The value-added tax identification number is used as a form of identification in several countries. Each business that has registered for VAT is given a unique identification number. The majority of business owners register for VAT due to certain situations, such as the entry of commodities into the EU and the transportation of goods or services subject to VAT. Each nation in the EU is given a unique VAT number. Business workflow quickly improved as a result of integrating Odoo ERP into a system. Quick management of the VAT numbers is made possible by the Odoo 18 Accounting module. This verification was made possible by Odoo 18's support for the European VIES service.

Businesses that conduct cross-border commerce in the EU must verify the VAT numbers of their suppliers and consumers in order to adhere to tax laws. In intra-community transactions, when mistakes or invalid VAT numbers may result in fines, rejected reports, or financial hazards, this is particularly crucial. The VIES (VAT Information Exchange System) service, offered by the European Commission, makes this process easier by allowing businesses to instantaneously confirm the legitimacy of VAT numbers against the EU's central database.

The VIES service is immediately integrated into Odoo 18 Accounting's accounting module, facilitating rapid and easy VAT number verification. Users can validate figures in real time within their Odoo environment rather than manually reviewing them on external websites. In addition to assisting companies in lowering their administrative burden, this integration guarantees cross-border transaction trust, compliance, and reporting accuracy.

Sales of commodities in each state are subject to VAT taxes, which are determined by the applicable gross margin. On a specific transfer from manufacturer to merchant, value-added taxes are paid. India and Union Territories are among the countries with VAT laws. The value-added tax calculation is divided into two sections: input VAT and output VAT. The formula used to calculate the VAT is as follows, VAT is primarily employed in the purchase and sale of goods and removes the chance of error. Value-added taxes use a uniform tax payment process to ensure efficiency.

How Can I Configure and Verify VAT Numbers in Odoo 18 Accounting?

