Storno accounting, also known as reversing entries or reversing accounting entries, is a critical practice within the field of accounting that ensures accurate and transparent financial reporting. It involves the creation of entries that reverse the effects of a previous transaction in the subsequent accounting period. Storno entries are typically made at the beginning of a new accounting period and serve to correct errors, facilitate accurate reporting, and simplify the overall accounting process.

Correcting errors or changes made during the preceding accounting period is the main goal of storno accounting. For instance, storno entries are used to undo the consequences of original entries when an error was made in recording them or when an accrual was made in a prior period that needs to be undone. As a result, the financial records' integrity is preserved and accurate data is provided in the financial statements.

Storno entries are distinguished by the sign that is the exact opposite of the original entry. The storno entry will be a credit if the initial entry was a debit, and vice versa. The accounts are restored to their original condition using this method, as if the mistaken entry never happened. As a result, the financial statements for the current period appropriately reflect the company's actual financial situation.

By removing the requirement for human adjustments while creating financial statements, reversing entries further streamline the accounting procedure. Accounting professionals would have to manually reverse earlier period accruals or prepayments without the use of storno entries, which could be laborious and error-prone. These modifications are automated through the use of storno entries, lowering the possibility of errors and enabling accountants to concentrate on more difficult jobs.

When accruals, deferrals, or estimations that were recorded at the end of the prior period are no longer applicable in the current period, storno accounting is particularly helpful. A storno entry would reverse the projected expense and replace it with the real expense, for example, if an estimated expense was entered for the previous month but the actual amount is known in the current month.

A key method known as storno accounting guarantees the effectiveness and accuracy of financial reporting. To fix mistakes and streamline the accounting process for modifications made in the prior period, reversal entries are created. Businesses may retain precise financial records, deliver trustworthy financial accounts, and streamline their accounting processes by using storno entries.

Storno accounting, a brand-new feature in Odoo 16, records all reverse entries as negative credits or debits. In a business, there are frequently a number of situations when reversals occur for various causes. If the journal entry is made manually, there may be a chance for errors when accounting transactions are reported. For instance, the journal entry could contain incorrect information regarding the amount, tax, accounts, or accounting date. So, reversing is required to correct this. Another illustration would be the reversal of bills through the use of credit notes and refunds. These are all examples of a type of reverse journal entry that may be made for various purposes. As a result, the credit and debit values in such entries are treated negatively by storno accounting.

The Storno Accounting system is widely used in Eastern European countries. Numerous countries, including China, the Czech Republic, Croatia, Poland, Romania, Russia, Serbia, Slovakia, Ukraine, etc., require the use of storno accounting.

They think storno accounting is the best technique for undoing negative debits and credits in journals so that the accounting system doesn't include duplicate data. Reversals can occur for a variety of reasons, including discovering faults in the initial transaction or needing to apply the reimbursement for returned products, etc. This accounting technique is sometimes referred to as Red Storno since bookkeepers typically use red ink to write Storno entries. All of these things will be highlighted in red in the accounting reports.

