Calculating an asset's life and depreciation requires classifying or categorizing it. This process is known as asset management. The Odoo Accounting module simplifies asset management for long-term company assets. The Asset Management feature allows for asset category definition, asset models to be set, and depreciation computation. This functionality produces an accounting entry for the relevant depreciation at the conclusion of a fiscal year. Effectively overseeing company assets and monitoring depreciation is essential for ensuring precise financial record-keeping.

In this blog, we'll delve into the robust features of Odoo 17 Accounting, guiding you through the process of managing assets seamlessly while ensuring precise depreciation calculations.

Setting Up Assets in Odoo 17

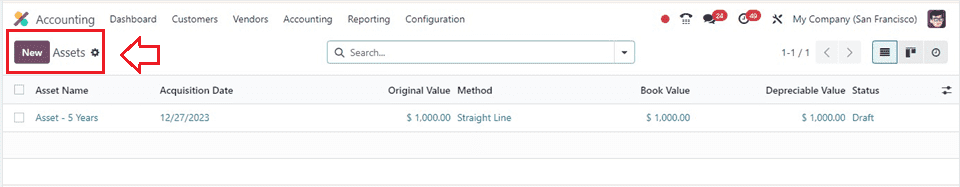

Users can simply create or manage their company assets from the Odoo 17 Accounting module. Start by accessing the Assets option from the ‘Accounting’ menu. Upon accessing the dashboard, you will find a display of the existing asset records, showcasing their corresponding Asset Name, Acquisition Date, Original Value, Method, Book Value, Depreciable Value, and Status, as depicted below.

Here, you can register and categorize various assets owned by your company by opening a new asset configuration form.

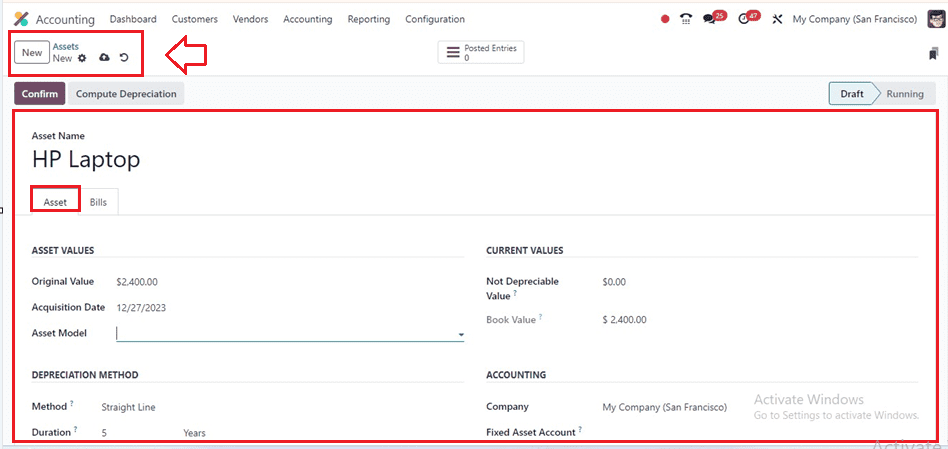

Inside the form fields, input essential details such as Asset name. The ‘Asset’ tab can be used to set Asset Values, Depreciation Method, Current Values, Accounting, etc. Specify the product's Original Value, Acquisition Date, and Asset Model within the 'ASSET VALUES' section.

The Not Depreciable Value and the Book Value of the asset can be configured inside the ‘CURRENT VALUES’ section.

Setting Asset Model

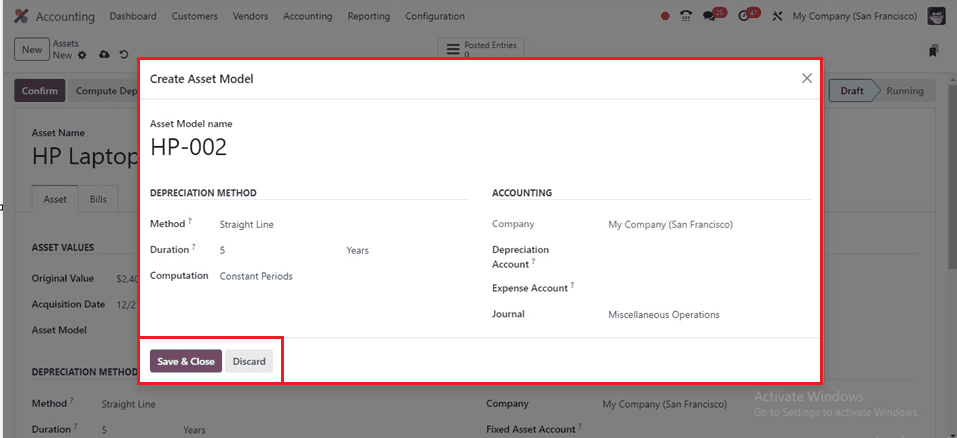

We can set or store various product model details inside the Asset configuration form using the ‘Asset Model’ field. If model data is available, you can select an existing model from the dropdown menu or create a new model. This field will open another pop-up wizard where we can provide the important new product model details, as shown below.

