Accounting Localization in Odoo refers to the adaptation of the Odoo accounting module to meet the specific financial regulations, tax requirements, and reporting standards of different countries. This localization ensures that the accounting practices within Odoo are compliant with local laws and are tailored to the business needs of a particular region.

Businesses may be guaranteed to adhere to local financial reporting standards and legal requirements by using the Serbian localization module, which is in line with the nation's accounting and tax legislation. The module has financial report templates and formats, including profit and loss statements and balance sheets, that are designed to comply with Serbian reporting requirements. By doing this, companies can make reports that comply with regional laws. The Serbian translation of Odoo 17 adjusts billing procedures to satisfy regional needs, including generating compliant invoices with the required information and formats. Additionally, it interfaces with nearby banks and accepts regional payment options.

Serbian Accounting Localisation

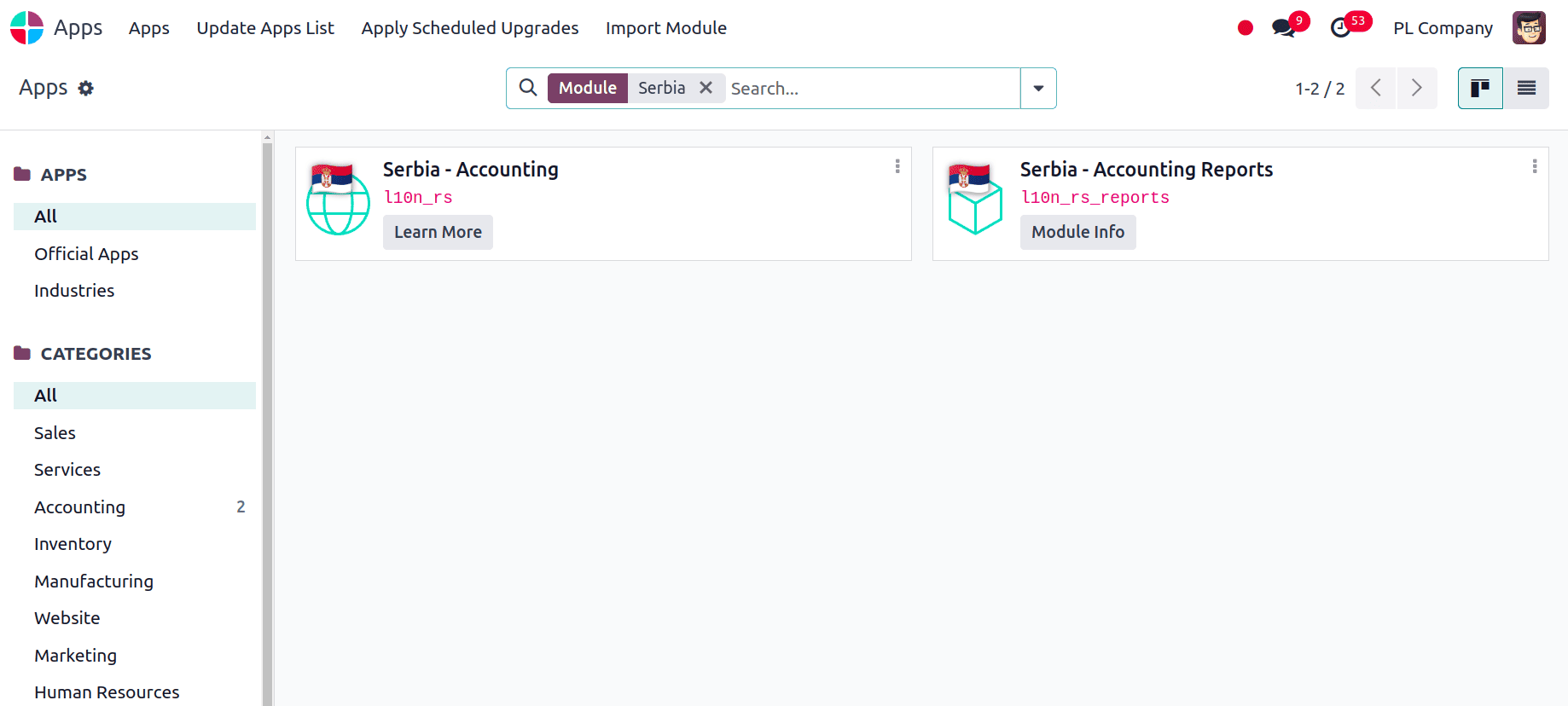

In order to obtain the accounting localization for Serbia in Odoo 17, we have two options: either install the accounting localization modules or choose Serbia as the Country during database creation. To install the modules required for accounting localization, go to Apps and search for the necessary modules for localization.

