In the realm of European Union (EU) commerce, navigating the regulations surrounding intra-community distance selling is a crucial aspect for businesses. Odoo 17, a comprehensive business management software, offers robust accounting features that can streamline this process, ensuring compliance and efficiency. In this blog, we'll delve into the essentials of EU intra-community distance selling and explore how Odoo 17's accounting capabilities can facilitate smooth operations within this framework.

Understanding EU Intra-Community Distance Selling

Intra-community distance sales refer to the movement of goods from one EU member state to various recipients, which can include another member state or consumers. Typically, these transactions are subject to taxation in the member state where the deliveries conclude. For micro businesses, sales are usually taxed in the member state where the transportation originates. This category of sales encompasses a wide range of transactions, including orders of physical goods, telesales, mail orders, and similar methods of commerce. EU intra-community distance selling refers to transactions where goods are sold and transported between EU member states to customers who are not VAT registered. These transactions are subject to specific VAT rules aimed at ensuring fair taxation and preventing tax evasion within the EU single market.

Below, we outline several factors that are contingent upon EU Intra-Community Distance Sales:

Dispatched or Transported Goods

In the realm of intra-community distance sales, the dispatching of goods by the supplier occurs through various channels. Firstly, suppliers may opt to subcontract the transportation of goods to third-party logistics providers for delivery. Alternatively, suppliers may assume partial or complete responsibility for the delivery of goods facilitated by third-party carriers. Transport fees paid by customers are typically collected by the provider and earmarked for the transportation service. Consequently, the delivery of goods is contingent upon the authorization of the supplier.

Multiple Customers

The scope of goods supply is delineated to specific customers within intra-community distance selling. These customers encompass non-taxable entities, legal persons such as international organizations and NATO, among others. Additionally, taxable individuals participating in second-hand margin schemes, flat-rate schemes applicable to farmers, and similar arrangements are included in the customer base.

Internet Sales

Distance selling also encompasses online purchases made by customers, necessitating compliance with value-added tax (VAT) requirements. Various VAT regulations govern electronically supplied services conducted over the internet. These regulations fall under the purview of intra-community distance sales, serving to manage tax obligations and fiscal positions effectively.

