Odoo ERP modules offer fiscal localization packages, which provide a chart of accounts, pre-configured taxes, legal declarations, and fiscal positions on a database. These modules simplify tax automation by allowing users from different countries to localize ERP goods according to their regulations. Odoo ERP enhances localization functionality in modules like the Odoo 17 Accounting module, simplifying electronic invoice storage, applying taxes, managing customer tax, withholding taxes, credits, and book payments. Fiscal localization also facilitates the integration of accounting transactions, enabling the development of multiple reports and centralizing organizational data.

Activating Fiscal Localization

Fiscal Localization Packages are specialized modules designed for specific countries to cater to your fiscal management requirements. They install pre-set taxes, fiscal positions, account charts, legal statements, certificate setups, and other features, into your accounting system.

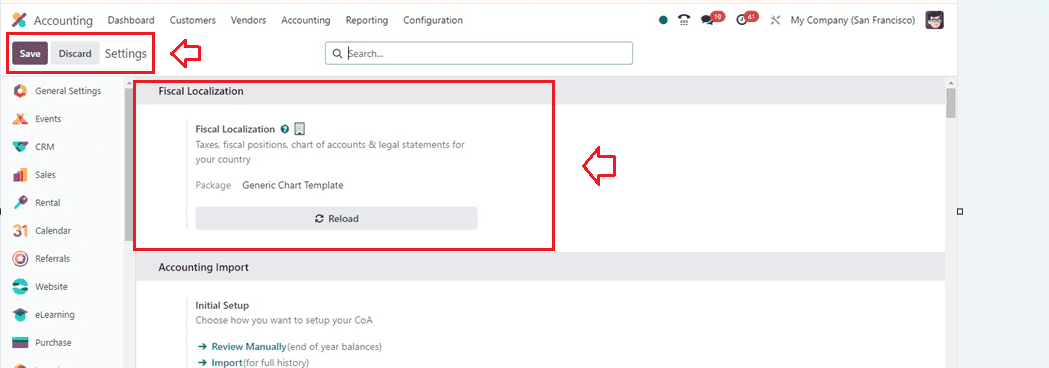

Odoo automatically installs a fiscal localization package for your business, depending on the nation you choose while creating the database. You can go to the ‘Configuration’ menu and activate the ‘Fiscal Localization’ option from the ‘Settings’ window to select a package, then save the configuration changes.

Configuring Fiscal Years

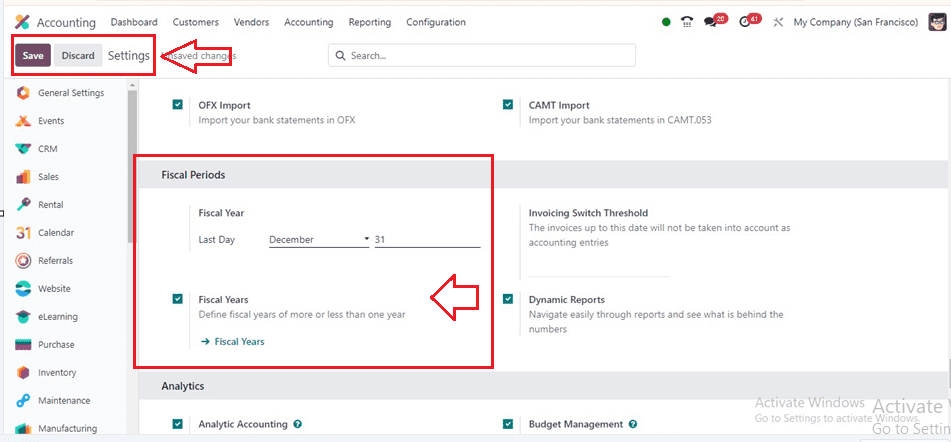

You can also access and enable the ‘Fiscal Year’ functionality in Odoo 17 Accounting by going to the ‘Settings’ tab as shown below.

