What is accounting localization?

When we talk about accounting localization in Odoo 17, we mean that the system has been modified to meet the unique rules and specifications of a certain nation. Accounting rules, tax regulations, reporting requirements, and currency conventions can differ from nation to nation. Consequently, setting up the accounting module in Odoo 17 in accordance with these particular guidelines is part of the accounting localization process. Accounting localization makes sure your tax laws and accounting rules apply to your country and your Odoo 17 accounting system. Factors such as tax computations, reporting styles, and chart of accounts structure are included. You reduce the possibility of mistakes or non-compliance problems that can occur when utilizing a general accounting system by adhering to localized accounting rules. In accordance with regional accounting rules, Odoo localization frequently offers a pre-defined chart of accounts. Establishing accounts this way guarantees consistency and saves you time and work. These are some of the noticeable features of Odoo 17 accounting localization.

So in this blog, let's discuss the accounting localization for Belgium in Odoo 17.

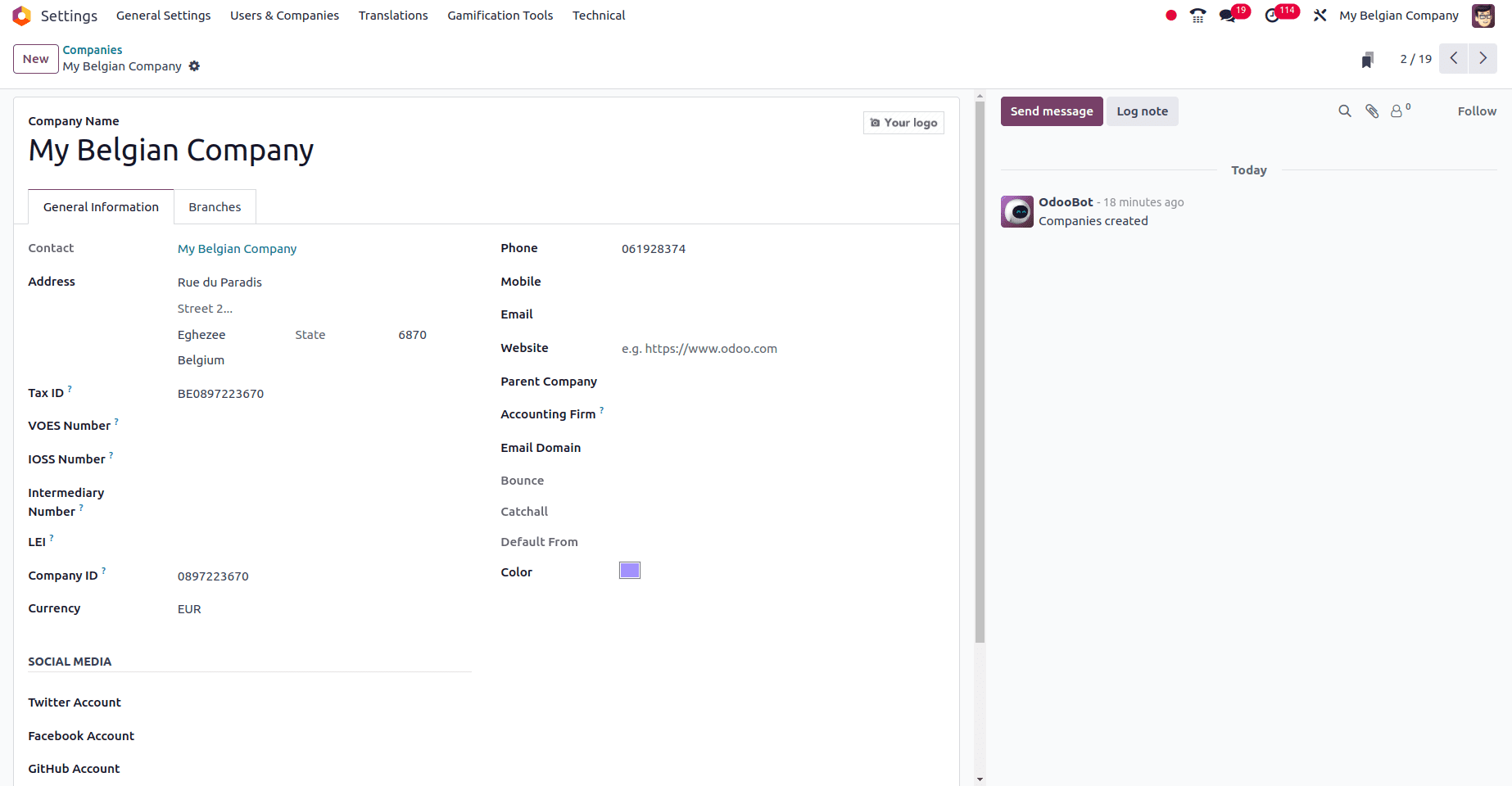

Before setting up the localization, we want to create a new Belgium-based company. So to set up the company, let's move to the General Settings of Odoo 17. There you can find a Users & Companies menu. Click the Users & Companies and then the sub-menu Companies. There will be a list of companies that have already been created. To create a new company, click the New button in that window, and you will get a form for entering the details of the new company. In that form give the name of the company, the address of the company, and also the country of the company. Along with these details, you can also add more details about the company from the same form or from the Contact application of Odoo 17.

