The government-imposed tax for selling services and goods is a Sales tax. It varies from product to product and state to state, unlike GST or VAT. A national sales tax system does not exist in the United States, and indirect taxes are inflicted at the subnational level. As per the US constitutional guidance, each state contains the power to apply its tax or sales for citizens. The tax rates vary in the US per state, and Alabama is one of the sales tax destination spots. In Alabama, sales tax occurs according to the rate buyers ship to the location. You can manage the sales tax of Alabama by running an Odoo ERP software.

This blog provides you to configure sales tax in Alabama(US) using Odoo 16 Accounting.

Tax management of company sales in Alabama was made easy through the Odoo Accounting application. It is to apply a specific percentage of sales tax for a particular state within the Tax feature of Odoo 16. Let's see the process of developing sales tax in Alabama(US) in the Odoo ERP.

Basic Information on Sales Tax in Alabama

We must focus on essential details to register a sales tax permit in Alabama. A few of these include facts about personal or business identification, start date, a local tax of a specific country, Nexus activities, and more. Alabama contains a Sales tax rate of 4% for products and services in a firm. It would be best if you had a nexus to collect tax on this state. The physical and economic nexus is the two ways sellers are tied to a state.

Sufficient tangible presence in a state to pay the sales tax means a Physical nexus. In contrast, the progress of the economic threshold of a state's total transactions is referred to as the Economic nexus. The physical nexus applies to a seller who owns any retail store, warehouse in a state, and presence of salespeople. Economic nexus is available for the vendor who makes more than $250000 in the annual sales of a particular state. Most services in Alabama are untaxable, and an individual must deal with sales tax of products related to various services in an organization.

How to Create Sales Tax for Alabama in Odoo 16 Accounting?

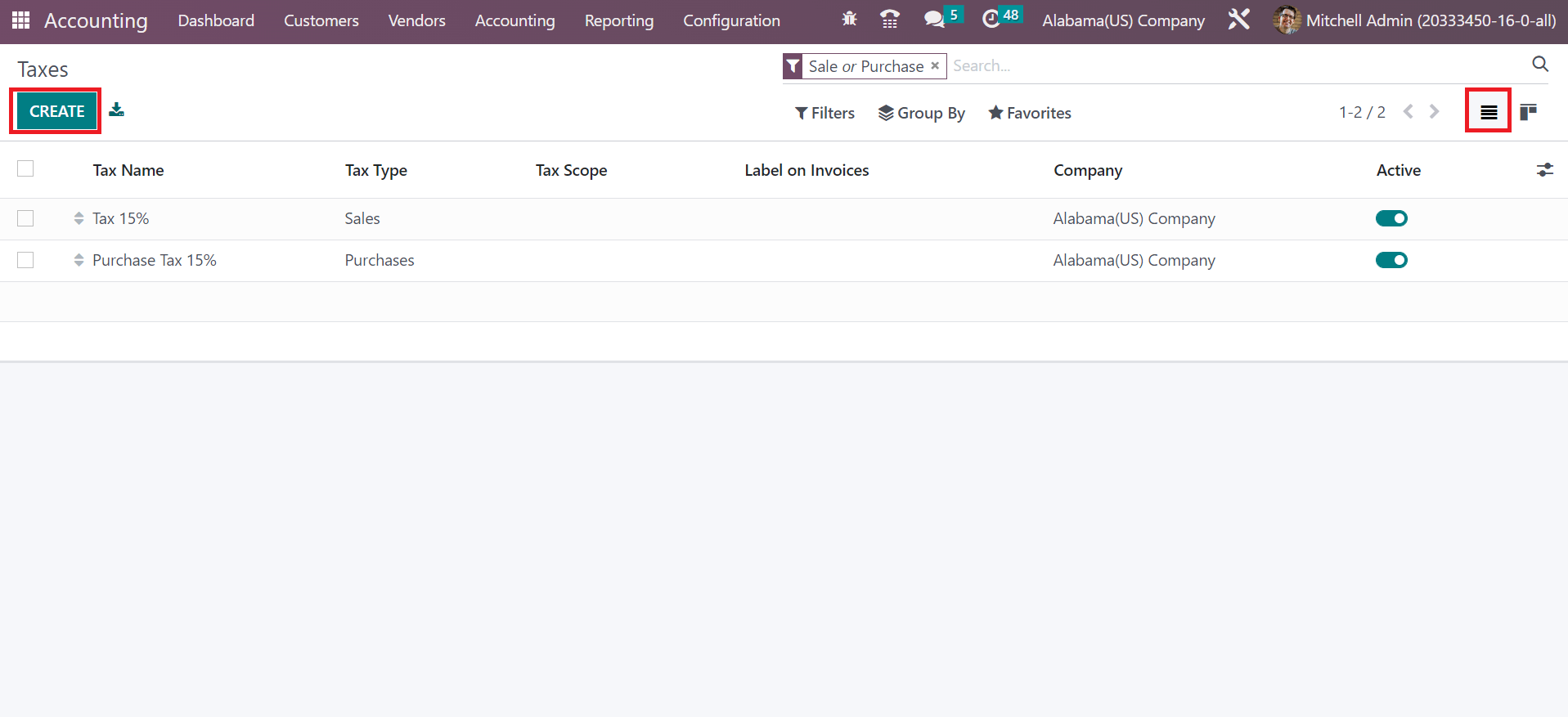

The sales tax rate of Alabama ranges from 4% with a maximum rate of 7%. On the other hand, local sales tax rates are considered as due varies widely. Users can generate a new sales rate by selecting the Taxes menu in the Configuration tab. Information about each tax, including Tax Type, Company, Label on Invoices, and more, are obtainable to the user in the List view. To develop a new tax, click the CREATE button in the Taxes window, as depicted in the screenshot below.

