A tax on customers to purchase services or items is a sales tax in the United States. Statewide sales tax is collected by more than 45 states in the USA. Based on each state, we can see variations in sales tax rates and impacts on the revenues from a tax. There is an exception for groceries in most states with sales tax for consumers. The overall tax structure of a country mainly depends on the sales tax and use tax rates. Administration of various tax rates on your business is easy with the Odoo 16 Accounting app.

This blog examines the Massachusetts(US) Sales Tax calculation within Odoo 16 Accounting.

The accounting dashboard of Odoo 16 is beneficial for configuring Taxes, accounting periods, charts of accounts, and more. In addition, users can quickly set default taxes for purchase and sales transactions in a firm. Next, we can view Massachusetts(US) tax calculation process in the Odoo 16 Accounting.

Analysis of Massachusetts(US) Sales Tax

A 6.25% tax is applied for Massachusetts sales tax for tangible personal property and other services rented/sold in the state. In addition purchase price, a sales tax pays by the buyer. A buyer pays sales tax directly to the state for trailer sales and motor vehicles. Internet access and television are exempted from the sales tax rate of Massachusetts. The use tax is imposed on a consumer who buys furniture for Massachusetts entrepreneurship. Buyers can directly pay the use tax for the government efficiently. A sales tax vendor must have a business location and property in Massachusetts.

Massachusetts Department of Revenue assists in registering your business's sales or use tax rates. A sales tax registration certificate is accessible to a user once registered with the Department of Revenue. Users must carry information such as business activity, description type, identification number, and more for sales tax registration. Tax rates are applied differently to buyers as per chosen products/items in a business.

To Generate Massachusetts(US) Company in Odoo 16

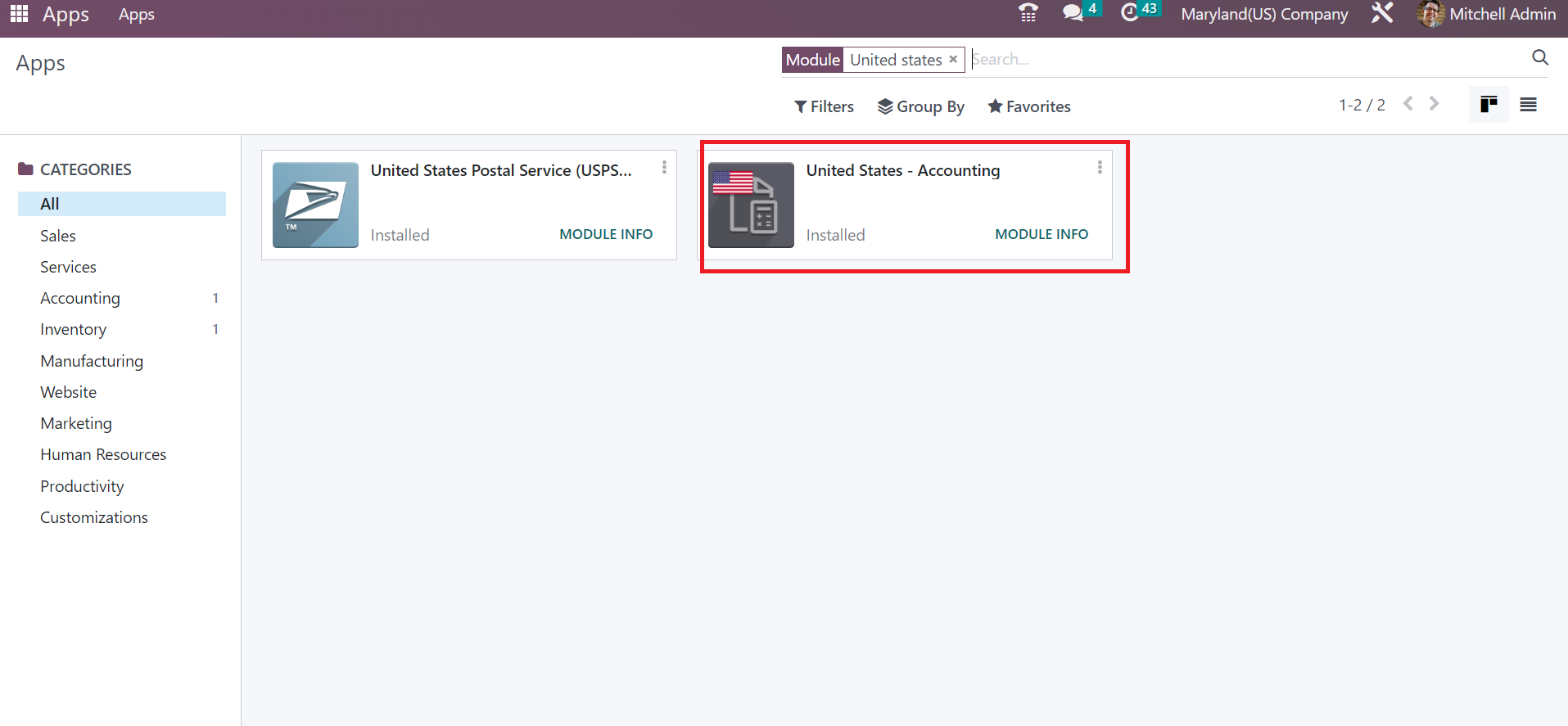

Users must install the United States - Accounting app to manage localization of the US in your company. In the Odoo Apps, search United States - Accounting app in the search bar, and individual results are visible to the user. Then, install the specific app to administer your company data based on localization, as defined in the screenshot below.

