A company's ability to accurately calculate each employee's pay based on their job position depends heavily on its management of salary packages. A clear salary structure is necessary to guarantee ease in paying any employee's salary in your company. The wage structure is a collection of guidelines and standards that aid an organization in effectively determining each employee's allowance. A wage structure is a thorough explanation of an employee's whole compensation package. We require a dynamic system to manage to establish the wage structure and salary rules or criteria.

The most dependable open-source ERP management program, Odoo, offers a wide range of features and functionalities. Nearly all HR administration tasks, including employee management, contracts, attendance, timesheets, time off, and payroll, may be managed by Odoo users. Odoo gives you the effective Payroll Management module to manage all payroll operations in a company. Payrolls are the entire amount of money that an organization gives its workers. Payroll is determined by a number of criteria, including total work hours, basic pay, overtime, and additional benefits.

The employer enters into a contract with the employee at the time of hiring, outlining the compensation package that will be provided for the specific work role. With Odoo's Payroll Module, we can establish wage guidelines and specify the pay scale for workers in any position. It is a simple and effective platform for handling all employee payroll tasks within a company.

The setup of the salary structure and payroll rules, as well as how to use them to create salary slips in Odoo, will be covered in this article.

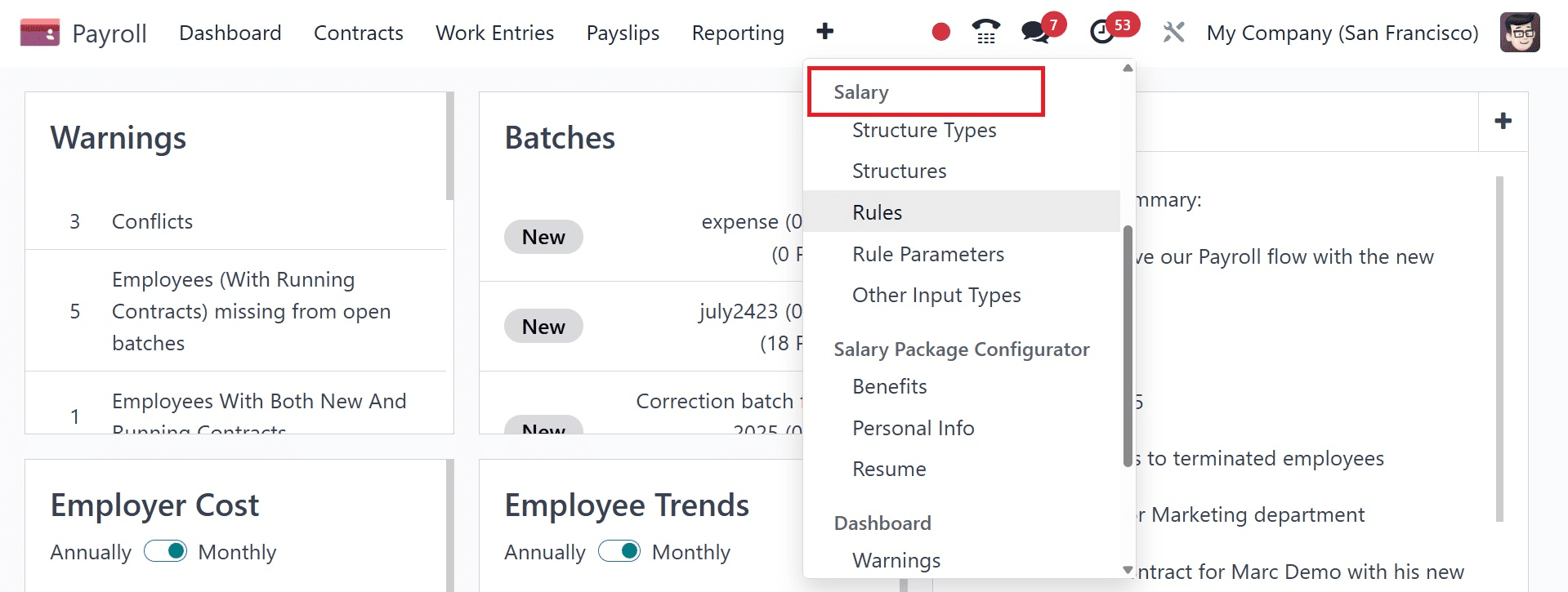

Make sure to install the Odoo Payroll module on your system after obtaining it from the Apps module. You will see a glimpse of all of your company's employees' data when you first access this section. We have a lot of options under this module's settings menu to define the salary regulation and structure.

Salary Structure and Structure Type, Salary Rules, Salary Rule Parameters, Other Input Types, and Salary Package Configurator, such as Benefits, Personal Information, and Resume, are all possible, as the graphic illustrates. Let's go into more depth about each of these in the section that follows.

