Accounting localization is modifying your accounting system to conform to the unique tax laws, financial rules, and reporting requirements of a certain nation. To comply with Swedish accounting regulations, firms operating in Sweden must configure Odoo to handle VAT, personalize financial reports, and follow regional bookkeeping guidelines. Tax laws and accounting requirements vary throughout nations. Localization lowers the possibility of compliance problems and possible fines by ensuring that your Odoo system complies with Swedish legislation. Financial operations like invoicing, tax computation, and financial reporting are streamlined by a well-localized accounting system. Consistent data collection and processing are facilitated by localization.

Sweden is renowned for its extensive tax laws and strict accounting standards. Localization for Odoo users in Sweden includes setting up different parts of the system to conform to Swedish financial customs. This includes establishing the VAT rates, setting up the Chart of Accounts, and making sure that financial reporting adheres to the legal requirements in Sweden.

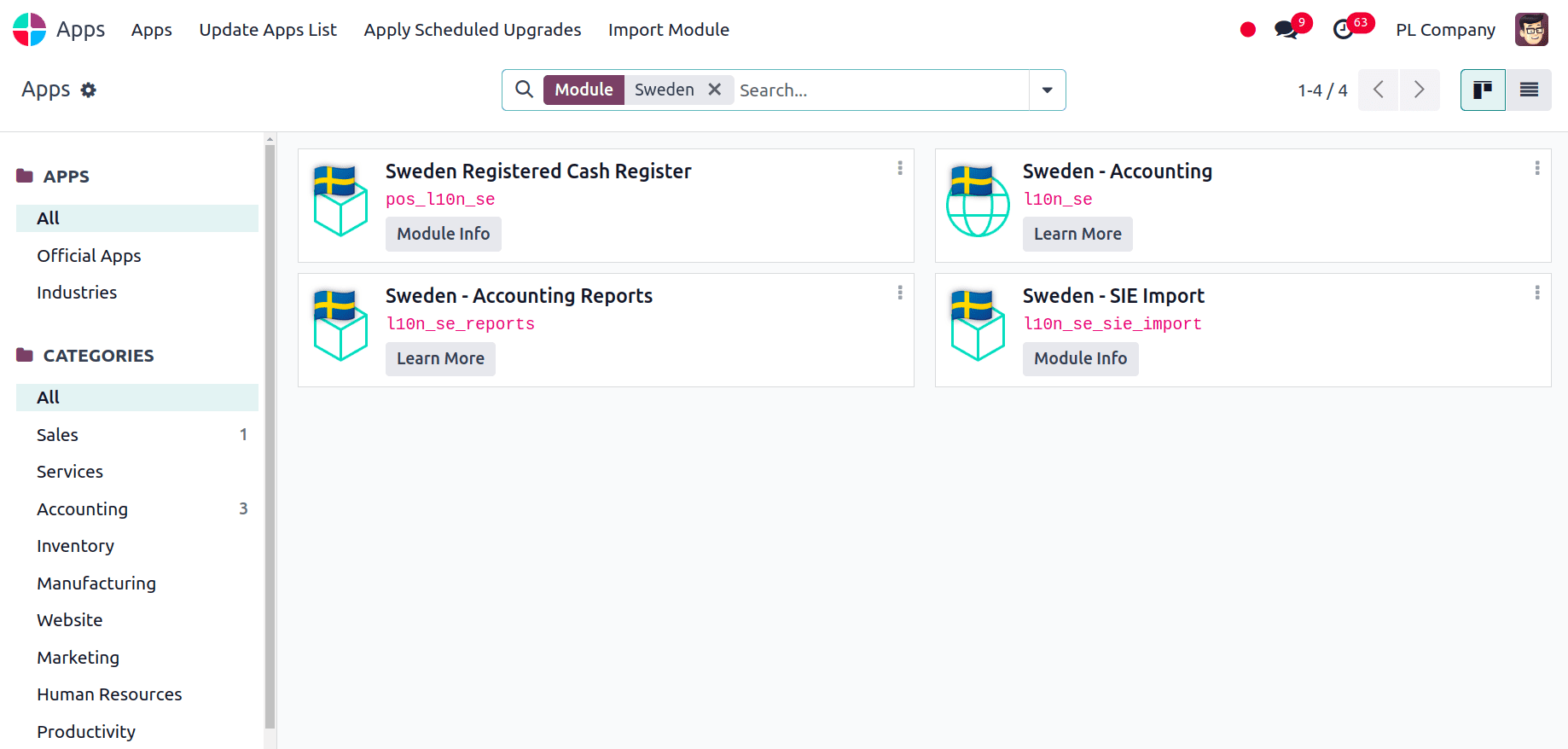

Next, we have to install the modules for the Sweden Localisation by going to the Apps and searching for Sweden.

