The sales price of the goods is listed on some websites as the actual selling price. This shows that both the sales price and the tax amount are included in the selling price displayed. The price that includes tax is referred to as the "Tax Included Price." Therefore, the consumer only needs to pay the showing cost in these situations. When paying for the order, there is no additional amount included for tax.

Sometimes, though, the online retailer only shows the product's discounted price. Tax is not included in that price. The customer is therefore required to pay the tax individually. Therefore, it is only after the product has been placed to the cart that the real payment amount is shown. Therefore, the buyer must also pay the relevant tax amount in order to finalize the deal. This arrangement is referred to as the "Tax Excluded Price".

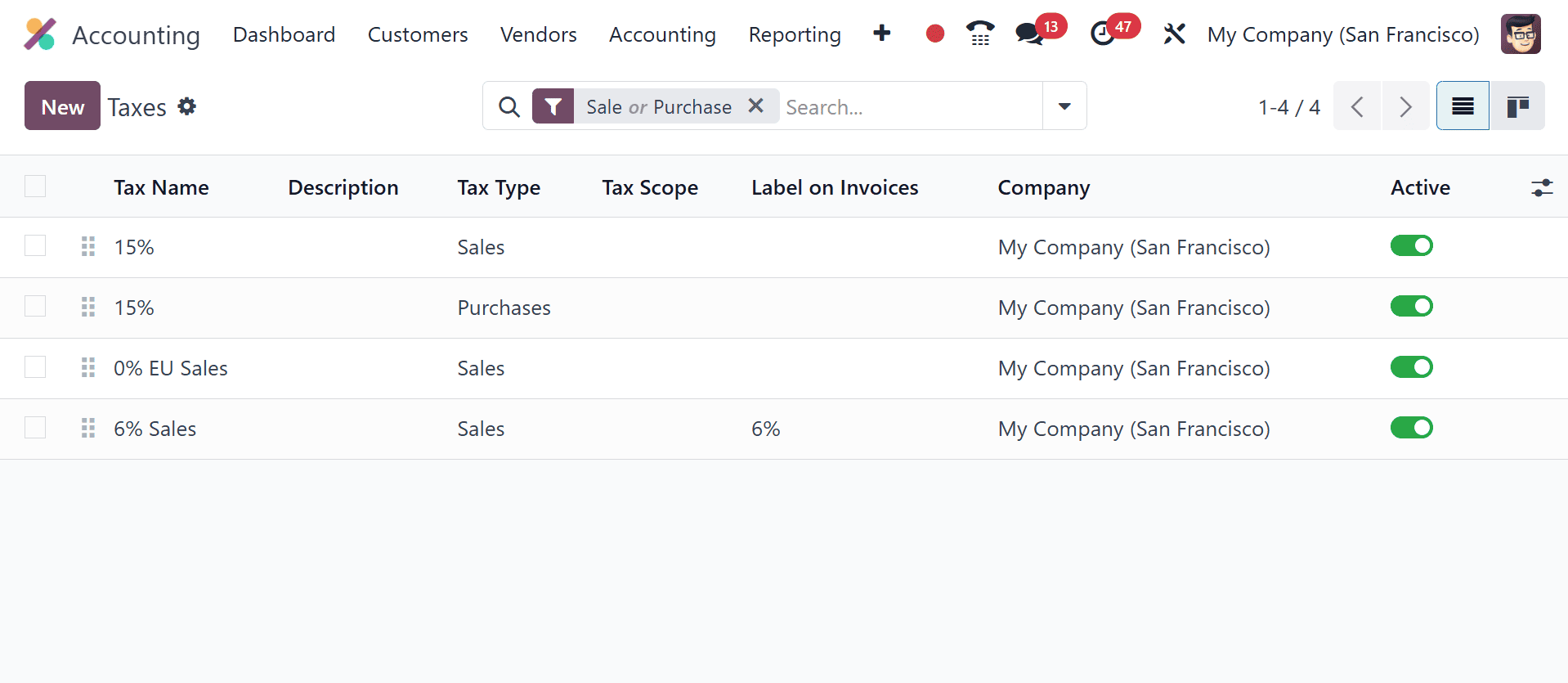

Tax Configuration

Depending on a number of variables, including the product category, customer location, and tax jurisdiction, taxes are added to the items in Odoo 18. Users can define rules and tax rates using the system.

Users can set up taxes via the Accounting Module. From the Configuration tab, let's examine the tax.

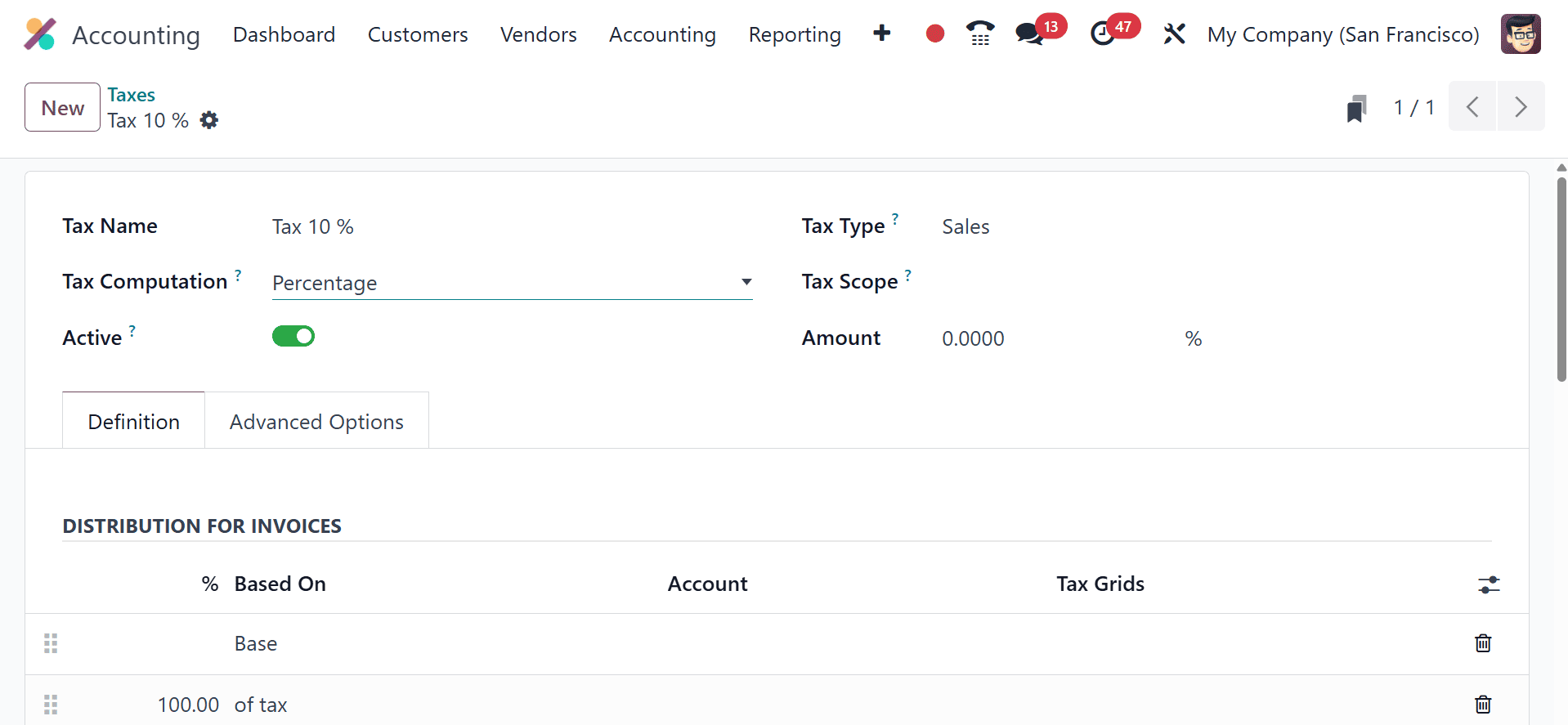

This tax was previously set up and is called Tax 10%. There are various approaches to tax configuration. Here, the "percentage of the price" of the product's sales price is used to calculate the tax.

