The accounting module's employee expenditure management tools have been significantly enhanced in Odoo 18, the most recent version of the well-known open-source business management software. With its smooth and automated approach to personnel cost tracking and management, this upgrade aims to improve accuracy and efficiency for companies of all sizes. The increased integration of the accounting and employee expenditure procedures in Odoo 18 is a noteworthy feature. This improvement guarantees seamless expense data synchronization, enabling accurate and automatic accounting book reflection. Businesses can keep accurate and current financial records by lowering the possibility of errors.

The Employee Expenses feature in Odoo's Accounting module offers a simplified and effective method of managing and compensating employees for expenses they incur while conducting business. Employees can report expenses for travel, lodging, food, and office supplies, and these reports can be examined, accepted, and entered straight into the accounting system. This guarantees responsibility, openness, and accurate financial monitoring. This tool, which is closely integrated with Odoo's accounting and HR apps, automates journal entries and reimbursements, cutting down on human labor and increasing financial accuracy.

The Odoo 18 Accounting module offers better options for reporting and expense classification, just as the previous Odoo ERP version. Classifying and evaluating different costs has been easier with the ability to specify expense categories and subcategories. Additionally, firms now have access to analytical expenditure reports and visualizations that effectively highlight spending trends thanks to improved reporting choices.

This gives businesses the ability to allocate resources and regulate costs with knowledge. Improved reporting capabilities, streamlined processes, and better integration are all features of Odoo 18's accounting module for employee spending management. Businesses can now effectively monitor and track employee expenditure thanks to these enhancements, which eventually result in accurate financial records, better resource allocation, and more informed decision-making.

