Strong accounting features are included in Odoo 18, an open-source ERP system with many features. Adding the initial balance is a vital step in the Odoo accounting setup process. The opening balance shows the state of your business's finances prior to using the Odoo Accounting module. It's crucial to convert the year's ending funds into the beginning funds for the following fiscal year at the end of the current one.

To handle and set up this initial sum for your financial activities in the new fiscal year, Odoo, a program for managing business operations, uses journals and journal entries. The current starting amount is represented by creating what is known as an equity account. To make sure that the account balances are converted into the beginning amounts for the upcoming fiscal year, you also make a journal entry. Setting the date of the entry as the start of the new accounting period is essential when creating this new journal entry. Your financial records will remain well-organized and prepared for the next year thanks to this procedure.

We'll guide you through adding opening balances in Odoo 18 Accounting in this blog.

Examining the starting balance in an account, whether it be associated with a bank, client, or supplier, is necessary to comprehend the opening balance in Odoo. Usually, this initial sum is decided upon at the beginning of a fiscal or accounting period. Assigning a starting balance is an essential step in creating an Odoo account for your business. Depending on the credit or debit transactions that took place in the previous period, the initial balance may be positive or negative. Let's examine the procedures described in the Odoo 18 Accounting module to acquire knowledge about efficiently handling the opening balance.

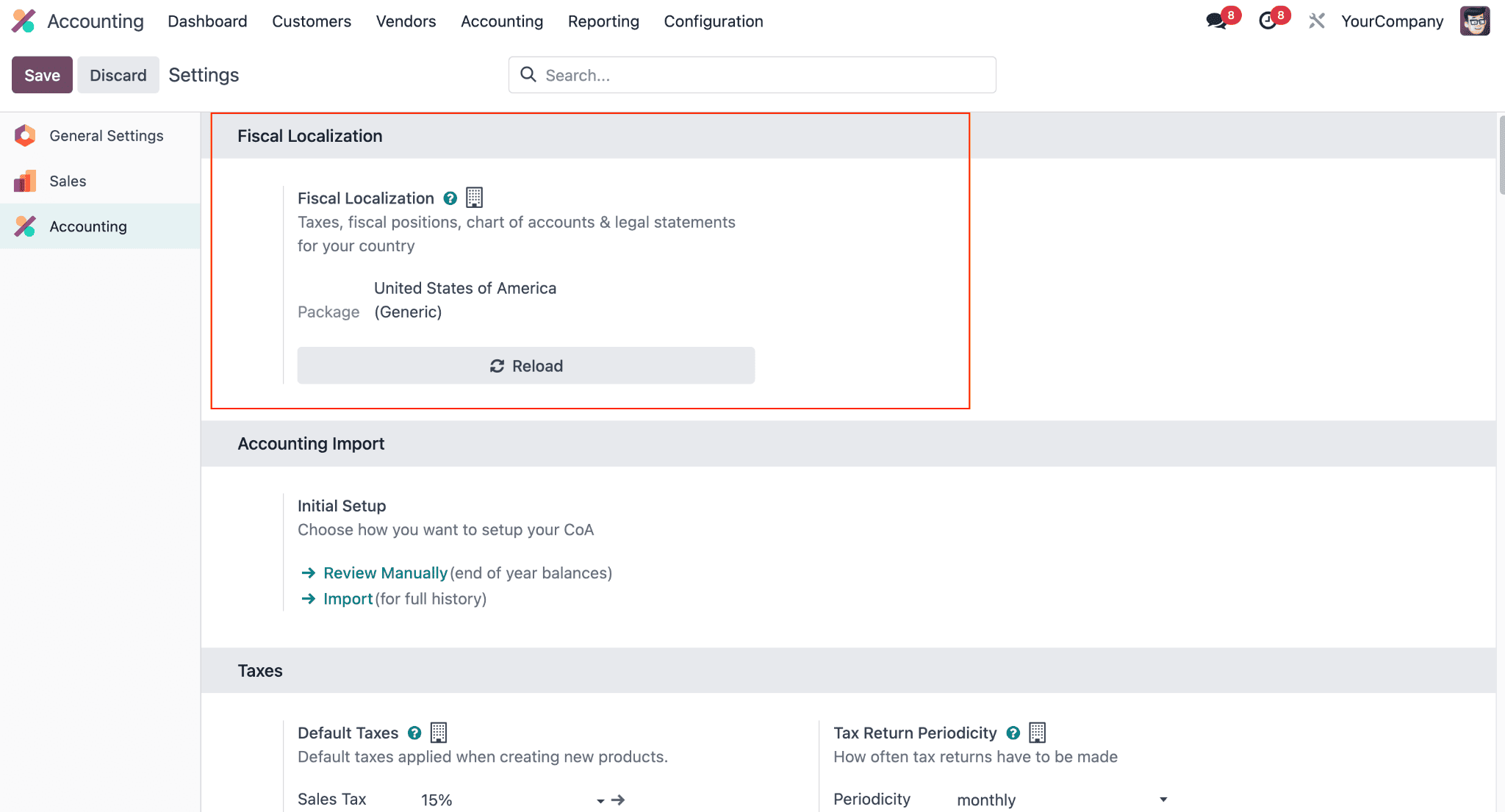

First, choose the Accounting module from Odoo 18's main dashboard to begin the procedure. Make sure your database has the fiscal localization function enabled. This can be done simply by going to the Accounting module's configuration settings menu.

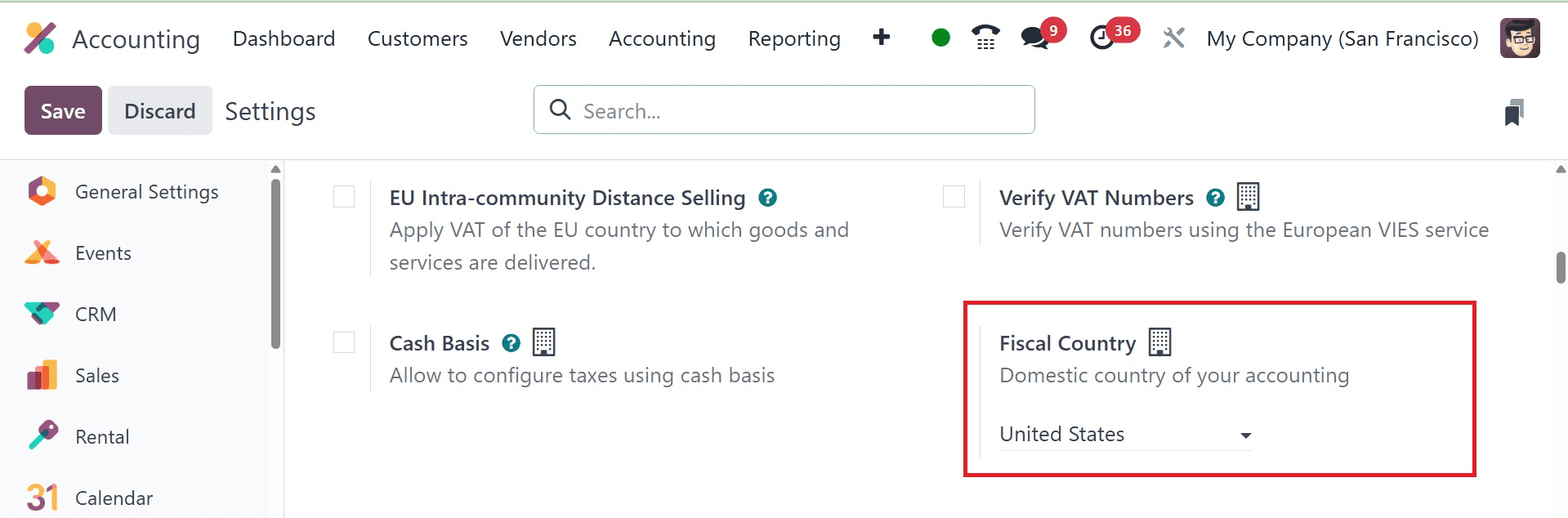

The chosen Fiscal Country, a critical parameter that identifies the nation linked to all ensuing accounting activities and charts of accounts, is also shown in the settings.

