Indirect taxes are applied on a sub-national level in the US instead of a national sales-tax system. According to US Constitutional restrictions, the state has the right to impose a sales tax for specific products/services. Moreover, local jurisdictions in many states also impose taxes and sales. Sales tax management is a complex process for most companies based on particular locations. By running ERP software into your business, you can quickly configure taxes as per each state. Odoo 16 Accounting application enables users to check out taxes and mention them on specific orders/invoices for customers.

This blog emphasizes the sales tax management of Arkansas(US) within the Odoo 16 Accounting.

Applying default taxes in a customer invoice is accessible through the Accounting module of Odoo 16. In addition, users can analyze invoice reports, audit reports, partner reports, and more in the Odoo 16 Accounting module. Let's view the steps to manage sales tax in the Arkansas(US) company using Odoo ERP.

Overview of Arkansas(US) Sales Tax in 2022

The rental of tangible personal property is termed a sale. Tangible products and services in Arkansas are taxable. Taxable benefits included telephone, electricity, water, repair, and more. The sales tax rate of Arkansas is considered as 6.5% of gross receipts from sales related to specific services or properties. Some of the exceptions from sales tax include sewer service, gas produced from biomass, timber harvesting machines, and more. Furthermore, local taxes are charged by each state apart from state sales in Arkansas(US).

By registering the online portal of Arkansas Taxpayer Access Point(ATAP), we can acquire sales tax permits in Arkansas. Some of the vital information needed for registration are Business entity type, ITIN number, nature of business, NAICS code, and more. As a part of the taxable sales, shipping charges are levied for customers as a part of selling products in Arkansas.

To Specify Arkansas(US) Company Data in Odoo 16

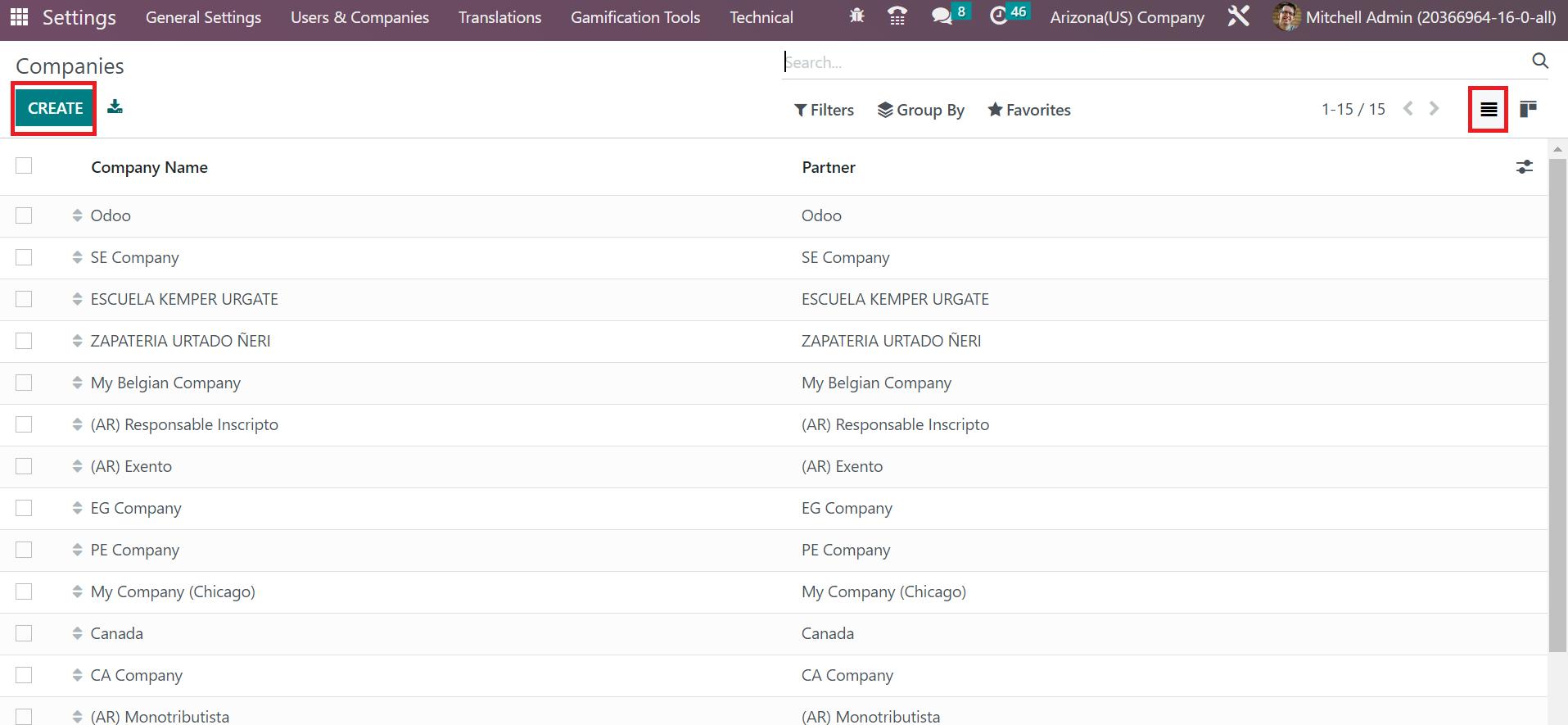

Before applying a state sales tax rate, the user must set the company details of a particular place in the Odoo 16. Move to Odoo 16 Settings, and you can access the Companies menu below the Users & Companies section. The information about every company is acquirable to users in the List view. To formulate new company details, select the CREATE button, as implied in the screenshot below.

