Getting a specific inventory valuation is important on the grounds that it is the recorded stock or inventory calculation that affects the price of sold products, net profit, and total benefit on the statement of income. The correct inventory valuation often calculates the existing assets, cash flow, the equity of owners or proprietors listed on the balance sheet.

Here in this blog, we are discussing the product category and inventory valuation in Odoo ERP.

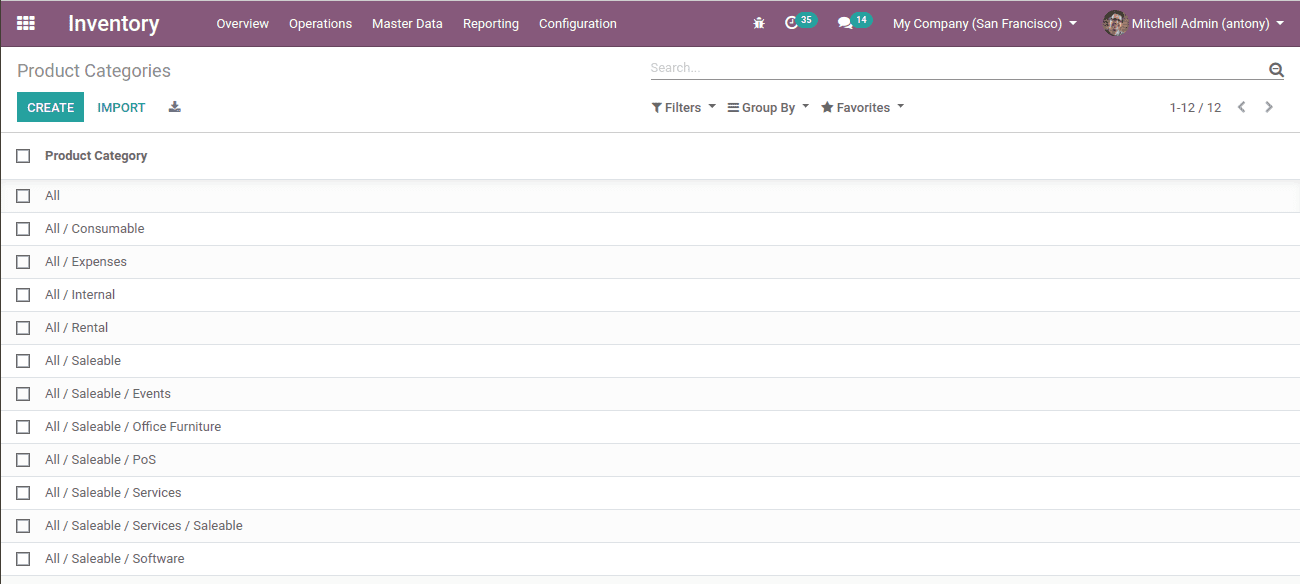

The product category is such a beneficial feature that we can identify or group by the product based on category. To configure or create a product category go to, Inventory -> Configuration -> Products -> Product Category.

