Monitoring a company’s financial performance is essential for business sustainability, and among the most crucial tools for this purpose is the Profit and Loss report. In Odoo 18, the Accounting module has been enhanced to offer more precise, dynamic, and user-friendly financial reporting features that help businesses of all sizes analyze their profits and losses with clarity and efficiency.

A Profit and Loss report, also referred to as an income statement, is a comprehensive financial document that summarizes the revenues, costs, and expenses incurred by a company during a specific period. It acts as a mirror reflecting whether the business is running at a profit or a loss. Odoo 18 brings refined capabilities to generate, customize, and analyze these reports, enabling managers, accountants, and stakeholders to make well-informed decisions backed by accurate and real-time financial data.

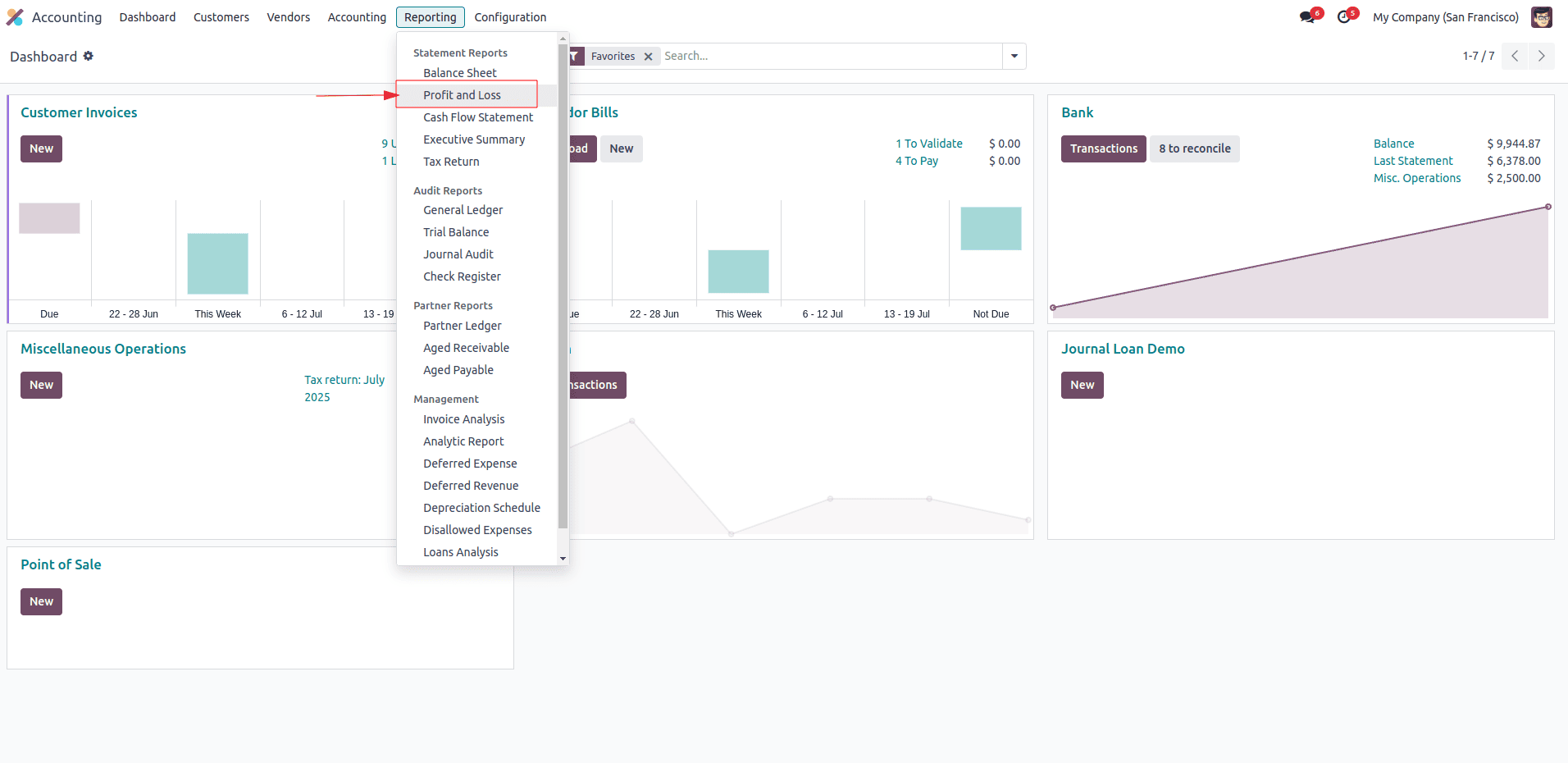

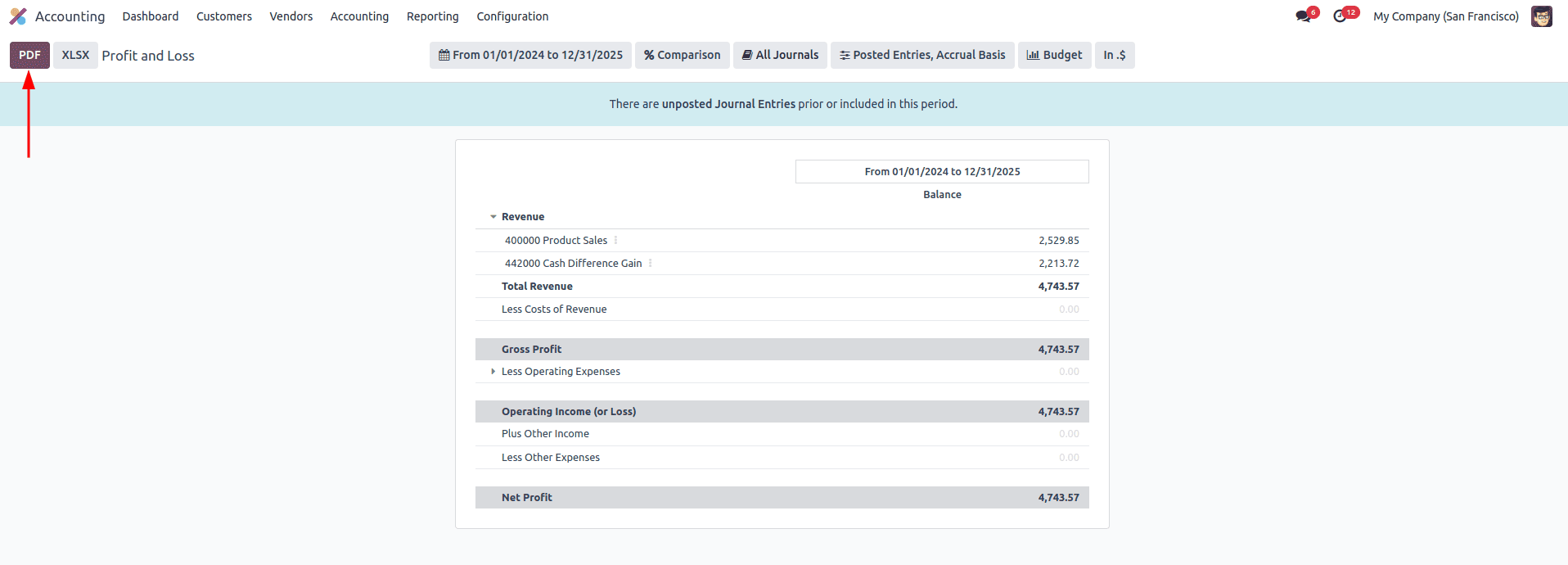

Accessing the Profit and Loss report in Odoo 18 is simple and seamless. Users can navigate to the Accounting module and select the 'Reporting' tab, where the Profit and Loss option is available.

