Odoo is a powerful and flexible ERP system that provides various ways to display and interact with data. In this blog post, we'll delve into Storno Accounting Odoo 18. Storno Accounting is a feature in Odoo's accounting module. This method involves reversing previously posted journal entries by using negative debit or credit amounts, rather than creating separate correcting entries. Through this approach, any financial record that contains errors or inaccurate figures can be effectively cancelled or adjusted. It offers a cleaner and more traceable way to rectify mistakes in accounting entries, ensuring accurate and compliant bookkeeping.

Once an incorrect accounting entry is canceled, it's your responsibility to input the correct amount to maintain accurate financial records. When using Storno Accounting in Odoo, the system automatically generates a reversal of the original journal entry. This reversed entry mirrors the original but with the amounts displayed as negative values, clearly indicating that it serves as a cancellation of the initial transaction.

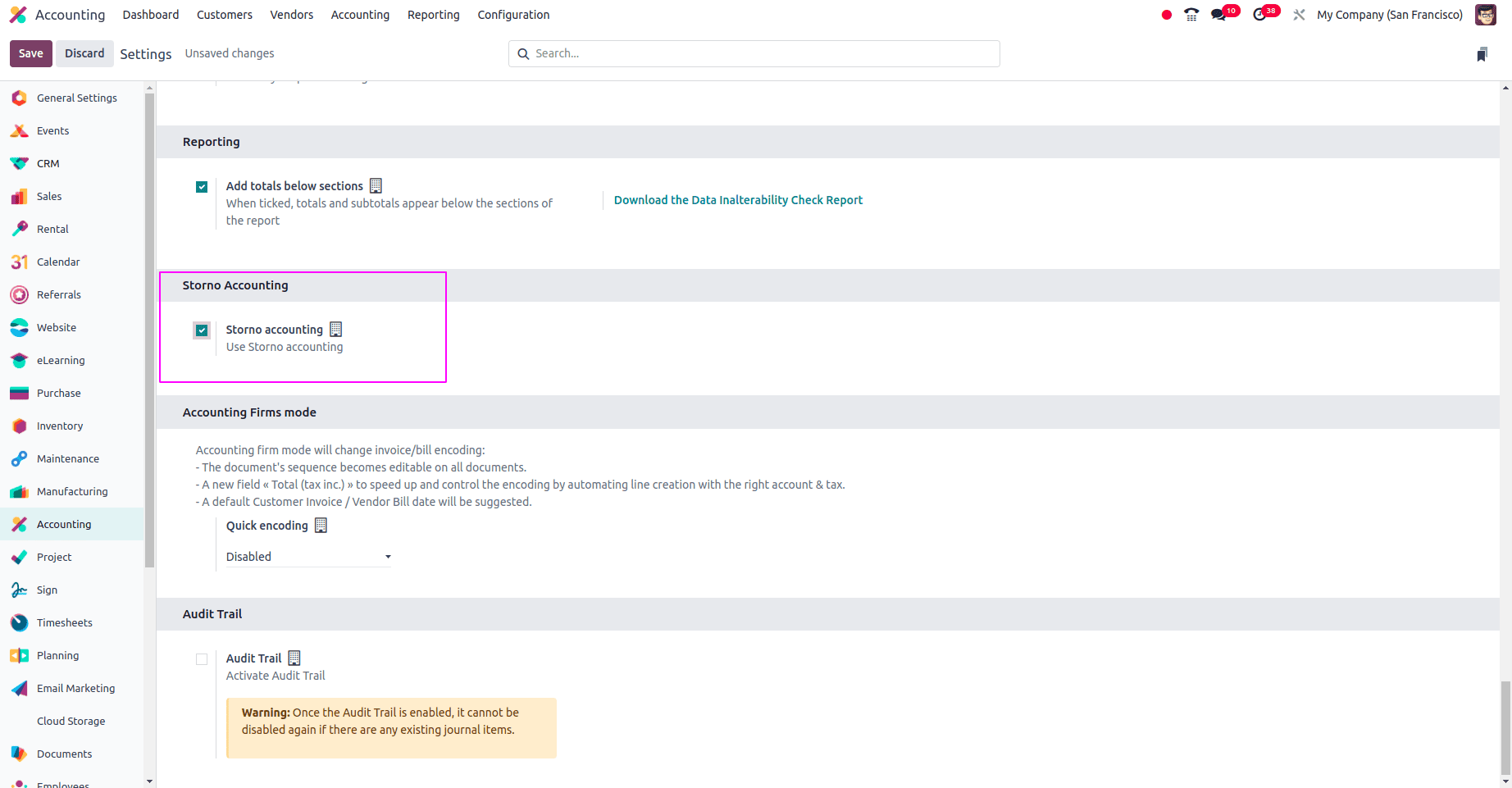

To enable this feature, you first need to activate Storno Accounting by navigating to Accounting > Settings in your Odoo. Once activated, the system will apply the Storno method for reversing journal entries.

