A profit and loss statement, often known as an income statement, is a financial statement that summarises the Income, expenses, and net gain or loss of the company during a given period. The main goal of the report is to offer information on how a business is doing financially and its profitability.

The report is typically divided into two main sections: revenue and expenses. The income part lists all of the revenue earned by the company throughout the period, usually from sales of goods or services. The expenses section lists all of the costs that the company has incurred during the period, including salaries, rent, utilities, and other expenses. The Company’s net income can be identified by the difference between earned total income and expenses.

The profit and loss report can be used to evaluate a company's financial health, identify areas where costs can be reduced, and make decisions about future investments or strategies. It is also important for investors and other stakeholders who are interested in understanding a company's financial performance.

Odoo 16, Profit and Loss report enables users to view the income statement.

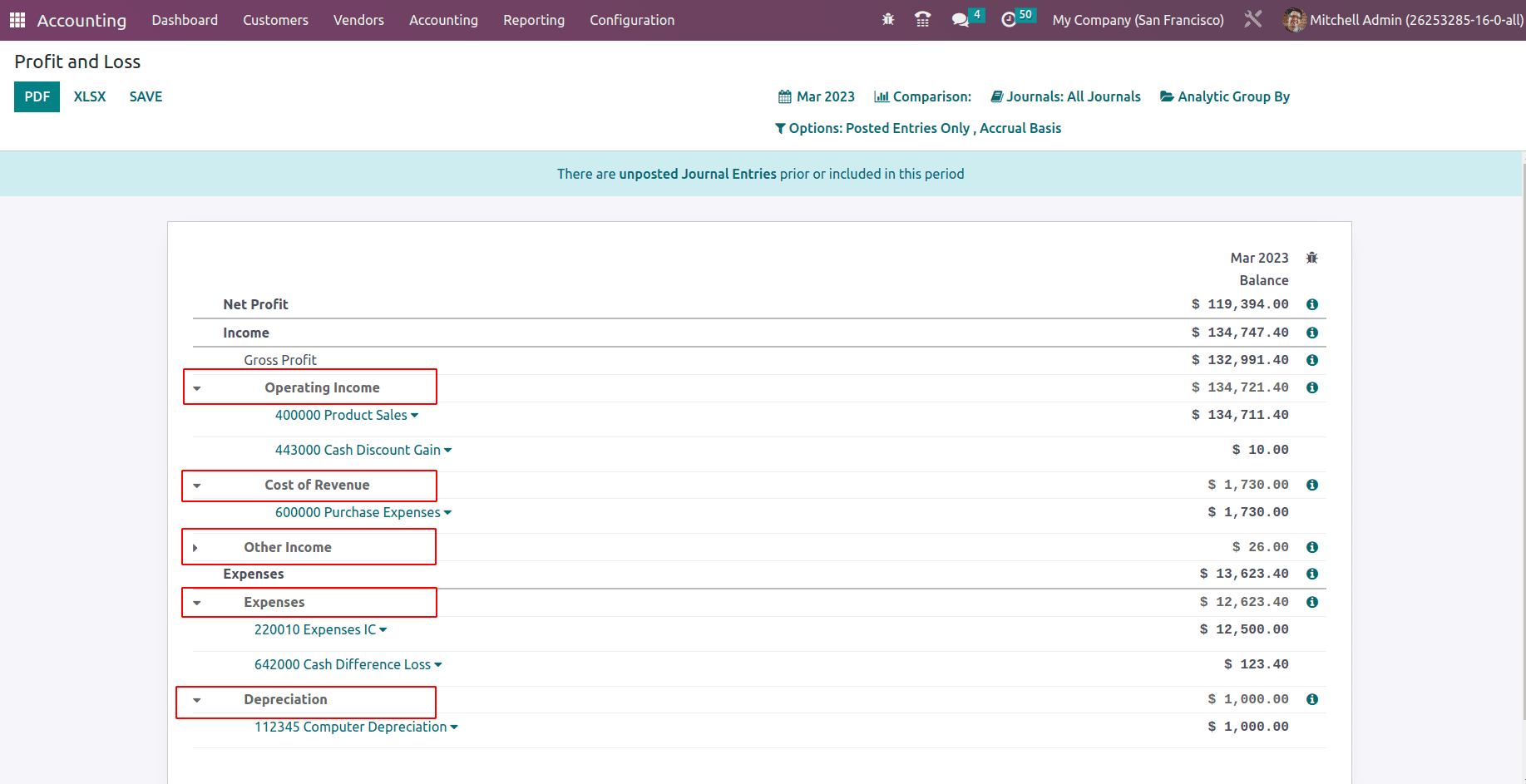

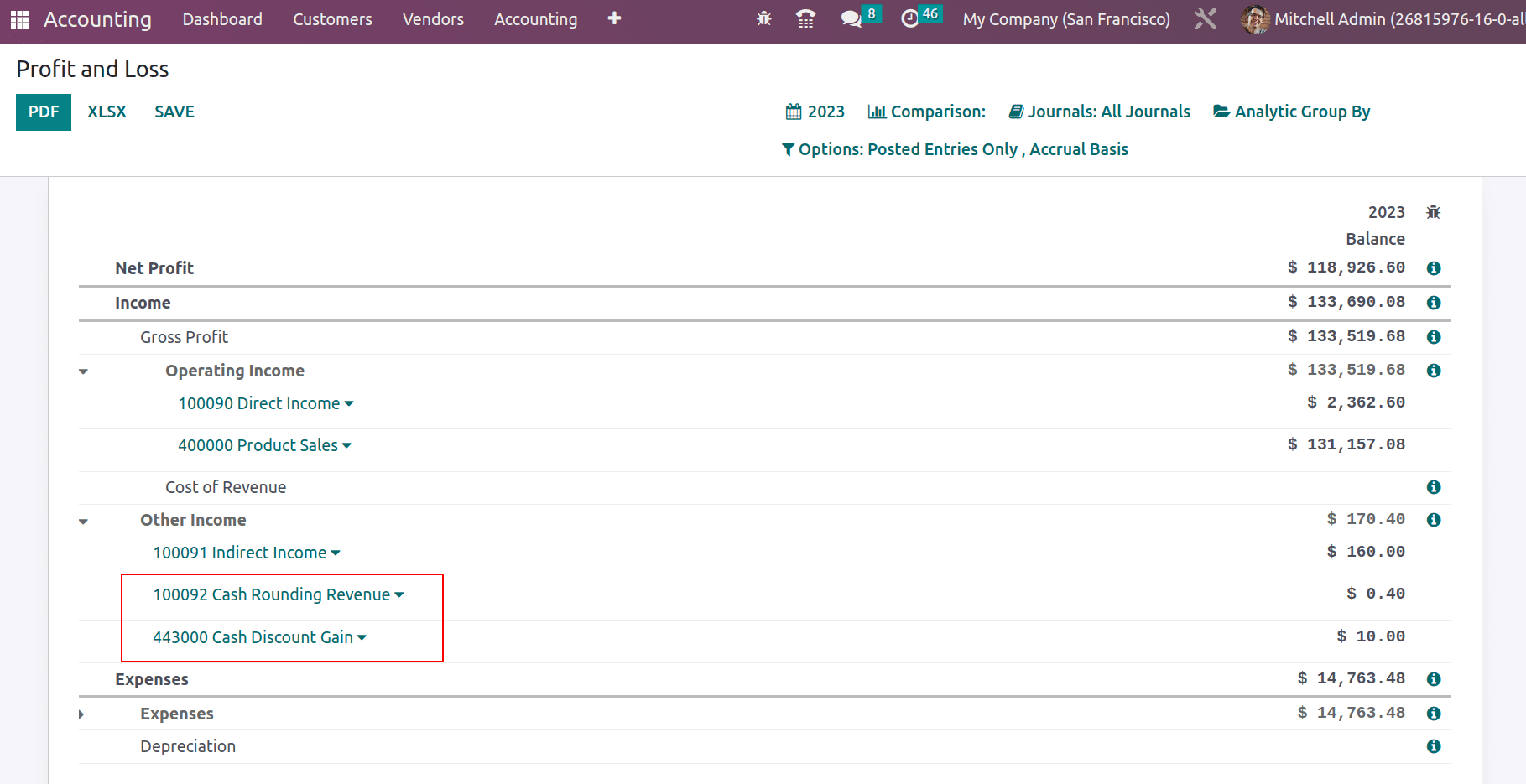

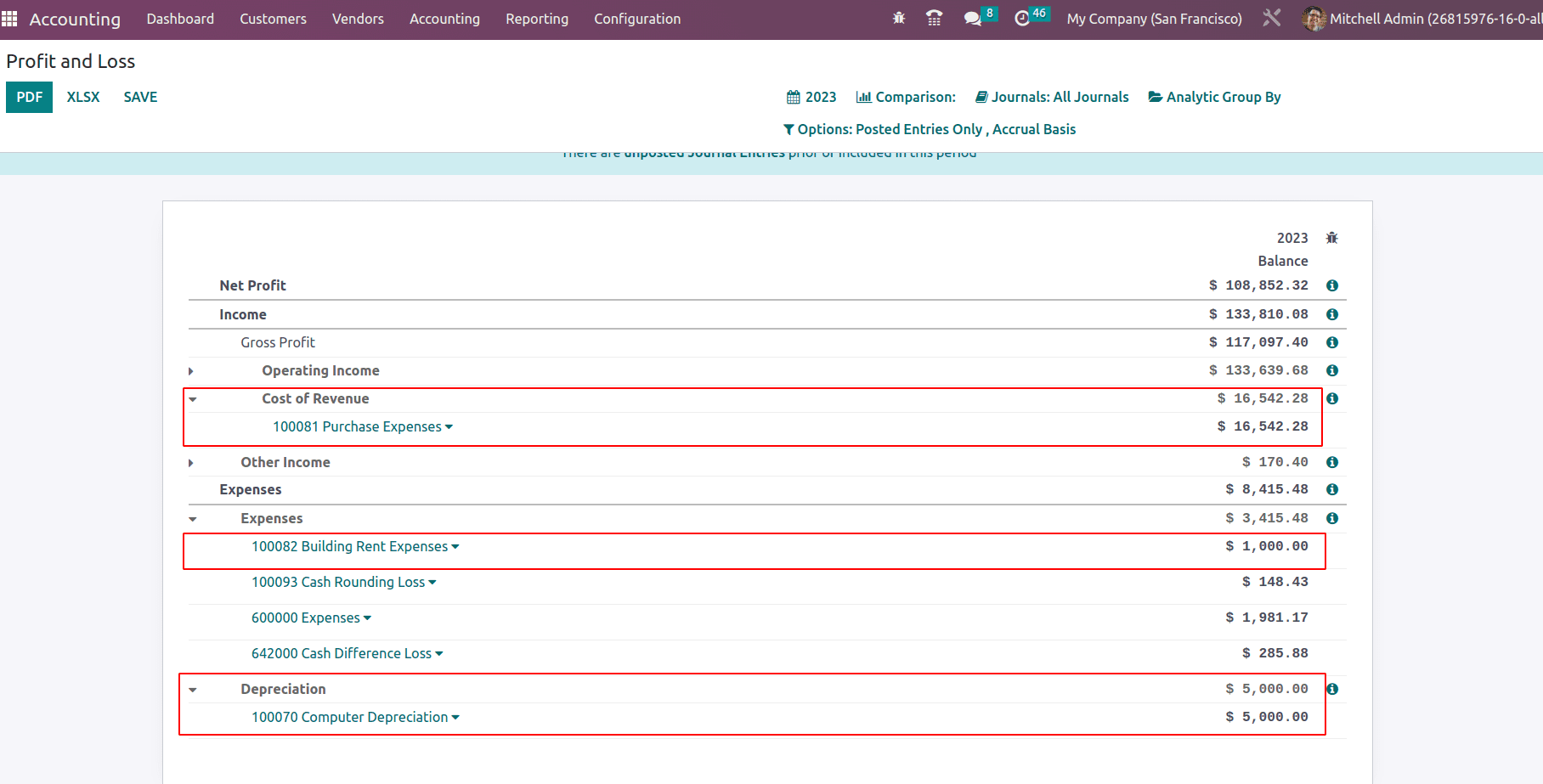

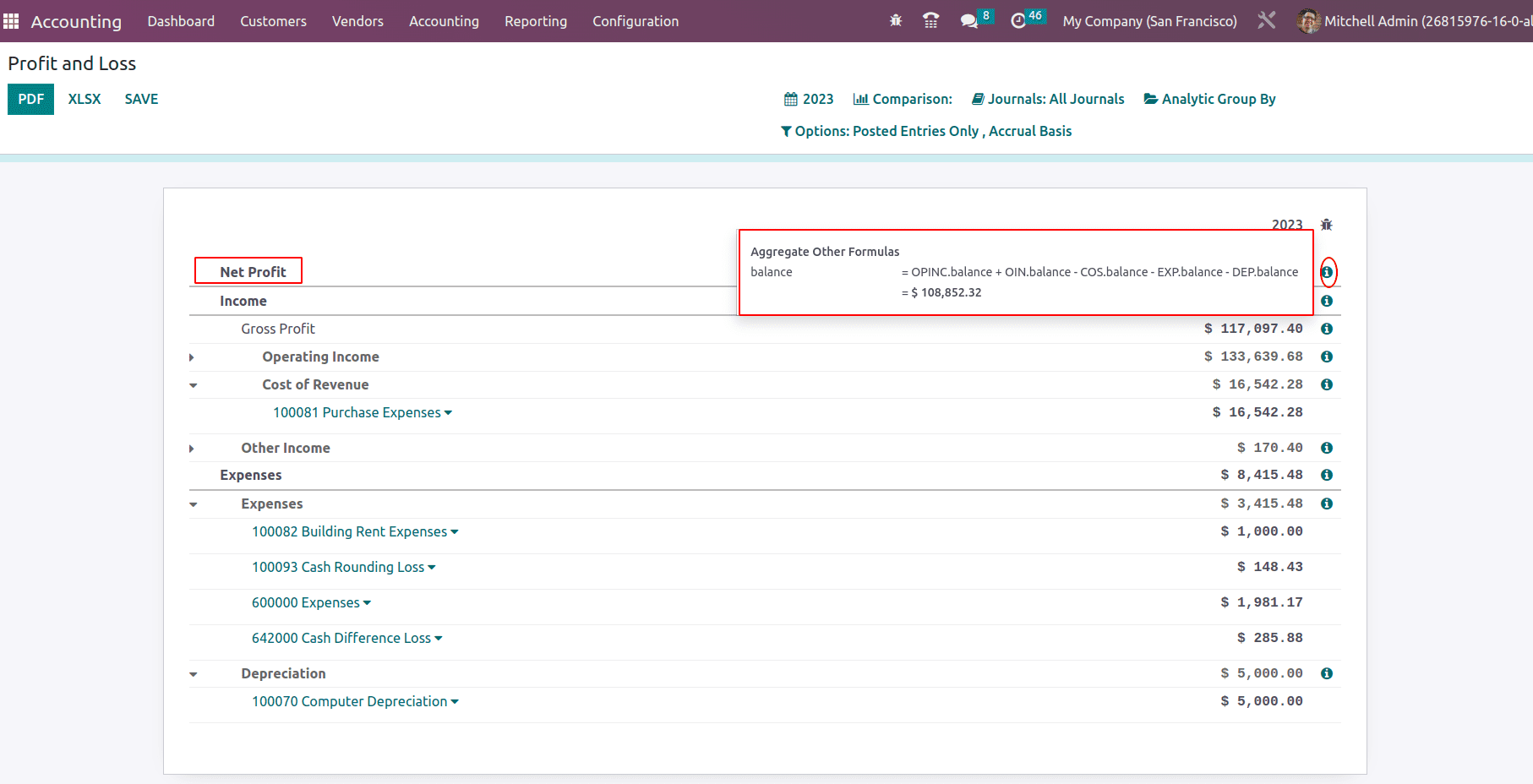

The above screenshot outlines the Profit and Loss Report in Odoo. There are various sections in this report including Net profit, Income, Operating Income, Cost of Revenue, Other Income, expenses, and Depreciation. Each of these sections affects the report of various operations. Let us see each of them.

Operating Income

In this section the direct income earned during different operations. Take an example that a company sells any of their product say some physical product or services. So the company can earn some revenue from that sale. This income is direct and will usually be counted as operational income.

