You can calculate a product's total cost using Odoo 18's landed costs function, which accounts for not only the product's purchase price but also any extra charges for shipping, customs duties, insurance, and other fees associated with transporting the items to their destination. These extra fees are added to the product's real cost to determine the selling price. Landed costs are calculated using a variety of techniques, depending on the policies of each company. In order to alter the product's selling price in the inventory module, landed costs can be calculated and allocated to each unit. By monitoring their landing costs, businesses can make sure they are pricing their products correctly and not losing money on each transaction.

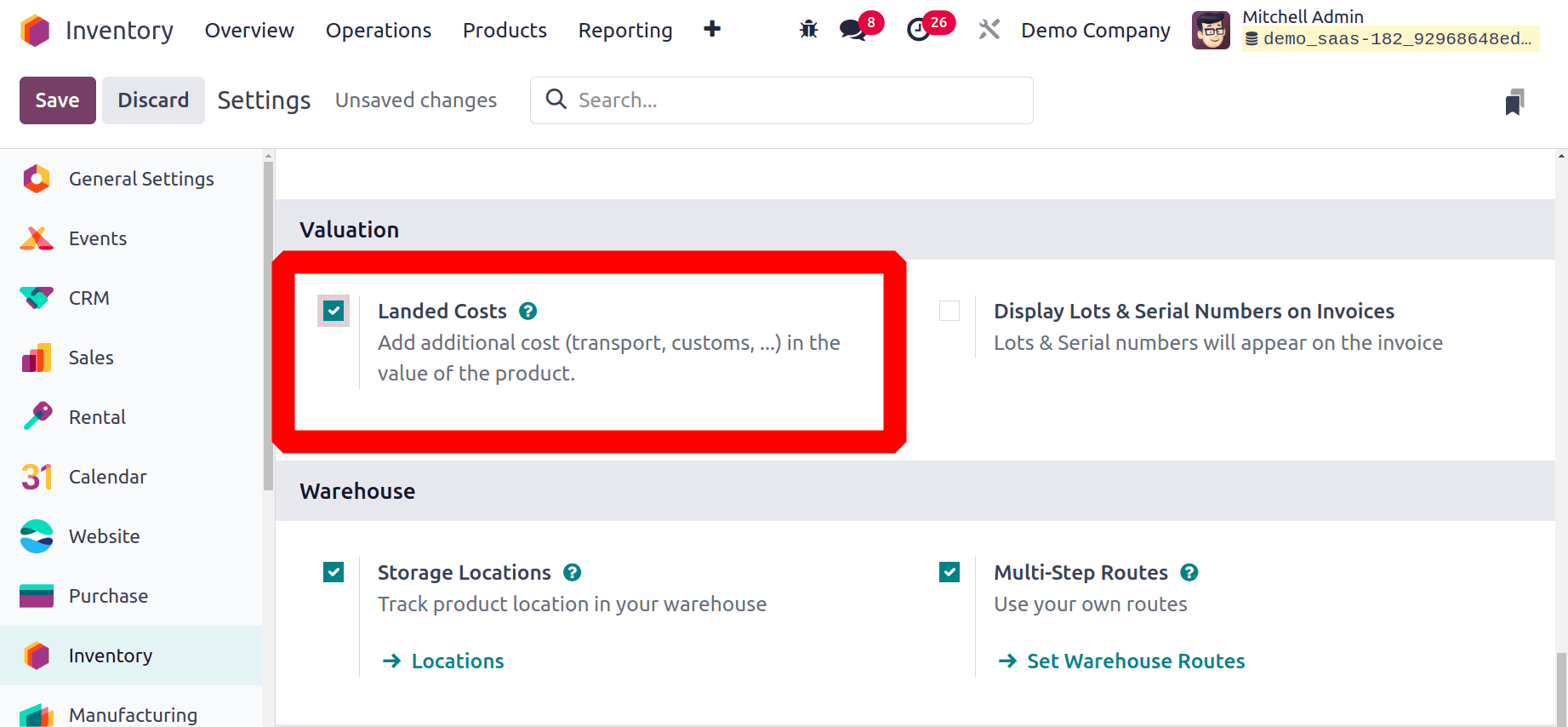

Go to the inventory settings' valuation section and turn on the landed cost option to take advantage of it.

Enabling this option will allow you to apply customized landing costs to your products. It should be mentioned that only items with automated inventory valuation and an AVCO or FIFO costing method selected can have landing costs defined. Let's discuss each method separately in this blog.

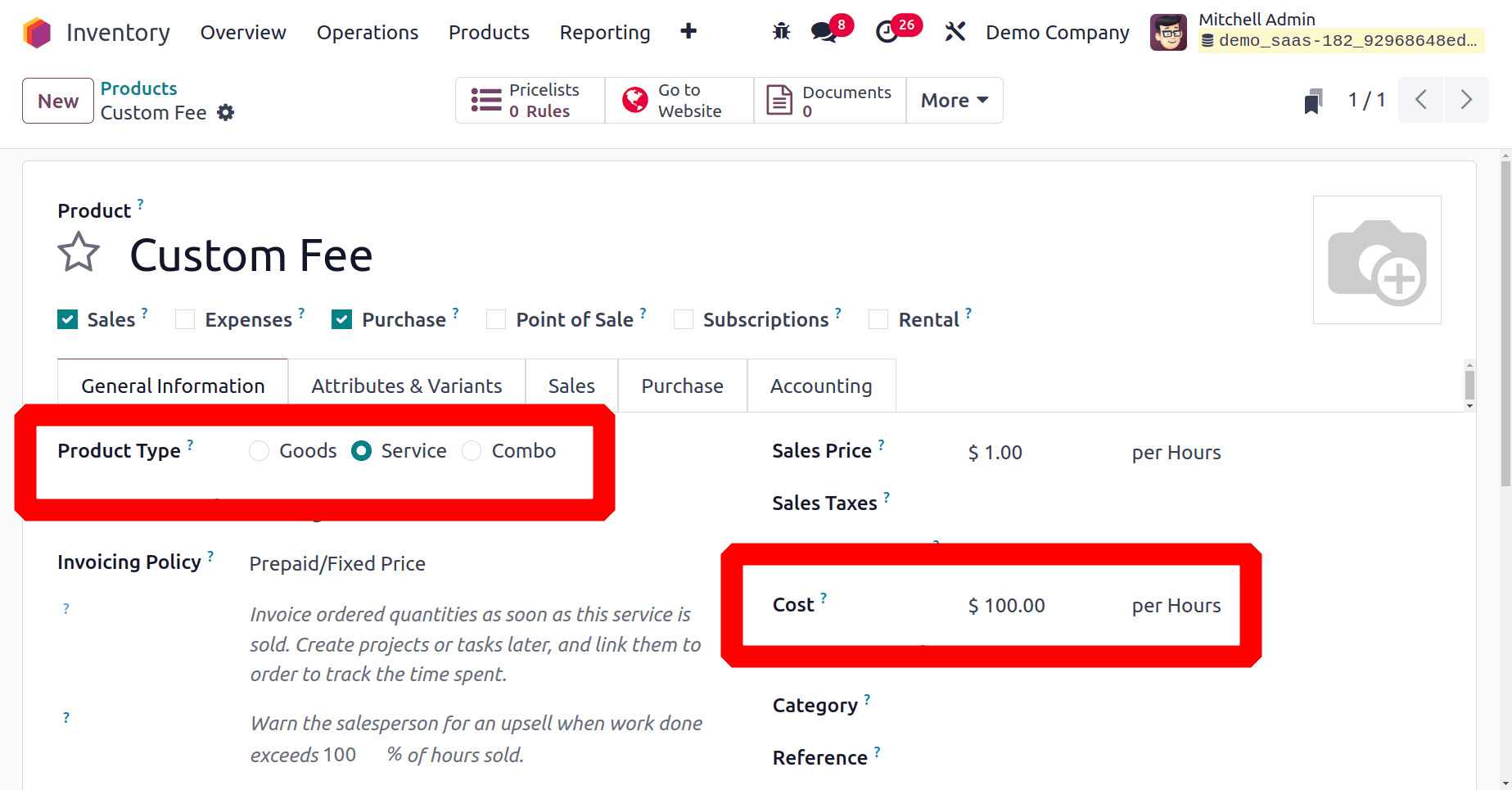

Therefore, we can start by creating a product as a landed cost using the service product type.

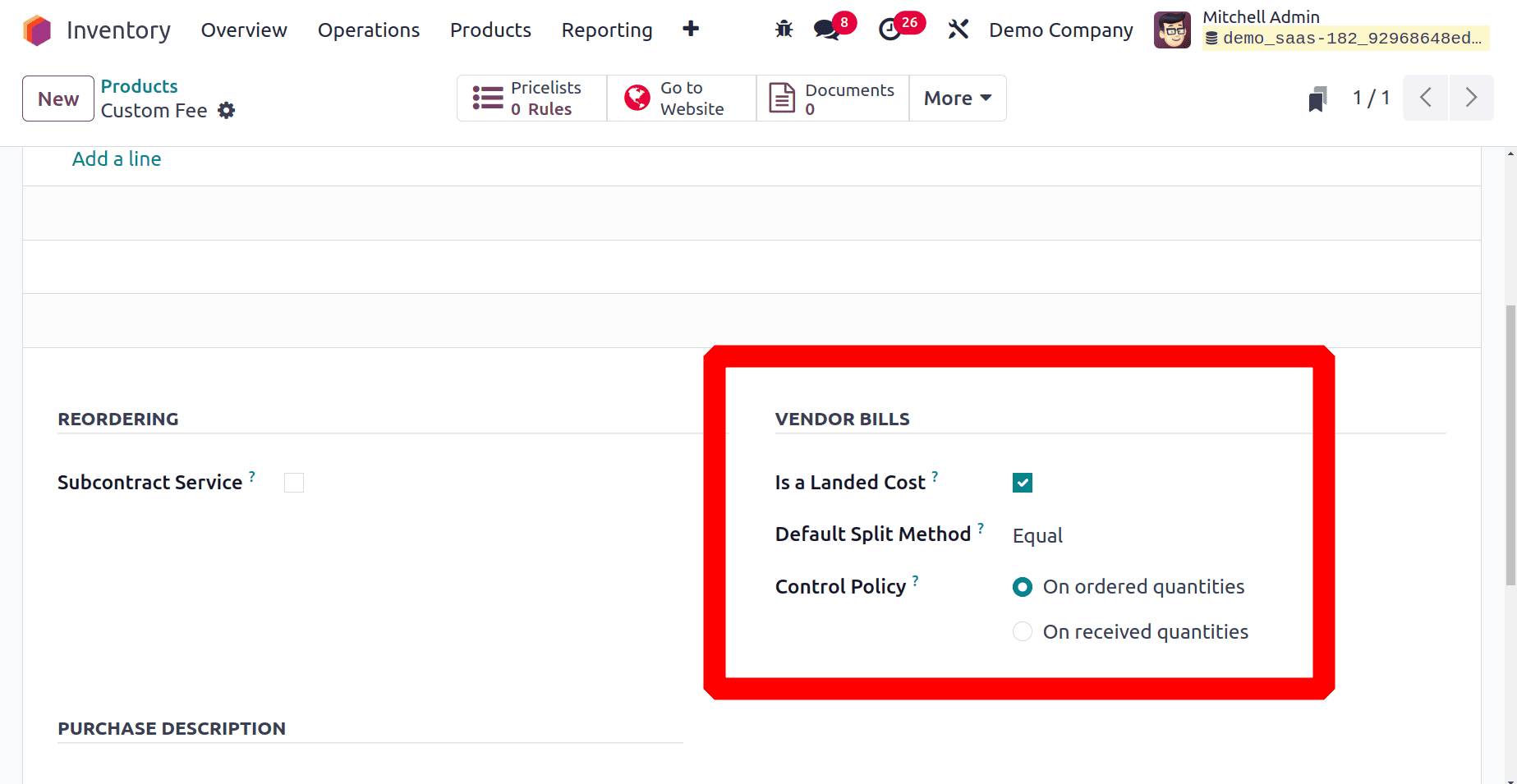

Additionally, you can set up this service product as a landed cost from the purchasing tab.

Also, you have the option to split the landed cost by default. The various splitting methods are as follows: equal, by quantity, by current cost, by weight, and by volume. When confirming the landed cost, you can also alter the split mechanism.

* Equal: All of the products in the transfer receipt receive an equal share of the landing cost using this method.

* By Quantity: According to the quantity of each good listed on the transfer receipt, this method divides the landing cost.

* By Current Cost: According to the current price of each good shown on the transfer receipt, this method divides the landed cost.

* By Weight: According to the weight of each commodity shown on the transfer receipt, this method divides the landing cost.

* By Volume: The volume of each product in the transfer receipt determines how the landing cost is divided using this method.

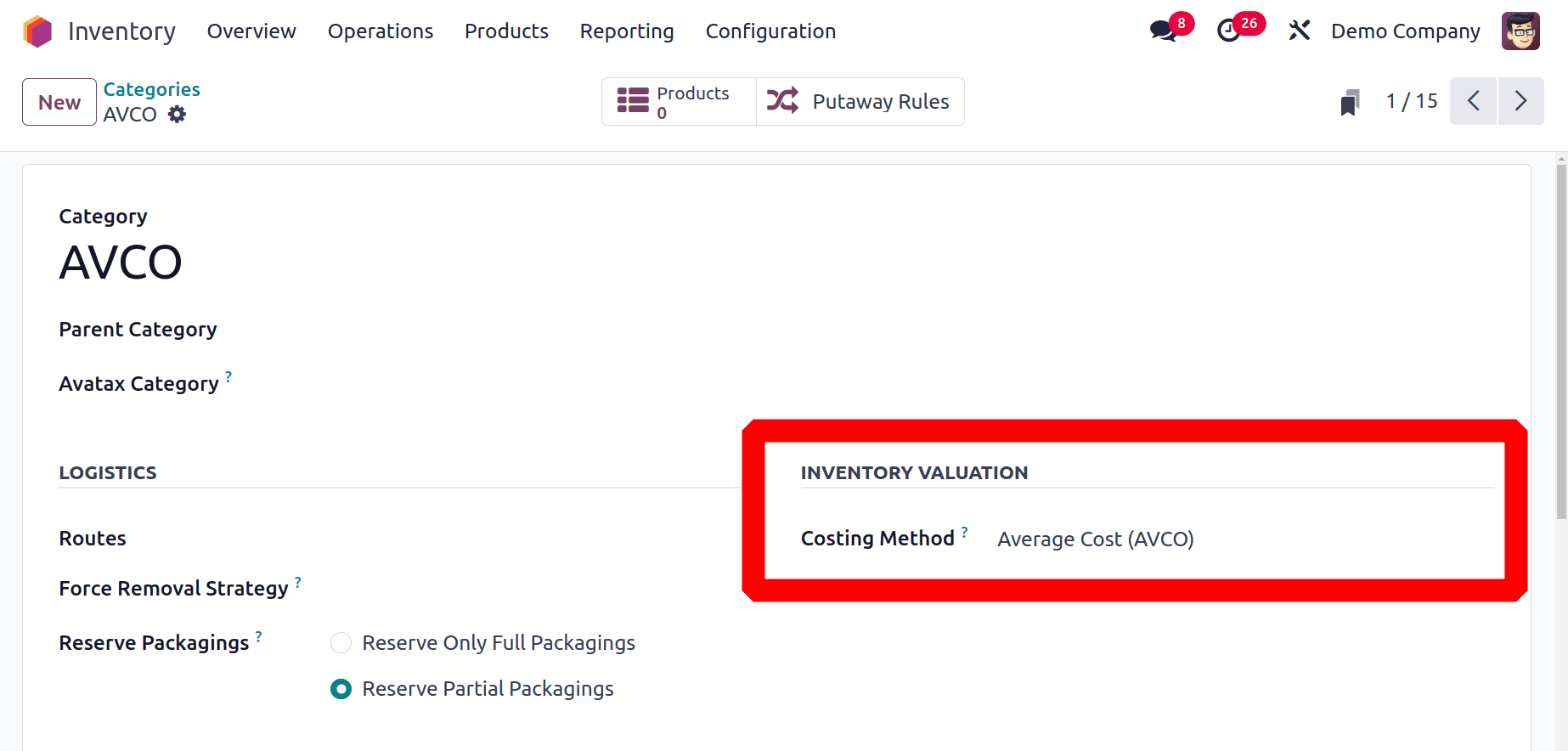

Landed cost on Average Costing Method

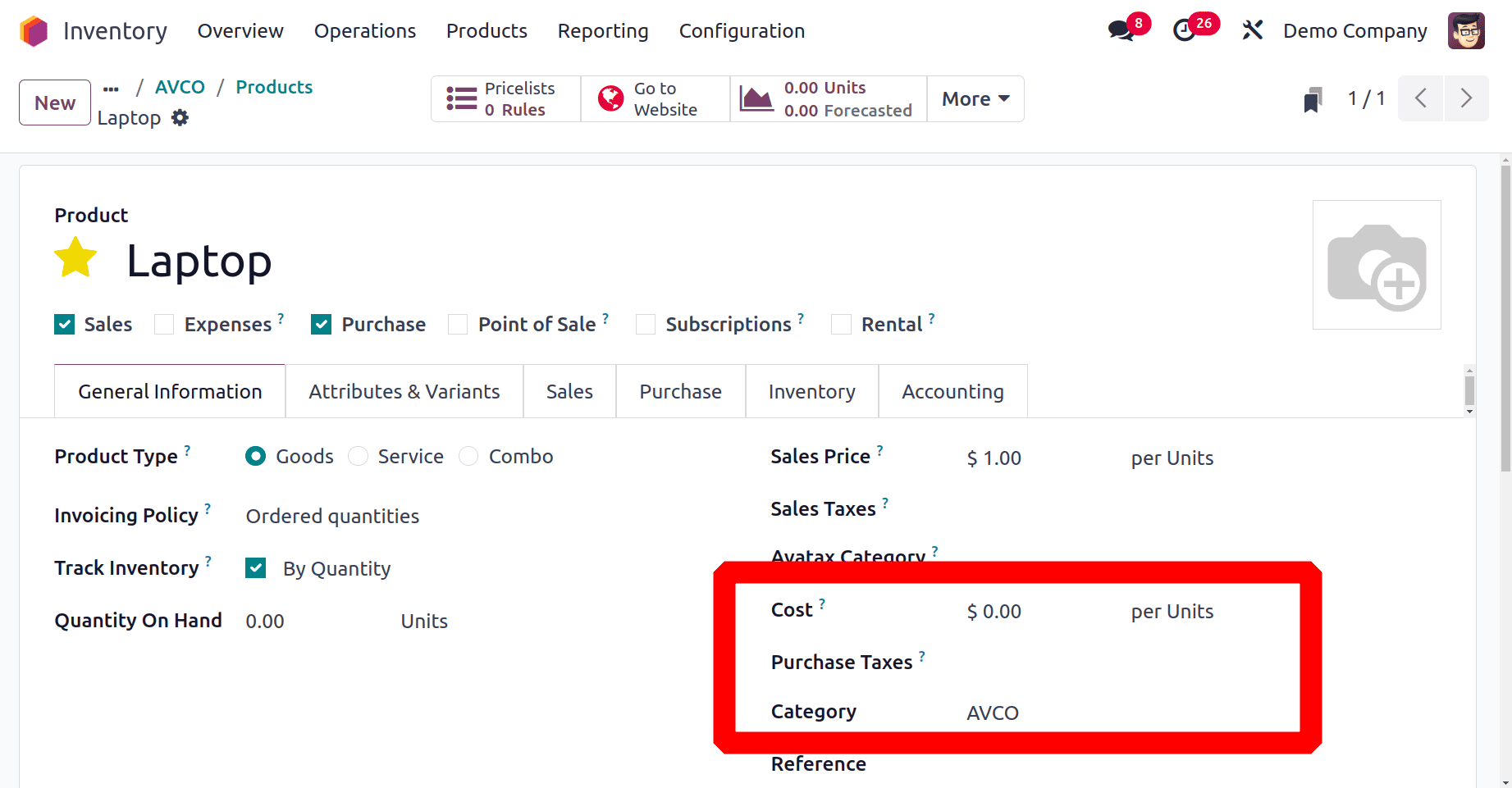

So let's check how the landed cost is added to the product when the costing method is the Average costing method. For that, set the Costing method as Average costing inside the product Categories. The cost of goods sold (COGS) is determined by averaging the costs of all available inventory units using the average cost (AVCO) technique of inventory valuation.