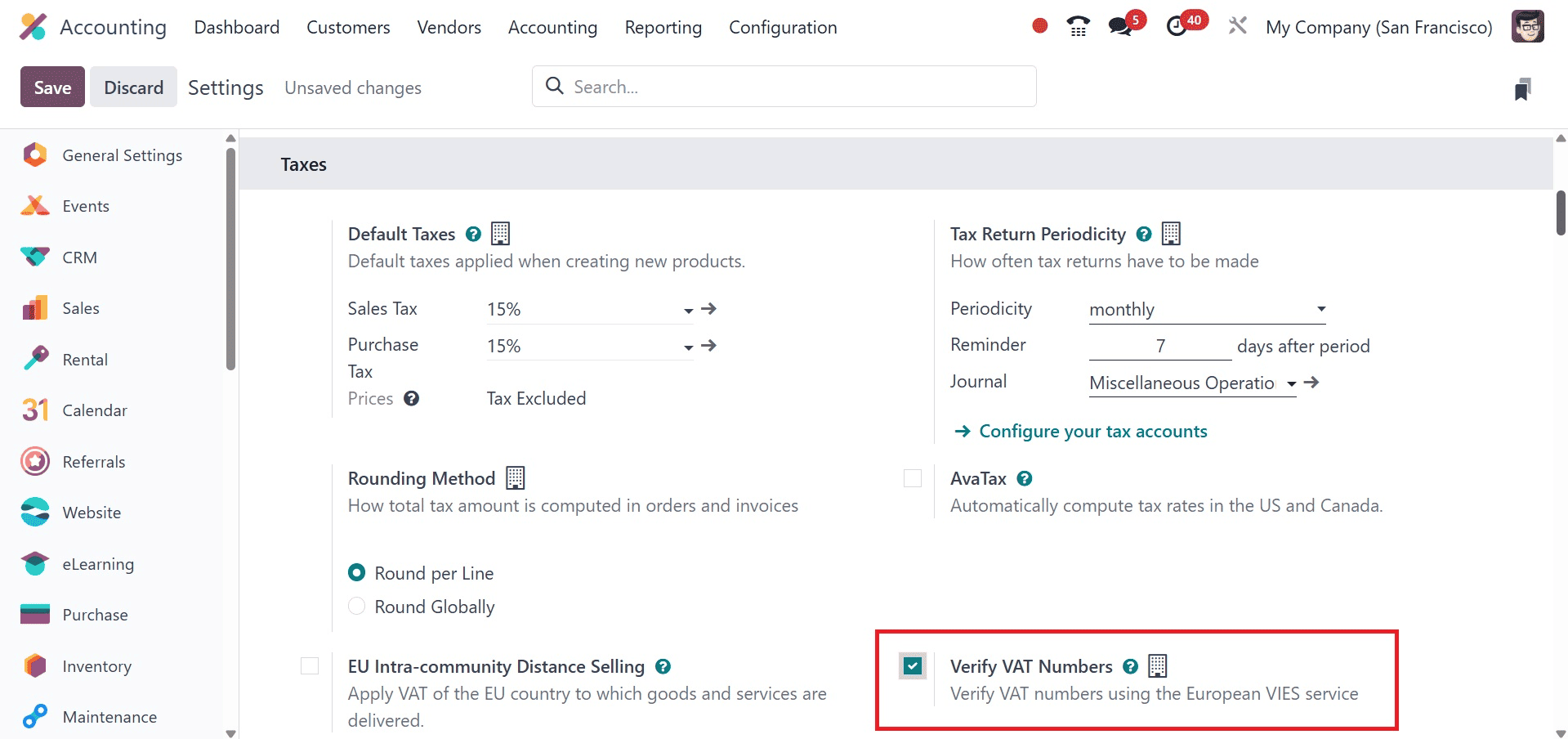

The tool provided by the European Commission is the VAT Information Exchange System. It assists you in confirming the validity of VAT numbers registered by EU companies. The Verify VAT Number function in Odoo 18 Accounting makes it easier to save a contact. By choosing the Settings option from the Configuration tab, the user can see the Taxes section. Click the SAVE icon after turning on the Verify VAT Numbers area, as seen in the screenshot below.