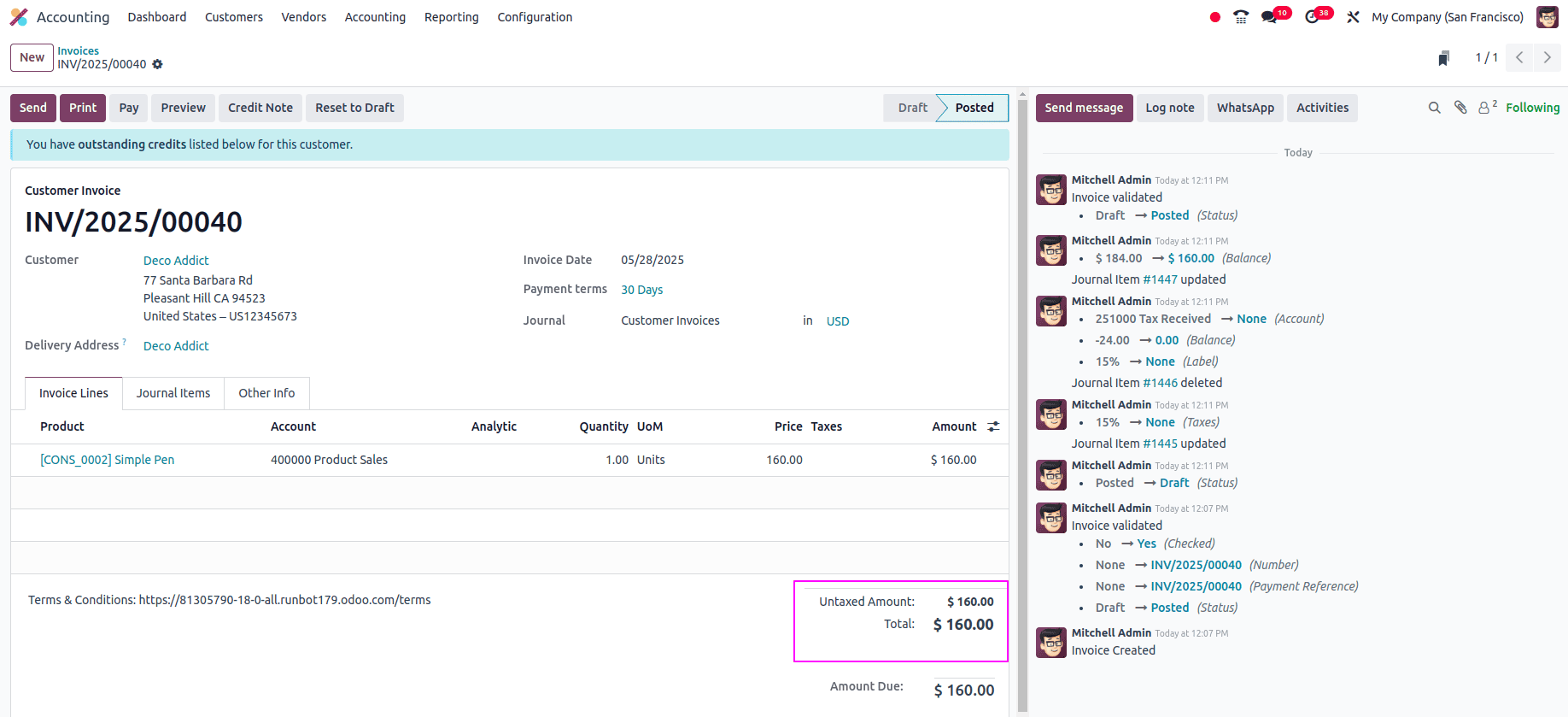

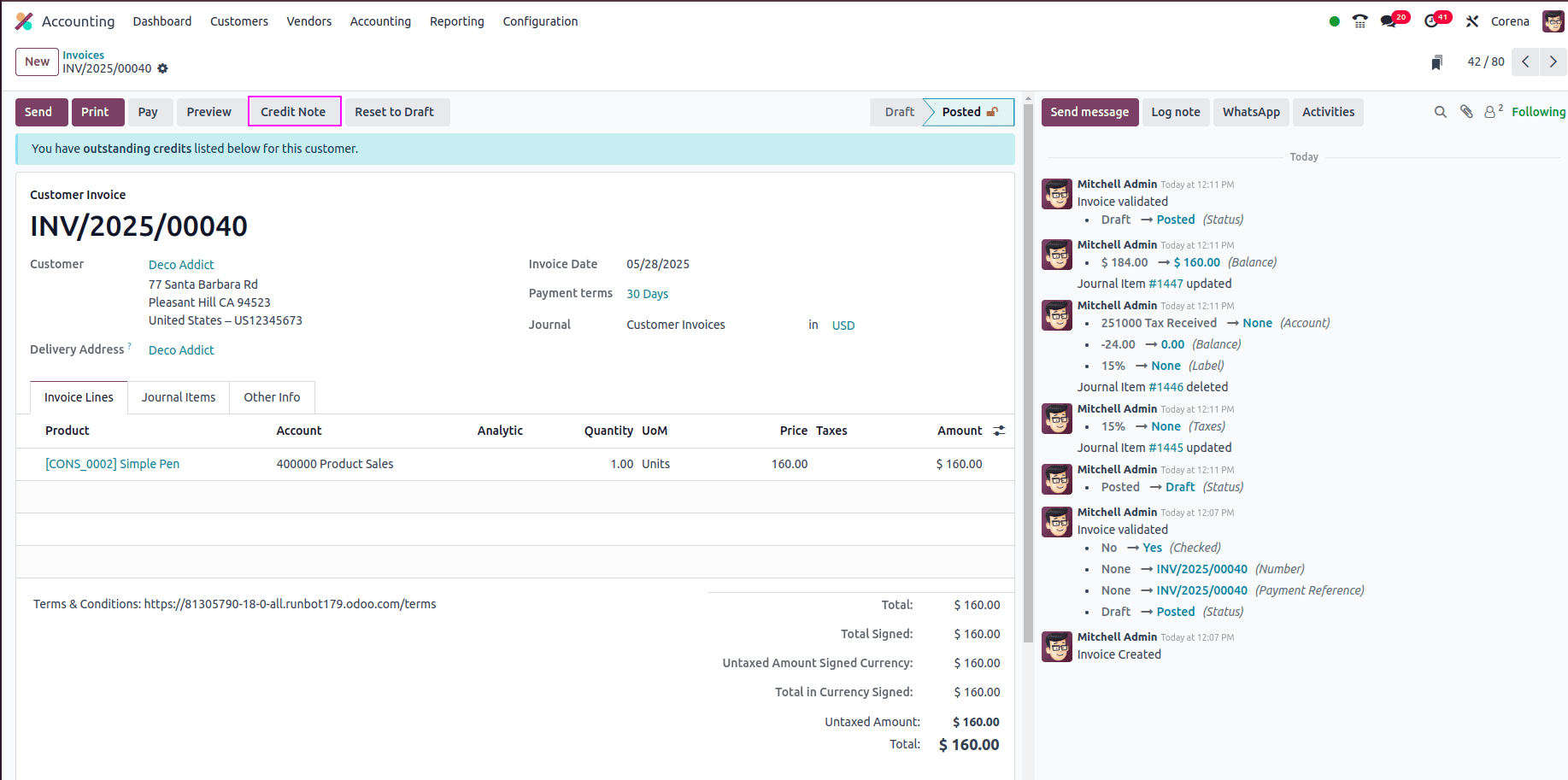

To effectively test how the Storno Accounting feature works in Odoo, begin by creating a Customer Invoice with a sample amount. Once the invoice is filled out and saved, post it to generate the corresponding journal entry in the system. This original journal entry represents the financial transaction recorded in your books. If there's an error or the invoice amount needs to be corrected later, you can reverse this entry using the Storno method. This reversal will create a mirror journal entry with negative debit or credit values.

