Businesses must navigate the rules governing intra-community distance selling in the context of European Union (EU) commerce. Strong accounting capabilities in Odoo 18, a complete business management program, help expedite this procedure while guaranteeing efficiency and compliance. The fundamentals of EU intra-community distance selling will be covered in this blog, along with how Odoo 18's accounting features can help ensure seamless operations in this context.

Understanding EU Intra-Community Distance Selling

Intra-community distance sales are movements of goods from one EU member state to multiple recipients, such as consumers or another EU member state, and are typically subject to taxation in the member state where the deliveries conclude. For microbusinesses, sales are typically taxed in the member state where the transportation originates. This category of sales includes a wide range of transactions, such as mail orders, telesales, physical goods orders, and similar methods of commerce. EU intra-community distance selling is the sale and transportation of goods between EU member states to customers who are not VAT registered. In order to maintain equitable taxation and deter tax evasion inside the EU single market, these transactions are governed by certain VAT regulations.

We include a number of variables that affect EU Intra-Community Distance Sales below.

Shipped or Delivered Items

When it comes to intra-community distance sales, the provider uses a variety of ways to ship the items. First, suppliers may choose to hire outside logistics companies to handle the delivery of their goods. Alternatively, suppliers may bear partial or entire responsibility for the delivery of goods assisted by third-party carriers. Customers usually pay transport costs, which are collected by the supplier and used for the transportation service. As a result, the supplier's approval is required before the items are delivered.

Several Clients

Through intra-community distance selling, the range of items supplied to certain customers is defined. These clients include, among others, non-taxable organizations and legal persons like NATO and international organizations. The client base also includes taxable individuals who are involved in flat-rate systems for farmers, second-hand margin schemes, and similar arrangements.

Online Sales

Customers' online purchases are also included in distance selling, which means that value-added tax (VAT) regulations must be followed. Online services that are offered electronically are governed by a number of VAT requirements. These rules, which are relevant to intra-community distance sales, help to efficiently handle tax liabilities and financial situations.

