Indonesian localisations designed for companies working in Indonesia which includes the rules and regulations based on that country. Like the localization for other countries, accounting properties will be auto-generated at the time of installing the localization package for Indonesia also.

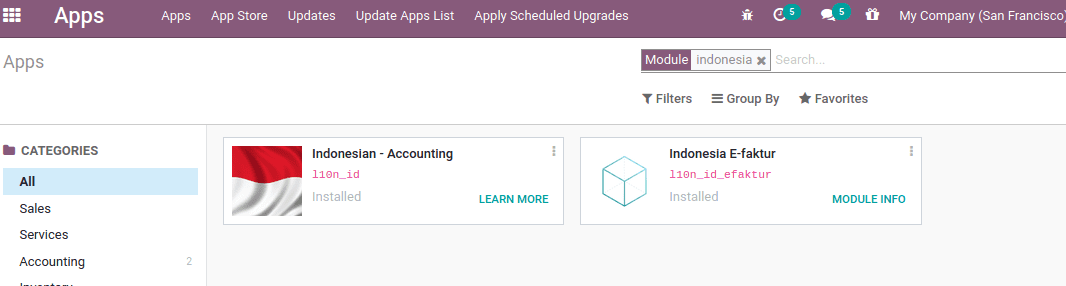

Install the Indonesian localization package from the Odoo apps.

The Indonesian accounting package includes:

Indonesian-Accounting (l10n_id): This is the most recent Indonesian Odoo localization needed for SMEs to operate Odoo accounting with a generic Indonesian chart of accounts and tax structure.

Indonesia E-Faktur (l10n _id_efaktur): handles e-invoicing and tax invoice

E-Faktur Module

The electronic tax invoice or E-faktur system is not an electronic invoicing system, but a system for creating a tax invoice (Faktur Pajak) that has been verified by the Tax Office (and stored on its system) and that contains an integrated VAT return. The e-faktur module gets installed along with Indonesian accounting package.

It helps one to generate a CSV file for one tax invoice or for a batch of tax invoices to be submitted to an e-factur application of the tax office.

NPWP/NIK settings

NPWP stands for Nomor Pendaftaran Wajib Pajak (taxpayer Registration Number). It is a 15 digit tax identification number for which the company can pay the taxes of their eligible employees under a single NPWP number. As per the tax office in Indonesia, all individuals should have this number, including a temporary resident. Even a temporary resident has to pay income tax here. While NIK is the Customs Identification Number, the personal identification number issued to users of customs services, such as importers and exporters, by the Directorate General for Customs and Excise.