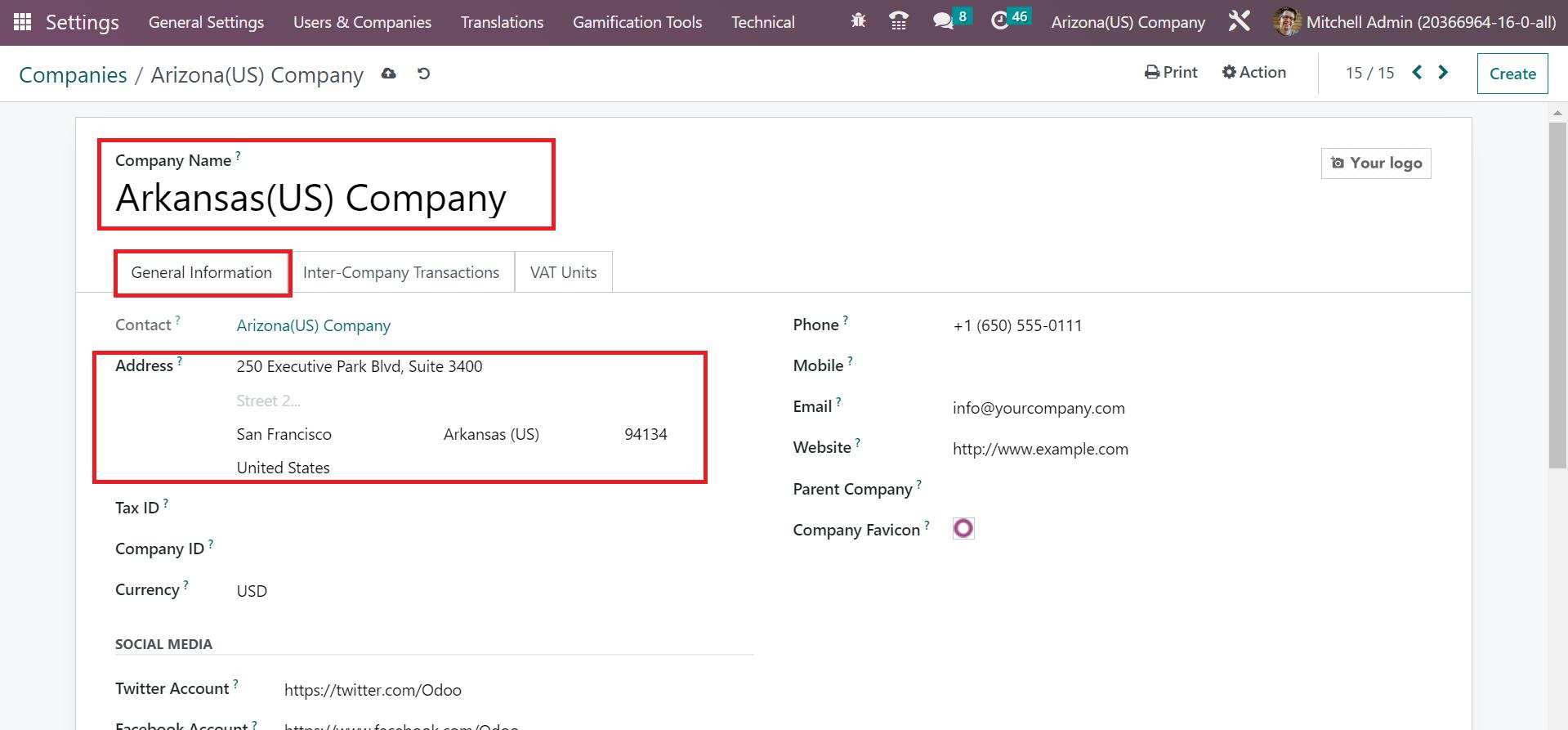

In the new window, mention the Company Name as Arkansas(US) company. Users can specify firm addresses in the Address field under the General Information tab. Add the street address, pin code, state as Arkansas, and the country as United States.

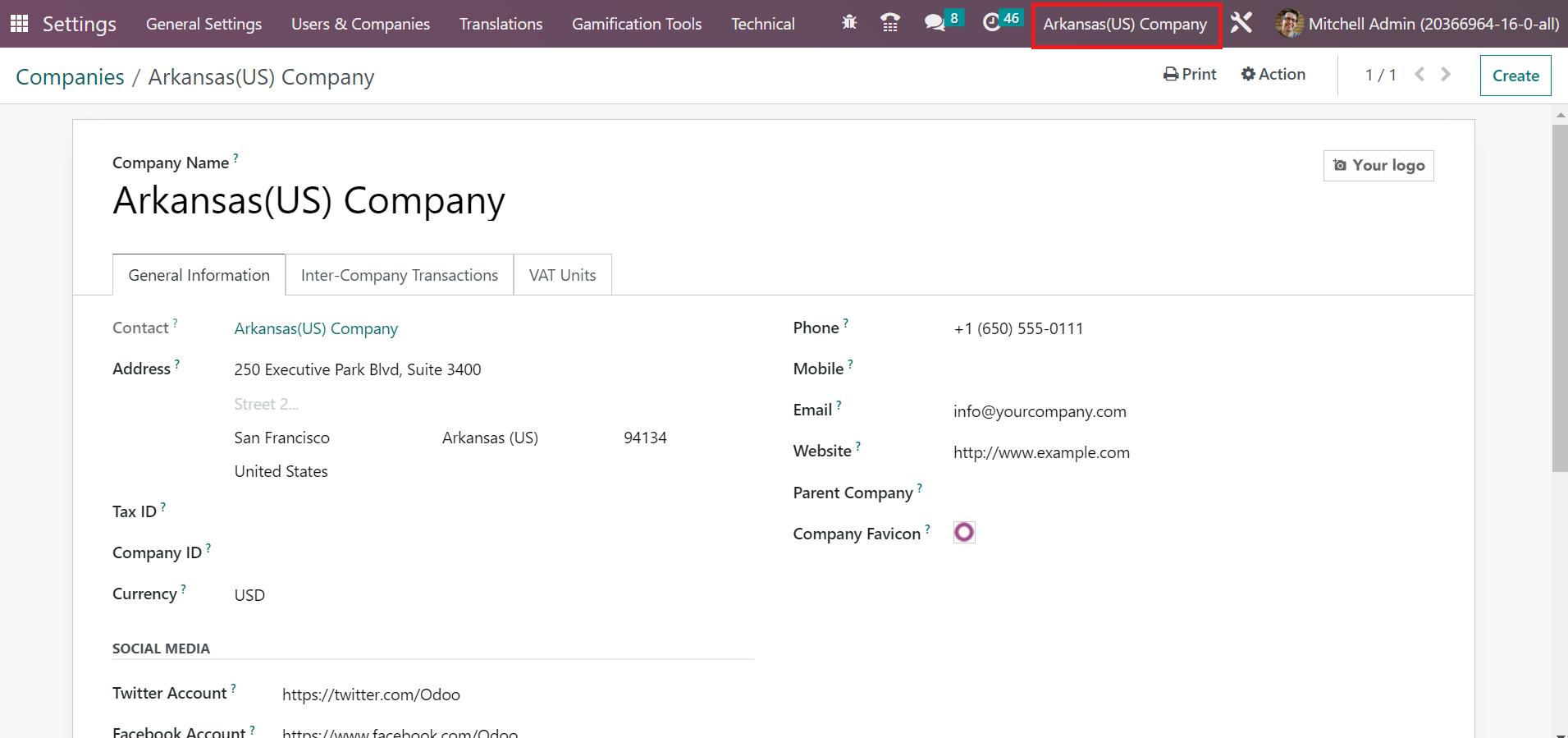

Applied information about a company by the user is saved automatically. You can see the created company name at the top bar right end, as cited in the screenshot below.

How to Create Arkansas Sales Tax in the Odoo 16 Accounting?

