In any business, effective financial management relies on maintaining a structured system for tracking income, expenses, assets, and liabilities. This is achieved through the use of accounts, which categorize every financial transaction the company performs. To organize these accounts systematically, businesses use a Chart of Accounts (COA). The chart of accounts provides a structured list of all the accounts used in an organization's general ledger, offering a clear framework for accurately recording and reporting financial information.

In Odoo, the accounting module comes with a default chart of accounts tailored to different countries or industries. This default setup includes the most commonly used account types, such as income, expenses, receivables, payables, and bank accounts, enabling companies to kickstart their accounting processes efficiently. As the business evolves, users can customize the COA by adding new accounts or modifying existing ones to suit their specific operational needs. Odoo's flexible and modular approach ensures that businesses can scale their accounting structure without disrupting their financial workflows. Odoo's open-source and modular design ensures that financial management remains adaptable, scalable, and efficient, regardless of the size or complexity of the business.

This blog provides a step-by-step guide on configuring default accounts in Odoo 18 Accounting to streamline various financial operations. Configuring default accounts is a crucial step in setting up Odoo Accounting. These accounts are assigned to automate various financial processes, such as tax postings, inventory valuation, or customer and vendor transactions. You can manage and configure these accounts through the Chart of Accounts section under the Configuration menu in the Accounting module.

