What is Accounting localization in Odoo?

Accounting localization in Odoo refers to the process of adjusting the accounting features of the Odoo ERP system to the legal and regulatory frameworks governing finances in specific countries. It is guaranteed that Odoo's accounting features, including the tax settings, reporting formats, chart of accounts, and legal compliance capabilities, will be localized to adhere to the unique accounting standards and practices of the target country. Accounting software from Odoo is more appropriate and easier to use for businesses that operate in multiple countries. This allows for accurate financial reporting and compliance with local laws and regulations. Tax codes, charts of accounts, and fiscal positions that are preconfigured ensure respect for regional laws and reduce data entry errors. Doing this decreases the possibility of mistakes that could result in fines or financial inconsistencies.

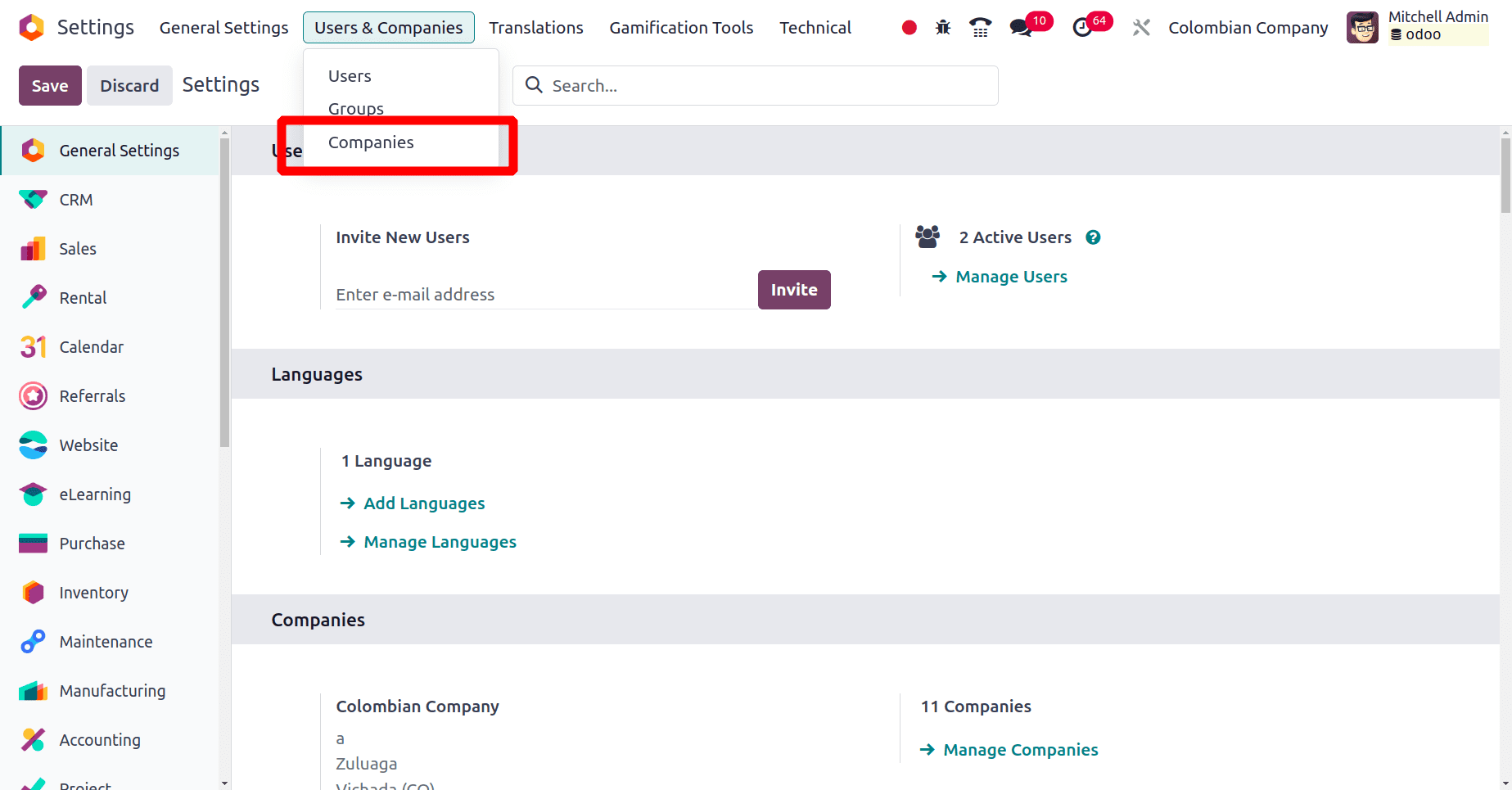

Here in this blog, we are going to discuss the accounting localization for companies from Hong Kong. So, to set up the accounting localization, first we need a company from Hong Kong. Move to the General Settings of Odoo and choose the Companies sub-menu under the Users & Companies.