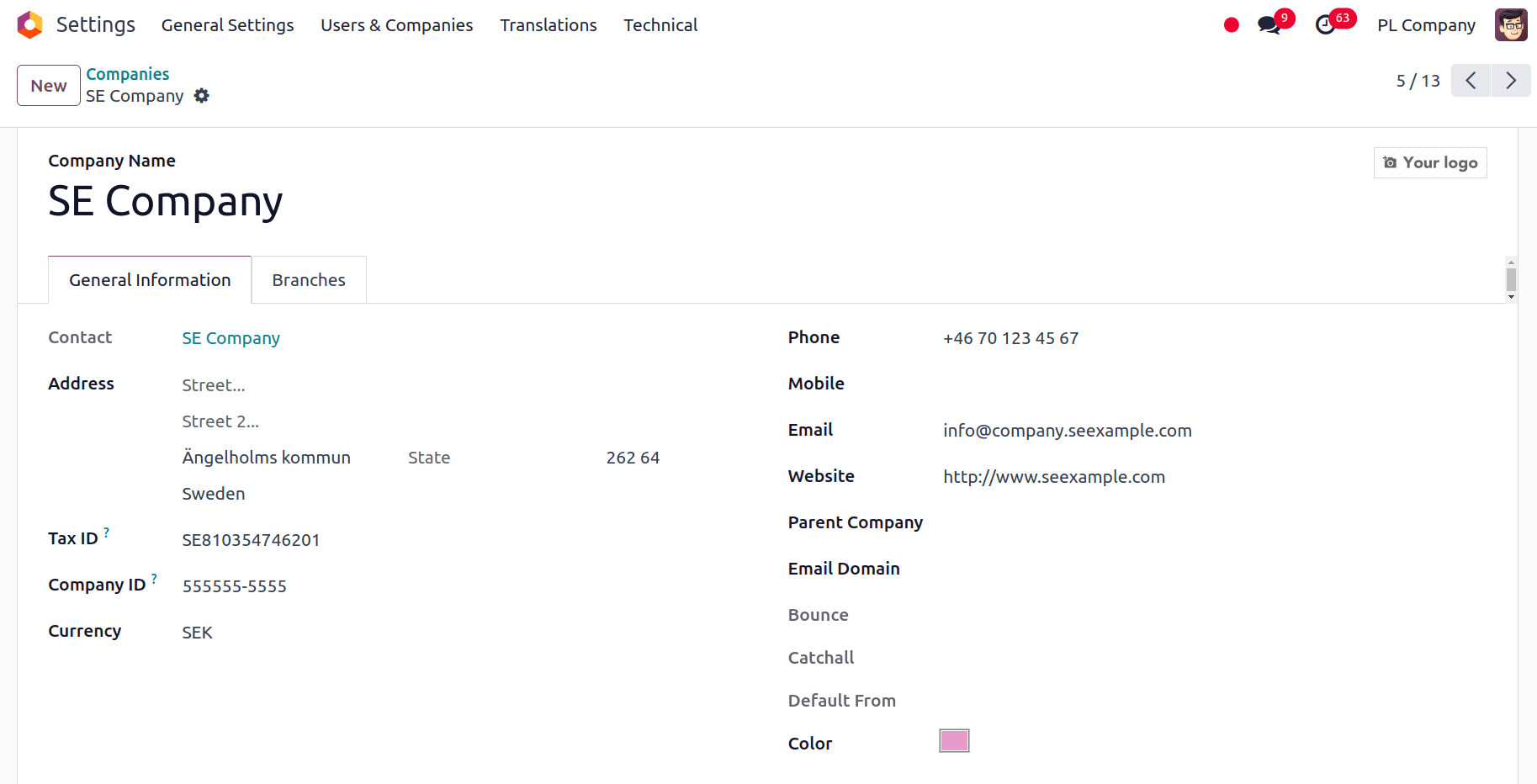

After all the required modules for setting up the localization have been successfully installed, we can now set up the company details accurately. Go to Settings > Users and Companies > Companies. Select the company and check the details like Country, District, Tax ID, Currency, etc.

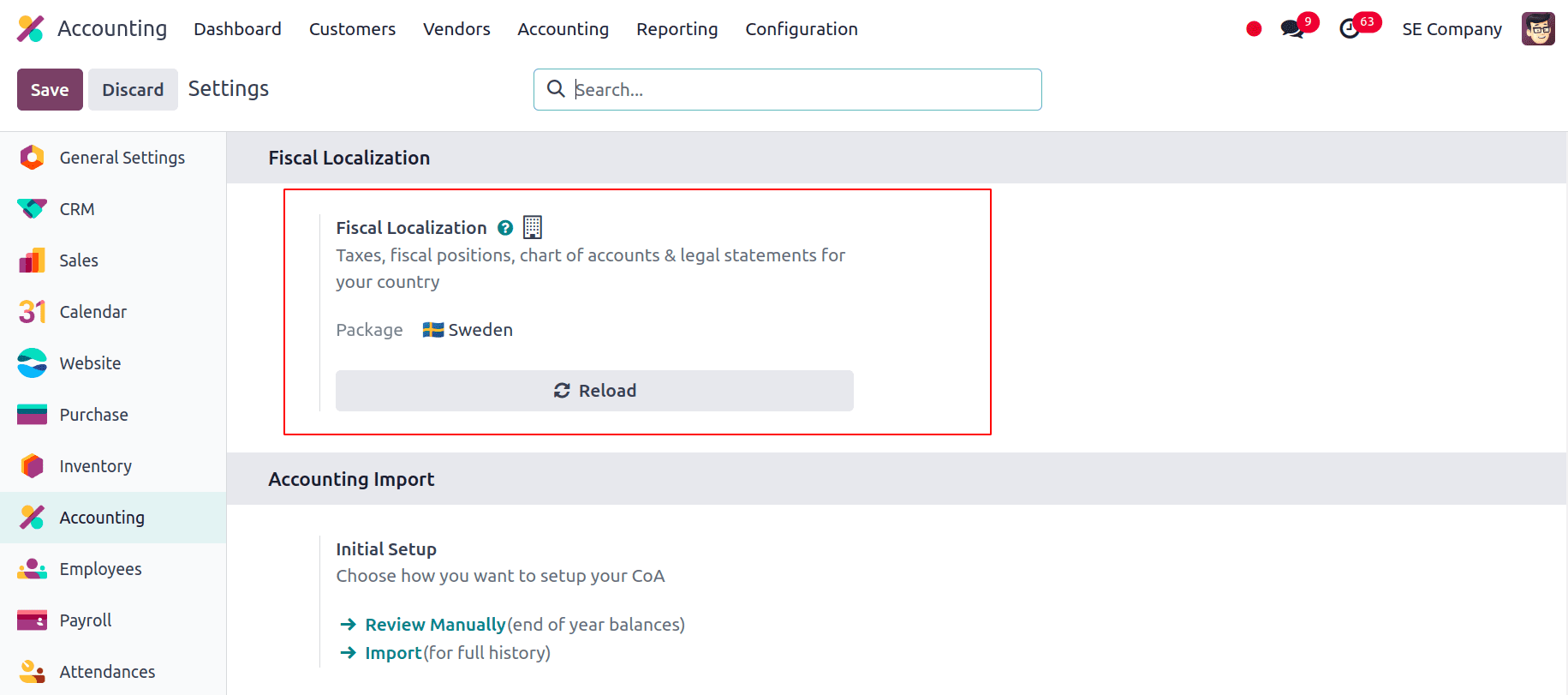

When we install the Sweden Accounting localization modules, the Fiscal Localization will be set to Sweden, and the Default Taxes, Currency, Chart of Accounts, Journals, etc will be pre-configured according to the localization. Go to Accounting > Configuration > Settings; there, we can see the Fiscal Localization.

