What are the different accounting systems in Odoo 18?

Odoo 18 mainly provides two accounting systems. Anglo-Saxon Accounting system and continental Accounting system. Both of these accounting systems follow different standards during each and every operation that is taking place in Odoo 18. These accounting systems vary from country to country. In this blog, we can discuss in detail the Continental accounting system and the ledger postings.

What is Continental Accounting in Odoo 18?

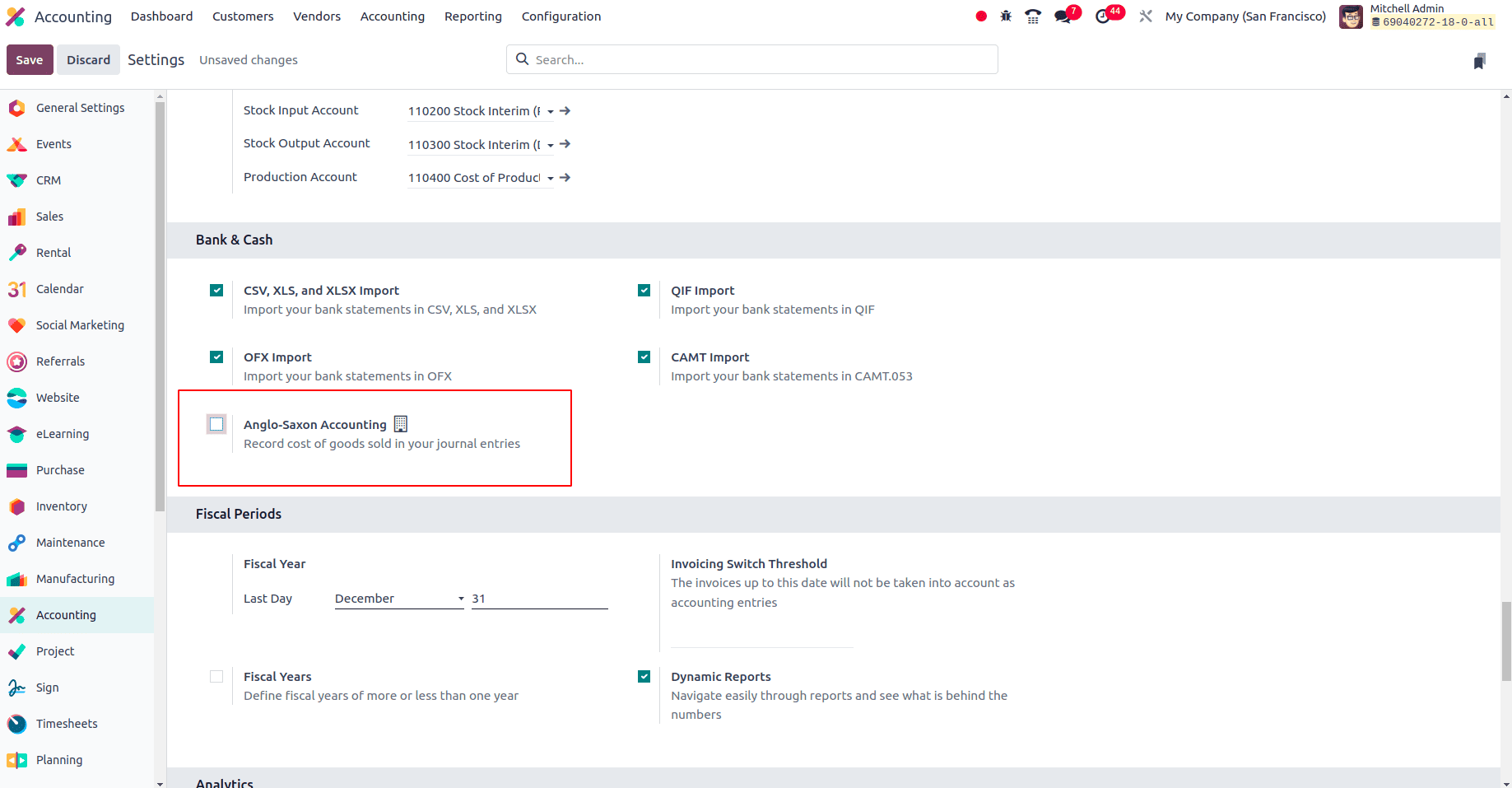

The continental accounting system is the Normal accounting standard provided by Odoo. If we are not enabling Anglo-Saxon Accounting from the Configuration > Settings of the accounting application, then it will be in the Continental accounting. In the Continental accounting system, whenever a purchase has been made, the expense for that purchase will be automatically posted in the ledger.

So to set up and function the continental accounting system, there is no need for you to set up any configurations. By default, Odoo provides the continental accounting system to use. Only after you have set up Anglo-Saxon Accounting from the Configuration settings, Odoo move the accounting system from Continental to Anglo-Saxon. So move to the Configuration settings and check whether the Anglo-Saxon Accounting is disabled or not. If Anglo-Saxon Accounting is enabled, just disable it.

Then after disabling this, click the Save button to save the changes, and now Odoo provides the accounts as continental.