Then create a new product under this Category. Here, the product is a Laptop. No cost is added to the product.

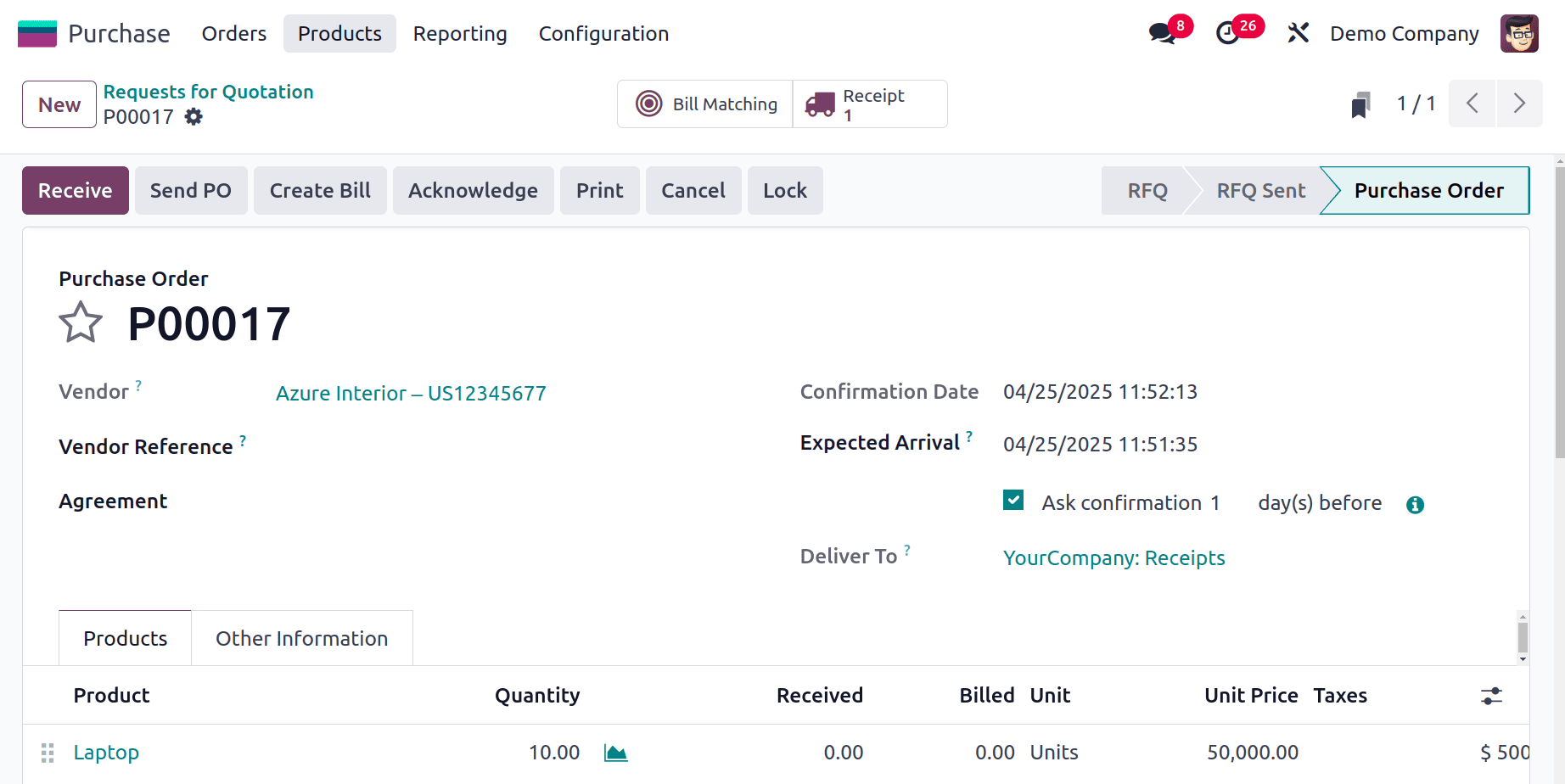

Once these have been set up, you can draft a purchase order that includes any extra fees. As you can see, a request for proposals (RFQ) has been made for ten laptops, each costing $50,000. Once this RFQ has been verified as a purchase order, validate the receipt for it.

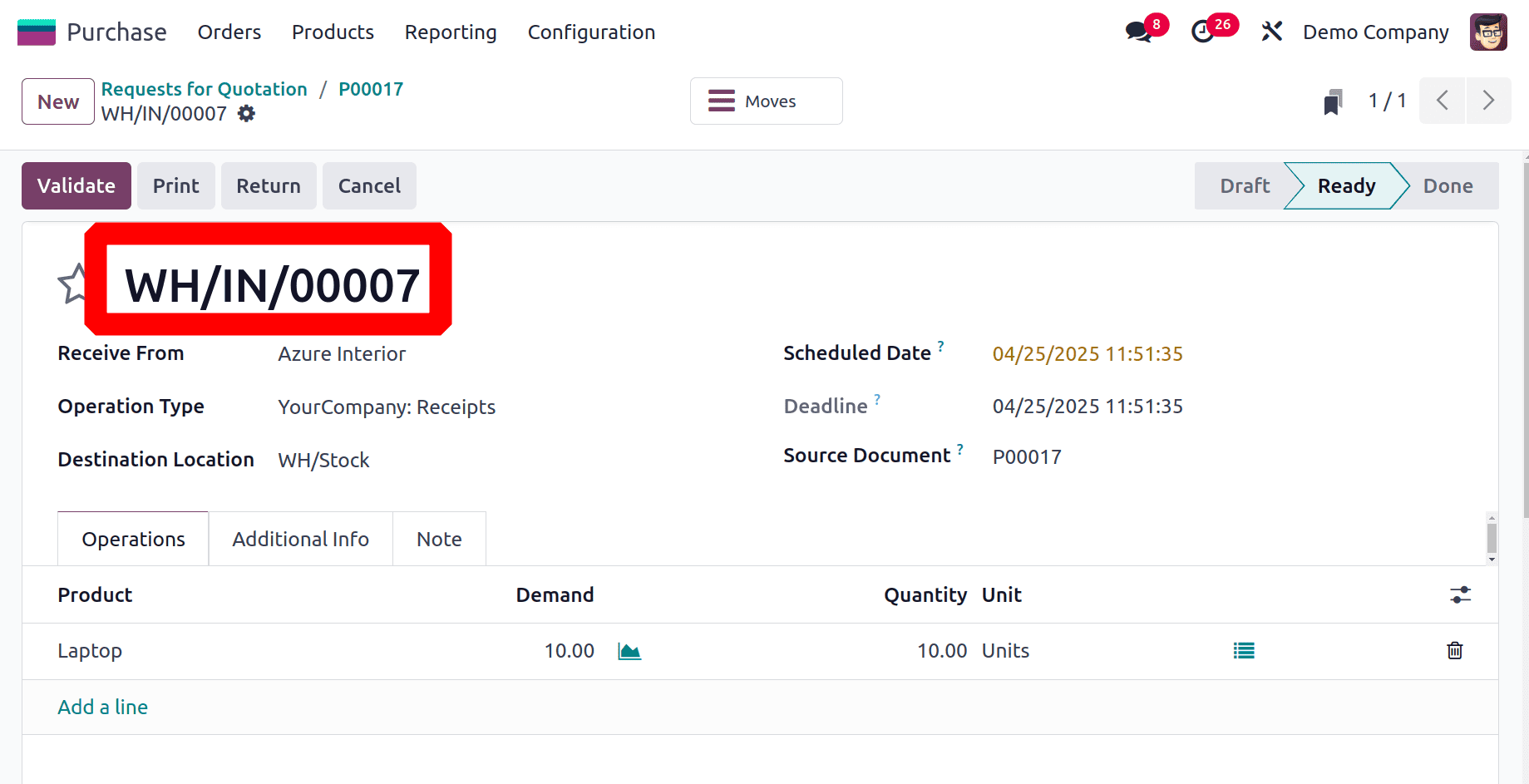

As you can see, the seller is sending the product to you. Remember to take note of the transfer reference number. The extra fee must be applied to this specific transfer.

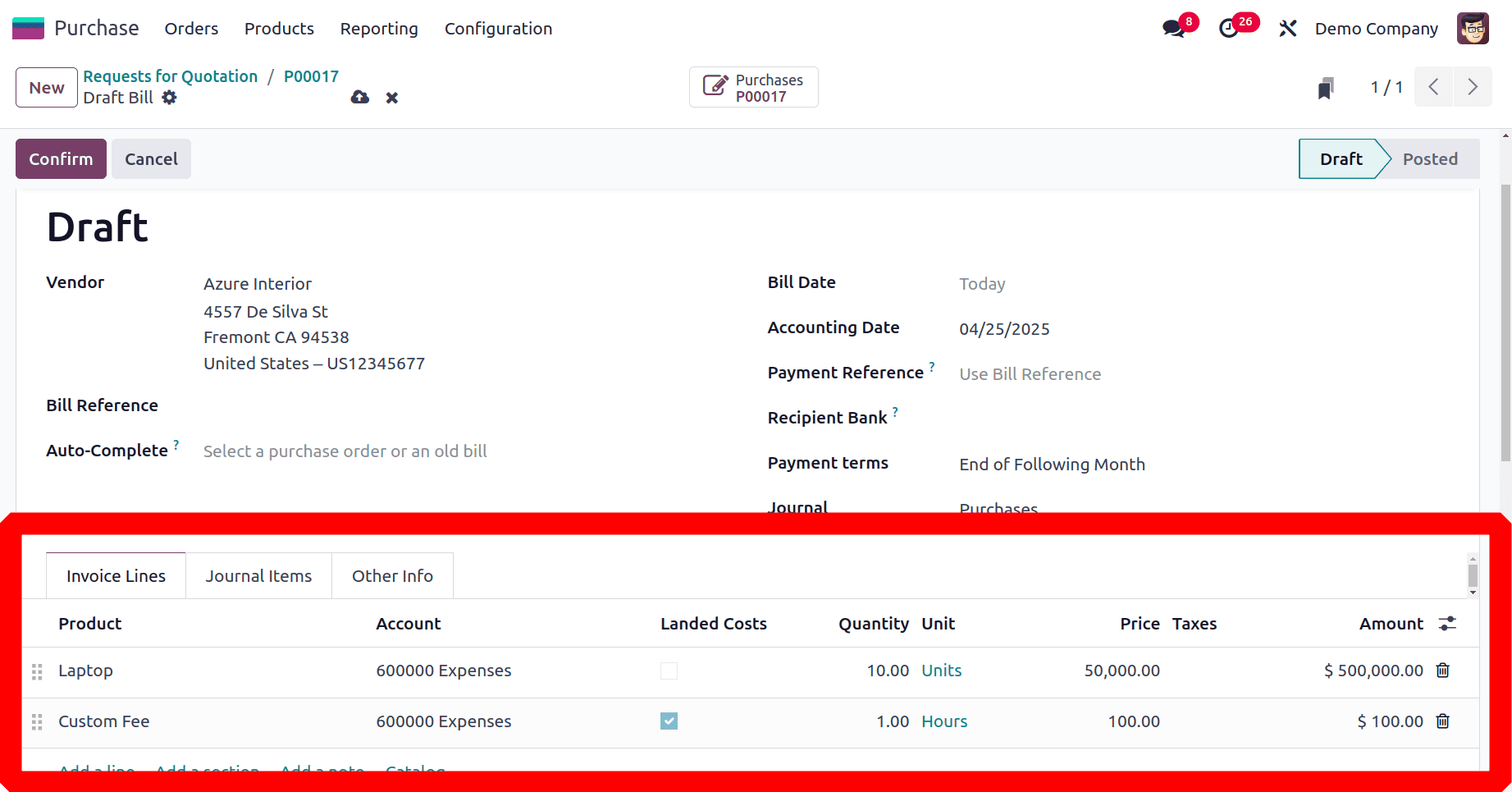

You can therefore include the landing cost associated with your product transfer in the draft bill.

As you can see, the additional product port fee is immediately included in the landing cost. After that, confirm that this draft law will proceed.

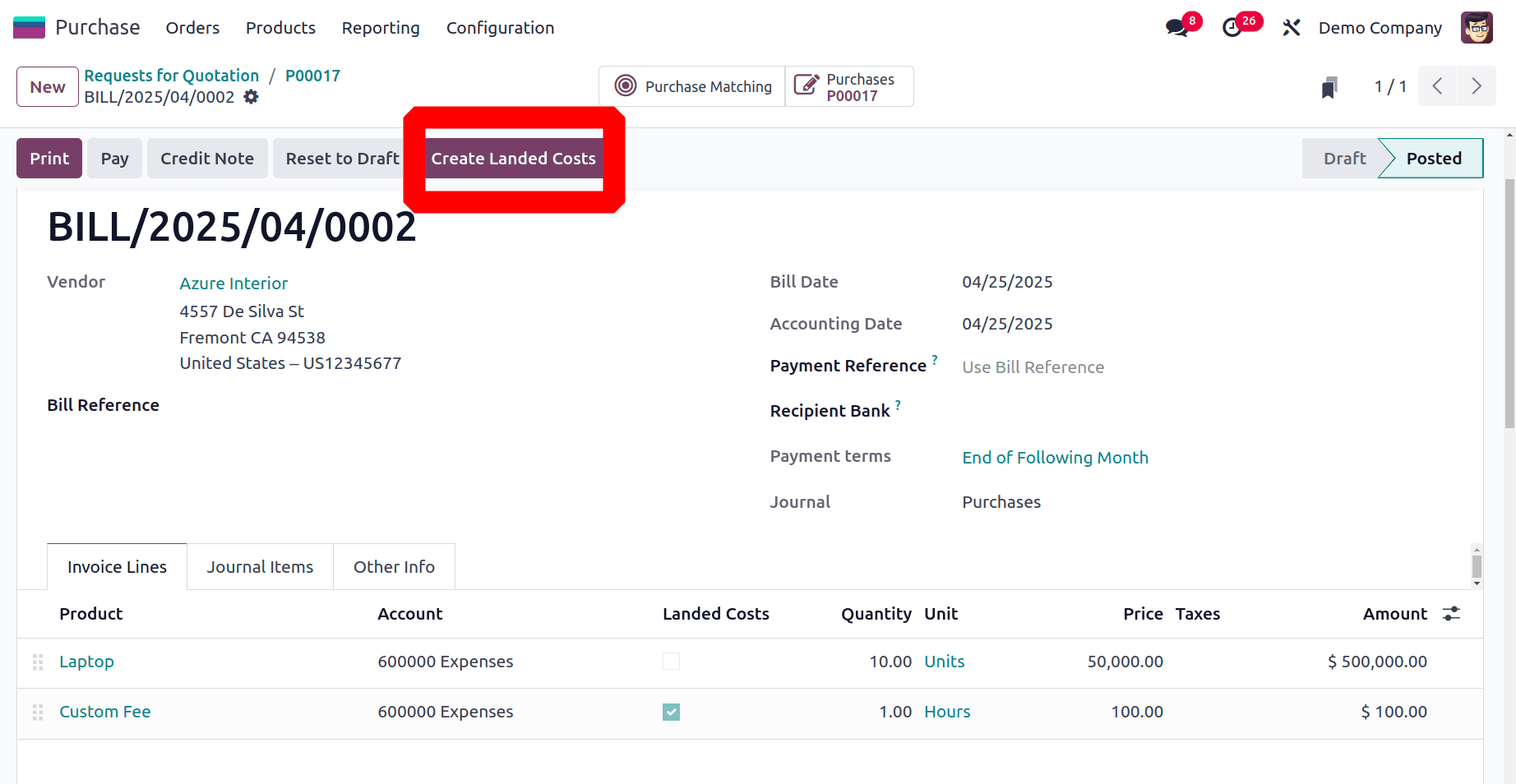

By selecting the "Create landed cost" button, you may configure the landed cost.