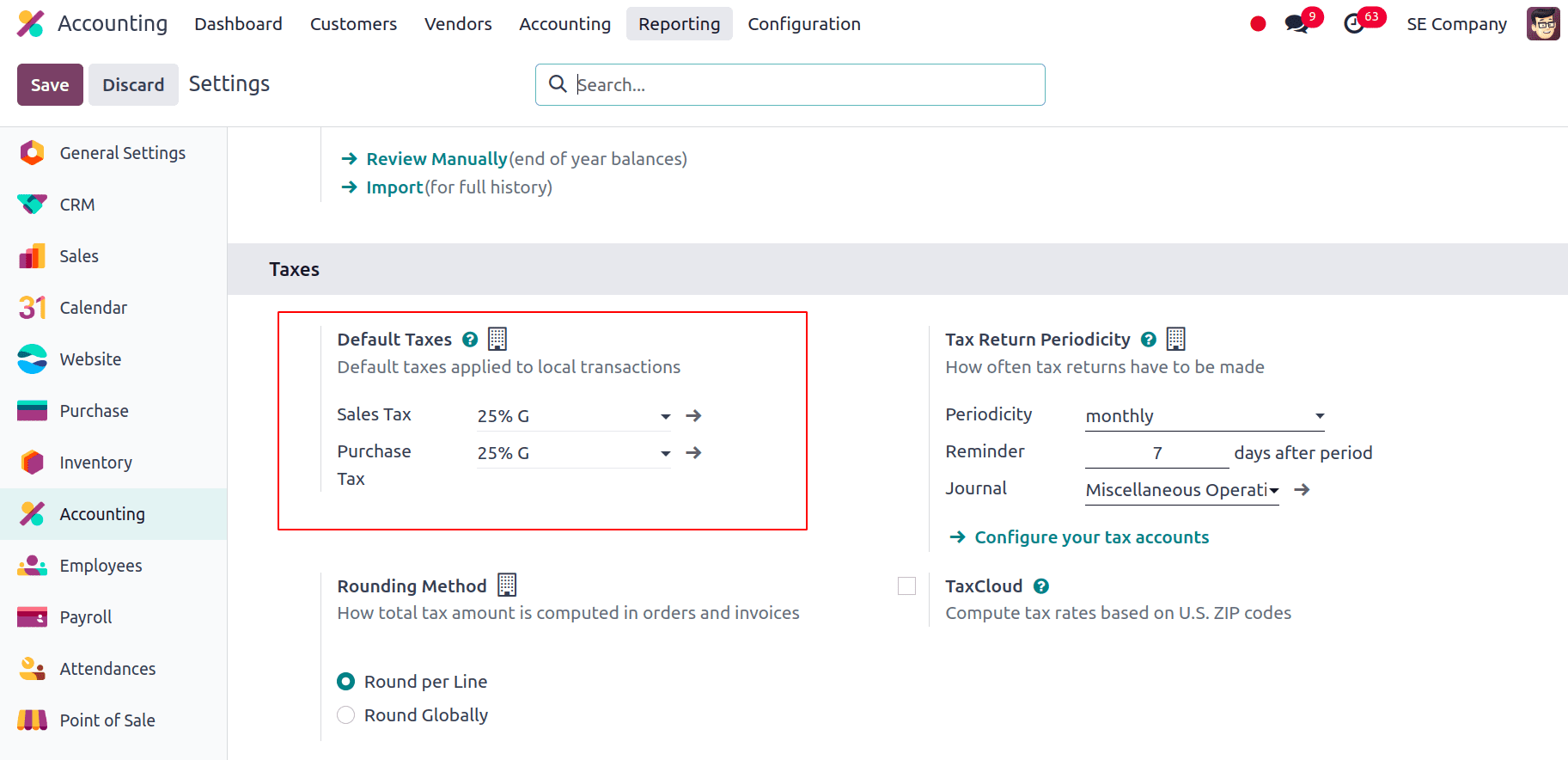

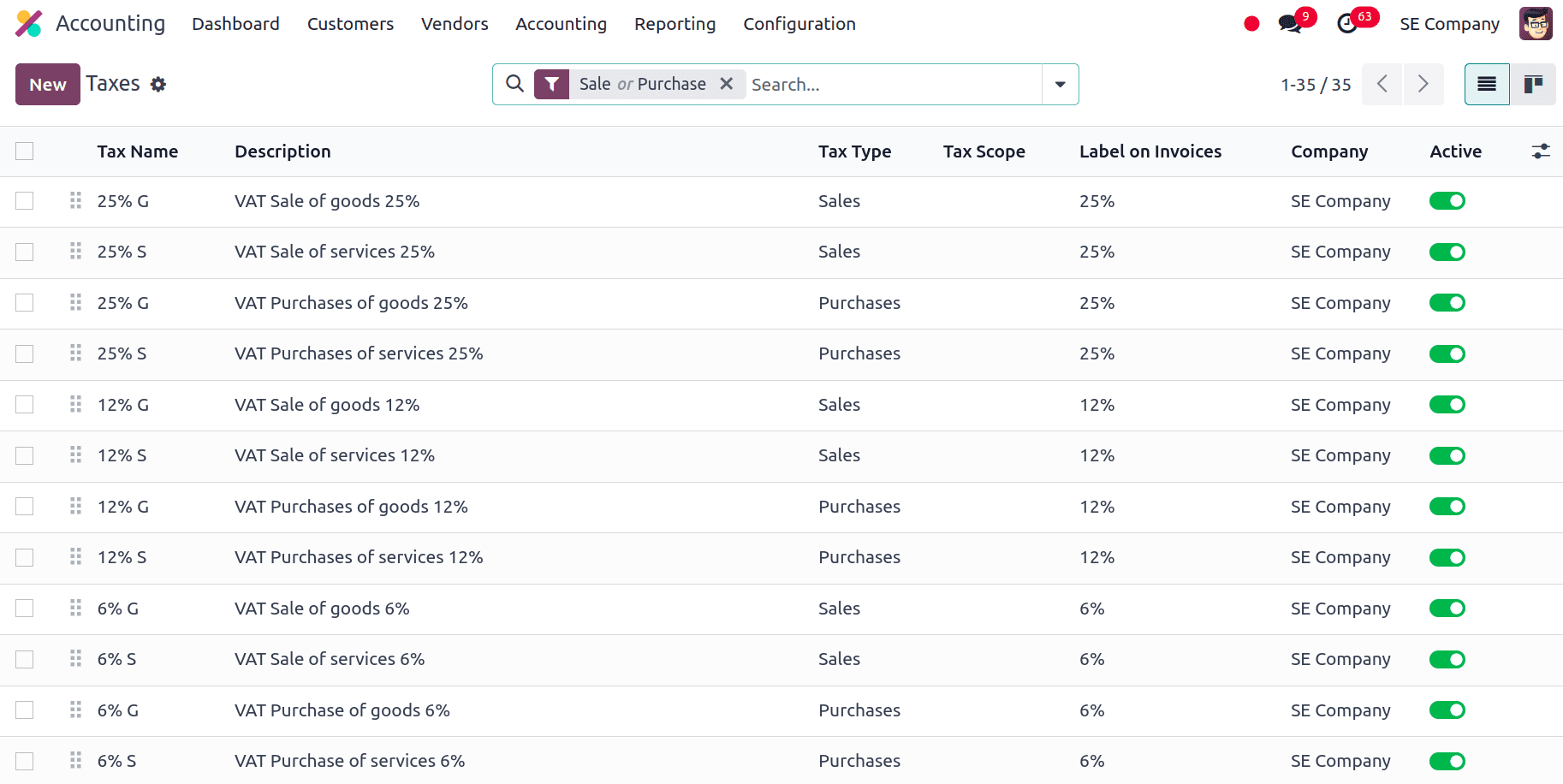

Default Taxes are the pre-configured tax settings that are automatically applied to transactions based on their kind and the region in which a firm operates. These default taxes are configured to take into account local tax laws, guaranteeing that financial records like purchase orders and invoices have the appropriate tax rates on them. Odoo makes tax management easier by employing default taxes, which aids in helping companies stay compliant with regulations and keep correct financial records. Here the Sales Tax and Purchase Tax is set to 25% G and all the sales and purchase transactions will use this tax by default unless it is changed manually.

