Businesses must navigate a complicated web of tax laws, financial regulations, and reporting standards that differ greatly between nations in today's globalized society. Accounting localization is a critical procedure that helps ensure reliability and compliance for organizations operating in the United States. It involves modifying accounting methods and financial reporting in accordance with local legal and regulatory standards. Knowing the specifics of accounting localization can help you manage your financial operations more successfully and steer clear of expensive problems, whether you're a small business owner, financial professional, or employee of a large multinational corporation, as it aids in optimizing financial operations and avoiding costly missteps.

The accounting situation in the United States is diverse and intricate, with a patchwork of municipal, state, and federal laws. Businesses operating within its borders must ensure integrity while optimizing financial operations. The comprehensive solution provided by Odoo's US accounting localization module minimizes the complexity of US tax and accounting standards while optimizing financial procedures. Here we can look into the U.S. accounting standards and examine the local legislation' effects.

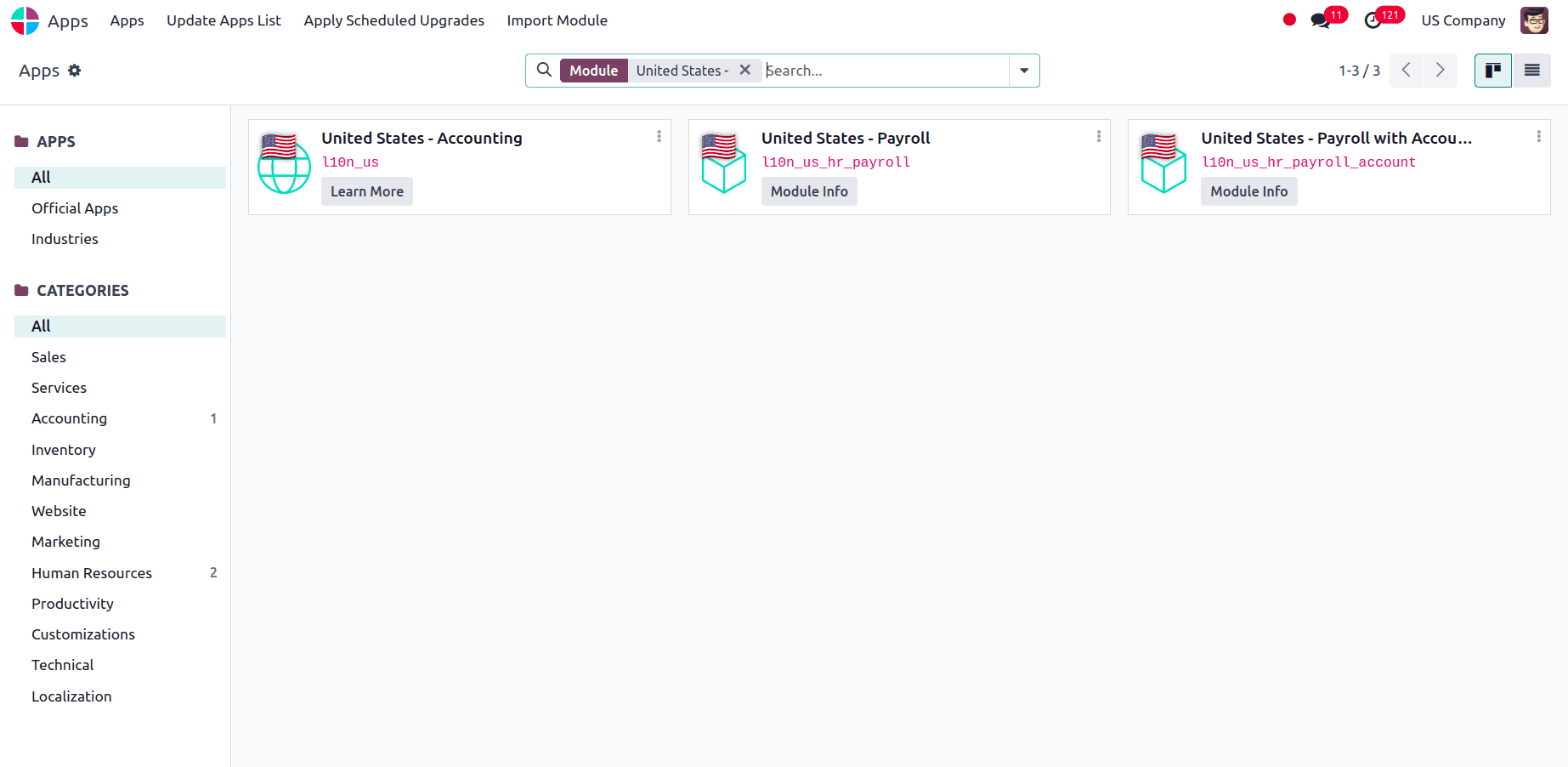

In the Apps we can search for the United States and install the required modules for the localization, or while creating the database we can set the country as United States, then the accounting localization for that country will be pre-installed along with the Chart of Accounts, Journals, Taxes etc.