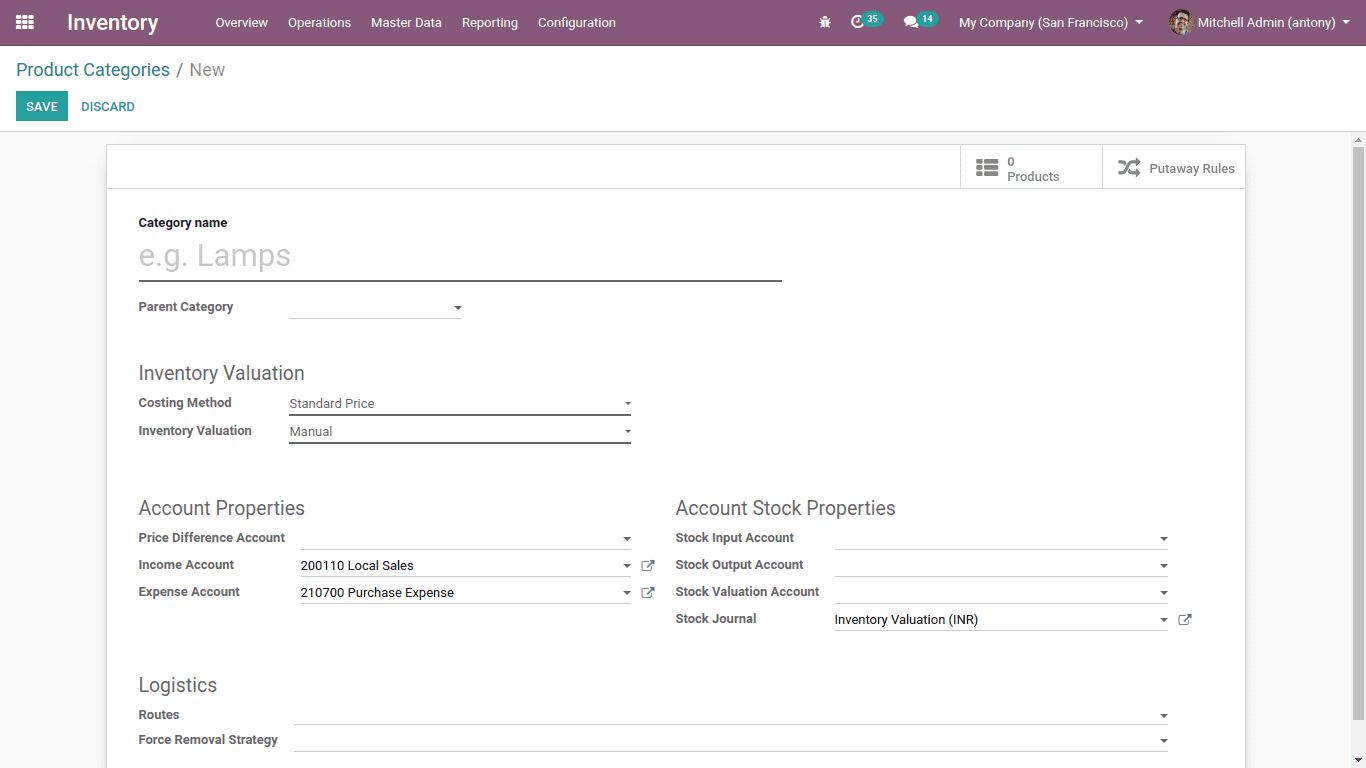

Click on the “Create” button. A form will appear.

* Category name: here we shall give a name for the category.

* Parent category: here we can set the parent category to this category.

* Routes: here we shall set the route/path for the product to move on.

* Force removal strategy: here we shall mention the removal strategy that is used while there is no source location is given for the category.

Here we have 3 types of removal strategy in Odoo,

FIFO: First In First Out

FEFO: First Expiry First Out

LIFO: Last In First Out

* Costing method: here we have 3 types of costing method,

Standard price: products are valued at its standard cost given on the product

First In First Out: products are valued based on First entered in and first leave

Average Cost: valuation based on weighted average cost

* Inventory valuation: here we have 2 types

Manual: when a product enters or leaves the account entries of its inventory won’t be posted automatically.

Automated: Here the accounting entries will be posted automatically.

