Controlling cash flow is one of the most important parts of running a company. You can clearly see how money comes into and goes out of your business with the cash flow statement in Odoo 18 Accounting, which may be fully automated with the right setup.

Cash Flow Statements in Odoo 18 Accounting

Odoo is renowned for its completely integrated accounting capabilities that are easy to use. The cash flow statement is one of the improved financial reporting features in Odoo 18.

Viewing the Cash Flow Statement

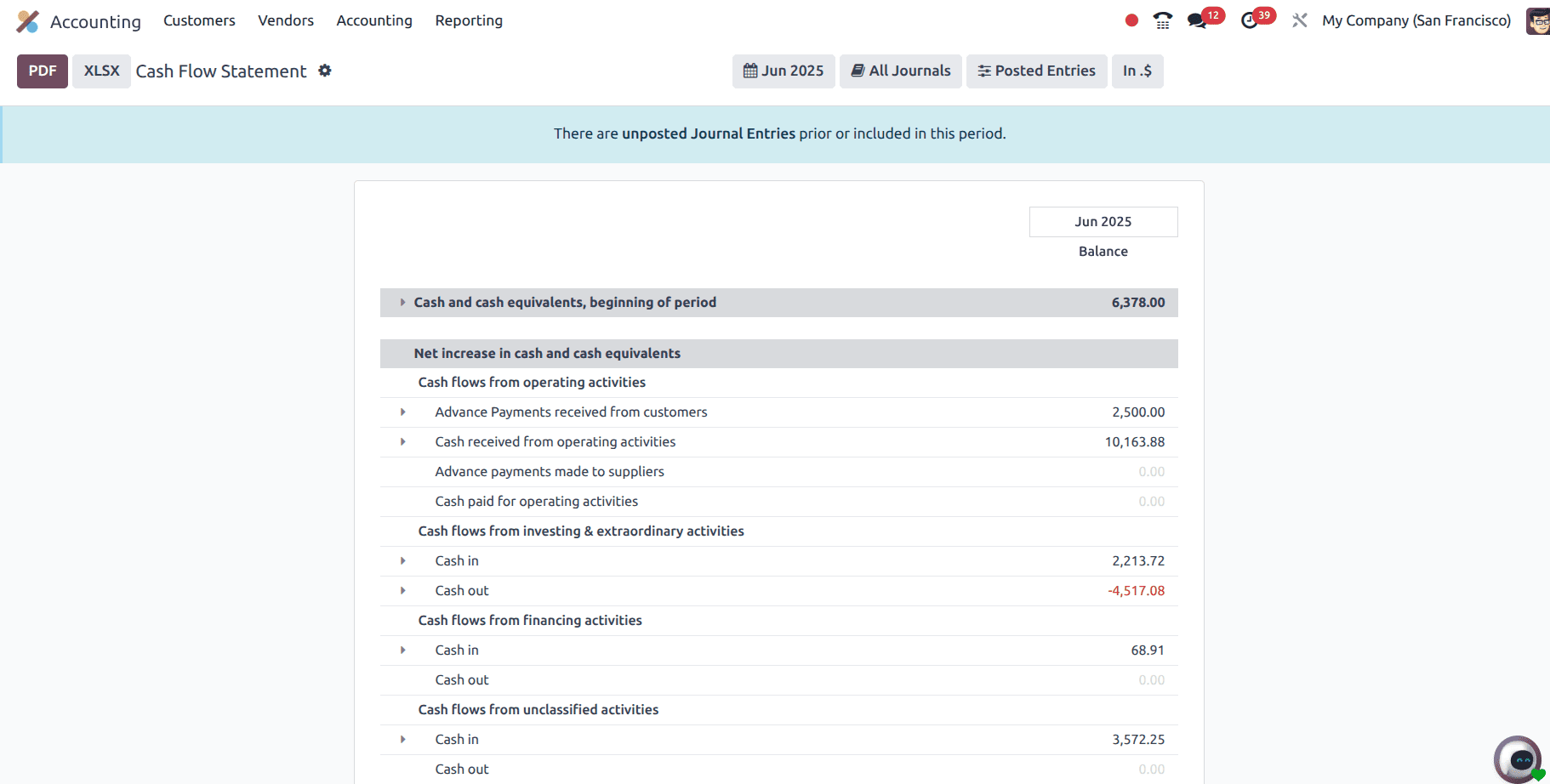

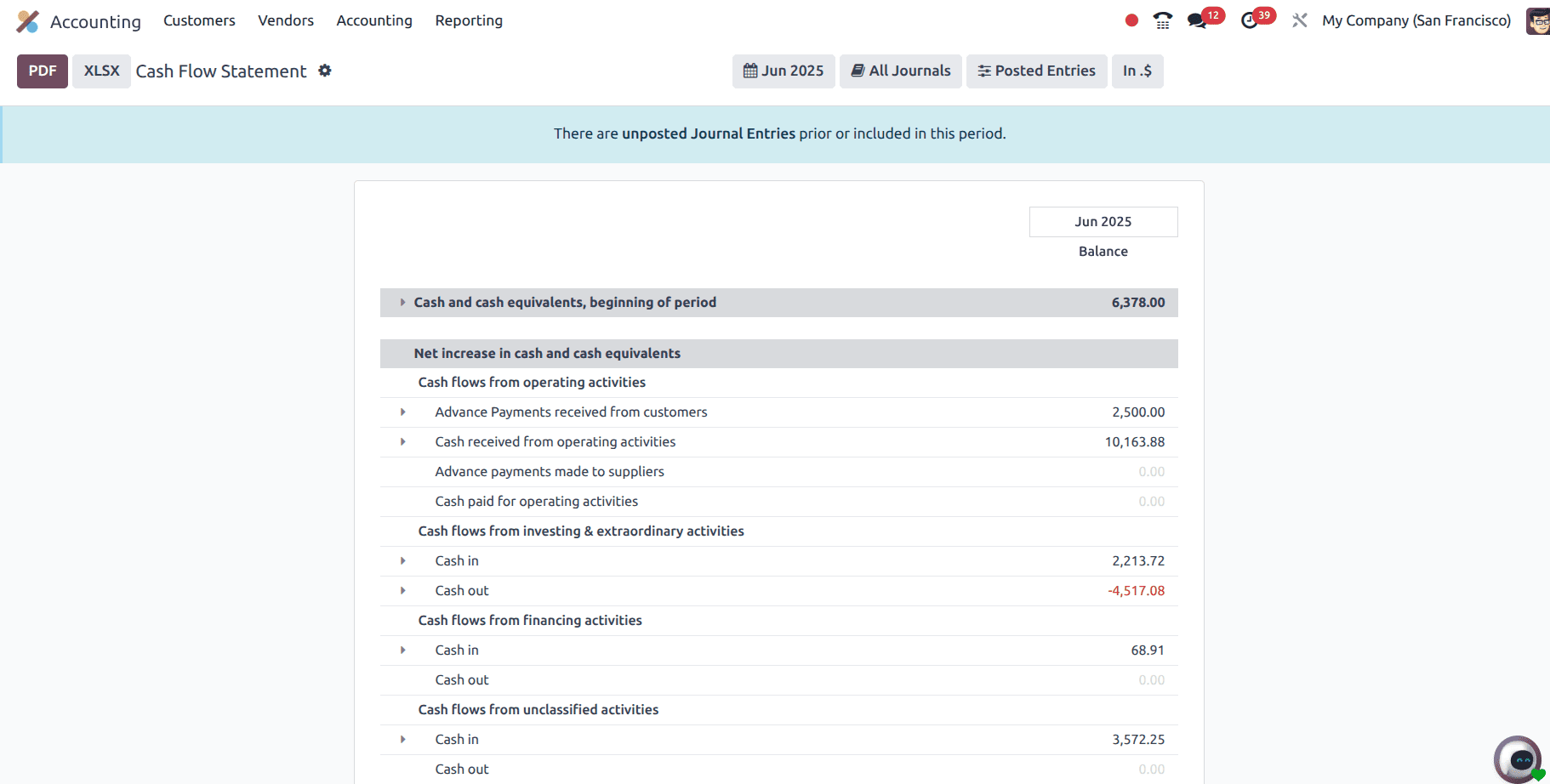

When you open the cash flow statement in Odoo 18 (Accounting > Reporting > Cash Flow Statement), you’ll see a breakdown like this:

This report is organized into:

- Opening Balance: Cash and cash equivalents at the start of the period (e.g., bank balance).

- Operating Activities: Cash flows related to daily operations — customer payments, supplier payments, etc.

- Investing and Extraordinary Activities: Such as buying assets and making money off of currency fluctuations.

- Closing Balance: The final cash position for the period.

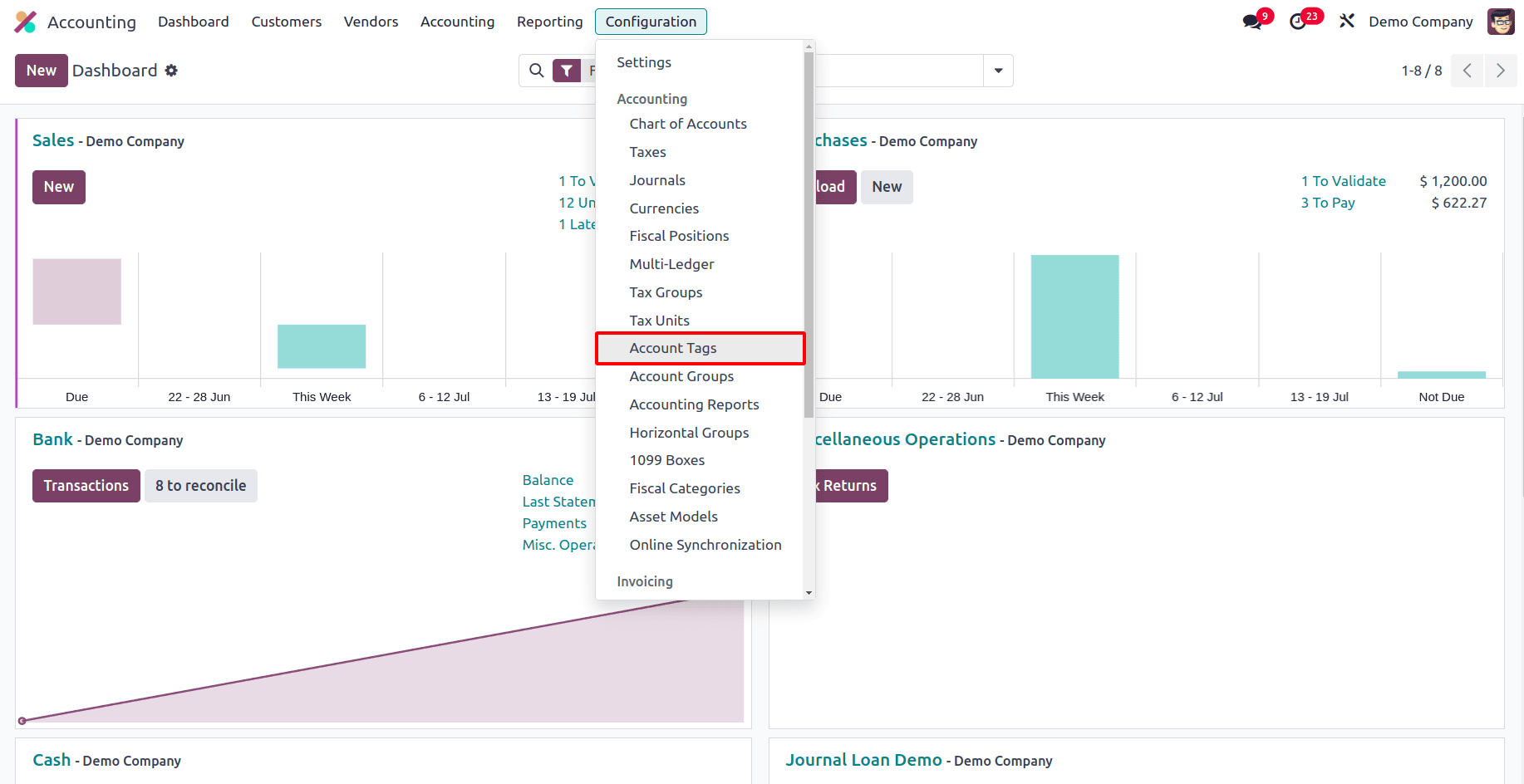

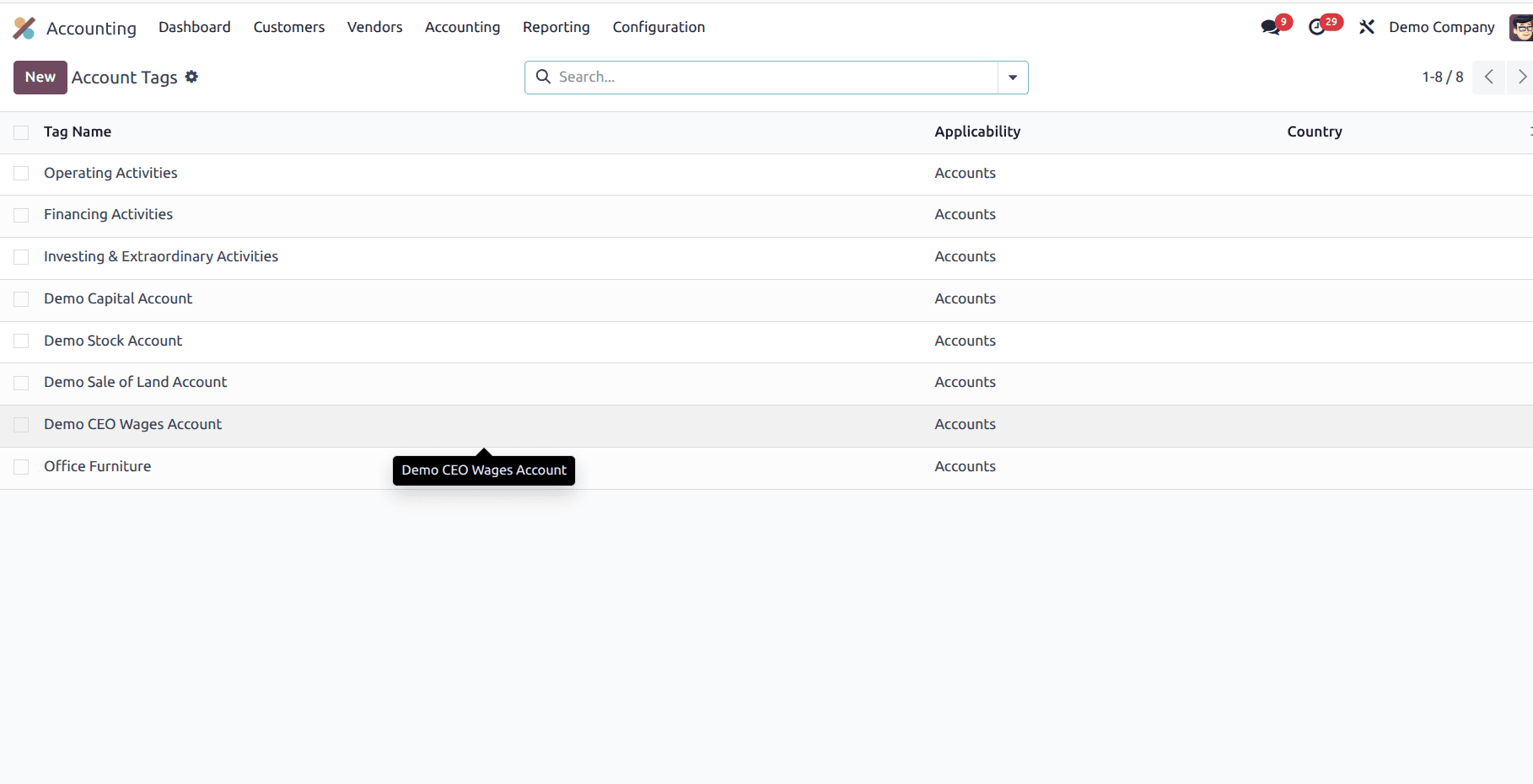

What are Account Tags and Their Role?