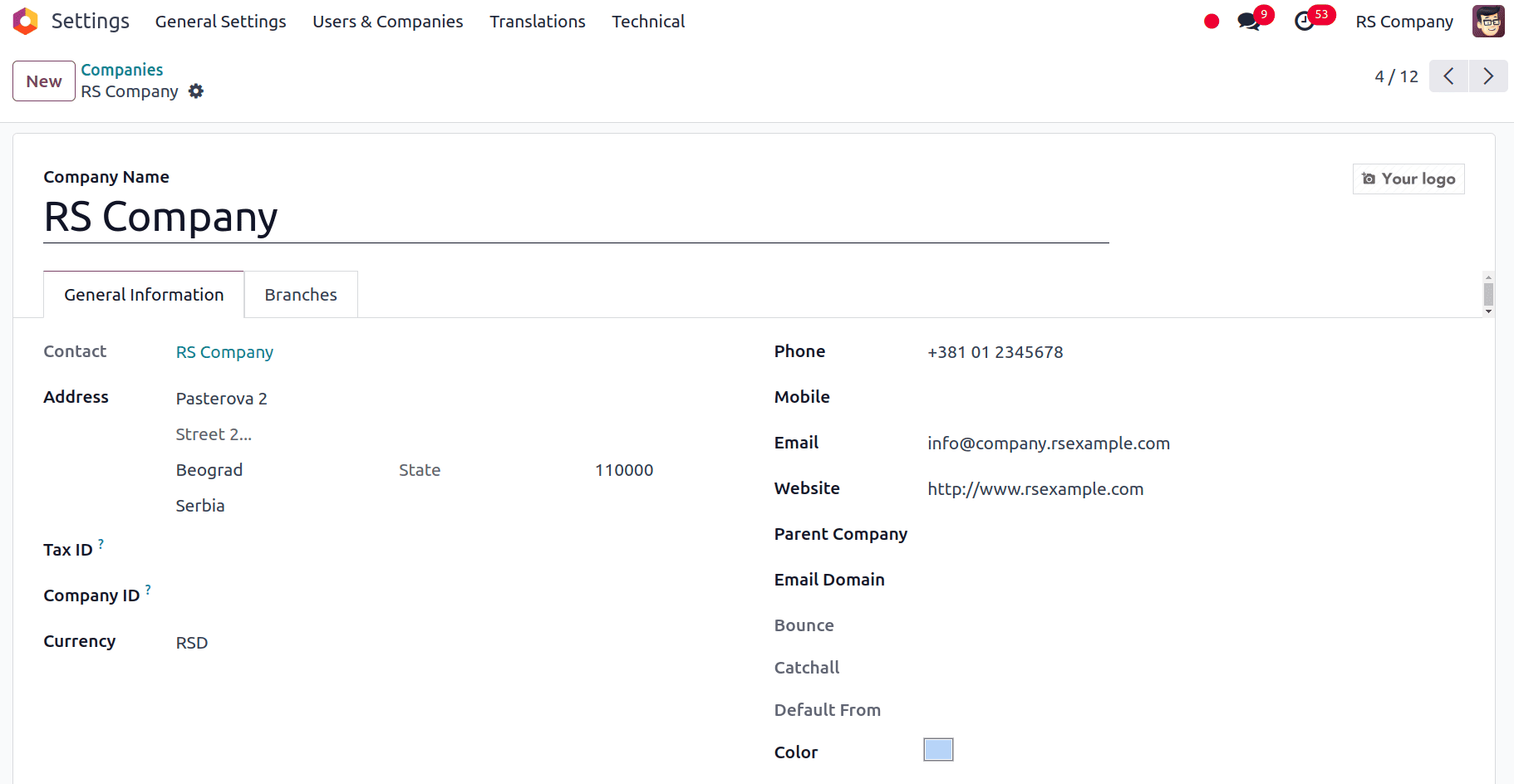

After the installation of the required accounting localization modules, we have to check the company's configuration. The company has to be accurately configured in accordance with the country and other details for smooth accounting operations. To access the companies, we can go to Settings > Users and Companies > Companies, choose the company, and check the configuration.