Configuring EU Intra-Community Distance Selling in the Odoo 17

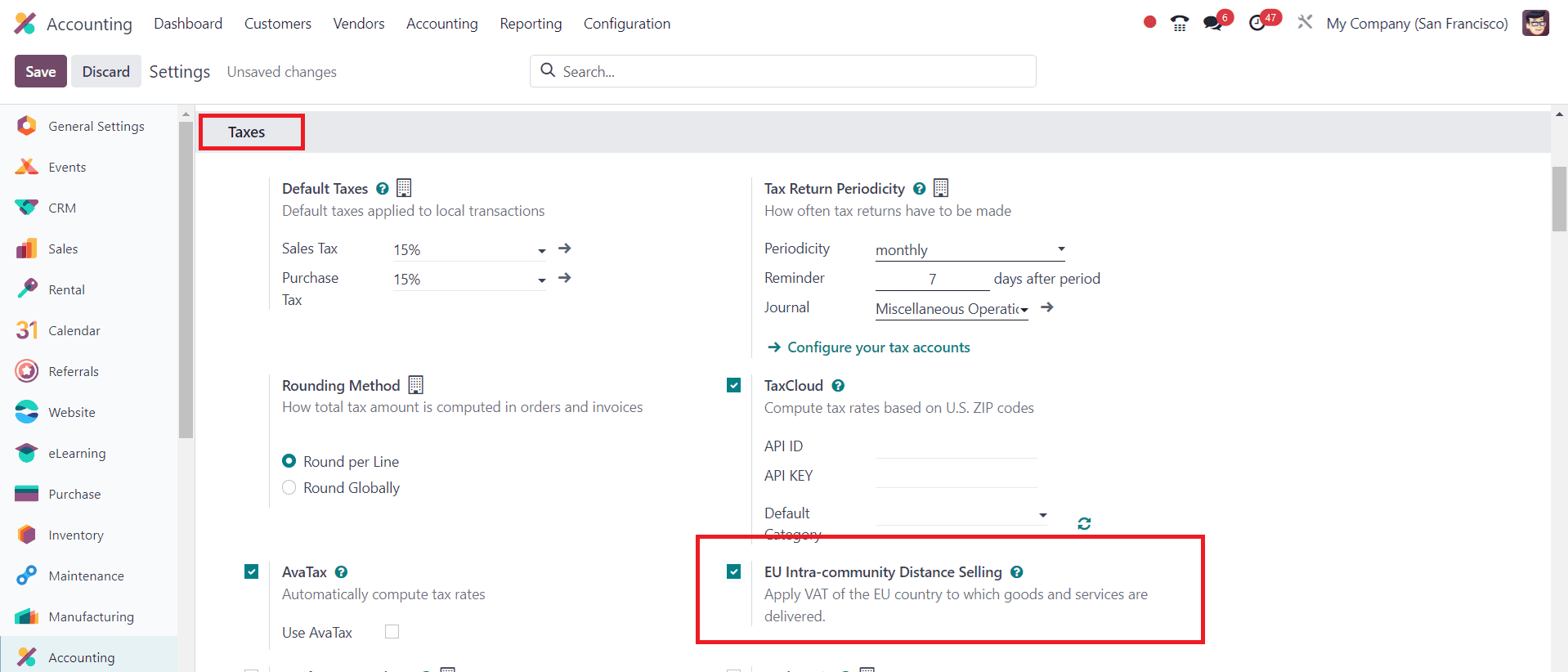

Odoo 17 accounting module offers powerful tools to streamline EU intra-community distance selling processes. To access the EU distance selling feature within the Odoo ERP software and effectively manage taxes across various countries, users can navigate to the Settings menu located within the Configuration section.

Once there, they can find the Taxes section, which houses crucial settings for tax management. Enabling the EU Intra-community Distance Selling feature is a straightforward process within Odoo Accounting. Once in the Settings window, users will find a dedicated option for enabling the EU Intra-community Distance Selling feature. Upon enabling this feature, Odoo ERP empowers businesses to streamline their tax management processes, particularly in the context of intra-community distance sales within the European Union. This functionality enhances compliance with EU tax regulations, facilitating smoother operations and reducing the administrative burden associated with cross-border transactions.

Upon activating the EU Intra-community Distance Selling feature, users gain the capability to specify value-added taxes (VAT) applicable to EU countries for both services and goods delivered. Finally, users should remember to click on the SAVE icon to preserve their changes.

When you activate the EU Intra-community Distance Selling feature, all essential taxes required for each EU member state are automatically generated based on the company's country settings. Now, let's examine the fiscal positions of your company's countries to ensure compliance and accuracy following the activation of the EU distance selling feature.

Taxes and Fiscal Positions in each EU Member State in Odoo 17 Accounting

The European Union partnership comprises 27 European countries known as Member States or EU Countries, collectively covering most of the European continent. These countries include Austria, Italy, Romania, Poland, among others. It's worth noting that many Member States maintain individualistic approaches to fiscal policy. The disparity between current expenditure and revenue is typically illustrated through a fiscal balance.