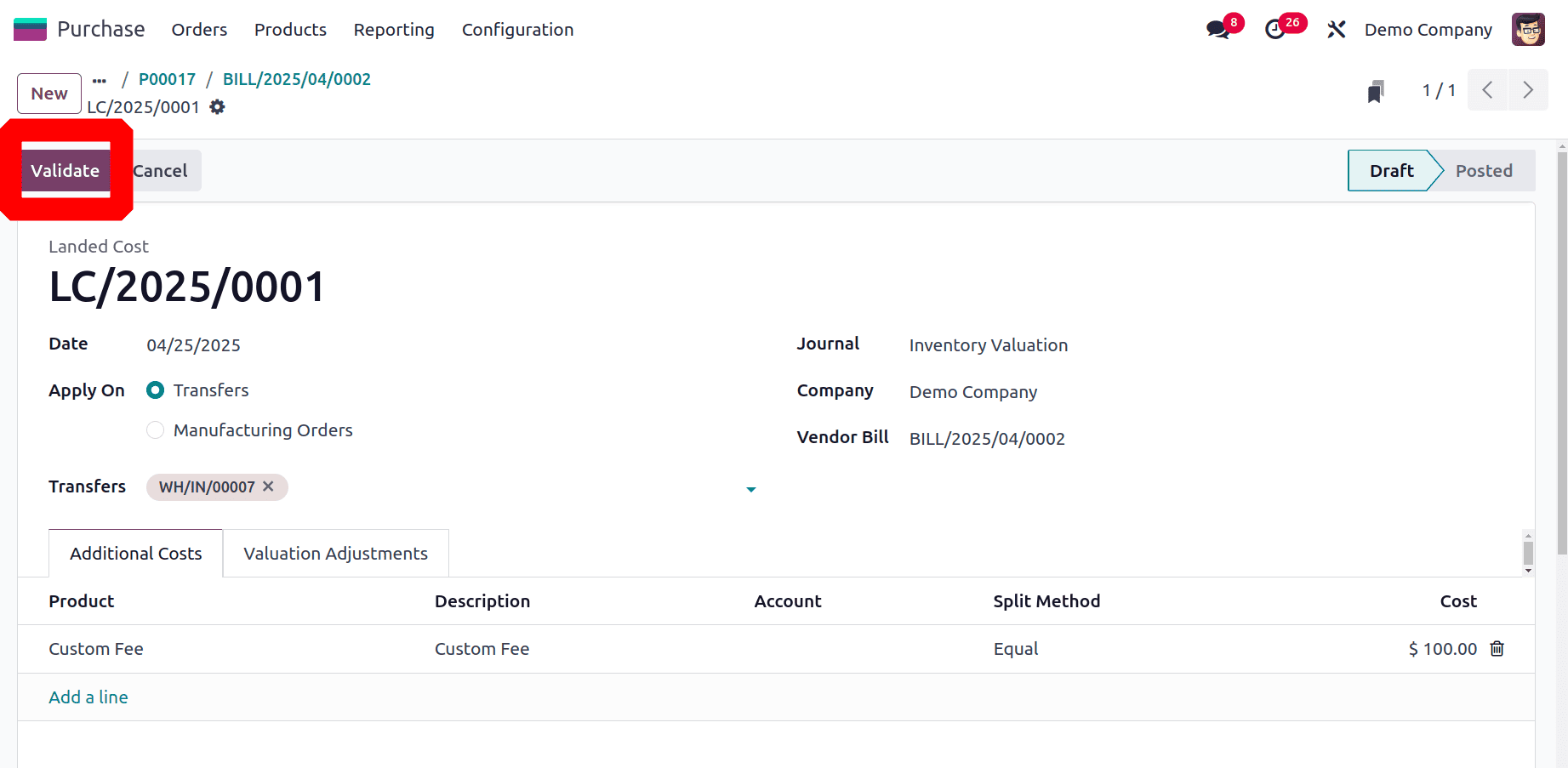

Clicking the create landed cost button will take you to the landed cost page. The transfer reference number that we used to receive the merchandise is available for you to select from here. Click the Validate button to get the product's pricing with the extra charge included.

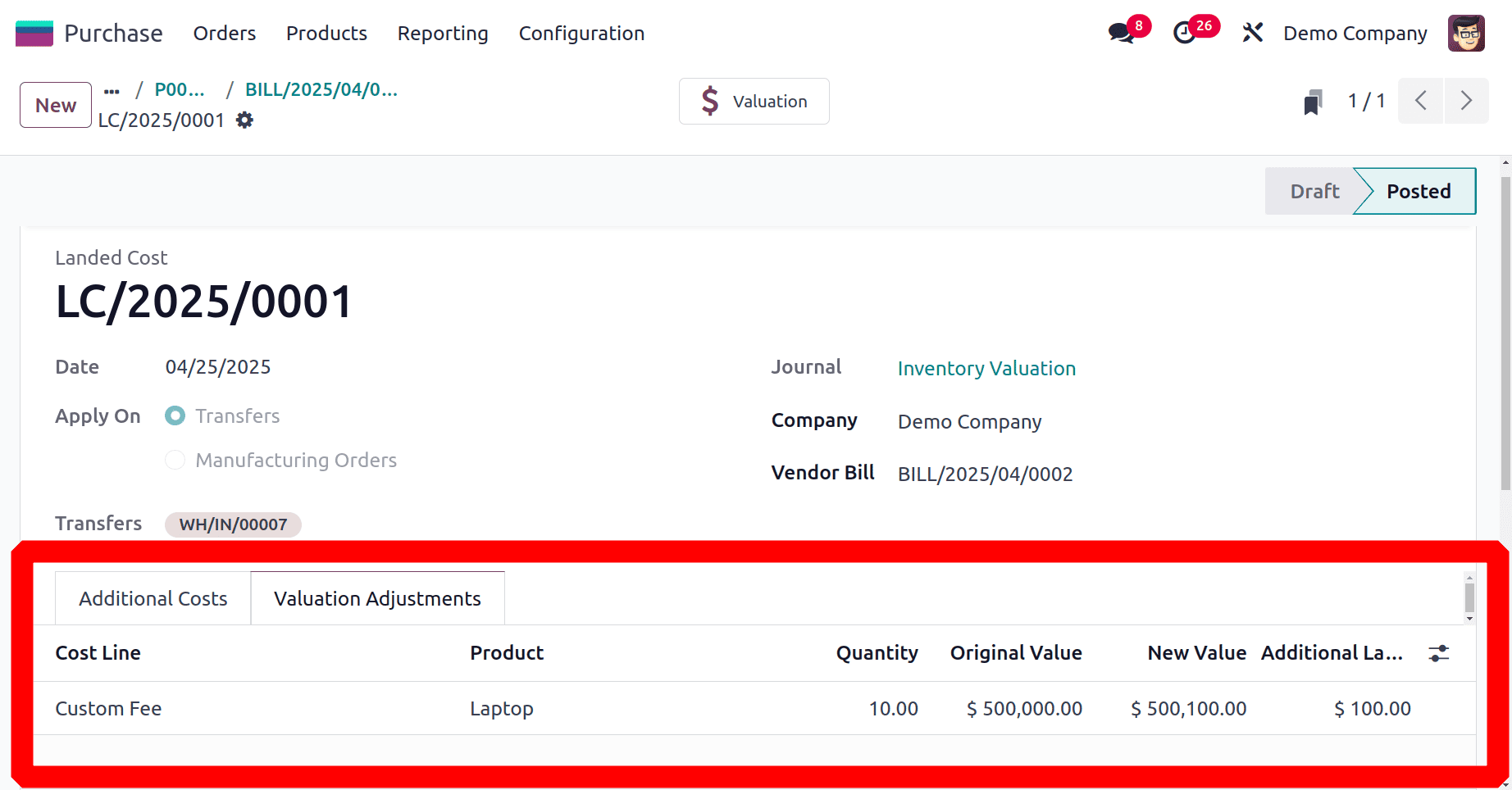

Here, you can see the product's initial worth as well as the new value that was created by include the additional landing cost. The landing cost is applied uniformly to all of the amounts because we decided to divide the expense equally. Additionally, to finish the process, remember to click the validate button.

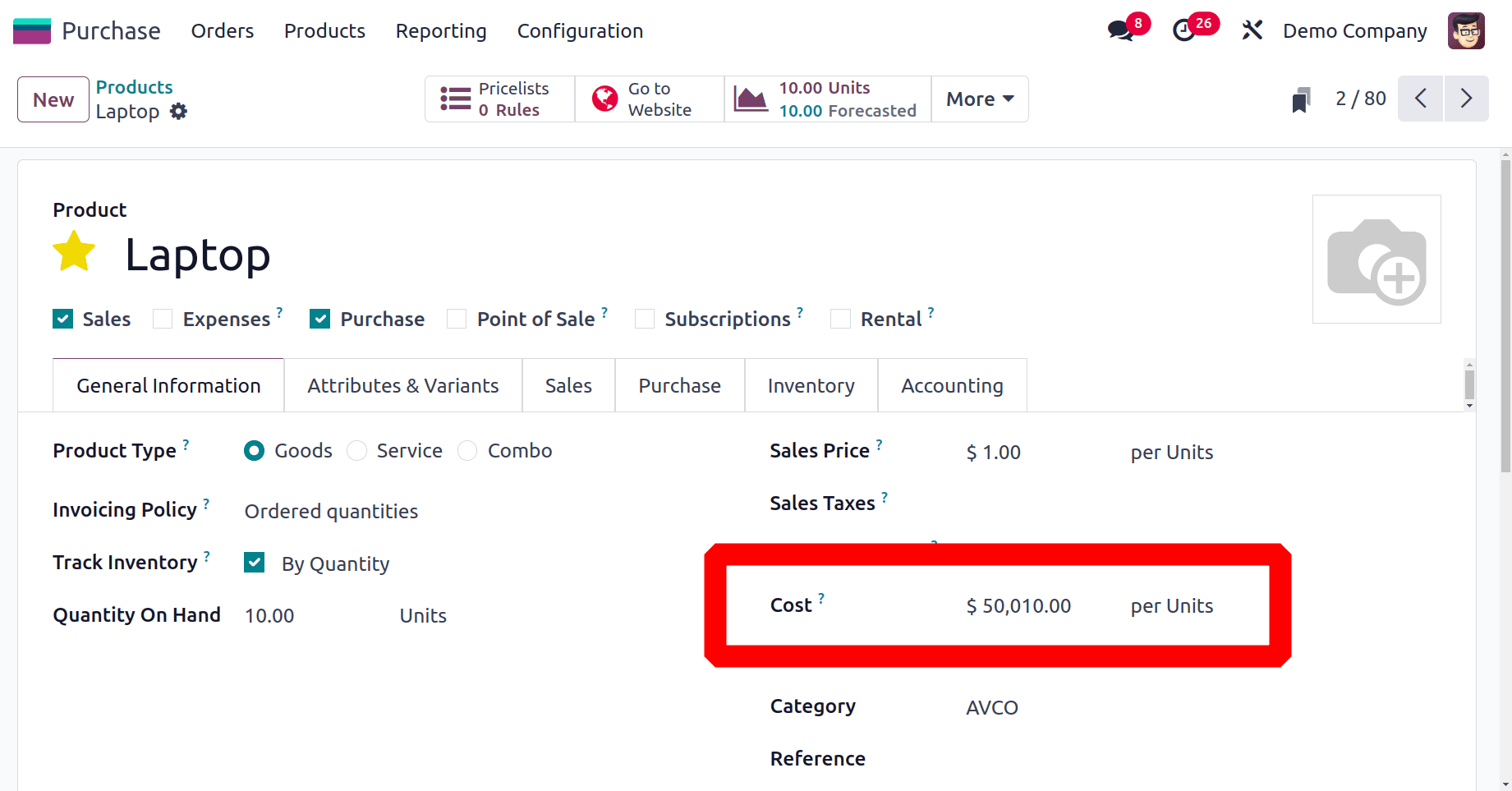

This is how product transfers are affected by the landing cost. Let's now examine the price of the item we bought.

The product used to cost nothing. The current amount is $50010. The vendor's price was $50,000. Additionally, the ten quantities we bought are divided among the $100 additional landed cost. Therefore, the landed cost was increased by $10 for each amount. As a result, the product's price increased to $50010.

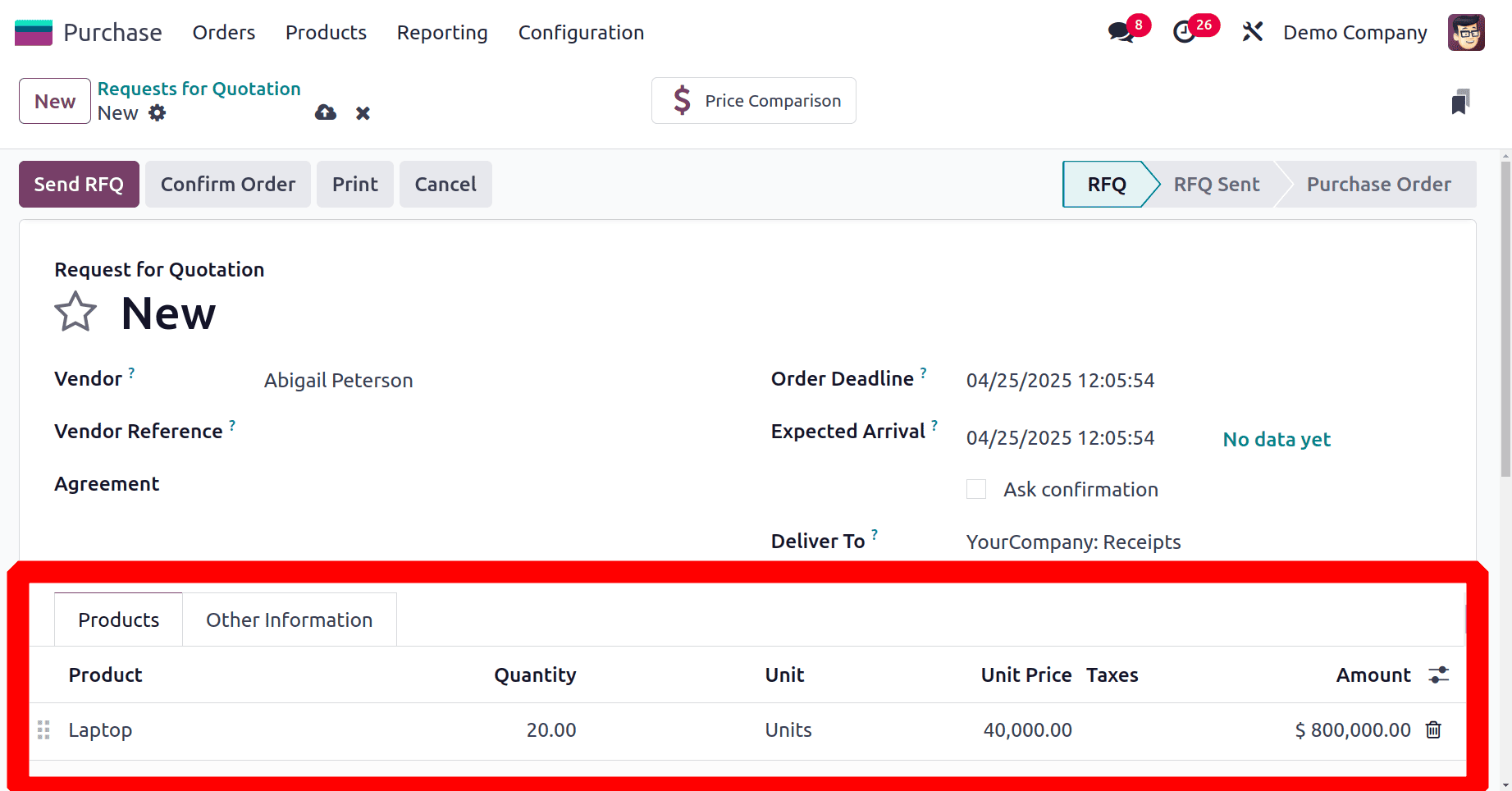

Let's make a purchase from another vendor. This time, the quantity is set as 20, and the cost of goods is just $40,000. Confirm the order and receive the product first.

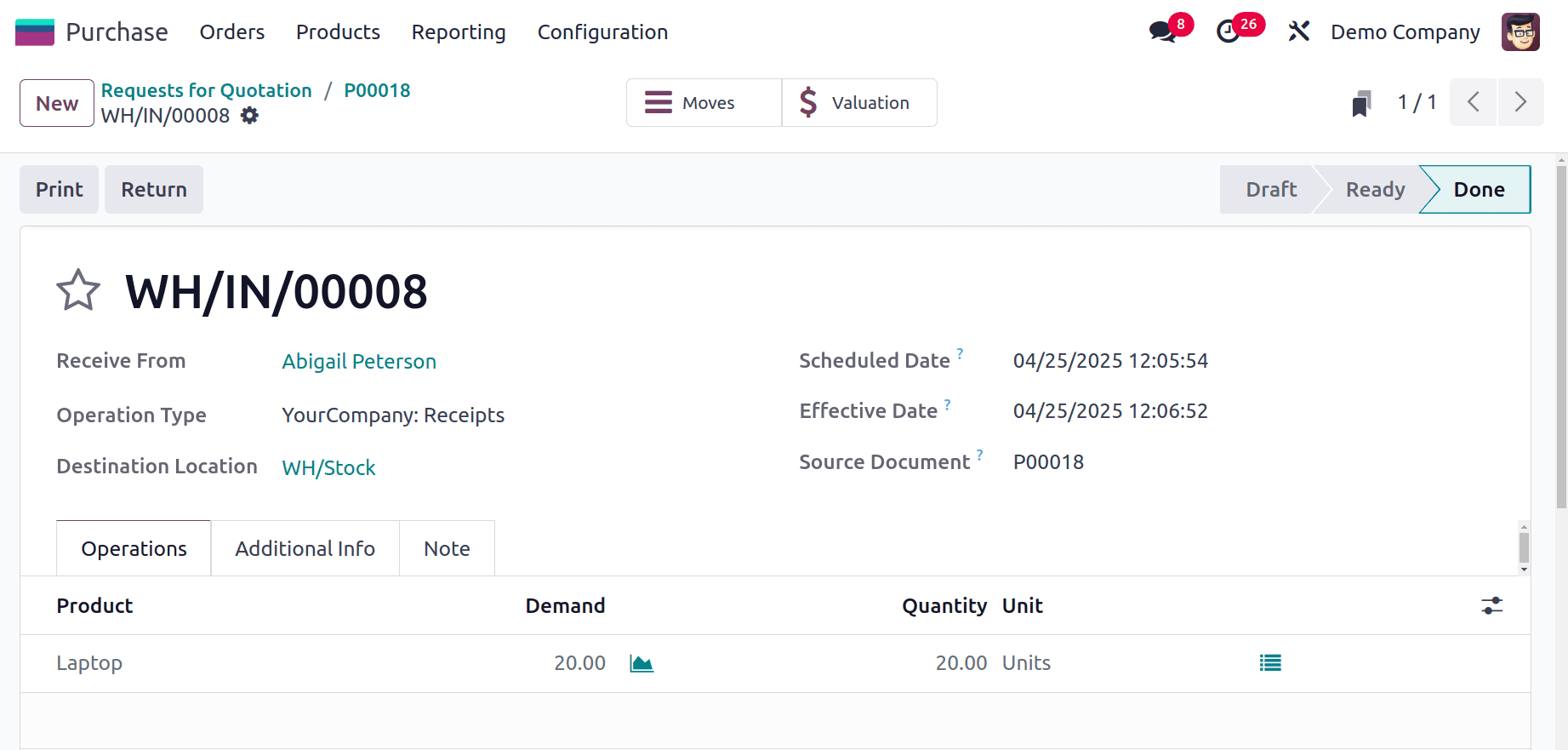

Here, the Receipt shows 20 quantities received into stock.

