The value-added tax identification number is used in many countries as an identifier. Every venture registered for VAT is assigned to it through a unique identification number. Most entrepreneurs register for the VAT due to several cases, such as transportation of goods or services tax with VAT and intra-EU accession of goods. Each EU Country consists of a different VAT number as per the nation. Business workflow smoothed quickly by implementing Odoo ERP in a system. Verification of the VAT numbers is maintained quickly using Odoo 16 Accounting module. This verification was made possible by supporting the European VIES service in Odoo 16.

This blog gives an idea about verifying VAT numbers using the European VIES service within Odoo 16 Accounting.

Benefits of Value-Added Taxes

In the goods sales in every state, we can see VAT charges as per the respective gross margin. A value-added tax is collected from manufacturer to retailer on a specific movement. The VAT law exists in several countries, such as Union Territories and India. Output and Input VAT are two components for calculating the Value Added Taxes. The equation for calculating the VAT is given below;

VAT = OUTPUT TAX - INPUT TAX

The chances of error are eradicated when using VAT, and it is mainly applied to the purchase/sale of commodities. A uniform tax payment process ensures efficiency through value-added taxes.

To Set a Tax ID for a US Company in Odoo 16

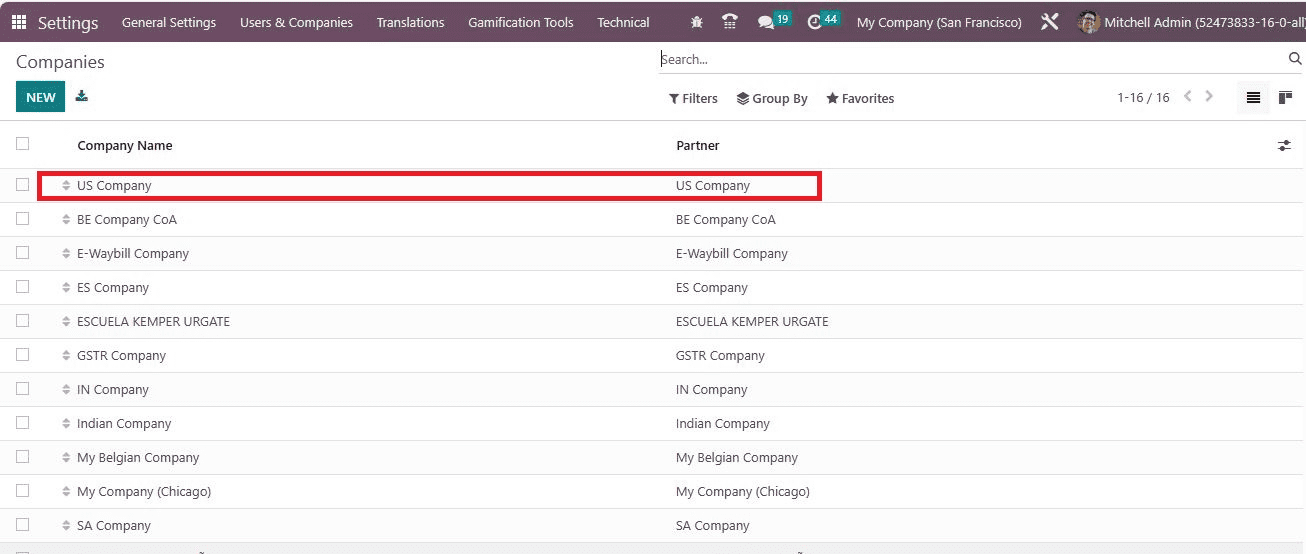

It is possible to set the Tax ID for a company within the Odoo 16 Settings. Choose the Companies menu below the Users & Companies tab. The list of all companies is accessible to users in a new window, and information such as Company Name or Partner is visible. Pick your US Company within the Companies window as indicated in the screenshot below.

