Odoo is a powerful and flexible ERP system that offers a range of tools to streamline financial management. In this blog post, we’ll explore the Invoicing Switch Threshold feature in Odoo 18 Accounting. The Invoicing Switch Threshold enables businesses to archive or cancel all invoices, bills, and journal entries prior to a specified date, ensuring that only transactions from the chosen period onward are reflected in the company’s accounts. This is especially useful during system migrations or when businesses want to start with clean accounting data. By applying a threshold, Odoo provides a simple yet effective way to maintain accurate, organized, and compliant financial records.

When using the Invoicing Switch Threshold in , the system archives or cancels all accounting entries dated before the specified threshold date. This ensures that only transactions from the chosen date onward affect the company’s financial records. It is especially useful during migrations or when starting a new fiscal period, as it helps maintain clean and accurate accounting data without the clutter of past entries.

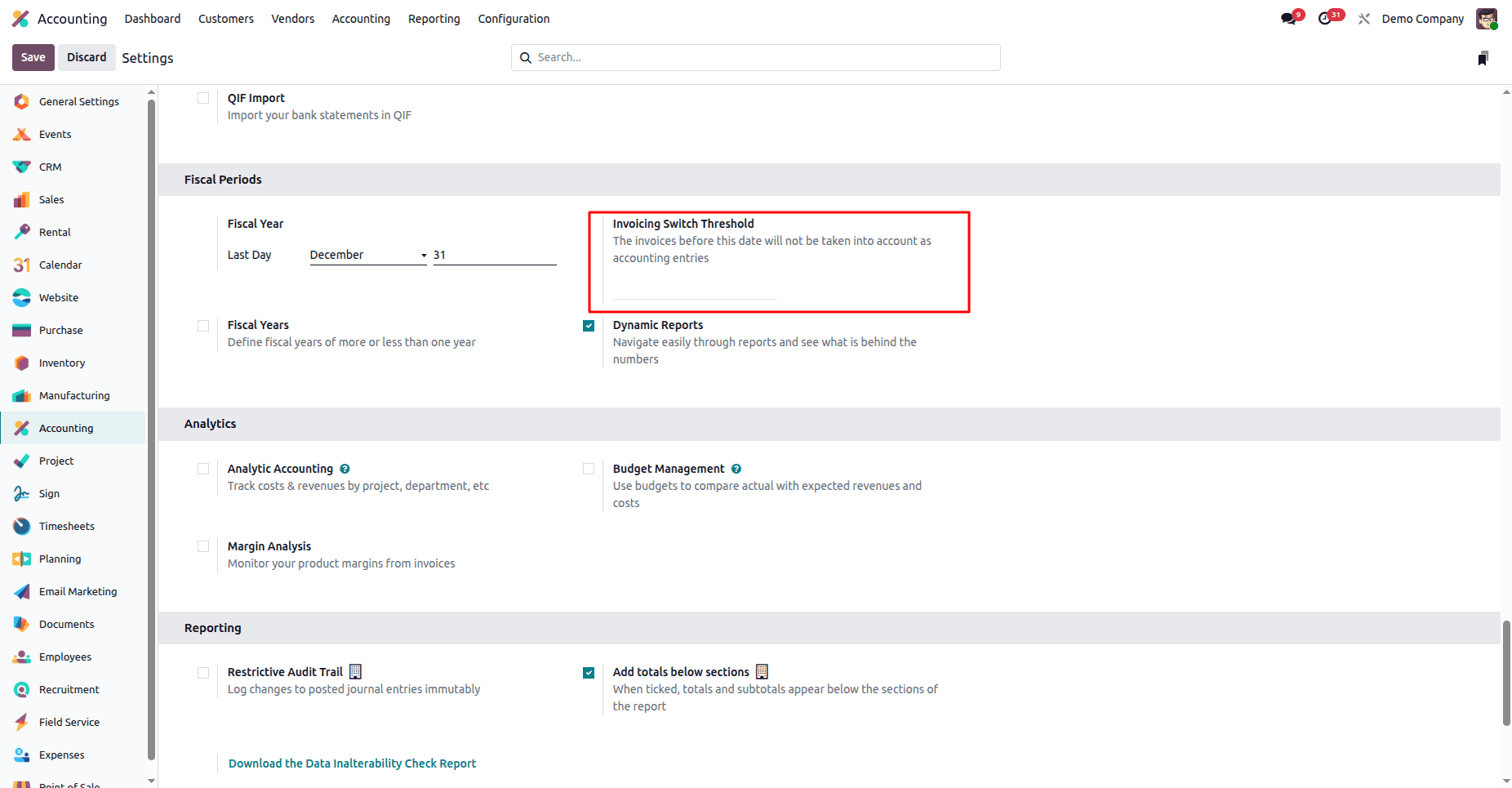

To enable this feature, you first need to select the date in the Invoicing switch threshold section, which will be found under Accounting > Settings in your Odoo system..

