In any business that allows customers to purchase goods or services on credit, managing receivables becomes a critical part of financial control. While extending credit can help build trust, encourage repeat business, and increase sales volume, it also exposes organizations to the risk of delayed payments or bad debts. Without a proper system to monitor customer dues, outstanding balances can quickly pile up, affecting liquidity and disrupting cash flow. This is where Odoo 19 Accounting plays a crucial role by offering a structured and automated approach to credit management through its Sales Credit Limit feature.

The Sales Credit Limit in Odoo 19 Accounting is designed to help businesses regulate how much credit they extend to customers. It allows organizations to set predefined financial thresholds and continuously track customer receivables against those limits. By doing so, Odoo ensures that sales and accounting teams are always aware of a customer’s credit position before confirming new transactions. This proactive monitoring helps businesses minimize credit risk, avoid unpleasant payment surprises, and maintain overall financial stability.

At its core, the Sales Credit Limit feature works by comparing a customer’s outstanding receivables, such as unpaid invoices or overdue amounts, against a configured credit limit. When the receivables approach or exceed this limit, Odoo immediately notifies the user. Instead of discovering payment issues after the fact, businesses can take timely action during the sales or invoicing stage itself. This makes the feature especially valuable for companies dealing with high transaction volumes, long payment cycles, or customers with varying creditworthiness.

To begin using the Sales Credit Limit feature in Odoo 19, it must first be activated from the Accounting settings. Users can navigate to Accounting > Configuration > Settings and scroll down to the Customer Invoices section.

Here, enabling the Sales Credit Limit option activates credit monitoring across customer transactions. Once saved, this setting becomes part of the accounting workflow, seamlessly integrating with sales orders and customer invoices without requiring additional manual steps.

After activation, Odoo allows businesses to define a default credit limit that applies to all customers by default. This default limit acts as a baseline credit policy for the organization. For example, if the default credit limit is set to $1,000, Odoo will automatically track each customer’s unpaid invoices and outstanding receivable amounts. As soon as a customer’s total due exceeds this amount, the system recognizes that the credit limit has been crossed. This centralized control ensures consistency in how credit is extended across the customer base, especially for new or occasional customers.

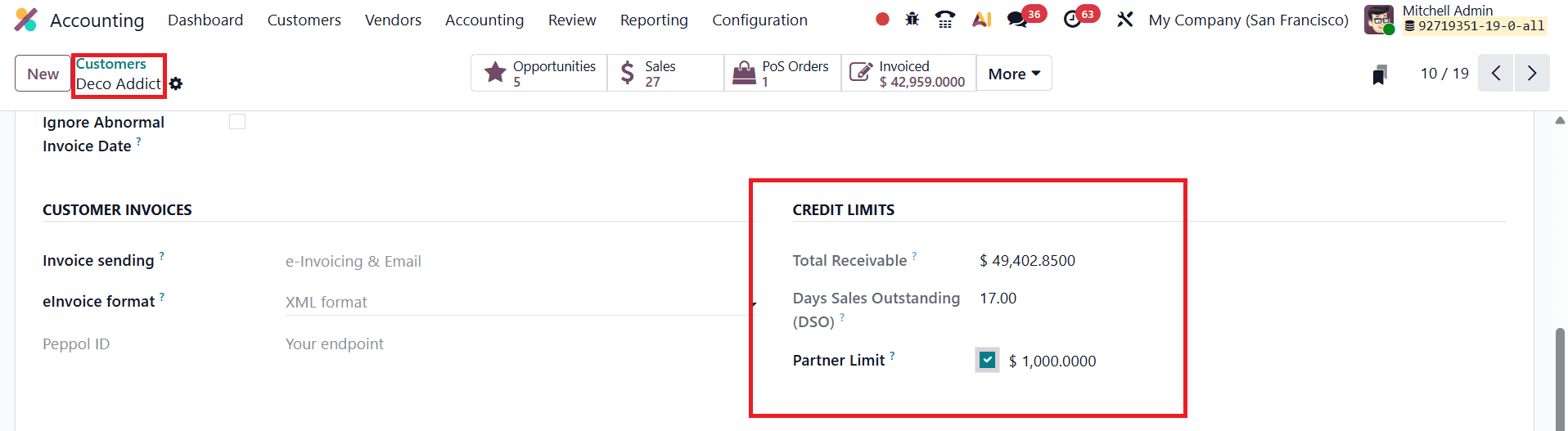

However, businesses often deal with customers who have different purchasing patterns, payment behaviors, or negotiated credit terms. Recognizing this, Odoo 19 Accounting provides the flexibility to configure individual credit limits for specific customers. This is particularly useful for long-term clients, high-volume buyers, or customers with proven payment reliability who may be allowed higher credit exposure. To configure a customer-specific credit limit, users can navigate to Accounting > Customers, open the relevant customer record, and move to the Accounting tab. Here, enabling the Partner Limit option allows users to specify a custom credit limit tailored to that customer’s agreement.

Within the same Accounting tab, Odoo displays the Total Receivable amount for the customer. This field shows the real-time outstanding balance, including unpaid and overdue invoices. By presenting this information directly on the customer form, Odoo gives sales and accounting teams immediate visibility into the customer’s financial status. This transparency supports better decision-making, as users can quickly assess whether a customer is within their credit limit before proceeding with new sales.