Suppose you’ve already recorded a vendor bill for $160. Later, while processing the payment, you realize the correct amount should have been $100. In this case, you’ll need to reverse the original journal entry using the Storno Accounting method. Once the incorrect entry is reversed, you can then proceed to create a new invoice with the accurate amount of $100.

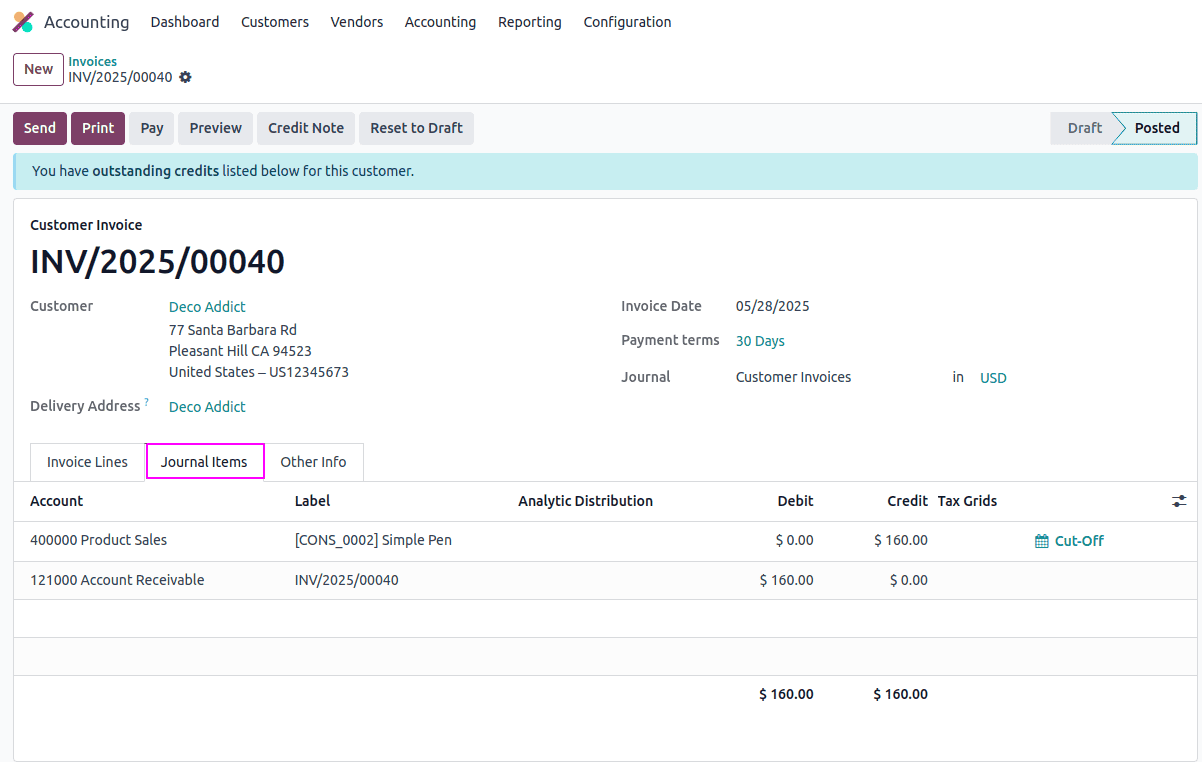

The screenshot displays the customer invoice with a total amount of $160. You can view the corresponding journal entries by navigating to the Journal Items tab, as illustrated below.

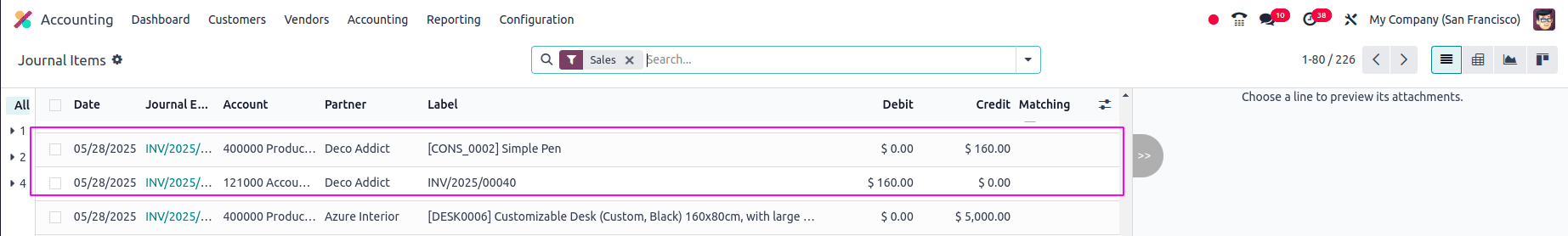

By reviewing the Journal Items section within the Accounting module, you can see the posted entries reflecting the recorded amount, as demonstrated in the screenshot below.