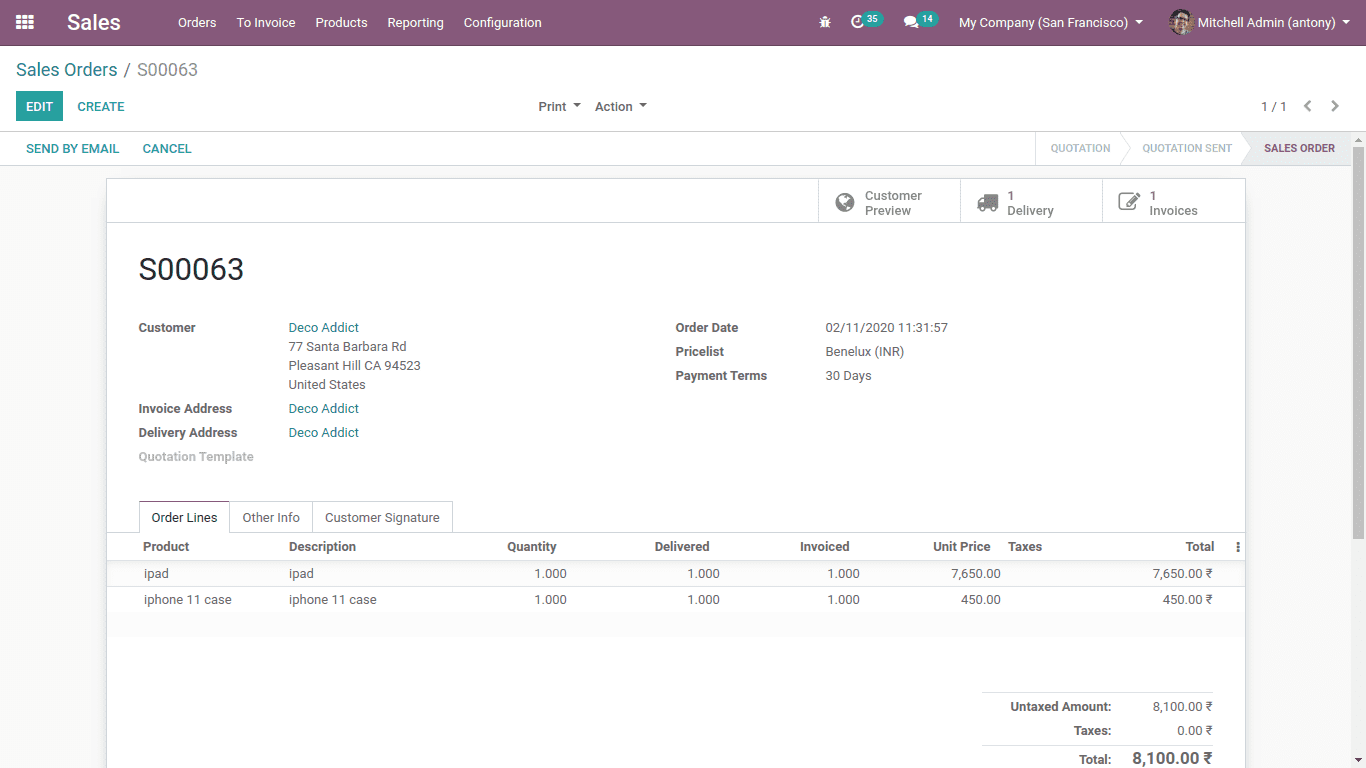

For an illustration, we can sell two products with automated inventory valuation and manual inventory valuation.

Here iPad is automated and iPhone 11 case is manual.

