Accounting localization in Odoo is crucial for businesses operating in diverse regions, as it ensures that financial practices align with local regulations and standards. This localization adapts Odoo’s robust accounting system to meet specific tax laws, reporting requirements, and financial conventions of different countries. By incorporating local accounting rules, businesses benefit from accurate financial reporting and reduced risk of errors. Effective accounting localization not only facilitates smoother operations but also enhances the reliability of financial data, enabling businesses to make informed decisions and maintain regulatory adherence across various jurisdictions.

Odoo’s accounting localization for Vietnam is designed to address the specific financial and regulatory requirements of businesses operating in the Vietnamese market. This localization module integrates key features that align with Vietnamese accounting standards and tax regulations, ensuring that companies can manage their financial operations efficiently and in compliance with local laws. With all the functionalities designed for VAT calculations, financial reporting, and statutory compliance, Odoo simplifies the complexities of Vietnamese accounting practices. This enables businesses to streamline their accounting processes, improve accuracy, and meet overall operational efficiency.

Vietnam Accounting with Odoo 17

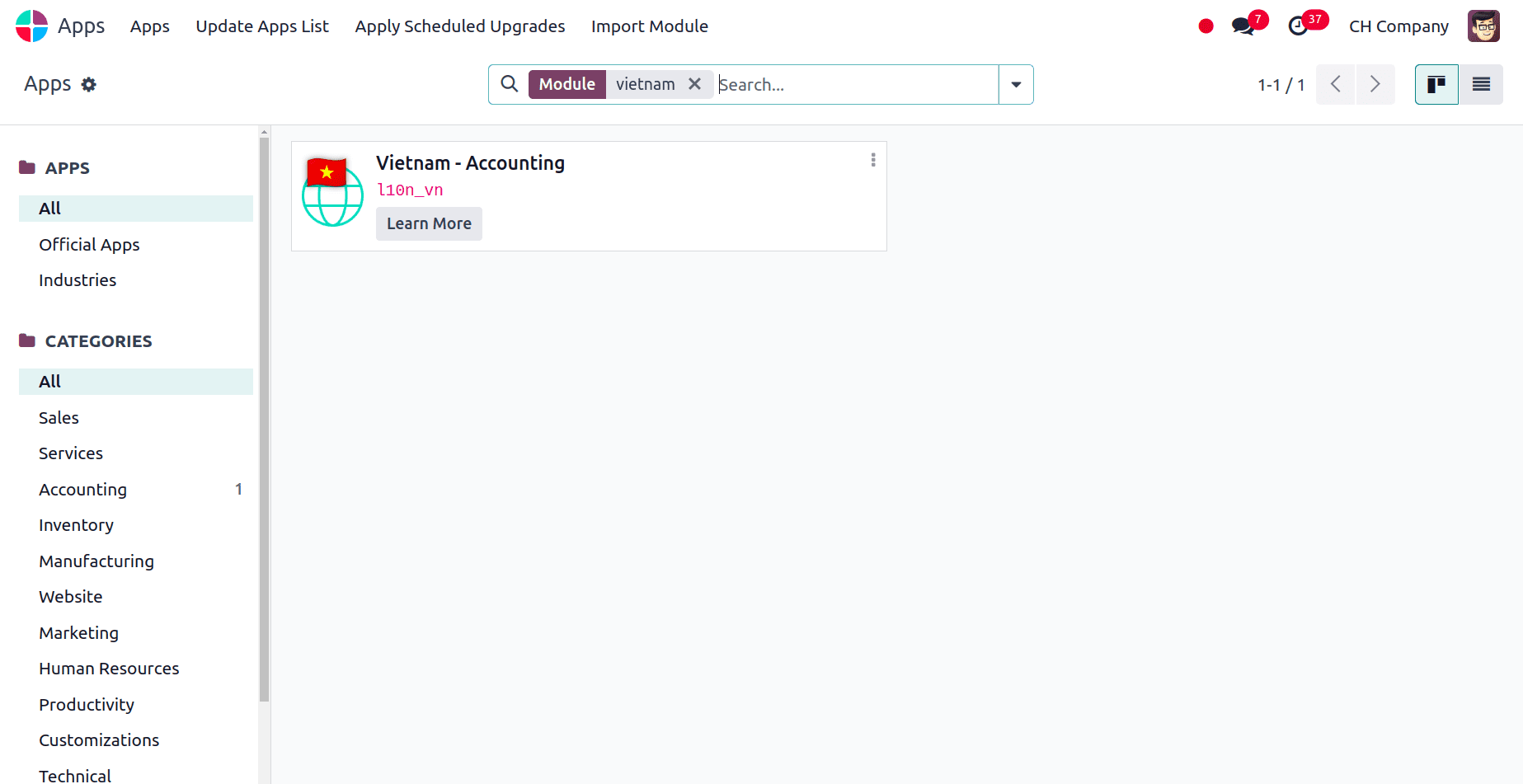

Odoo 17's Vietnam localization module makes it simple to adhere to regional tax and accounting regulations. Installing the localization of Vietnam is the first step in configuring the accounting localization for Vietnam. To accomplish this, we can install the modules needed to set up the Vietnam accounting localization by going to Apps.

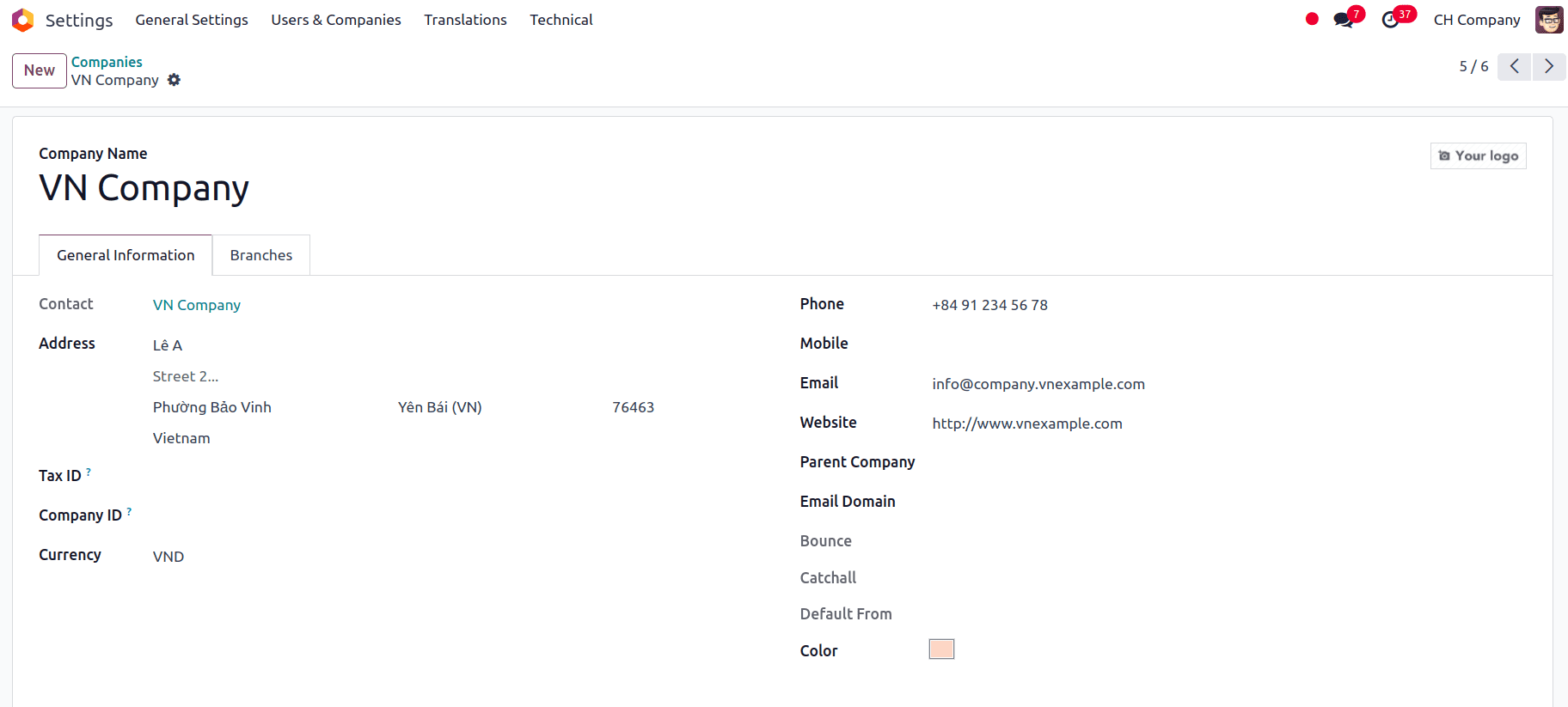

Verifying the current company setup is crucial to ensuring accurate data and functionality in Odoo; if necessary, we can create a new company with the necessary information. This setting establishes important details about your company. Go to Settings > Users and Companies > Companies. Select the company whose configuration we wish to check from the list.