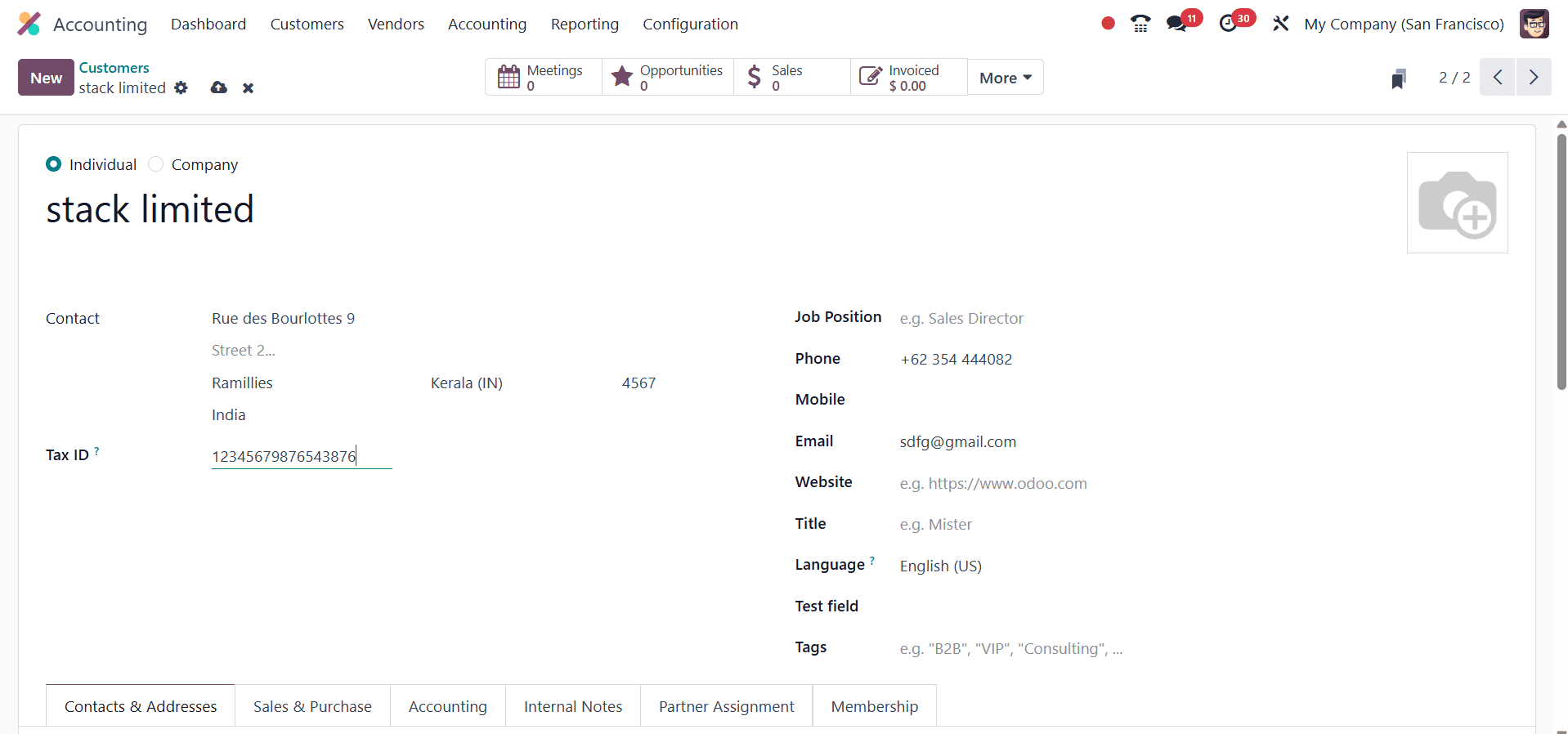

Users can validate the VAT numbers via the European VIES service after turning on the Verify VAT Numbers feature. Once the Verify VAT Numbers feature is enabled, if the contact’s Tax ID field is populated and its country is different from your company’s country, Odoo displays an Intra-Community Valid checkbox. Odoo tests the VAT number through the VIES and automatically checks or unchecks the Intra-Community Valid checkbox depending on the validity of the VAT number.

Odoo performs a VIES VAT number check when you click Save, and if the VAT number is incorrect, it shows an error notice.