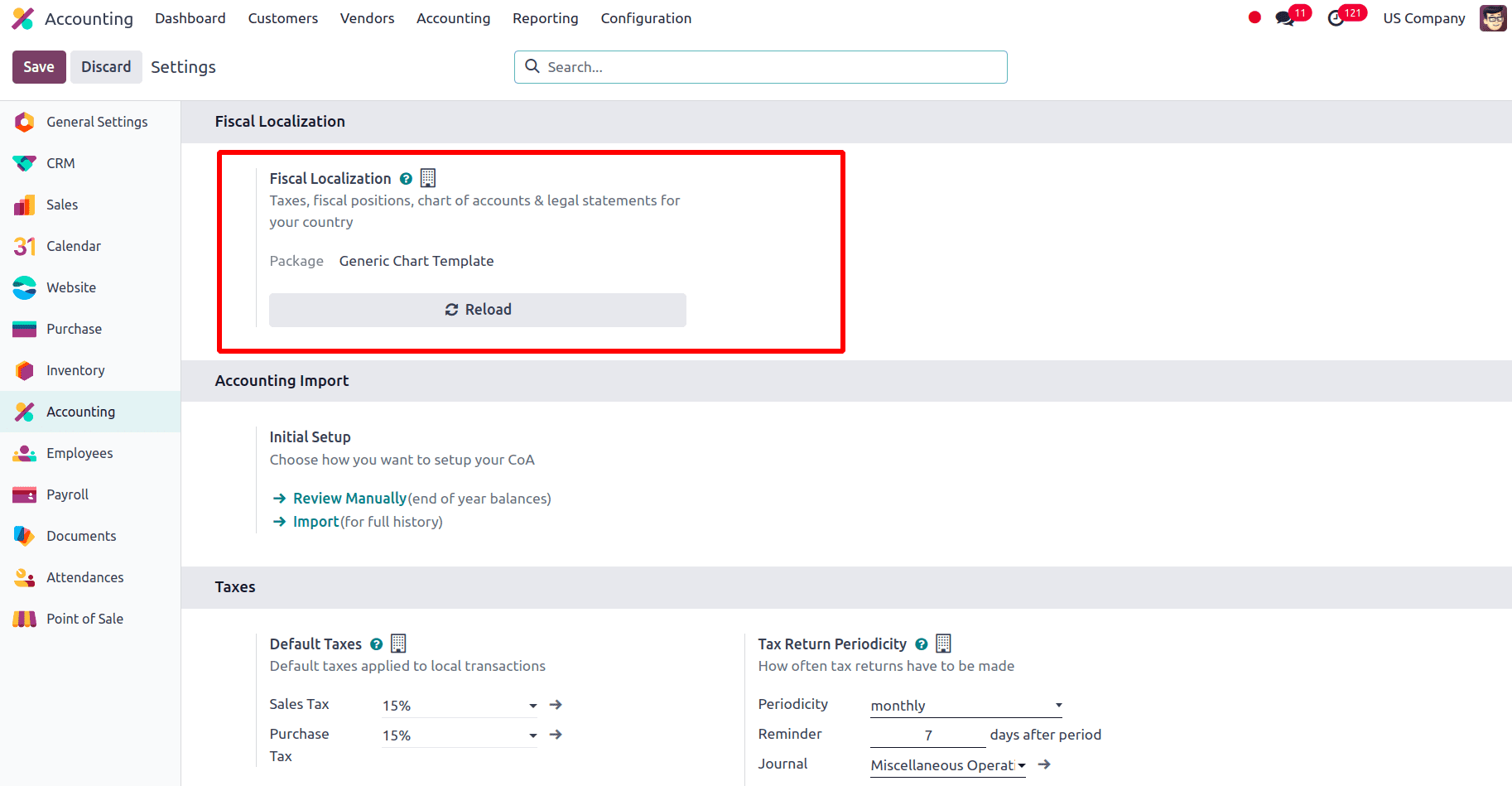

However, it is the default package that will be installed during database initialization and has all of the necessary components for Odoo to function under the US fiscal localization. In the configuration settings of the Accounting module we can make sure that the Fiscal Localization will be set to Generic Chart Template. Given the complexity and unpredictability of US accounting regulations, Odoo's usage of a “Generic Chart Template" for US localization is appropriate.

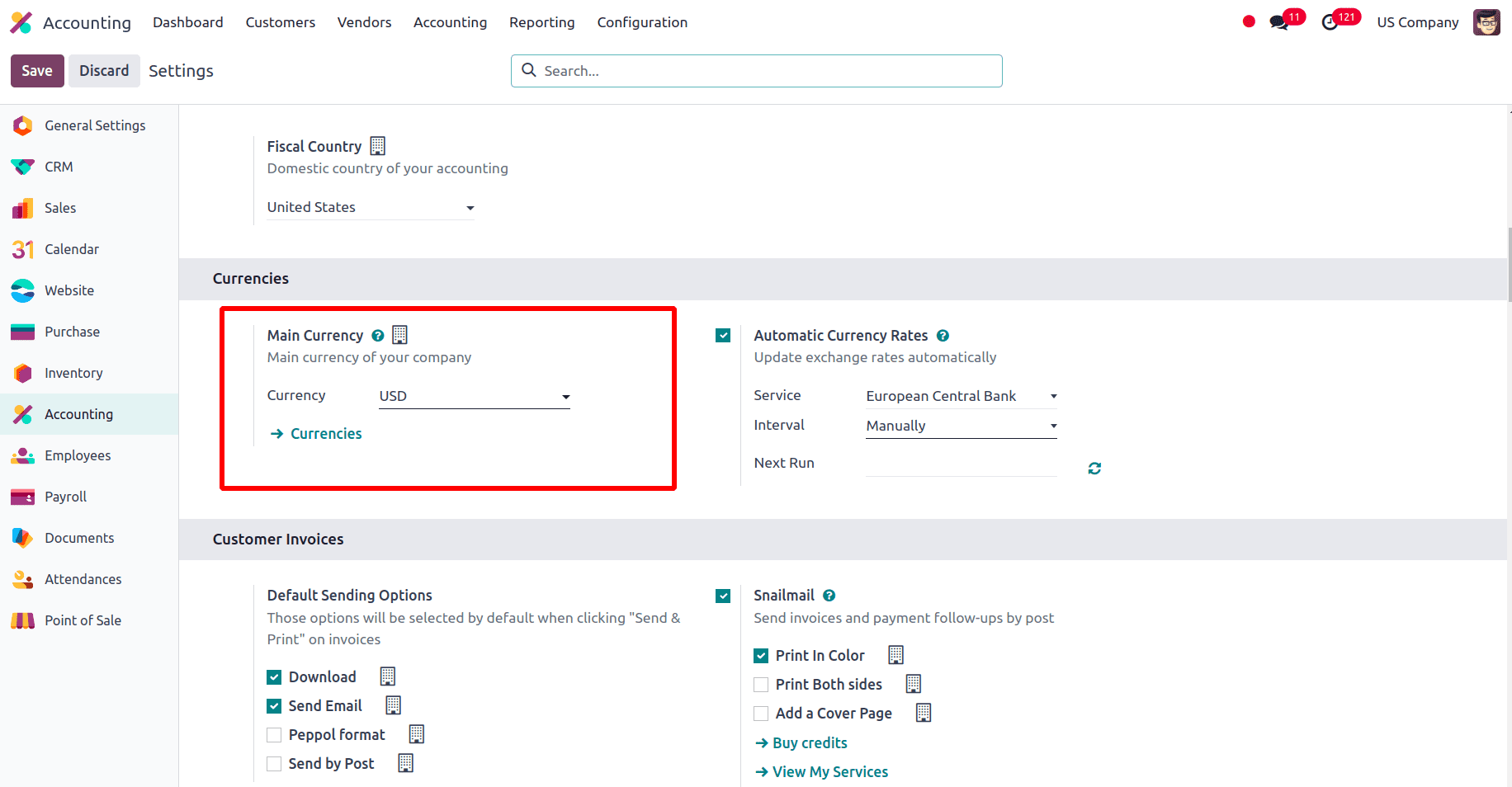

The Main Currency will be set to the official currency of the United States, the United States Dollar (USD) so that all the transactions take place in that currency.

