Your customers sign the Mandates, which give you permission to regularly withdraw funds straight from their accounts. Payments from customers can be swiftly accepted with Odoo18's EURO SEPA Service. You can get signed mandates from clients allowing you to take money out of their linked bank accounts by integrating SEPA Direct Debit. This feature is useful for processes involving recurrent payments.

The European Union's SEPA (Single Euro Payments Area) payment-integration program makes it easier and more uniform for participating nations to make electronic payments in euros. Customers who use SEPA Direct Debit (SDD) sign a mandate allowing you to take future payments out of their bank accounts. This is especially helpful for subscription-based recurring payments.

Successful modern corporate operations depend on the efficient completion of financial transactions. Odoo is a robust and flexible open-source ERP system that offers a comprehensive solution for managing all aspects of a company's operations, including financial transactions. One essential element of financial management is the use of direct debit mandates, which speed up the process of collecting payments from clients.

Consumers authorize companies to automatically withdraw money from their own bank accounts for purchases and subscriptions by signing direct debit mandates.

In an Odoo environment, they are necessary for:

* Effectiveness: By eliminating the need for manual payment processing, required direct debits alleviate businesses of their administrative burden. Payments are automatically started on designated days, ensuring timely collection.

* Cost Reduction: By automating payment collection, businesses can significantly reduce costs associated with manual payment processing, paper invoices, and checks.

* Improved Cash Flow: Businesses may more effectively plan and allocate resources when consistent and dependable payments enhance cash flow management.

* Improved Customer Experience: Customers appreciate automatic payments because they eliminate the hassle of manually initiating payments and remembering due dates.

* Reduced Late Payments: By making late payments rare, direct debit regulations contribute to the development of a more reliable and consistent revenue stream.

Odoo allows you to record client SDD mandates and create XML files that detail the payments that must be collected in conjunction with the mandates. Your bank will be instructed to collect these payments from your clients if you upload these files to them.

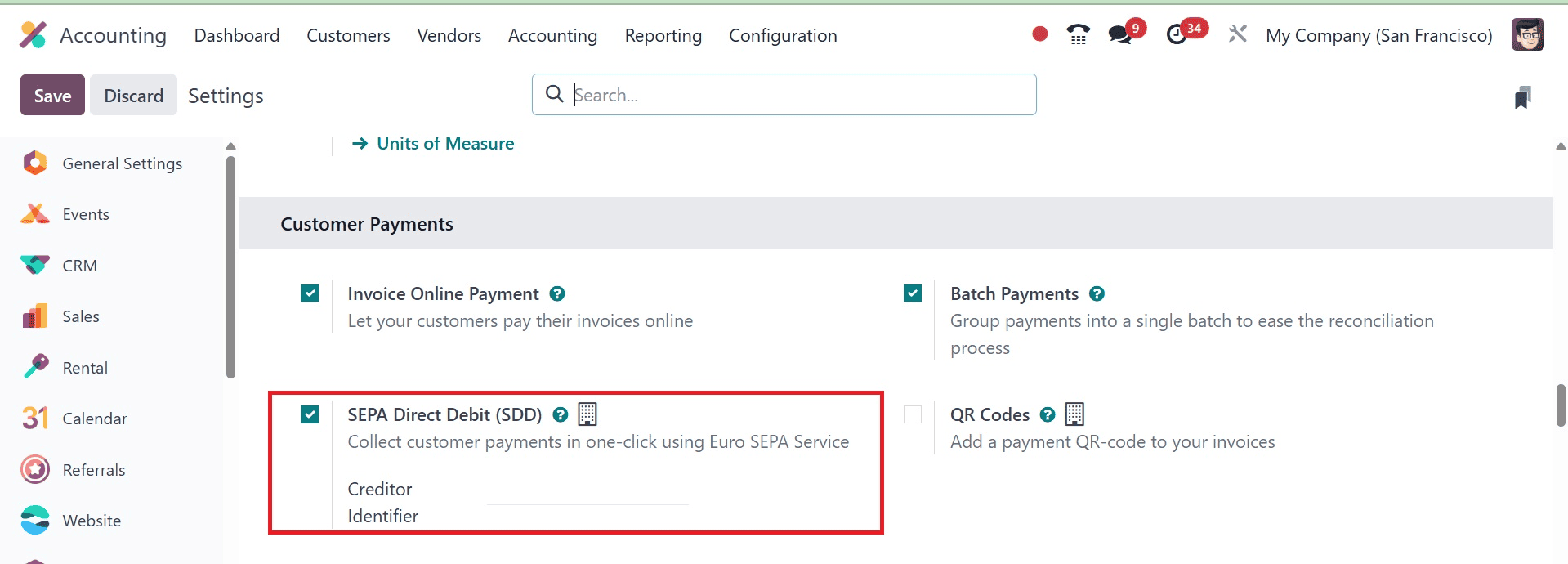

Users can activate the SEPA Direct Debit feature from the Odoo 18 Accounting module Settings panel, as shown below. Once this feature is enabled, enter your company's Creditor Identifier in the designated field.

