Accounting using Odoo Configuring Odoo's accounting capabilities to conform to the unique tax laws, financial regulations, and reporting requirements of a given nation is known as localization. Localization guarantees that companies utilizing Odoo stay in compliance with local legal requirements, such as invoicing restrictions, tax calculations (such as VAT, GST, or sales tax), statutory reporting, and language preferences, as accounting standards differ greatly between regions.

Numerous nations, including those in the Gulf Cooperation Council (GCC), India, the US, Germany, and France, have their own localization modules available through Odoo. Predefined charts of accounts, tax structures, electronic invoicing formats, country-specific reporting, and interfaces with regional banks and government websites are frequently included in these localization packs.

By adopting Odoo Accounting Localisation, organizations can automate compliance, decrease manual errors, and provide accurate financial reporting according to local standards. This facilitates cross-border operations for businesses while ensuring transparency and compliance with local regulations in each of the nations they serve.

A fiscal localization package is made up of country-specific modules that provide a chart of accounts, pre-configured taxes, legal statements, and fiscal positions on a database. People from various nations can localize ERP commodities in accordance with national regulations by using localization. Taxes vary by nation, and the localization function simplifies tax automation. ERP software makes it simple to remove any obstacles from your company. In practically every module, Odoo ERP adapts its localization features to the business demands of its clients. The Odoo 18 Accounting module allows you to use various country-specific localization packages.

With the accounting program, we can manage a number of business operations, including payments, bank reconciliation, taxes, currency, and more. Evaluation of trial balances, balance sheets, journal entries, etc., made available via Odoo 18 Accounting. Let's take a look at Odoo 18 Accounting's crucial introduction to Odoo Fiscal Localization.

Benefits of Accounting Localisation

Odoo 18's fiscal localization functionality is dependent on a number of nations. Every fiscal localization based on a nation has its own quirks. The following list includes some typical benefits of utilizing Odoo fiscal localization:

- With fiscal localization, it is easy to save electronic invoice documents in a system database. The information can be saved for use in the future when the business needs it.

- To handle customer taxes, withholding taxes, credits, book payments, and other matters, apply standard or new taxes to goods and sales.

- Using fiscal localization, we can effortlessly integrate a company's accounting transactions based on several business cycles.

- Easily create several reports with comparable accounting and localization features.

- By merging the domestic and overseas tax returns, report preparation is made easier.

- Using reports, centralize all of an organization's data into a single database.

