Disallowed expenses are business costs that cannot be deducted from taxable income due to tax regulations. These may include expenses like entertainment, fines, or donations, which require careful tracking to ensure compliance and accurate financial reporting. Odoo 18 Accounting simplifies the management of disallowed expenses with its intuitive interface and powerful configuration options. This guide outlines the steps to configure and manage disallowed expenses effectively in Odoo 18.

Before managing disallowed expenses, ensure the following:

The Accounting and Expenses modules are installed in your Odoo 18 database. You have administrative access to configure settings in the Accounting module.

Configuring Disallowed Expenses in Odoo 18

To begin managing disallowed expenses, follow these steps to set up the necessary configurations:

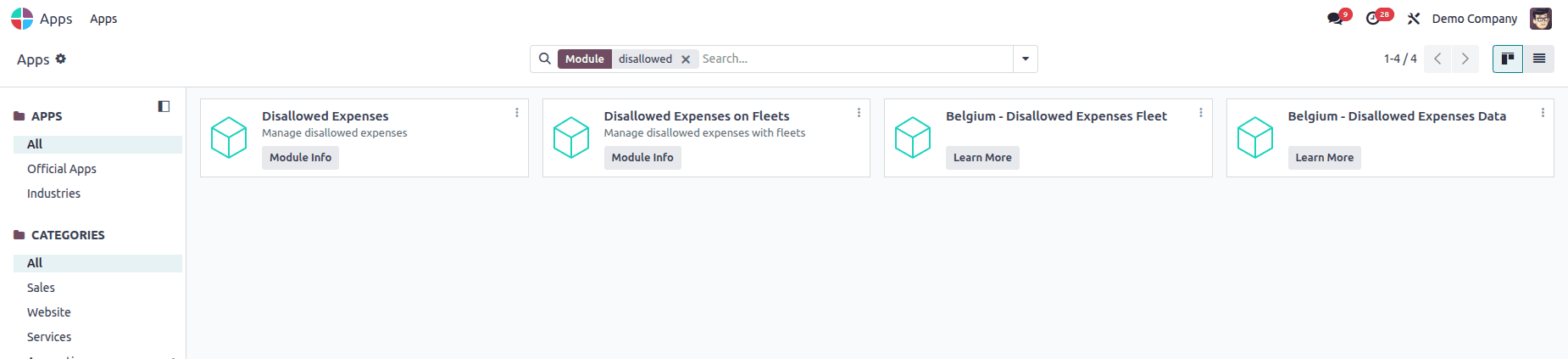

Install Required Modules

From the Odoo Apps, search for and install the Accounting and Expenses modules if they are not already installed. Once installed, install any additional modules related to disallowed expense management.

Access the Accounting Module from the Odoo main dashboard, and navigate to the Accounting module.