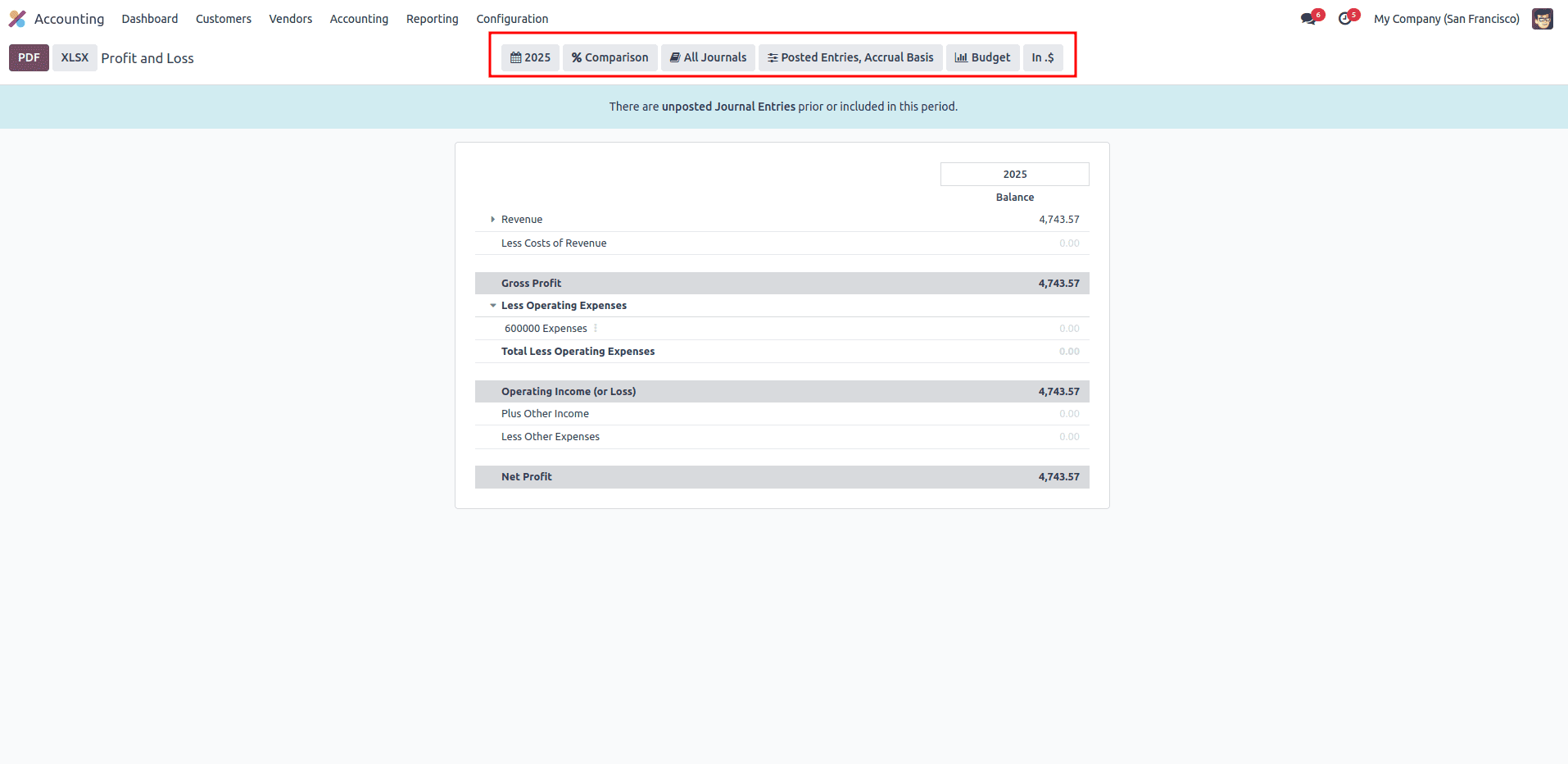

Once accessed, the report is automatically generated based on the default period, typically the current fiscal year. However, Odoo provides full flexibility to change this timeframe based on specific business needs. Users can generate the report for a month, quarter, year, or even for a custom-defined period. This flexibility is particularly useful for businesses that operate on non-standard fiscal calendars or need to analyze performance during particular events or campaigns.

To better understand the Profit and Loss report in Odoo 18, it’s important to grasp the meaning of key financial terms as they are used within the system. Below is a breakdown of these essential terms, explained in the context of how Odoo tracks, calculates, and presents them in the report:

Revenue

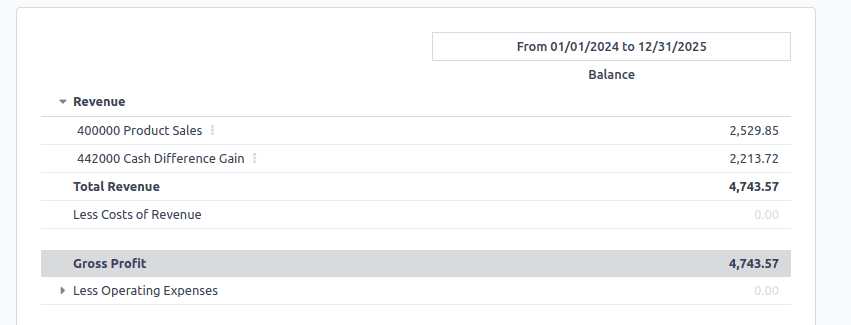

In Odoo 18, Revenue refers to the total earnings generated from the company’s primary business operations, such as the sale of products or services. This data is automatically captured through invoices, sales orders, or point-of-sale transactions. Depending on the configuration of your accounting and sales modules, these transactions post entries into designated income accounts, which are then aggregated and presented in the P&L report.

Gross Profit

Gross Profit in Odoo is calculated by subtracting the Cost of Goods Sold (COGS) from the total revenue. The COGS figure is derived from stock valuation (if real-time inventory valuation is enabled) and purchasing data. It gives insight into the core profitability of the business before accounting for indirect expenses like administration or marketing.

Operating Income

Operating Income shows the company’s earnings from its routine business operations. In Odoo, it is computed by subtracting operating expenses—like salaries, office rent, and depreciation—from the gross profit. These expenses are recorded through purchase bills, journal entries, or the employee expense module, and automatically linked to relevant expense accounts in the Chart of Accounts.

Cost of Sales

Also known as the Cost of Revenue, this section includes direct costs associated with delivering goods or services. In Odoo, these are automatically populated from stock movements, inventory valuation layers, and supplier bills. If perpetual inventory valuation is activated, the costs are journaled in real time, ensuring the P&L accurately reflects up-to-date operational expenses.

Expenses

Expenses in Odoo encompass all indirect costs required to run the business, such as marketing, utilities, staff wages, and professional services. These are typically recorded in expense accounts through purchase journals or miscellaneous entries. Properly setting up the account tags and default accounts in products and vendors ensures accurate reporting.