Odoo 18 Employee Expense Management

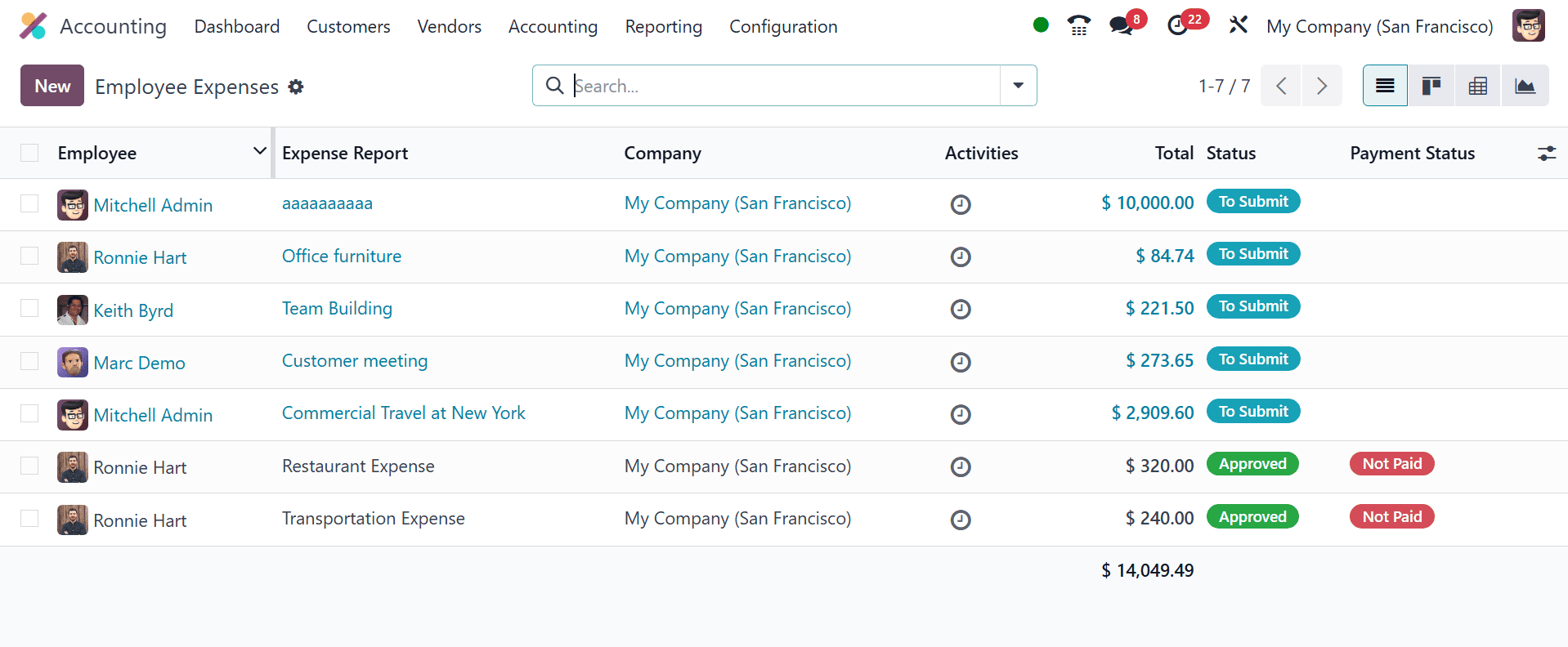

The Odoo 18 Accounting module makes it simple for staff members to document costs incurred on the company's behalf. Choose Employee Expenses from the Vendors menu. From this window, you may view the dashboard of all employee expenses that are kept in your accounting database, as illustrated below.

Important information, including the individual, the expense report, the business, the activities, the total amount, the status, and the payment status, is all available in the list view of employee spending. Reports can be submitted once expense reports have been scanned using the Scan option, and new reports can be made by clicking the "New" button.