Now, we will proceed to reverse the journal entry, as the invoiced amount does not reflect the correct value. To initiate the reversal, click on the Credit Note button located on the invoice.

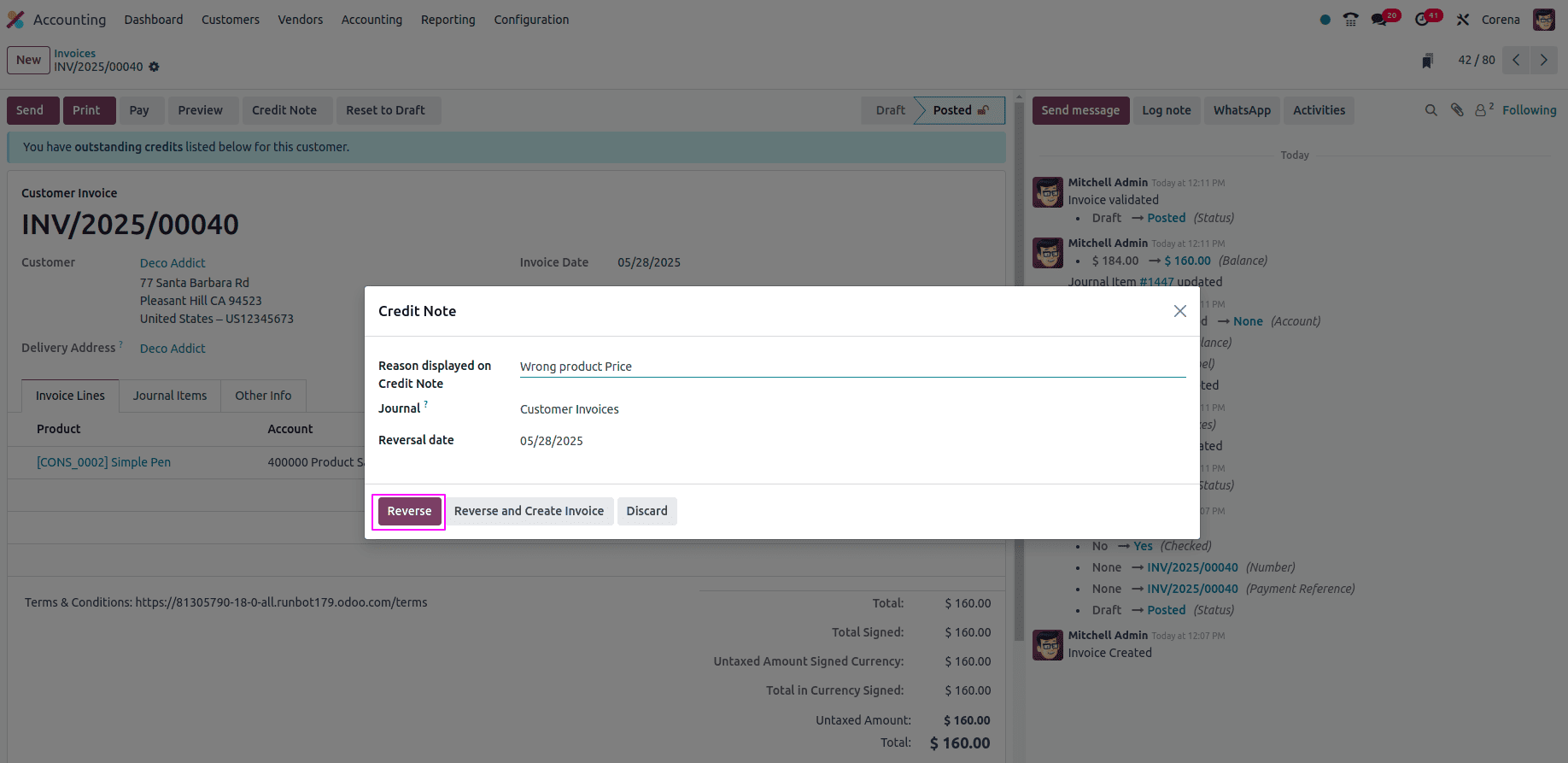

By clicking the Credit Note button on the invoice, a wizard will appear, allowing you to configure the reversal details.