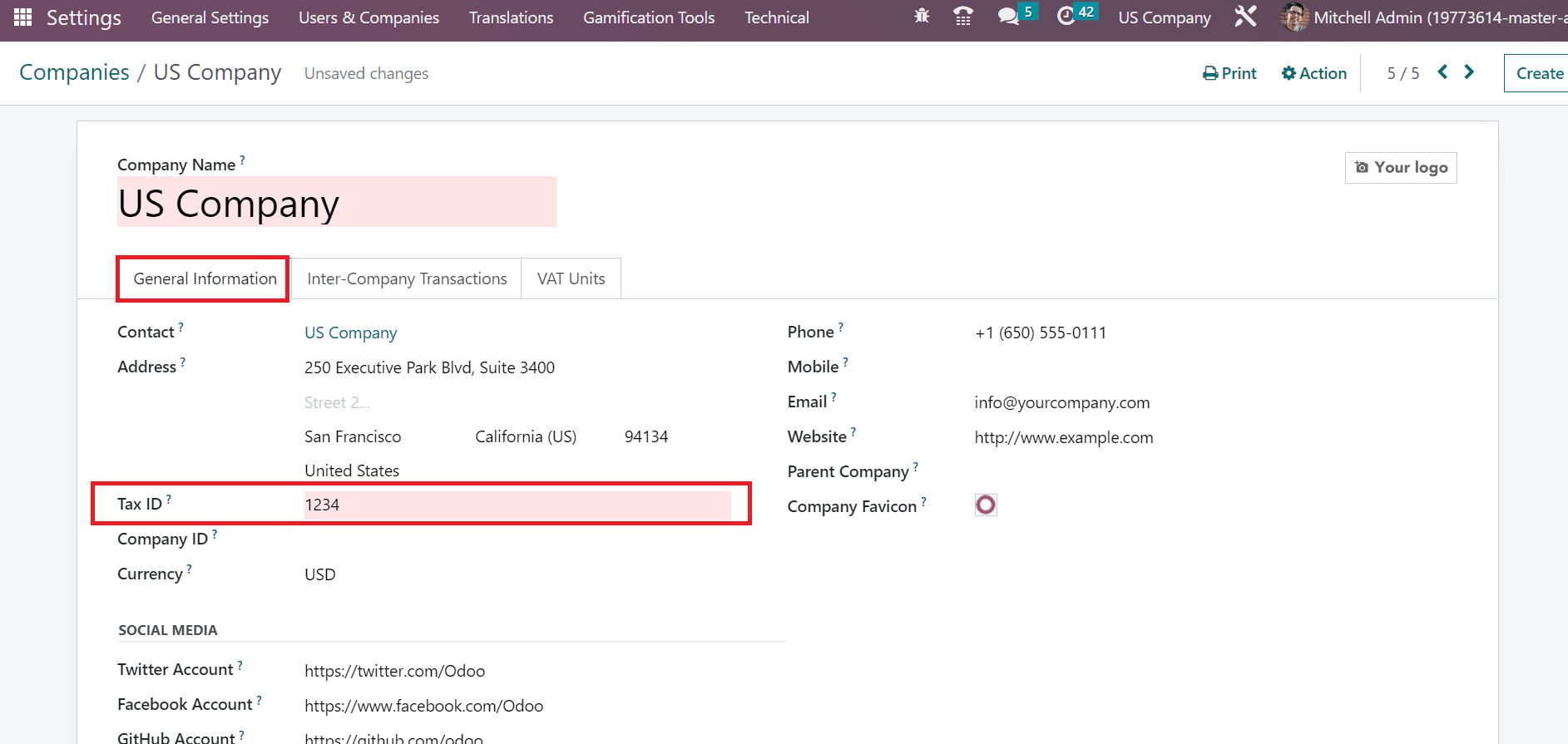

On the new page, we can see Company Name and other General Information such as Contact, Address, Email, etc. The permanent account number assigned to each taxpayer is a Tax Identification Number (Tax ID or VAT). Users can apply the Tax ID of the US company below the General Information tab, as portrayed in the screenshot below.

Now, we can see the steps to configure a value-added tax number in Odoo 16 Accounting.

How to Configure and Verify VAT Numbers in Odoo 16 Accounting?

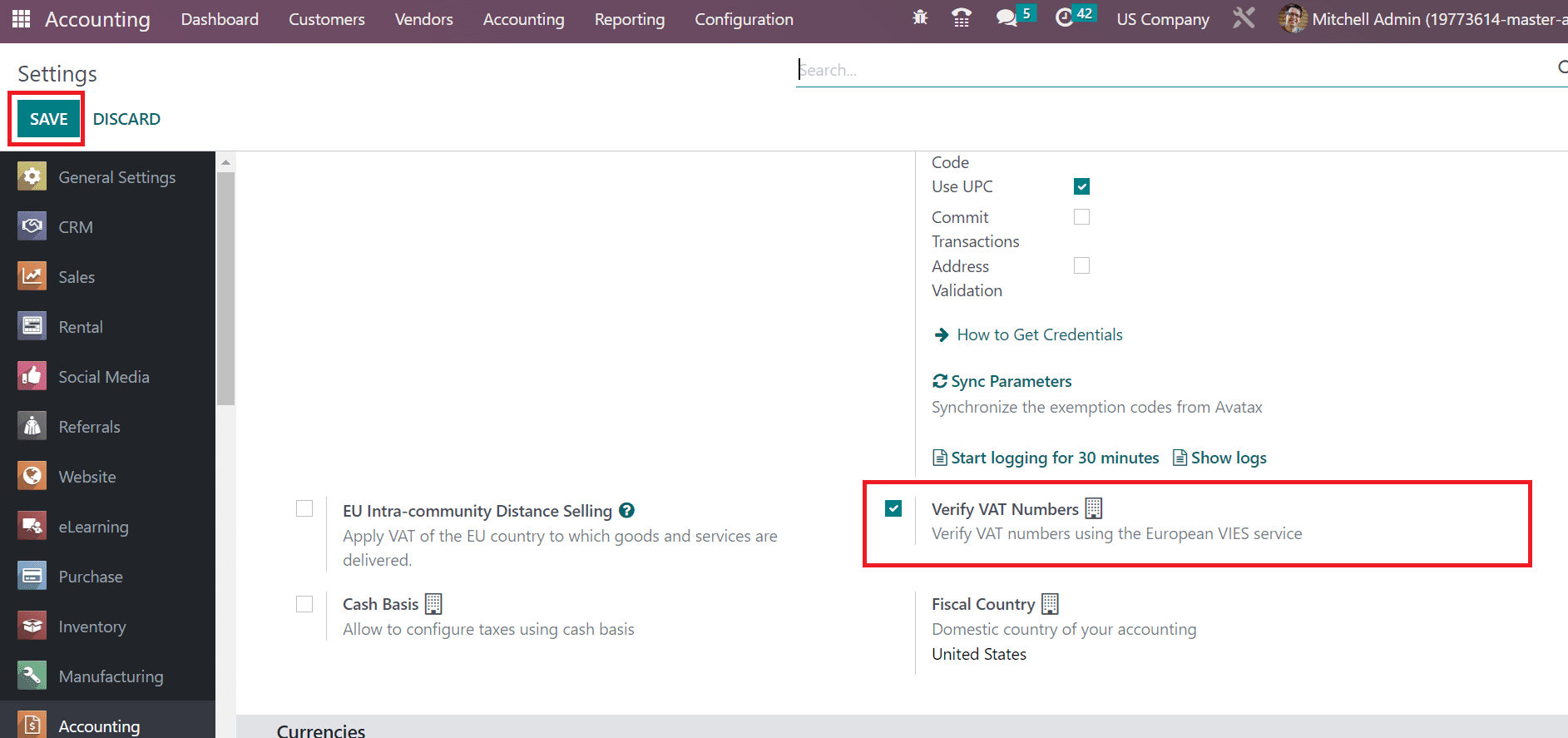

The tool provided by European Commission is VAT Information Exchange System. It assists you in checking the validity of VAT numbers registered by companies in the European Union. The Verify VAT Number feature helps to save a contact in Odoo 16 Accounting. Choose the Settings menu in the Configuration tab, and the Taxes section is visible to the user. Activate Verify VAT Numbers field and click the SAVE icon as marked in the screenshot below.

Users can validate the VAT numbers using the European VIES service after enabling the Verify VAT Numbers feature. Next, let's see the VAT number validation in the Odoo 16 Accounting module.