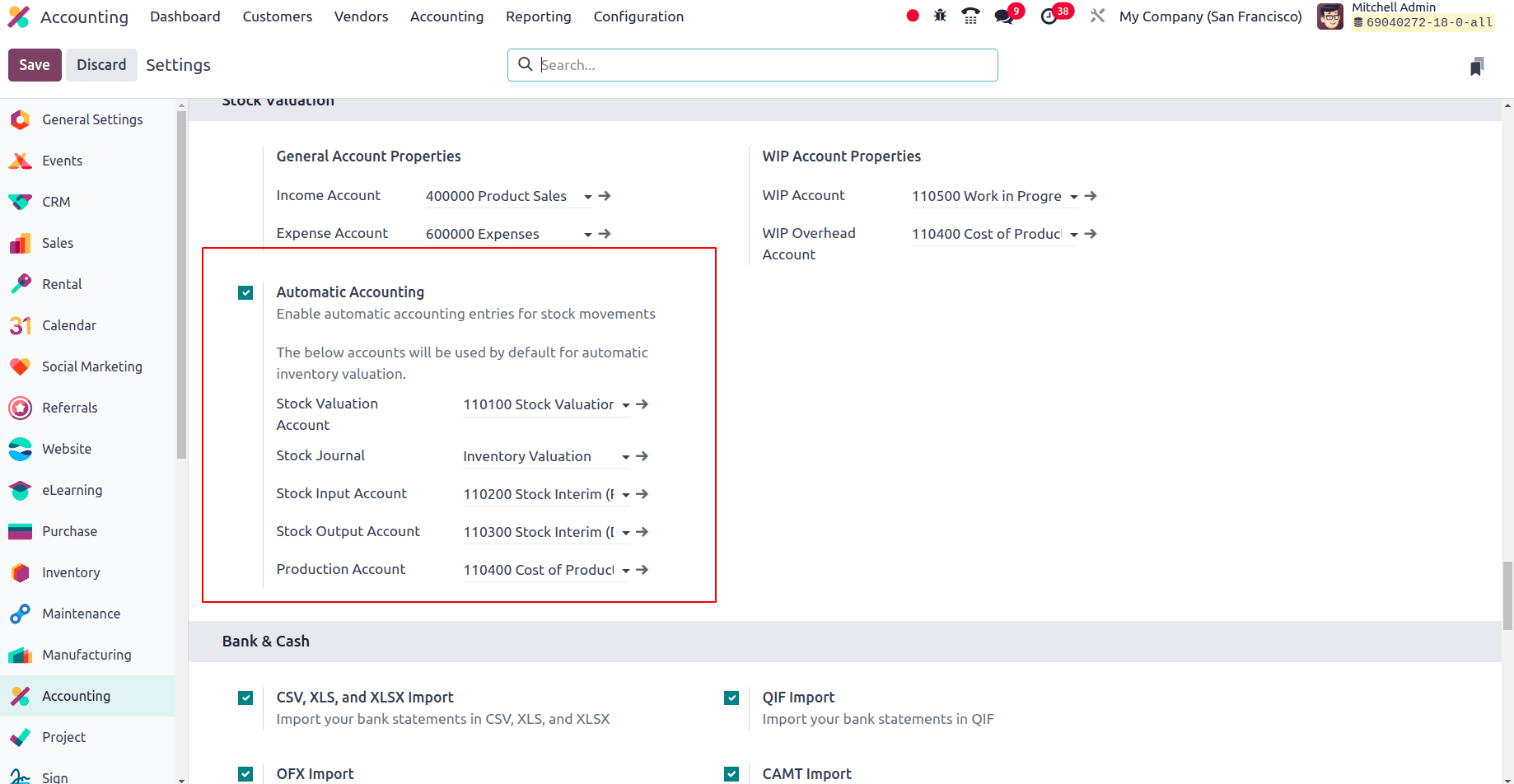

We are going to try the Continental accounting with a specific product category, so we should need to set the inventory valuation as automatic. That is only when the inventory valuation gets automated, an accounting entry is automatically created to value the inventory when a product enters or leaves the stock of the company. To automate the inventory valuation, you need enable the Field ‘Automatic Accounting’ from the Configuration > Settings of the Accounting Application.