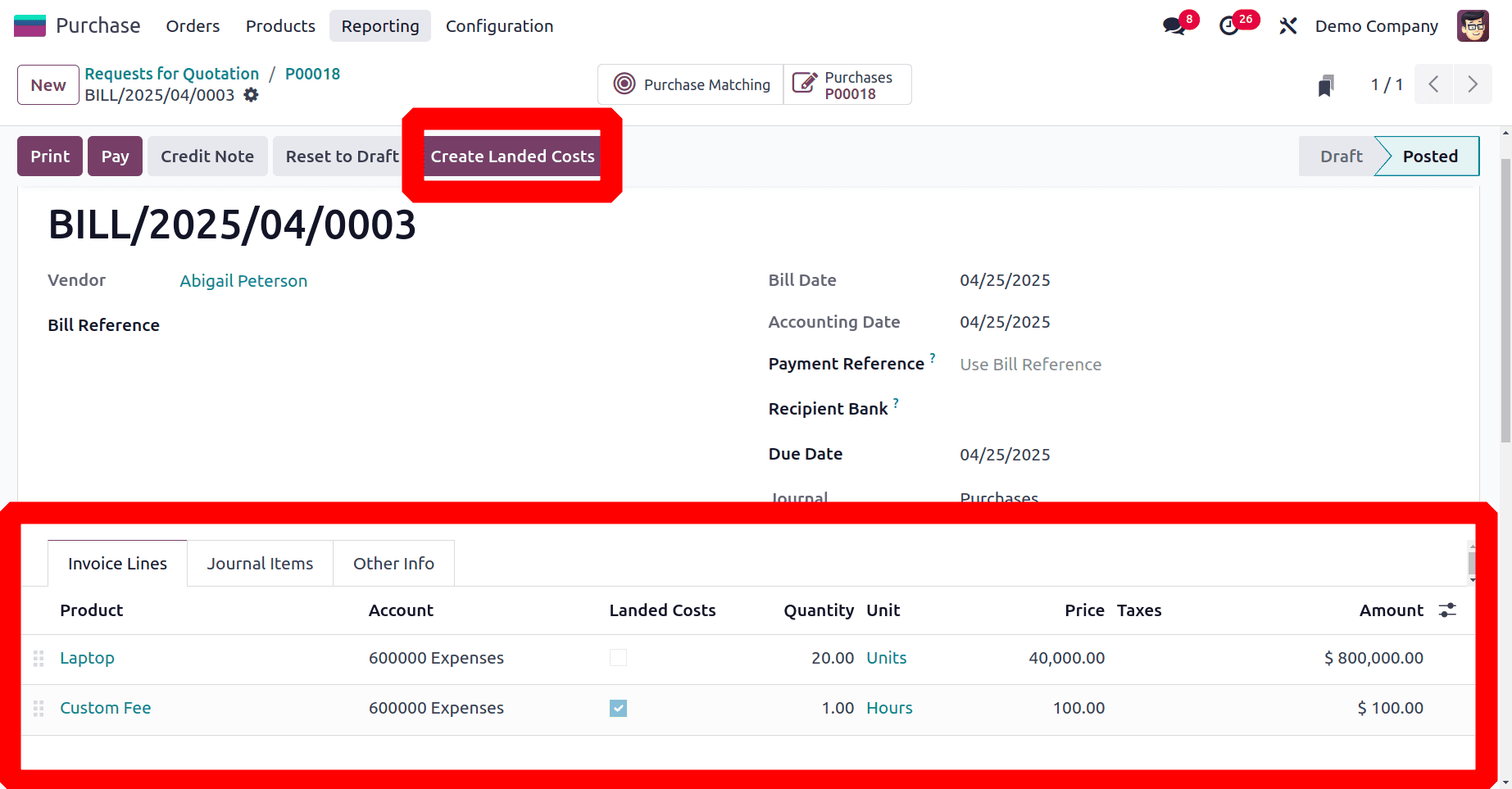

Then create the vendor bill. Add the Landed cost product inside the bill before posting the entry. Then click on the Create Landed Cost button.

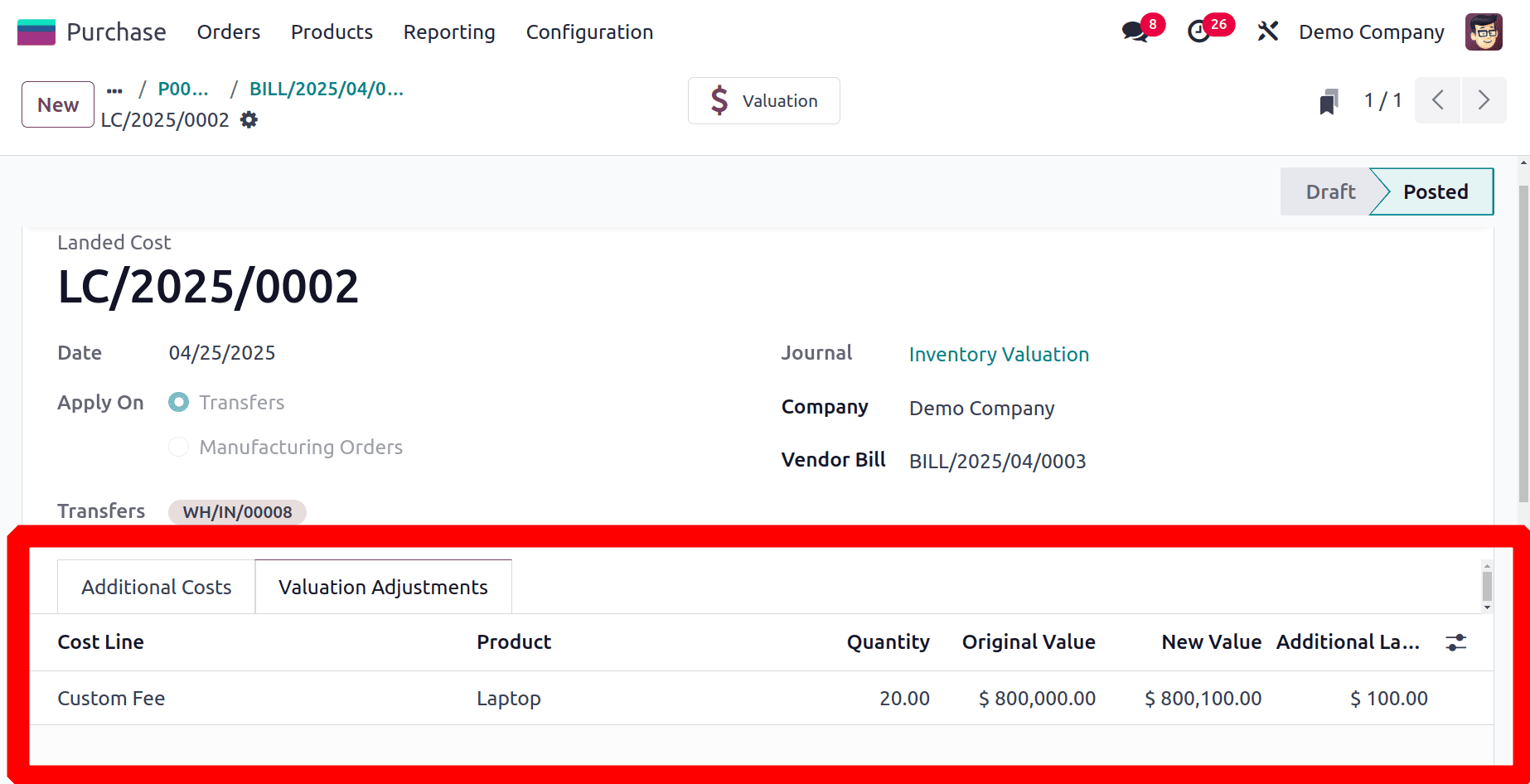

After confirming the Landed cost, check the Valuation Adjustment tab to check the cost. The slit method is Equal, so the total cost applied equally on each quantity.

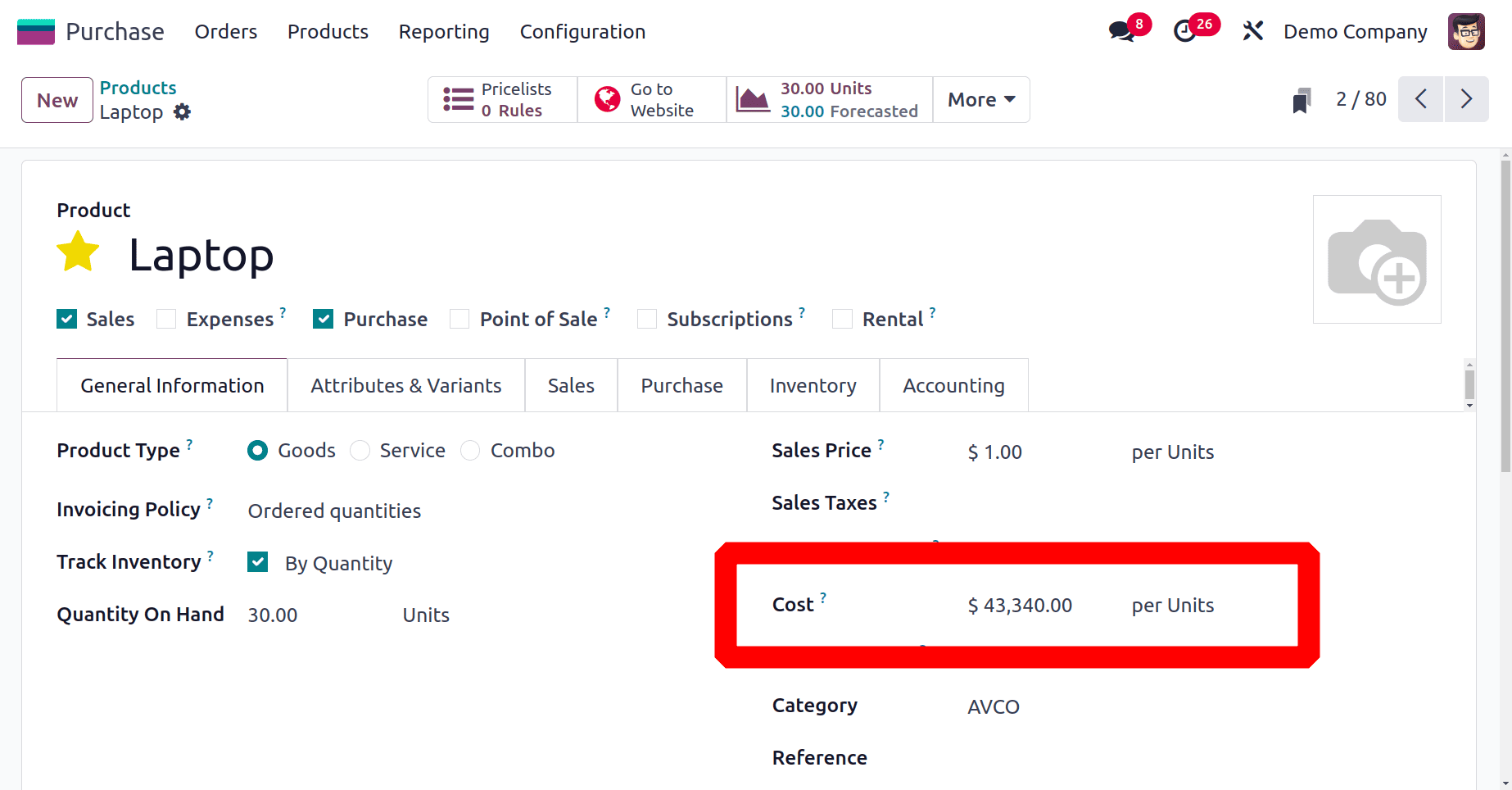

Now, let's take another look at the item's price. The product's prior price was $50010. Right now, it's $43,340.00.

The vendor's price for the second purchase was $40,000. Additionally, the 20 quantities we bought are divided among the $100 additional landed cost. Therefore, the landed cost was increased by $5 for each amount. As a result, the product's price for second purchase quantities increased to $40005.

Here, the costing method is the Average Costing method. So the equation for calculating Cost is

= (No. of Quantities in 1st purchase* Unit cost of 1st purchase) + (No:of Quantities in 2nd purchase* Unit cost of 2nd purchase) / Total Quantities.

So here is the purchase

No. of Quantities in 1st purchase = 10

Unit cost of 1st purchase (including landed cost) = ( $50000 + $10 = $50010)

No. of Quantities in 2nd purchase = 20

Unit cost of 2nd purchase (including landed cost) = ( $40000 + $5 = $40005)

Total Quantities = 30

So the Cost of the product = (10*50010) + (20*40005) / 30 = 43,340.00

Landed cost on First In First Out Costing Method

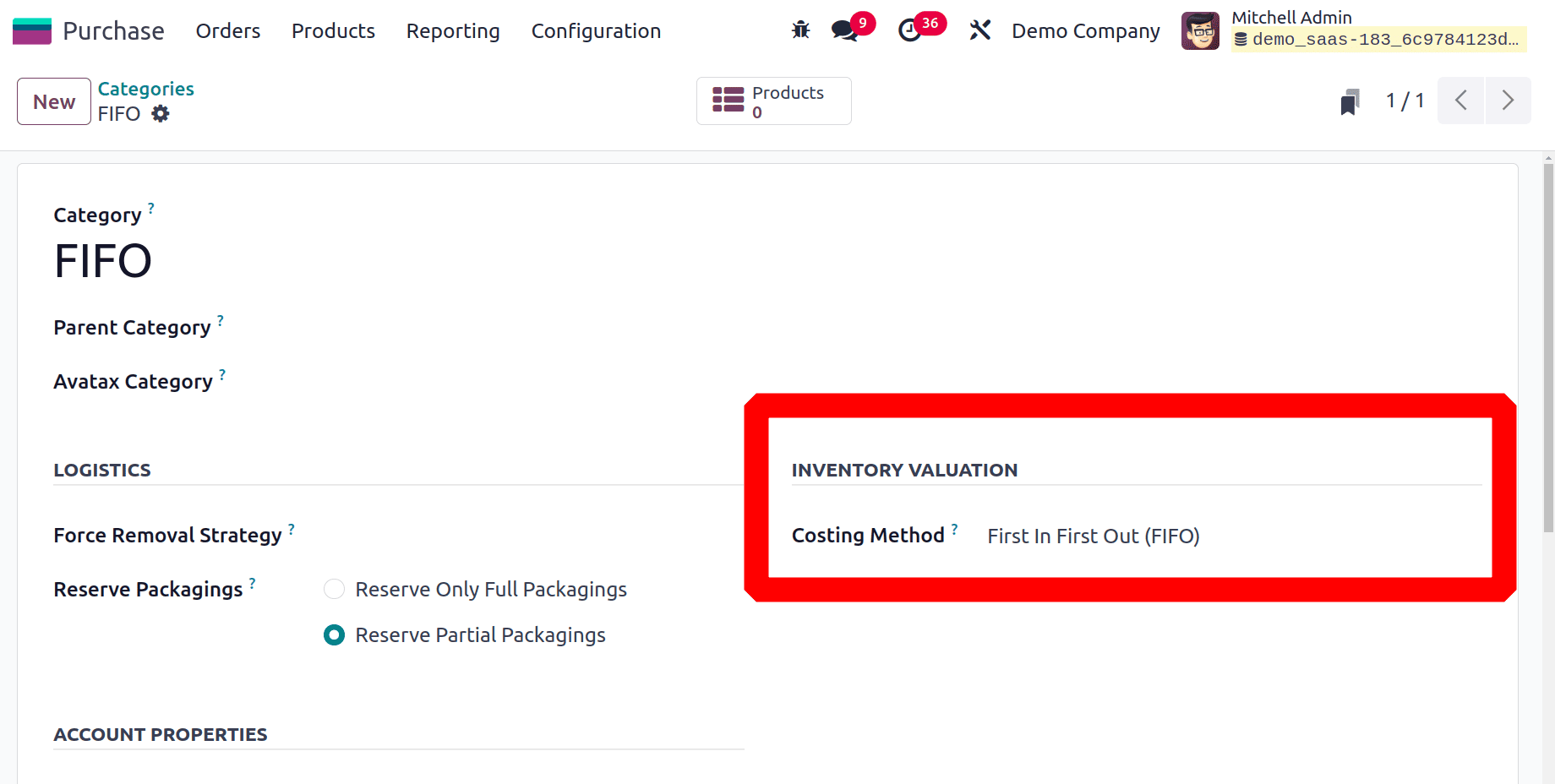

Then let's check how the landed cost is added to the product cost when the costing method is FIFO. The First In First Out (FIFO) approach of inventory valuation makes the assumption that the first inventory units sold are the same ones that were bought. Choose a product category with the costing method as FIFO.

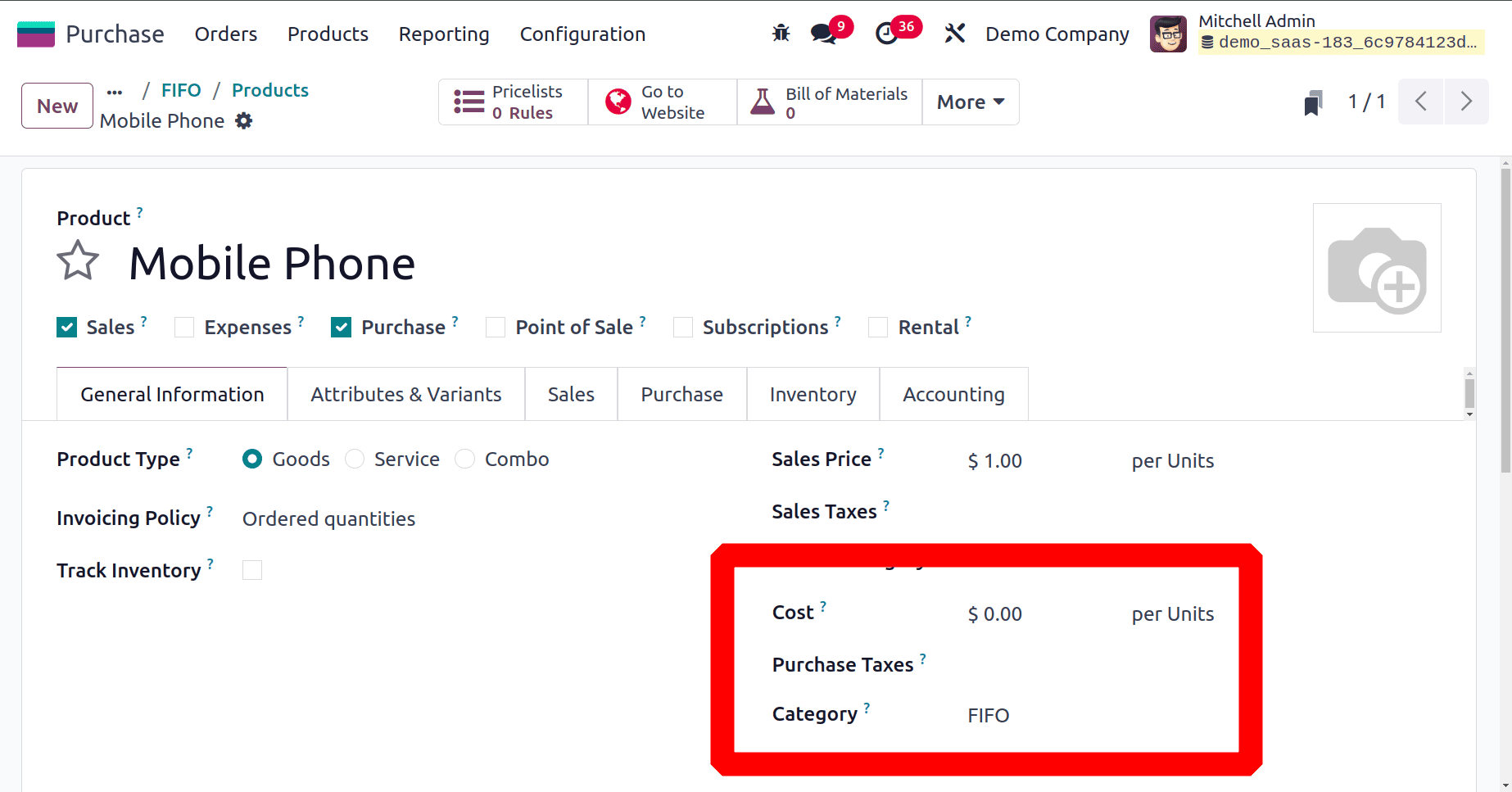

Then create a new product under the same category. Here, the product is a Mobile Phone, with no cost.