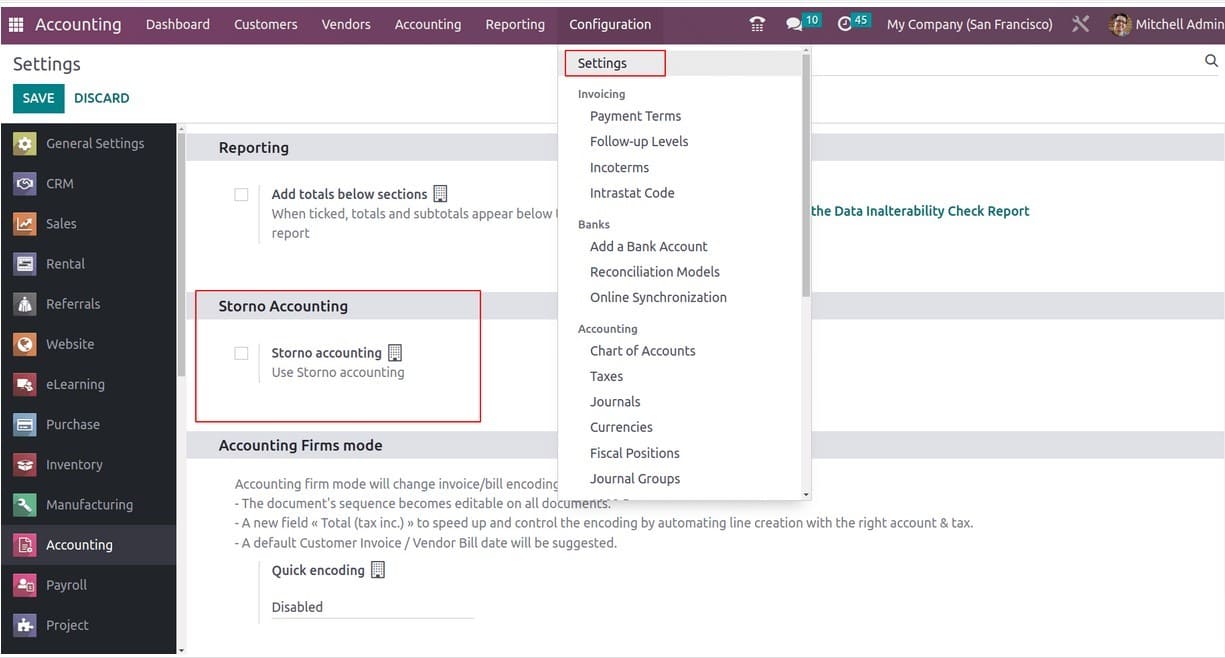

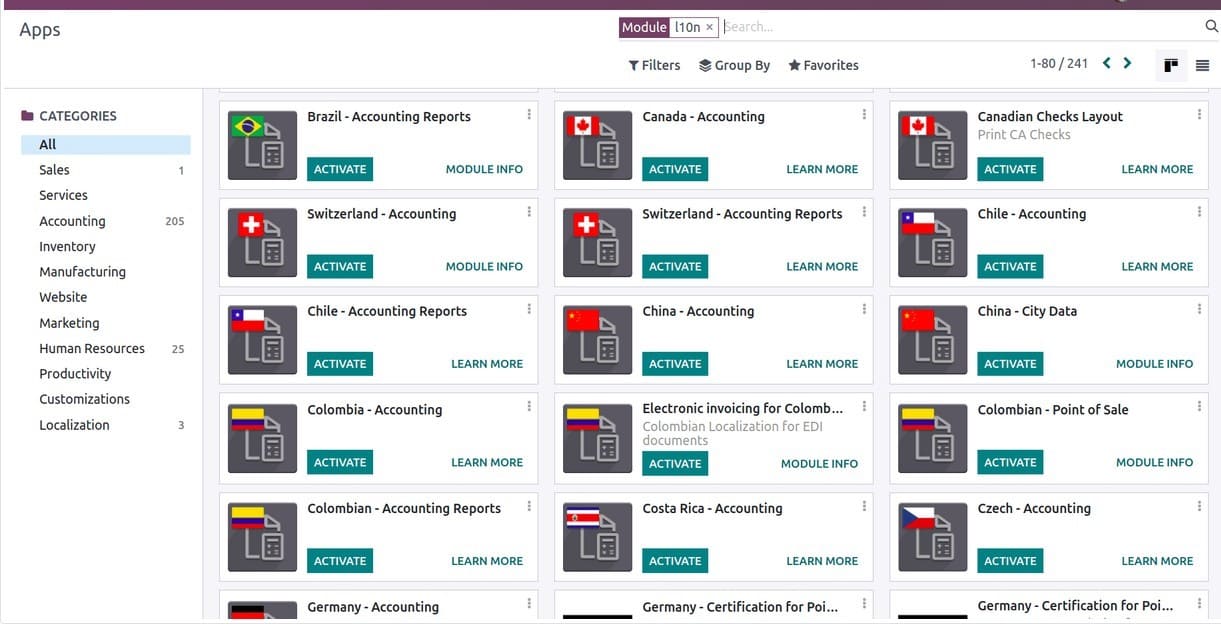

The 'Storno Accounting' option enables Odoo Accounting to utilise the storno accounting features in Odoo 16. For use in all of those nations, Odoo offers a wide range of fiscal localization packages. When you conduct a search in Odoo Apps, you can find the localization packages.

Some nations may employ this storno accounting, and one can activate the appropriate accounting localization package based on their country. So, if necessary, they can also turn on the storno feature.

Let's see how ledgers are being impacted by these entries now. Imagine a situation when a sale is returned. Therefore, a negative credit and debit are recorded for the reversed amount. Even stock journal entries and accounting journal entries are subject to these negative credits and debits. Since the stock reversal is also a part of the reversal process.