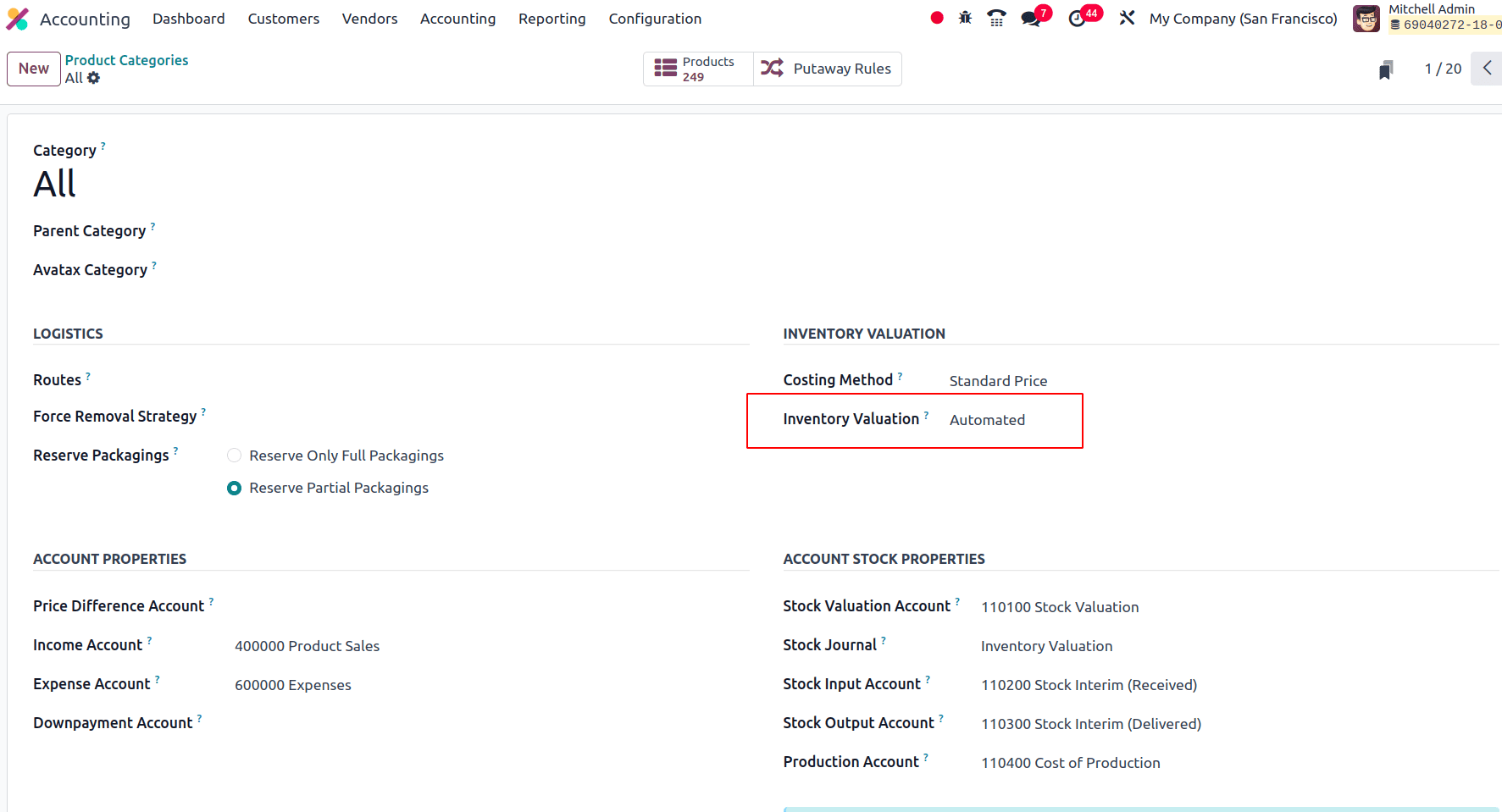

So on clicking the Configuration menu of the Accounting application, move to the product category sub-menu and then choose one of the product categories. Then set the inventory valuation of that product category as Automatic.

Now we have set the inventory valuation of the product category “All” as automatic, and then under the inventory valuation, odoo automatically updates the Accounts Stock Properties of this category instantly.