Chart of Accounts

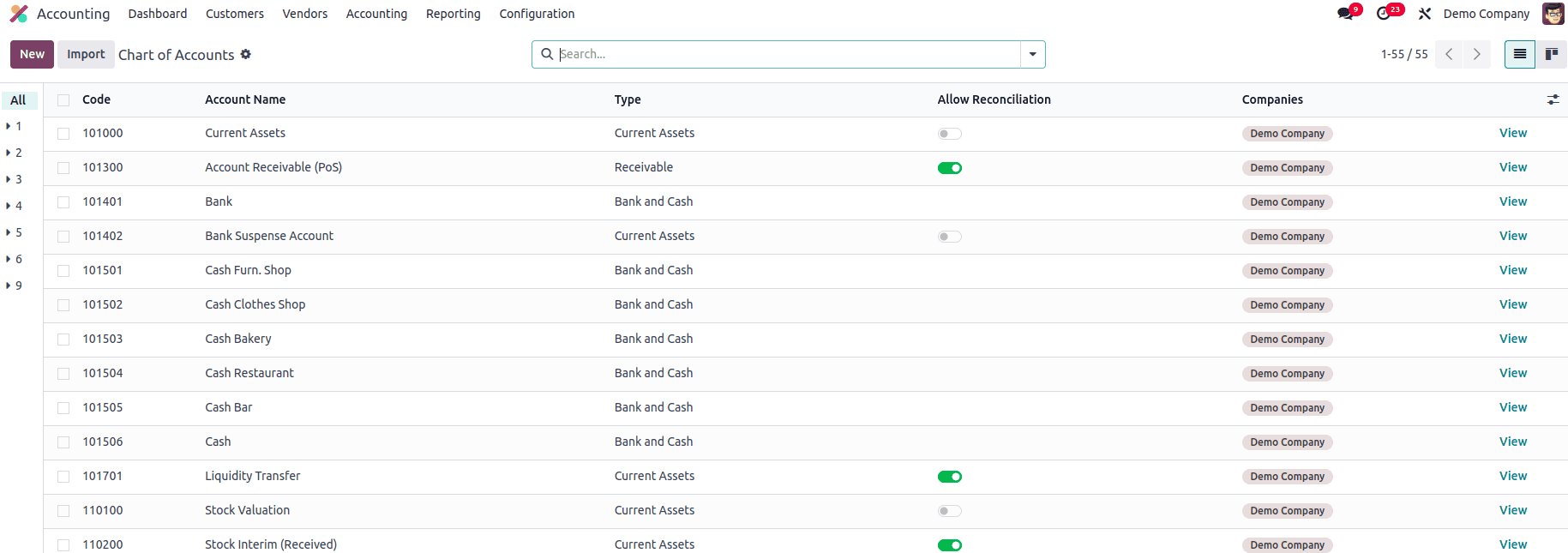

To access the list of available accounts in Odoo 18, navigate to the Chart of Accounts option under the Configuration menu in the Accounting module. This section displays all accounts currently used in the company’s general ledger to record various financial transactions, such as income, expenses, assets, and liabilities. These accounts form the foundation of the organization’s financial reporting. Odoo allows you to edit existing accounts or create new ones directly from this interface, giving you the flexibility to adapt the chart based on your operational and reporting needs.

In the Chart of Accounts list view, you’ll find key details such as Code, Account Name, Type, Allow Reconciliation, and Company. Each of these fields provides important information about how the account functions within the financial system. The Type field plays a crucial role in financial reporting and year-end processes. It helps Odoo generate country-specific legal reports, define fiscal year closing rules, and create opening entries for the new financial year. Enabling the Allow Reconciliation option allows the account to match journal entries with related invoices or payments, which is essential for tracking outstanding balances and ensuring accurate reconciliation.

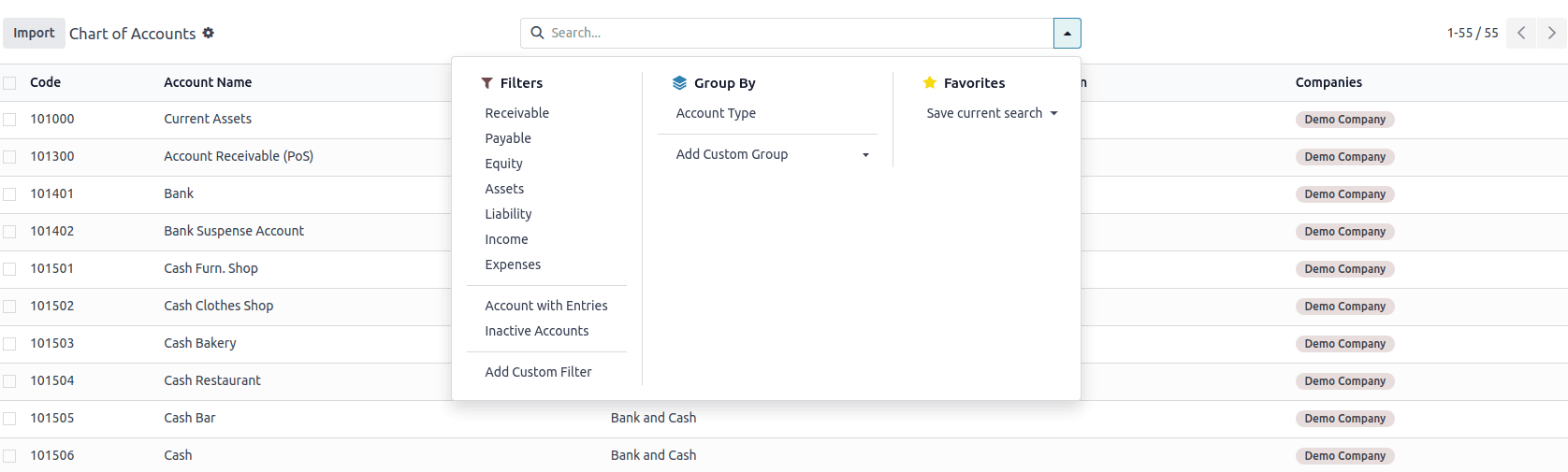

Odoo 18 provides several default filters in the Chart of Accounts view to help you quickly navigate and analyze your accounts. These include Receivable, Payable, Equity, Assets, Liability, Income, Expenses, Accounts with Entries, and Inactive Accounts. You can also group accounts based on their Account Type to get a more structured overview. For additional customization, Odoo offers Add Custom Filter and Add Custom Group options, allowing you to tailor the view according to your specific reporting and analysis needs.