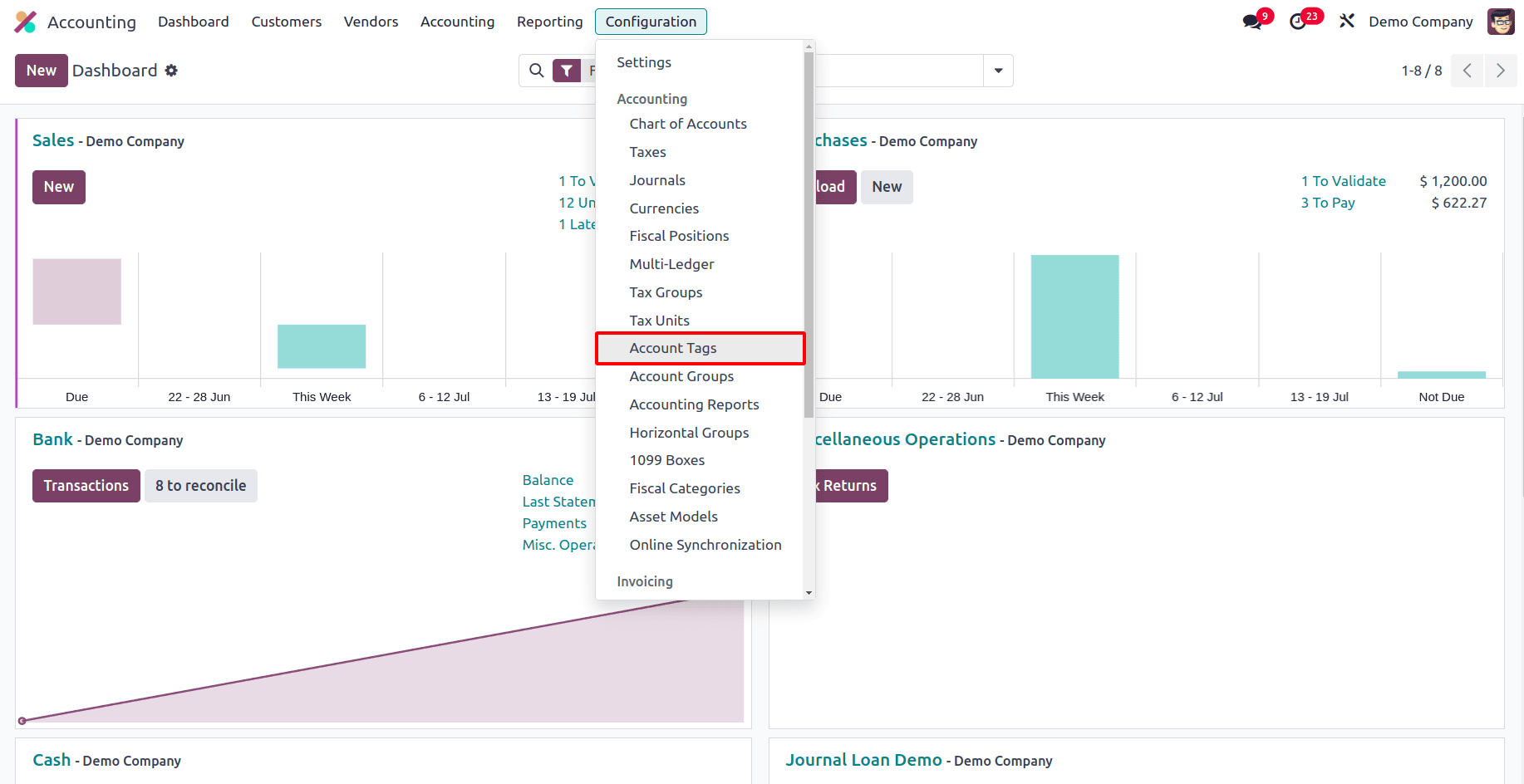

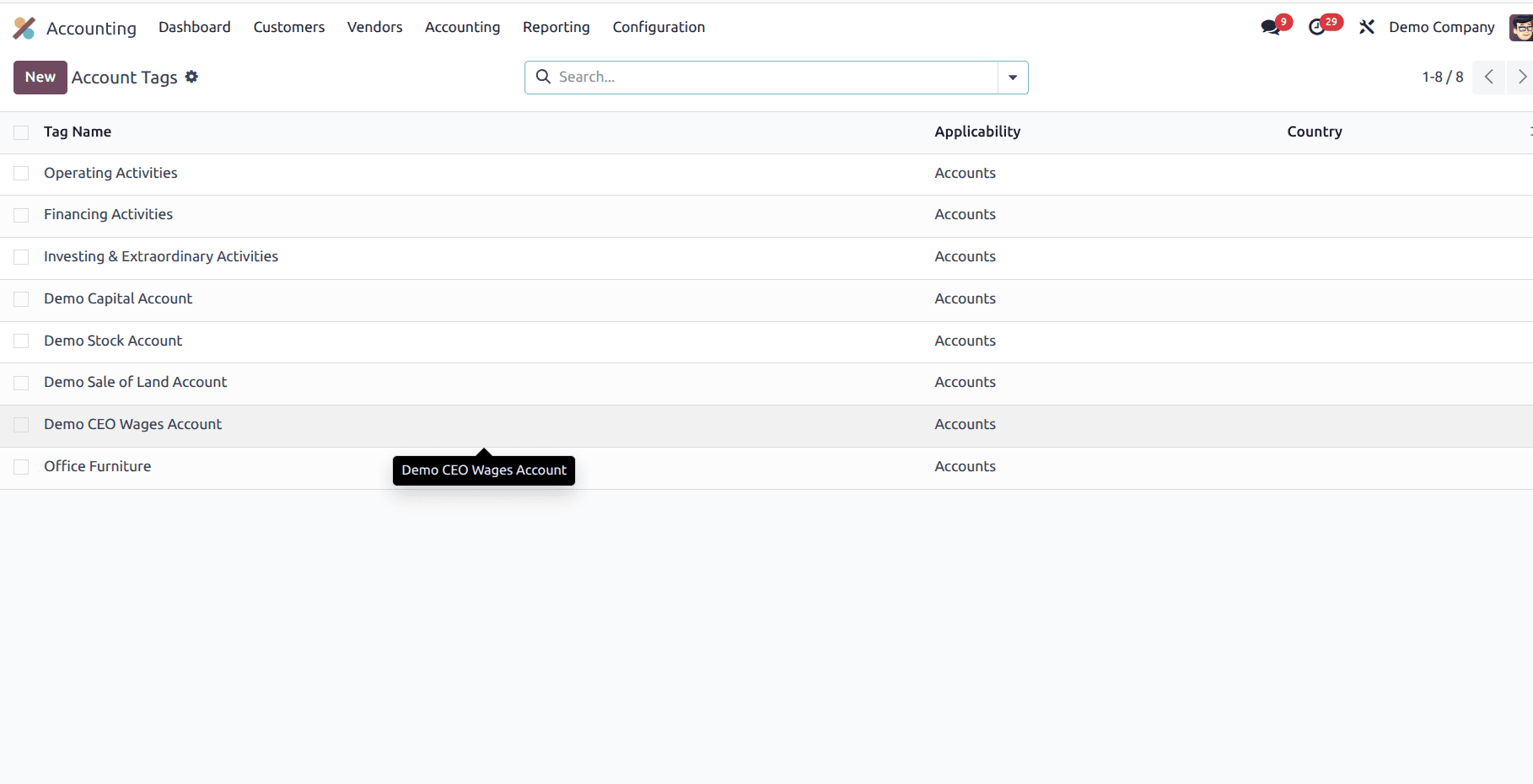

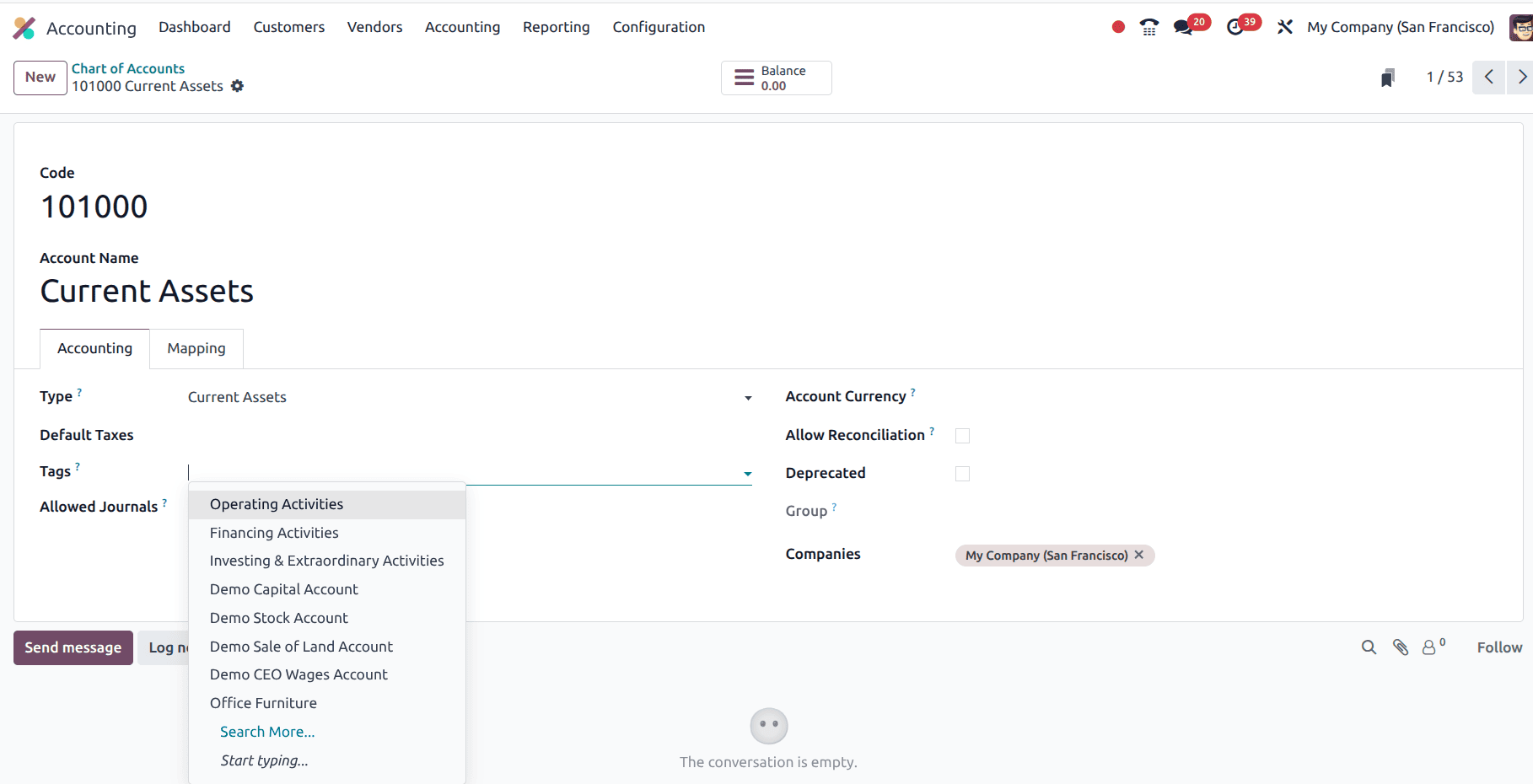

In Odoo 18, Account Tags are mainly used to categorize the transactions in the cash flow statement.

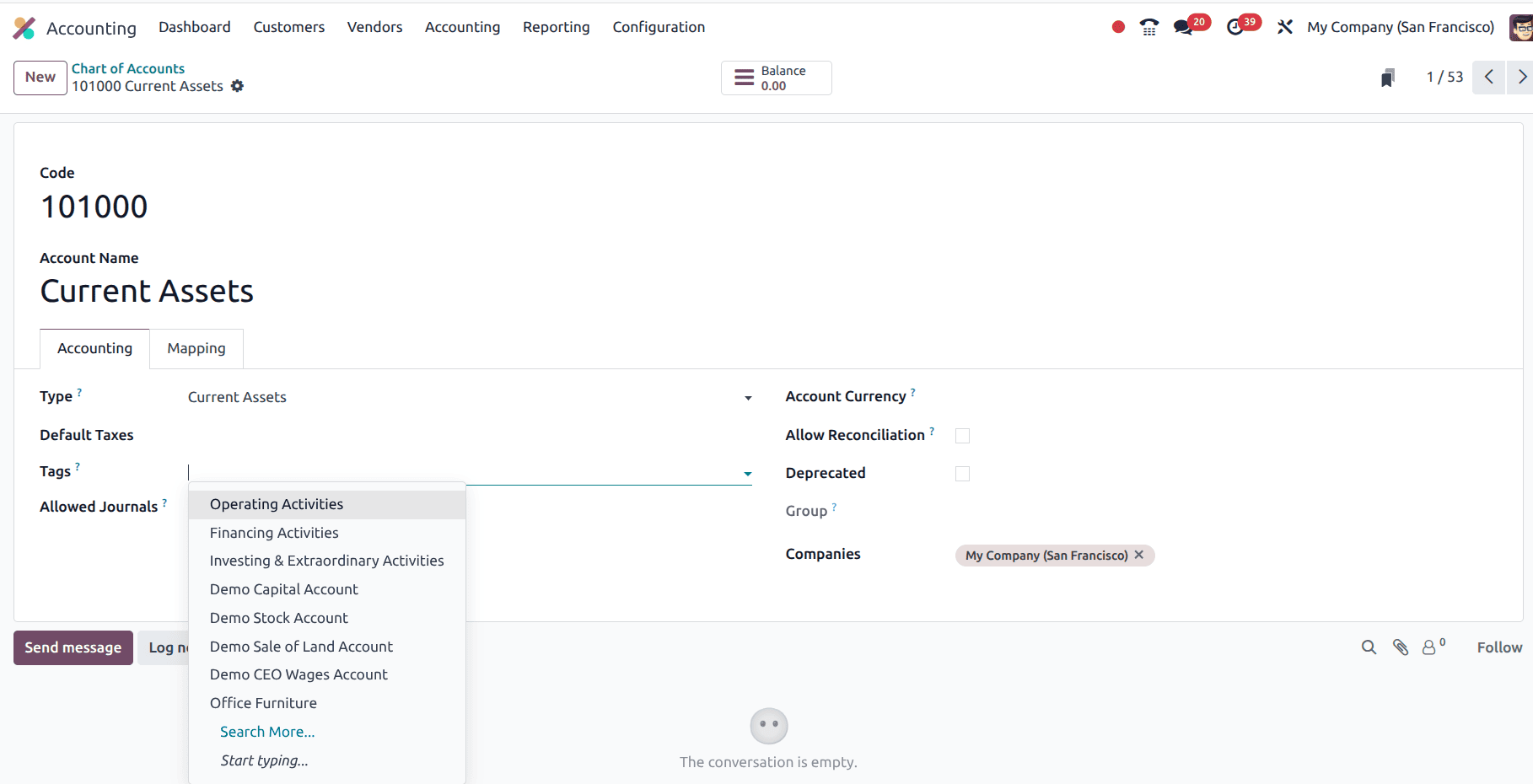

When you create or edit an account under the Chart of Accounts, you can assign Tags (like Operating, Investing, Financing).

This tells Odoo where to include amounts in the cash flow statement:

- Operating: Day-to-day cash flows (e.g., sales income, supplier expenses)

- Investing: Purchases or sales of assets

- Financing: Loans, capital injections, dividends paid

Without correct tags, your transactions might be missing from the right section, causing an inaccurate cash flow statement.