Salary Structure Type

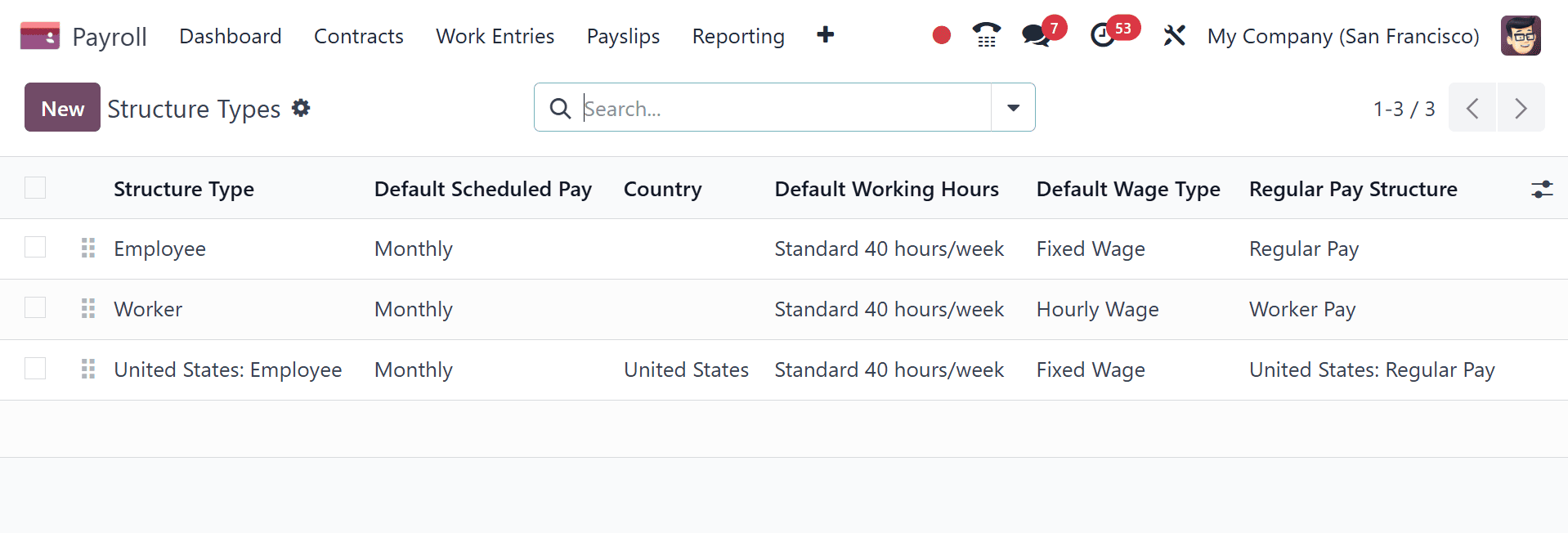

This feature allows you to establish a new type of compensation structure. When drafting a new contract with a newly hired employee, it is crucial to include the type of wage structure. Employees, laborers, and trainees can each have their pay structure type specified, with the options of hourly or monthly.

The list displays various compensation structures, including Regular Pay Structure, Wage Type, Default Scheduled Pay, and Default Working Hours. To establish a new type of salary structure, click the "New" button.

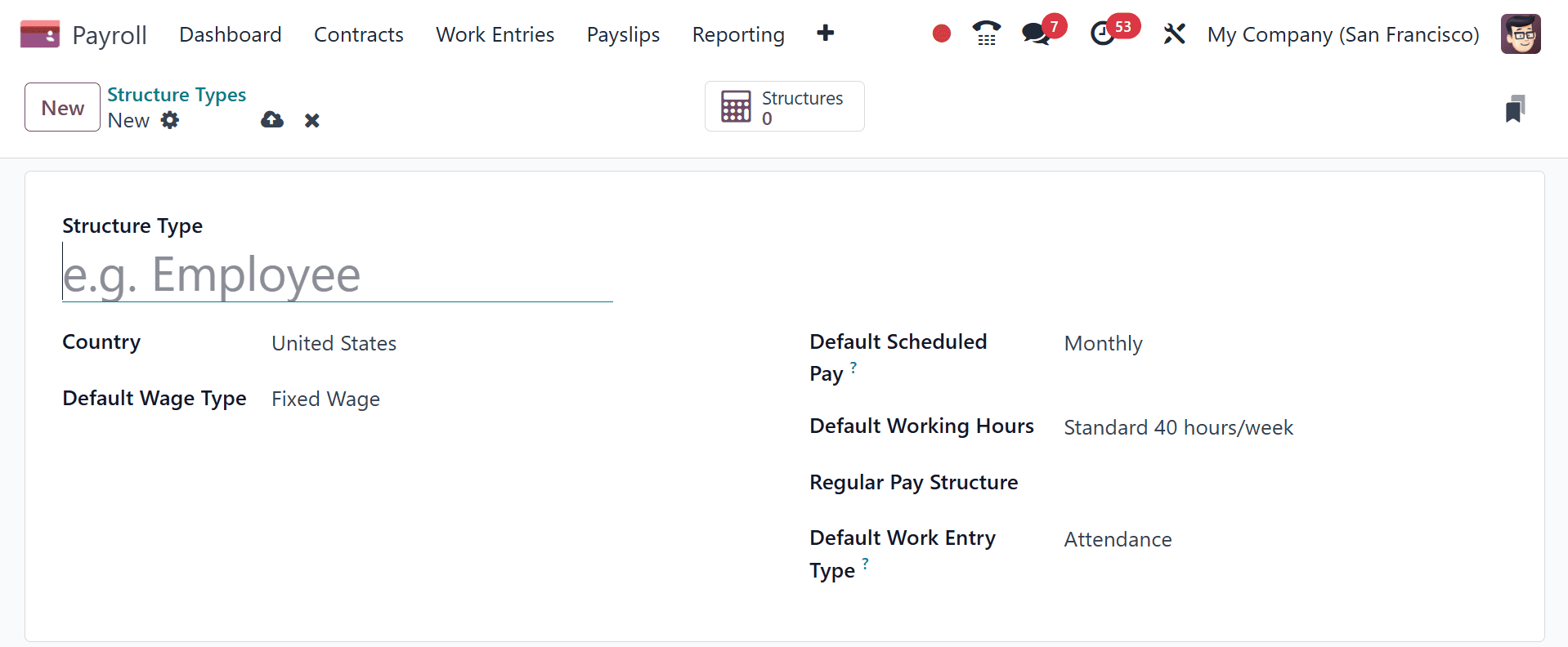

Enter Structure Type and Country in the designated fields. You can choose between an hourly wage and a monthly fixed wage under Wage Type. Monthly, quarterly, annual, weekly, bi-weekly, or bi-monthly payments can all be scheduled. In the designated fields, state the Work Entry Type, Pay Structure, and Working Hours. Once all the information has been included, save the new compensation structure type. Then, when establishing contracts, you may use this new type for a suitable salary structure.