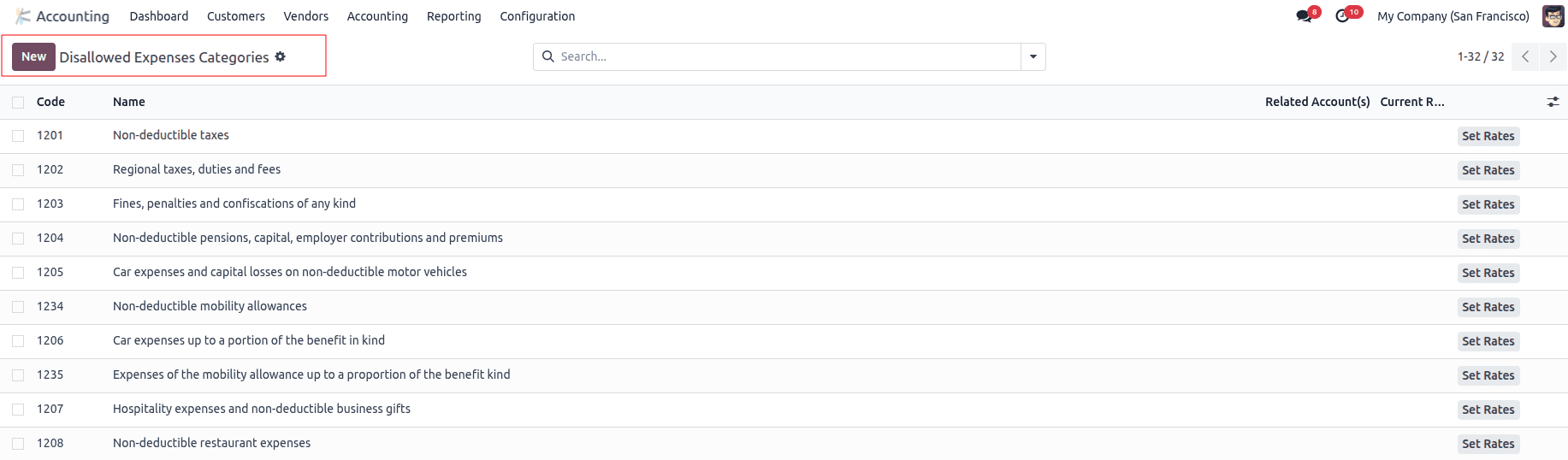

Set Up Disallowed Expense Categories

* Go to the Configuration menu and select Disallowed Expenses Categories.

* A window will display existing categories, including details like Code, Name, Related Accounts, and Current Rate.