All charts of accounts are guaranteed to be solely associated with the specified nation thanks to this setup.

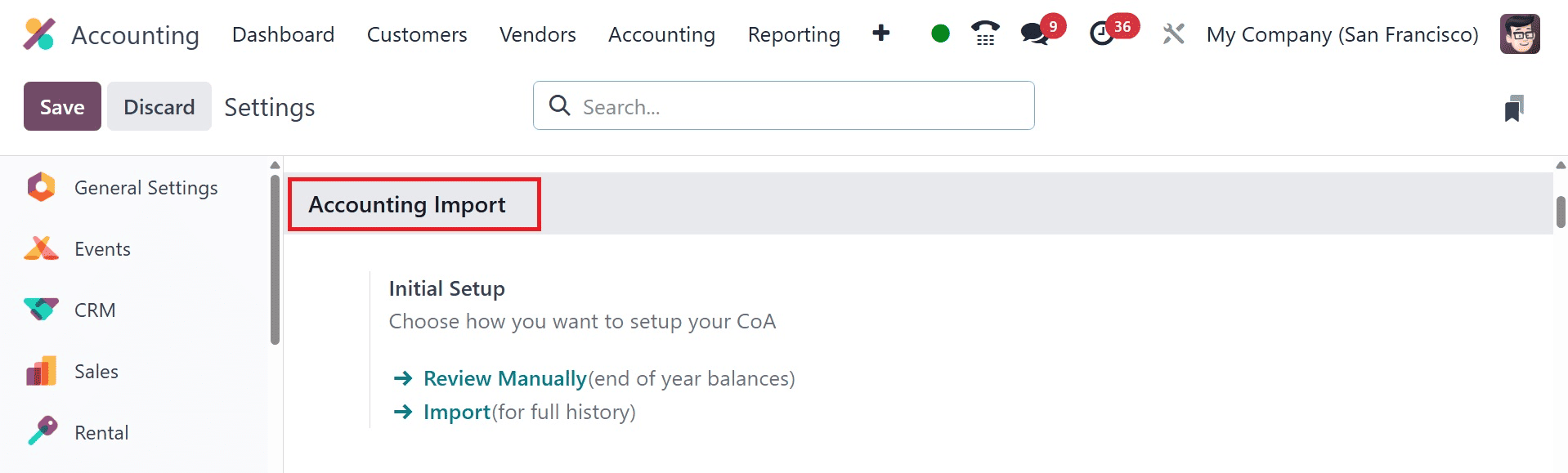

Use the "Review Manually" option in the Account Import page if you want to expedite the process of establishing the opening balance straight from the accounting settings.

This tactical decision makes it easier to accurately build up year-end balances, which then flow into the opening balance for the next year.