Structure

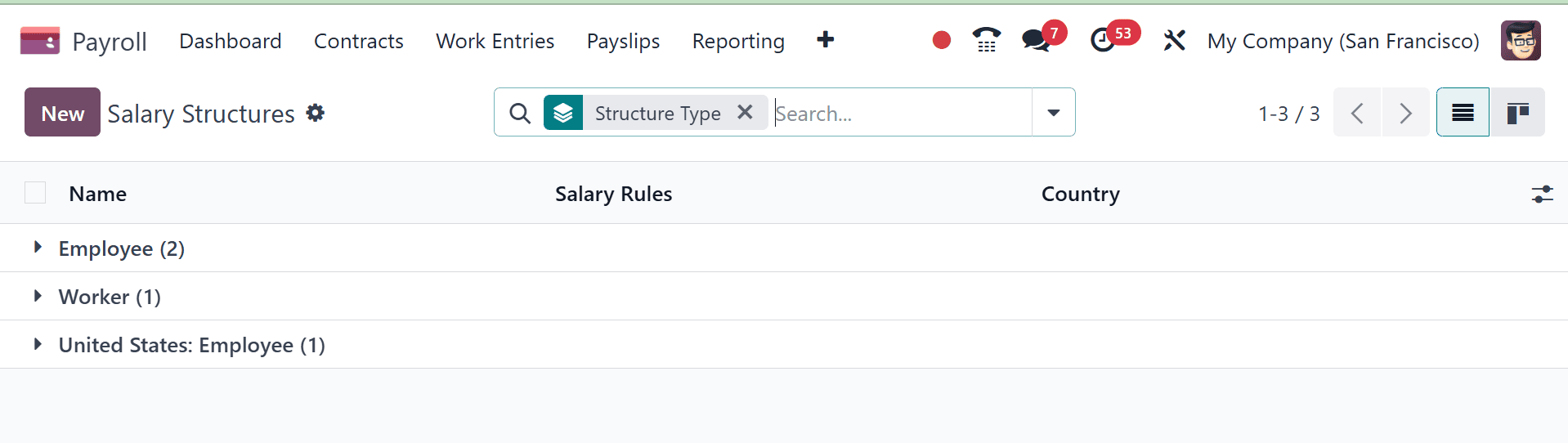

You can establish a new salary structure in Odoo with the aid of this field. A wage structure is crucial for creating a payslip for every payroll and determining each employee's pay based on their job position.

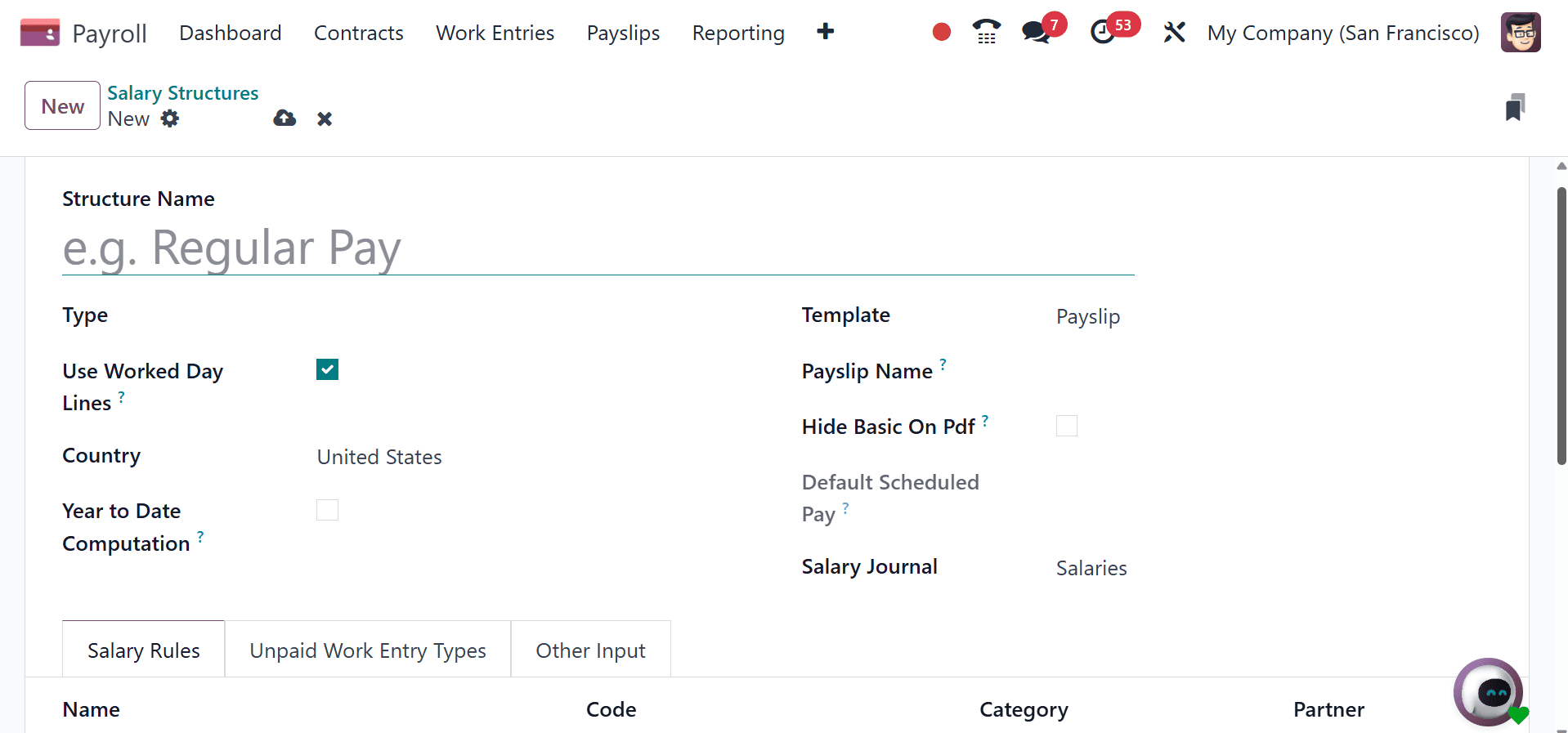

All of Odoo's wage structures are included in the list. To establish a new pay structure, click the "New" button.

