Payroll

The most challenging responsibility for the HR and accounting departments in an organization is payroll management. It serves as an essential precondition for company operation. Through efficient payroll administration, a corporation may handle payslips for employees at predetermined periods. Tax payments for employees and maintaining accurate records can occasionally be time-consuming tasks. With a precise payroll management system, you can settle and process all of these documents.

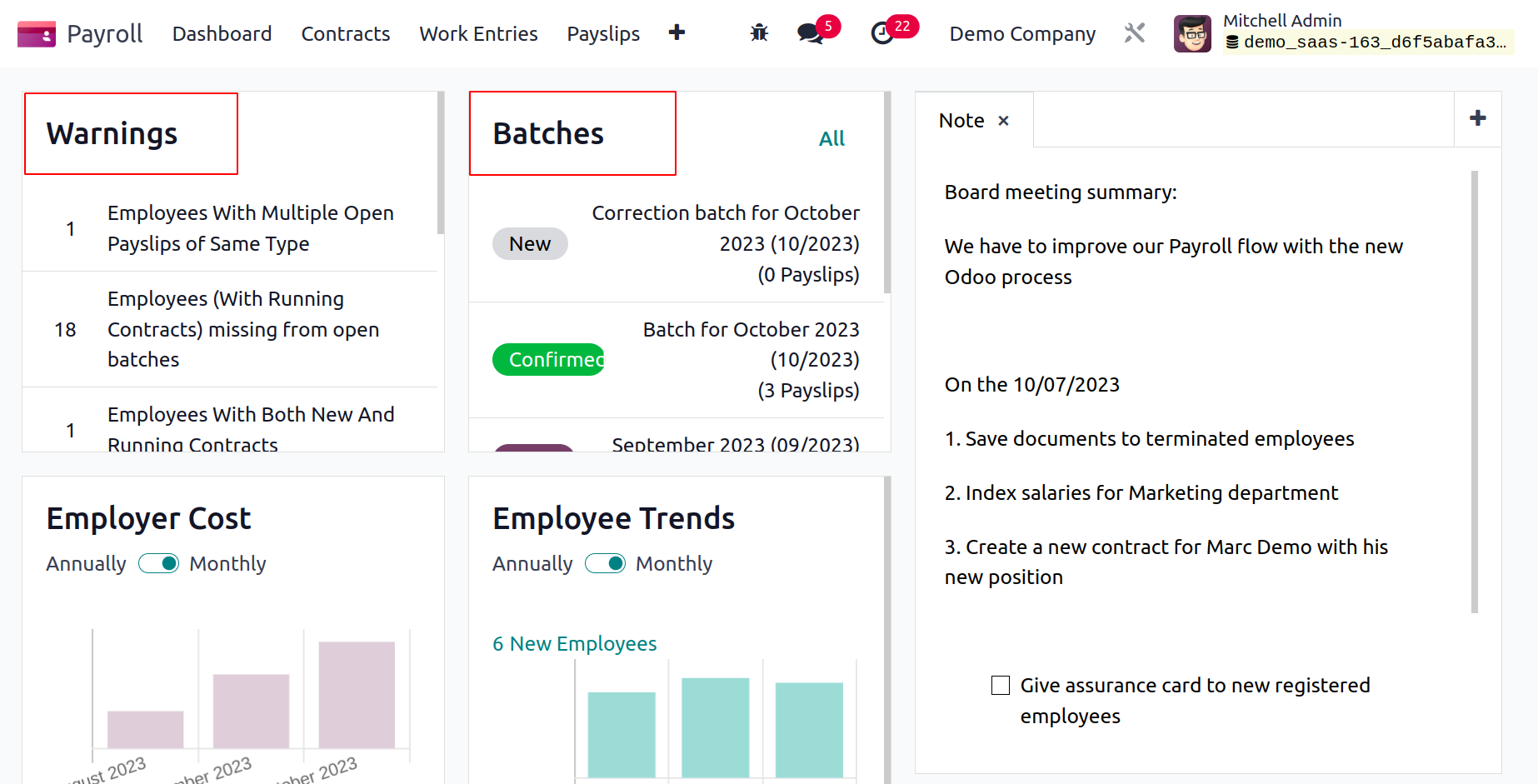

Dashboard

The data for warnings, batches, notes, graphic displays of employer costs, and employee trends are defined in the Odoo 17 Payroll dashboard. Below the Warnings section, users can find the required cautions regarding employee contracts. We have access to confirmed or brand-new paystubs for employees in the Batches area.

Within the Note tab, it is simple to get more payroll flow summaries. You can add a new note about the payroll information by selecting the plus icon on the right end. Additionally, on a monthly or annual basis, we can assess employer costs and employer trends independently. As a result, it is simple to analyze the number of workers' salaries by looking at the graphical representation.