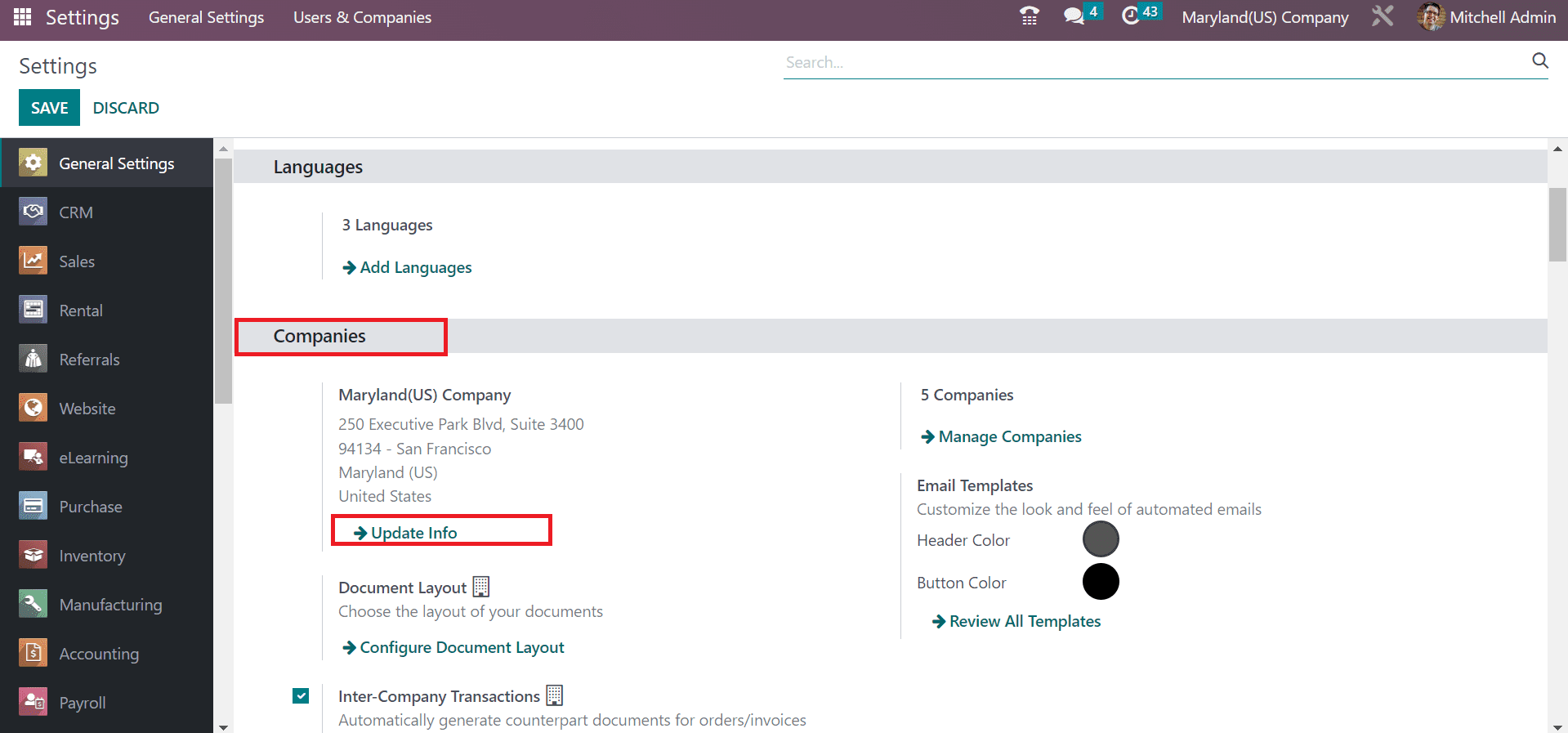

Move to the Odoo 16 Settings after the installation of the United States - Accounting app. Select the Update Info under the Companies section of Settings to change your recent company data, as mentioned in the screenshot below.