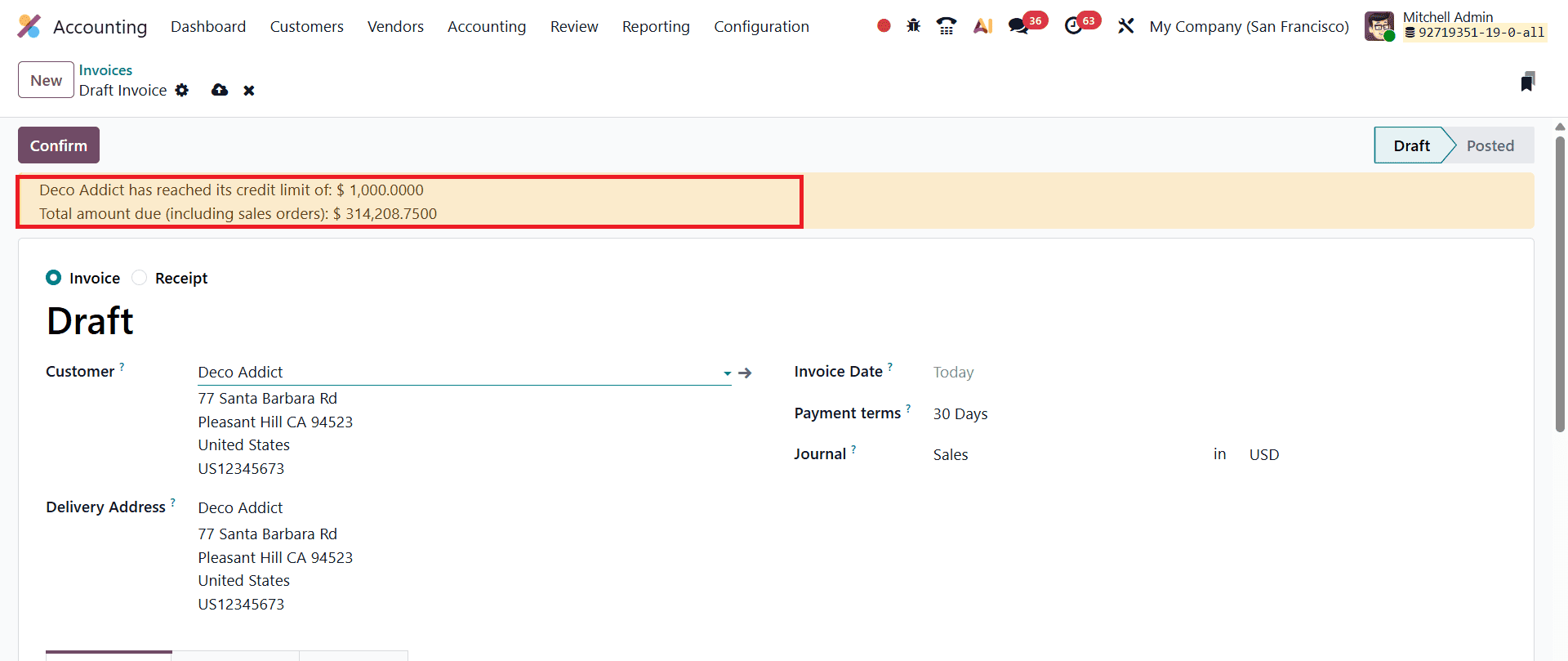

One of the most practical aspects of the Sales Credit Limit feature is how it behaves during transaction processing. When a user attempts to create or confirm a sales order or customer invoice for a customer whose receivables exceed the defined credit limit, Odoo 19 displays an on-screen warning message. This warning clearly informs the user that the customer has surpassed their credit threshold and highlights the total receivable amount. Rather than silently allowing risky transactions, Odoo ensures that users are fully aware of the credit situation at the moment of action.

Importantly, Odoo’s approach is designed to support flexibility rather than rigid enforcement. The warning message does not automatically block the transaction; instead, it acts as a decision-support tool. This allows businesses to handle exceptions intelligently. For instance, a sales manager may choose to proceed with the order for a trusted customer, request partial or advance payment, or coordinate with the accounting team to review overdue invoices. In other cases, the transaction may be postponed until previous dues are cleared. This balance between control and flexibility makes the feature suitable for a wide range of business models.

From an operational perspective, the Sales Credit Limit feature enhances collaboration between sales and accounting teams. Sales personnel gain immediate insight into customer credit status, reducing the risk of overpromising or closing deals that later face payment issues. Meanwhile, accounting teams benefit from better receivables control and reduced follow-up effort, as potential credit problems are addressed earlier in the sales cycle. This alignment helps organizations maintain smoother workflows and stronger internal communication.

Another key advantage of Sales Credit Limit management in Odoo 19 is its contribution to cash flow optimization. By preventing excessive credit exposure, businesses can ensure a more predictable inflow of payments. This is especially important for small and medium-sized enterprises, where cash flow disruptions can significantly impact operations. With Odoo continuously monitoring receivables, companies can plan collections more effectively and reduce dependency on emergency financing or short-term loans.

The feature also supports better customer relationship management. Clear credit limits and timely warnings help businesses set transparent expectations with customers regarding payment responsibilities. Instead of reacting abruptly to overdue payments, companies can have structured discussions backed by accurate data. Over time, this can encourage better payment discipline among customers and foster healthier, more professional business relationships.

In conclusion, the Sales Credit Limit feature in Odoo 19 Accounting is a powerful and practical tool for controlling customer credit exposure. By allowing businesses to define default and customer-specific credit limits, providing real-time visibility into receivables, and issuing timely warnings during sales and invoicing, Odoo helps organizations reduce financial risk without compromising sales flexibility.

To read more about How to Manage Customer Credit Notes in Odoo 18 Accounting, refer to our blog How to Manage Customer Credit Notes in Odoo 18 Accounting.