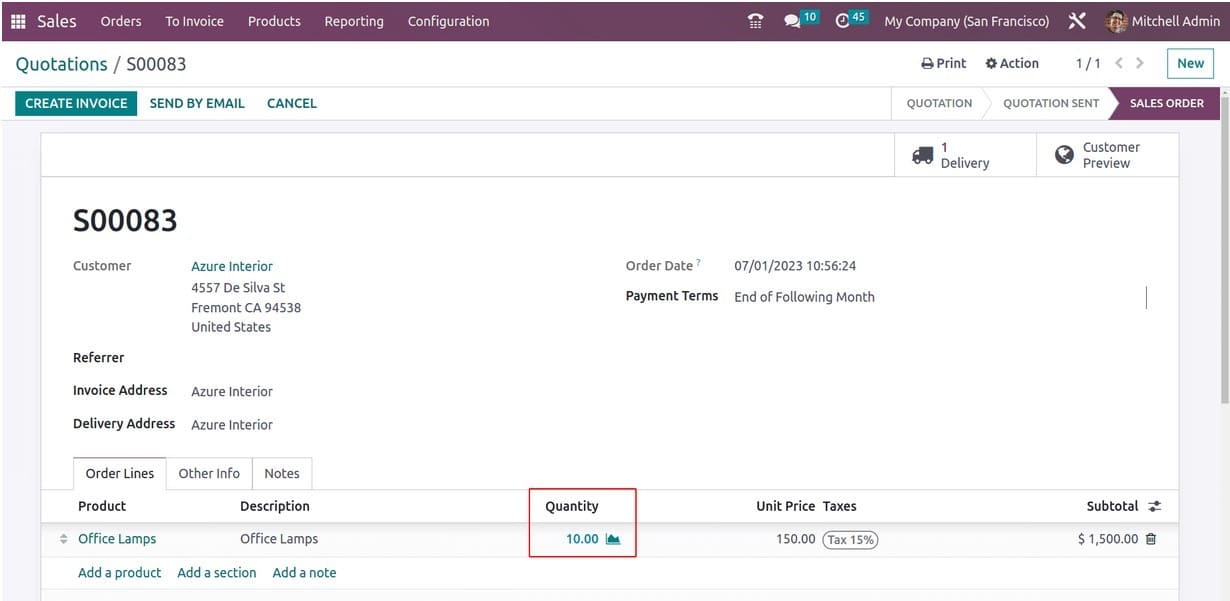

Create a sales order for a product now with 10 quantities requested by the customer.

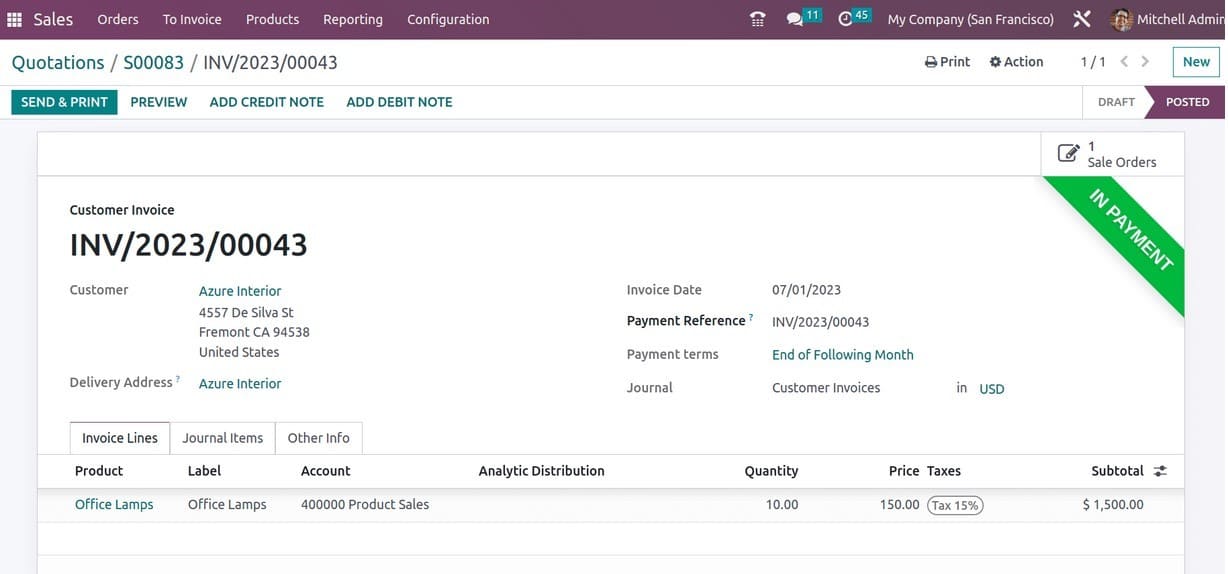

Now that the invoice is ready to be sent, we can do so (depending on the policy for invoicing). Now that the customer has already made a payment, the invoice is emailed to them.