Depreciation

Depreciation is handled within Odoo using the Asset Management feature. Once a fixed asset, such as machinery or furniture, is created and confirmed, Odoo automatically generates depreciation entries over its useful life according to the configured depreciation method (e.g., straight-line or declining balance). These scheduled journal entries are then reflected under the depreciation line in the P&L.

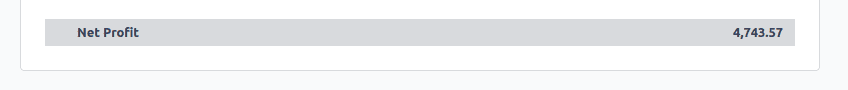

Net Profit

Net Profit is the final result presented in the Profit and Loss statement after all incomes and expenses have been applied. In Odoo, this value is calculated based on all posted entries for the selected reporting period. It represents the business’s actual gain or loss and serves as a critical measure for evaluating performance, making investment decisions, or planning future budgets.

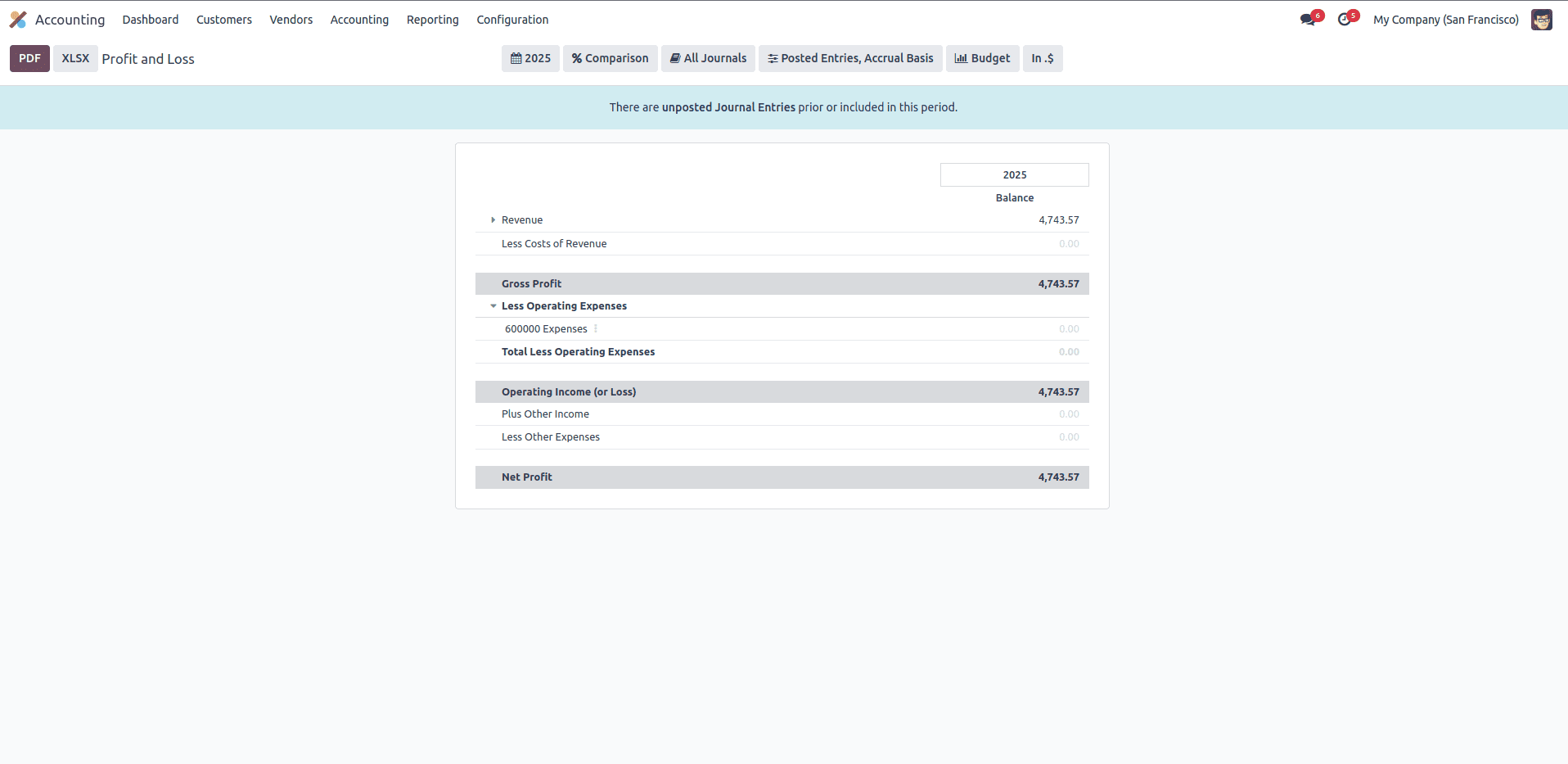

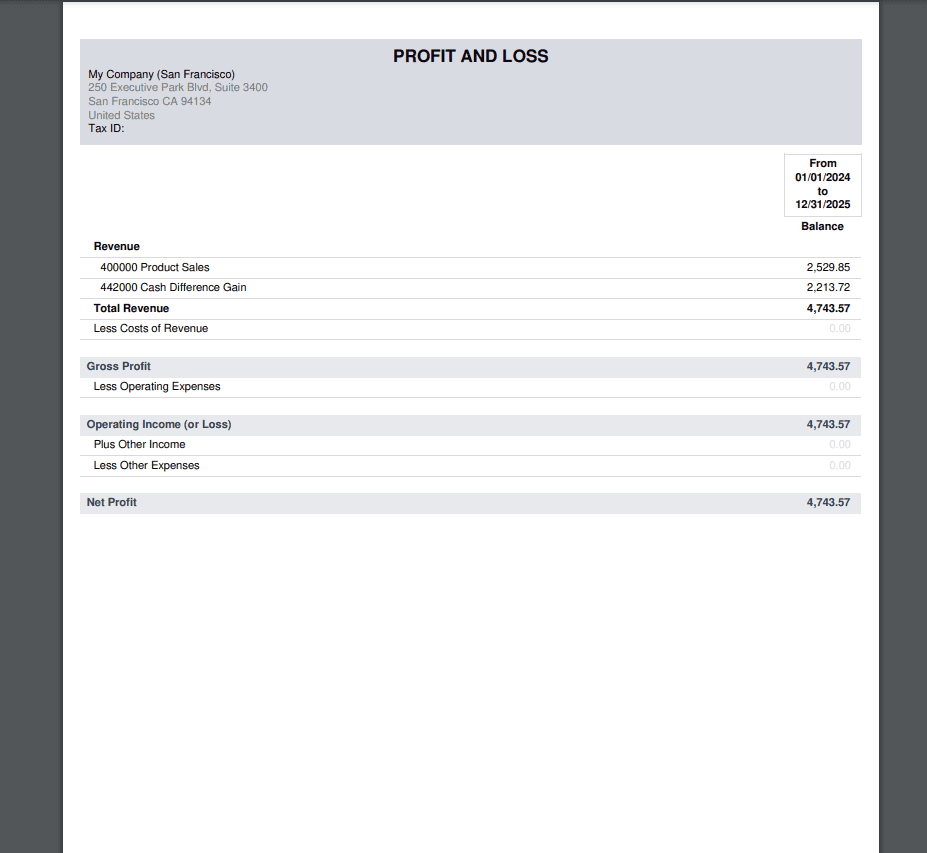

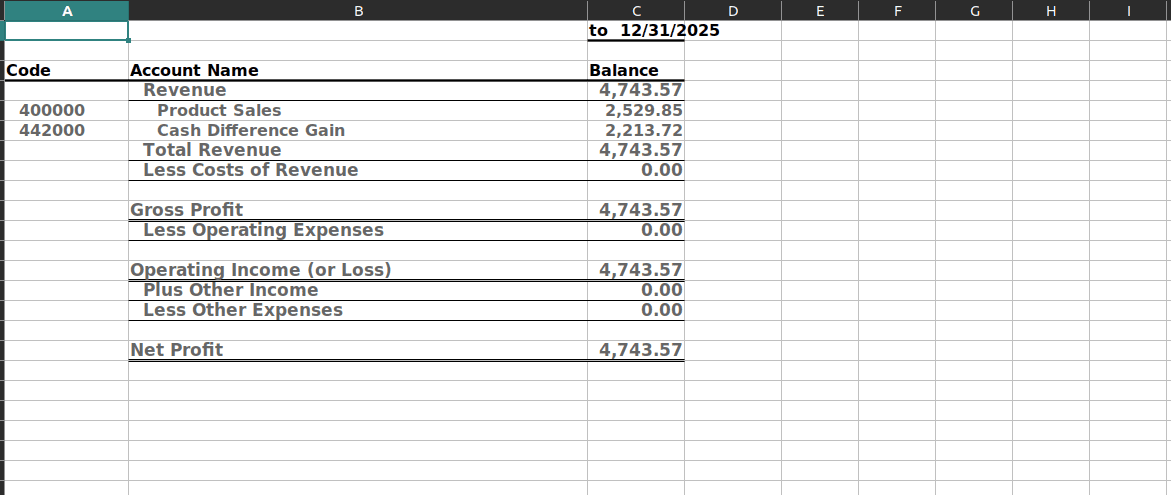

The structure of the Profit and Loss report in Odoo 18 is laid out in a clear, categorized manner. At the top of the report, revenue figures are displayed—this includes the total income the company has earned from its primary business operations, such as selling products or delivering services. Following this, the cost of goods sold, which includes expenses directly related to the production or procurement of those goods and services, is shown. By subtracting the cost of goods sold from the revenue, Odoo calculates the gross profit, giving an immediate sense of the company’s operational profitability.