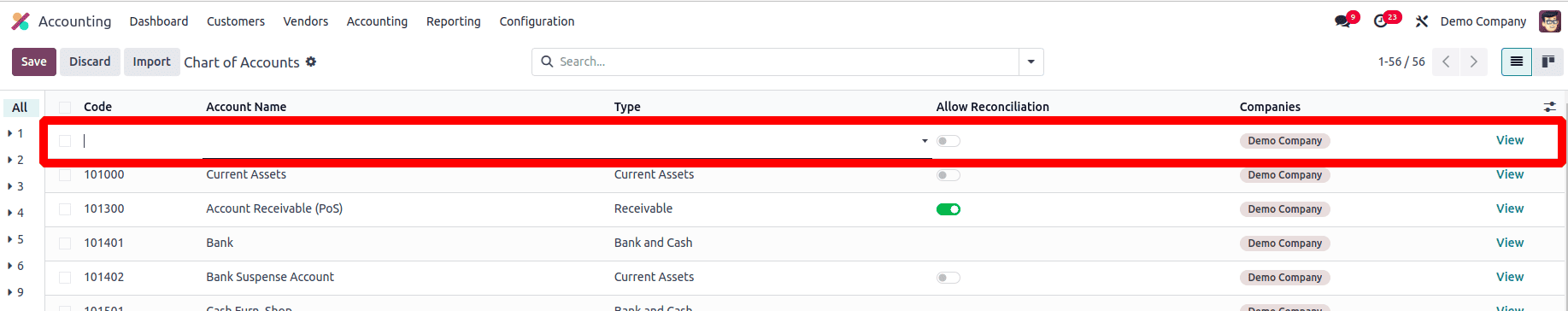

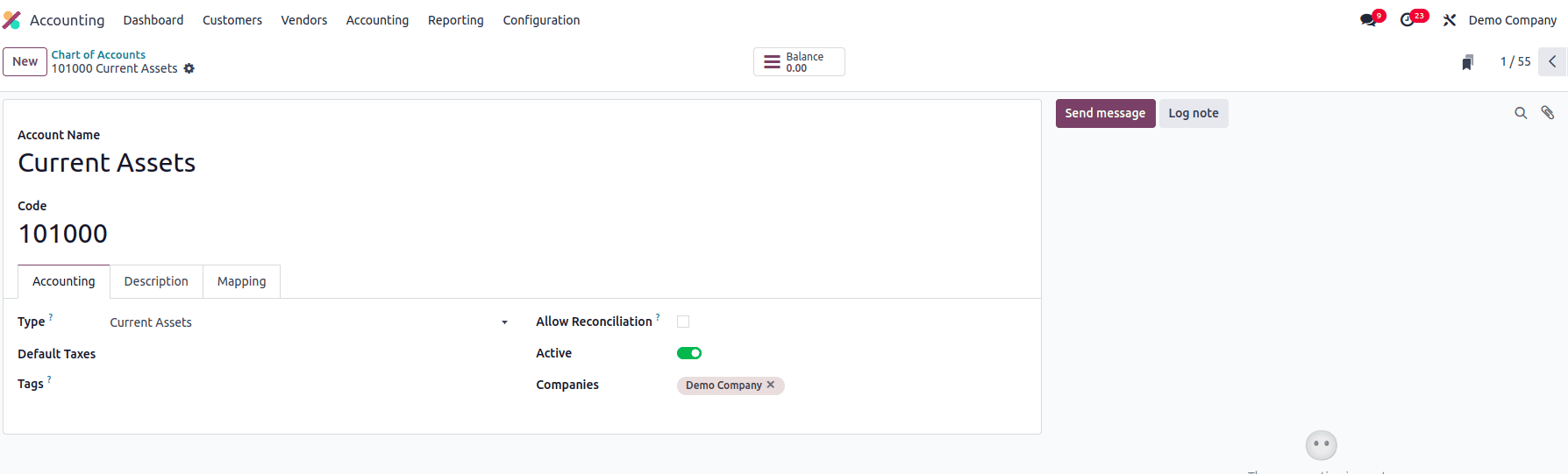

To add a new account to the Chart of Accounts in Odoo 18, click the ‘New’ button. This action will generate a new line in the list where you can enter the account details. You’ll need to fill in fields such as Code, Account Name, Type, and Company. If you need to modify the details of an existing account, you can use the ‘View’ button to access and update the account configuration.

The Balance smart button provides a quick view of the account’s debit and credit balances. You can enhance reporting by adding Tags in the designated field, which are useful for generating custom reports based on specific criteria. This completes the process of creating a new account within the Chart of Accounts in Odoo 18.