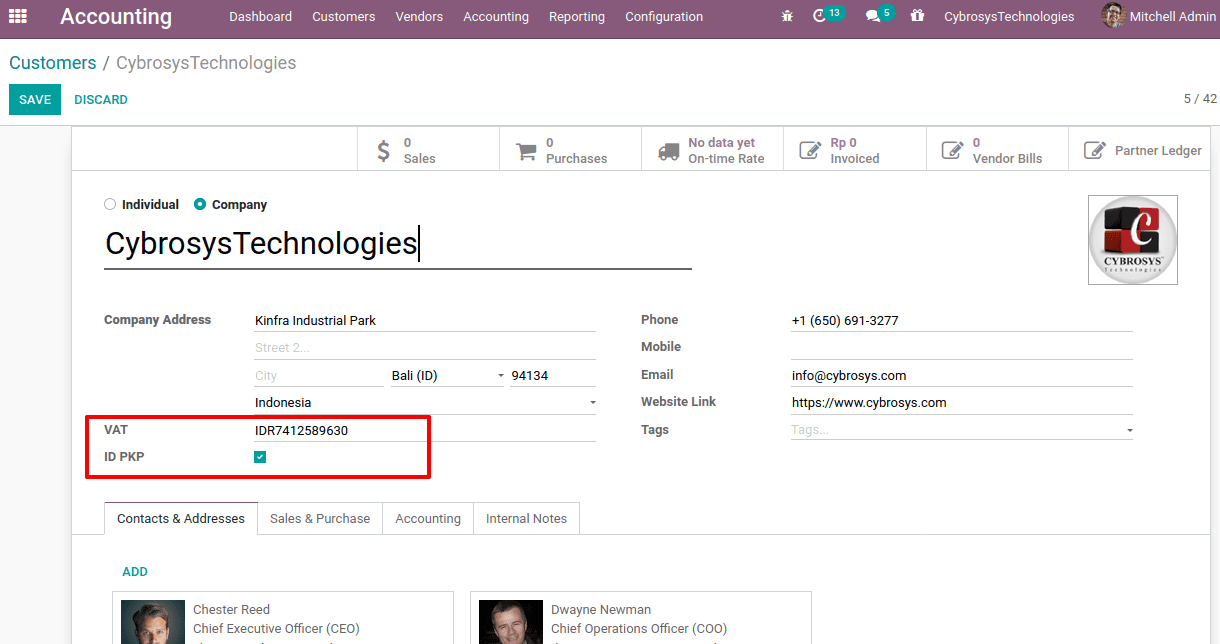

Your Company

The VAT number should be added to the related partner contact of the company, else it would not be able to generate the e-faktur for the invoice from an invoice.

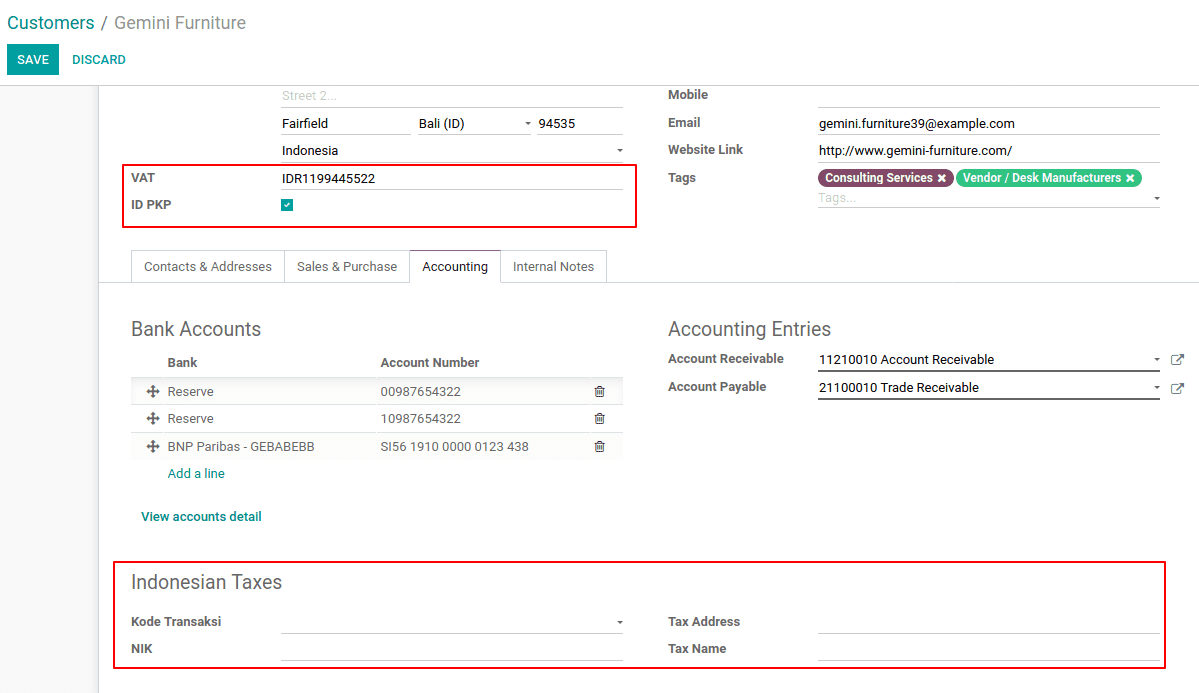

Your Client

For customer contact, generate E-fakturs for the customer to enable the checkbox ID PKP.

One can use the VAT field on the customer contact to set the NPWP required to generate the e-Faktur file. If your customer does not have an NPWP, simply enter the NIK in the same VAT area.

Under the accounting tab, add Indonesian tax details like Kode transaksi (Transaction Code) which is the first two digits of the tax number, NIK number, tax Address, and tax name.