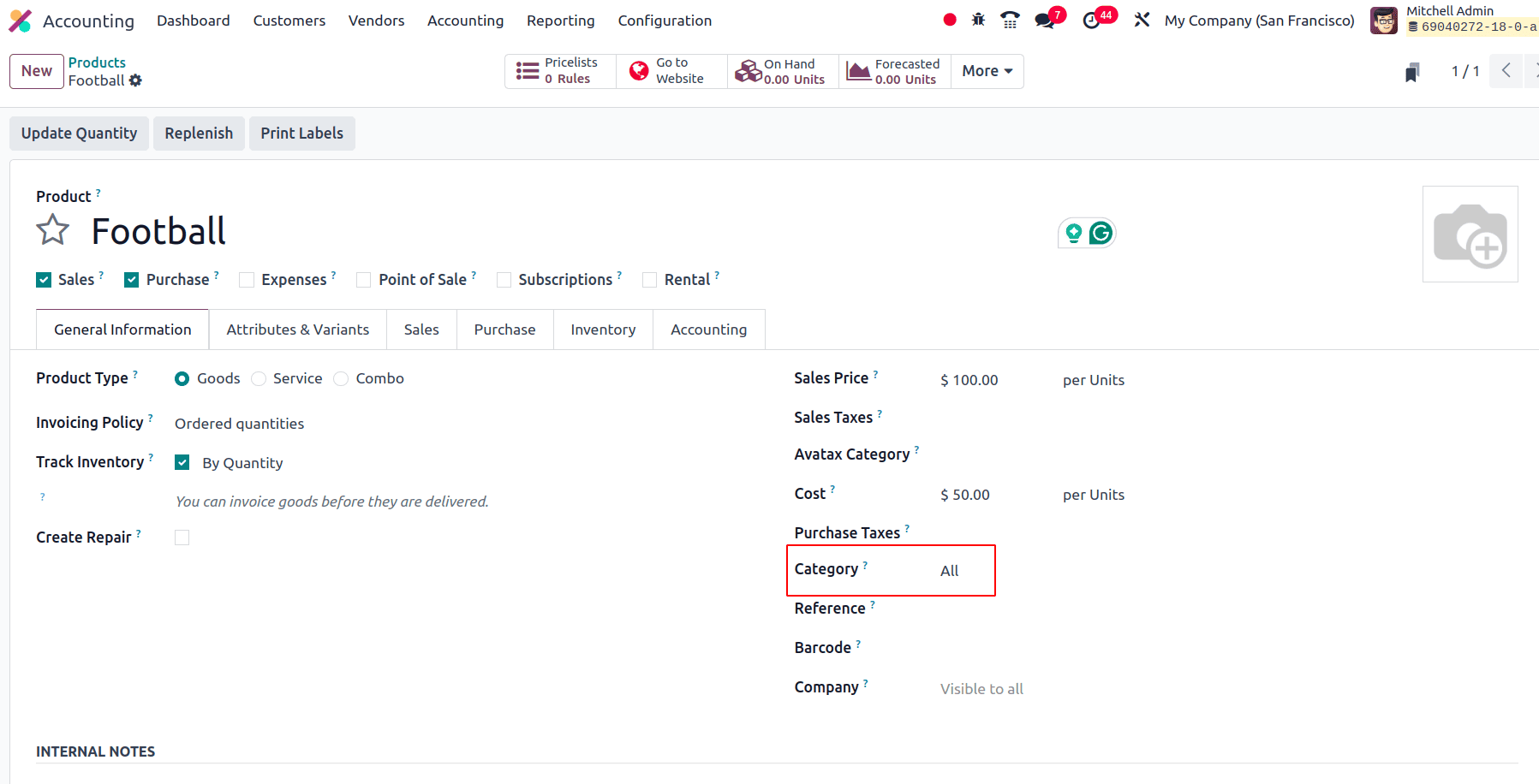

Next, we need to create a product from this category, and we can use this on several operations so that we can identify the actions of the continental accounting.

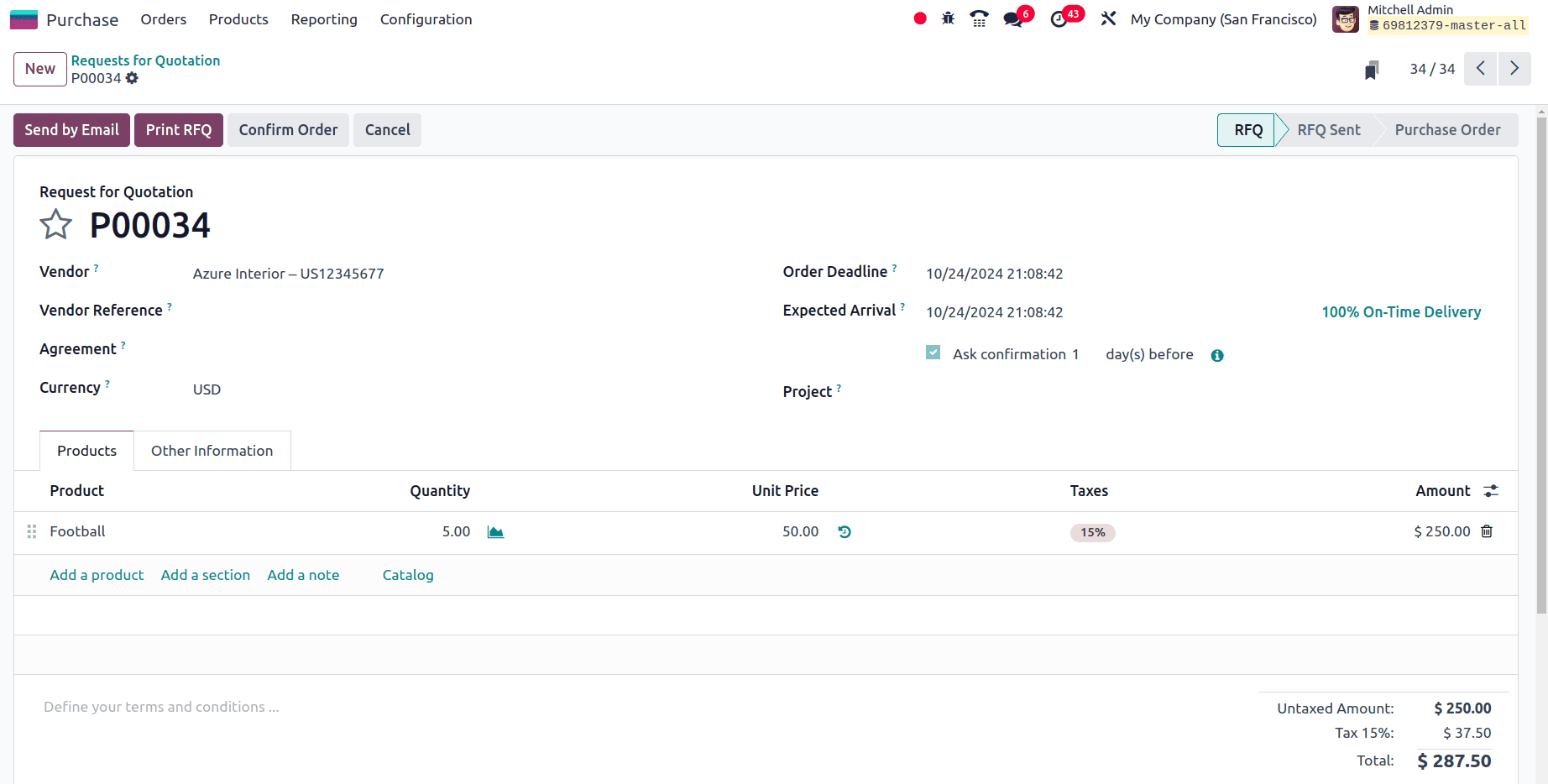

Now, we have created a new product, Football, from the category "All." Then we can create a purchase order for this product, and the ledger posting will be done after the bill for the purchase order has been created. So either move to the purchase module to create the purchase order or just create a vendor bill for this product from the Odoo 18 Accounting module. Move to the purchase module and create a purchase order for the product football.