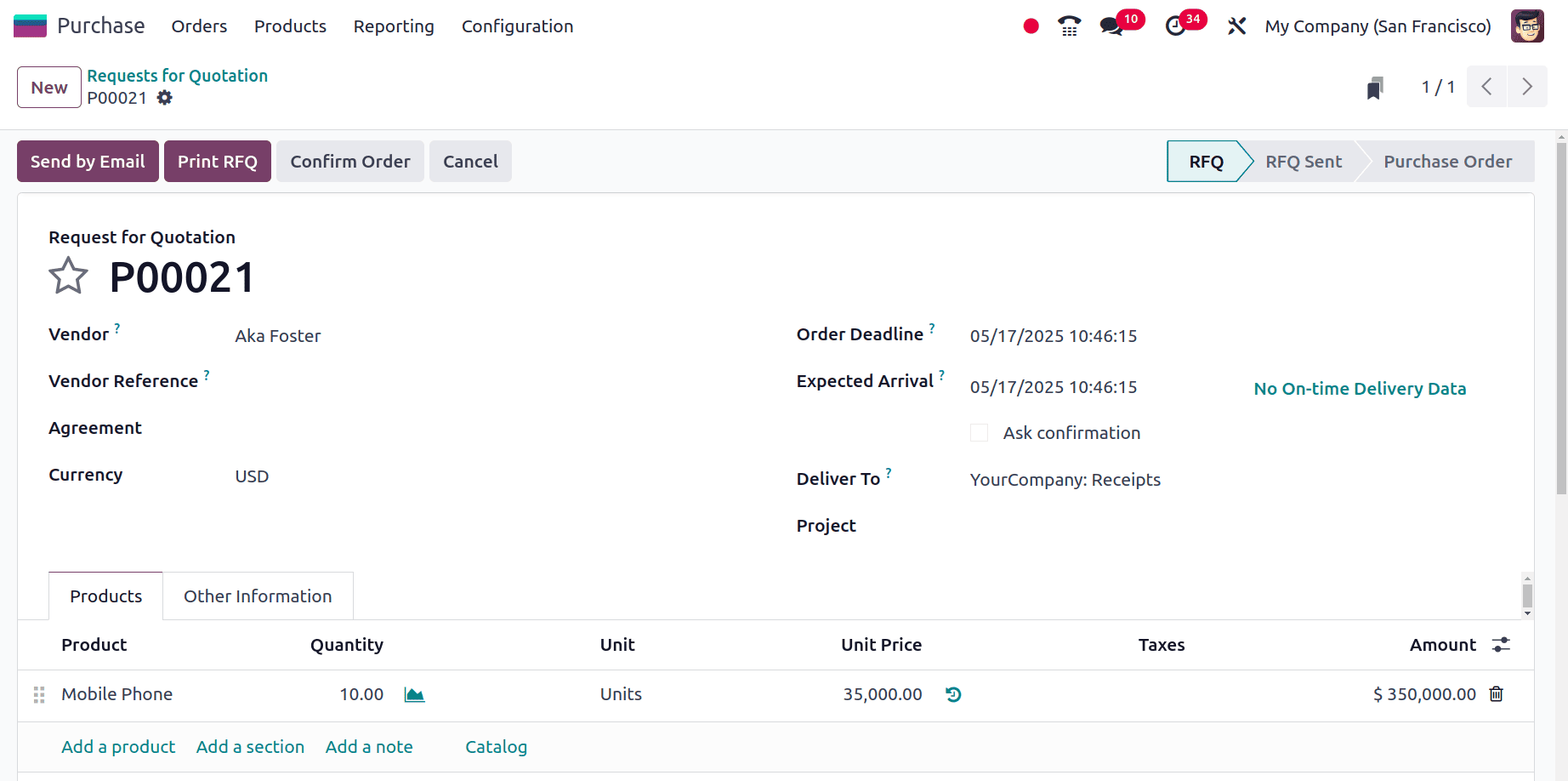

Create a new purchase order for the product. Here, the Vendor is Aka Foster. The company requested 10 quantities with a unit price of $35000. So let's validate the order first.

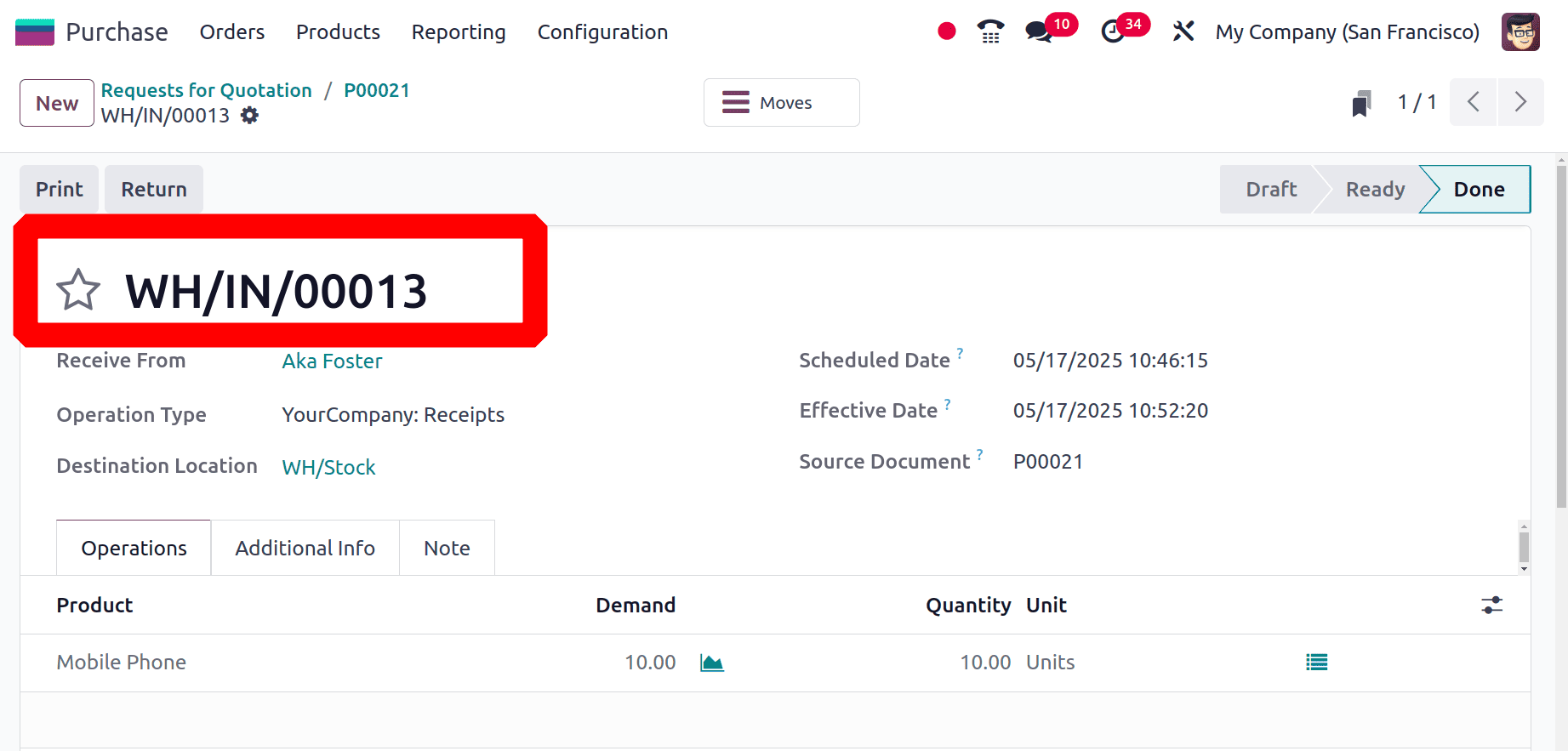

Then, validate the receipt. Remember the sequence number of the Receipt.

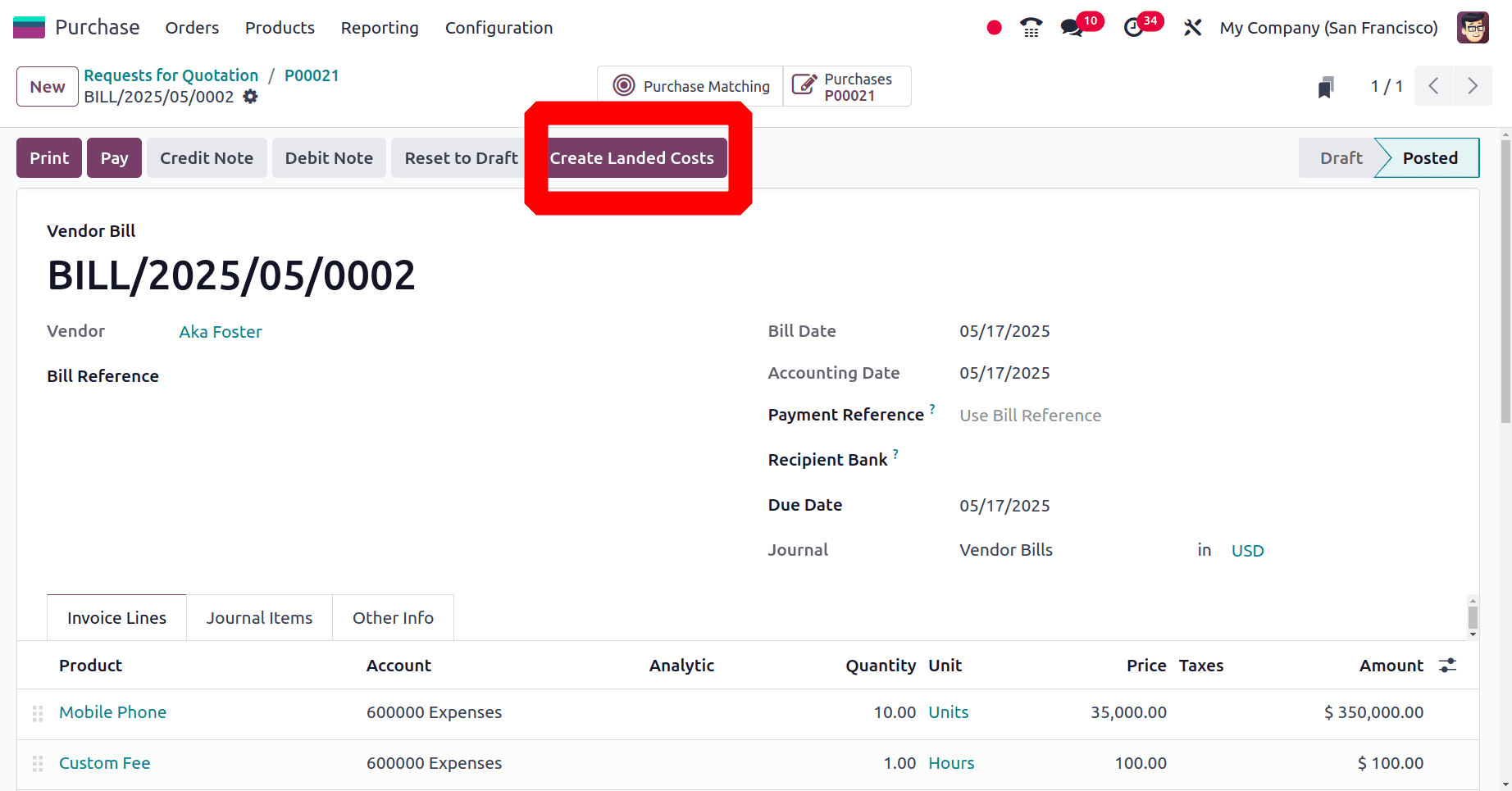

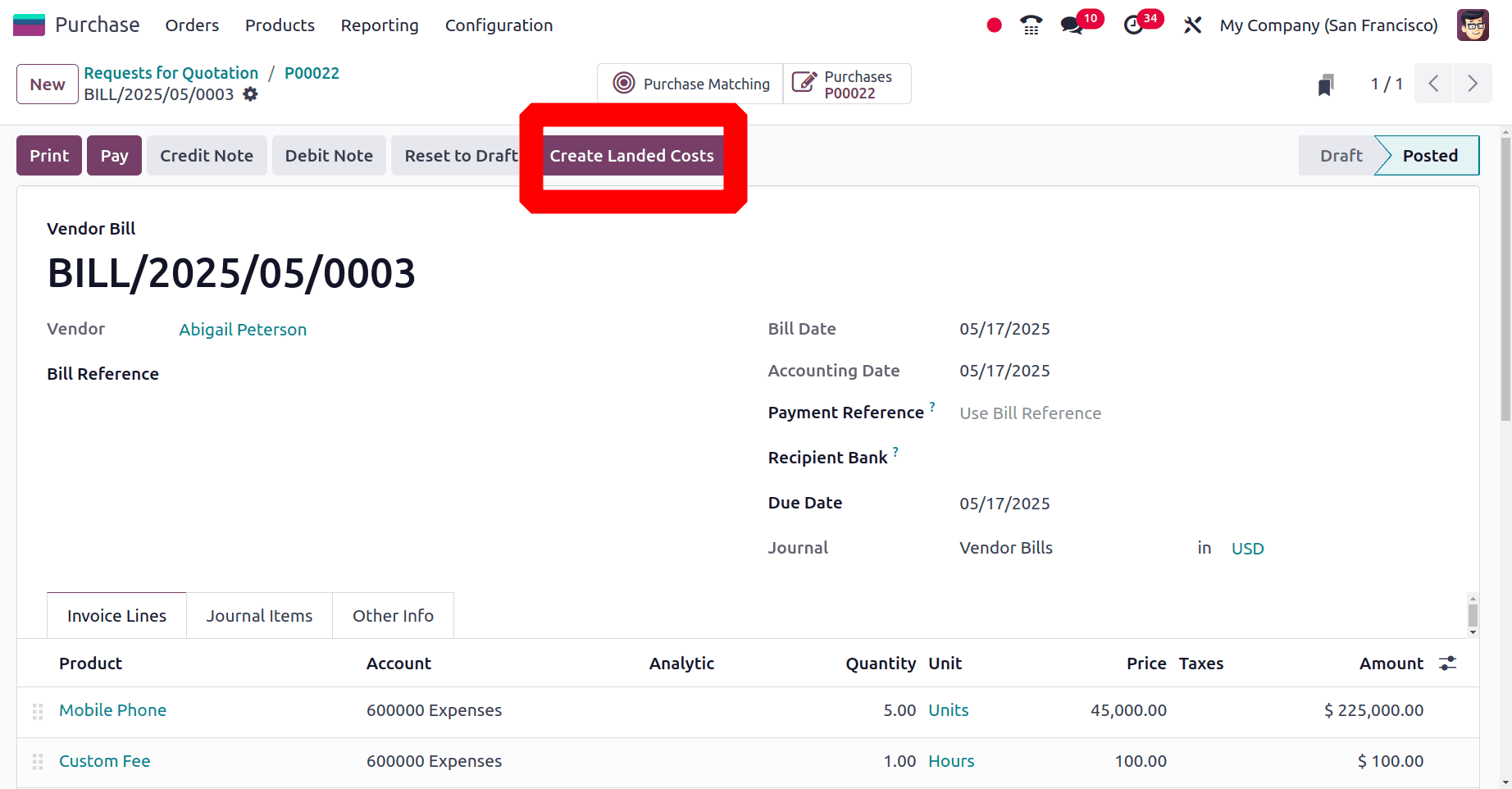

Create the vendor bill. Add the Landed Cost product Custom Fee. Then confirm the Bill. Click on the Create Landed Cost button to create a new Landed Cost transfer.

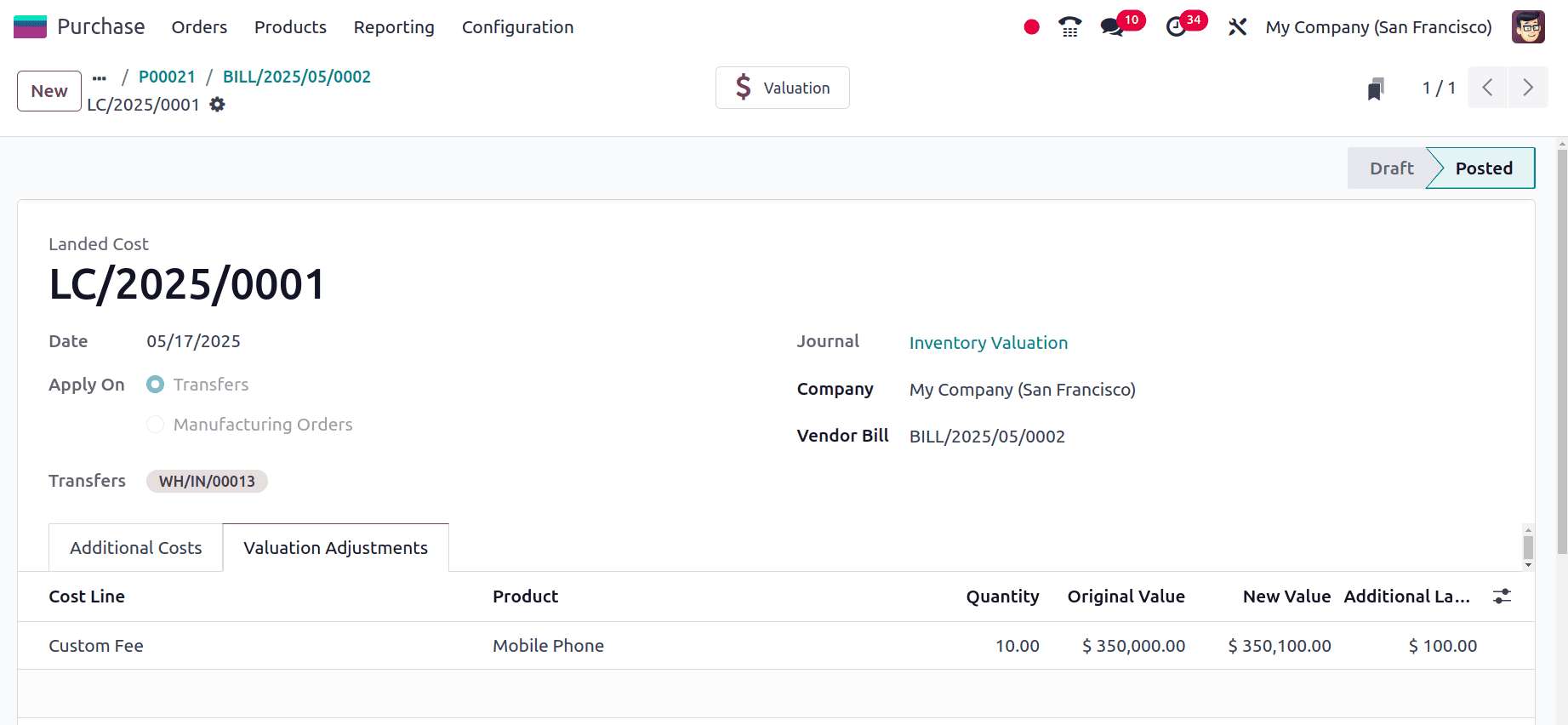

After validating the Landed cost, check the cost information from the Valuation Adjustment tab.