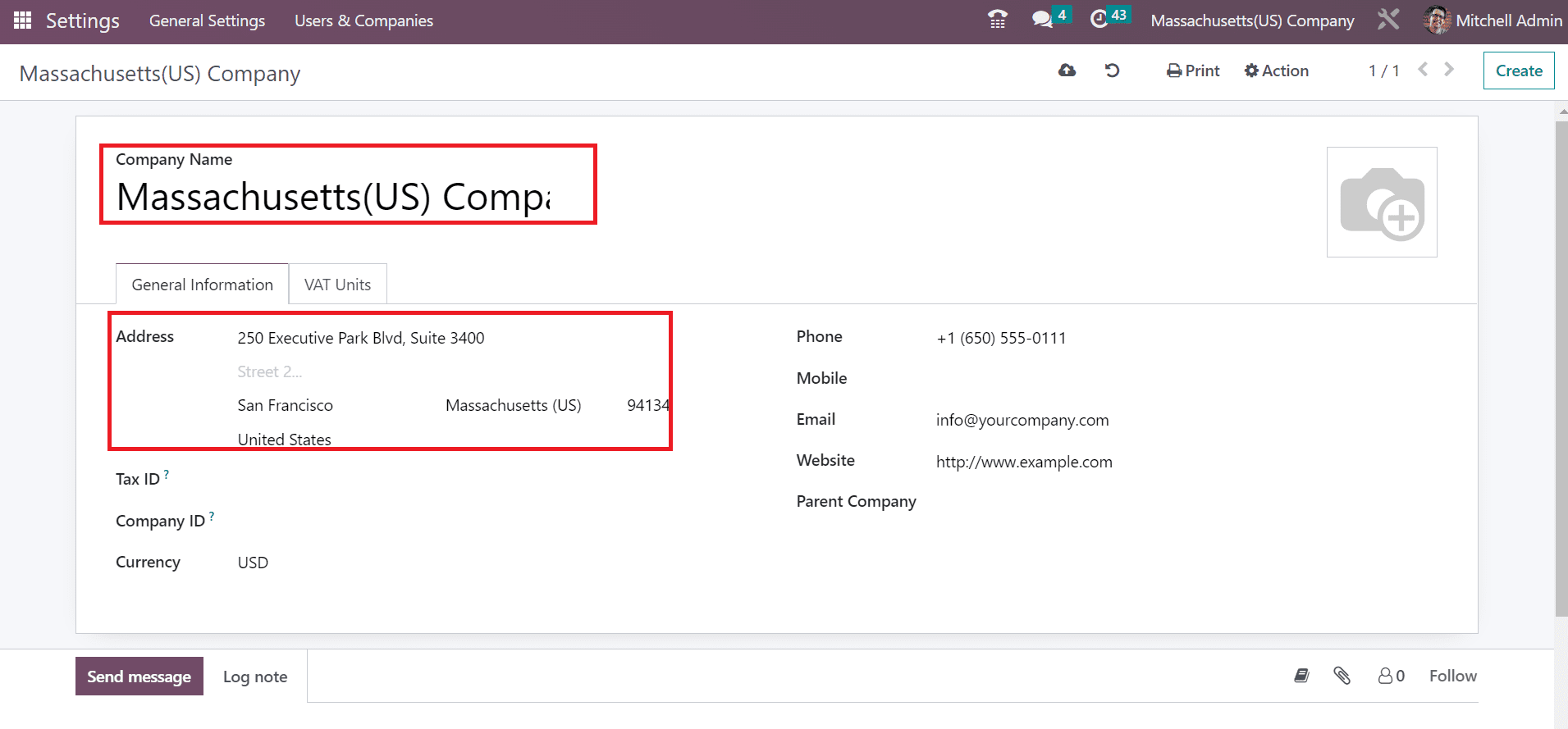

In the Companies window, replace the Company Name as Massachusetts(US) Company. Users can enter a detailed view of their Massachusetts company in the Address field. As signified in the screenshot below, make sure to choose Massachusetts(US) in the State option and US as a country.

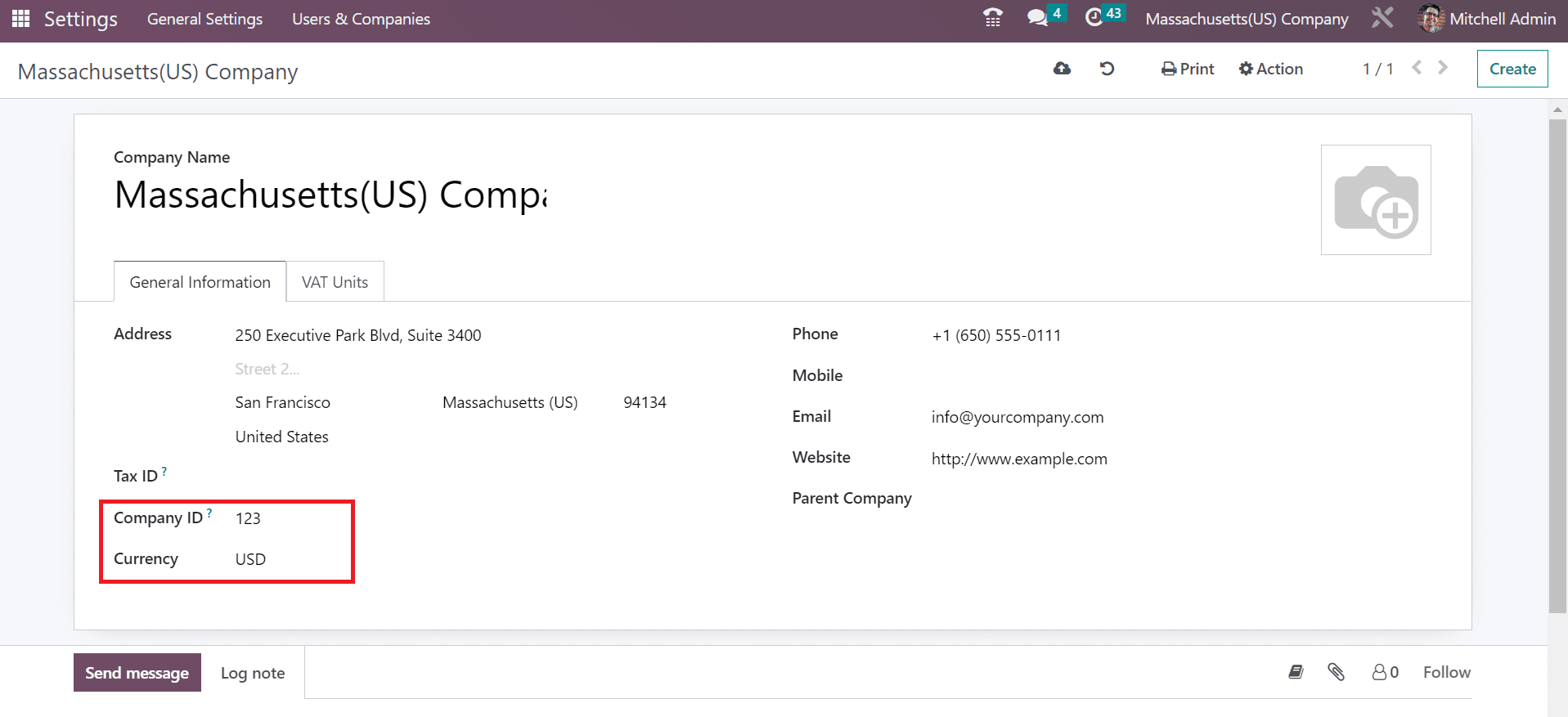

Apply the unique identifier number or term in the Company ID field. Next, we pick USD as the Currency for your Massachusetts(US) company, as depicted in the screenshot below.

All the added details are saved manually within Odoo 16.