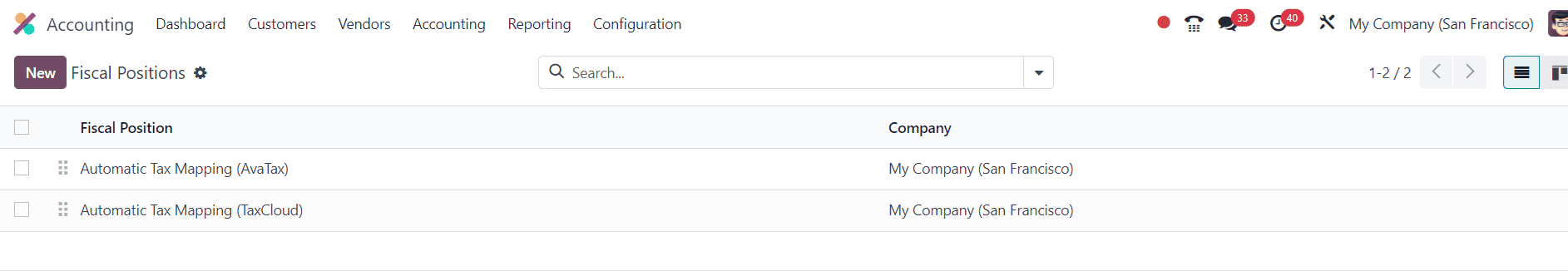

To access information on fiscal positions concerning EU Member States within the Odoo ERP software, users can navigate to the Fiscal Positions menu located in the Configuration tab. This menu provides a comprehensive record of all fiscal positions relevant to EU Member States, facilitating efficient management and compliance with tax regulations.

Within the List view, users can access detailed information such as the associated Company and Fiscal Position, allowing for easy reference and analysis of fiscal data.