Here, the original value of the goods is $35000, and the landed cost is $100. When equally dividing the additional cost to products, one has an additional cost of $10. Which means the current cost of the Mobile Phone is $35000+$10 = $35010.

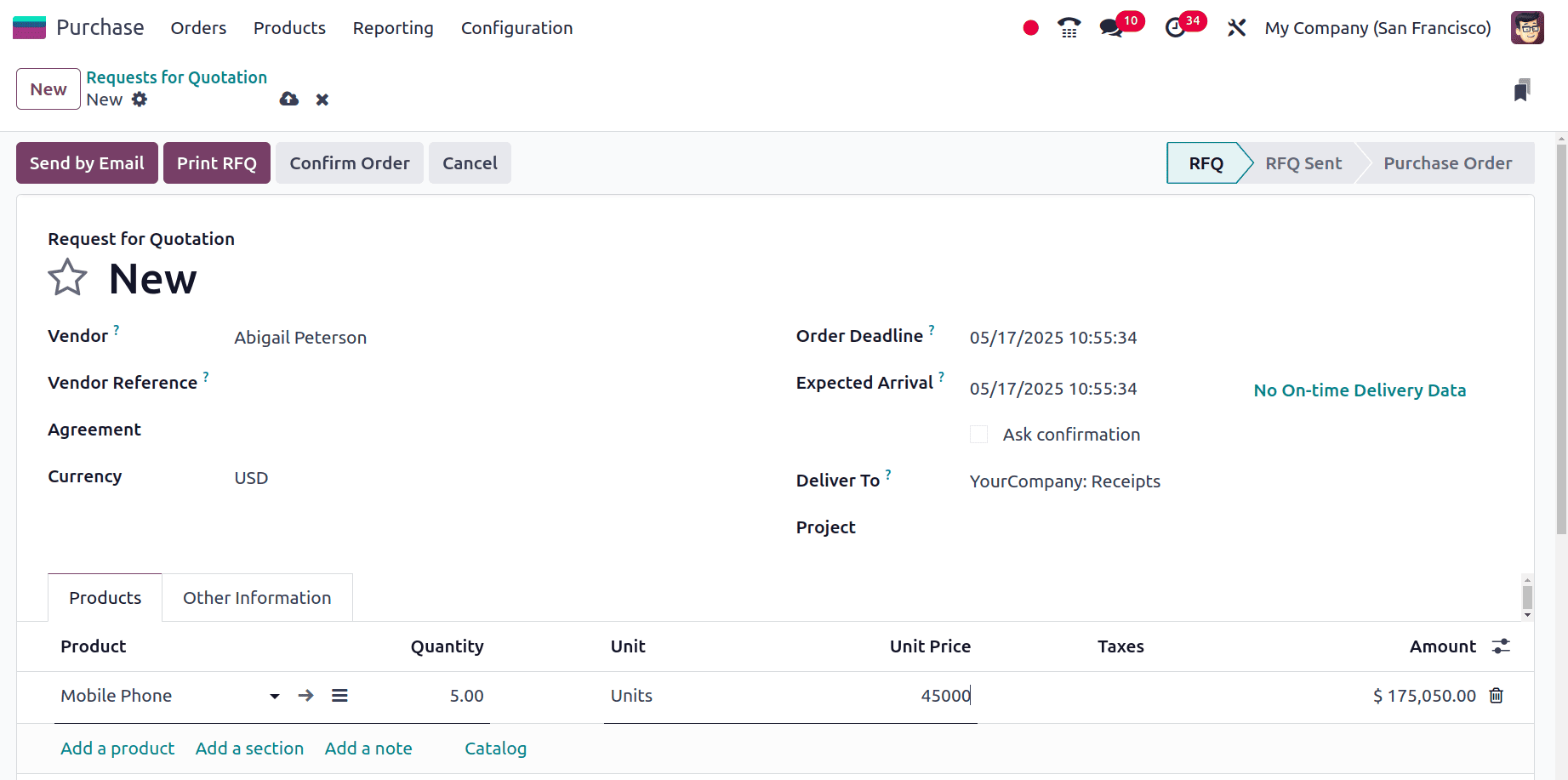

Let's purchase an additional 5 quantities of Mobile phones from another vendor. So here the cost is 45000 dollars. Confirm and receive the order.

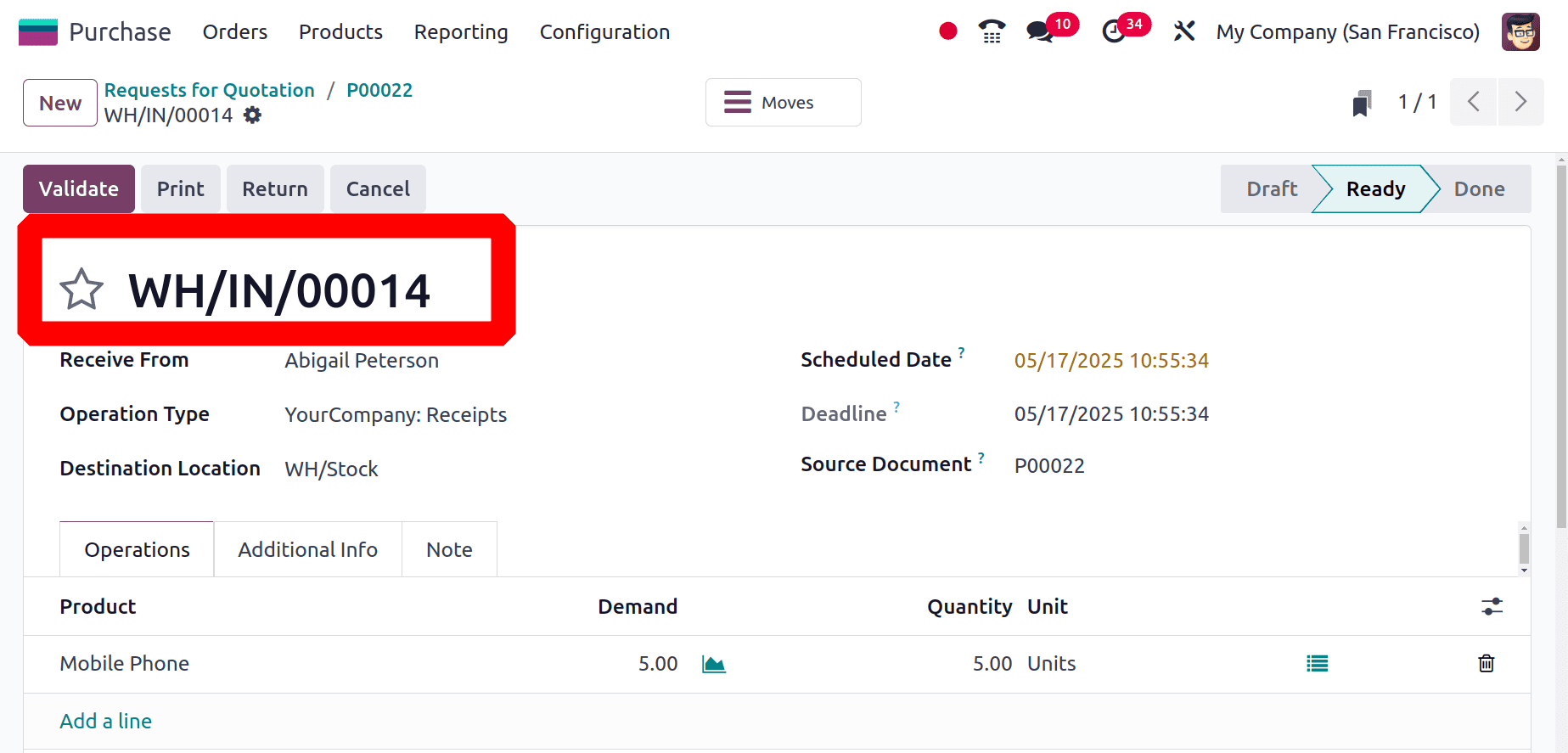

Here is the receipt validating it to add the product to the stock.

Create and confirm the bill with the landed cost first, then create the Landed cost from there.

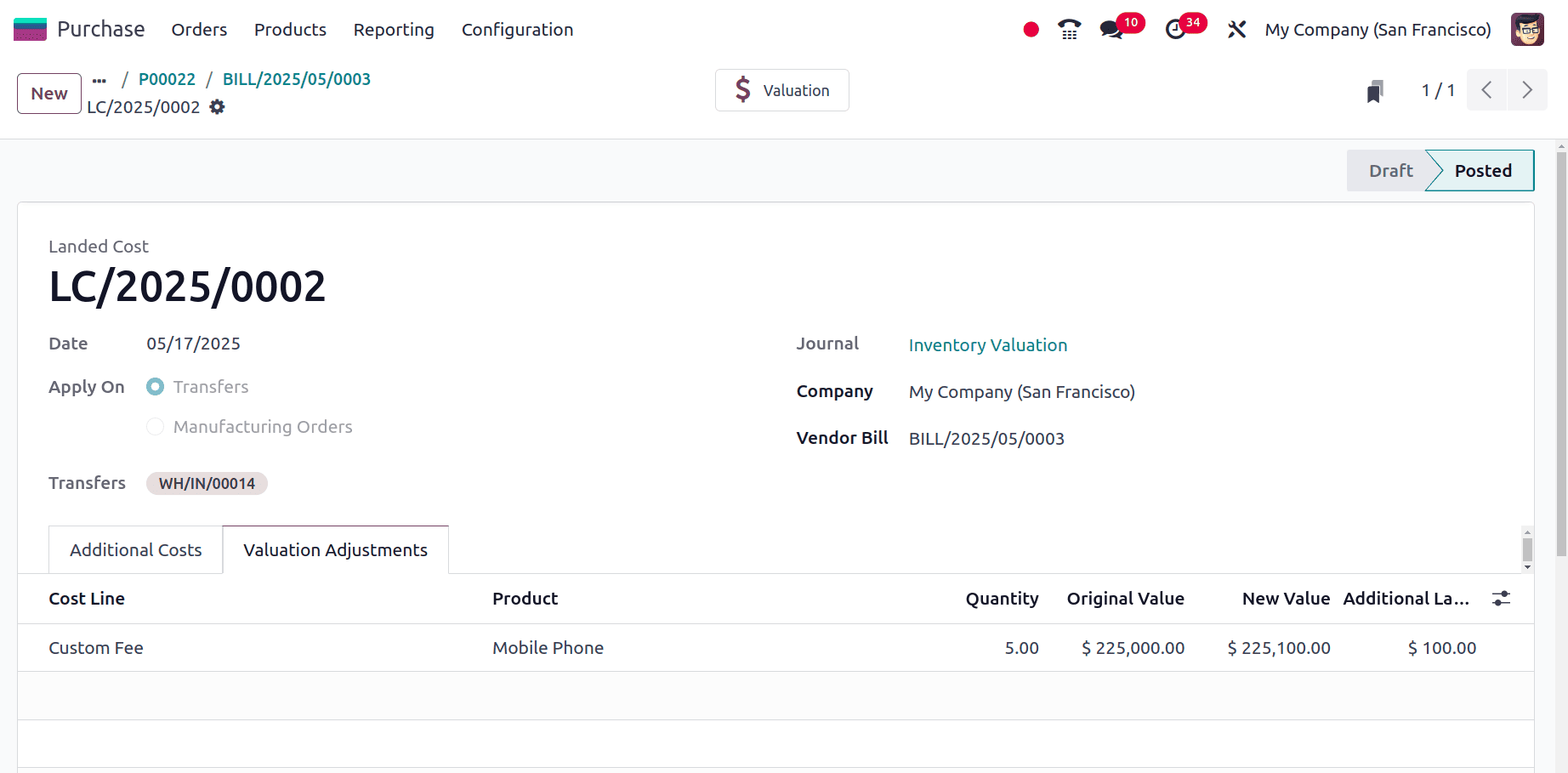

So the created landed cost can be validated from the very next page. While checking the Valuation adjustment tab, the cost details of the purchase can be viewed.

Here, $45,000 is spent on each of the five quantities. Thus, $225,000 is the overall value. It costs an extra $100. Each quantity has an extra $20 when divided equally. This indicates that the price of a single mobile phone during a subsequent purchase is $45000 + $20 = $45020.

