Journal entries are the cornerstone of Odoo 18's accounting module, which documents a business's financial transactions. By recording both the inflow and outflow of funds, they maintain a historical record of financial activity. They may simply create journal entries manually or automatically using a variety of built-in modules thanks to Odoo's user-friendly interface. In order to keep the accounting equation balanced, debit and credit lines are provided in every entry.

By letting users add descriptions, references, and category-based journals, Odoo facilitates precise and orderly record-keeping. Because journal entries facilitate analysis, compliance, and decision-making, they are crucial for maintaining financial openness.

Journal Items are essential to Odoo 18's inventory and accounting integration. By acting as a middleman between inventory management and financial transactions, they represent the products or services that a business buys or sells. The Odoo inventory module facilitates the production and management of items and allows for the specification and categorization of attributes such as tax rates, units of measurement, and price.

In order to ensure that sales and purchases correspond with inventory changes and financial statements, items and journal entries are synced. Items facilitate appropriate inventory assessment and analysis, which in turn support correct financial reporting and informed business decisions.

Journal entries and items work together to keep financial transactions in the Odoo accounting system accurate. Because journal entries capture the essence of transactions, they maintain a visual record for compliance, auditing, and analysis. The integration of items enables accurate valuation and seamless reconciliation by combining inventory and finance management. Both elements seamlessly connect financial activity and physical goods to give businesses meaningful data that supports their decision-making, adherence to industry standards, and bookkeeping accuracy.

Why Use Odoo 18 Accounting to Manage Journal Entries and Items?

* Automated Journal Entry

Odoo 18 improves automation by allowing users to design rules for automatic journal entries. This feature significantly lowers the quantity of manual data entry, guarantees accurate transaction recording, and minimizes errors. Automation saves time and increases the overall correctness of financial data.

* Advanced Reconciliation

Reconciliation is a crucial component of financial management, and Odoo 18 Accounting provides excellent tools for this process. By being able to reconcile many things at once, businesses may ensure accurate and current financial statements and speed up bank reconciliations.

* Personalized Journals and Products

Odoo 18 lets you customize journal entries and other things, and it recognizes that every firm has unique bookkeeping needs. Users can make journals that are tailored to their own needs and design unique items to monitor various financial activities. This level of adaptability ensures that Odoo 18 Accounting adapts to the unique organizational structure and operating protocols of any company.

* Reporting in real time

Having real-time access to financial performance data is essential for making informed company decisions. Odoo 18 Accounting's robust reporting features give a complete picture of the business's financial status. Support for Multiple Currencies For businesses that operate globally or have clients from different nations, managing currency exchange is a common challenge. To address this, Odoo 18 provides enhanced support for several currencies. The ease with which users can record and track transactions in several currencies simplifies the accounting process for global organizations.

* Connectivity with Additional Odoo Modules

An integrated business management system is the outcome of Odoo 18 Accounting's seamless connection with other Odoo modules. The link, which can connect to the sales, inventory, or human resources modules, guarantees the constant flow of financial data across the entire company. In addition to increasing efficiency, this integrated approach provides a thorough grasp of how firms function. Odoo 18 Accounting is evidence of the company's commitment to offering businesses robust, user-friendly solutions. Odoo 18 enhances accuracy, simplifies financial procedures, and provides businesses with the data they require to thrive in the current competitive landscape by placing a strong emphasis on journal entry and item management.

In this blog, we'll examine how Odoo 18 accounting aids businesses in streamlining their financial operations.

One of Odoo 18 Accounting's biggest features is its intuitive UI. The system's user-friendly layout makes it simple and easy for even those without much accounting experience to use.

Maintaining journal entries and things is made easy by the neat UI and well-organized menu structure.