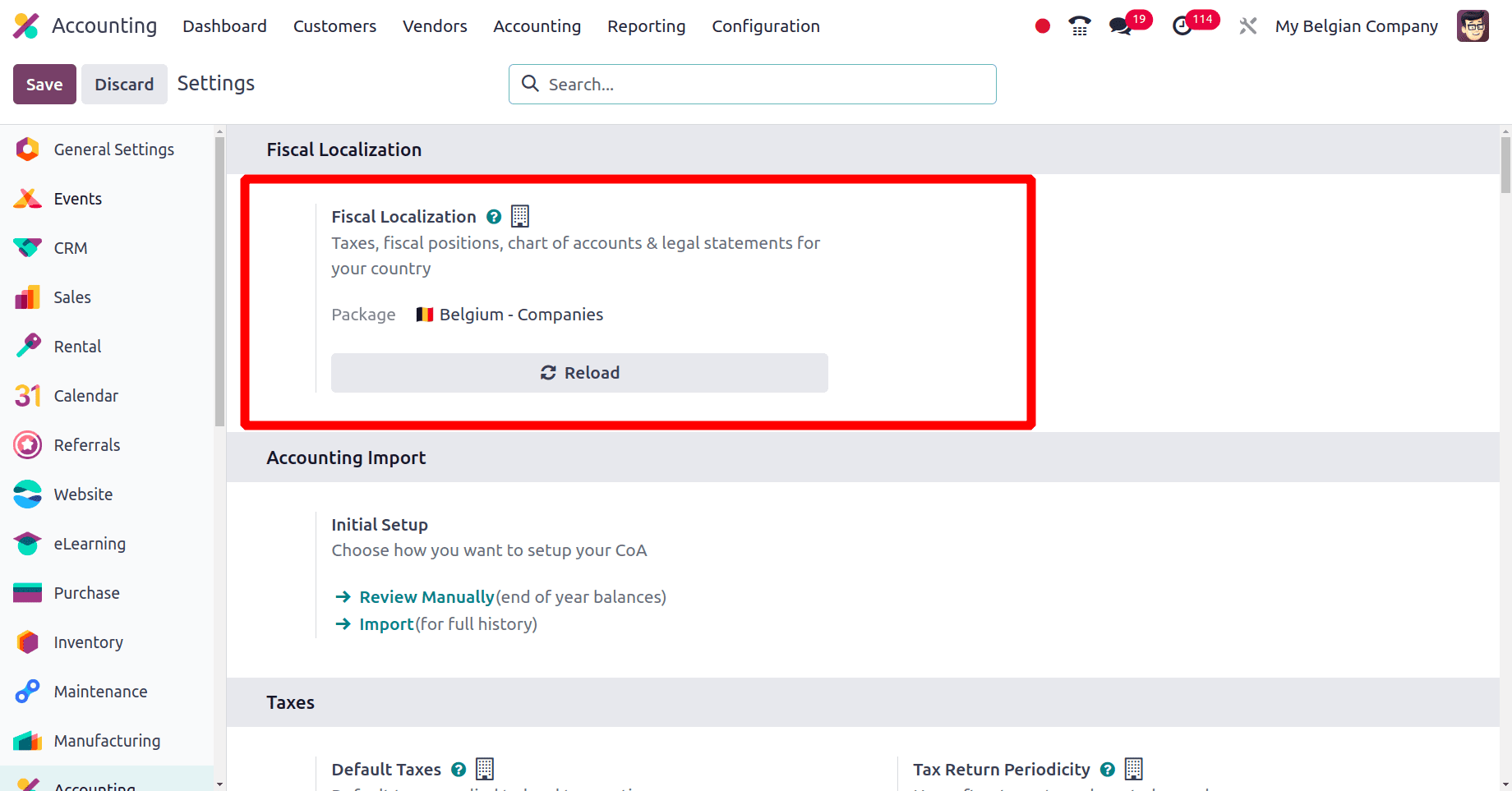

Here we have set the company details and saved the details. The next step is to set up the localization for the company. For that, just move to the accounting application on Odoo 17. Under the Fiscal Localization section, there is an option to set up the package for the company. Here we have created a Belgium company, so configure the package also as Belgium.

After the package has been configured properly, click the Save button to save the changes in the settings.