Packages for Fiscal Localization

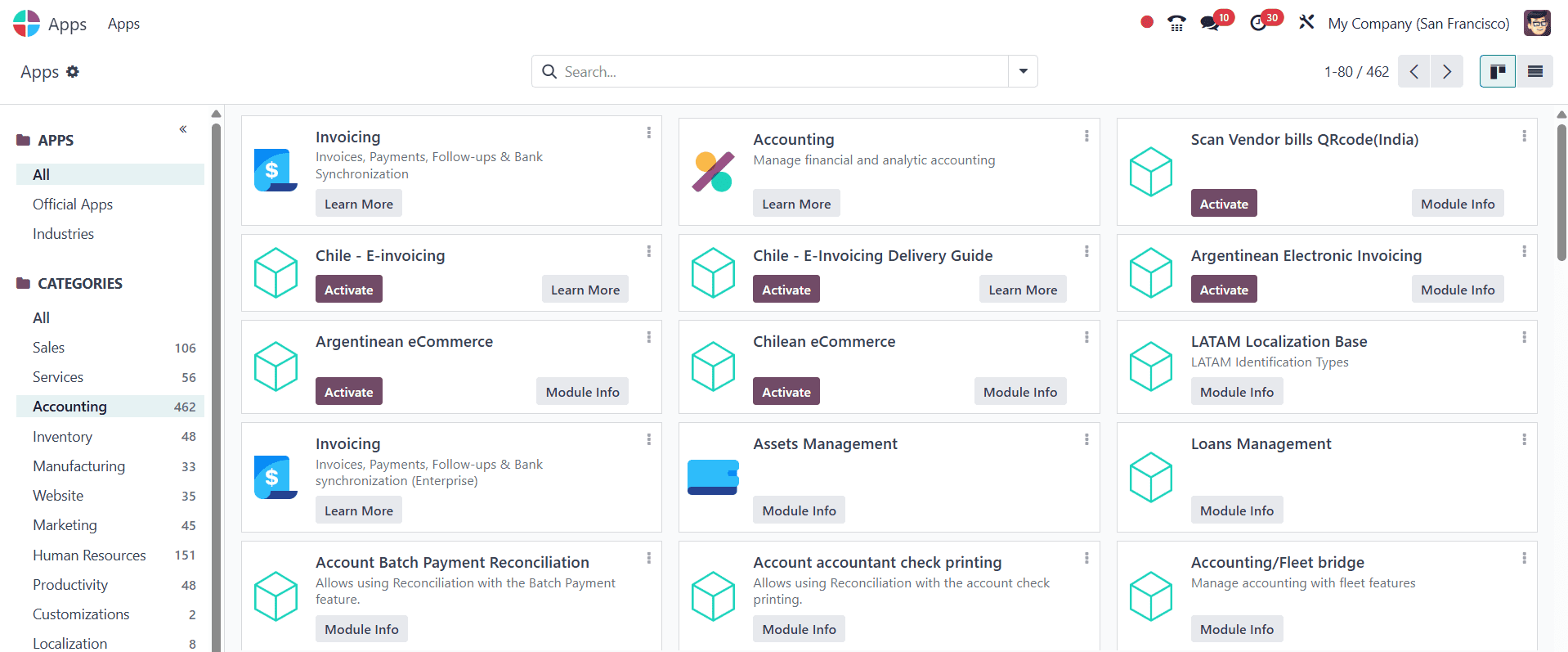

The fiscal localization package is one of the deployed country-specific modules for fiscal positions, legal statements, and other purposes. Odoo will automatically install the right package for your business based on your country. With these products, we may set up country statements and certifications and enable taxes according to the needs of the business. It is possible to execute Odoo 18 Accounting according to a certain country by putting in place a country-specific package. You can get your nation package by selecting Odoo 18's Apps module. Select the Accounting area in the Apps window. As seen in the screenshot below, the user can view a list of all localization packages.

Localization packages for nations including Australia, the United Arab Emirates, Austria, Belgium, and others are available here. The option will be available after enabling the option under settings, as in the image below.

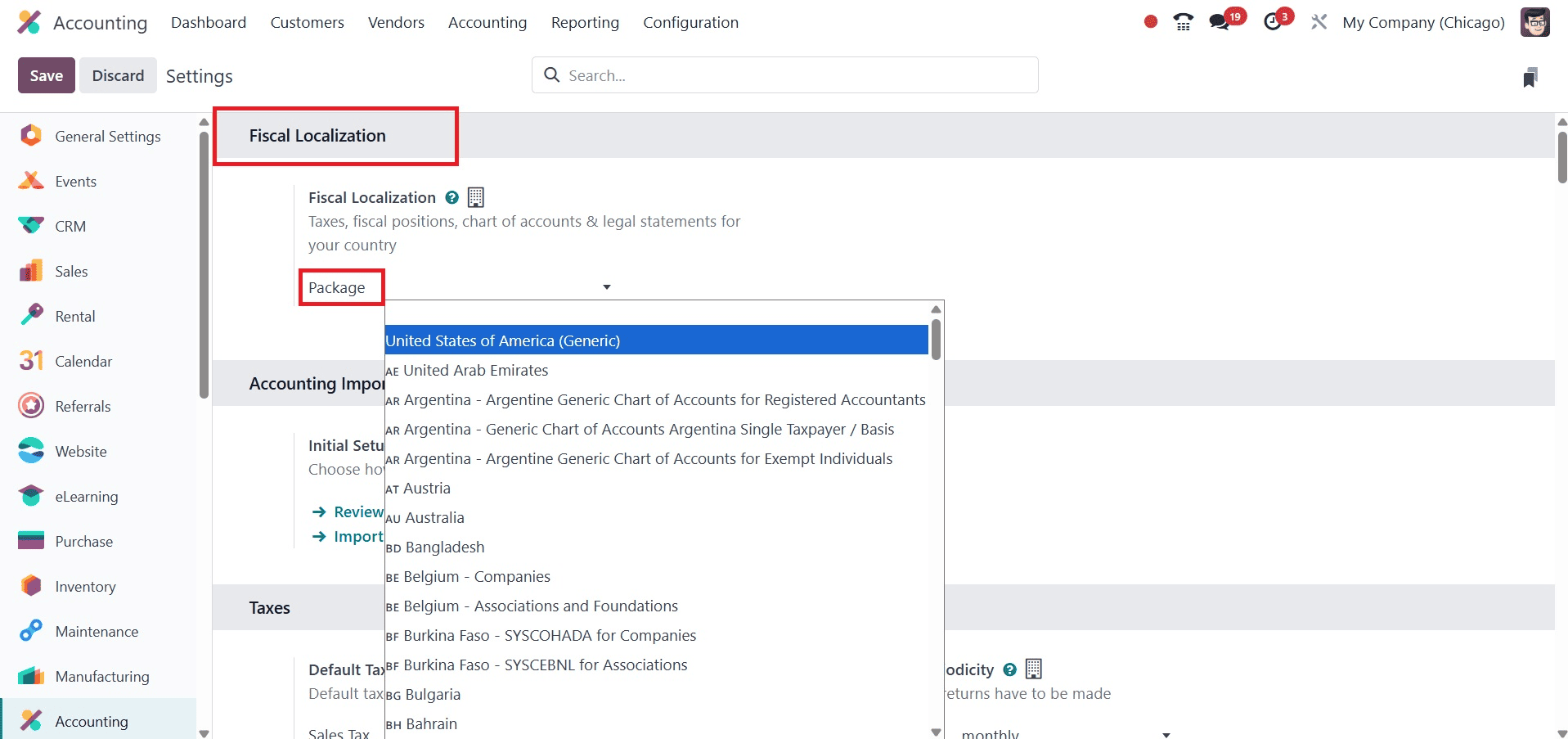

There is another way to add an accounting package. If a new company is created, we can then have the Packages option, under which we can select the required localization. For that open the Accounting module and click on the Configuration menu. Then choose the Settings.