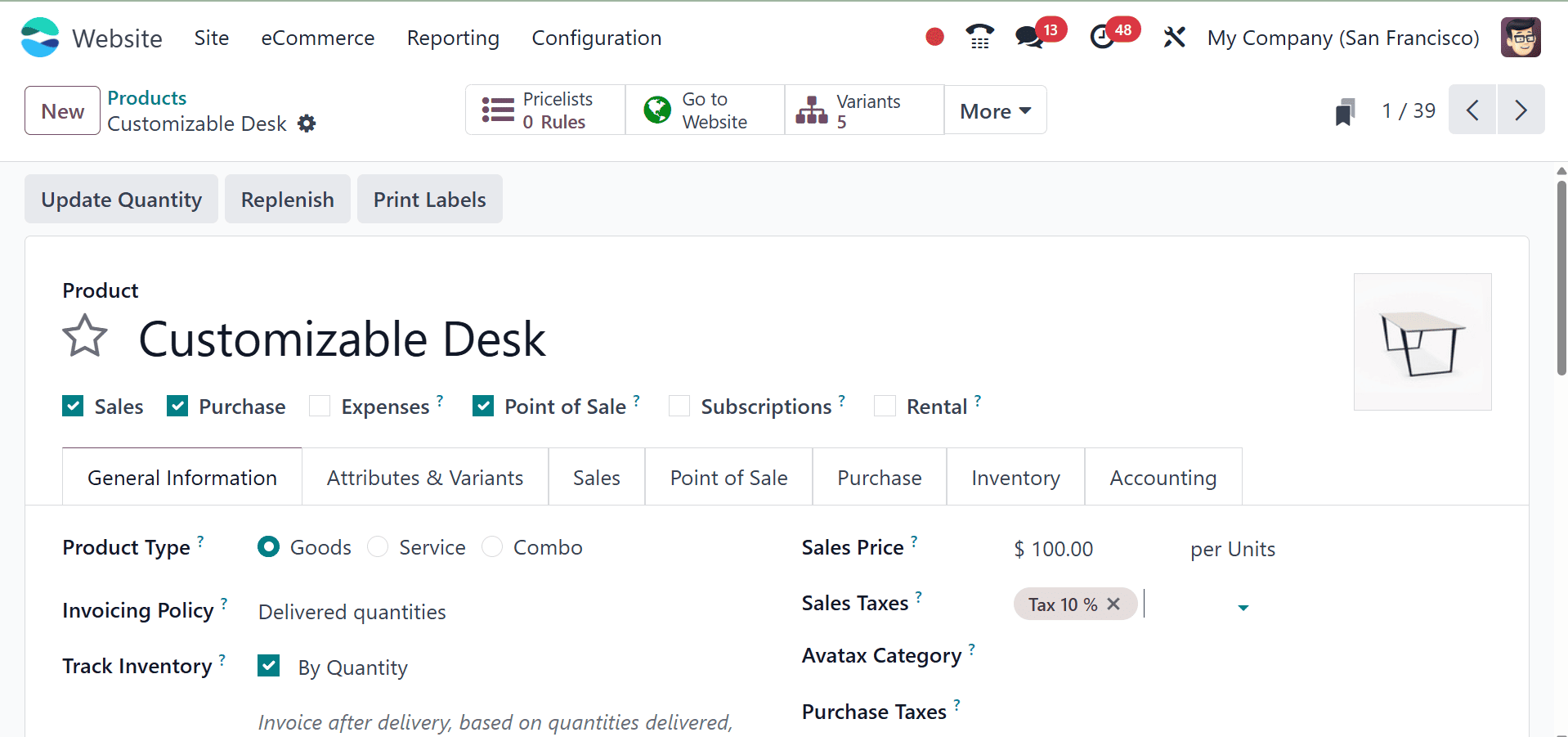

Product Configuration

Let's proceed to setting up a product for online sales. Select the item from the online store. Select the Storage Box product here. One hundred dollars is the sales price. Here, you can add the configured tax.

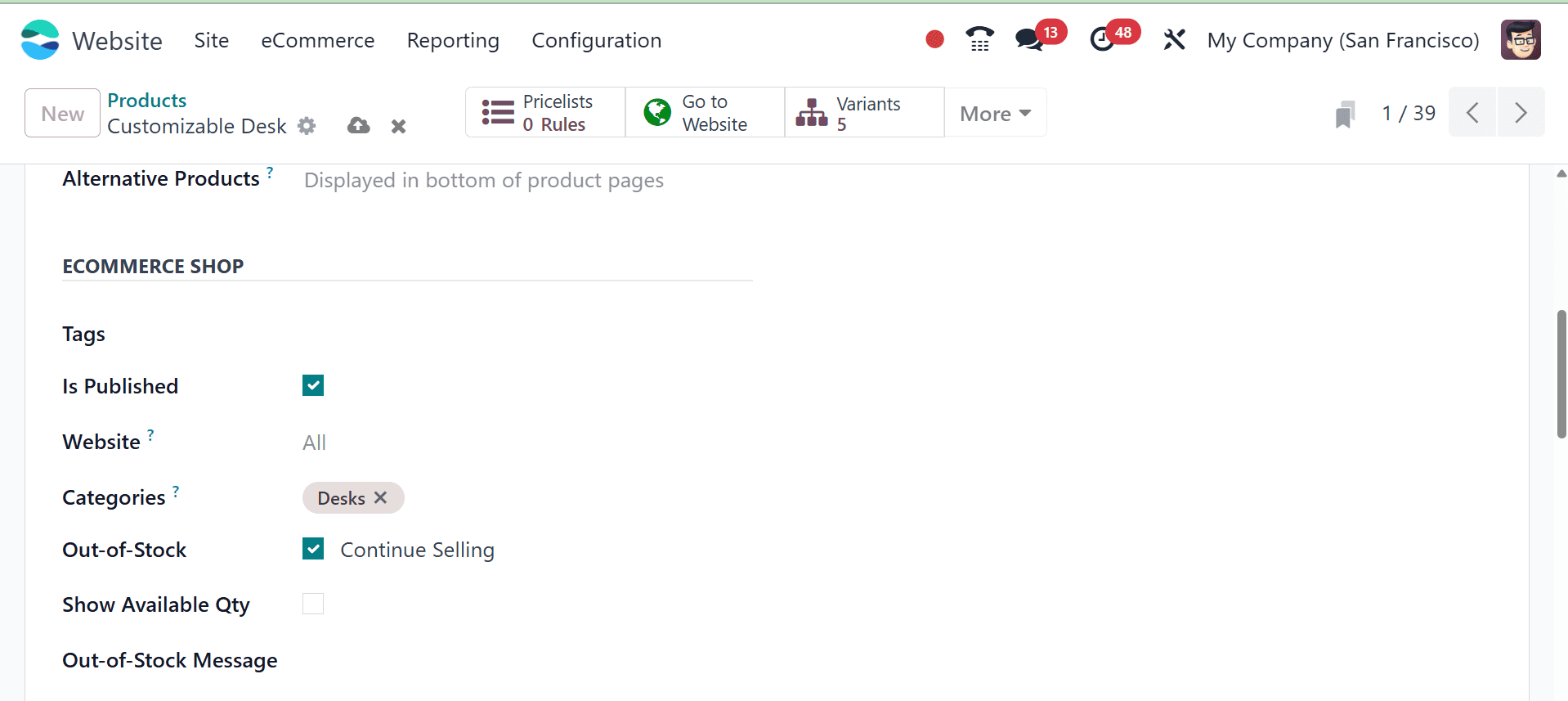

The Sales tab is where you may configure the website's sales. The ECOMMERCE SHOP division is one of them. data such as the product's category, website sequence, and other data can be set there. Save the configuration.