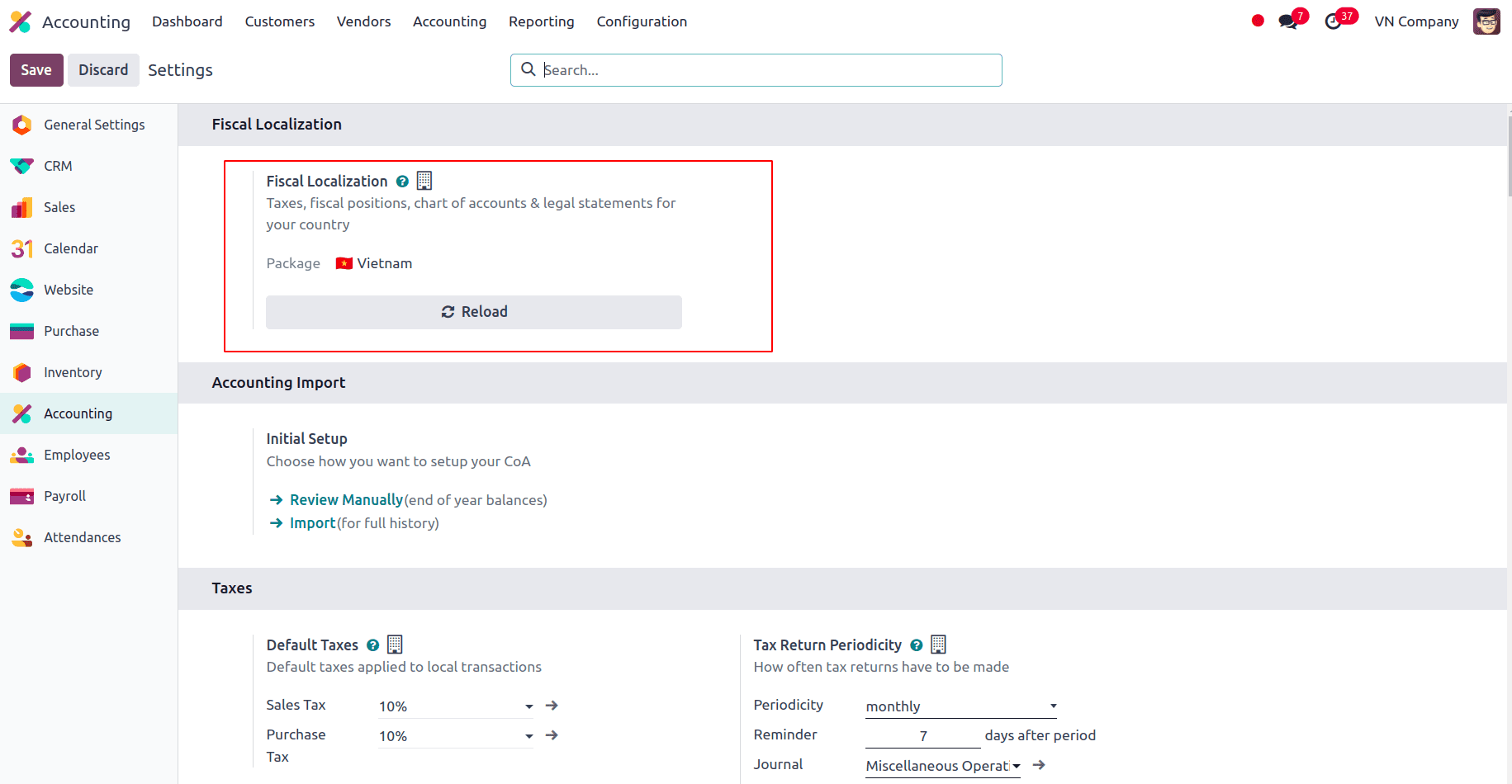

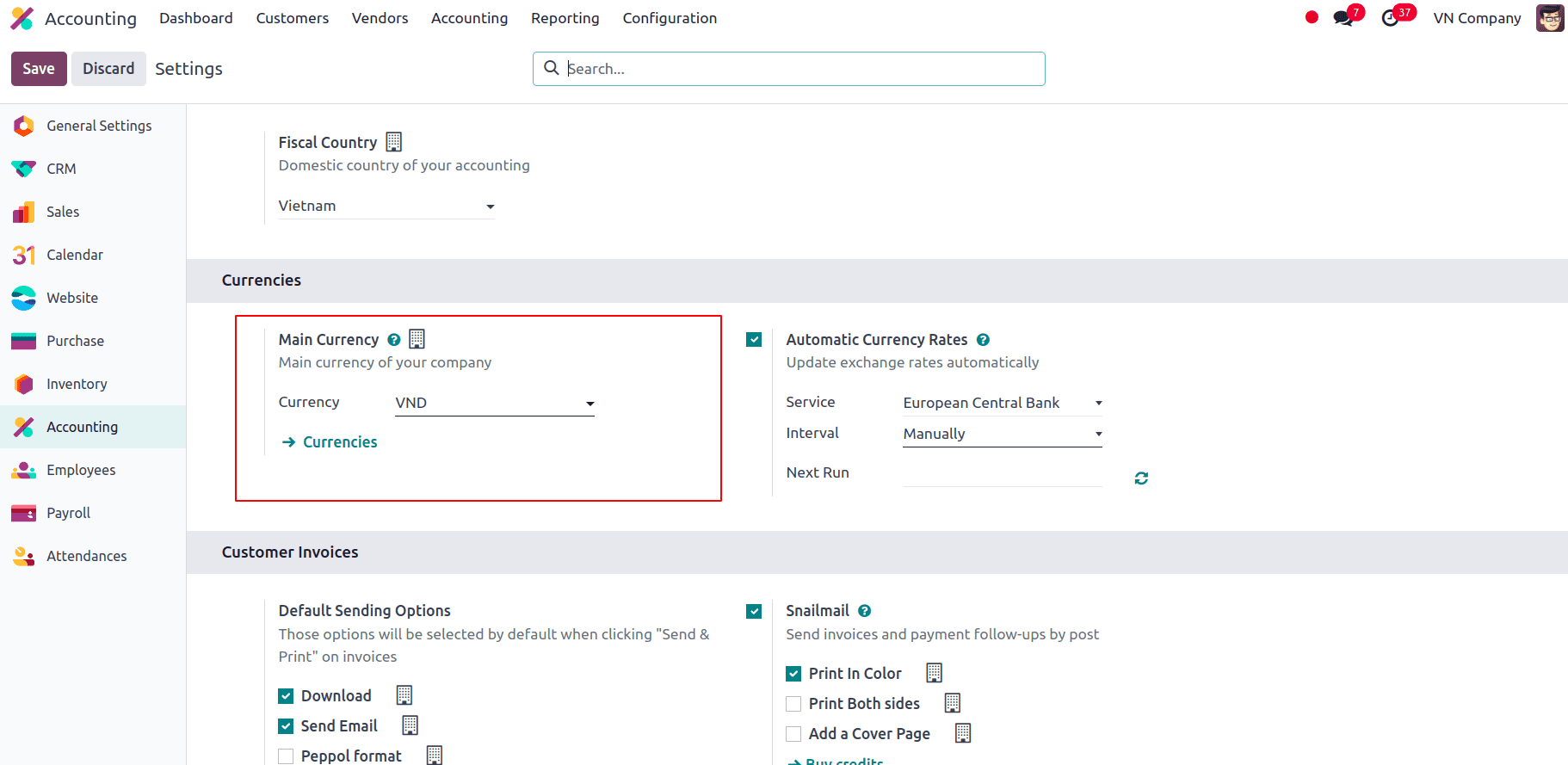

Now, we can go to Accounting > Configuration > Settings to see the modifications made for this localization after installing Vietnam localization and verifying the accuracy of the company information. By going to Accounting > Configuration > Settings, we can observe that Vietnam will be selected as the fiscal localization.