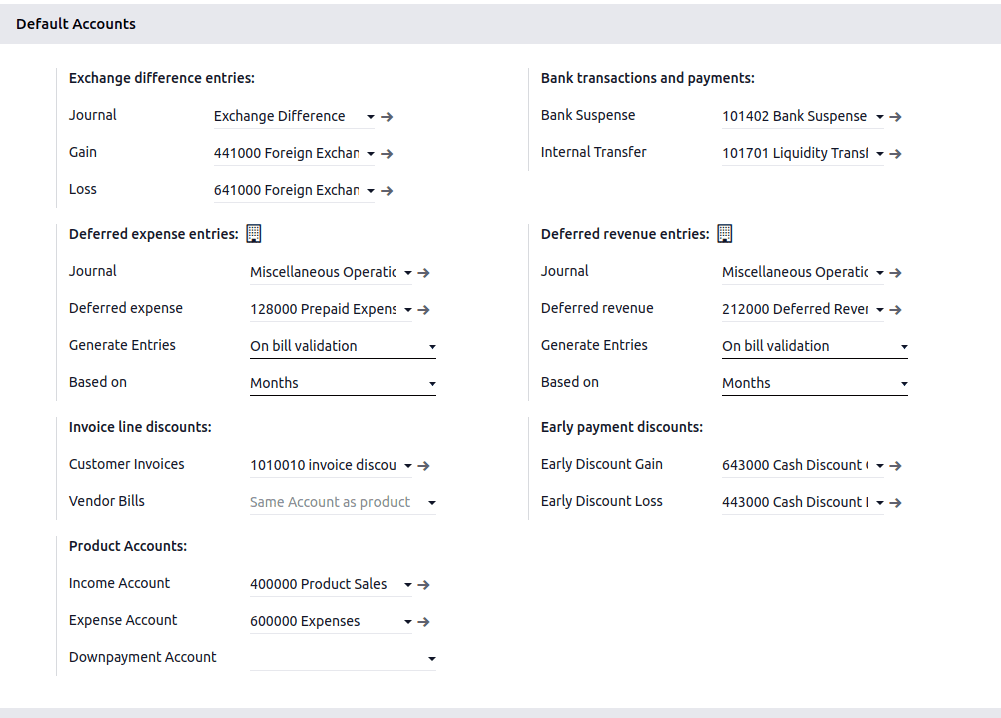

Default Accounts

After configuring the essential accounts needed for your accounting operations, you can proceed to assign default accounts for specific financial processes. To do this, navigate to the Settings menu within the Accounting module. Under this section, you’ll find a dedicated tab labeled Default Accounts, where you can specify which accounts should be automatically used for various accounting functions such as customer invoices, vendor bills, tax entries, and more.

Exchange Difference Entries

* Journal: The journal where exchange difference entries are posted.

* Gain: When you receive more money due to favorable exchange rate changes.

* Loss: When you lose money due to exchange rate changes.