Tax Excluded

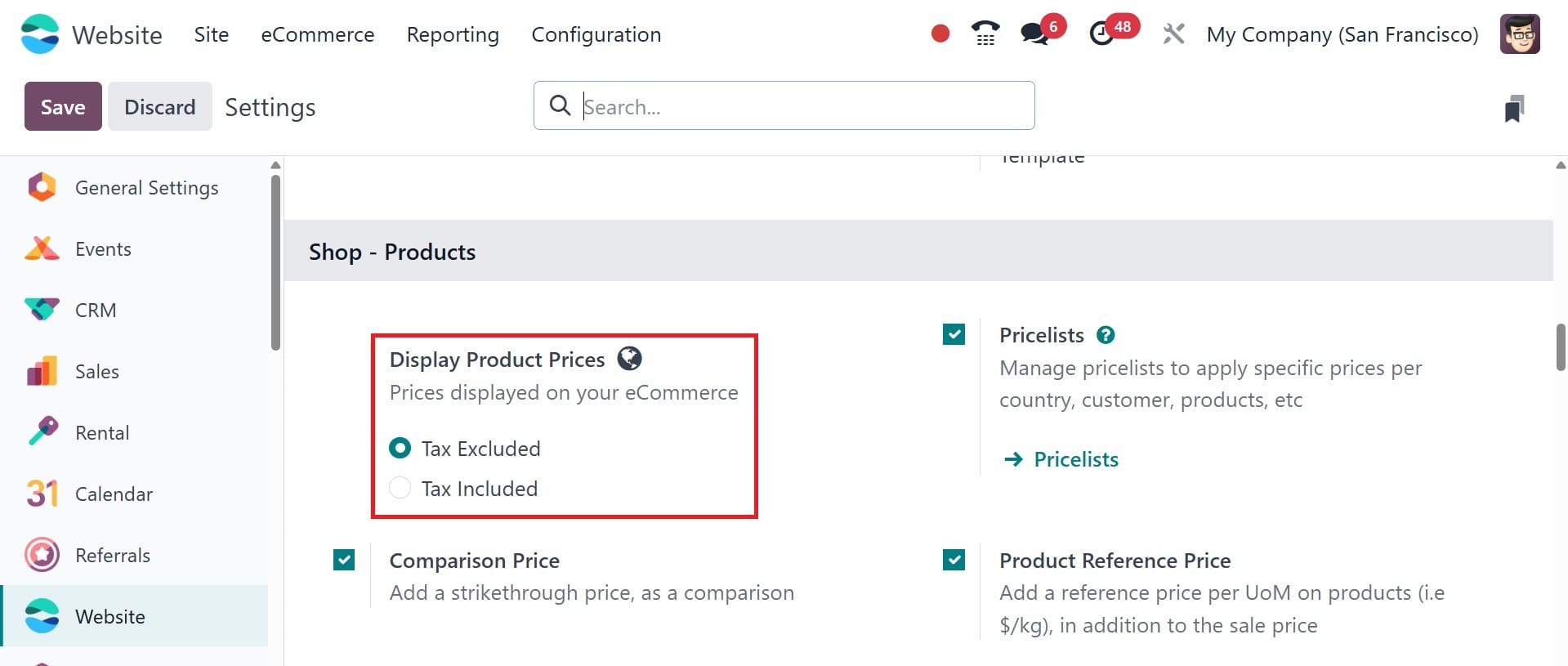

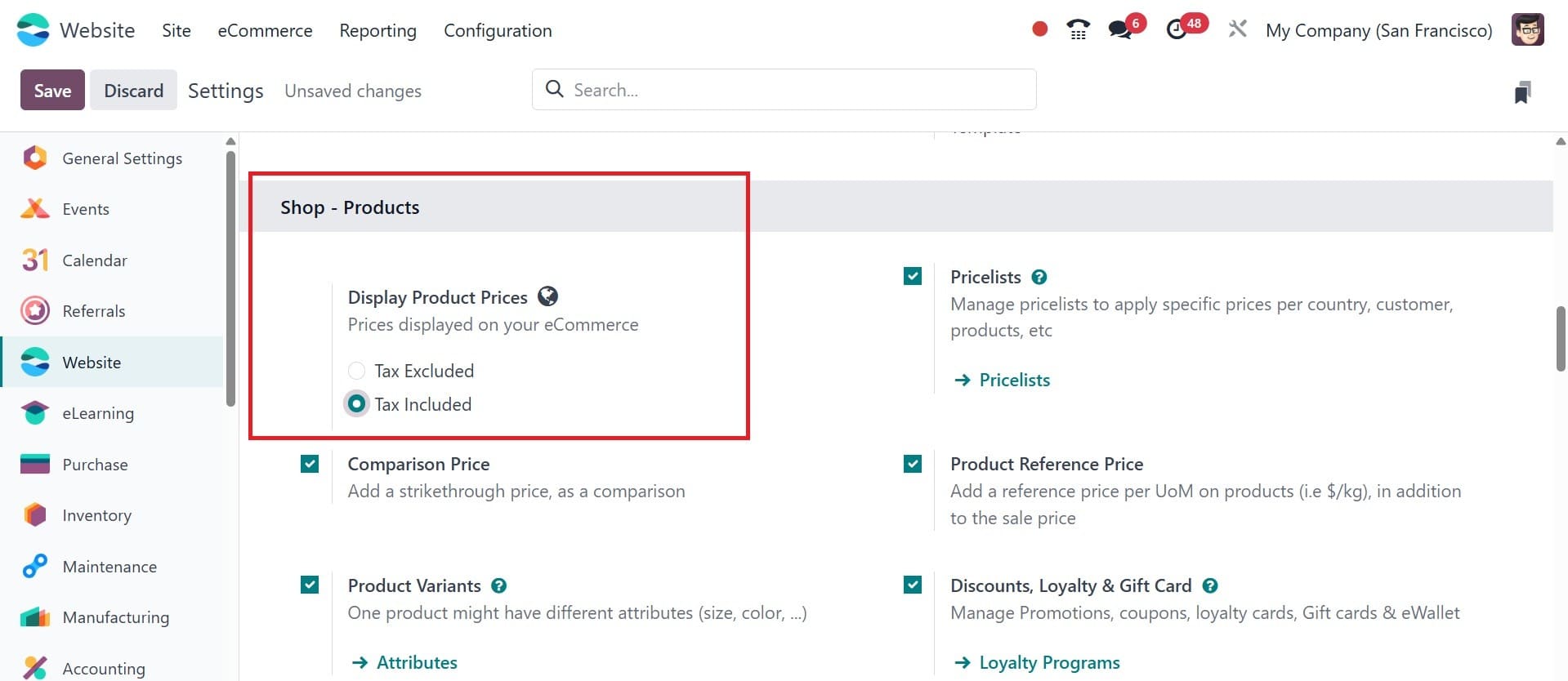

In the configuration options, let's set the price that is exempt from taxes. Select Settings from the Configuration tab after navigating to the website module.

Configuration > Settings > Display Product Prices > Tax Excluded

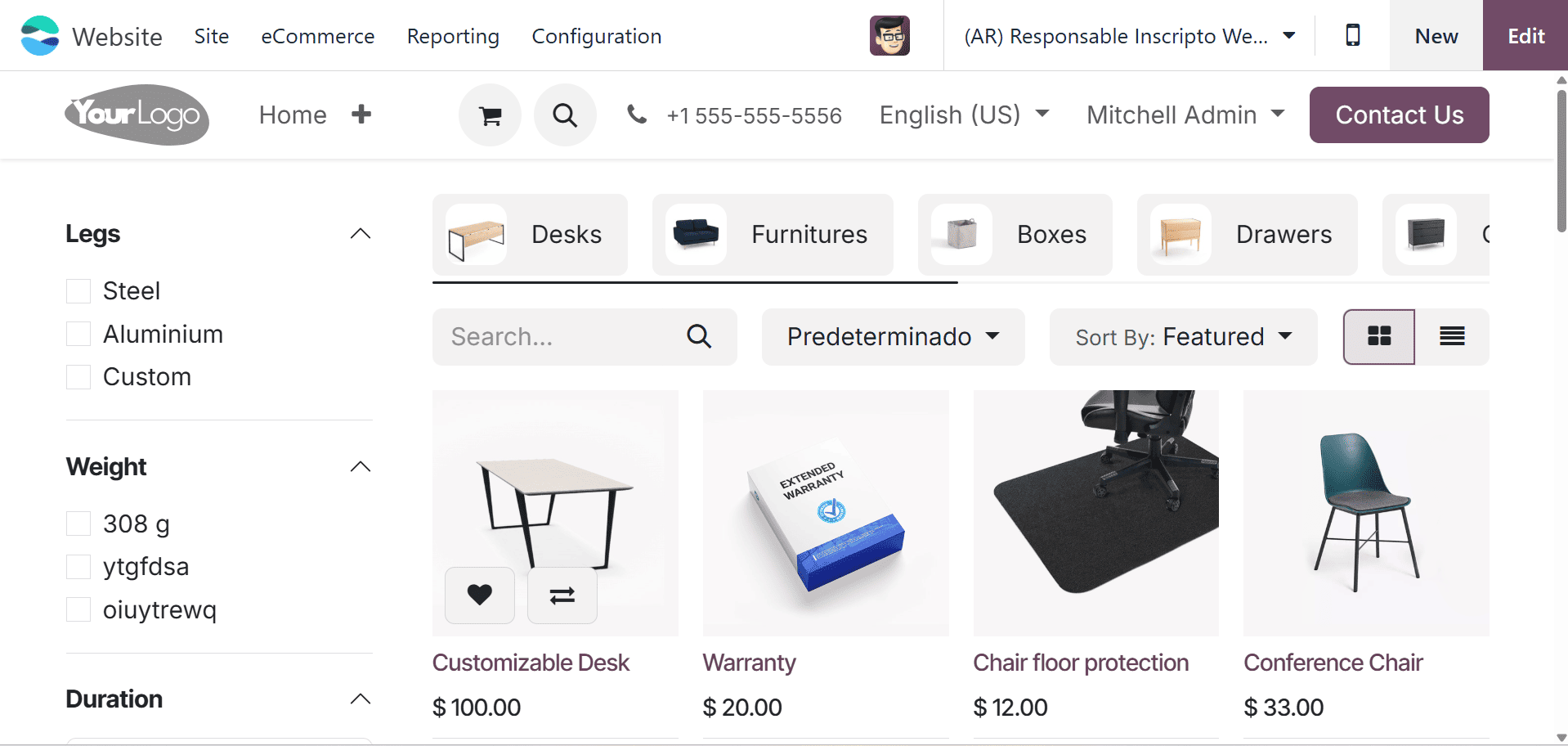

Visit the online store. The store displays every item. There, you can also see the Storage Box that was built. To see the price and tax, open the product.