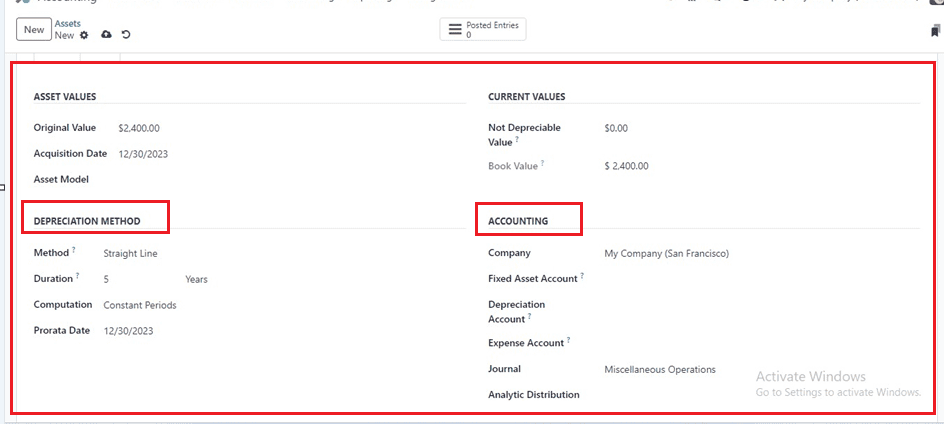

In the form view, the firm name is automatically filled inside the ‘Company’ field. It is important to choose a ‘Method’ to use for computing the depreciation lines, and the ‘Duration’ field specifies the amount of depreciation needed for an asset. The 'Computation' technique is configured with settings for No Prorata, Constant Periods, and Based on days per period. While the ‘Depreciation Account’ is used to reduce the asset's value, the Fixed Asset Account documents the asset's acquisition and initial cost. A portion of the asset is recorded as an expense in the mentioned ‘Expense Account.’ Finally, add the accounting entry journal in the ‘Journal’ area. Odoo 17 allows you to organize assets into specific categories, facilitating streamlined management.

Depreciation Methods: Odoo 17 offers flexibility in choosing Depreciation Methods that align with your company's accounting practices. From straight-line to declining balance methods, select the one that best suits your needs. Define parameters such as the number of periods and residual value to customize depreciation calculations.

Bills Tab

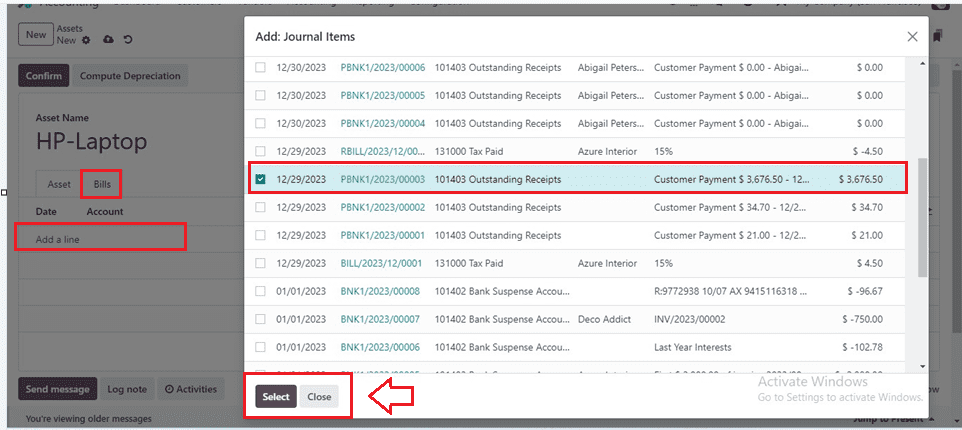

We can add the bill details of the asset inside the ‘Bills’ tab section with their Date, Account, Label, Debit, and Credit details. Click the ‘Add a line’ button to add the bill details from the journal items dashboard, as shown below.

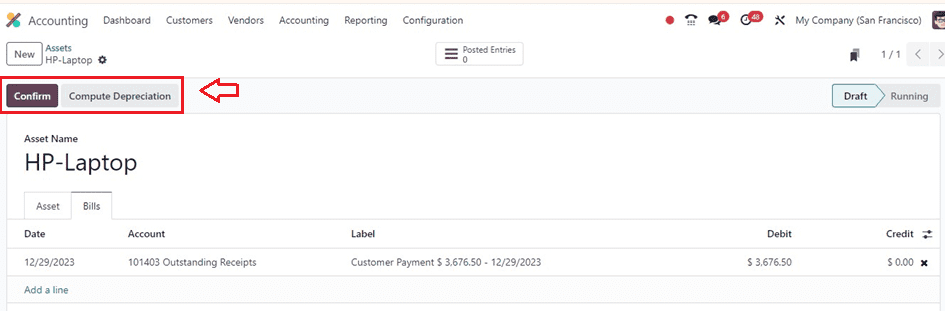

Choose the journal items and click on the ‘Select’ button. Then, go back to the asset configuration form.