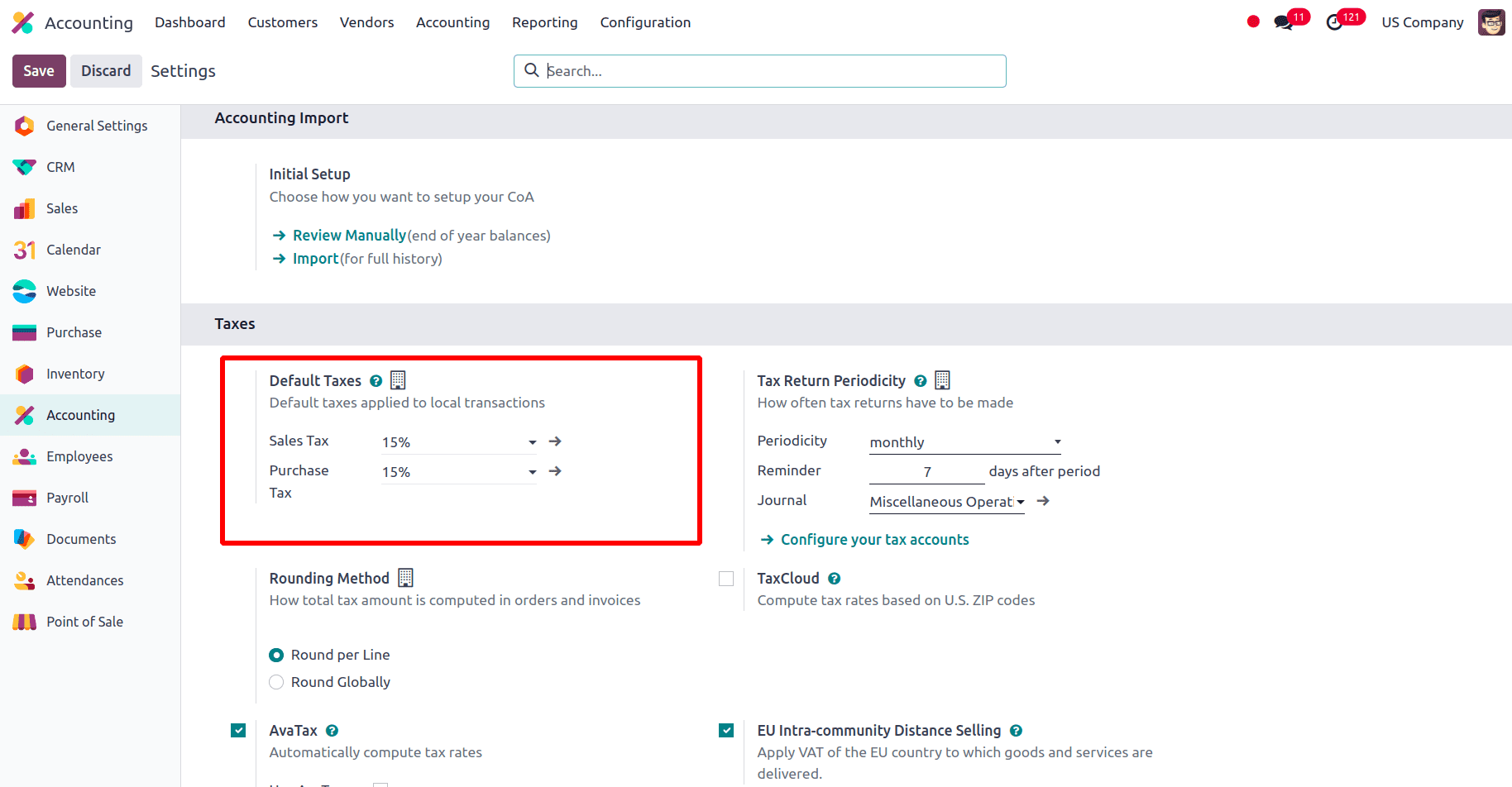

The Default Taxes in Odoo with USD localization relate to pre-established tax setups that the system uses to compute and apply taxes automatically on financial transactions such as invoices, sales, and purchases. These default taxes are intended to help with proper financial reporting and accountability while also complying with US tax laws. Here the default Taxes for sale and purchase are pre-defined as 15% according to the US accounting localization.

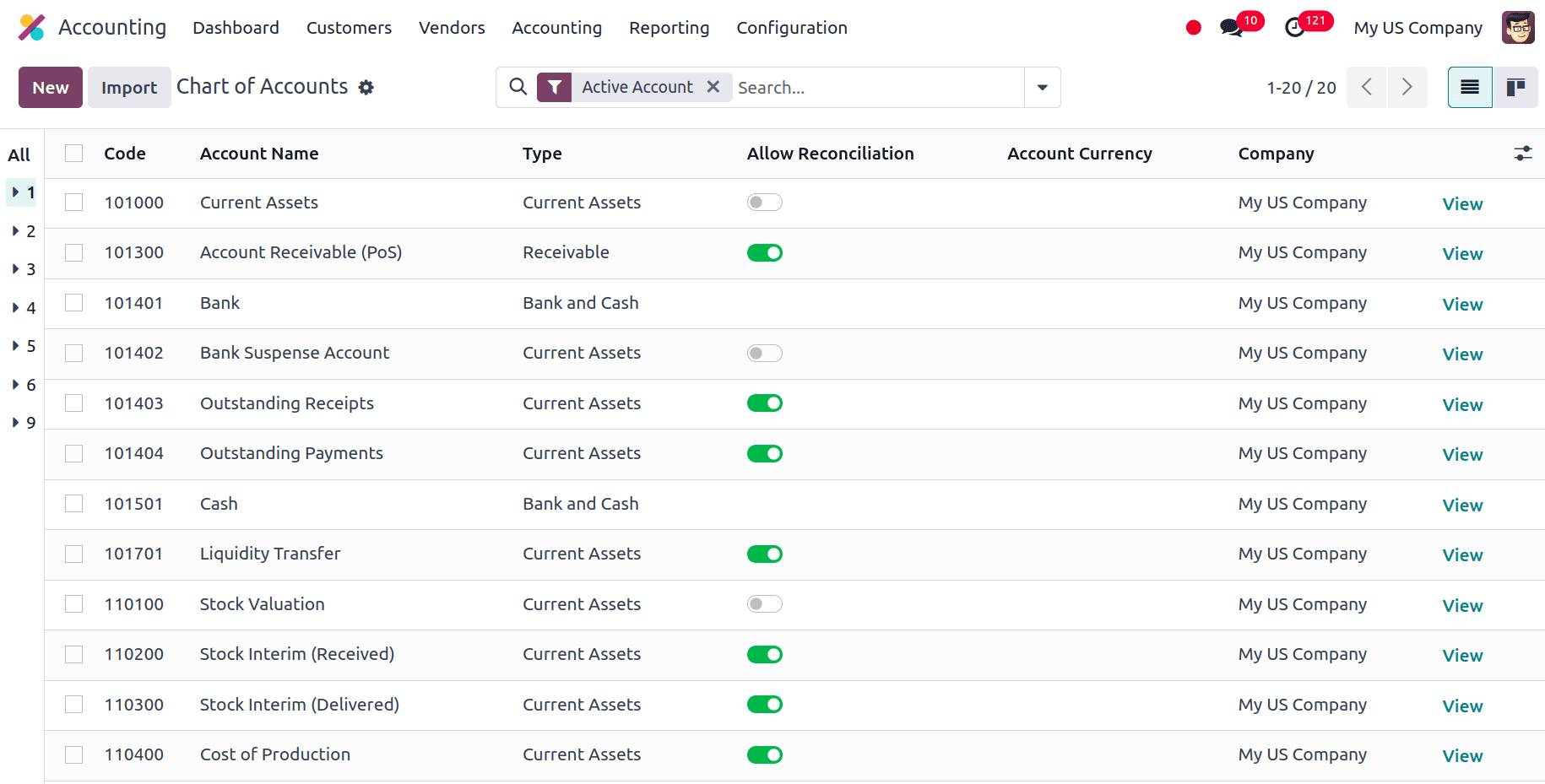

The Odoo Chart of Accounts (COA) for the US localization follows the normal GAAP structure. Chart of accounts guarantees accurate and organized recording by classifying all financial transactions into distinct accounts (such as assets, liabilities, equity, income, and costs). It makes it easier to record everyday financial operations such as purchases, sales, payments, and receipts; every transaction is recorded under the appropriate account. Also, some of the key differences in the chart of accounts for the US compared to other countries include:

* Specificity: Compared to several other nations, US GAAP frequently calls for more thorough accounting. This can provide more detailed information in financial reporting by having distinct accounts for different kinds of income, costs, and assets.

* Regulatory requirements: Compared to several other nations, US GAAP frequently calls for more thorough accounting. This can provide more detailed information in financial reporting by having distinct accounts for different kinds of income, costs, and assets.

* Industry practices: In the US, several industries could have particular CoA structures or unusual accounting standards. Financial institutions, for instance, frequently have specialized accounts for loans, investments, and interest revenue.