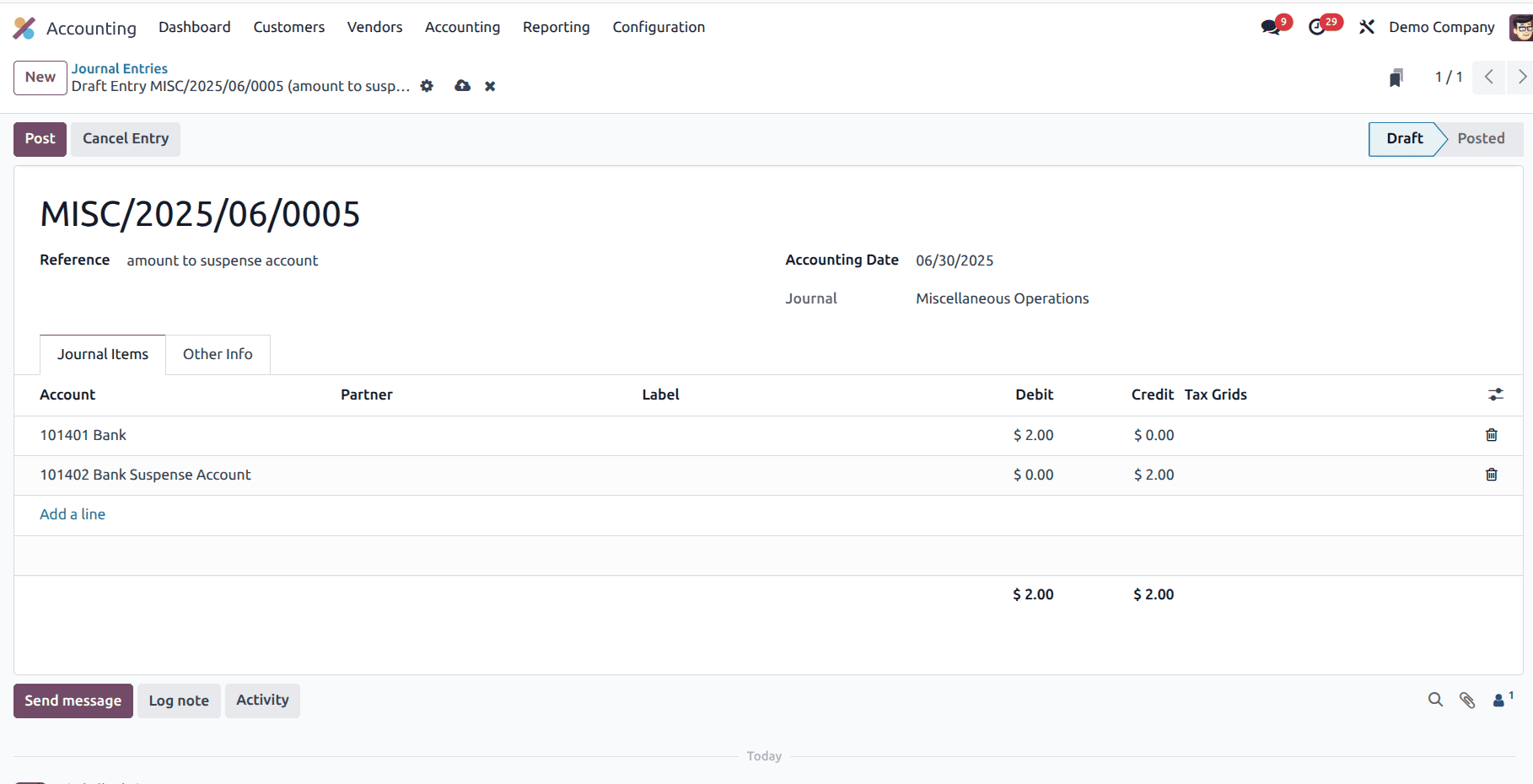

Posting a Journal Entry

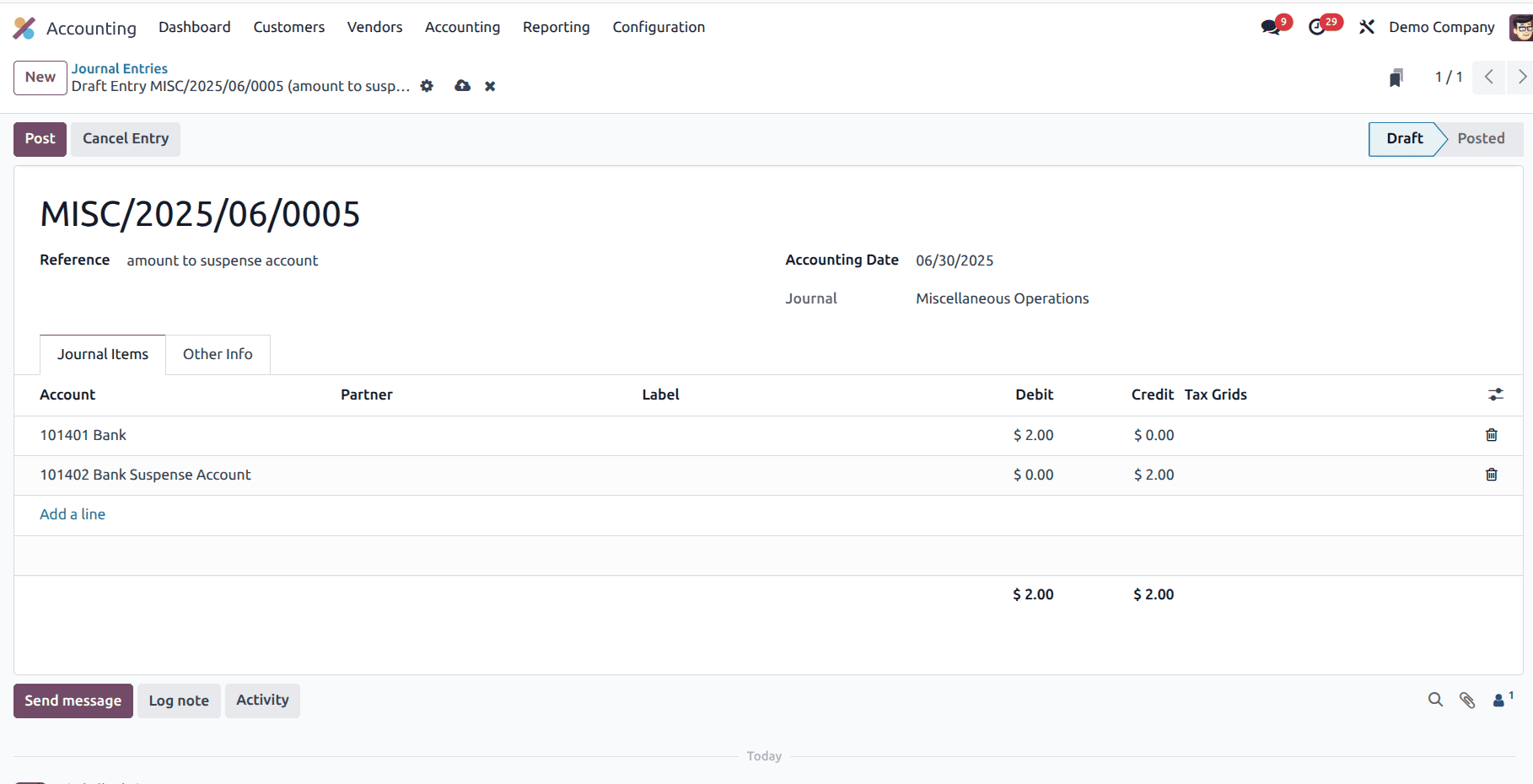

Create a Journal Entry

Go to the Accounting Module > Accounting > Journal Entries > Create.

- Add your bank account 101401 bank.

- Add a suspense account.

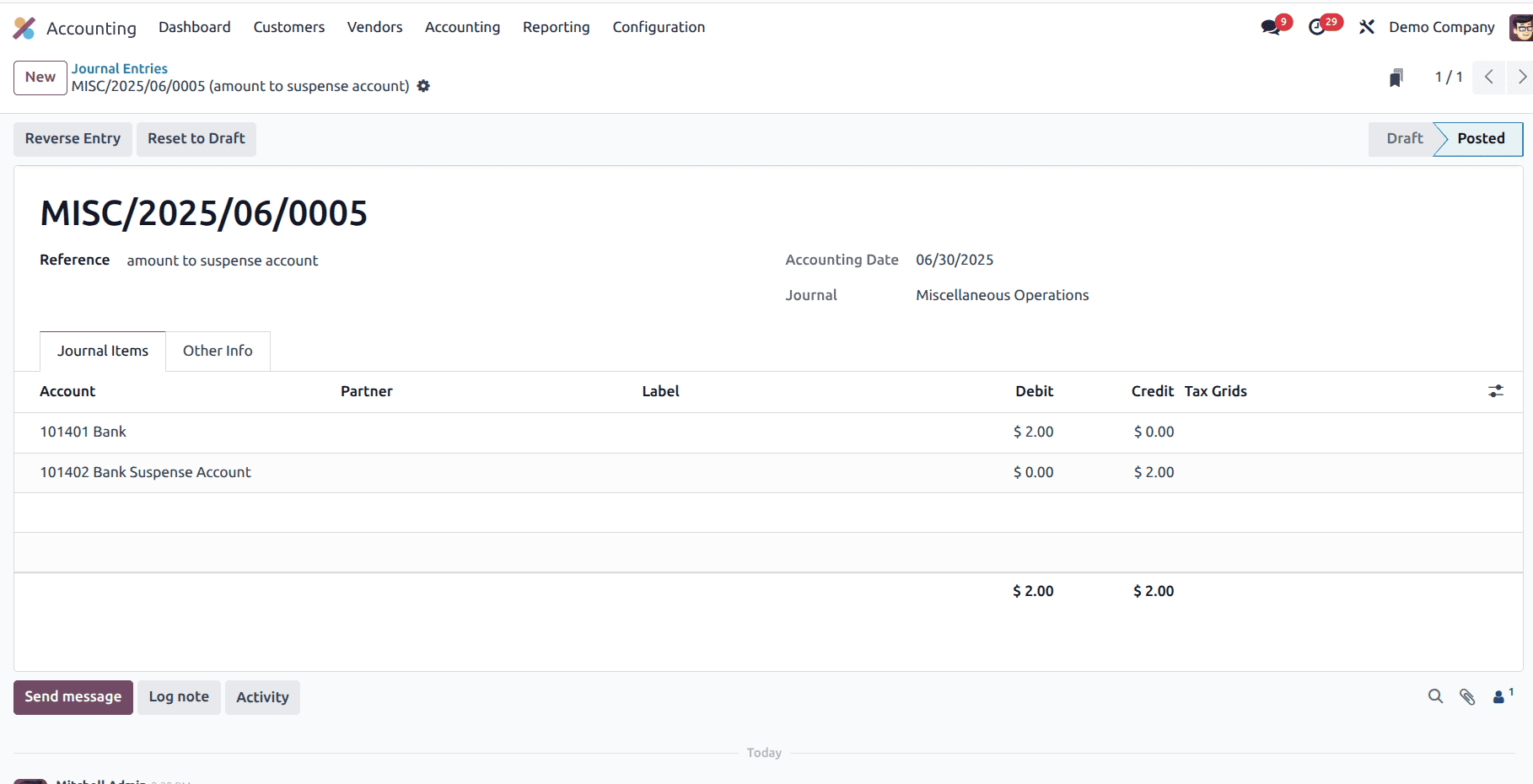

Once you confirm the details, click Post. This moves the entry from draft to posted status, meaning it’s included in reports.

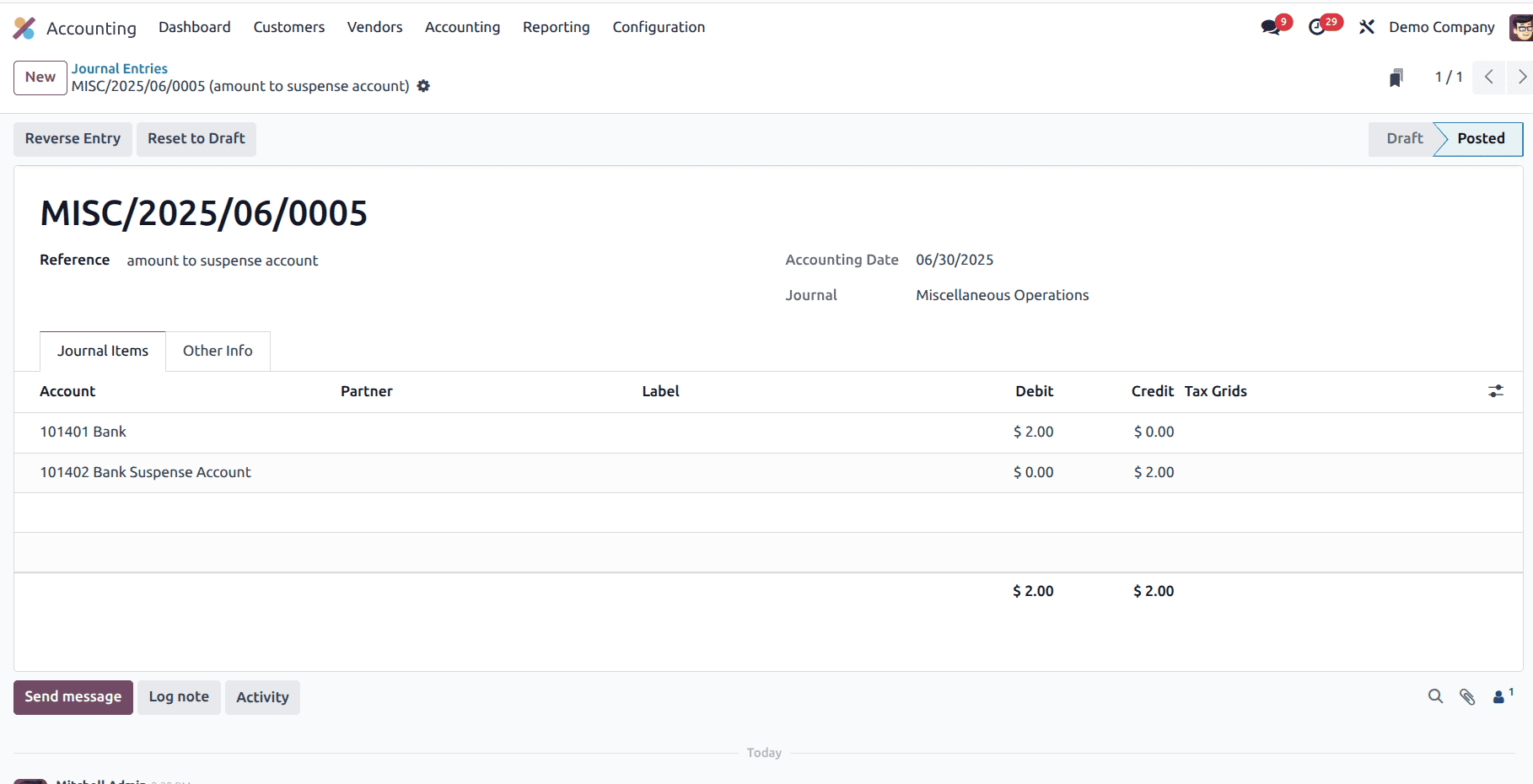

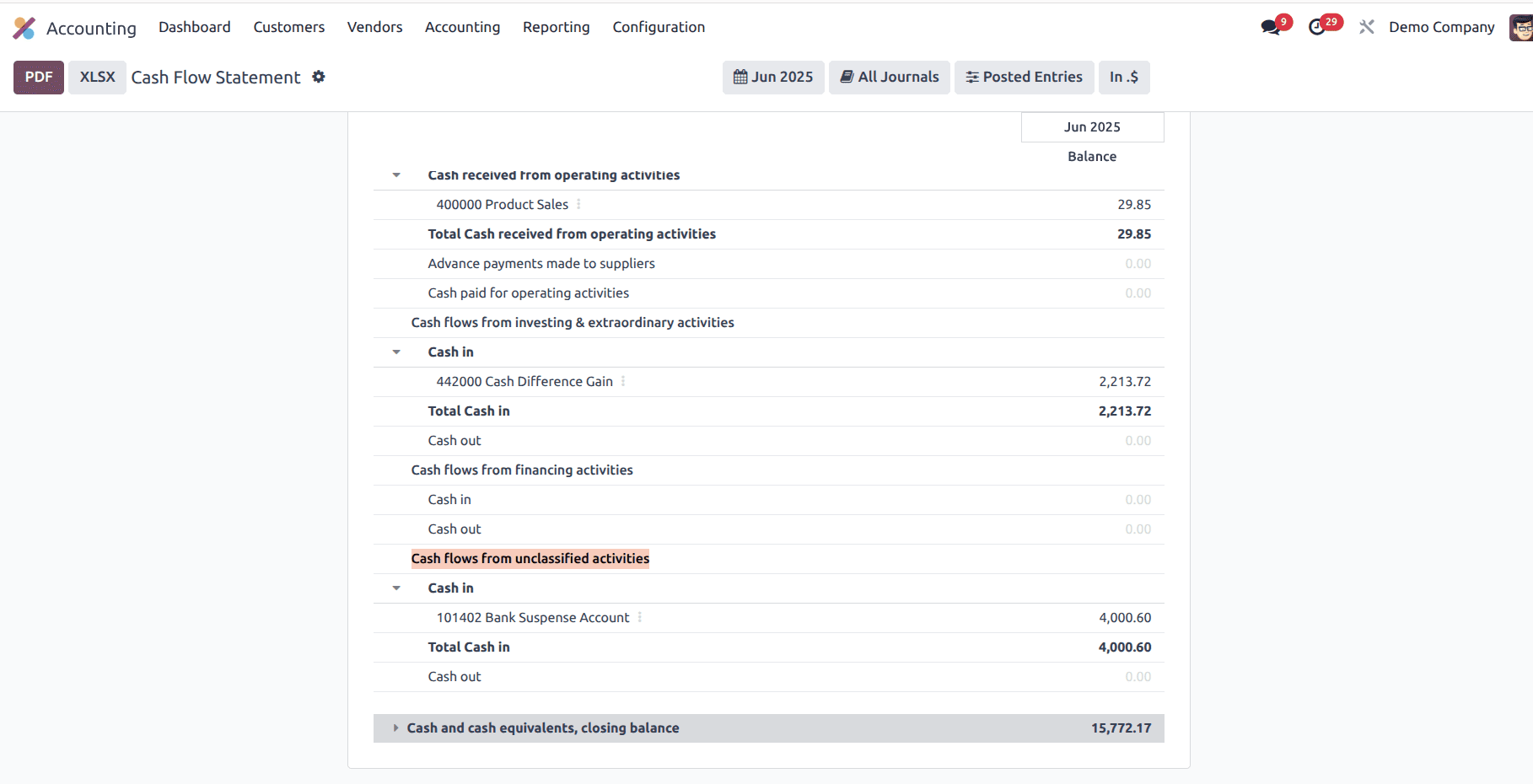

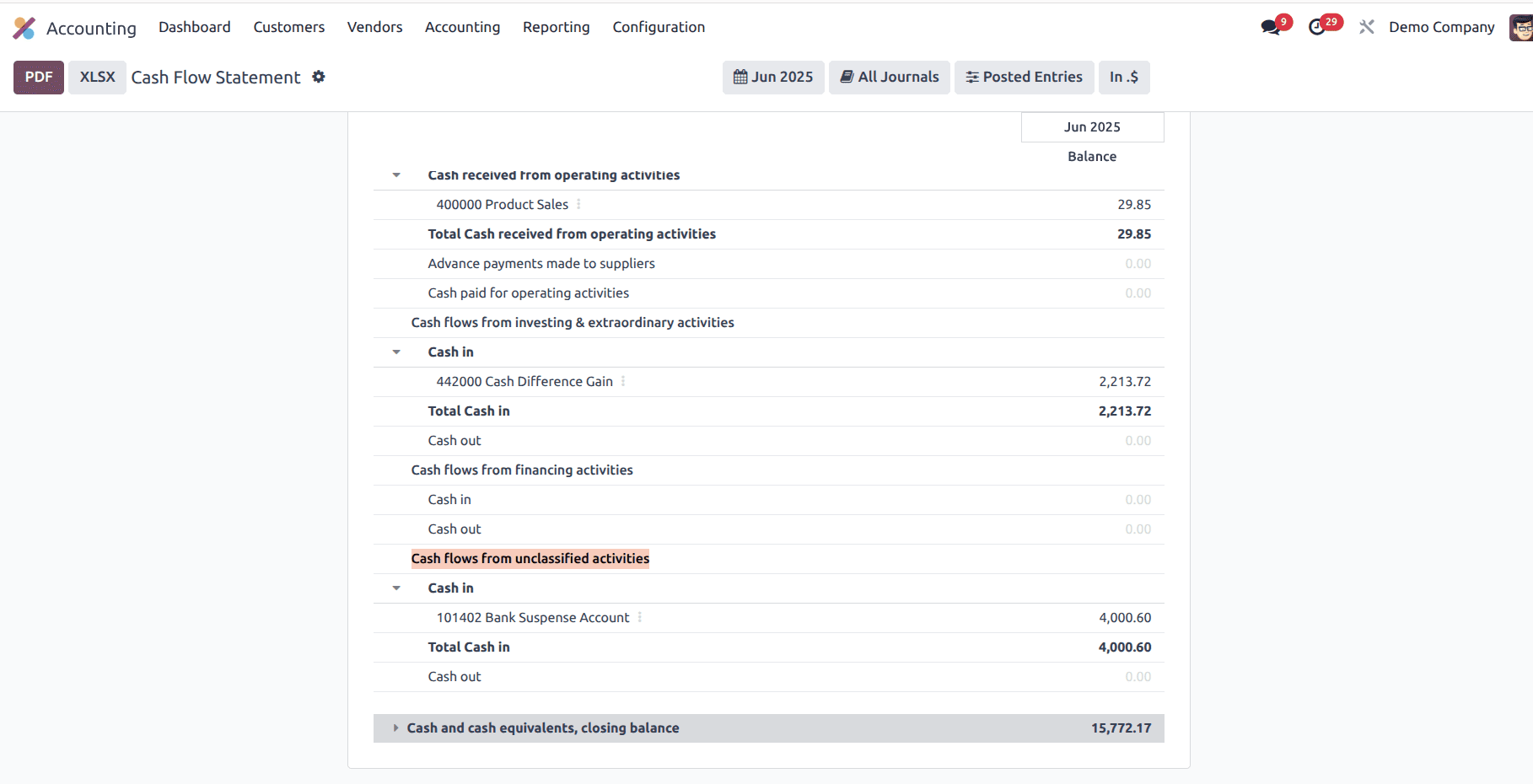

Recheck the Cash Flow Statement

Now, go back to Reporting > Cash Flow Statement for the same period.