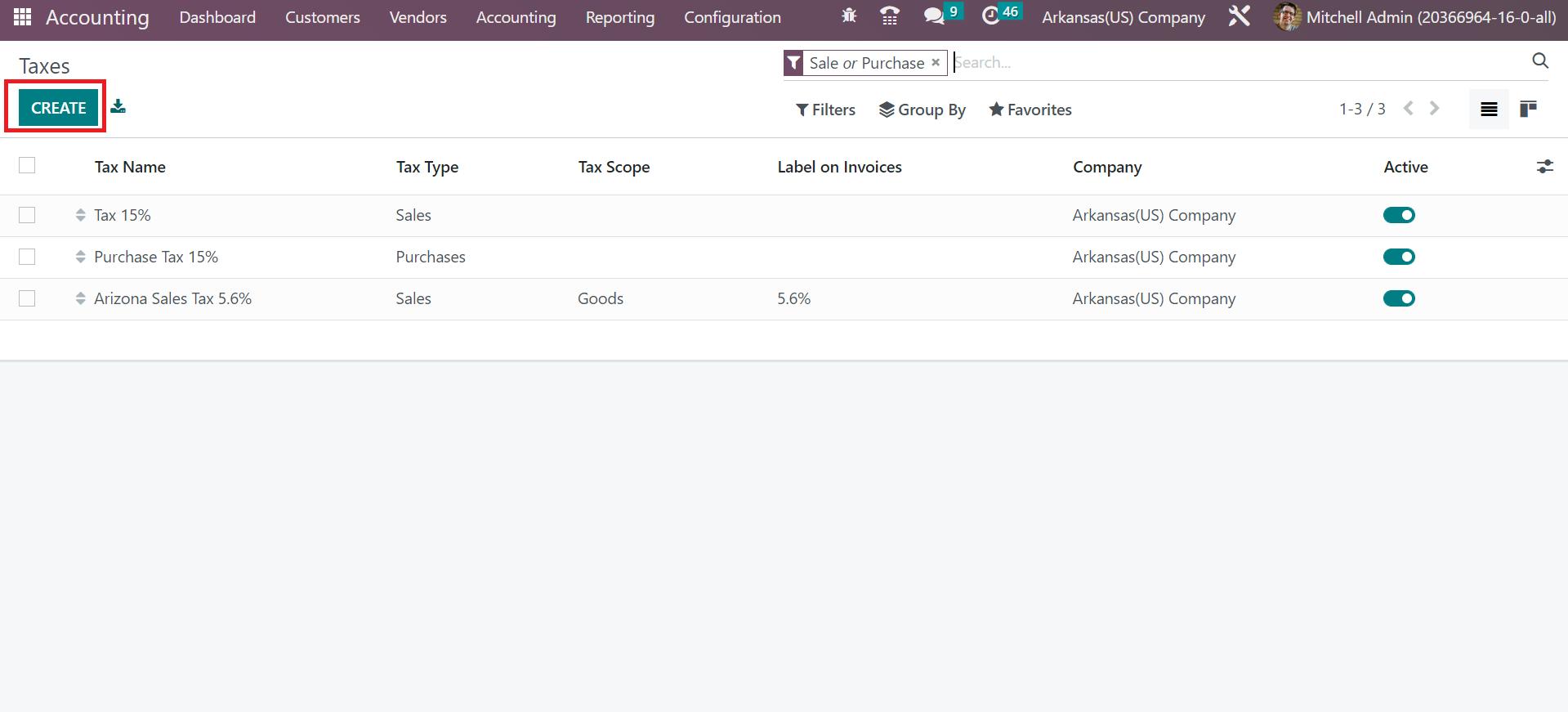

You can obtain the Taxes menu from Configuration, and the record of all created taxes is viewable to a user. To produce new tax information, click the CREATE icon in the Taxes window, as outlined in the screenshot below.

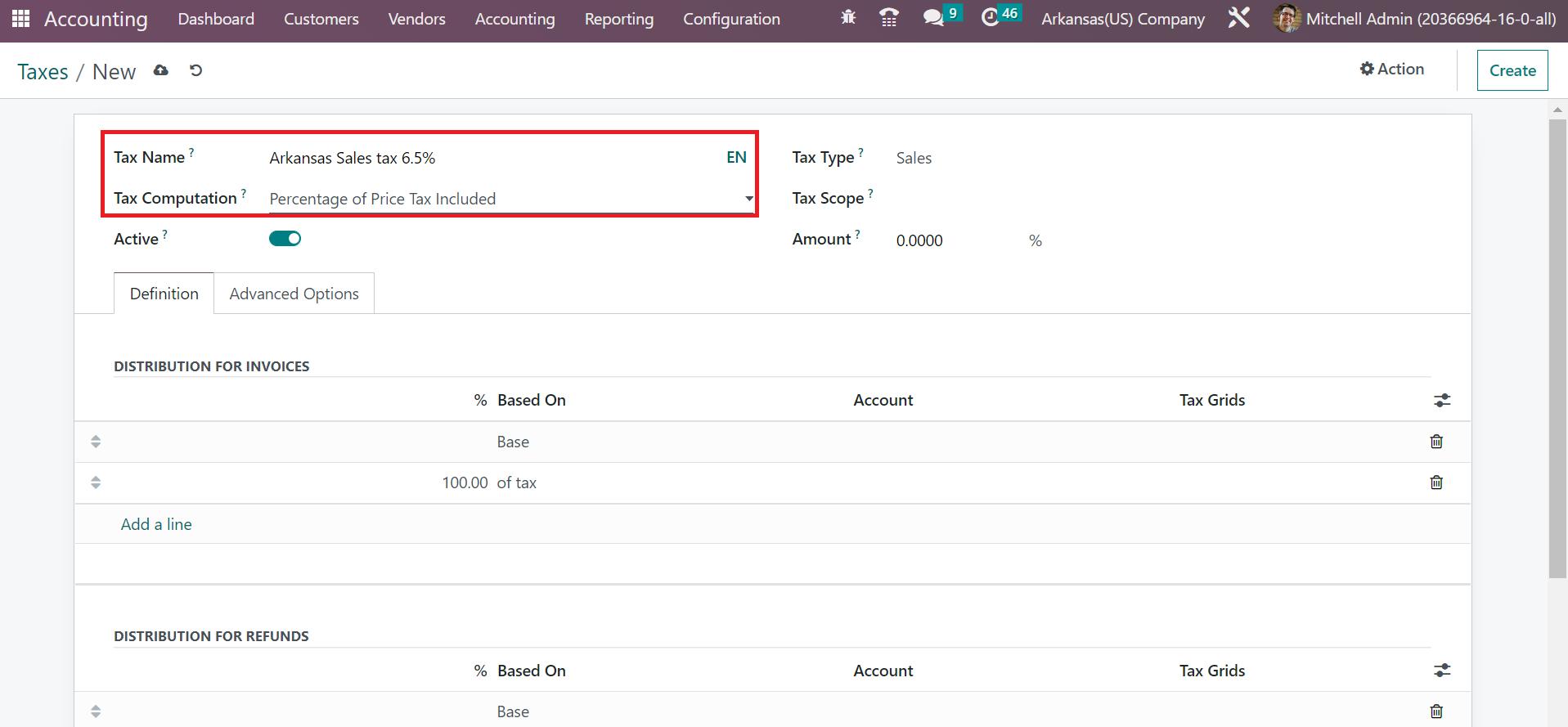

As mentioned before, the sales tax of Arkansas is 6.5%. In the open window, put the Tax Name as Arkansas Sales Tax 6.5%, as noted in the screenshot below.