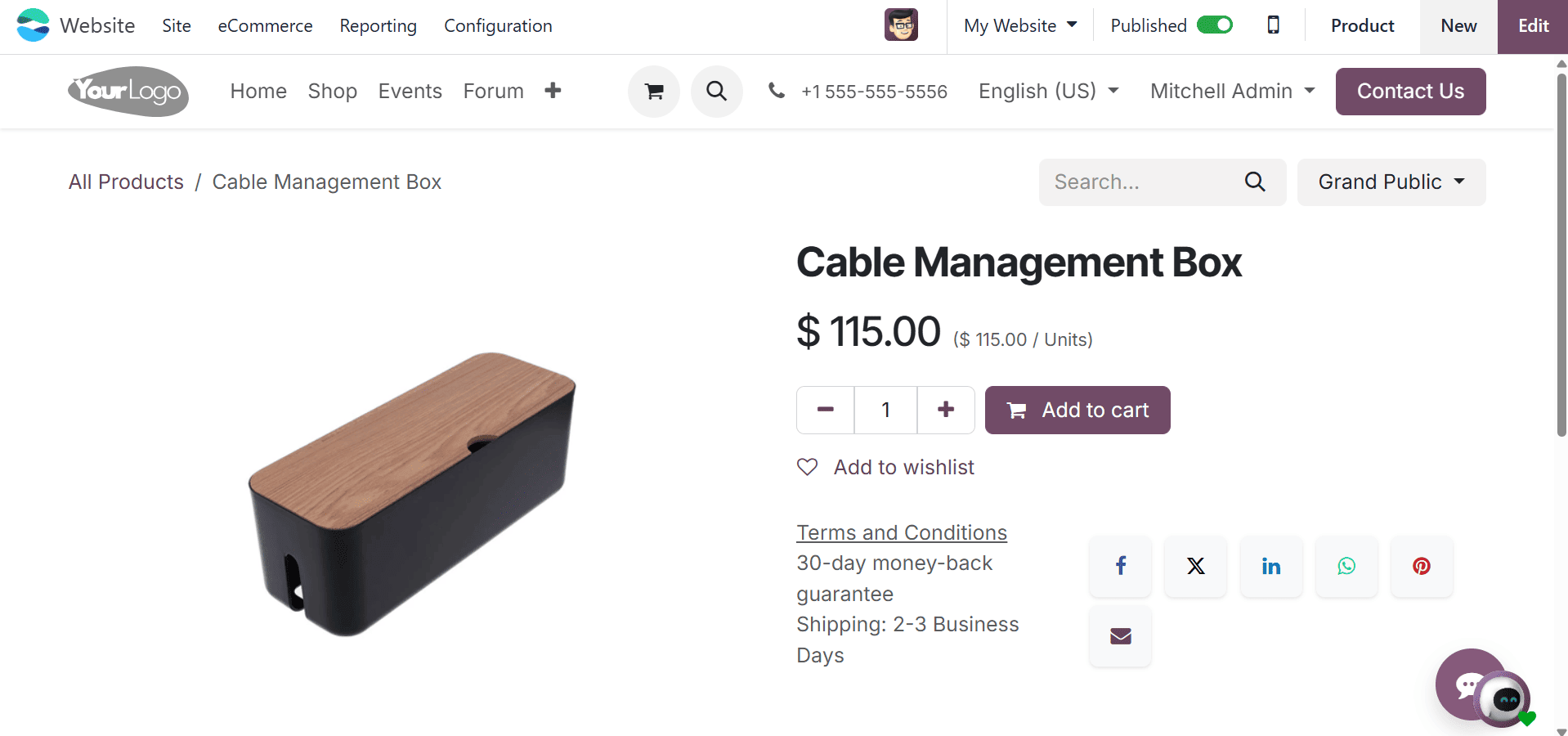

The Cable Management Box costs $100 when the product is opened. The user enters a 15% tax and $100 as the sales price in the product catalog. Thus, the product's true cost, including tax, is $115. Here, however, the view displays the price that is exempt from taxes.

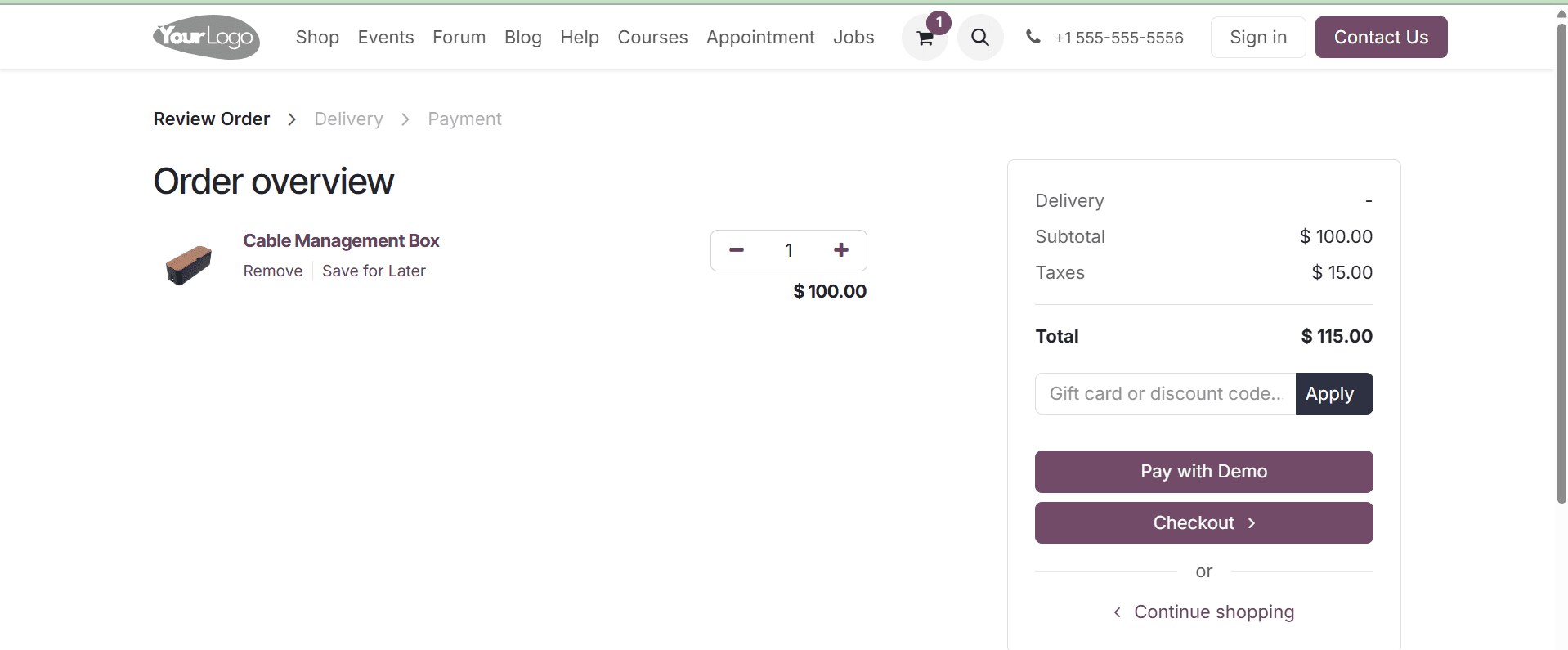

To make a purchase, add the item to your cart and proceed to the payment page. While the product's actual price seems to be $100 when the consumer evaluates their order, 15% tax must also be paid.

Click the Proceed to Checkout button to make the purchase. After that, select the payment option to finish the transaction.