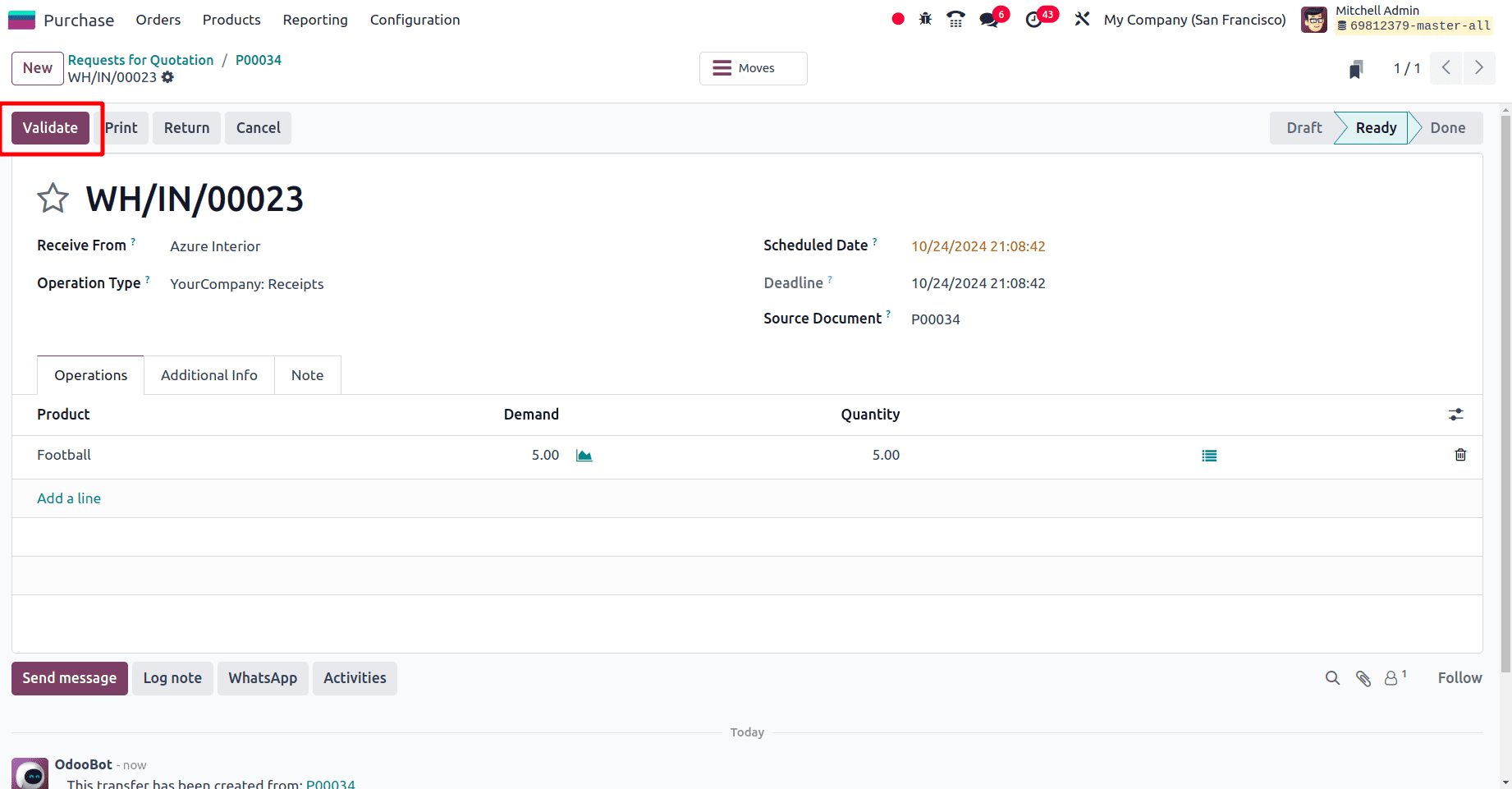

Then click the confirm order button to confirm the purchase order for this product and then we can receive the product from the vendor by clicking the receive button and clicking the validate button to validate the receipt of the purchase order.