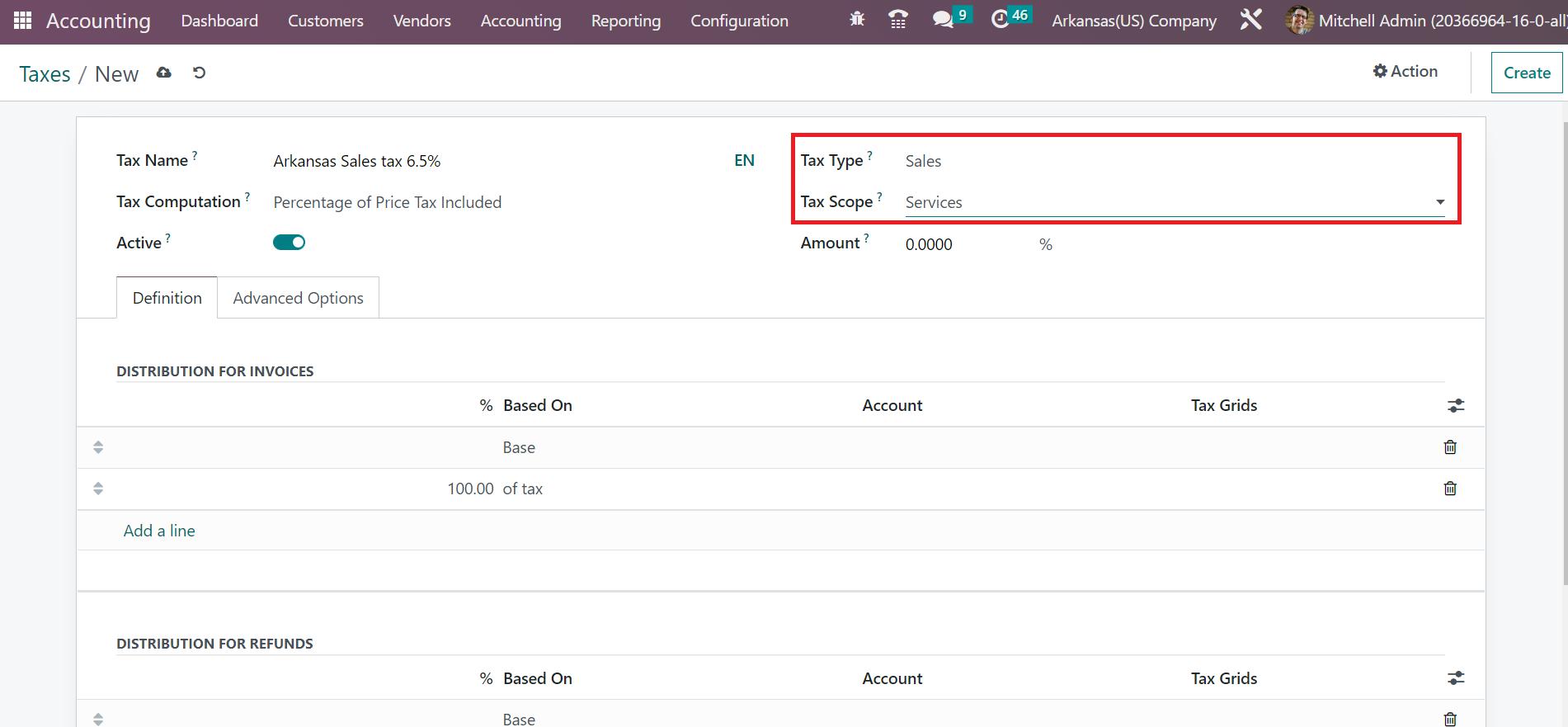

Next, the user can choose the tax calculation method within the Tax Computation field. We select the Price Tax Included option percentage inside the Tax Computation option, as marked in the screenshot above. After choosing the Percentage of the Price Tax included feature, the total amount will be taxable. Afterward, set the Tax Type as Sales and pick the Services option in the Tax Scope field, as demonstrated in the screenshot below.

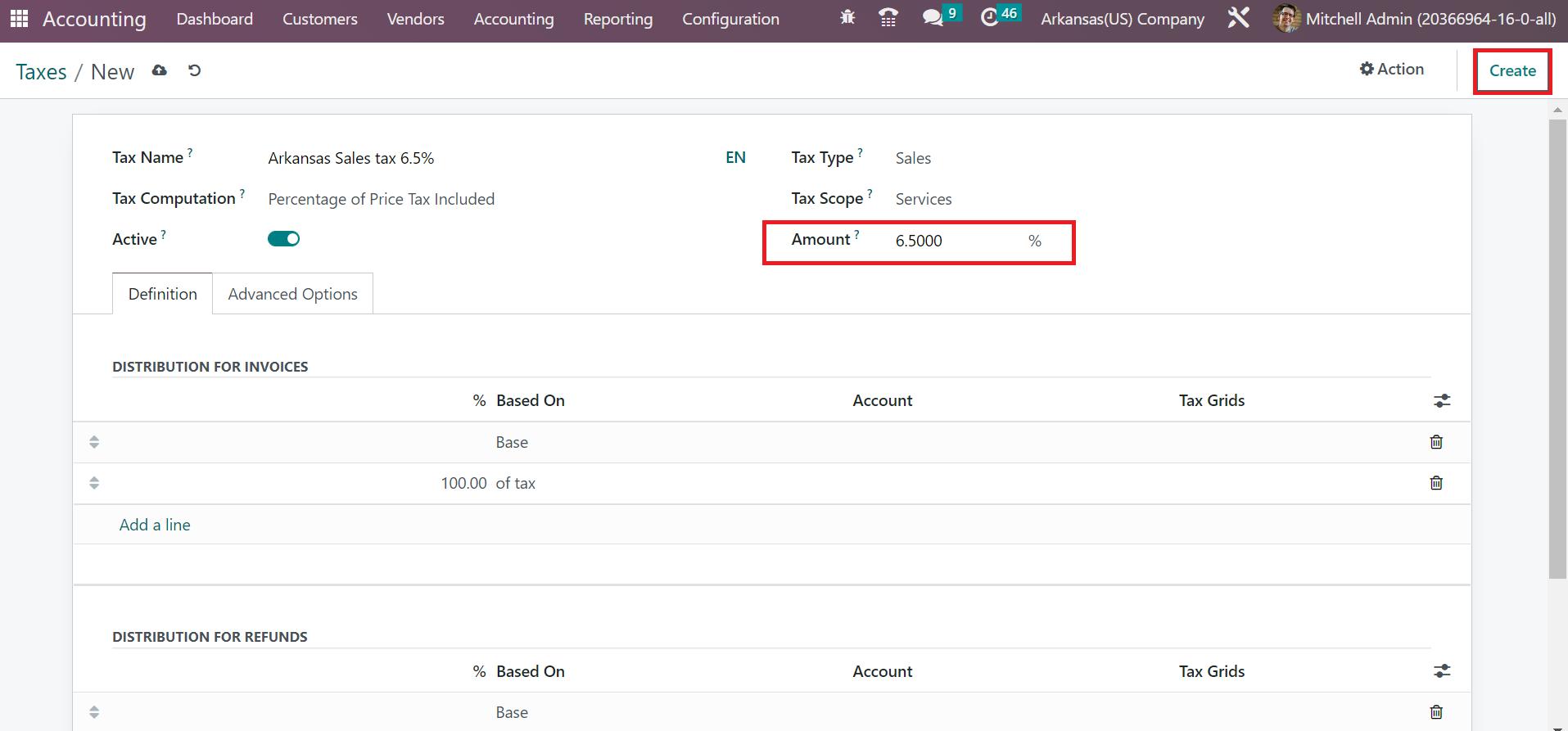

You can apply your sales tax's price percentage in the Amount field. All the entered information is saved accordingly in Odoo 16. To develop a new tax concerning Arkansas, you can press the CREATE icon in the right corner of the window.