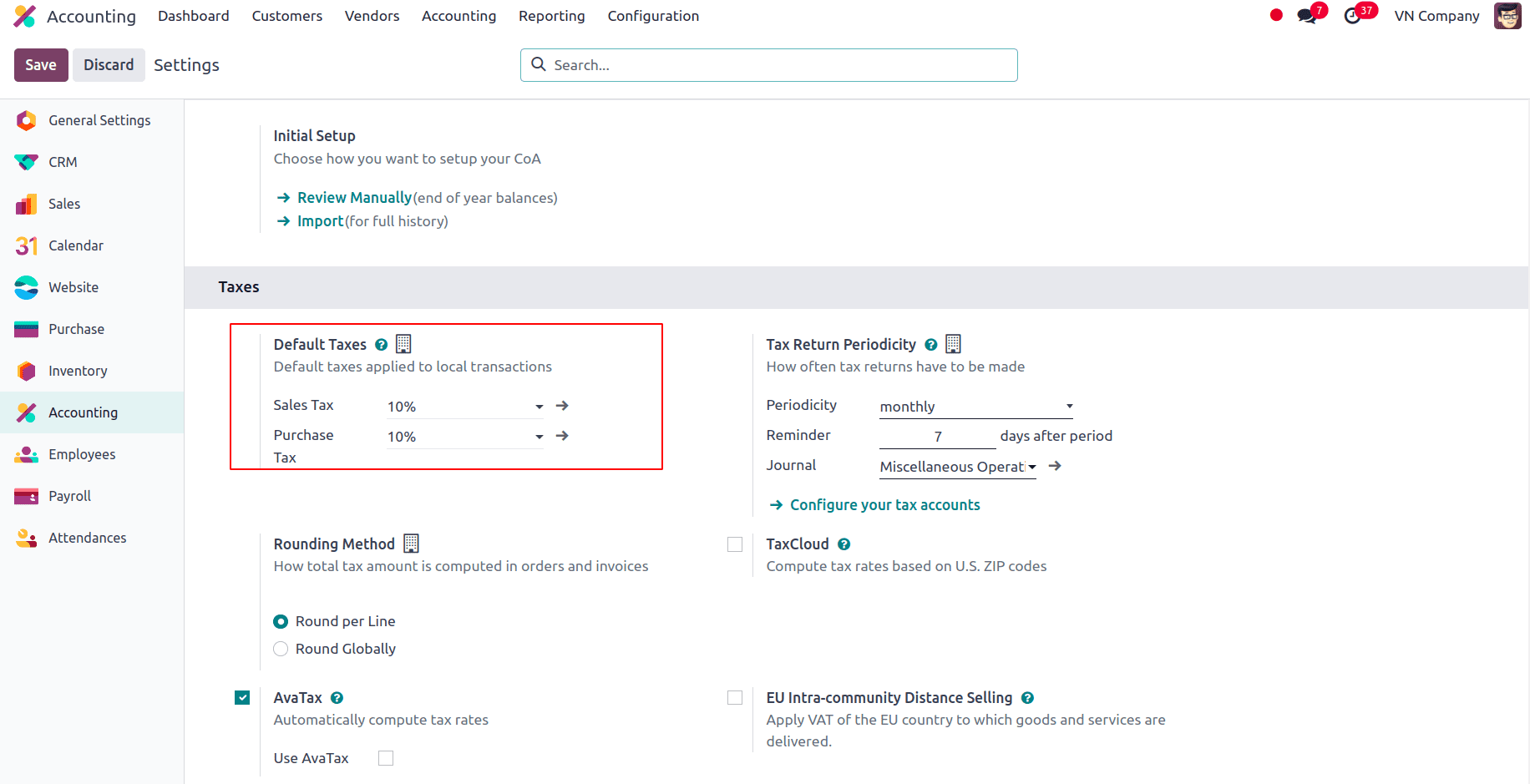

Default taxes in Odoo are predefined tax settings that streamline the management of sales and purchases within the system. These default taxes are configured to automatically apply the appropriate tax rates to transactions based on predefined criteria such as product type, customer location, or transaction type. Here, for Vietnam Localisation, we can see that the default tax is set to 10% Sales and Purchase Tax. By setting up default taxes, businesses ensure consistency in tax calculations, simplify invoicing processes, and enhance accuracy in financial reporting.

The Main Currency will be set to the official currency of Vietnam which is the Vietnamese dong (VND).

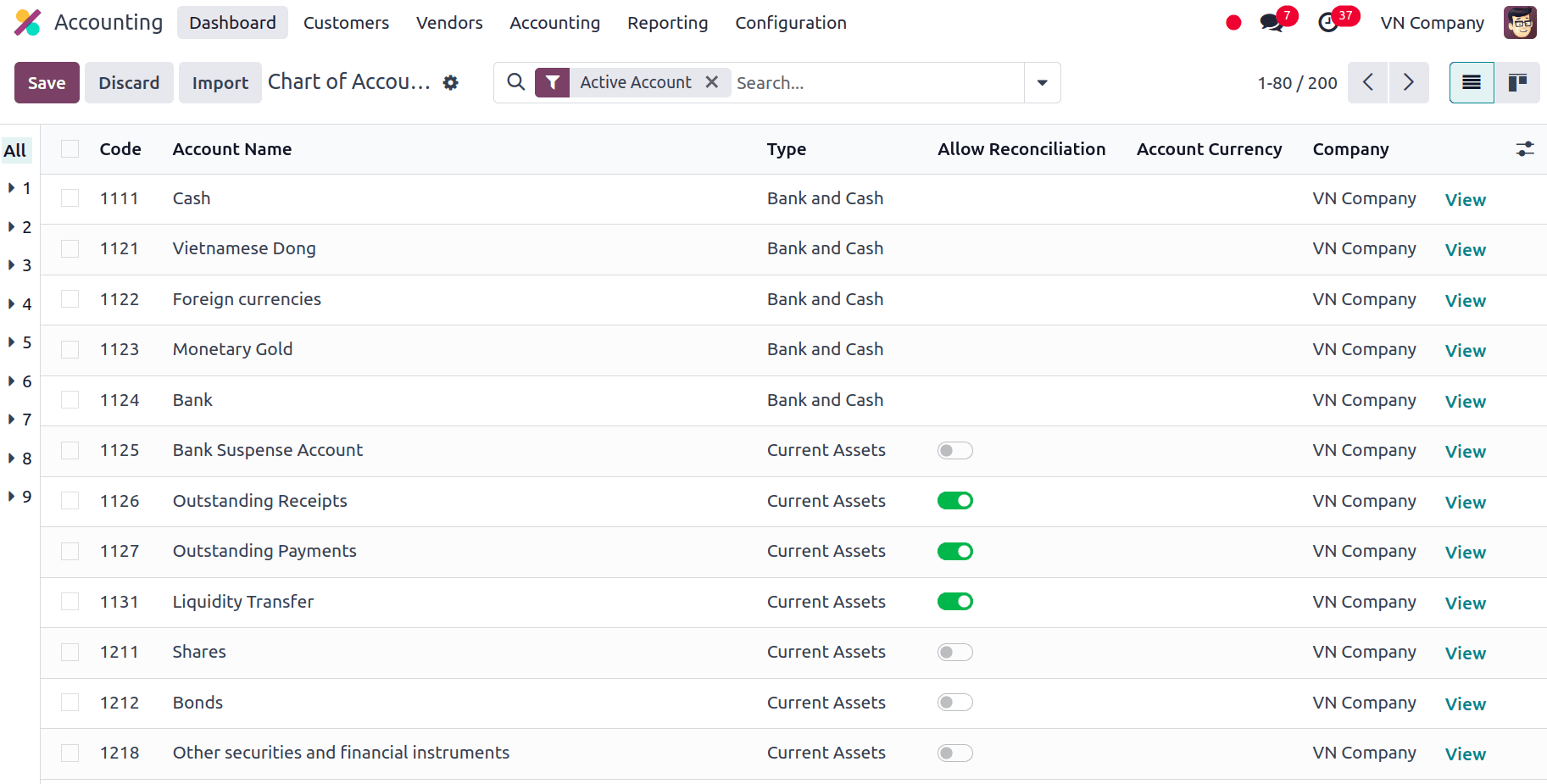

Chart of Accounts

The Chart of Accounts (COA) in Odoo is a fundamental component of financial management that organizes and categorizes all financial transactions. It ensures accurate financial data collecting and reporting for the accounting system. The COA makes it easier to handle finances clearly and effectively by offering a systematic framework for grouping accounts like assets, liabilities, income, and expenses.