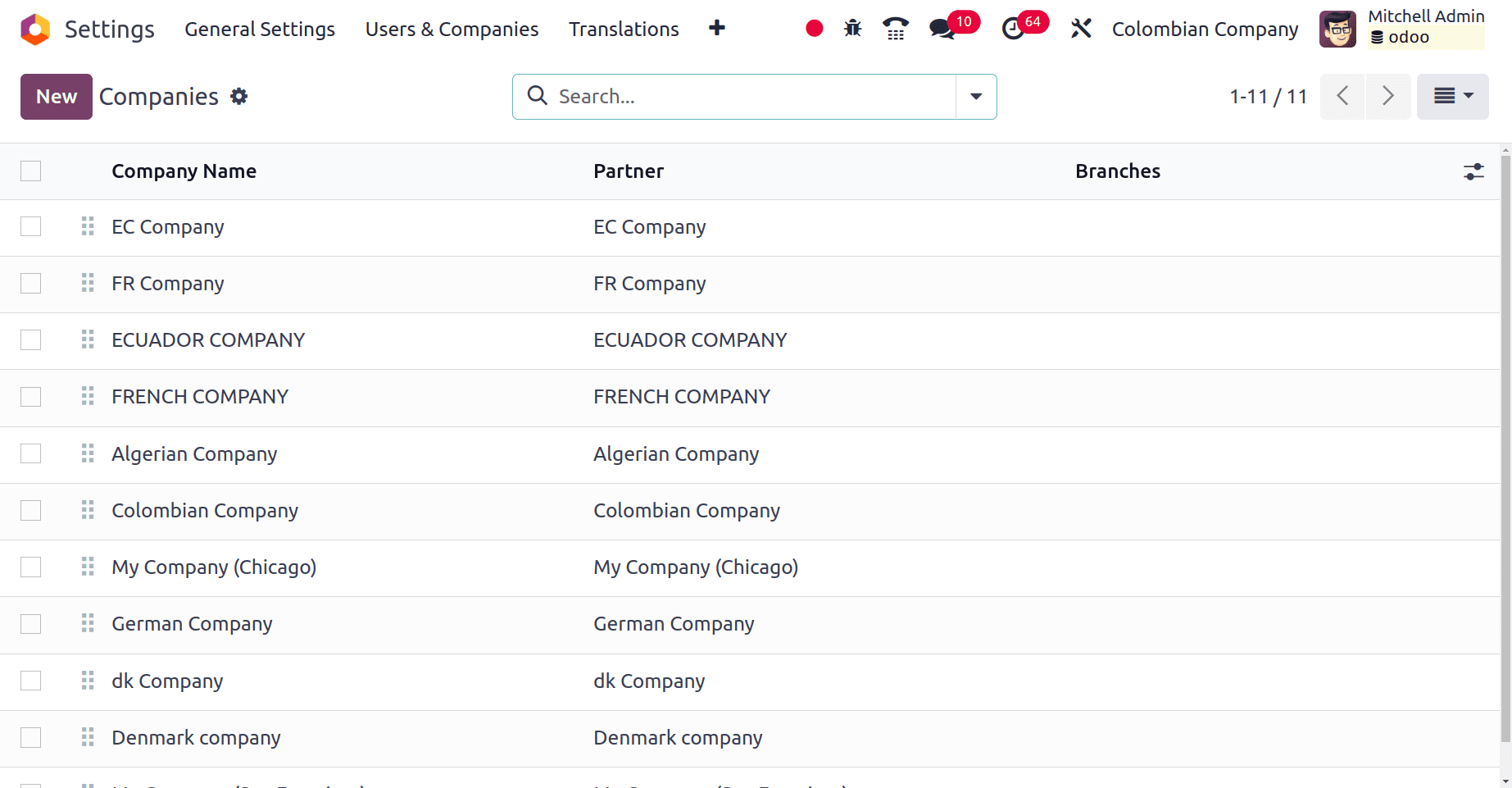

We get a list of companies that are already created when we choose the Companies sub-menu. There will be a New button on the page, and click that New button to create a new company.

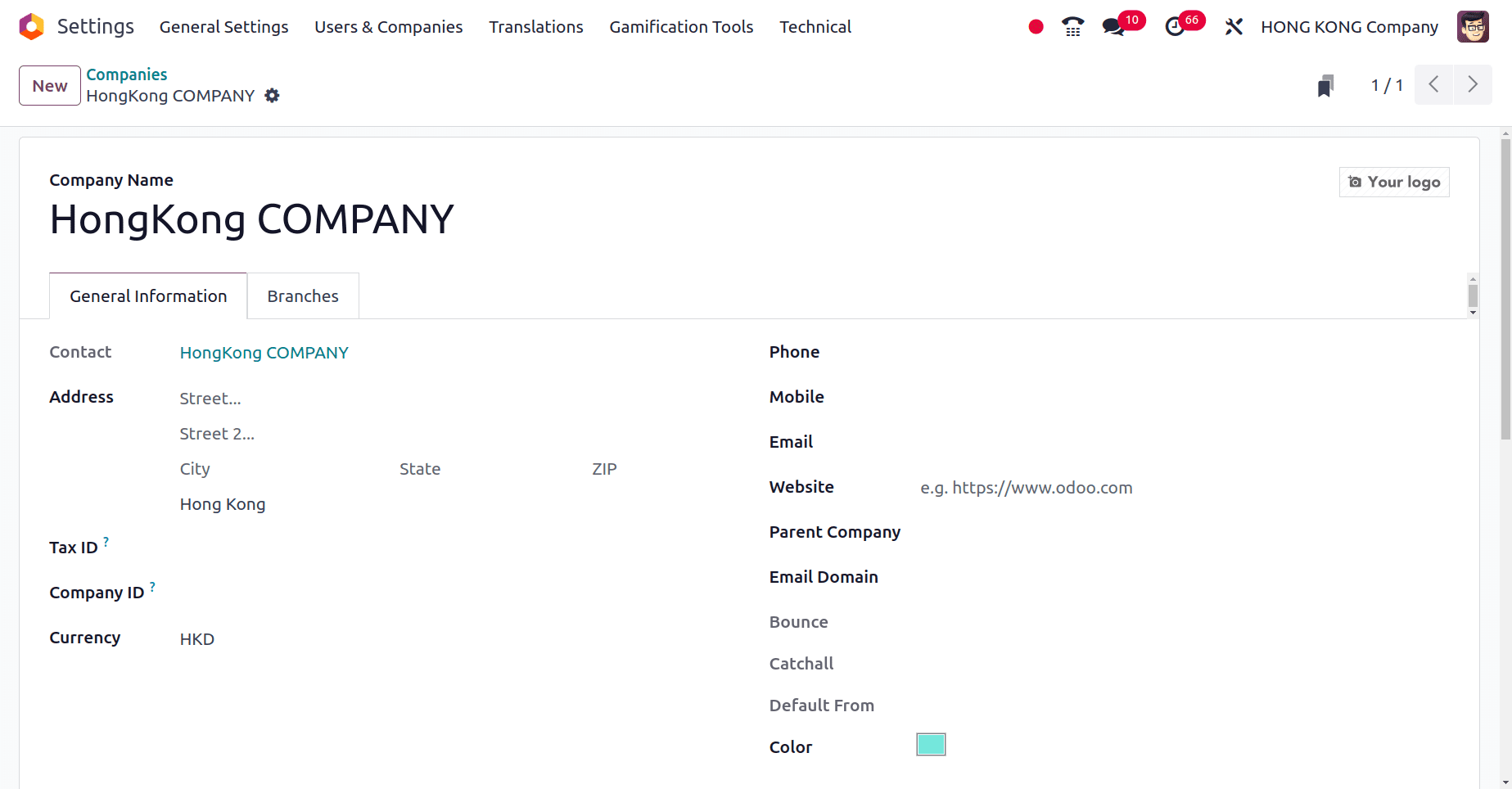

On clicking the new button a form will appear and we can provide all the details of the company in that form. Provide the name of the company, address, country in which the company belongs, etc. When the country for the company is given the currency of the company will automatically configured by odoo and save the company.