* Tax Considerations: To guarantee compliance with tax rules and expedite tax reporting, the CoA may additionally include tax considerations, such as accounts for deductible expenses, deferred tax assets, and liabilities.

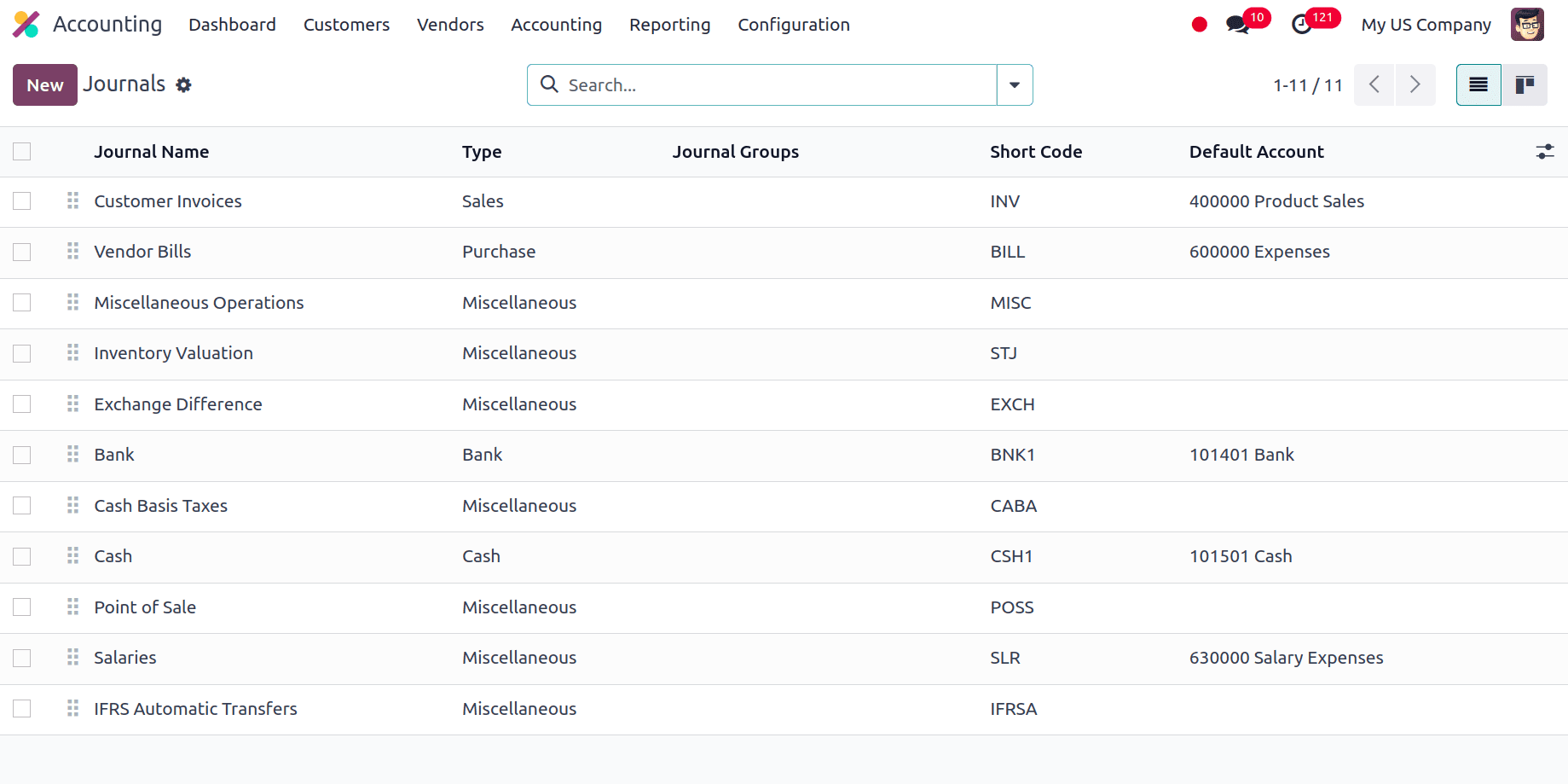

Journals are crucial tools in Accounting for tracking and organizing all the financial activities that take place in the company. They offer a methodical approach to entering and classifying various transaction kinds in the accounting system. There are basically 5 types of journals, Sales, Purchase, Bank, Cash, and Miscellaneous.

* Sales: A sales journal in Odoo is a record of all sales transactions. It includes details like the customer, invoice number, date, amount, and taxes. This journal is crucial for tracking sales revenue, managing accounts receivable, and generating sales reports.

* Purchase: All transactions related to vendor purchases are tracked in Odoo using a unique ledger called the Purchase Journal. It serves as a central repository for keeping an eye on and managing your company's liabilities.

* Cash: All of your company's cash-based transactions are tracked in the cash journal. This covers both cash withdrawals (payments) and inflows (receipts).

* Bank: Deposits, withdrawals, bank transfers, and other transactions on your bank accounts are all recorded in bank journals in Odoo.

* Miscellaneous: When recording financial activities that don't fall under one of the conventional categories—sales, purchases, cash, or bank journals—Odoo's Miscellaneous Journal is a useful tool.

Here we can see that under each type we have several journals that are used in the company.

