In Odoo 18 Payroll, salary attachment refers to an administrative procedure whereby a certain amount of an employee’s pay is automatically deducted to satisfy regulatory requirements or outstanding debts. This feature ensures adherence to business policy and governmental requirements by assisting HR and payroll departments in effectively managing wages and other required deductions. The salary attachment feature in the payroll module tracks payments, automates the deduction process, and appropriately represents them on the employee’s payslip. For businesses managing multiple deductions for numerous employees, it reduces manual errors and streamlines payroll administration.

What is Salary Attachment in Odoo 18 Payroll?

Odoo 18 Salary Attachment is a legal or administrative function known as payroll that enables an employer to deduct specific amounts from an employee’s paycheck to satisfy duties such as debt repayments, fines, child support, or court laws. Through this payroll system, this function guarantees adherence to legal obligations while automating the deduction procedure.

Benefits of Salary Attachments in Odoo 18 Payroll:

- Automated Deductions

- Adherence to the Law

- Open Recordkeeping

- Secure and Confidential Transactions

- Saves Time

- Integrated Reporting

- Reduction of Errors

- Customized Configuration

- Easier Audit and Review

Salary Attachment In Odoo 18 Payroll:

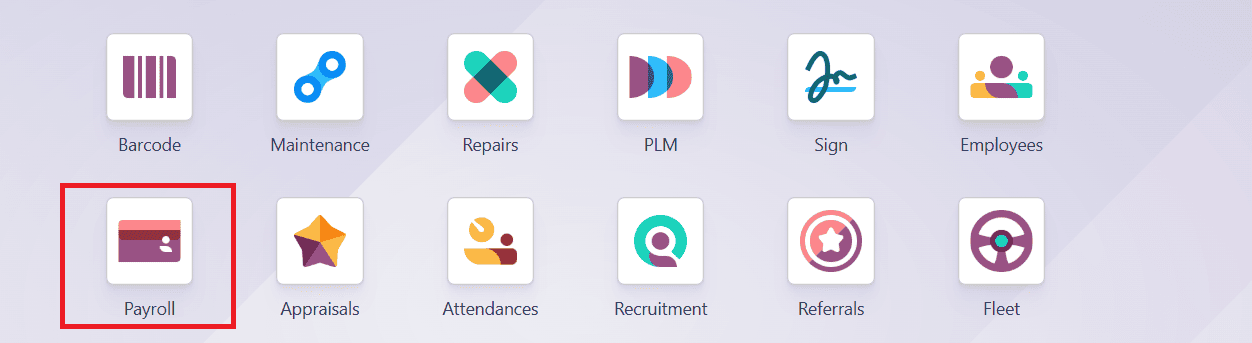

Firstly, select the Payroll app from the Odoo 18 dashboard.

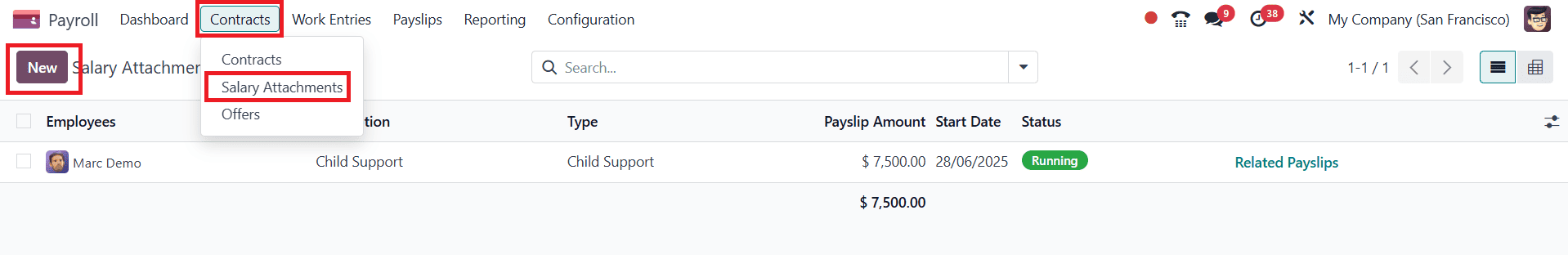

Then navigate to Contracts > Salary Attachments and click on the New button as shown below:

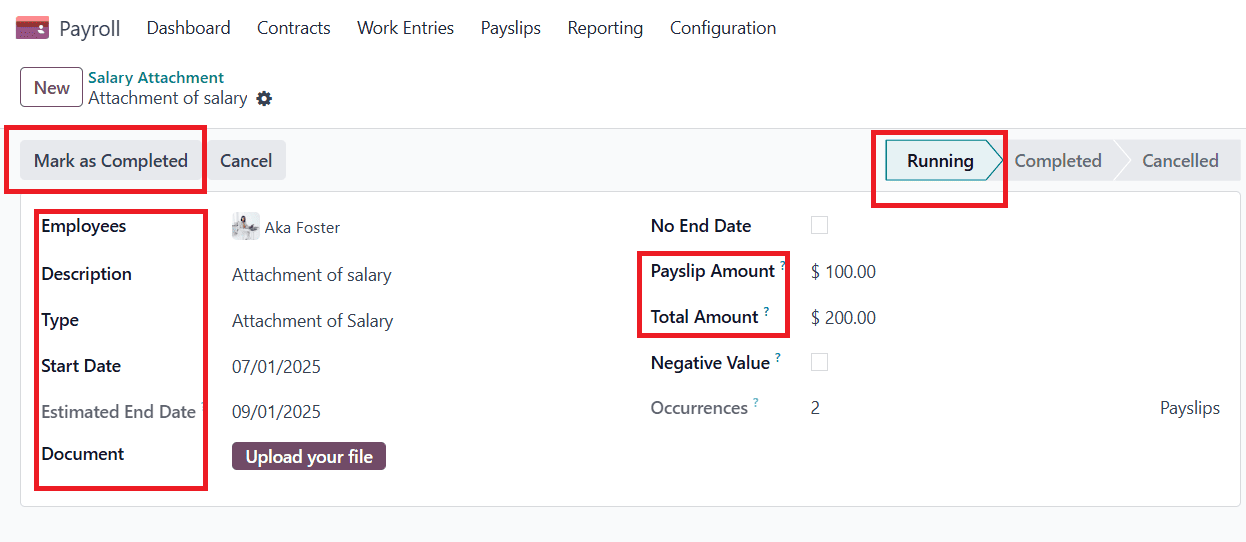

Here, you can add an existing employee under the Employees option. In the Description option, you can add information about the salary attachment. Under the Type option, you can select one of the following options: Child Support, Assignment of Salary, or Attachment of Salary. You can attach any necessary files under the Document section. You can also add the Pay Slip Amount and the Total Amount to be paid. The starting date can be mentioned under the Start Date option. The Estimated End Date will be automatically mentioned. You can see the current status of the salary attachment as Running state. Then click on the Mark as Completed button as shown below:

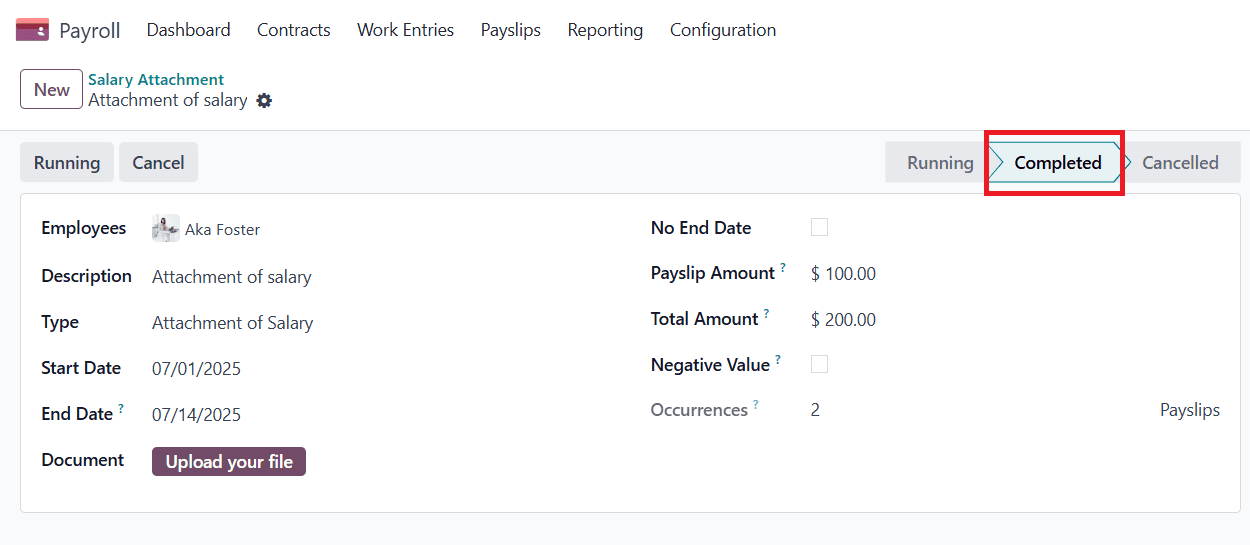

Here, you can see the salary attachment status as Completed.

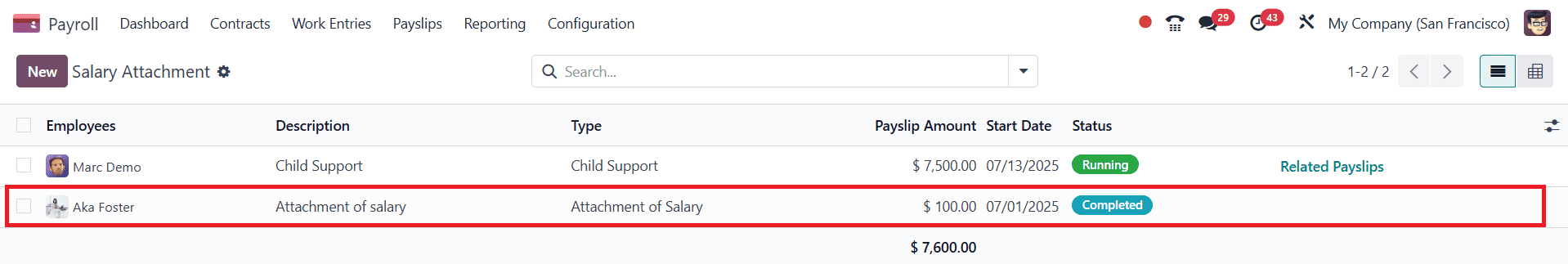

Here, in the salary attachment dashboard, you can view the newly created salary attachment.

Conclusion:

Payroll rules in Odoo 18 automate the deduction process, making it more straightforward for businesses to handle salary attachments. The system manages court-ordered and repayment agreements with ease, all within the framework of the employee’s payslip. In addition to guaranteeing legal compliance, this improves payroll accuracy and transparency. Reducing manual calculation errors and maintaining accurate records saves HR departments a significant amount of time. Additionally, providing a transparent explanation of deductions helps build trust among staff members. For companies of all sizes, Odoo 18’s Salary Attachment functionality streamlines complicated deduction scenarios and improves payroll operations overall.

To read more about An Overview of Odoo 18 Payroll Module, refer to our blogAn Overview of Odoo 18 Payroll Module