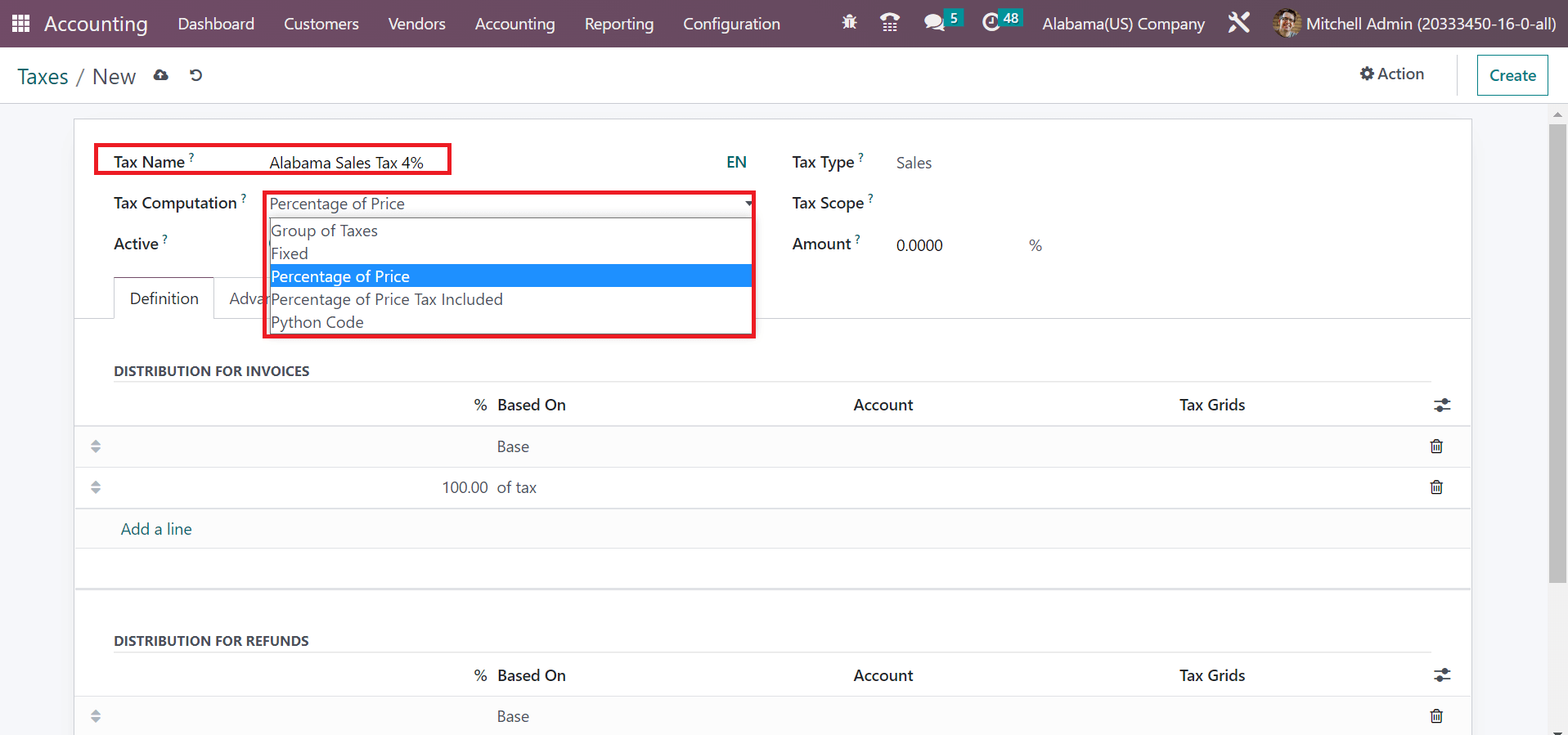

In the new window, add the name of the tax in the Tax Name field. We entered the Tax Name as Alabama Sales Tax 4% in the Tax Name field. Users can configure the tax in various ways, including Group of Taxes, Fixed, Python Code, Percentage of Price, and more, as defined in the screenshot below.