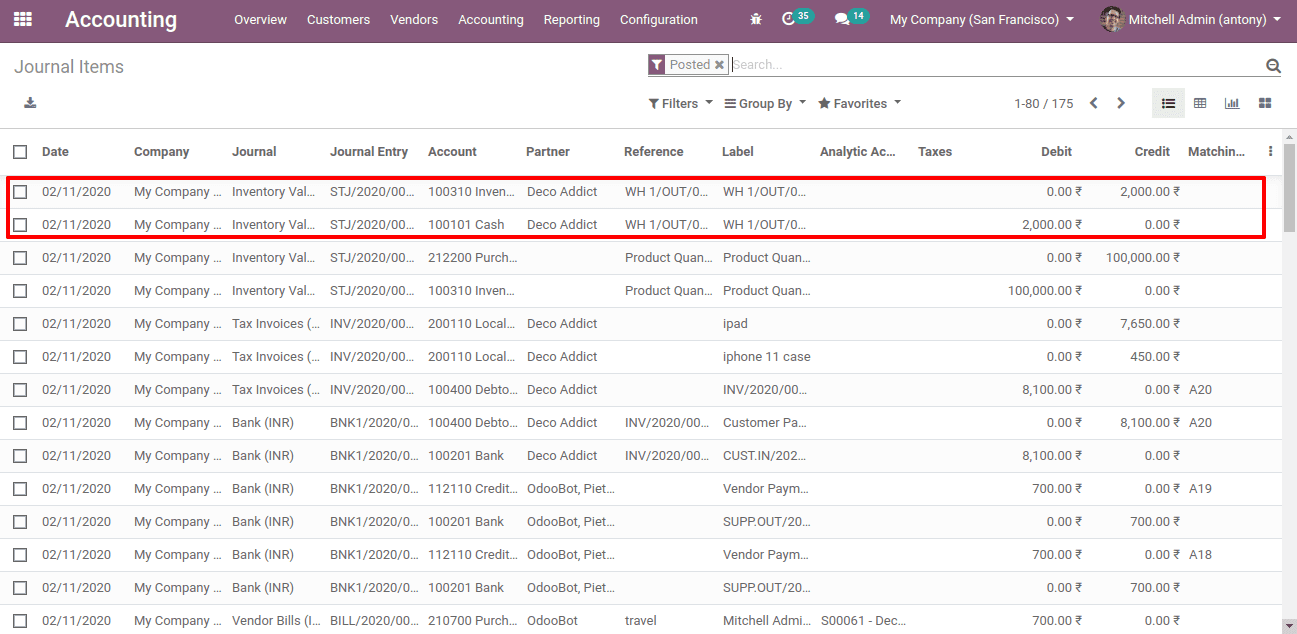

Now when we do the delivery of the products, the accounting entries of the iPad will be automatically generated for the inventory valuation. For the iPhone 11 case, there won’t be automatically generated entries.

Here we can see the automatically generated accounting entries of the iPad for its valuation of inventory when a sale order is made.

Cost variation based on Inventory valuation

Standard Cost

When we keep the Costing Method as ‘Standard price’ of a Product category and sell or purchase a product under this category the cost of the product will not change automatically. We can manually update the cost, or else it won’t change.

Average Cost

Now in another case, we shall select the Costing Method as ‘Average Cost’ of a Product category. Now make a purchase of a product under this category at a different price then there will be a change in the cost automatically. But when we make a sale order for this product it won’t affect it.

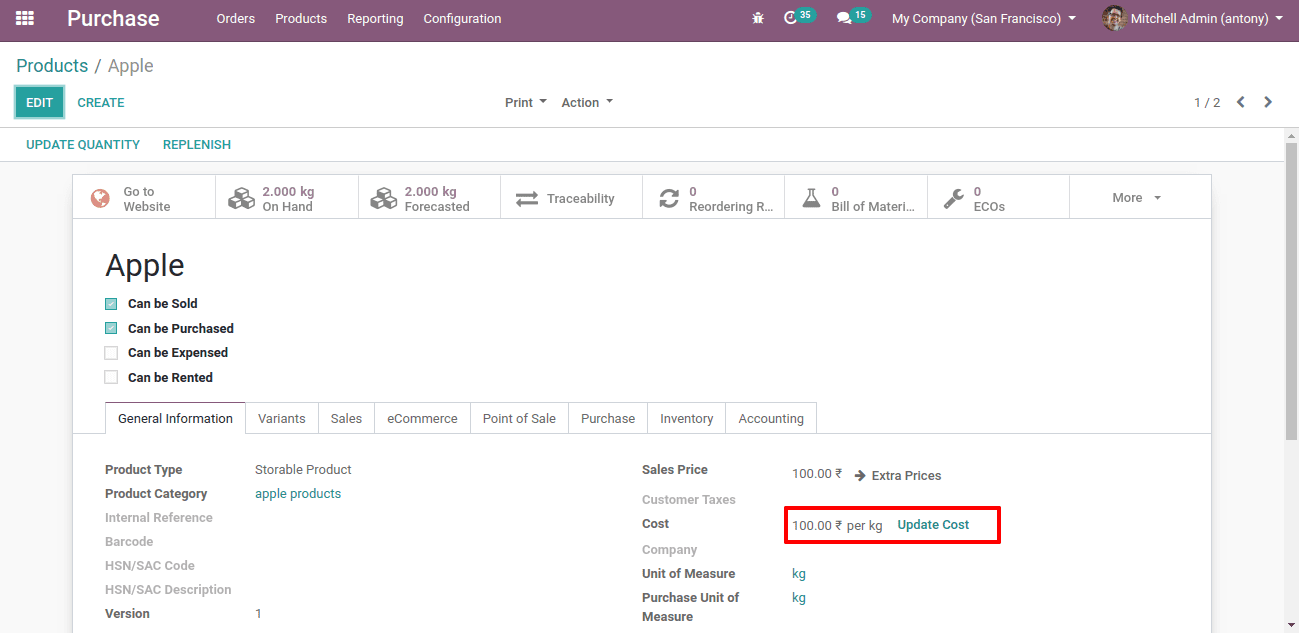

For example, here we created a product called ‘Apple’. Its cost is 0. Then we purchased 2 kg of Apples which has a unit price of 100. Then the cost is 100.

Again we purchase the same product in different quantities and different prices, then the cost again changes.