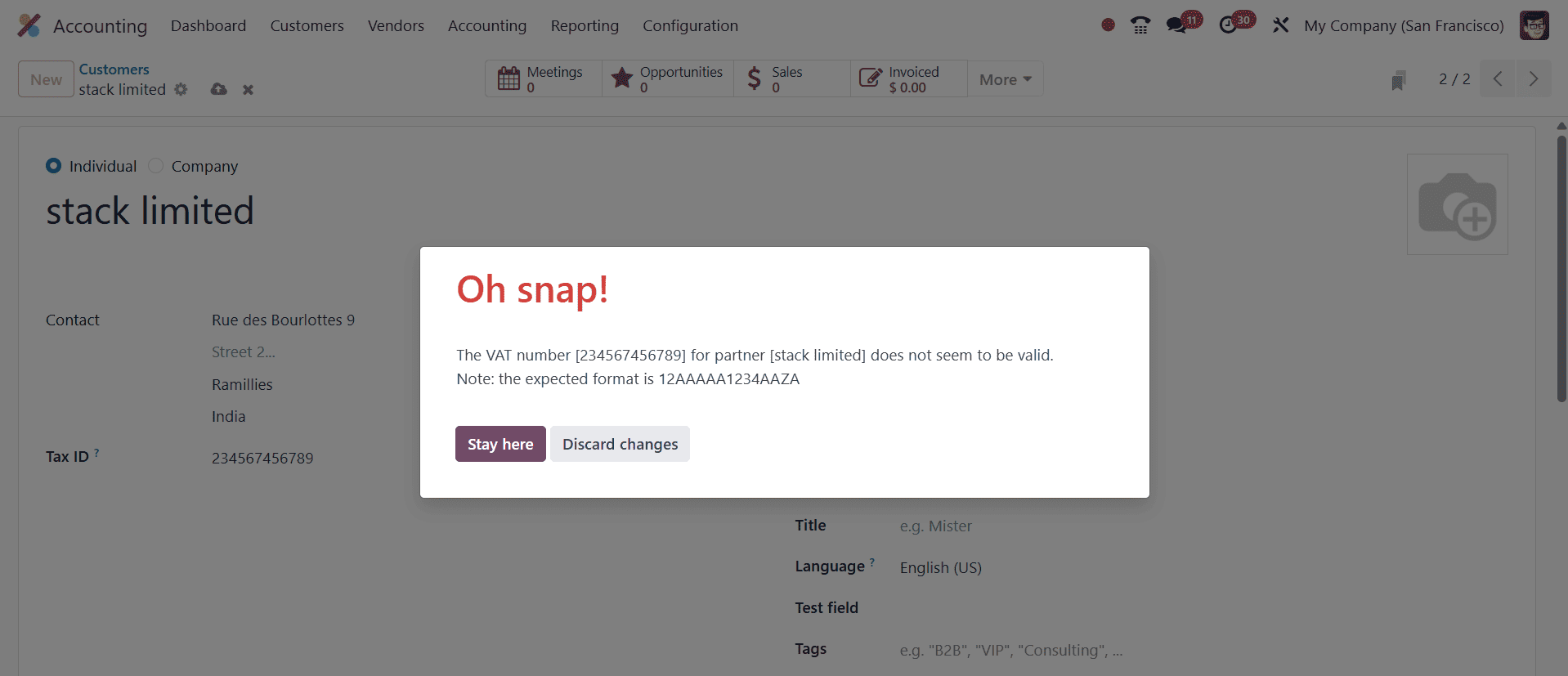

Then correct the VAT number accordingly. Now, to add fiscal position with VAT no, go to the fiscal position option under the Configuration menu, and go for New icon.