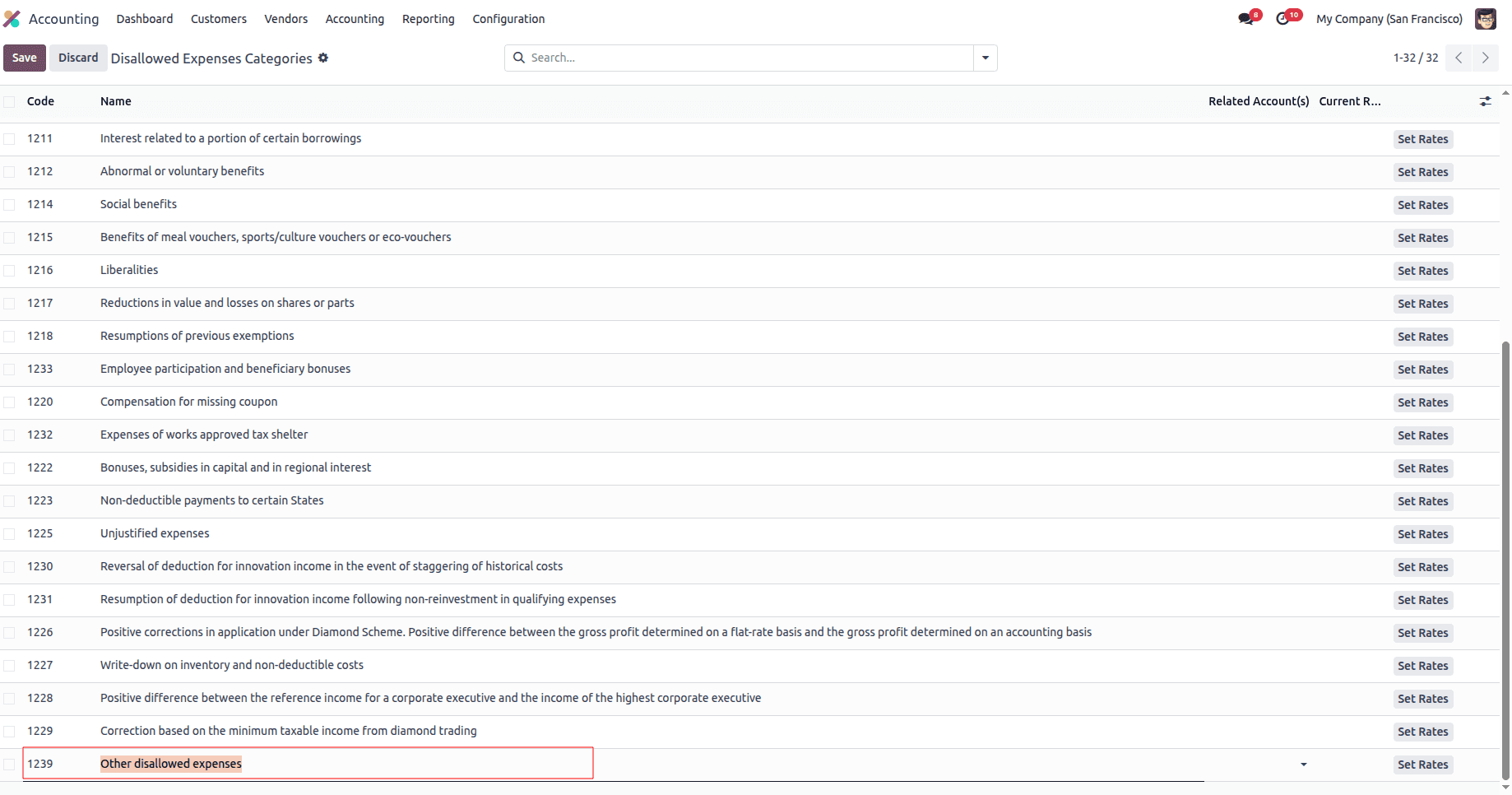

* To create a new category, click the New button.

* Enter the category details, such as:

a. Name: A descriptive name for the disallowed expense category (e.g., "Business Entertainment").

b. Related Account: The expense account linked to this category.

c. Current Rate: The percentage of the expense that is disallowed for tax purposes.

* Save the category.

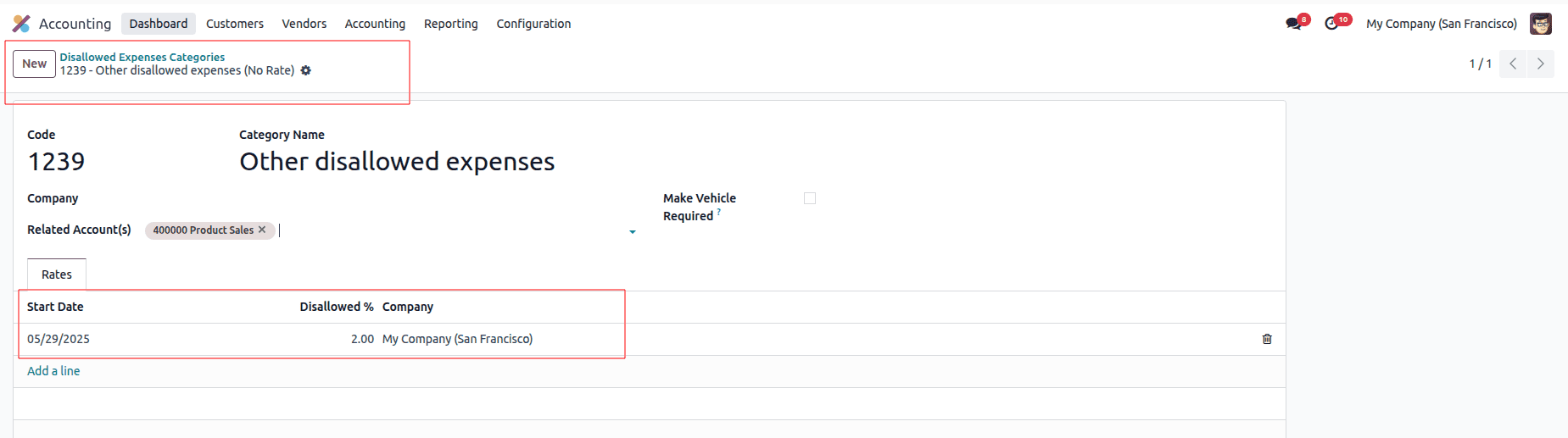

Configure Rates for Disallowed Expenses

* Click the Set Rates button within a category to define rates.

