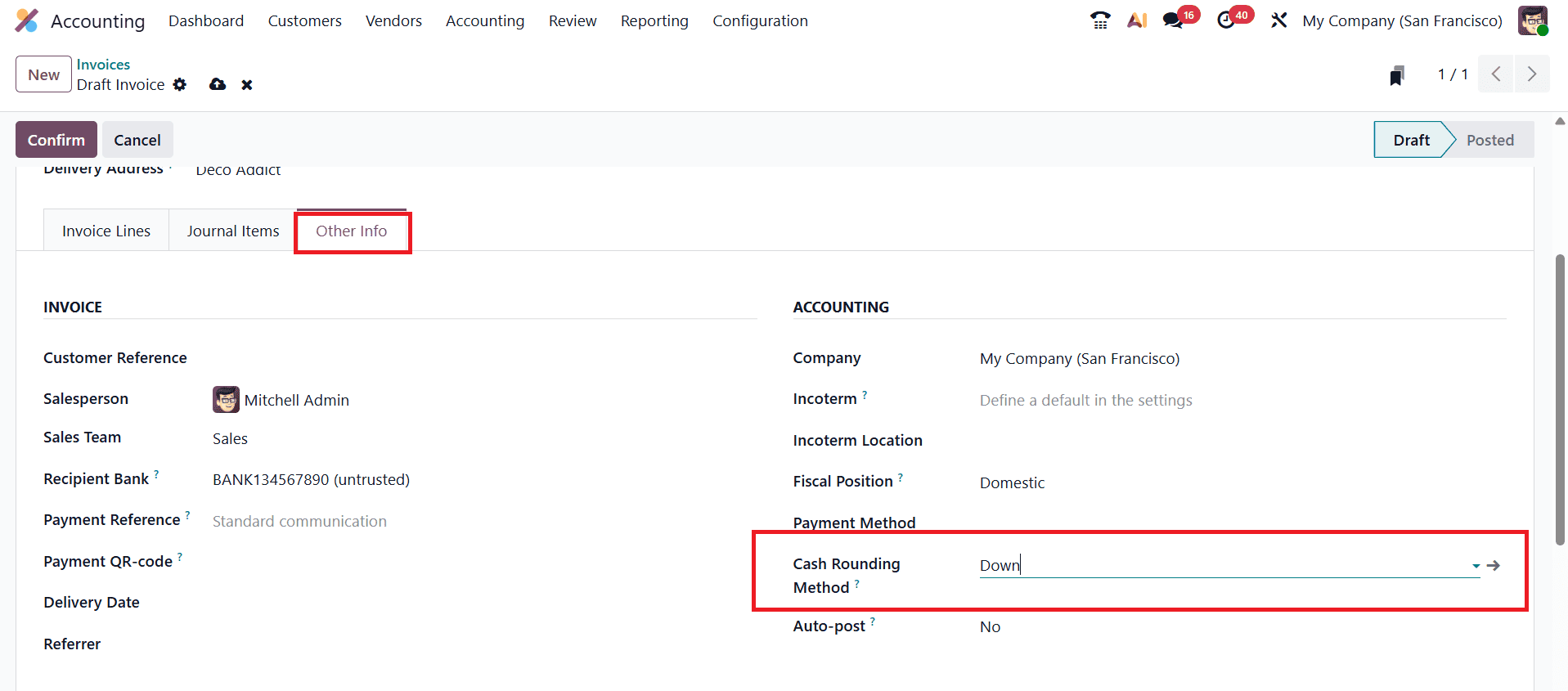

Under the Invoice Lines tab, add the products or services being billed. Once the items are entered, switch to the Other Info tab. In the Accounting section, you’ll find the Cash Rounding Method field. From the dropdown list, choose the rounding rule you configured earlier.

After entering all required details, save the invoice and click Confirm to finalize it. For demonstration, you may select any sample products; Odoo will automatically apply the selected rounding method to the invoice total. As soon as the invoice is confirmed, the system recalculates the total amount according to the defined cash rounding rules, clearly showing the rounded value on the invoice.

Choosing a Rounding Method

Nearest

In Odoo 19, the Nearest rounding method replaces the earlier Half-Up strategy. When this method is selected from the cash rounding configuration window, Odoo will round the invoice total to the nearest valid denomination based on the rounding precision you have defined.