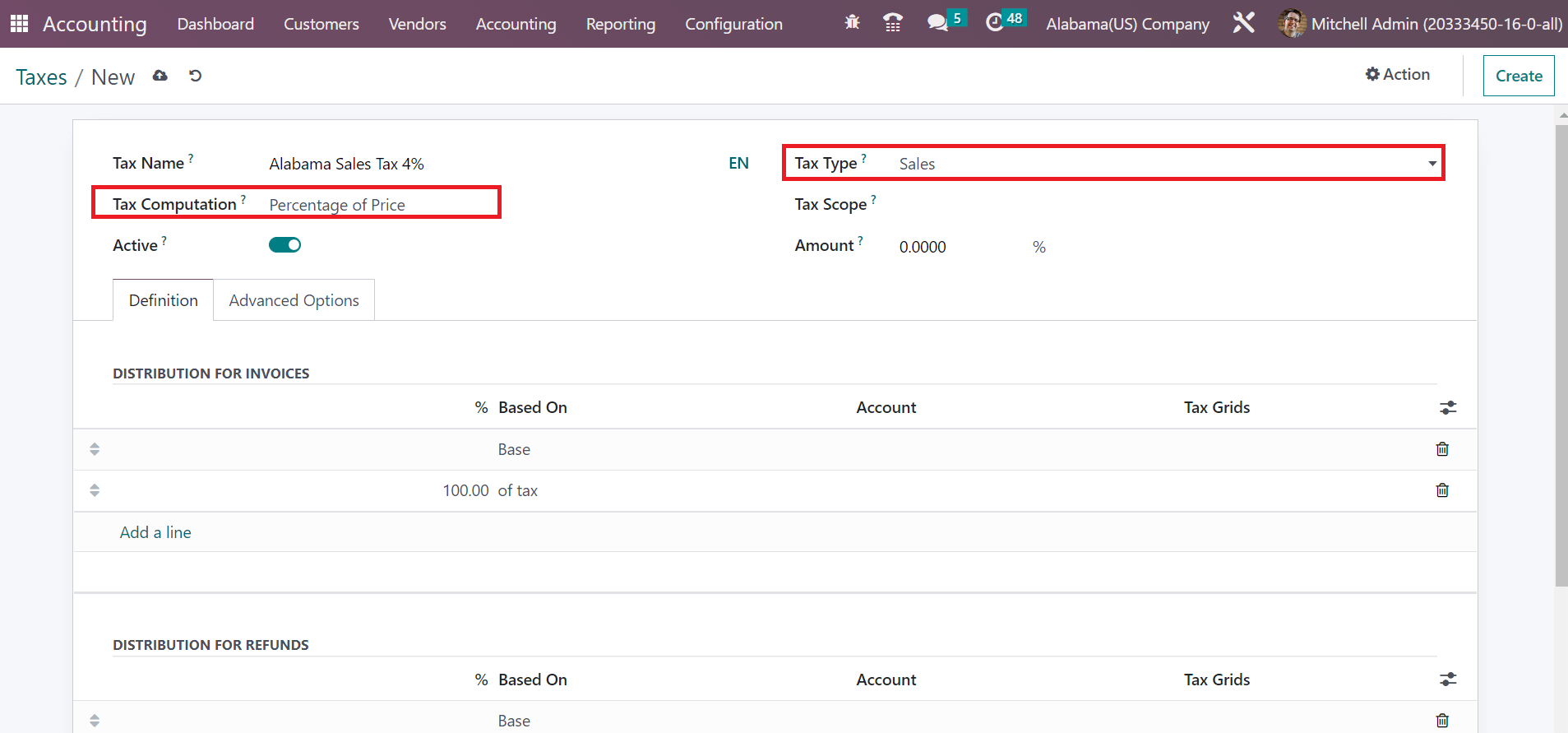

The tax amount becomes the price percentage after choosing the Percentage of Price option in the Tax Computation field. After selecting the specific tax computation method, choose your type of tax in the Tax Type field, which classifies as Sales, None, and Purchase. So, you need to pick the Sales option inside the Tax Type field, as mentioned in the screenshot below

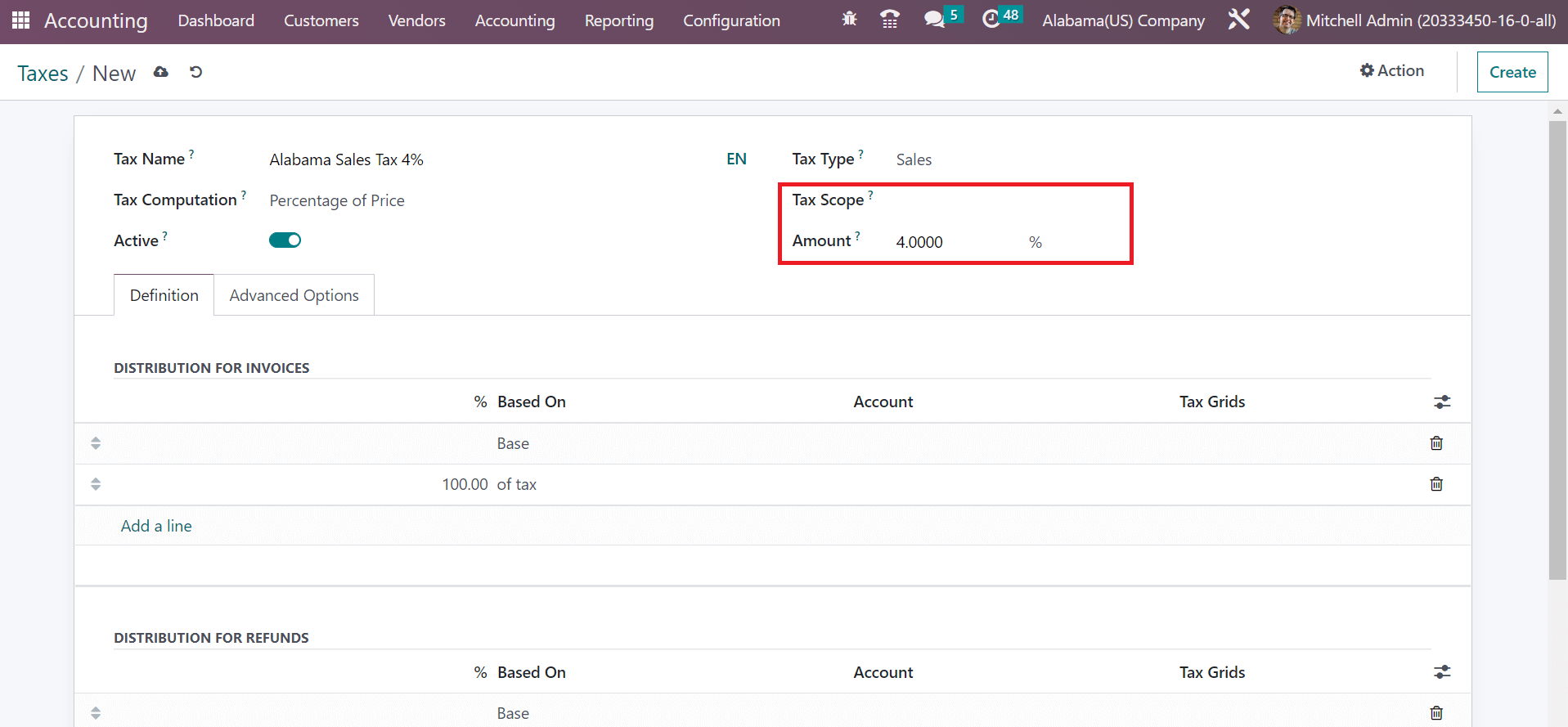

Next, we can apply the particular scope of tax in the Tax Scope field, which categorizes as Products or Services. The tax scope restricts the use of taxes for specific product types in Odoo. Afterward, specify your tax amount in percentage within the Amount field, as marked in the screenshot below.