To Create Massachusetts Sales Tax in Odoo 16 Accounting

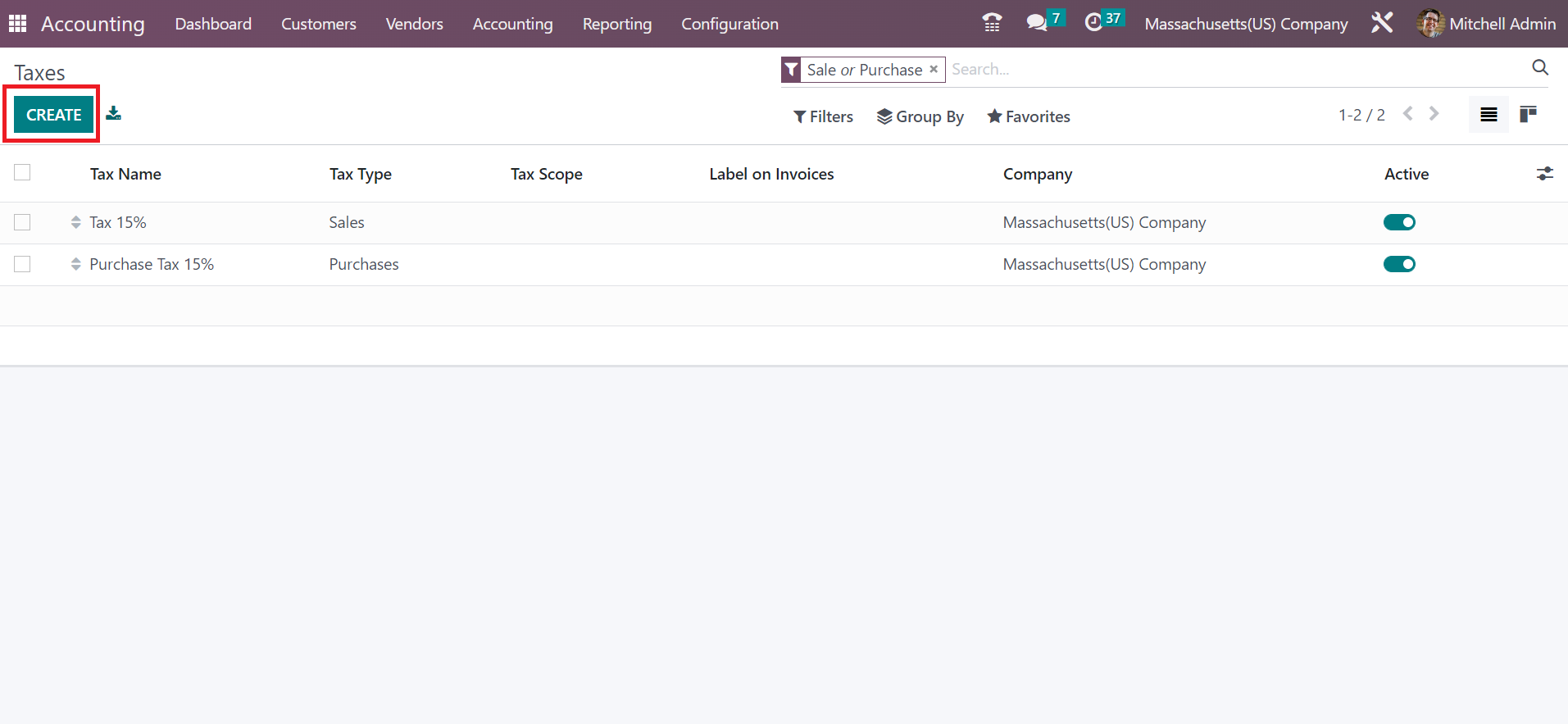

Users can quickly develop the sales tax after choosing the Taxes menu in the Accounting module. Several purchases and sales taxes are accessible in the Taxes window, and click the CREATE icon to generate a sales tax for Massachusetts, as portrayed in the screenshot below.

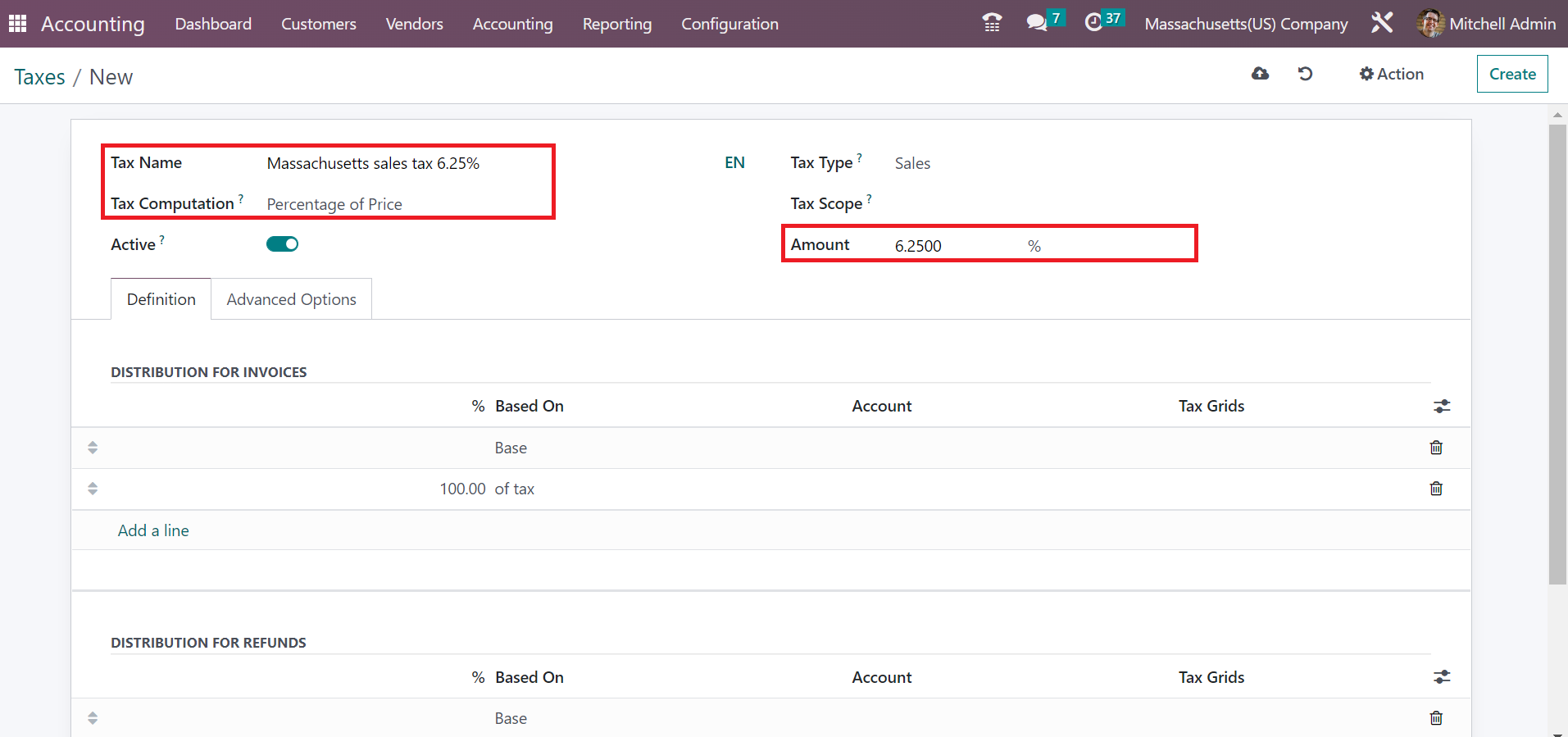

Add Massachusetts sales tax of 6.25% under Tax Name. Afterward, the user can select a tax calculation method for Massachusetts sales tax. Apply 6.25% in the Amount option once choosing your computation way in the Tax Computation, as presented in the screenshot below.