Further down the report, users can review the company’s operating income, which is determined by accounting for day-to-day operational expenses such as employee salaries, office rent, utilities, and depreciation. These figures give insight into how effectively a company is managing its internal operations. Additional income or miscellaneous expenses not directly tied to core operations are also included, such as interest income or foreign exchange differences.

At the bottom of the report lies the most critical indicator, the net profit or loss, calculated by subtracting all expenses from the total income. This figure ultimately tells whether the business is profitable during the selected period.

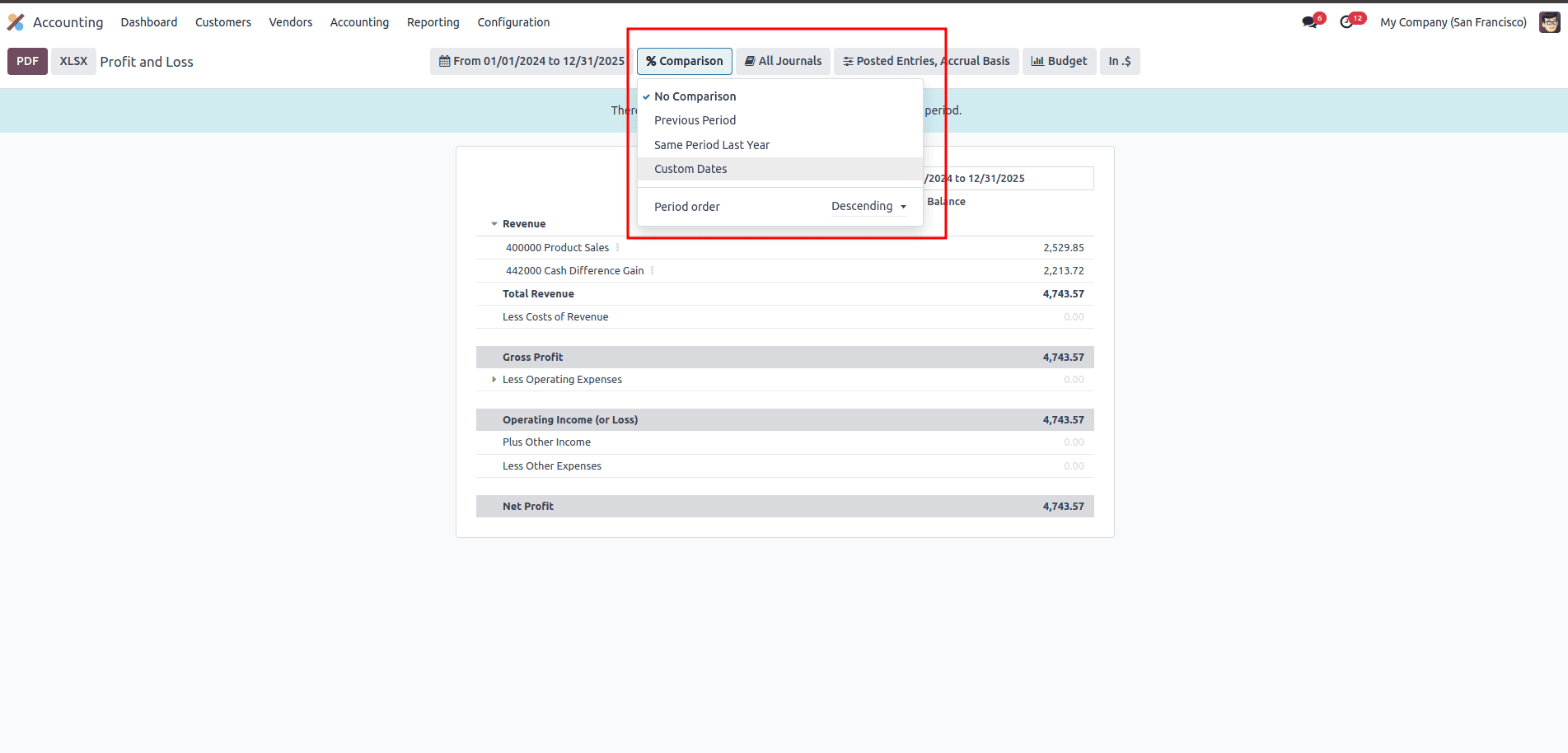

Odoo 18 enriches financial analysis by offering built-in comparison tools. Users can compare Profit and Loss reports across different timeframes, such as comparing the current month with the previous month, or analyzing the same period in the previous year. This feature is particularly useful in evaluating growth trends, seasonal fluctuations, or the impact of strategic decisions taken during a specific quarter. The comparison can be easily set by selecting the desired periods using the “Compare” option. Once applied, the report is updated to reflect differences, making it easy to identify financial patterns and evaluate whether the company’s financial trajectory is improving or declining.