You should see that: The Cash flow from the unclassified activities section now reflects your new supplier payment.

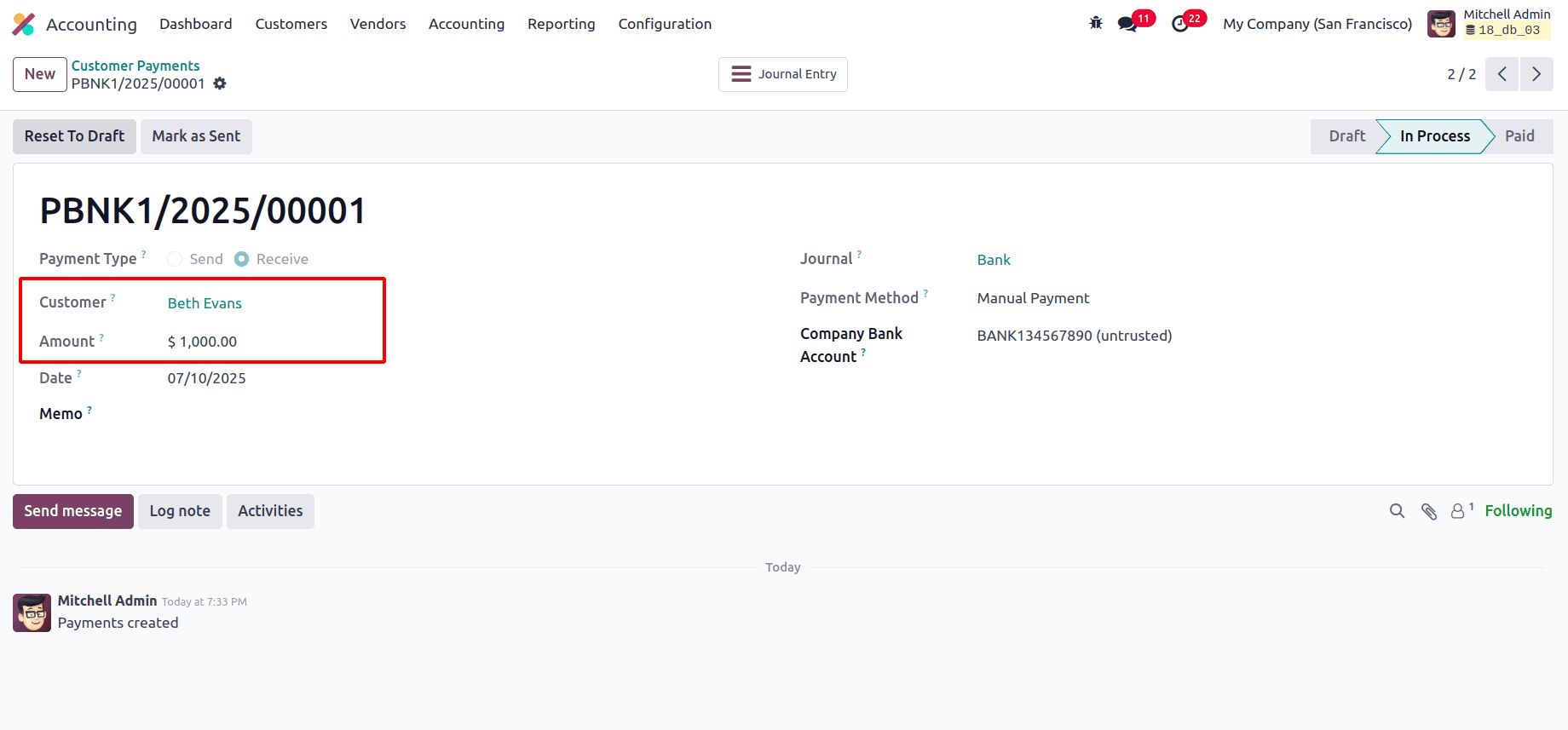

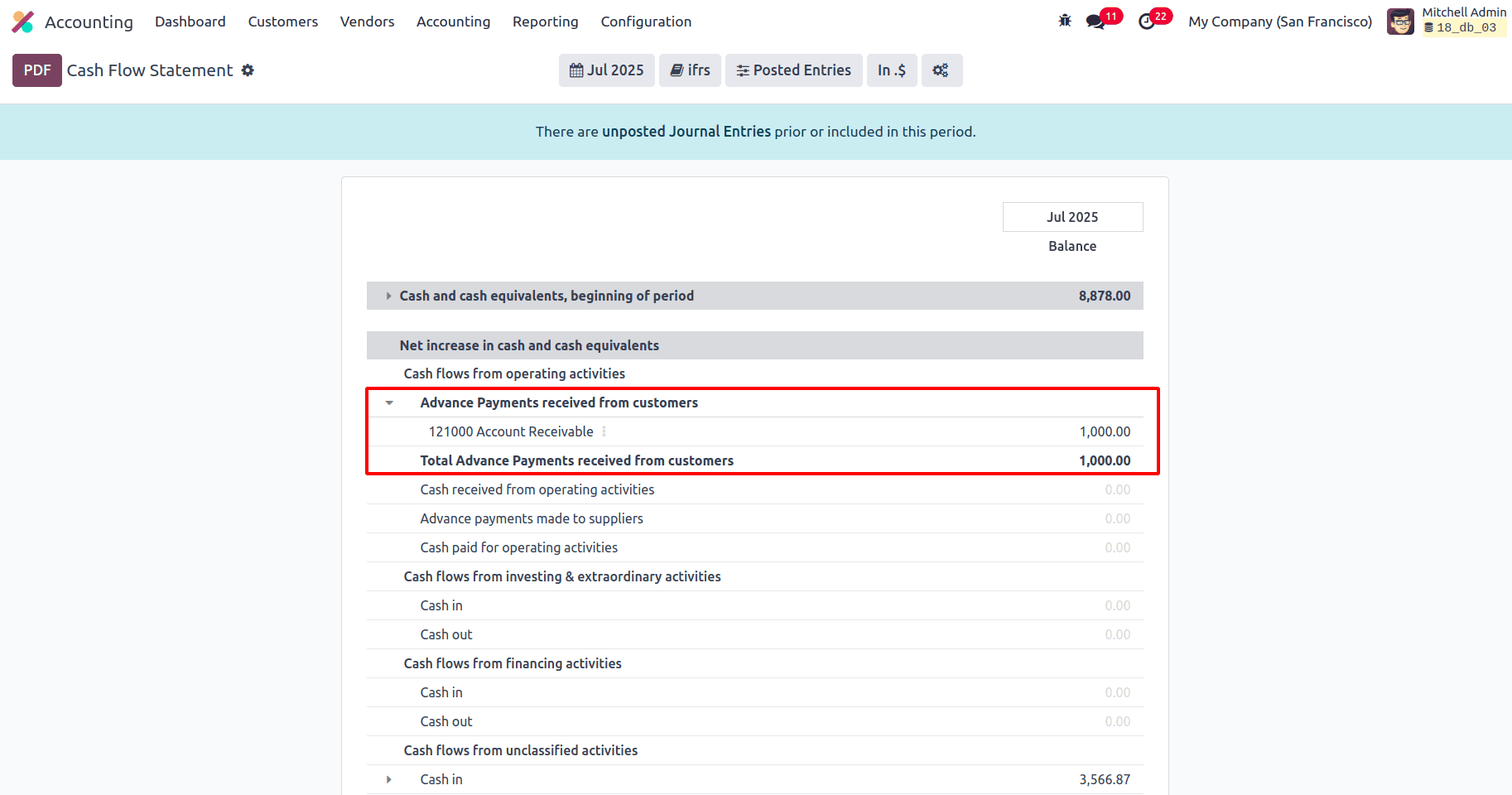

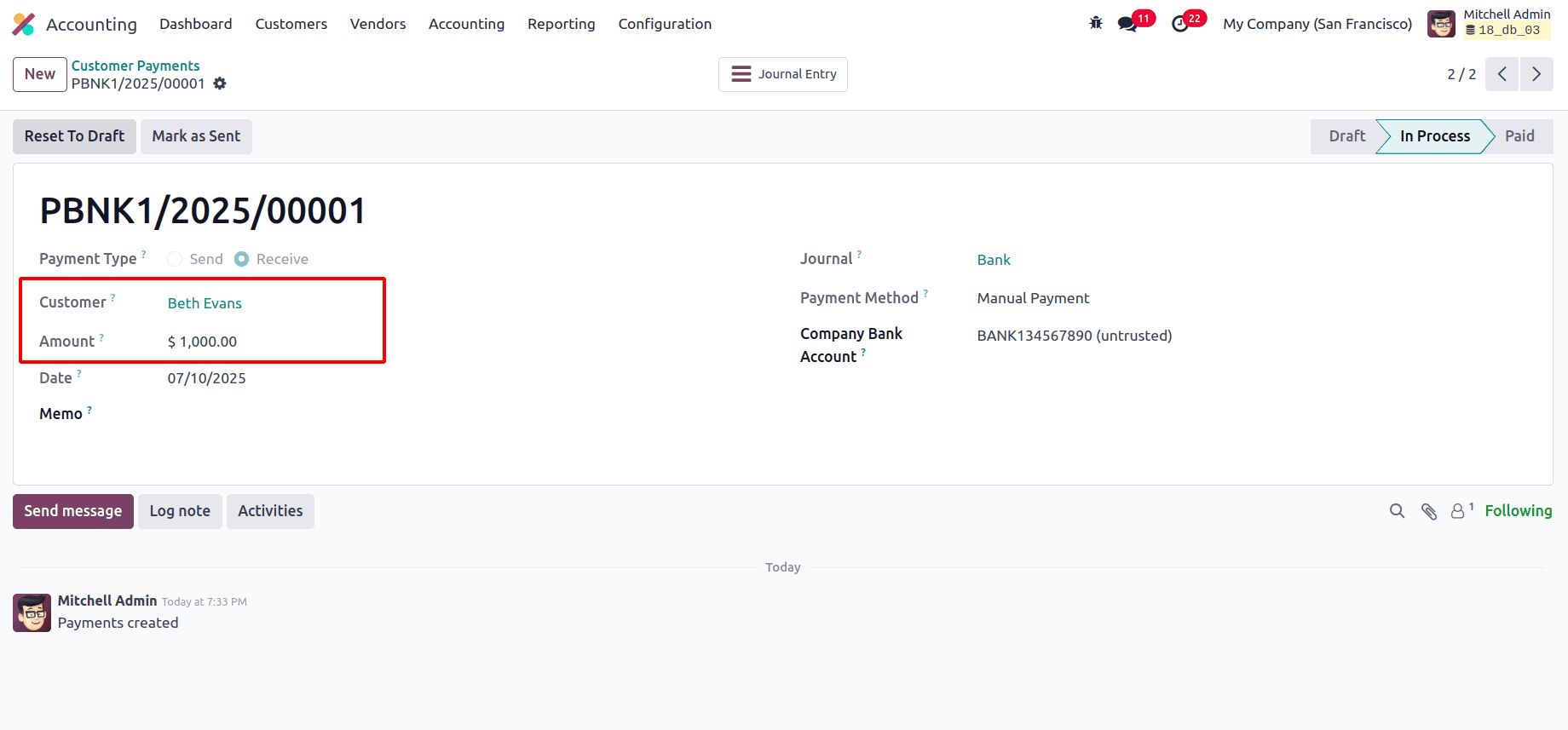

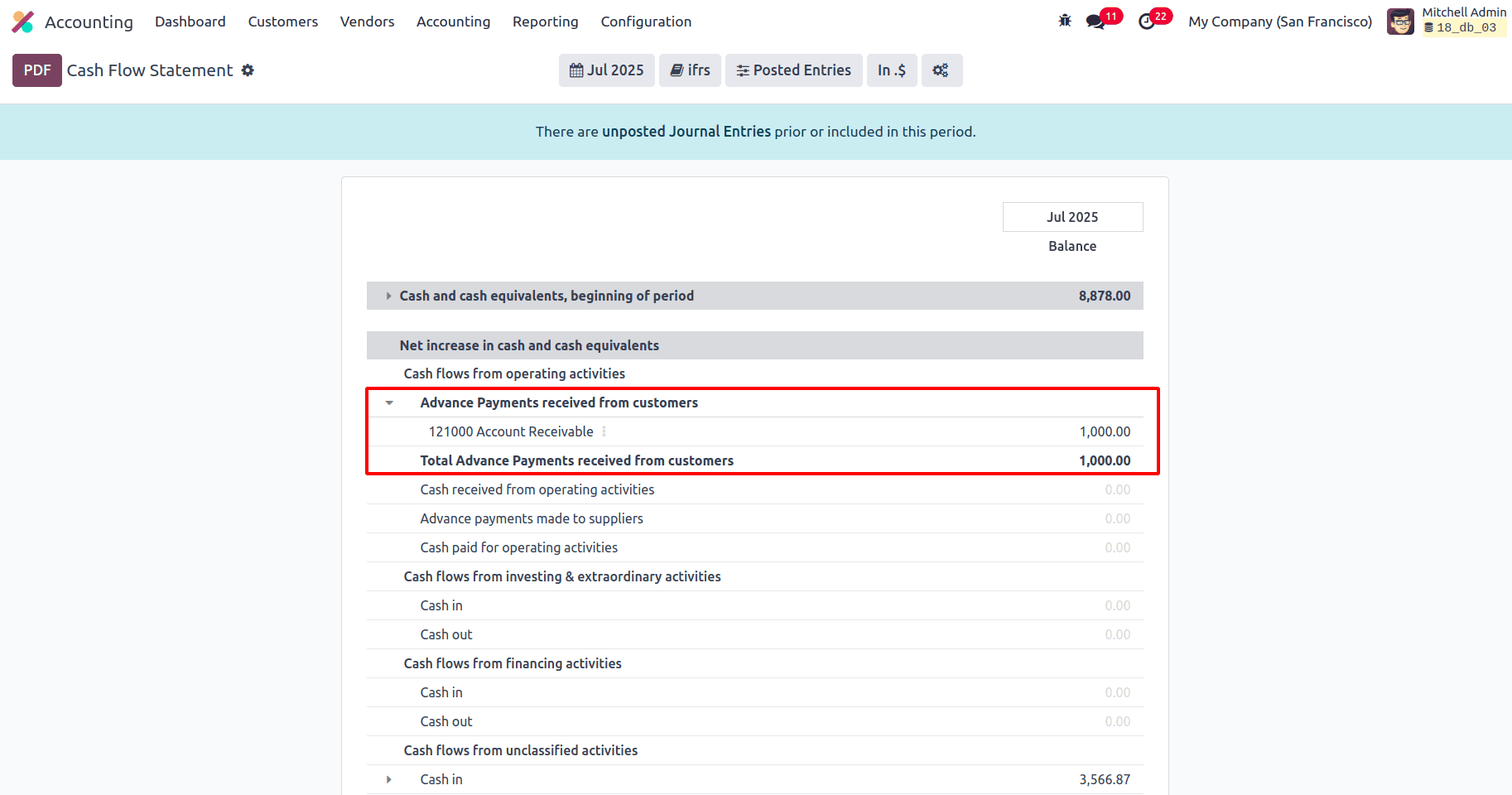

Also, when a customer pays an advance amount, it will be marked in the Cash Flow Statement under the Advance Payments received from customers. Let's say a customer, Beth Evans, has paid $ 1000 as an advance payment.

The advance amount paid by the customer will be recorded under 'Advance Payments Received from Customers'.