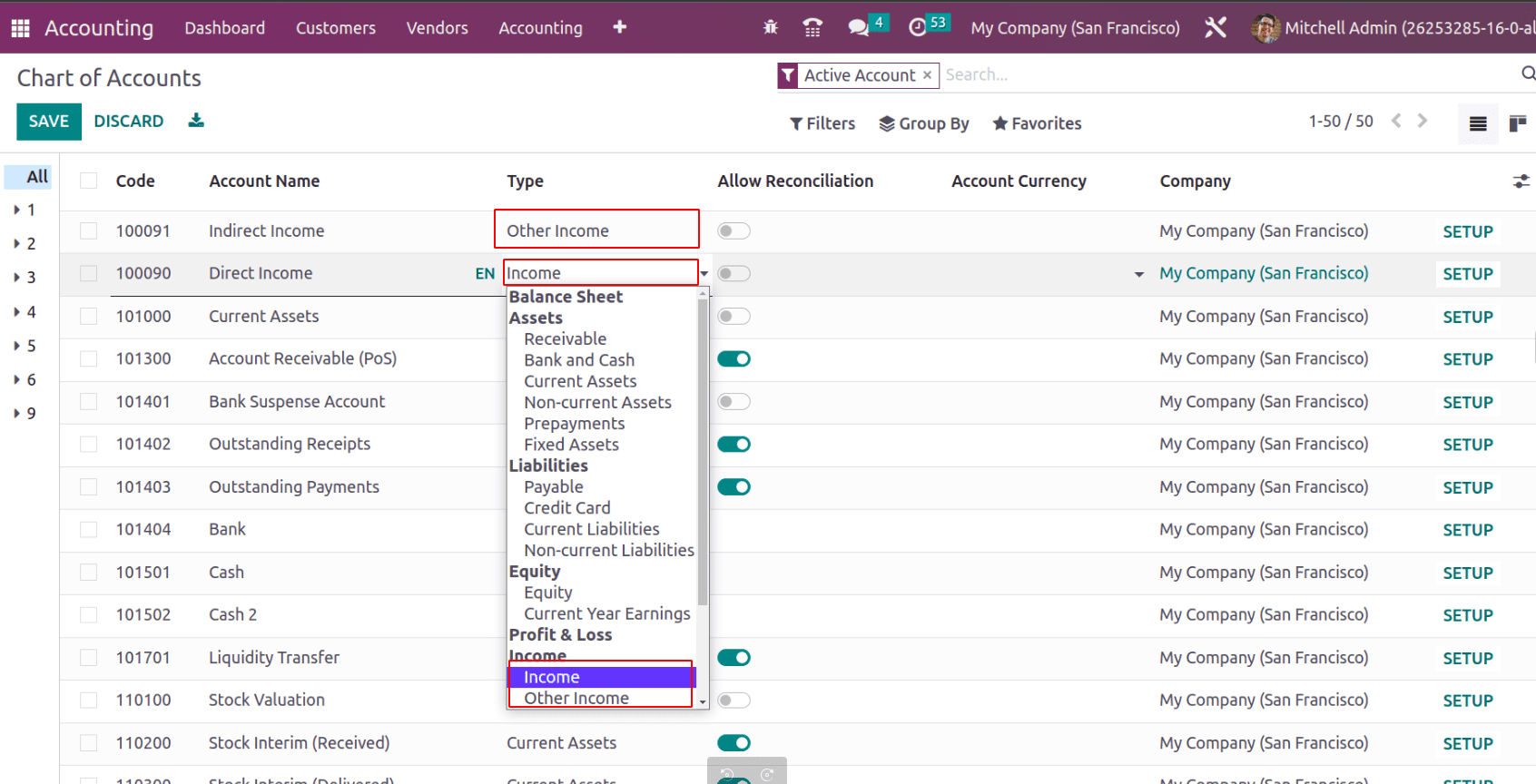

Now come to the chart of accounts.

Under the “Income” type, there are generally two types of income: ‘Income’, and ‘Other Income’.

They are the direct income and the indirect income respectively. Direct income is earned by selling company products. It will be the active income. They are configured with account type ‘Income’ and they come under the section Operating income of the company. Thus for a company operation, the chart of the account records the direct income of the company, its account type should be ‘Income’.

Other Income

They are the passive income earned. Sometimes there might be some revenues generated by selling the scraps, old newspapers, or some income generated at the cash rounding (at the time of rounding up), etc. These can be considered indirect income.

The account type of the chart of accounts that records indirect income should be ‘Other income’. Thus the Other income section of the Profit and Loss report depicts all the indirect income.

Income

The top line ‘Income’ (above the operational activities) in the Profit and Loss report defines the Total Income, which is the sum of Operational Income and Other Income. Total Income includes both the direct and indirect income of the company.

Now let's see a demo on how this direct income and indirect income affect the profit and loss report.

From the above screenshot, we have two COA: 100090 Direct Income (whose account type is Income) and 100091 Indirect Income (whose account type is Other Income).

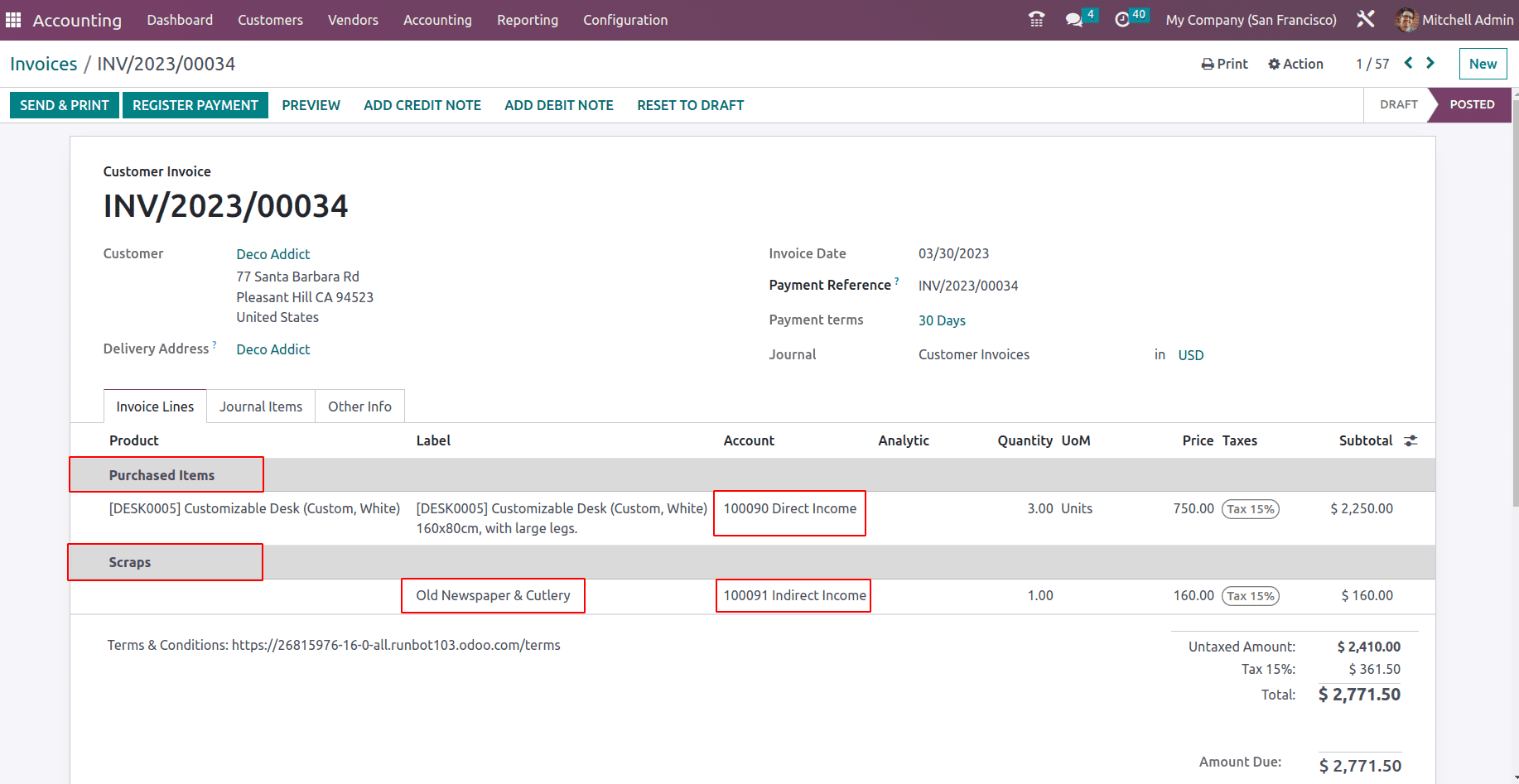

Suppose Deco Addict is a customer as well as he is the person who is collecting the scraps of the company for money. He pays for the total weight of the scraps.