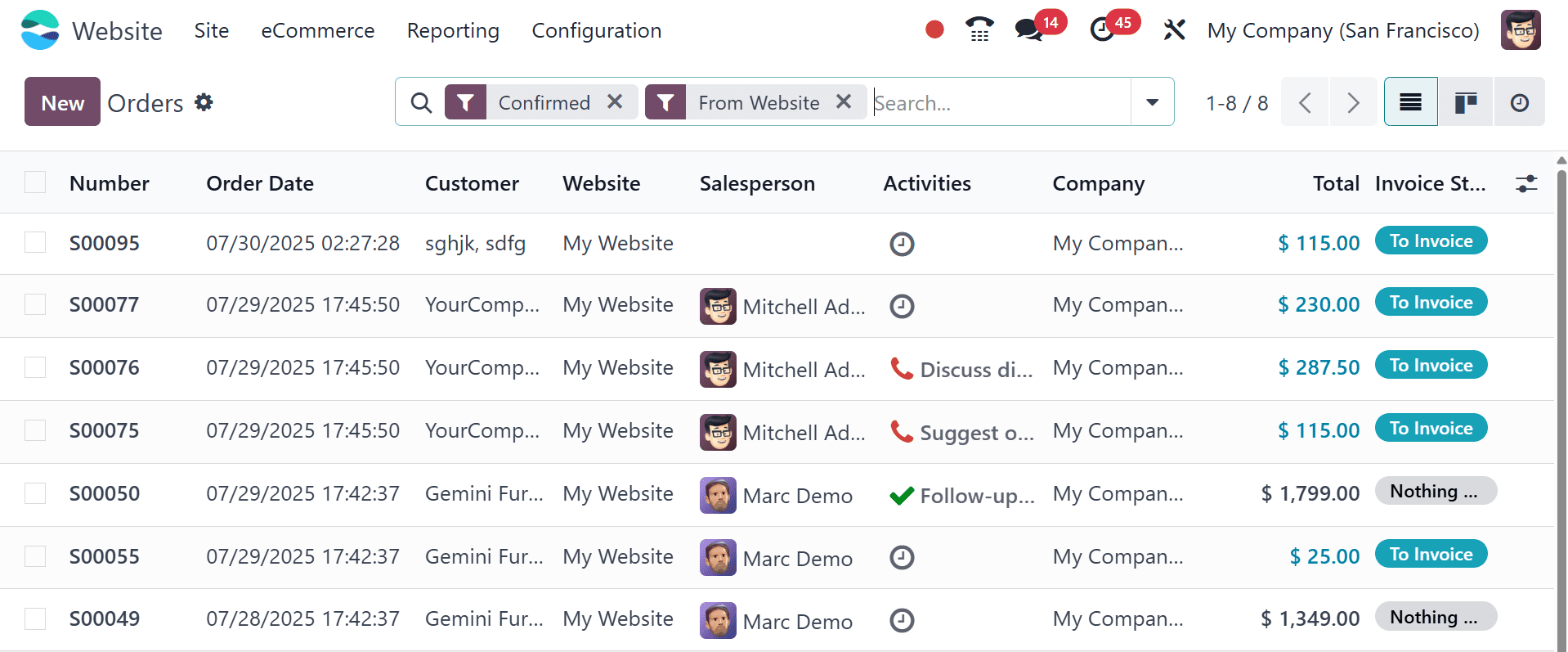

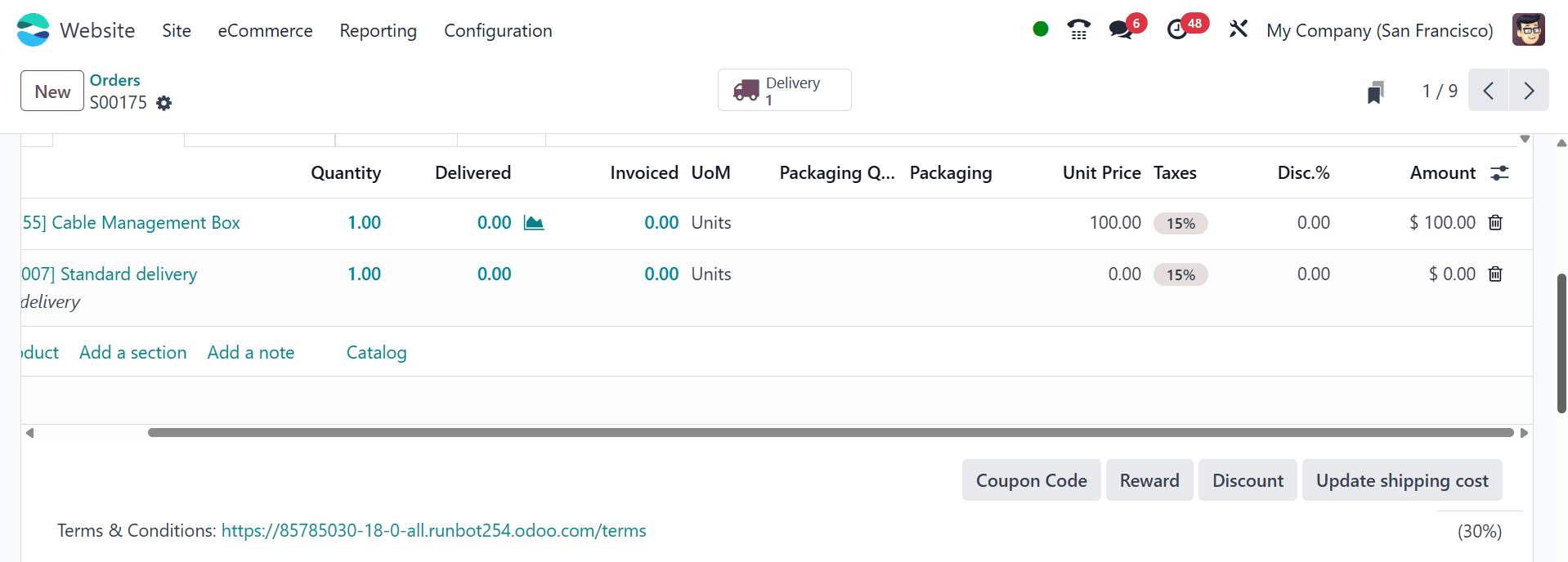

The generated order is visible to the user. Select the Order option from the eCommerce menu to do that. From the list, select the most recent order, then open it.

The product with a $100 sales price and a 10% tax is listed on the order line. The shipping option of free shipment has been added. Delivery was not finished here.