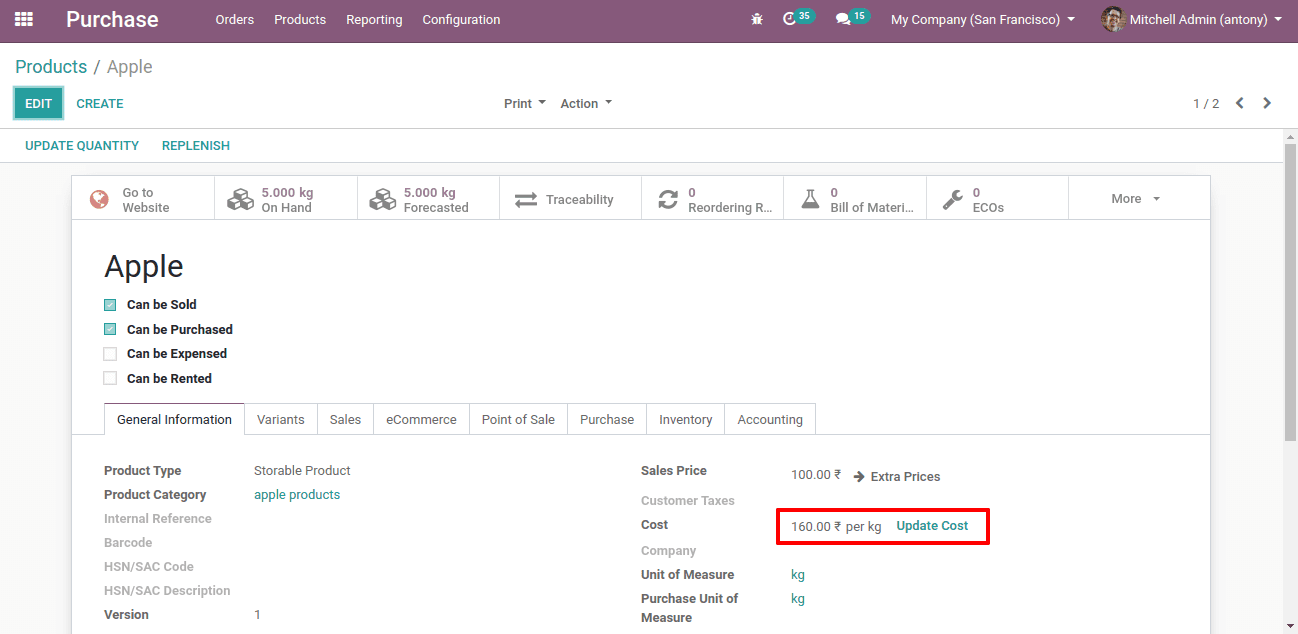

Here we purchase 3 kg of apples at a price of 200.

Here the cost became 160.

So the calculation is,

2 multiplied by 100, plus, 3 multiplied by 200, divided by 5 and the result is 160

(2*100+3*200)/5=160. So,this is the cost here.

FIFO

Now let's keep the Costing Method as ‘FIFO’ of a Product category, also we can set the force removal strategy as ‘FIFO’. Now we shall make a purchase, in different price and quantity, of the newly created product with product category of ‘FIFO’ Costing method. After that we shall sell the product, then the cost will be changed automatically.

Here the product that was purchased first will be sold first. And the cost of the last moved product will be the cost of the product here.