Changes formed when the package was configured in Odoo 17

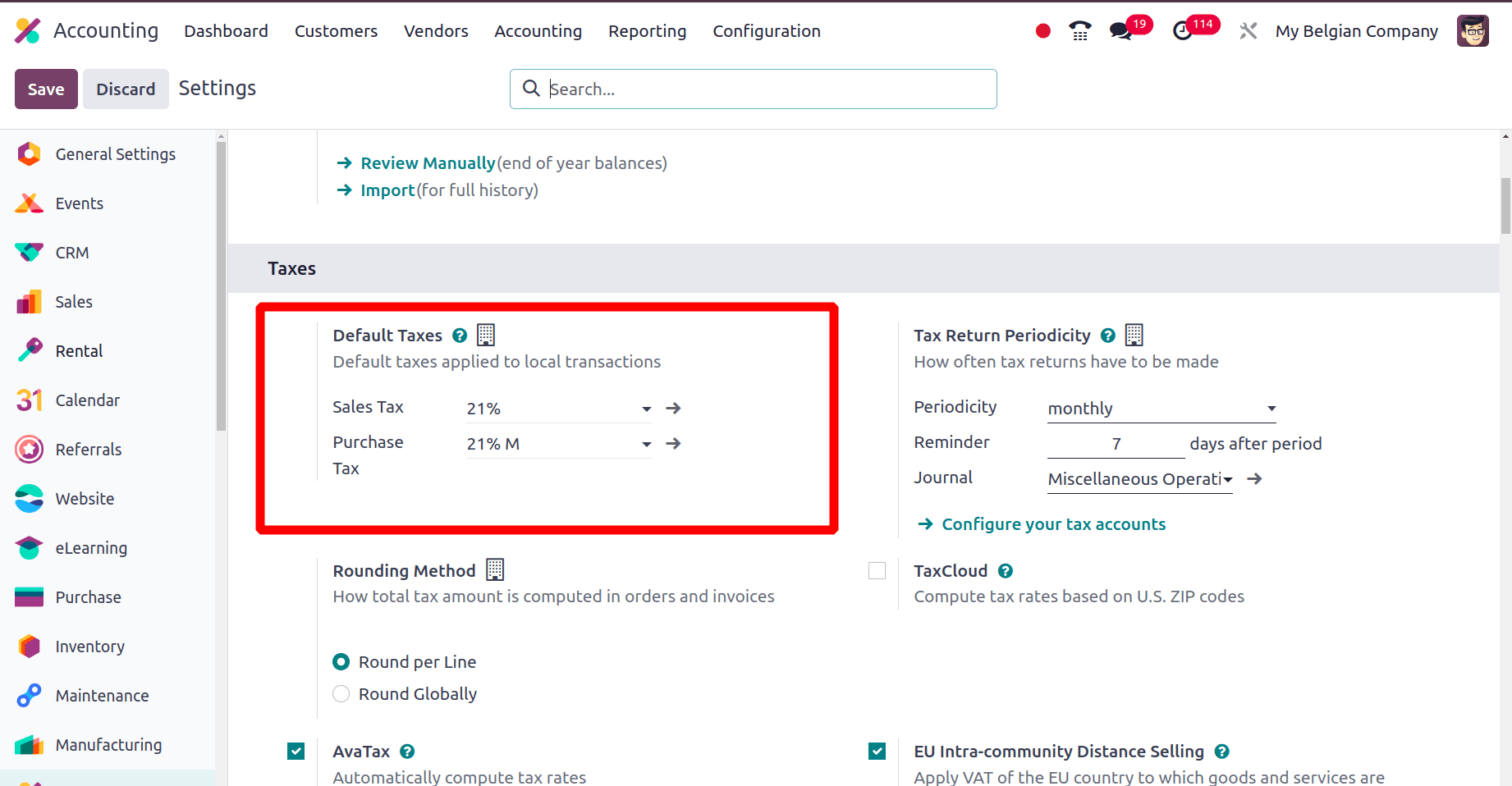

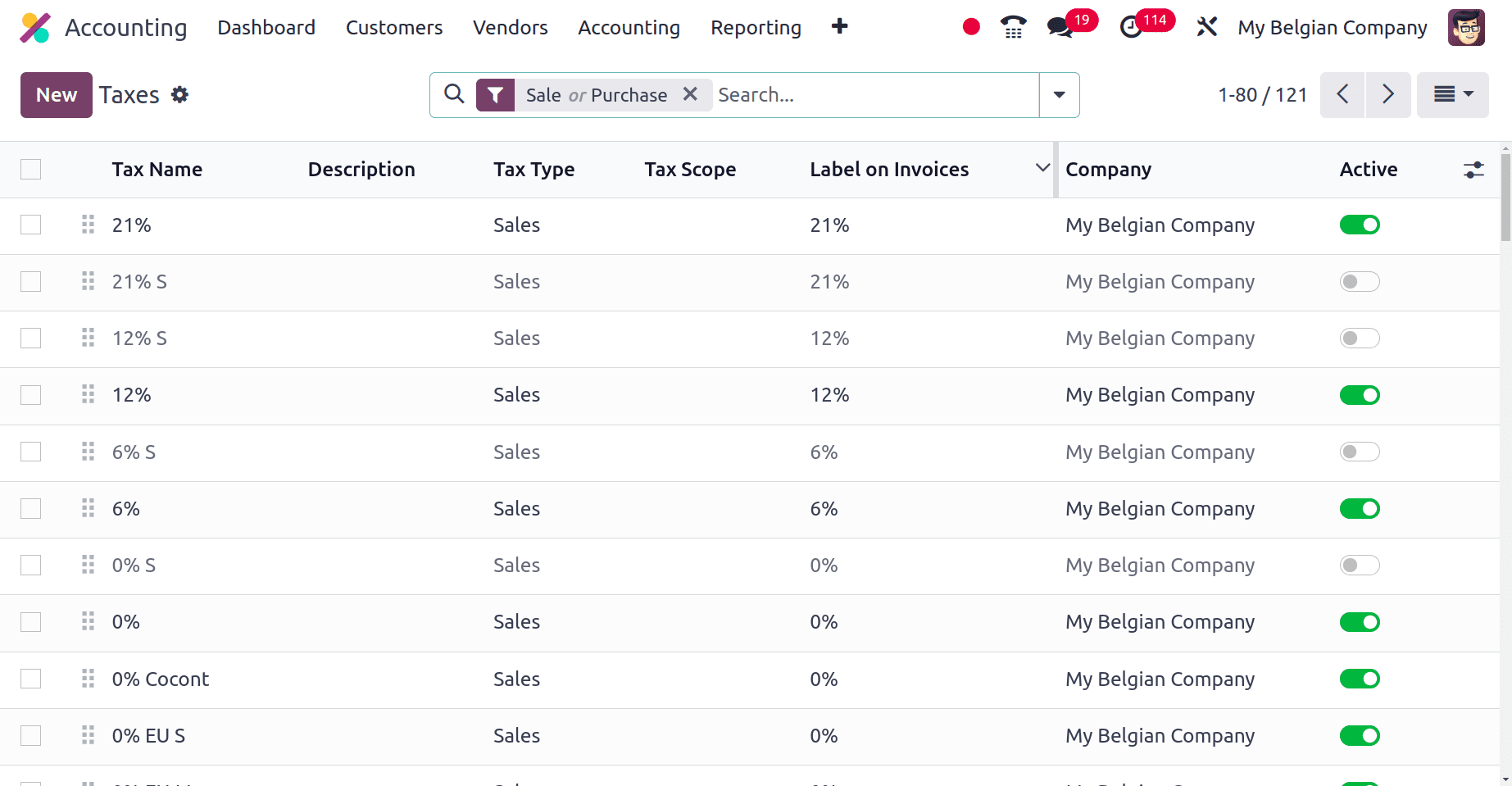

Each country has its own default taxes on every purchase order, sales order, etc. It may be configured manually or automatically. But here, Odoo 17 configures the default tax automatically when the package for the country has been saved.

From the above screenshots, you can see that 21% default sales tax and 21% default purchase tax have been configured for this company by Odoo automatically.

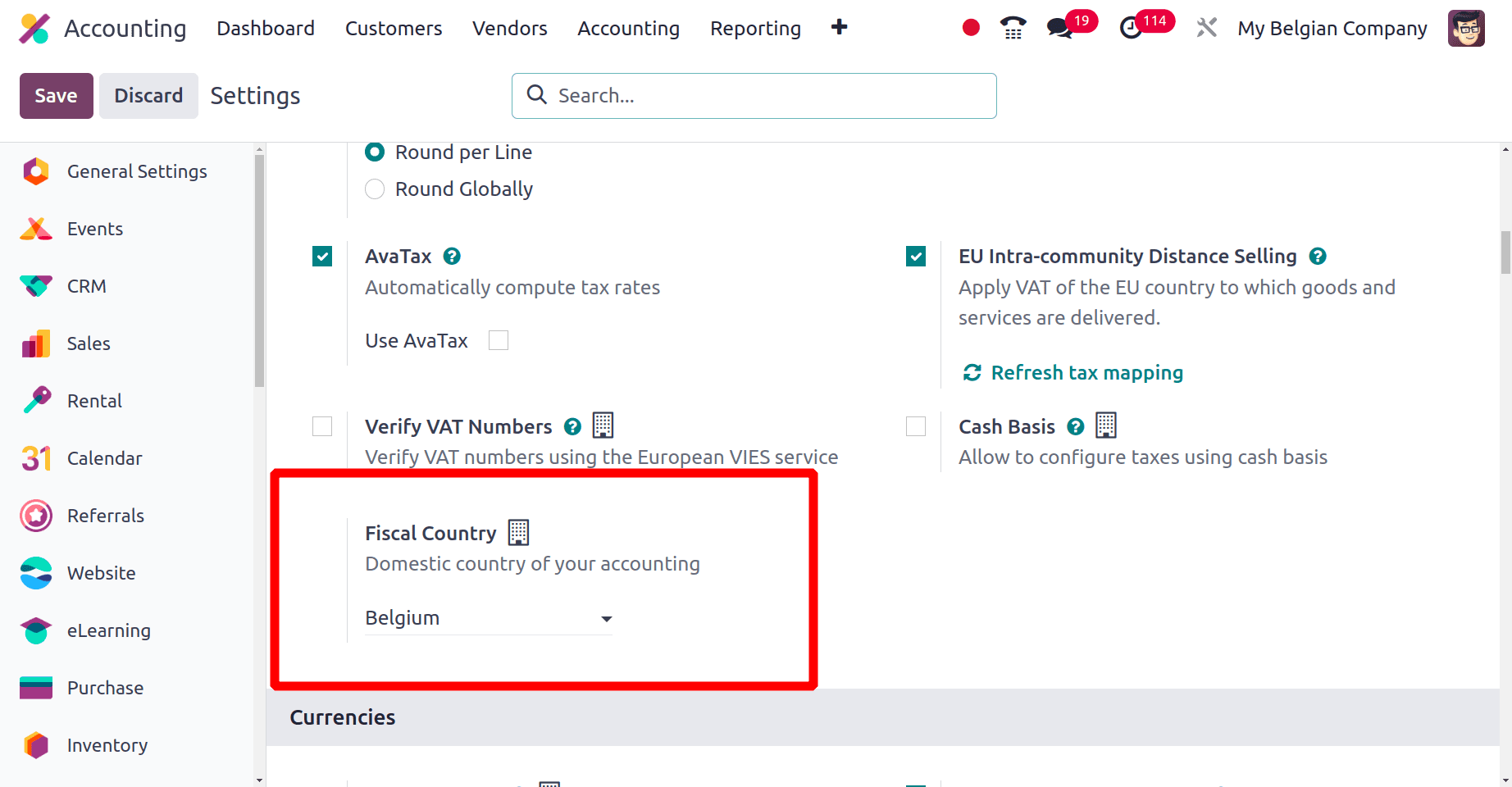

Under the taxes section itself, there is a field ‘Fiscal country’ and it is able to set the fiscal country for the company in that field. Here, Odoo set the Fiscal country for the Company as Belgium because the package for the country is set as Belgium.