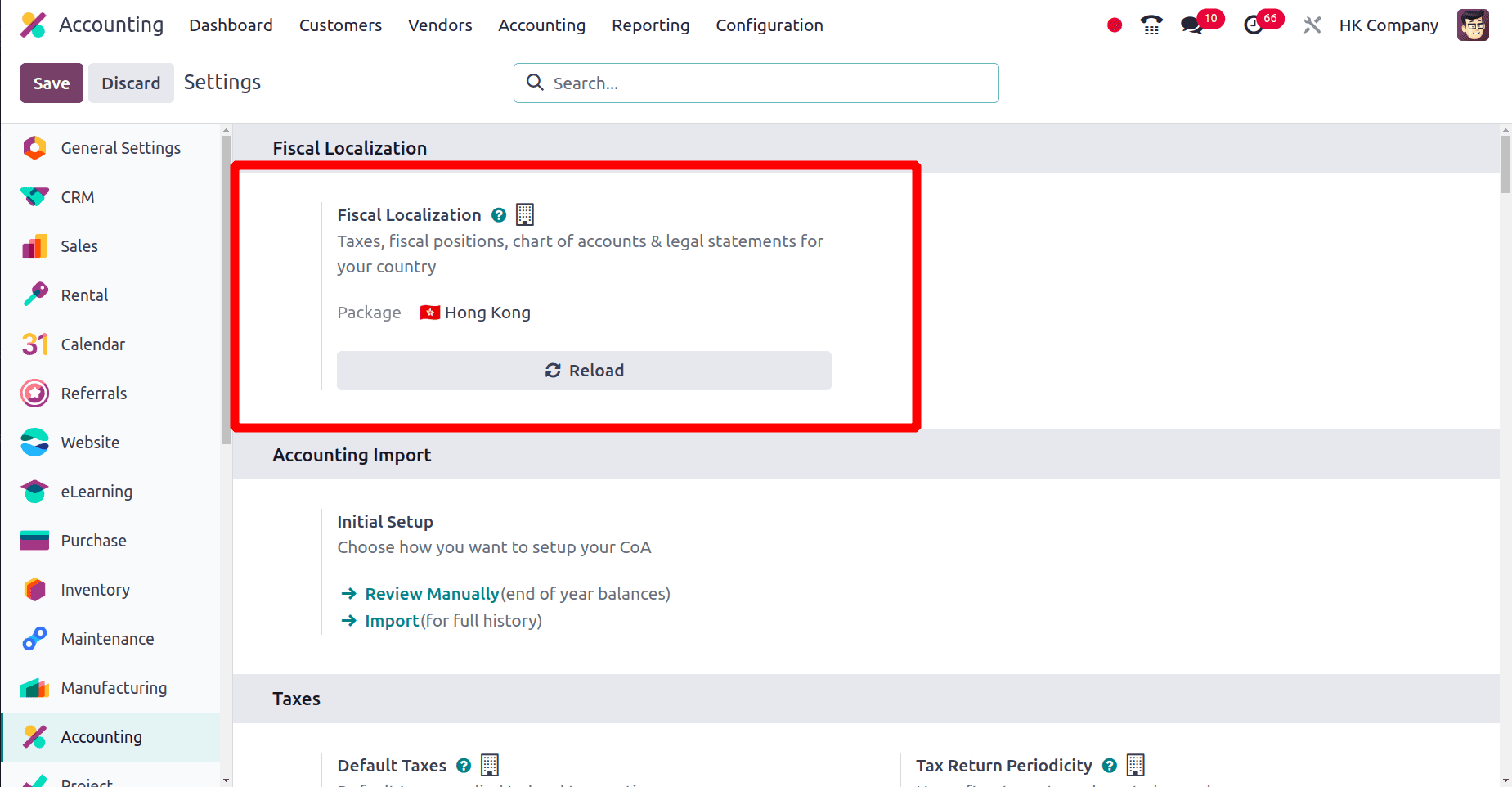

The next step is to set the localization package for this newly created company. To set up the localization package for this company move to the Accounting application of Odoo. Move to Configuration > Settings and under the Fiscal Localization section there is an option to set the localization package for this company. Here we are going to set up the package as Hong Kong.