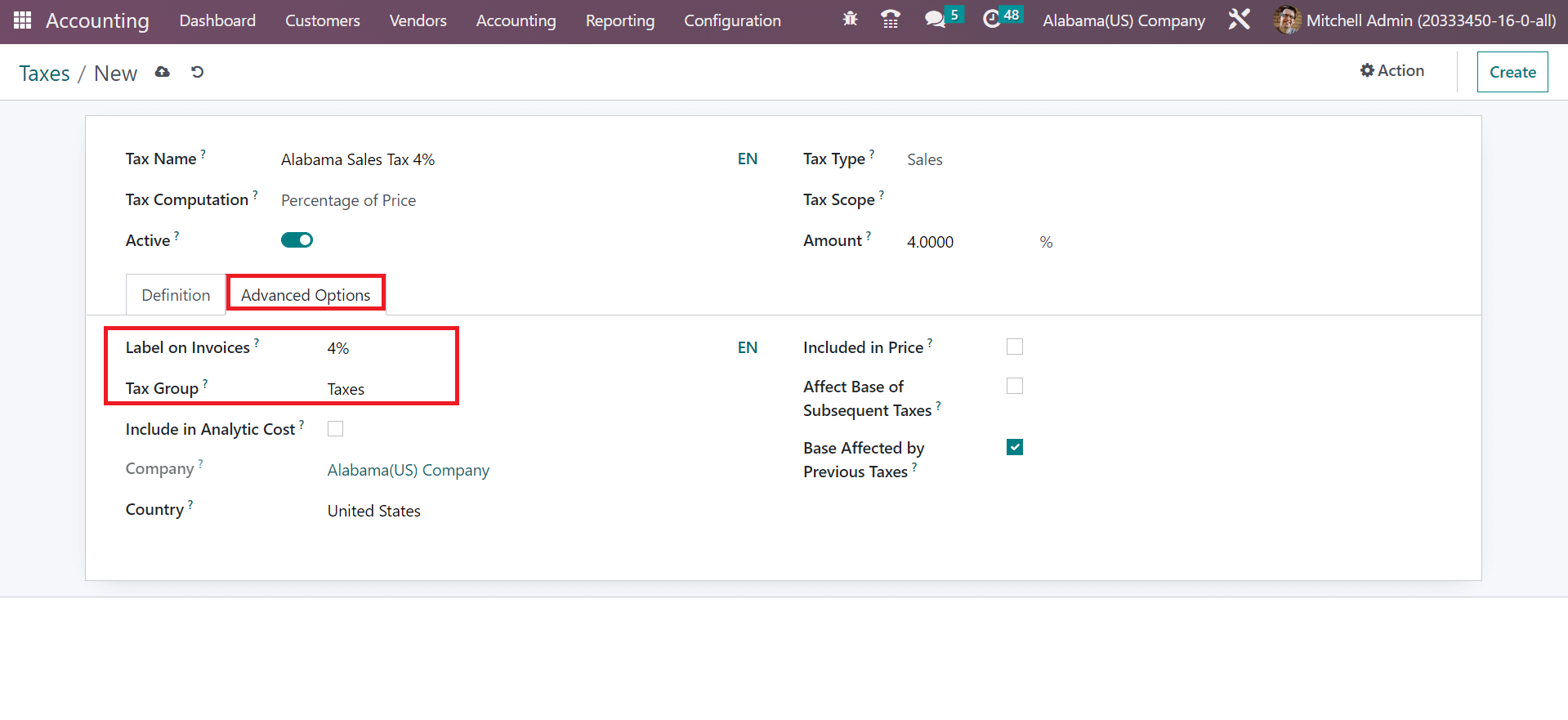

Here, we add 4% in the Amount option for the Alabama Sales Tax 4%. Users can manage the advanced settings of tax under the Advanced Options field. The tax applied on invoices is visible in the Lable on Invoice field. Moreover, you can set the taxation group in the Tax Group field, as demonstrated in the screenshot below.