Making Reports on Expenses

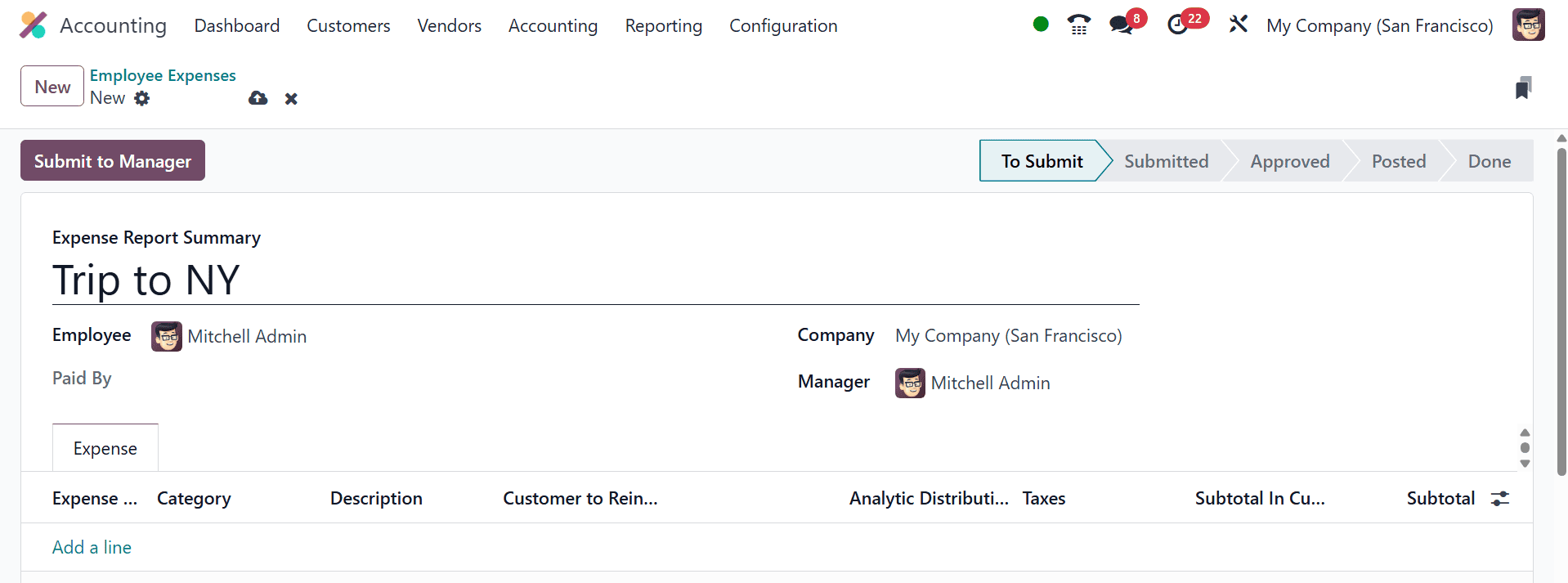

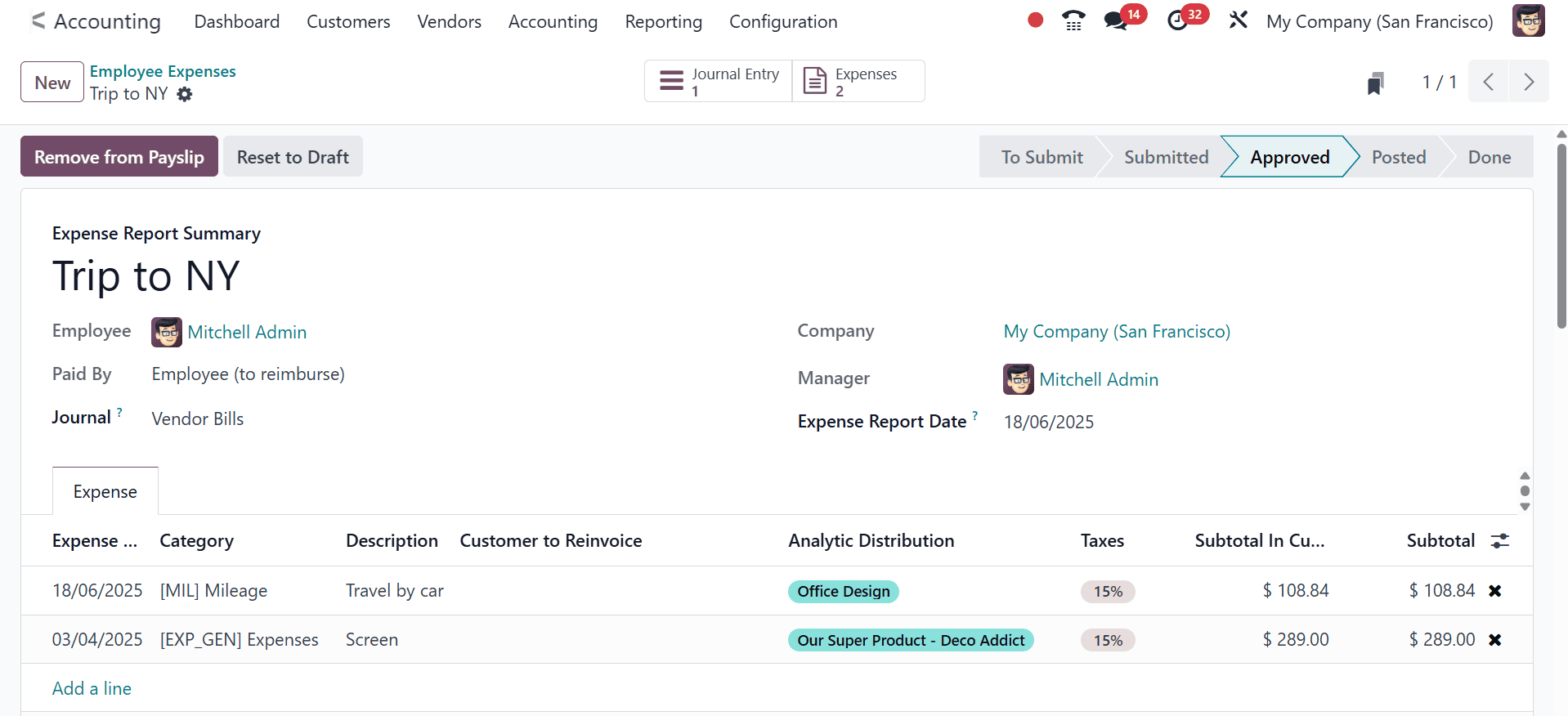

Users can provide a title to the "Expense Report Summary" field when generating a new report, and the employee's name will appear automatically. Information regarding the Paid- Information about the company and the necessary manager approval can be specified by account.