Usage

Generate Tax Invoice Serial Number

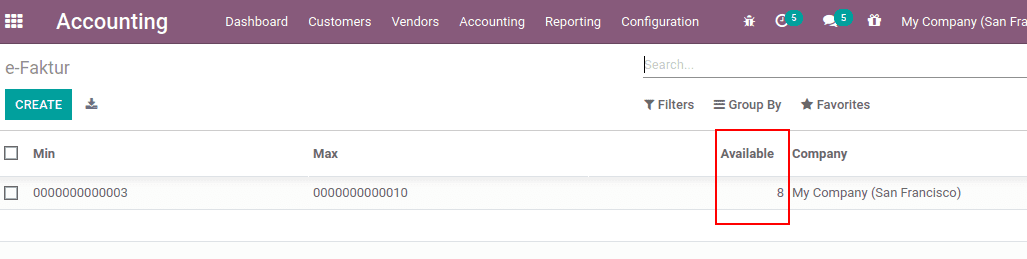

To export the customer invoice as e-faktur for the Indonesian government, one must add the range of numbers allotted by the government. For that Go to Accounting Module > Customers > E-Faktur > Create.

After obtaining the serial numbers from the Indonesian revenue department, one can use the serial numbers for the tax invoice. All you have to do is enter the Min and Max of each group of serial numbers, and Odoo will automatically format the number to a 13-digit number, as required by the Indonesia Tax Revenue Department.

A counter value ‘available ‘ displays how many unused numbers are left in that category.

A number will be allocated depending on these ranges when you verify an invoice.

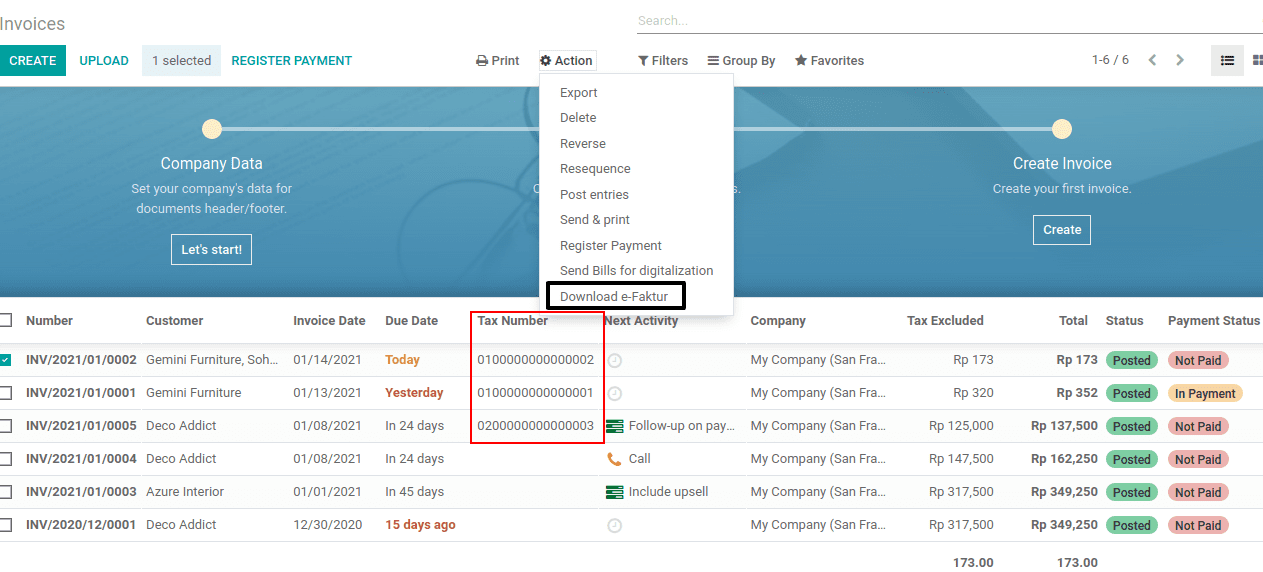

One will then sort the invoices that are yet to be exported from the list of invoices and click ‘Action’, then Download e-Faktur.

2. Generate e-faktur CSV for a single invoice or a batch invoices

Create an invoice for a customer, whose country is Indonesia and ID PKP is set, then Odoo will allow generating an E-faktur for the customer.