Let's discuss the specialties of Hong Kong localization in Odoo 17

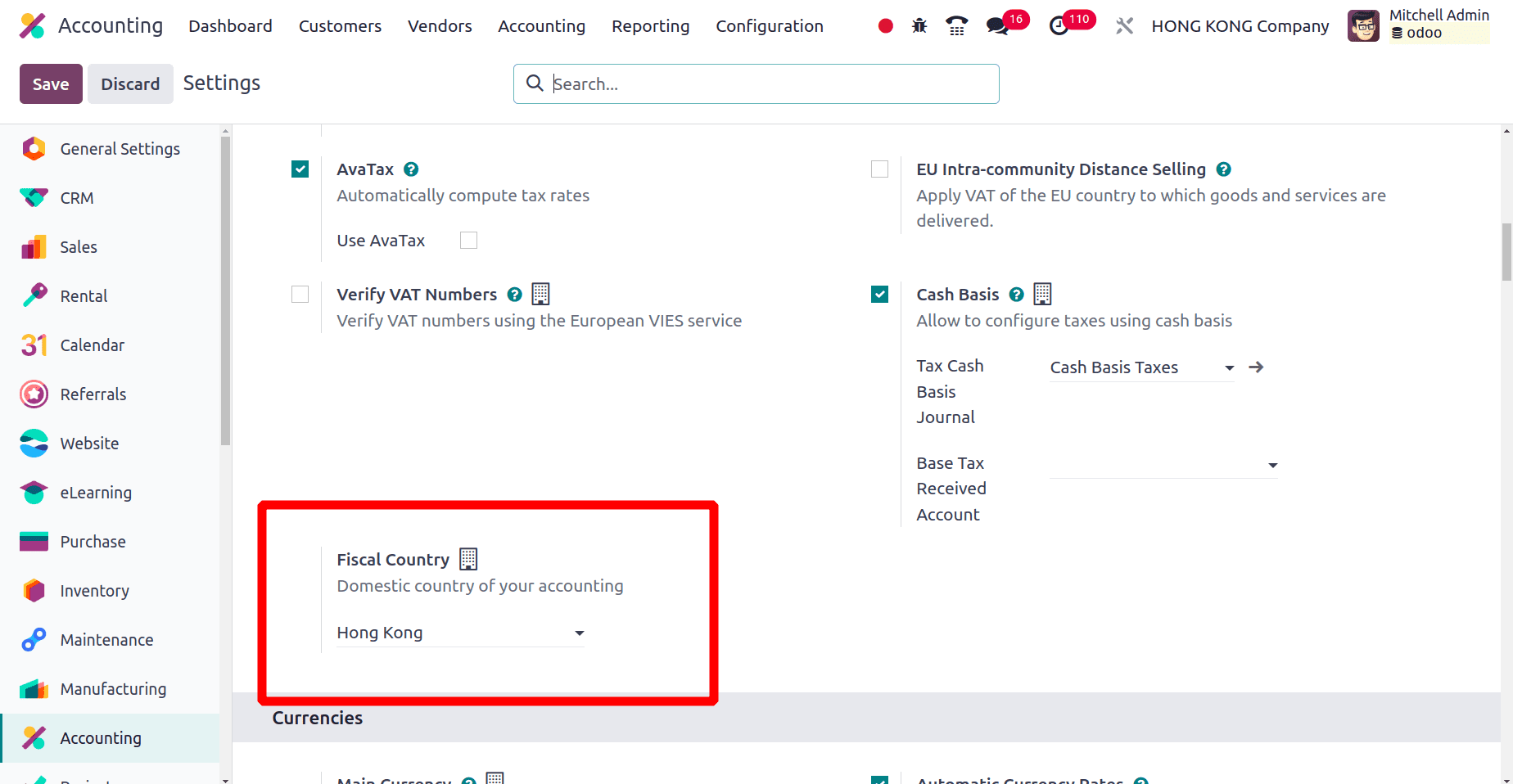

When you set the Fiscal localization package as Hong Kong, under the Taxes section there is a Fiscal Country field. So when the package is set as Hong Kong Odoo automatically sets the Fiscal country for the company as Hong Kong.

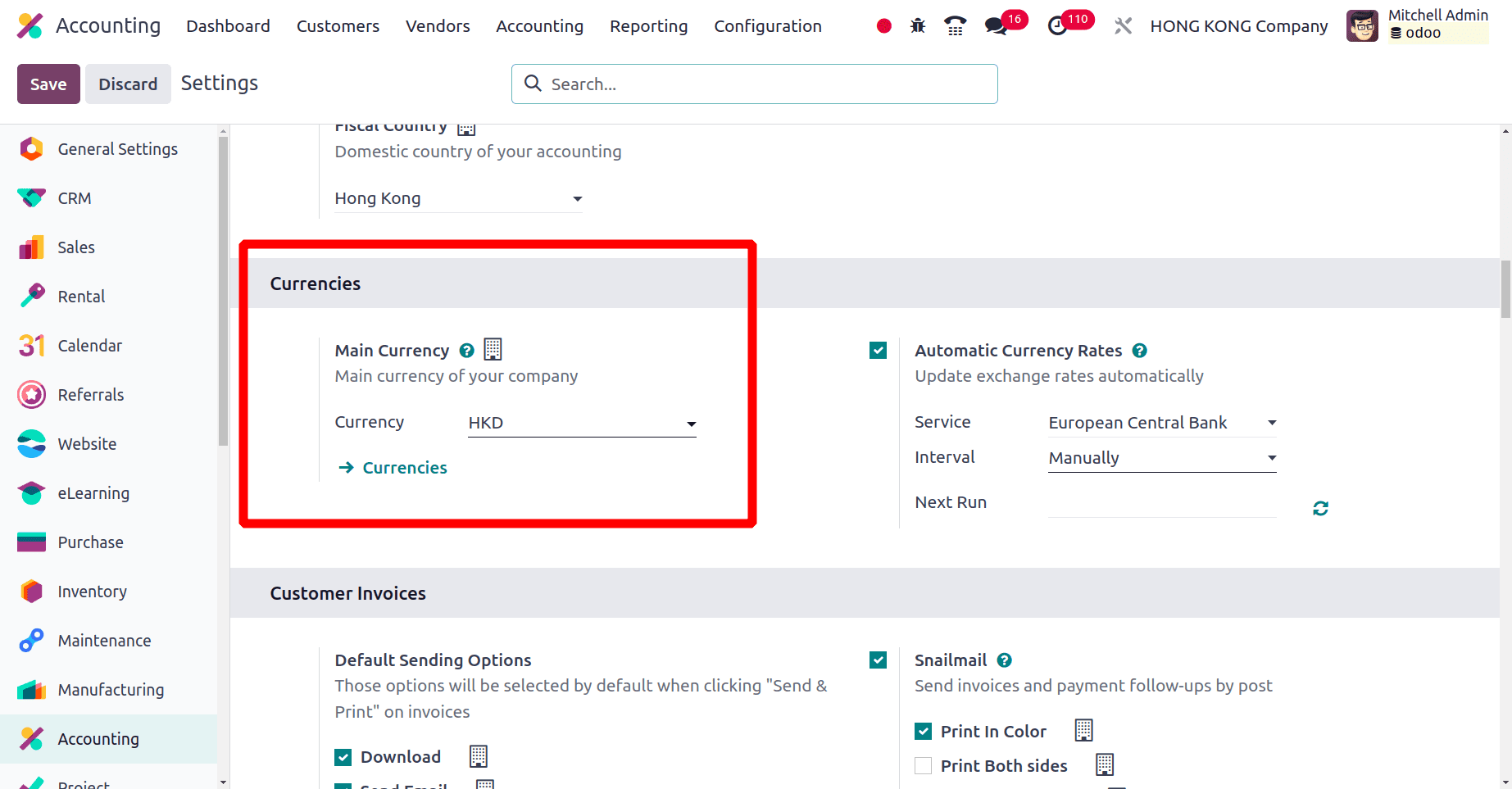

The next is the currency for the businesses in Hong Kong. We know that the official currency used in Hong Kong is the Hong Kong Dollar (HKD) and here under the currencies section we can see that the currency for the company is set as Hong Kong Dollar (HKD) by Odoo automatically when the Localization package is saved

Fiscal positions, Charts of accounts, Journals, taxes, etc are the backbone of a company's accounts. When a Localization package is configured for a company properly, Odoo automatically sets all of these configurations for that specific company.