* Add details such as:

a. Start Date: When the rate becomes effective.

b. Disallowed%: The percentage of the expense that is disallowed.

c. Company: The company to which this rate applies (if using multi-company setup).

* Save the rates to apply them to the category.

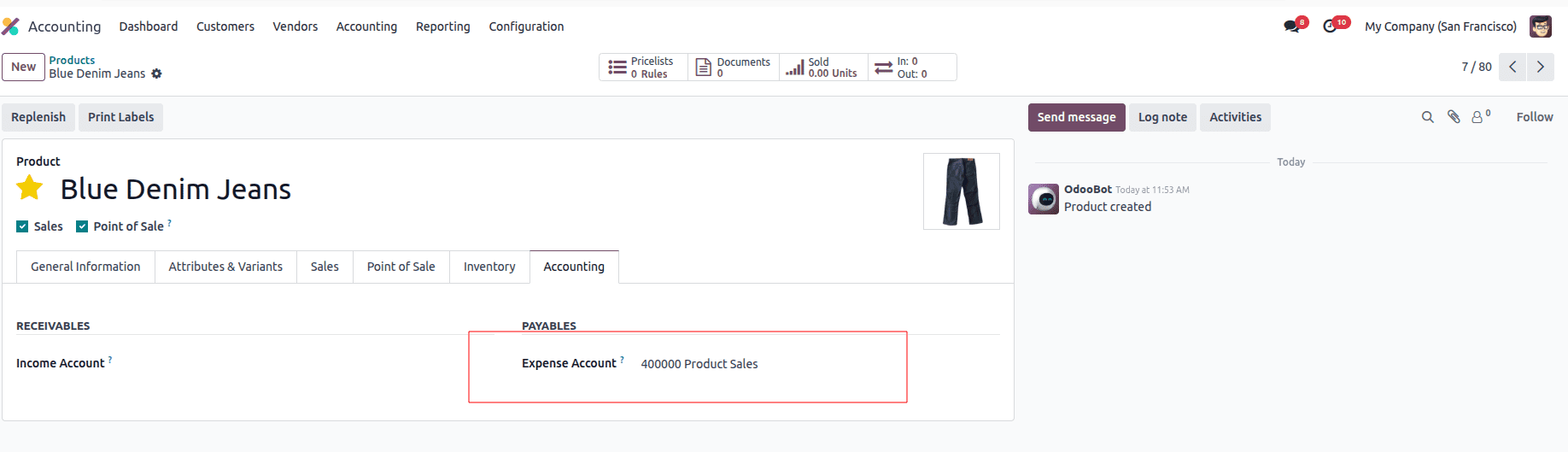

* Navigate to the Chart of Accounts under the Accounting module.

* Select or create an expense account and link it to the appropriate disallowed expense category in the Disallowed Expenses field. This connection ensures that expenses recorded under this account are automatically calculated as disallowed based on the assigned category’s rate.

Managing Disallowed Expenses in Transactions

Once the configuration is complete, you can manage disallowed expenses through regular business transactions, such as purchase orders and vendor bills.