Choose the kind from the provided list and name the pay structure. Include the following in the new salary structure: Scheduled Pay, Report Method, Country Name, and Salary Journal. You can build salary rules using the module's Configuration menu and add them under the Salary Rules section. After filling out all the fields, you can save the data and connect the Unpaid Work Entry Type details to the new compensation structure.

Salary Rule

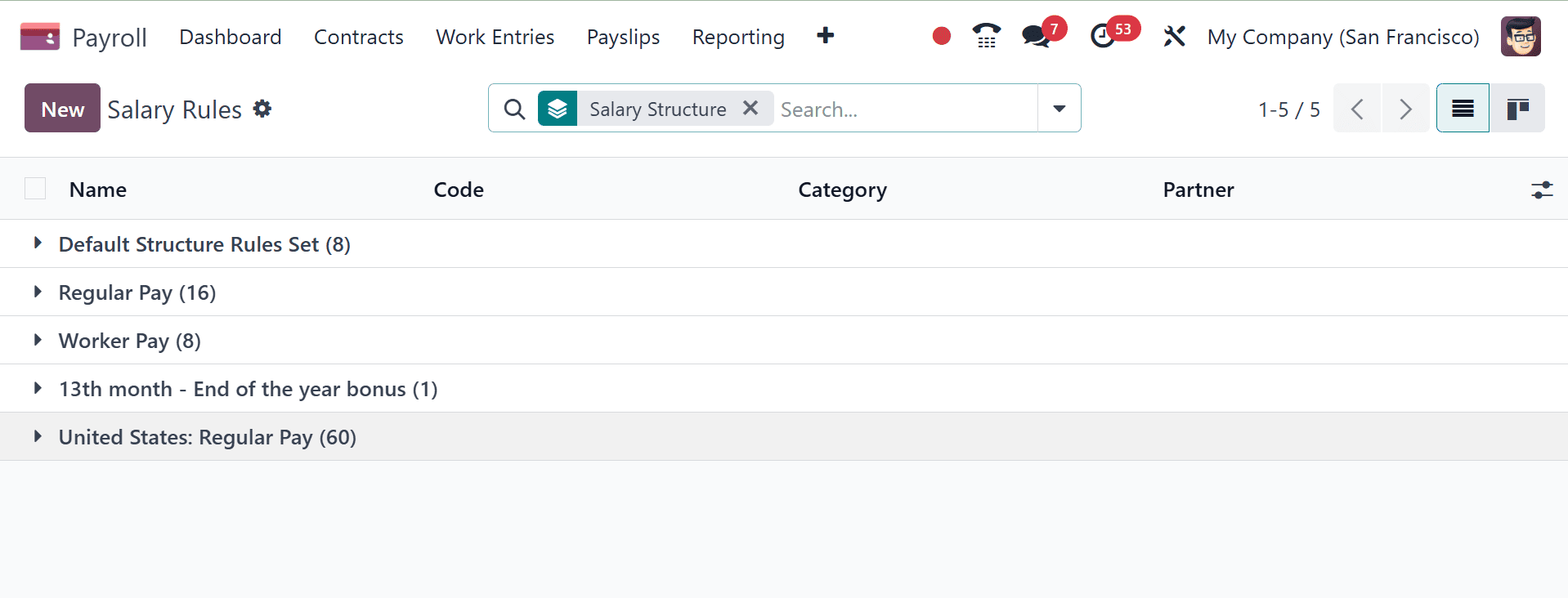

Establishing conditions in the form of compensation guidelines is crucial for determining an employee's pay. The particular set of rules will determine how the net amount changes. The "Salary Rule" option in the Odoo payroll configuration menu provides access to all of the salary rules that have been developed in this module.