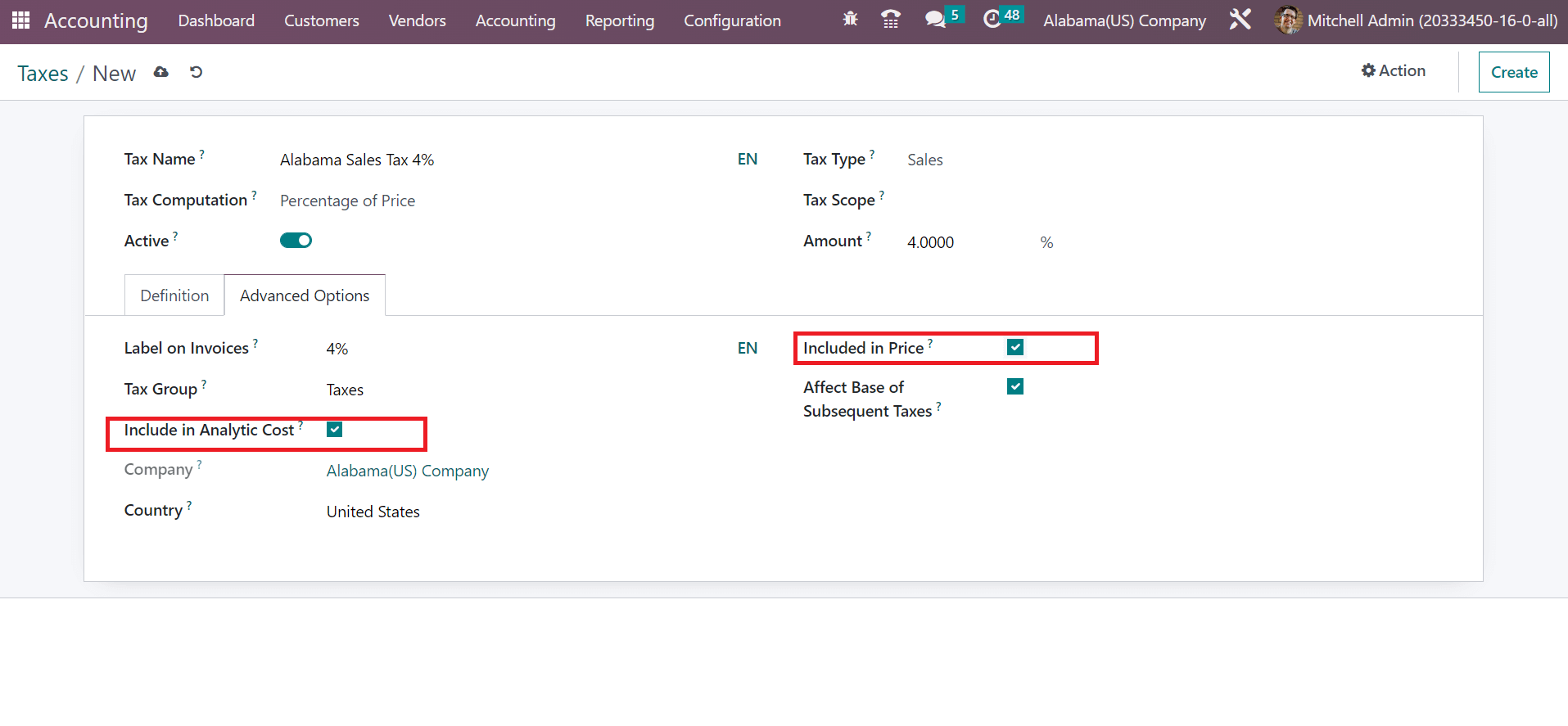

To apply the specific tax on Analytic Cost, you must activate the include in the Analytic Cost field. Similarly, you need to enable the Included in Price option if the amount you use on products or services is included in your tax.

Your details about tax are saved automatically within Odoo 16 is different than Odoo 15. Next, we can apply the Alabama(US) Sales Tax on a customer invoice.