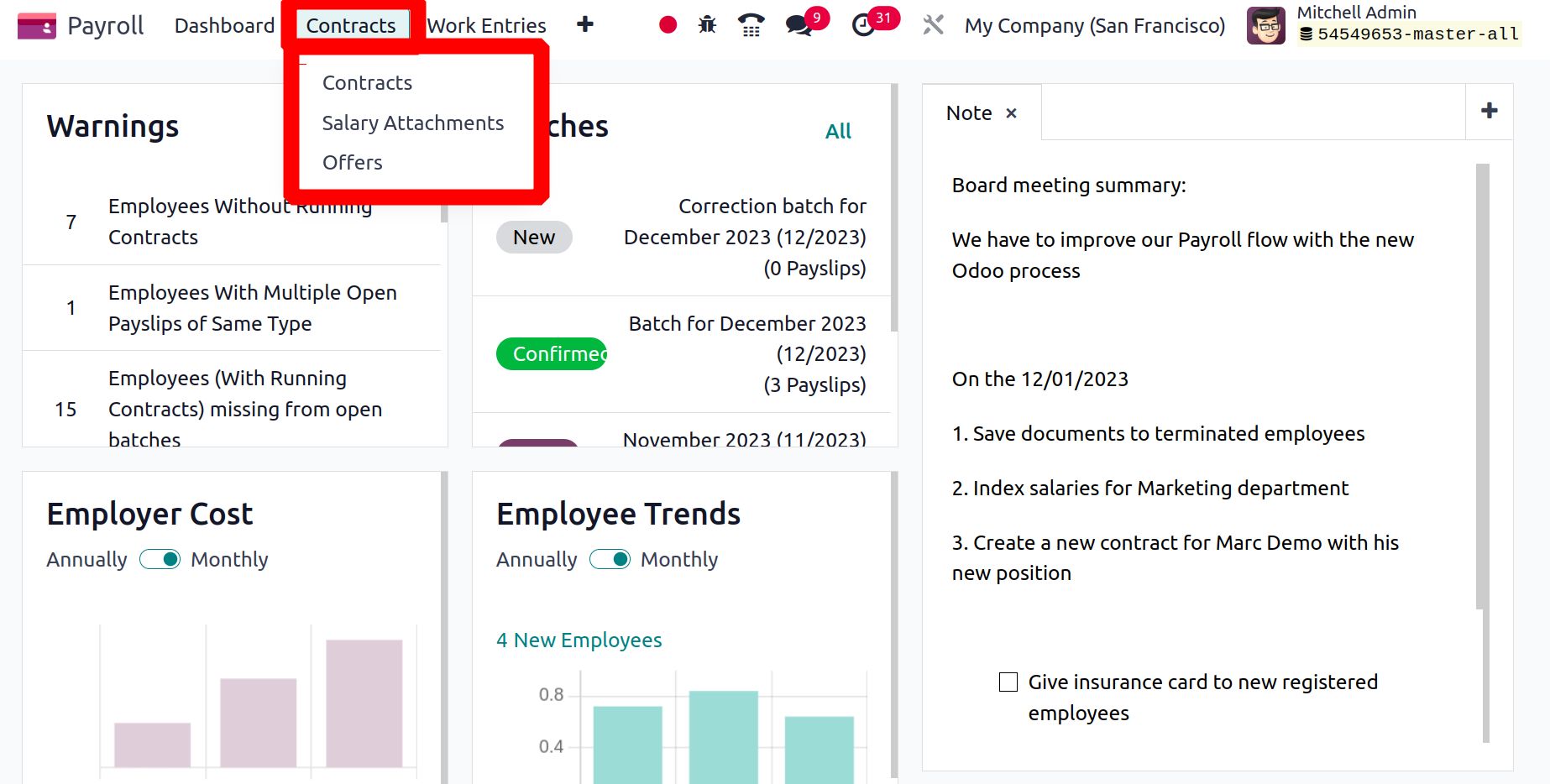

Contracts

The Contracts tab of the Odoo 17 Payroll module allows users to manage employee contracts and salary attachments. When you select the Contracts tab, three menus will become available to you: Contracts, Salary Attachments, and Offers. Let's examine each of these choices in turn.