If a new package is chosen, then the corresponding chart of accounts and tax are installed inside the company.

To Use Odoo 18 Accounting to Establish a Company's Fiscal Year

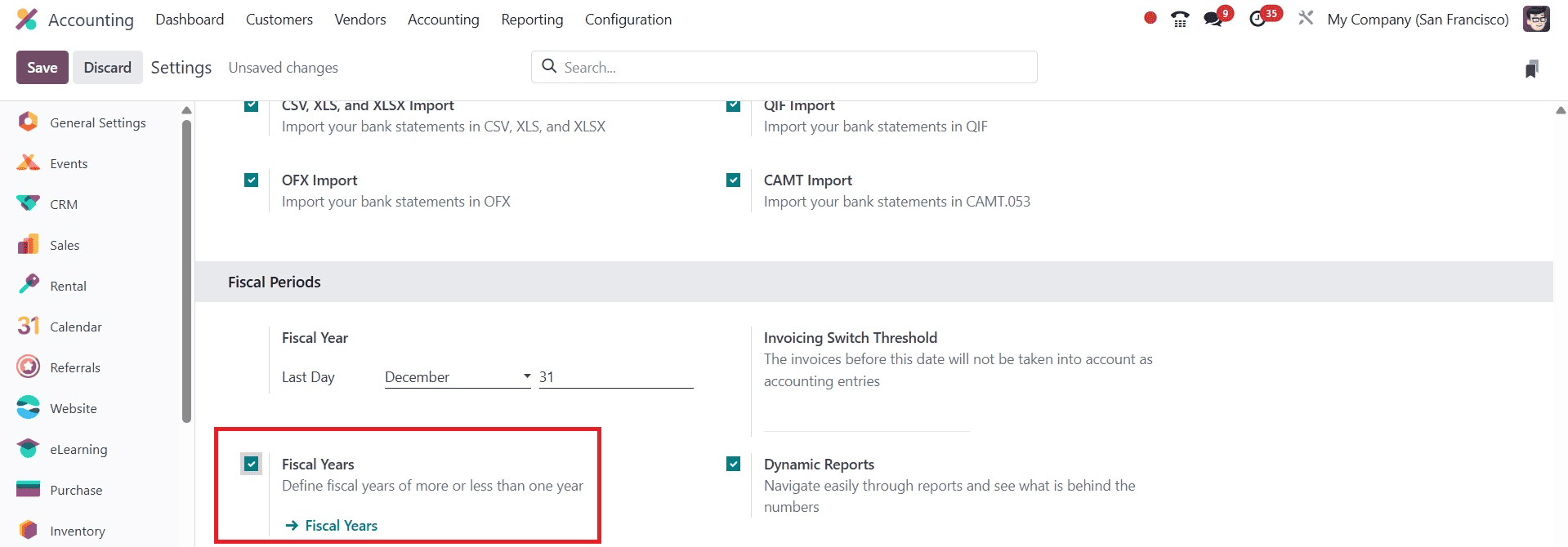

Users must select the Settings option in Configuration in order to activate the fiscal year capability. To choose fiscal years that are longer or shorter than a year, activate the Fiscal Years option located beneath the Fiscal Periods section. As shown in the screenshot below, click the SAVE icon in the Settings box after activation.