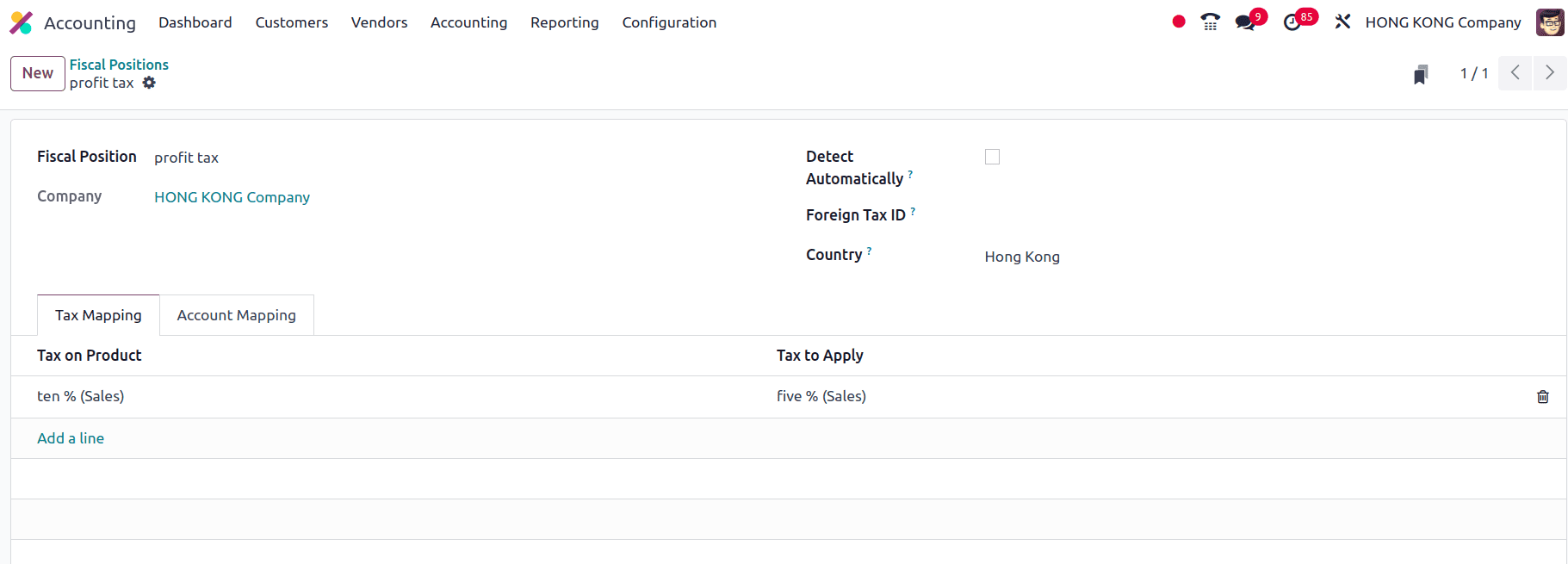

A fiscal position in Odoo 17 is an effective tool that lets you automatically modify taxes and accounts according to certain parameters like client location, type of business, or other pertinent details. This guarantees correct financial reporting and adherence to tax laws. Under the Configuration menu, we have the Fiscal position sub-menu. And there by clicking the New button, we can create a new fiscal position for the company. A form will be there and in the form fill in the data like from which accounts to which accounts and from which tax to which tax the mapping takes place.

On moving to the account mapping tab we can map the account as our need and by clicking the save icon, we can save the fiscal position that we have created. Hence the tax on the product will be mapped to the tax to apply and the account on the product will be mapped to the account to use mentioned when this fiscal position is applied on an invoice.