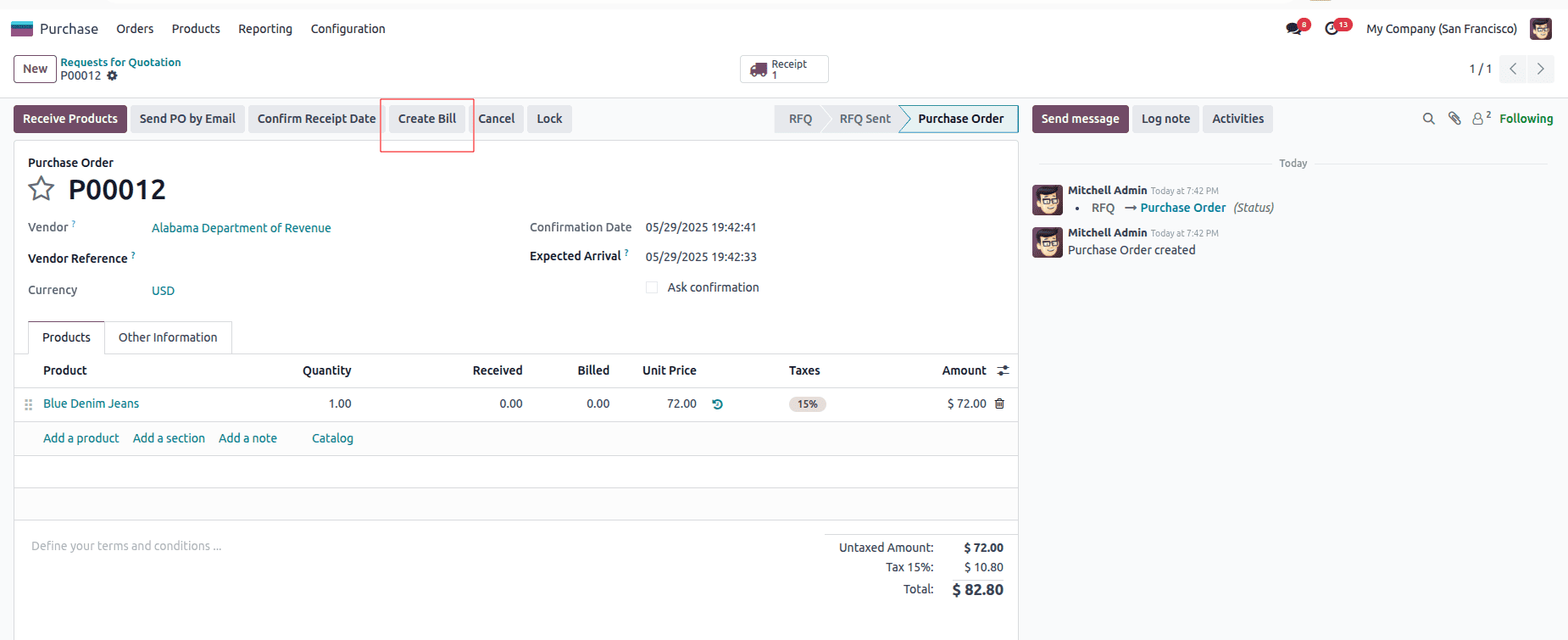

Create a Purchase Order

Create a new purchase order, specifying a product linked to an expense account associated with a disallowed expense category.

Navigate to the Purchase module and select Purchase Orders from the Orders menu. Confirm the purchase order and ensure the receipt of goods or services.