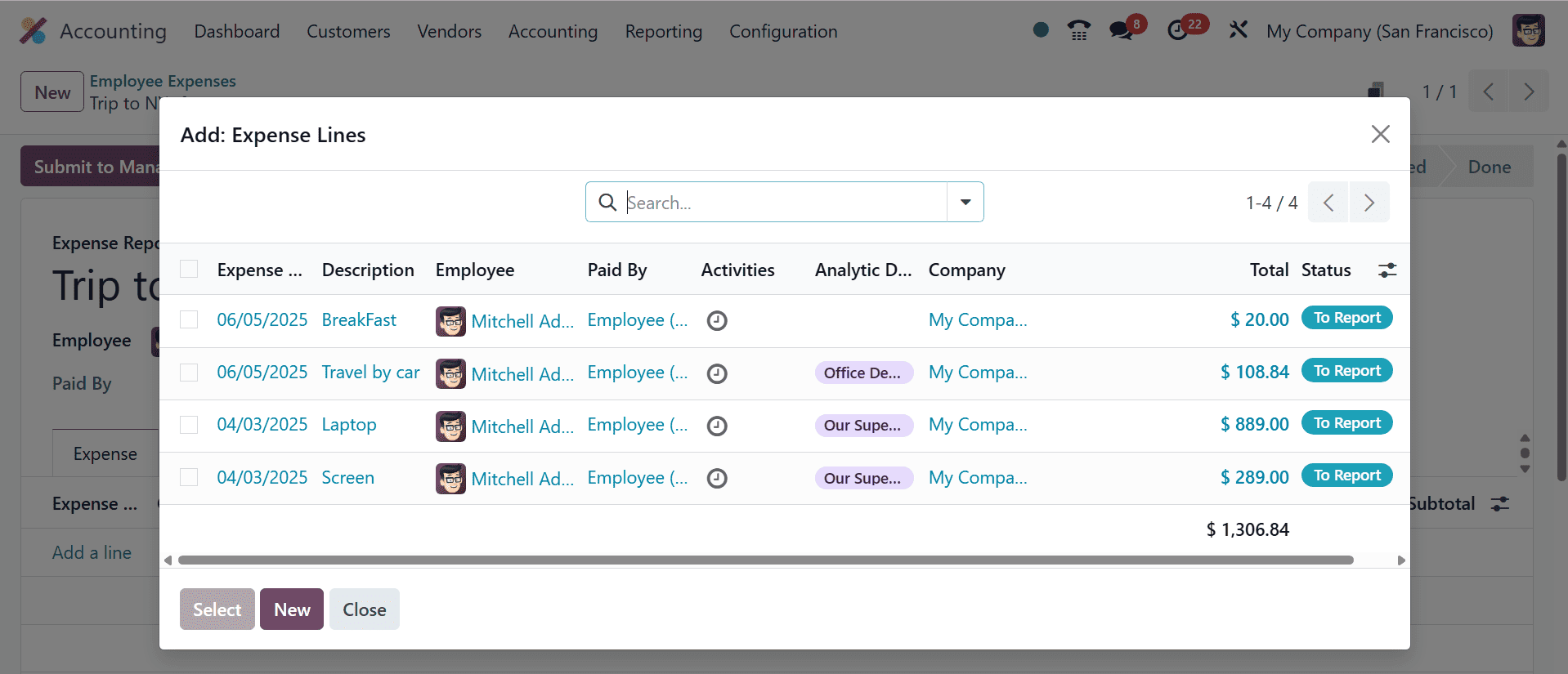

The "Add a Line" button on the Expense tab allows you to input expenses one at a time. From the pop-up box that appears, users can enter information about the employee, payment account, category, description, total cost, and more, as seen in the screenshot below.