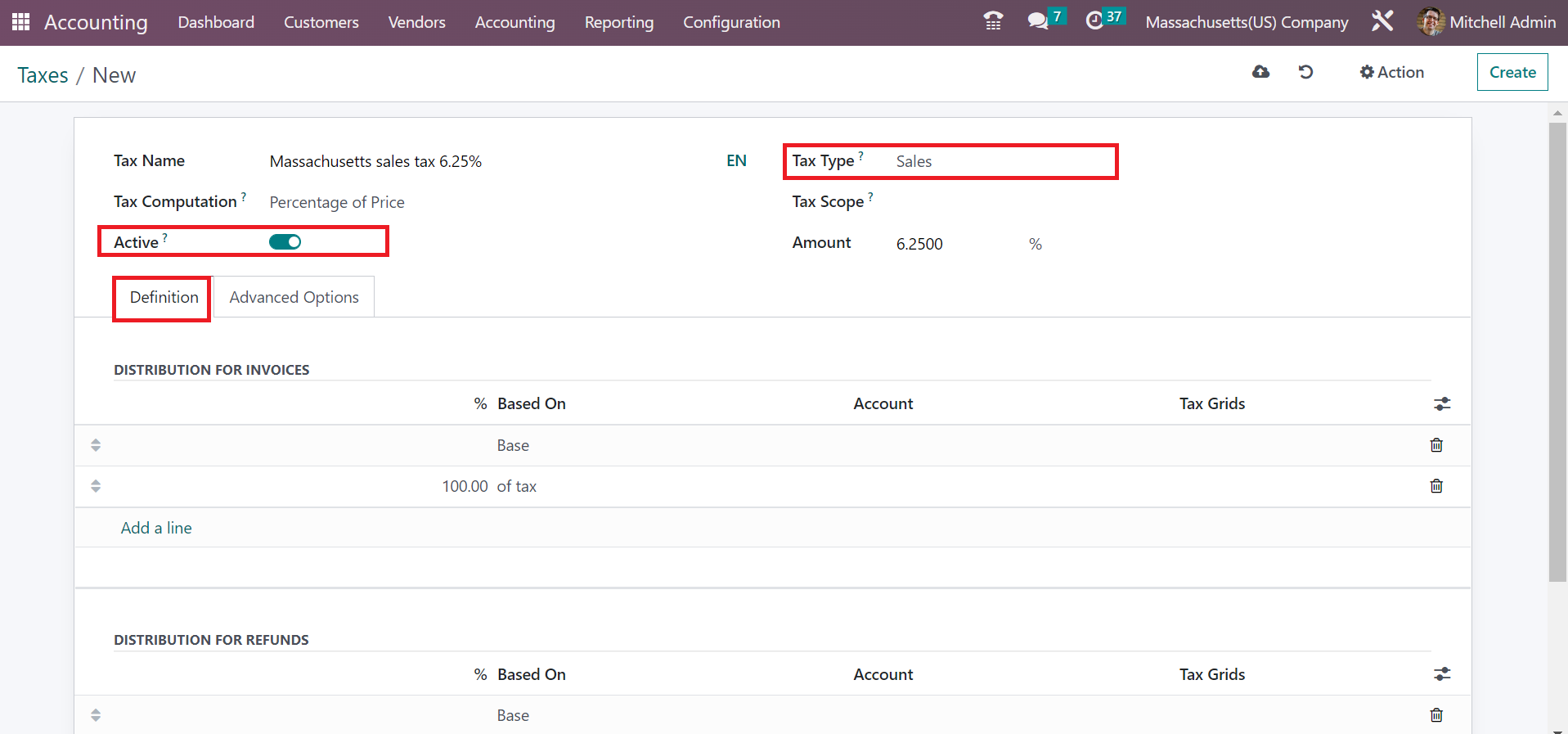

Pick the Sales option under the Tax Type field due to the Massachusetts sales tax. Also, you need to enable the Active field for running the specific sales tax. Inside the Definition tab, it is possible to divide the tax for refunds or invoices distinctly.