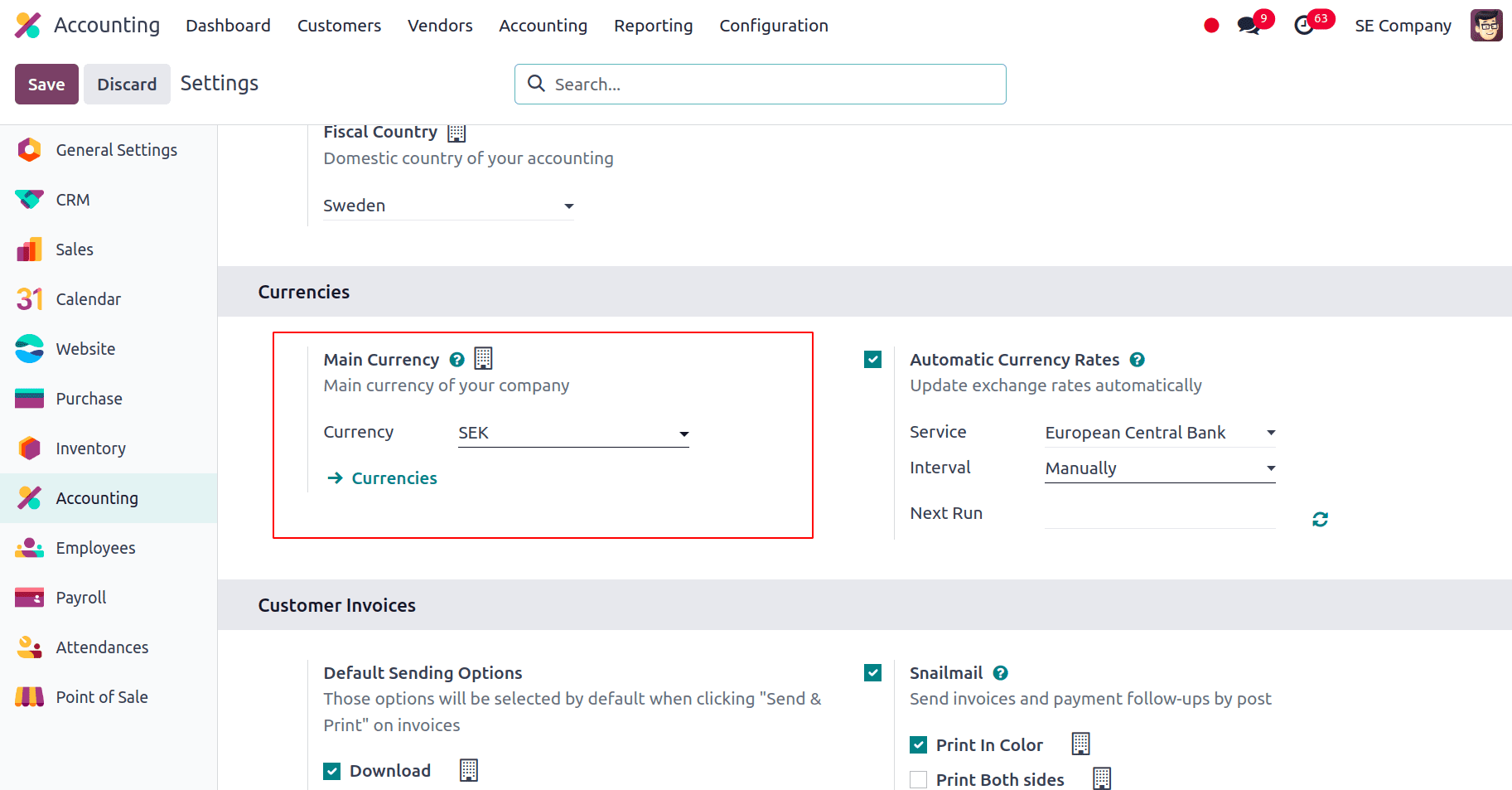

With the installation of the Sweden localization modules, the Main Currency in the settings will be set to Sweden’s official currency, Swedish Krona (SEK).