To Validate a VAT Number in Odoo 16 Accounting

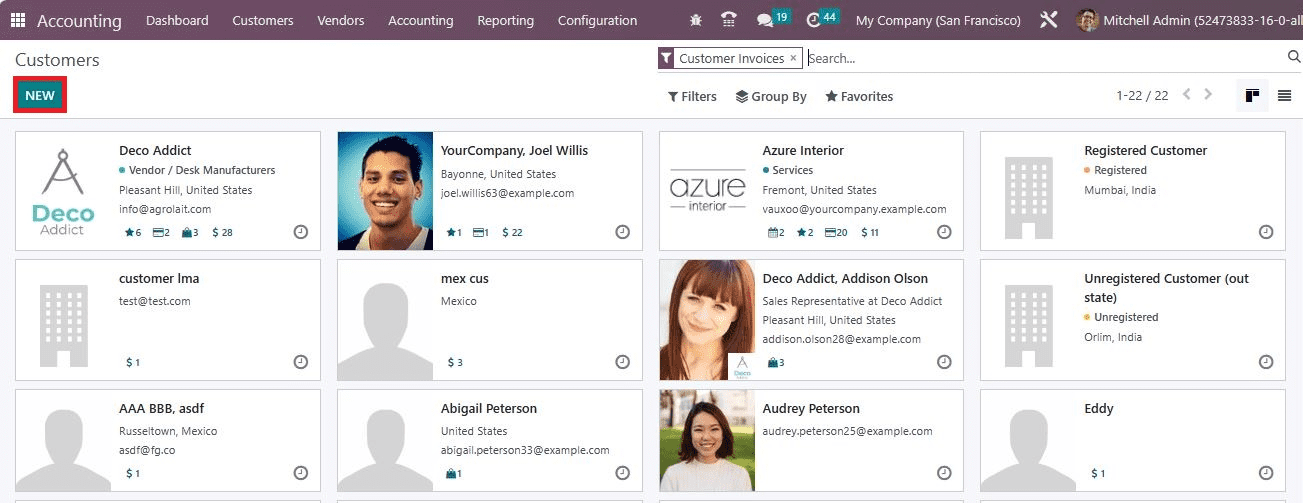

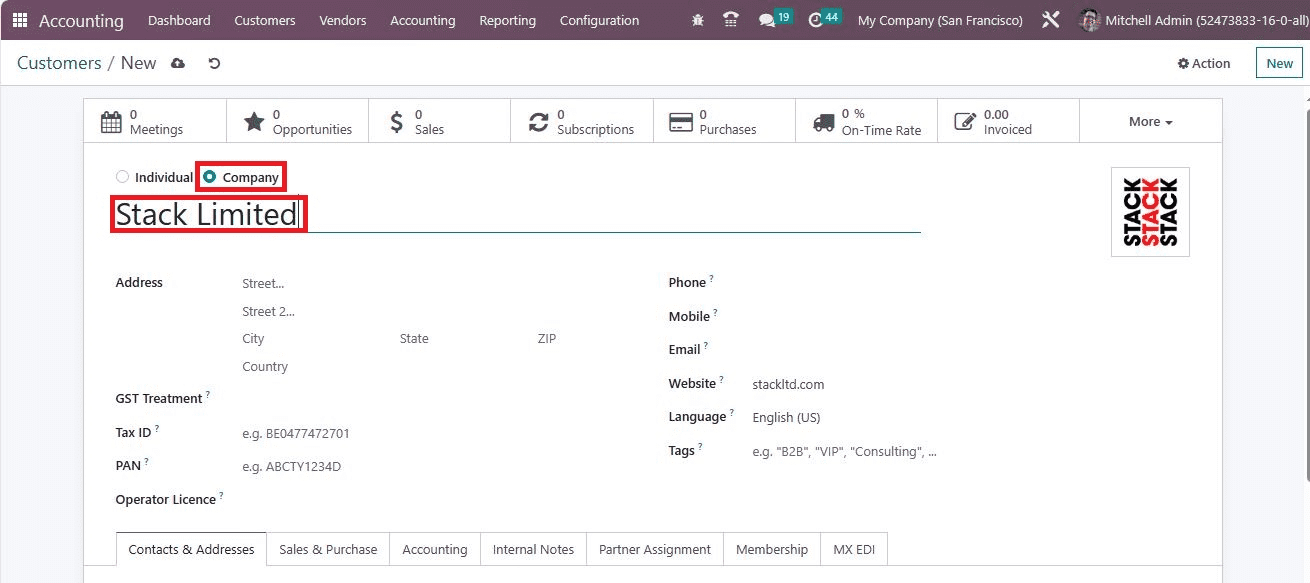

We can manage the value-added tax number when creating new customer details in Odoo 16. For that purpose, select the Customers menu, and the record of all created partners is accessible to a user. In the Kanban view, we can access the details of each customer separately. It includes information such as email ID, name, country, revenue, and other data, as displayed in the screenshot below. To generate new customer data, select the NEW icon in the Customers window as specified in the screenshot below.

A new window appears to the user after selecting the NEW button. On the open page, users can set the customer information efficiently. Enable the Company option and add the firm's name as Stack Ltd, as noted in the screenshot below.