So let us create an invoice for the customer ‘Deco Addict’. Suppose this customer purchased, a customizable desk from the company which will generate an active (direct) income for the company. This income is recorded in the COA: 100090 Direct Income. There are two sections defining purchased items that define this person as a customer purchasing the customizable desk. See the below screenshot.

Also, we are selling the scraps to the same person. Thus in the next section, it records the collected scrap details and income from this recorded in the COA 100091 Indirect Income.

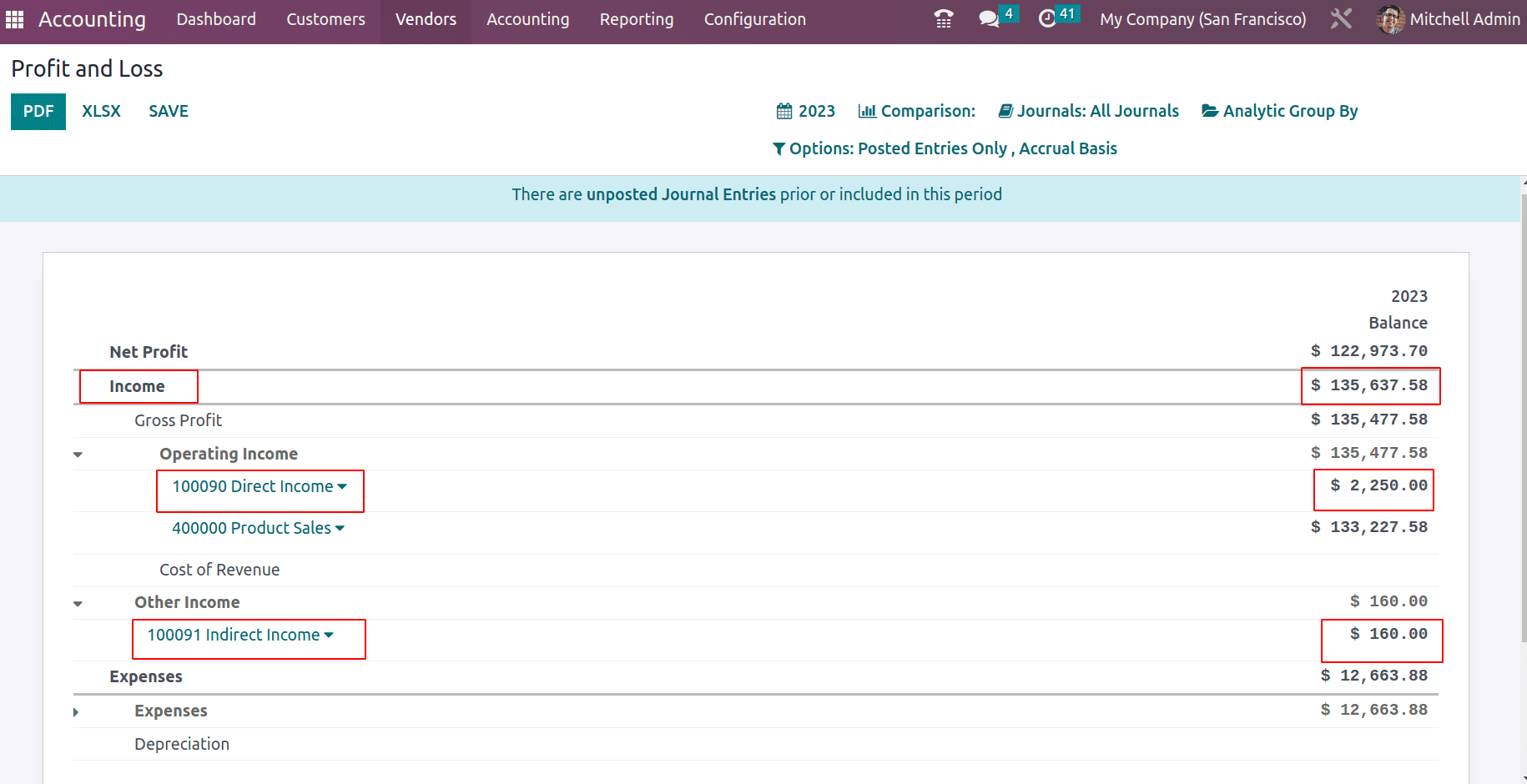

Let's see how this affects the Profit and Loss report. Direct Income is recorded under the Operational Activities section and Indirect Income affects the Other income section ofProfit and Loss report.

The total direct income earned is $135,477.58 (sum of product sales and direct income= $133,277.58 + $2,250.00) and the total indirect income earned is $160. Thus total Income earned is $135,637.58).

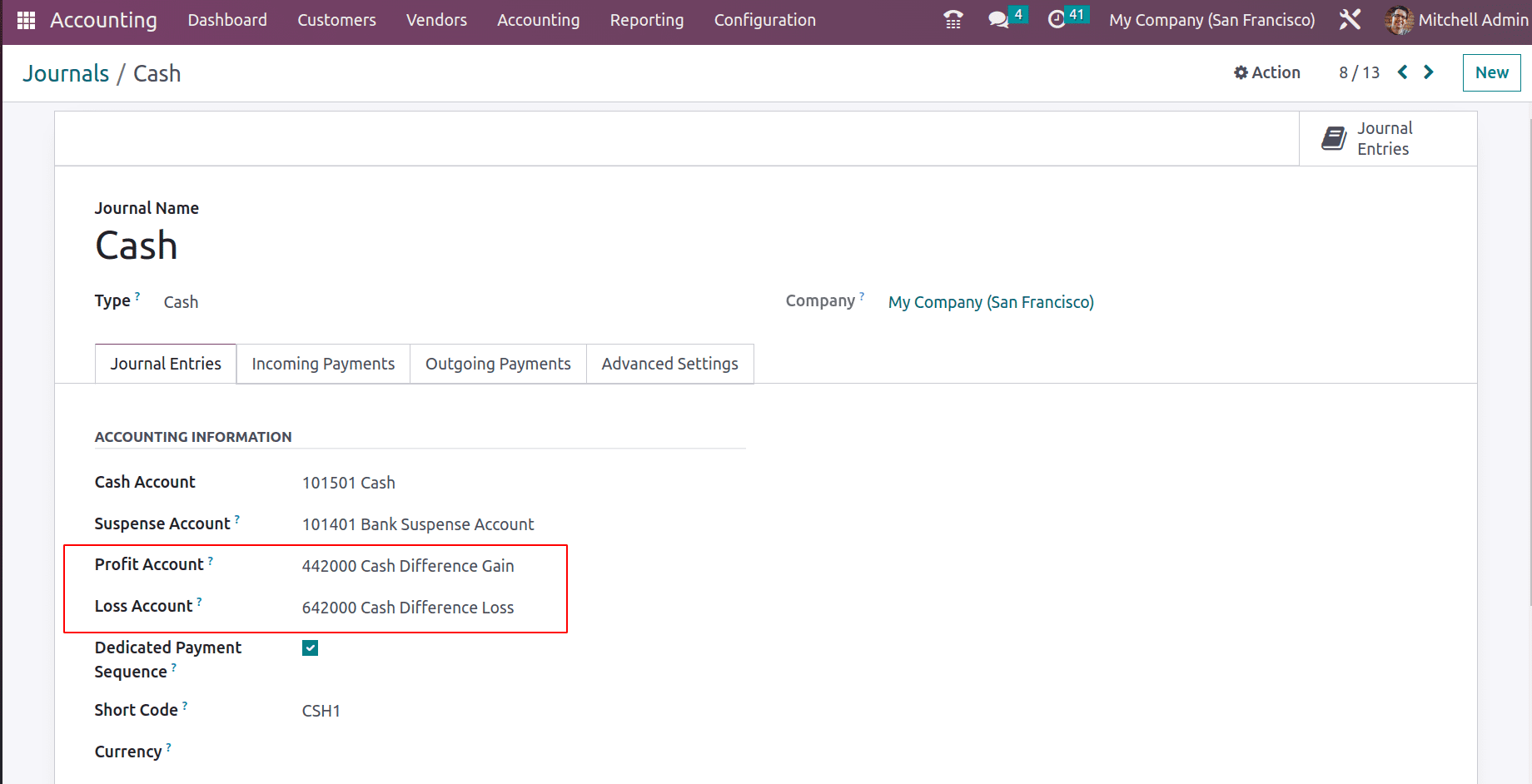

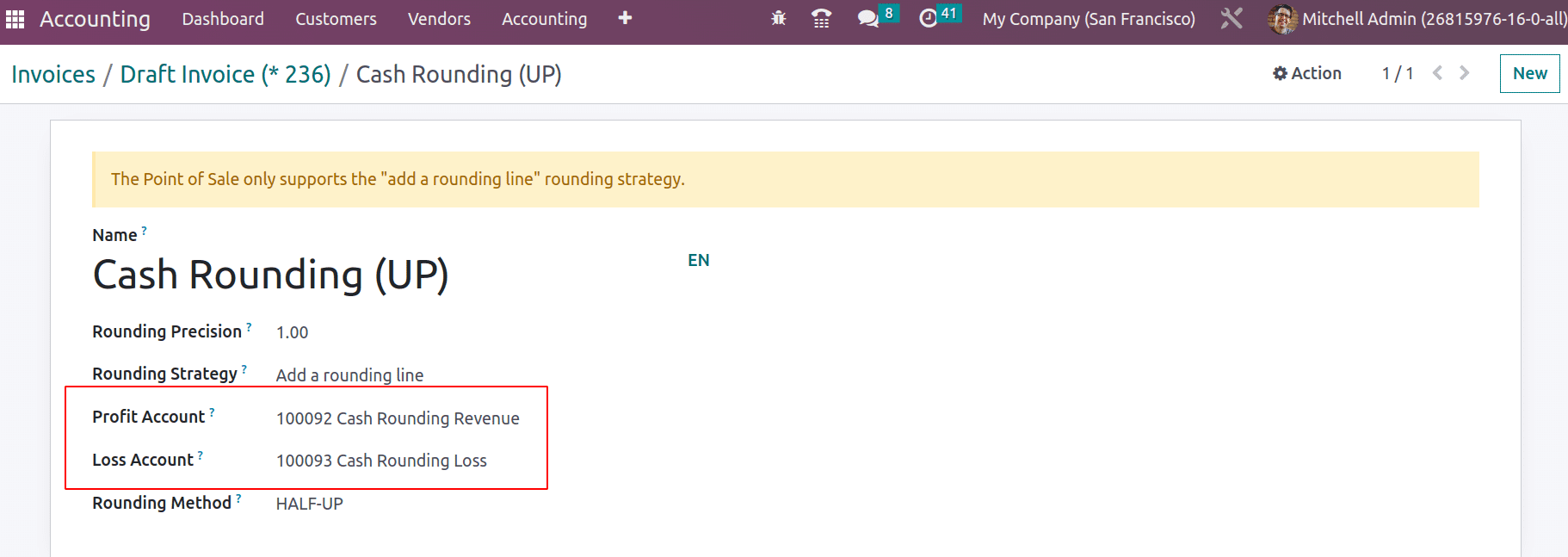

In the cash and bank journals, there will be two accounts which are the profit account and the loss account. So when making a payment with any of the payment journals, and if any discounts are provided, it might be a gain/loss for a company. If it is a gain, which means it’s a passive income. Similarly, if any cash rounding is applied to the invoice, especially round-up, this will also give income.