It is possible to record a transaction in a journal as an entry. A good journal entry includes the reference information, the amount to be debited and credited, the accounting date, and a summary of the transactions. At least one credit line and one debit line are necessary for Odoo's Double Entry Bookkeeping System. There must be an equal amount of credit and debit in a journal entry. The separate lines that comprise a journal entry are known as journal items. You can access the Journal Entries platform through the module's Accounting menu.

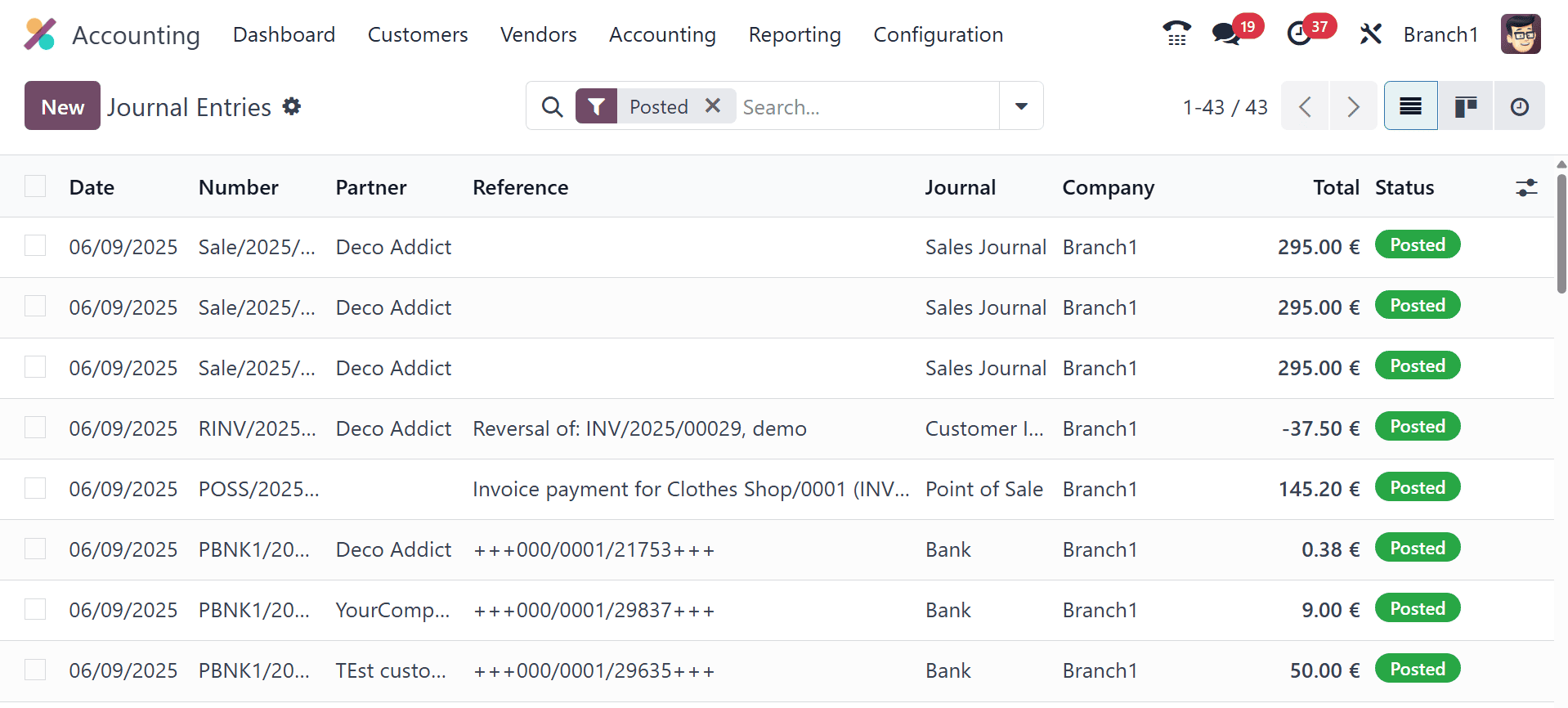

The list view displays the Date, Number, Partner, Reference, Journal, Company, Total, and Status of each journal entry. To begin and add a new journal entry to a specific journal, click the Create button.