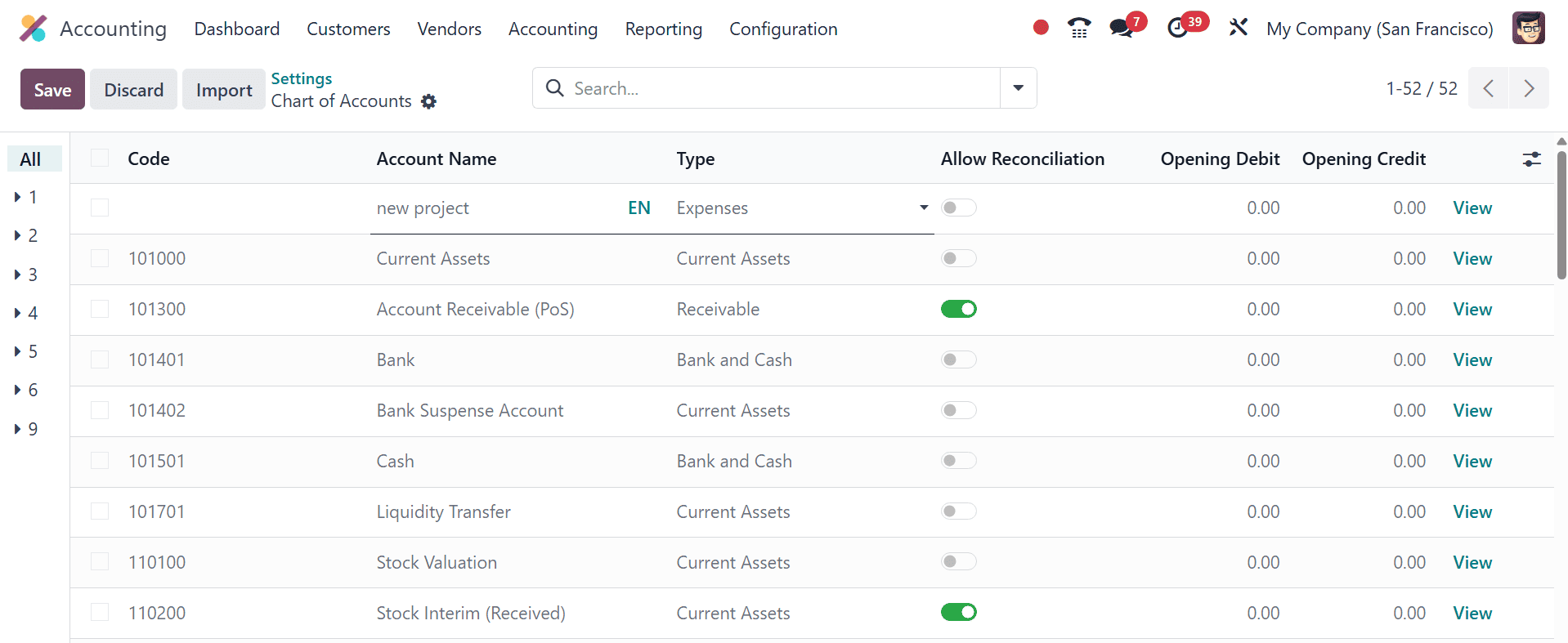

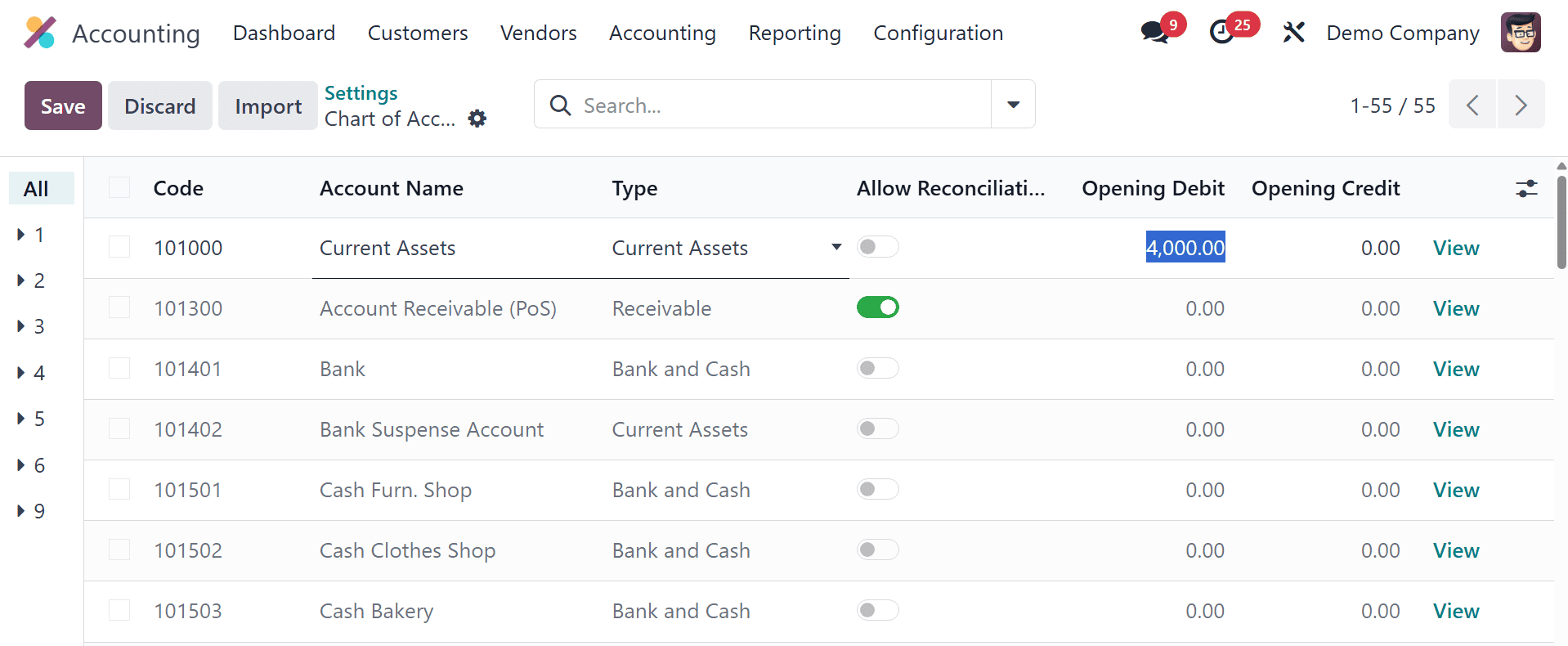

You can specify the initial balance for the new fiscal year in the onboarding window that appears in the Chart of Accounts, and ability to set up the opening debits and credits.

Clicking the "New" button initiates the process of creating a new account and adding an initial balance. As an alternative, adding an opening balance to an existing account entails indicating credit or debit balances in the relevant ledgers.

A new line appears when you select "New," and you may enter details like Code, Account Name, Type, Allow Reconciliation, Opening Debit, and Opening Credit.

Consider classifying the account as an expense type and calling it "new project" for the upcoming accounting period, as an example. Select an opening debit, such as $4000, and click the Allow Reconciliation option.