Bank Transactions and Payments

* Bank Suspense Accounts: Temporary holding account for unmatched or unidentified bank transactions. During bank reconciliation, if a * transaction can't yet be matched to a customer invoice or vendor bill, it is posted here.

* Internal Transfer: Used during fund transfers between two of your company’s bank accounts. Acts as an intermediate step, ensuring both sides of the transfer are recorded correctly.

Deferred Revenue Entries

* Journal: The journal is used to post the deferred revenue entries. You can customize or use a dedicated "Deferred Revenue Journal" instead for cleaner tracking.

* Deferred Revenue: Temporarily holds customer payments received in advance before revenue is earned. Revenue is recognized over time rather than immediately.

* Generate Entries: Creates a deferred revenue schedule when the invoice is validated.

* Based on: The deferral amount will be divided evenly across months. It can also be based on days, etc

Deferred Expense Entries

* Journal: Used to record deferred expense entries (could be customized to “Deferred Expense Journal”).

* Deferred Expense: Temporarily holds prepaid expenses that benefit future periods.

* Generate Entries: Starts the deferred expense schedule when the vendor bill is validated.

Early Payment Discounts

* Early Discount Gain: Recognizes income when you save money by paying a vendor early.

* Early Discount Loss: Recognizes the cost of offering early payment discounts to customers.

Product Accounts

* Income Account: Default sales revenue account.

* Expense Account: Default expense/cost account for purchased products.

* Downpayment Account: If down payments are used in sales, this account holds the advance received.

Invoice Line Discounts

* Customer Invoices: The discount given is posted to the same income account as the product being sold.

* Vendor Bills: Same as above, but for purchases. A discount reduces the value in the product's expense account.