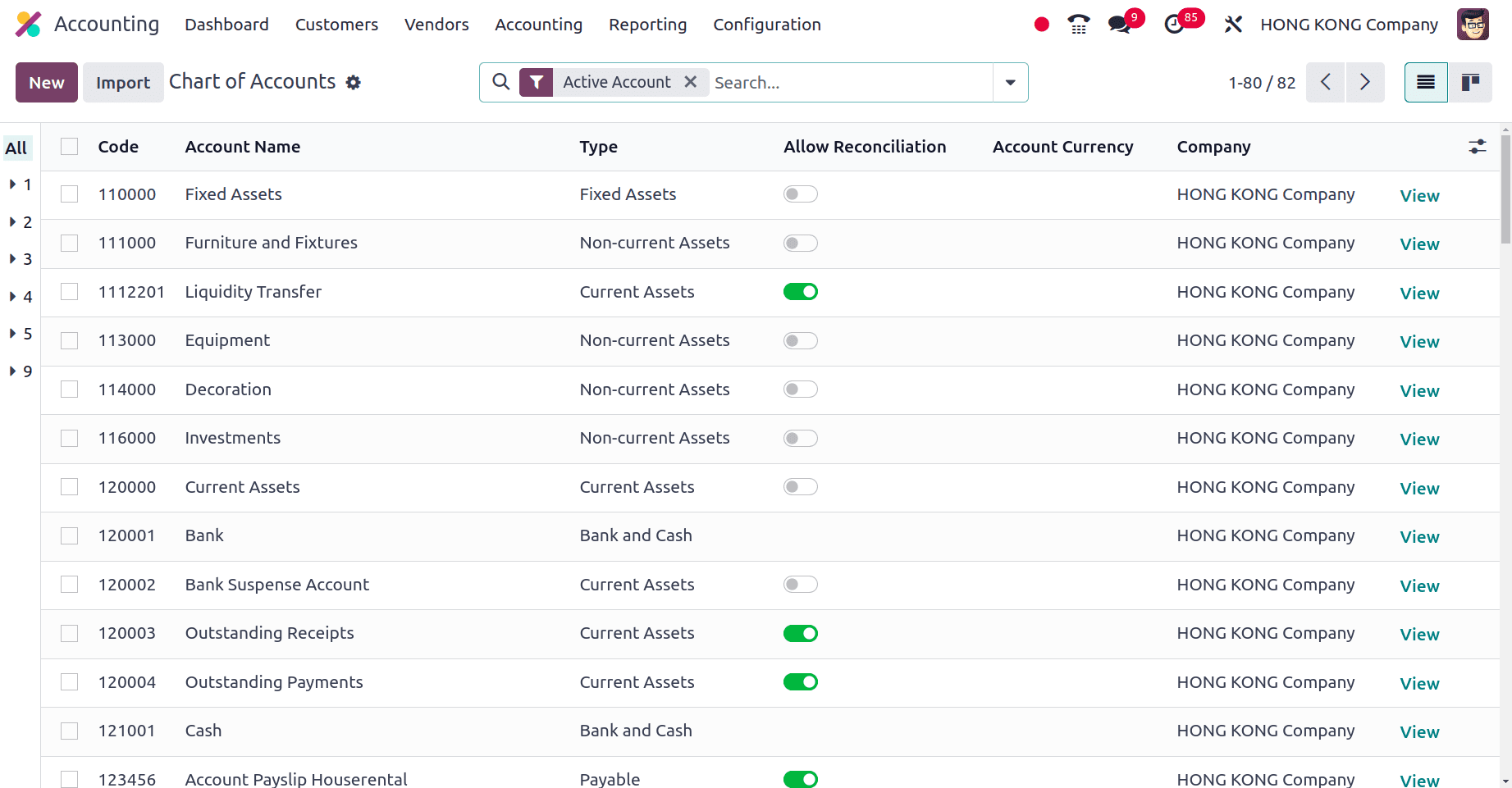

A chart of accounts is a structured list of all the financial accounts used to record and classify your business transactions. It's the backbone of your accounting system, providing a clear overview of your financial health. Under the configuration menu, we have the chart of accounts sub-menu and there you can see the list of accounts that a company can use for all of their purpose.

Here we can able to import or even create a new chart of accounts for a company. With Odoo 17 we can create a chart of accounts that perfectly aligns with your company's specific needs and structure.

Odoo 17 offers robust tax management capabilities to help businesses handle various tax complexities efficiently. Odoo provides different tax types (sales, purchase, adjustment) with specific rates, computation methods (fixed, percentage, group), and applicability based on products or services. Under the Configuration menu, we have the taxes sub-menu and there we can see all the pre-configured taxes. However, Hong Kong operates a territorial taxation system, meaning only income sourced within Hong Kong is taxable. There's no concept of personal income tax like in many other countries.

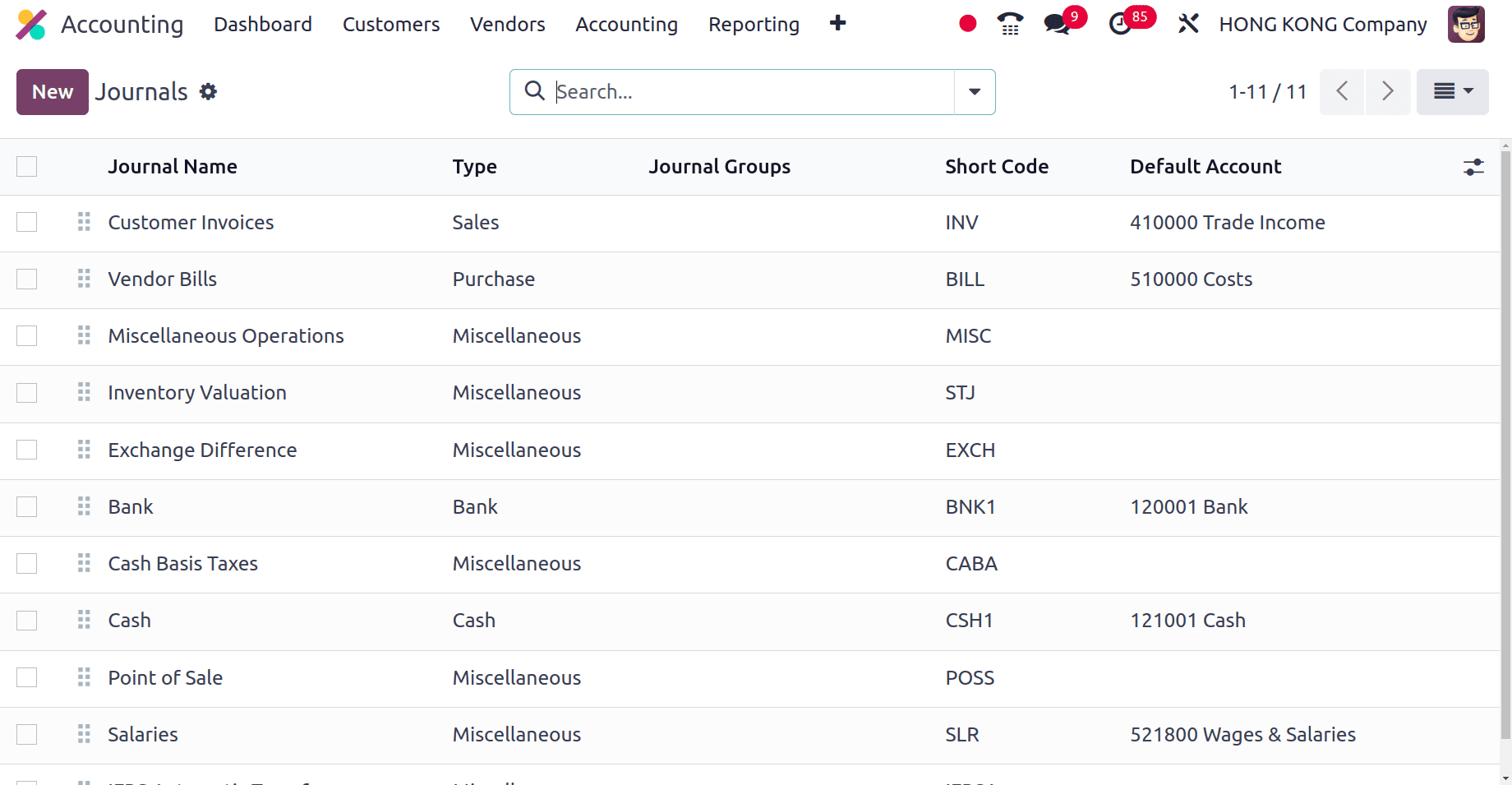

In odoo accounting journals are the backbone of your financial records. They are chronological records of your business transactions, categorized by type. Each journal entry represents a financial event, with corresponding debits and credits to balance the accounts. Under the configuration of the accounting application, we have the journals and there we can see a list of journals that the company from Hong Kong can use.

Next on moving to the reporting menu of the accounting application, we can see the balance sheet, Profit and Loss report, Executive summary, tax report, etc.