Setting Up Odoo 18 for EU Intra-Community Distance Selling

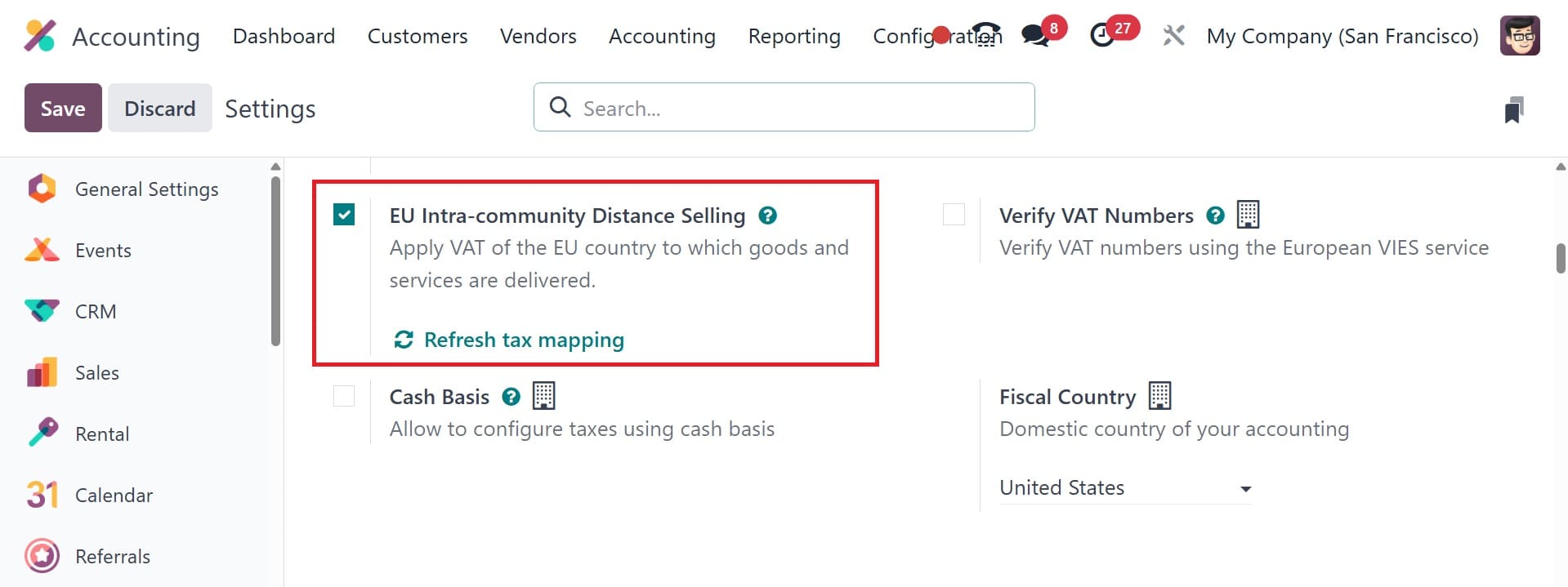

Strong tools are available in the Odoo 18 accounting module to improve intra-community distance selling procedures in the EU. Users can go to the Settings menu in the Configuration part of the Odoo ERP software to use the EU distance selling capability and efficiently handle taxes across many nations.

They can locate the Taxes section there, which contains important tax management settings. In Odoo Accounting, turning on the EU Intra-community Distance Selling capability is a simple procedure. Users can activate the EU Intra-community Distance Selling capability by selecting the appropriate option in the Settings box. When this option is enabled, Odoo ERP gives companies the ability to simplify their tax administration procedures, especially when it comes to intra-community distance sales within the EU. This feature facilitates smoother operations and lessens the administrative load related to cross-border transactions by improving compliance with EU tax legislation.

Value-added taxes (VAT) that apply to EU countries for delivered products and services can be specified by users after the EU Intra-community Distance Selling option is activated. In order to save their modifications, users need to remember to click the SAVE icon.

All necessary taxes for every EU member state are automatically generated depending on the company's country settings when you enable the EU Intra-community Distance Selling option. Let's now look at the financial standing of the nations where your business operates to make sure everything is accurate and compliant once the EU distance selling capability was activated.

Taxes and Fiscal Situations in Odoo 18 Accounting for Every EU Member State

Together, the 27 European nations that make up the European Union partnership—also referred to as Member States or EU Countries—cover the majority of the continent. These nations include, among others, Austria, Italy, Romania, and Poland. It's important to remember that many Member States continue to pursue individualistic budgetary policies. A fiscal balance is commonly used to show the difference between current expenditure and revenue.