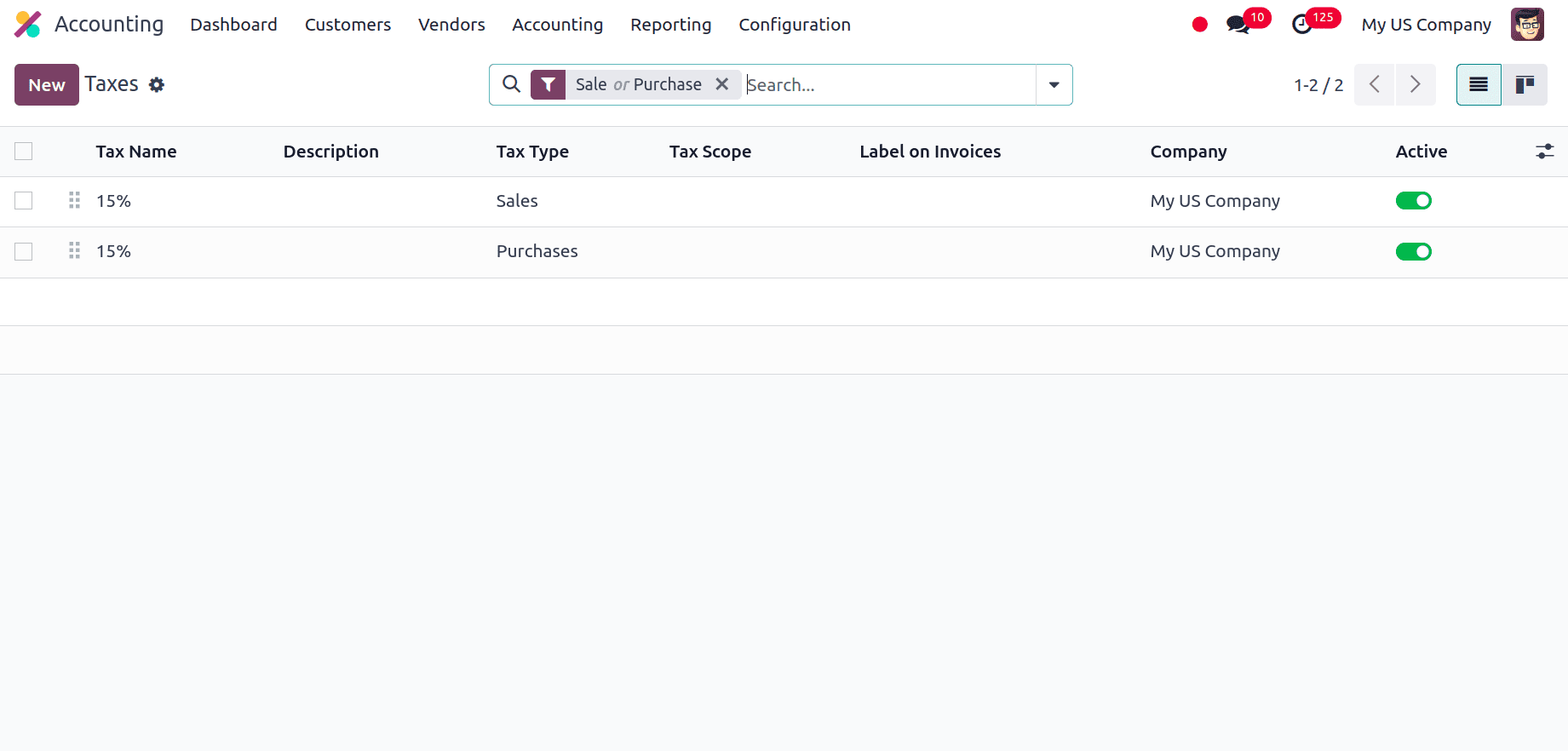

Taxes are essential for managing and automating the tax-related components of financial transactions in Odoo Accounting. They simplify tax reporting, guarantee adherence to tax laws, and work in unison with other accounting operations. Under the configuration, we have the Taxes option, by selecting that we can see there are two taxes that are pre-defined for this localization 15% Sales and Purchase Tax.

The sales of goods and services are subject to a consumption tax known as Sales Tax. Depending on the tax rates and rules set up for certain products or client categories, sales tax in Odoo is automatically computed and applied to invoices. In Odoo, Purchase Tax refers to the taxes imposed on goods and services that a business purchases. The purchase price and the relevant tax rate are used to compute it. When generating purchase orders or vendor bills, Odoo automatically computes purchase tax, guaranteeing correct financial documentation and tax calculations.

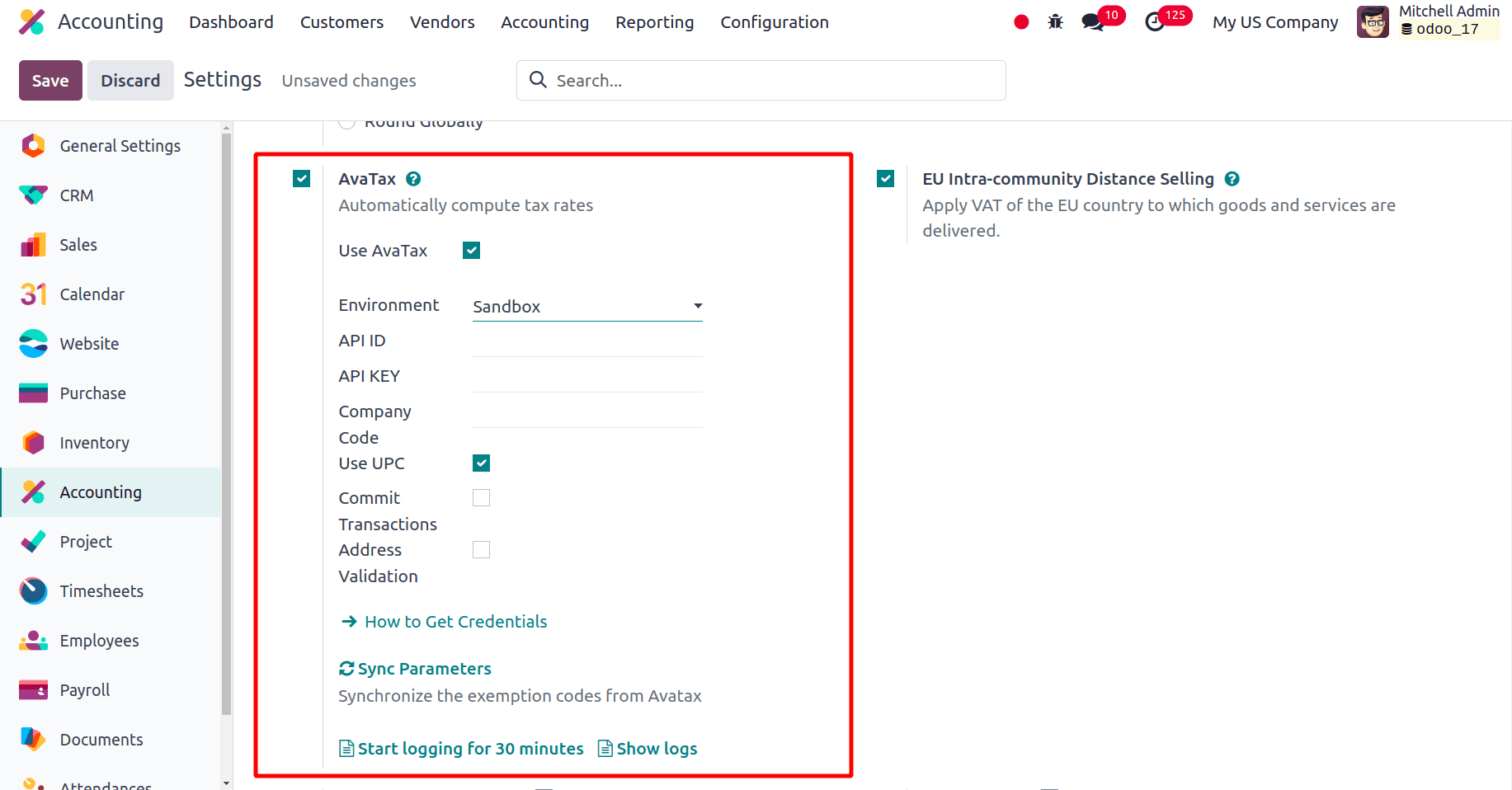

Also under the Taxes section of Configuration> Settings of the Accounting module, we can view the Ava Tax. Odoo can be integrated with Avalara AvaTax, a cloud-based tax computation and compliance tool, for accounting localisations in the US and Canada. Real-time, location-specific tax computations are made possible by integrating AvaTax with Odoo whenever goods are bought, sold, or invoiced within the database.