After clicking the Credit Note button, a reversal wizard will appear where you can specify the necessary details. In this wizard, you'll be prompted to enter a Reason for the reversal, which helps in tracking why the entry is being reversed. You can also set the Date for the reversal and choose the appropriate Journal where the reversed entry should be recorded. Once all the details are filled in, simply click the Reverse button to generate the Storno entry. This creates a negative journal entry that cancels out the original transaction, maintaining transparency and accuracy in your accounting records. Confirm the reversal.

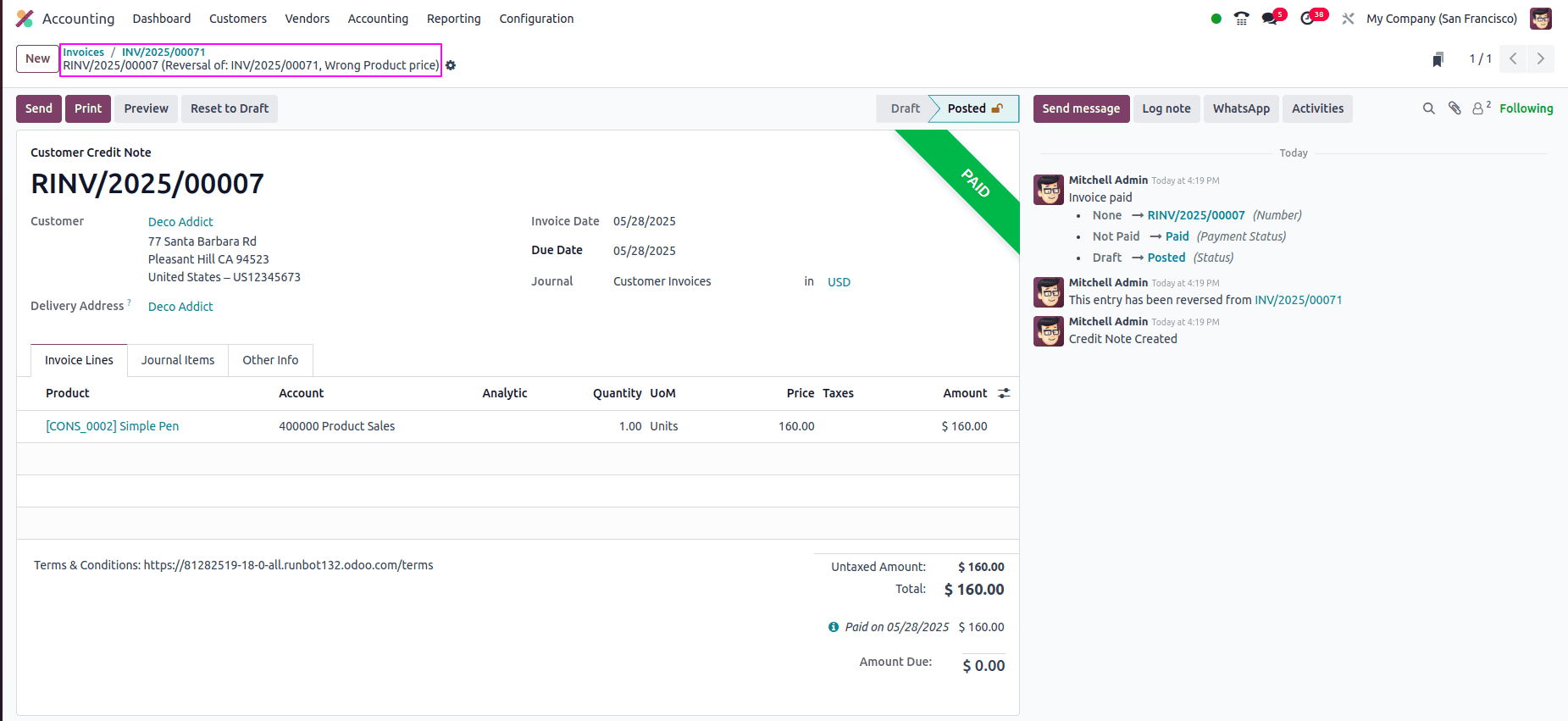

After confirming the reversal, you'll be redirected to a new draft invoice titled accordingly INV/2025/00071 RINV/2025/00007 (Reversal of: INV/2025/00071, Wrong Product price). This reversal invoice mirrors the original entry but with negative amounts. To finalize the process, simply post the reversal invoice, and the system will automatically generate the necessary journal items to cancel out the original transaction.