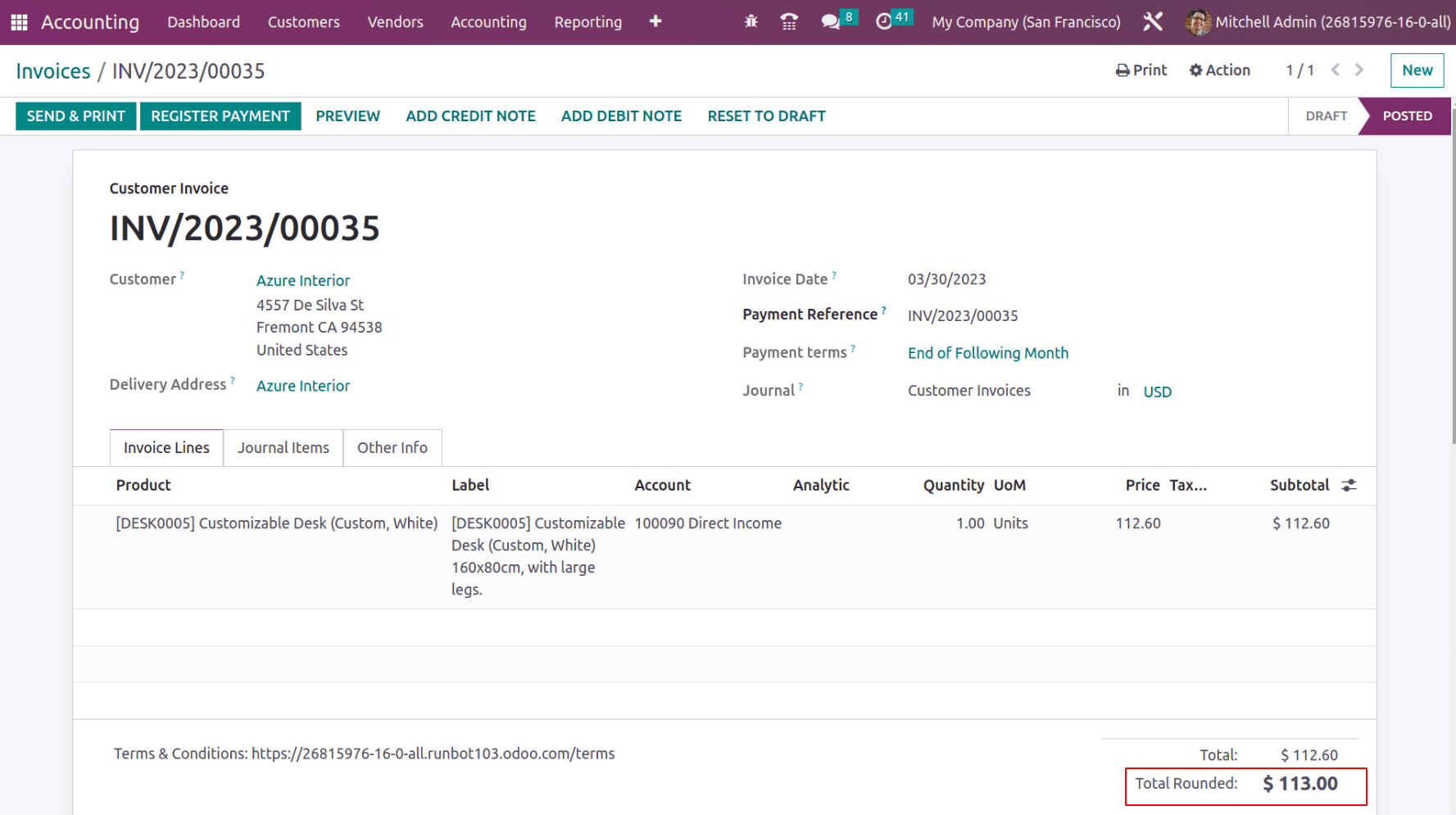

While configuring the rounding method, the profit account records the extra rounding amount earned and the loss account records the loss amount while rounding the invoice or bill. Let us see an example of this.

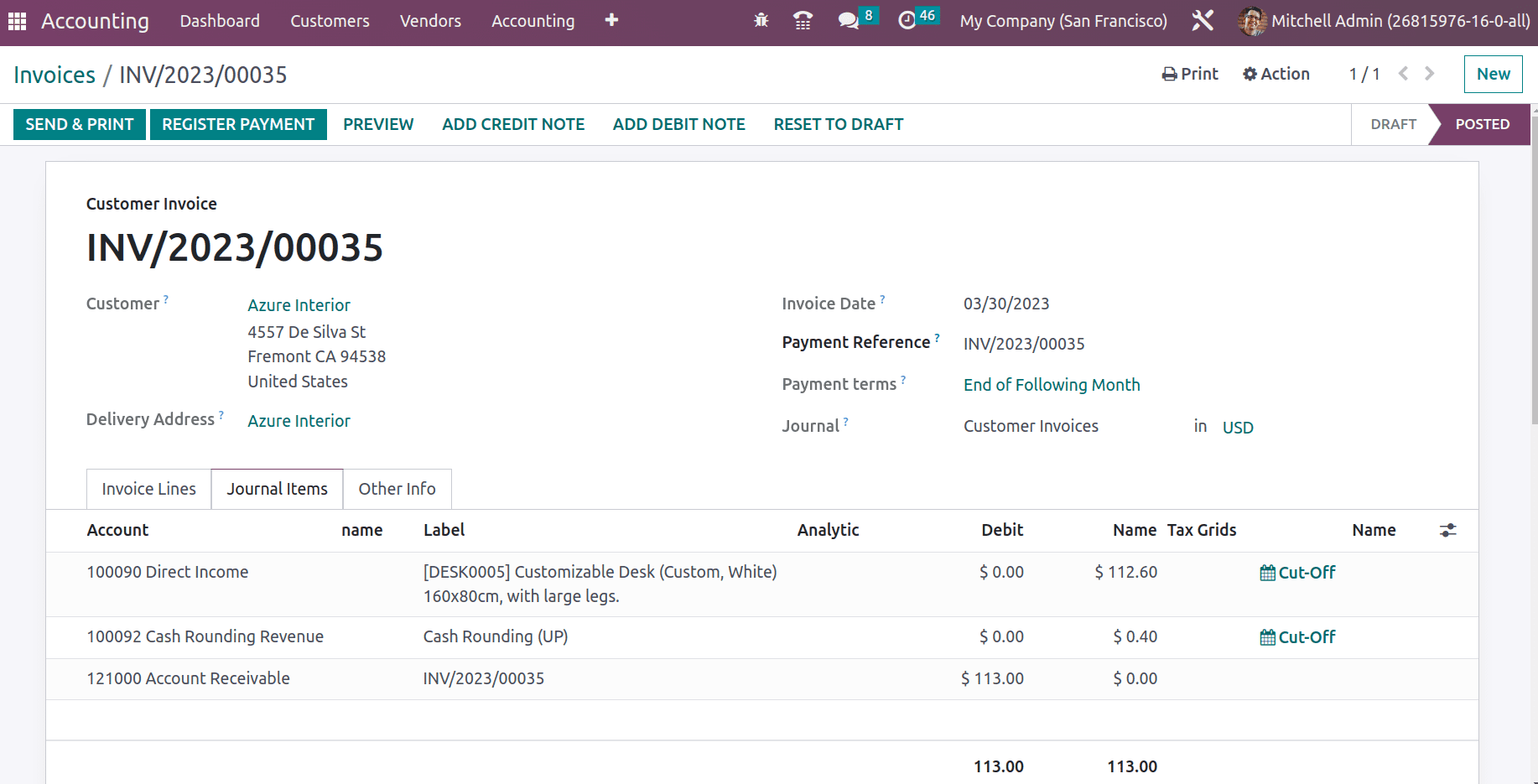

In the below invoice, a rounding method is applied. The subtotal is $112.60 and the rounded total is $113.60.

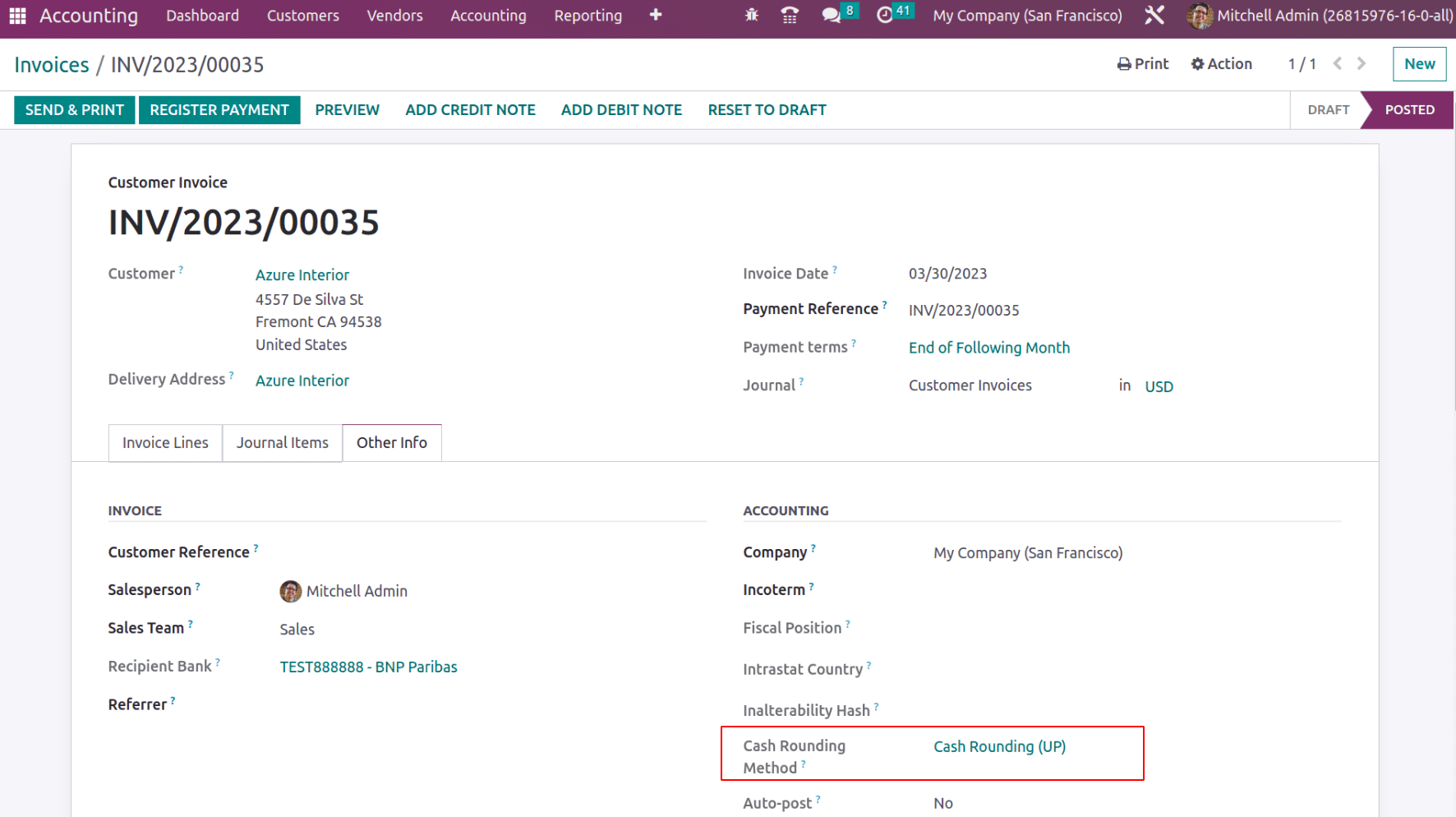

This is because the rounding has been applied in the ‘Other Info’ tab.

See the journal items below.