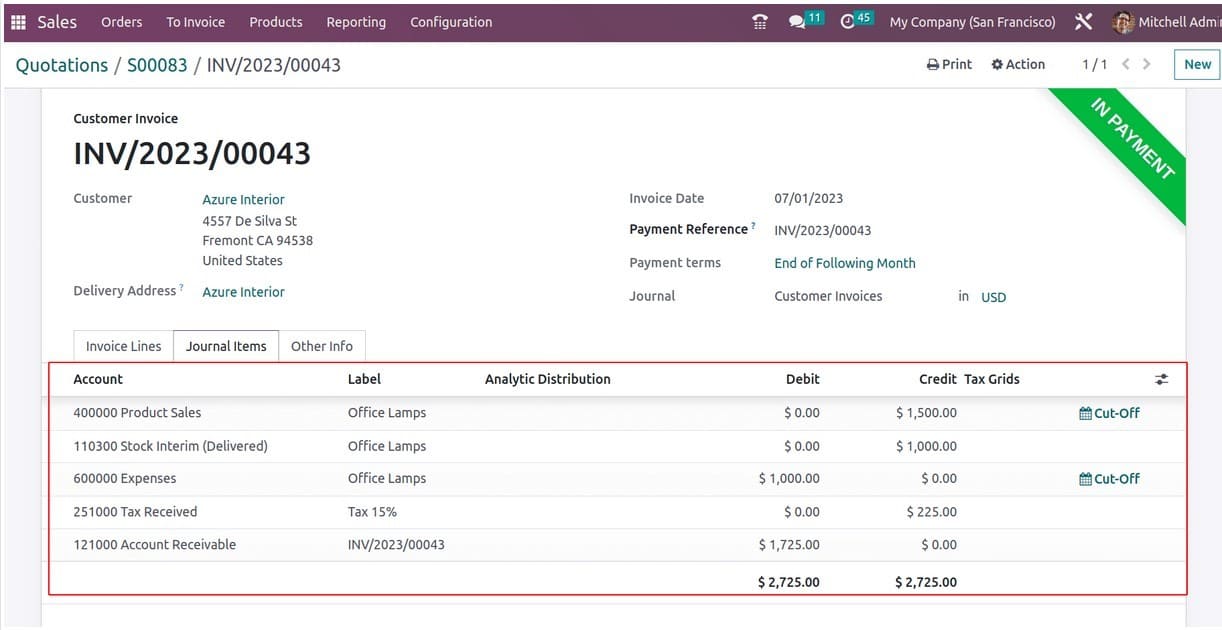

We can see the ledger posting to the appropriate accounts in the journal Items tab.

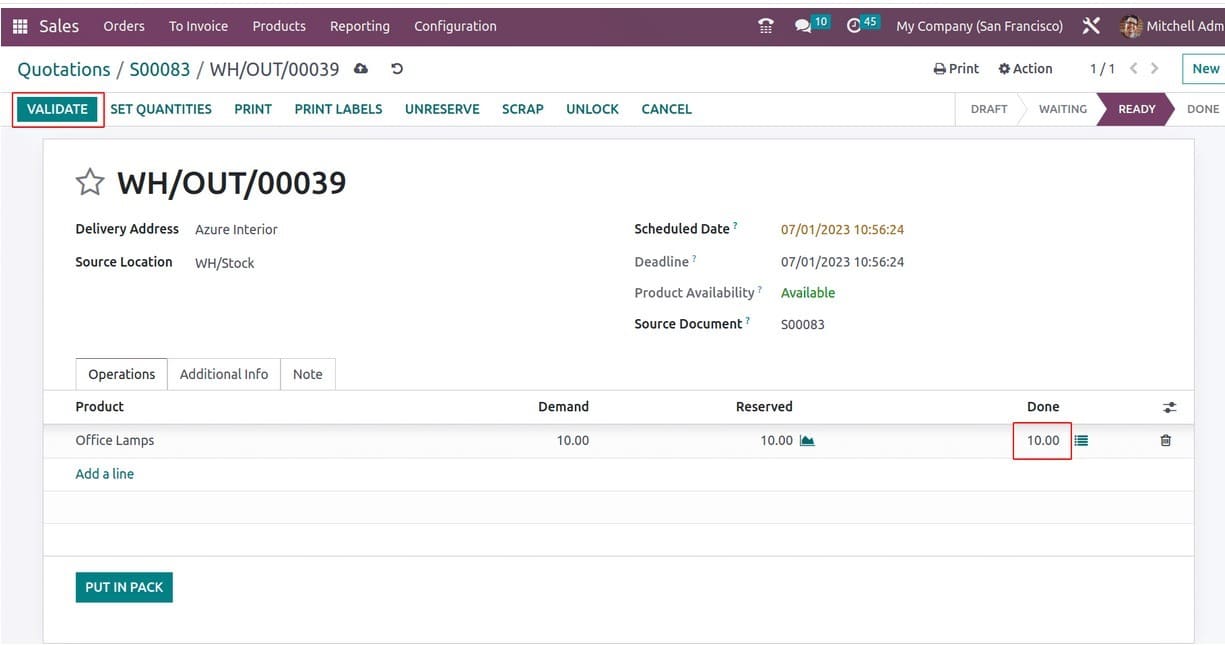

And as per the customer's request, 10 quantities are delivered to the customer.