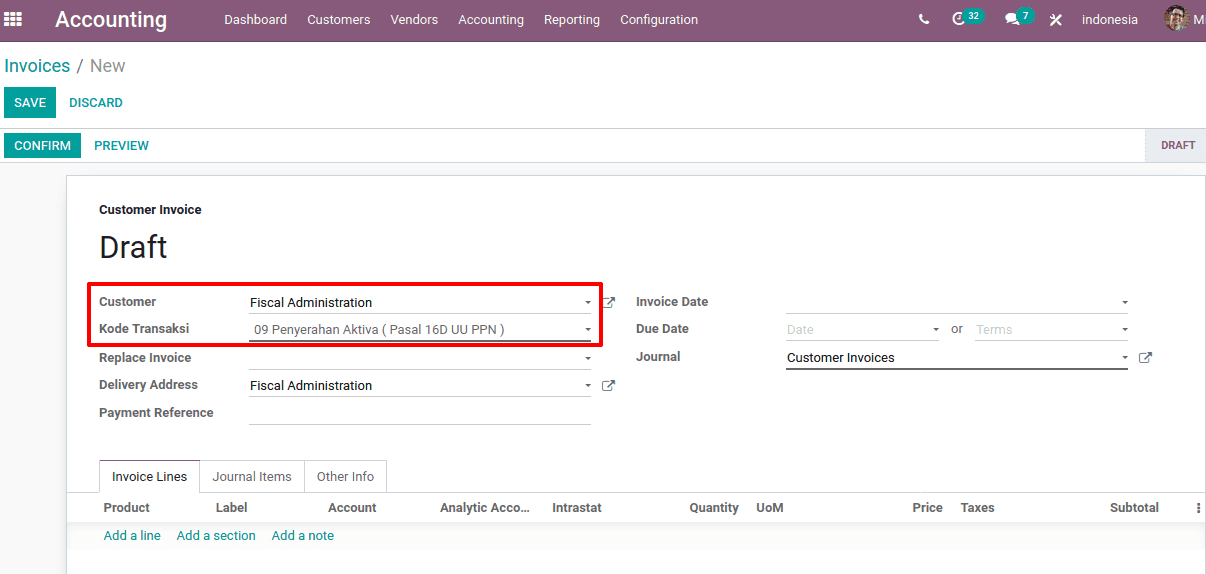

Draft an invoice from Accounting module > Customers > Invoices,

Add the Kode Transaksi to the invoice. There are things that contribute to the Kode Transaksi and the kind of VAT added to the invoice lines.