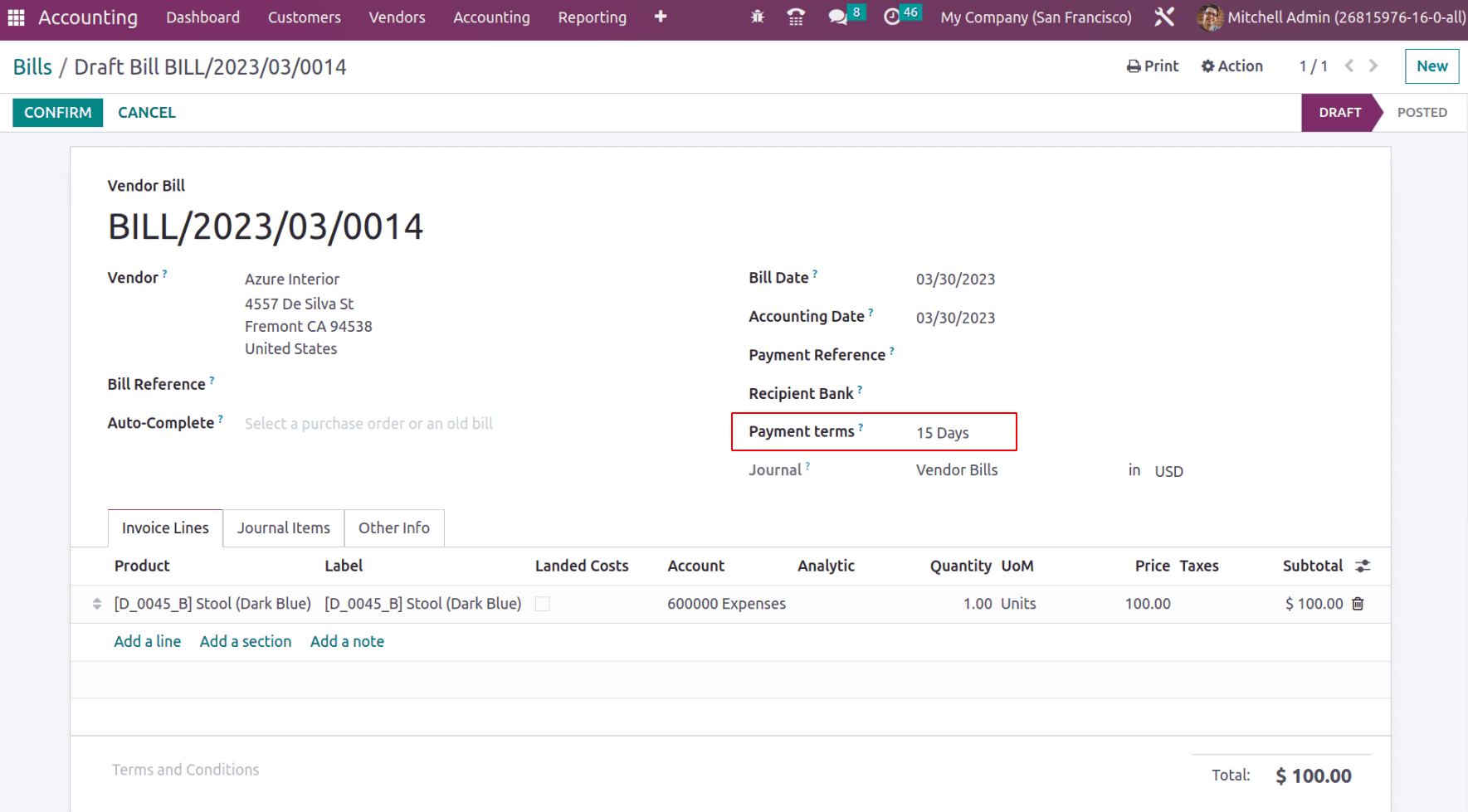

See another example of creating a bill for a vendor, where the Bill amount is $100, and the payment term provide as 15 Days. Sometimes vendors may provide some discounts or there might be some early payment discounts. Those discounts also can be configured as indirect income. It is not mandatory to record such income as indirect income. Based on your requirement you can keep them as Income or Other Income and, how and when this kind of income should appear in the profit and loss report.

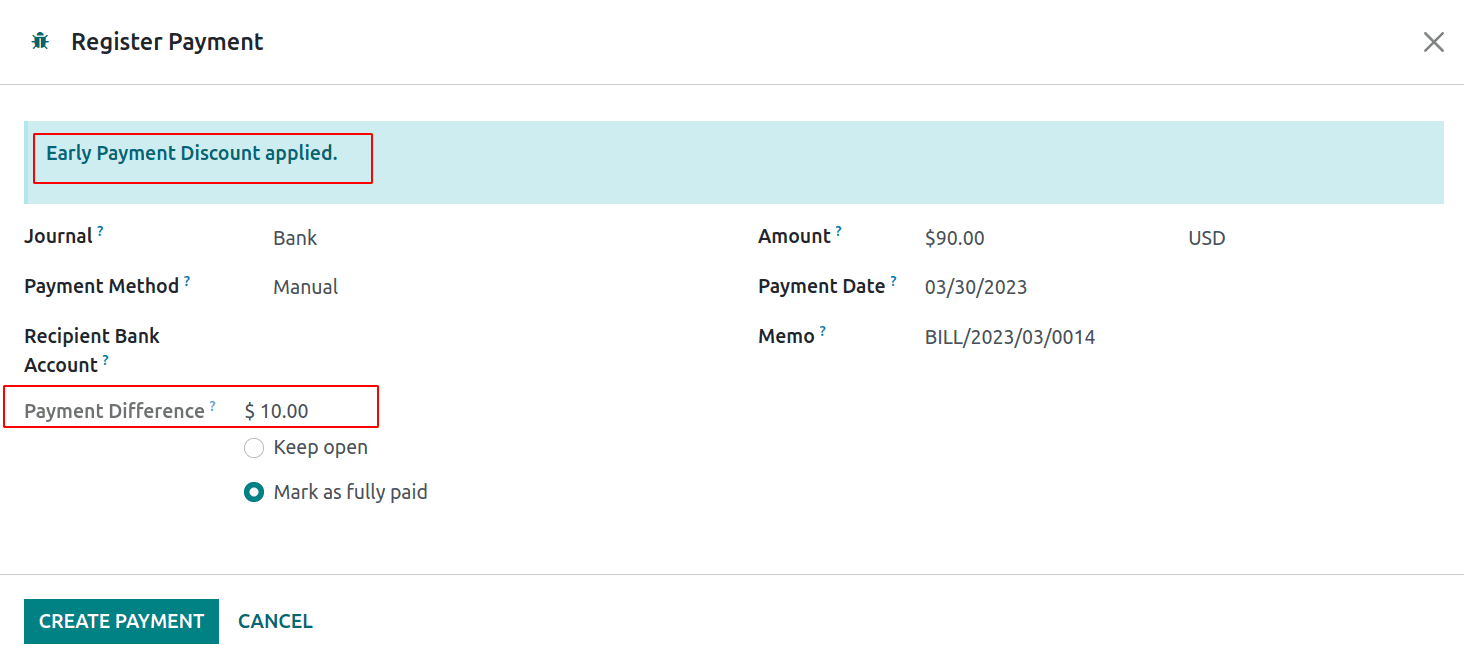

While registering payment the early discounts will be automatically applied or if any discounts are applied by the vendor, an amount will be gained from payment.

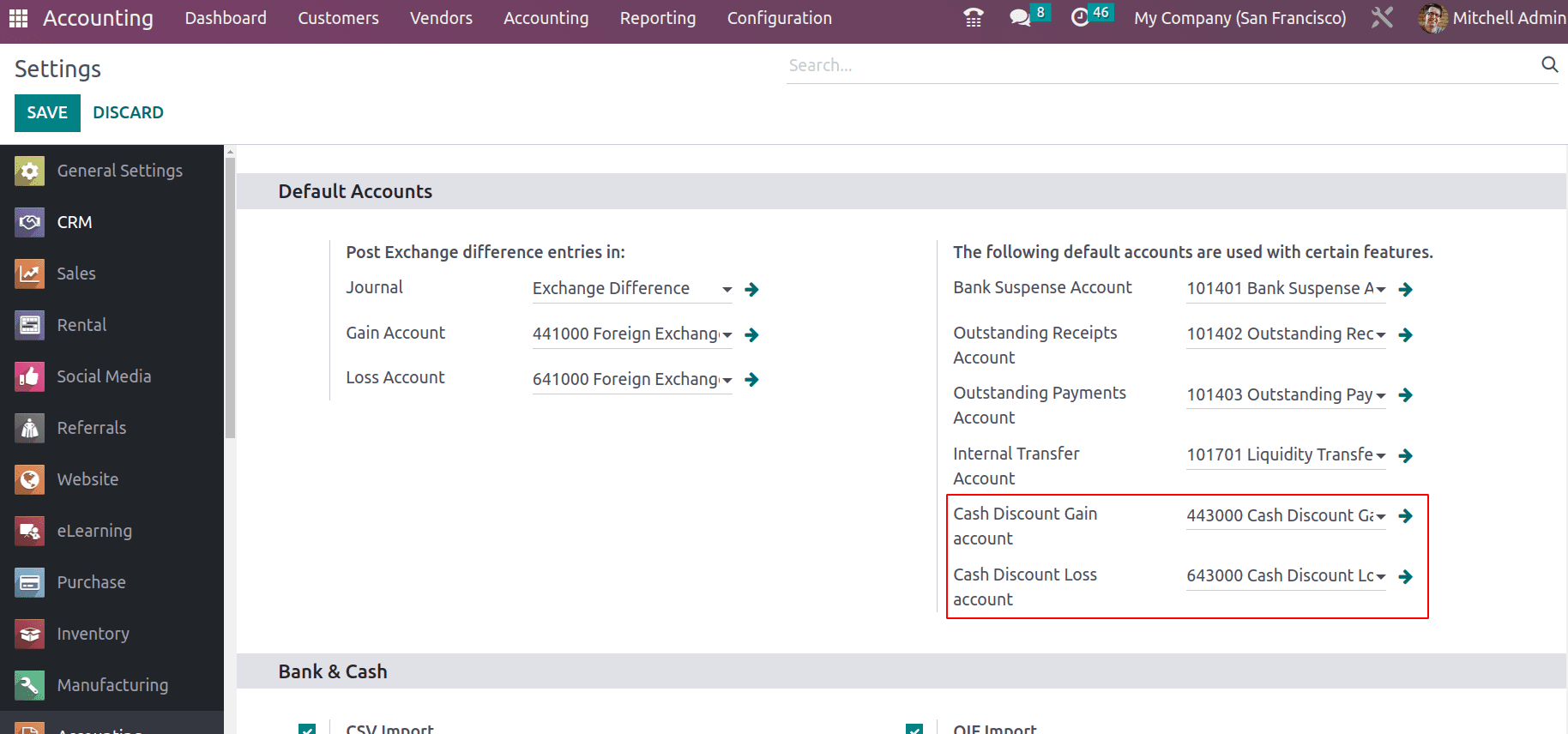

Thus the cash discount is recorded in the Cash Discount Gain Account, which is defined under the Default section of Accounting Configuration Settings.

Now see the Profit and Loss Report.

Thus the total Income is updated accordingly.

Cost of Revenue

Cost of revenue is the direct expenses that a company incurs. A direct expense defines as the expense generated at the time of manufacturing products, and purchasing goods. A general trading company, as they purchase products to their inventory for selling. So while purchasing they will have to make payment to the vendor and they will have a purchase expense. Such expenses are considered to be direct expenses or Cost of Revenue.

