Accounting is a necessary process for any organization. Precise accounting is indeed needed for the smooth running of the company without any financial losses. Any error happening in the accounting area will directly affect the financial stability of the company. So accurate accounting is unavoidable for any company. Now to aid the accounting activities of a company, the software can be made use of, if it is an ERP software things get even better. Odoo 12 accounting is very capable accounting software which can make your business run smoothly without much hassles.

There are many features which make Odoo 12 a very capable accounting software. Synchronized transactions, Paypal connectivity, instant invoice creation, mail sending, integration with other Odoo apps and report making are some of the very distinctive features of Odoo 12 accounting.

Odoo accounting features

1. Double entry: Odoo 12 accounting automatically creates an additional entry for each of the accounting transactions like customer invoices, the point of sales, inventory movement expenses etc. For this double-entry bookkeeping system is put into practice. With these journal entries are fully stabilized.

2. Cash basis and accrual: Accrual and cash basis methods are supported in Odoo 12 accounting. With this income/expense at the time of transactions or payment can be reported.

3. Multi-company support: Odoo 12 accounting is robust enough to manage several companies.

4. Multi-currency support: The Odoo 12 accounting also provides multi-currency support. In case if you have to make a transaction with other countries, Odoo 12 accounting can be made use of.

5. International standard: More than 50 countries are supported in Odoo 12 accounting thus making it internationally suitable and standard. For each country, specific modules are there to meet their standards.

6. Accounts receivable and payable: A single account is used in Odoo 12 accounting for all receivable and payable account entries. There are options to create separate accounts based on customers also.

7. Financial reports: Real-time financial report creation is also made possible with Odoo 12. Various reports like management reports, performance reports, cash reports etc. can be created using Odoo 12 accounting software.

8. Automatic bank feeds: Importing bank feeds automatically is also possible in Odoo 12 accounting. Odoo 12 accounting supports bank reconciliation and makes the task easy by importing bank statements directly from your bank to Odoo account. Odoo 12 accounting speeds up the bank reconciliation process altogether.

9. Tax calculation: Odoo 12 accounting provisions with the easy calculation of taxes via using details of accounting transactions for a tax period.

10. Inventory valuation: Odoo 12 accounting also helps in inventory valuation. Both manual and automatic valuations are possible in Odoo 12 accounting software.

11. Retained earnings: The part of income which you have with you from doing your business is called retained earnings. With Odoo 12 accounting the current year earnings are calculated automatically. This eliminates the possibilities of year-end journals and rollovers.

Odoo accounting for entrepreneurs

Here we discuss the various features Odoo 12 accounting has to offer exclusively for entrepreneurs.

1. Chart of accounts: The Odoo 12 accounting chart of accounts deals with the balance sheet or P&L accounts.

2. Journal entries: The financial documents associated with a company is recorded as a journal entry in Odoo 12 accounting.

3. Reconciliation: The process of matching credits and debits by linking journal items of an account is also made possible in Odoo 12 accounting.

4. Bank reconciliation: The bank reconciliation process can easily be done using Odoo 12 accounting software.

5. Checks handling: Odoo 12 accounting can handle both internal wire transfer and also can manage checks.

Setup

Now we will discuss how to set up the Odoo 12 accounting.