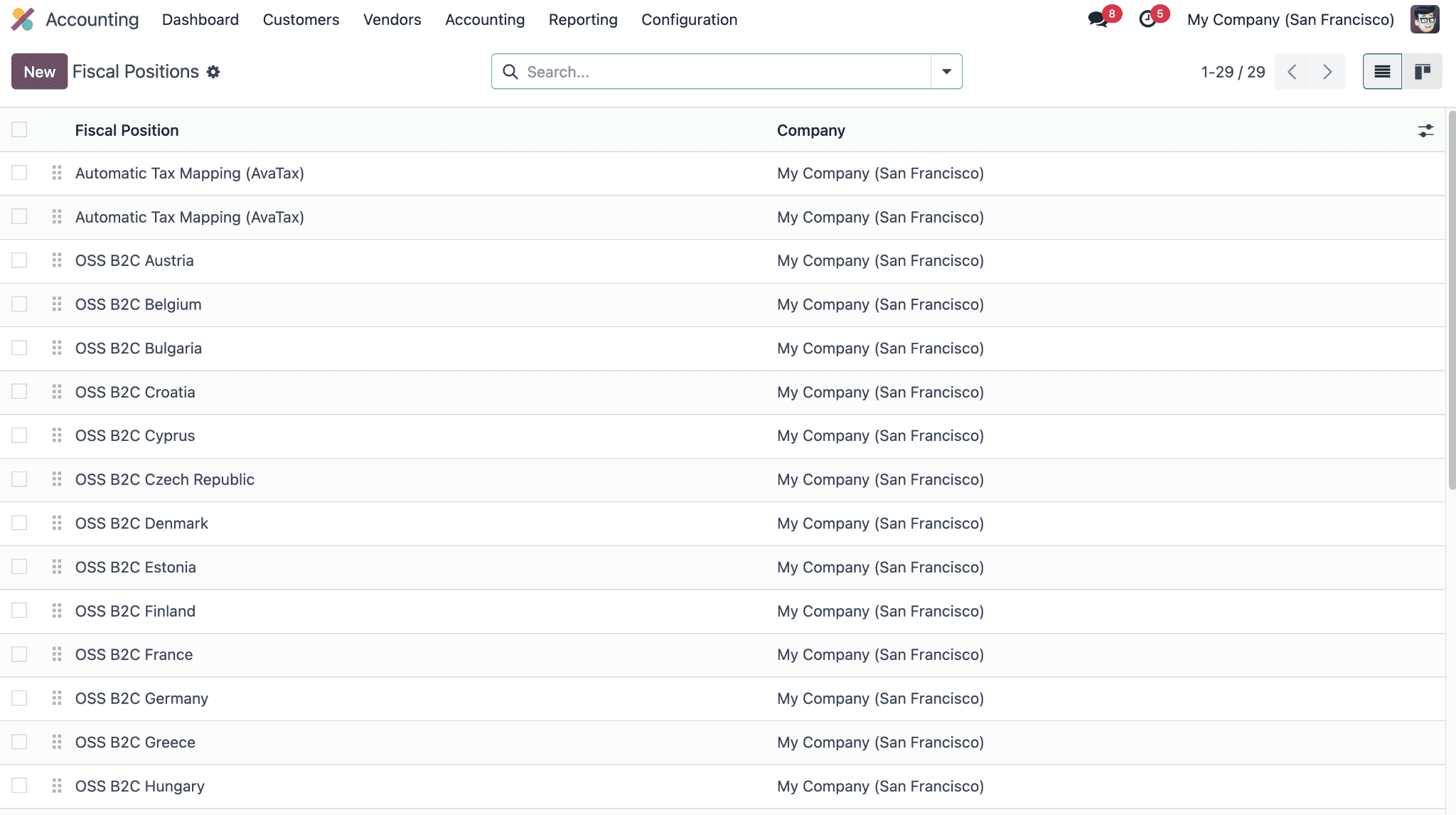

Users can go to the Fiscal Positions option in the Configuration tab of the Odoo ERP software to obtain information on fiscal positions pertaining to EU Member States. This menu facilitates effective management and adherence to tax laws by offering a thorough record of all fiscal positions pertinent to EU Member States.

Users may easily reference and analyze fiscal data by accessing detailed information, including the linked Company and Fiscal Position, within the List view.