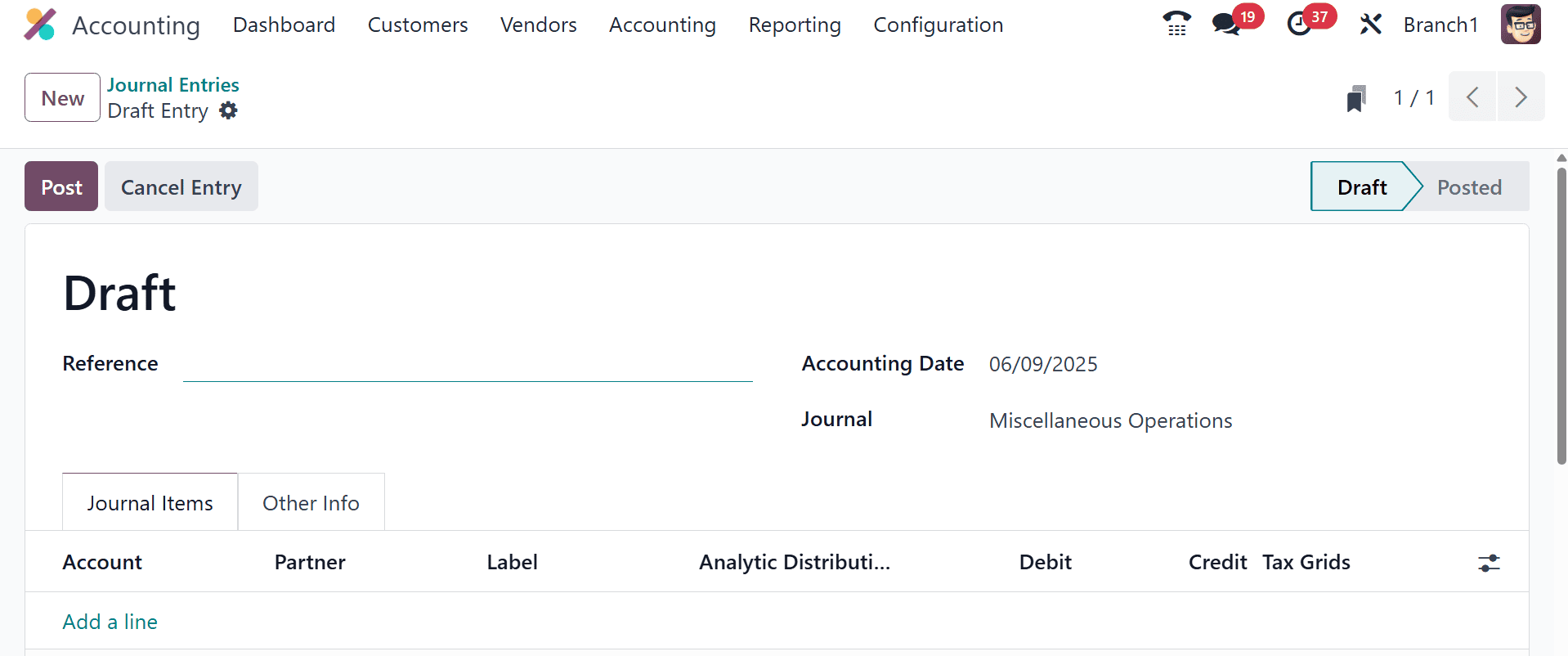

Any sources that are pertinent to this journal article can be cited in the Reference section. The Accounting Date of the entry will be shown in the corresponding field. To add this entry to your journal, select the relevant journal from the list of possibilities. The Add a Line button beneath the Journal Items menu allows you to add journal entries one at a time. One diary entry consists of these sentences.