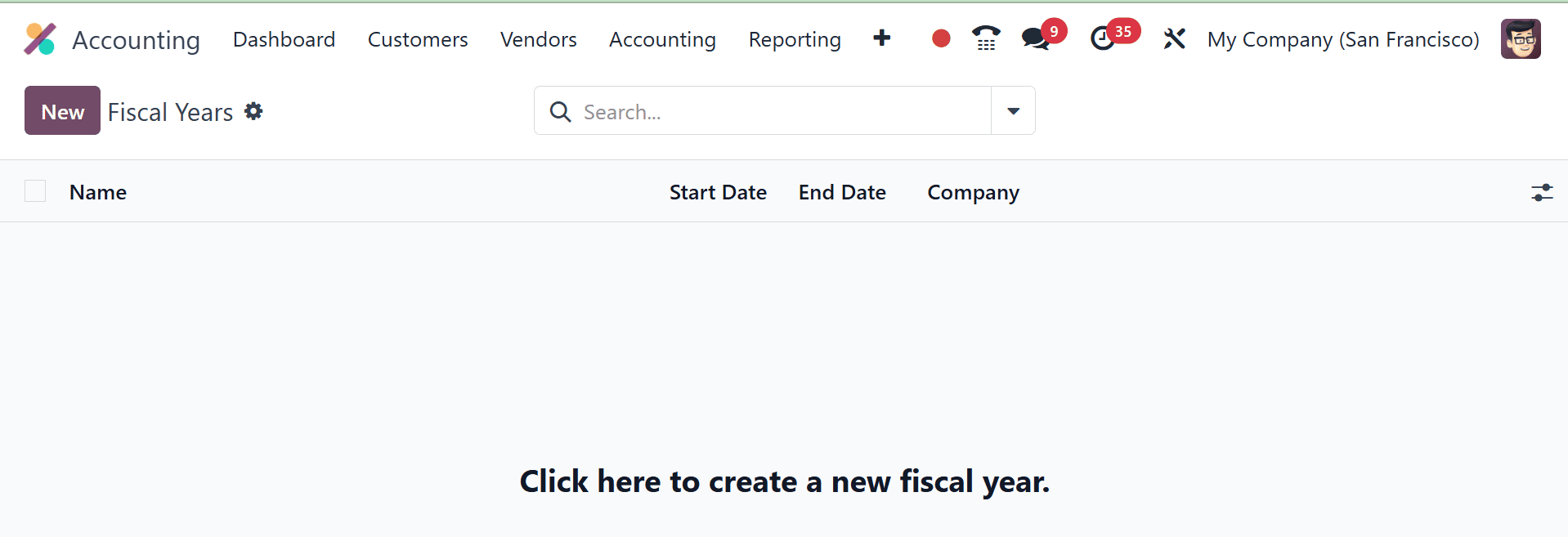

The fiscal year functionality in Odoo 18 Accounting is now operational. The Fiscal years functionality is accessible through the Configuration tab. A company's fiscal year can be readily defined in the new screen by choosing the New option, as seen in the screenshot below.

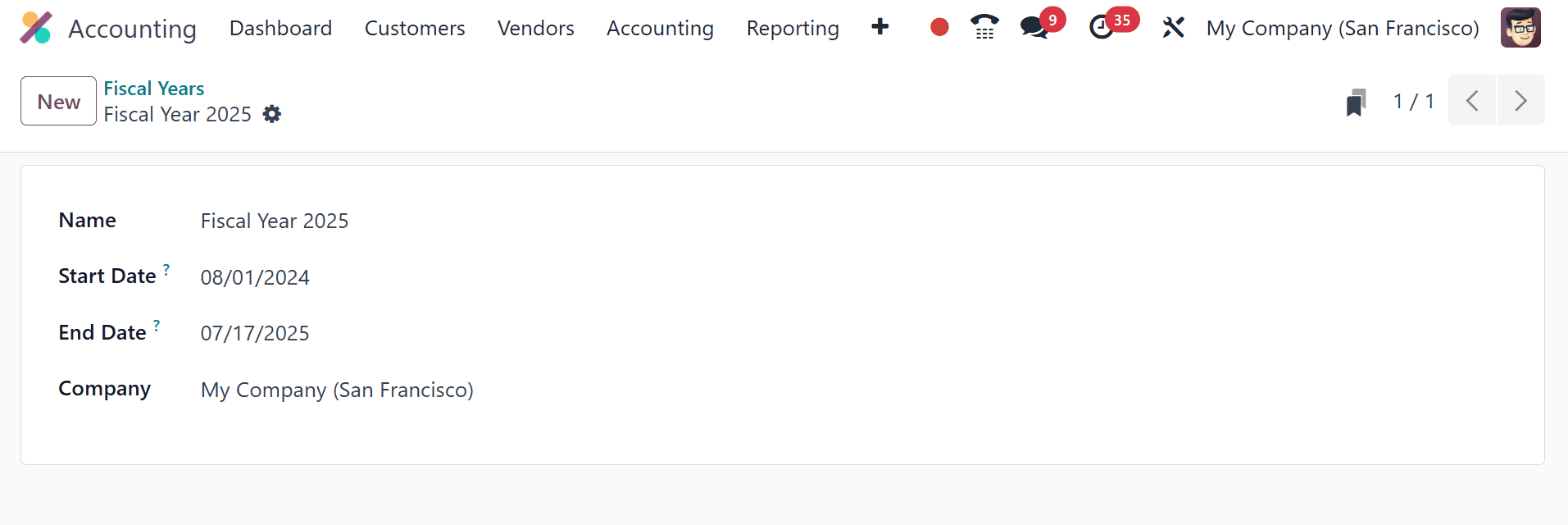

In the Name area on the open page, enter the year as Fiscal Year 2025. Using the Start Date field, select the start date of your company's fiscal year. However, as seen in the example below, the user can enter the last day of the business fiscal year in an End Date field.