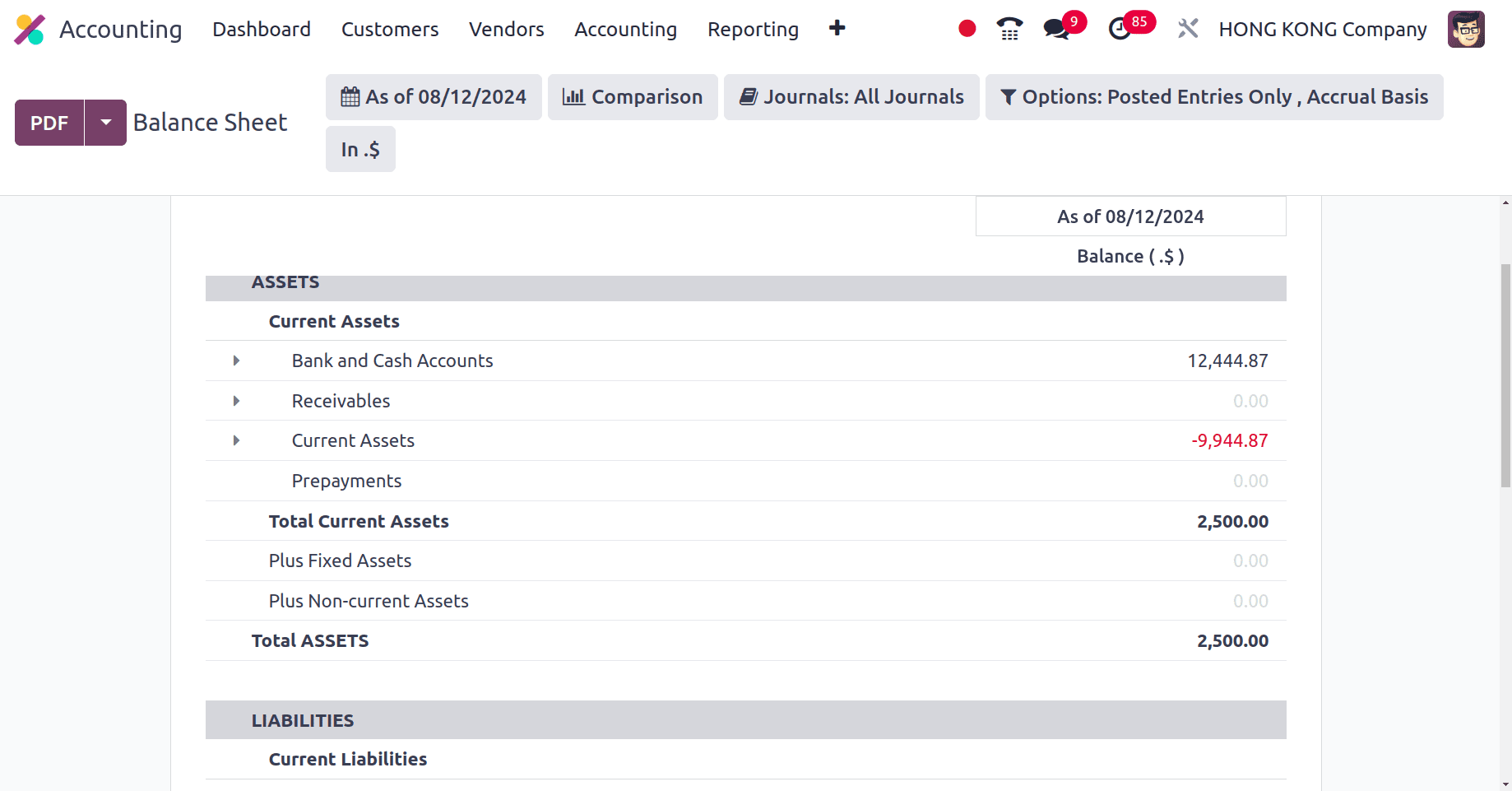

Balance sheet: A balance sheet is a financial statement that provides a snapshot of a company's financial health at a specific point in time. It outlines a company's assets, liabilities, and equity.

In the Balance sheet of the company from Hong Kong, the Asset, Liability, and Equity sections are labeled. Current assets, Receivables, Prepayments, Bank and Cash accounts, etc are included in the assets section. Current liabilities, plus non-current liability, payables, etc are in the Liability section. Unallocated earnings, current year earnings, Retained earnings, etc are in the Equity section.

