In the HR and financial operations of any firm, payroll reporting is essential. Businesses can create precise and informative payroll reports with Odoo 18, which helps accountants and HR managers track employee contributions, salaries, deductions, and other relevant details. The payroll module of Odoo 18 offers sophisticated capabilities for creating reports based on contracts, departments, job positions, payslips, and timeframes. These reports provide decision-makers with access to real-time wage information, while also aiding in auditing and compliance. Every aspect of payroll, from journal entries to cost centers, payslip summaries, and detailed breakdowns, can be precisely managed via Odoo’s integration with the Accounting, HR, and Employee modules. This blog examines the payroll reporting features in Odoo 18 and offers guidance on customizing them to meet the specific needs of your business.

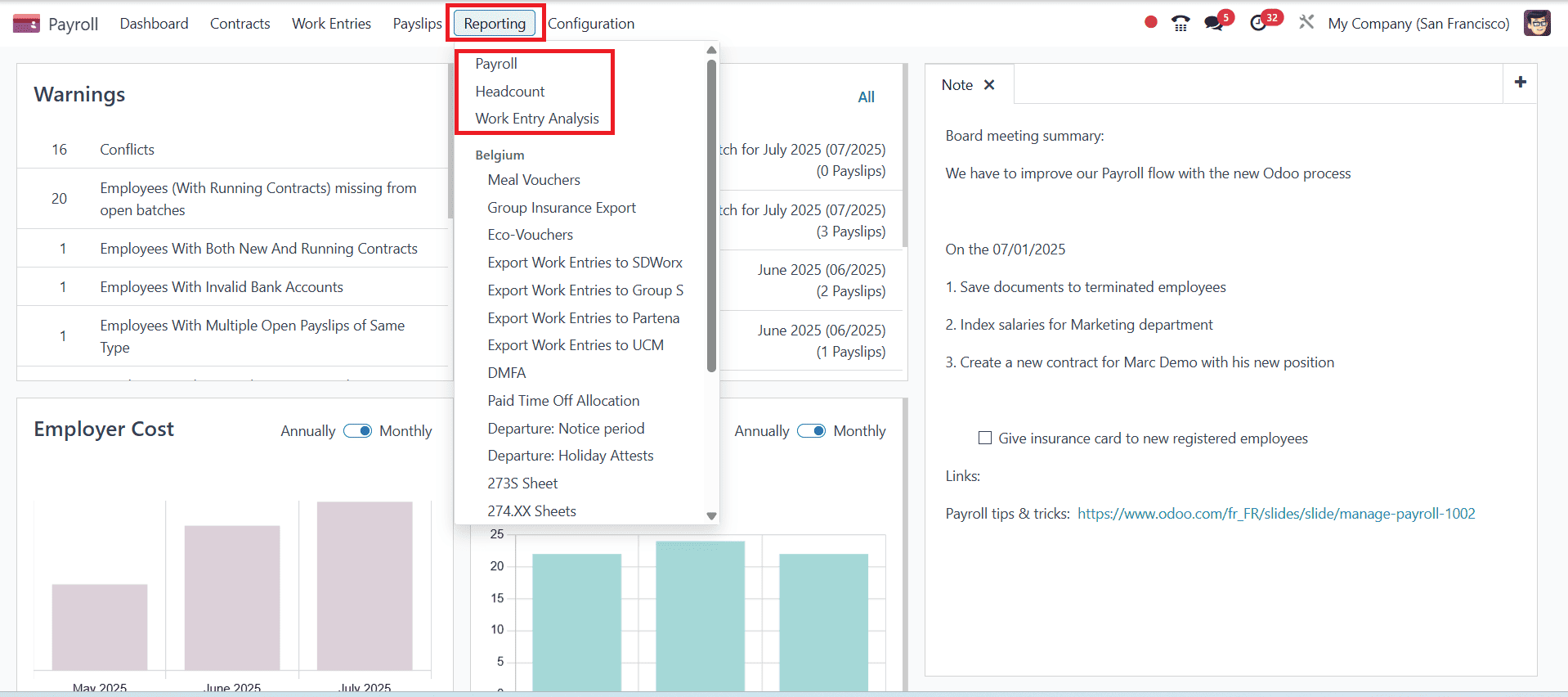

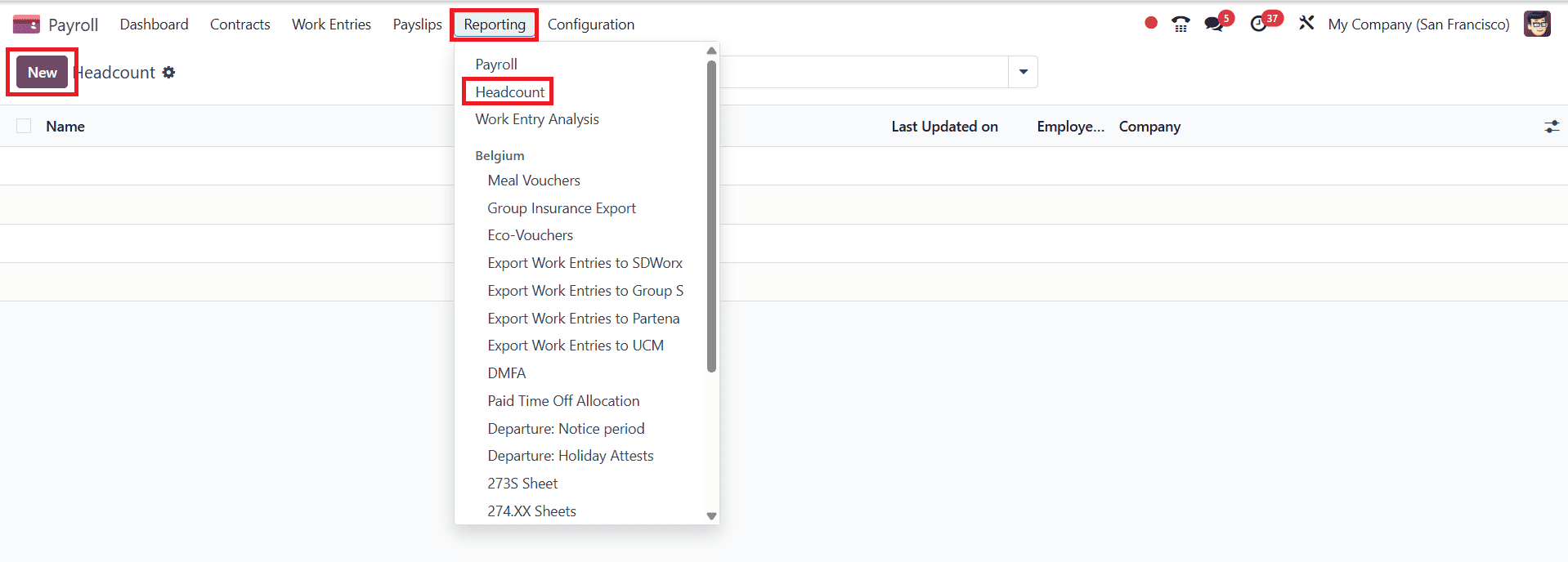

To access Payroll reports, navigate to Payroll > Reporting. Here, you can view the main reporting sections, including Payroll, Headcount, and Work Entry Analysis. Reports can also be localized and viewed in alphabetical order based on the country. These are crucial to understanding the loss of local taxes and the specific benefits that result from it. If a user attempts to access a report without permission, a pop-up message will notify them: “You must be logged in to a (country) company to use this feature.” Here, you can specify the country name where your company is configured.

Payroll:

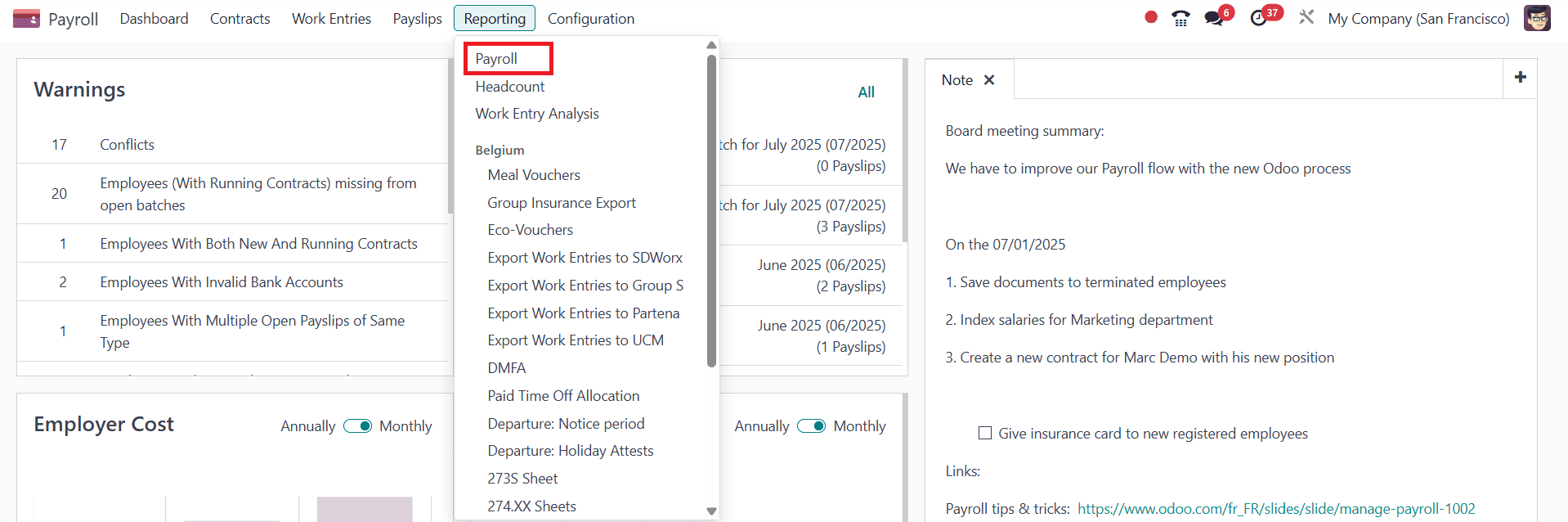

Under the Reporting tab, navigate to Payroll, which gives you a comprehensive Payroll Analysis.