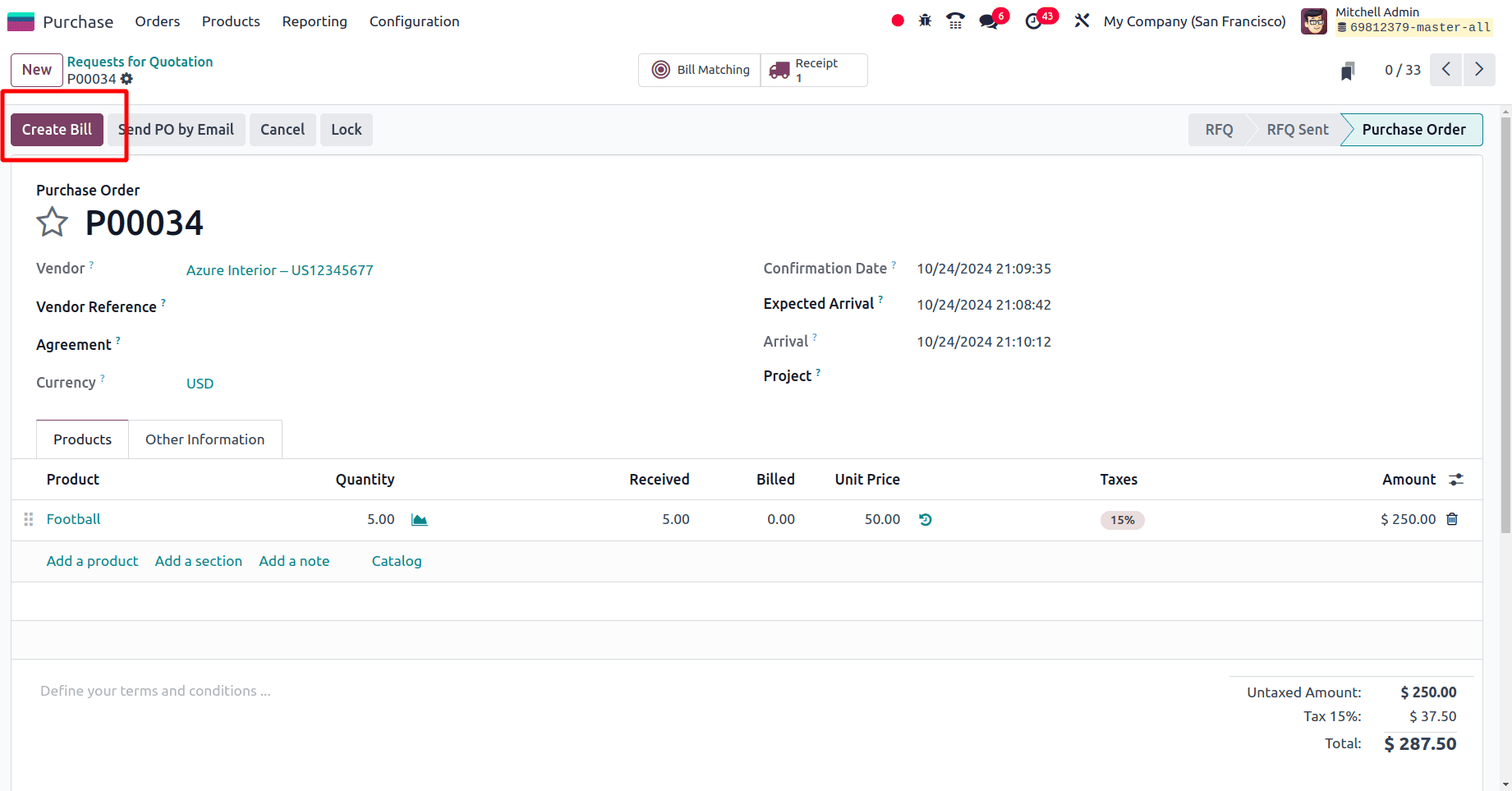

After the validation, move back to the purchase order where we can find the option to create the bill for this purchase order.

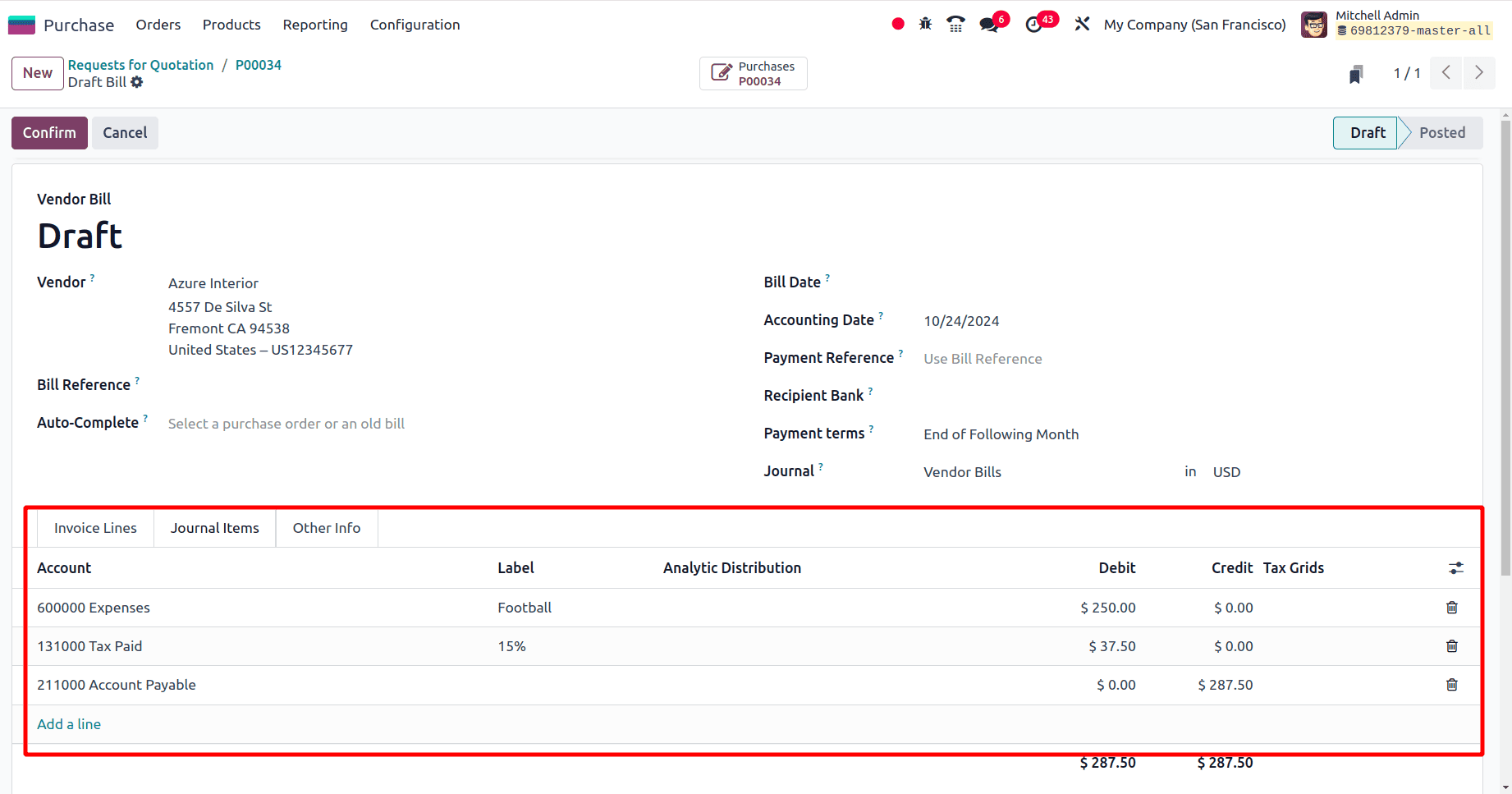

Click the create bill button to form a bill for the purchase order, and once the bill has been created, a journal item tab will be formed, and there we can see all the journal items that are created according to the purchase order.