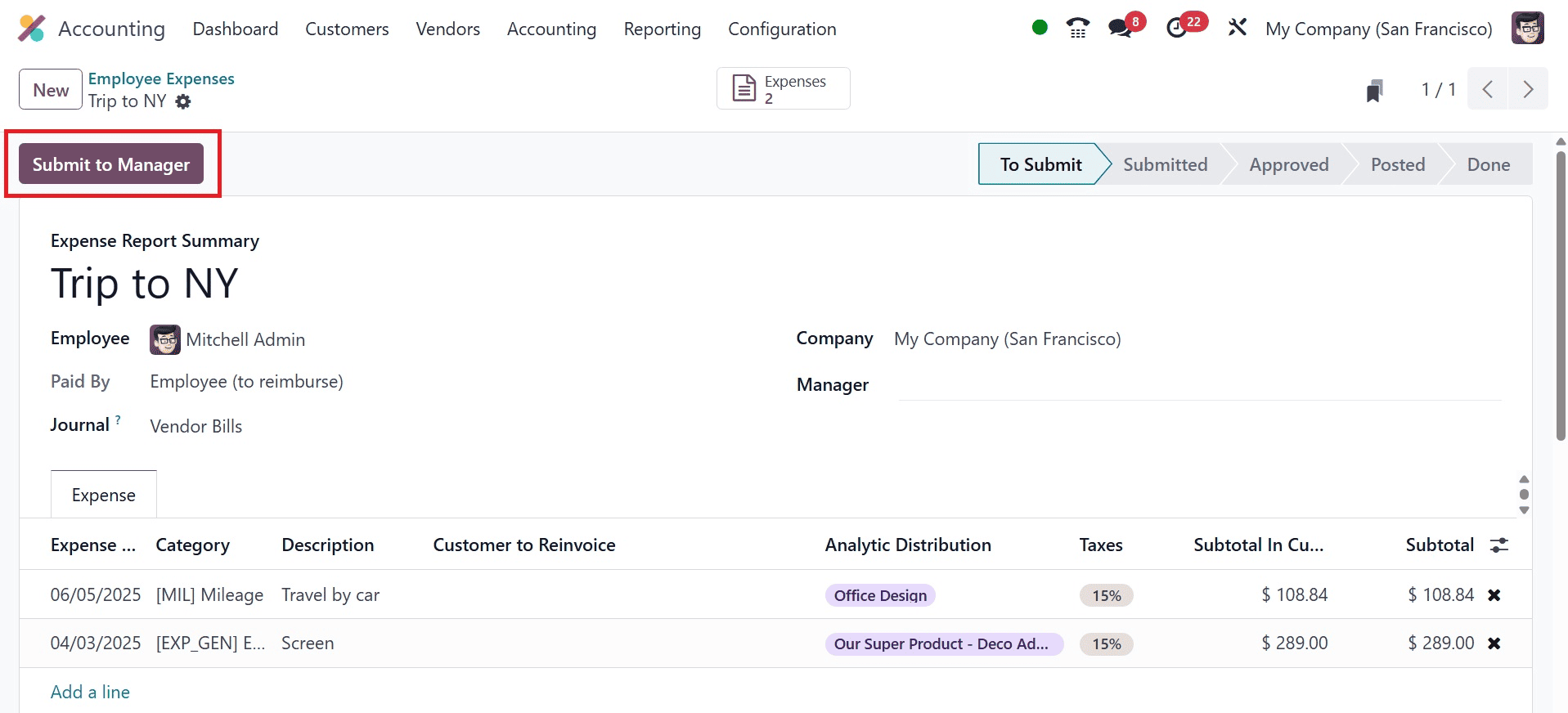

The expense lines are sent for approval when the "Submit To Manager" button is clicked inside the expense setting form. After reviewing, managers have the option to accept, reject, or go back to the draft of the report. The following payslip may include accepted costs.