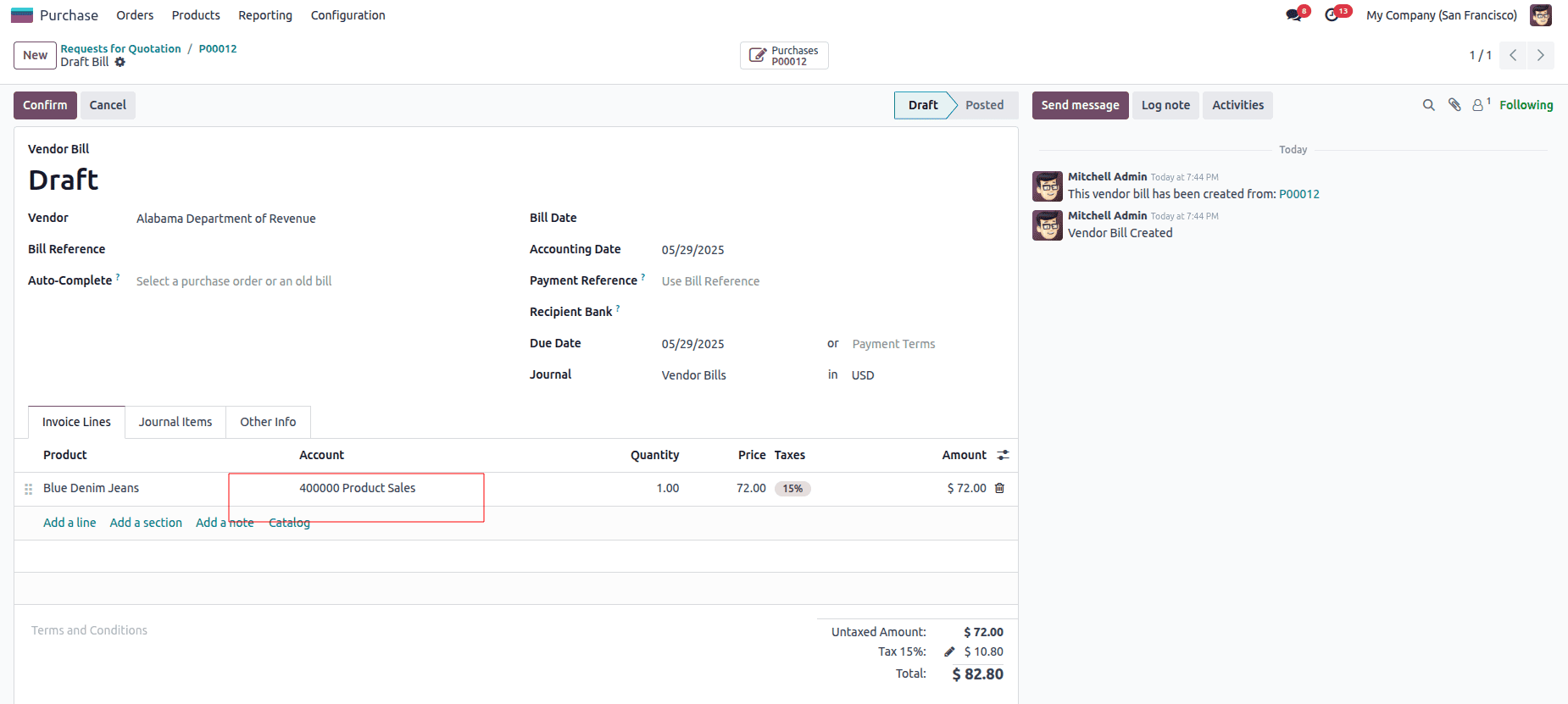

After confirming the purchase order, click the Create Bill button to generate a vendor bill. Verify the bill details, ensuring the expense account linked to the disallowed category is correctly applied.

Reporting Disallowed Expenses

Odoo 18 provides comprehensive reporting tools to track and analyze disallowed expenses:

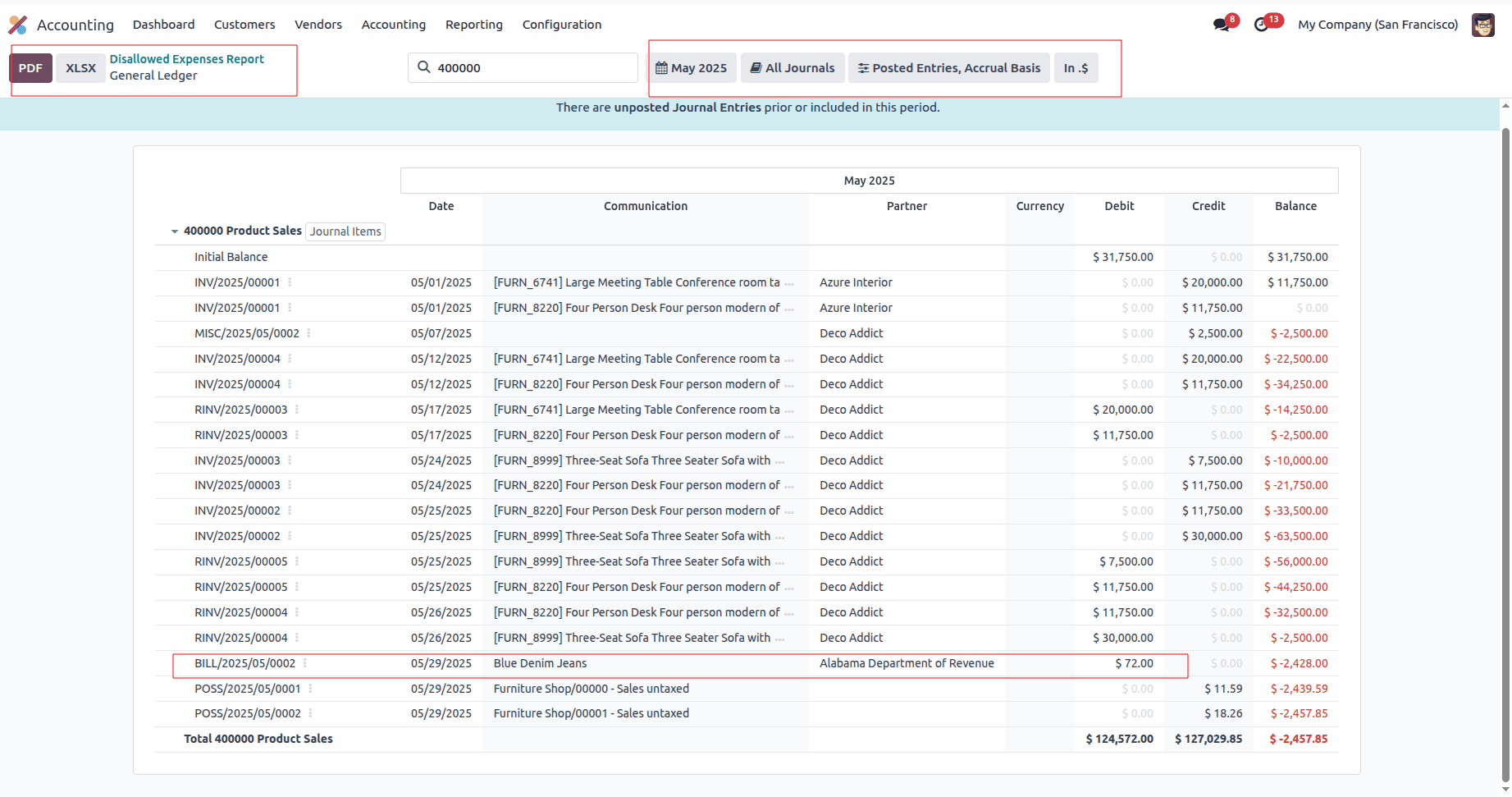

Navigate to the Reporting menu in the Accounting module and select the Disallowed Expenses Report. The report includes details such as Journal items, Date, Partner, Currency, Debit amount, and Disallowed amount.

* Export the report in PDF or XLSX formats for further analysis or compliance purposes.

* Use the General Ledger button to dive deeper into the accounts associated with disallowed expenses.

* Add annotations or footnotes to the report using the Annotate button for additional context or clarity.

Odoo 18 Accounting simplifies the management of disallowed expenses by providing a structured and automated approach to configuration, tracking, and reporting. By setting up disallowed expense categories, linking them to the Chart of Accounts, and utilizing robust reporting features, businesses can maintain compliance with tax regulations while gaining real-time financial insights. With Odoo 18, managing disallowed expenses becomes a seamless part of your accounting workflow, ensuring accuracy and efficiency.

To read more about How to Manage Disallowed Expenses with Odoo 17 Accounting, refer to our blog How to Manage Disallowed Expenses with Odoo 17 Accounting.