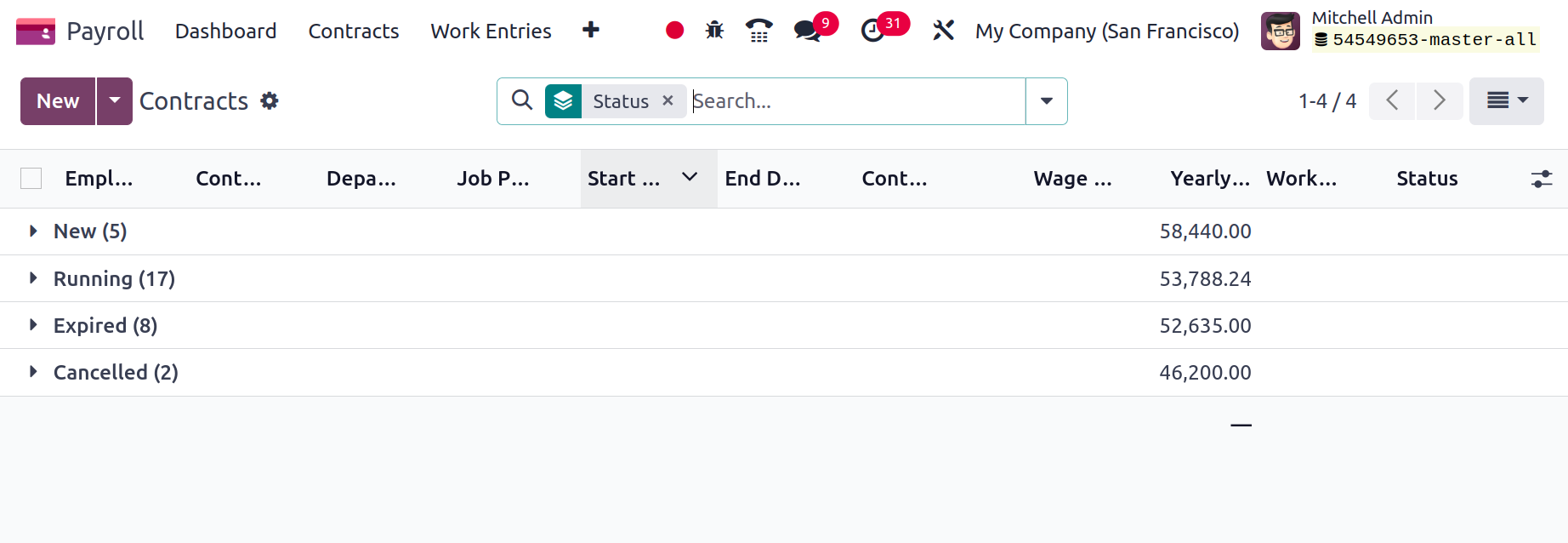

Contracts

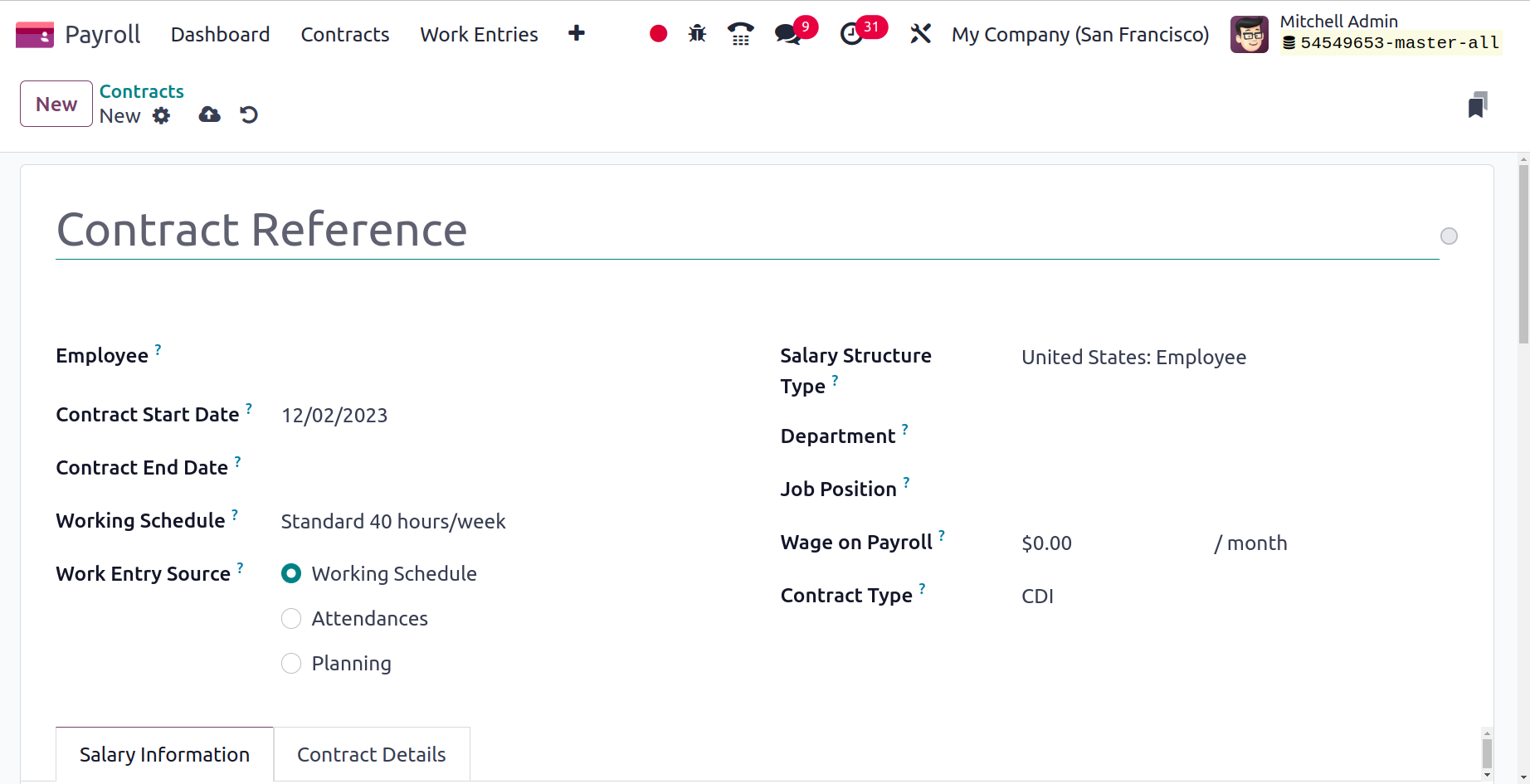

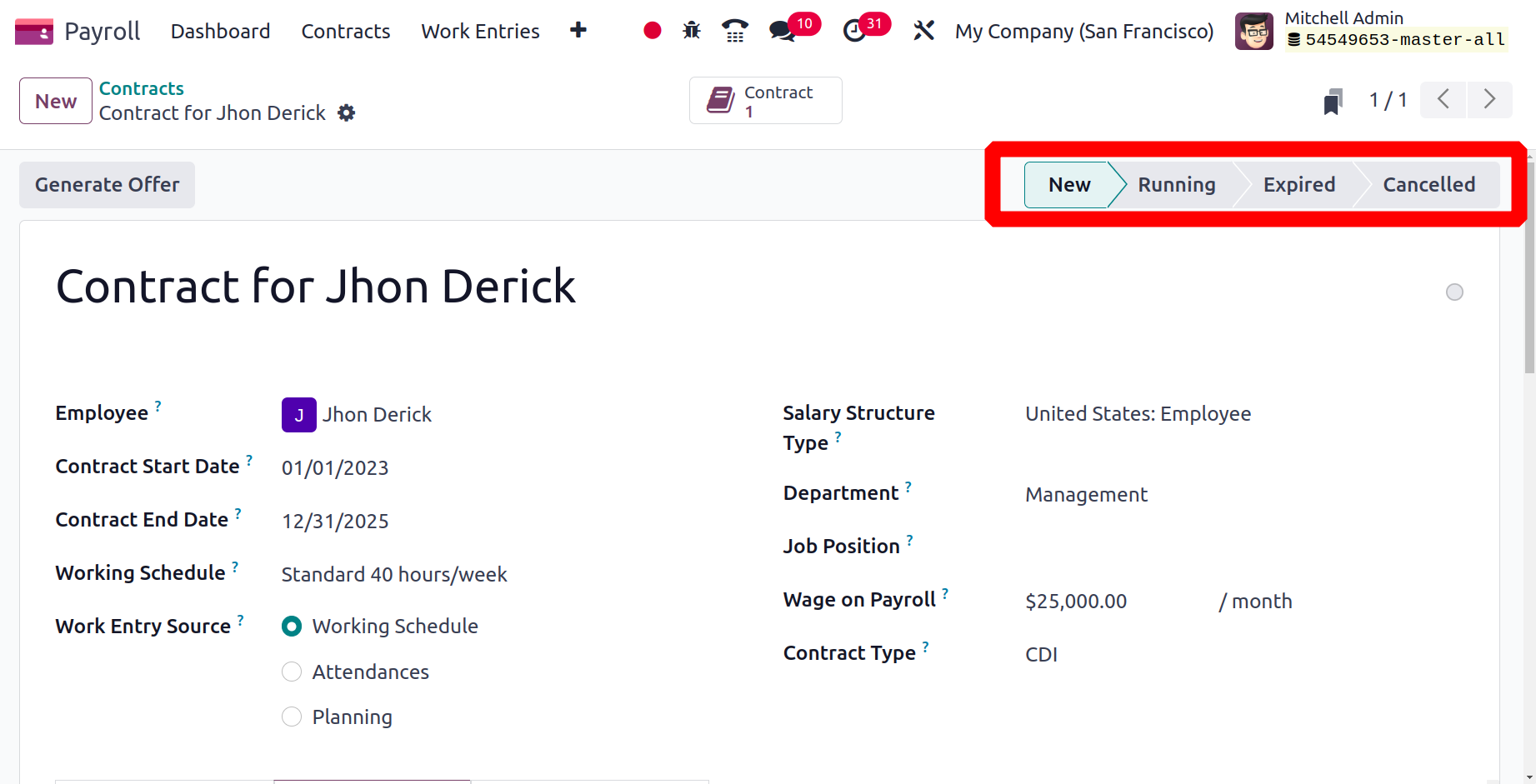

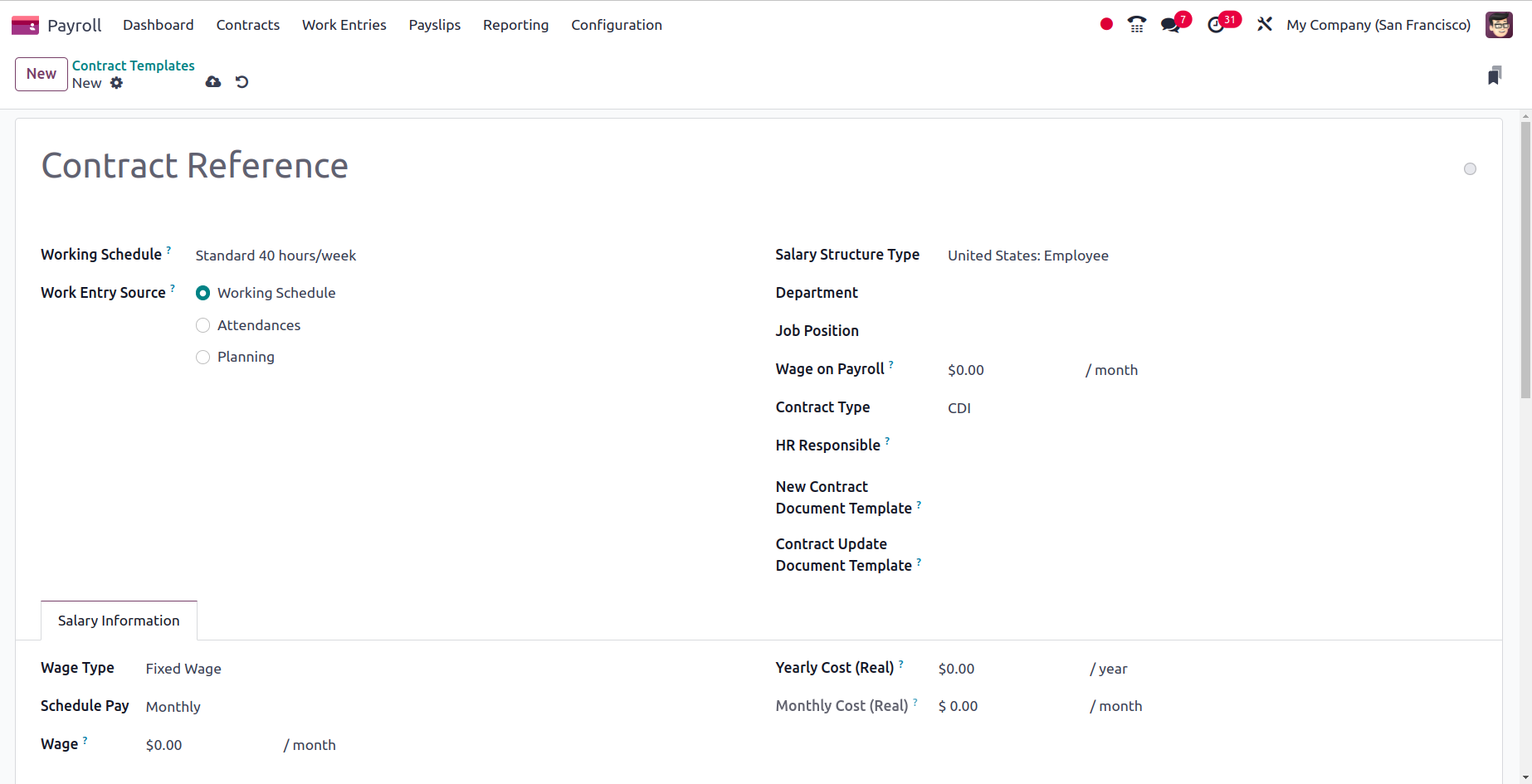

By selecting the New icon in the Contracts, users can also define a brand-new employment contract. You can choose your Employee and enter the contact's name on the open page. After choosing the employee, the user is immediately shown information about the employee's department, job title, and contract type.

In the Contract Start Date box, specify the beginning of the contract, and in the Contract End Date field, specify the ending date. You can select the work schedule of the employees in hours/week after selecting the type of salary structure. The source for work entries in contact can then be described. Planning, Working Schedule, and Attendances are three different sources of work entry. When the Working Schedule option is selected, working entries are created according to the standard working hours. Working entries will be produced based on employee planning if the Planning option is chosen.

The Salary structure type can be changed between worker and employee. Later, you can enter the wage from the contract in the Wage on Payroll field.