Then click the confirm button to confirm the vendor bill. When moving to the journal items created we can say that ‘600000 Expenses’ and ‘211000 Accounts Payable’ are the two accounts that are used to post the journal entries here. 600000 Expenses is an expense account and here the expense account gets debited because when the expense gets increased the account will be debited. The next account, 211000 Account payable is a type of liability account and according to a liability account, when the liability is increased, the account will be credited. So here, when the product has been purchased from a vendor the liability on the product gets increased and the account gets credited. Then the Tax paid account as is an asset account, and when the asset is increased, the account will be debited.

| Account | Nature | Increasing/Decreasing | Credit/Debit |

| 600000 Expenses | Expenses | Increasing | Debit |

| 211000 Account payable | Liability | Increasing | Credit |

| Tax paid | Asset | Increasing | Debit |

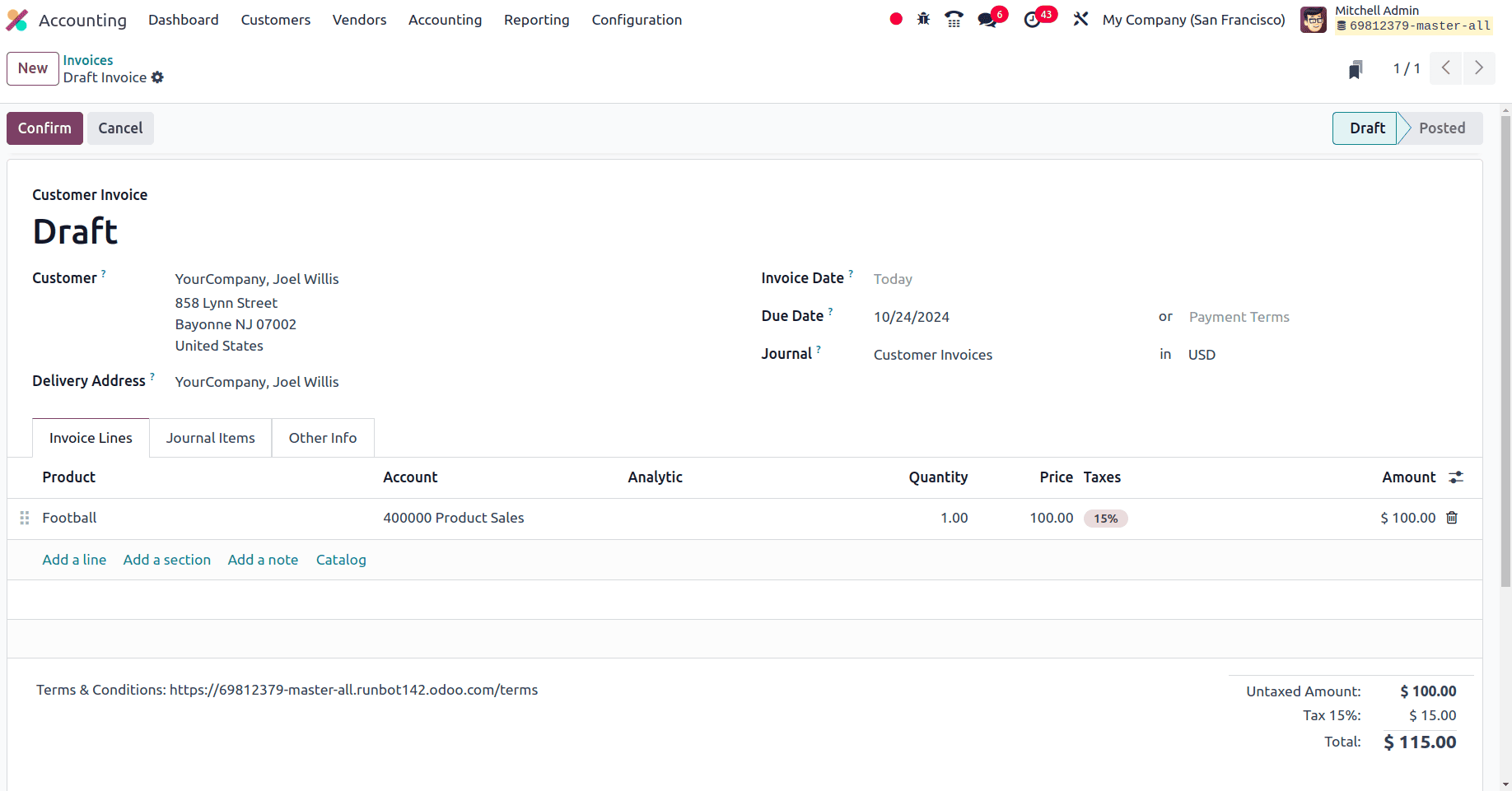

The next step is the selling of the same product. So move to the sales module to create a new sale order or just create an invoice for the product ‘Football’ from the accounting application. Under the ‘Customers’ menu of the accounting application, we have the invoices sub-menu, and on clicking the invoices, all the pre-created invoices are listed, and create a new invoice by clicking the New button.