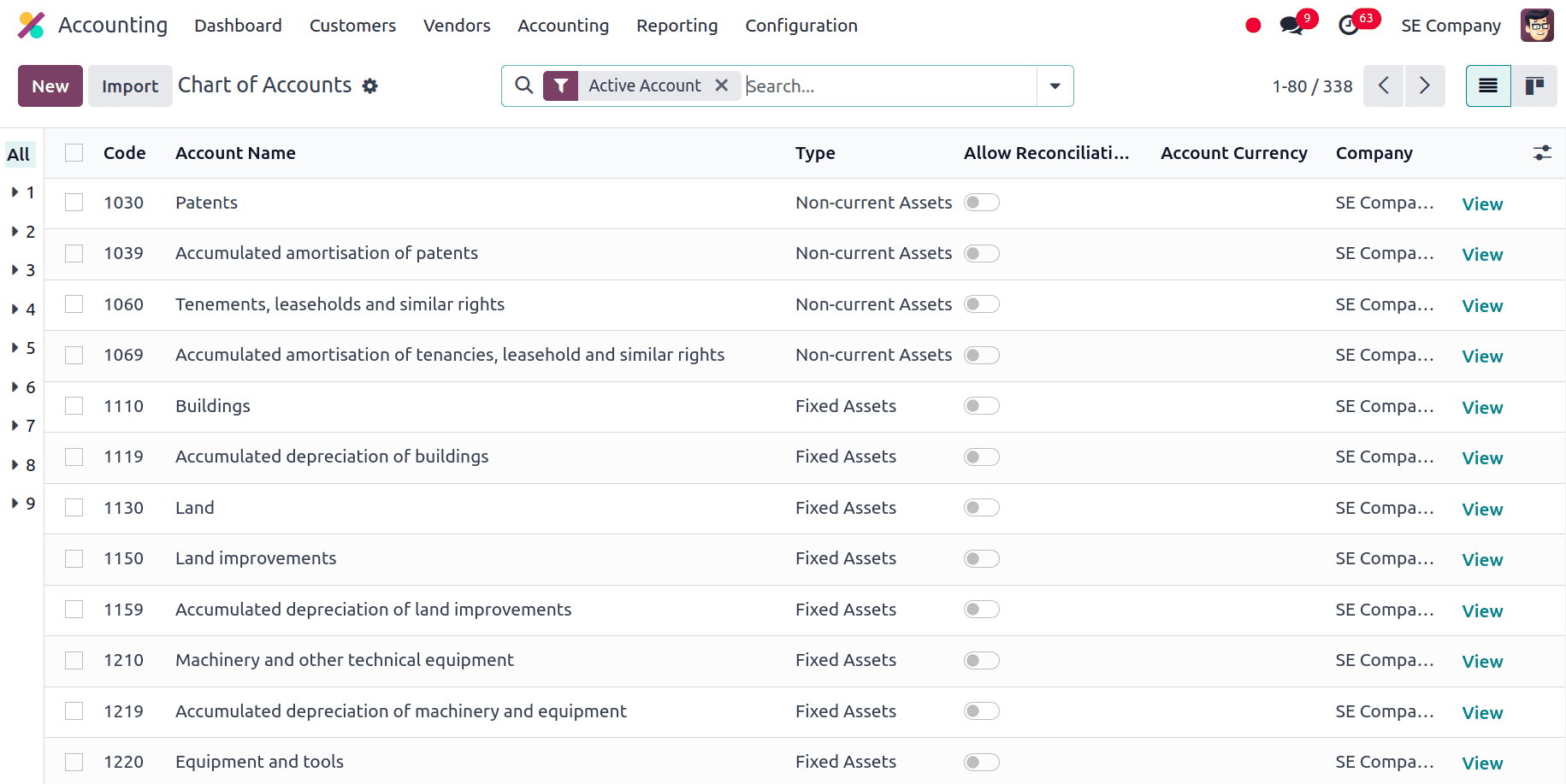

Chart of Accounts

A thorough list of financial accounts needed to record and categorize transactions is provided by Odoo's Chart of Accounts. It organizes financial data into categories, including assets, liabilities, equity, revenue, and costs, and acts as the framework for the accounting system. The methodical strategy employed guarantees precise financial reporting and analysis. It includes various Charts of Accounts like Patents. The specific patent account facilitates precise monitoring of the company's patent holdings' worth. By doing this, it is guaranteed that the assets' genuine worth is shown in the financial accounts. The Accumulated Amortisation of Patents account tracks the entire amount of amortization that has been recorded against the patent's value. This aids in computing the patent's net book value, which is equal to the initial cost less cumulative amortization. Both asset appraisal and financial reporting depend on accurate net book value. The Tenements, Leaseholds, and Similar Rights account in Odoo accounting is used to track and manage the financial implications of property rights, long-term leasing agreements, and similar arrangements. Like this, there are several other charts of accounts too that are specifically tailored for this localization.

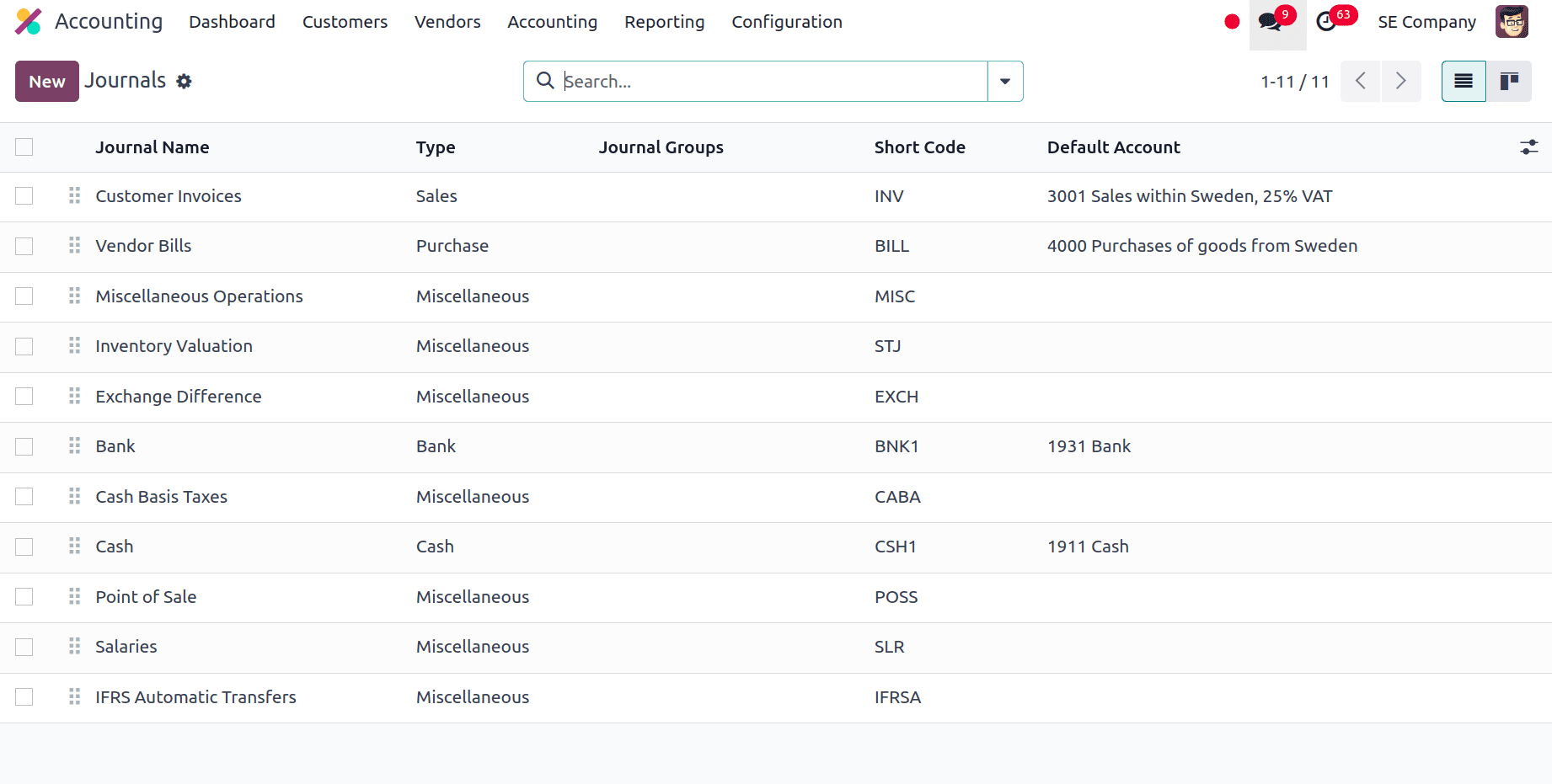

Journals

Digital records of financial transactions are called Journals in Odoo. Transactions are categorized according to their type (e.g., purchases, sales, or bank activity). This organization assists in producing reports, keeping up-to-date financial records, and guaranteeing that accounting rules are being followed. Odoo's journals are crucial to Swedish accounting's ability to keep precise and legal financial records. Transactions are categorized into distinct accounts, such as sales, purchases, cash, and bank accounts, using these electronic ledgers. Odoo's localization for Sweden includes customized journal templates and account structures that comply with Swedish accounting standards (KRAAP), allowing companies to effectively handle their finances while also meeting local laws.