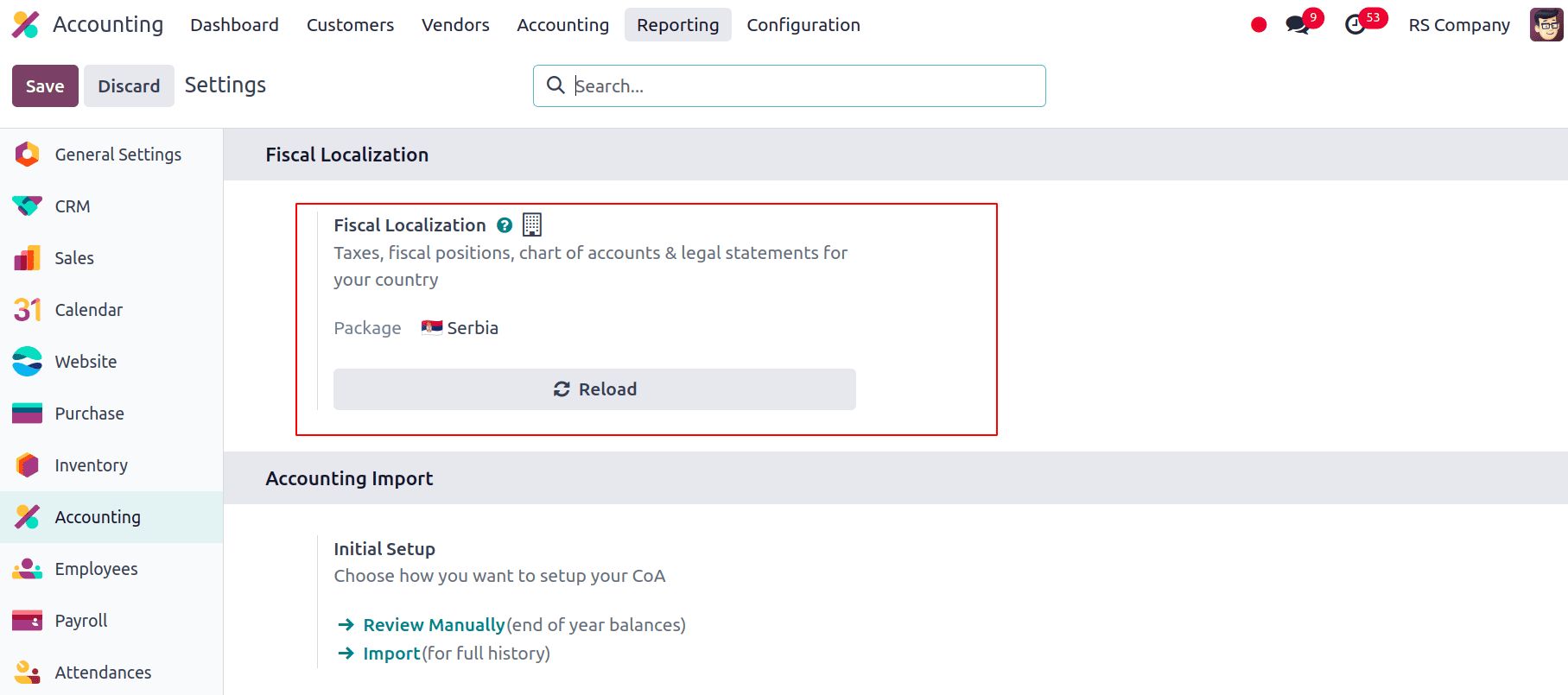

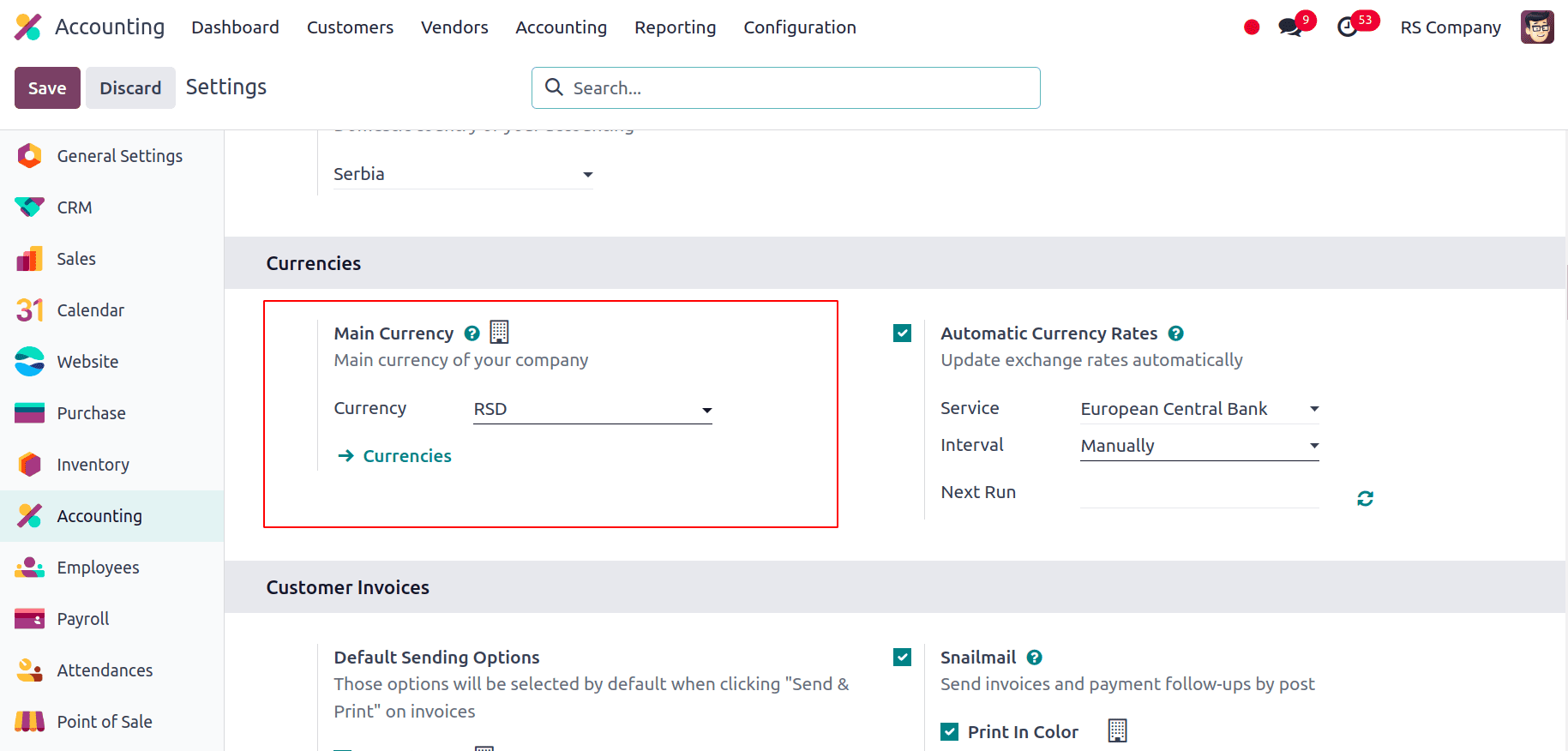

After ensuring proper company setup, we can now view the changes for this localization.

In the Configuration Settings of the Accounting Module, we can see that the Fiscal Localization will be set to Serbia.

The main currency in which all the transactions take place will be set to Serbia's official currency, Serbian Dinar (RSD).

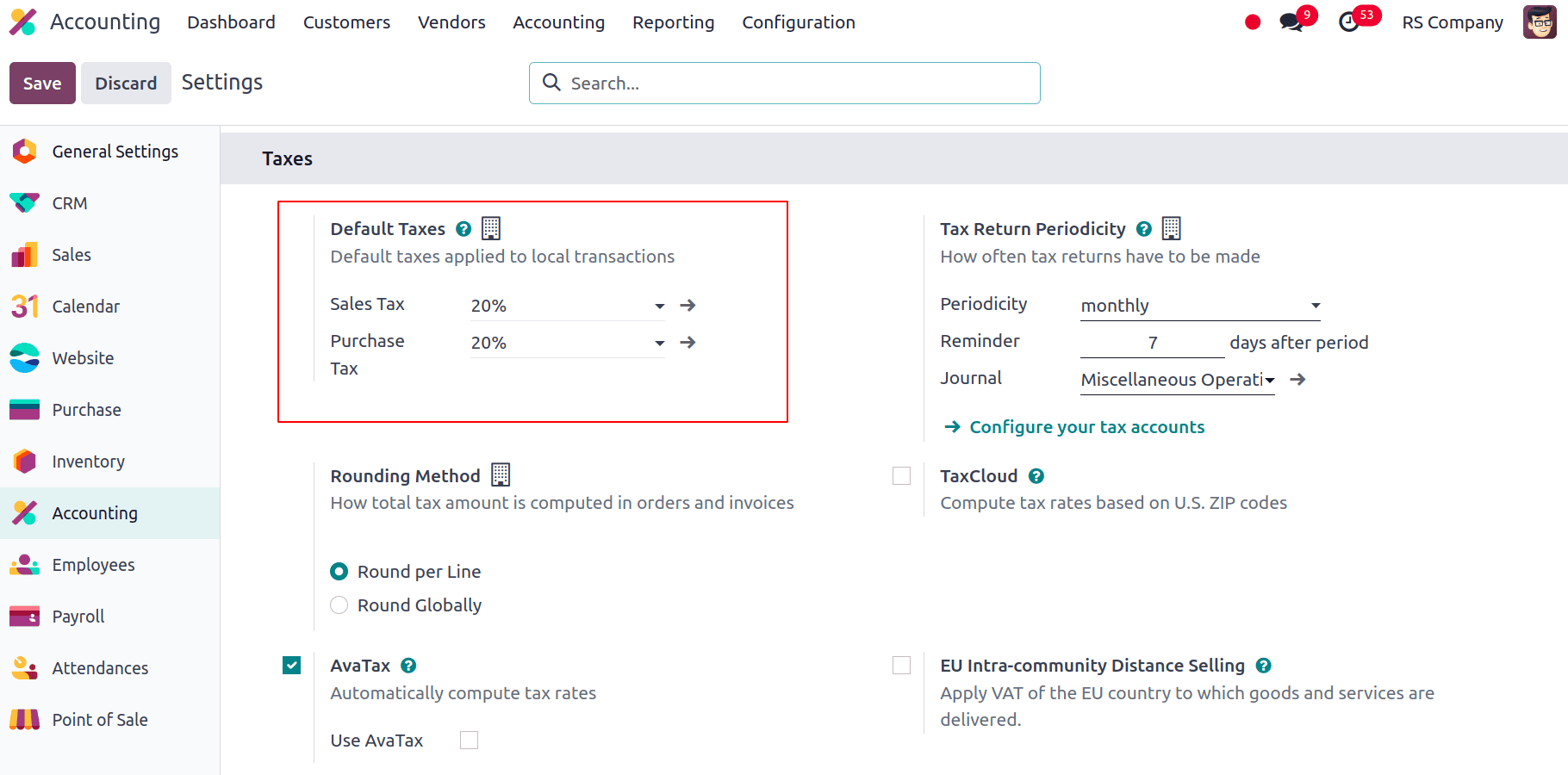

Also, in the settings, we have to set the Default Taxes so that all the sales and purchase transactions that take place will, by default, use this tax. Since we have installed the Serbian Localisation, we will be able to see that the default tax will be set to Serbia’s tax, which is 20%, for both sales and Purchases.