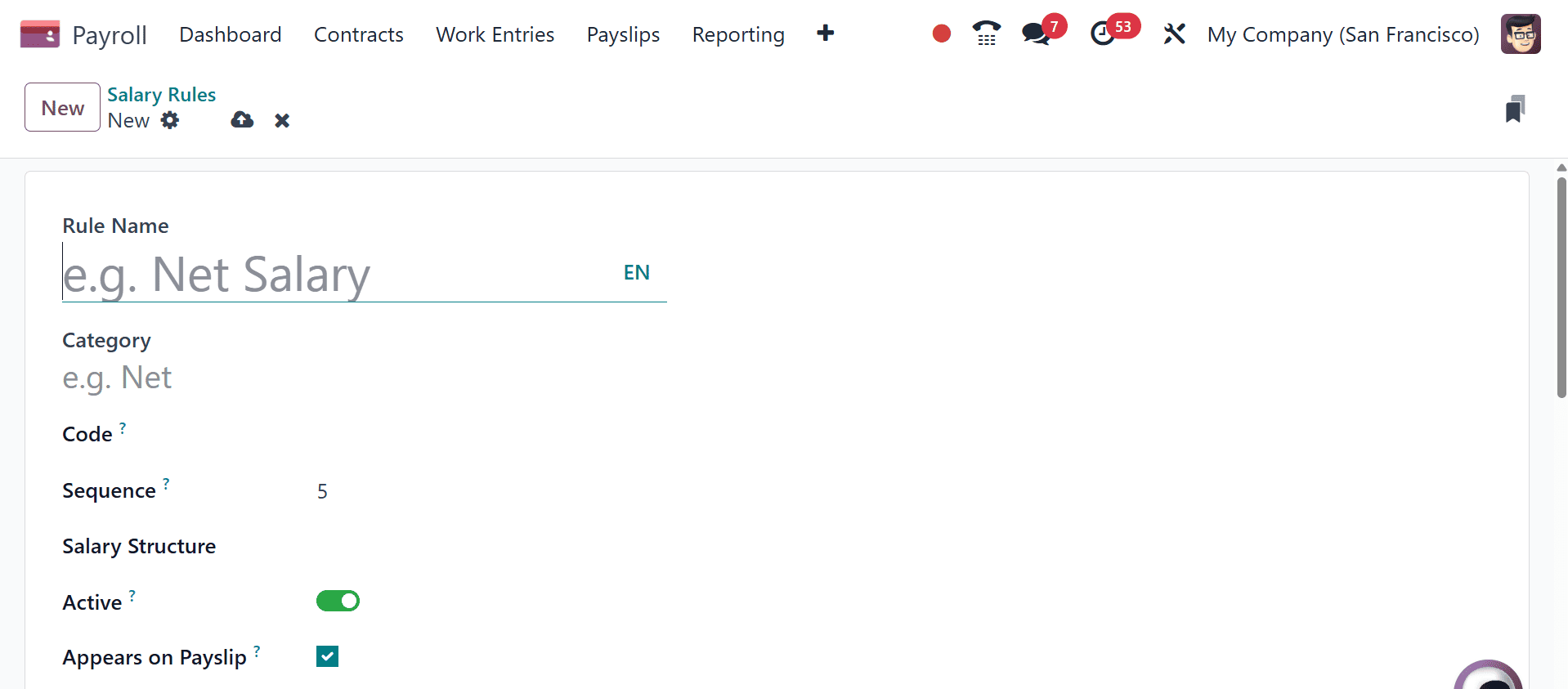

To establish a new salary rule, click the "New" option as usual. When drafting a new employee contract, these are used to specify the pay scale.

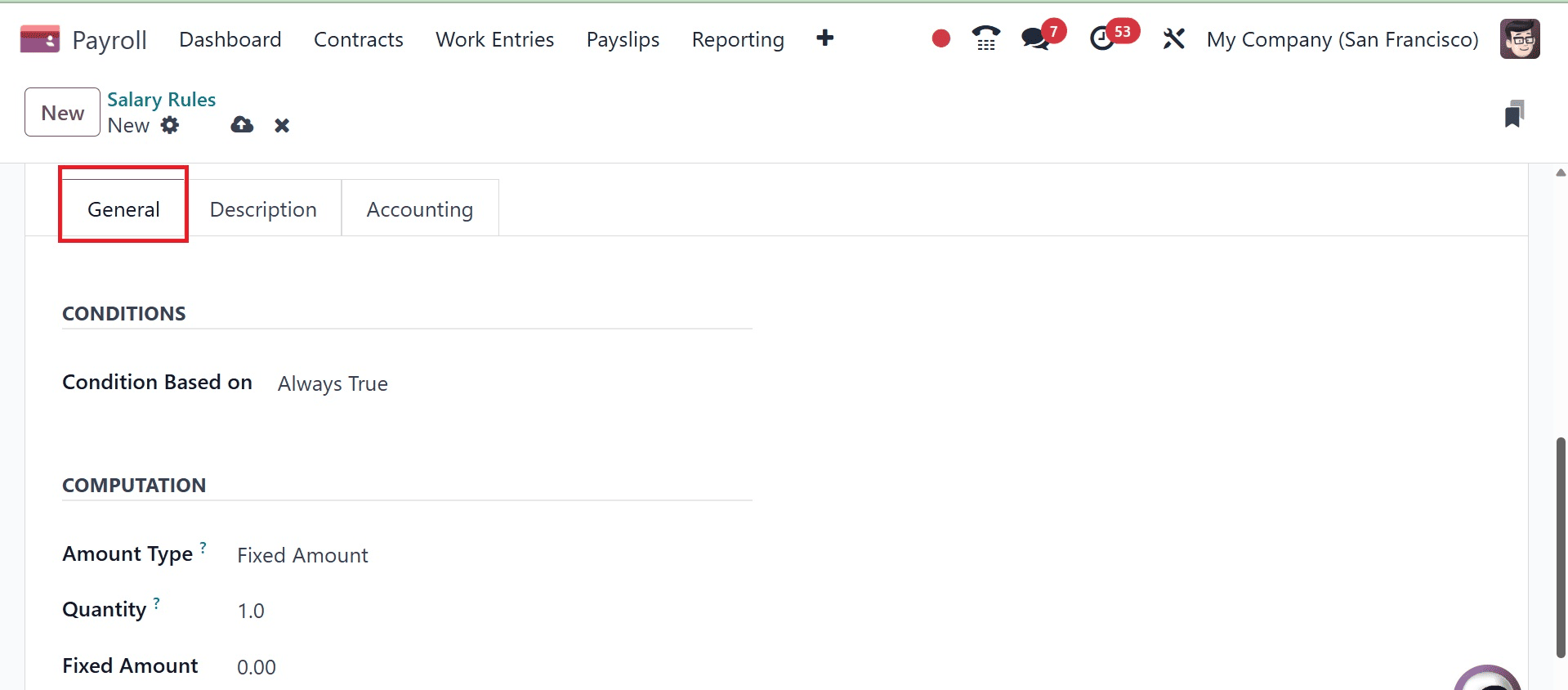

Provide the payment's name and choose the pay category (basic, bonus, allowance, code, sequence, or salary structure). Provide broad details about the salary rule under the "General" tab.

The conditions can be chosen using Range, Always True, or Python Expression. Based on your selections, more fields will show up based on the Condition. Enter the fixed amount, amount type, and quantity in the Computation area. Choose the Partner salary rule under the Company Contribution. If a description is needed, add it in the "Description" tab.