To Apply Alabama Sales Tax on a Customer Invoice in the Odoo 16

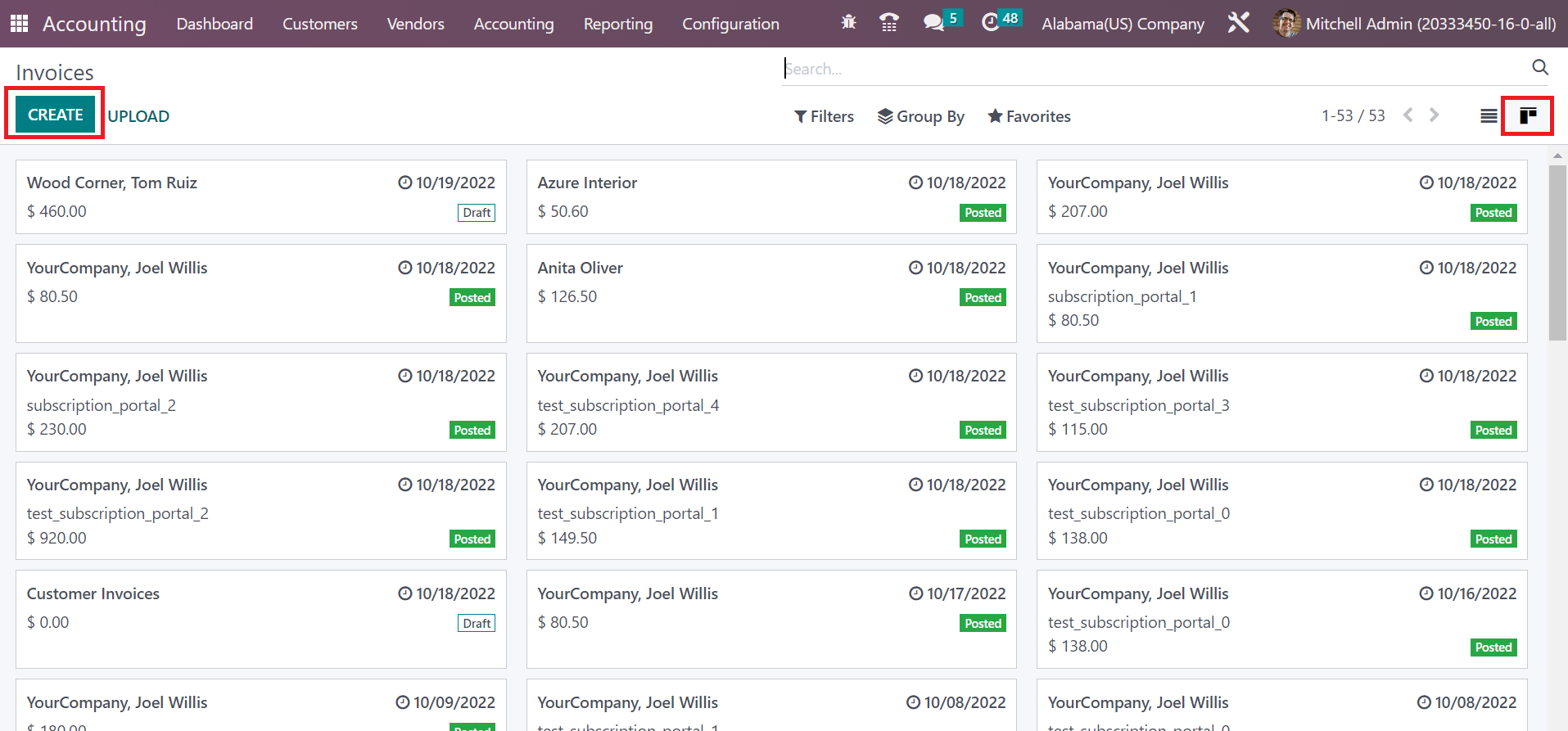

Users can generate a custom invoice by selecting the Invoice menu below the Customers tab. In the Kanban view, you can find data about each invoice, such as Customer name, revenue, date, status, and more. Select the CREATE icon to formulate a new invoice for a customer, as cited in the screenshot below.

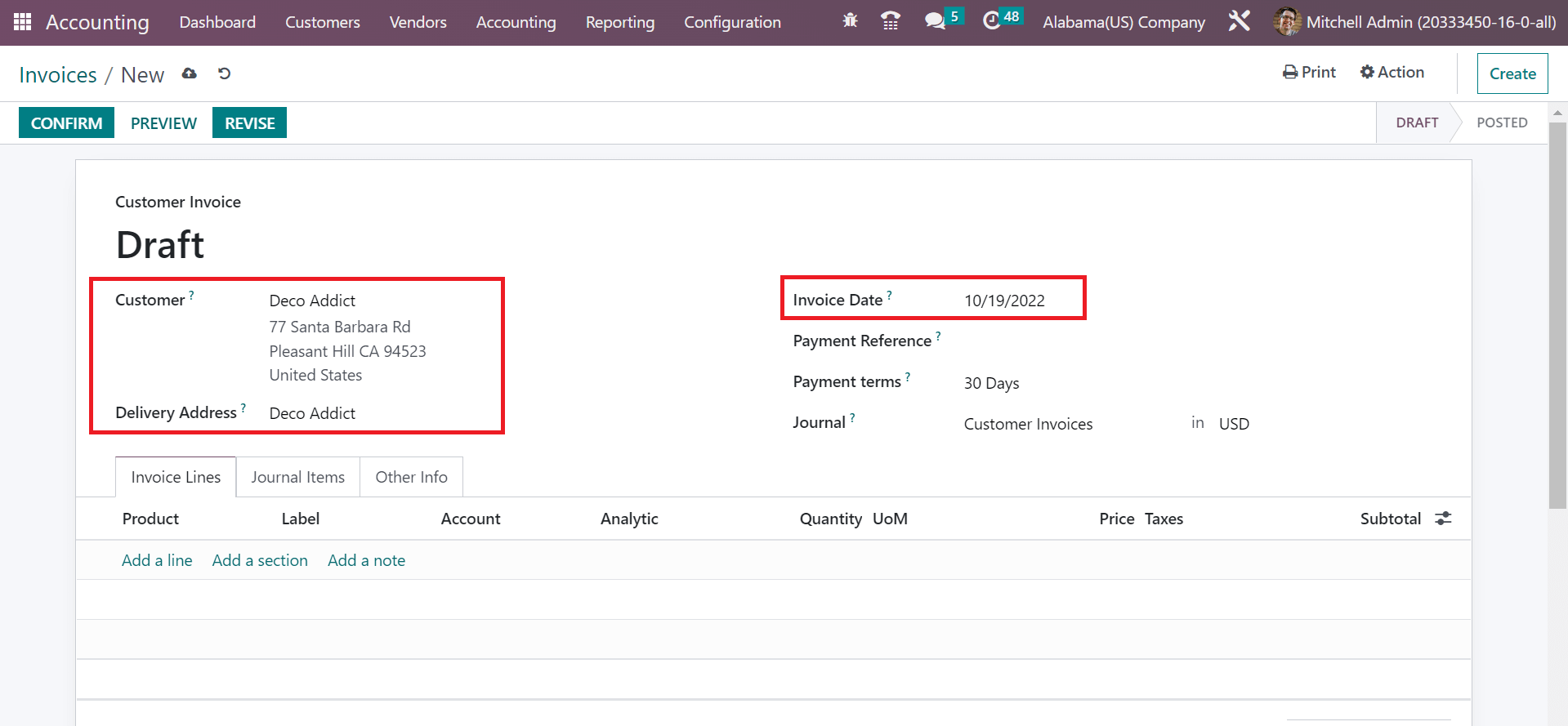

In the new screen, choose your buyer in the Customer field, and you can obtain the Delivery Address of the selected buyer. Additionally, apply the invoice issue date in the Invoice Date field, as cited in the screenshot below.