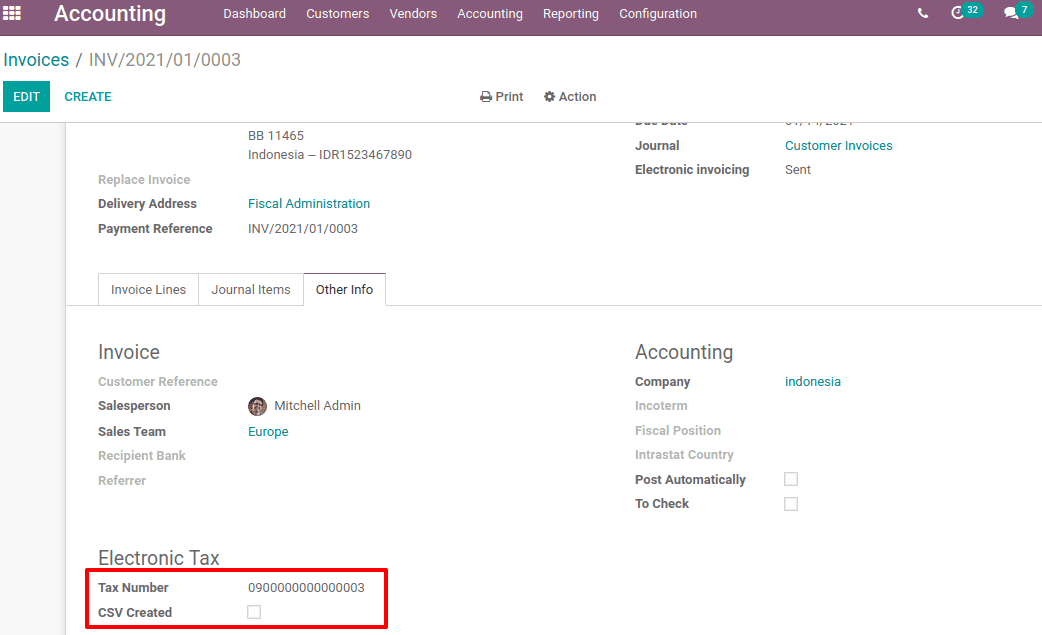

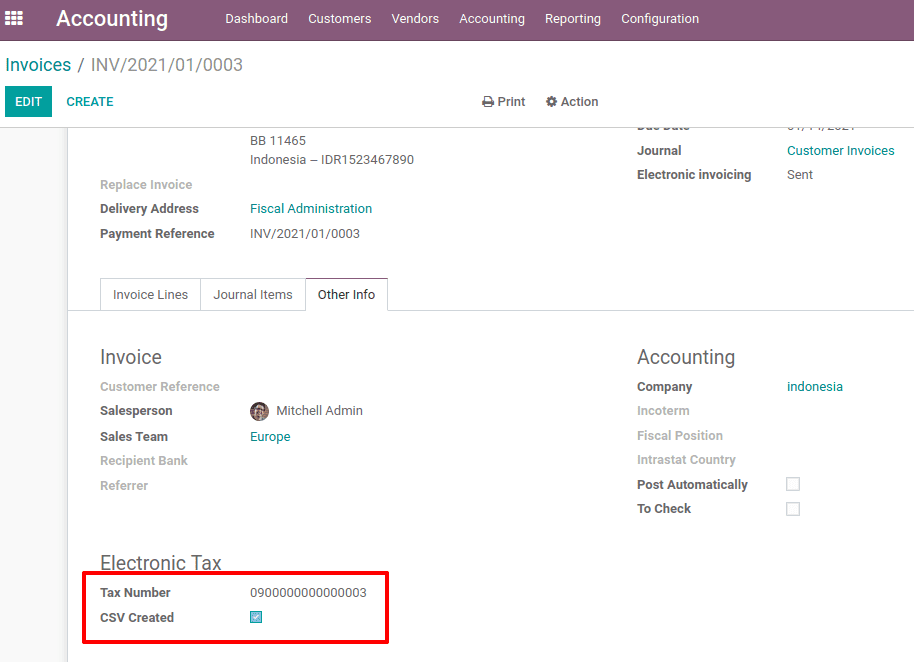

On confirming the invoice, Odoo will assign a ‘Tax number’, which is the next available number. Under the ‘Other info’ tab one can view the assigned tax number.

The E-faktur can be downloaded from ‘Actions’, once the invoice is posted. The downloaded file will be in CSV format and thus after downloading, check the electronic tax details under the ‘Other info’ tab. Then one can see that the ‘CSV Created’ is enabled.

One can filter out all the invoices ‘To generate the e-Faktur’ from the filter option. So all invoices whose e-Faktur is not generated will be displayed. Now, one can choose the invoices and generate the E-faktur as a batch.

Kode Transaksi FP (Transaction Code)

The available transaction codes for generating e-Faktur includes:

01 Kepada Pihak yang Bukan Pemungut PPN (Customer Biasa)

02 Kepada Pemungut Bendaharawan (Dinas Kepemerintahan)

03 Kepada Pemungut Selain Bendaharawan (BUMN)

04 DPP Nilai Lain (PPN 1%)

06 Penyerahan Lainnya (Turis Asing)

07 Penyerahan yang PPN-nya Tidak Dipungut (Kawasan Ekonomi Khusus/ Batam)

08 Penyerahan yang PPN-nya Dibebaskan (Impor Barang Tertentu)

09 Penyerahan Aktiva (Pasal 16D UU PPN)

Correct an invoice that has been posted and downloaded: Replace Invoice feature

Replace invoice function is for the correction of the invoice that has been posted and downloaded.

Cancel any of the posted and downloaded invoice, For instance, the above-created invoice INV/2021/01/0005 is canceled. Suppose one needs to change the transaction code from 09 to 04.