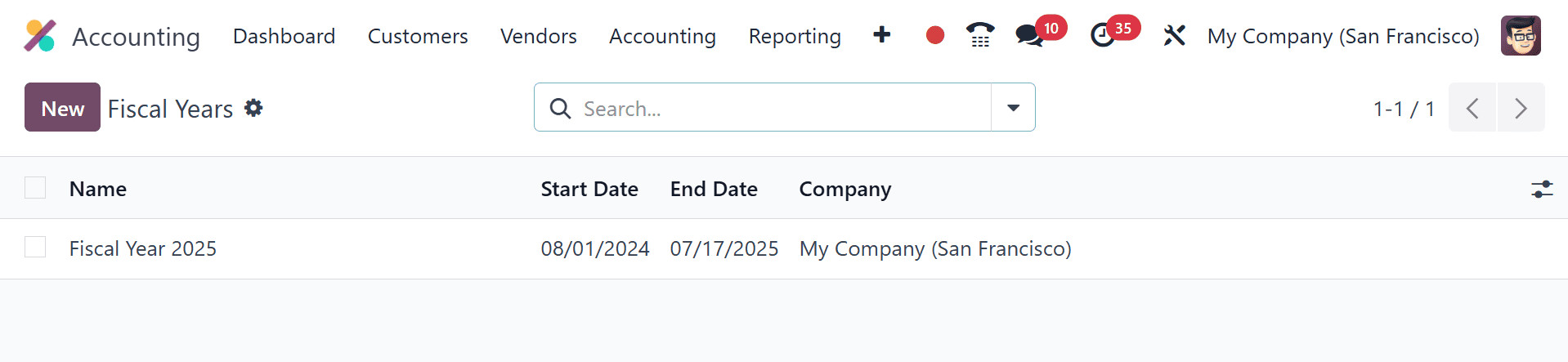

From the Company field, choose My Company. Select your firm name and then click the Save manually icon in the Fiscal Years window. As seen in the example below, you may access the fiscal year data you prepared in the main window.

How can I create a fiscal position in Odoo 18 depending on my company?