The Chart of Accounts for Vietnam accounting localization includes some extra accounts like Monetary Gold, which is used to categorize and track investments in gold held as a financial asset. This account type is specifically designed to manage and record the value of gold, which is considered a monetary asset, separate from other forms of investments or physical inventory. Working Capital Provided to Sub-Units is used to track and manage the funds allocated to subsidiary units or departments within an organization. This account records the working capital provided to these sub-units to support their operational needs. There are other accounts that have also been added to the Chart of Accounts with Vietnam accounting localization that are required to run the business smoothly.

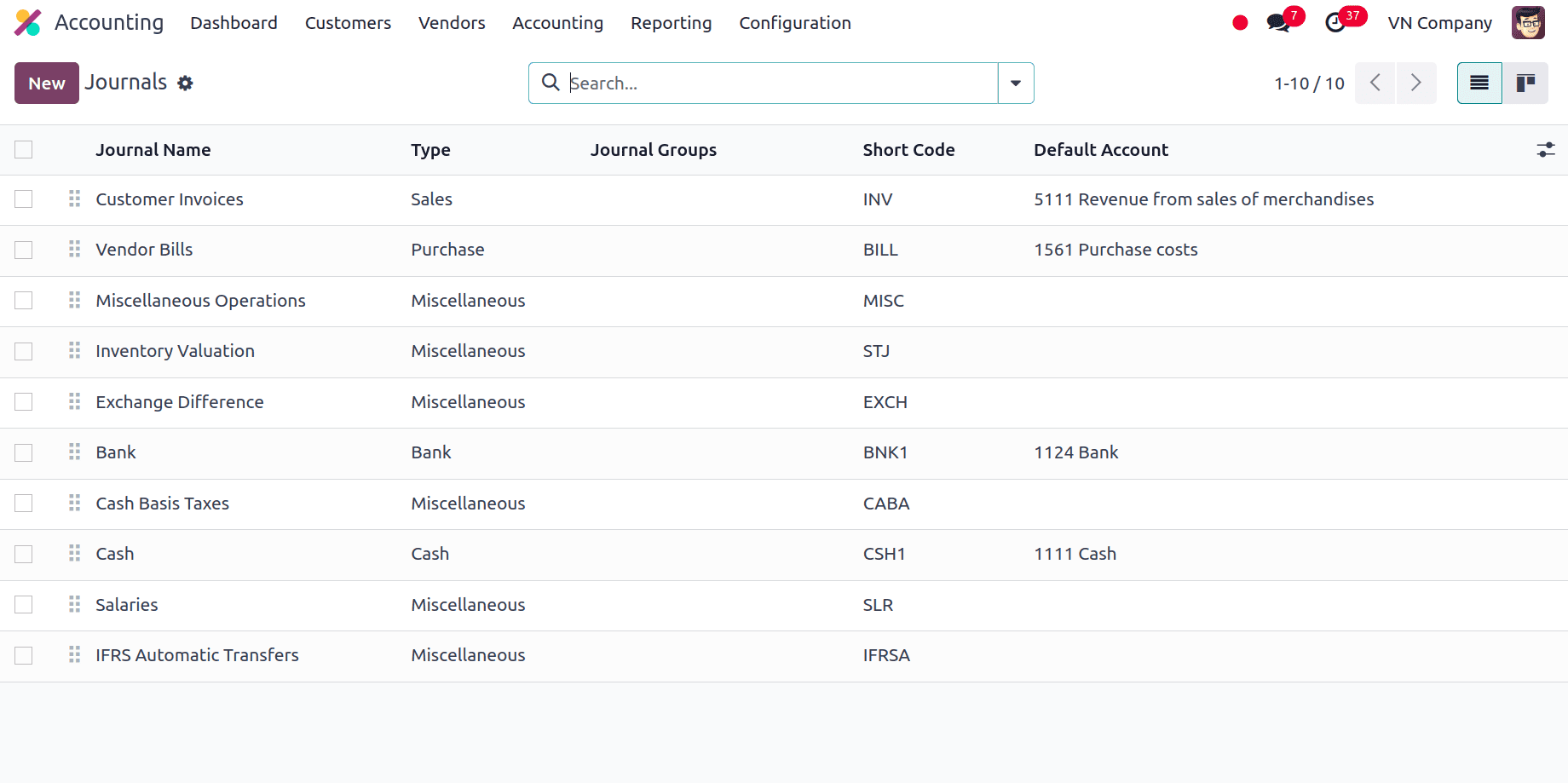

Journals

Odoo journals are essential for keeping detailed and well-organized financial records. They are the main tool for systematically recording all transactions, including purchases, sales, and expenses. By categorizing transactions into specific journals, businesses can ensure precise bookkeeping and streamlined financial reporting. Journals facilitate traceability and verification of transactions, support compliance with accounting standards, and provide a clear audit trail. This organizational structure enhances the accuracy of financial data and simplifies the reconciliation process, making it easier to manage and analyze financial performance. The journals in odoo with Vietnamese accounting localization include all the basic journals along with the Exchange Difference Journal, which is vital for accurately managing and recording currency fluctuations in transactions. This journal tracks and documents the impact of exchange rate changes on financial transactions and balances, ensuring that the value of foreign currency assets and liabilities is correctly reflected in the financial statements.