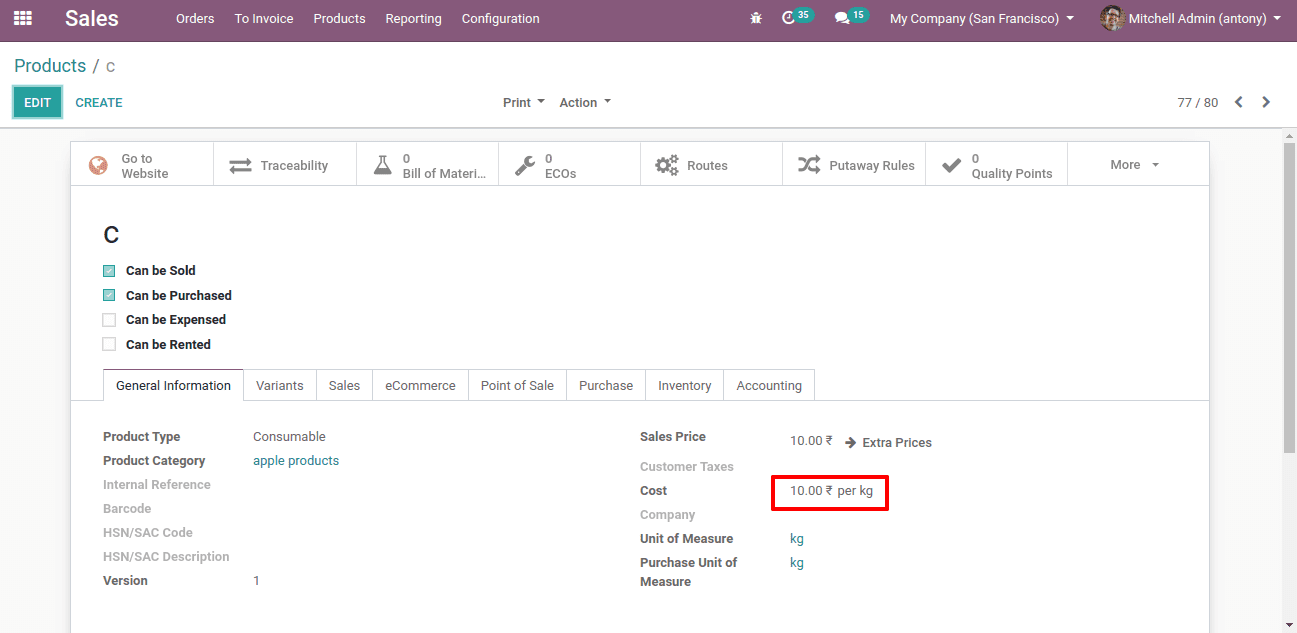

Here first we purchased a 10 kg product at 10 rs per kg. And in the second purchase 10 kg in 14 rs per kg.

Now we sold the product “C” 10 kg at 10 rs per unit.

Here the cost became 10.

The reason is the product removed from the first set of products that we purchased.

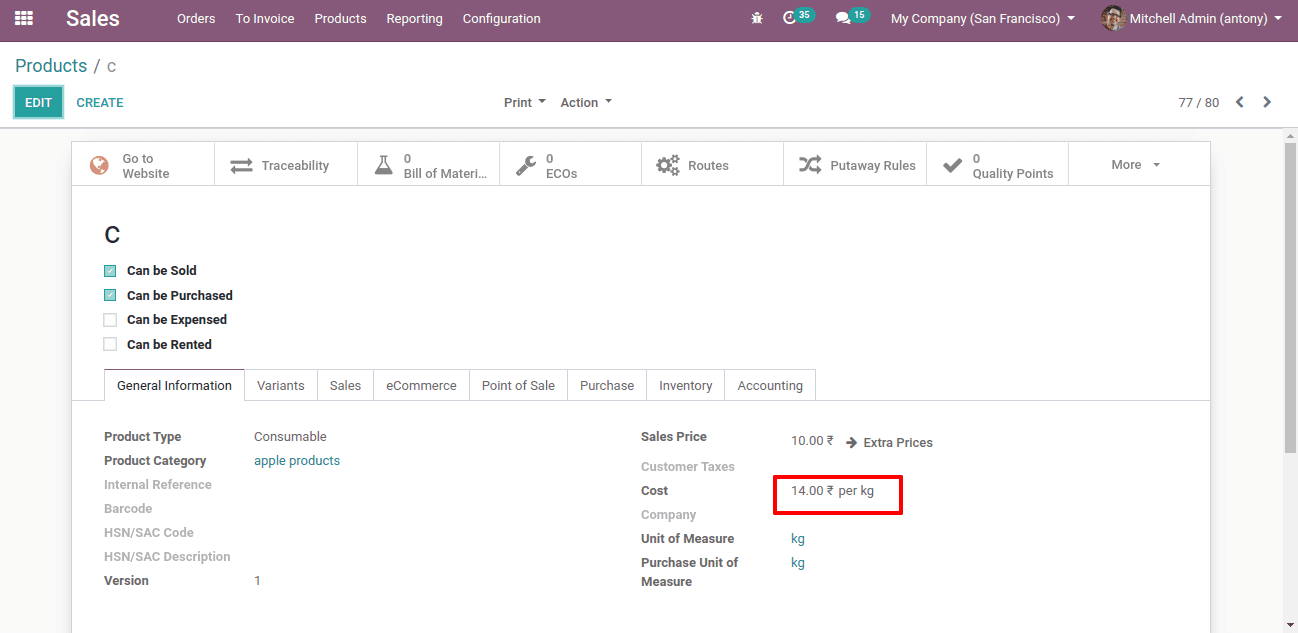

Again we made a sales order. Here we sold 5 kg in 5 rs per kg.