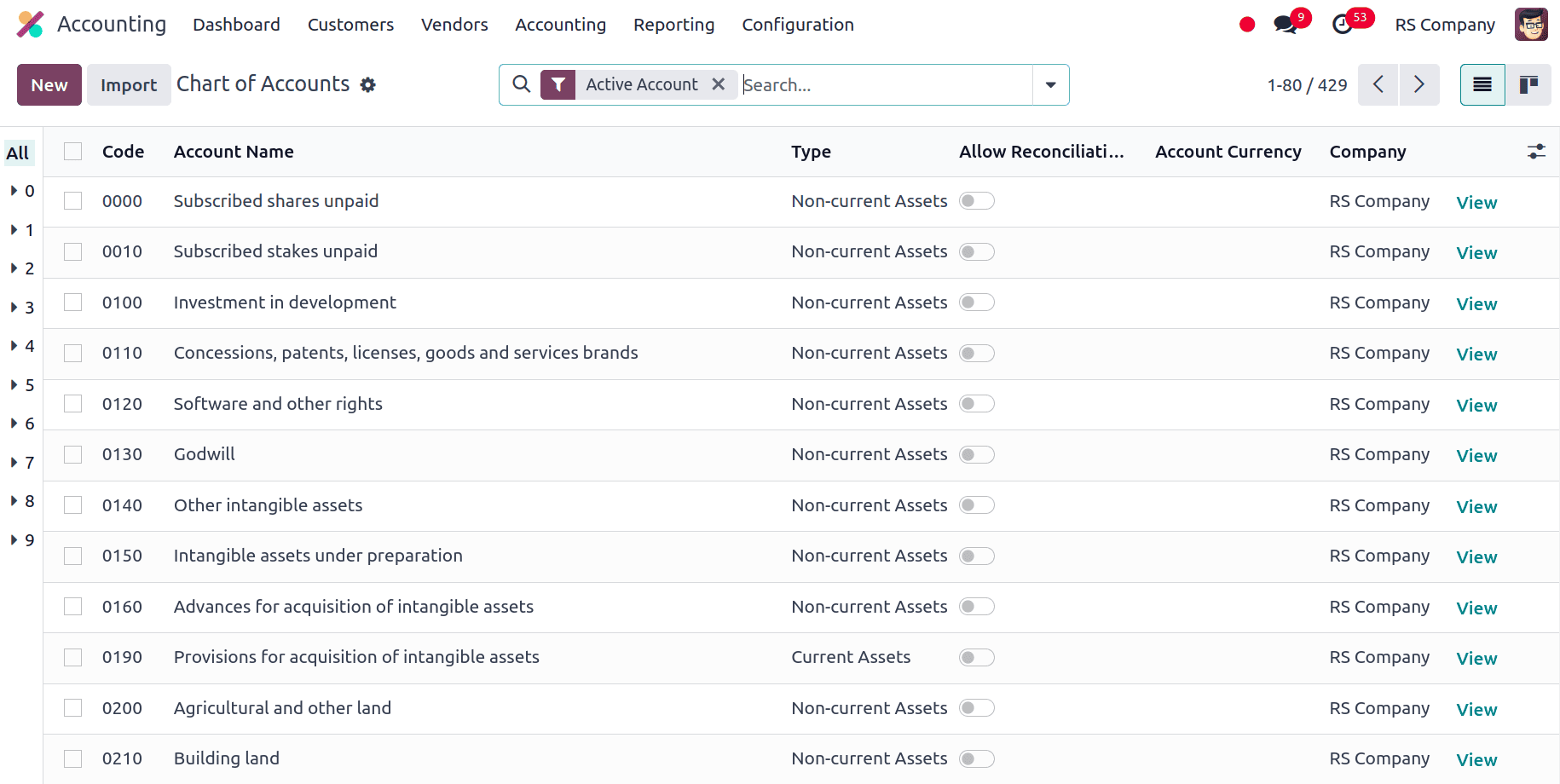

When we install a localization, we will also get the pre-defined Chart of Accounts according to that localization. With its well-structured and arranged framework for classifying transactions, the Chart of Accounts is an essential tool for managing a business's financial data. It makes financial reporting easier by grouping transactions into different accounts, like assets, liabilities, income, and spending. In-depth financial statements, such as balance sheets and profit and loss reports, are produced by this organization and are crucial for evaluating the success of businesses.