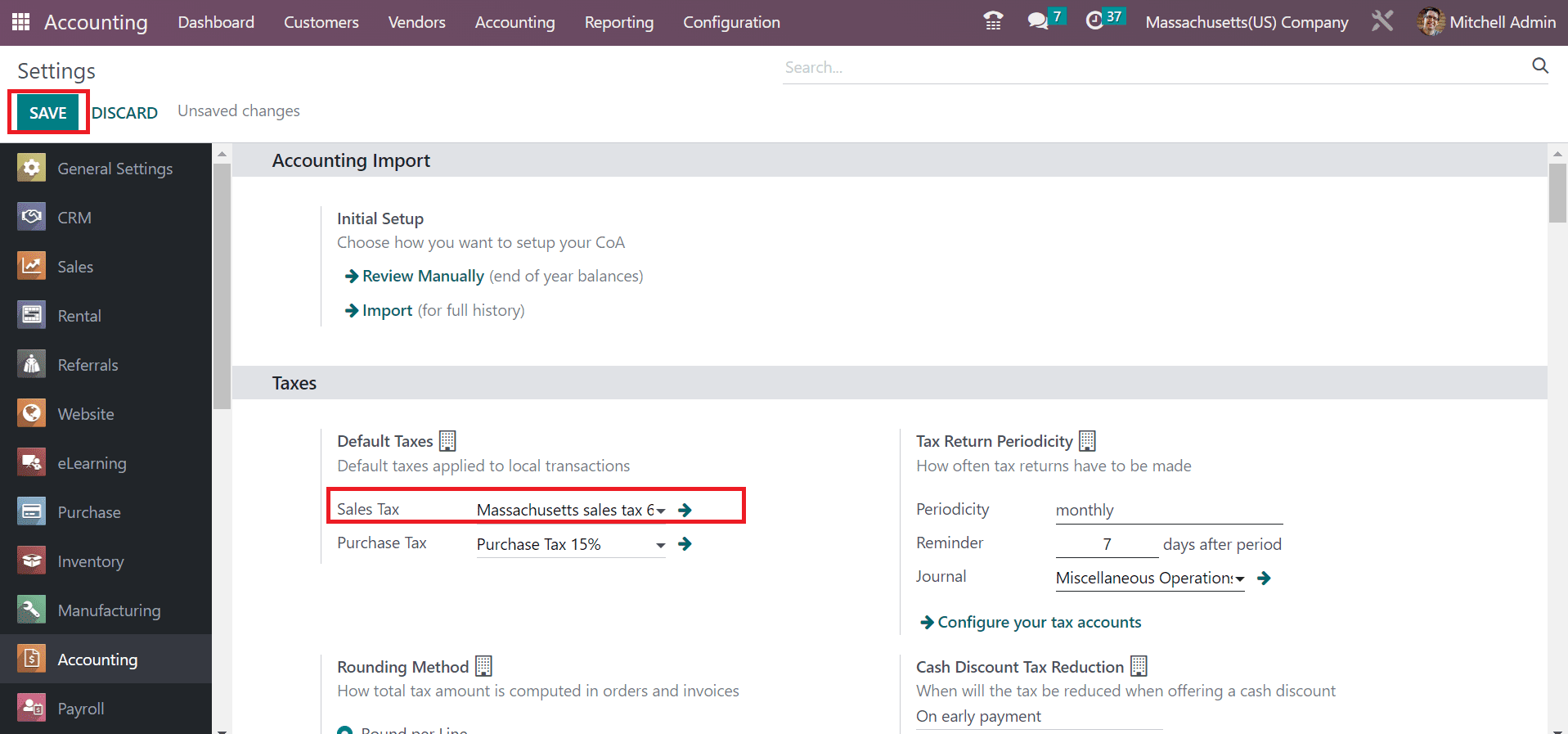

After manually saving the data, we can develop customer invoices based on the particular sales tax of Massachusetts. Before formulating the invoice, the user can make the Massachusetts sales tax 6% as default one in Odoo 16 once moving to the Settings window. In the Sales tax field, select Massachusetts sales tax 6.25% and press the SAVE icon on the Settings page, as illustrated in the screenshot below.

Your added sales tax is automatically obtainable in each invoice.

How to Apply Massachusetts Sales Tax on a Customer Invoice in Odoo 16?

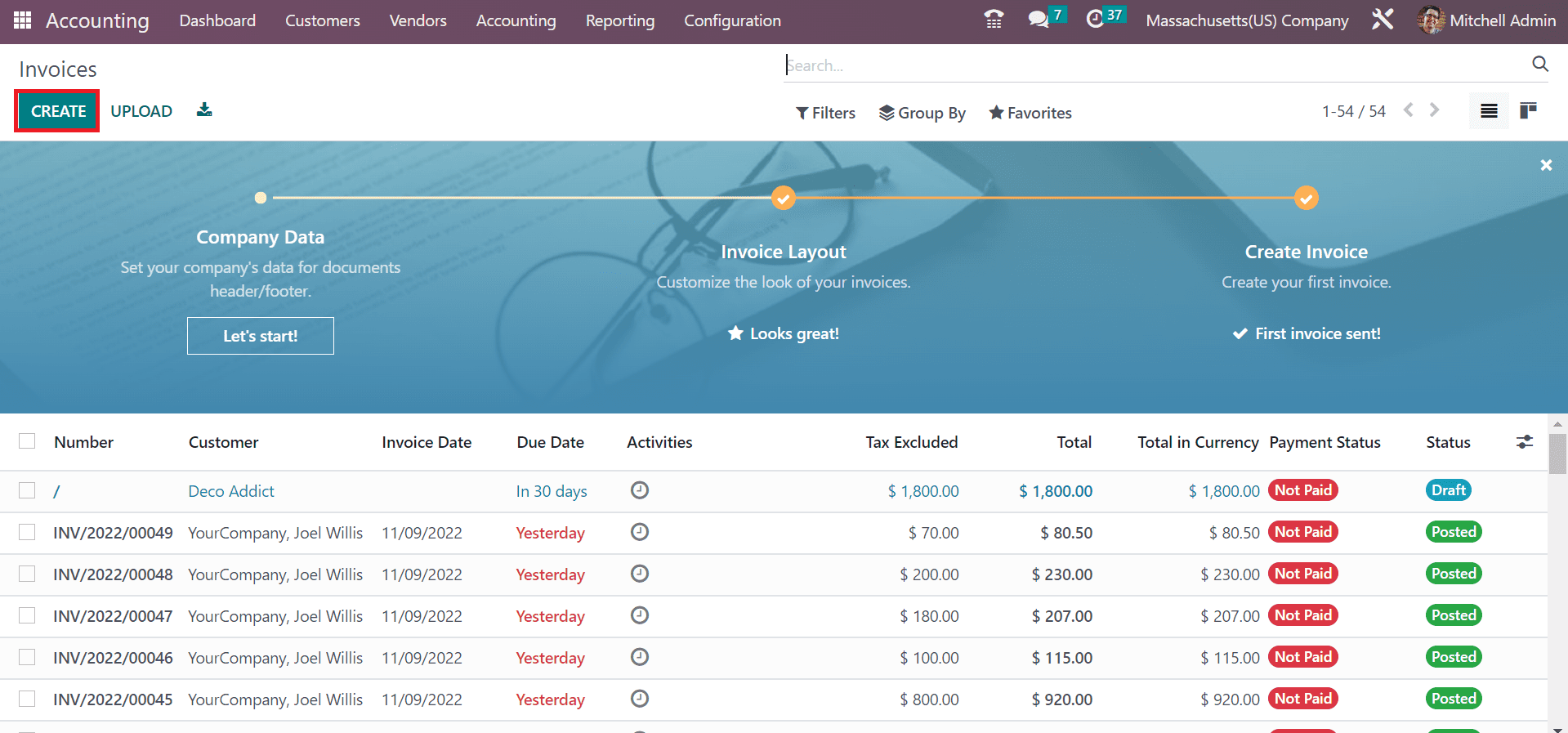

Invoices history is acquirable after clicking the Invoices menu from the Customers tab. Users can access each invoice separately with different data, including status, customer, due date, etc. We can proceed with a new customer invoice by selecting the CREATE button, as displayed in the screenshot below.