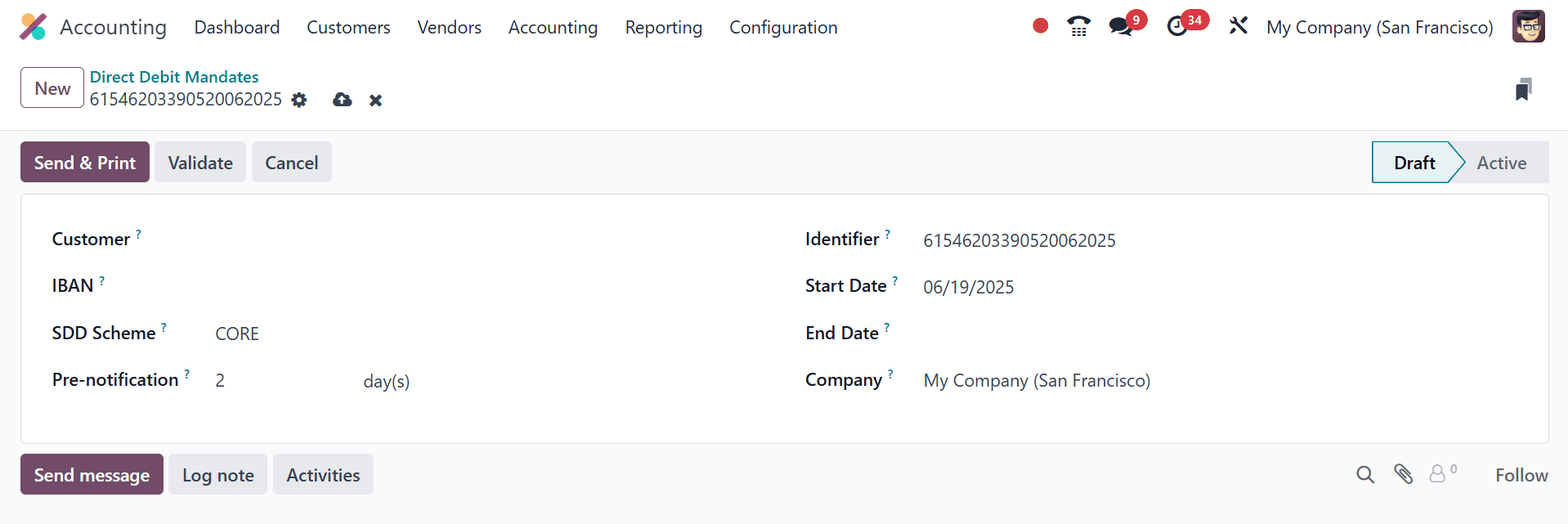

You may now create a new Direct Debit Mandate from the Customers menu. Once an invoice has been prepared in Odoo18 for a client with an active mandate on the invoice date, all you have to do to get payment is create a SEPA Direct Debit (SDD) XML file with this action and send it to your bank.

Go to Accounting > Customers menu > Direct Debit Mandates.

You can input the customer ID whose payments are to be handled by this mandate in the Customer section. In the IBAN field, you can add the customer's account to accept payments. Payments from this mandate's SEPA Direct Debit will be made to the Journal specified on the applicable form. In the relevant fields, you can enter the SDD Scheme, the special identification number for this mandate, the Start Date, the End Date, and the Company.

* Customer: Select the customer associated with the mandate.

* IBAN: Enter the customer's bank account number (IBAN).

* Journal: Specify the bank journal used for receiving SEPA Direct Debit payments.

* SDD Scheme: Choose the appropriate scheme (CORE for B2C, B2B for B2B customers). The B2B is an optional scheme, offered exclusively to business payers. Some banks might not accept B2B SDD scheme.

* Pre-notification: The minimum notice period in days, used to inform the customer prior to collection.

* Unique Mandate Identifier: Assign a unique reference for the mandate.

* Start Date & End Date: Define the validity period of the mandate.

* Company: Select the relevant company if you have multiple entities.

After completing all relevant fields, click the Validate button to confirm this obligation.

Suppose you wish to use Direct Debit for regular payments from your client "ABC Corp," and you offer a subscription service. You have entered your company's Creditor Identifier and enabled SEPA Direct Debit in Odoo settings. You make "ABC Corp" a new Direct Debit Mandate.

You choose the SDD Scheme (CORE for a standard consumer subscription), enter ABC Corp's IBAN, pick the relevant bank journal, and establish a start and end date.

The mandate is validated by you. The active mandate will be instantly recognized by Odoo when you create an invoice for ABC Corp (for example, for a monthly subscription). After the invoice has been validated, you can create an XML file for your bank, which will cause ABC Corp's account to be directly debited. The relevant smart buttons in the window display the invoice paid using this mandate, as well as the amount owed to this customer.

We can now easily finish this operation thanks to the advanced Odoo 18 ERP system. Through Odoo's EURO SEPA service, the money may be removed from the customer's account with a single click. You can also integrate SEPA, a direct debit service, into your system with Odoo. This allows you to get your clients to sign authorizations and mandates, which you can then use to collect money from each customer's account. When it comes to recurring payments and subscriptions, this feature will benefit both the customer and the company.

To read more about How to Manage Deferred Revenues in Odoo 18 Accounting , refer to our blog How to Manage Deferred Revenues in Odoo 18 Accounting.