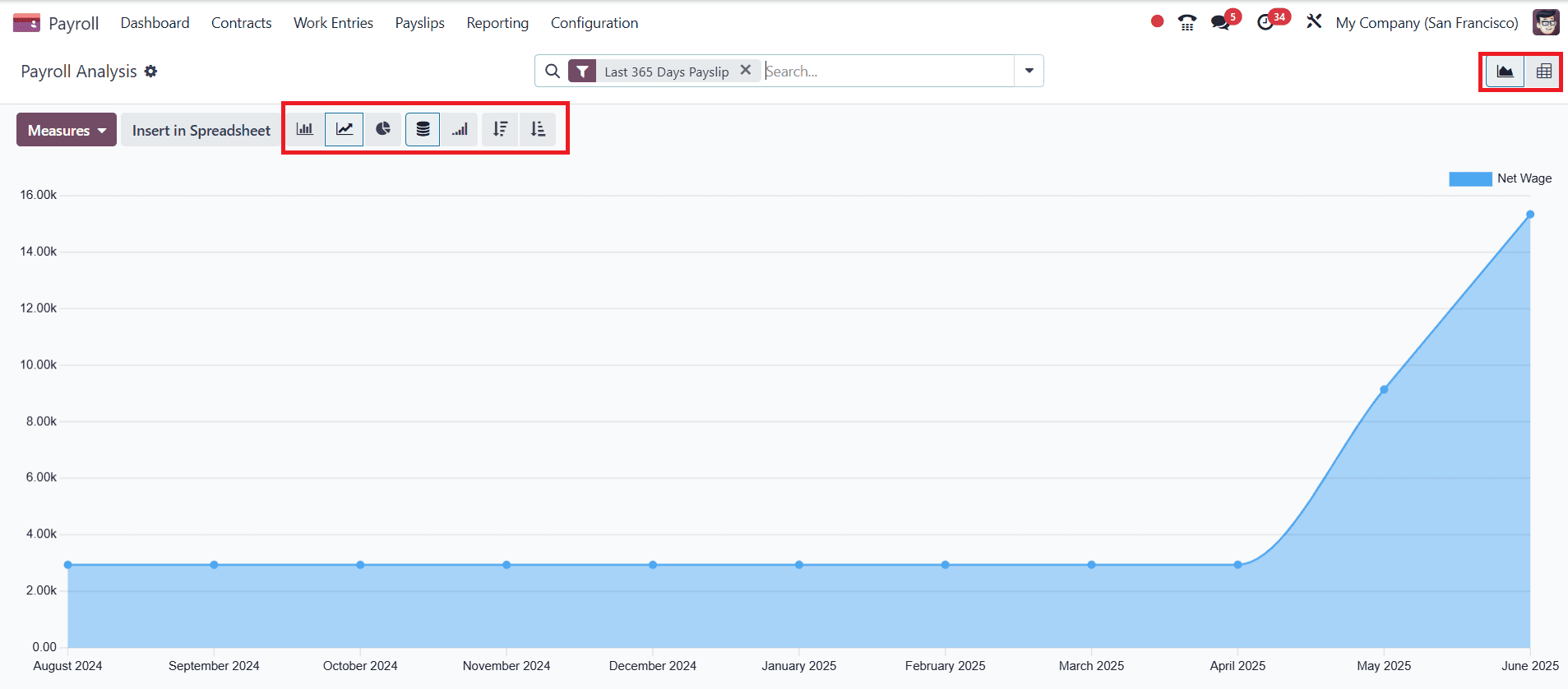

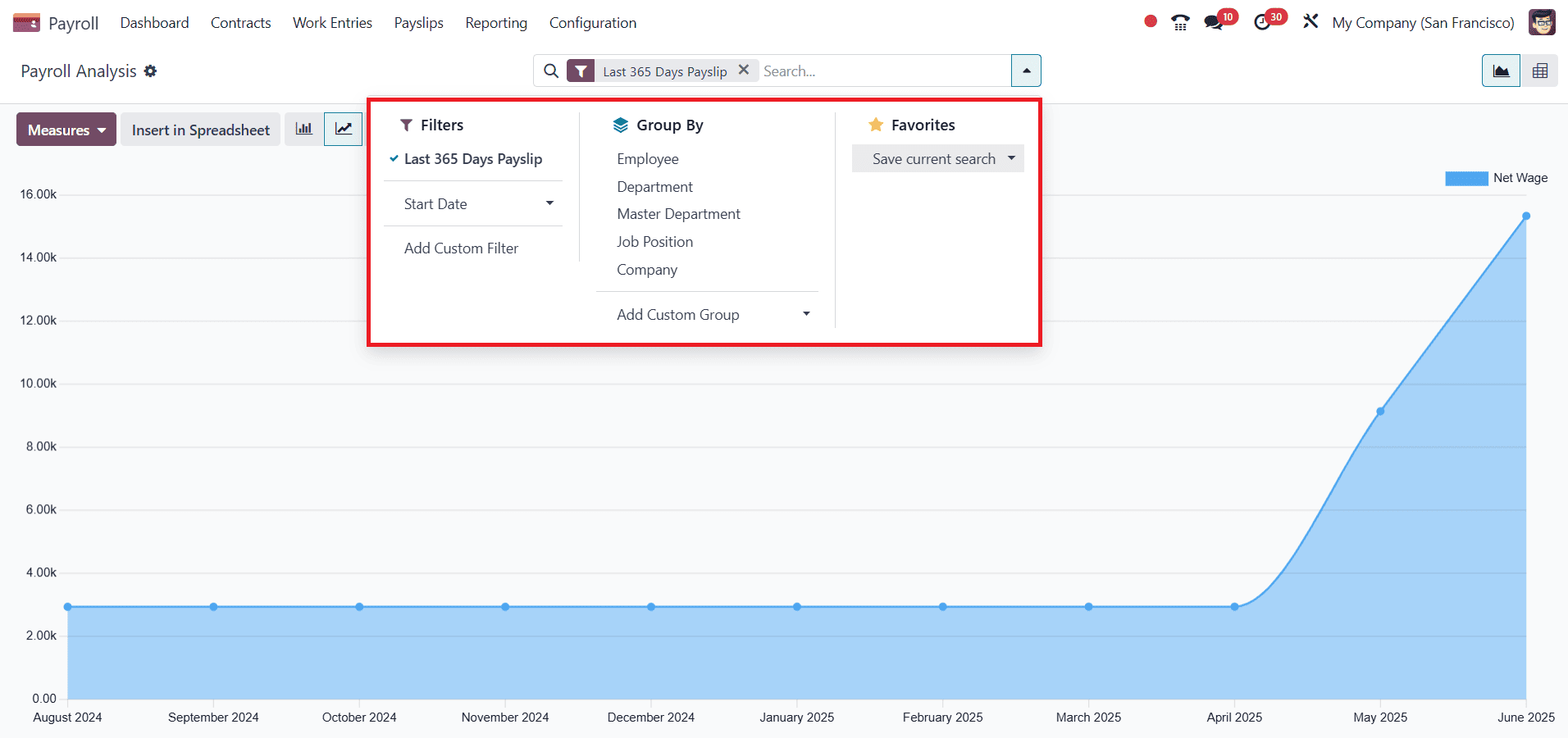

By default, this report shows all payroll generated in the Last 365 Days. These filters are applied automatically. These reports are also available for viewing in a variety of formats, including pie charts, bar charts, and line charts. You can also view the data in a stacked view, a cumulative view, and sort the data in either ascending or descending order. The X-axis of the Payroll Analysis window's graph shows the start date, and the Basic salary is shown on the Y-axis.