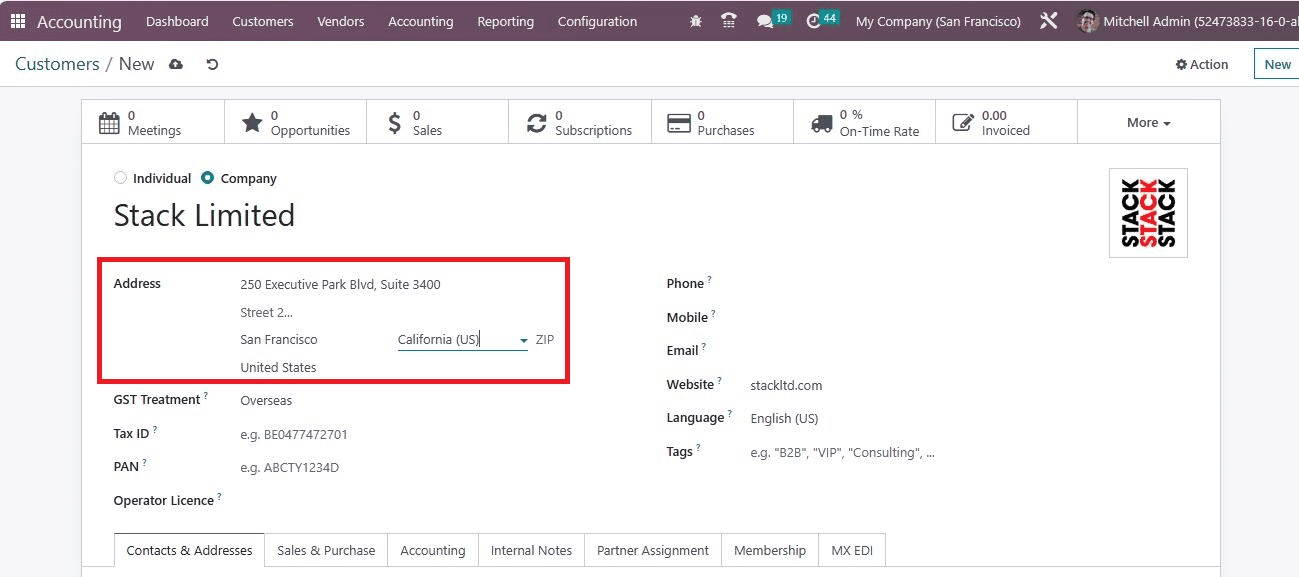

Afterward, enter the company's address, including Street name, City, Country, ZIP, State, and more, as mentioned in the screenshot below.

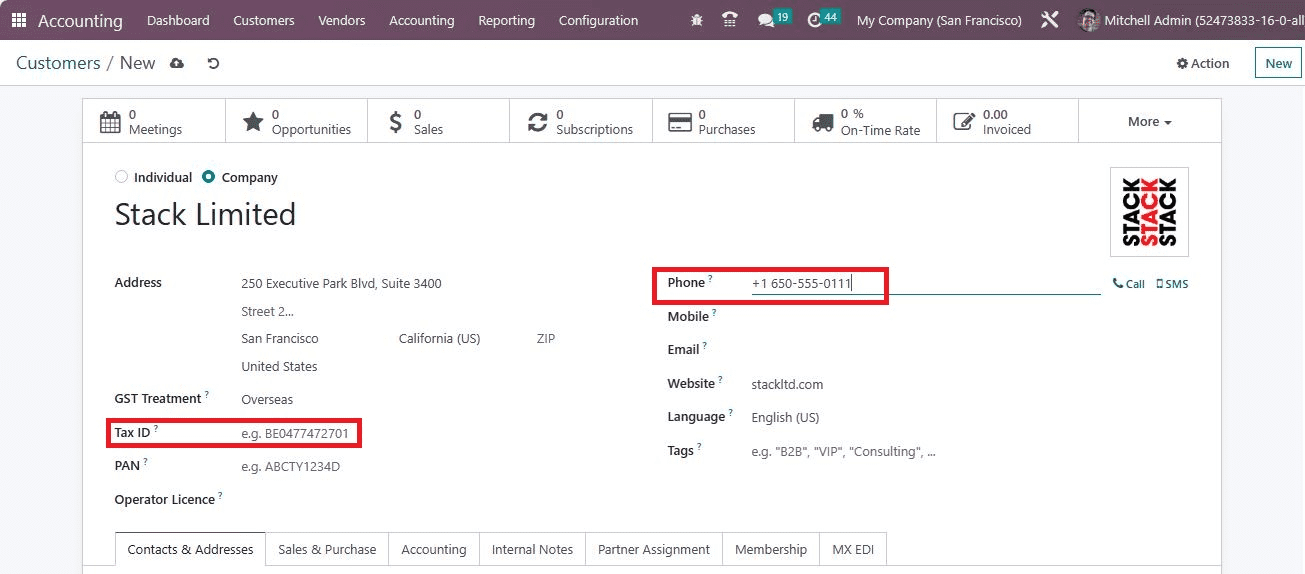

Users can apply for the value-added tax number within the Tax ID field and add the Phone number of the company in the Phone field.

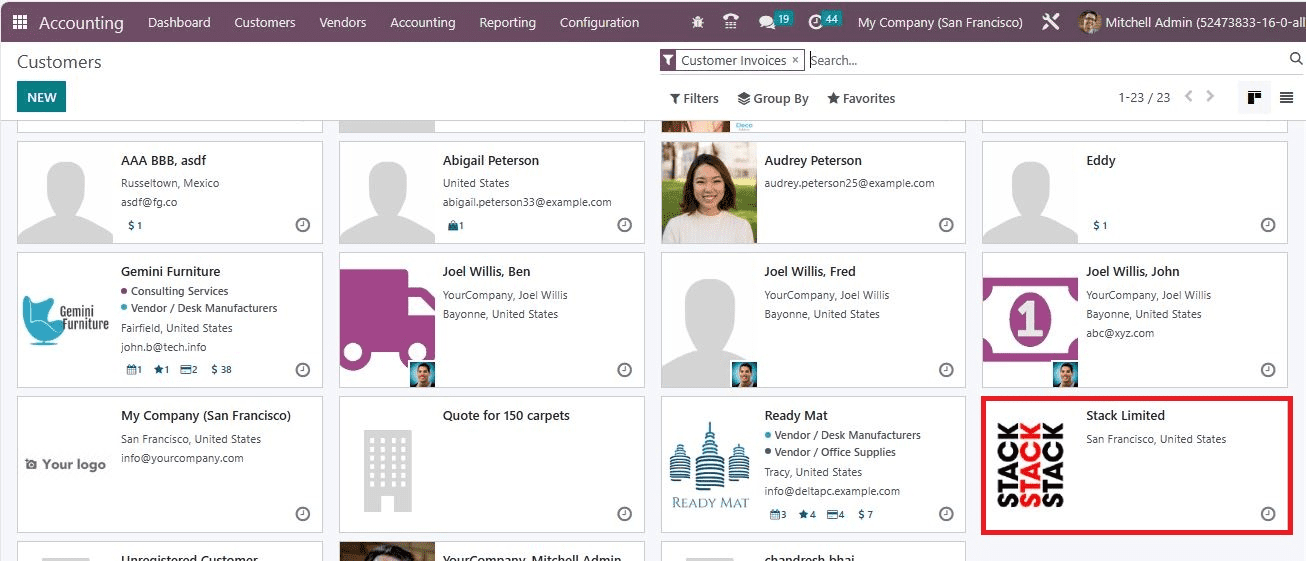

After applying the necessary information, the details will be automatically saved into the system. otherwise, you can use the Save manually icon, as shown in the screenshot above. Users can get an error message if the Tax ID is invalid. Customer details are saved easily after applying for the correct VAT number. The created customer data is accessible in the main Customers window, as presented in the screenshot below.