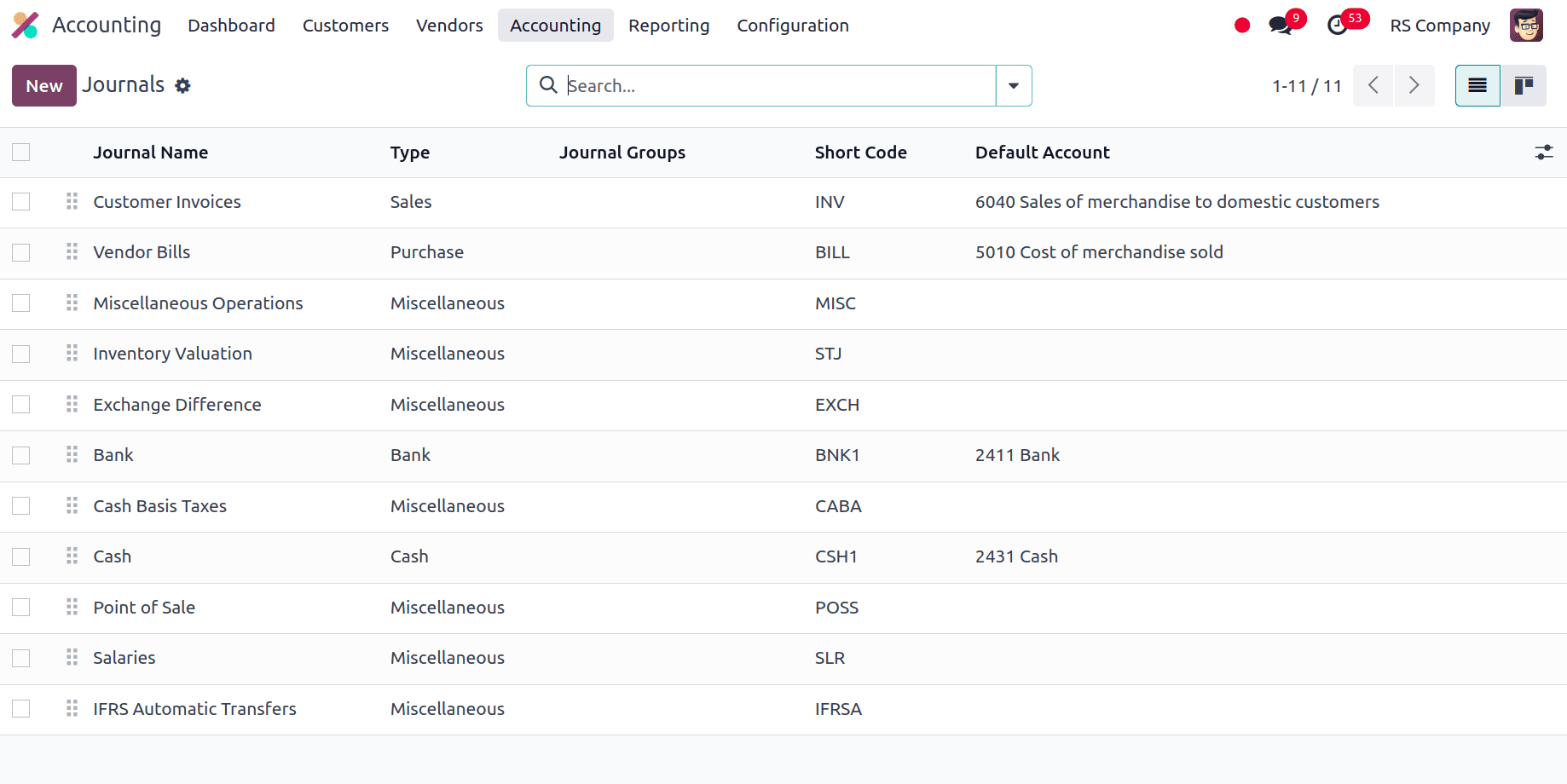

Financial transactions of all kinds, such as purchases, sales, and bank operations, are documented in Journals. They function as the main points of entry into the accounting system for these transactions. Journal entries are guaranteed to comply with Serbian accounting norms and legal specifications thanks to the localization into Serbian. This includes following regional recording conventions and formats. Journal entries are guaranteed to comply with Serbian accounting norms and legal specifications thanks to the localization into Serbian. This includes following regional recording conventions and formats.

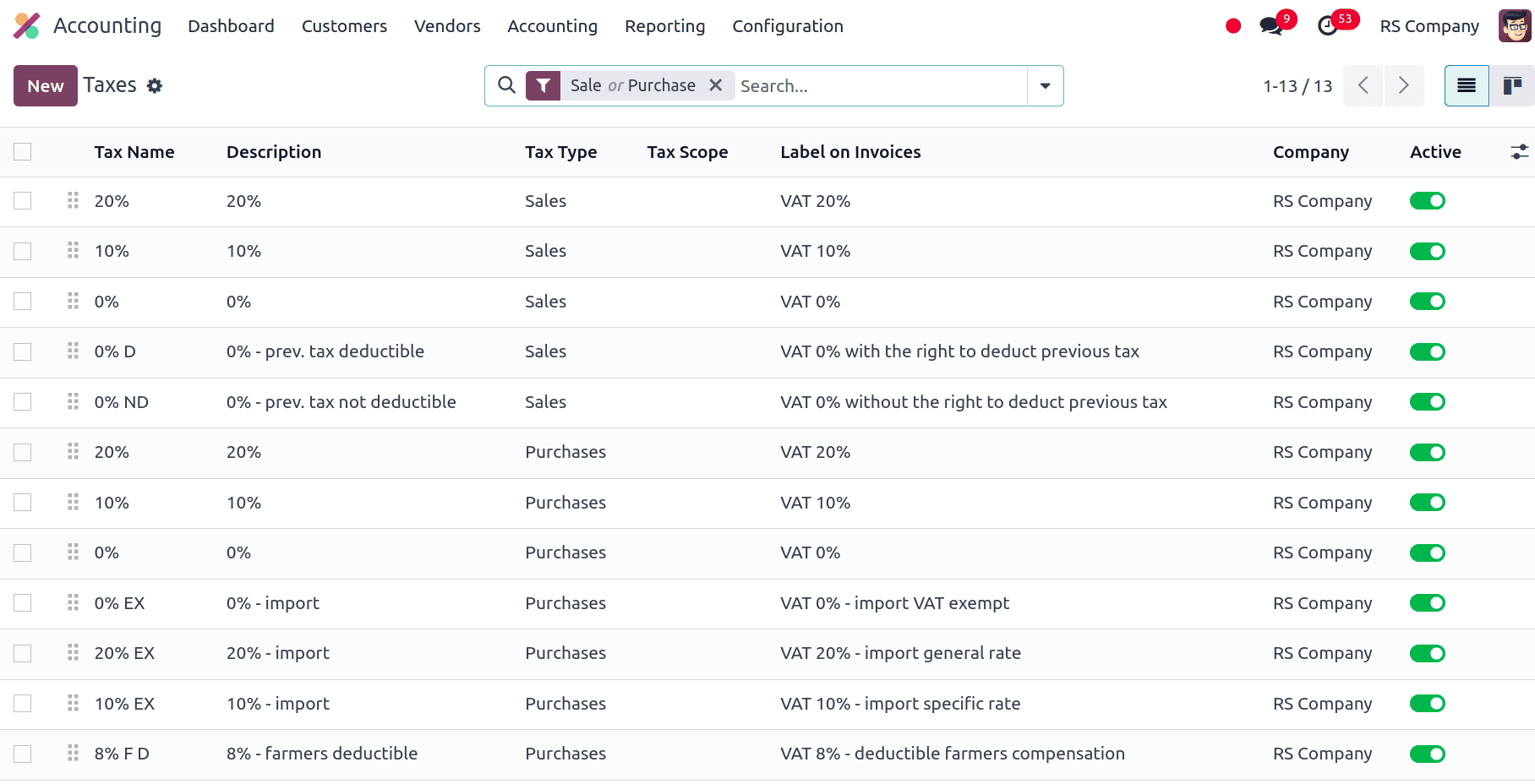

To guarantee compliance with Serbian tax laws, the tax management system in Odoo's Serbian accounting localization has been carefully created. The process of preparing and submitting tax returns is streamlined by automating the computation and reporting of VAT and other municipal taxes. Companies can set up several tax rates according to Serbian legislation, and these can be easily integrated with accounting and invoicing software to guarantee precise tax management. In-depth tax analysis capabilities are also provided by this localization, assisting companies in efficiently monitoring their tax obligations and credits. Odoo's Serbian localization streamlines tax administration lessens administrative burden, and facilitates accurate financial reporting by matching local tax laws and automating crucial activities.