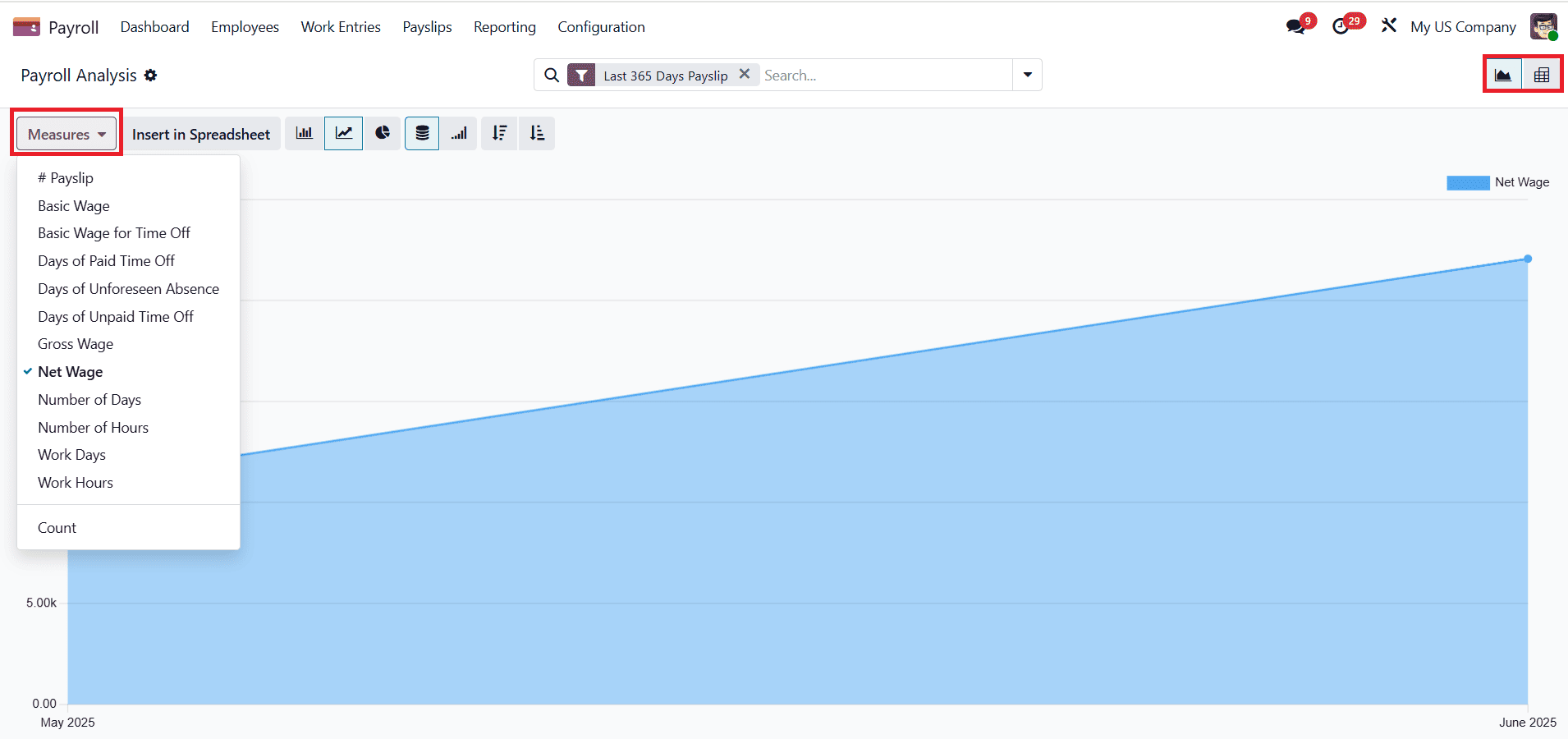

This report is highly customizable. Click on the Measures button; by default, it will be Net Wage. You can modify it to include options such as: Basic Wage, Basic Wage for Time Off, Days of Paid Time Off, Days of Unforeseen Absence, Days of Unpaid Time Off, Gross Wage, Number of Days, Number of Hours, Work Days, Work Hours, and Count.

The filters help you get the precise data you want. Under the Group By option, data can be grouped by Employee, Department, Master Department, Job Positions, or Company. You can also save the report as favorites for future analysis.

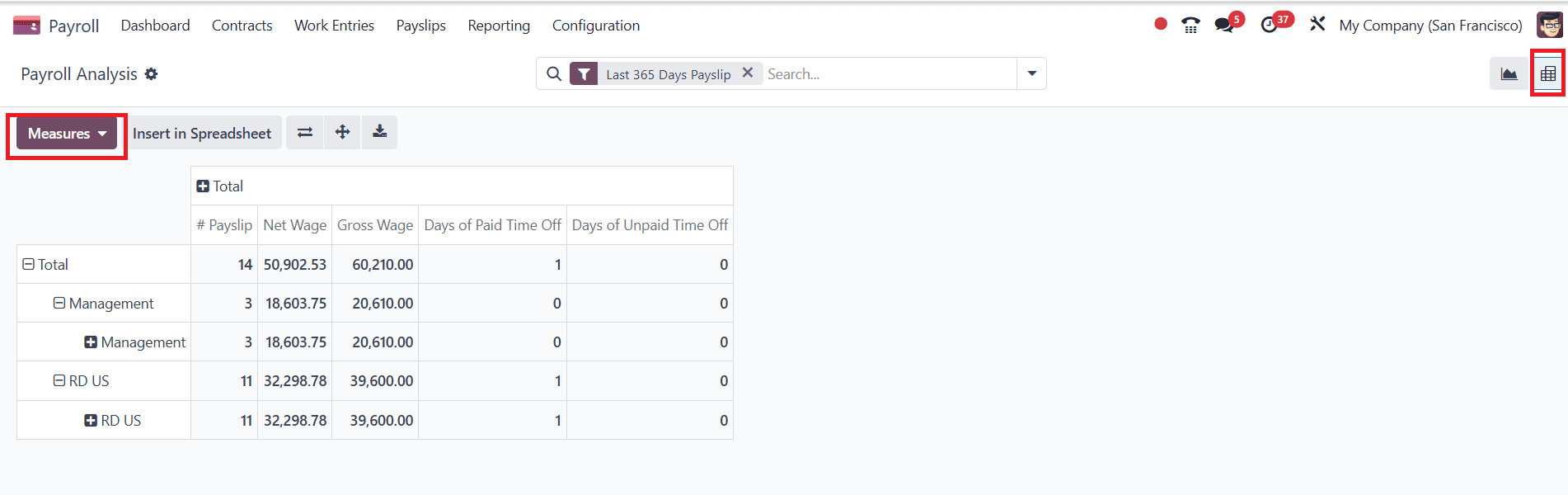

You can also view through a Pivot table for detailed analysis. By default, it shows metrics like Payslip, Net Wage, Gross Wage, Days of Paid Time Off, and Days of Unpaid Time Off. To add more information, click on the Measures button to add new metrics such as Basic Wage, Basic Wage for Time Off, Days of Unforeseen Absence, Number of Days, Number of Hours, Work Days, Work Hours, and Count. You can also directly insert the data into a spreadsheet by clicking on the Insert Spreadsheet.