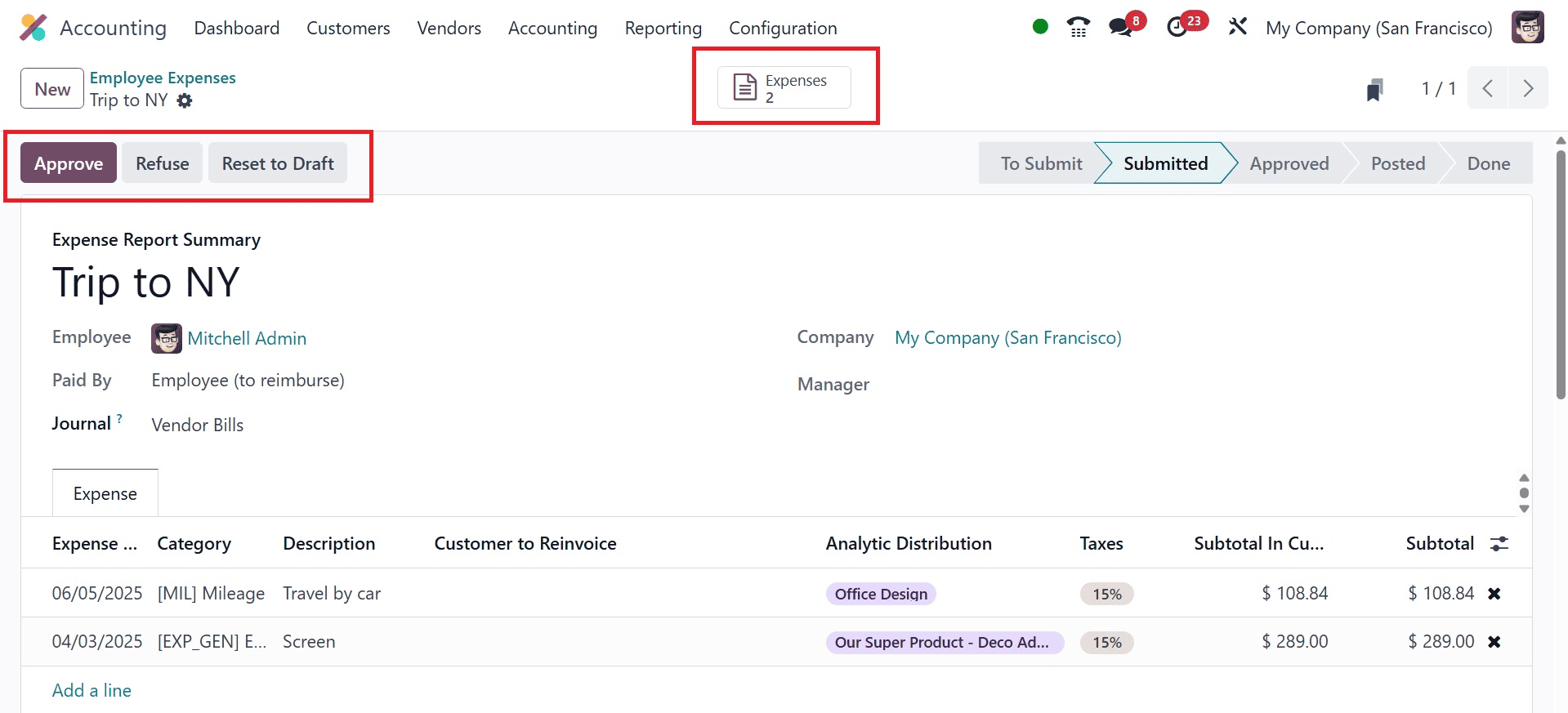

The manager can use the "Approve" or "Refuse" buttons to accept or reject the expense request after it has been sent to them.