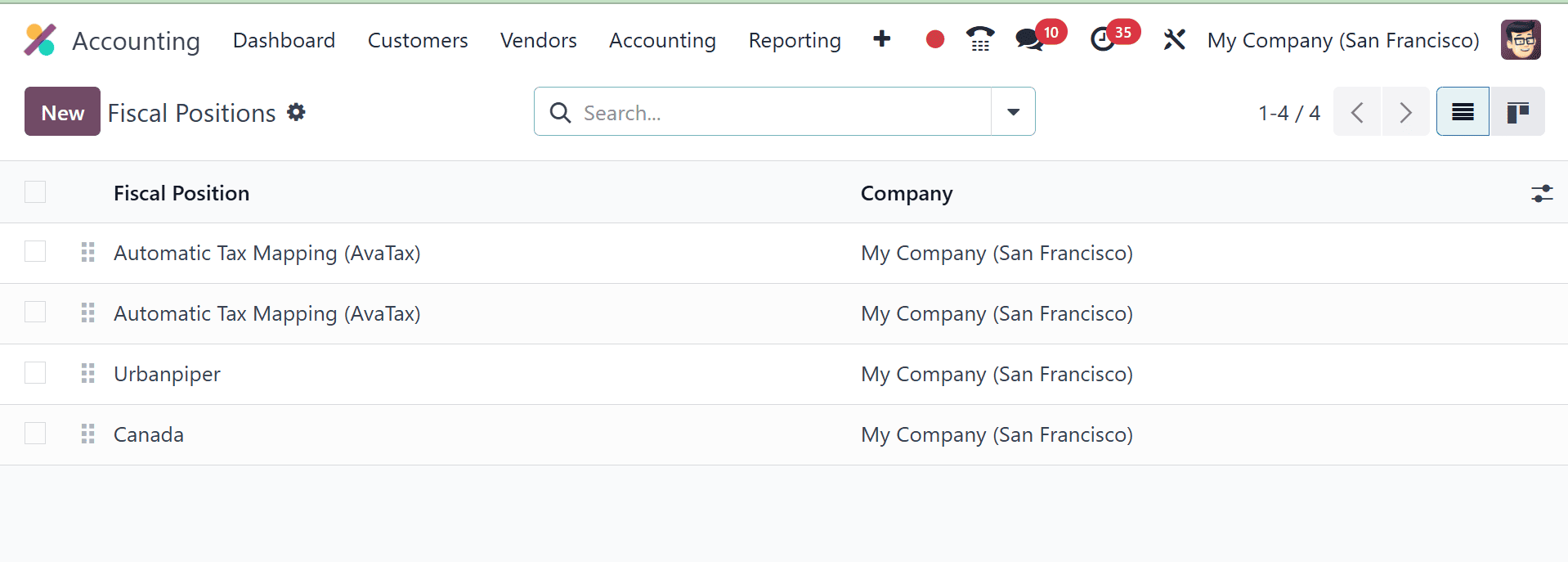

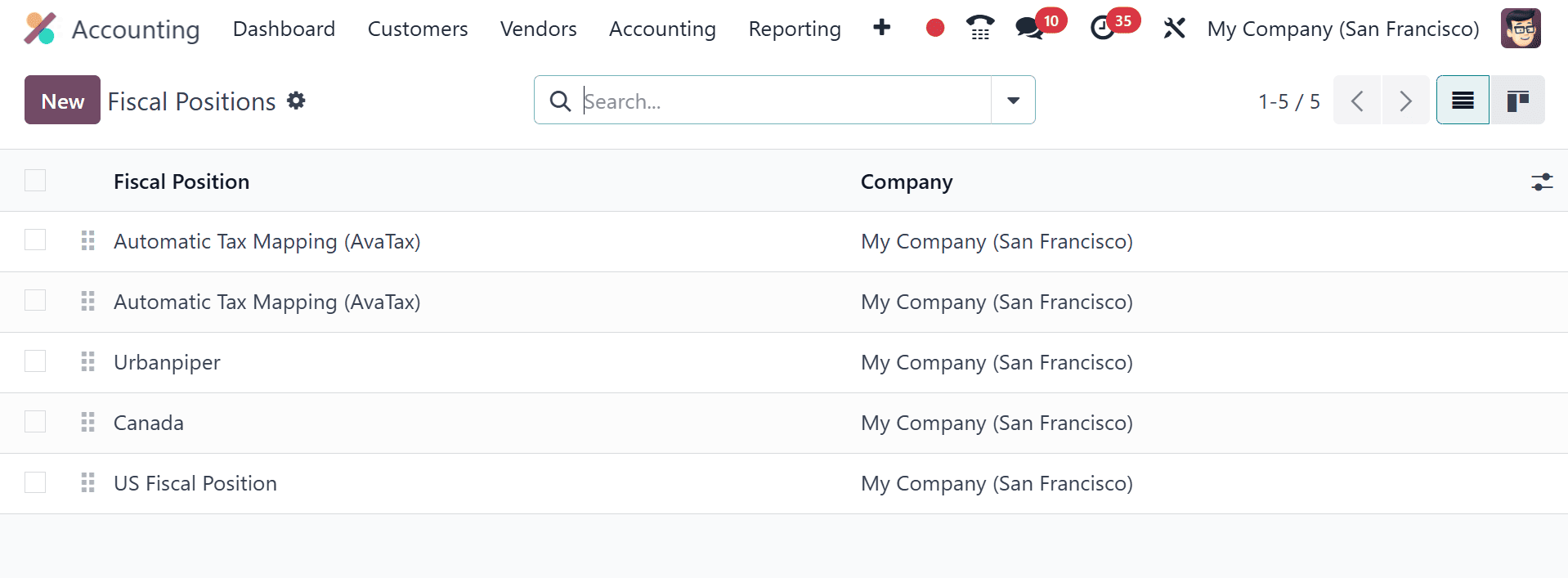

The fiscal situation of a nation makes it easier to manage different taxes. The fiscal stance guarantees that users create guidelines for using transaction accounts and manually adjusting taxes. There are several ways to apply for these fiscal positions: manually on a transaction, automatically using specific rules, and easily assigning to a partner. You can obtain the Fiscal Position under the Accounting section by selecting the Configuration tab. Each fiscal position's record is displayed separately in the List view, which also defines facts like the company or fiscal position. To create a new financial position for your company, select the New icon.