Hence, it is easy to verify the Tax ID for a customer within the Odoo 16 Accounting module.

Tax Report in Odoo 16 Accounting for Users

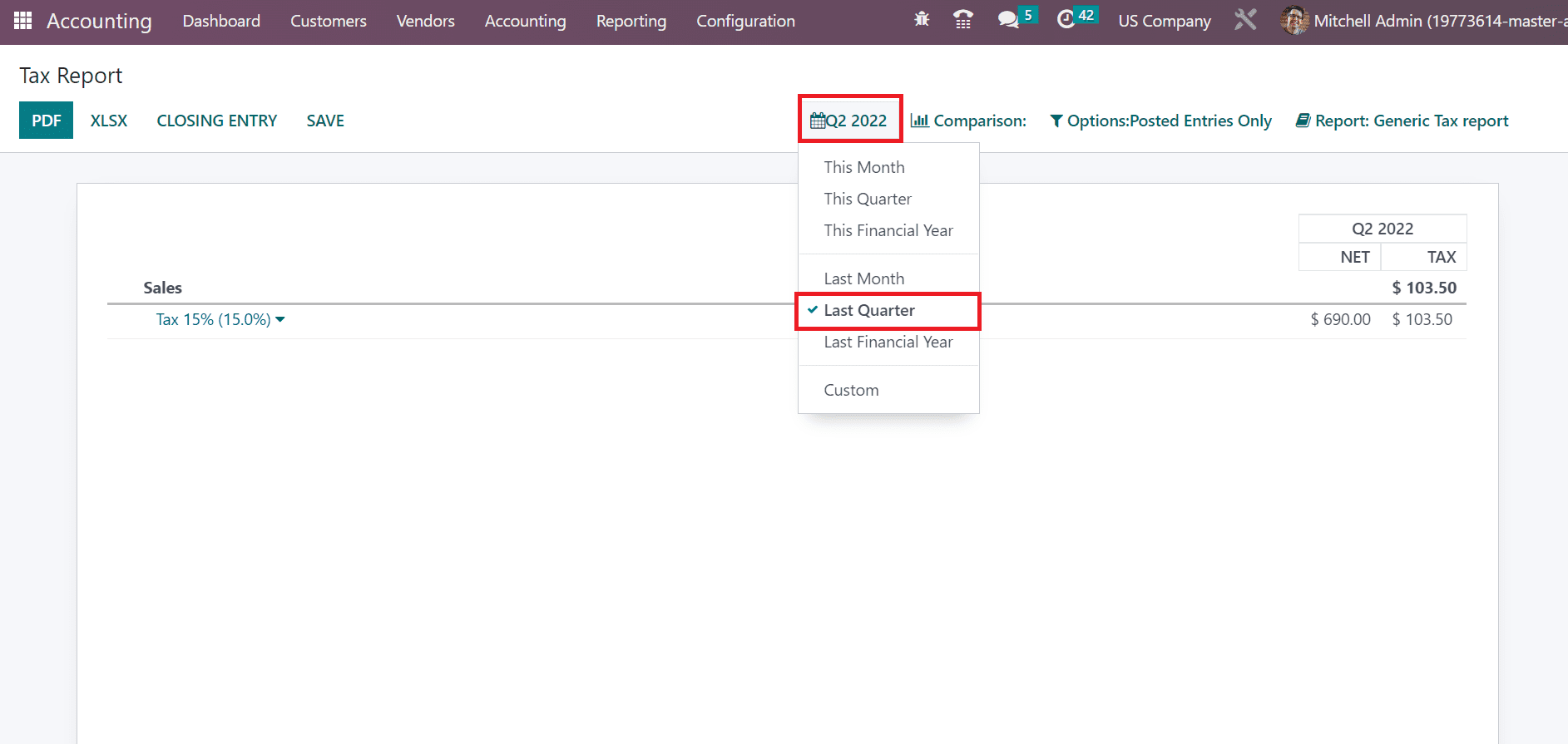

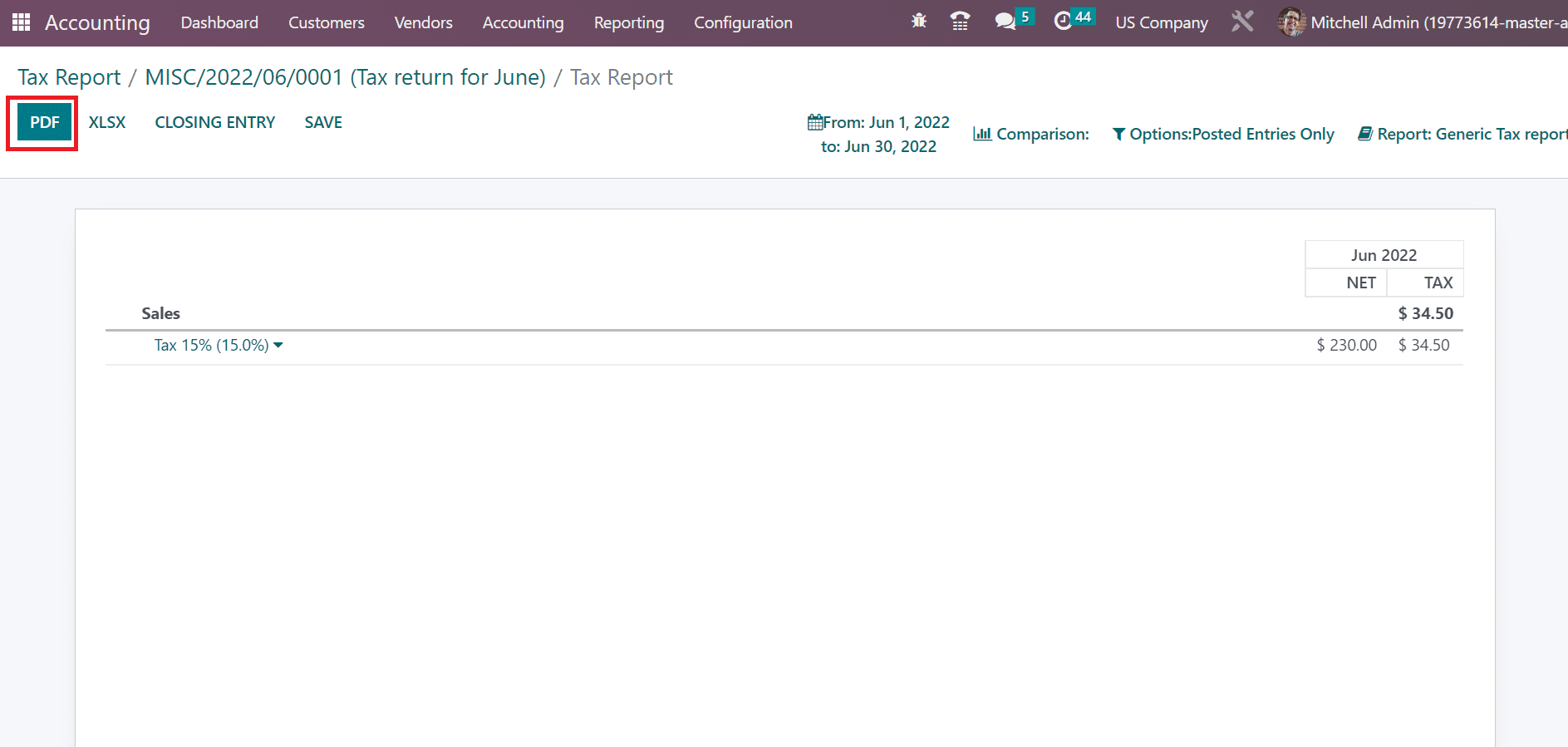

We can analyze the tax reports of a company during a specific time within the Odoo Accounting module. Select the Tax Report