You can enter details about Account, Partner, Label, Analytic, Debit, Credit, and TaxCloud on this page.

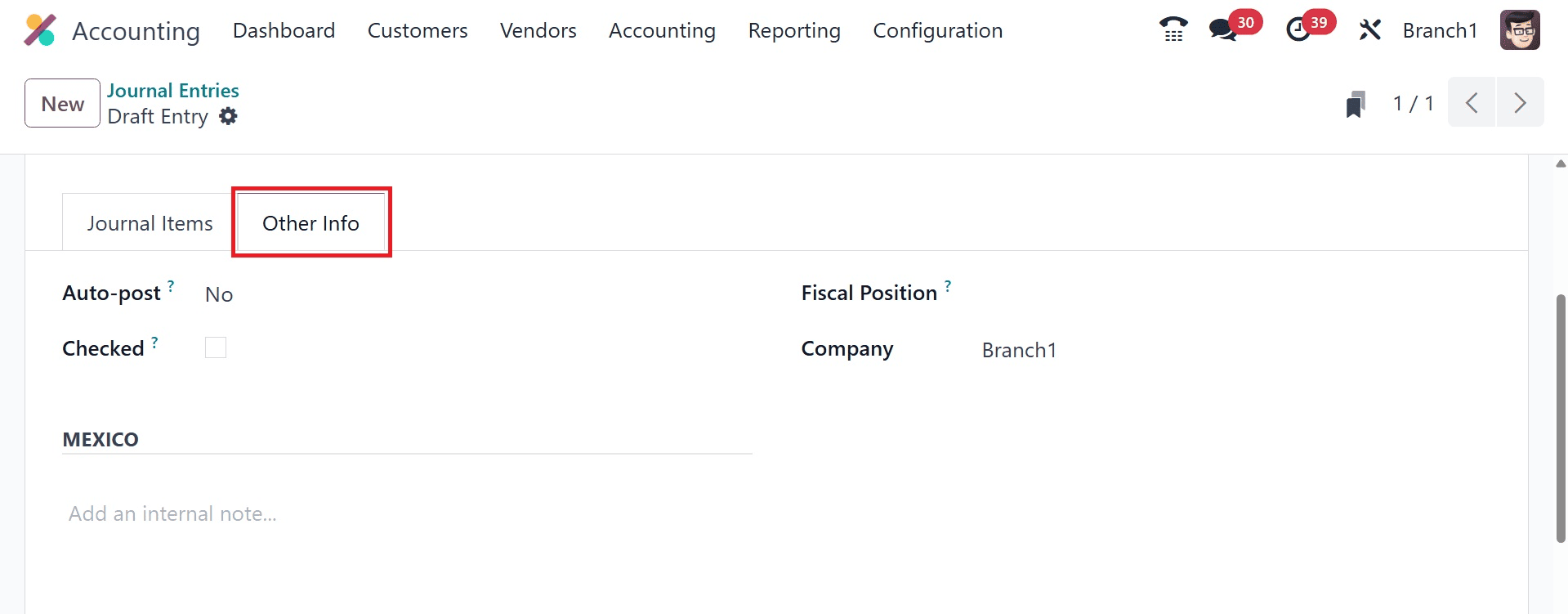

Under the Other Information tab, you can choose the Auto-post option, which will cause the item to be posted automatically on the pertinent accounting date. If you need to double-check the entry, you can activate the To Check field. Once you have selected the Fiscal Position and Company, you can click the Post button to post the entry in the relevant journal.