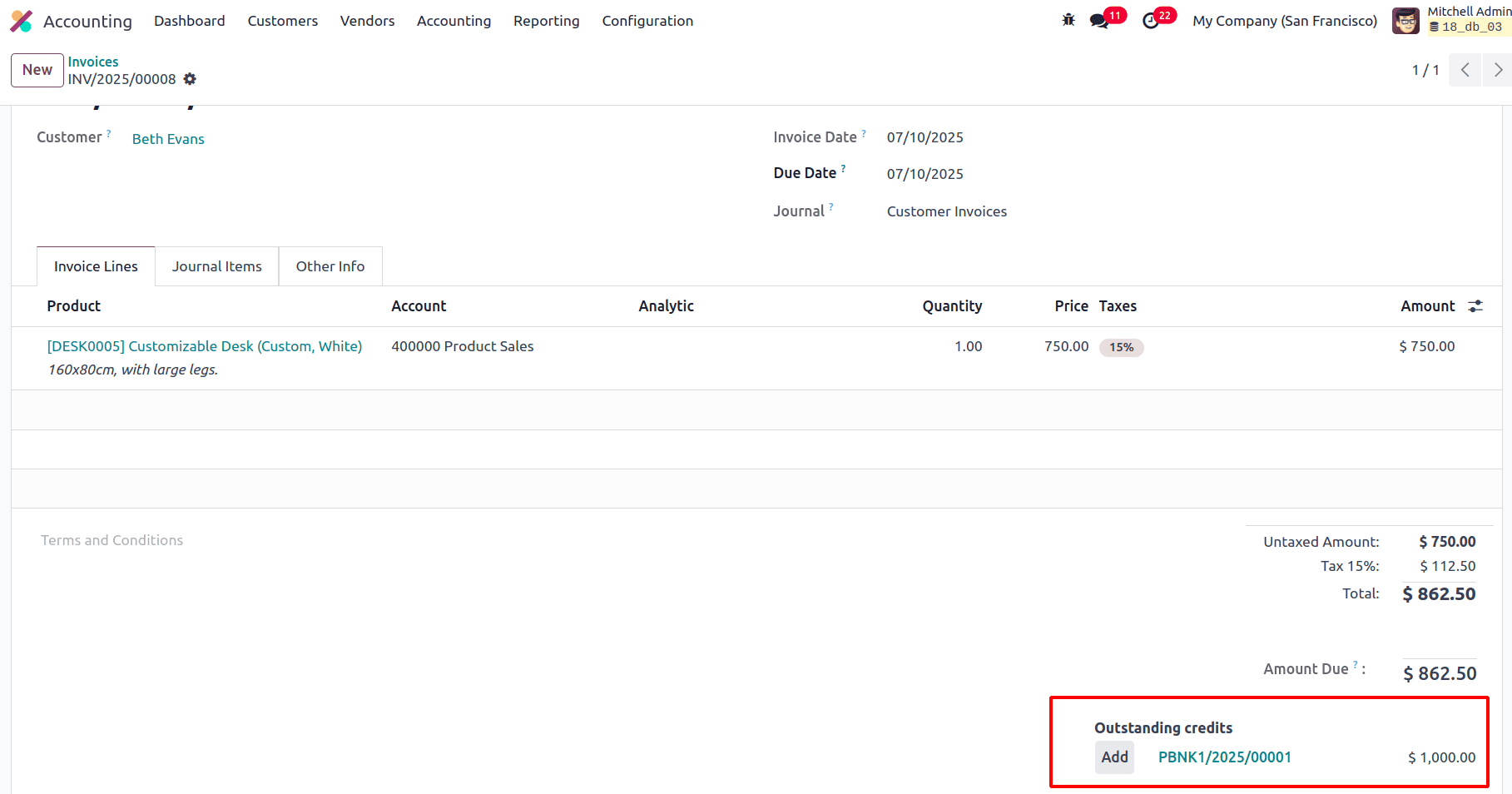

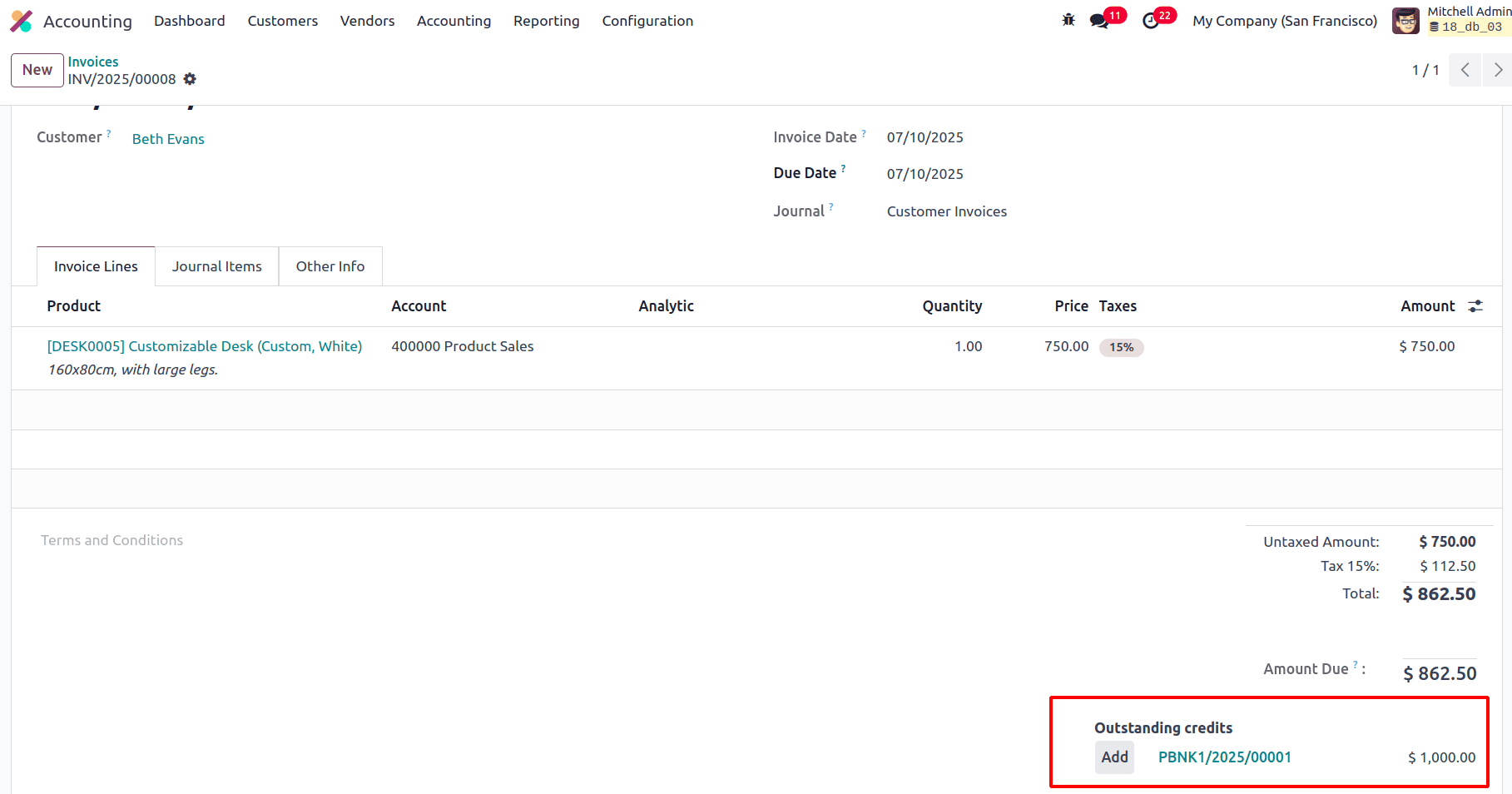

If a customer invoice is later generated with a payment amount of $ 500, the previously received advance payment will appear as an outstanding credit. You can apply this credit to the invoice by clicking the Add button, which will allocate the advance towards the invoice payment.

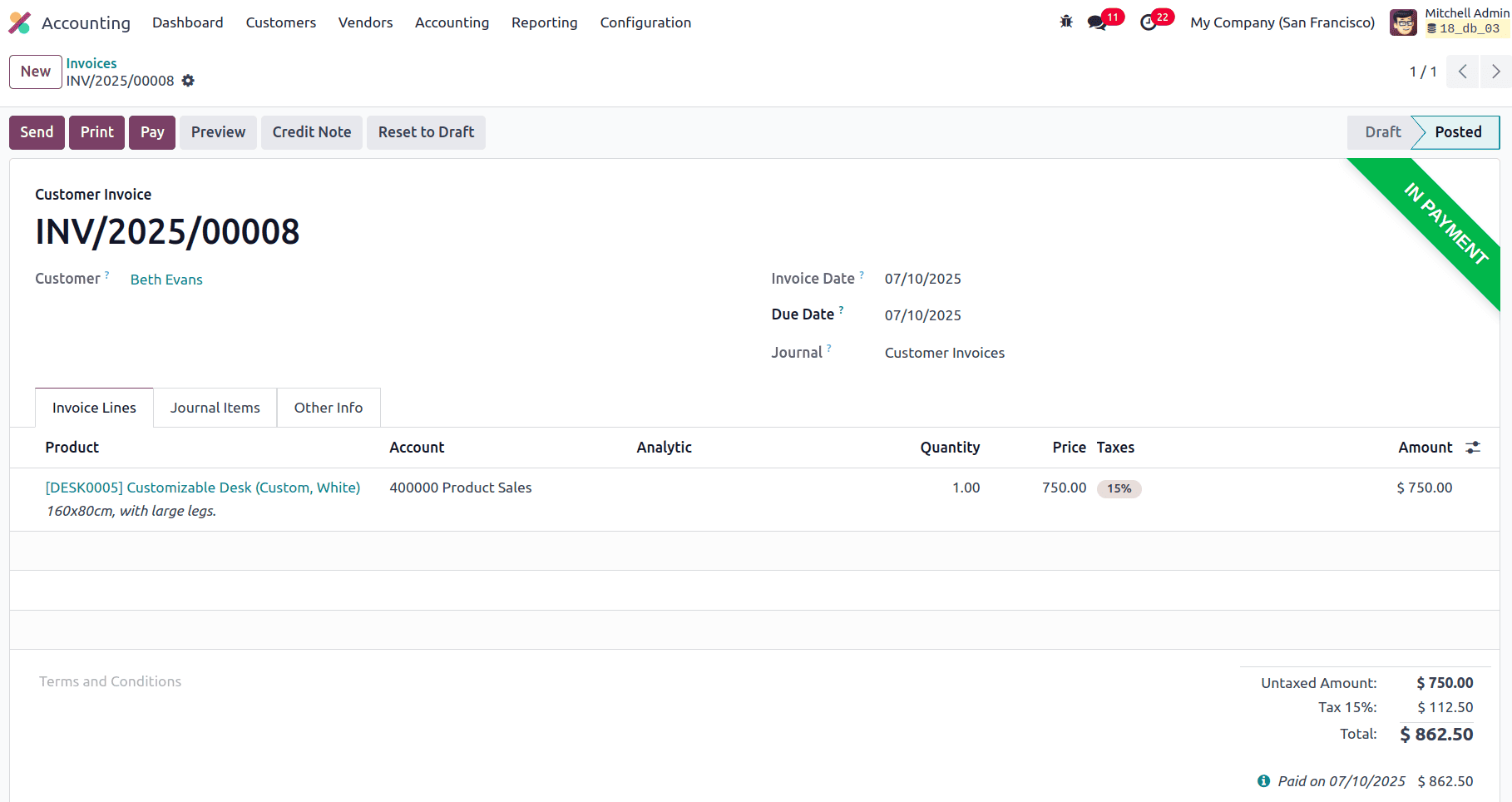

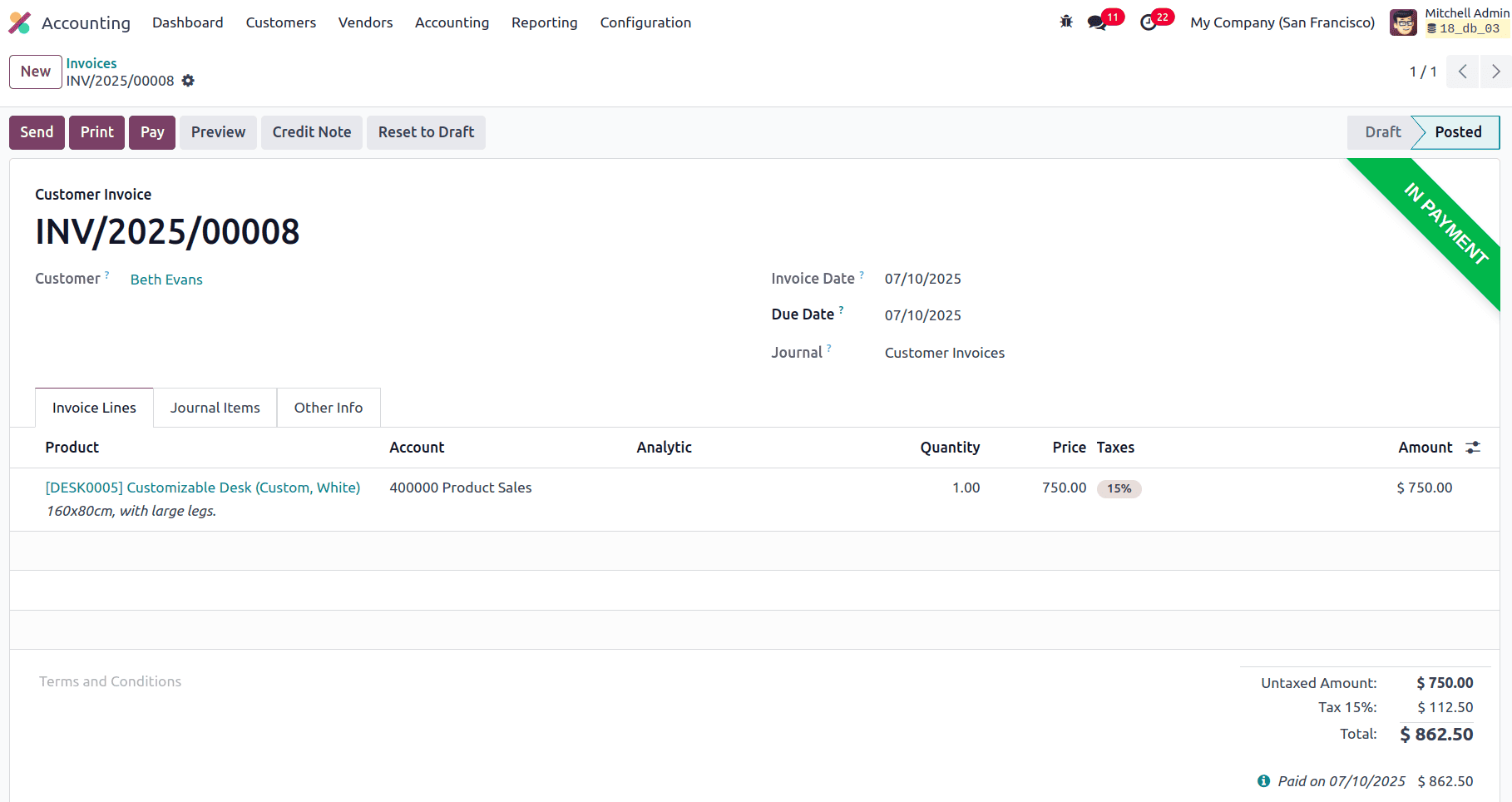

When it is added, the invoice will be in the In Payment state.