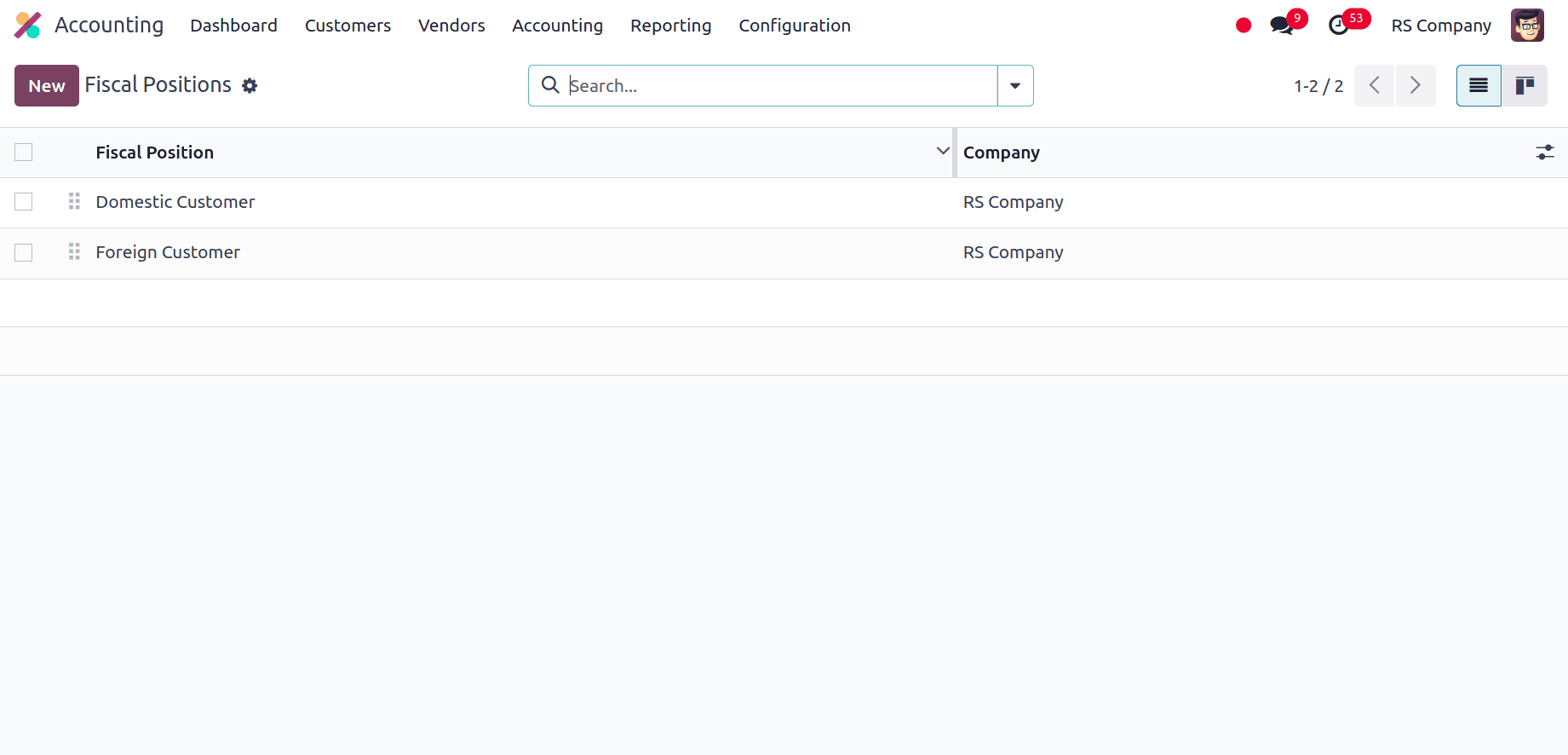

Fiscal Position

Fiscal Positions of Local and Foreign Customers in Odoo with Serbian Accounting Localisation. Fiscal positions are crucial to applying the proper tax treatments for both domestic and international customers and guaranteeing compliance with local rules in Odoo's Serbia accounting localization.

* Fiscal Position of Domestic Customer: Odoo permits the configuration of fiscal positions to apply the appropriate VAT rates and tax regulations for transactions with Serbian clients. By doing this, it is made sure that all sales and purchase transactions follow the regular, reduced, or exempt VAT rates set forth by Serbian VAT legislation. Businesses can automate the application of VAT rates on invoices and other financial documents, simplifying compliance and reporting by creating fiscal positions expressly for domestic consumers.

* Position for Foreign Customers: In Odoo, fiscal positions assist in managing transactions in compliance with Serbian export laws and international tax standards while working with foreign customers. For instance, in some circumstances, sales to overseas clients may be subject to zero percent VAT in accordance with Serbian export regulations. Businesses can manage the paperwork needed for export transactions and automatically modify VAT rates thanks to Odoo's fiscal position setup, which guarantees that export transactions are accurately reported and in compliance with both domestic and international tax rules.