Taxes

Odoo simplifies tax management by automating calculations and generating reports. With features like pre-configured tax rates, rules, and accounts, businesses can easily handle various taxes, from sales and purchase taxes to specific local levies. This automation ensures accuracy and compliance, saving time and resources. Accurate calculations and reporting are made possible by the system's incorporation of particular Swedish tax legislation. Odoo streamlines the process, eliminating manual errors and guaranteeing compliance for everything from VAT (moms) to other relevant taxes. With tools like automatic tax declarations and tax registration numbers, firms may easily negotiate Sweden's tax environment.

PEPPOL Electronic Document Invoicing

An electronic invoicing and procurement standard called PEPPOL (Pan-European Public Procurement Online) was created to make it easier to send and receive electronic documents securely and seamlessly between various systems and nations. In Sweden, ensuring compliance with national and EU rules and modernizing procurement processes are largely dependent on the use of PEPPOL for electronic invoicing. Odoo's Swedish accounting localization modifies the platform to follow regional reporting standards, tax laws, and financial regulations. It guarantees that electronic invoicing conforms to Swedish legal and regulatory standards when paired with PEPPOL.

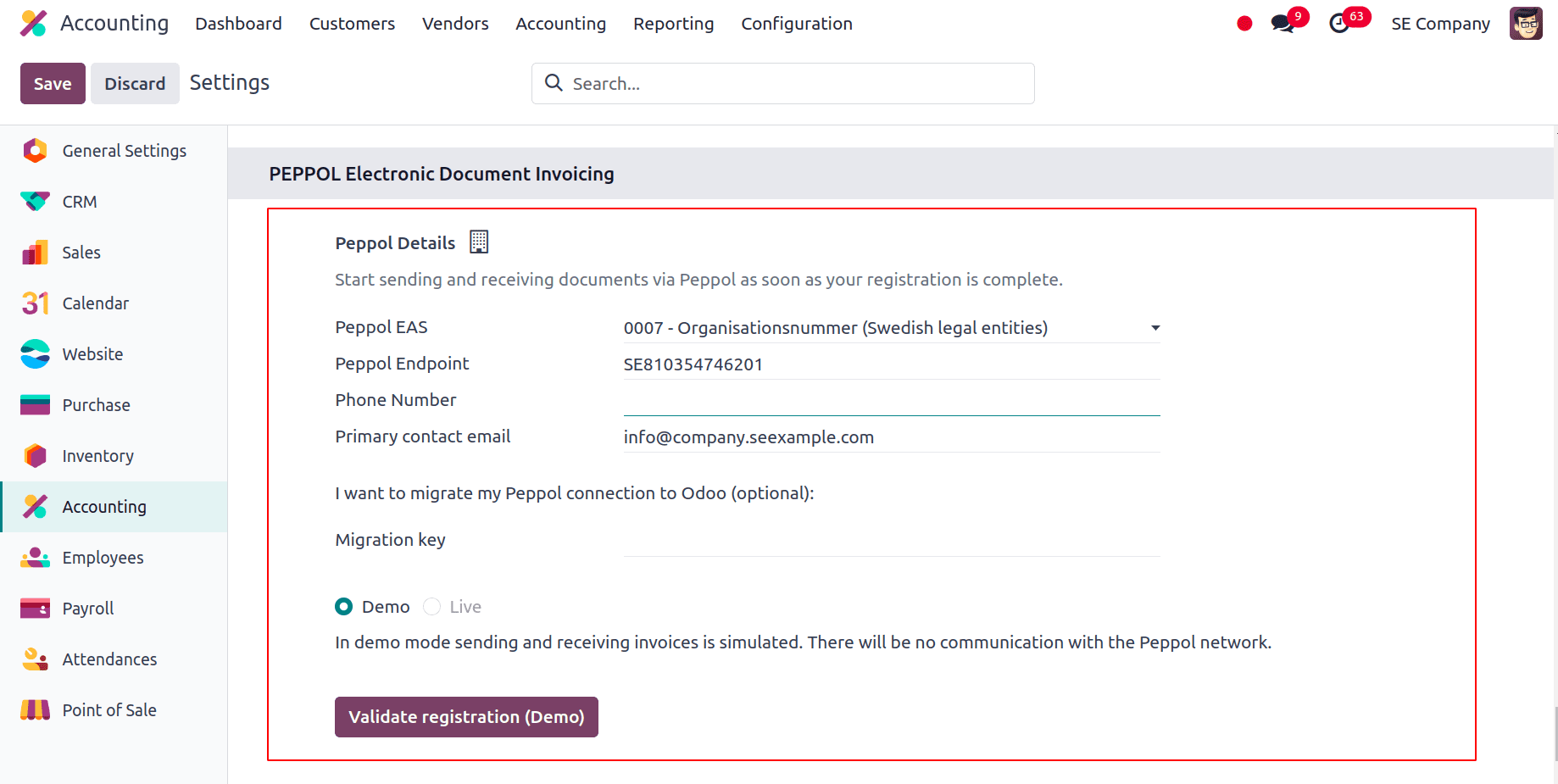

Navigate to Configuration settings of the Accounting Module, there we have a section for PEPPOL Electronic Document Invoicing. There, we have to fill out the Peppol Details. We will be able to send and receive documents via Peppol as soon as the registration is complete.

In addition to the PEPPOL network, PEPPOL EAS (Electronic Archiving Service) is designed to facilitate the safe electronic preservation of invoices and other commercial documents. The PEPPOL network's essential elements, PEPPOL Endpoints, allow companies to transmit and receive electronic documents—like invoices—over a standardized, secure route. We have a demo mode, where sending and receiving invoices are replicated in demo mode. No communication will take place with the Peppol network in demo mode. Once all the information is filled we can click Validate Registration (Demo) and validate the registration.