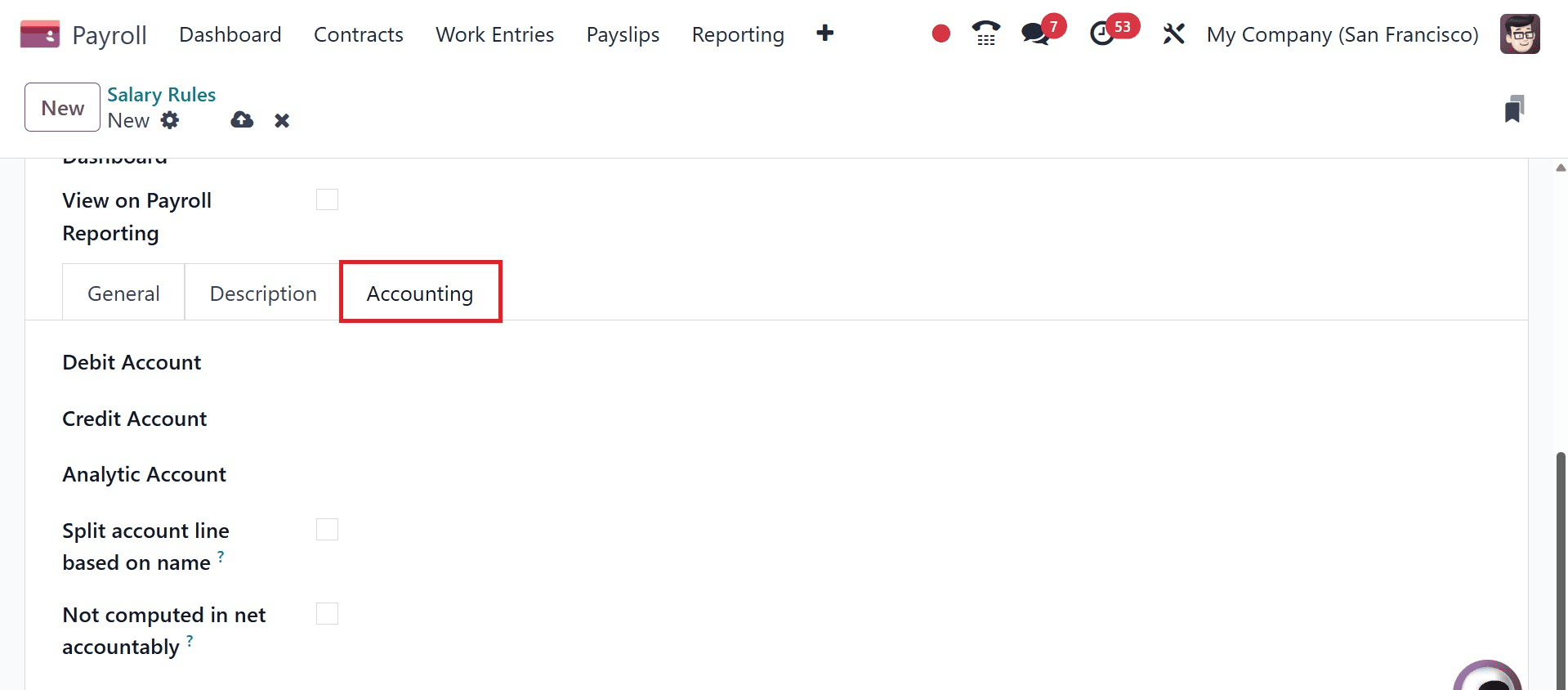

Configure the Debit Account, Credit Account, and Analytic Account information under the "Accounting" page in order to prepare the new salary rules. When determining the proper wage structure, save the updated salary rule and refer to it.