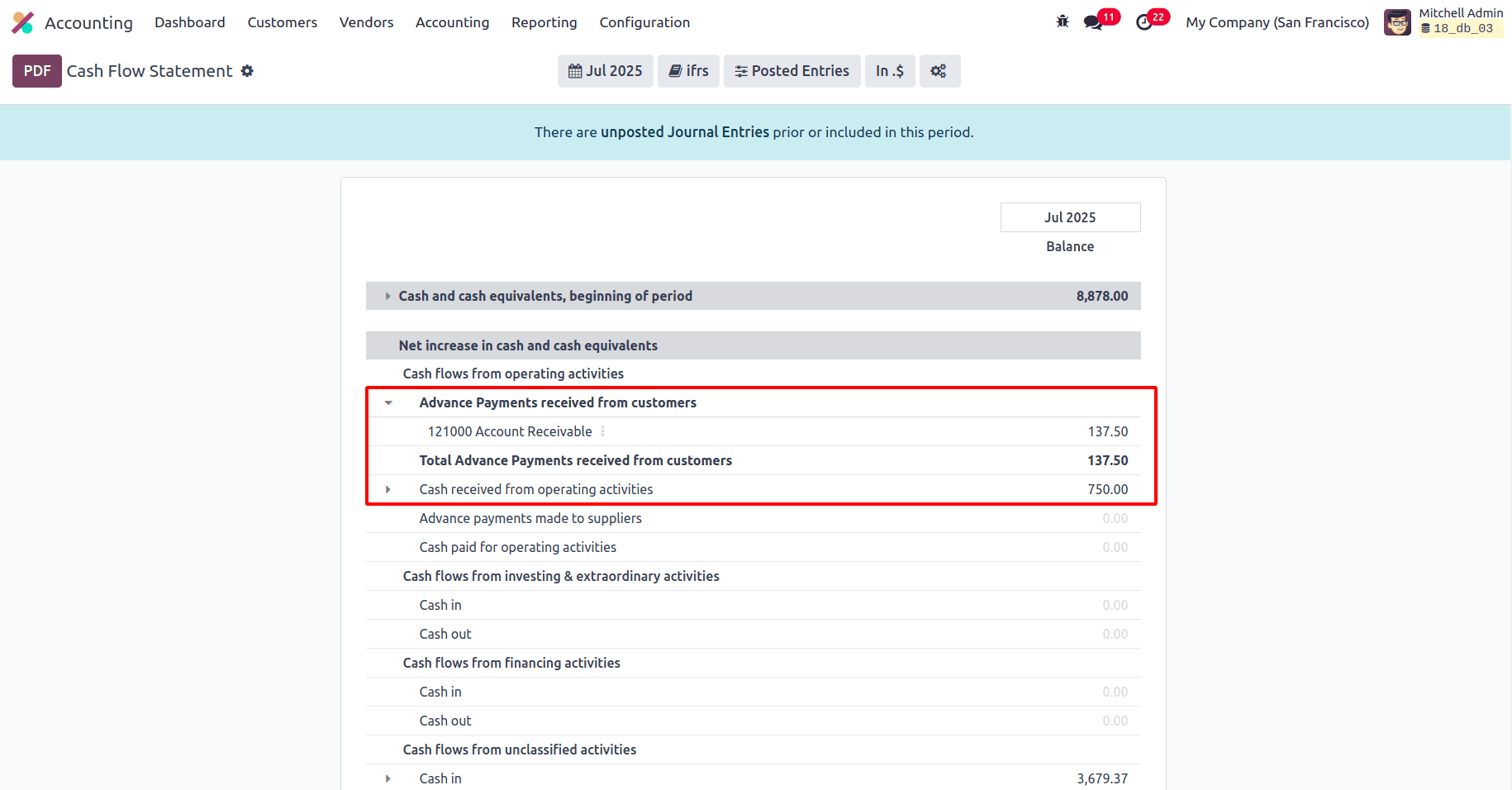

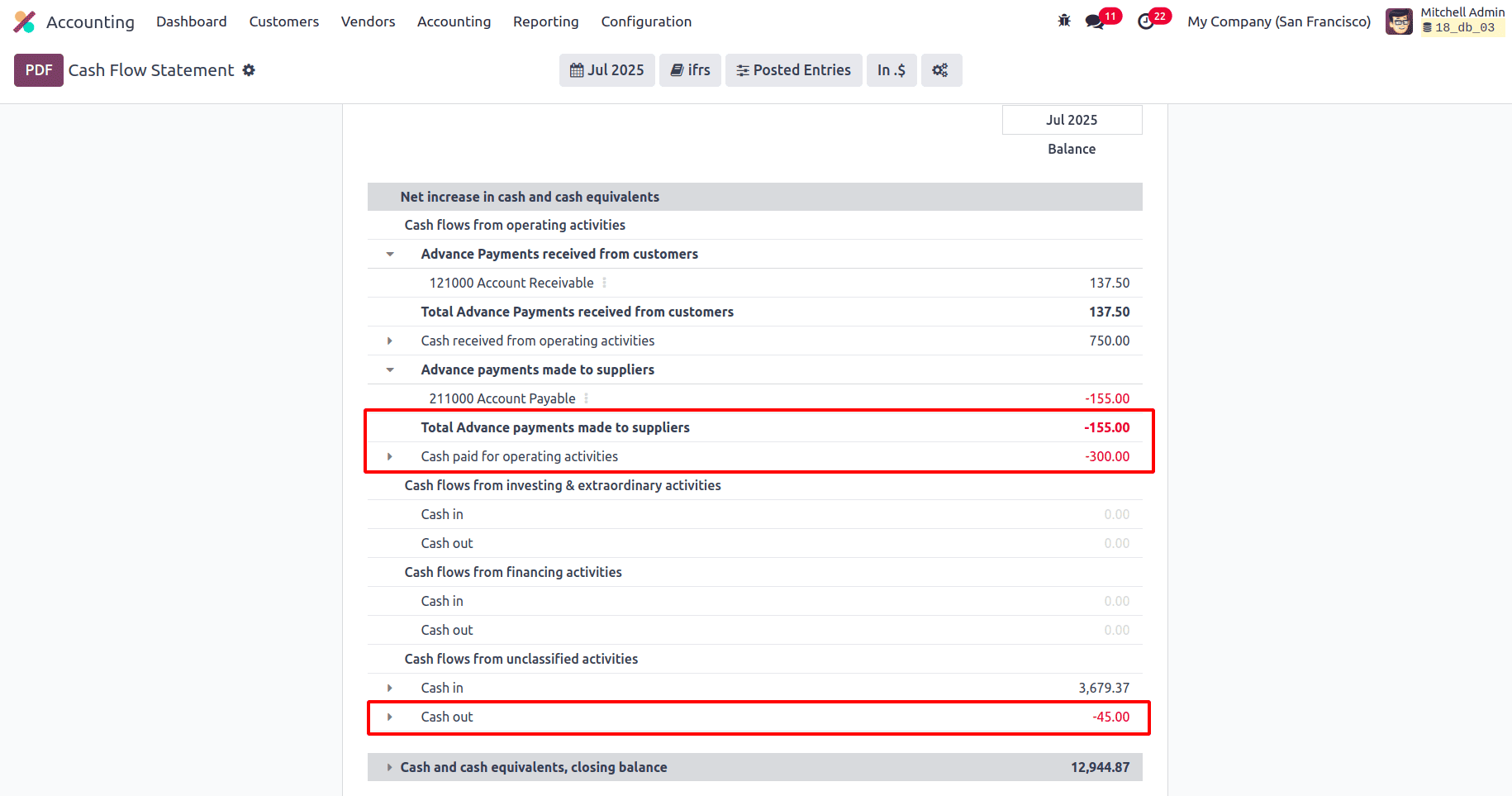

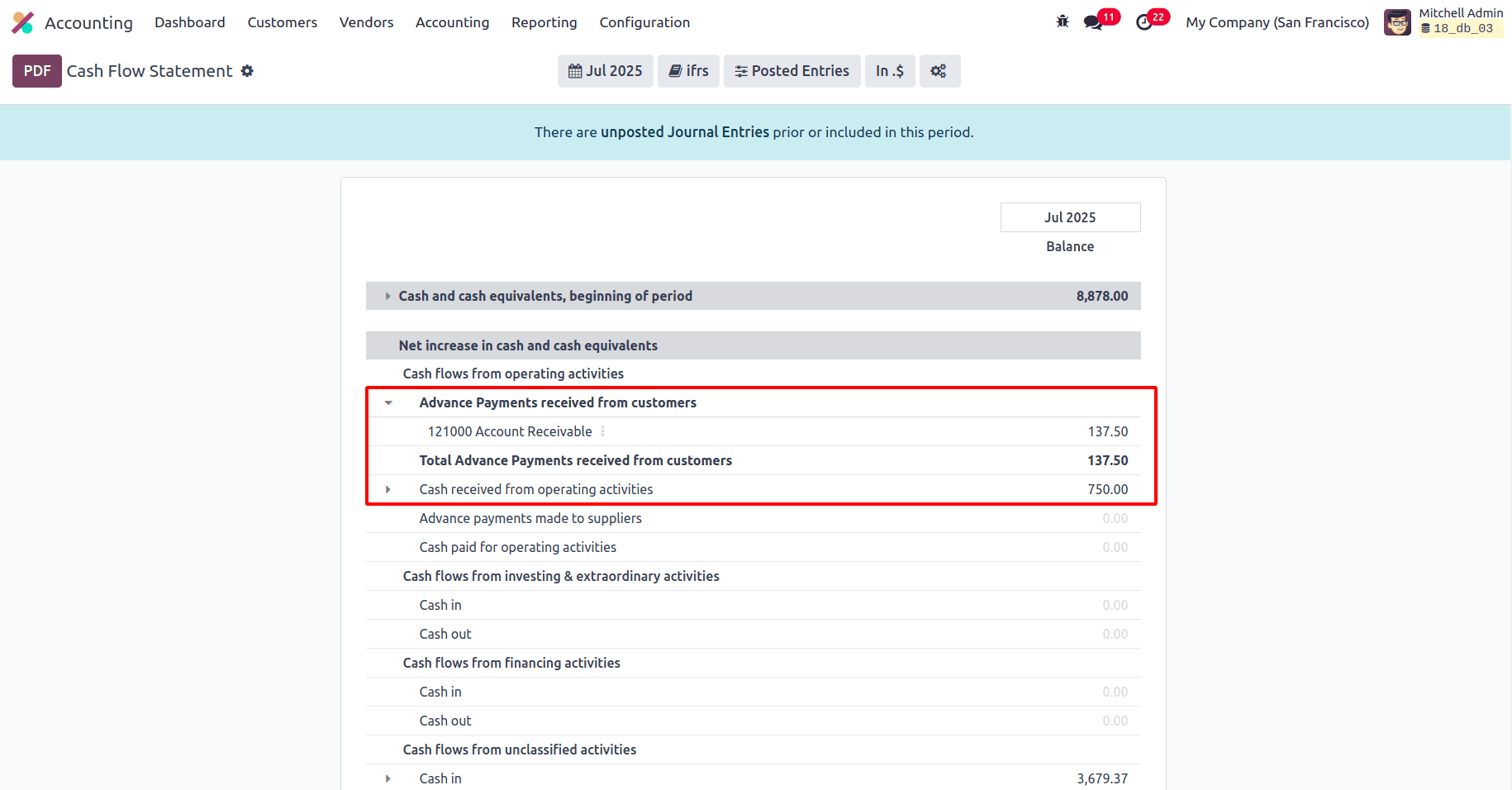

Here, when the payment of $ 862.50 has been done using the advance payment made by the customer, it can be seen that the Advance Payments received from customers has been reduced to $ 137.50 from $ 1000. And the tax-excluded amount $ 750 has been recorded in the Cash Received from the operating activities in the cash flow statement. And the tax amount $ 112.50 is recorded in Cash in under the Cash flows from Unclassified activities.