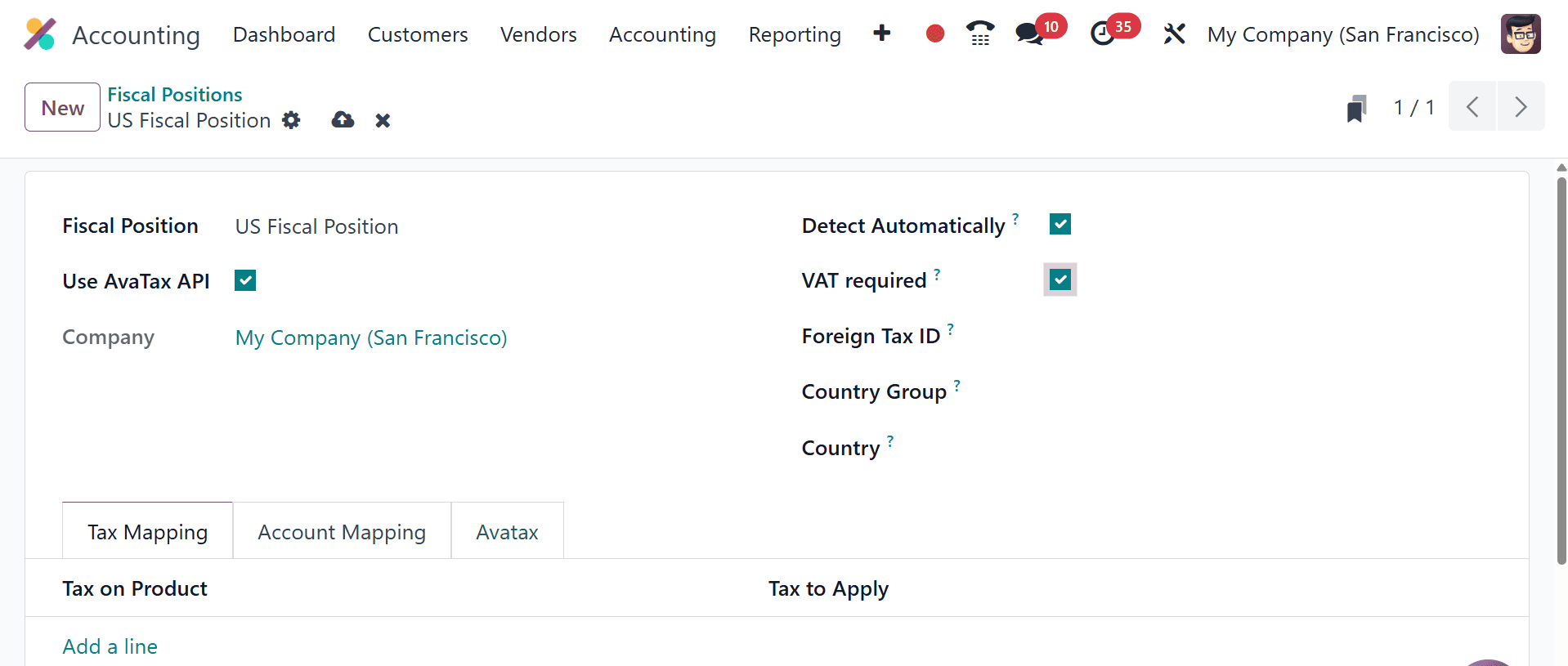

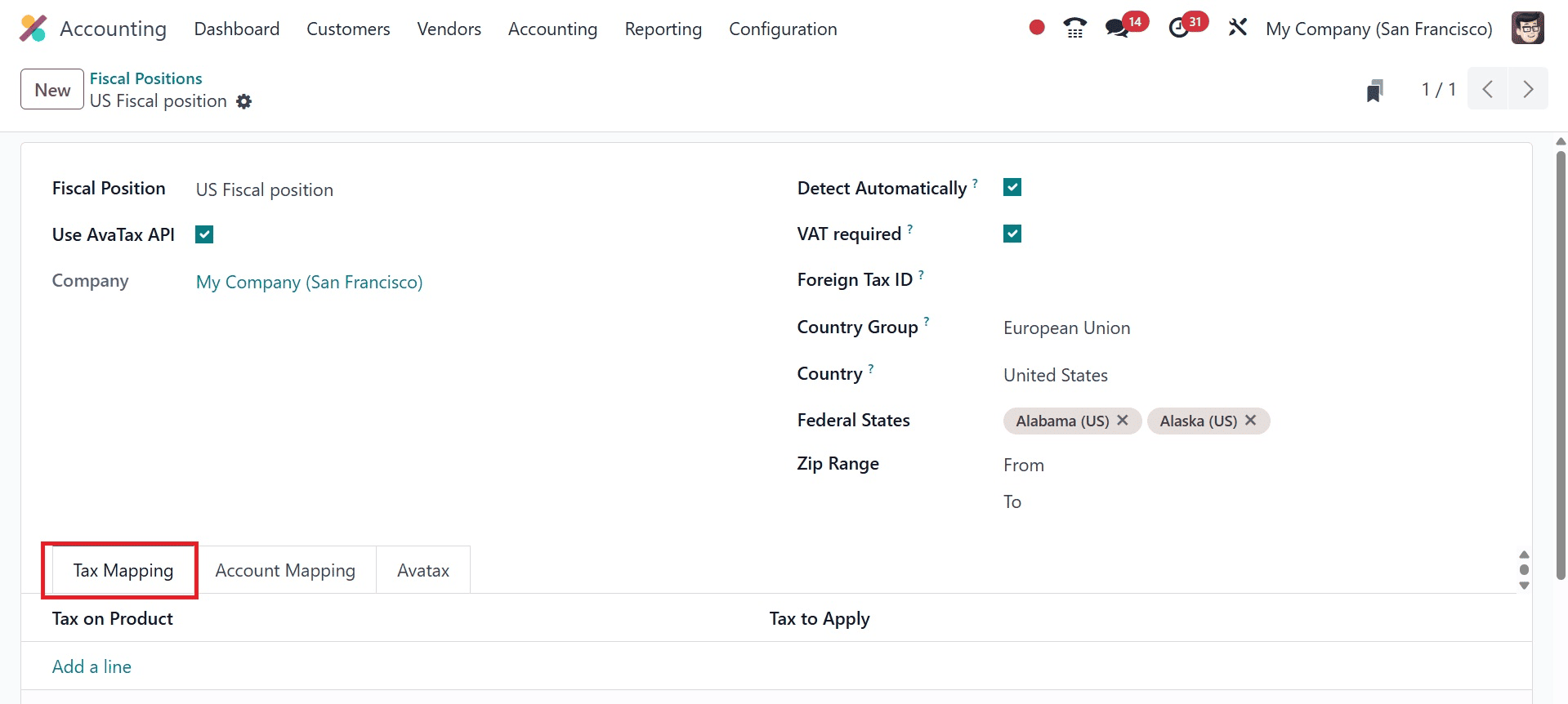

Enter your fiscal position name, such as US Fiscal Position, on the page that opens. Once the Use TaxCloud API option is enabled, users can configure taxes using their tax cloud credentials. Likewise, after turning on the Use Avatax API option, as seen in the screenshot below, you can calculate taxes according to Avatax.