Rule Parameter

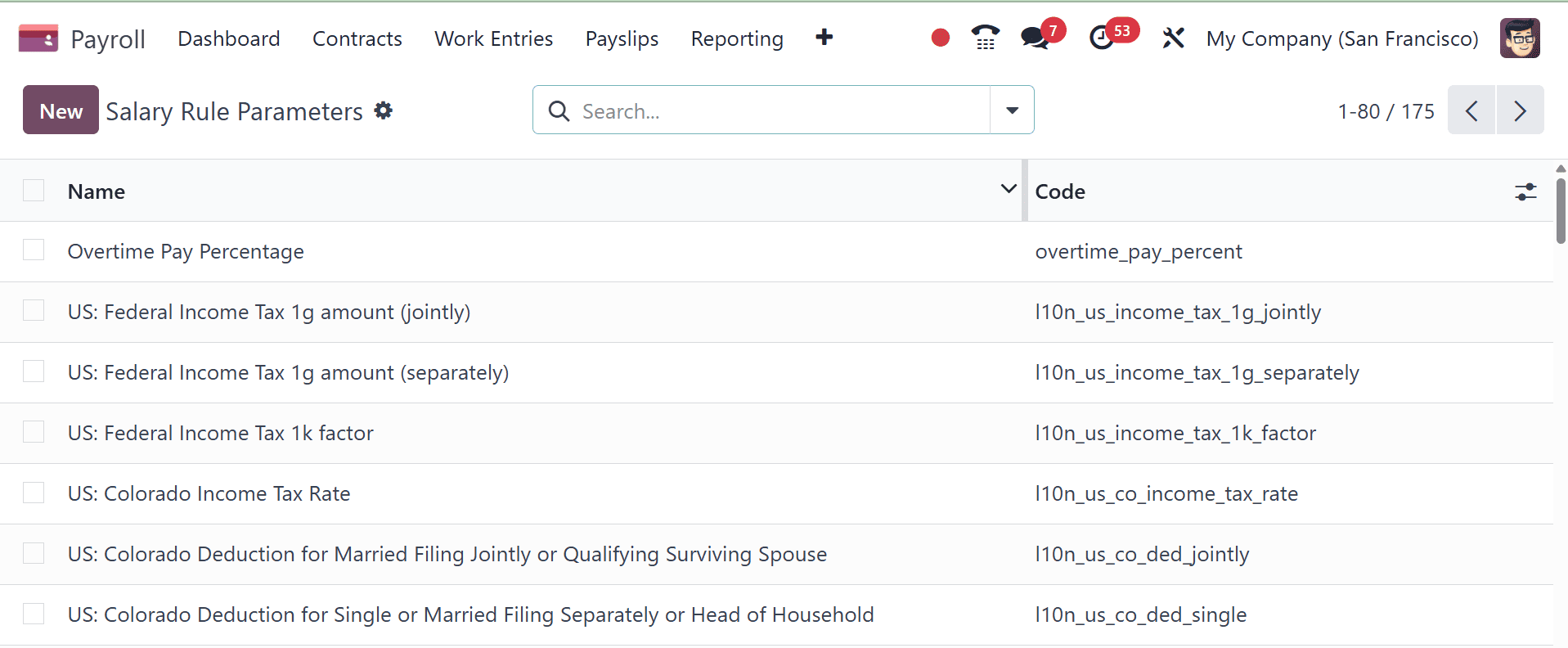

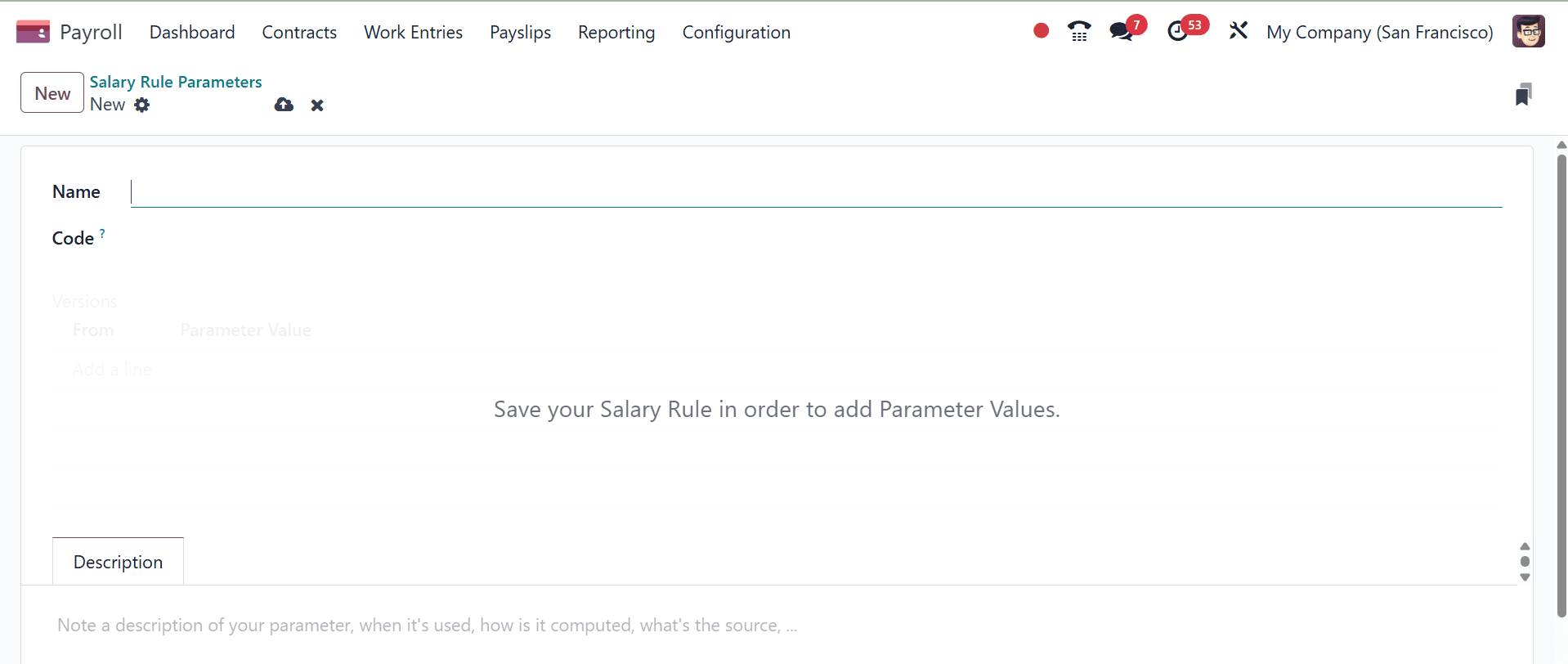

The "New" option in the Configuration menu's Salary Rule Parameters section makes it simple to add additional parameters. The salary rule parameter that we set in this field serves as the basis for defining the salary rules. On selecting the option, you will get the configured rule parameters here.

And the creation page will be, as in the image below.