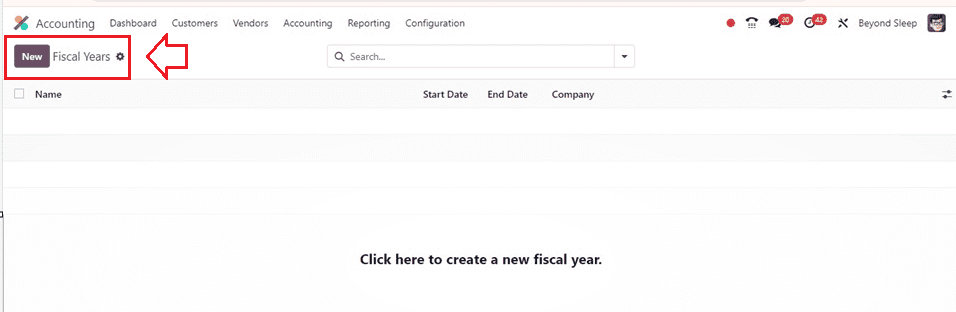

After activating the Fiscal Localization features, go to the ‘Fiscal Years’ option from the ‘Configuration’ menu’s dropdown list.

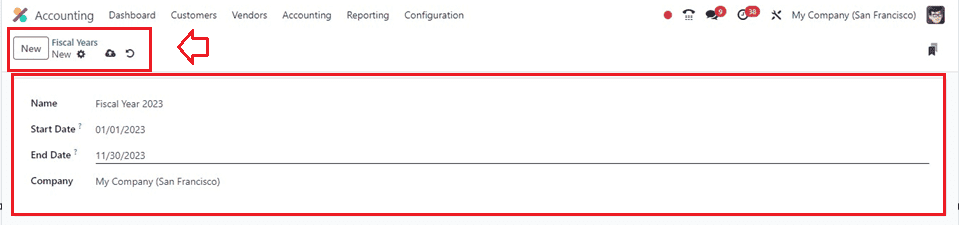

By clicking the ‘New’ button on the fiscal year dashboard window, an organization may quickly design a fiscal year.

Type the name of the fiscal year in the ‘Name’ field. Then, you have to provide a ‘Start Date’ and ‘End Date’ of the corresponding Fiscal Year. Finally, choose the ‘Company’ and save the data using the Save icon. Then, move on to the next process.

Creating Fiscal Positions in Odoo

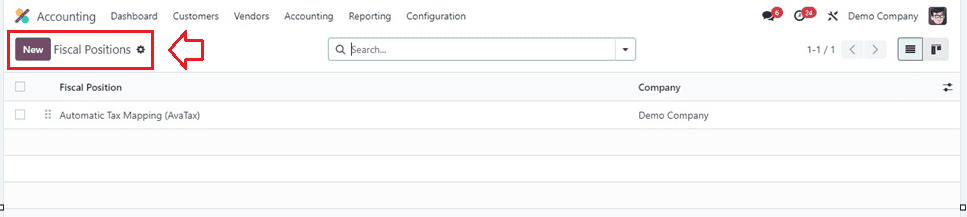

By using fiscal position based on a nation, users may simplify tax administration by using transaction accounts and creating rules for manual tax adaption. Partners may be appointed to these roles, which may be applied for manually or automatically. Accounting fiscal positions may be acquired via the ‘Fiscal Positions’ window of the ‘Configuration’ tab.

By choosing the ‘New’ icon, a new fiscal position may be formed. The List view shows distinct entries for every fiscal position.