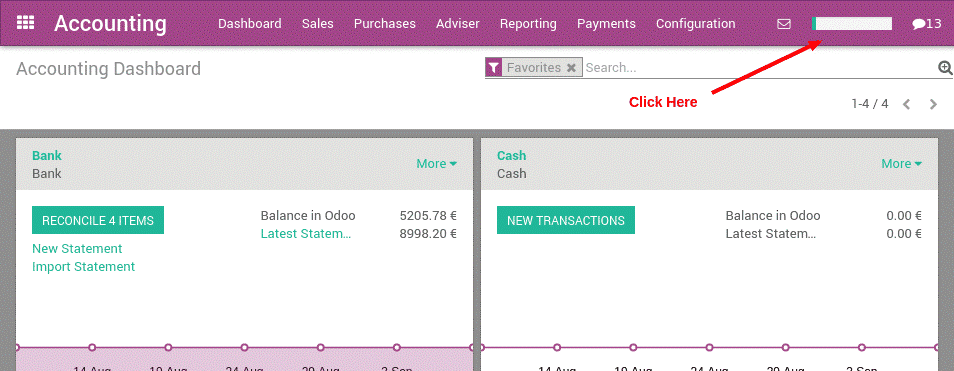

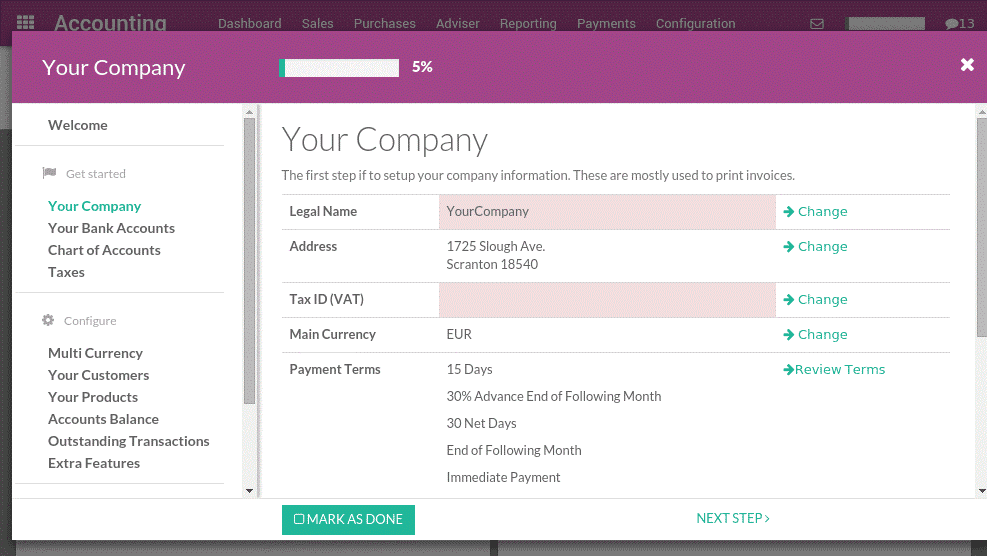

There is an implementation guide in Odoo 12 accounting. Follow the steps in the implementation guide to configure the accounting application. Once the Odoo 12 accounting application is installed, the implementation guide can be accessed from the top right progress bar.

There are several steps for configuration. Once a step is completed you should check ‘mark as done’ button to track the progress of the configuration.

Odoo accounting process

From customer invoice to payment collection

Odoo 12 accounting support different types of invoicing and payment workflows from which you can select the one which suits your business.

Invoice creation: From sales orders, purchase orders etc. we can manually generate draft invoices. A customer shall be provided with an invoice having all necessary information. Now we will see different areas of invoicing;

1. Draft invoices: The invoices created by the system which are set to draft state are called draft invoices. These are invalidated and don't have any impact on the system.

2. Open invoices: Various details like price, quantity, dates, parties involved, tax details etc. will be there on an invoice. Now when an invoice is ready you can validate it, then the draft invoice will be changed to open invoice. A unique number will be provided by Odoo once the invoice is validated.

Along with these accounting entries are also automatically created.

3. Sending invoice to the customer: After validating the invoice you can send it to the customer through email.

4. Payment: When the account entry and payment entry are reconciled Odoo will consider the invoice as paid. If reconciliation doesn’t happen invoice will still be in the open state.

5. Partial payment through bank statement: The bank statements can be either entered manually or be imported from a CSV file. Also, it can be entered according to the accounts localization.

6. Reconcile: Next step is the reconciliation step.

Mass reconciliation and individual reconciliation are possible in Odoo 12. Once reconciliation is done the invoice will display “you have outstanding payments for this customer. You can reconcile them to pay the invoice”.

Once you apply for the payment it will be added along with the invoice.

7. Payment follow up: Tracking the payment and keeping a regular follow up is always necessary since each customer behaves differently. In case of overdue and all, you can take necessary actions using Odoo 12 accounting. In the case of overdue, you can go to customer record and access the overdue payments. There you can notice the follow-up message and invoices which are overdue.