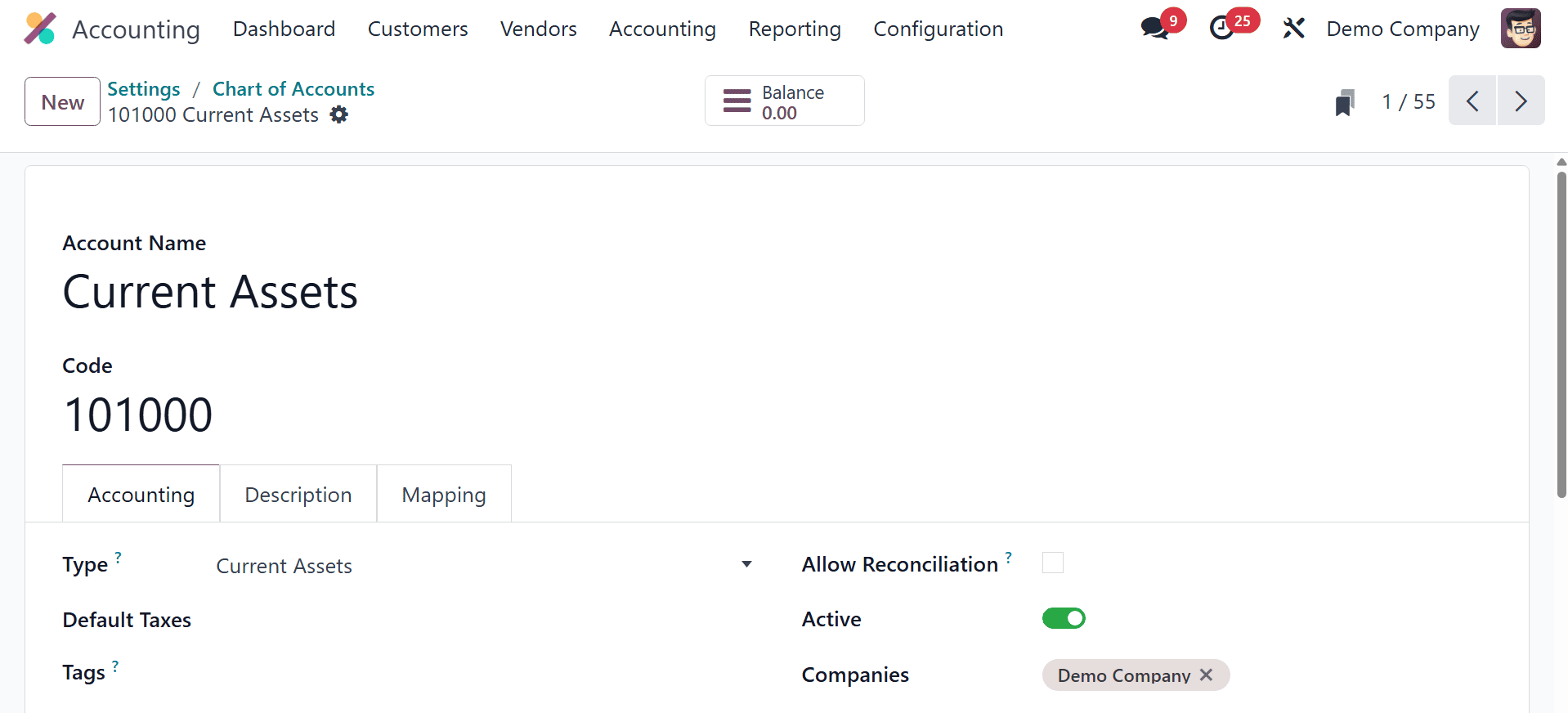

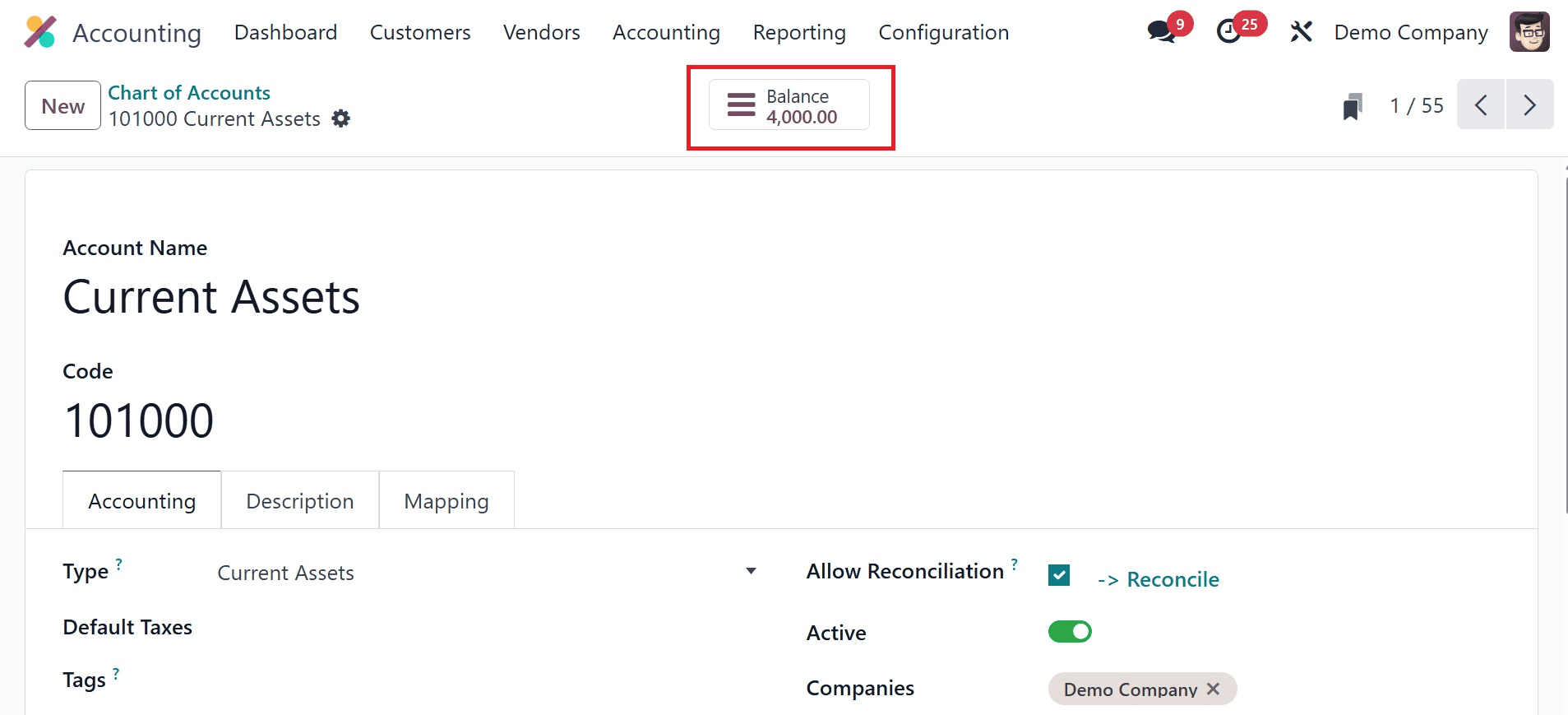

The details of the newly established account are shown in a new window when you click the View button.

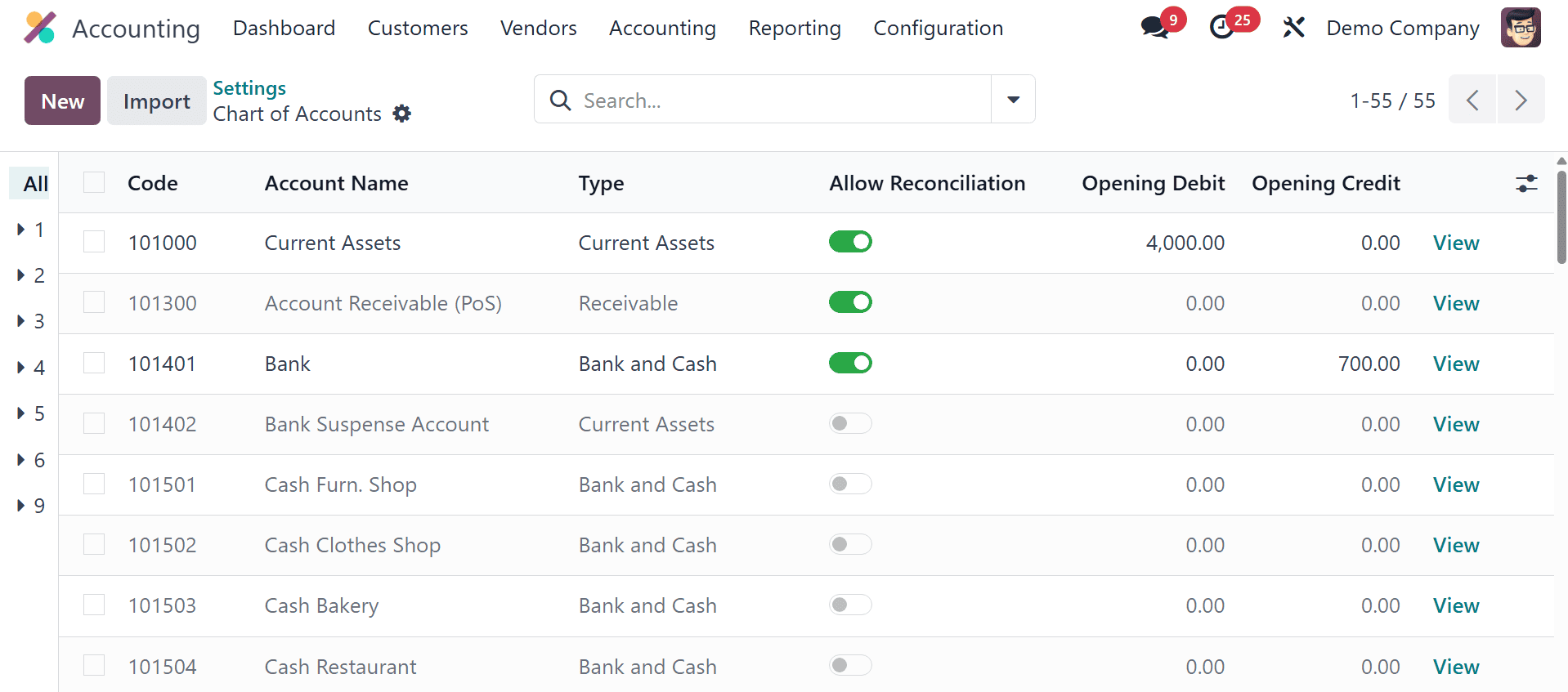

Now, in the chart of accounts, if required, you can activate the allow reconciliation option. Now, set the opening credit of bank and cash as 700, as in the screenshot below.