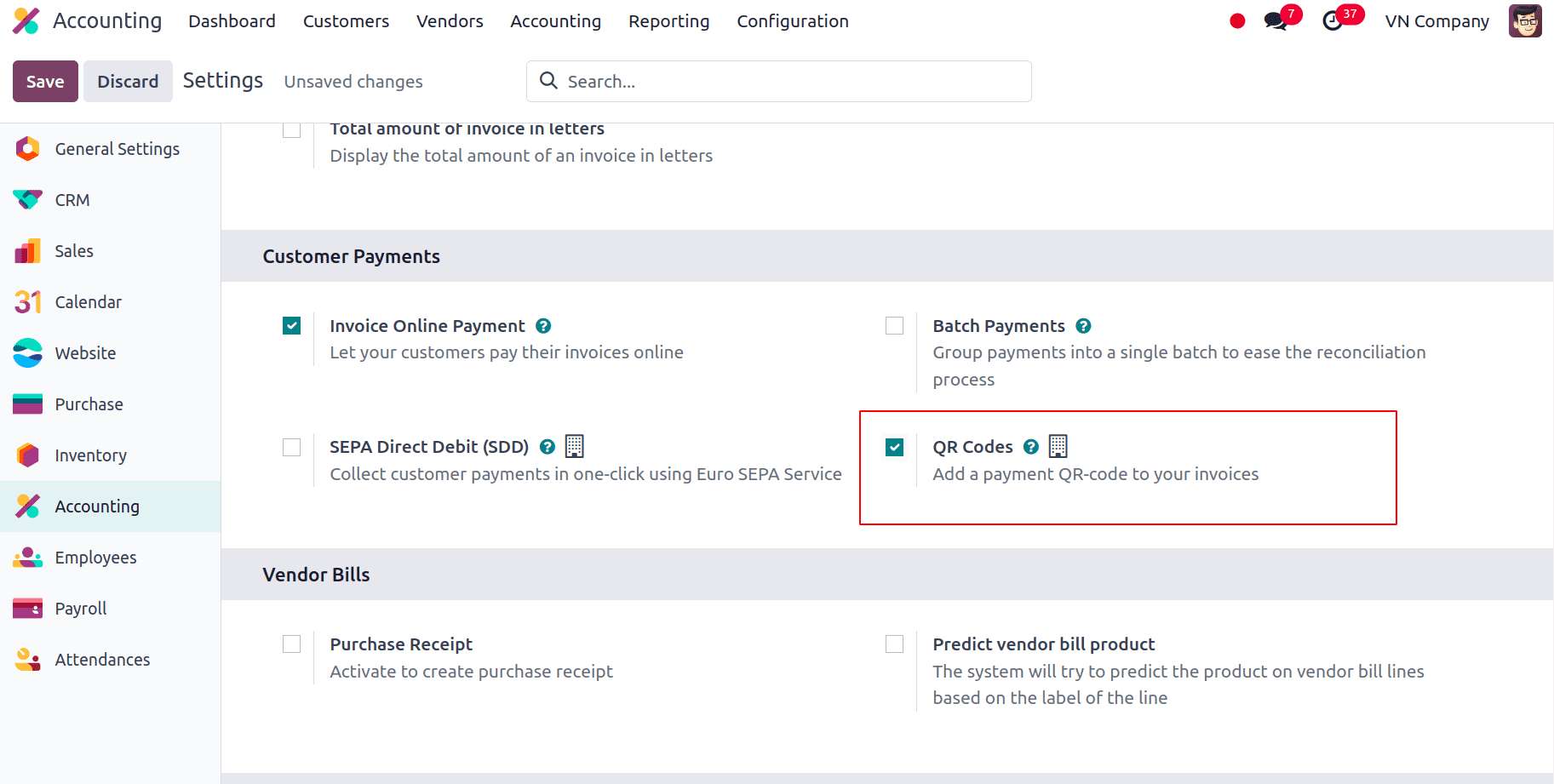

QR Banking Code to Invoices

With Vietnamese QR banking, users can use the internet and mobile banking to instantly send money domestically to people and businesses in Vietnamese dong. To perform this we can add QR codes to the invoices, for that, navigate to Accounting > Configuration > Settings > and under the Customer Pymentrs section we have the QR codes option available, we can enable that feature and Save.