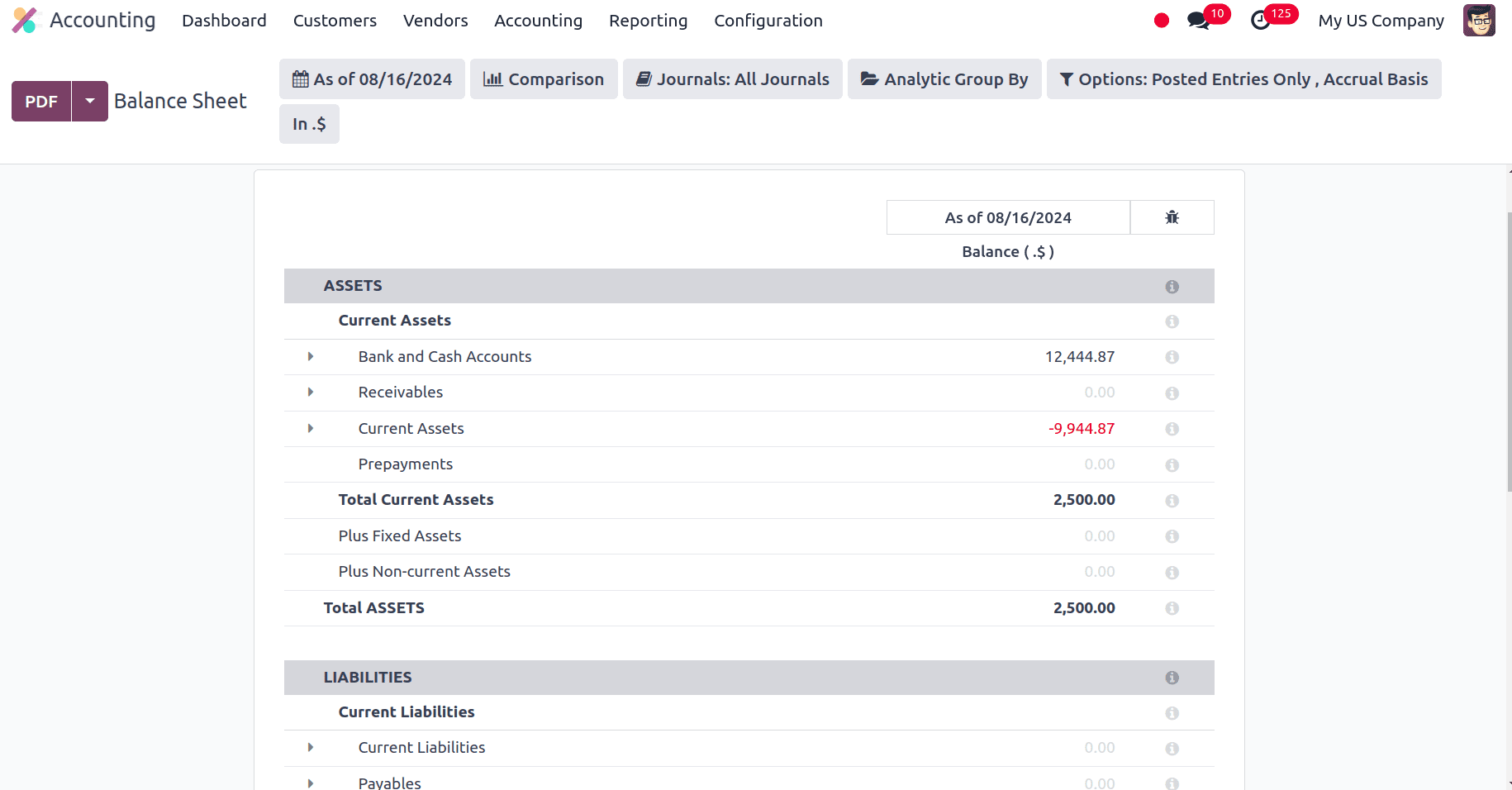

Balance Sheet

A company's assets (what it owns) and liabilities (what it owes) are shown in detail on the Balance sheet. This facilitates stakeholders' understanding of the stability and health of the company's finances. It examines the business's capacity to fulfill both immediate and long-term commitments. A stakeholders' assessment of liquidity can be made by comparing current assets to current obligations. They can assess the ability of the company to meet its liabilities by comparing total assets to total liabilities.

In the balance sheet, we can see three sections, Assets, Liabilities, and Equity. Under assets, we have the current assets and the total current assets. Assets classified as Current Assets are those that are anticipated to be sold, consumed, or turned into cash within a year, or during the length of the business's operating cycle, whichever comes first. It describes the distinct parts of assets that are anticipated to be spent or turned into cash within a year. On the balance sheet, each category of current assets, such as cash, accounts receivable, and inventory is listed separately. The total of all current assets shown on the balance sheet is known as Total Current Assets. It is the total value of all assets that are categorized as current assets. It speaks of the total of each of the existing asset classes separately. It is the total of all current assets stated on the balance sheet added together.

Similarly, under Liabilities, we can see Current Liabilities and Total Liabilities. The term current liabilities describes the specific liability categories or line items that are anticipated to be paid off in less than a year. On the balance sheet, each category, such as accounts payable and short-term loans is listed separately. The total of all current obligations shown on the balance sheet is known as total current liabilities. It is the total amount of all the debts that are due in the upcoming year. Then we have the Equity, the equity section of the balance sheet contains Unallocated Earnings under which we can view the Total Unallocated Earnings, Current Year Unallocated earnings, and Total Current Year Unallocated earnings. The net profit or loss from a financial period that hasn't been properly closed or moved to the Retained Earnings account is referred to as Unallocated Earnings in Odoo. The profit or loss is held in this temporary account until the end of the fiscal year, at which point it is closed and transferred.