menu inside the Reporting tab and choose the suitable date by using the date Filter as represented in the screenshot below.

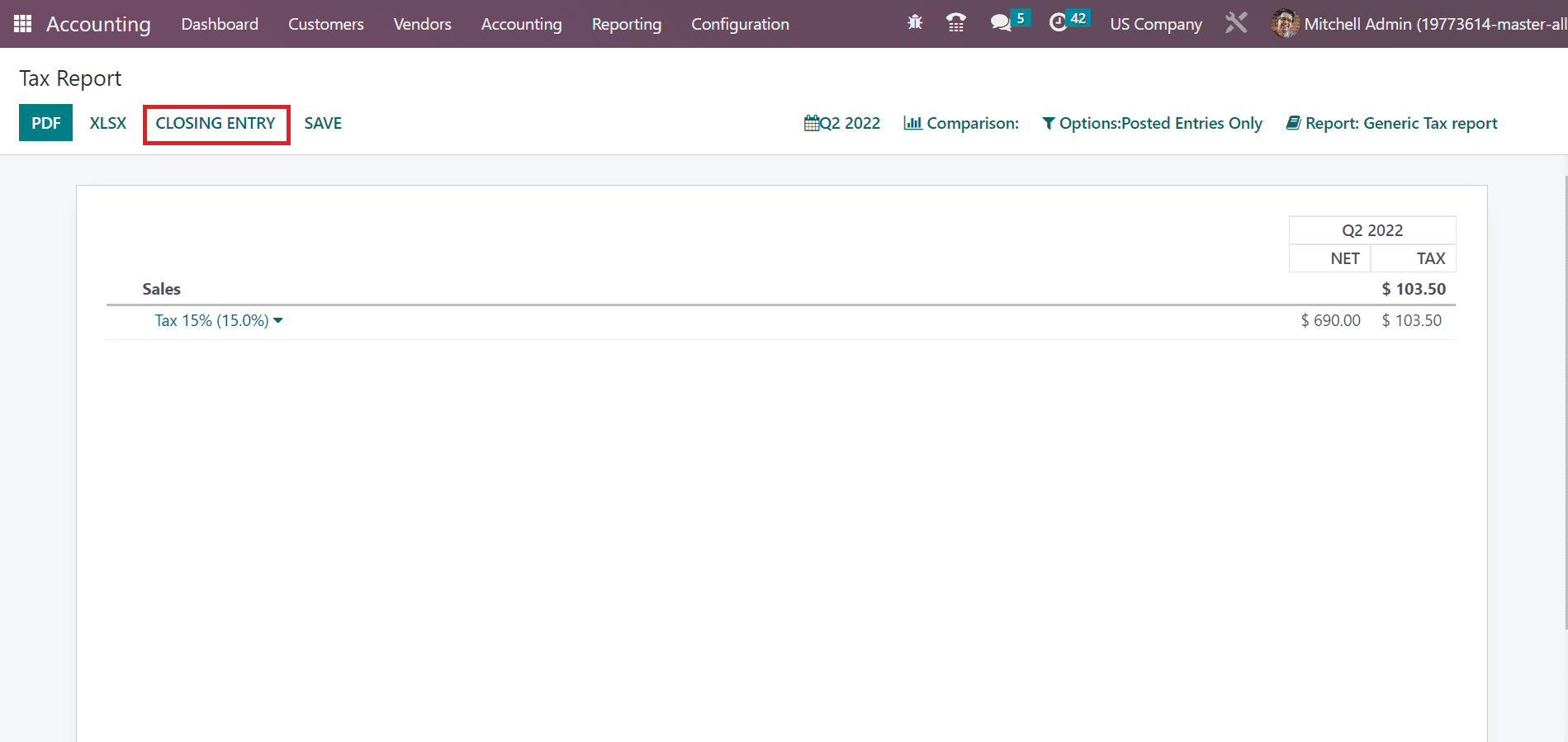

An overview of the tax reports is viewable to a user after filtering the date. Later, press the CLOSING ENTRY button in the Tax Report tab, as illustrated in the screenshot below.