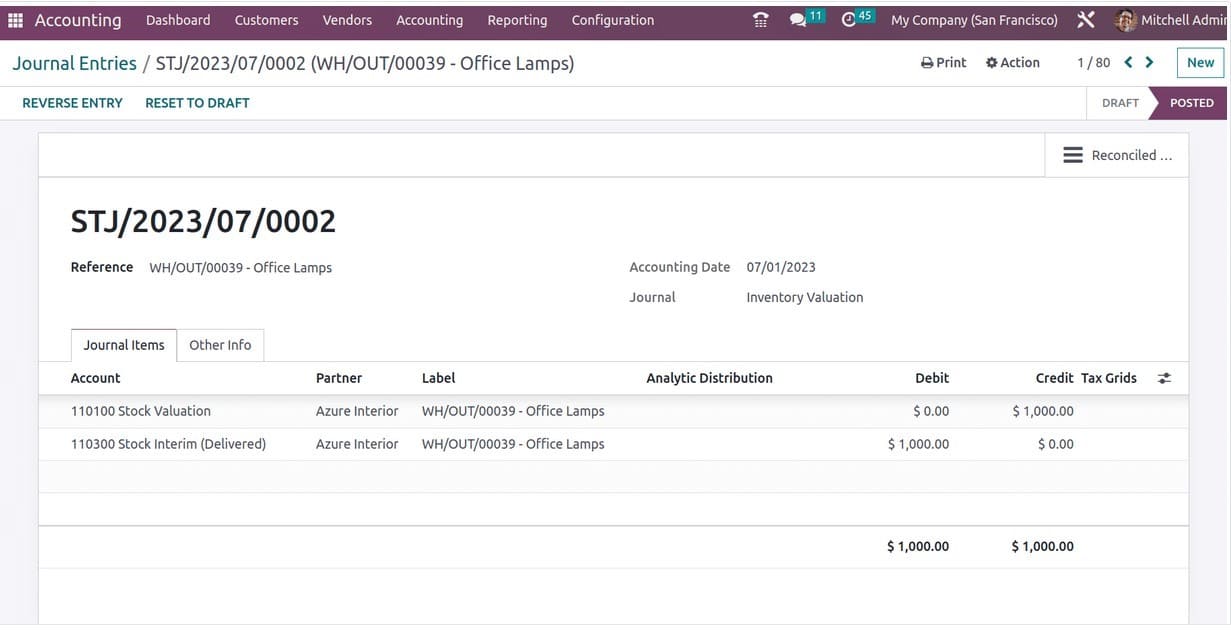

Let's look at the stock journal entries for the delivery. Here, the stock valuation account is debited and the stock output account is credited. This marks the status as DONE and the product will move from the stock to the customer. Product delivery may be completed after a few days because it depends on the customer's lead time.

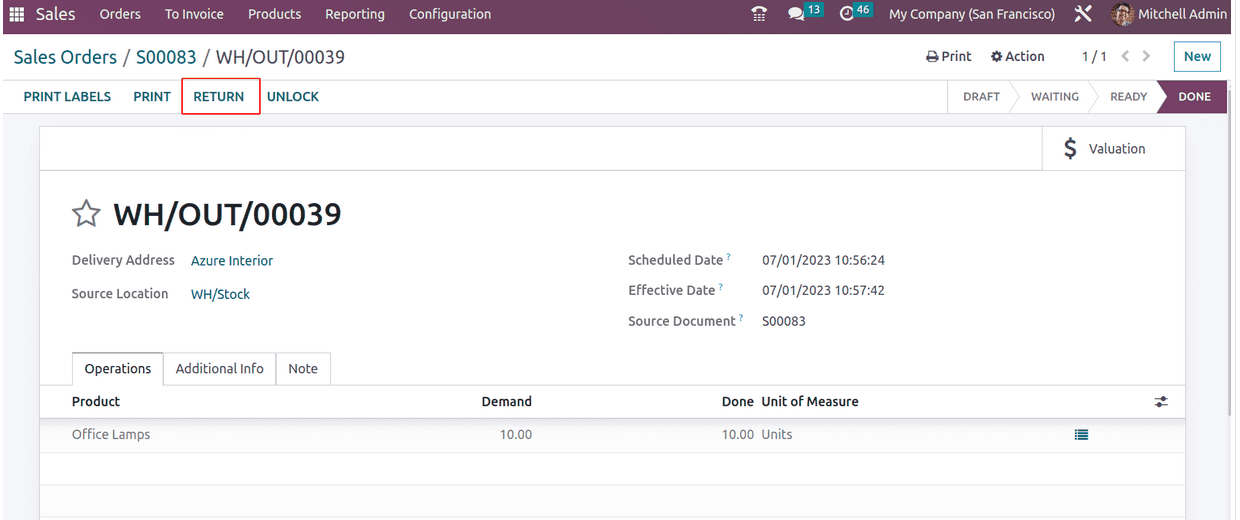

Let's say the customer discovered that two of the workplace bulbs are not functioning. He can then send the harmed item back to the business.

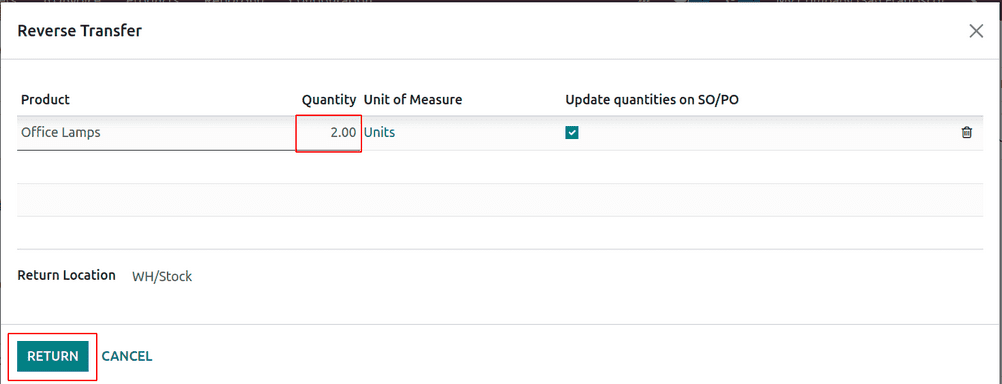

You can return the item using the return option. When the RETURN button is clicked, a pop-up window will open where users can specify how much the client is returning. Here, 2 units are returning. To add 2 to the quantity, click RETURN.