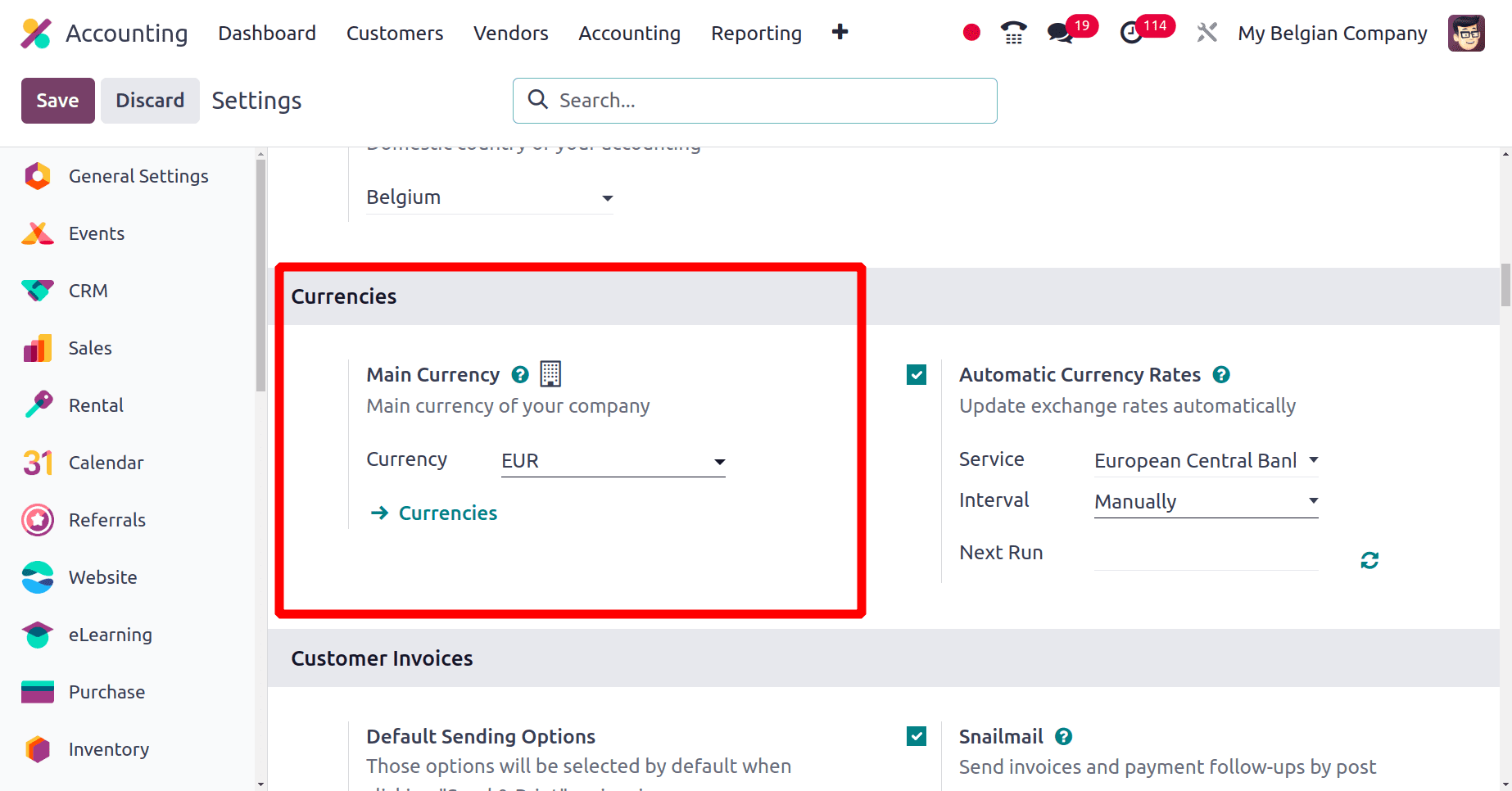

In the Configuration > Settings under the Currency section, you can set the Main Currency of the Company. You know that this company is Belgium-based and the currency in Belgium is the Euro (EUR) and the main currency of the company is automatically set as Euro (EUR).