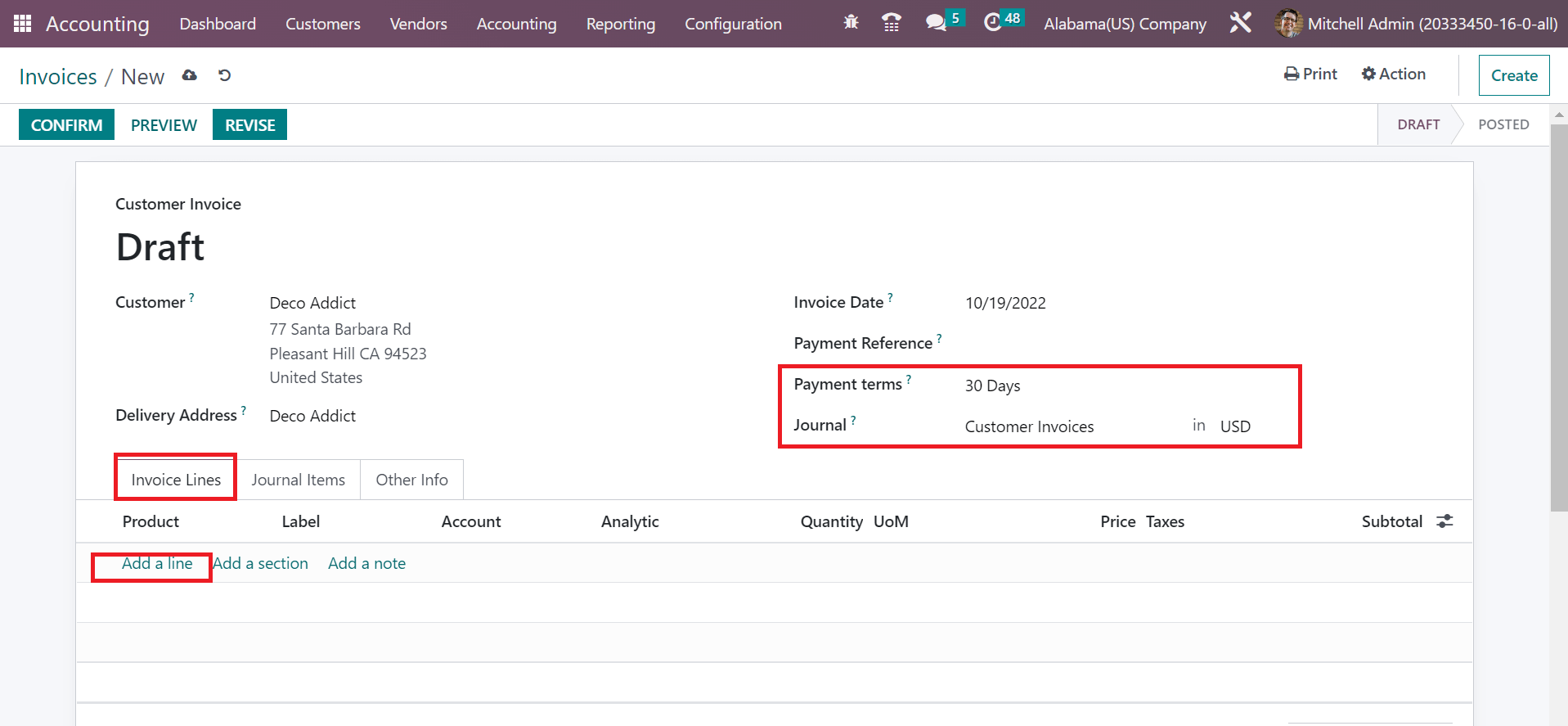

The payment conditions for a customer invoice are managed within the Payment Terms field. Set your Payment Terms as 30 days and choose the Journal related to the invoice, as represented in the screenshot below.