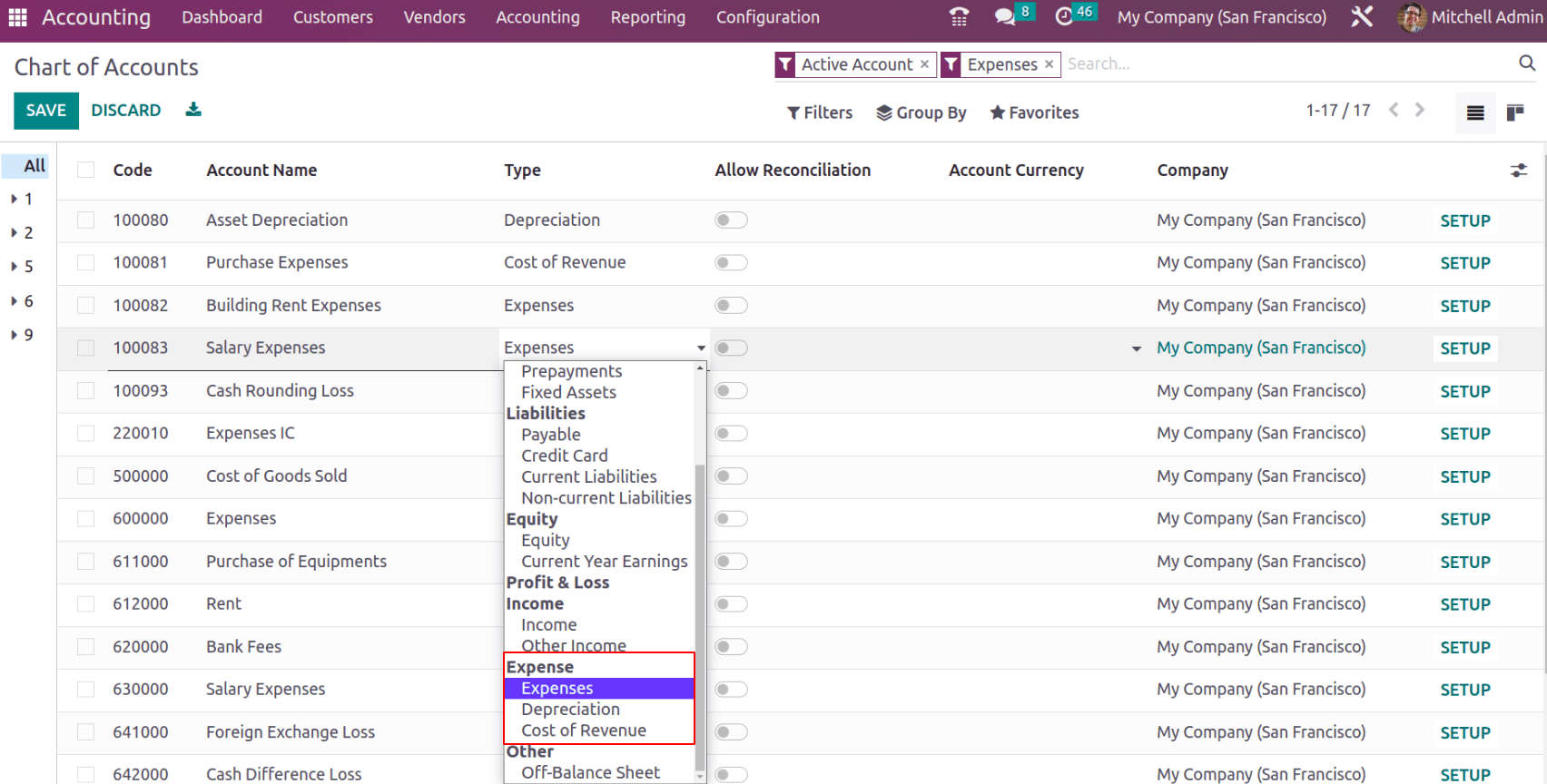

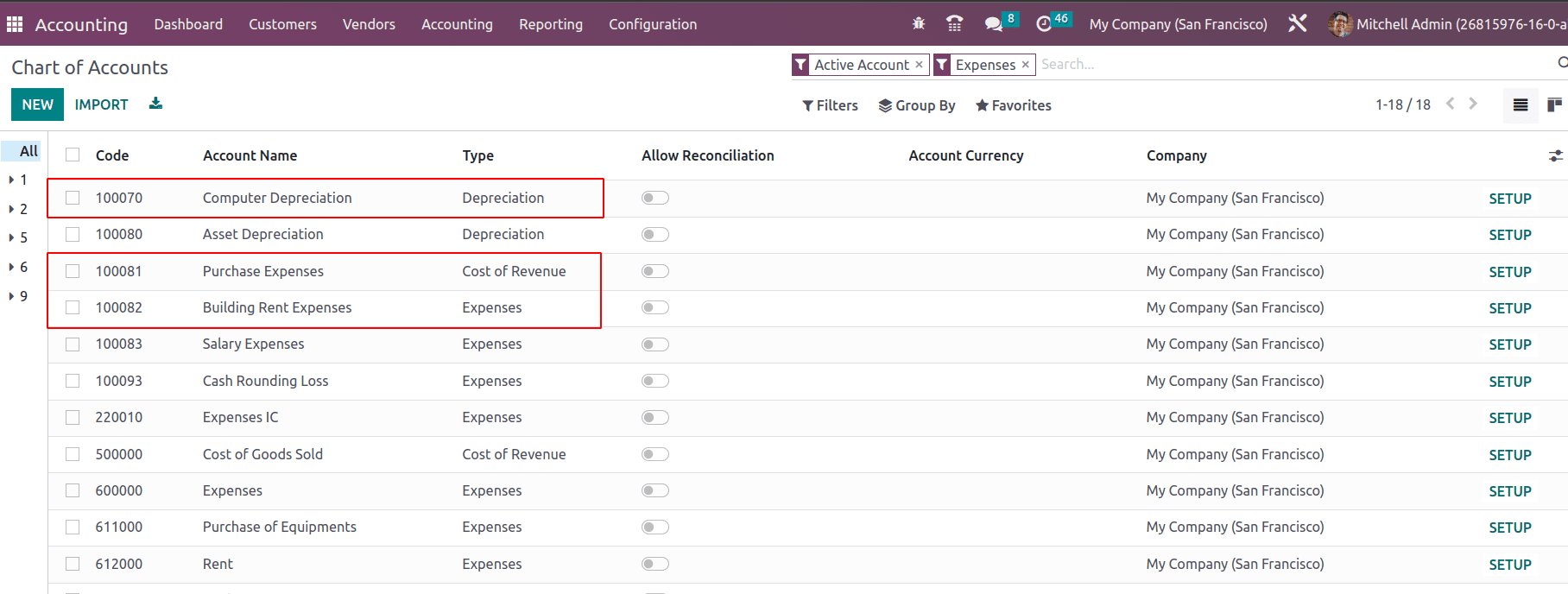

In Odoo, direct expense accounts are of account Type ‘Cost Of Revenue’. While configuring COA, under the expense, there are three account types: Expenses, Depreciation, and Cost of Revenue.

Thus direct expenses usually configure with account type: Cost of Revenue. So in the Profit and Loss Report, it comes under the section ‘Cost of Revenue’.

Expenses

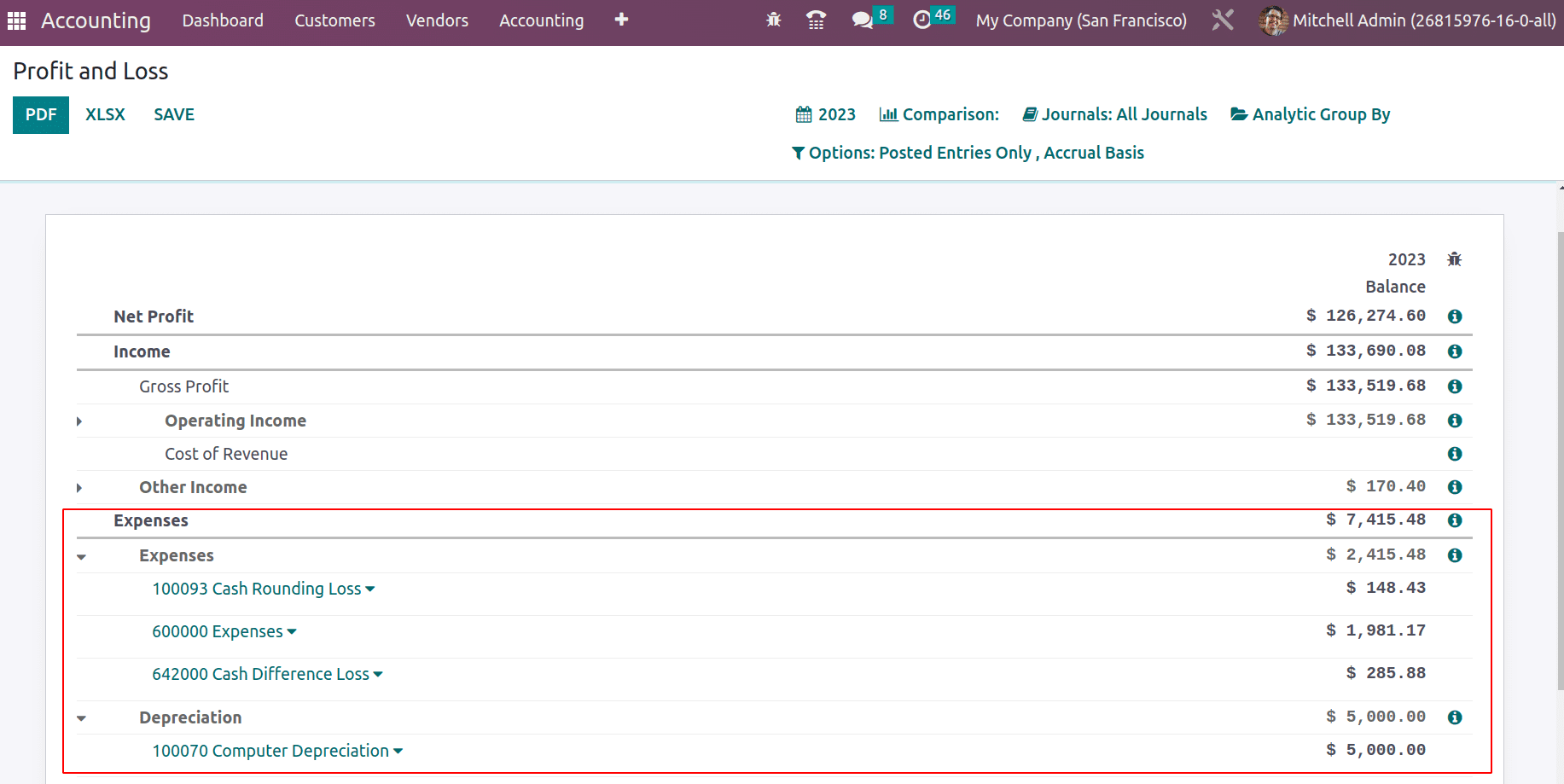

In the Profit and Loss report the expense section has two subsections: Expenses and depreciation. The total expenses will be the sum of expenses and depreciation.

The Expenses subsection defines the indirect expenses of the company, which can be building rent expenses, employee salaries expenses, advertising expenses, or even petty cash, etc can be considered as the indirect expense of the company. These indirect expenses are depicted under the section expenses.

Depreciation

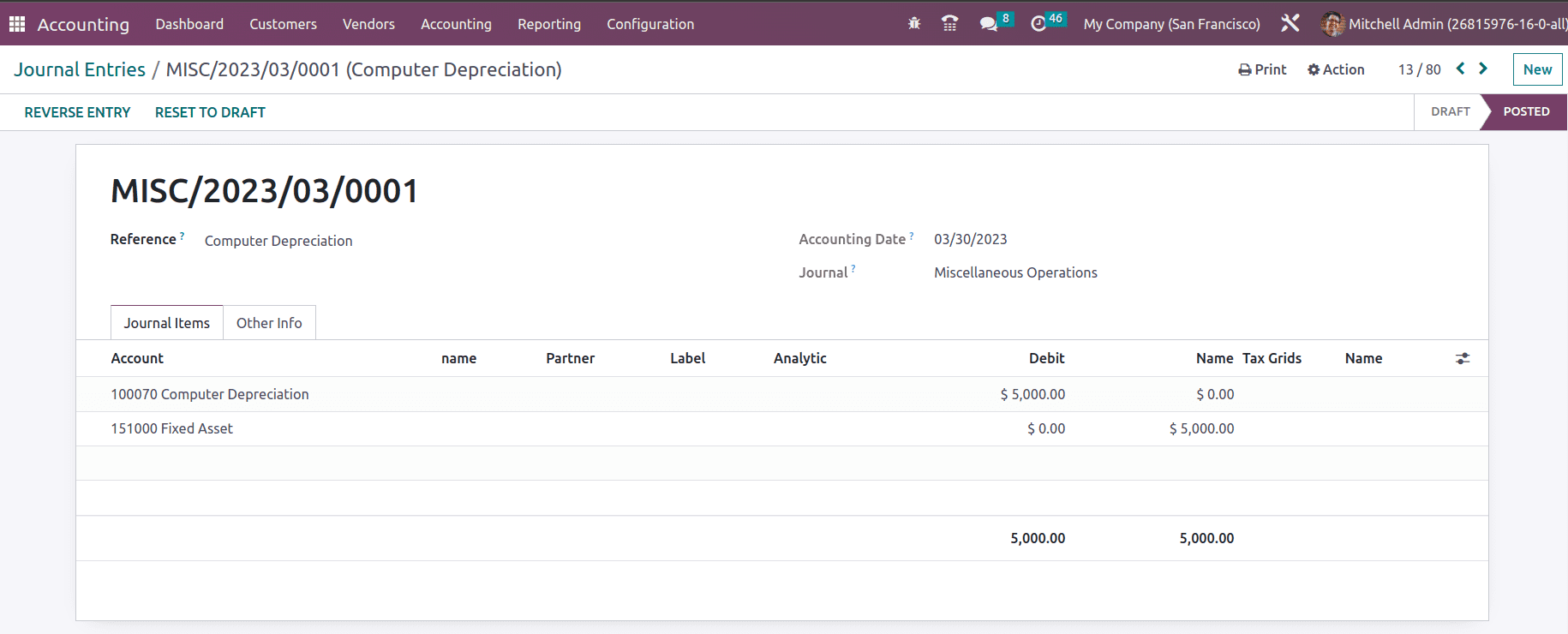

The machinery, furniture, or devices, in the long run, will undergo depreciation, considered a kind of expense. Due to wear and tear, the asset value gets reduced over a period of time. They will be recorded as depreciation under the section ‘Depreciation’ of Profit and Loss report.