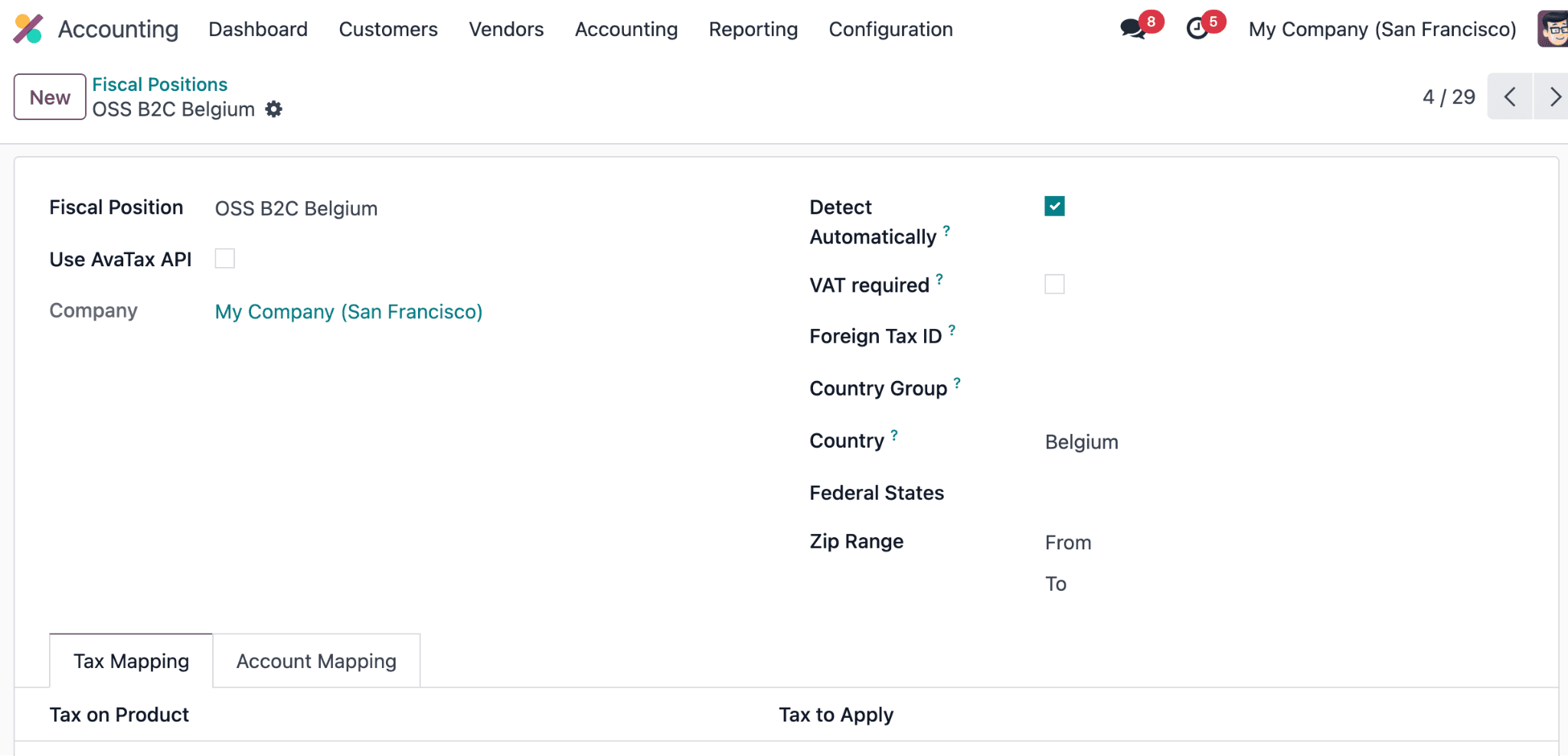

Just select the CREATE button from the Fiscal Positions menu to establish a new fiscal position for your nation. By choosing the appropriate fiscal stance, you can then allow VAT for a certain nation. For example, as shown in the screenshot below, you can construct the fiscal position linked with Ireland if you want to configure Value Added Taxes (VAT) for Ireland.