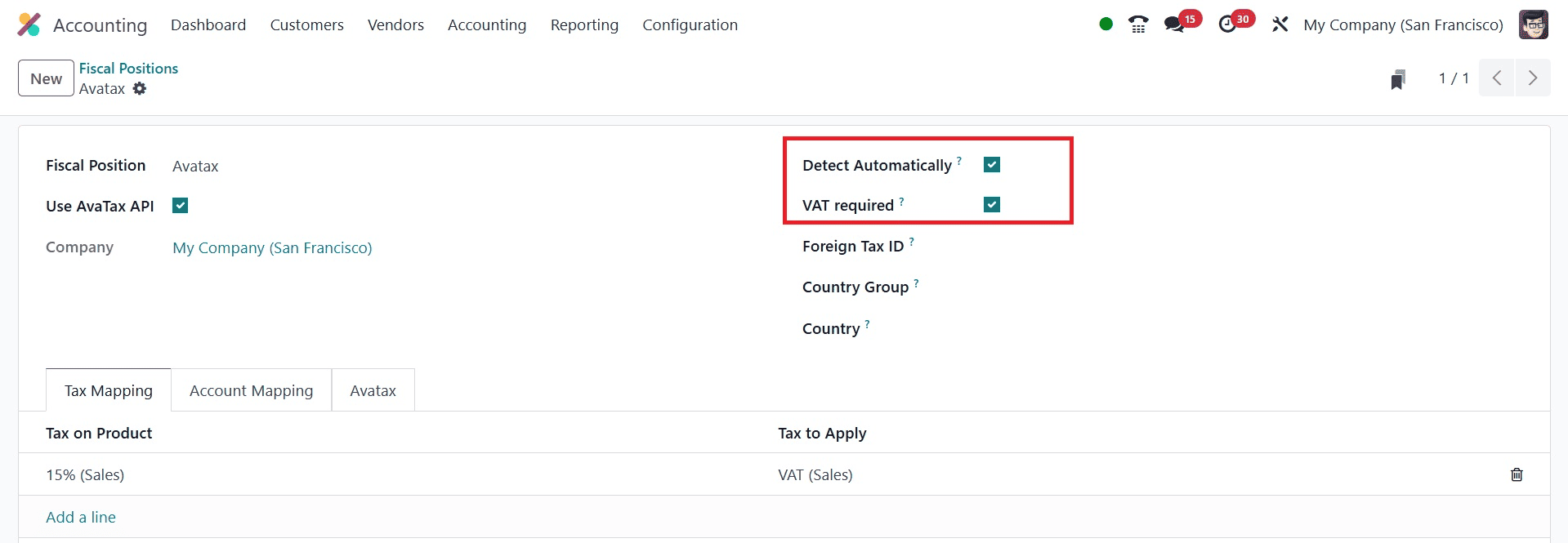

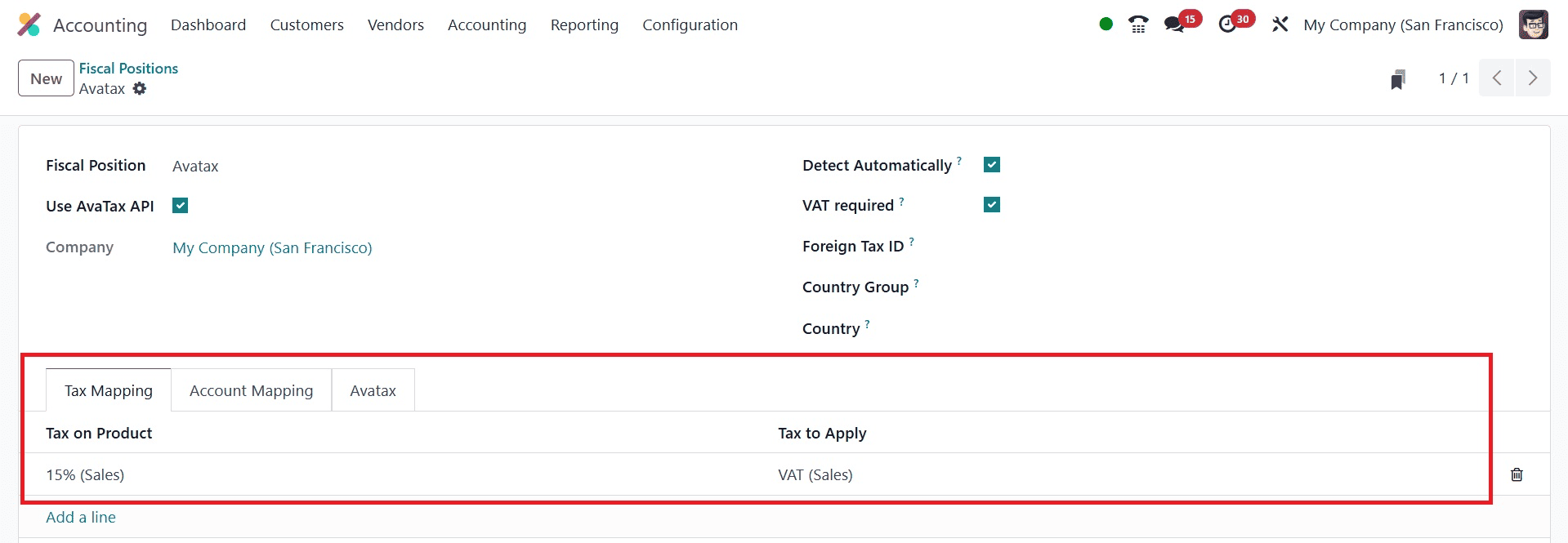

There, you have the detect automatically to activate, and then you will get the option of VAT required, as in the image above. To assign it to a partner who has a VAT number, make sure the number is submitted in the contact form and use the "VAT Required" condition to apply it automatically. Map your selected taxes using the "Tax Mapping"tab, as in the image below.

Go to the fiscal position's "Tax Mapping" tab after turning on automatic detection.

The "Add a line" button allows you to add a new tax mapping rule.