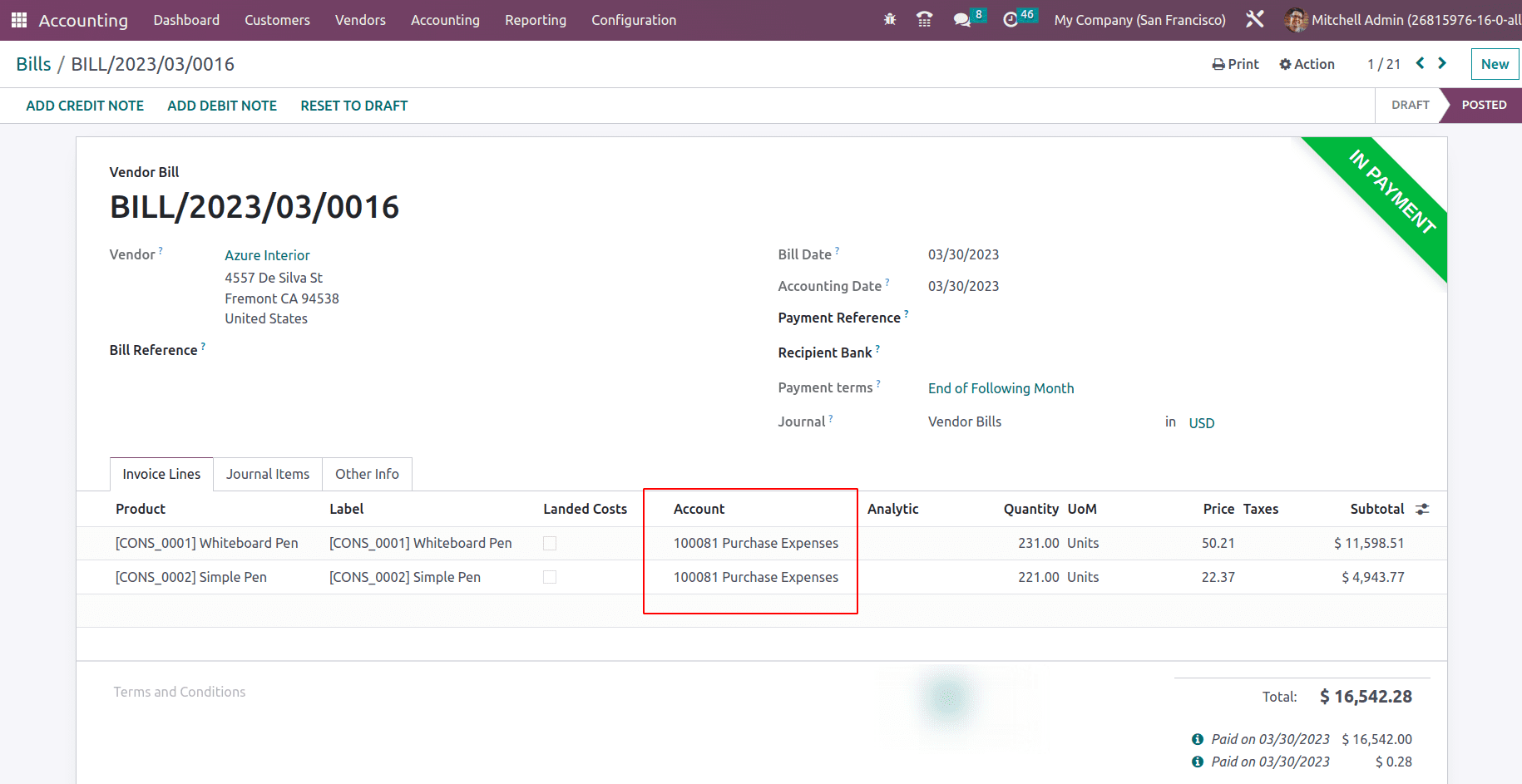

Now let's see the demo for how the cost of revenue, Expense, and depreciation are affected in the Profit and Loss report. For that let’s take some examples. Suppose for a trading company, a purchase is done from the vendor to receive some stock at the warehouse in order to sell the items to the customers. This will generate a direct expense.

In the above screenshot, the products are purchased in bulk quantity and expenses are recorded in account ‘100081 Purchase Expenses’. For this account, the account type provided is ‘Cost of Revenue’. Since it is a direct expense.

Thus the purchase expense will be shown under the Cost of Revenue section in the Profit and Loss report.

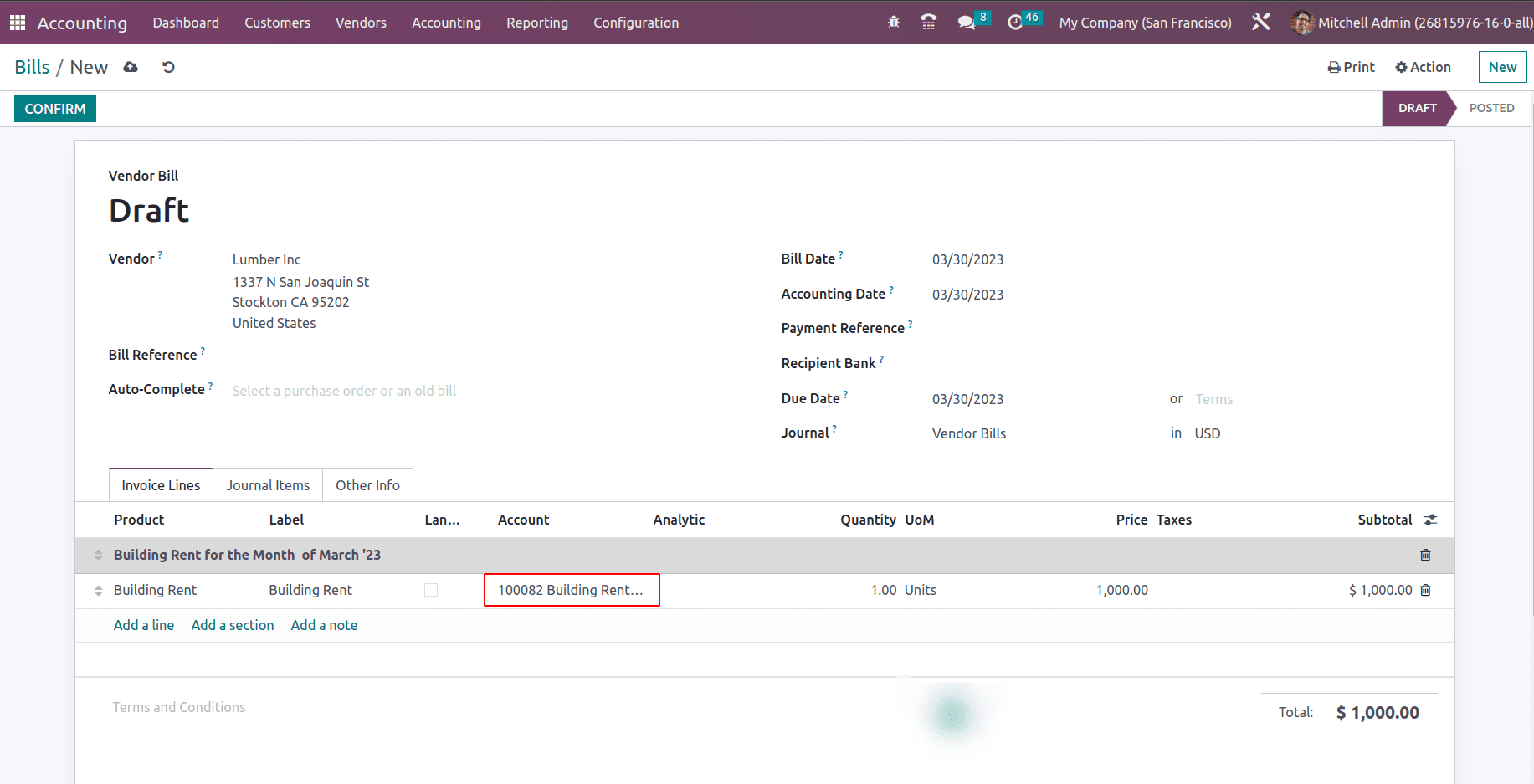

Now Consider another bill, which is provided for building rent. Thus the expense will be recorded in the COA: ‘100082 Building Rent Expenses’.

These building expenses are other expenses and are recorded under the sub-section Expenses of Profit and Loss report.

When it comes to depreciation, if any journal entry is added that the equipment is getting depreciated, those depreciations come under the section depreciation of profit and loss report, provided the account type of those accounts where depreciations are kept, should be ‘Depreciation’.

Now see the Profit and Loss report where all these entries are caught up.

Thus we have seen how all the basic details like operational income, cost of revenue, expenses, and depreciations are taken into the profit and loss report. Once these details are recorded our ultimate aim for this report is to identify the company's profit for a period. So let's find out how the Gross Profit and Net profit are calculated.

Gross profit

Gross profit is the income that remains after deducting production or purchasing costs from revenue, and it assists investors in determining how much profit a firm gets from the production and selling of its products.

Gross Profit is often called gross income, which is the profit of a company for which all the direct expenses are deducted from the earned revenue.

Gross Profit = Operational Income + Other Income - Cost of Revenue

Net Profit

Net profit, or net income, is the profit that remains after all expenses and costs have been deducted from revenue. It contributes to demonstrating a company's overall profitability, which reflects the effectiveness of management.

Net Profit = Operational Income + Other Income - Cost of Revenue - Expenses - Depreciation