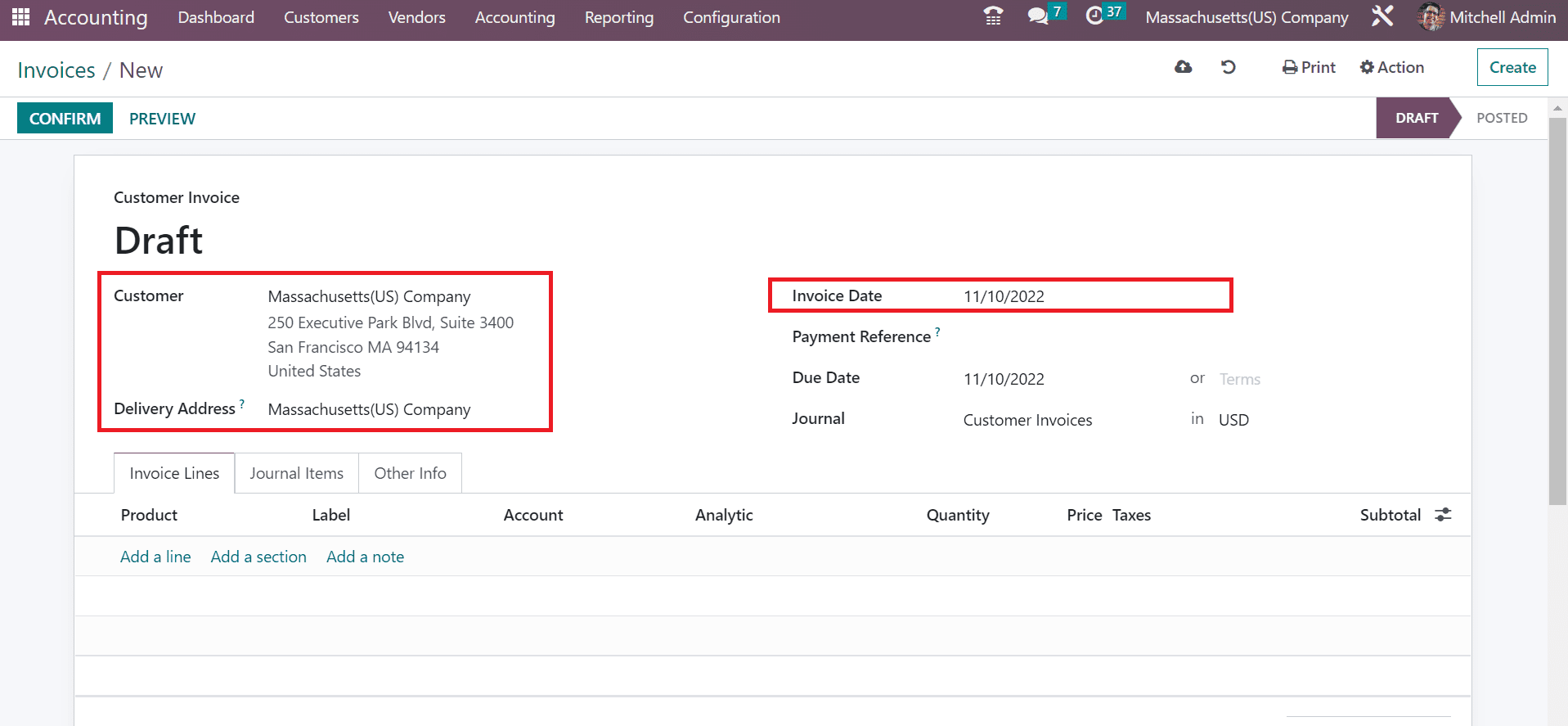

Choose Massachusetts(US) Company as your partner, and the Delivery address means the product delivered address for the user is automatically viewable. Later, mention the start day of the invoice in the Invoice Date option, as mentioned in the screenshot below.