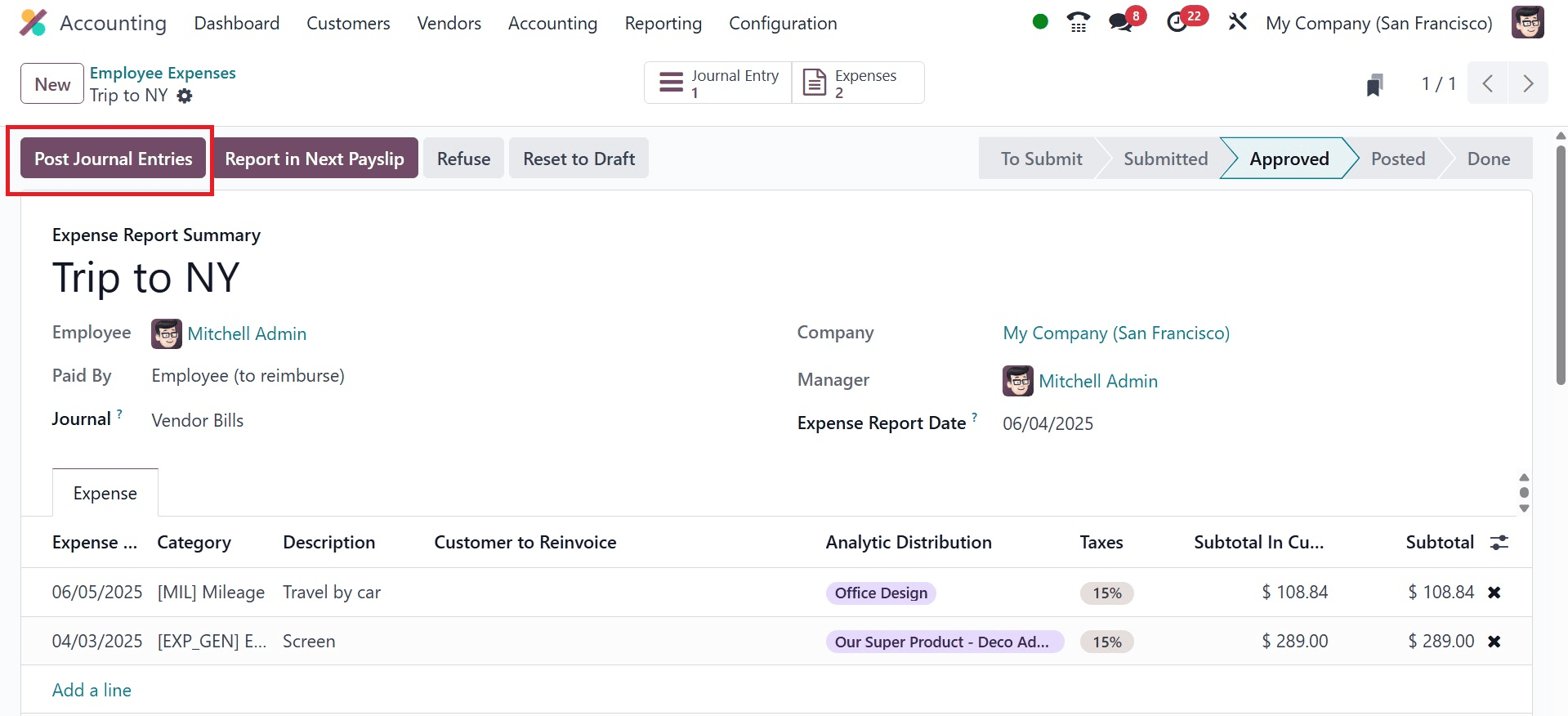

Details of the expenses the employee has added to this employee expense request can be found by clicking the "Expenses" smart button. Once the expense request has been approved, the user can utilize the "Post Journal Entries" button to enter the information as a journal entry into their accounting database.

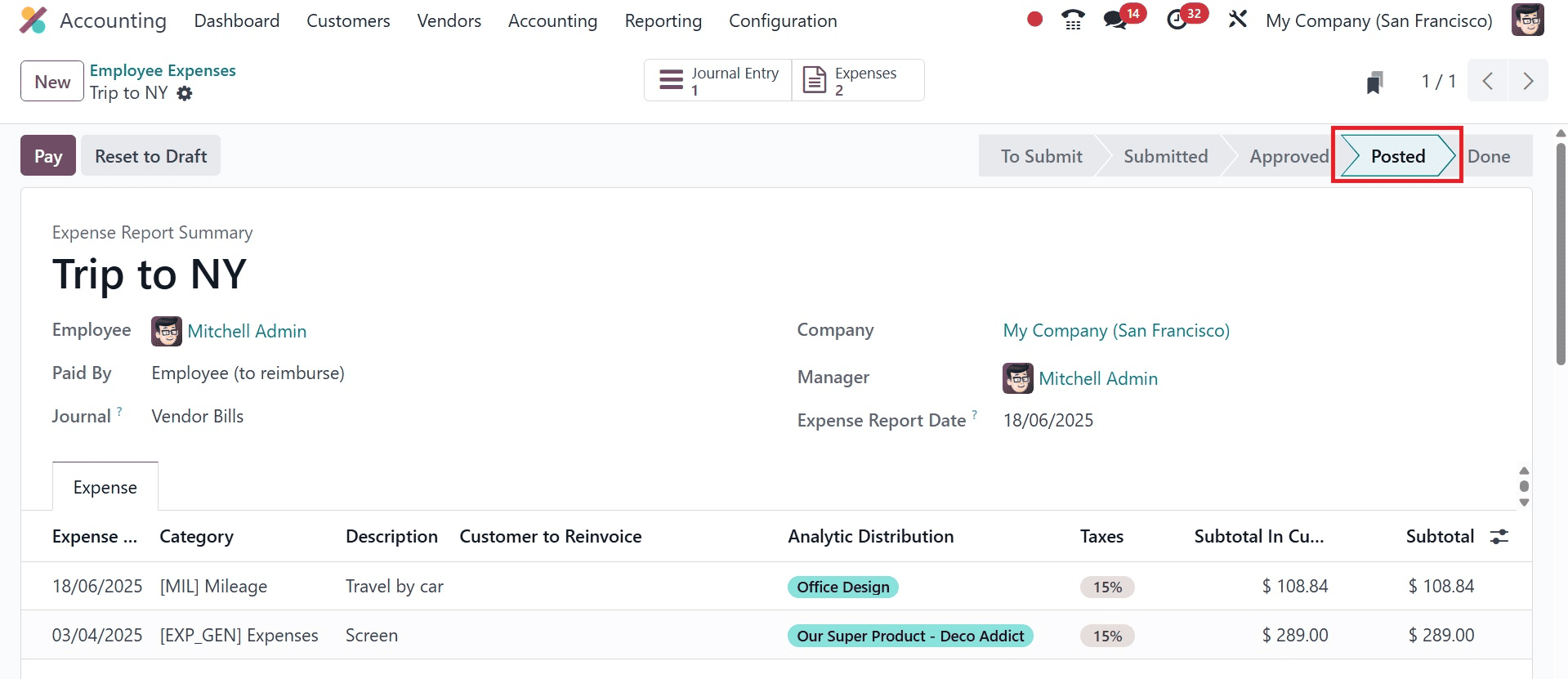

On selecting the option, you will get the page, as in the image below.