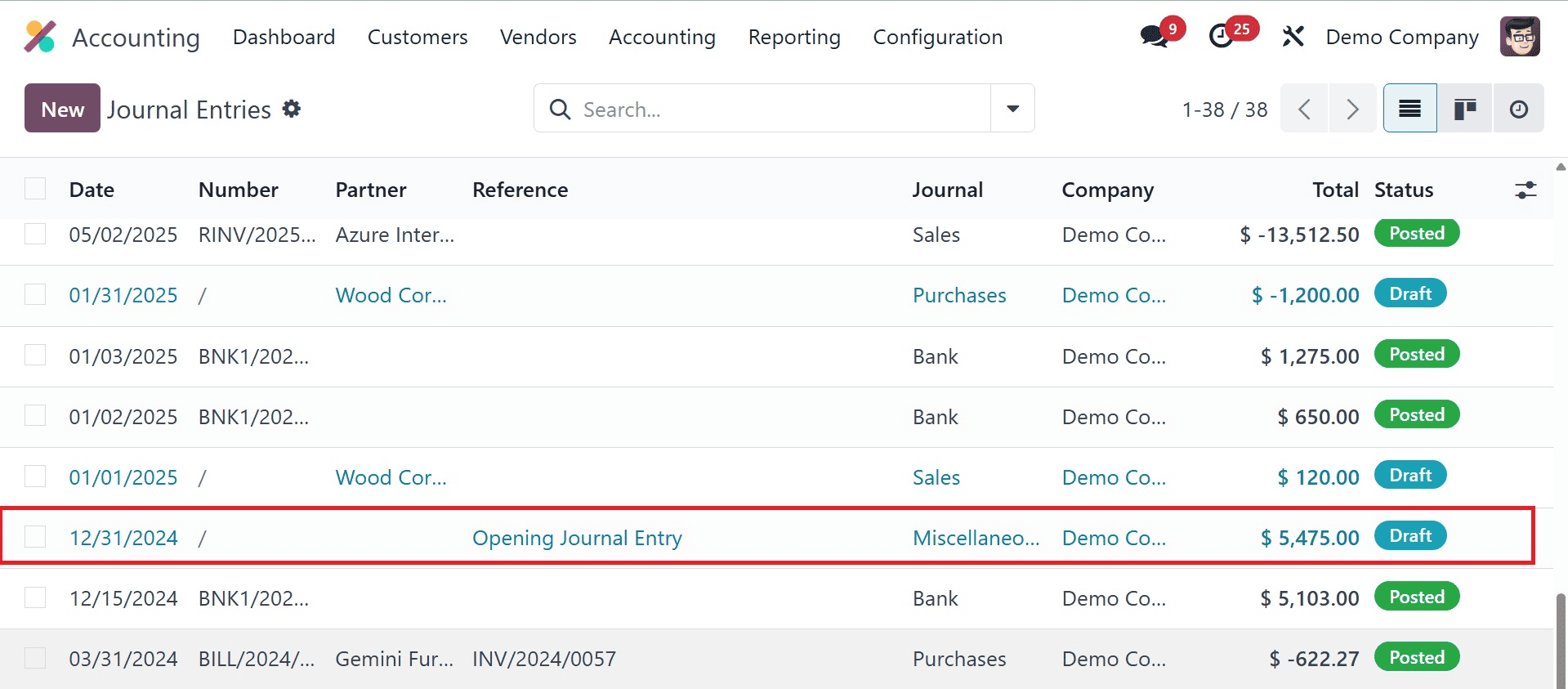

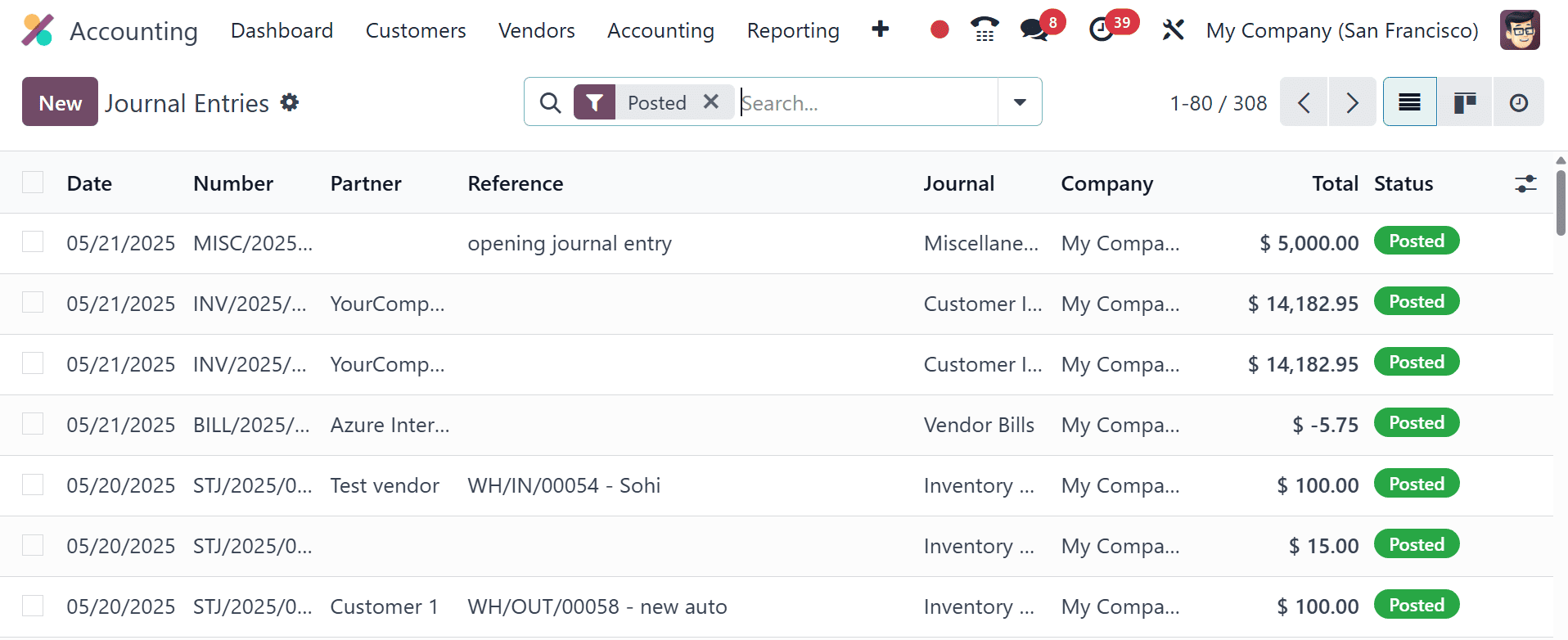

Similarly, you can set certain amounts, say, set bank and cash with an opening credit of 700, tax receivable, fixed asset, and many more. Create the opening balance as a credit or debit for additional accounts in the Chart of Accounts after preserving these details. After this configuration is finished, check the results in the Accounting menu's Journal Entries option.