Headcount:

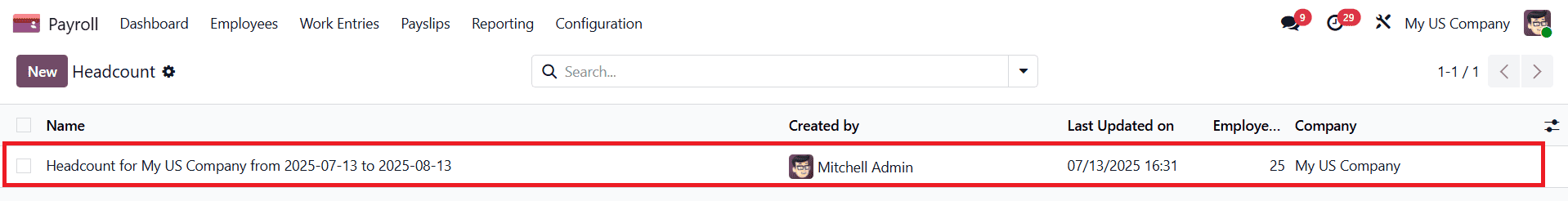

Navigate to Reporting > Headcount, and click on the New button as shown below:

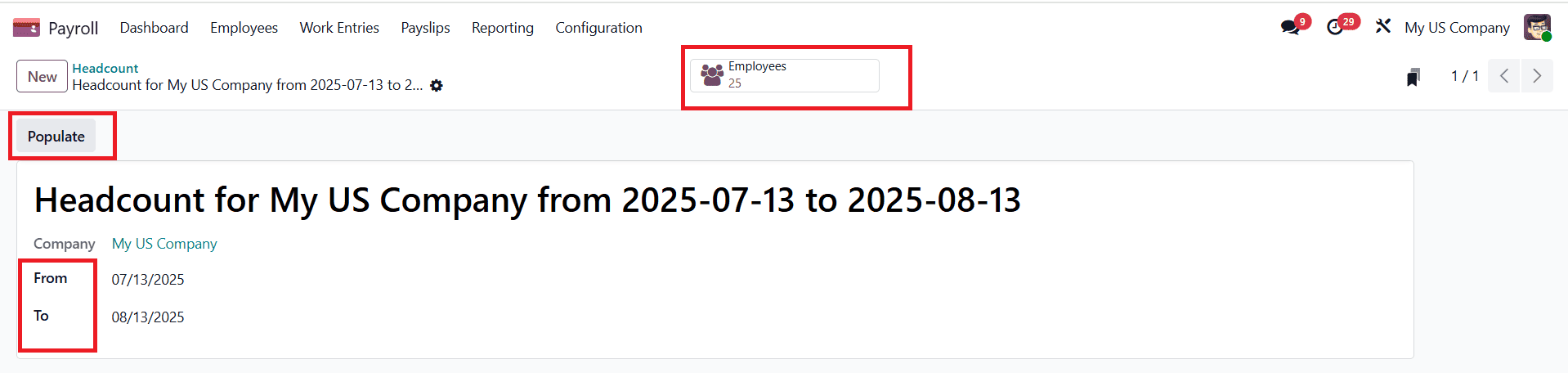

Here, you get a name for this new headcount reporting. You can also select a date range from which date to which date to call the number of employees within this date range, and click on the Populate button to view the headcount of employees as shown below:

Here, you can see the created Headcount in the dashboard as shown below:

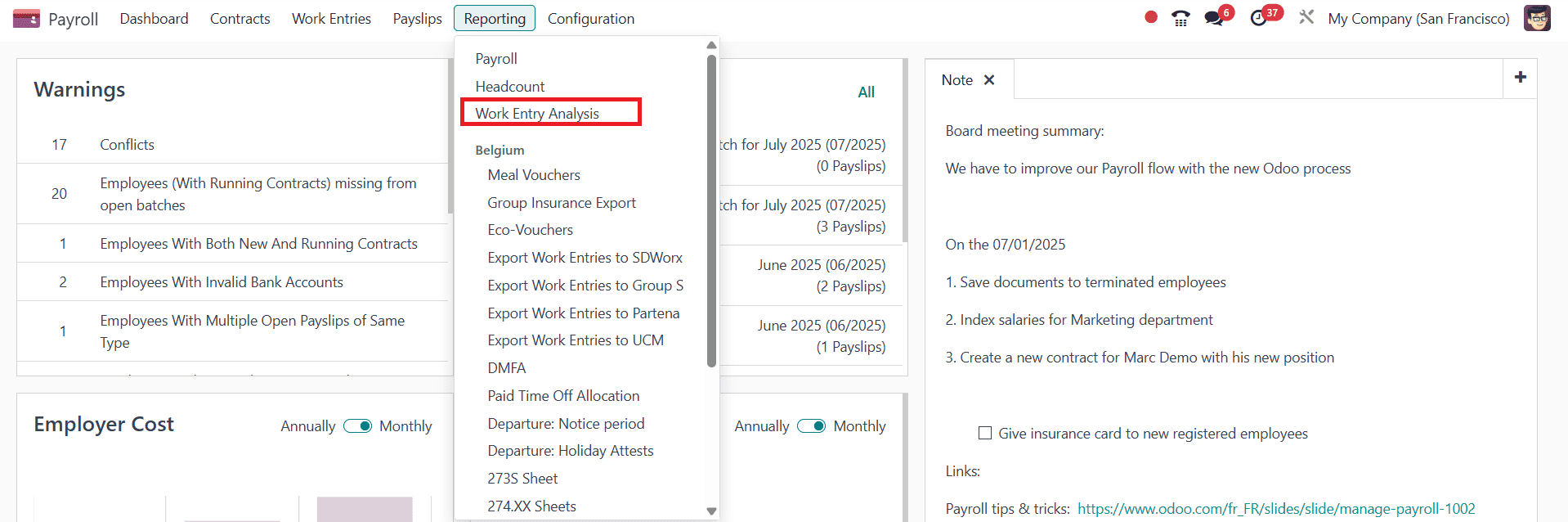

Work Entry Analysis:

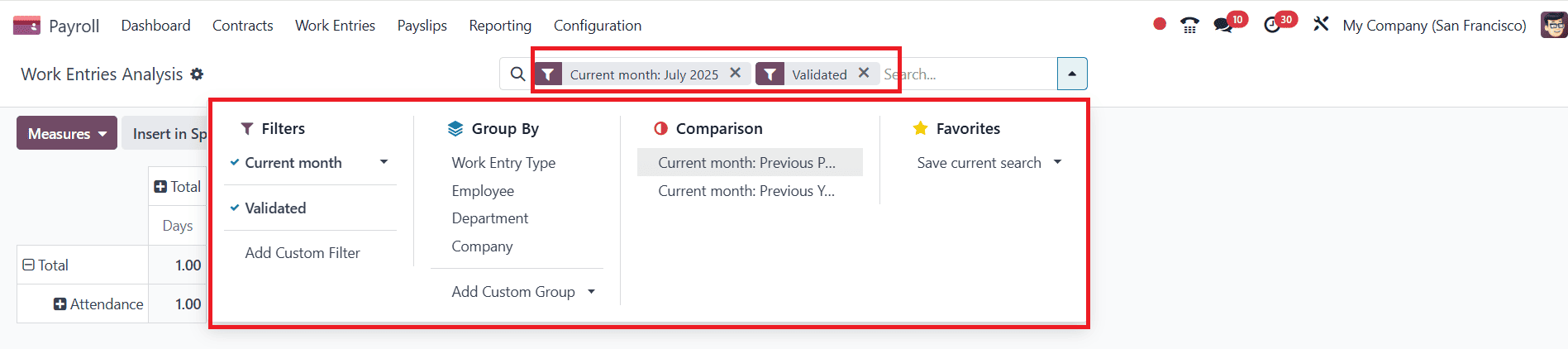

To view this report, navigate to Payroll app > Reporting > Work Entry Analysis.

Here, you can see the filter by default as Current month: July 2025 and Validated. You can also add custom filters or group information by different metrics, like Work Entry Type, Employee, Department, or Company. Some reports also offer a comparison option. You can also save it as Favorites.

Conclusion:

Payroll reporting in Odoo 18 provides a strong means of organizing and examining employee salary information with accuracy and clarity. By centralizing data, automating calculations, and delivering real-time insights, it simplifies HR tasks. For growing businesses, this functionality is not just a convenience but a necessity.

To read more about How to Manage Payroll in Batches in Odoo 18 , refer to our blog How to Manage Payroll in Batches in Odoo 18.