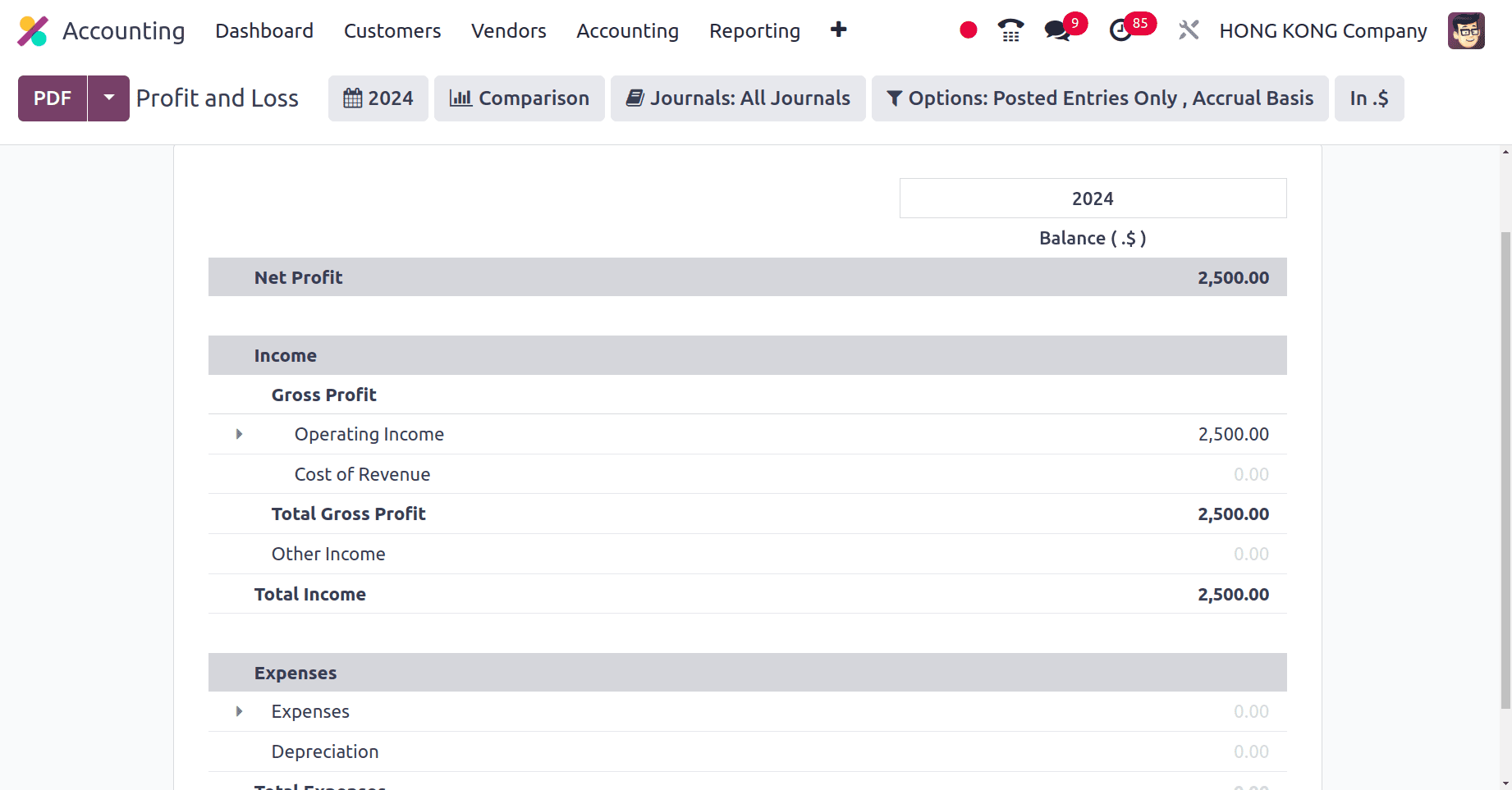

Odoo 17 provides a robust platform to generate comprehensive Profit and Loss (P&L) reports. This financial statement offers a clear overview of a company's revenue, expenses, and overall profitability for a specific period. Under the reporting menu, we have the company's profit and loss report.

Income and Expenses are mainly included in the profit and loss report. In the income section, operating income, Cost of revenue, and Gross profits are added. In the Expense section, Expenses, Depreciation, etc are included.

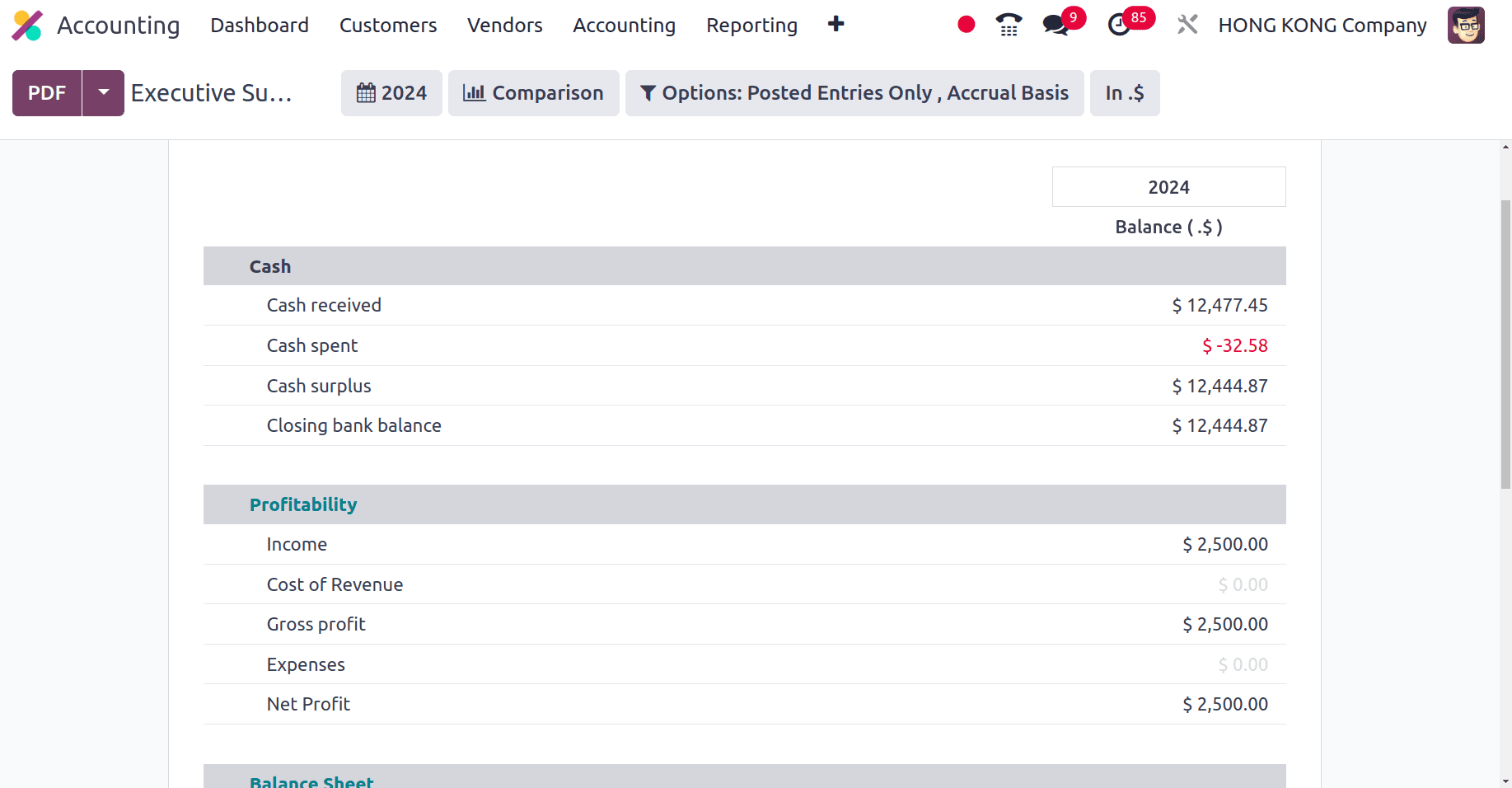

Odoo 17's Executive Summary report is a powerful tool designed to provide a high-level overview of your company's financial performance. It consolidates key metrics from various financial reports into a single, easily digestible format.

Cash, Profitability, Balance sheet, Performance, and Positions are included in the profit and Executive summary. All the incomes and expenses within each section are added in the Executive summary.

In conclusion, the Odoo 17 Hong Kong Accounting Localization offers a comprehensive and tailored solution for businesses operating in Hong Kong. By incorporating essential features such as compliance with local tax regulations, support for the Hong Kong General Accepted Accounting Principles (HK GAAP), and integration with the Hong Kong Inland Revenue Department's requirements, this localization ensures that companies can efficiently manage their accounting processes while staying compliant with local standards.

To read more about An Overview of Accounting Localization for Thailand in Odoo 17, refer to our blog An Overview of Accounting Localization for Thailand in Odoo 17.