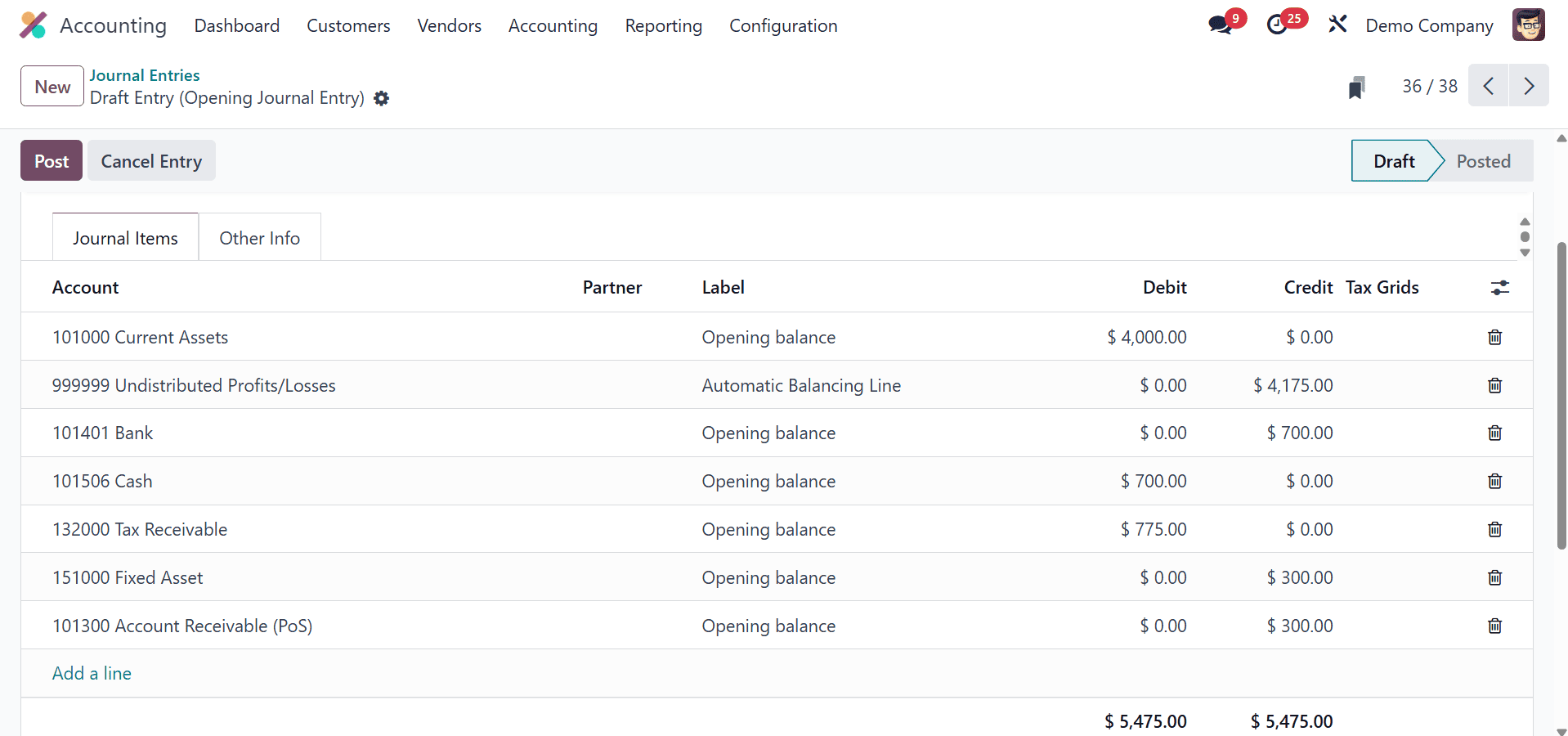

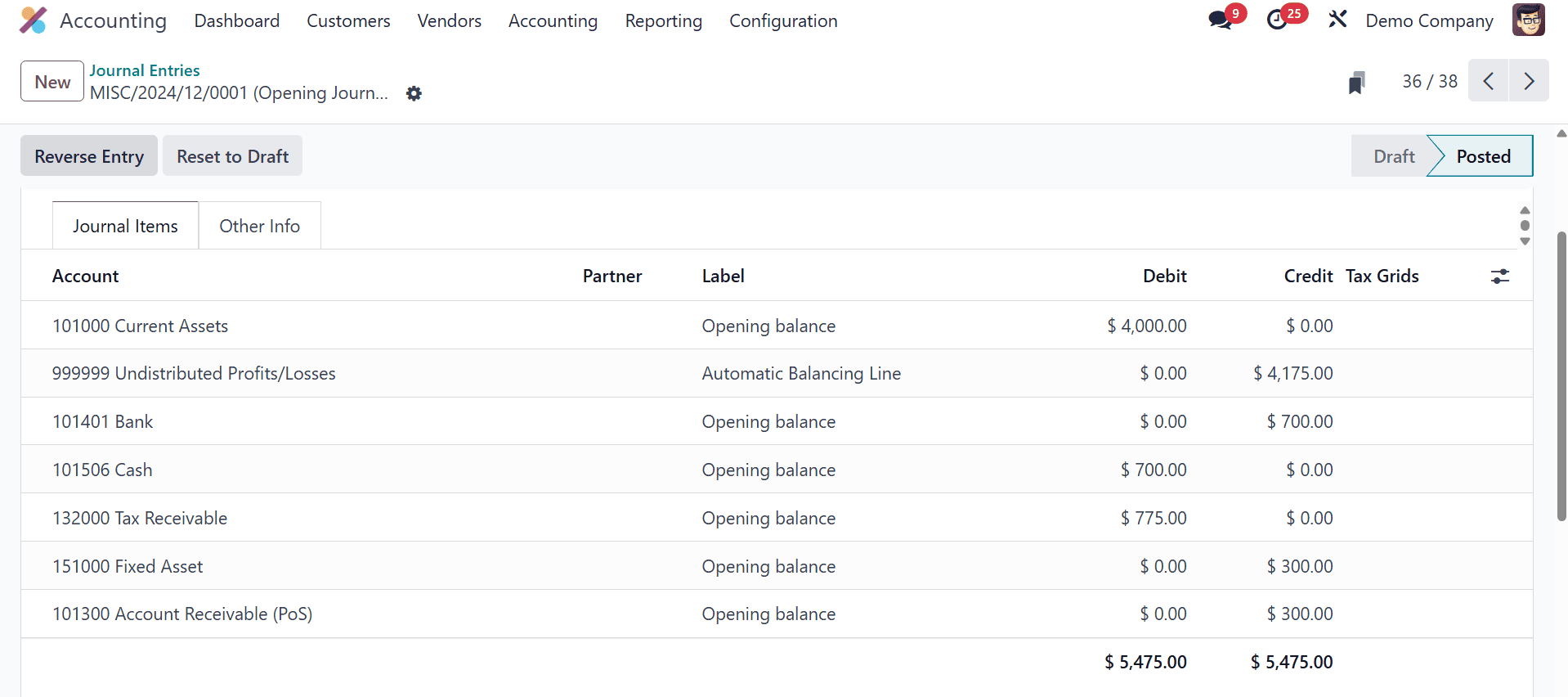

A detailed view of the newly generated journal entry, identified as "Opening Journal Entry," is presented. Examine the Journal Items added beneath this entry, ensuring that the debit and credit entries are equal.

Now, post the particular journal entry, as in the image below.