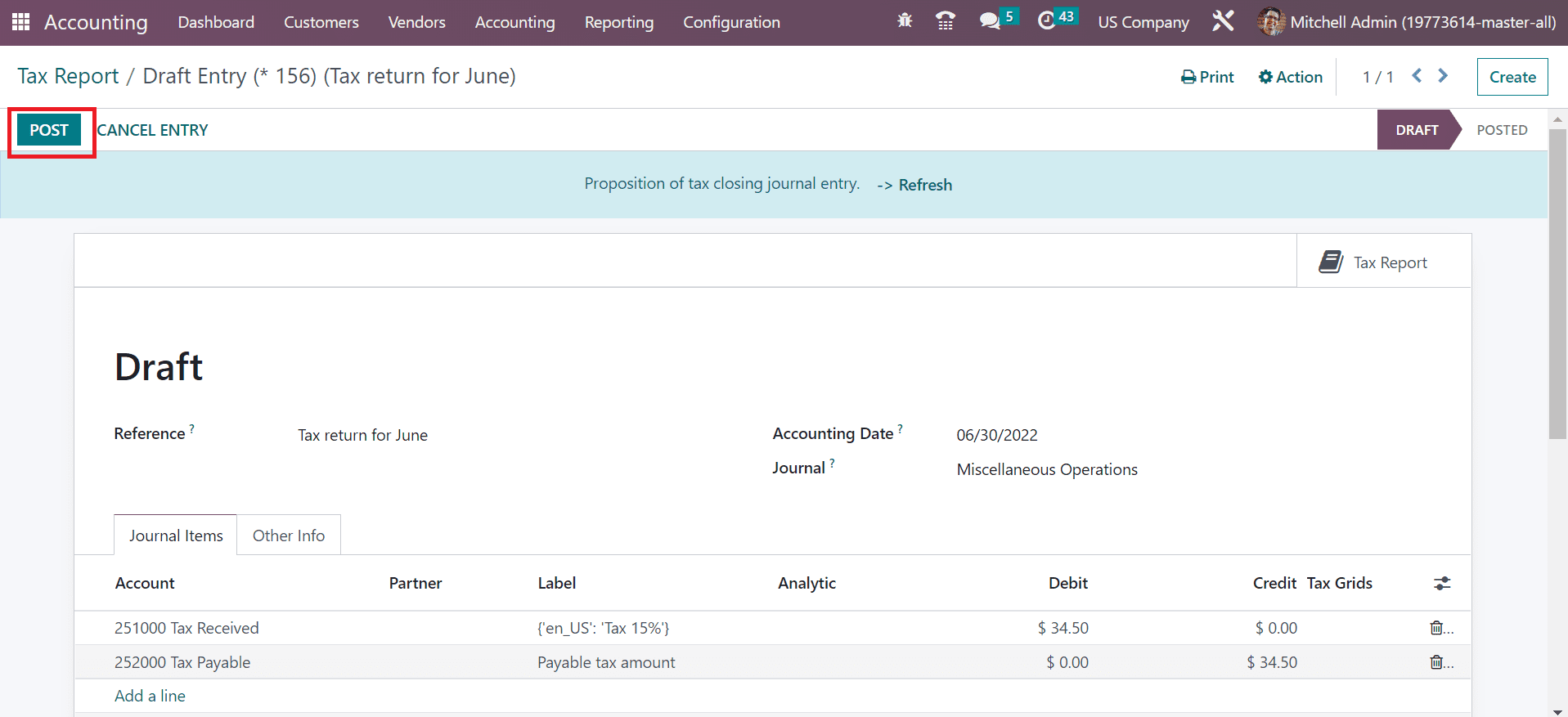

A draft entry of a tax return is accessible to a user, and it is possible to post the entry by selecting the POST icon in the Draft Entry window.