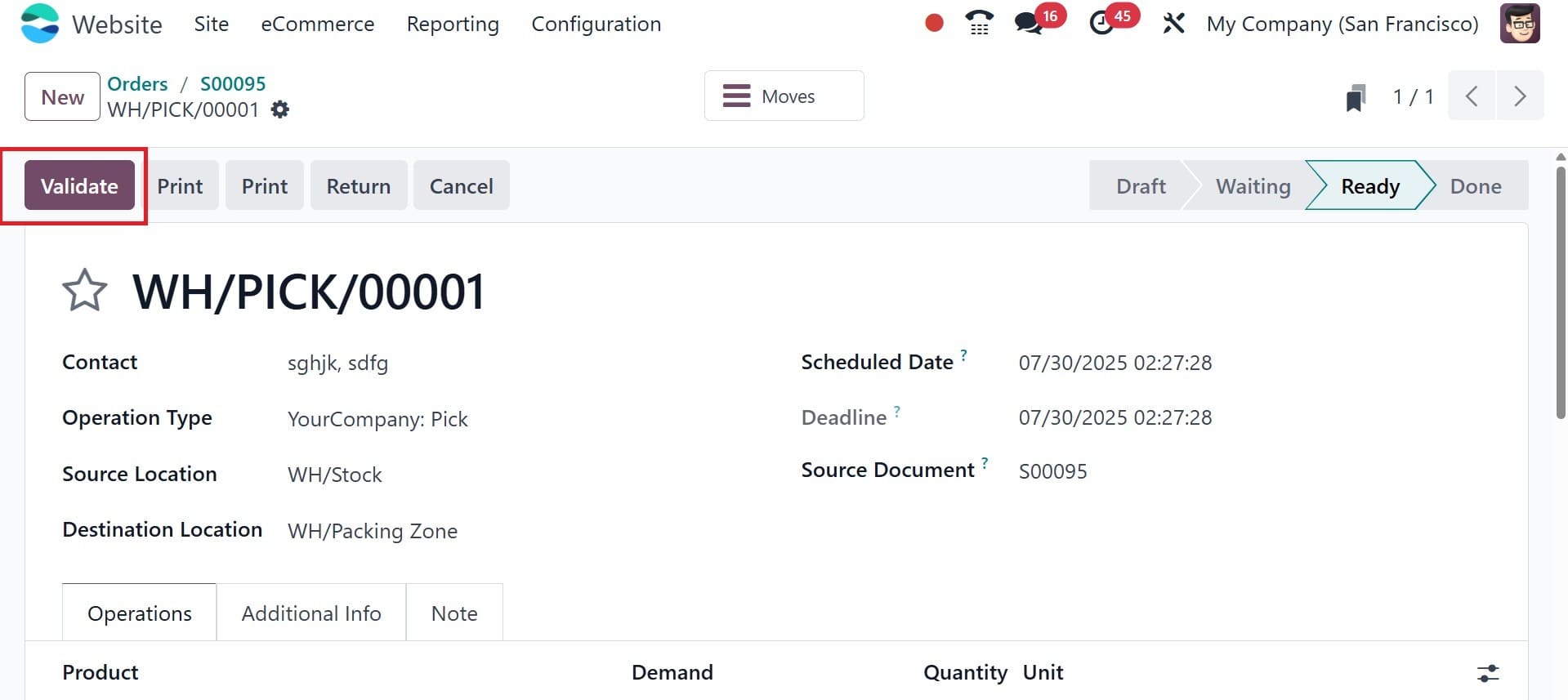

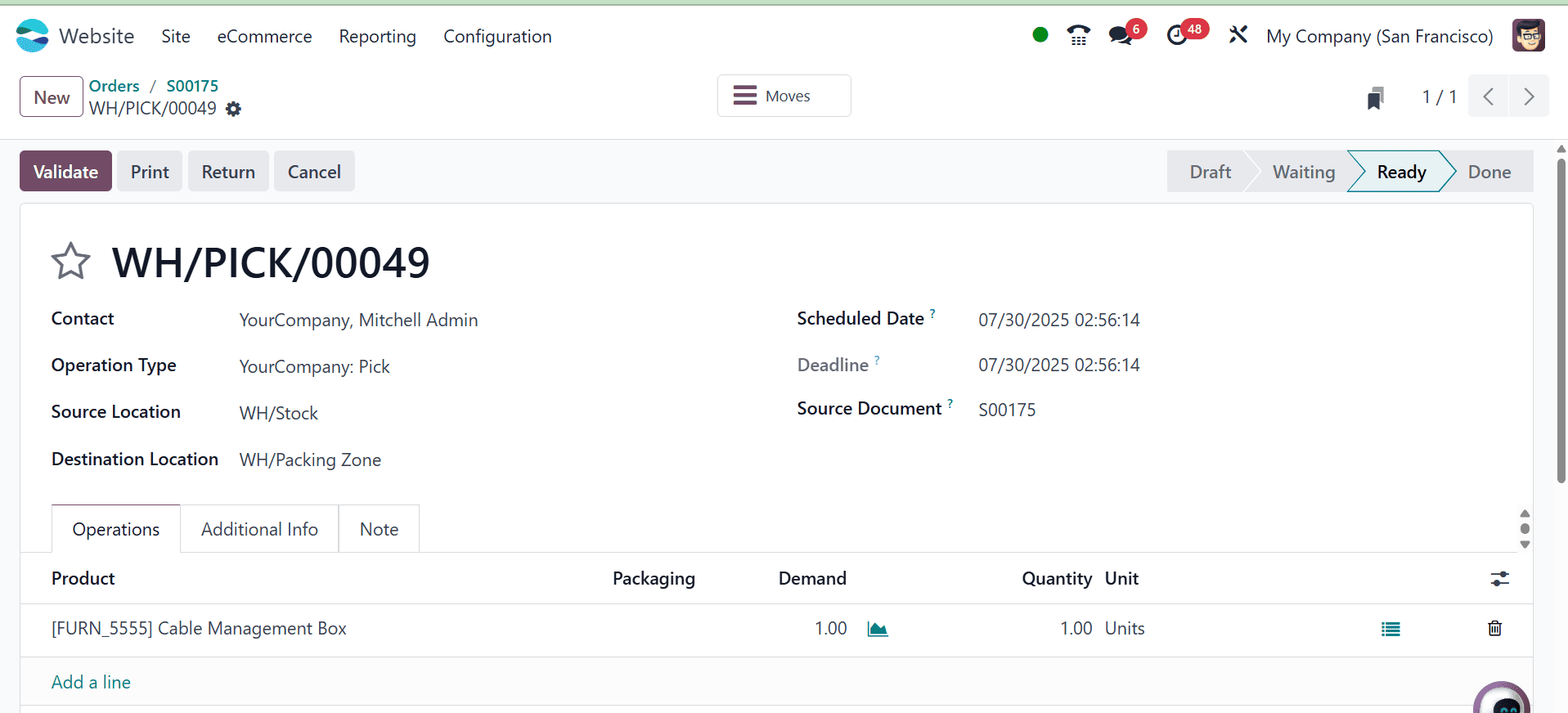

Thus, select the Delivery tab. The delivery is currently in the "Ready" stage. Thus, the user only needs to click the Validate button to confirm the delivery.