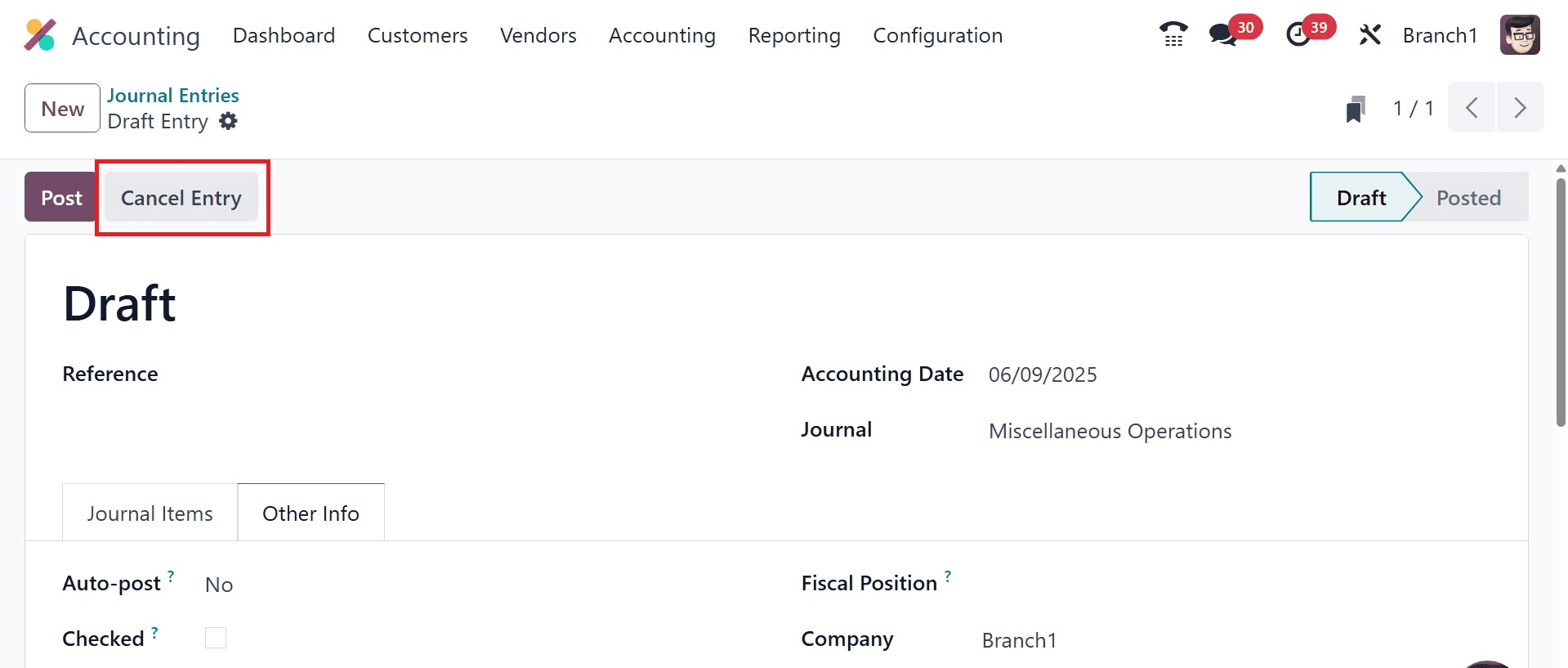

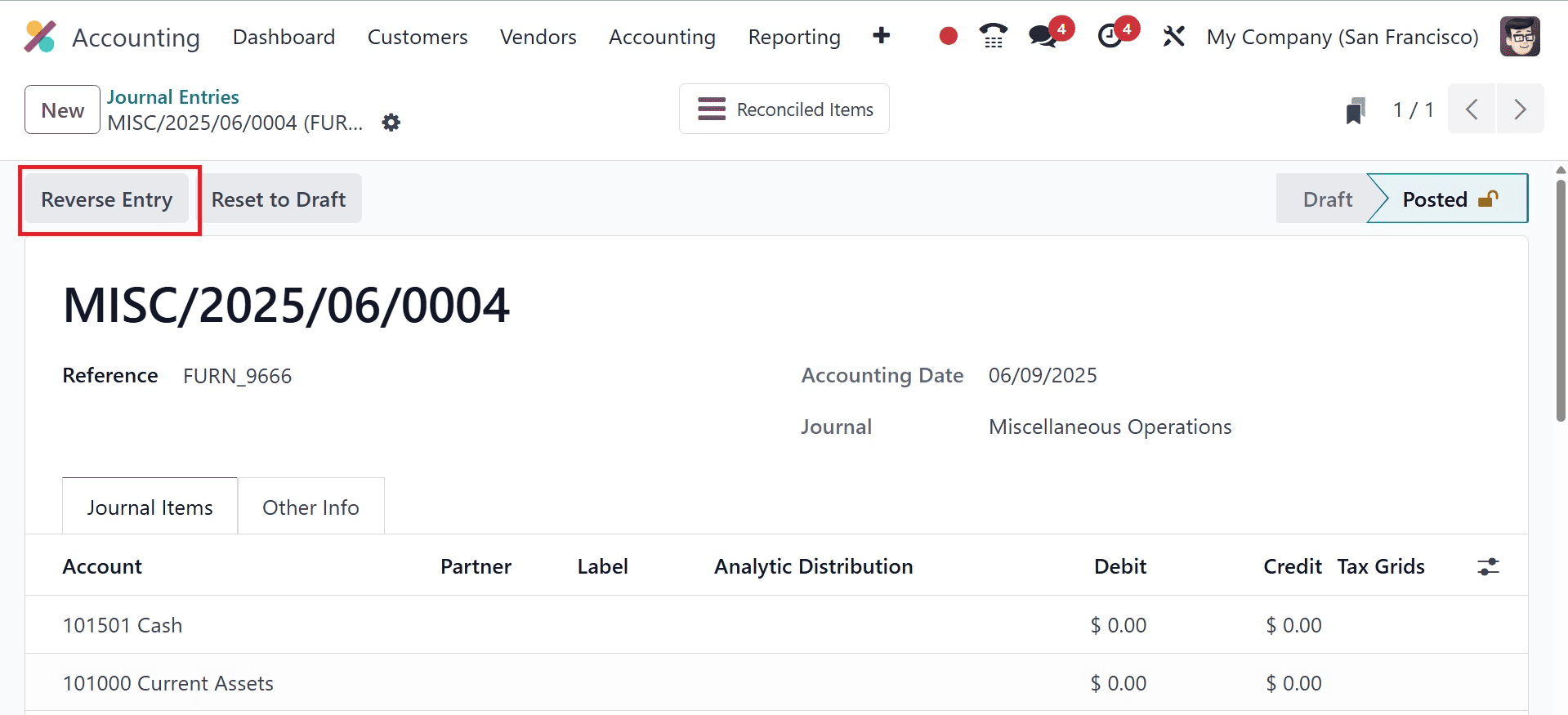

The entry can be removed before it is published in the journal by using the Cancel Entry option. Once the journal entry has been published, you will have the opportunity to use Reverse Entry.