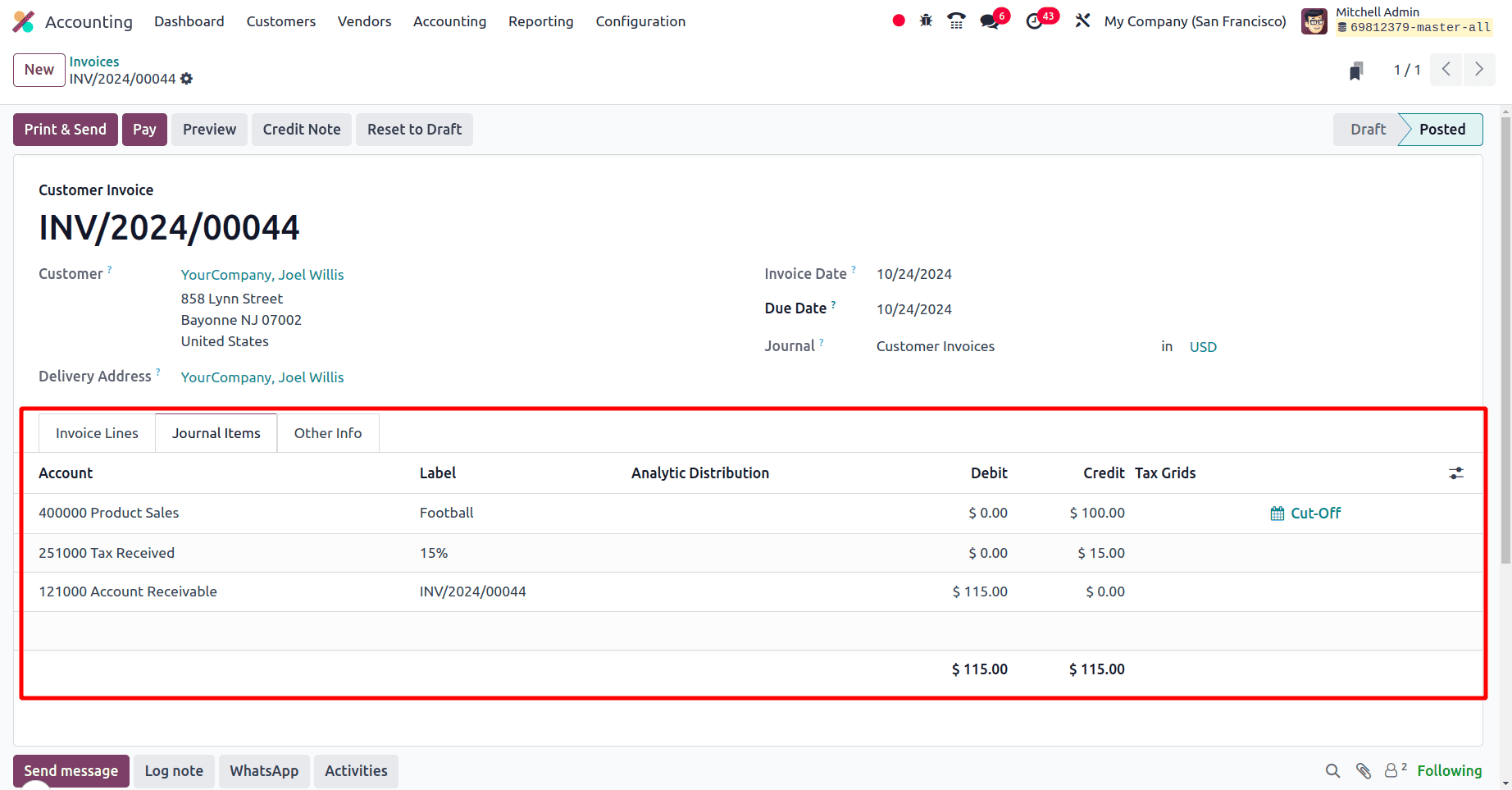

Once the products are added to the invoice line, we can confirm the invoice by clicking the Confirm button. There we can see the Journal items tab and under the tab all the journal entries according to the sale order were visible.

There we can see that the ‘400000 product sale’ accounts and ‘121000 Account Receivable’ are the two accounts that are used to post the journal entries from this sale order. The product sale account is an income account, and the increase in the income provides the account with a credit balance. The account ‘Account Receivable’ is an asset account, and the increase in the Assets increases the debit amount of the account. Then there is a tax account in which tax Received is a liability account, and when the liability increases, the account will be credited.

| Account | Nature | Increasing/Decreasing | Credit/Debit |

| Product sales | Income | Increasing | Credit |

| Account Receivable | Asset | Increasing | Debit |

| Tax received | Liability | Increasing | Credit |

We can say that when the Accounting system is set as continental Accounting the expense for a product is generated instantly whenever a vendor bill has been created for that product.

So in this blog, we have discussed the peculiarities of the continental accounting system in odoo 18 accounting and ledger postings that take place while purchasing and selling a product with the Continental accounting system.

To read more about How to Manage Ledger Posting in Odoo 17 Continental Accounting, refer to our blog How to Manage Ledger Posting in Odoo 17 Continental Accounting.