In addition to validating the return, this will generate a return transfer.

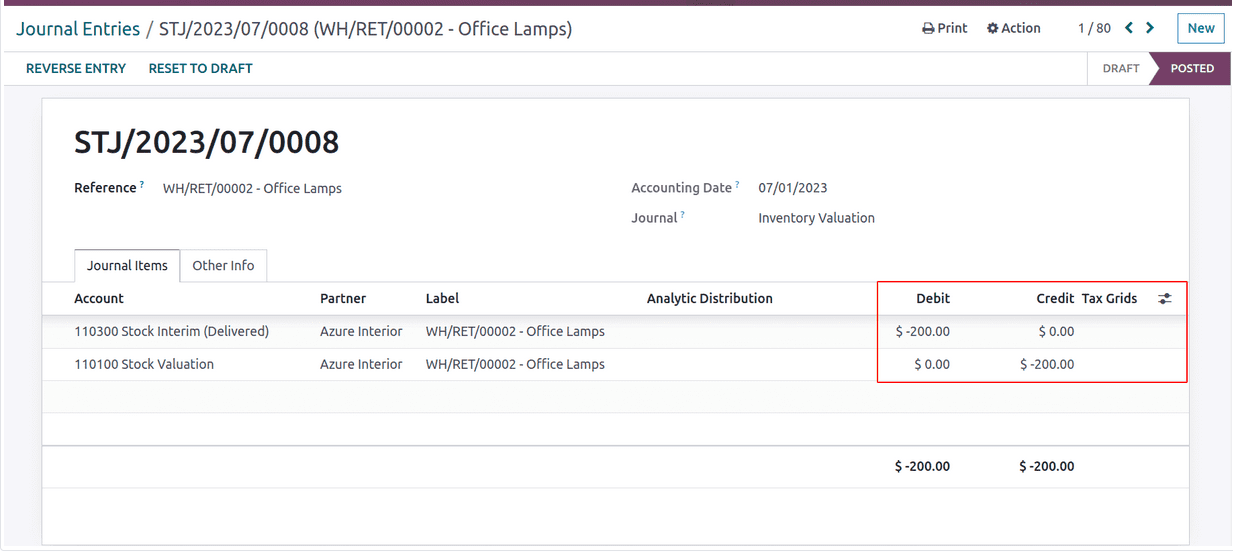

The stock valuation is in -(Credit) instead of Debit, and the affected values in the interim delivered stock are -(Debit) instead of credit

This is how the stock journal's reversal journal entries are impacted. The business must now reimburse the customer for the amount they have already paid. So, for that, create a credit note.