For example, if the product total is $2.98 and the nearest rounding precision is configured to 0.05, Odoo will round the amount to the closest value, either up or down, depending on whether the decimal portion is above or below the halfway point. The rounded difference will be displayed clearly in the Rounding Method field on the invoice.

Your accounting environment may contain several configured cash rounding options, and when preparing an invoice, you can select the appropriate method directly. This can be done either from the invoice’s configuration window or through the Other Info tab, where the Cash Rounding Method field appears under the Accounting section.

Once the rounding method is selected, Odoo automatically applies it to the total amount of the invoice. For example, if the total value of the invoice comes to $50.37, Odoo will assess the amount and round it to the nearest valid denomination according to your rounding precision.

The invoice footer will display both the original calculated amount and the rounding adjustment, making the process transparent and easy to verify. After reviewing the adjusted totals and rounding values, you can confirm the invoice and proceed to the next steps in your workflow.

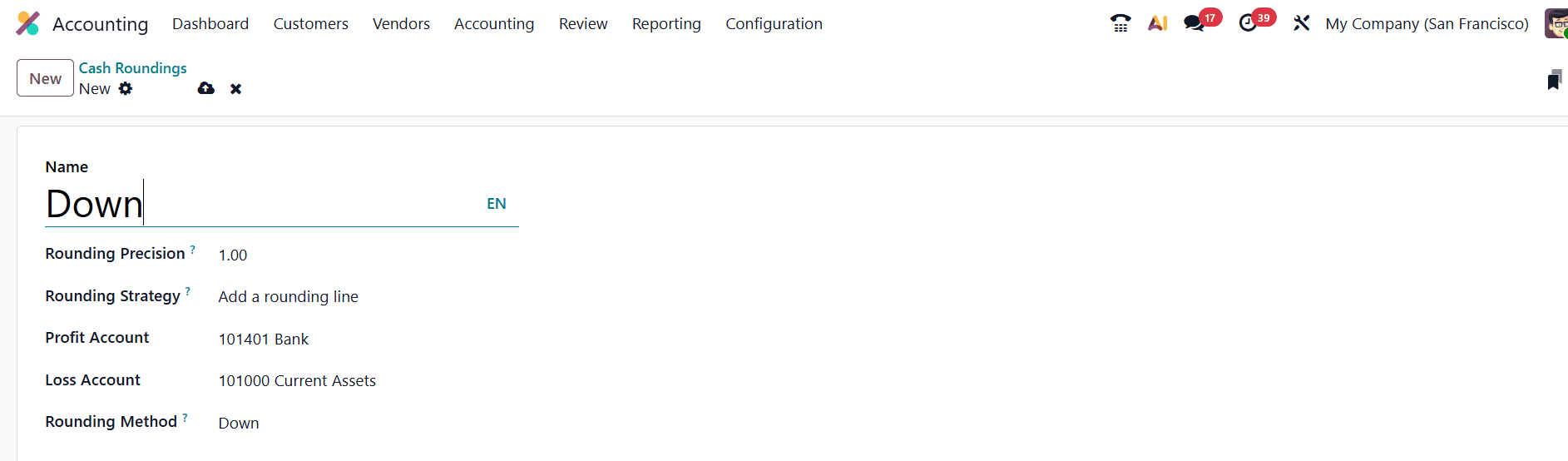

DOWN Method

When the DOWN cash rounding method is selected in the Cash Rounding configuration form, Odoo 19 will always round the invoice total downward to the nearest value based on the defined Rounding Precision. This method ensures that the final payable amount never exceeds the original calculated total.

To demonstrate this, create a new invoice using the same products selected in the previous example, but assign it to a different customer and choose the DOWN rounding method.

After adding the invoice lines and selecting the rounding rule, Odoo will automatically adjust the total to the nearest lower denomination defined by the Rounding Precision.

For instance, if the calculated total is slightly above a whole number or rounding step, Odoo will reduce it to the closest lower rounded amount. The final rounded value will be clearly visible at the bottom of the invoice, along with a separate rounding line if the chosen strategy uses one.