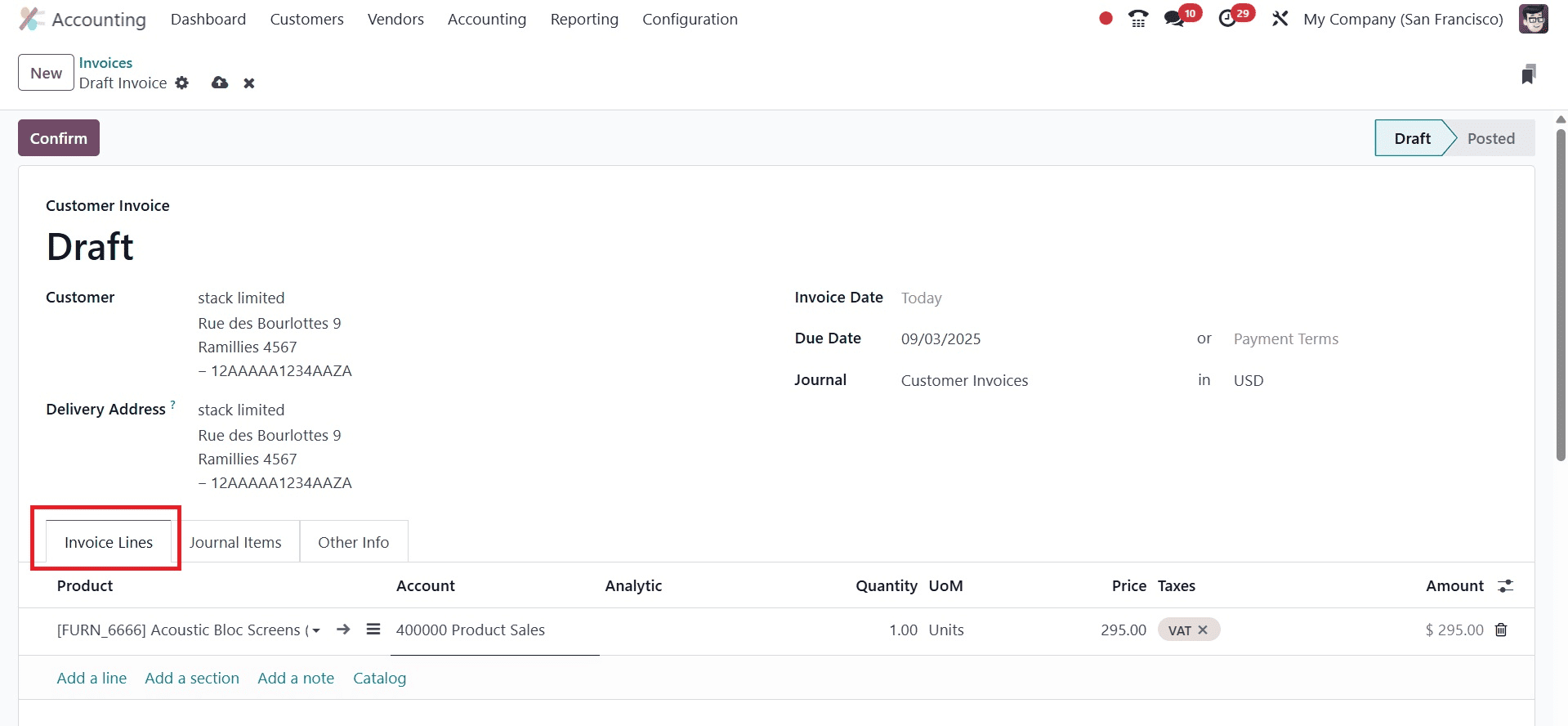

Choose the current tax you wish to have replaced for transactions under this fiscal position in the "Tax on Product" column. Choose the new tax created you wish to use in its place in the "Tax to Apply" column. Then, create an invoice with the created customer, and there you can see that under the invoice line, if you add a product with 15% tax, then the created VAT tax will automatically added, as in the screenshot below.