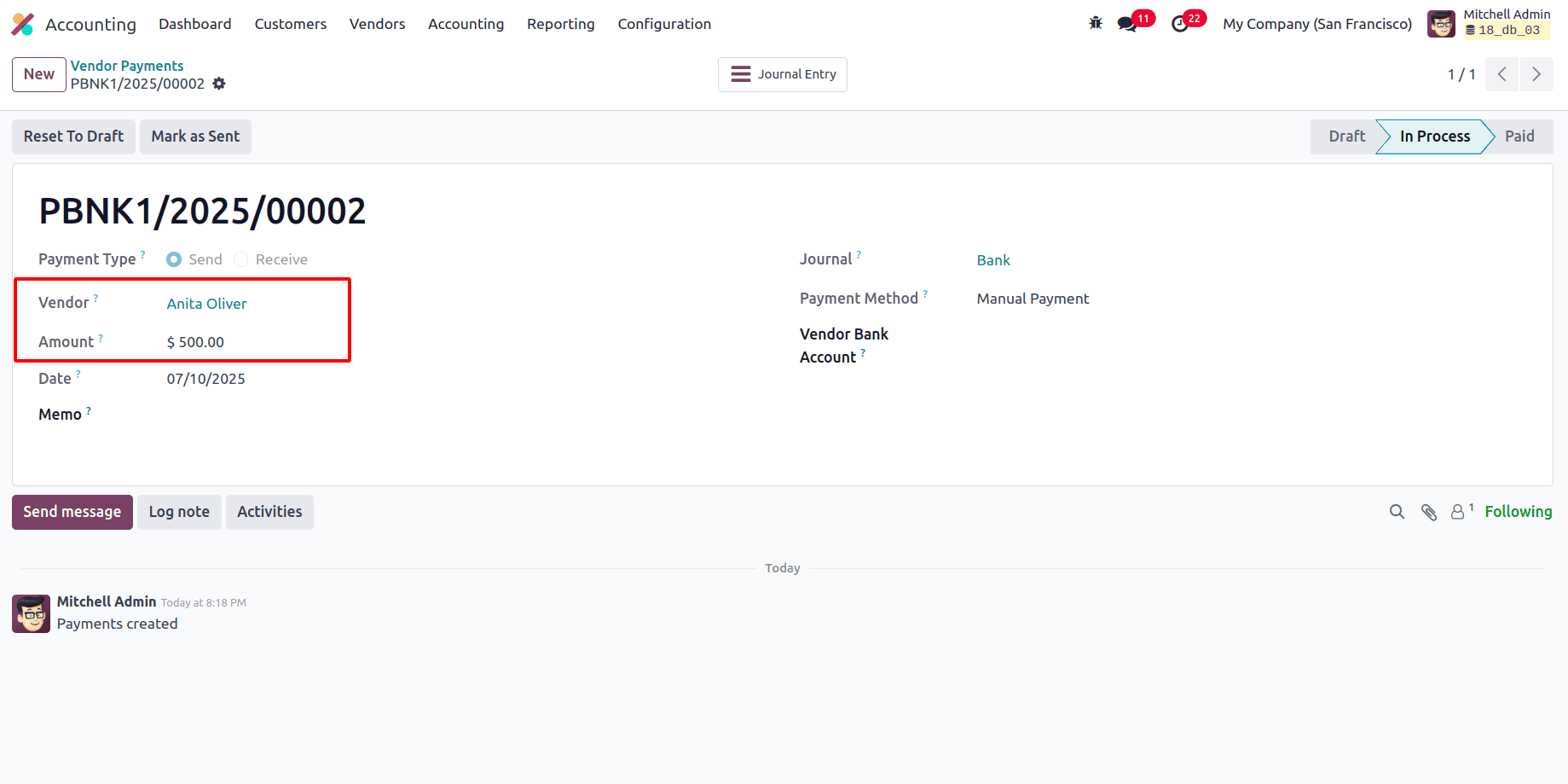

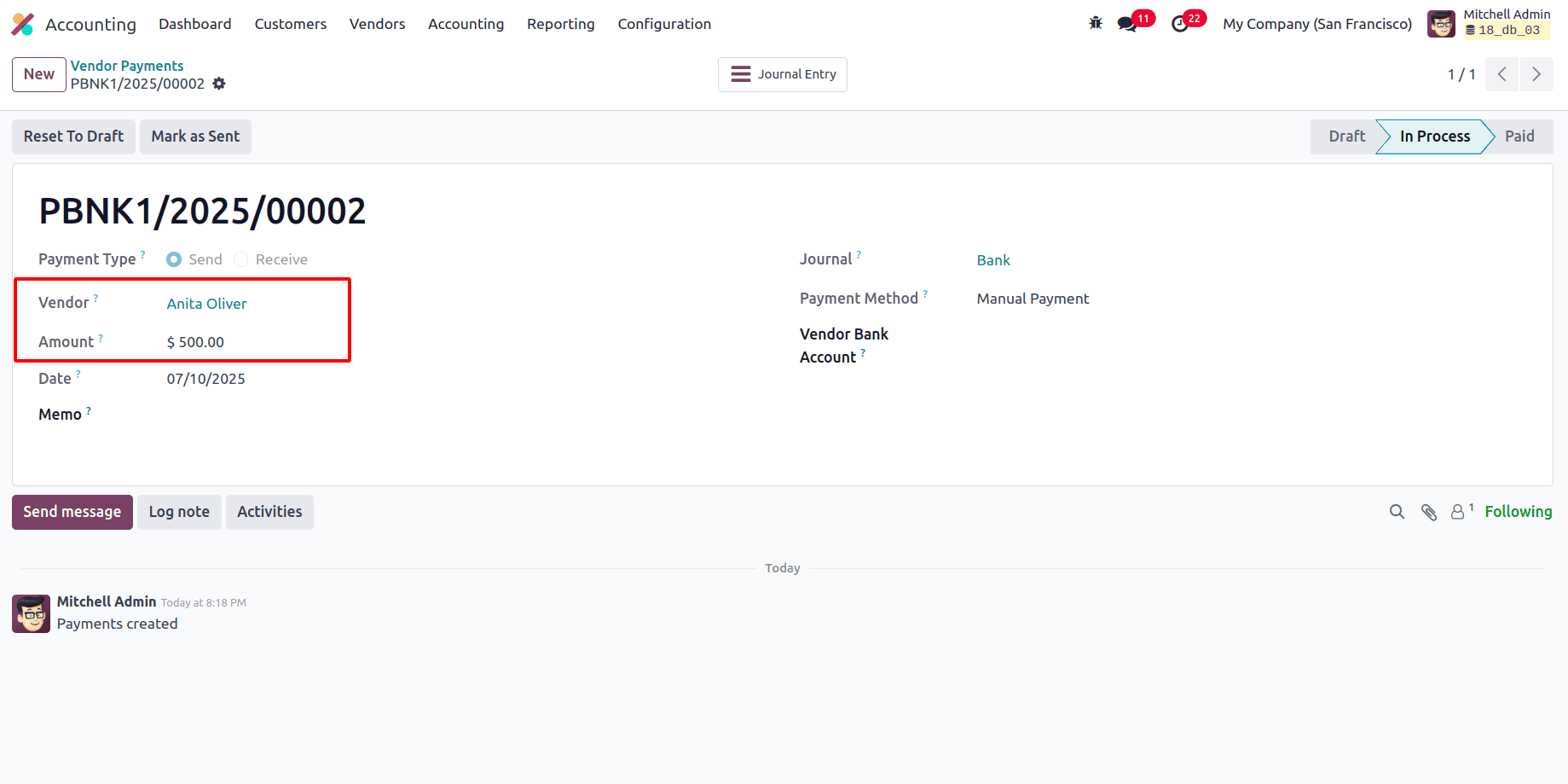

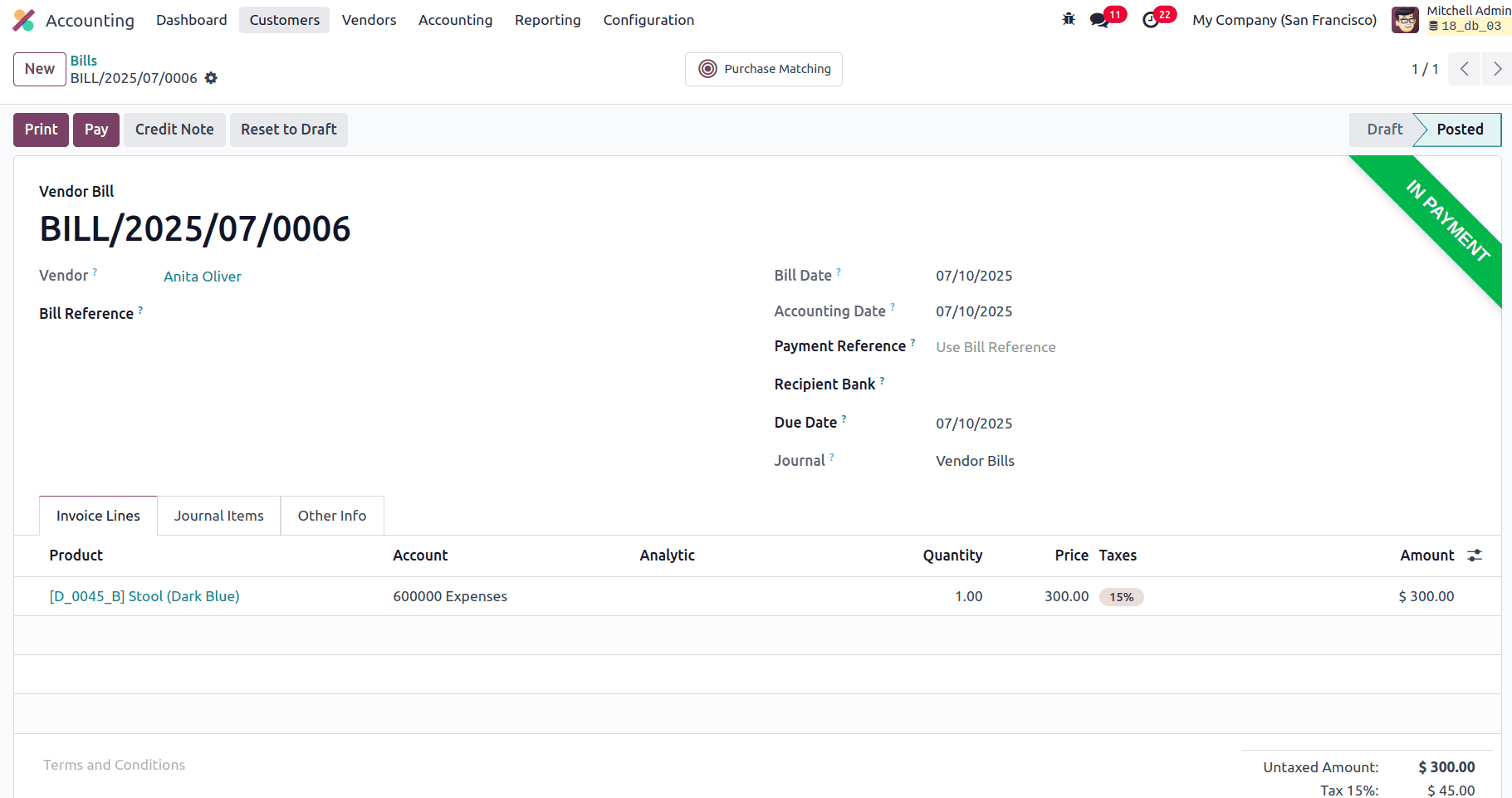

Similarly, consider that an advance payment of $ 500 has been made by a vendor.

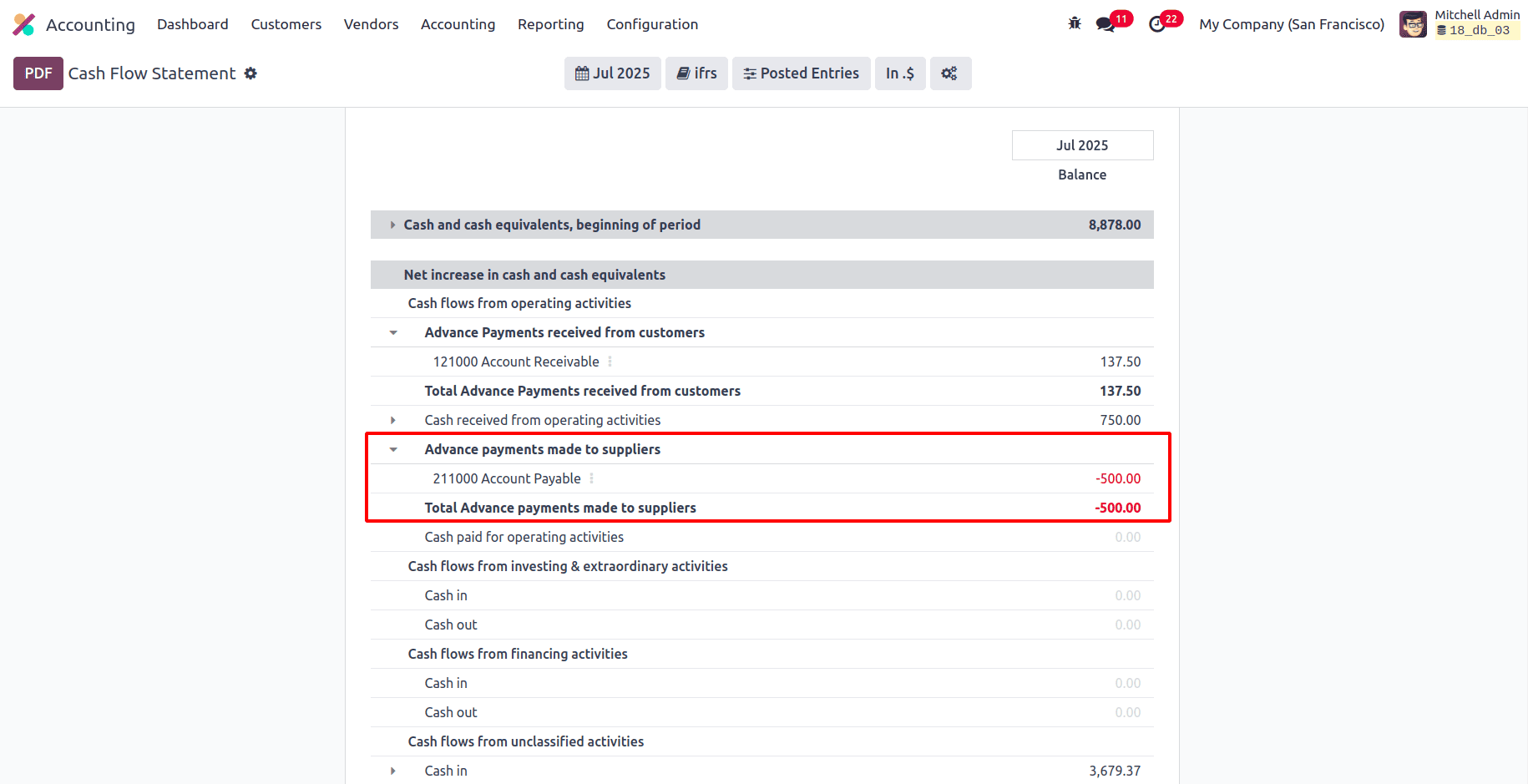

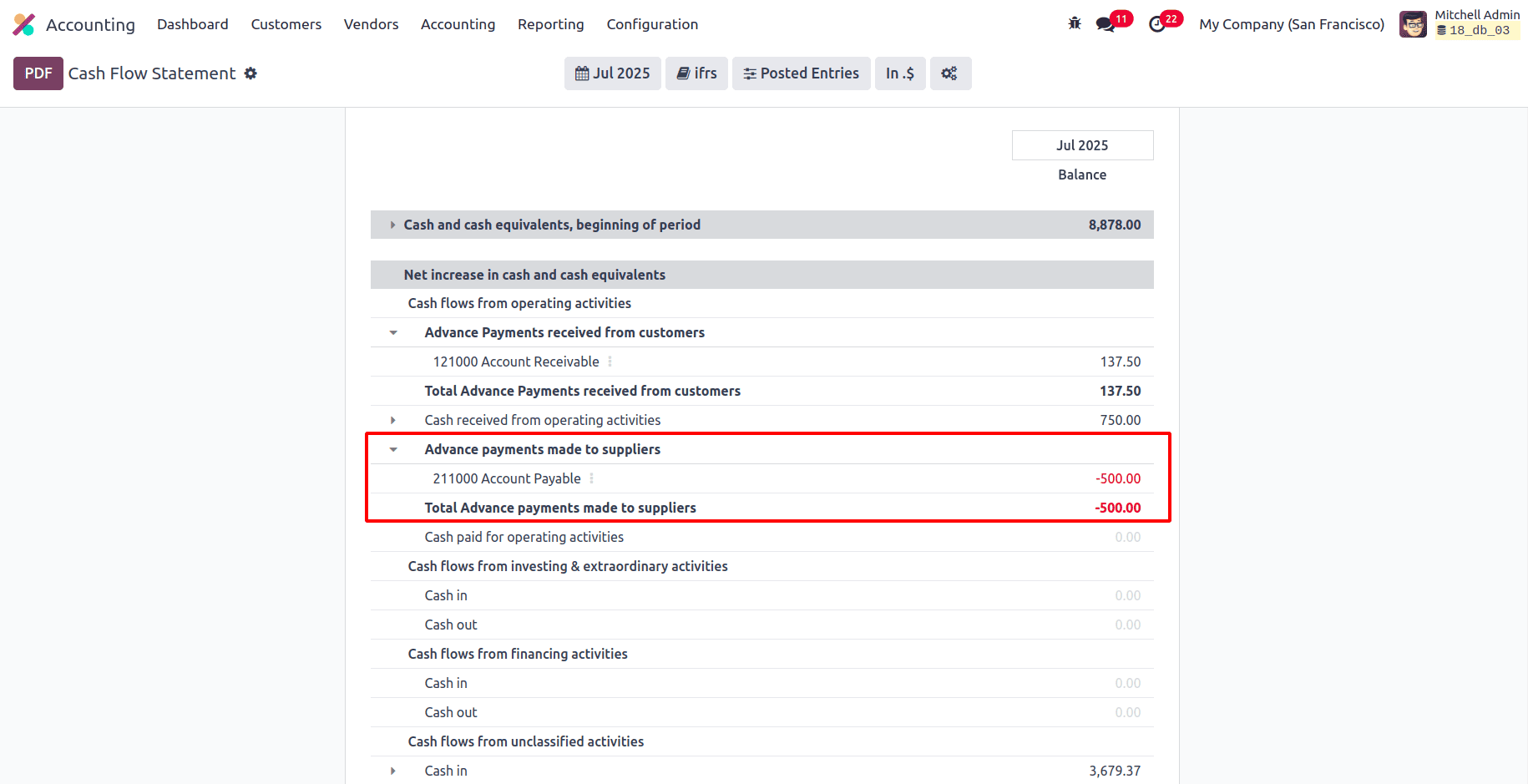

In the Cash Flow Statement, it will be recorded under the Advance payments made to Suppliers as -500.

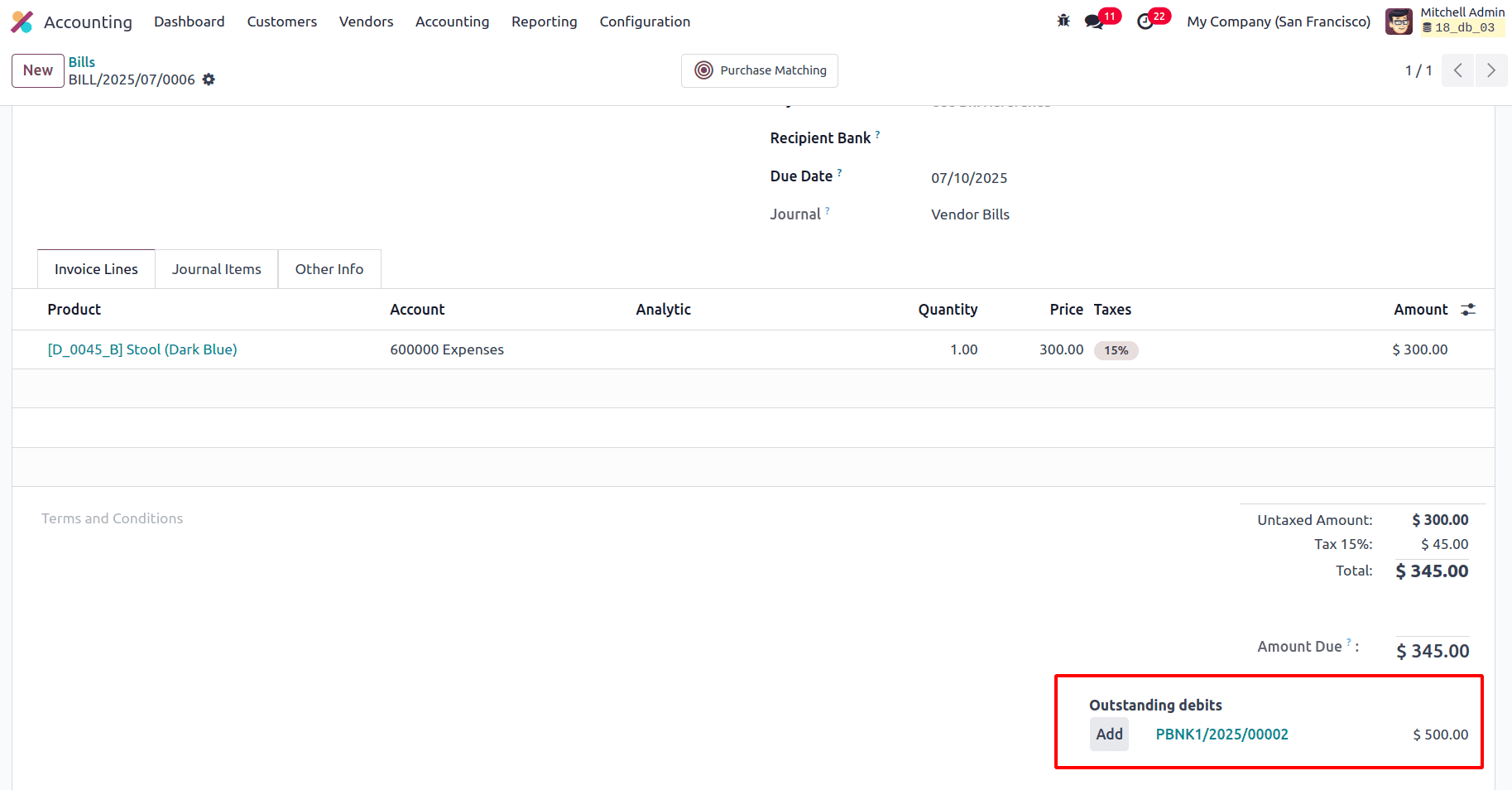

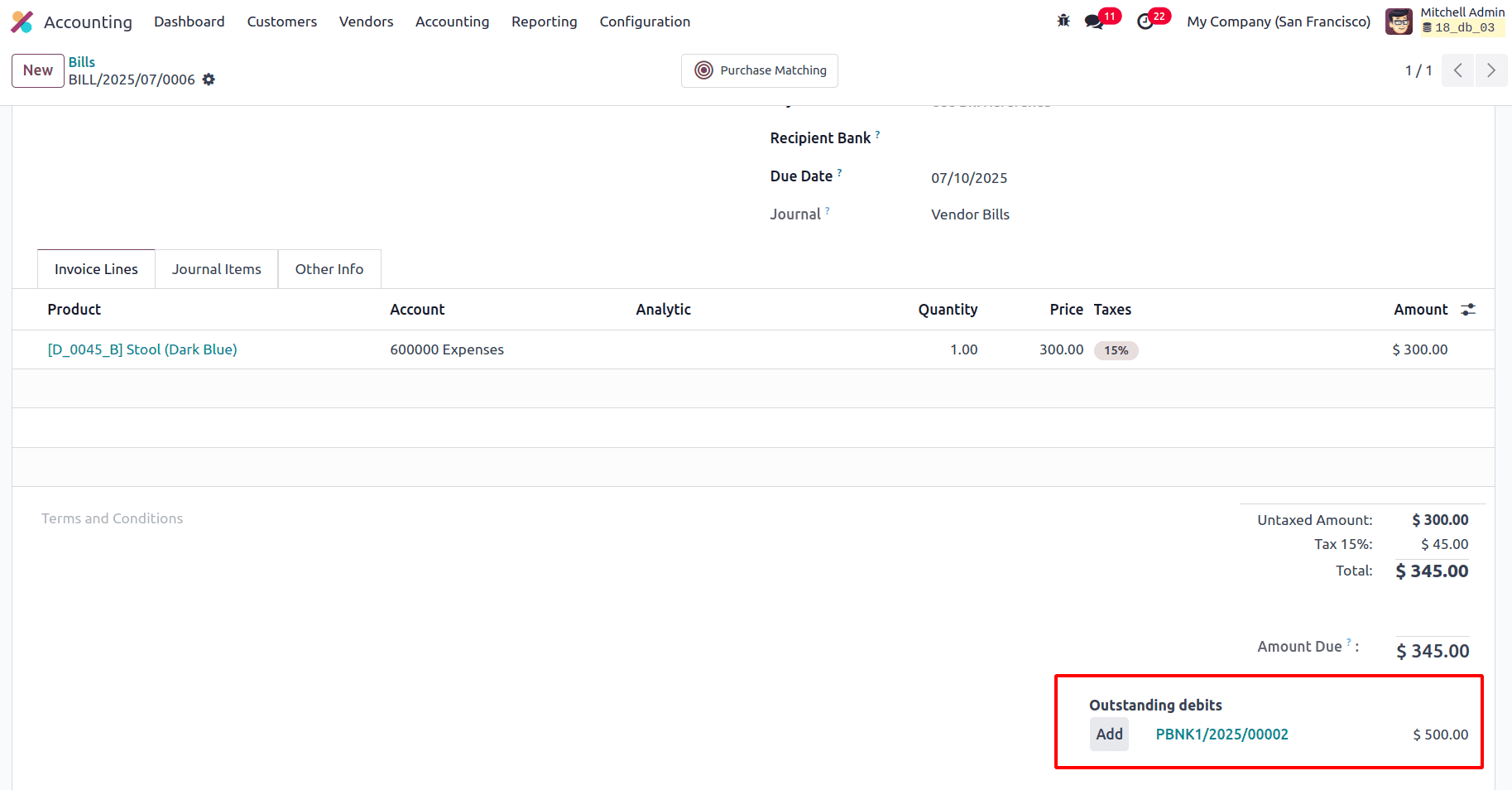

Now, this advance payment made to the vendor can be added to the bill using the Add button.