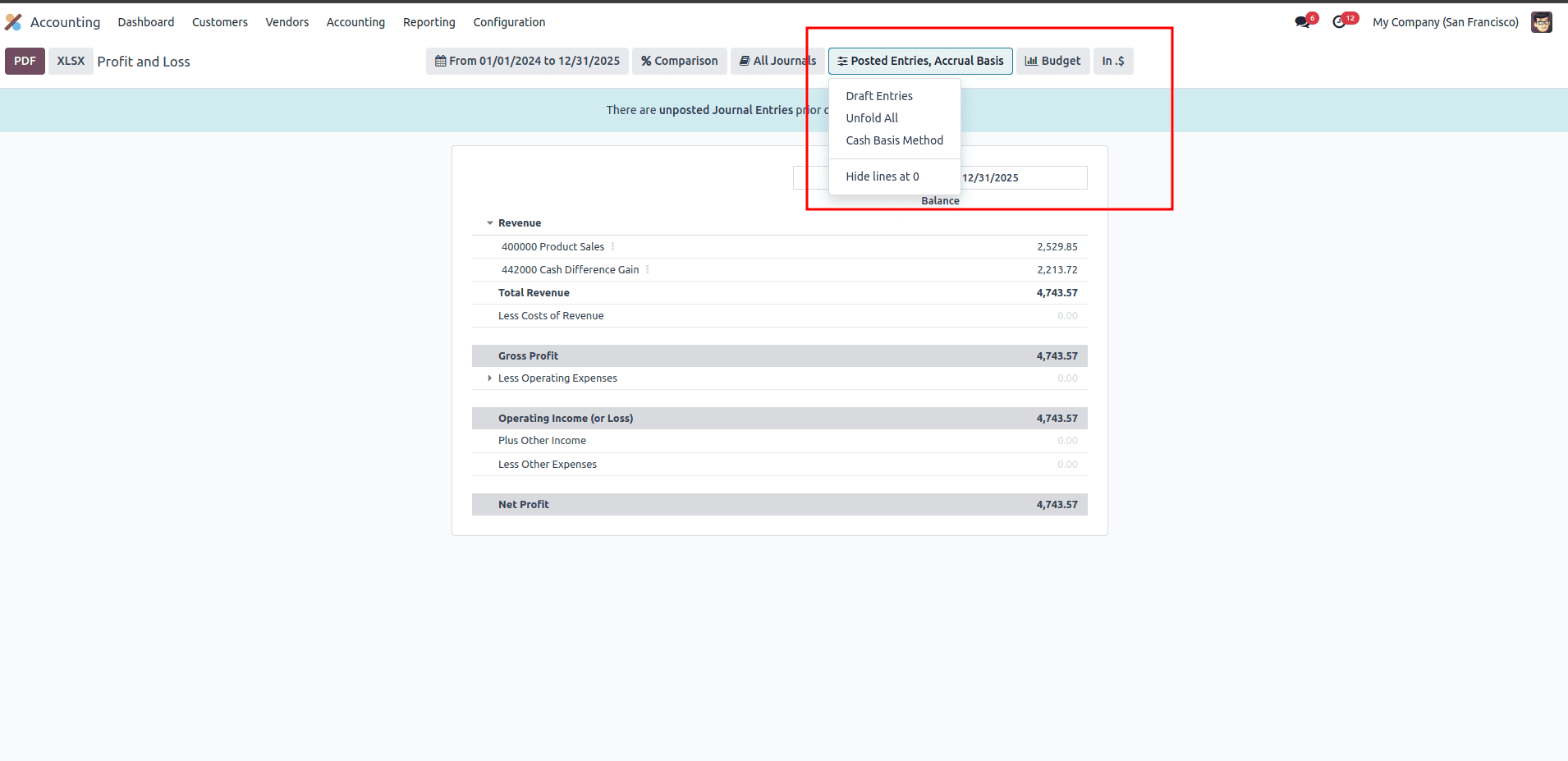

Moreover, Odoo 18’s P&L reporting offers advanced customization options to suit different accounting practices and internal policies. Users can select between cash basis and accrual basis accounting depending on how they want revenues and expenses to be recognized. The system also allows the inclusion or exclusion of unposted entries, helpful when forecasting or reviewing draft records.