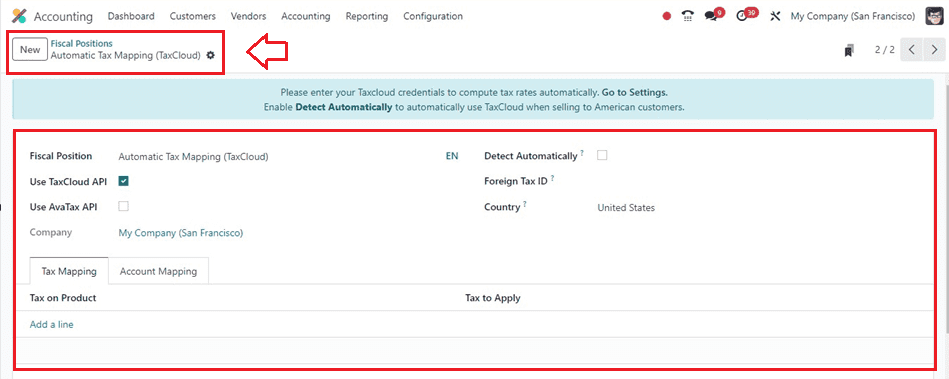

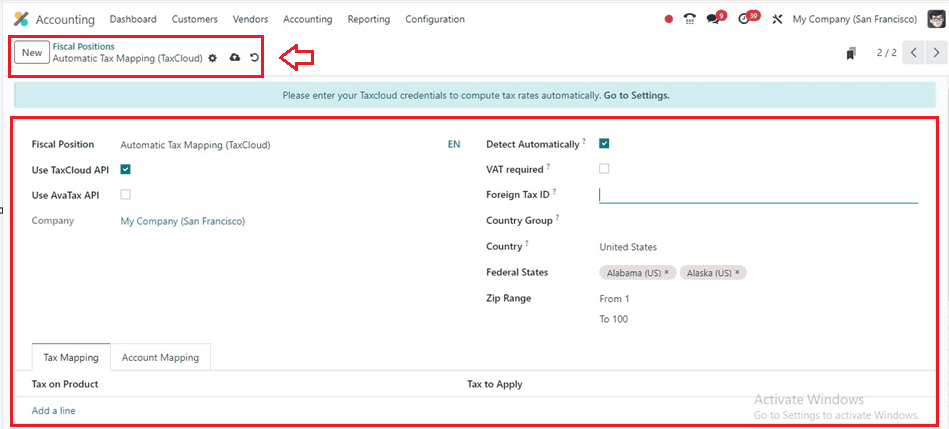

Users may activate the ‘Use TaxCloud API’ option and add their fiscal position name in the ‘Fiscal Position’ field in Odoo 17 to configure taxes. With the ‘Use Avatax API,’ they can also calculate taxes. To automatically identify the fiscal position, users can activate the ‘Detect Automatically’ box and choose their firm in the ‘Company’ field.

Users can add the tax ID matched by their company's fiscal situation in the ‘Foreign Tax ID’ field. If the nation group is comparable to the delivery ‘Country,’ then we can additionally mention it inside the ‘Country Group’ field. Users can input the range count in the ZIP Range field, and the Federal States field determines the states based on the selected nation.

By choosing the ‘Add a line’ option in the ‘Tax Mapping’ tab area, we can set the tax on a product and the Tax to Apply. Finally, in the Account Mapping section, users may also create a product account. Then, we have to manually save the data after applying the Fiscal Position information using the save icon.

Fiscal Localizations in Odoo

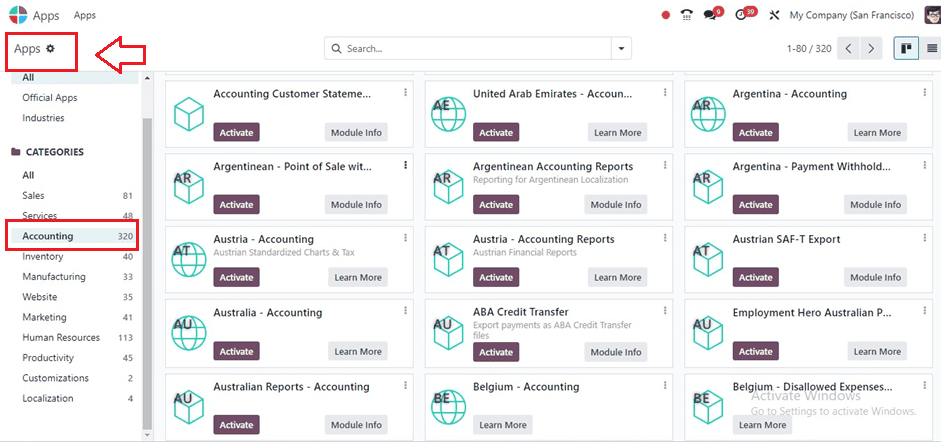

The fiscal localization package is a country-specific module in Odoo that allows companies to configure country statements and enable taxes. It is automatically installed for each country, allowing Odoo to run Accounting based on that country. To download a specific country package, users can choose the Apps module in Odoo 17 and select the Accounting section in the Apps window. This will display a list of all localization packages available to the user.

From this dashboard, Explore the Fiscal Localization list to pinpoint the perfect package tailored to your company's specific locale and region.

Odoo's fiscal localizations enhance tax management for businesses across various jurisdictions, reducing errors, promoting transparency, and enhancing operational efficiency and regulatory adherence. To read more refer to How to Map Taxes & Accounts Using Fiscal Position in Odoo 17 Accounting