8. Customer aging report: To know about customer credit issues and plan the work accordingly the customer aging report can be made use of.

9. Profit and loss: The details about the revenue and expense can be accessed from profit and loss statements. This gives you a clear idea about the present situation of your business.

10. Balance sheet: All the details regarding liabilities, assets, and equity of a company can be viewed from the balance sheet.

From vendor bill to payment

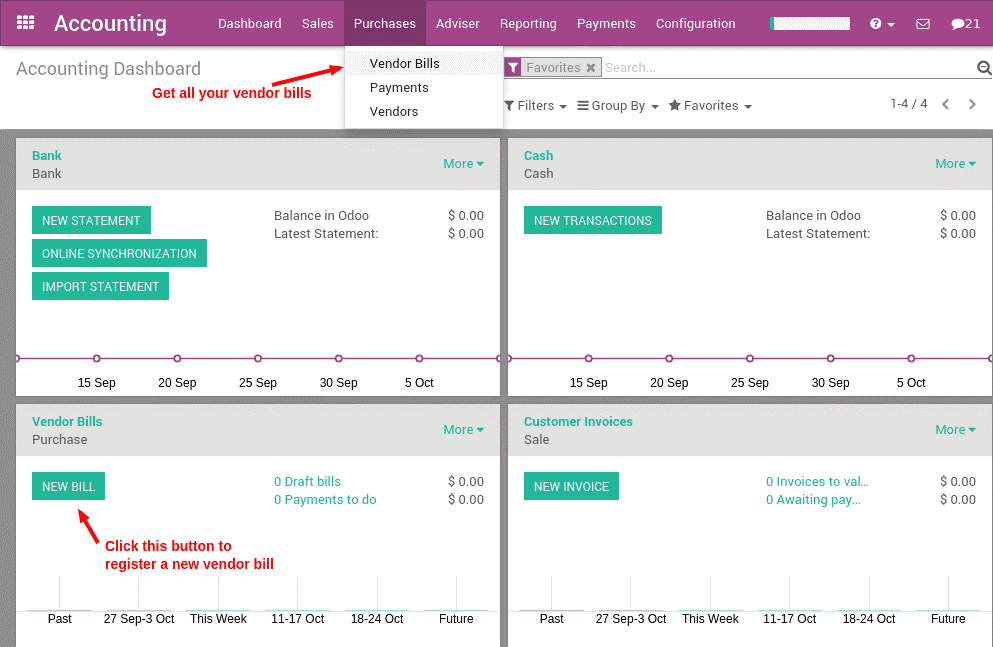

You can pay vendors for the amount which they require using Odoo 12. For this, you have to register to vendor bills in Odoo.

Now we can see the various steps of vendor bill payment;

1. Recording new vendor bill: To record a vendor bill, go to the accounting application. From there select purchases -> vendor bills. The new bill feature on accounting dashboard can be used as an alternative.

2. Validated vendor bill: After the vendor bill gets validated, based on the invoice, a journal entry too will be created.

3. Paying a bill: By clicking on register a payment you can create the payment for open vendor bill. Now select the payment method and the amount to pay. All the other remaining balance of bill will be proposed by Odoo. The vendor invoice number will be set as a reference in the memo field.

4. Printing vendor checks: We can also pay the vendor bills by check, Odoo has got the capability for that too. From the accounting dashboard, we will get information about the checks left to be printed.

5. Reporting: The aged payable balance can be used to get a list of open vendor bills and their due dates. This can be accessed from the reporting menu.

With all these features, Odoo 12 accounting software is a total solution for all the account related activities. With the use of Odoo 12 accounting software, an error-free and more efficient account system are guaranteed for your business.

To know more about Odoo 12, its extensive applications under varied modules, refer to our previous blog odoo 12 features

Read about Odoo accounting documentation from our Odoo v13 BookTo know more about Odoo Accounting, the Best Accounting Software. Watch the video below to understand more about the features of Odoo Accounting.