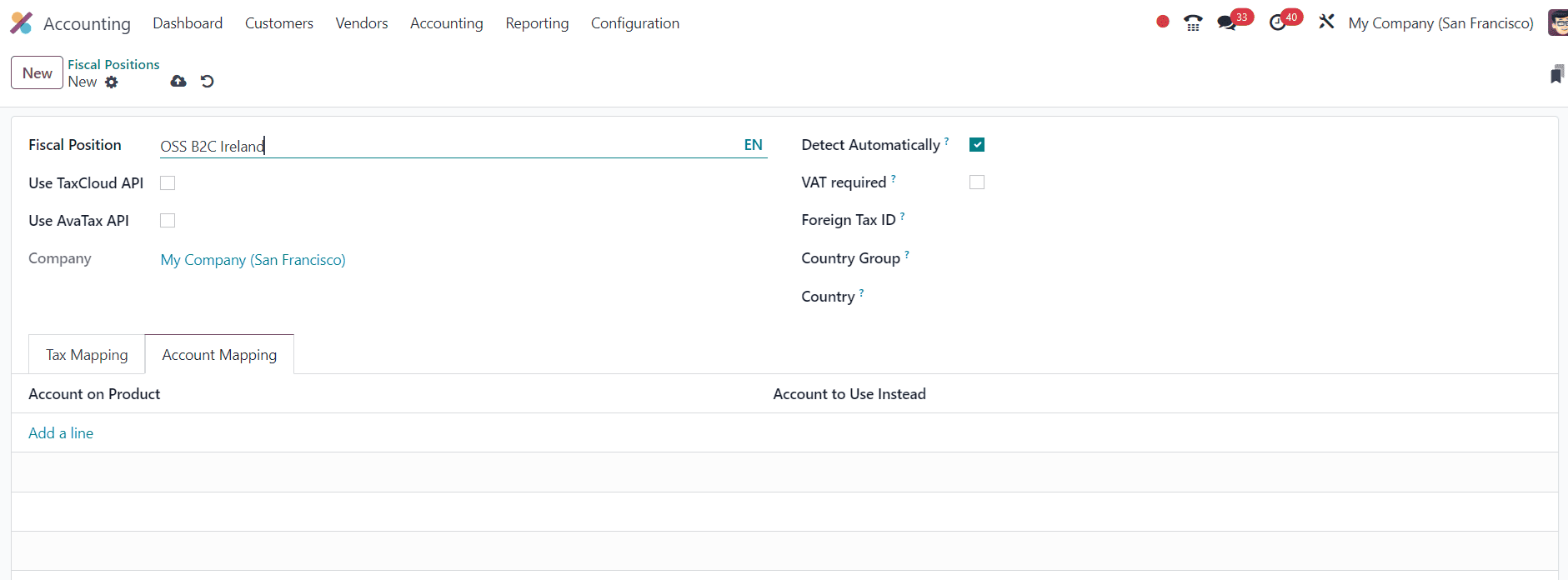

To create a new fiscal position for your country, simply click on the CREATE button within the Fiscal Positions menu. From there, you can enable VAT for a specific country by selecting the corresponding fiscal position. For instance, if you wish to configure Value Added Taxes (VAT) for Ireland, you can create the fiscal position associated with Ireland, as illustrated in the screenshot below.

Here, the Fiscal Position mentioned as "OSS B2C Ireland" along with the Company name. To streamline the application of this fiscal position, simply enable the "Detect Automatically" option, as highlighted in the screenshot provided. This setting ensures that the specified fiscal position is automatically applied where relevant, simplifying the management of tax regulations and compliance within your Odoo ERP system.

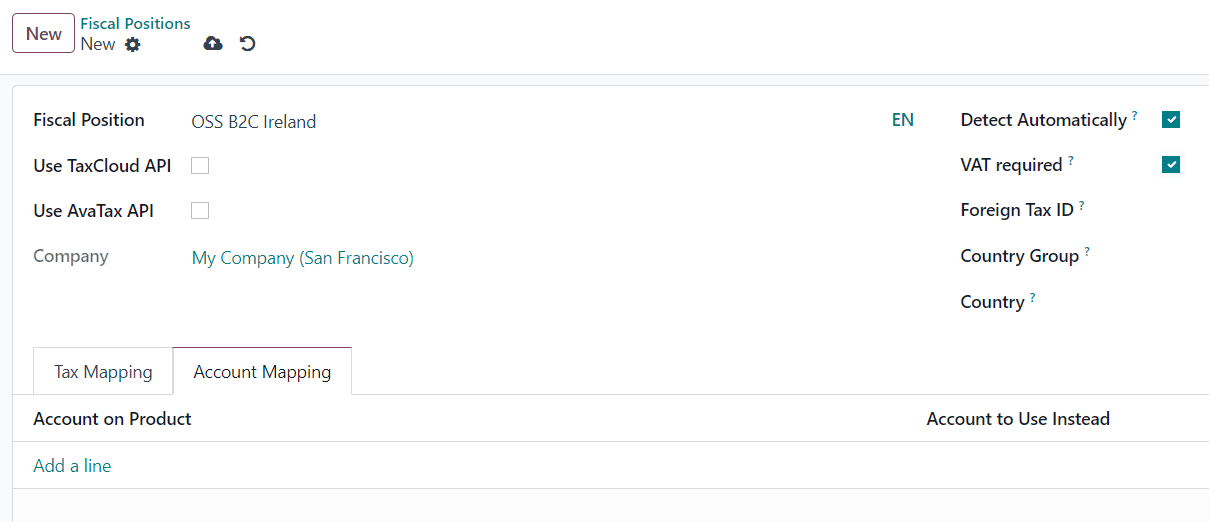

Users have the option to enable the VAT required field if the partner possesses a VAT number. Additionally, in accordance with the mapped region fiscal position, users can input their company tax ID into the "Foreign Tax ID" field, as depicted in the accompanying screenshot.

After inputting the required information regarding the fiscal position, users should select the SAVE icon to preserve the changes.

Odoo 17 Accounting features provide a comprehensive solution for businesses engaged in EU intra-community distance selling. By automating tax calculations, monitoring thresholds, supporting multi-currency transactions, facilitating integrated reporting, and validating VAT numbers, Odoo 17 empowers businesses to ensure compliance with EU VAT regulations while streamlining their accounting processes. By leveraging Odoo 17, businesses can navigate the complexities of intra-community distance selling with ease, enabling them to focus on growth and expansion within the EU single market.