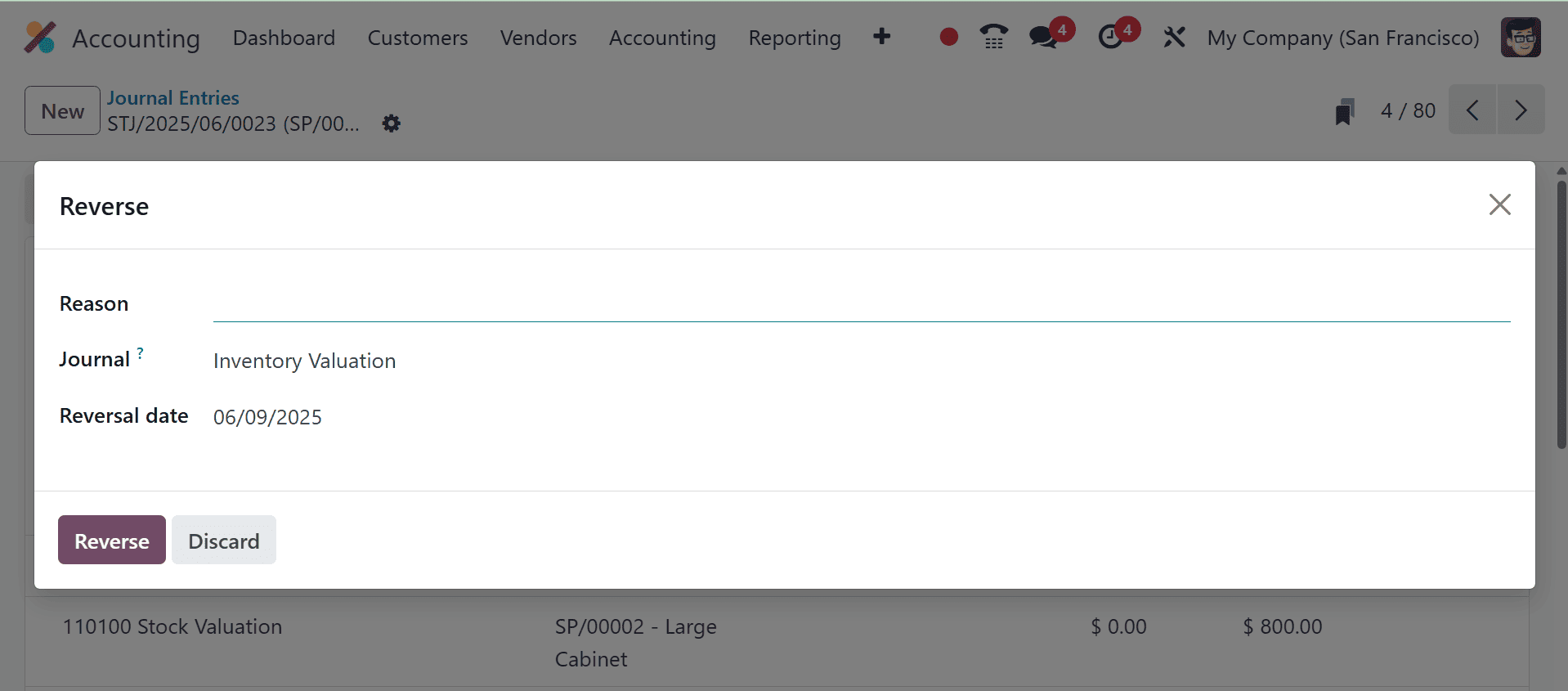

This button allows you to instantly undo a journal entry that has been published. A pop-up window will appear where you can enter the Reversal Date and Specific Journal.

The Reversal Date can be adjusted to match the Journal Entry Date by selecting the appropriate option. Clicking the Reverse button will reverse the diary entry.