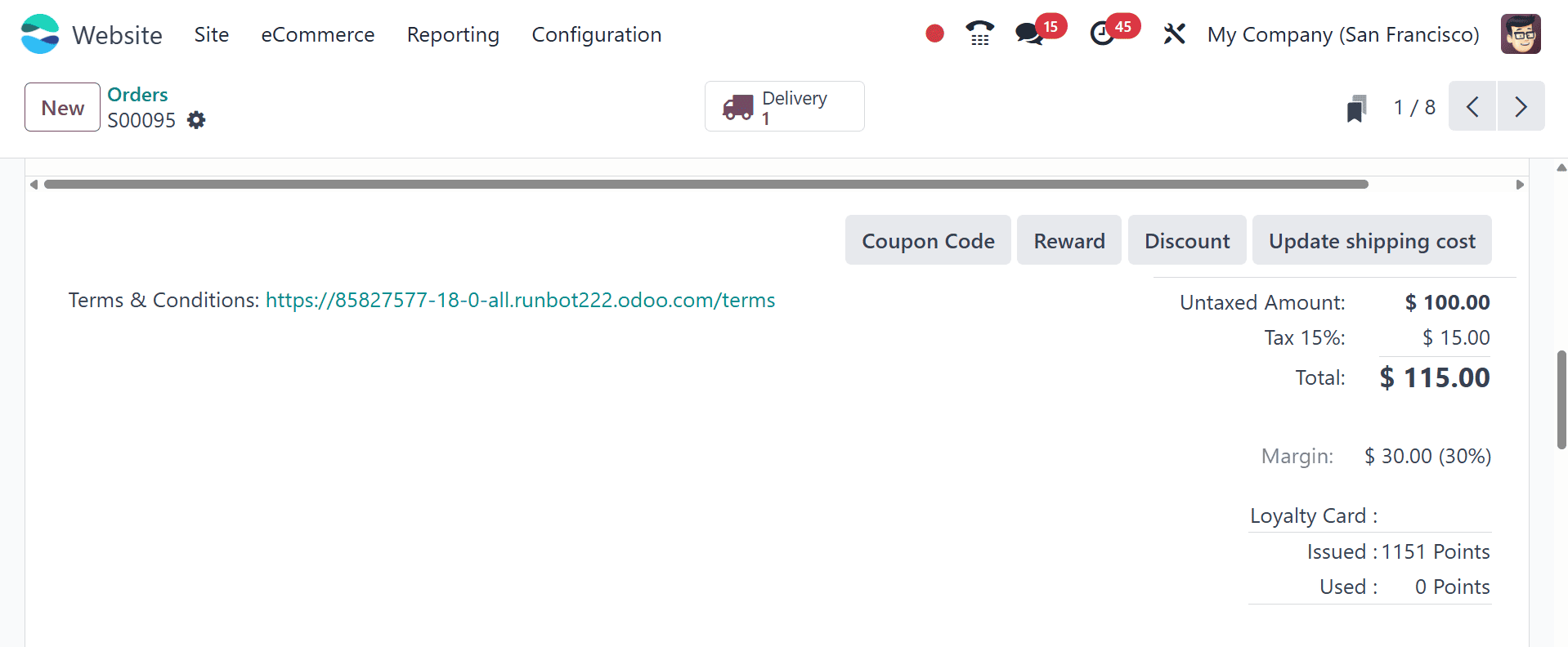

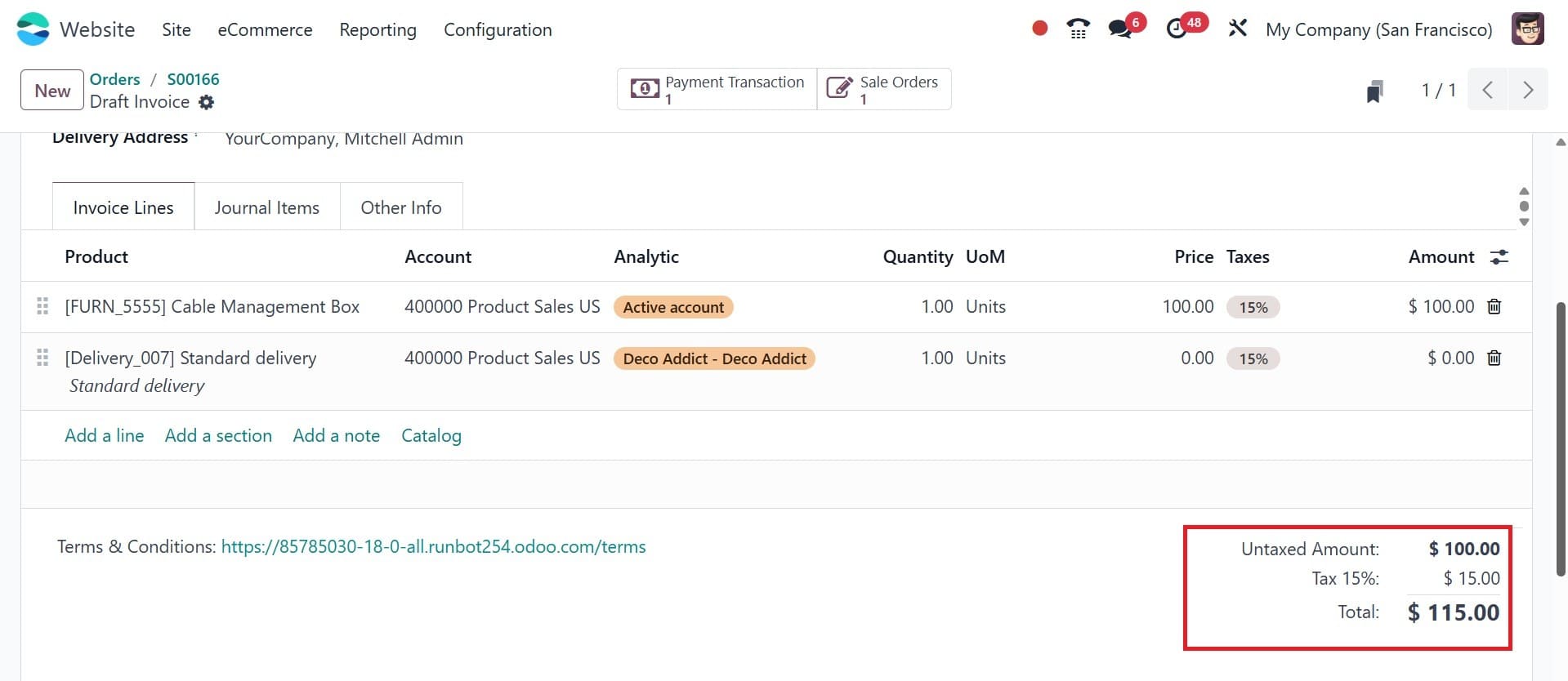

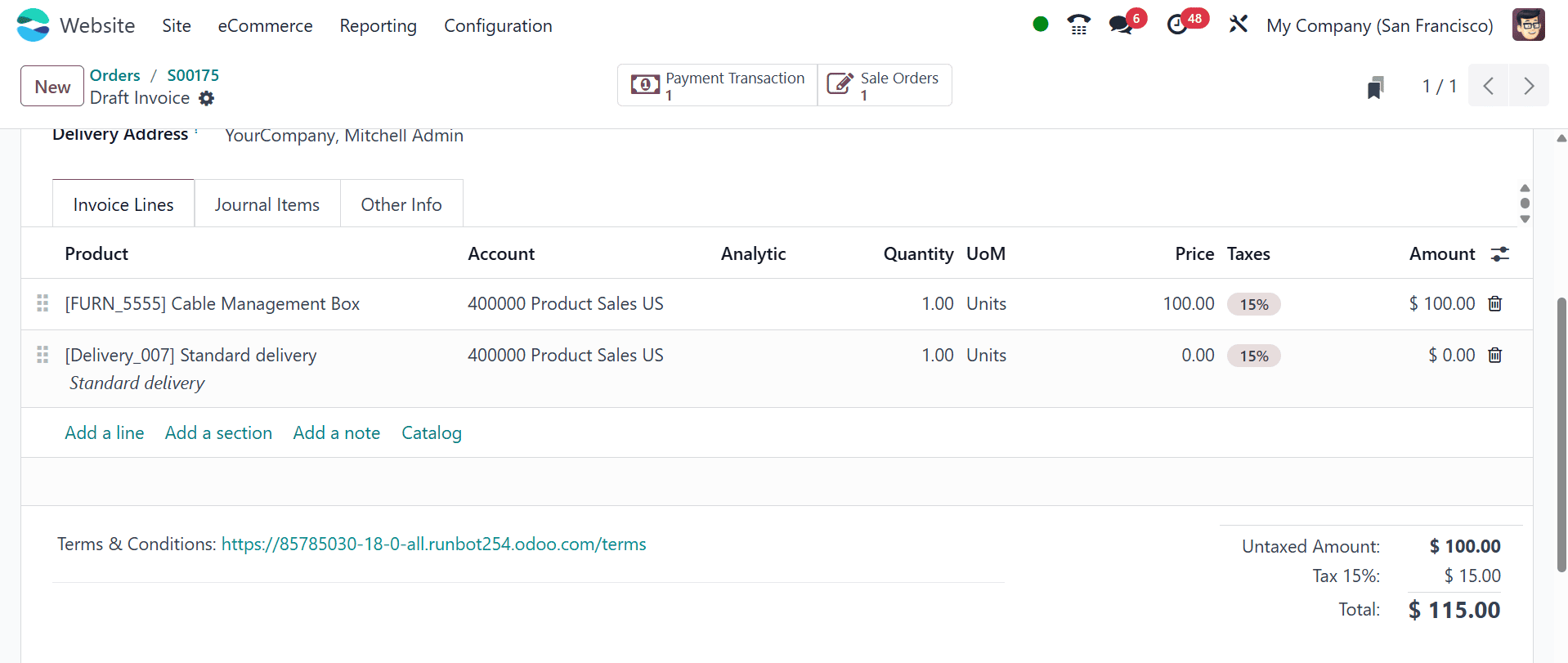

An invoice is produced. Click the smart tab to open the invoice. The tax and untaxed amount are displayed separately on the invoice.

There is a 15% tax on the $100 that is not taxed. Thus, the sum is

110 = 100+(100*15%) = 100+15.

Tax Included

From the configuration options, let's specify the tax-excluded price. Select Settings from the Configuration tab after navigating to the website module.

Save the updated configuration after changing it to Tax Included. As previously stated, simply visit the shop and look at the preceding item.

The Cable Management Box product is displayed above, however the sales price has been changed to $115. Since we don't alter the sales price, the Cable Management Box is available for $100. Now let's open the item. After selecting "Add to cart," check your order to see the true sales price.

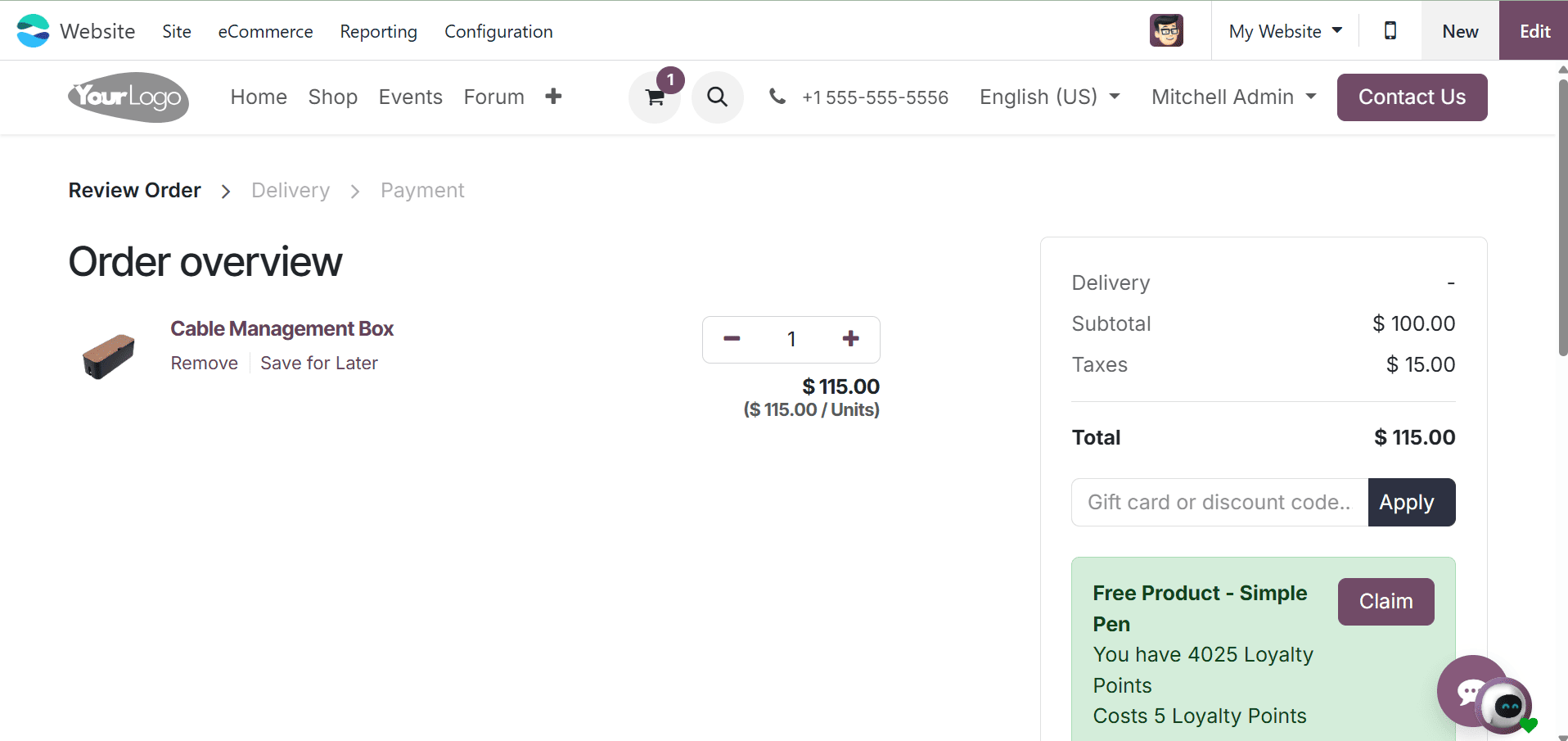

This indicates that a single quantity of the Cable Management Box has been added to the cart. Therefore, the price of one quantity, or $100, is the subtotal sales price. 15% is the added tax, so $15 is the result of 15% of $100. Thus, 115 dollars is the total amount after deducting the tax and the real sales price.