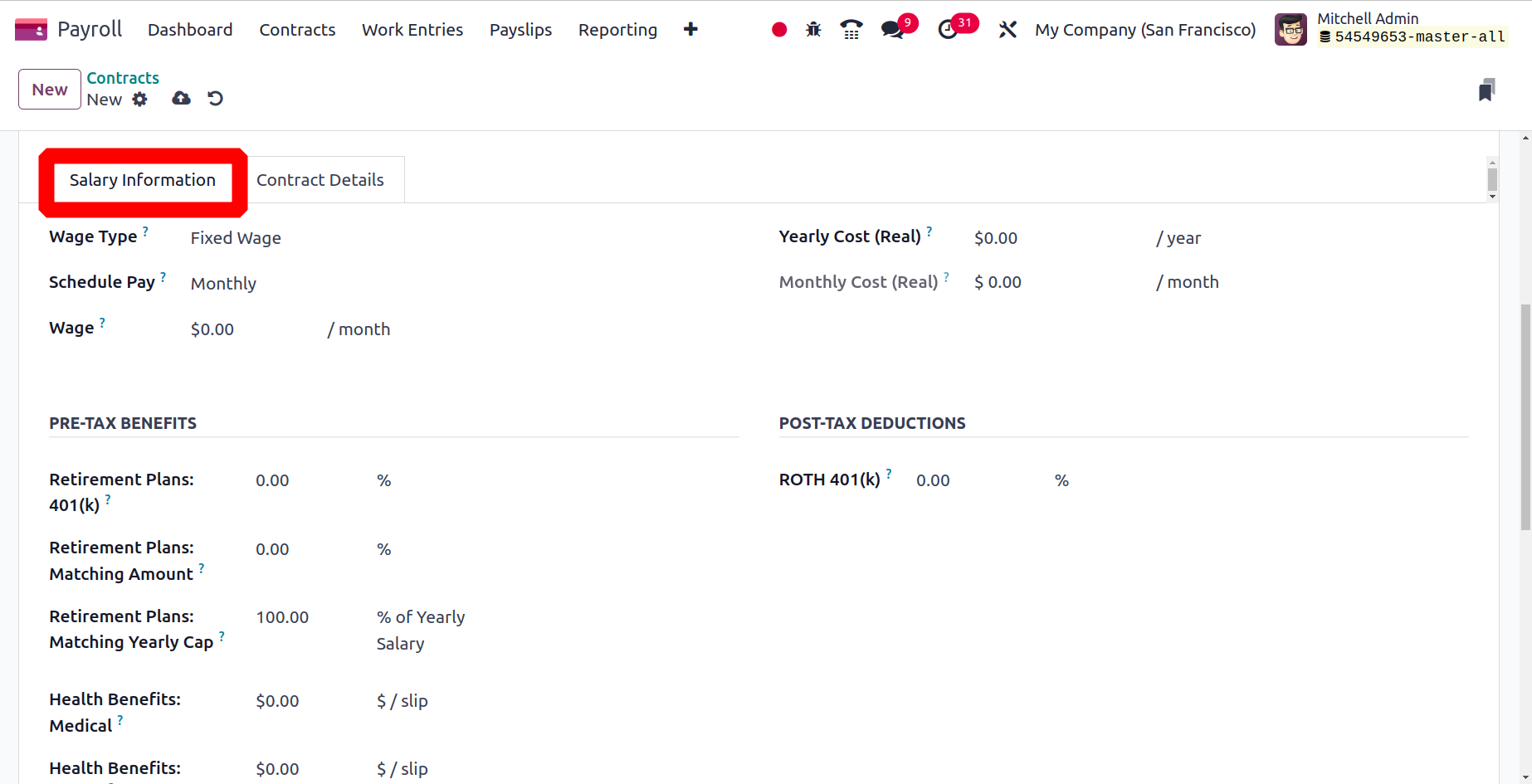

The user can enter their monthly basic salary in the Wage section of the Salary Information. Additionally, the Yearly Cost (Real) option auto-populates the whole year's cost for an employer. Mention the Schedule Pay and Wage Type as well.

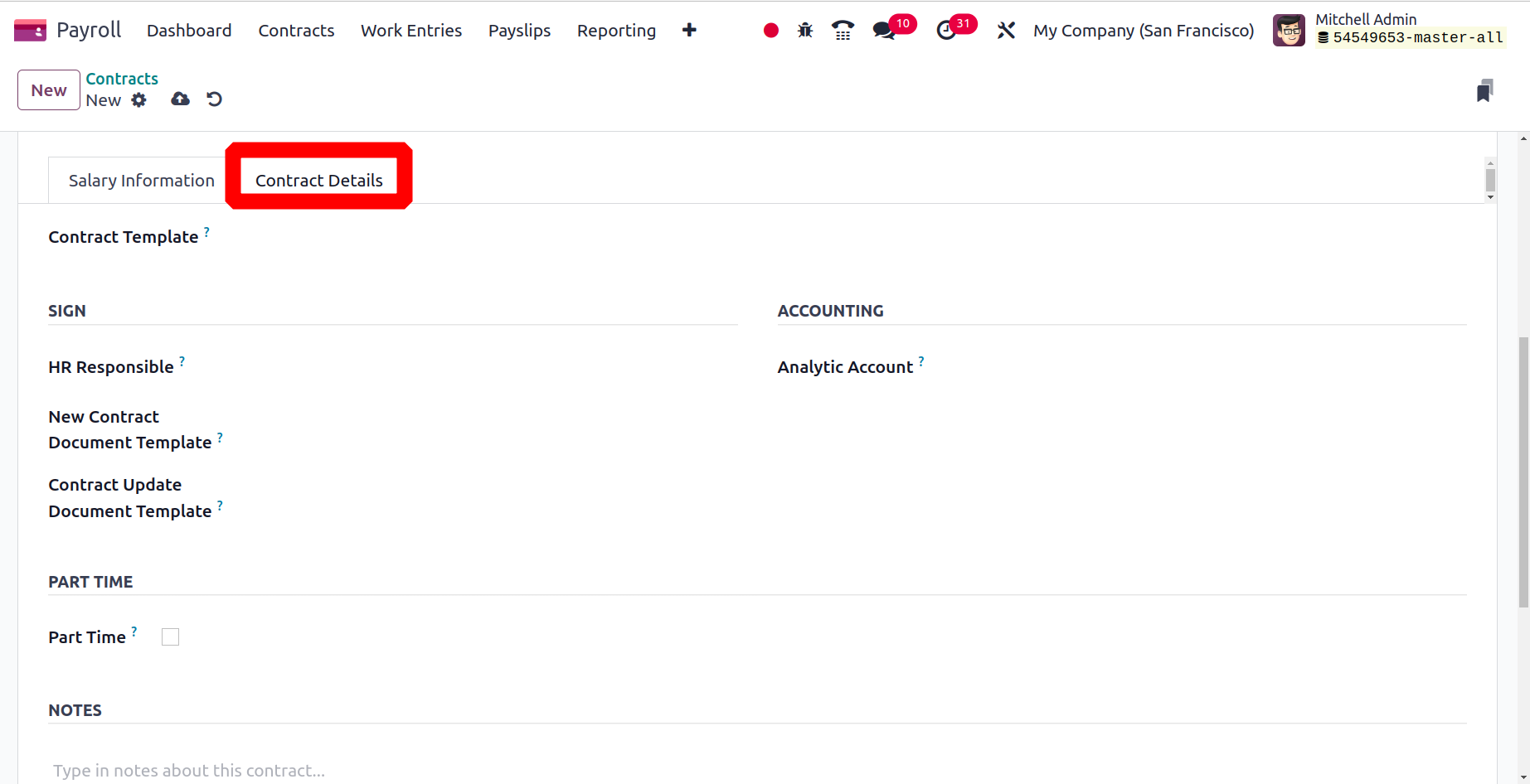

Add the Contract Template. The Analytic Account field can be added below the ACCOUNTING section. The default contract to sign to accept a contract offer can then be specified in the New Contract Document Template field. Within the Contract update Document Template field, users can specify the default document template for employees. Later, you can define responsible HR in HR Responsible. Then save the contract.