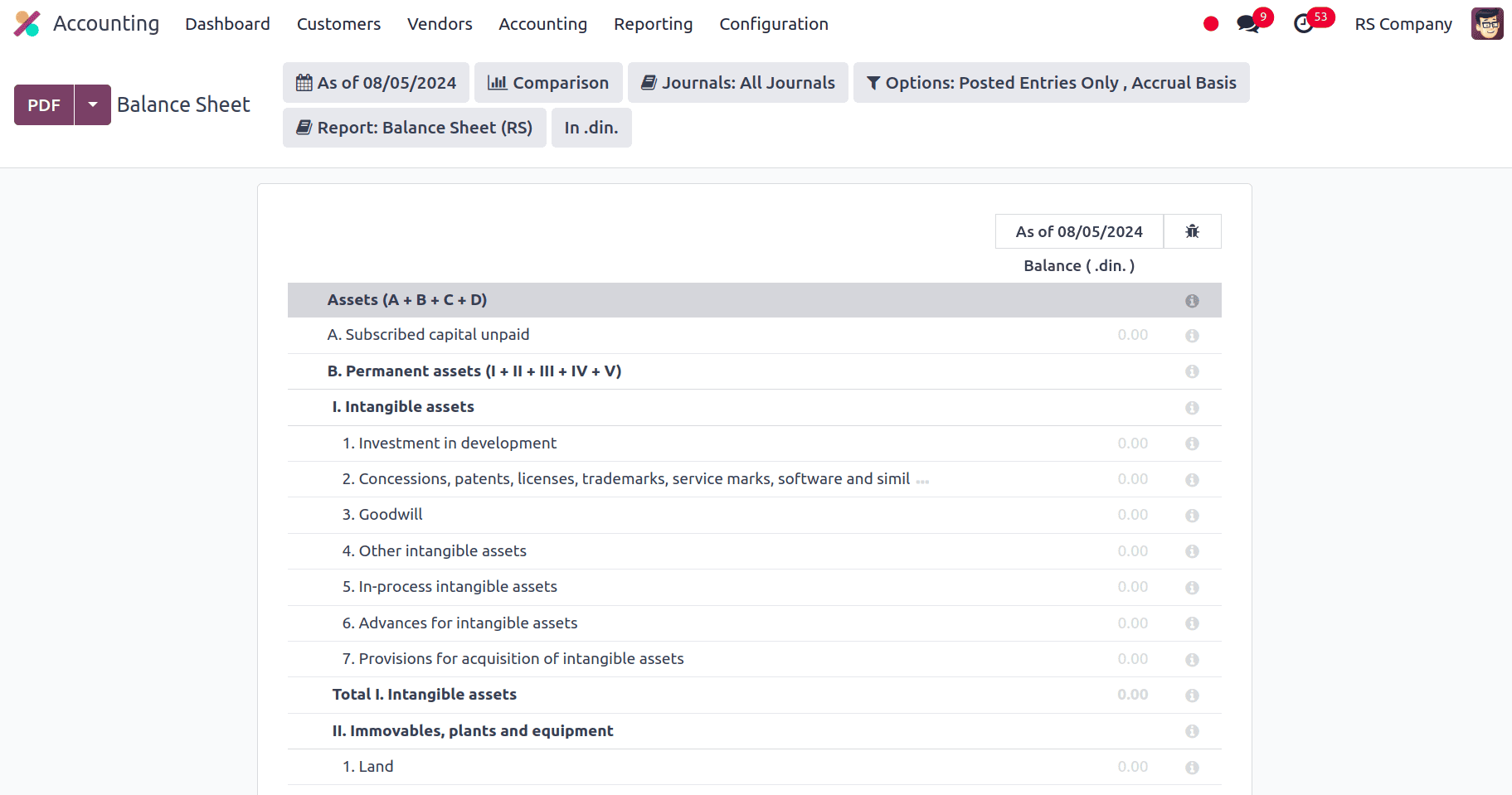

Balance Sheet

A full perspective of a company's financial status is provided by the balance sheet feature in Odoo's accounting localization for Serbia, which has been painstakingly crafted to conform to Serbian financial reporting rules. It adheres to regional laws and accounting standards and appropriately displays assets, liabilities, and equity. Odoo integrates accounting entries automatically, guaranteeing that the balance sheet is compliant with Serbian reporting rules and reflects current financial data. Precise and accurate financial reporting is made easier by the system's customizable templates and formats that adhere to Serbian requirements. With the help of this feature, firms may keep accurate financial records, get ready for audits, and make wise financial decisions by using a clear and comprehensive financial picture.

Permanent assets, also referred to as non-current assets in Odoo's Serbian accounting localization, are an important part of the balance sheet. They are long-term investments that are necessary for corporate operations and are not meant to be sold in the regular course of business.

Intangible assets: By keeping thorough records of their intangible assets, firms may ensure that the balance sheet presents an accurate and impartial picture of these long-term investments.

Immovables, plants, and equipment: Plants, machinery, and other immovables are all carefully maintained and documented on the balance sheet in accordance with Serbian accounting guidelines. To guarantee correct assessment and reporting, these tangible fixed assets—which include office equipment, machinery, and real estate—are carefully categorized. In order to account for the gradual decline in asset value, Odoo automates the tracking of acquisition expenses and manages depreciation in compliance with Serbian rules. Businesses can keep accurate records of their physical assets thanks to this connection, which gives them a transparent and compliant view of their long-term investments on the balance sheet.

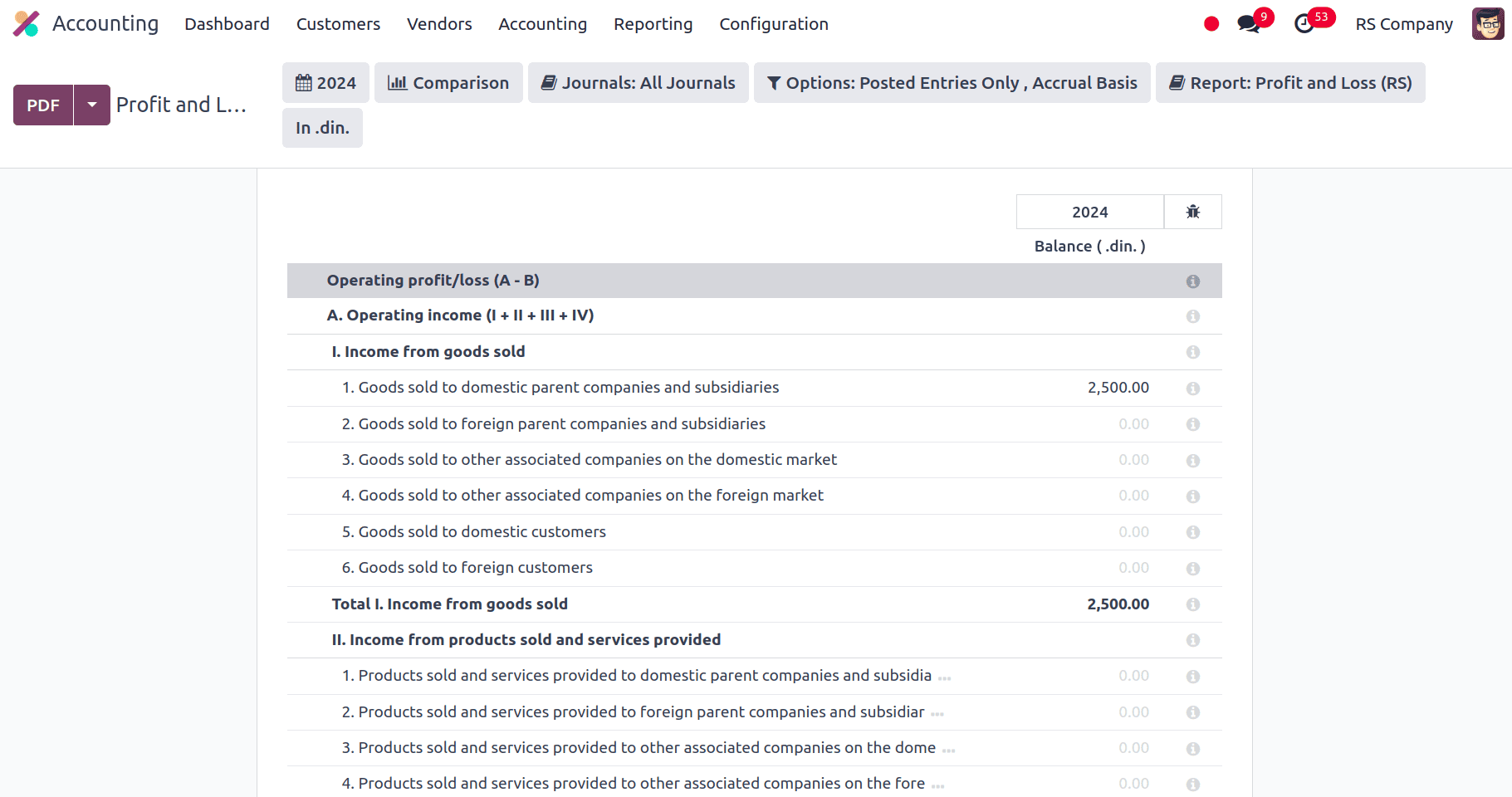

Profit and Loss Report

With a summary of sales, costs, and profits or losses for a given time period, the profit and loss report offers a thorough examination of a business's financial performance. The format of the report's income and cost presentation complies with local legal requirements and is designed to meet Serbian accounting standards. All transactions are reliably represented and classified in accordance with Serbian accounting standards, thanks to Odoo's automated financial data aggregation. Effective financial analysis and decision-making are made possible by this integration, which enables companies to produce thorough and compliant profit and loss statements.