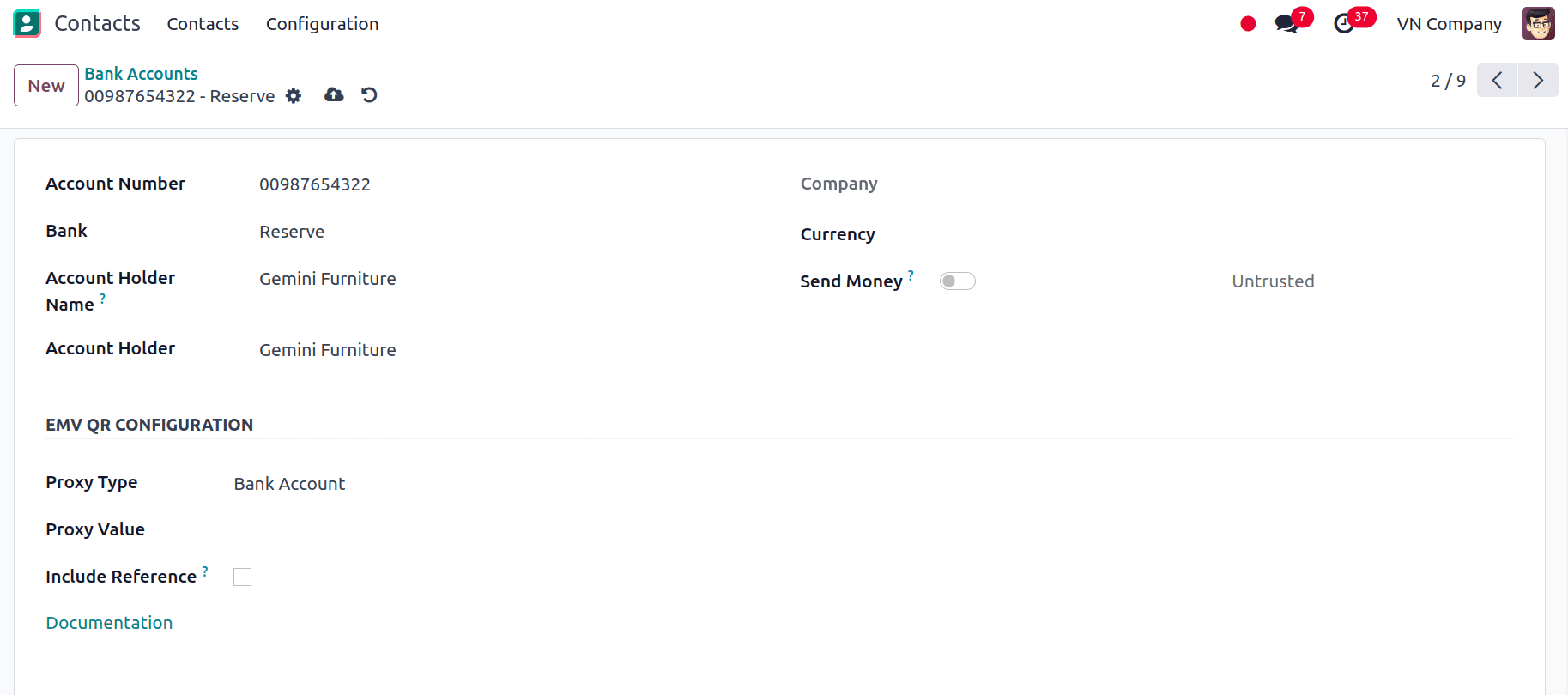

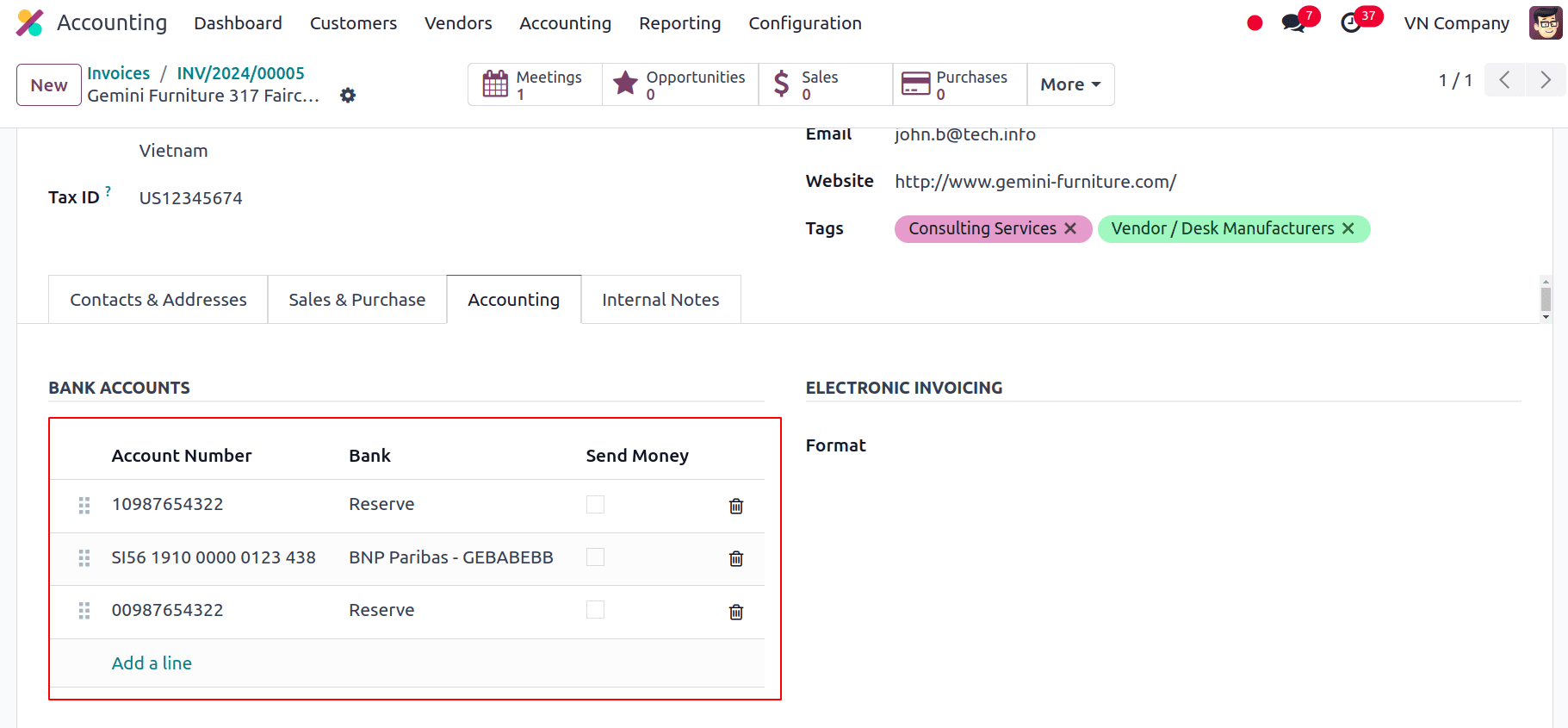

Then, we have to configure the bank account with a QR banking account configuration. For that, navigate to the Contacts module and choose the bank account for which we wish to activate Vietnamese QR banking under Configuration > Bank Accounts. Here, we can enter the Bank Identifier Code on the bank. Next, select the Proxy Type and enter the Proxy Value box based on your selection. Also, we have to make sure that the account holder's country is set to Vietnam.

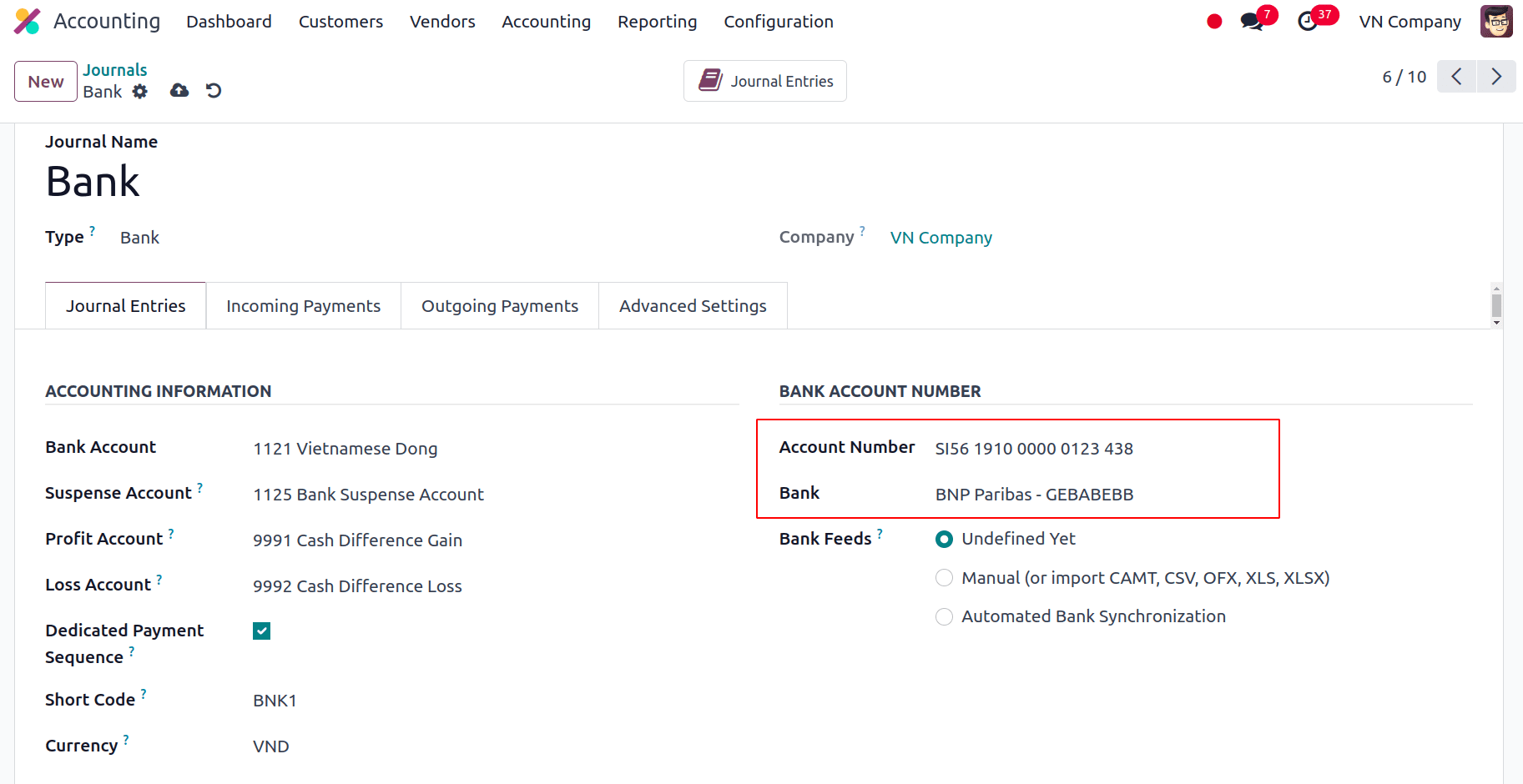

Now we can configure the bank journal for that navigate to Accounting > Configuration > Journals and fill out the Account Number and Bank under the Journal Entries tab.