UP Method

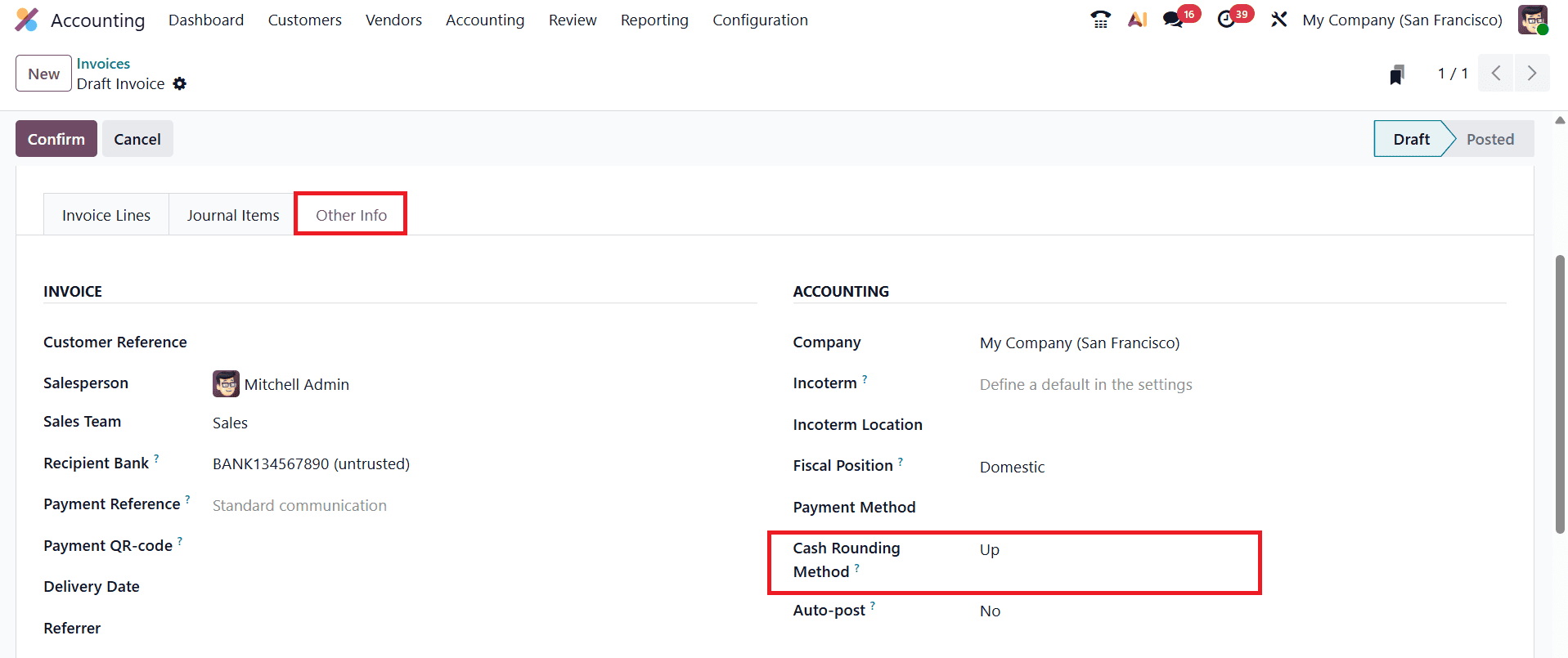

To apply the UP rounding method in Odoo 19, start by updating the rounding configuration in the Cash Rounding settings. Select the rounding method as UP, which ensures that all invoice totals are rounded upward to the nearest value based on the chosen Rounding Precision.

Once the UP method is configured, create a new invoice using any set of products.

After adding the invoice items, select the cash rounding method from the Other Info tab. Odoo automatically applies the rounding rule to the total amount. With the UP strategy, even if the decimal value is very small, the system will round the total upward to the next valid denomination defined by your rounding precision.

In the invoice view, the rounding adjustment will appear clearly in the invoice summary at the bottom of the page. Odoo displays the computed rounding difference as a separate line or adjustment, depending on the chosen rounding strategy. This makes the adjustment fully transparent and easy to track.

Odoo 19’s cash rounding feature ensures accuracy by recording the rounding difference separately in the accounting entries. This improves clarity and helps businesses maintain compliant bookkeeping practices. For countries that no longer use small currency denominations, or for businesses that prefer simplified cash handling, Odoo’s automated cash rounding provides a reliable and efficient solution. It minimizes manual corrections, reduces errors, and supports smoother financial operations across invoices and payments.

To read more about How to Configure Cash Rounding in Odoo 18 Accounting, refer to our blog How to Configure Cash Rounding in Odoo 18 Accounting