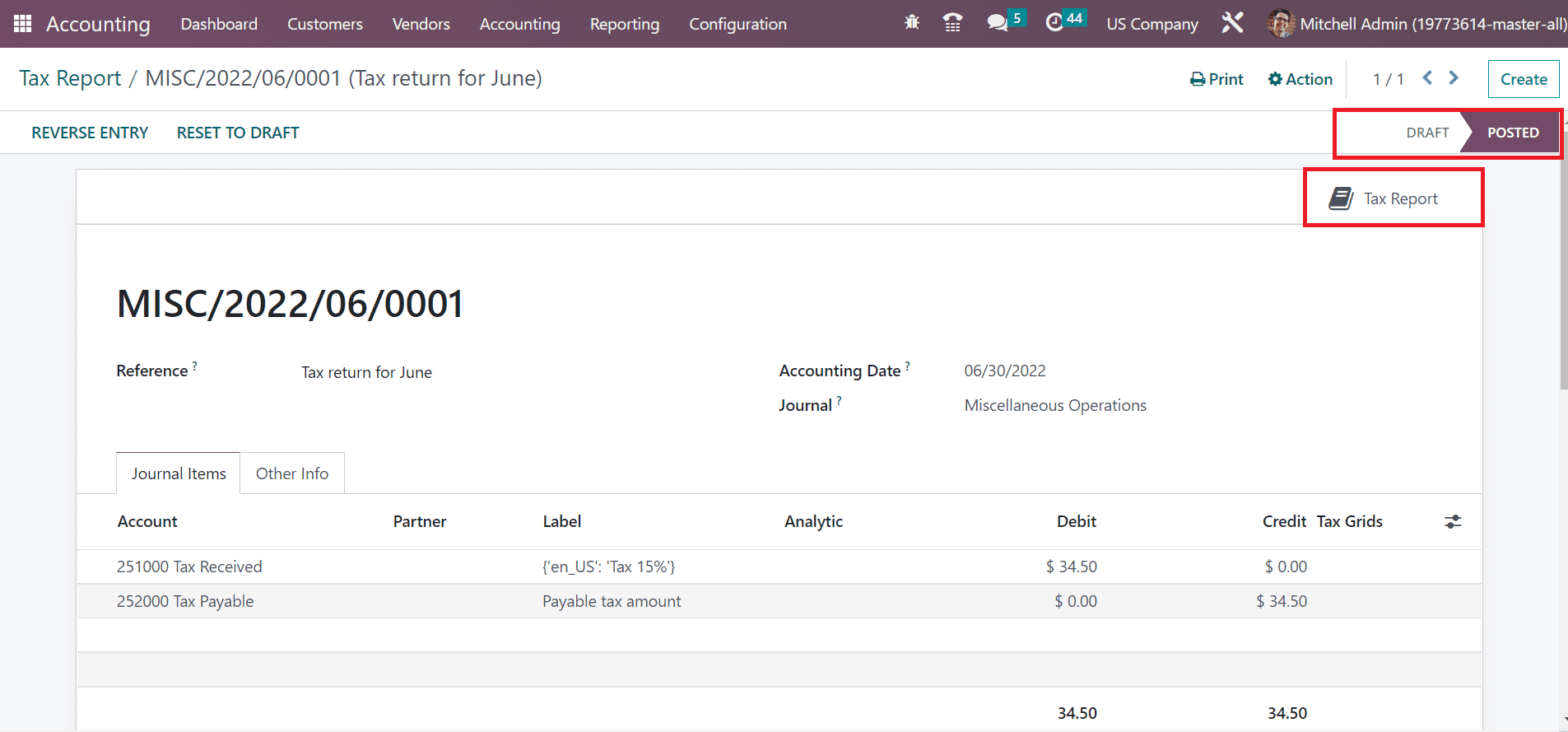

After posting the entry, the stage changed from DRAFT to POSTED. You can access the tax report after pressing the Tax Report smart button in a Tax report window.

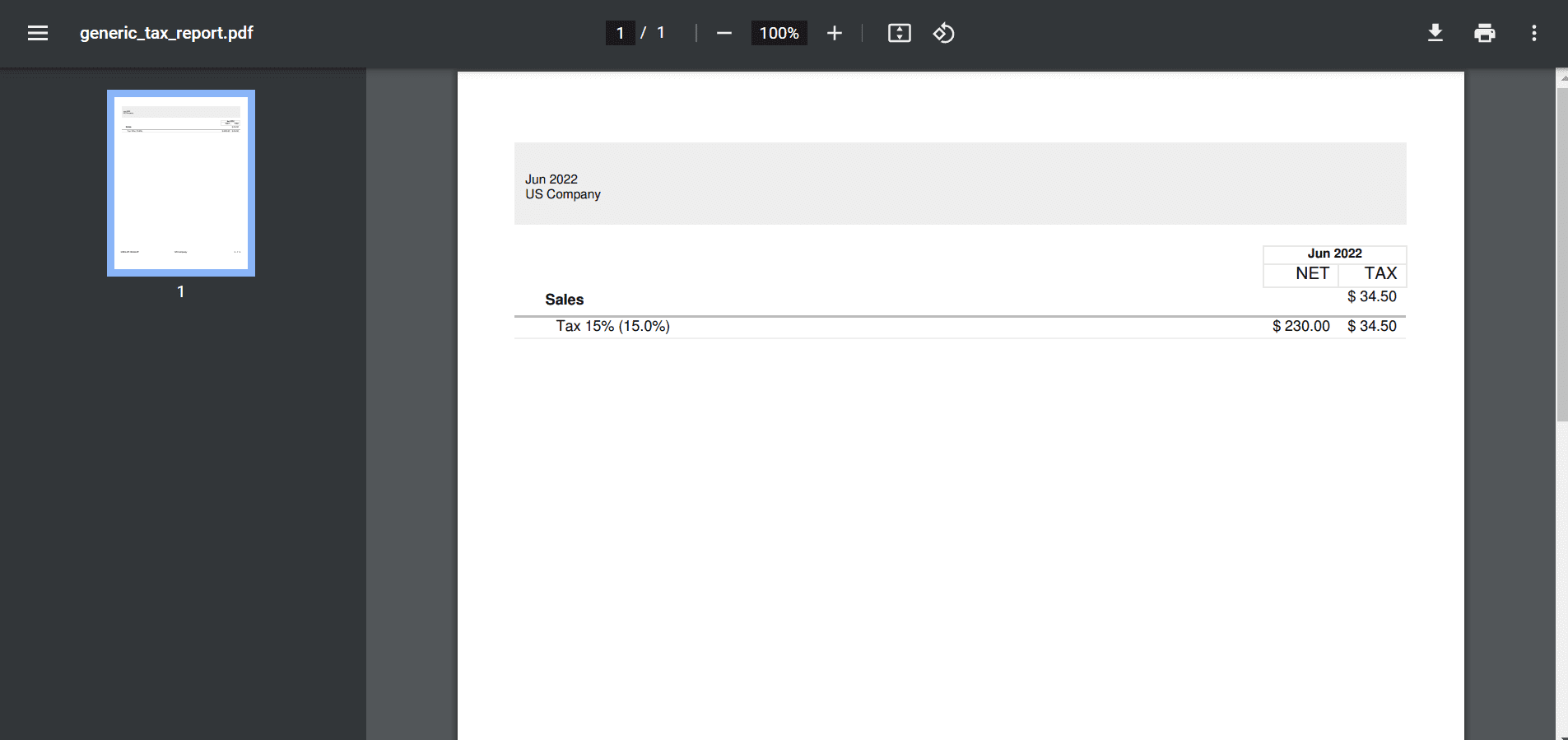

On the new page, we can access the total tax amount on your sorted month. Additionally, you can download the tax report by choosing the PDF button in the new window.

The general tax report is obtainable to users, as portrayed in the screenshot below.

Using the European VIES service, management of VAT numbers is made easy through the Odoo 16 Accounting module. It is easy to set up a Tax Id number for your company and configure it with the Accounting application in Odoo 16.

To read more about managing intra-community trade using Intrastat in Odoo 16, refer to our blog How to Manage Intra-Community Trade Using Intrastat in Odoo 16