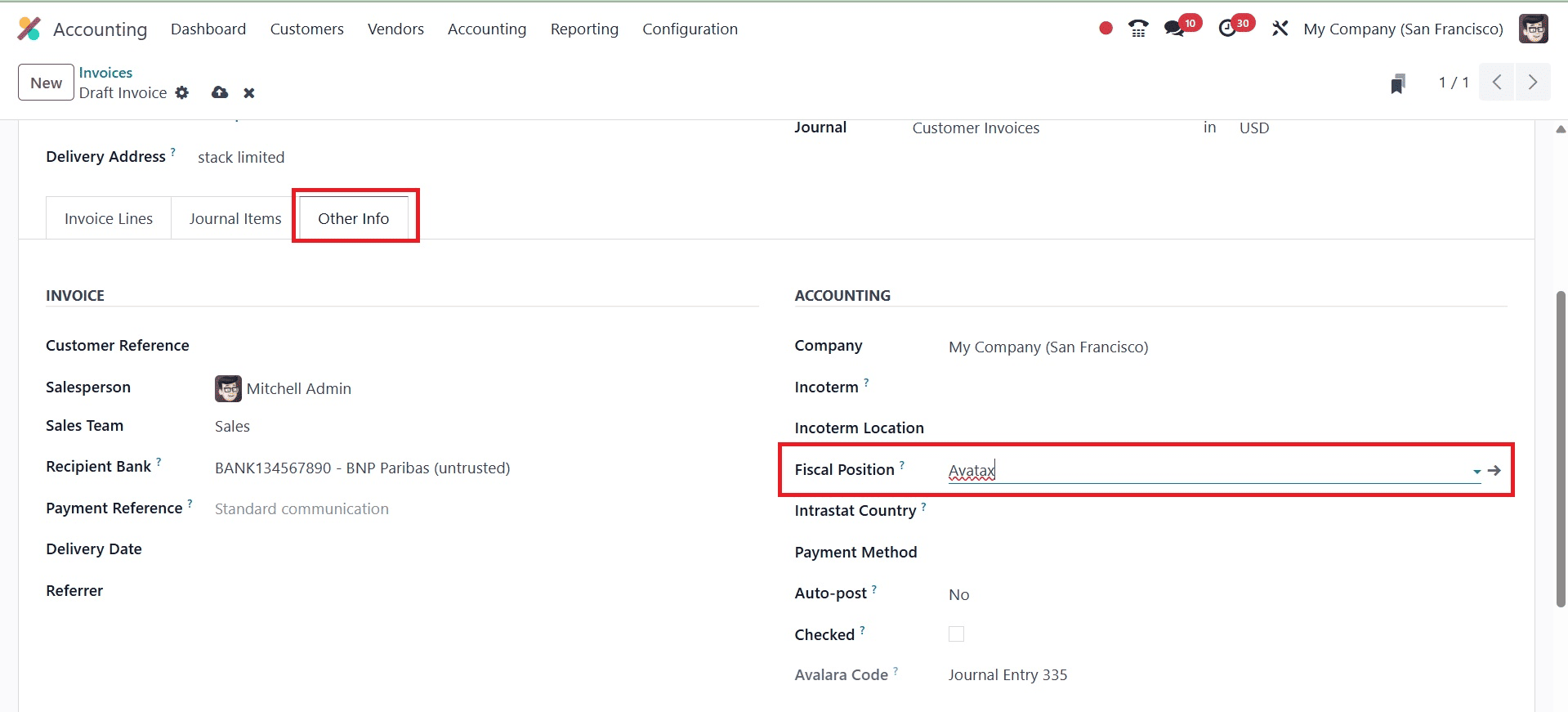

Similarly, you can see that, the fiscal position is added in the Other Info tab of the created customers invoice, as in the image below.

Now that the fiscal position's "Detect Automatically" option is activated, Odoo will automatically apply this fiscal position to transactions with that partner when such transactions satisfy the criteria you've specified (like having a VAT number).

VAT number validation in Odoo 18 Accounting is streamlined, dependable, and consistent with EU requirements when the European VIES service is used. Businesses may rapidly verify the correctness of supplier and consumer VAT numbers by integrating directly with VIES, which lowers the possibility of mistakes, fines, and fraudulent transactions. This guarantees adherence to intra-community tax regulations, expedites reporting, and enhances confidence in cross-border trade.

In the end, the VIES integration in Odoo 18 streamlines VAT verification, saving time and facilitating open financial management.

Businesses can validate VAT numbers while working with EU suppliers and consumers in a dependable and automated manner by using the European VIES function in Odoo 18 Accounting. Businesses can reduce compliance risks, guarantee the proper implementation of intra-community tax laws, and keep accurate records for audits by incorporating this verification method straight into the accounting workflow. In addition to increasing productivity, this ensures that all VAT information is current and accurately validated, which fosters trust with business partners. In the end, managing cross-border transactions is made easier, more transparent, and completely compliant with European tax laws thanks to VIES integration in Odoo 18.

To read more about How to Verify VAT Numbers Using European Vies in Odoo 17 Accounting, refer to our blog How to Verify VAT Numbers Using European Vies in Odoo 17 Accounting