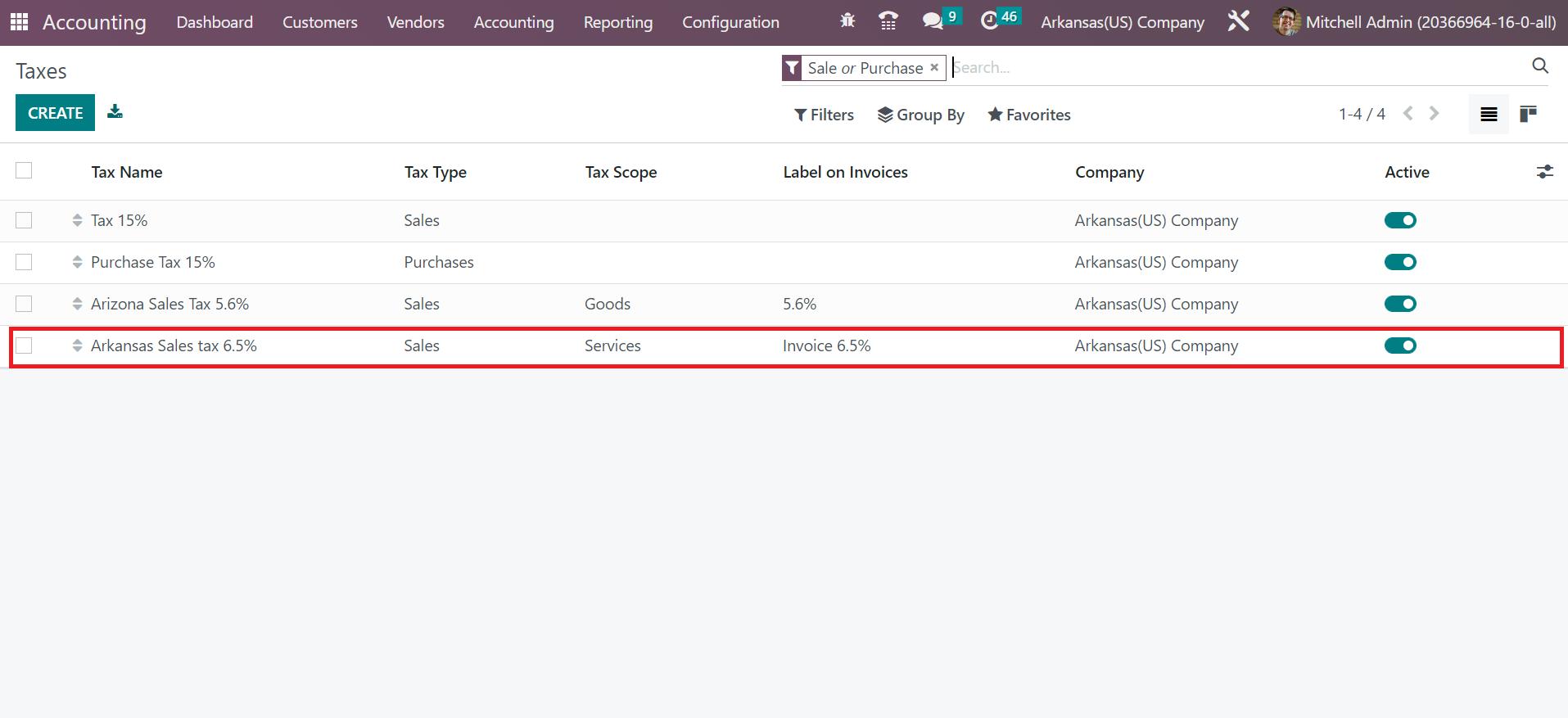

Your created tax details are visible in the main Taxes window in Odoo 16 Accounting. Users can view the added information on tax, such as Tax Type, scope, name, label on the invoice, and more, as described in the screenshot below.