Other Input Types

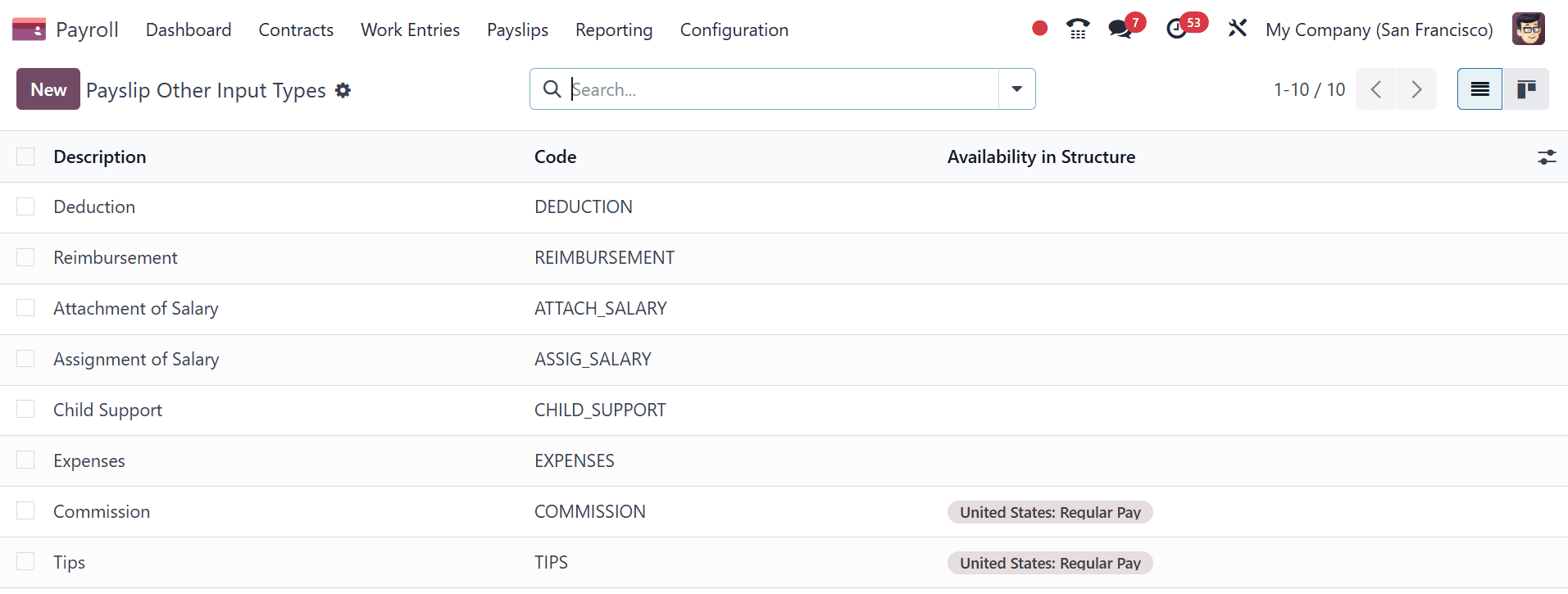

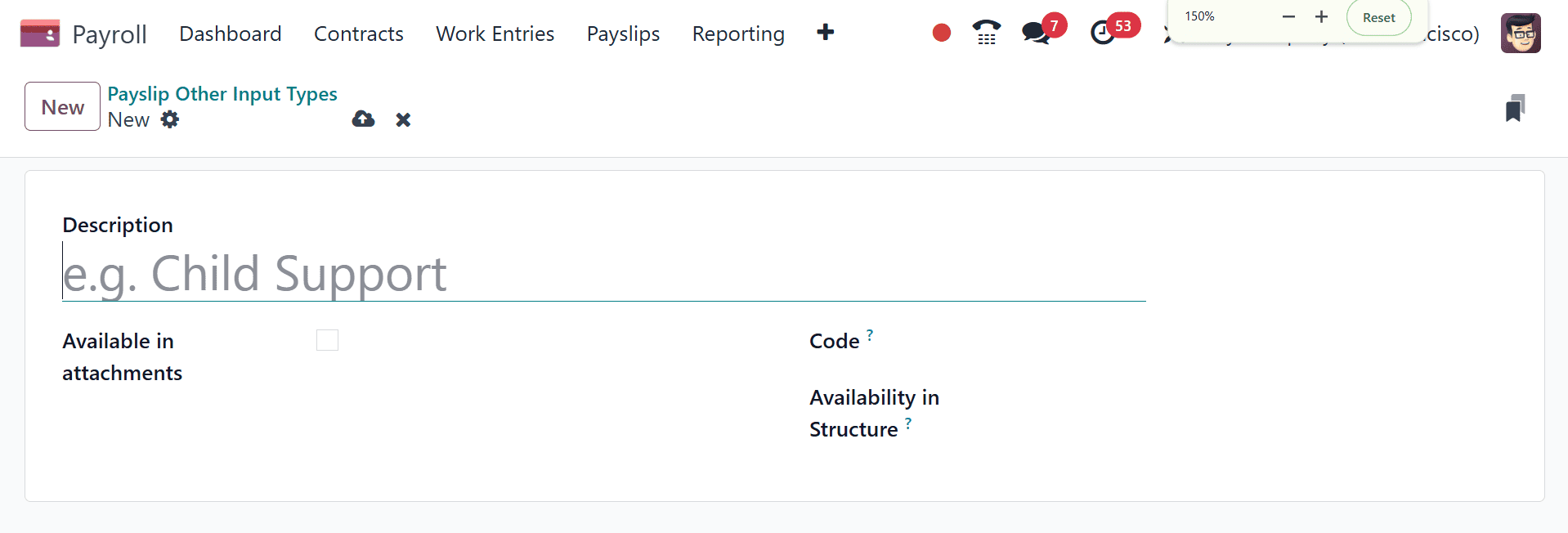

Under the Configuration menu's "Other Input Types," you can configure extra fields that will show up when a payslip is generated.

Add a special code to the input, choose the Availability in Structure, and provide a brief description under the creation page, as in the image below.

Configuring salary structures and salary rules in Odoo 18 is a vital step toward automating and streamlining the payroll process within an organization. By setting up well-defined salary structures, companies can ensure consistency and transparency in employee compensation. The use of salary rules allows for flexible and detailed breakdowns of salary components, including allowances, deductions, and taxes, all of which can be customized to meet organizational and legal requirements.

Odoo 18’s enhanced payroll module offers a user-friendly interface and powerful tools that simplify the management of even complex payroll scenarios. With proper configuration, HR and accounting departments can improve accuracy, reduce manual errors, and ensure compliance with local regulations, making payroll management more efficient and reliable.

To read more about How to Configure Salary Structures & Salary Rules in Odoo 16 Payroll, refer to our blog How to Configure Salary Structures & Salary Rules in Odoo 16 Payroll.