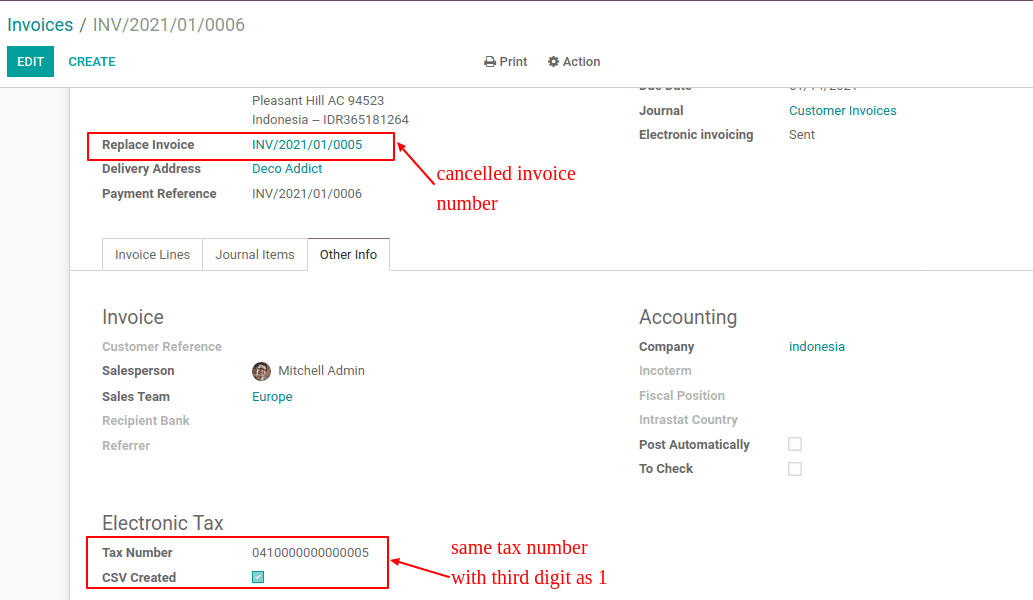

Create a new invoice for the same customer and add the new transaction code 09 and products. At the field ‘Replace invoice’ add the canceled invoice number. The Replace invoice field only shows the canceled invoice number.

On confirming the new invoice, it will assign the same tax number as the canceled invoice but its third digit changes to 1.

Correct an invoice that has been posted but not downloaded yet: Reset e-Faktur

To correct an invoice that is already posted but is yet to be downloaded.

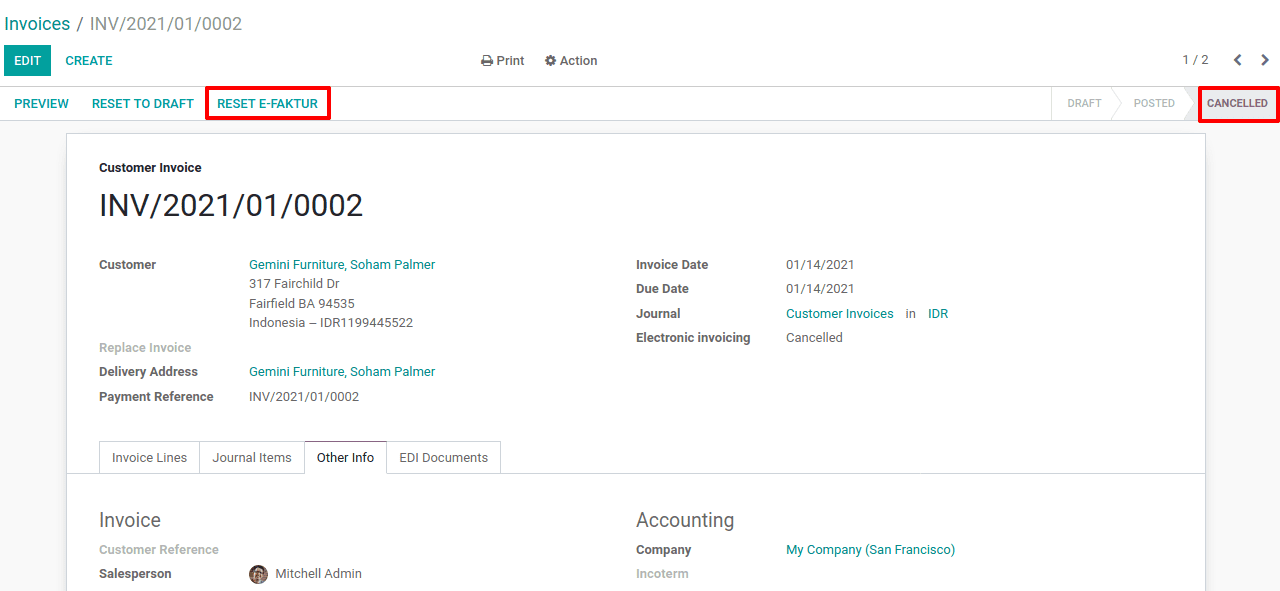

Open an invoice that is posted and the tax number is set, but not downloaded yet. Click on ‘Reset to draft’ and then cancel the invoice by clicking on ‘cancel entry’.

Then the status is changed to ‘Cancelled’ and a button ‘Reset E-faktur’ appears. Click on reset e-faktur, then the tax number assigned for the invoice is removed.

3. From now, the invoice can be reset to draft and edit further.