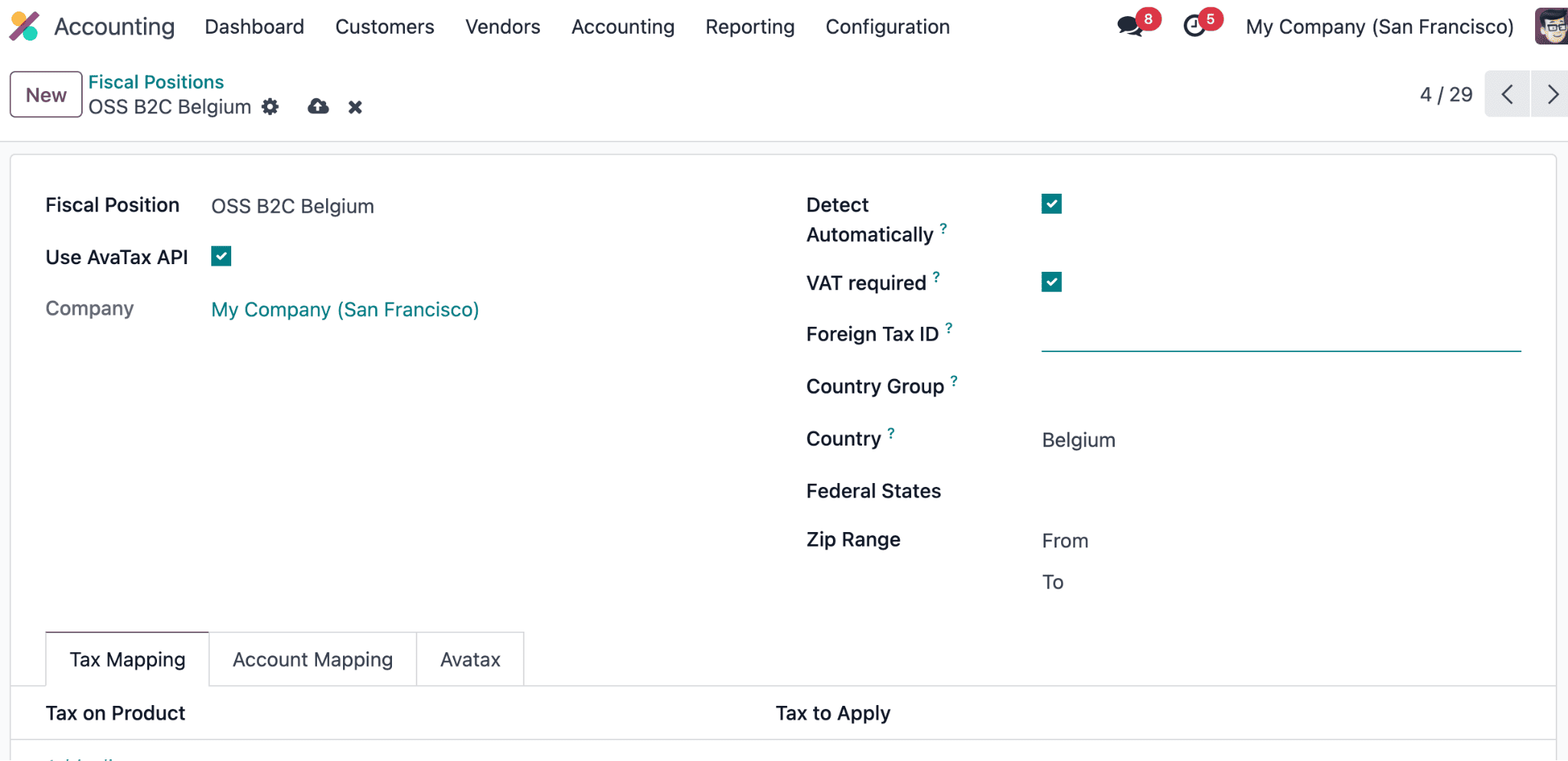

Here, the company name and the fiscal position are mentioned as automatic tax mapping. Just turn on the "Detect Automatically" option, as indicated in the screenshot, to expedite the application of this fiscal position. This feature makes it easier to manage tax laws and compliance within your Odoo ERP system by guaranteeing that the designated fiscal position is automatically applied where applicable.

If the partner has a VAT number, users can choose to enable the VAT needed field. Furthermore, users can enter their firm tax ID in the "Foreign Tax ID" section in accordance with the mapped region fiscal position, as seen in the screenshot that goes with it.

Users should click the SAVE icon to save their modifications after entering the necessary fiscal position data.

The European Union's OSS system streamlines VAT collection for international transactions of goods and services. It mostly pertains to B2C (business-to-consumer) situations. Businesses can utilize a single online portal to manage VAT responsibilities for their sales inside the EU and register for VAT in their home country with the OSS. The Union OSS scheme for cross-border services and the Import OSS scheme for items valued at or less than €150 are the two main programs.