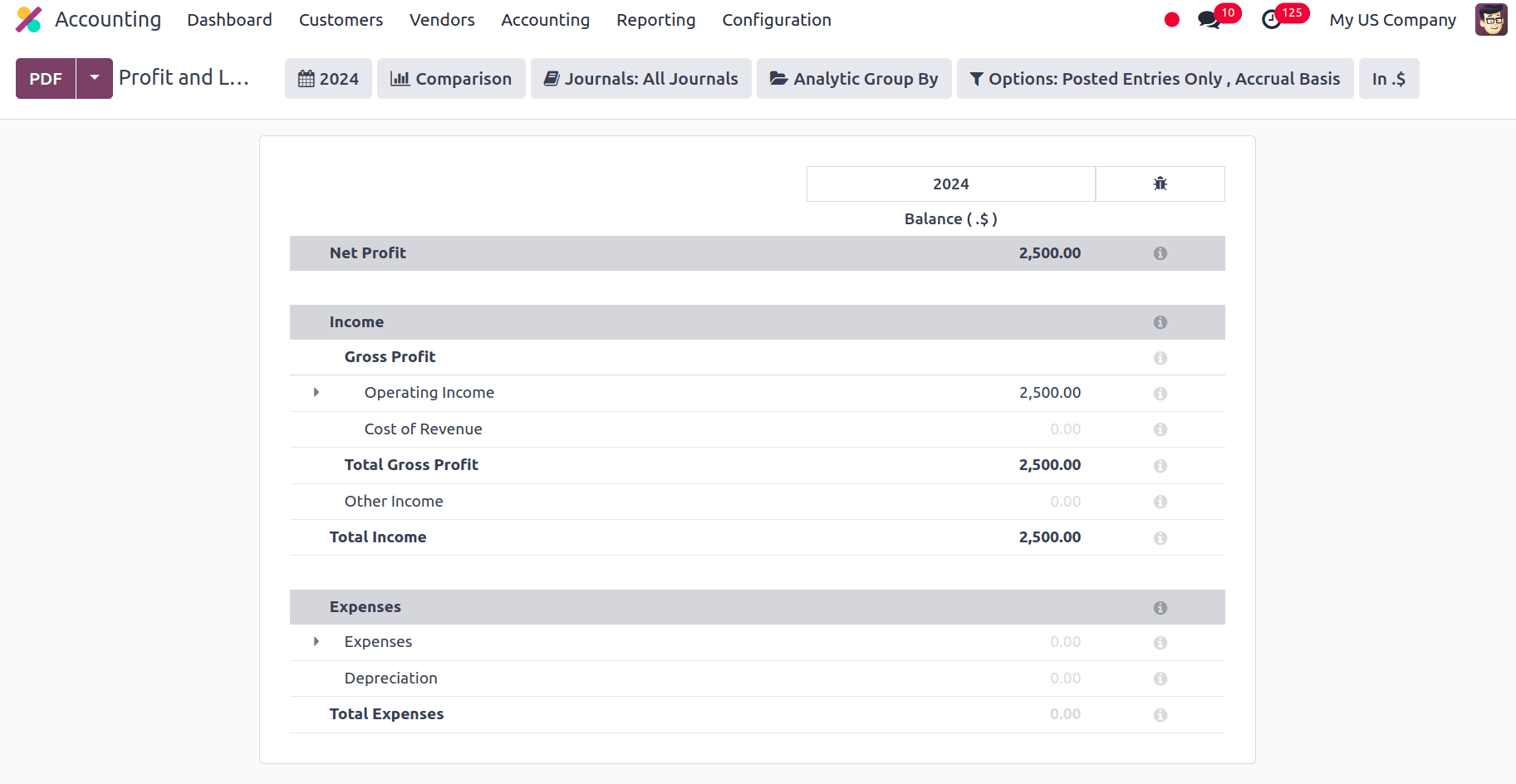

Profit and Loss Report

A company's revenues, expenses, and profits or losses over a certain period are summarised in the Profit and Loss Report, which is a crucial financial report in Odoo Accounting. Understanding a company's financial success requires knowledge of this report.

In the report, we can view the Net Profit. It is the amount that a company makes in the end after subtracting all of its costs from its overall revenue. It's a crucial sign of a company's financial health and the bottom line of its profitability. Also, the Income and Expenses of the company can also be viewed in the report.

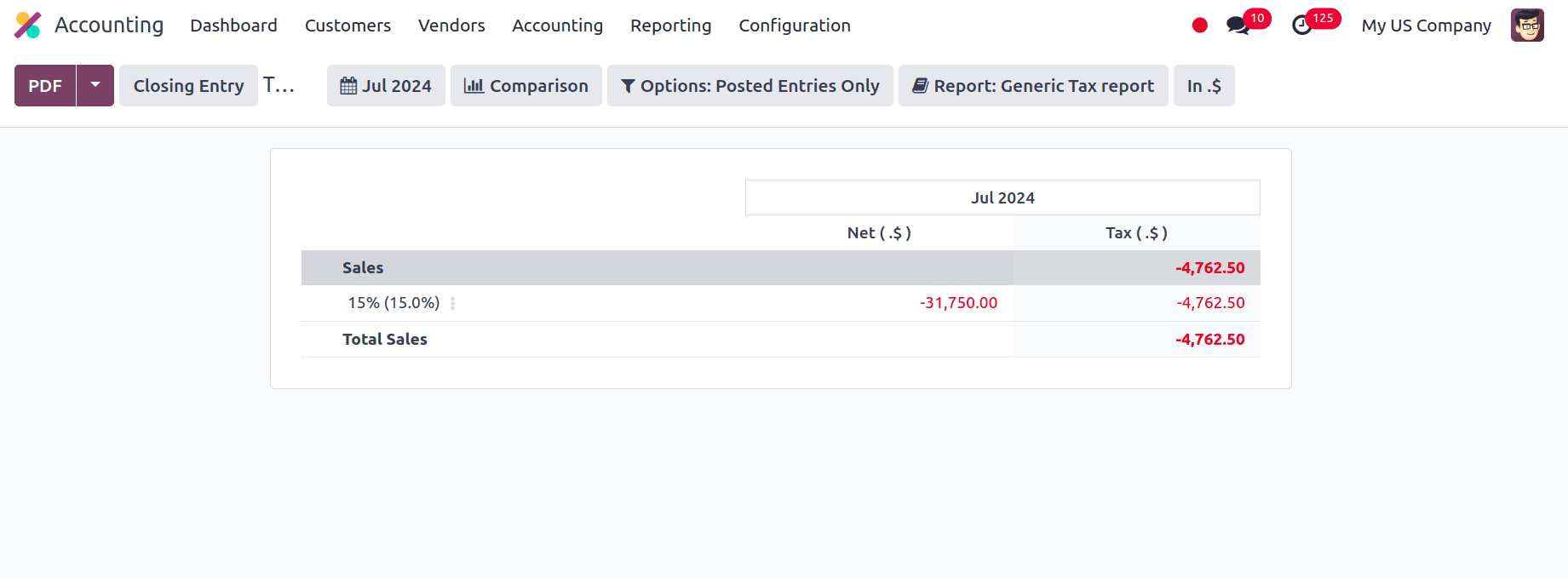

Tax Report

In Odoo, a tax report provides a thorough summary of all transactions pertaining to taxes for a certain time frame. It usually includes a breakdown of sales that are taxable and exempt, making a distinction between sales that are subject to applicable taxes and those that are not. The tax base, which is the entire value of taxable goods and services, and the total tax collected for each tax type are also summarised in the report. It facilitates compliance with local requirements by offering pre-formatted tax returns. The report also offers options for adjusting tax amounts as needed, reconciliations to compare reported taxes with actual tax payments, and data exporting in many formats for submission to tax authorities or additional analysis.

Along with these reports we also have several other reports :

* Cash Flow Statement: The report reveals the amount of cash and cash equivalents that a business has received and spent over a specific time frame.

* Executive Summary: This is a summary report that addresses the major financial performance metrics for a business, including debt, profit, and revenue.

* EC Sales List: For companies doing business in the European Union, the EC Sales List report in Odoo is an essential resource. It keeps track of sales to clients who are based in different EU members. In order to comply with EU VAT requirements, this report is necessary.