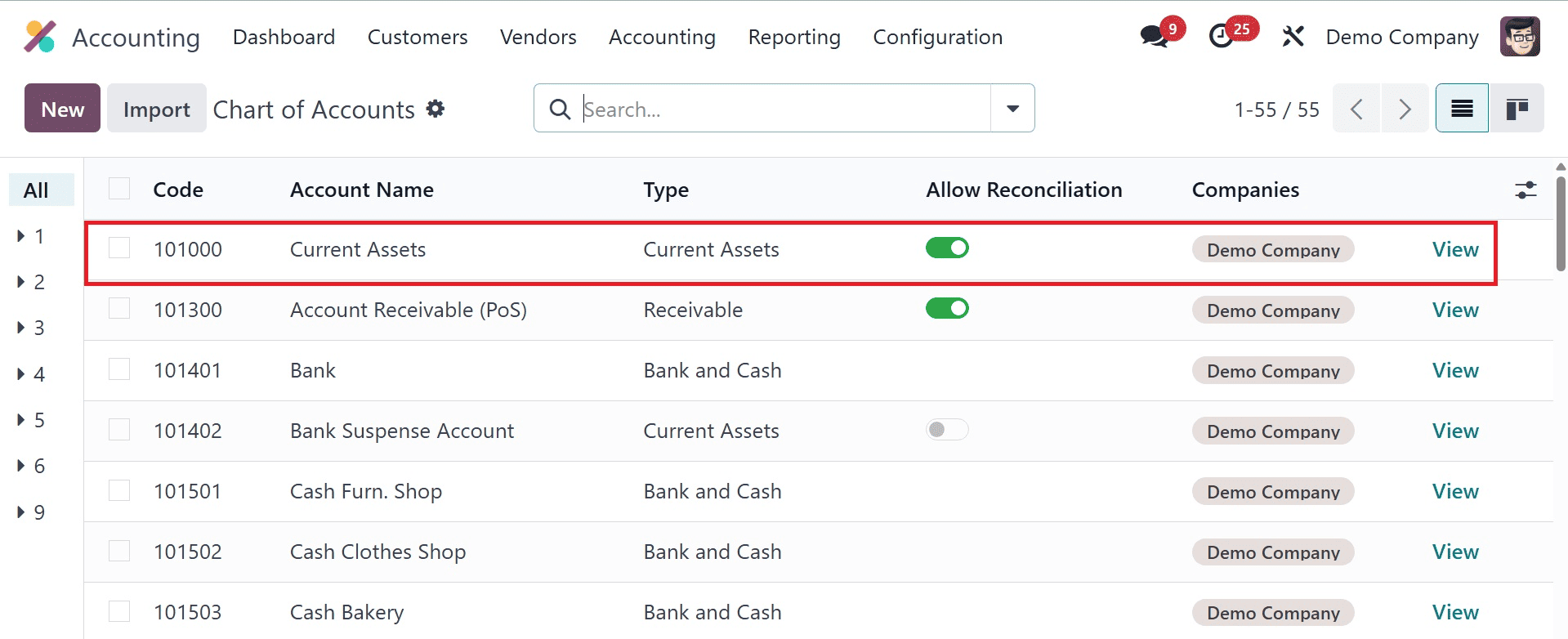

Go back to the Configuration menu and choose the Chart of Accounts option in particular.

To view the manifested opening balance, which is now clearly visible on the screen, select an account that has already been configured.

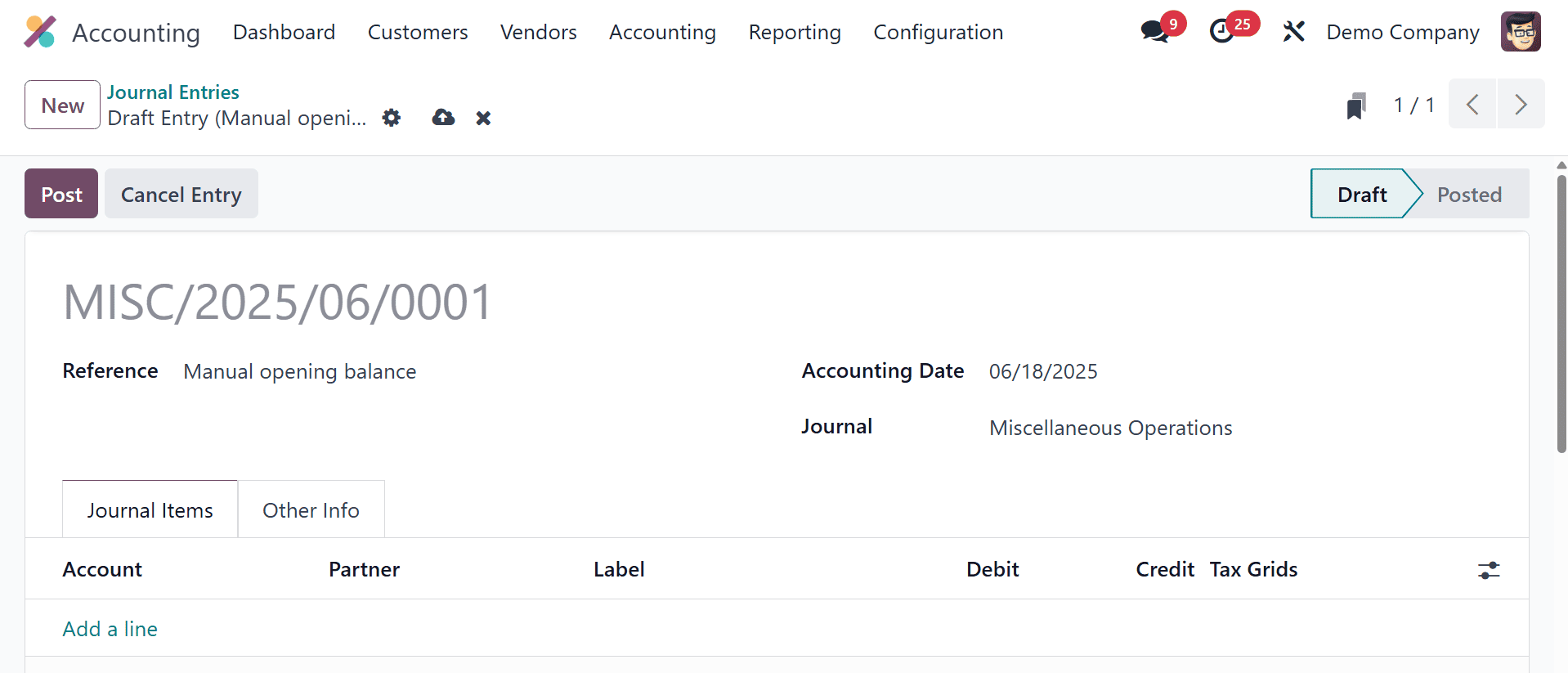

The Accounting module offers the opportunity to manually make journal entries for opening balances. Choose the Journal Entries option from the Accounting menu.

You can also create an opening balance manually if anything is missed. For that, a new form view is opened when the "New" button is clicked.