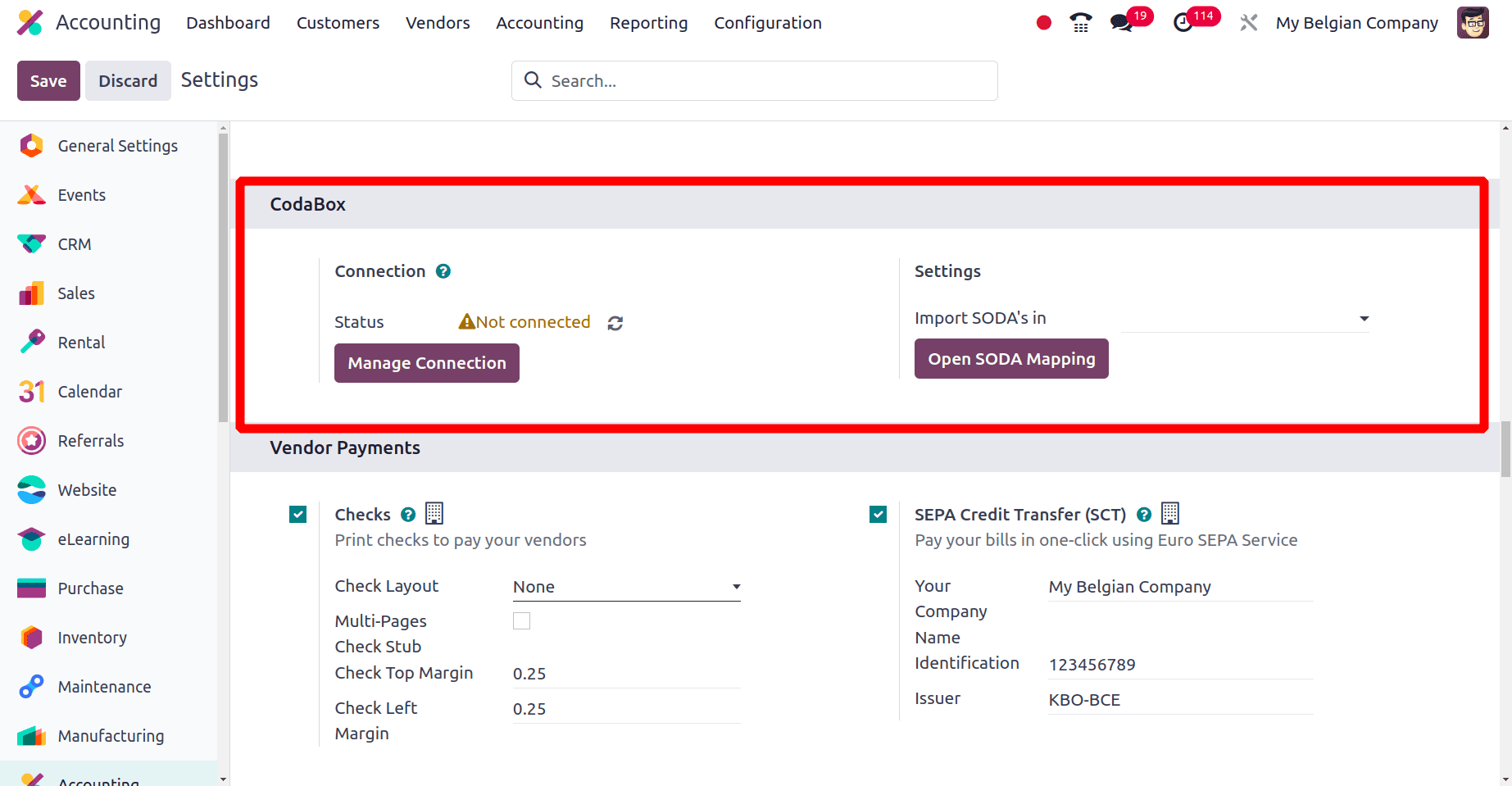

An extra section added to the Configuration Settings when a Belgium package is configured is the ‘CodaBox’. A Belgian startup called Codabox was founded with the purpose of making it easier for accountants in Belgium to manage bank statements and other financial data. For Belgian businesses, Codabox removes the labor-intensive manual process of obtaining and uploading bank statements. It safely retrieves information in a standardized CODA format from several Belgian banks. CODA format is the standard electronic format for Bank data exchange. Under the CodaBox section, you can manage the CodaBox connection and the SODA mapping too. Salary-related accounting records are imported using the SODA electronic XML format.

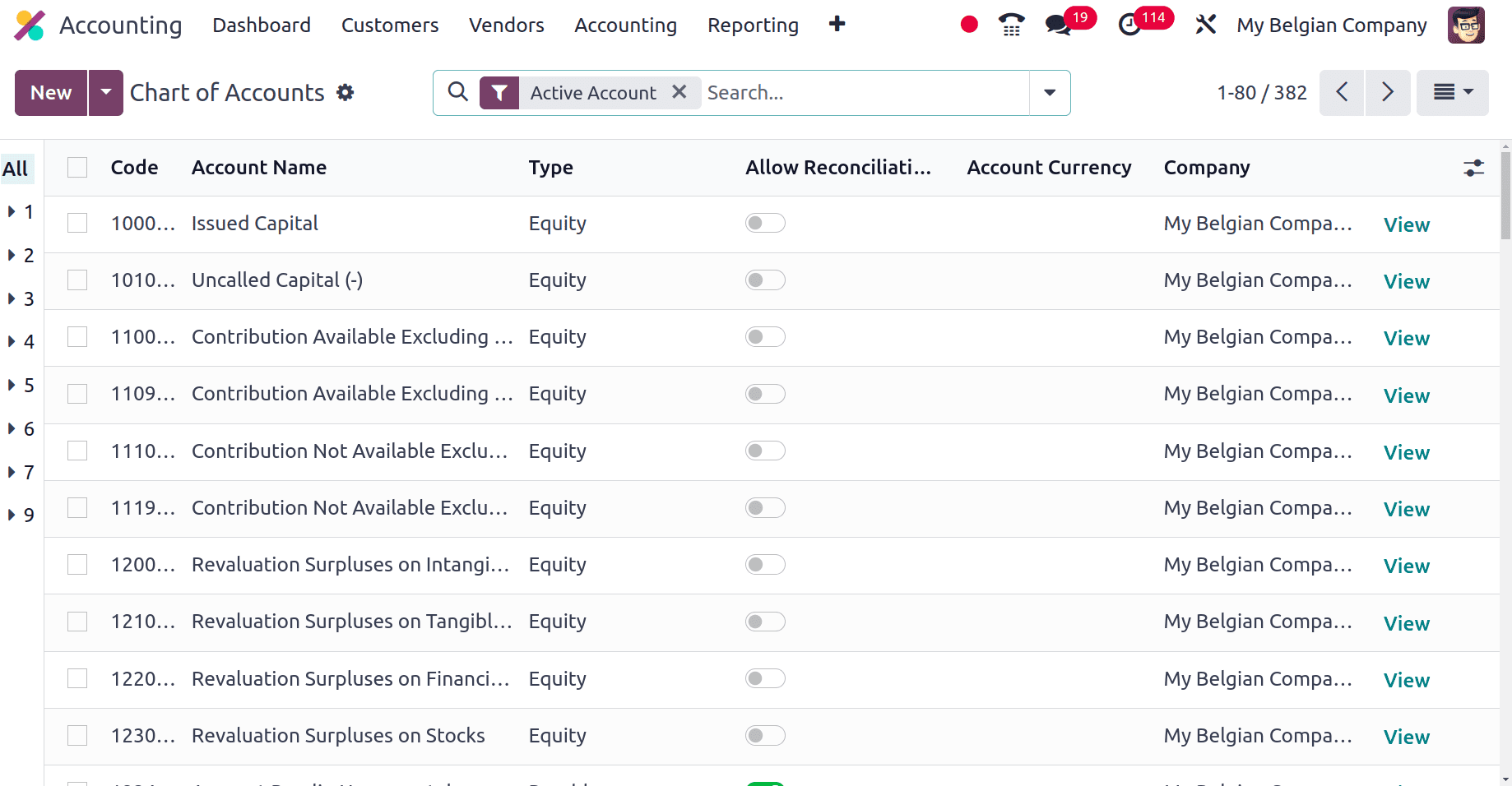

Next is the chart of accounts of this Belgium-based company. In Odoo, the chart of accounts is a crucial component for managing your financial activities. It basically serves as a list of all the accounts you utilize to keep track of the earnings and outlays for your business. From the above screenshots, we can see that different Chart of accounts used by the businesses in Belgium are shown above.

The next is the taxes used by the companies in Belgium. Different tax amounts are used by businesses in different countries for different purposes. Some of the taxes that the companies from Belgium can use are shown in the screenshot below.