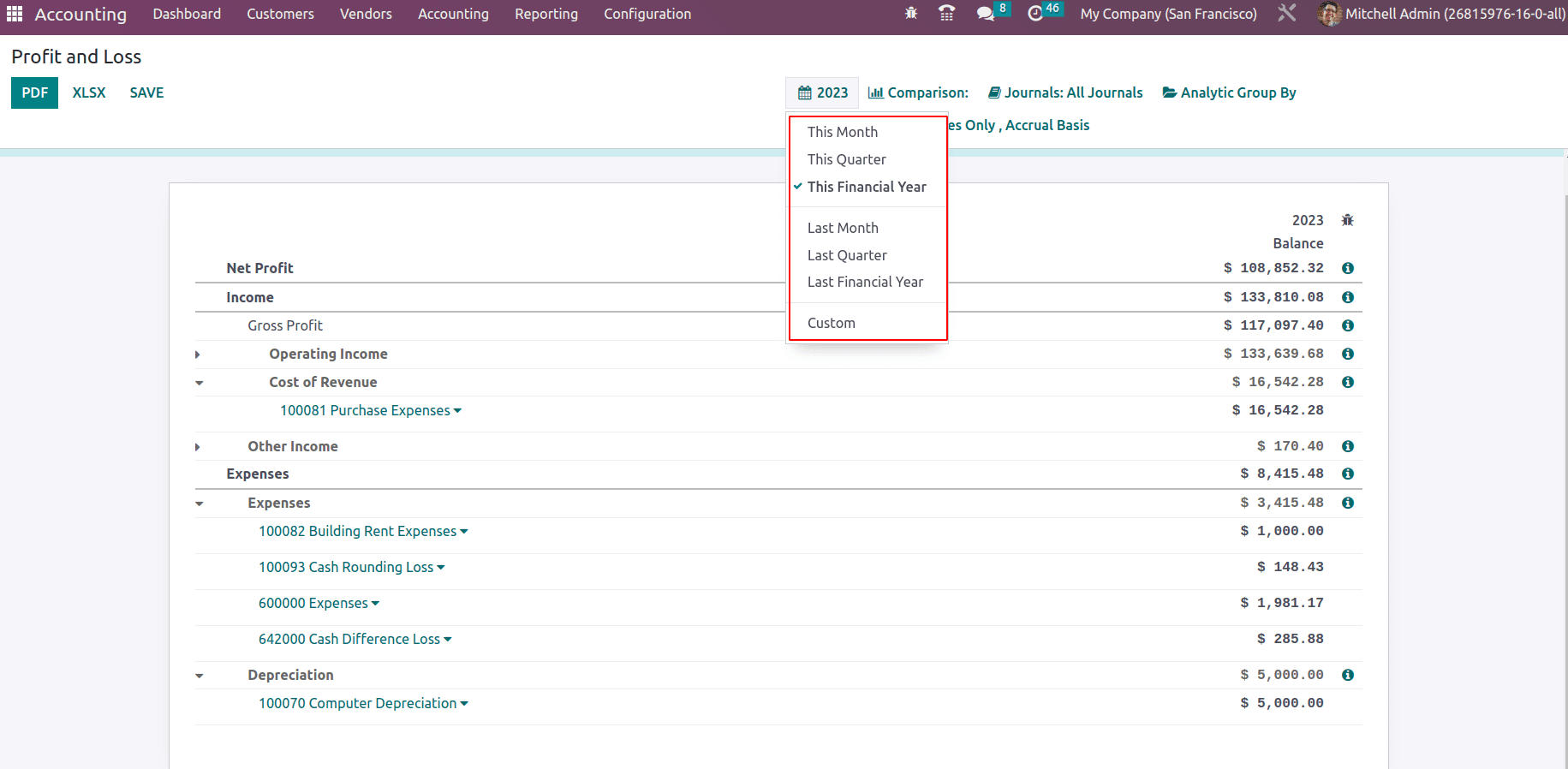

The little “i” on each line defines the formulae of each line. To take the profit and loss report of the period, a date filter can be specified and added. Date filters like ‘This month’, This Quarter’, This Financial Year’, ‘Last Month’, ‘Last Quarter’, and ‘Last Financial Year’ can be applied. The ‘Custom’ option enables filtering using a Start date and End date so that the Profit and Loss can be extracted between those dates.

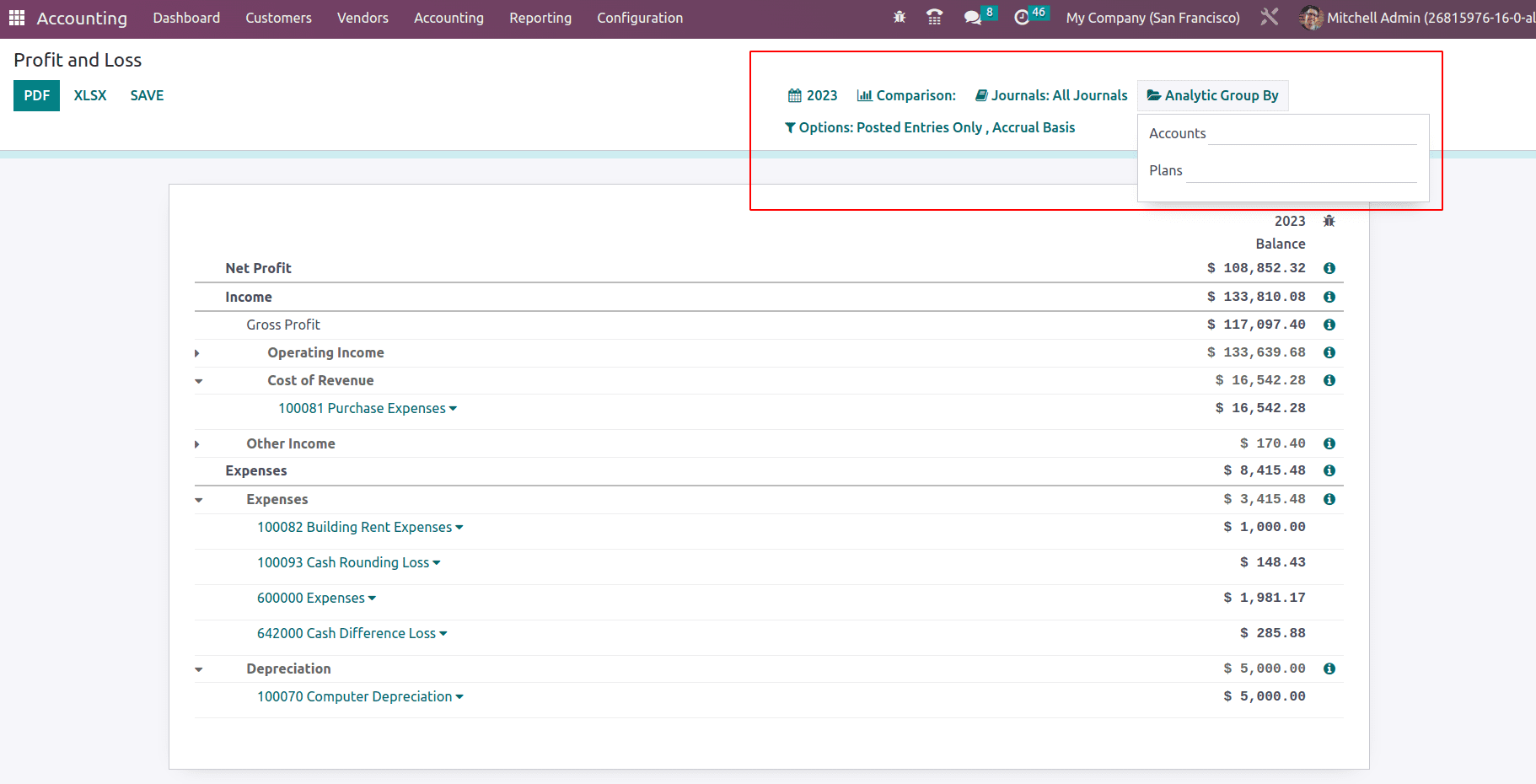

Also, other filters are available to extract the Profit and Loss report based on the Journals, Analytic Accounts, and Plans.

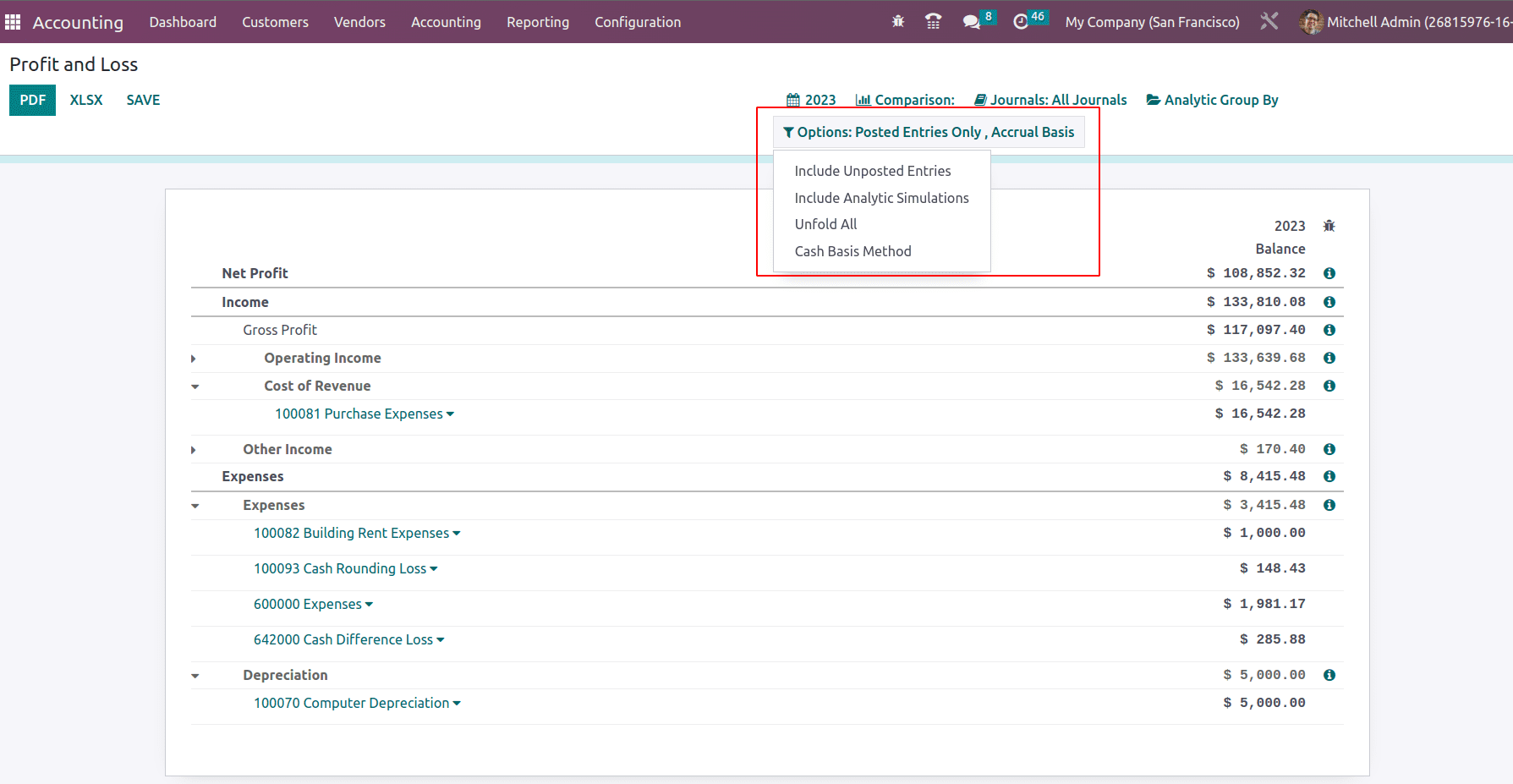

The Options filter enables filtering the Profit and Loss report to filter the entries with posted entities, unposted entries, cash basis methods, and so on.

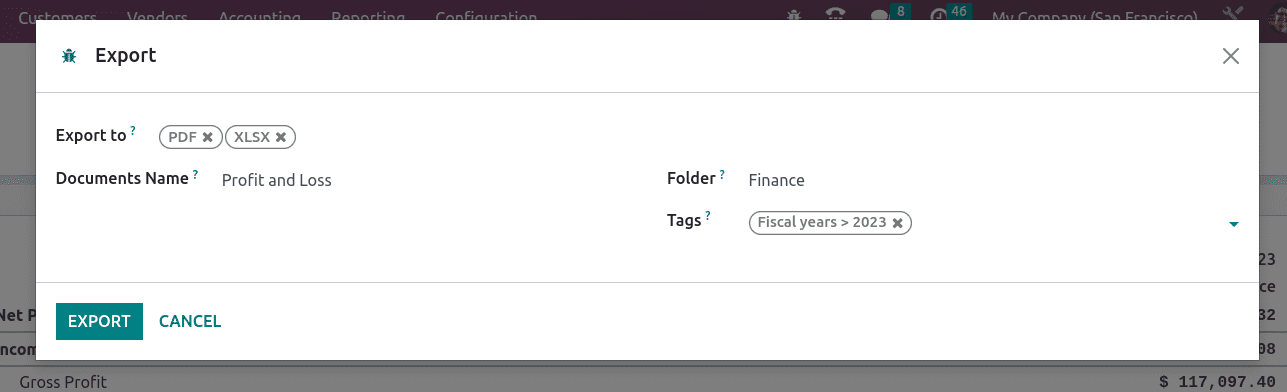

Next comes downloading the Profit and Loss Report in PDF and Excel format by clicking on the buttons PDF, and XLSX. The SAVE button allows you to save the Profit and Loss report in the Document module of Odoo itself, either in PDF or XLSX format. On clicking the SAVE button a pop up appears.

One can add the file format to export, the document's name, add in which workspace or folder this report is getting saved, and which tags need to apply to the document. Once hitting the EXPORT, the document gets saved in the Odoo 16 Documents module under the workspace ‘Finance’. Later this report can be shared among the other internal employees.

So this is how various financial activities hit your Profit and Loss Report in Odoo 16.