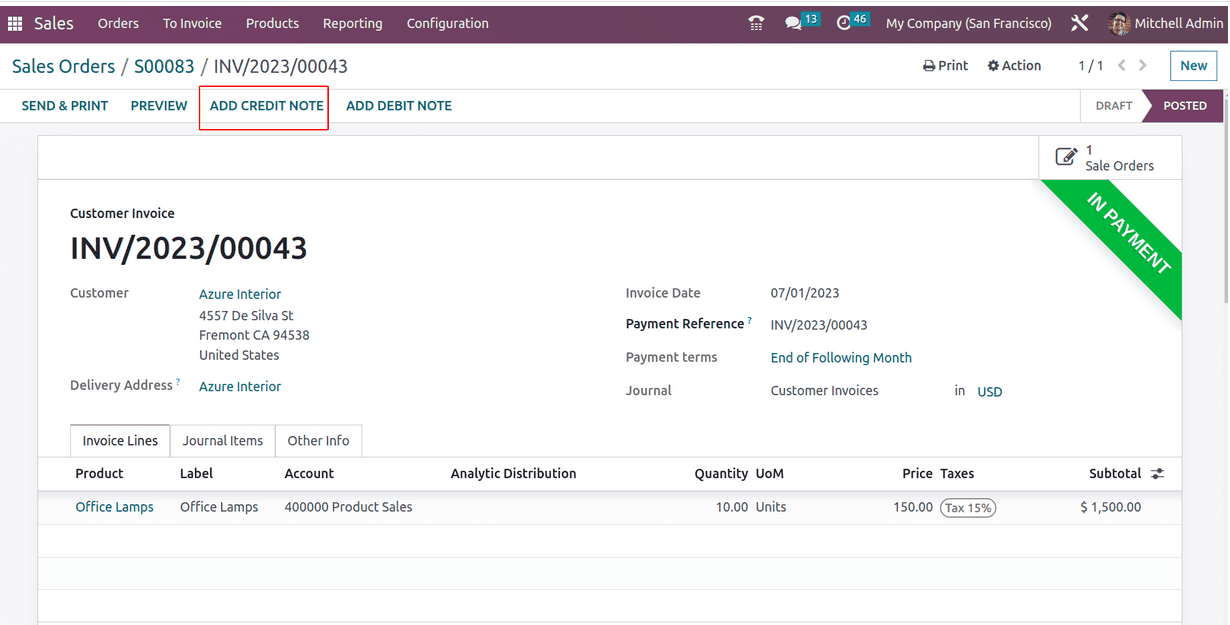

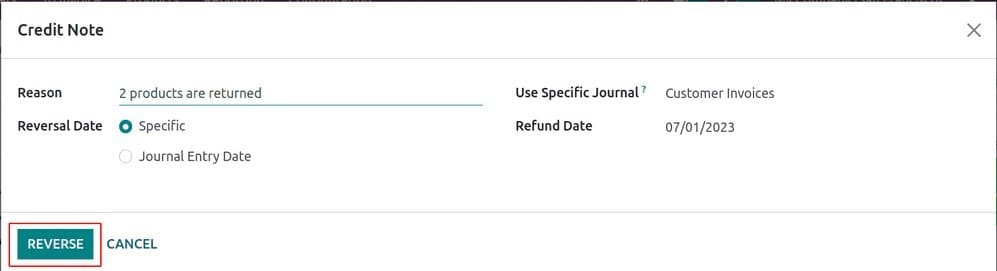

When you click input CREDIT NOTE, a pop-up window where you may input the reason for credit denial and create a reverse invoice appears.

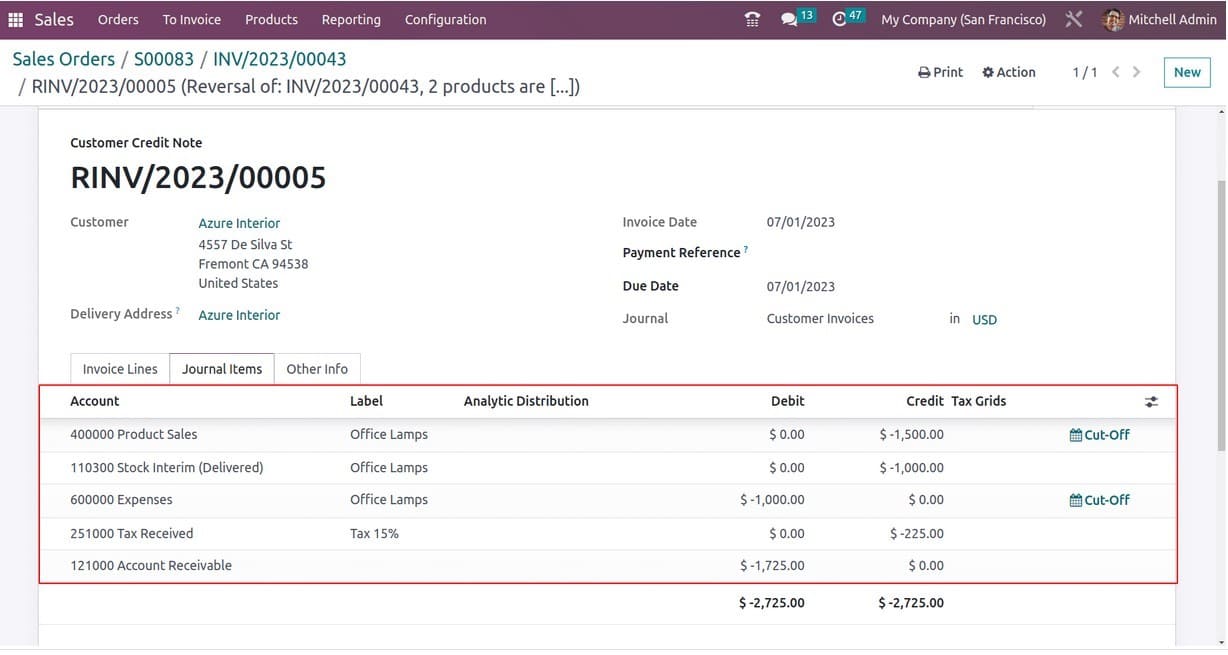

Let's now examine the reverse invoice's ledger.

Here, the income account is shown as -(Credit) rather than debit, and all other accounts are shown as negative.

In general, when an invoice is generated, the income accounts are credited while the accounts receivable are debited, and when the invoice is reversed, the income accounts are both credited while the accounts receivable are both debited. However, for the reverse entry in Storno accounting, the Account Receivable will be a "-ve" Debit and the Income Account a "-ve" Credit.