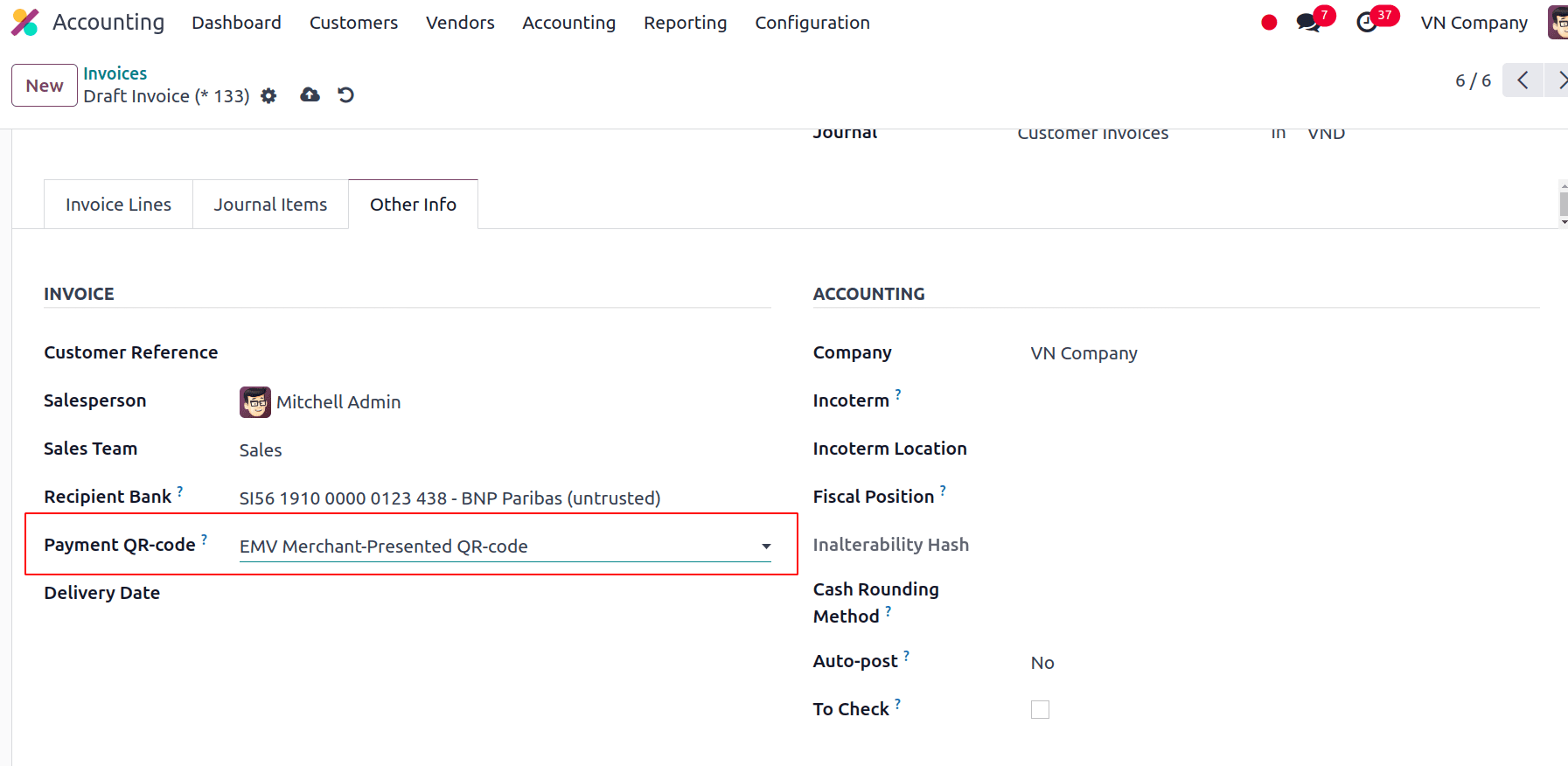

Now we can put the Vietnamese QR banking QR codes on invoices. Select the EMV Merchant-Presented QR-code under the Payment QR-code option when you create a new invoice by opening the Other Info tab.

We have to make sure the Recipient Bank is the same that we have you configured, as this field is used to generate the Vietnamese QR banking QR code.

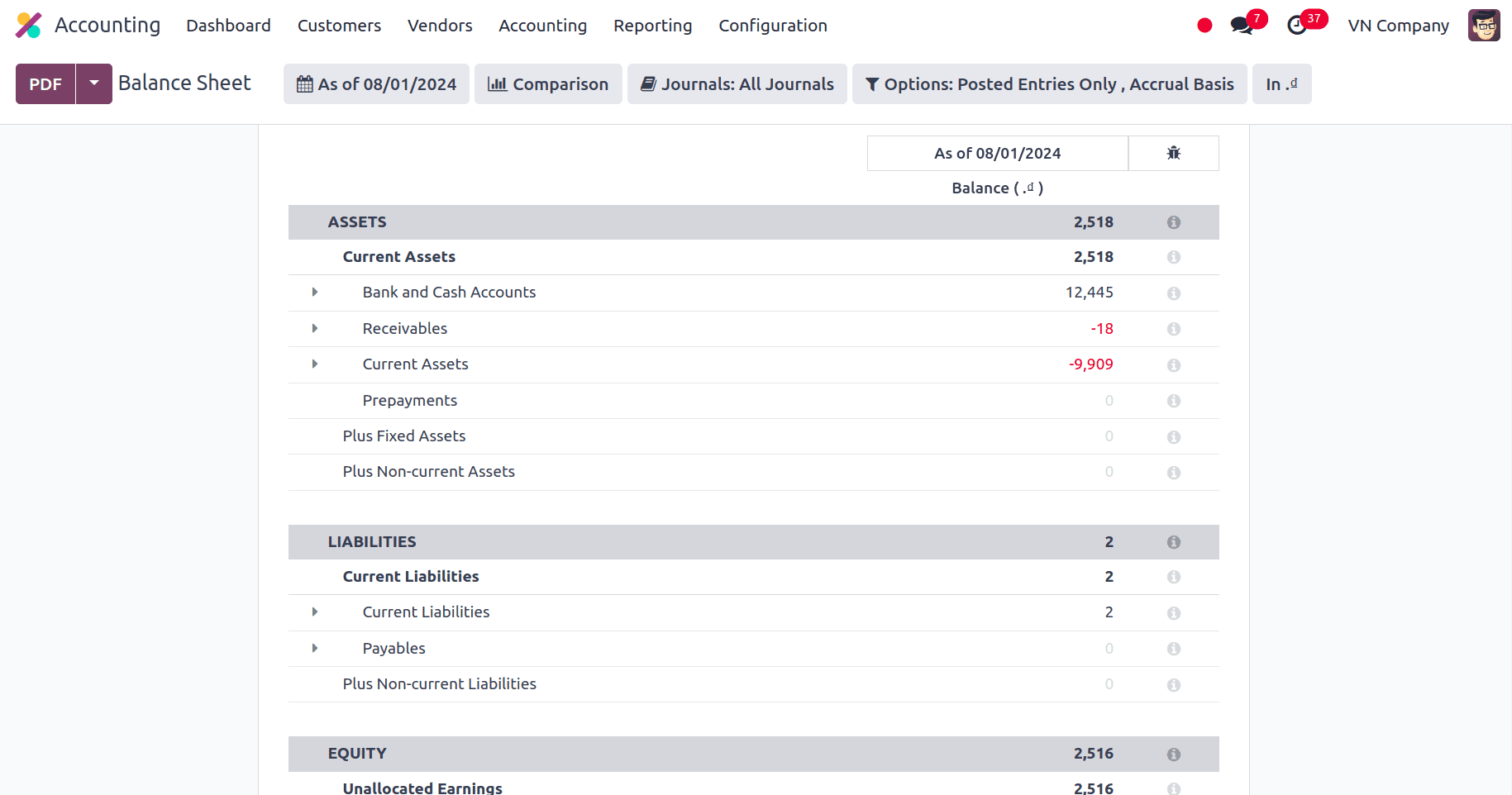

Balance Sheet

One crucial financial document that provides a summary of a company's financial status at a specific point in time is the balance sheet. By presenting equity, liabilities, and assets, it gives a comprehensive picture of the company's holdings and debts. For evaluating financial health, monitoring performance, and making wise company decisions, the balance sheet is essential. We may view the Assets, which are the company's resources, including cash, inventory, and real estate, that could produce future financial gains. We can view the current assets under the assets and Liabilities, which represent the debts and obligations that the business needs to settle, such as loans, accounts payable, and accrued expenses. Current liabilities can be viewed under this. Accurate tracking and reporting of liabilities in Odoo provide insights into the company's financial commitments and its ability to meet them, as well as the Equity, which represents the owners' stake in the business, including retained earnings, capital contributions, and shareholder equity. We can get a detailed report on the Unallocated earnings and the current year's unallocated earnings in the equity section.