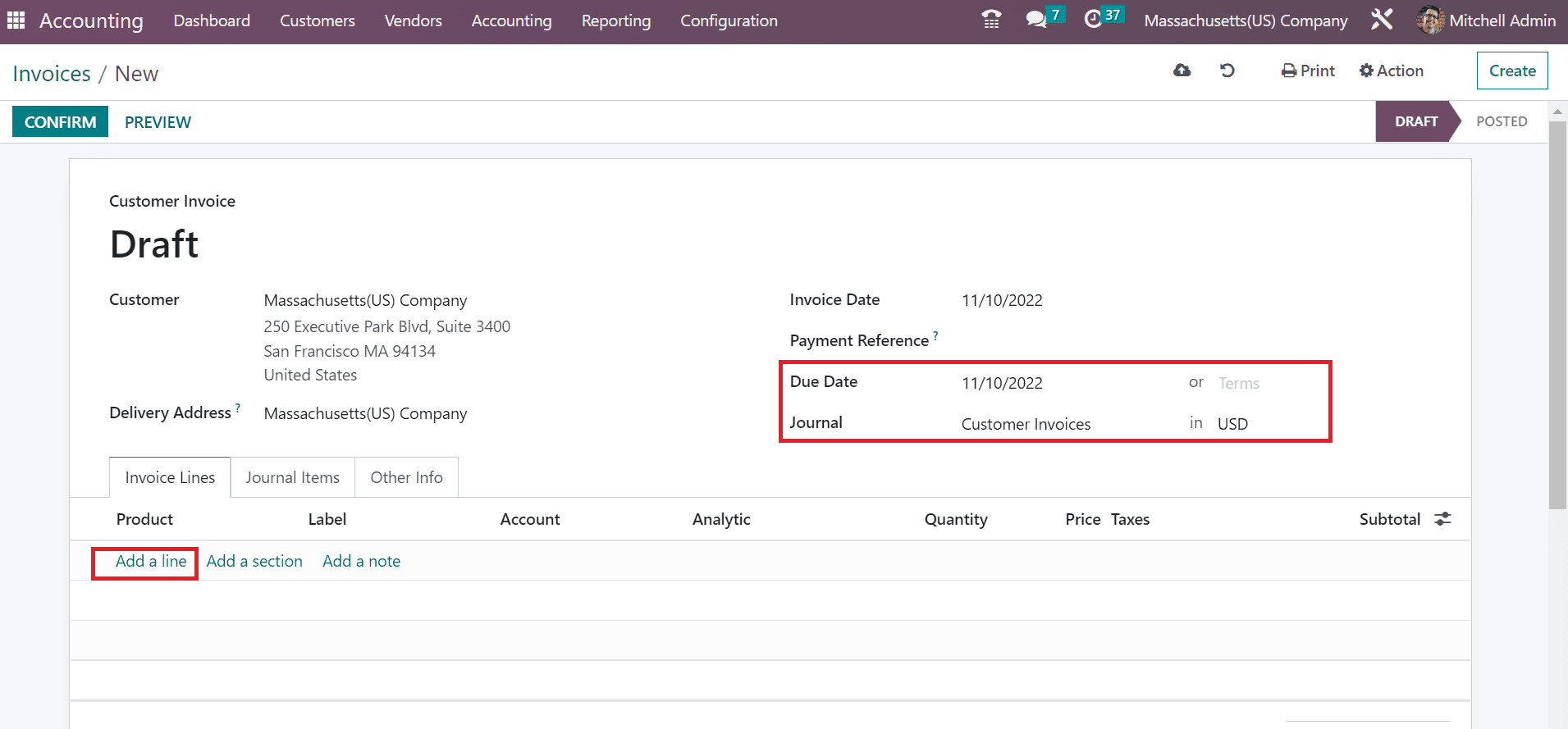

Mention your expiry day for customer invoices within the Due Date field. Moreover, you must select a journal related to your invoice in the Customer Invoice window. Choose the Add a line option for developing recent product data, as indicated in the screenshot below.

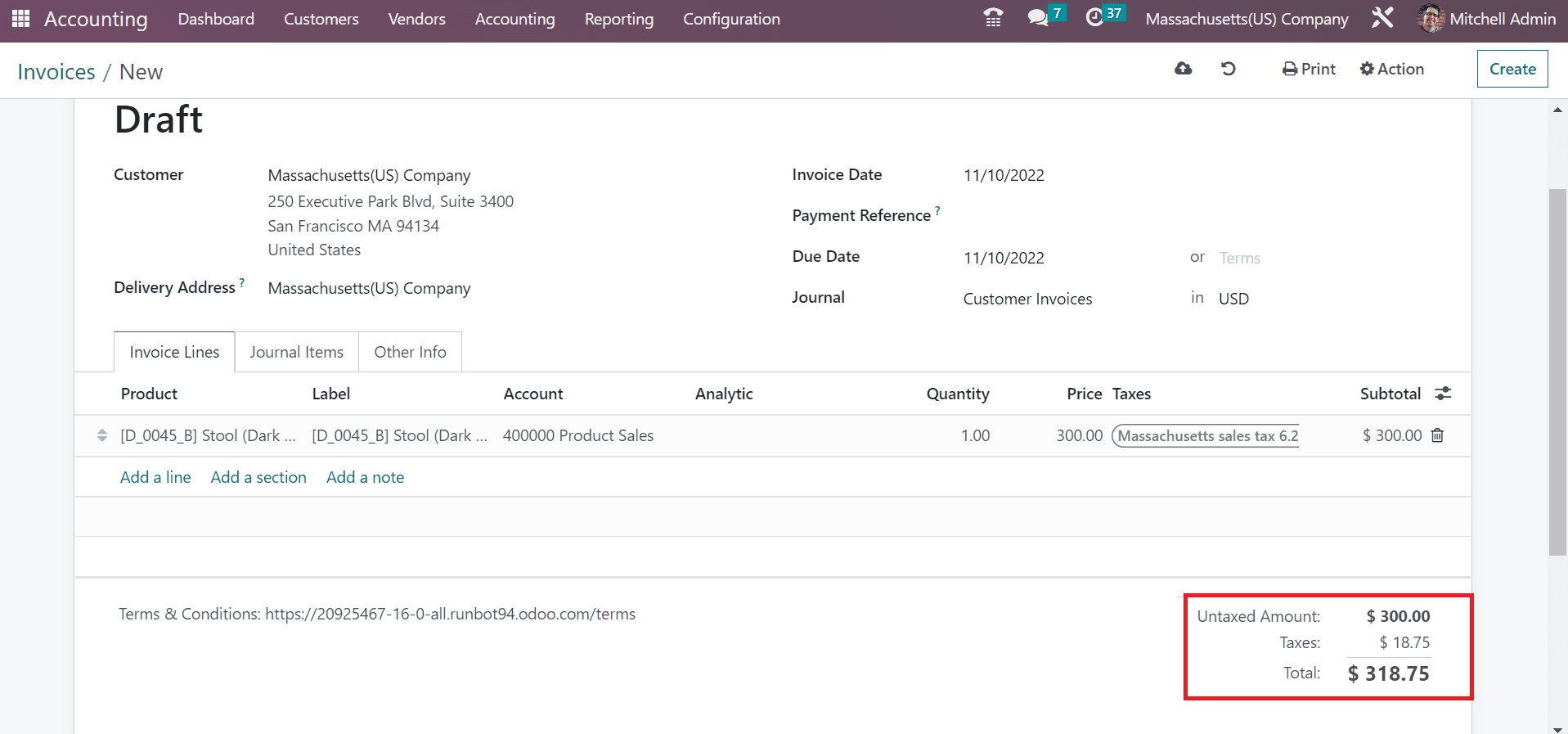

After choosing your product, pick the Massachusetts sales tax of 6.25% under the Taxes section. We can view the total price of an item with determined taxes in the Invoices window.

Next, the user can confirm the invoice after saving the information manually. Hence, it is simple to post your customer invoice in a business.

Odoo 16 Accounting application ensures the management of taxes per each state in a country. Maintenance of accounting operations in a business becomes smoother with Odoo ERP software. It is easier to compute tax rates based on a different percentage of every state in Odoo 16.

Refer to the below link to access the steps of Georgia(US) sales tax in Odoo ERP