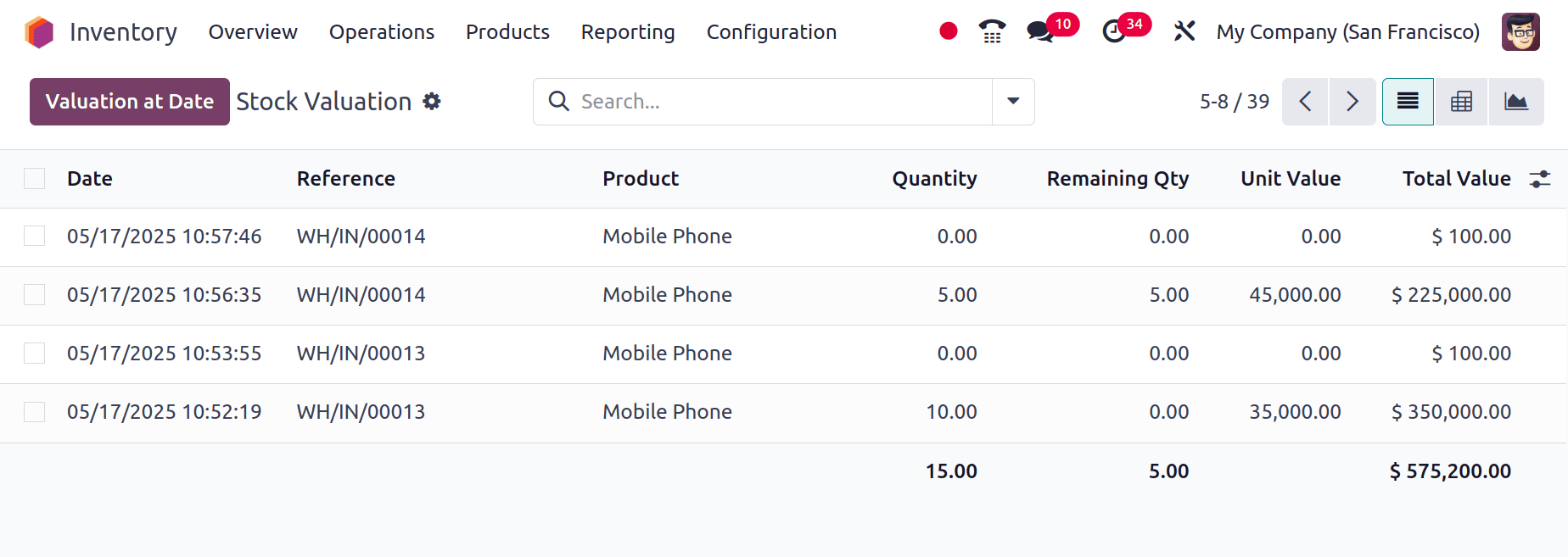

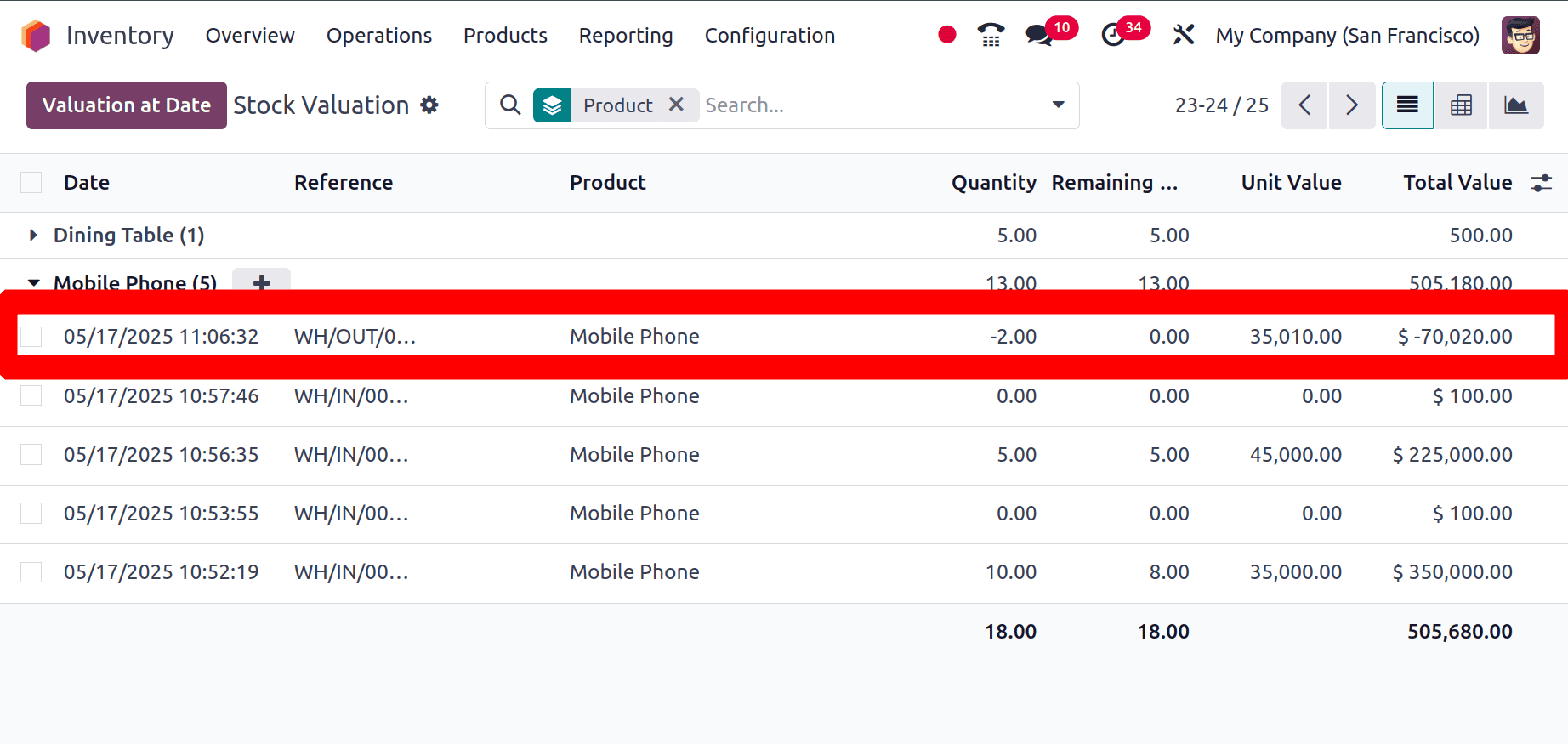

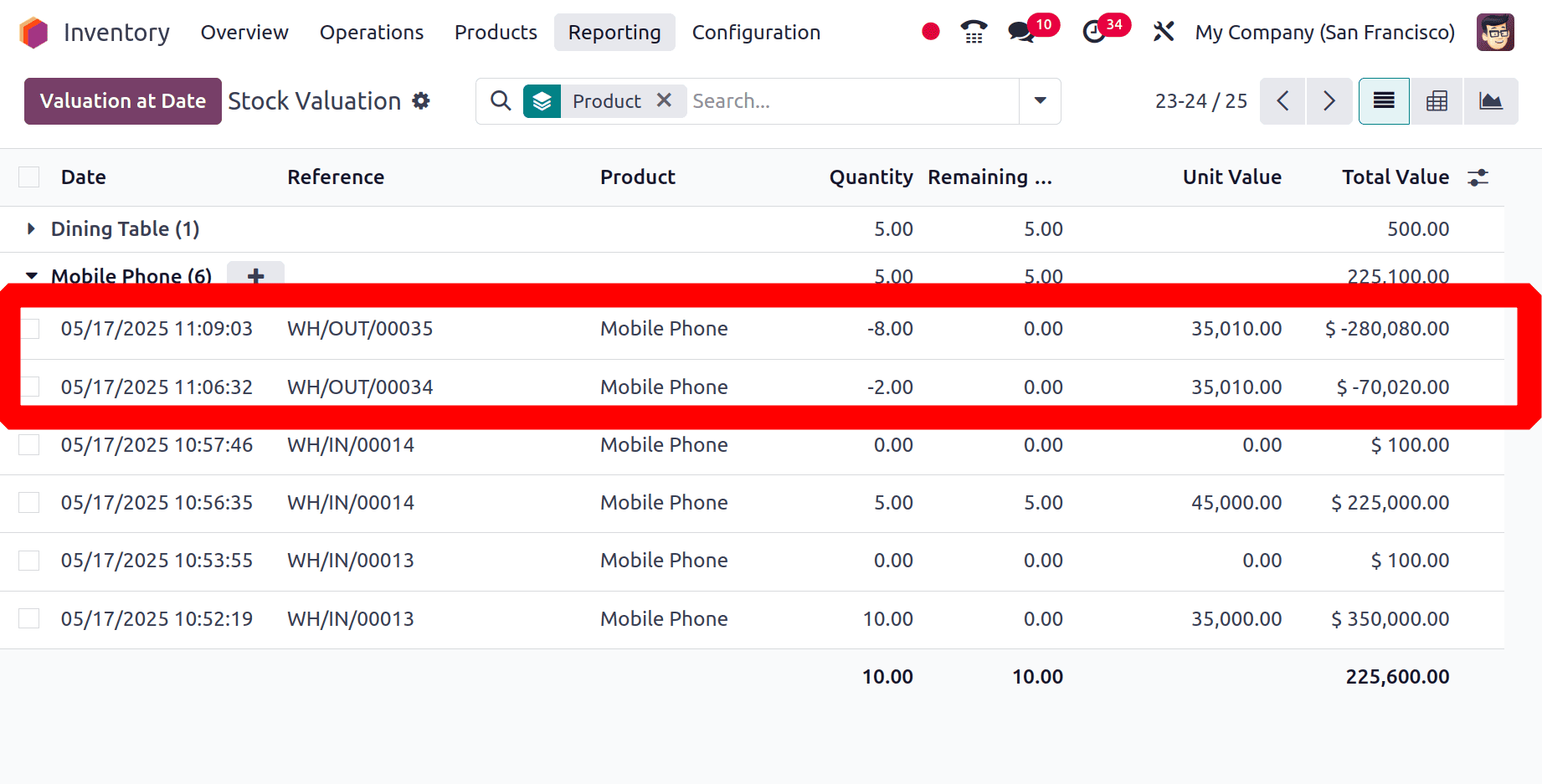

So let's check the Inventory Valuation report to check the valuation. For that, choose the Inventory Valuation from the Reporting.

Here we can see that the first purchase is for 10 quantities with a cost of $35000, and the Customs fee is 100, which means that for one quantity the cost price is $35010 for the first 10 quantities. Then purchased another 5 quantities at $45000 each, with a custom fee of 100. Then the custom fee for one quantity is $20. And the cost of the last 5 quantities purchased is 45020.

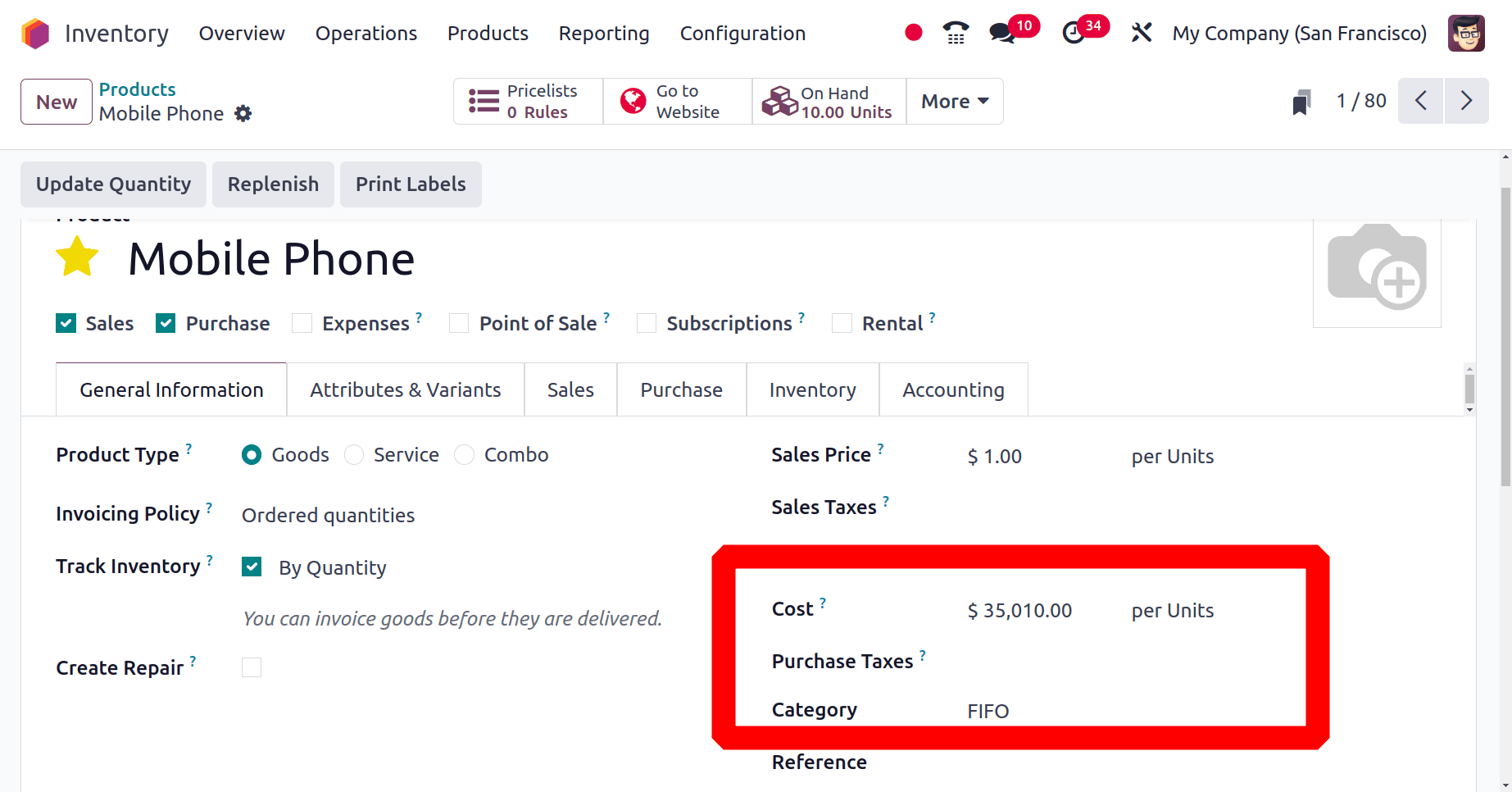

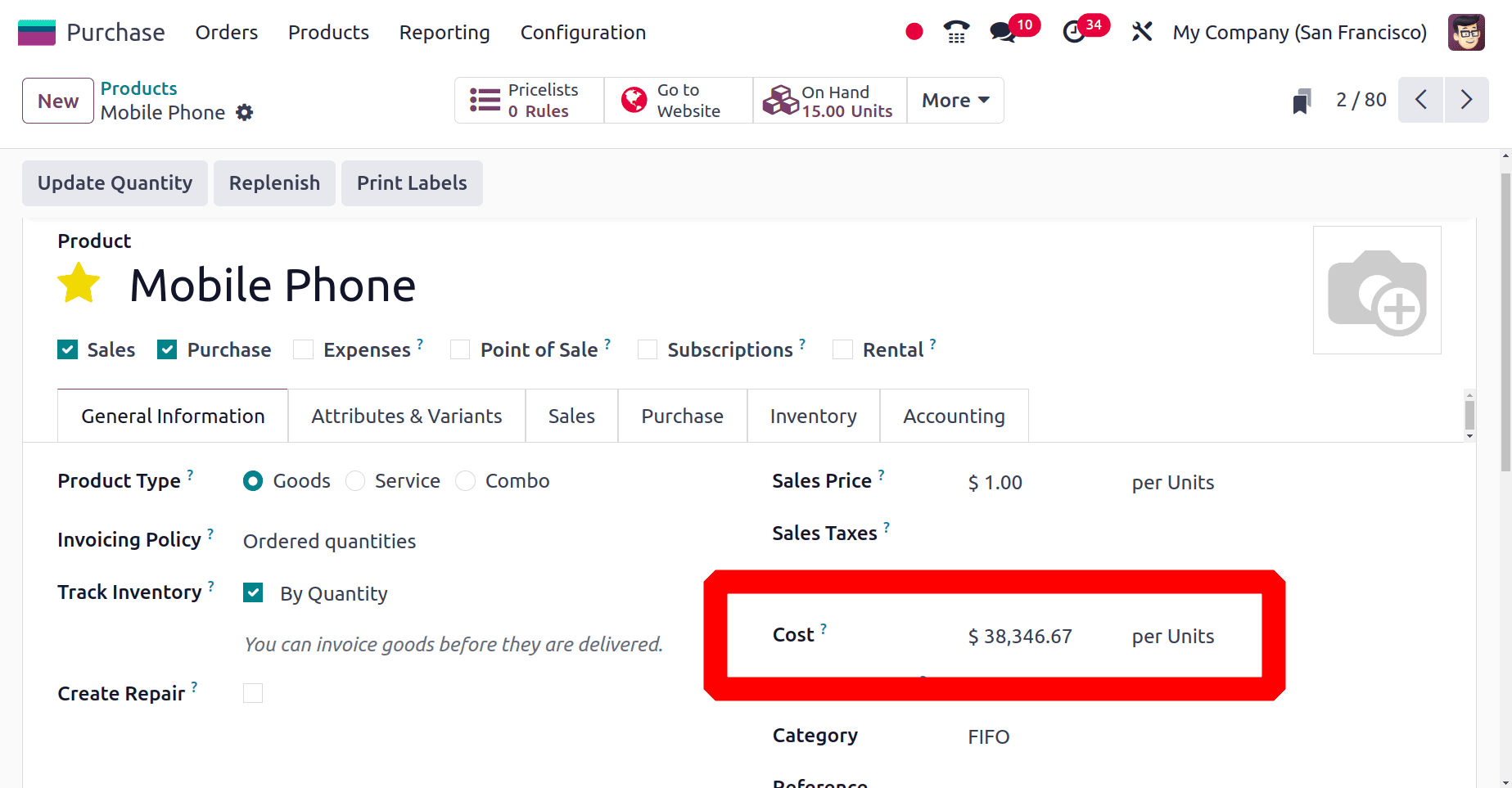

But on the product page currently the cost is updated based on the AVCO Method. So here the cost is (10*35010+5*45020)/15 = 38346.67.

Here, the cost of the product is currently updated on the basis of the average of two purchases. However, the pricing of the second purchase has not yet been changed after the product has been checked. Simply because First In First Out (FIFO) is the costing mechanism used here. This implies that only once the sale of the first acquired amount is completed is the price of the second buy adjusted.

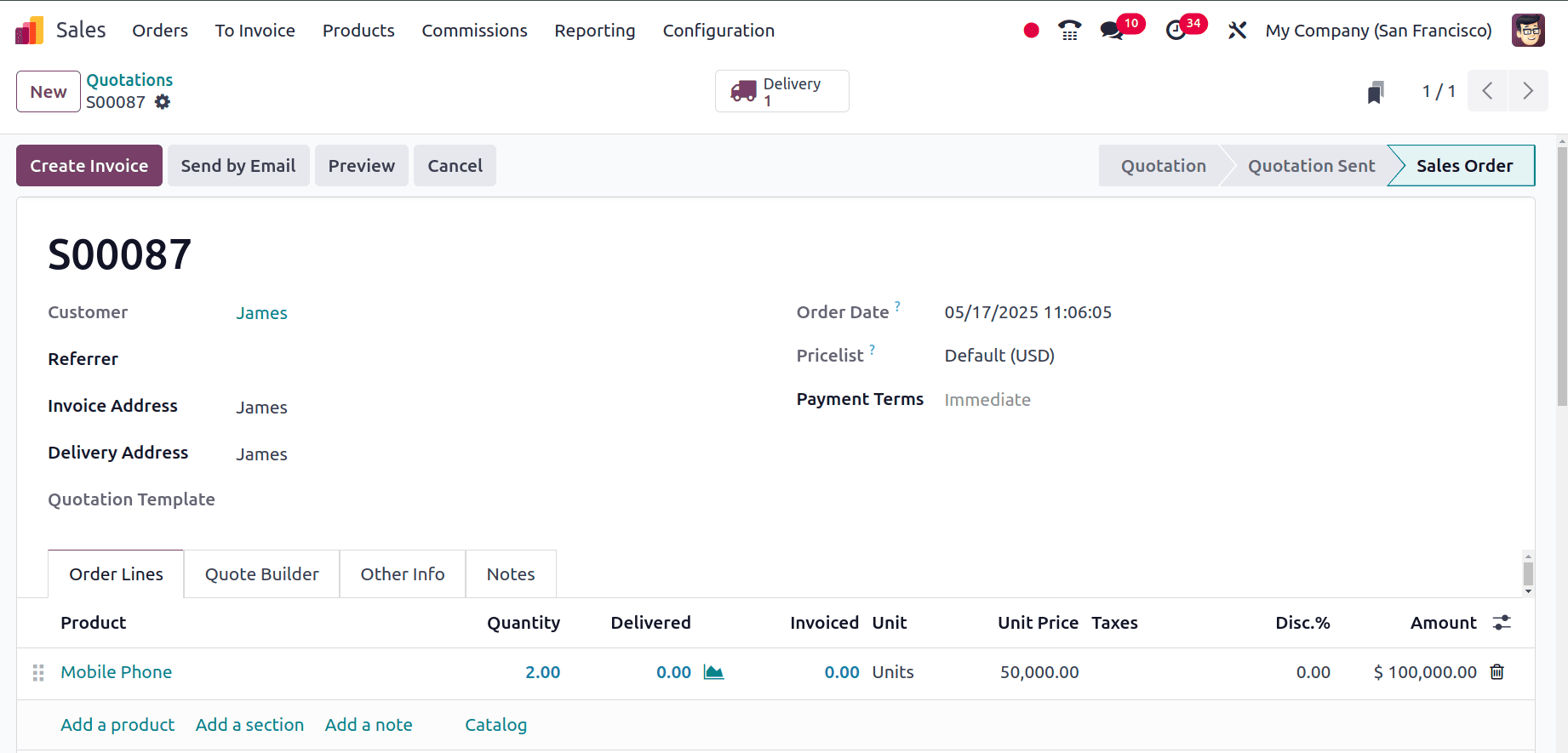

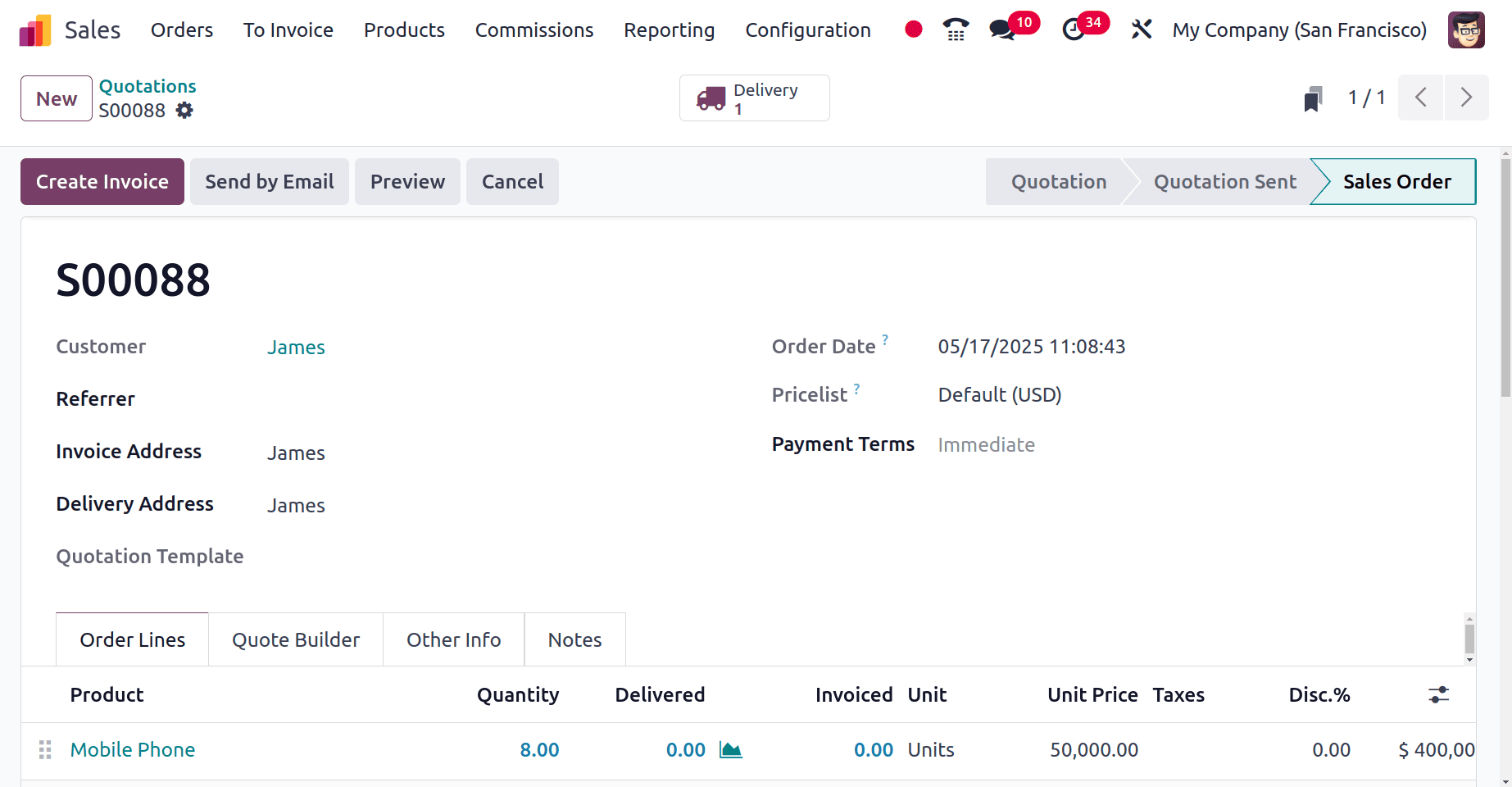

So let's sell the 2 quantities from the first purchase. Here, the 2 quantities are added inside the sales order. Confirm the sale order first.