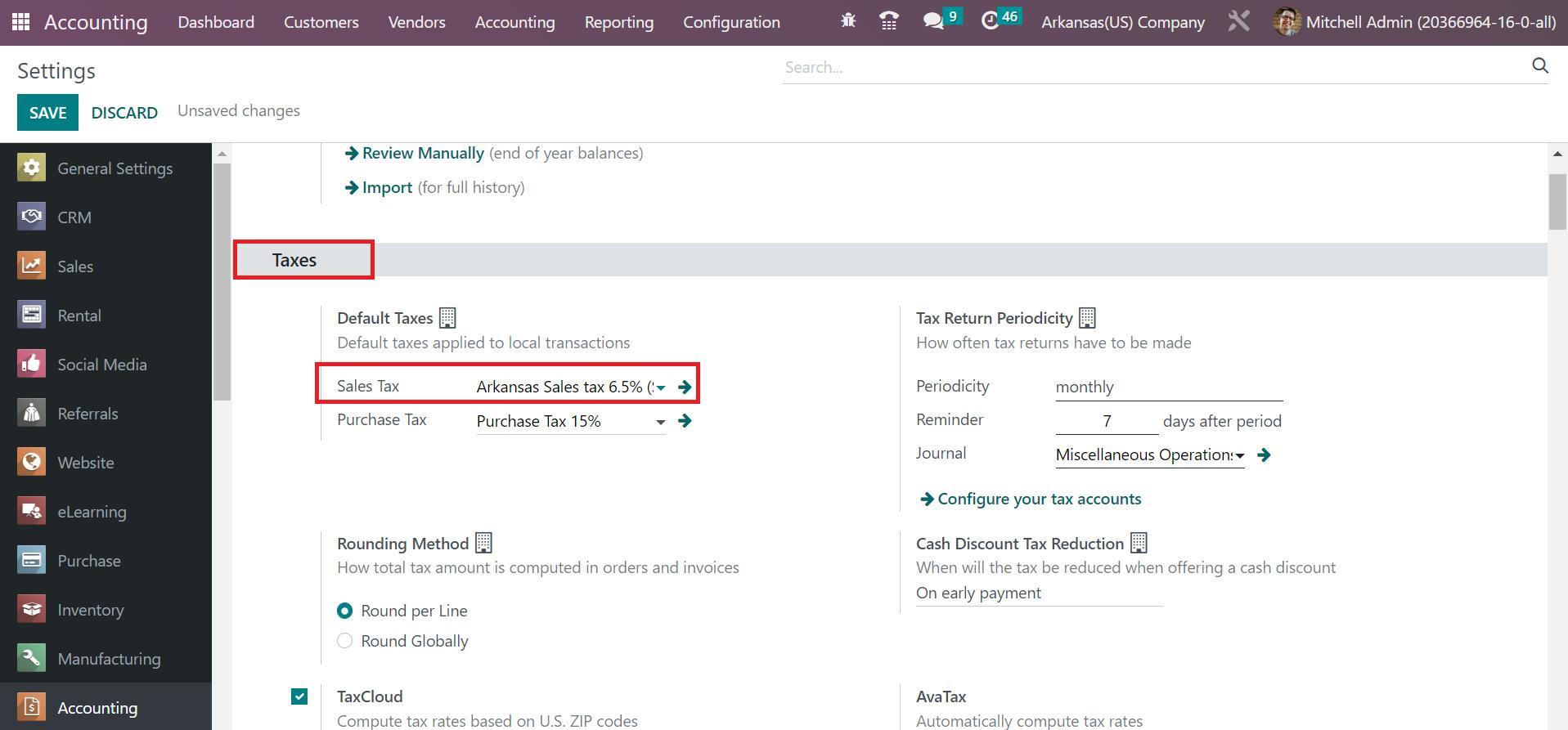

Setting the created tax Arkansas Sales Tax 6.5% as the invoice default is possible. For that, go to the Settings window of Odoo 16 Accounting, and you can access the Taxes section. Users can select the created tax inside the Sales Tax field below the Default Taxes heading, as portrayed in the screenshot below.

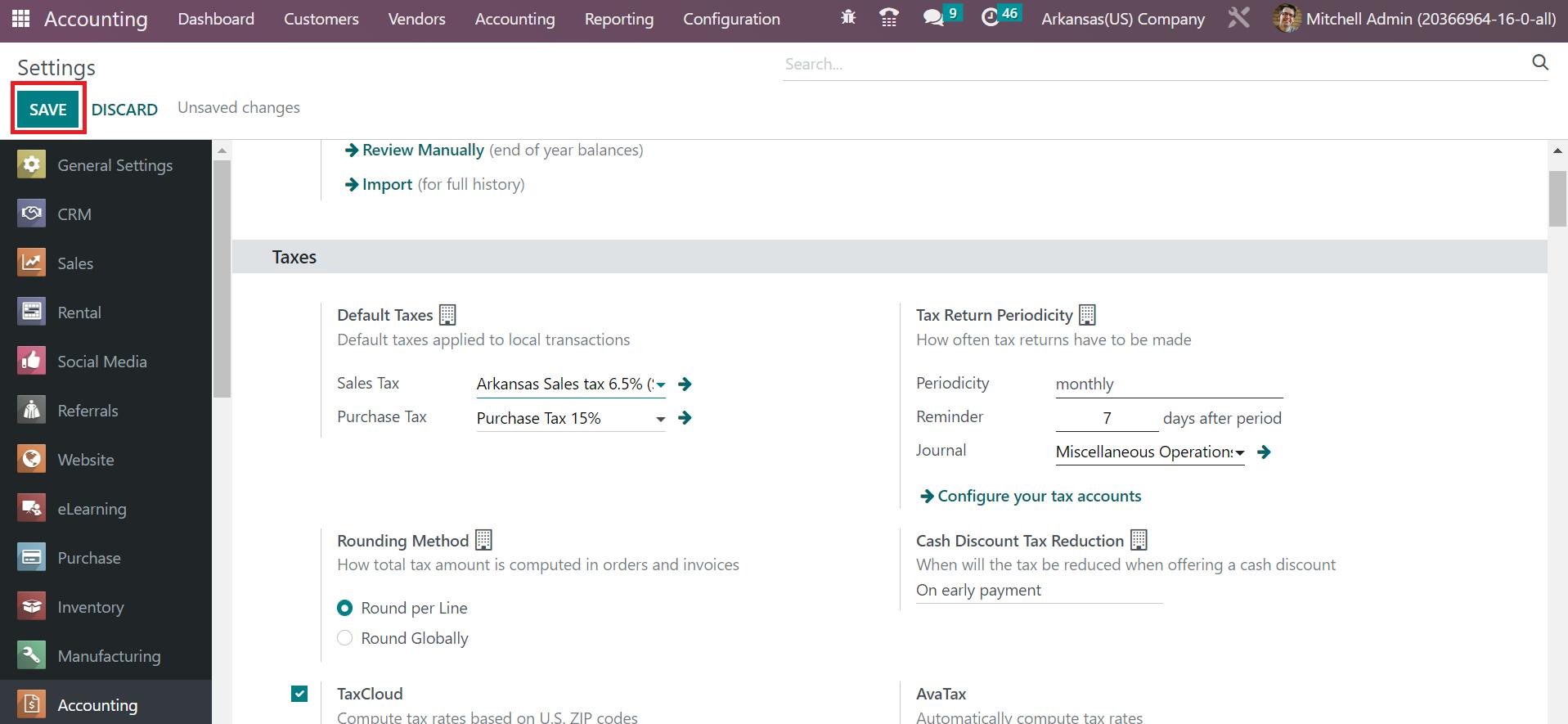

Here, we choose the Arkansas Sales Tax 6.5% in the Sales Tax field. The default taxes are applied for local transactions in Odoo 16. After specifying the default tax, press the SAVE button in the Settings window, as displayed in the screenshot below.