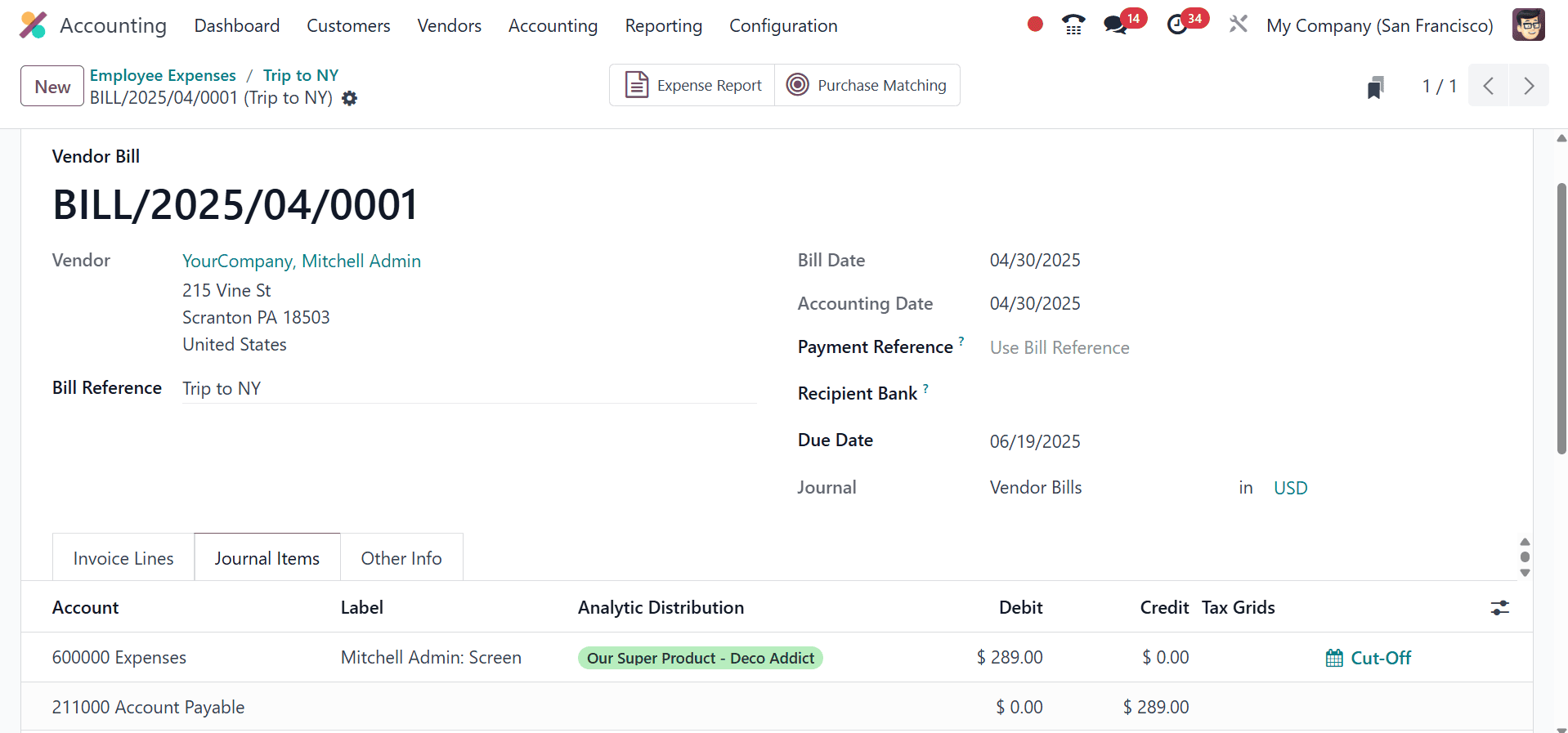

Here, on selecting the Journal Entry smart tab, you can view under which journal (that is, under the vendor bill journal) this journal entry is posted.

By using the "Report in Next Payslip" option, the payment can be added to the subsequent payslip, guaranteeing a smooth payroll and employee cost integration.

Businesses may successfully utilize Odoo 18's improved employee spending management features by following this step-by-step tutorial, which will encourage precise financial records and streamlined Odoo ERP software procedures.

To read more about How to Manage Employee Expenses in Odoo 17 Accounting, refer to our blog How to Manage Employee Expenses in Odoo 17 Accounting.