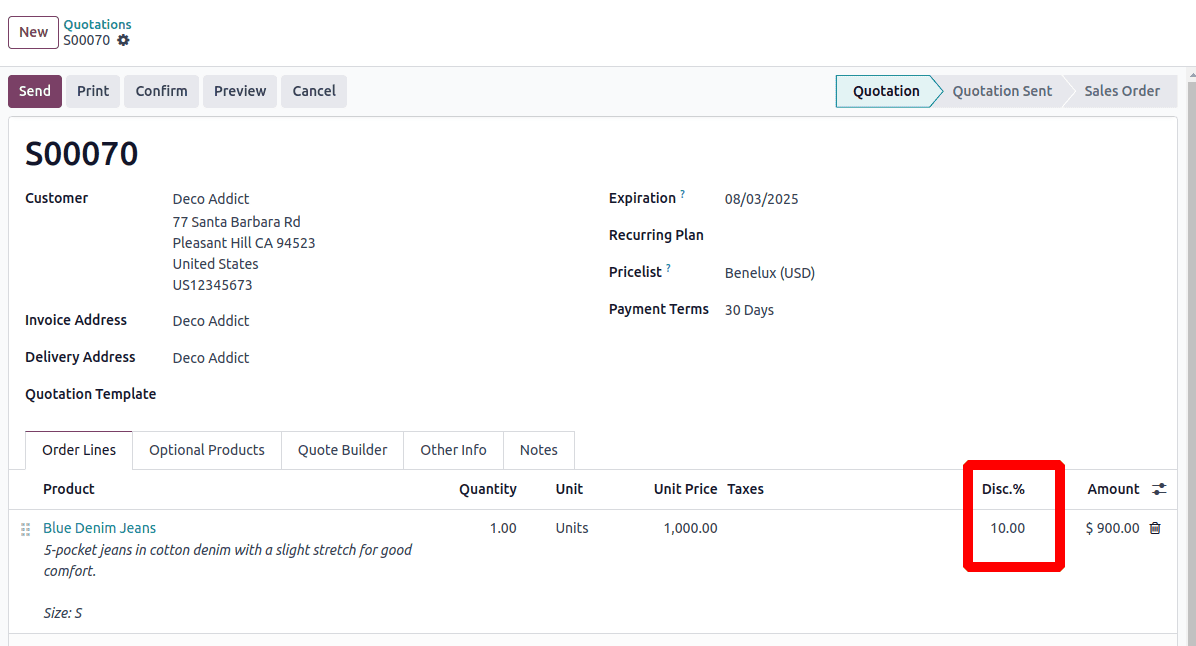

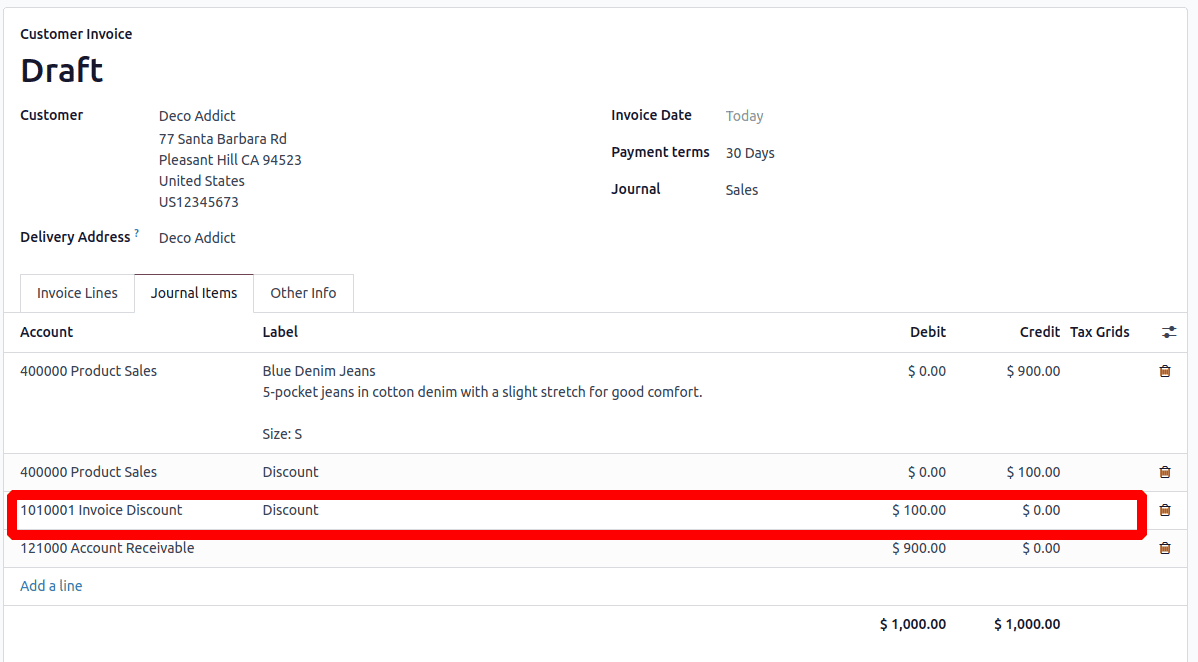

Example: When a discount is applied directly on the invoice line (not as a global discount), the discount amount is posted to a specific account, in this case, Invoice Discount.

In this quotation, I gave a 10% discount.

When I create an invoice from this order, the discount amount will be posted to the Invoice Discount account.

Understanding and configuring the default accounts in Odoo 18 is essential for accurate and automated financial management. These accounts ensure that every transaction, whether it's a sale, purchase, bank transfer, discount, or deferred entry, is properly recorded without manual intervention. By mapping the correct accounts for income, expenses, transfers, discounts, and deferrals, businesses can streamline bookkeeping, enhance reporting accuracy, and stay compliant with accounting standards. Proper use of these defaults not only reduces errors but also provides clearer financial insights, helping companies make informed decisions with confidence.

To read more about How to Manage Applications of Default Accounts in Odoo 17 Accounting, refer to our blog How to Manage Applications of Default Accounts in Odoo 17 Accounting.