Choose your company as My Company later. Enabling the Detect Automatically field allows users to select fiscal positions automatically. Additionally, if the partner has a VAT number, you can activate the VAT needed area.

In the Foreign Tax ID field, provide the Tax ID that corresponds to your company's fiscal status. If the delivery country is comparable to the group, then indicate your country group. Select the nation that best fits the financial situation of your business.

In the Federal States field, mention the states that depend on the nation you have selected. Afterward, enter the range count in the ZIP Range field. As seen in the screenshot below, you can impose tax on a commodity by choosing the Add a line option under Tax Mapping.

- To map to another tax or account, fill out the right column. To remove a tax, leave the field Tax to Apply empty.

- To replace a tax with several other taxes, add multiple lines using the same Tax on Product.

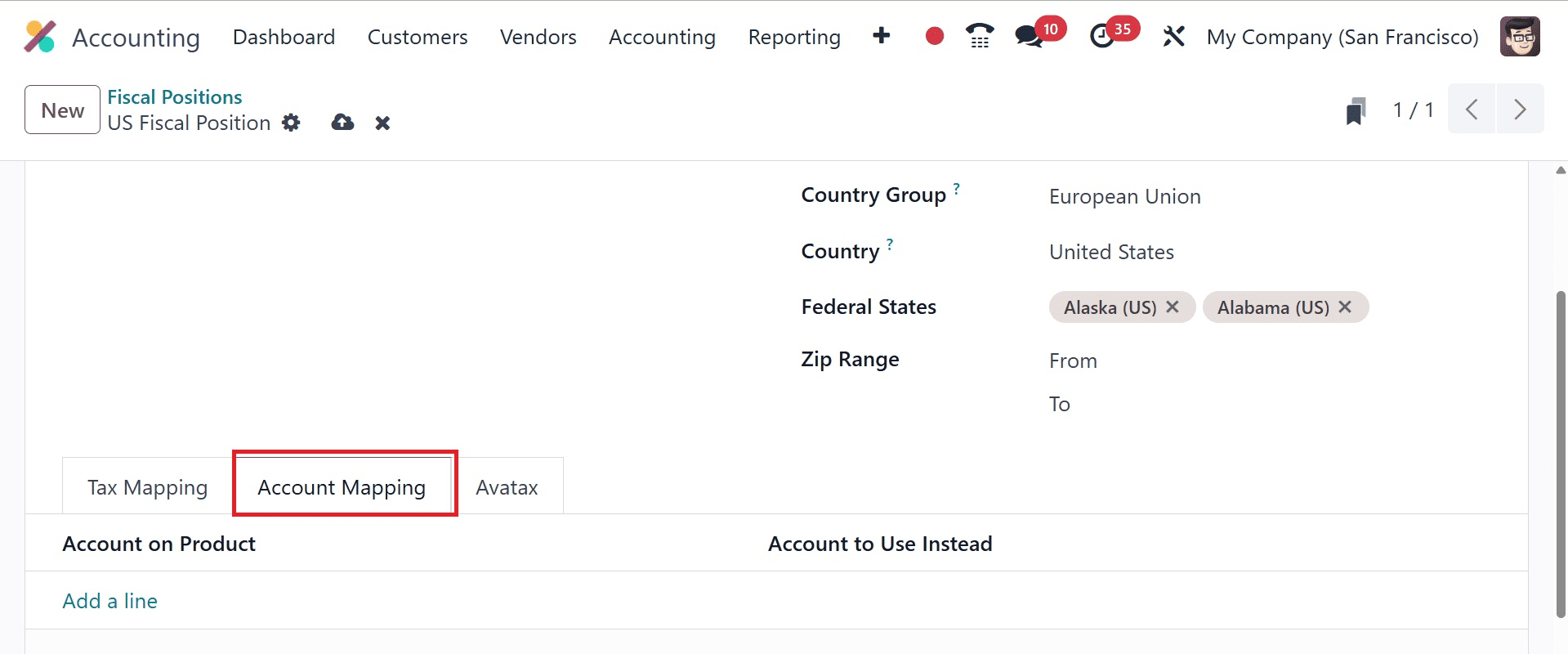

After choosing the Add a line option in the Account Mapping section, users can choose a product account. There, you have the options like,

Account on Product is the original account set on the product or category.

Account to Use is the replacement account that will be applied when the fiscal position is used.

Once the US Fiscal Position data has been applied in Odoo 18, click the Save manually button.

The created position is accessible through the Fiscal Positions pane.

Users are guaranteed to manage fiscal localization packages in accordance with business needs by the Odoo 18 Accounting module. To improve workflow, it is simple to establish the fiscal year, fiscal situations, and other details. Enhance your business's requirements after adding an Odoo ERP to your system.

To read more about An Overview of Accounting Localization for United States in Odoo 17, refer to our blog An Overview of Accounting Localization for United States in Odoo 17