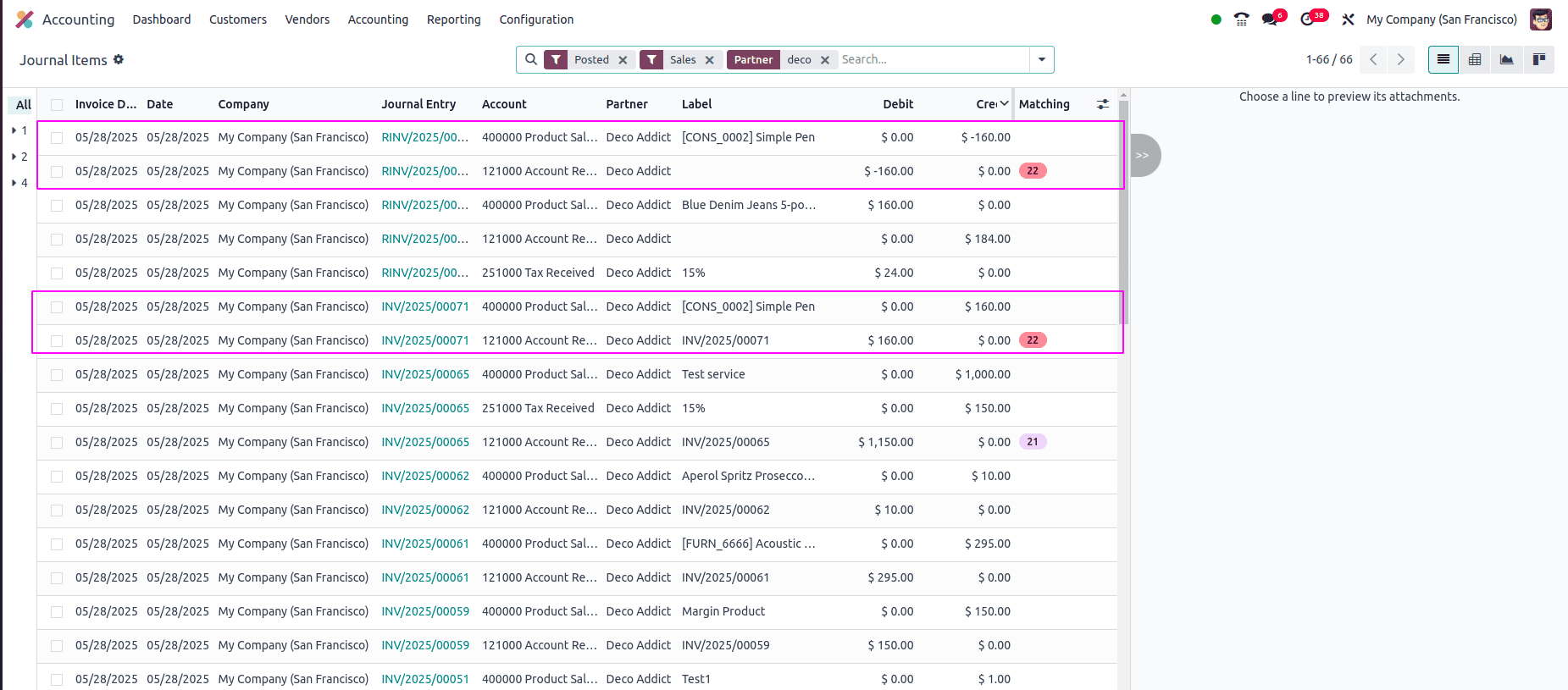

In the screenshot below, you can see both the original invoice and the reversal invoice. The reversal invoice displays negative values, which clearly demonstrates how Storno Accounting is applied in Odoo to reverse incorrect transactions.

To read more about A Detailed Overview of Storono Accounting in Odoo 16, refer to our blog A Detailed Overview of Storono Accounting in Odoo 16.