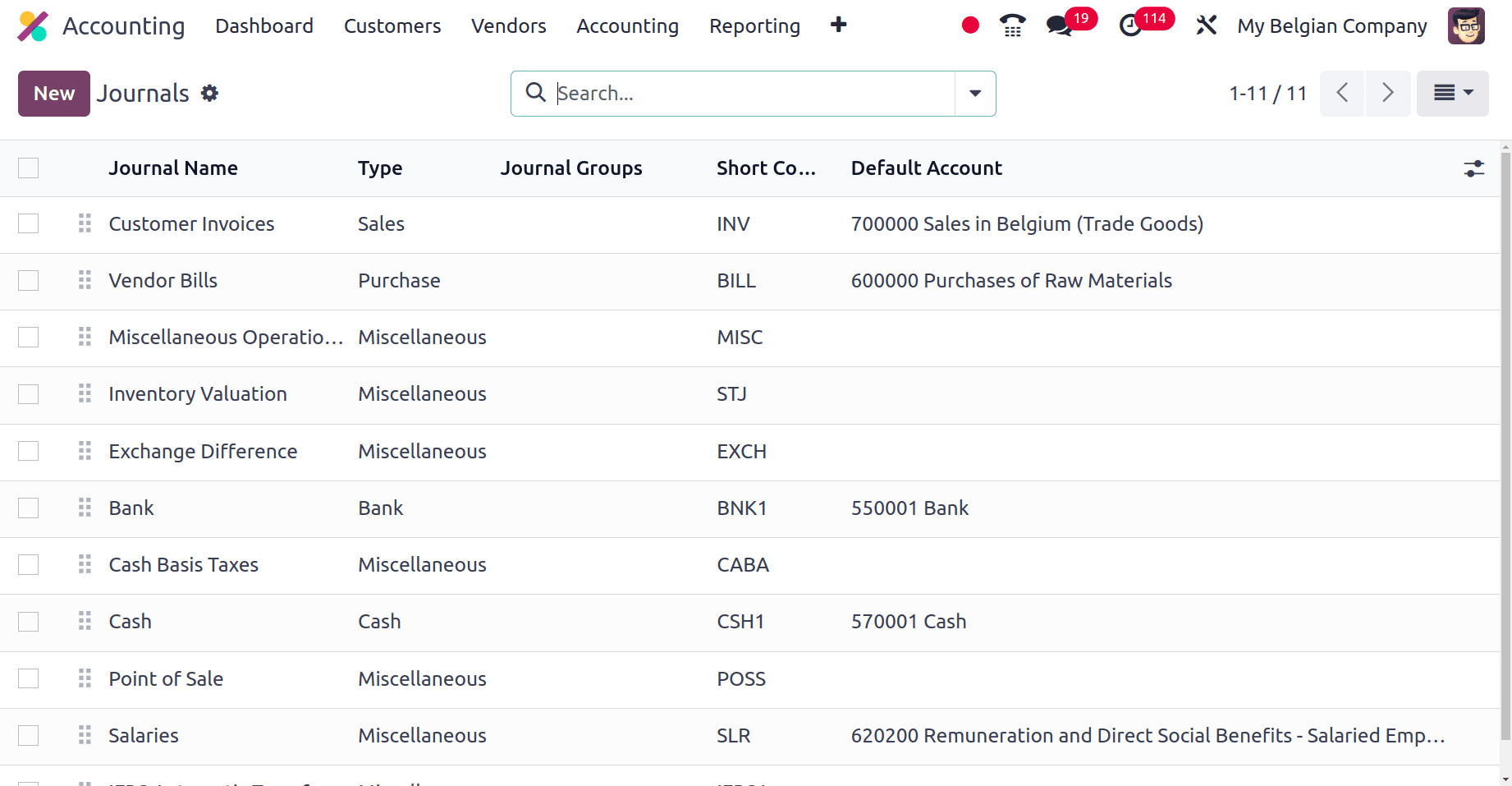

Your financial transactions are chronologically documented in journals. They basically record every financial transaction that takes place in your business. Customer Invoices, Vendor Bills, Miscellaneous operations, Exchange Differences, etc are some of the journals used by businesses in Belgium.

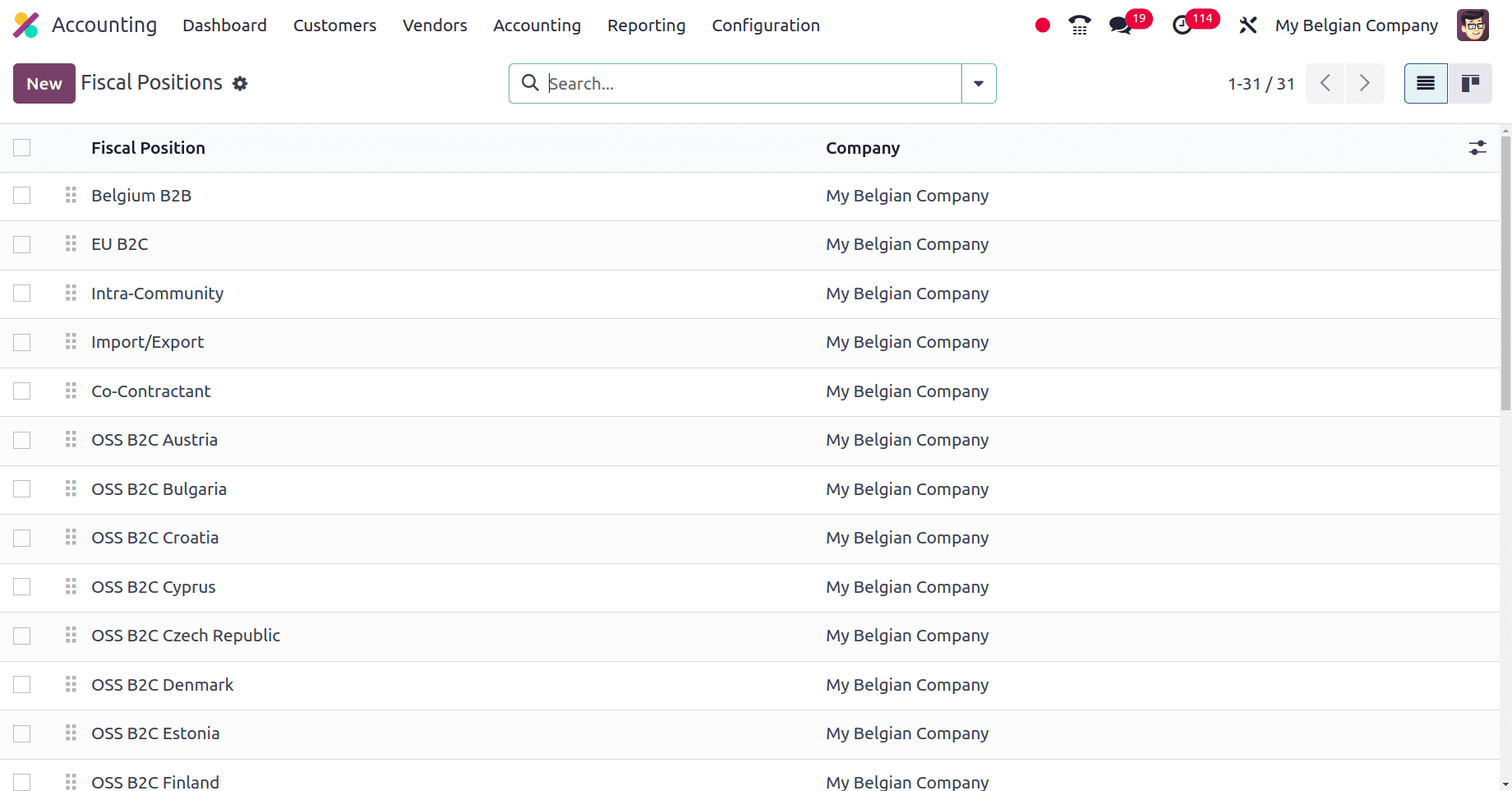

The way taxes and accounts are applied to transactions is automatically determined by the fiscal situation, which functions as a set of regulations. Basically, it assists you in handling tax complications according to several variables such as product kind, client location, or business activity.