The Odoo 17 Payroll immediately saves each of the details. The user can generate Offers to the employee. Additionally, you have the option to set the contract's status to New, Running, Expired, or Canceled.

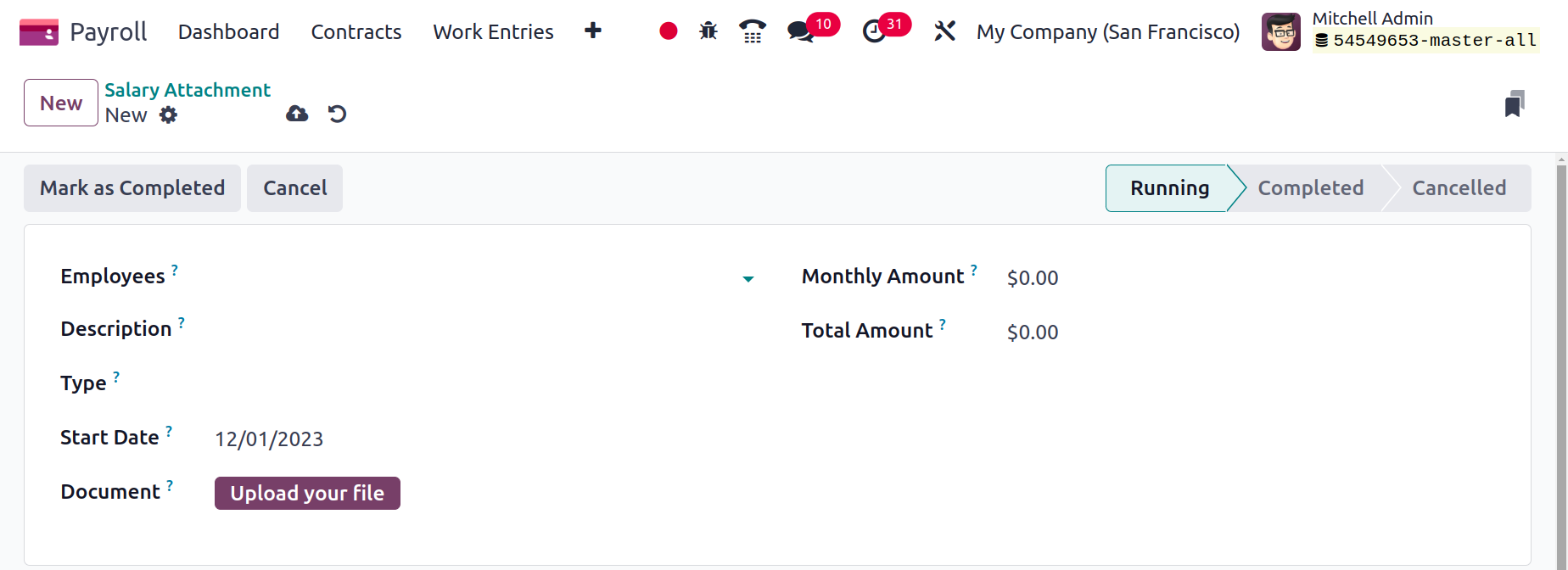

Salary Attachments

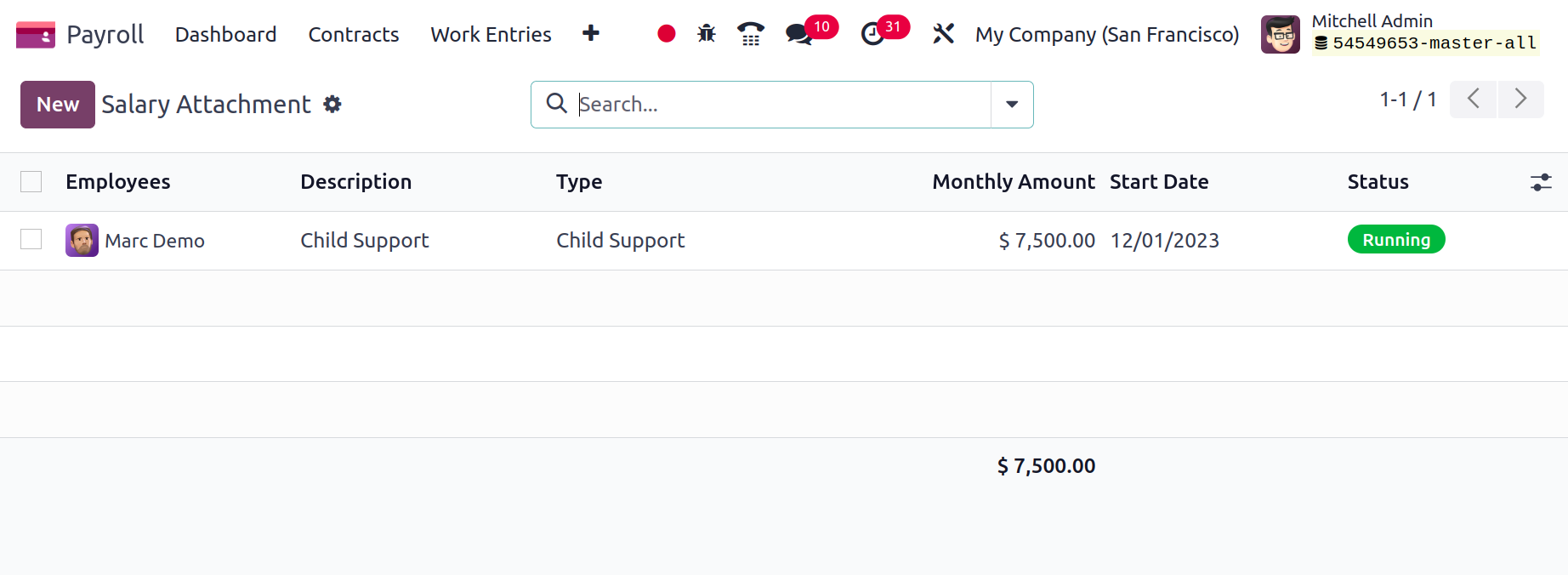

By selecting the Salary Attachments menu from the Contracts tab, we can get a list of every employee's pay attachments. Each salary attachment's information can be obtained, including the Employee, Type, Status, Description, Start Date, and more. In Odoo 17 Payroll, we may create a new salary attachment by selecting the New button.

The user can choose the Employee name and provide salary attachment information in the Description area in the open window. Users can select Child support, Assignment of Salary, and other options for the Type of Salary Attachment.