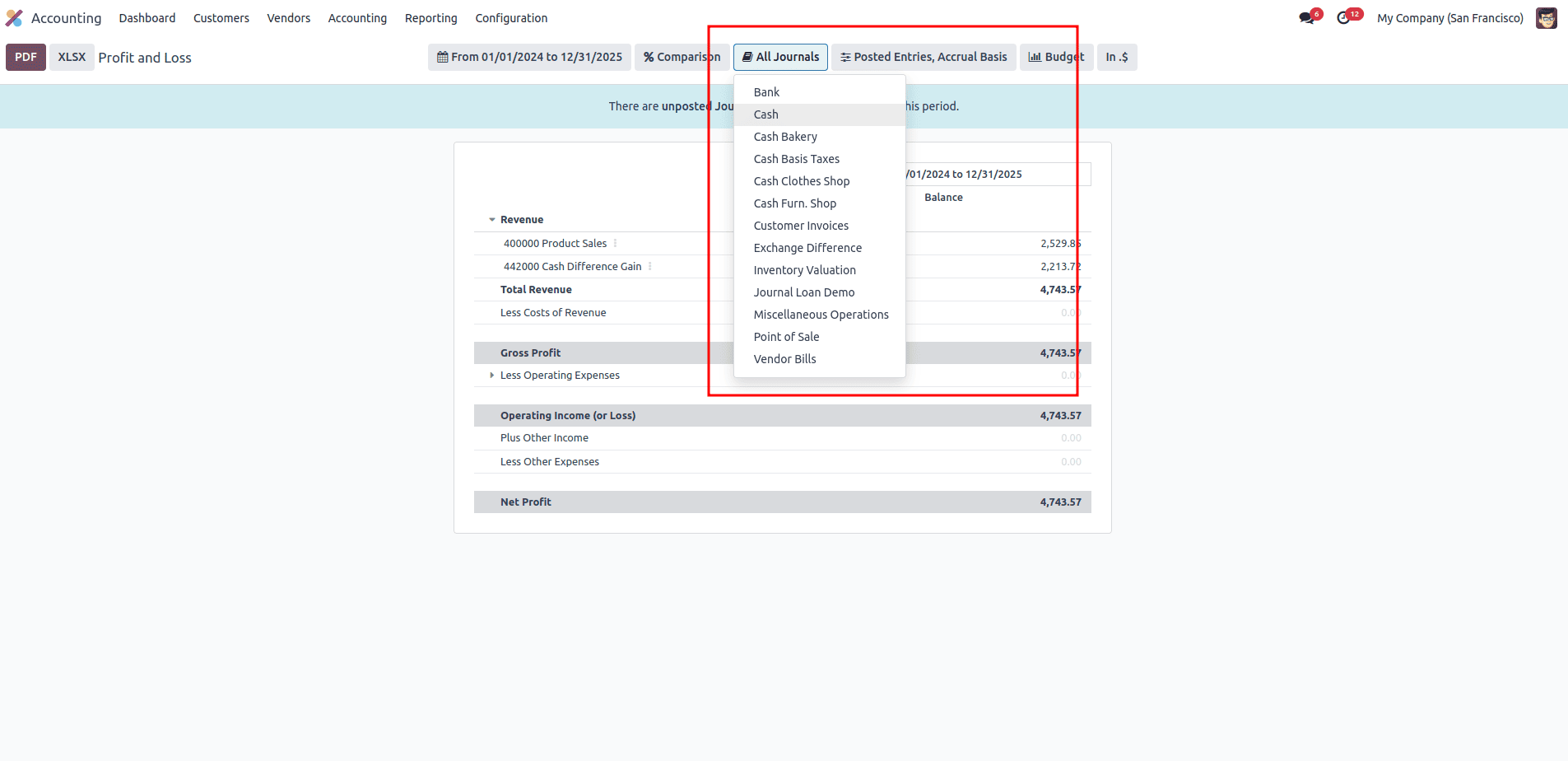

Another powerful feature is the ability to filter the report based on specific journals, such as focusing solely on sales transactions or analyzing costs linked to particular operational units. The system’s support for account hierarchies and subtotals ensures that financial data is organized in a clear and logical manner, enhancing the readability of the report.

In addition to viewing the report on-screen, Odoo 18 supports professional print and export options. Users can generate a print preview to visualize how the report would appear in a printed document. The report can be exported as a PDF for sharing with external stakeholders or printed for physical filing.

For deeper analysis or integration with external financial models, users can also export the report to Excel format. All customizations, filters, date ranges, and comparison views, are retained in the exported versions, ensuring consistency and clarity in reporting.

The practical applications of Odoo’s Profit and Loss report are extensive. Business managers rely on it to evaluate operational efficiency, while finance teams use it to prepare for audits, tax submissions, and budgeting. Investors and shareholders review the P&L statements to assess the financial viability and growth potential of the company. Furthermore, the insights derived from these reports serve as the foundation for planning future business strategies and optimizing resource allocation.

In conclusion, the Profit and Loss report in Odoo 18 offers a complete, flexible, and user-friendly way to monitor a company’s financial performance. With the ability to generate real-time reports, compare historical data, apply advanced filters, and export professional documents, Odoo equips businesses with the tools they need to manage profitability with precision. Whether you are aiming to improve margins, control expenditures, or simply stay compliant with financial reporting standards, Odoo 18’s P&L functionality delivers the clarity and control necessary for sound financial management.

To read more about An Overview of Odoo 18 Accounting Reports, refer to our blog An Overview of Odoo 18 Accounting Reports.