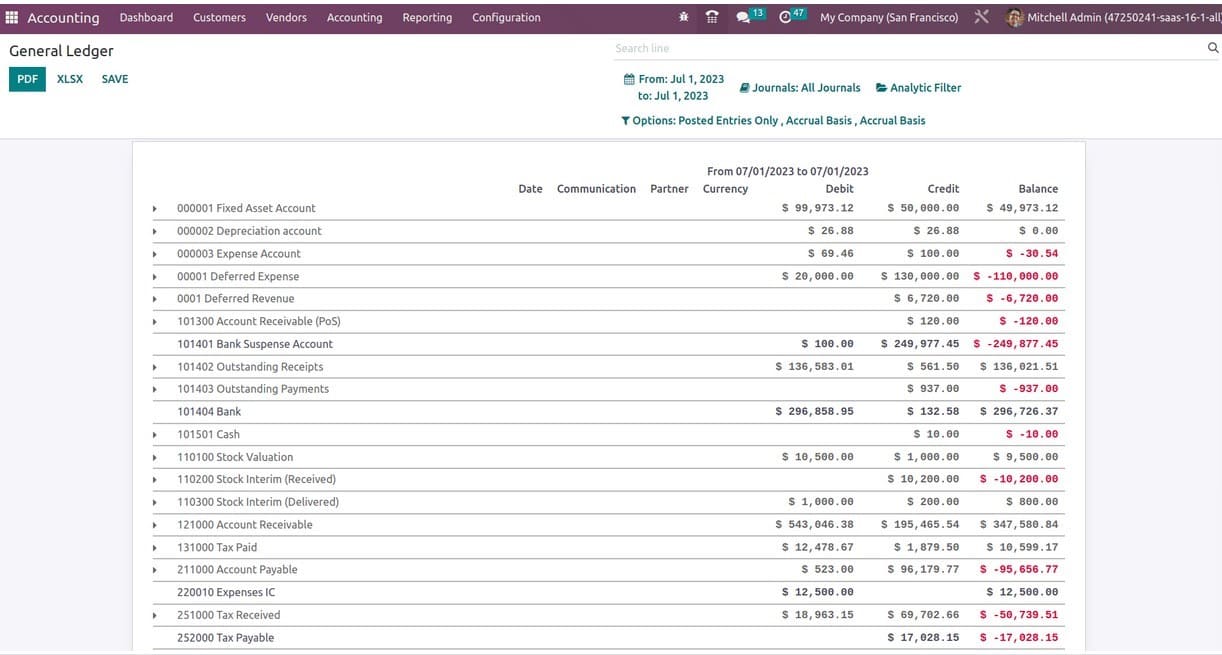

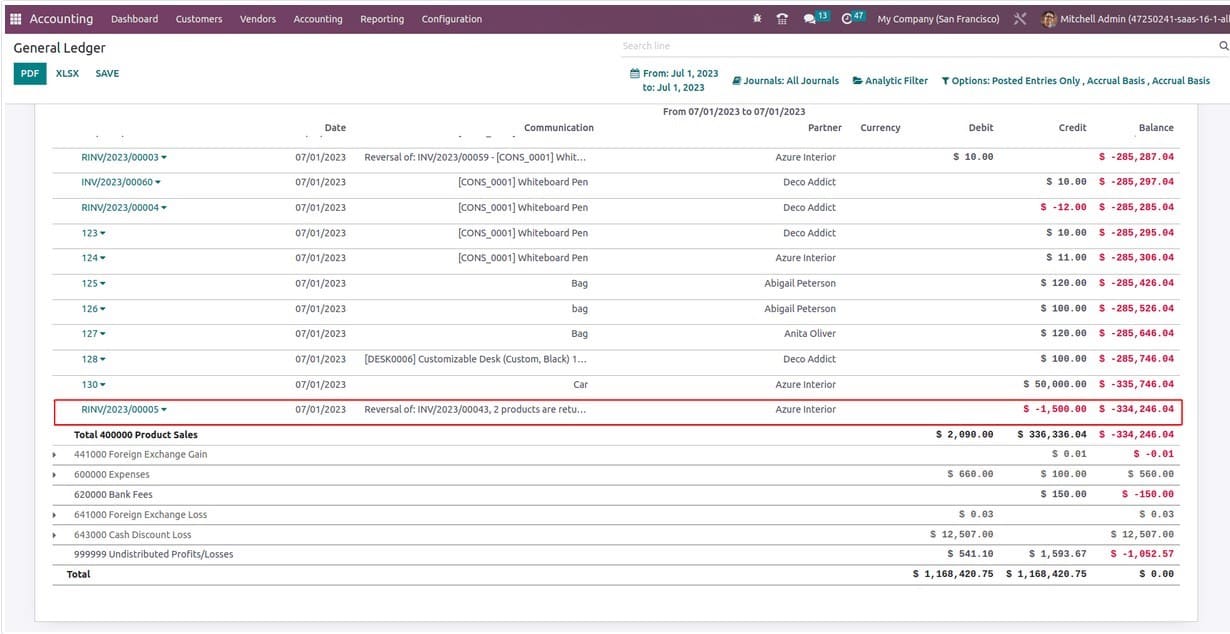

Additionally, this will appear negatively and in red colour on the accounting reports. You can locate all the balance amounts with negative amounts shown in red on the general ledger report.

To examine the corresponding journal entries in each account, one can unfold the accounts.

As a result, storno accounting is another method of accounting whereby accountants record reversal entries in the negative and highlight them in red to make them easier to spot.