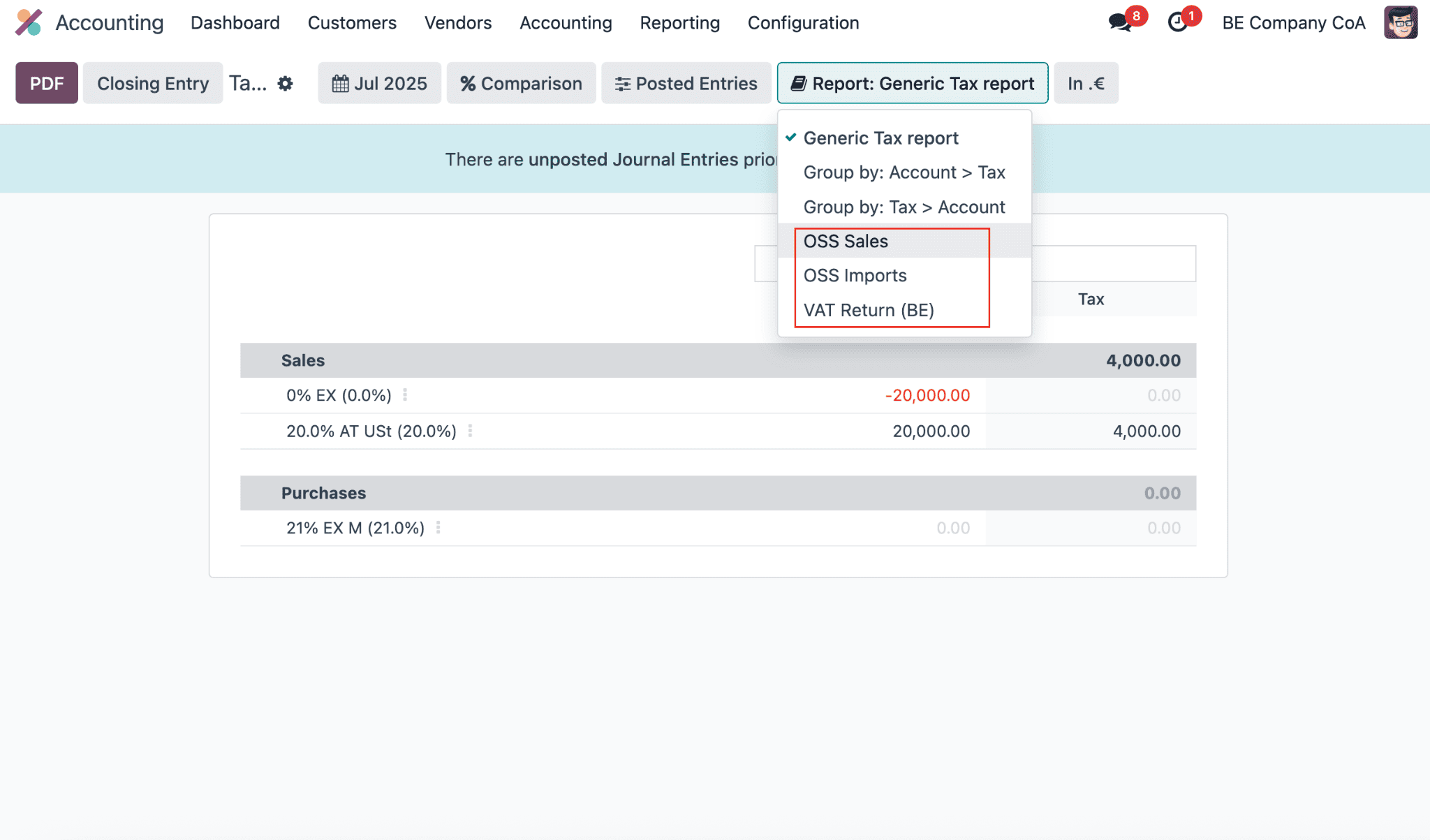

Go to Accounting ? Reporting ? Tax Report, click Report: Generic Tax report, and choose either OSS Sales or OSS Imports to create and send OSS sales or imports reports to the OSS site. After choosing, select PDF, XLSX, or XML from the menu in the upper-left corner. This creates the report in the chosen format that is now open. After it has been created, submit it to the OSS portal by logging into the platform of the appropriate federal authority.

For companies involved in intra-community distance marketing within the EU, Odoo 18 Accounting capabilities offer a complete solution. Through the automation of tax computations, threshold monitoring, multi-currency transaction support, integrated reporting, and VAT number validation, Odoo 18 enables companies to streamline their accounting procedures and guarantee adherence to EU VAT laws. Businesses can easily handle the challenges of intra-community distance marketing by utilizing Odoo 18, freeing them up to concentrate on development and expansion within the EU single market.

To read more about EU Intra-Community Distance Selling in Odoo 17 Accounting , refer to our blog EU Intra-Community Distance Selling in Odoo 17 Accounting.