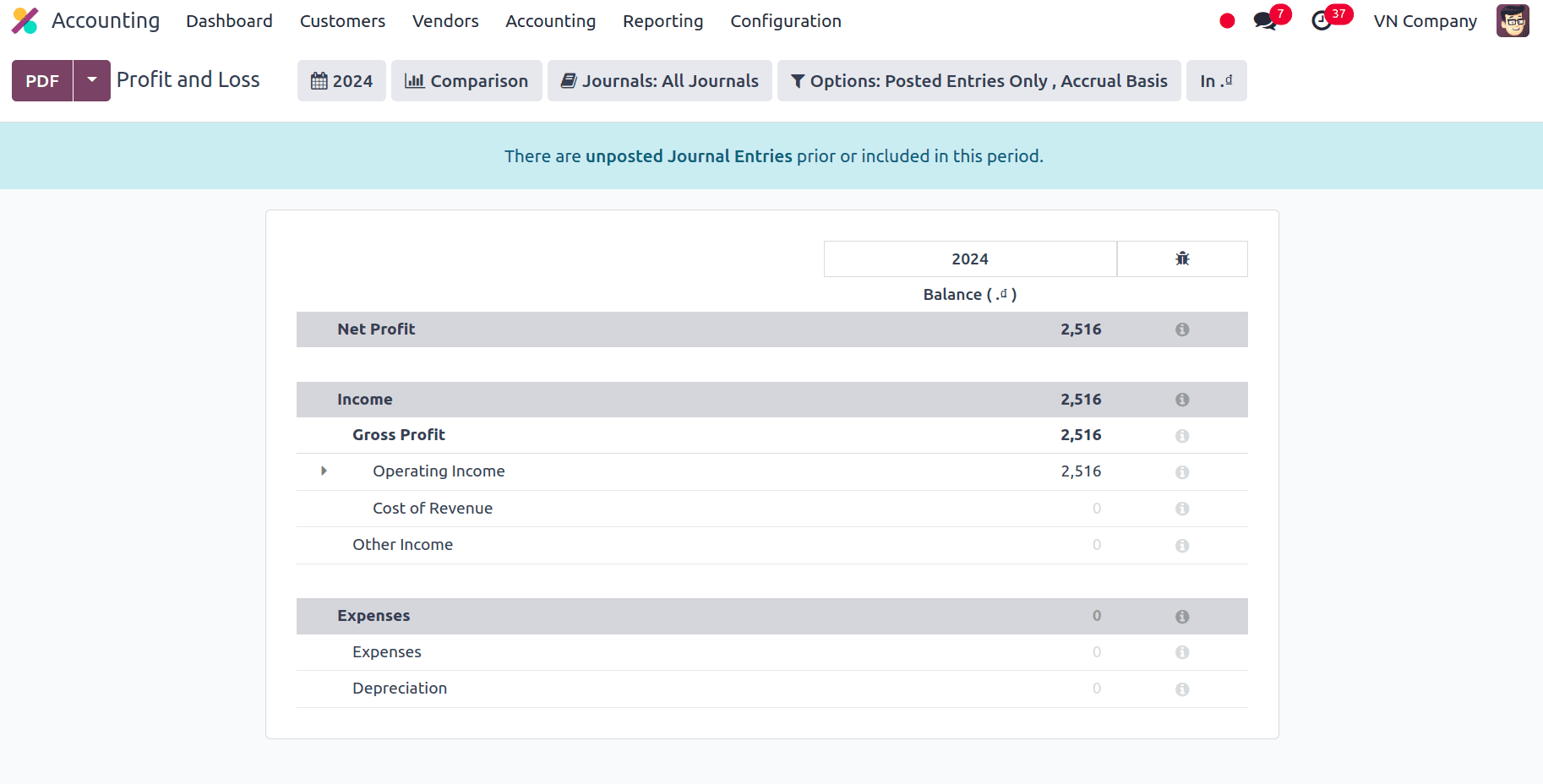

Profit and Loss Report

An extensive summary of a business's financial performance over a given time period can be found in Odoo's Profit and Loss (P&L) report. It provides information about the company's earnings and operational efficiency by breaking down sales, costs, and profits or losses. By summarizing income and expenditures, the profit and loss report helps businesses assess their financial health, track performance trends, and make informed decisions. We have three sections: Net Profit, Income, and Expenses. The gross profit can be viewed in the report as well as in the income section, which represents the difference between total revenue and the cost of goods sold (COGS).

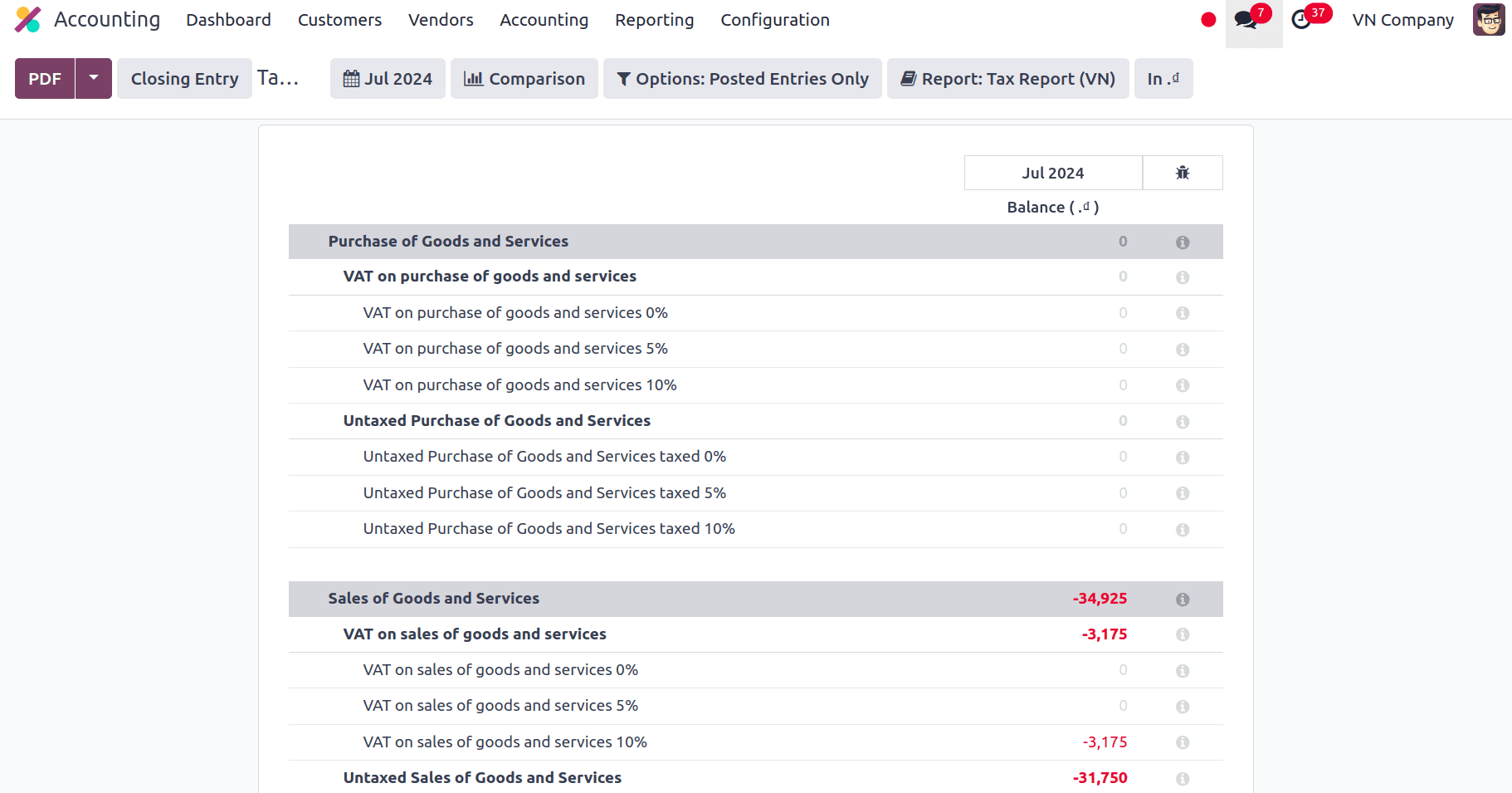

Tax Report

This report provides a detailed breakdown of taxes collected and paid, including VAT, which is essential for accurate tax reporting and submission. It incorporates local tax rules and rates, facilitating precise calculations of VAT liabilities and refunds. The tax report also helps businesses generate the necessary documentation for tax authorities, streamlining the filing process and ensuring adherence to local tax laws. Odoo's Vietnam localization streamlines tax administration, lowers error risk, and facilitates effective regulatory compliance by automating these activities.

We can see the report for Purchase of Goods and Services, which captures the details of VAT on purchased goods and services, reflecting the input tax that businesses can claim as a credit against their VAT liabilities. It provides a clear breakdown of VAT amounts paid on various purchases, ensuring accurate reporting of input tax credits. Similarly, we have the Sales of Goods and Services, which details the VAT collected on sales transactions, including the applicable rates and total amounts. It categorizes sales by type and applies the correct VAT rates to ensure accurate reporting of output tax. The report provides a comprehensive overview of VAT obligations related to sales, facilitating proper documentation and submission to Vietnamese tax authorities.

Thus, Odoo's accounting localization for Vietnam provides a solid option that is customized to satisfy Vietnam's unique legal and financial demands. We can see that with Vietnam localization, the customers can perform QR banking on invoices; with QR banking, customers can swiftly complete transactions, doing away with the need to manually enter payment or account information. The time spent on transactions is decreased by this streamlined procedure. This localization helps timely and compliant tax filings, guarantees correct and efficient management of transactions, and offers insightful information about financial performance.

To read more about An Overview of Accounting Localization for Kazakhstan in Odoo 17, refer to our blog An Overview of Accounting Localization for Kazakhstan in Odoo 17.