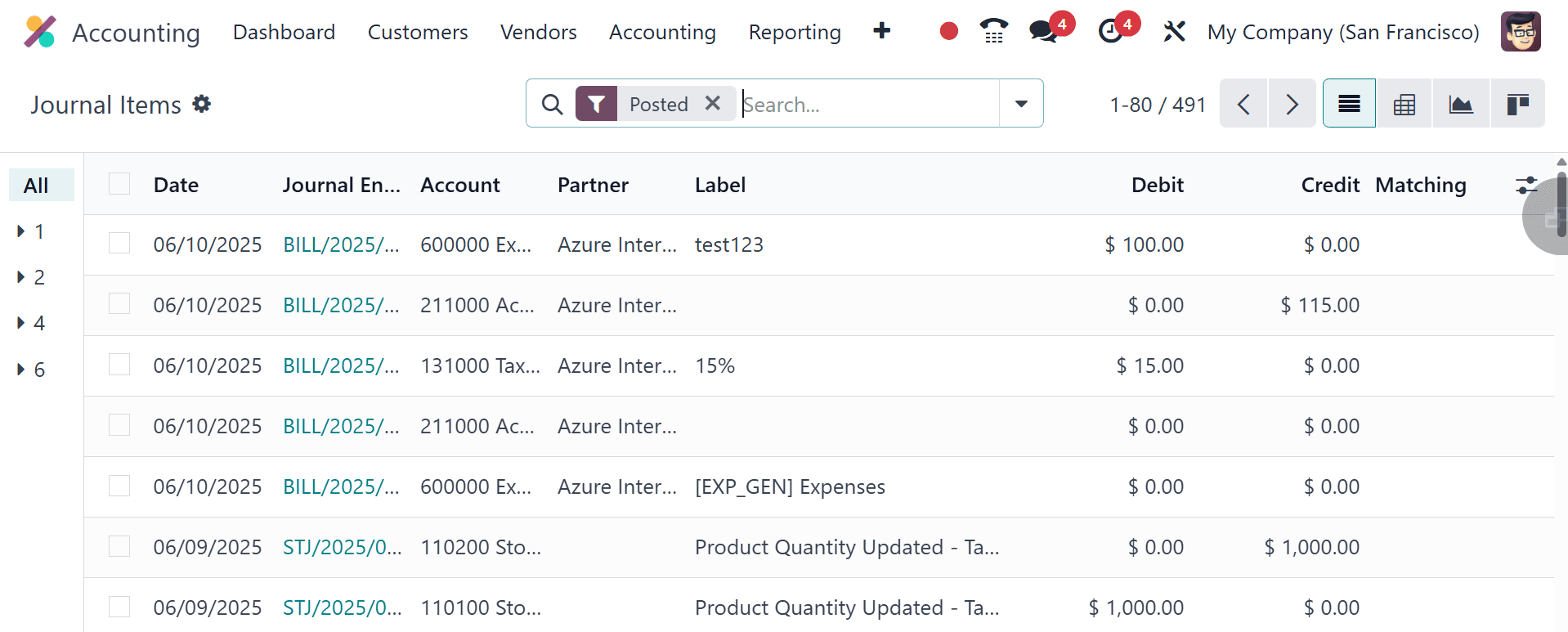

Users can access the journal items that have been added to different journal entries on a single platform in the Odoo Accounting module. By choosing the Journal Items option from the Accounting menu, you may document every journal item for your accounting entries.

The list view will show the information for the Date, Journal Entry, Account, Partner, Label, Currency Amount, Debit, Credit, Matching Number, and Analytics. The Match option allows you to match a particular bank statement with a diary entry.

Managing accounting job entries and items is necessary to maintain accurate financial records for businesses. The precise exchanges and actions associated with certain projects or contracts are called "job entries." Since these entries include a wide range of factors, including expenses, revenue, and resource allocation, they provide a comprehensive view of each project's financial performance. By carefully recording job entries, businesses may control expenses, track project profitability, and assess resource use efficiency.

Accounting items are the particular products, services, or materials that a company buys, sells, or uses in its operations. Proper item management requires classifying items, assigning them suitable codes or IDs, and maintaining current records of their quantities and values. Companies can use this to calculate their cost of goods sold, keep an accurate eye on their inventory levels, and assess the financial impact of their purchases and sales. Efficient item management reduces the likelihood of errors, streamlines ordering and stocking processes, and ensures compliance with tax and reporting requirements.

All things considered, proficiently handling accounting task entries and items provides businesses with a comprehensive understanding of their financial operations. Accurate financial records and reporting are provided, resource allocation is streamlined, and informed decision-making is enabled. By maintaining comprehensive and well-organized records of work entries and items, businesses can improve operational effectiveness, satisfy legal requirements, and eventually produce superior financial results.

To read more about How to Manage Journal Entries & Items in Odoo 17 Accounting, refer to our blog How to Manage Journal Entries & Items in Odoo 17 Accounting.