So the Fiscal position may vary from country to country. Belgium B2B, EU B2C, Intra-Community, Import/Export, etc are some of the fiscal positions used by the companies from Belgium.

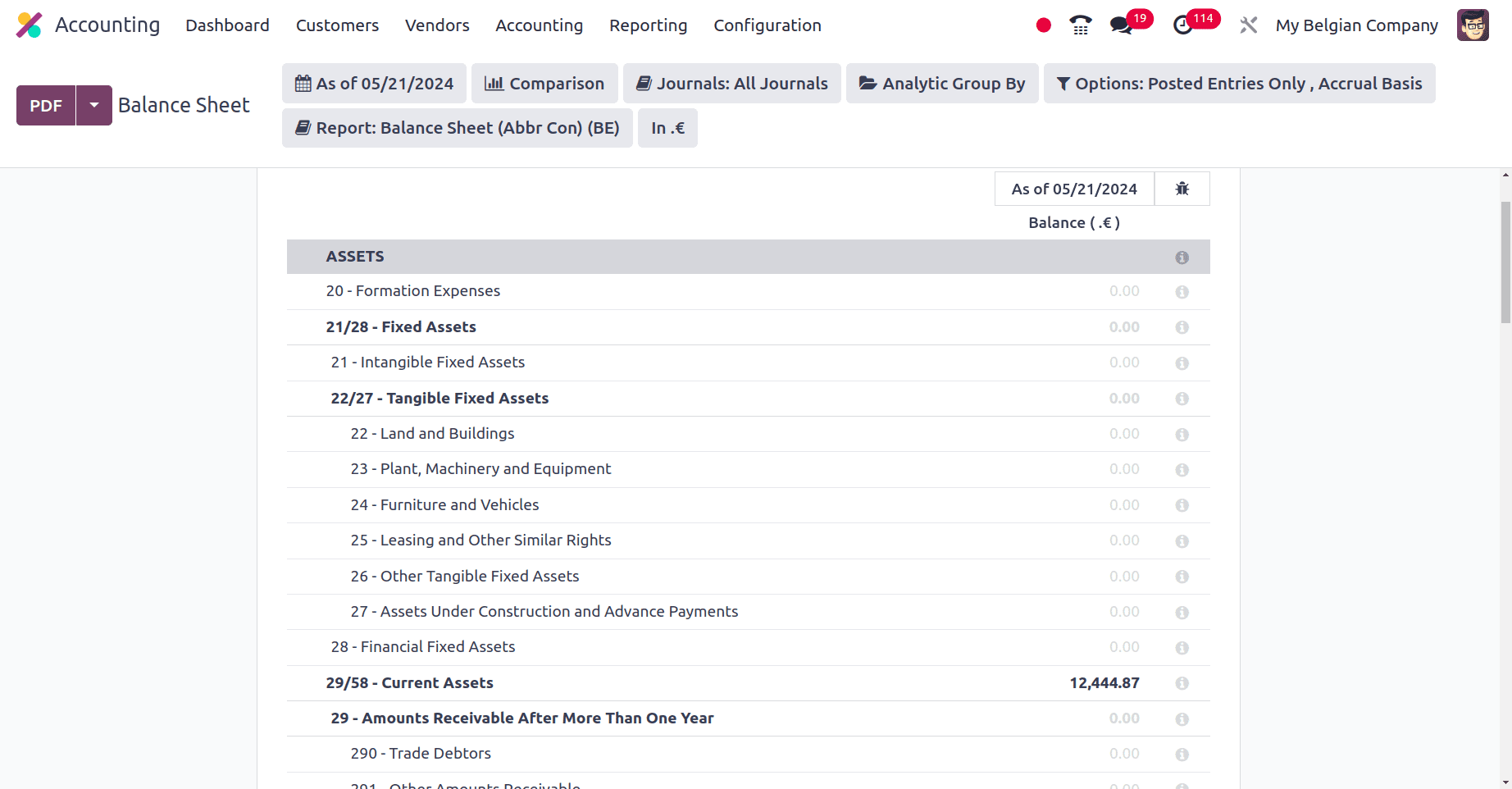

The next is the balance sheet of the companies from Belgium. A balance sheet is an essential financial report that shows the financial health of your business as of a particular date. It lists the assets, liabilities, and equity of your business as of that certain date. The Balance Sheet of this company mainly includes ‘ASSETS’ and ‘EQUITY AND LIABILITIES’. Fixed Assets, Tangible Fixed Assets, Current Assets, Stocks and Contracts in Progress, Accrual and Deferred Income, etc are included in the ASSETS. Equity, Contributions, Reserves, Accumulated profit, Provisions, and Deferred taxes, etc are included in EQUITY AND LIABILITIES