* Operating profit/loss (A - B): Operational profit or loss is the difference between an organization's operational income and operating expenses, and it is computed as A-B. When assessing the core profitability of a company's operation, that is, before non-operating income and expenses, this indicator is essential. By incorporating comprehensive financial data from several sources, including sales, cost of products sold, and operating expenses, into the financial reporting system, Odoo automates the computation of operating profit or loss.

* Profit from Financing (C-D): The "Profit from Financing" metric, which is computed as C-D, measures the profit obtained from financial activities by capturing the difference between financial income and financial expenses. This covers financing costs like interest paid on loans as well as interest earned from investments.

* Profit from other regular operations and irregular operations (E - F + G - H + I - J): Using the formula for profit from other regular and irregular operations (E-F+G-H+I-J), one can obtain a thorough understanding of a company's profitability from a range of operational and non-operational activities. Profits or losses from regular activities outside of the main business operations—like gains from asset sales—as well as irregular operations—like one-time costs or exceptional gains—are included in this statistic. Through the integration of data from various financial transactions and operational operations into the accounting system, Odoo automates the gathering and computation of these statistics.

* Profit before tax (Operating + Financing + Other regular and Irregular operations): A comprehensive picture of a company's pre-tax financial success is provided by "Profit Before Tax," which combines financing results, operating profit, and profits from other regular and irregular operations. In order to provide a thorough assessment of total financial health, this indicator includes the profitability obtained from core business operations, financial activities, and other regular and irregular transactions.

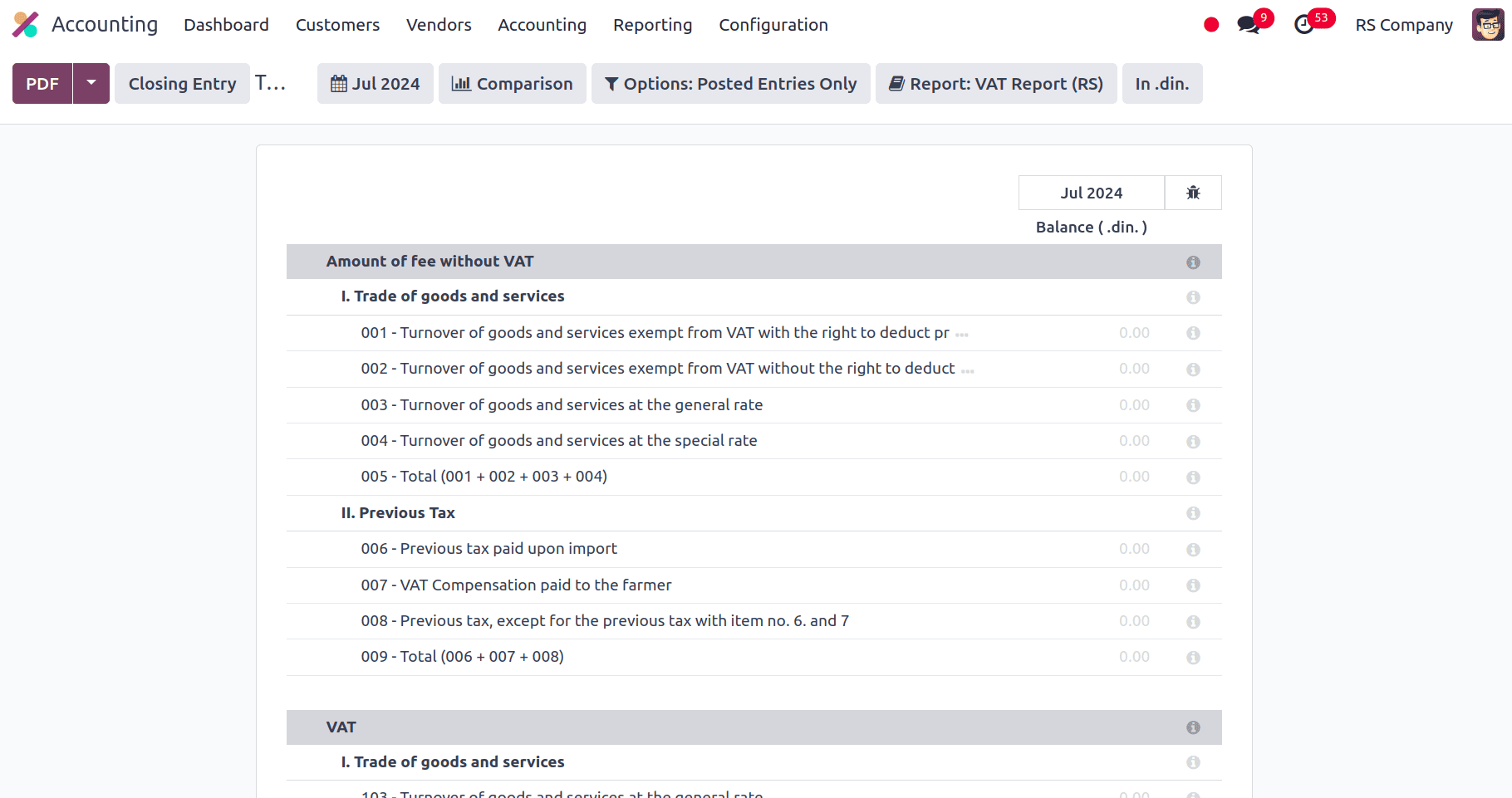

Tax Report

In accordance with Serbian tax laws, the tax report is carefully prepared to manage VAT and fee computations. The report provides an easy-to-understand analysis of the taxable and non-taxable components of transactions by differentiating charge Amounts of fees without VAT and with VAT. By guaranteeing that VAT is correctly computed on taxable fees and that non-VAT payments are appropriately reported, this segregation makes accurate VAT reporting and compliance easier. The automation of data extraction and organization from financial transactions using Odoo streamlines the process of preparing tax paperwork, including VAT reports.

Through customized features like correct tax reporting, comprehensive balance sheet management, and effective management of both routine and sporadic financial processes, Odoo guarantees that companies doing business in Serbia can keep precise and lawful account records. Effective decision-making is supported by the system's integration capabilities, which also improve financial visibility and expedite processes. Odoo optimizes financial management methods for organizations while streamlining compliance due to its compatibility with Serbian accounting standards. All things considered, Odoo's localization for Serbia stands out as a thorough approach to negotiating the nuances of Serbian taxation and bookkeeping.

To read more about An Overview of Accounting Localization for Lithuania in Odoo 17, refer to our blog An Overview of Accounting Localization for Lithuania in Odoo 17.