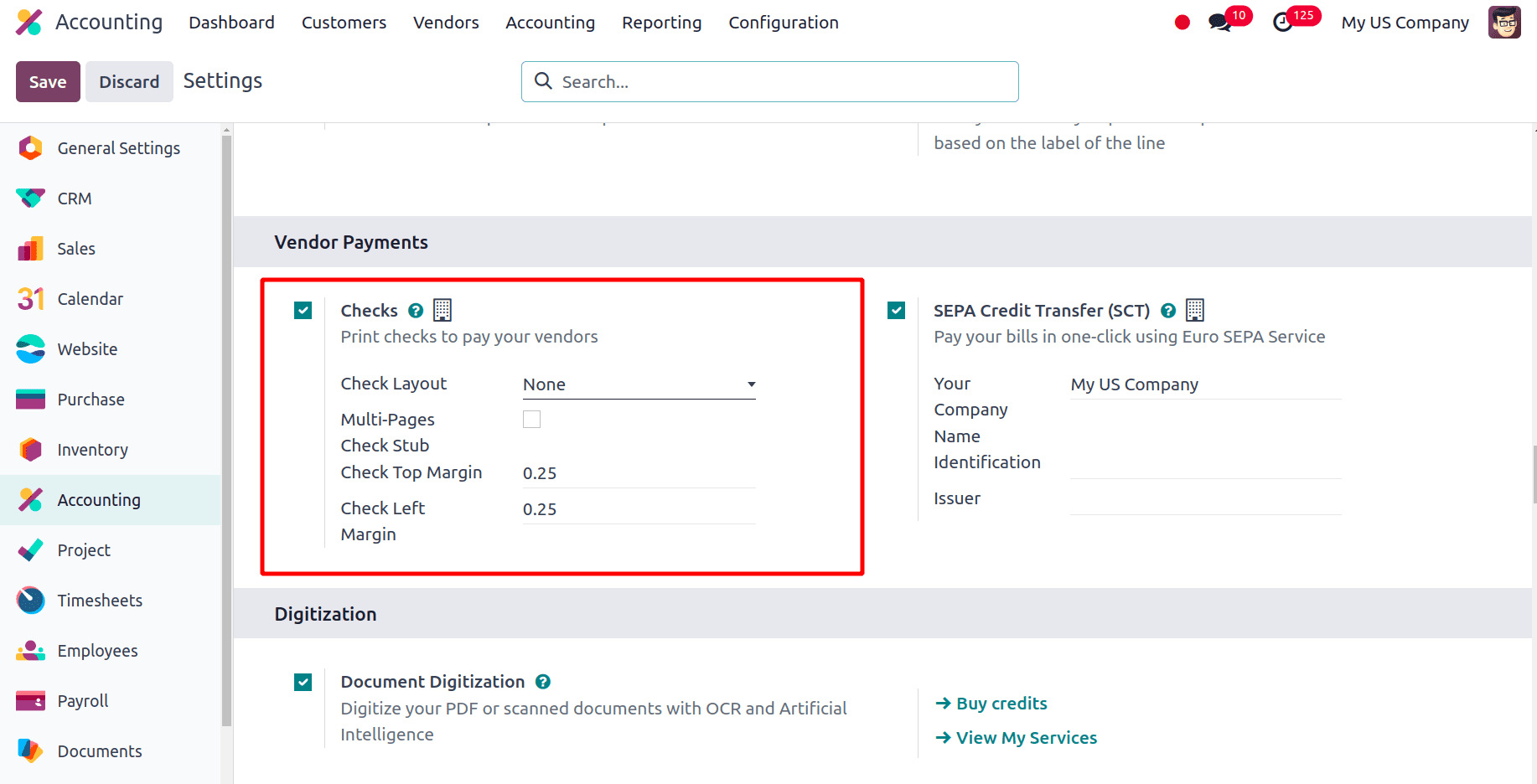

Checks

In the US, paying using checks is still a typical payment method. Navigate to Accounting > Configuration > Settings. Under the Vendor Payments section, we have the Checks option. Enable the field Go to Accounting Configuration Settings and locate the Vendor Payments section to enable cheque printing from Odoo. We can choose an option for the Check Layout from the drop-down menu.

* Print Check (Top) - US

* Print Check (Middle) - US

* Print Check (Bottom) - US

Next, select whether to activate the checkbox for the Multi-Pages Check Stub. If necessary, optionally set a Check Left Margin and Check Top Margin. Save the settings after all check setups are finished.

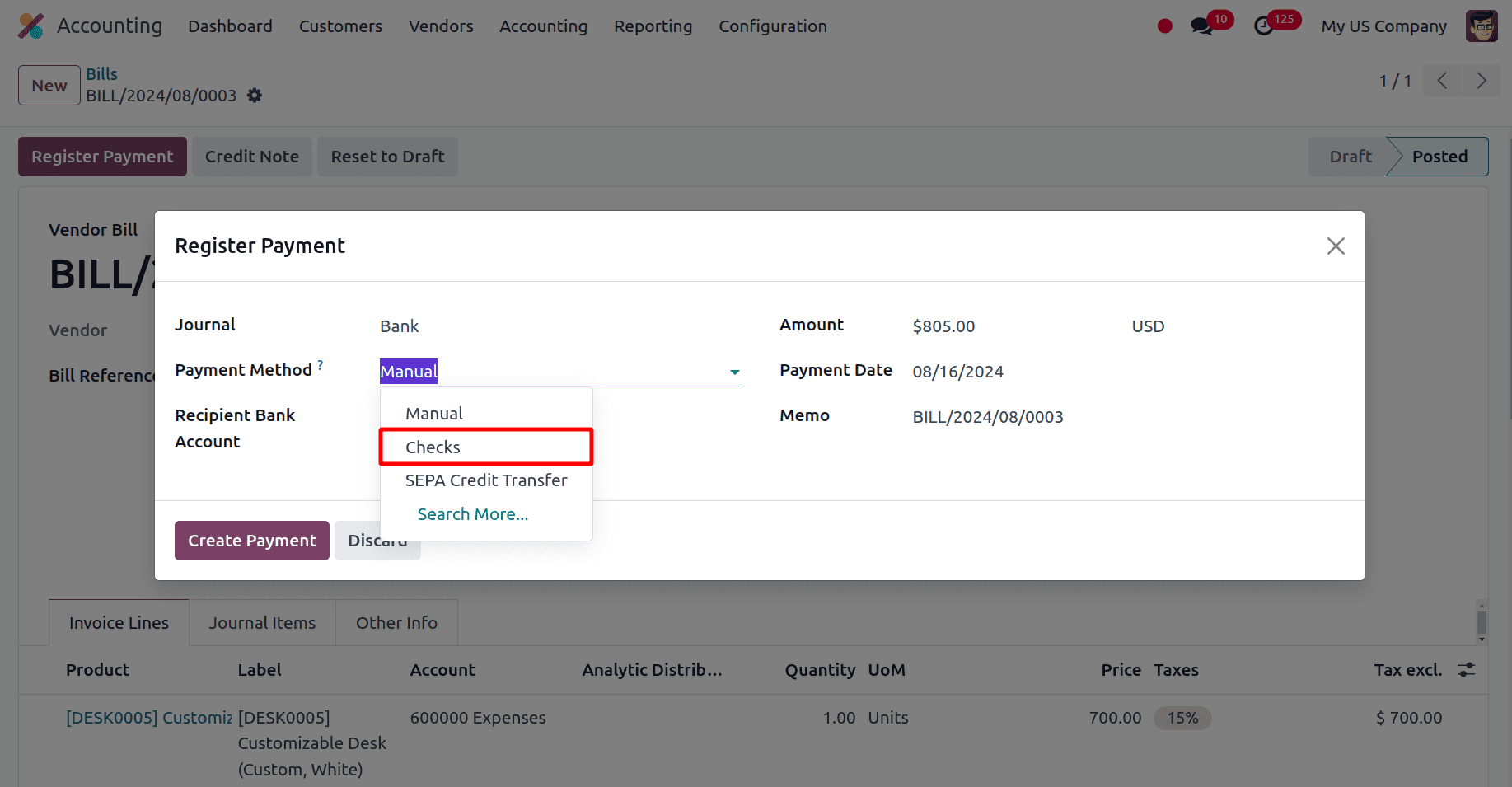

Now for paying with a check we can create a Vendor Bill and choose the Payment Method as Check while registering the payment.

For handling financial processes in accordance with American accounting standards and laws, Odoo's accounting localization for the United States offers a reliable and customized solution. With features like a chart of accounts tailored to the United States, automated tax computations, and comprehensive reporting tools, Odoo makes sure that companies can effectively manage their financial operations while abiding by regional regulations. The ability to provide crucial financial insights and preserve accurate records is further improved by the integration of tax reports, balance sheets, and profit and loss statements. In the end, Odoo's localization for the US simplifies accounting procedures, lowers administrative burdens, and helps companies achieve regulatory compliance and financial clarity.

To read more about An Overview of Accounting Localization for Hong Kong in Odoo 17, refer to our blog An Overview of Accounting Localization for Hong Kong in Odoo 17.