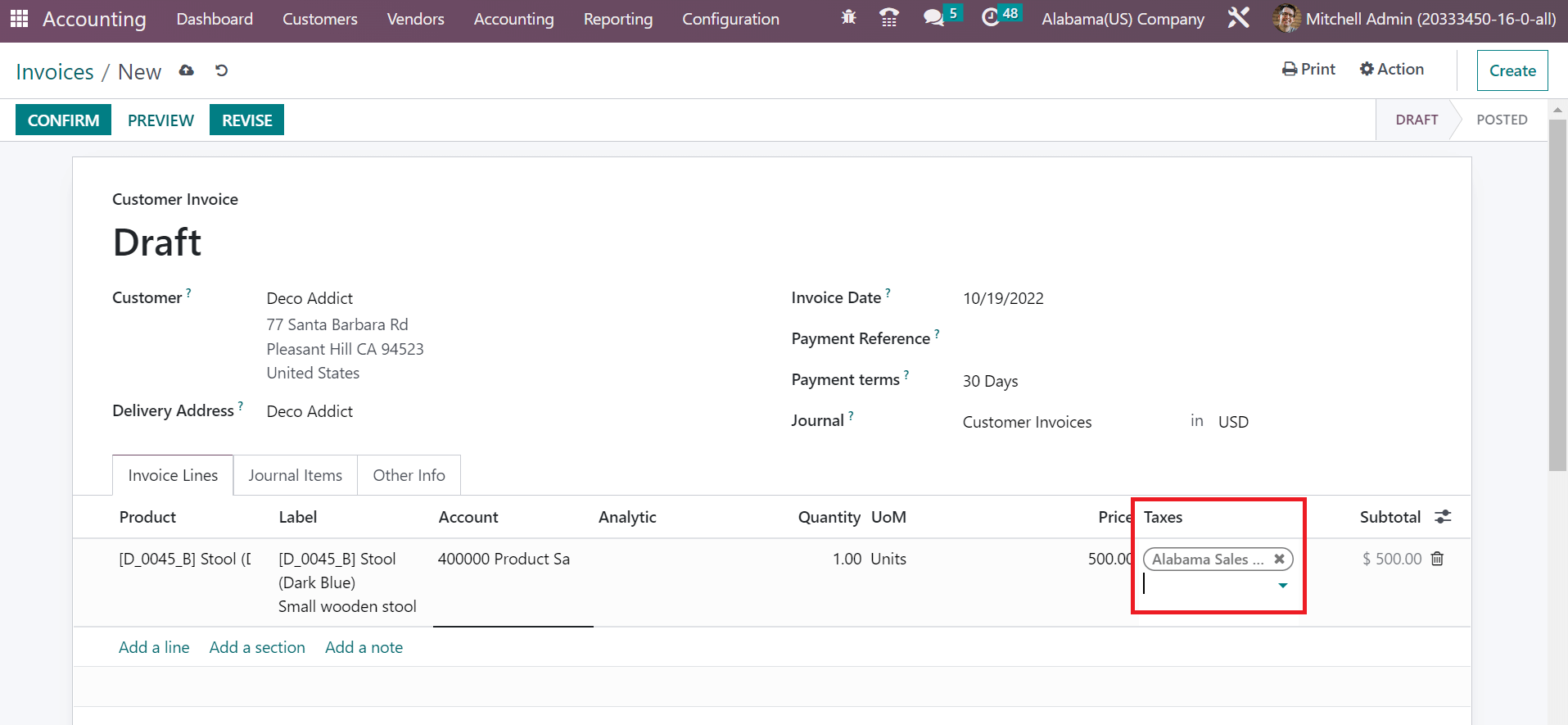

Users can pick the product for consumers by clicking on the Add a line option inside the Invoice Lines tab. We choose one quantity of Stool(Dark Blue) for the customer. It is possible to select your created tax, Alabama Sales Tax 4%, inside the Tax section, as noted in the screenshot below.

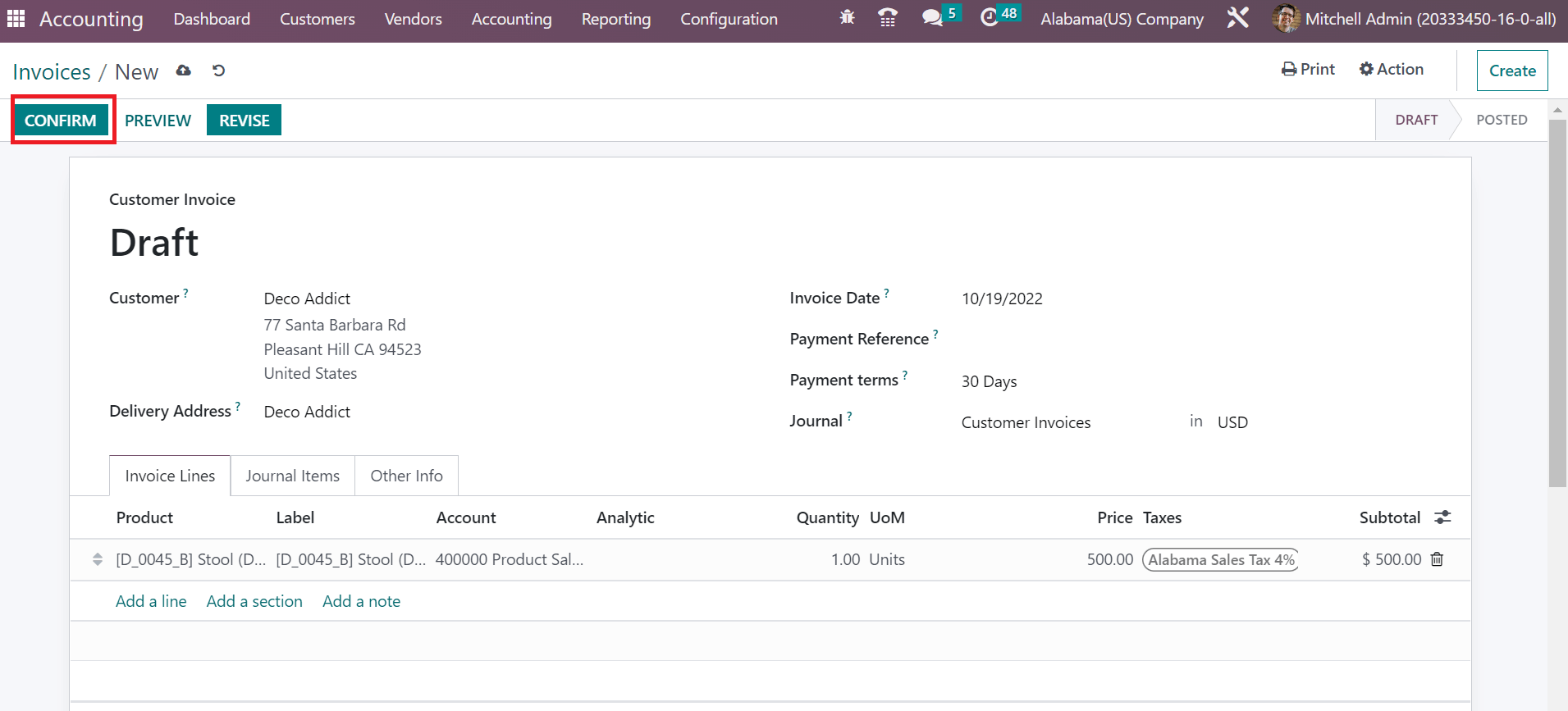

At the end of the Invoice Lines tab, the user can identify the total amount for a product by including the tax rate. Each piece of information about the invoice is saved automatically, and press the CONFIRM icon to post the customer invoice.

Hence, we can quickly post a customer invoice based on a specific State tax within the Odoo 16.

Sales Tax computation based on a State in a country is made possible through Odoo 16 Accounting module. Tax management of companies exiting in various locations of an organization becomes an easy process by installing ERP software into your business.