Now the cost became 14.

The reason is, here the products are removed from the second set of products we purchase at rs 14.

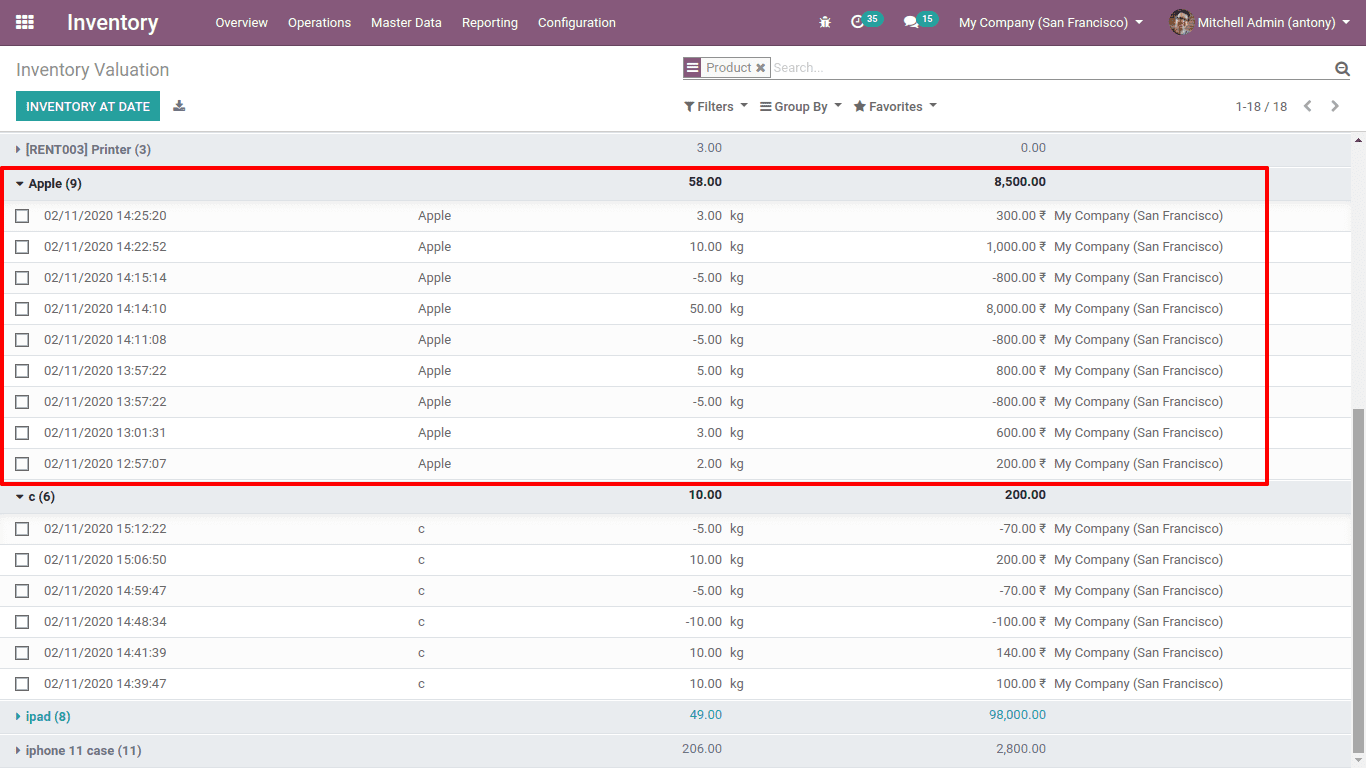

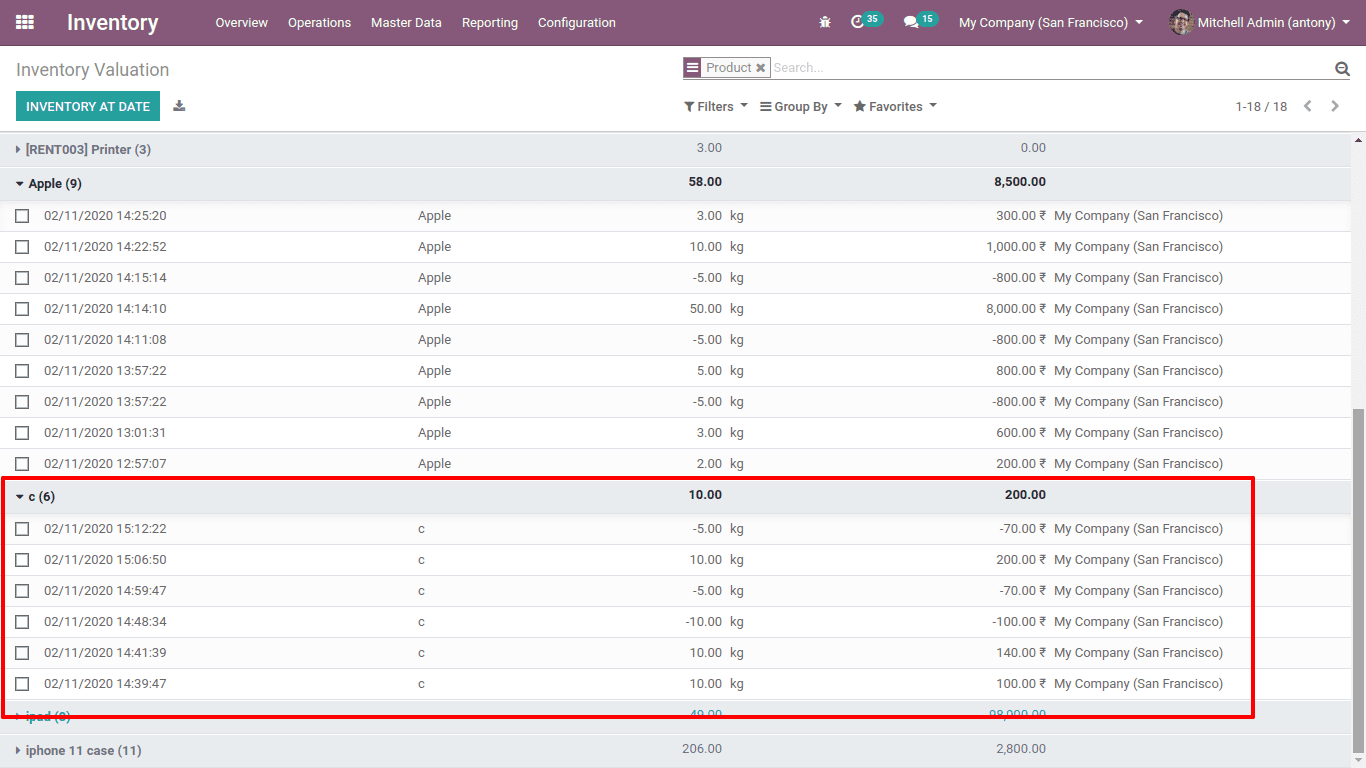

Now we can see the variation in inventory value while changing Costing Methods.

Average cost

Here the minus quantities are indicating the sales.

Others are indicating purchase.

FIFO

Here the minus quantity indicates the sales and positive quantity indicates purchase.

* Account properties

Price difference account: This account will be used to measure the difference in price between the purchase price and the accounting costs. The price differential account is for Anglo-Saxon accounting only. If the price for a commodity is different in the purchase order and the price in the purchase invoice, then the price difference account is used to keep the difference between these two values.

Income account: This account is used while validating a customer invoice which ensures that the specifics of the sum invoiced (without tax) will be kept. When you manage a sales order that includes various products in different categories, then you can use different accounts for different categories of goods. So you can easily understand the accounting specifics of different products.

Expense account: We use this account when we validate a vendor bill. When we process a purchase order that includes various products in different categories, then we shall use different accounts for different categories of goods. So that we can easily understand the accounting specifics of different product categories.

* Account stock properties

Stock input account: while we do an inventory in real-time, all incoming stock movements will be listed in this account unless a different valuation account is set at the source location

Stock output account: while we are doing a real-time inventory valuation, all outgoing stock movements will be posted in this account, unless a different valuation account is set on the location of the destination.

Stock valuation account: This account is for holding the current value of the product during the real-time valuation.

Stock journal: when we enable the real-time valuation all the stock moves will be automatically posted here.