Invoice Creation based on Arkansas(US) Sales Tax in Odoo 16

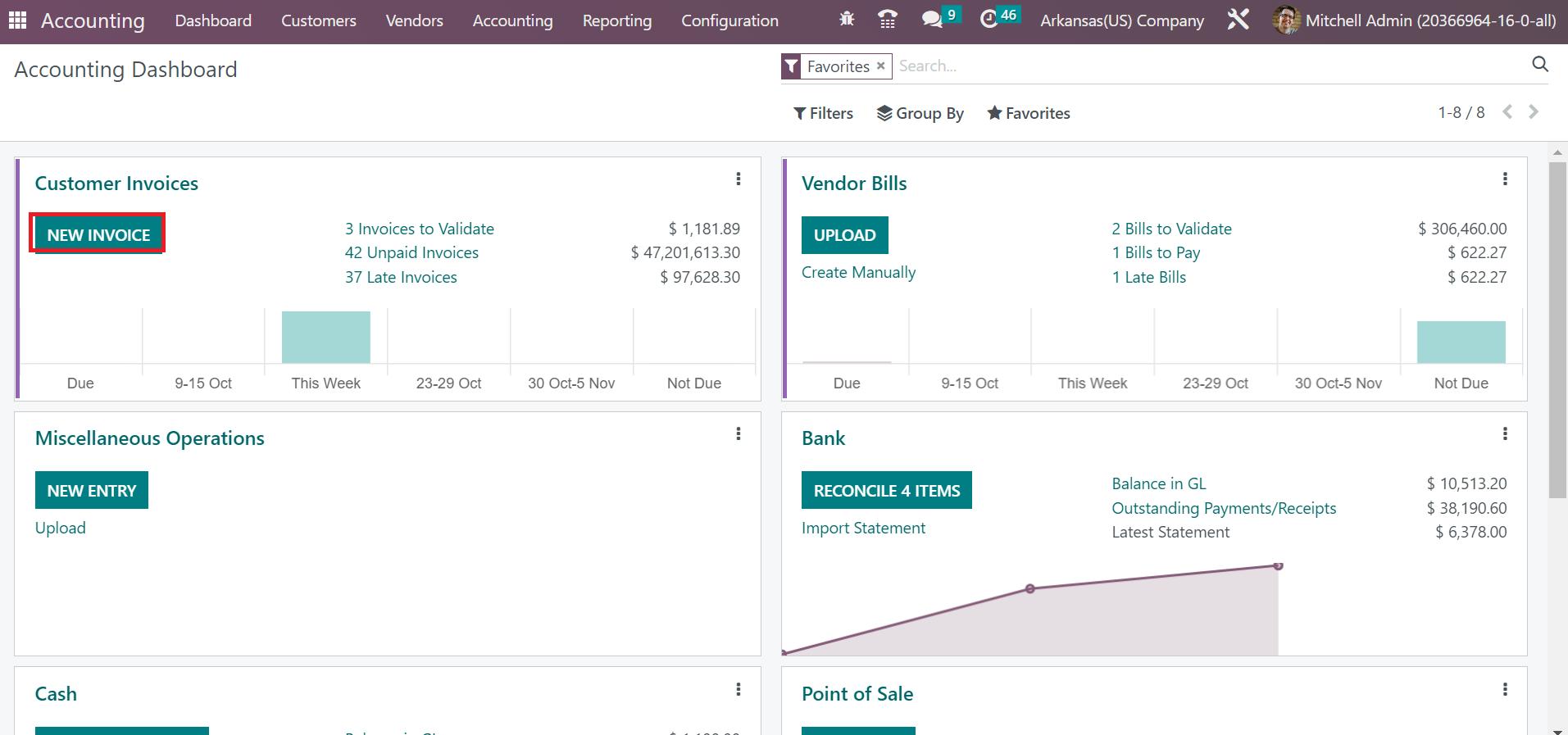

Generating a new invoice becomes a simple task using the Odoo 16 Accounting module. Users can create an invoice by moving to the Odoo Accounting dashboard. You can identify the Customer Invoices journal in the Accounting Dashboard window. Details related to unpaid, late, and invoices to validate are viewable to users inside the Customer Invoices journal. Click the NEW INVOICE button to develop a new customer invoice, as portrayed in the screenshot below.