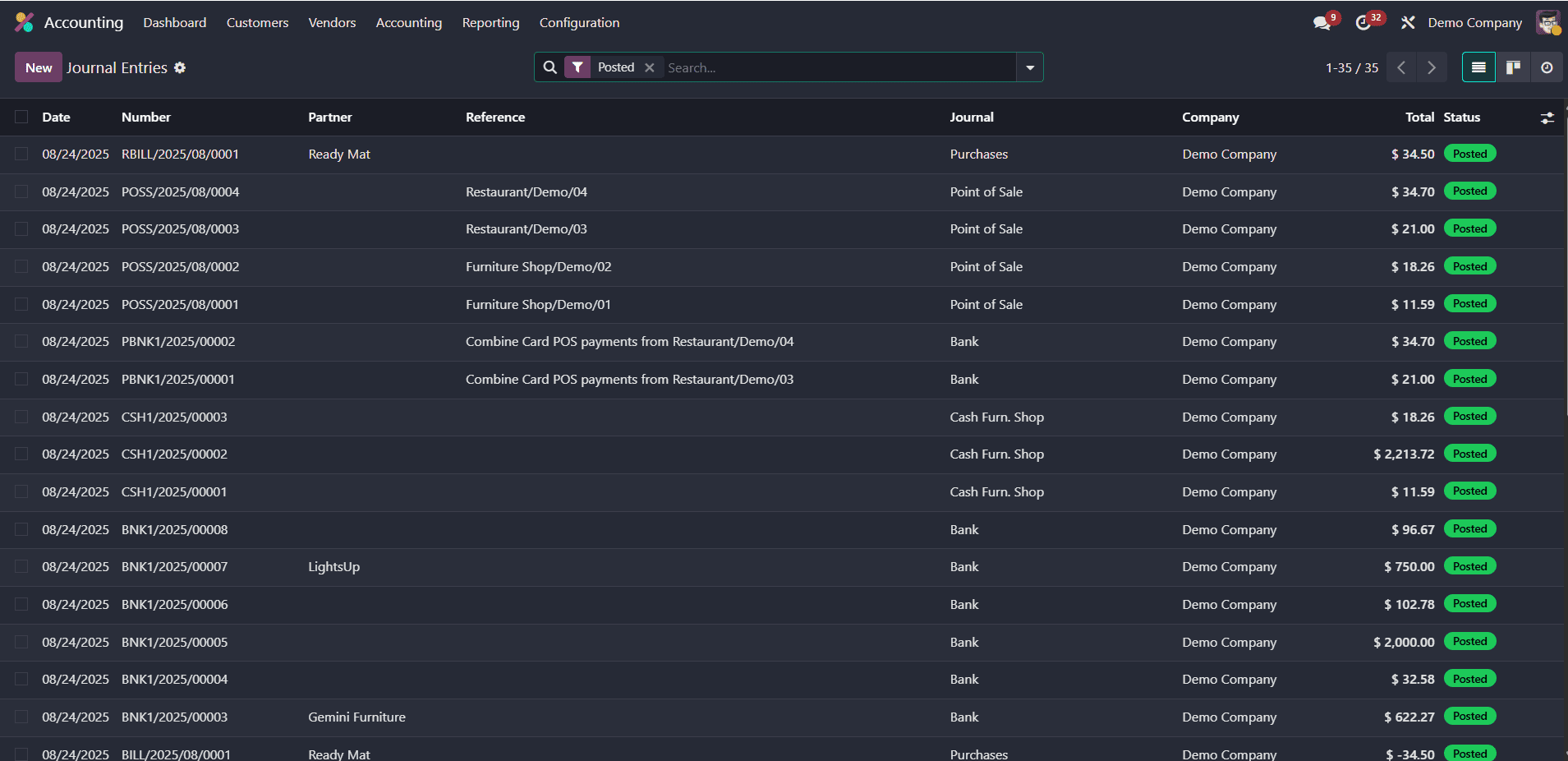

Before adding the threshold date, all the existing invoices, bills, and journal entries remain active in the system. These entries continue to affect your company’s accounting reports:

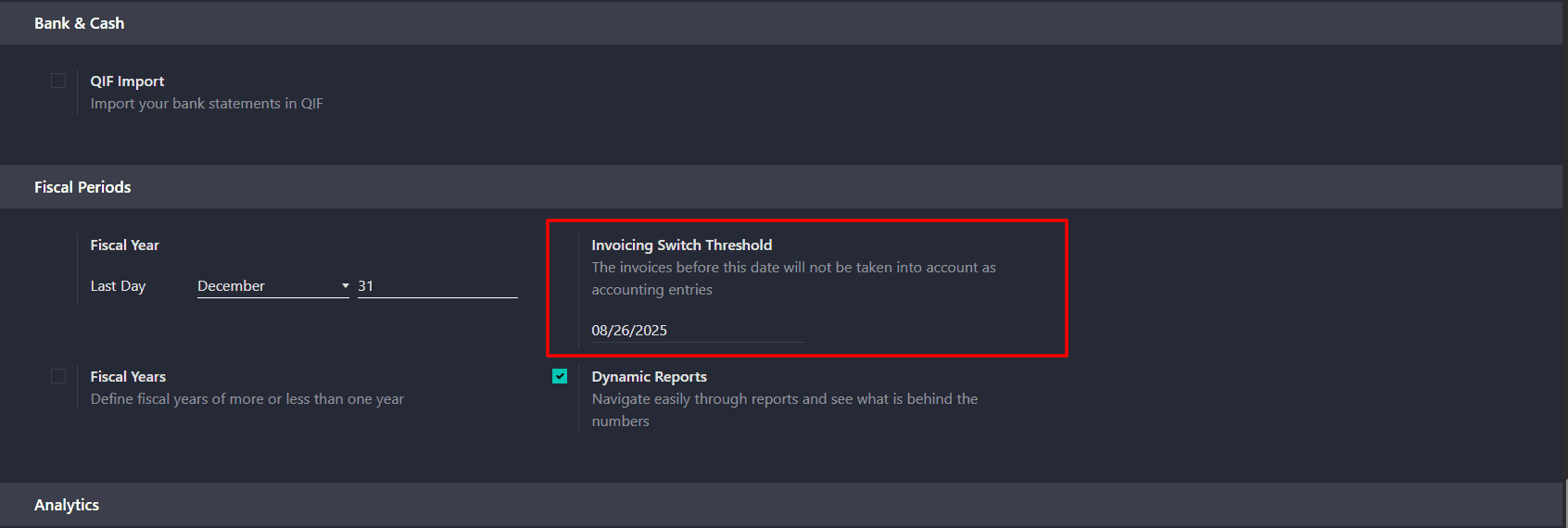

Once you apply the Invoicing Switch Threshold, all entries dated before the selected cutoff date will be automatically archived or canceled. This ensures that only entries created on or after the threshold date are considered in the company’s financial statements.

Below, you can see the configuration of the Invoicing Switch Threshold inside the Accounting settings.