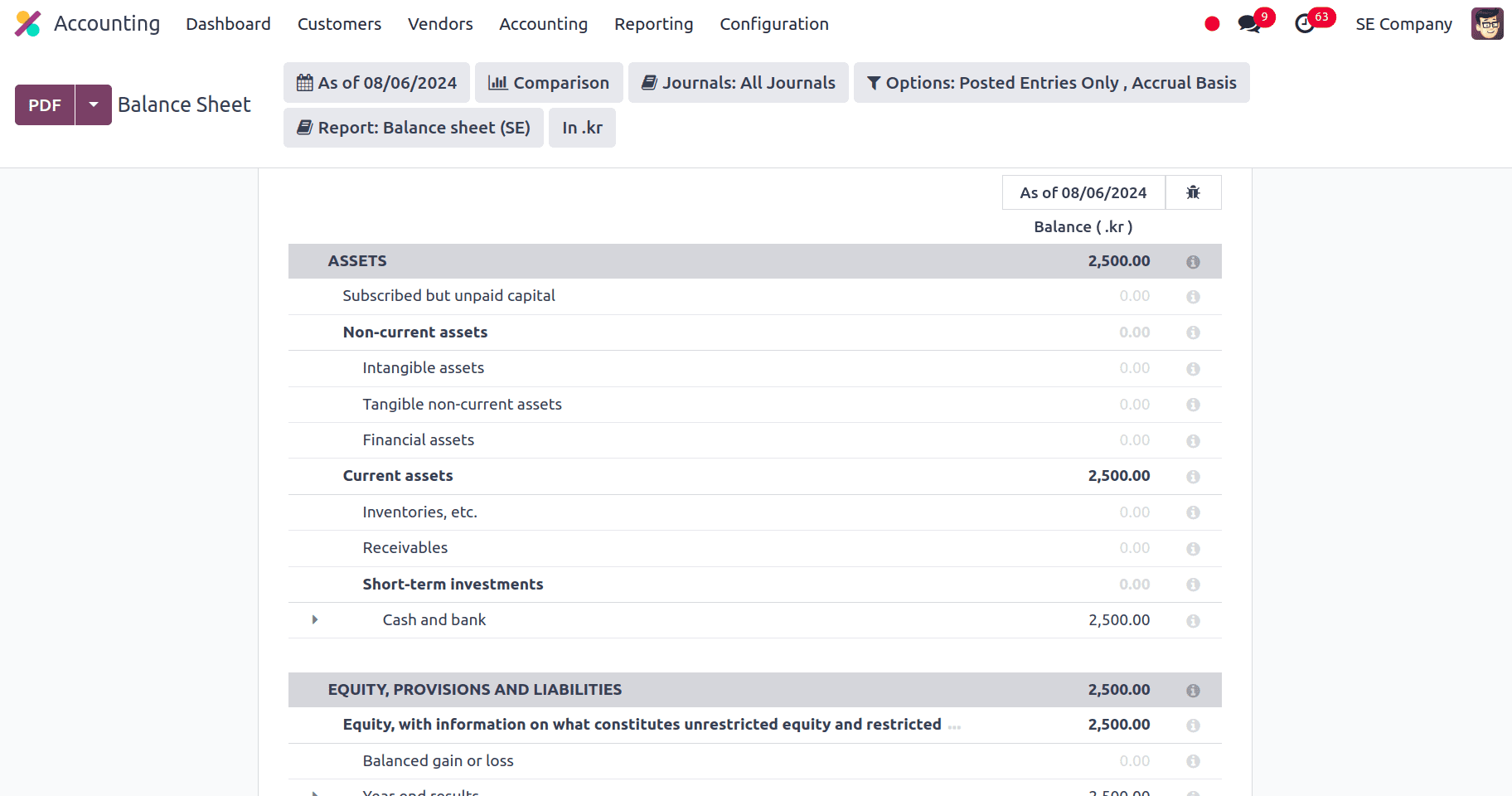

Balance Sheet

A balance sheet provides a thorough overview of a company's equity, liabilities, and assets. Odoo guarantees precise and compliant balance sheet generation with features like asset depreciation, account classification, and interaction with other financial modules. This gives companies the ability to make well-informed decisions with a strong financial basis. Under assets, we have the Short-term investments. It is expected that these investments will be repaid in full within one operating cycle or one fiscal year, whichever comes first. The short-term investments account is categorized under current assets on the balance sheet, indicating their liquidity and the likelihood that they will be converted into cash soon.

Equity, which represents the ownership stake in the business, is an essential component of the balance sheet in Odoo with Swedish localization. Unrestricted and restricted equity, each having unique attributes and accounting methods, make up the equity division. The part of equity that the business can utilize as it pleases is known as unrestricted equity. Funds that are legally or contractually set aside for particular uses and aren't allowed to be used freely are known as restricted equity.