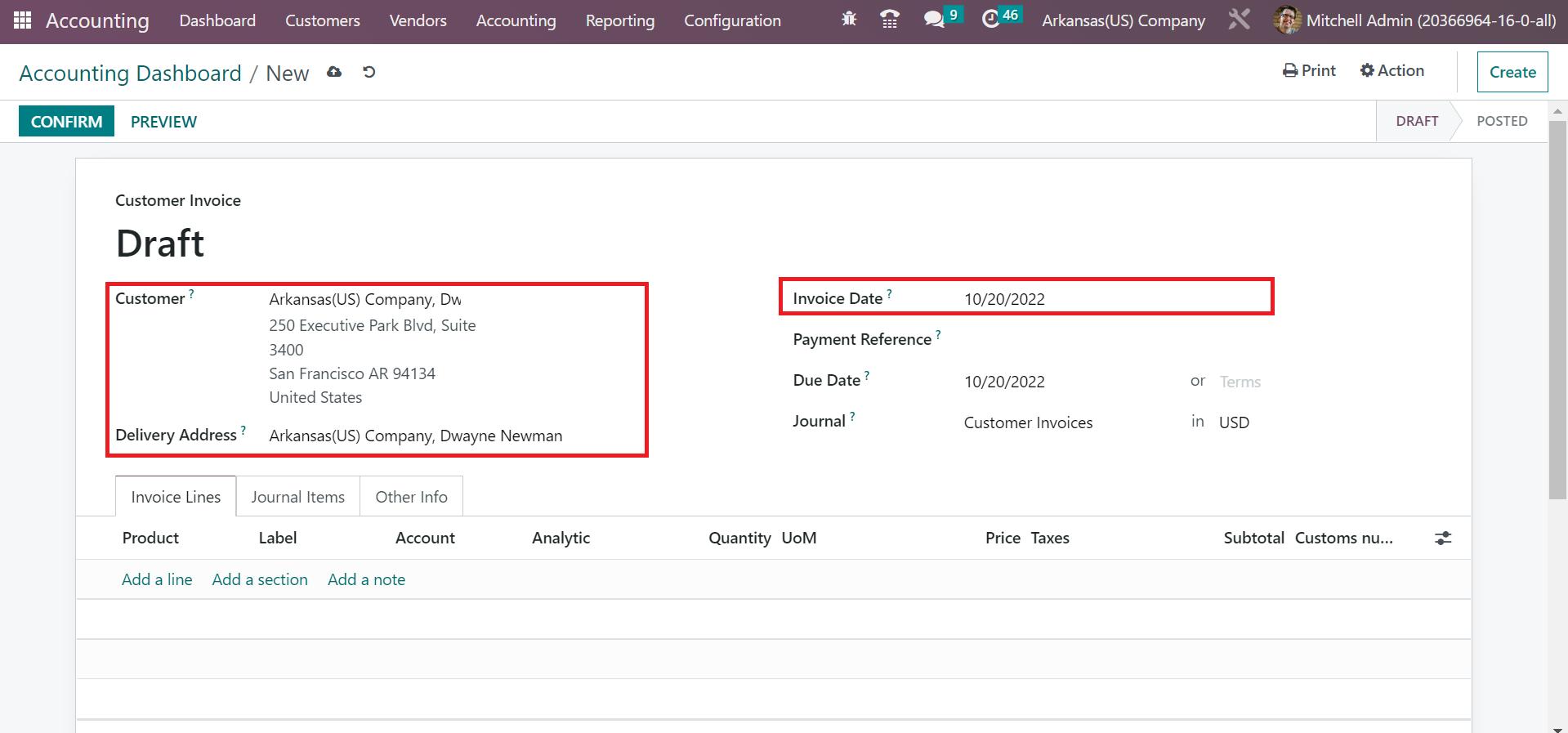

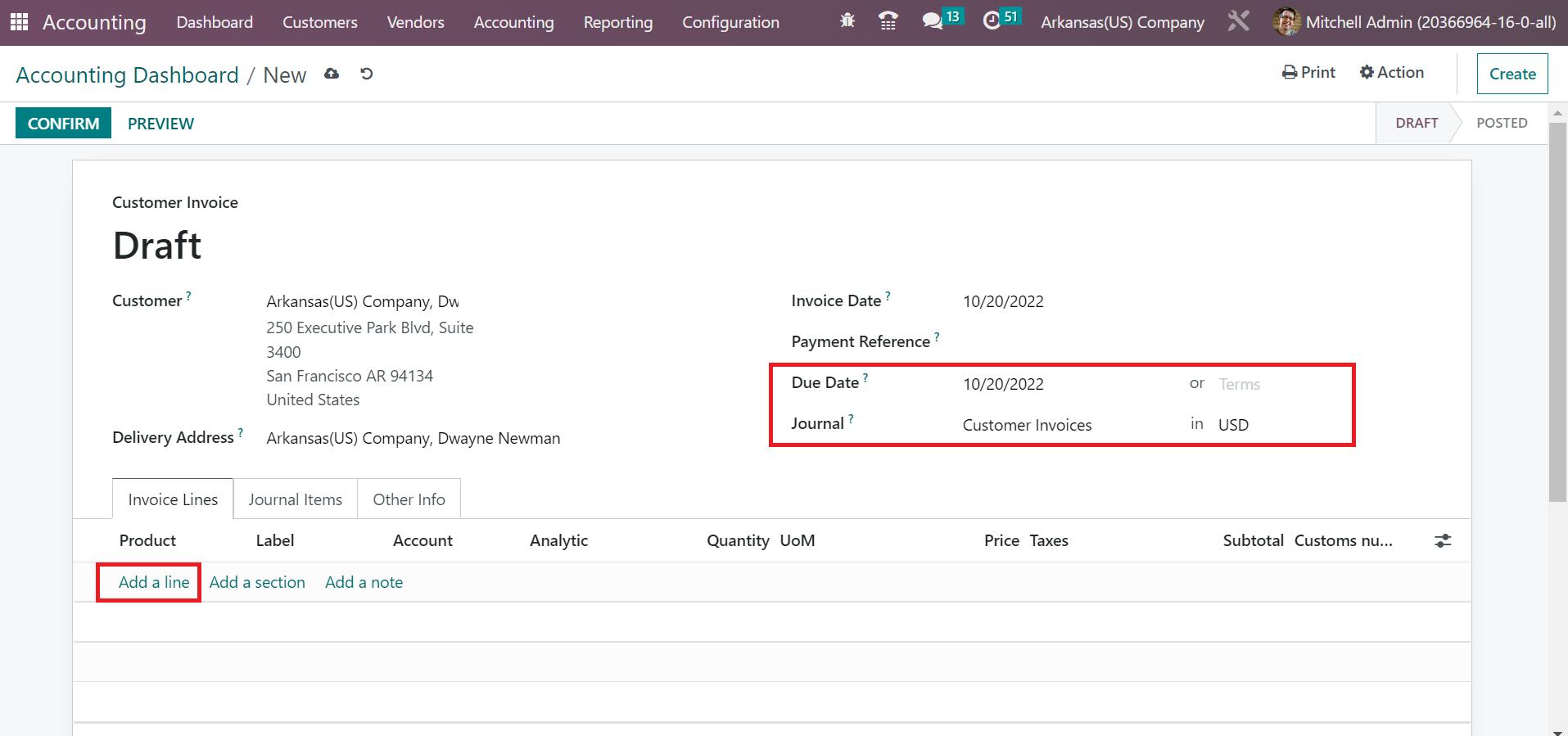

Select Arkansas US Company in the Customer field in the Draft invoice window. The address regarding your partner is accessible in the Delivery address field. Later, select your invoice date, as represented in the screenshot below.

Enter the invoice date due within the Due Date option. Also, enter the journal related to your invoice inside the Journal field, as illustrated in the screenshot below.

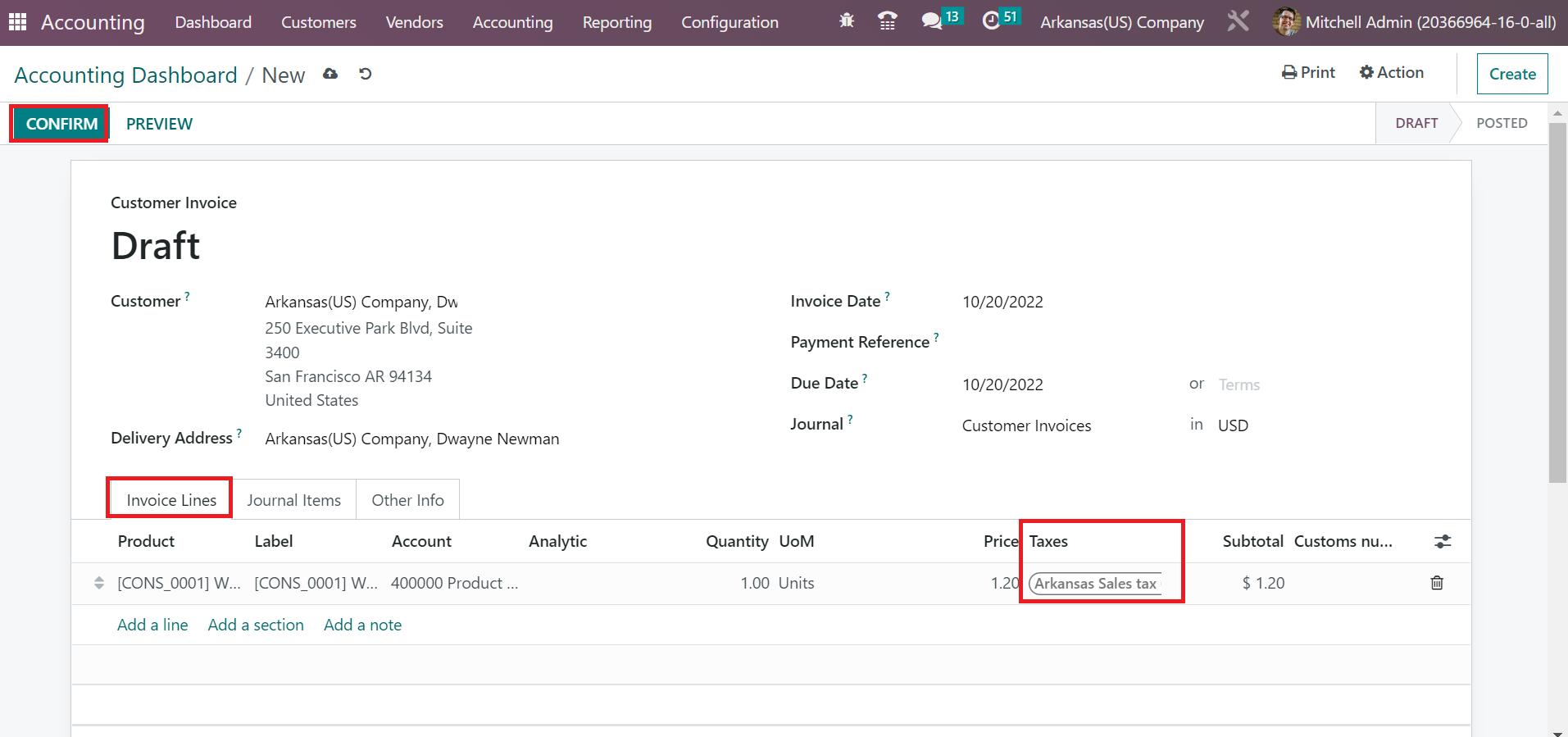

To mention the product details, click the Add a line option inside the Invoice Lines tab as specified in the above screenshot. A new space opens before the user to adds your product data. After selecting the product, the default tax is automatically applied below the Taxes section, as defined in the screenshot below.

Added details about customer invoices saved automatically in Odoo 16. Click the CONFIRM icon in the Customer Invoice window to post your order for a customer, as shown in the above screenshot.

Sales Tax calculation of Arkansas(US) is made easy through the Odoo 16 Accounting application. Management of applying sales tax on customer invoices based on each country in a company occurs with the support of Odoo ERP. You can boost the company sales by administrating the tax rates in your state.