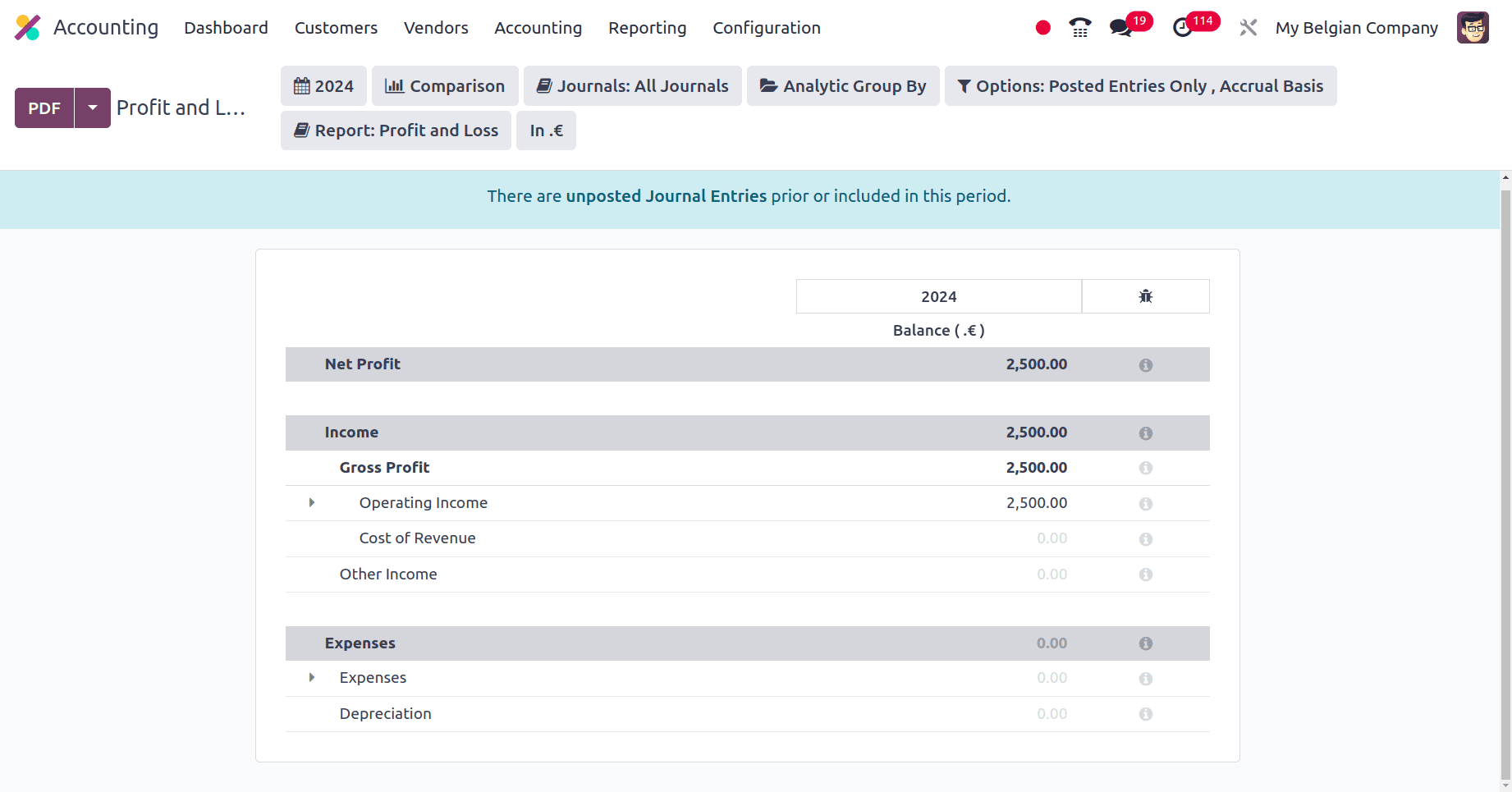

Profit and loss reports are financial statements that provide an overview of your business's earnings and outlays for a given time frame. It basically displays if, over that period of time, you were profitable (earning more than you spent) or not.

The profit and loss report of the businesses in Belgium includes Operating income, Cost of revenue, Other income, Expenses, etc.

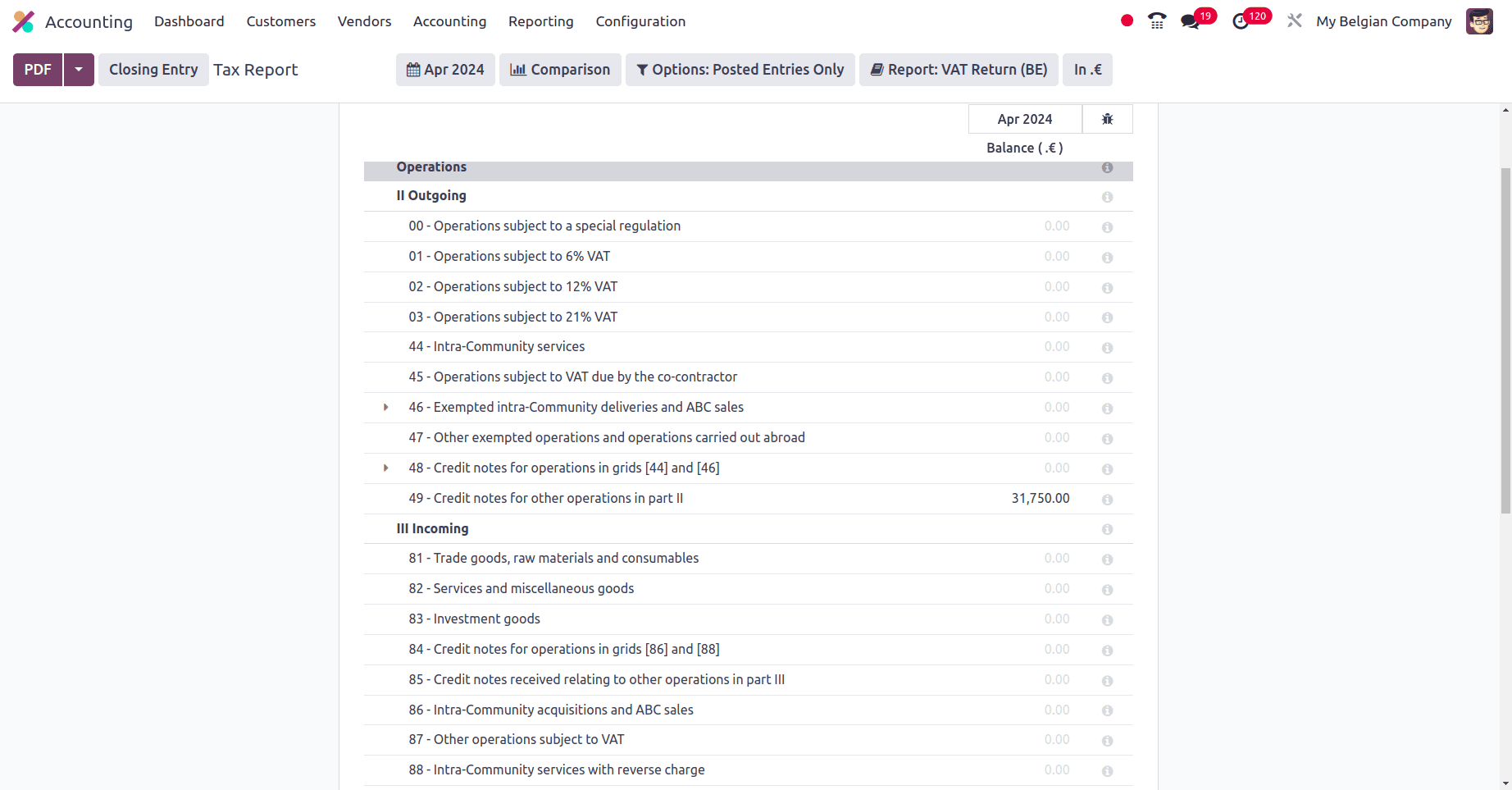

You can create reports with Odoo's tax report feature that summarizes the tax data for your business over a given time frame. These reports are essential for submitting tax returns to the appropriate authorities and adhering to tax legislation. The Tax report of the company includes Outgoing taxes, Incoming taxes, Taxes which are due, etc.

For Belgian businesses, Odoo 17 accounting localization provides a complete solution that ensures compliance, streamlines procedures and enhances overall accounting accuracy and efficiency.

To read more about An Overview of Accounting Localization for Algeria in Odoo 17, refer to our blog An Overview of Accounting Localization for Algeria in Odoo 17