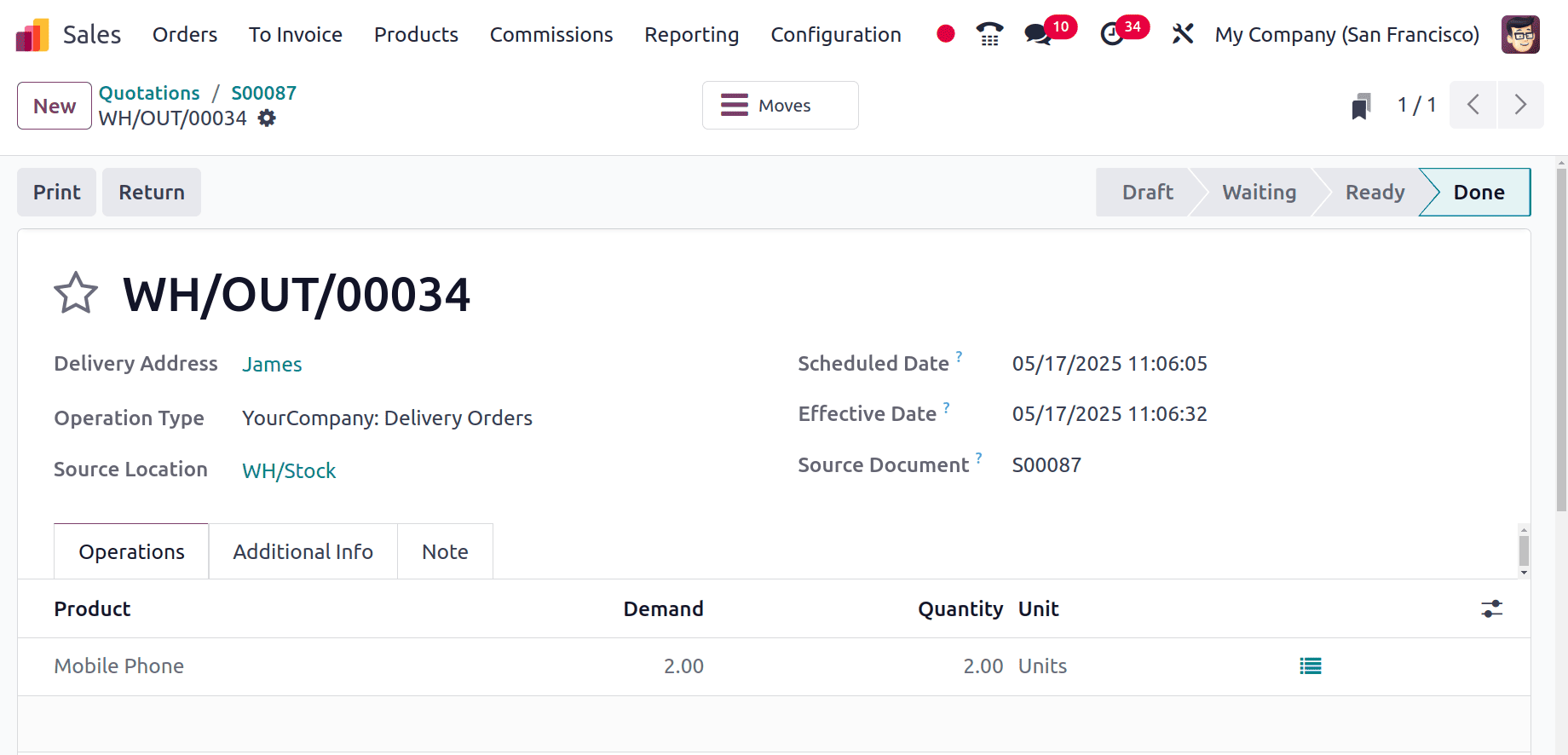

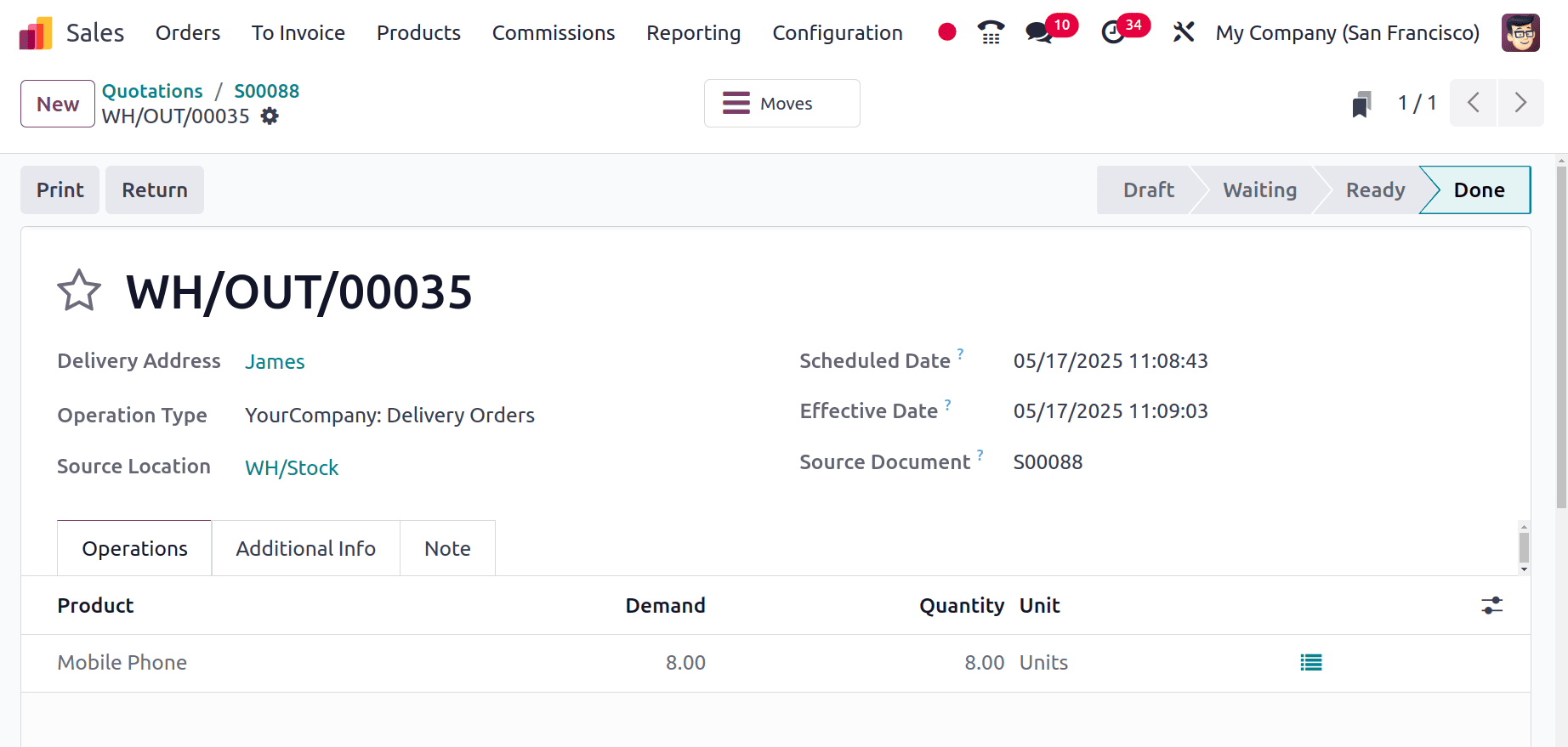

Then go to the Delivery. Confirm the delivery to complete the Sale.

So the 2 quantities are removed from the stock, which is removed from the first purchased quantities. Now, check the Inventory Valuation once again.

So, here it's clear from the report that the products are removed from the first purchase. Because the Unit Value shows the cost of the first purchase.

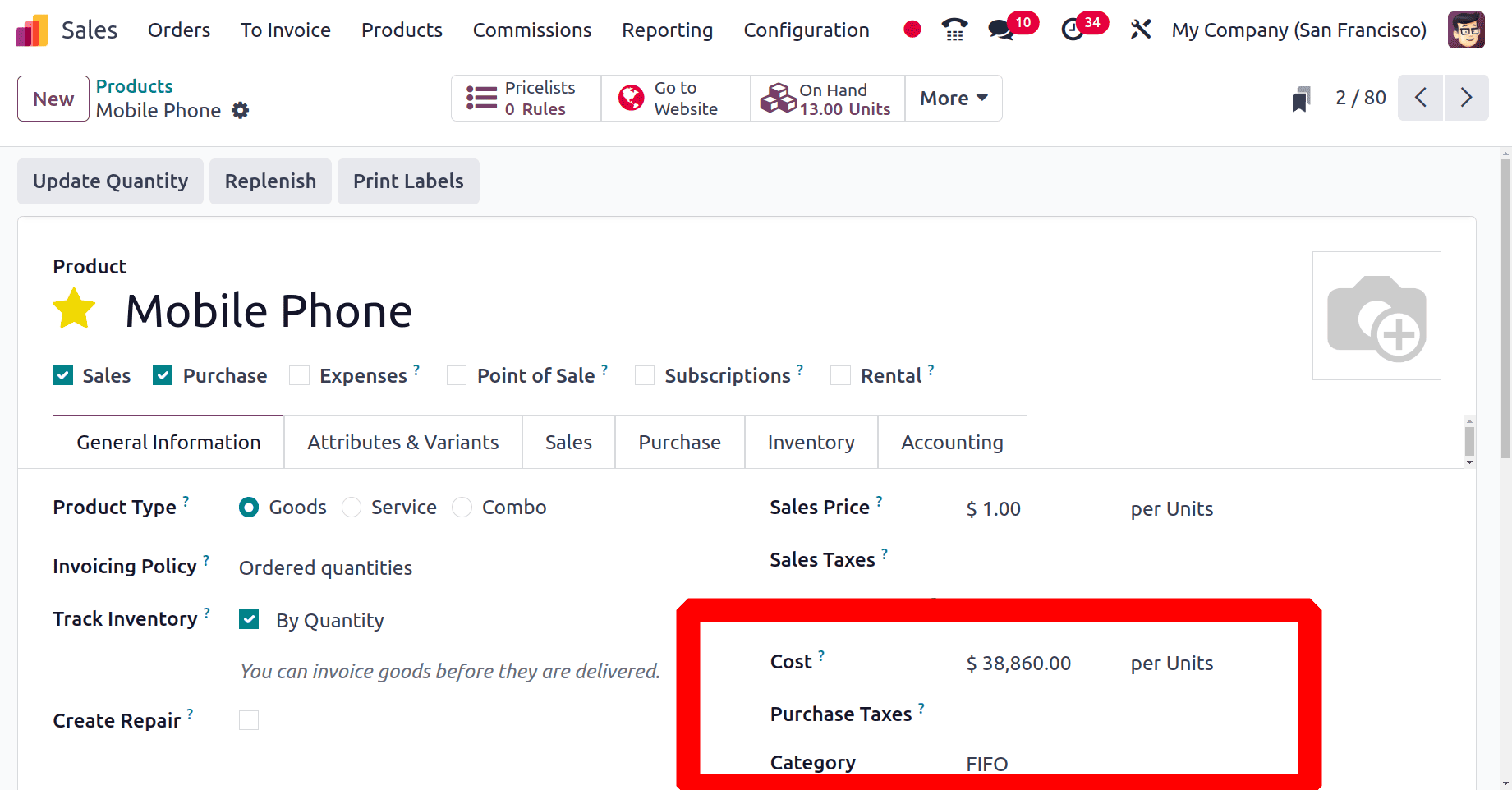

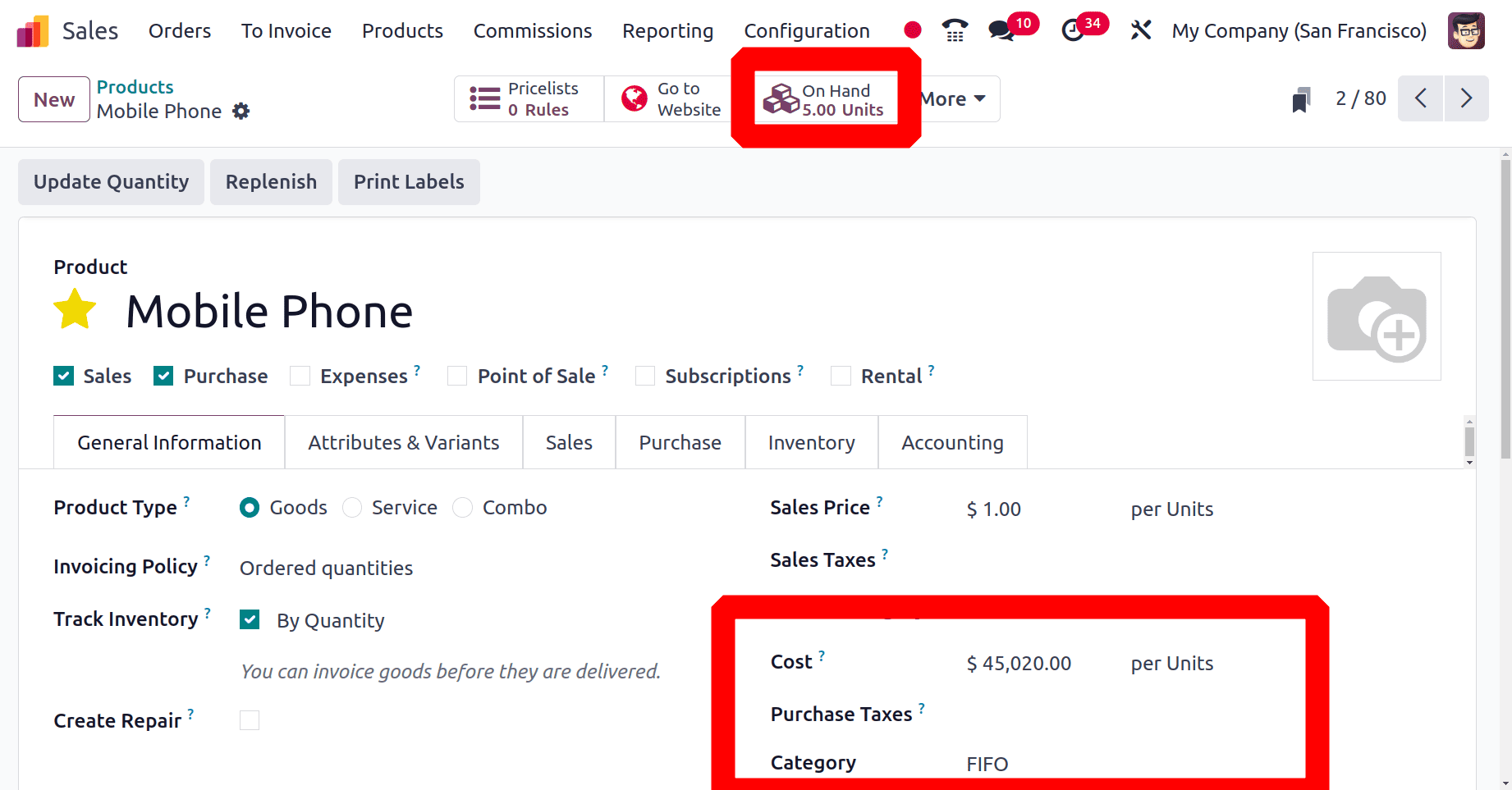

Let us check the Cost updated inside the product, which is updated as shown below.

Here, the remaining quantity from the first purchase is 8 quantities, and from the second purchase is 5 quantities. So the on-hand quantity is shown as 13 units. So while checking the cost, Cost = (8*35010+5*45020)/13 = 38860.

Then, while selling the whole quantity from the first purchase, the cost of the second purchase will automatically be updated here. To check that, sell the remaining 8 quantities. Here, the below sale order is created for 8 quantities.

Here, the Delivery order shows that 8 quantities of Mobile phones are removed from the company stock.

Then again, open the Inventory Valuation report. Here, the report shows that both the quantities that were sold from the stock are removed from the First purchase. Thich means the unit value is $35010, which is the Cost of the First purchase.

Then the Cost of the Product Mobile Phone, is automatically updated as the cost of the second purchase, which is $45020. And the Onhand quantity is reduced to 5 quantities.

In summary, the FIFO costing approach will only update the second purchased cost as the product cost once the sale of the first purchased quantity has been completed.

All things considered, landed cost is a useful characteristic that can help companies. Businesses can make sure they are setting competitive prices for their goods and optimizing their earnings by keeping a close eye on their landed expenses. Additionally, assist companies in lowering the possibility of suffering monetary losses as a result of poor inventory control or pricing.

To read more about How to Calculate Landed Cost in Odoo 16 Inventory Module, refer to our blog How to Calculate Landed Cost in Odoo 16 Inventory Module.