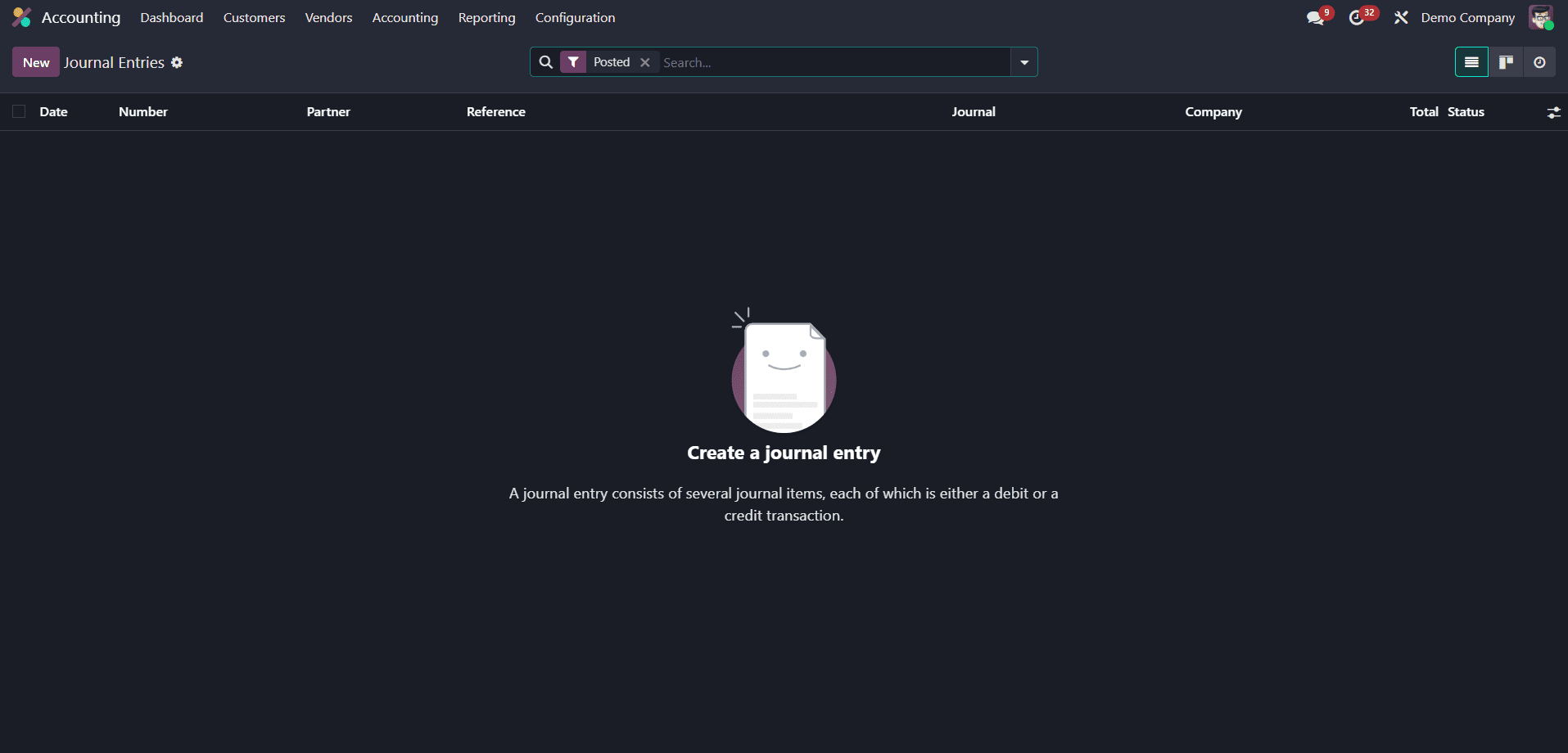

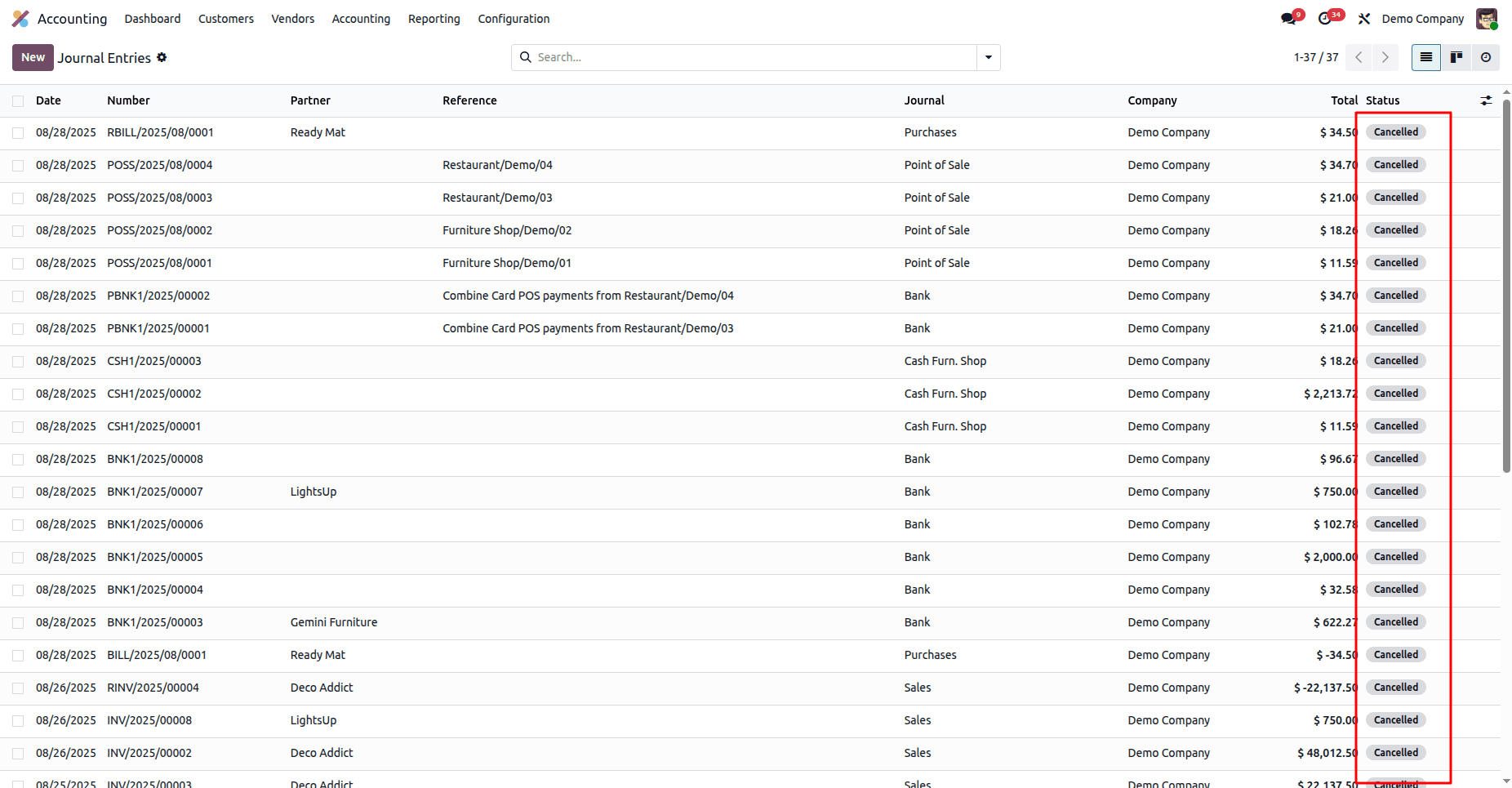

After applying the threshold, all previous journal entries are excluded or archived from the system’s financial impact, as shown below.

Once the threshold date is applied, journal entries before that date are marked as Cancelled, and become visible if you remove the filter..