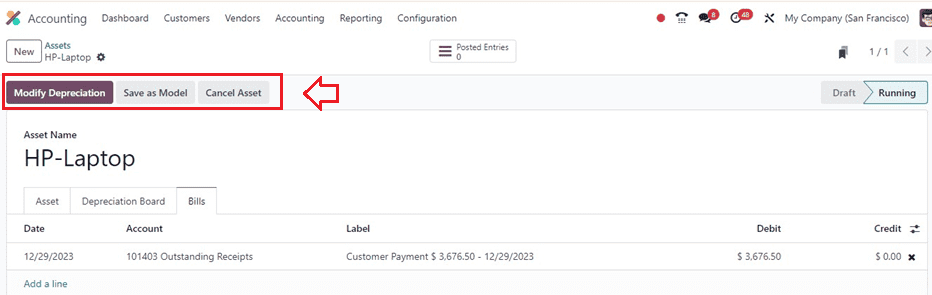

Automating Depreciation Entries: Odoo 17 simplifies the depreciation process by automating journal entries. Once you've configured asset details and depreciation methods, the system generates entries automatically. Doing so reduces the likelihood of mistakes that come with human data entry and saves time. After choosing the journal bills, you will get a ‘Modify Depreciation’ button, as shown below.

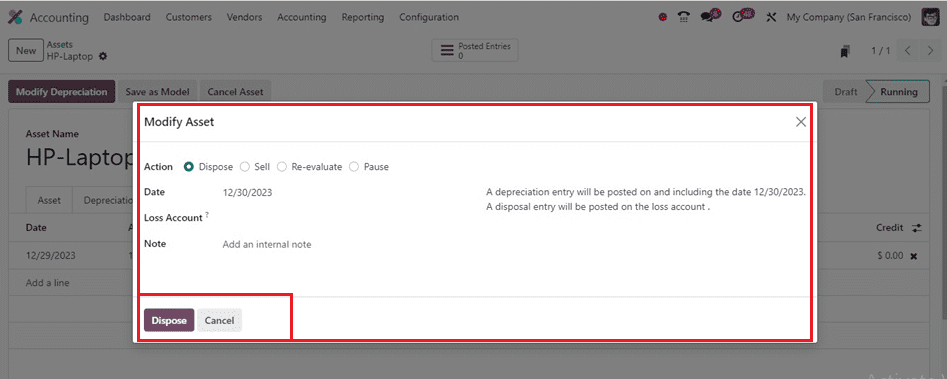

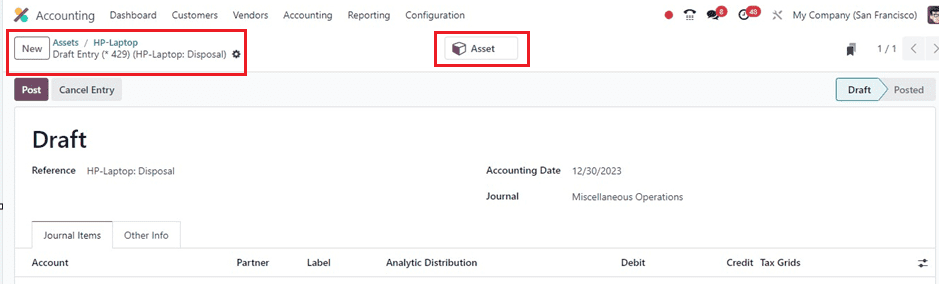

When you click on the ‘Modify Depreciation’ button, it will open another pop-up window where you can set the depreciation. Select the Action as Dispose, enter the date in the corresponding box, and enter the account information for loss journal items in the Loss Account field in order to dispose of an asset. Internal remarks for adjusted depreciation are contained in the Note field. When the Pause option is chosen, depreciation is halted, and the Depreciation Board tab shows the modifications.

When the need arises to dispose of an asset, Odoo 17 simplifies the entire process. Simply mark the asset as 'Dispose,' and the system will automatically generate the necessary accounting entries to reflect the disposal. This guarantees precise financial reporting and adherence to accounting standards.

After disposing of the assets, you will get an ‘Asset’ smartbutton which can be used to access the asset details.

For tracking a business's asset portfolio, Odoo 17 provides comprehensive reporting features that deliver in-depth information on asset depreciation, disposals, and current valuations. Because of its integrated approach, which enables smooth module collaboration and guarantees a comprehensive picture of a business's financial health, the Assets module integrates with Accounting and Inventory with ease.

Odoo 17 Accounting simplifies asset management and depreciation, improving accuracy and financial efficiency for companies.