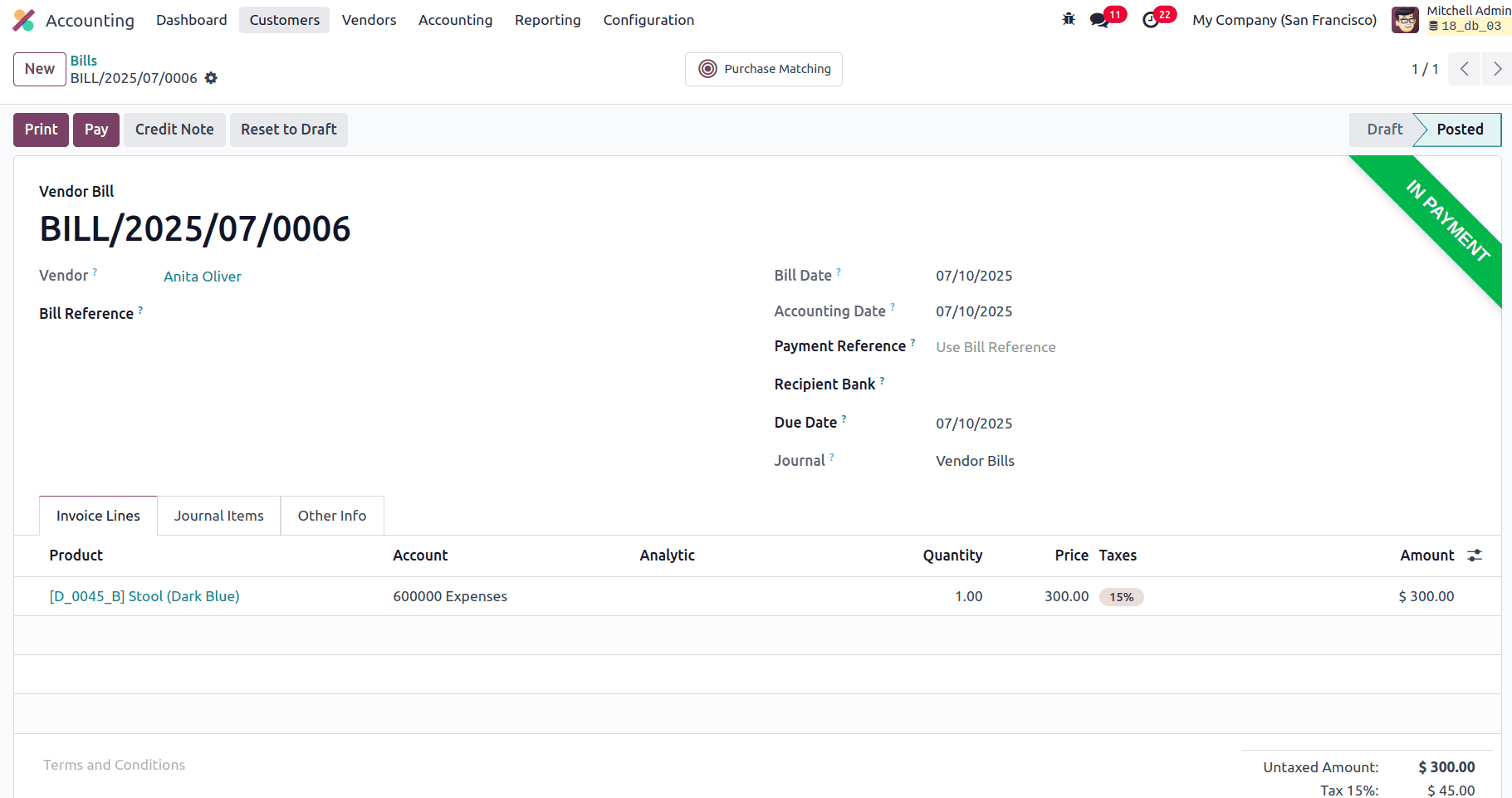

And then the bill will be in the ‘In Payment’ state.

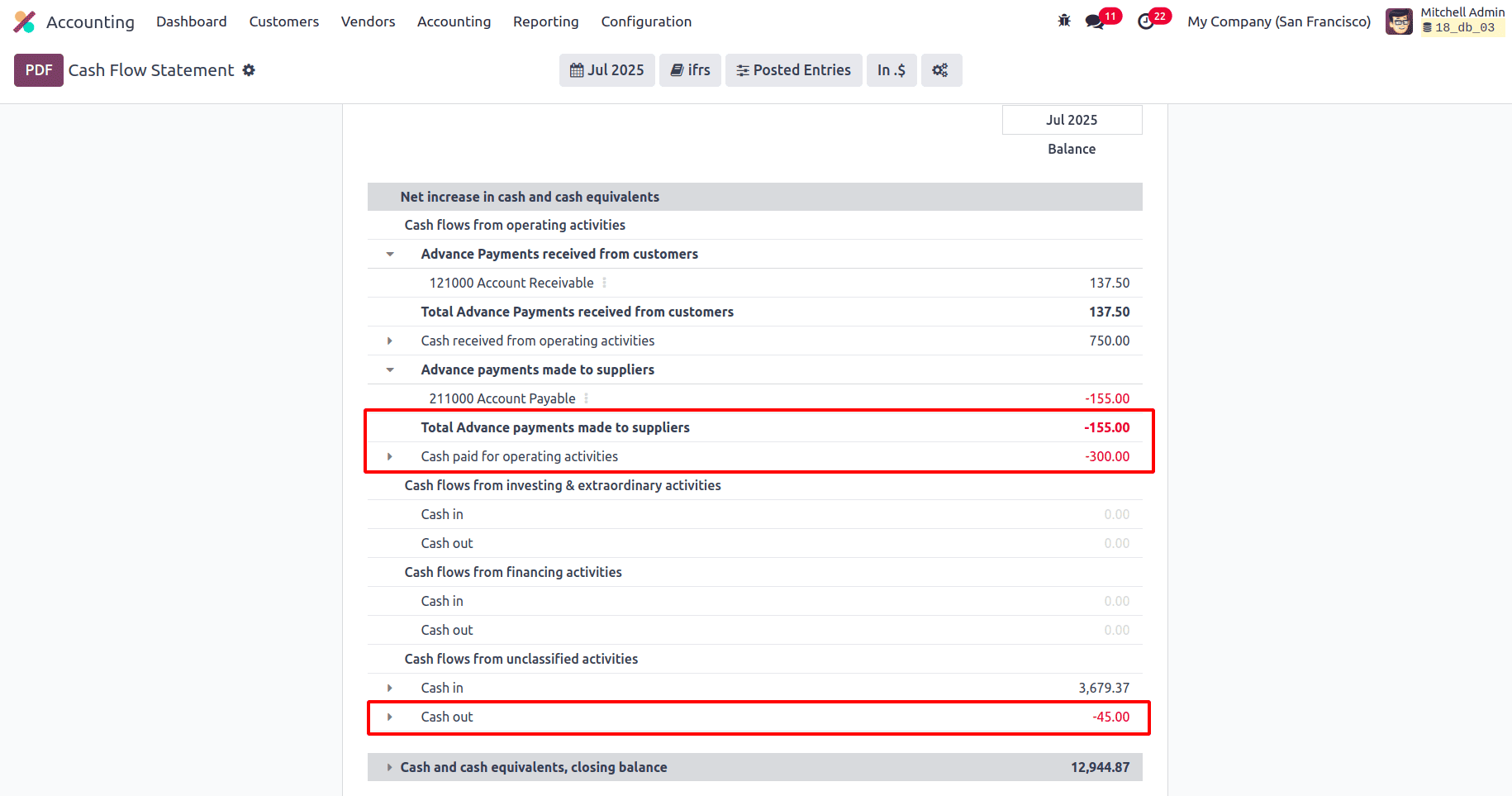

In the Cash flow statement under the Advance payments made to Suppliers, it can be seen that the amount is reduced to - 155 since 300 is the amount paid for the bill excluding the tax and that amount will be recorded in the Cash paid for operating activities and the amount -45 will be recorded in the Cash Out under the Cash flows from unclassified activities.

How Odoo Handles This Automatically

You can avoid manually allocating each line to your cash flow statement by using account tags. Making use of accounts that are properly categorised as operating, investing, or banking:

- Understands where to allocate the incoming or outgoing cash.

- Quickly updates the report whenever new transactions are posted.

- Ensures that your claims remain consistent and accurate.

Without these tags, your cash flow statement may miss transactions or show incorrect numbers.

Why This Matters for Real Businesses

Let’s say you rely on your cash flow statement to plan next month’s expenses. If you forget to post entries or miscategorize accounts, your report won’t show the real cash position. You might think you have more cash than you actually do, which can lead to bounced payments or missed investment opportunities.

By understanding how posting works and how account tags feed into the cash flow statement, you keep your financials reliable.

How to Keep Your Cash Flow Statement Accurate

A cash flow statement is only as reliable as the data behind it. In Odoo 18, here are some practical ways to make sure yours stays up-to-date and meaningful:

- Reconcile Frequently: Always reconcile your bank and cash journals regularly. This ensures that the balances you see in your cash flow statement match the actual bank balances.

- Use Clear Account Names: Give your accounts clear, descriptive names — like “Product Sales,” “Supplier Payments,” or “Loan Repayments” — so you and your team can immediately see what each line means.

- Automate Reminders: Set up payment follow-ups for customers and suppliers. Late customer payments can affect your cash position, so the sooner you know about delays, the better.

- Review Cash Flow Trends: Don’t just look at the cash flow statement once a month. Plan ahead by using the trends.

- Train Your Team: Make sure anyone entering data understands the importance of correct account tags and posting entries on time.

With the help of Odoo's intelligent accounting features, you can increase your confidence in your data and make wiser business decisions every day by following these steps.

The cash flow statement in Odoo 18 shows exactly how cash moves through your business: operations, investments, and financing. The location of each transaction in the report is controlled by account tags. Always confirm that journal entries have been uploaded; only posted entries are included, not drafts.With each transaction, Odoo automatically updates the cash flow report so you always have an accurate picture.

Businesses can spot any cash flow issues and take action to fix them by knowing the various parts of a cash flow statement and how to evaluate it. By regularly reviewing and updating the cash flow statement, businesses may stay on top of their finances and achieve their financial goals. All things considered, a cash flow statement is an essential tool for any company trying to successfully manage its finances and preserve long-term financial stability.

To read more about What is Cash Flow Statement in Odoo 16 Accounting, refer to our blog What is Cash Flow Statement in Odoo 16 Accounting.

Controlling cash flow is one of the most important parts of running a company. You can clearly see how money comes into and goes out of your business with the cash flow statement in Odoo 18 Accounting, which may be fully automated with the right setup.

Cash Flow Statements in Odoo 18 Accounting

Odoo is renowned for its completely integrated accounting capabilities that are easy to use. The cash flow statement is one of the improved financial reporting features in Odoo 18.

Viewing the Cash Flow Statement

When you open the cash flow statement in Odoo 18 (Accounting > Reporting > Cash Flow Statement), you’ll see a breakdown like this:

This report is organized into:

- Opening Balance: Cash and cash equivalents at the start of the period (e.g., bank balance).

- Operating Activities: Cash flows related to daily operations — customer payments, supplier payments, etc.

- Investing and Extraordinary Activities: Such as buying assets and making money off of currency fluctuations.

- Closing Balance: The final cash position for the period.

What are Account Tags and Their Role?

In Odoo 18, Account Tags are mainly used to categorize the transactions in the cash flow statement.

When you create or edit an account under the Chart of Accounts, you can assign Tags (like Operating, Investing, Financing).

This tells Odoo where to include amounts in the cash flow statement:

- Operating: Day-to-day cash flows (e.g., sales income, supplier expenses)

- Investing: Purchases or sales of assets

- Financing: Loans, capital injections, dividends paid

Without correct tags, your transactions might be missing from the right section, causing an inaccurate cash flow statement.

Posting a Journal Entry

Create a Journal Entry

Go to the Accounting Module > Accounting > Journal Entries > Create.

- Add your bank account 101401 bank.

- Add a suspense account.

Once you confirm the details, click Post. This moves the entry from draft to posted status, meaning it’s included in reports.

Recheck the Cash Flow Statement

Now, go back to Reporting > Cash Flow Statement for the same period.

You should see that: The Cash flow from the unclassified activities section now reflects your new supplier payment.

Also, when a customer pays an advance amount, it will be marked in the Cash Flow Statement under the Advance Payments received from customers. Let's say a customer, Beth Evans, has paid $ 1000 as an advance payment.

The advance amount paid by the customer will be recorded under 'Advance Payments Received from Customers'.

If a customer invoice is later generated with a payment amount of $ 500, the previously received advance payment will appear as an outstanding credit. You can apply this credit to the invoice by clicking the Add button, which will allocate the advance towards the invoice payment.

When it is added, the invoice will be in the In Payment state.

Here, when the payment of $ 862.50 has been done using the advance payment made by the customer, it can be seen that the Advance Payments received from customers has been reduced to $ 137.50 from $ 1000. And the tax-excluded amount $ 750 has been recorded in the Cash Received from the operating activities in the cash flow statement. And the tax amount $ 112.50 is recorded in Cash in under the Cash flows from Unclassified activities.

Similarly, consider that an advance payment of $ 500 has been made by a vendor.

In the Cash Flow Statement, it will be recorded under the Advance payments made to Suppliers as -500.

Now, this advance payment made to the vendor can be added to the bill using the Add button.

And then the bill will be in the ‘In Payment’ state.

In the Cash flow statement under the Advance payments made to Suppliers, it can be seen that the amount is reduced to - 155 since 300 is the amount paid for the bill excluding the tax and that amount will be recorded in the Cash paid for operating activities and the amount -45 will be recorded in the Cash Out under the Cash flows from unclassified activities.

How Odoo Handles This Automatically

You can avoid manually allocating each line to your cash flow statement by using account tags. Making use of accounts that are properly categorised as operating, investing, or banking:

- Understands where to allocate the incoming or outgoing cash.

- Quickly updates the report whenever new transactions are posted.

- Ensures that your claims remain consistent and accurate.

Without these tags, your cash flow statement may miss transactions or show incorrect numbers.

Why This Matters for Real Businesses

Let’s say you rely on your cash flow statement to plan next month’s expenses. If you forget to post entries or miscategorize accounts, your report won’t show the real cash position. You might think you have more cash than you actually do, which can lead to bounced payments or missed investment opportunities.

By understanding how posting works and how account tags feed into the cash flow statement, you keep your financials reliable.

How to Keep Your Cash Flow Statement Accurate

A cash flow statement is only as reliable as the data behind it. In Odoo 18, here are some practical ways to make sure yours stays up-to-date and meaningful:

- Reconcile Frequently: Always reconcile your bank and cash journals regularly. This ensures that the balances you see in your cash flow statement match the actual bank balances.

- Use Clear Account Names: Give your accounts clear, descriptive names — like “Product Sales,” “Supplier Payments,” or “Loan Repayments” — so you and your team can immediately see what each line means.

- Automate Reminders: Set up payment follow-ups for customers and suppliers. Late customer payments can affect your cash position, so the sooner you know about delays, the better.

- Review Cash Flow Trends: Don’t just look at the cash flow statement once a month. Plan ahead by using the trends.

- Train Your Team: Make sure anyone entering data understands the importance of correct account tags and posting entries on time.

With the help of Odoo's intelligent accounting features, you can increase your confidence in your data and make wiser business decisions every day by following these steps.

The cash flow statement in Odoo 18 shows exactly how cash moves through your business: operations, investments, and financing. The location of each transaction in the report is controlled by account tags. Always confirm that journal entries have been uploaded; only posted entries are included, not drafts.With each transaction, Odoo automatically updates the cash flow report so you always have an accurate picture.

Businesses can spot any cash flow issues and take action to fix them by knowing the various parts of a cash flow statement and how to evaluate it. By regularly reviewing and updating the cash flow statement, businesses may stay on top of their finances and achieve their financial goals. All things considered, a cash flow statement is an essential tool for any company trying to successfully manage its finances and preserve long-term financial stability.

To read more about What is Cash Flow Statement in Odoo 16 Accounting, refer to our blog What is Cash Flow Statement in Odoo 16 Accounting.