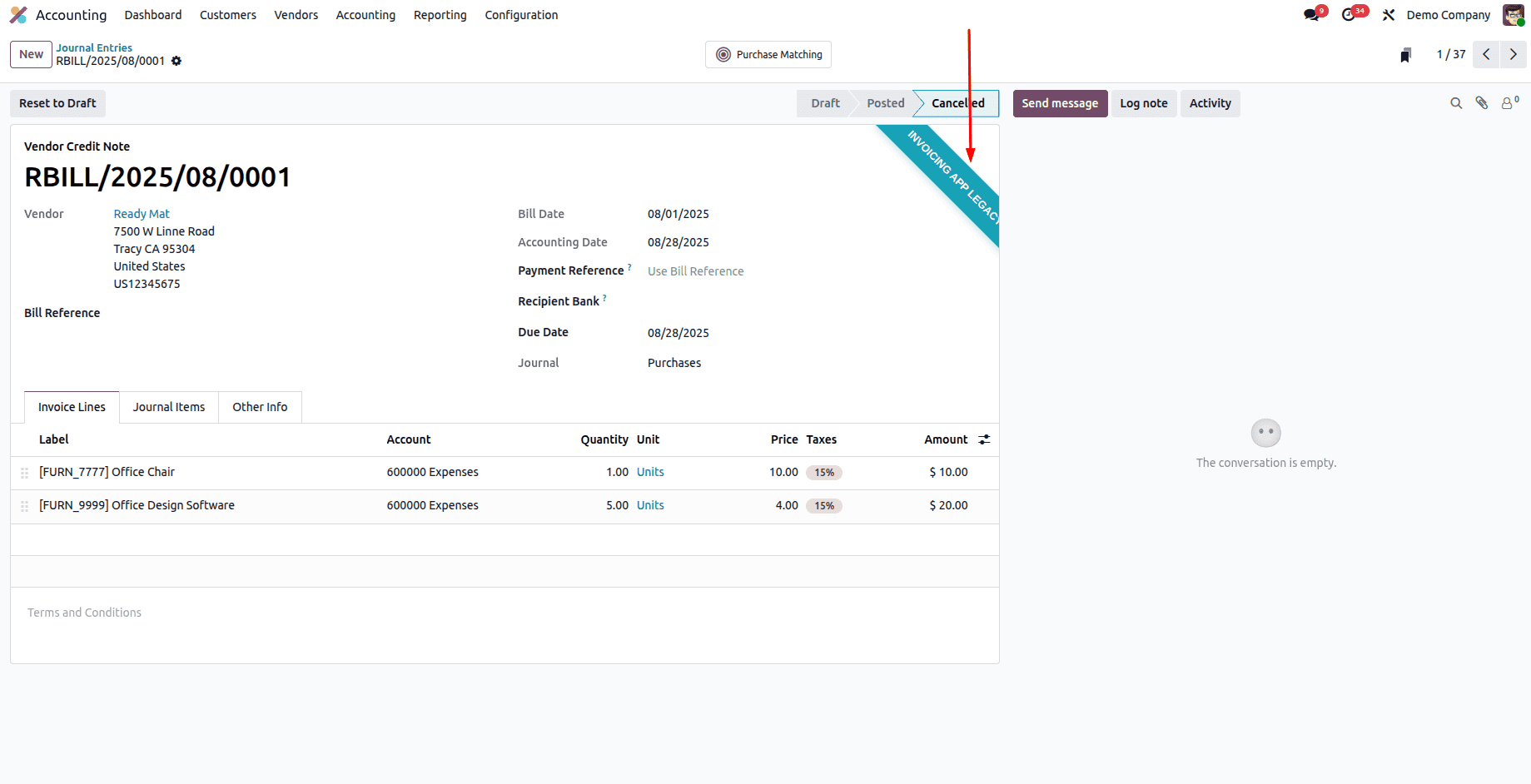

The form view automatically marks journal entries dated before the threshold as ‘Cancelled’, and a clear ribbon has been added for improved visibility.

When to Use Invoicing Switch Threshold

The Invoicing Switch Threshold proves highly valuable in several business situations, but it also has a few key considerations. One of the most common use cases is during a migration from another ERP system, where businesses may not want to carry forward all historical transactions into Odoo. By setting a threshold date, only recent and relevant entries are considered in accounting, while older data remains archived for reference. Another practical scenario is the start of a new fiscal year, allowing companies to begin their books cleanly and ensure that only transactions from that period onward are reflected in reports. Similarly, organizations with years of accumulated data can utilize this feature to clean up historical clutter, keeping records organized and preventing outdated entries from impacting day-to-day reporting. It also enhances audit readiness, as past records are archived but still accessible for verification, allowing accountants to focus on current financials. However, it’s essential to take certain precautions into account: this feature is only available in the Enterprise edition of Odoo, invoices or payments crossing the threshold date may require manual reconciliation checks, and it cannot replace the standard year-end closing process. For best results, businesses should always test the configuration in a staging database before applying it in production to avoid unexpected disruptions.

Benefits of the Invoicing Switch Threshold

Using the Invoicing Switch Threshold in Odoo 18 brings several clear advantages for businesses. First, it helps ensure clean financial data by removing the influence of outdated transactions on current reports, giving accountants a clear picture of the company’s present financial position. It also speeds up report generation, since the system no longer has to process large volumes of historical data, making financial analysis more efficient. Another key benefit is that it makes system migration smoother, allowing companies to carry forward only the transactions they need while still keeping older records archived for reference. At the same time, the feature simplifies audits and compliance by maintaining access to past entries without letting them interfere with ongoing accounting. Lastly, it prevents outdated transactions from affecting key performance indicators (KPIs), ensuring that managers and decision-makers work with accurate, up-to-date financial insights.

Overall, the Invoicing Switch Threshold in Odoo 18 brings clarity and structure to business accounting. It is particularly valuable during system migrations or at the start of a new fiscal year, allowing companies to reset their accounts without losing access to historical records. By archiving past entries and ensuring that only transactions from a chosen date onward affect financial reports, this feature helps maintain clean, compliant, and accurate financial data. For any business looking to streamline its accounting processes while preserving audit-ready historical information, the Invoicing Switch Threshold is an essential tool that delivers both flexibility and control.

To read more about How to Manage Customer Invoices in a Business with Odoo 18 Accounting, refer to our blog How to Manage Customer Invoices in a Business with Odoo 18 Accounting.