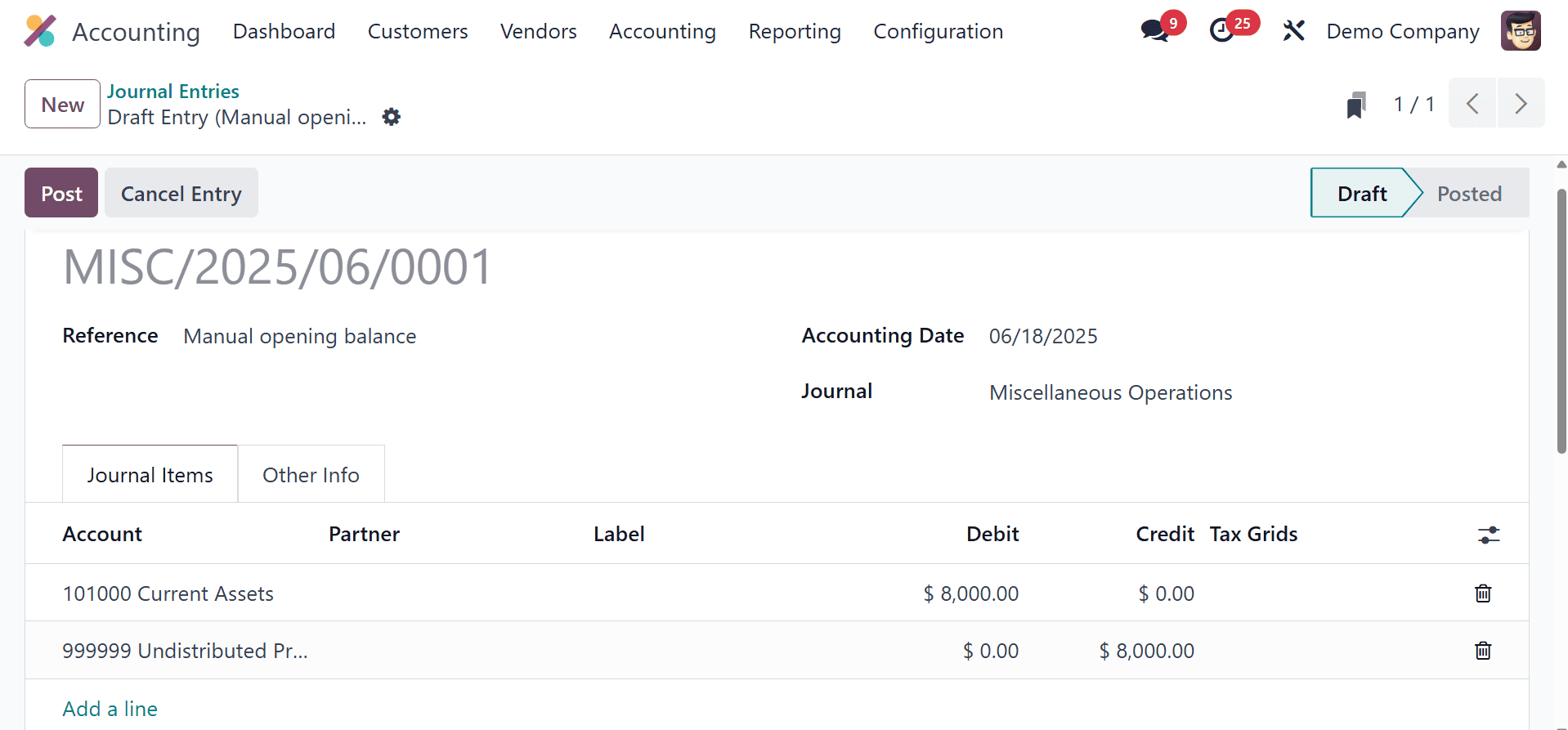

Enter the journal information and accounting date in this form, and choose "Opening Balance" as the reference. Incorporate accounts and specify opening debits or credits by clicking the "Add a Line" button. Post the journal item after making sure the credit and debit lines are always equal. Usually, opening debit and credit won't be equal. So, in order to post the unbalanced amount, it will be posted to the undistributed account with the account type ‘ Current year earnings’. Also, accounting dates need to be taken care of. The accounting date should be properly added as the opening date. Then only it will be properly reflected in the balance sheet.

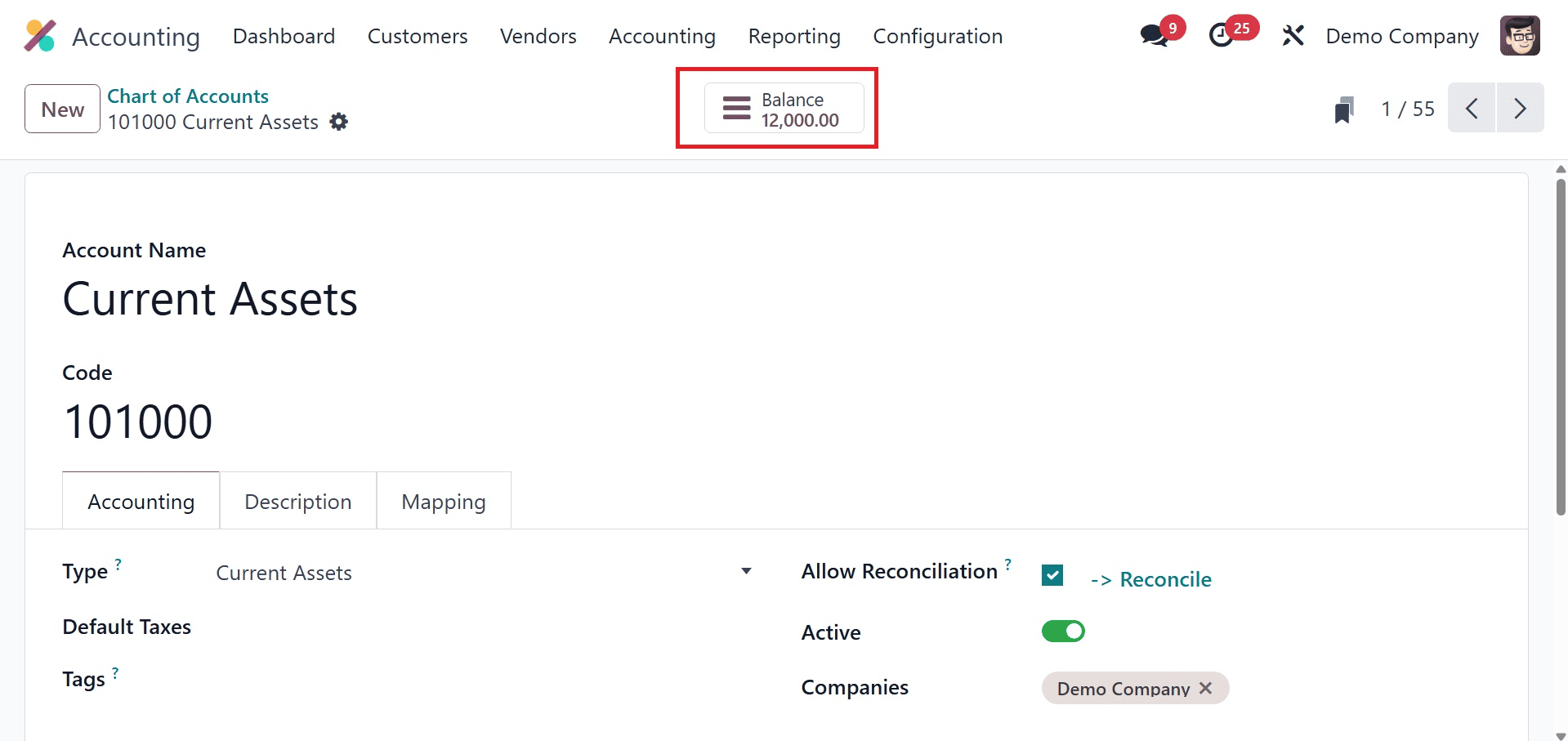

For example, think about stating that the current asset account will be debited 8000. After posting this entry, click the View button for the Current Assets account to go back to the chart of accounts and see the increased amount. Here, you can observe that the opening balance in the account "current asset" has increased from 8000 to 12000.

Setting up your financial records correctly in Odoo 18 Accounting requires adding opening balances. By doing these actions, you can make sure that Odoo accurately depicts your starting financial situation, setting the groundwork for efficient accounting and money management.

To read more about How to Add Opening Balance in Odoo 17 Accounting, refer to our blog How to Add Opening Balance in Odoo 17 Accounting.