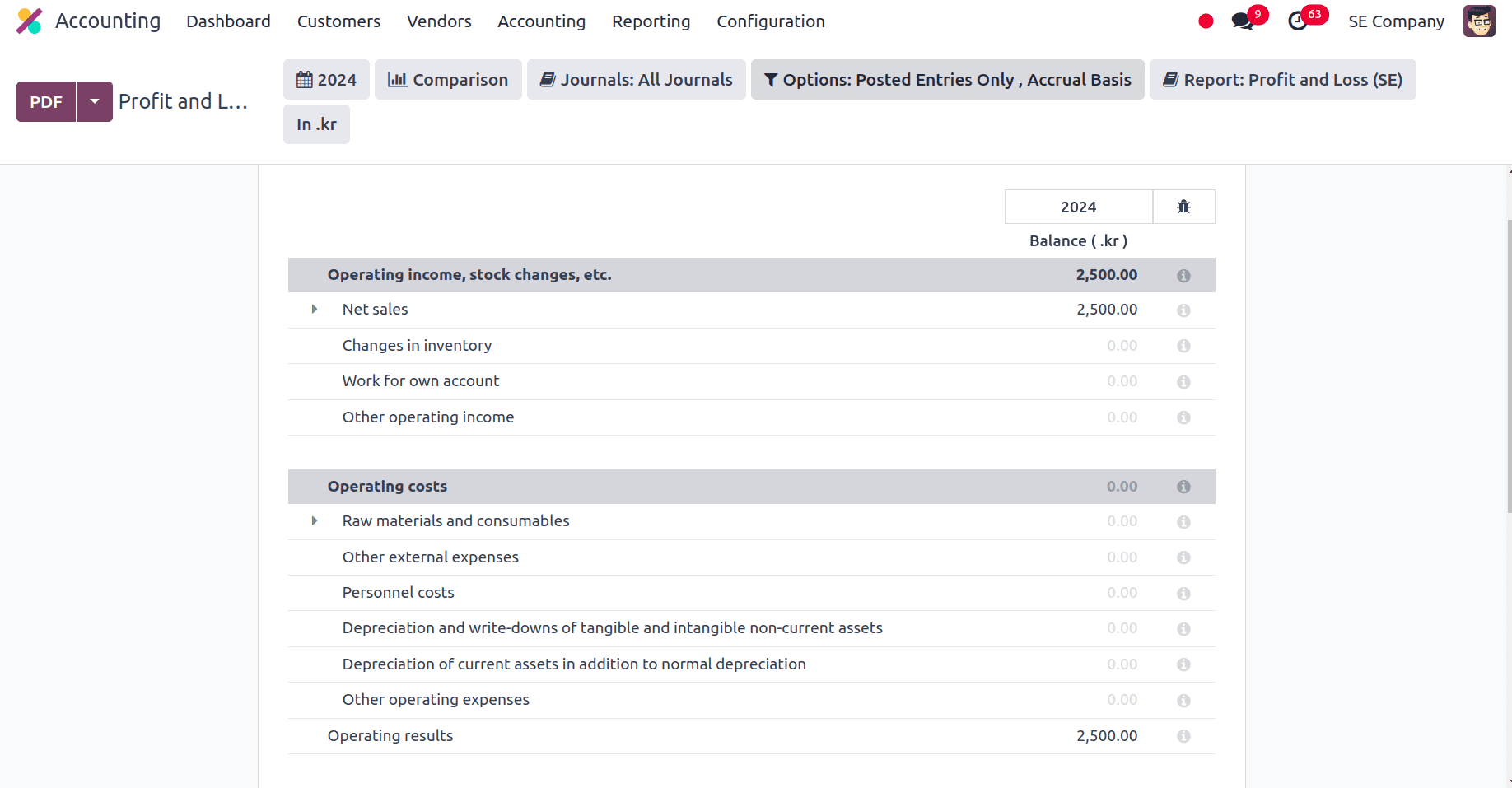

Profit and Loss Report

A business's receipts, expenses, and earnings for a specific period of time are comprehensively summarised in the Profit and Loss Report, with Swedish localization. In the report, we have the following four sections:

* Operating income, stock changes, etc: Operating Income, is the profit that is left over after deducting non-operational costs and revenues from the main business operations. It serves as a gauge of the business' effectiveness and performance in its main operations.

* Operating costs: Also known as operating expenses, they are the costs associated with keeping a business's daily operations running smoothly. They don't include expenses for finance or non-operational operations, but rather a range of charges directly connected to the provision of goods and services.

* Financial items: Earnings from the company's investments and other financial activities are referred to as financial items. Although they usually have nothing to do with the main functions of the business, they have a big effect on total profitability.

* Taxes: The amount of tax that a business must pay in relation to its taxable income is represented by tax costs. Since these costs have an effect on net profit or loss, they are a crucial part of financial reporting.

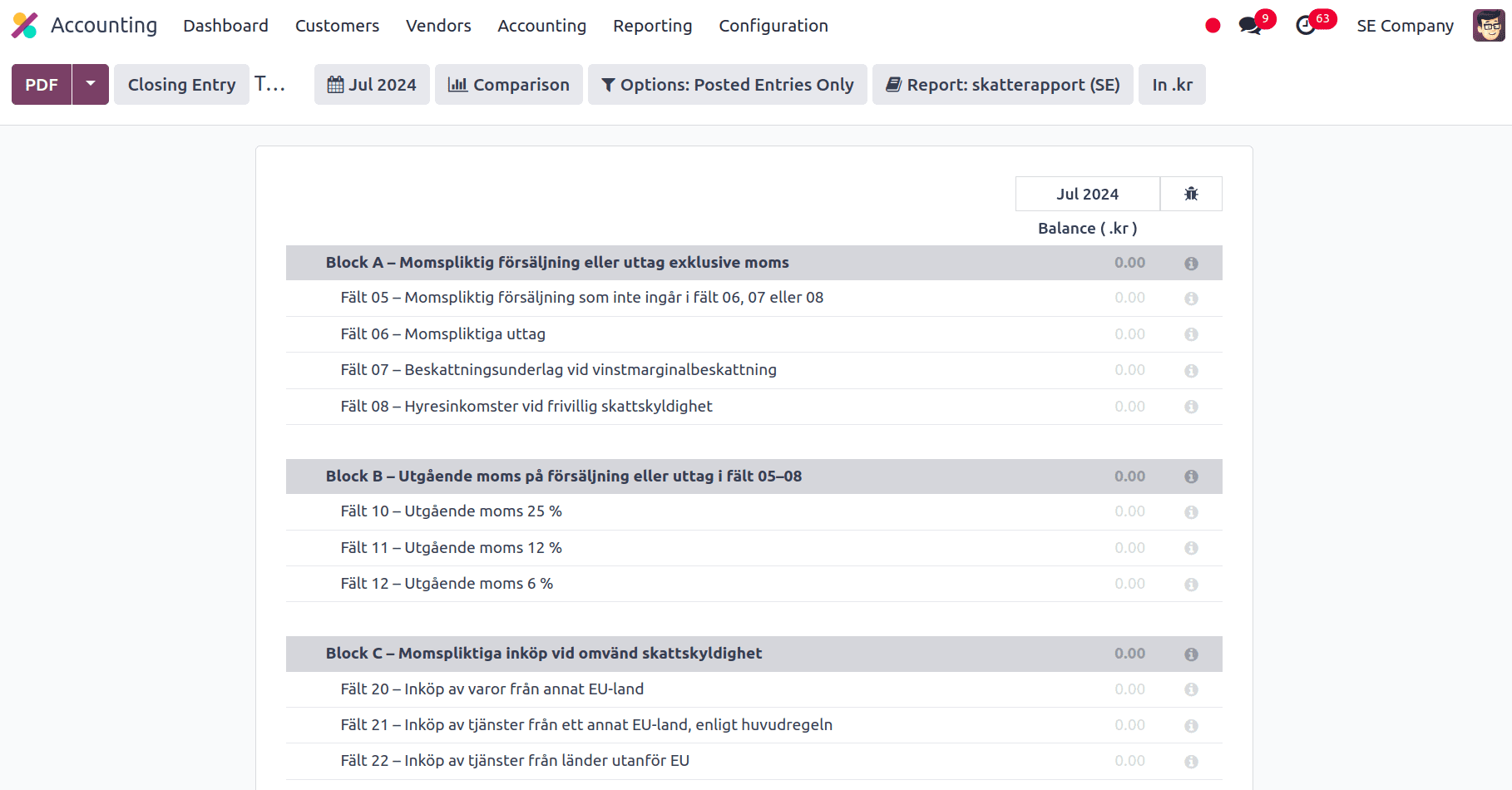

Tax Report

An essential tool for tracking and reporting VAT and other taxes is the Tax Report. Businesses may easily satisfy their tax obligations and maintain accurate financial records by correctly configuring tax configurations, creating and analyzing tax reports, and guaranteeing compliance with Swedish tax legislation. To enable efficient tax management and reporting, regular reviews and reconciliations of tax data guarantee continued correctness and compliance.

Odoo 17's accounting localization for Sweden offers companies a strong framework for managing their financial operations in compliance with Swedish tax laws and accounting standards. Odoo 17 guarantees that businesses can manage their accounting processes effectively and in accordance with local regulations by incorporating essential features like personalized Charts of Accounts, VAT administration, and precise Profit and Loss reporting.

To read more about An Overview of Accounting Localization for Peru in Odoo 17, refer to our blog An Overview of Accounting Localization for Peru in Odoo 17.