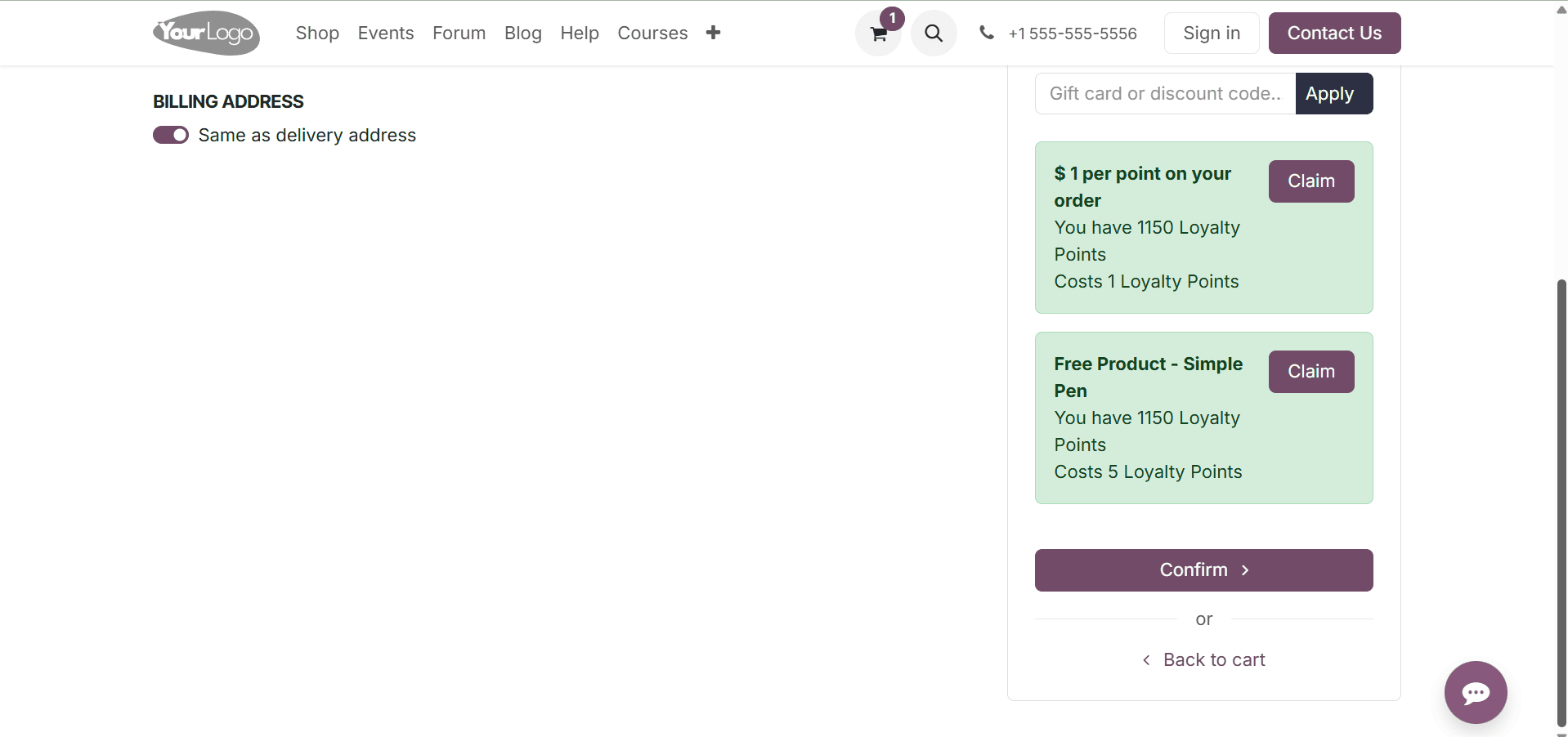

Once the customer has chosen their preferred payment option, click the Pay Now button.

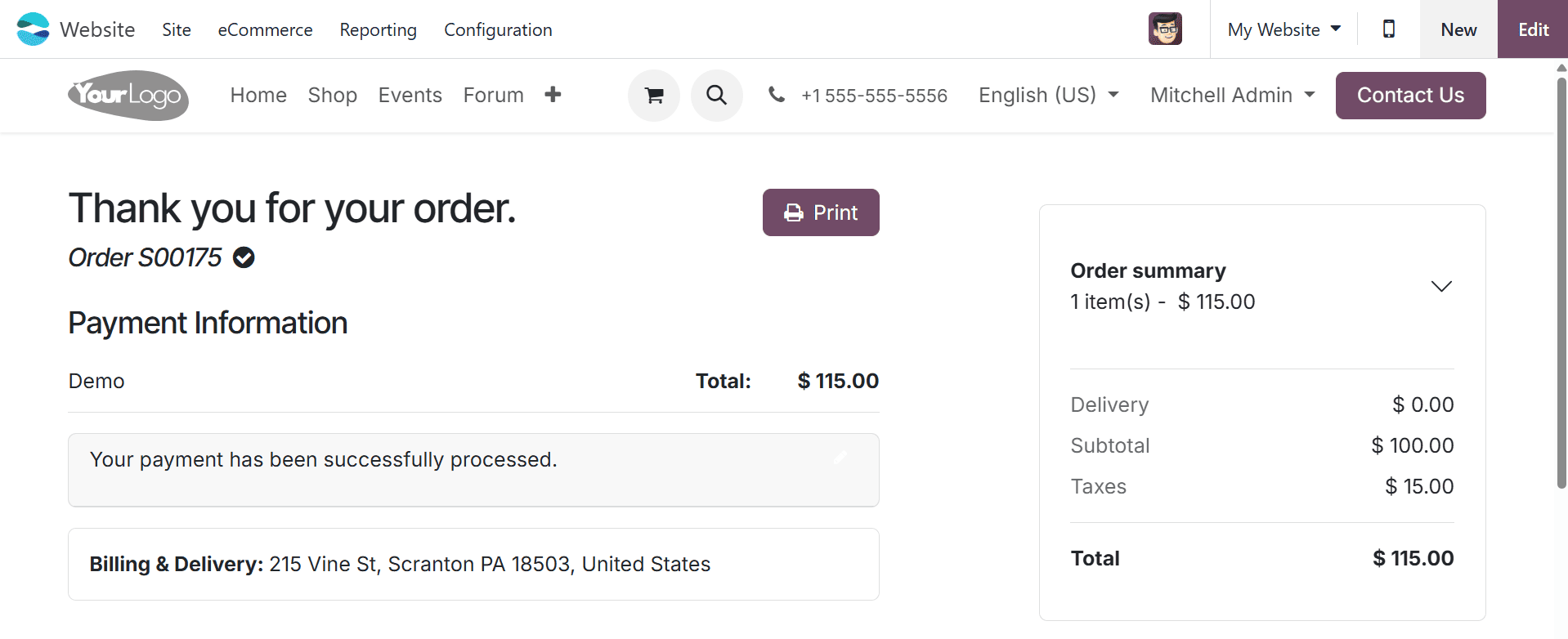

Let's examine the order from the back end once the payment has been completed.

To do it, select orders from the list under the eCommerce tab. This includes a collection of orders from several states. Select the order that is presently being constructed; it can be found by using the sequence number. View the information by opening the order.

In this case, the goods sales price is displayed as including tax. Although the order has been invoiced, the quantity has not yet been delivered.Open Delivery as the user must deliver the order. After finishing the quality check, confirm the delivery.

Open the smart tab Invoice to see the invoice. The sum is paid and the invoice is posted.

To sum up, Odoo E-Commerce offers a strong and flexible framework for managing B2B and B2C sales tactics. Businesses may improve customer experiences, expedite processes, and spur growth in a variety of markets by providing features that are specific to each model—all within a single, integrated system.

To read more about How to Manage Ecommerce Access in Odoo 18, refer to our blog How to Manage Ecommerce Access in Odoo 18.