The starting date can then be applied in the Start Date field. By selecting the Upload your file symbol in the Document box, you can upload any necessary files. Mention the monthly payment amount in the Monthly Amount section as well. The Total Amount field can be used to apply the entire cost to be paid.

In the Odoo 17 Payroll, every piece of data is manually saved. Once you click the Mark as Completed icon, you can mark the level as complete. Your unique wage attachment for an employee will be canceled if you select the Cancel option.

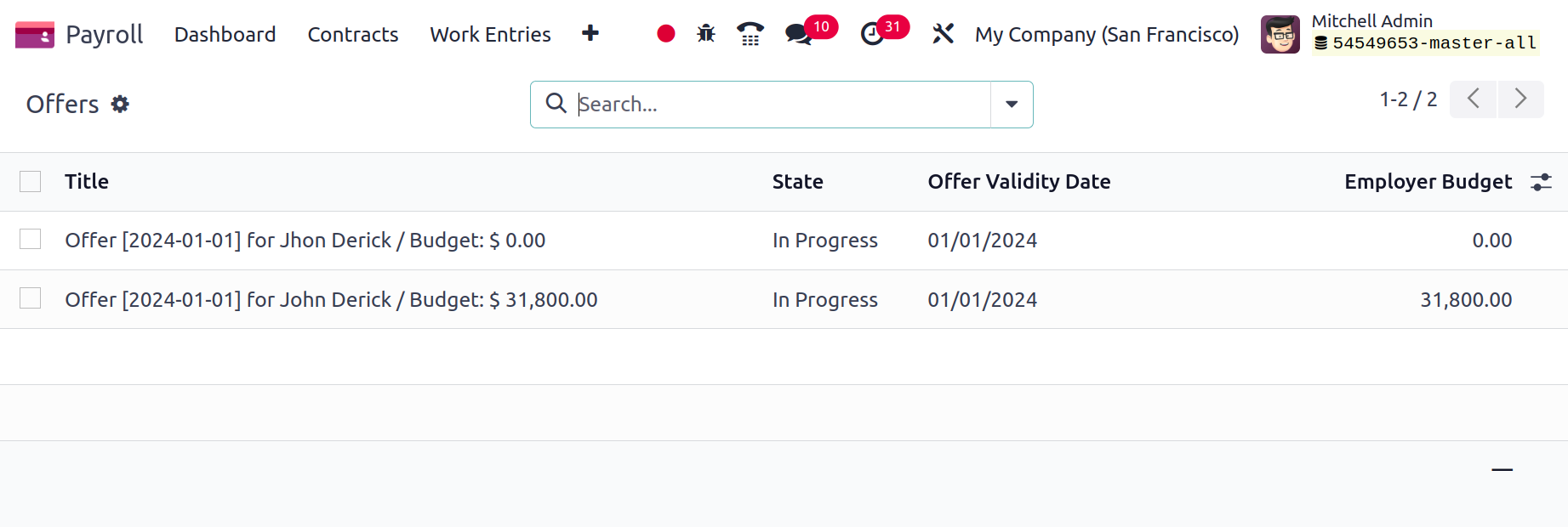

Offers

Payroll contains offers created for employees as well. Which is comparable to what the Recruitment module mentions. The list view displays the Employed Budget, Title, State, and Offer Validity Date.

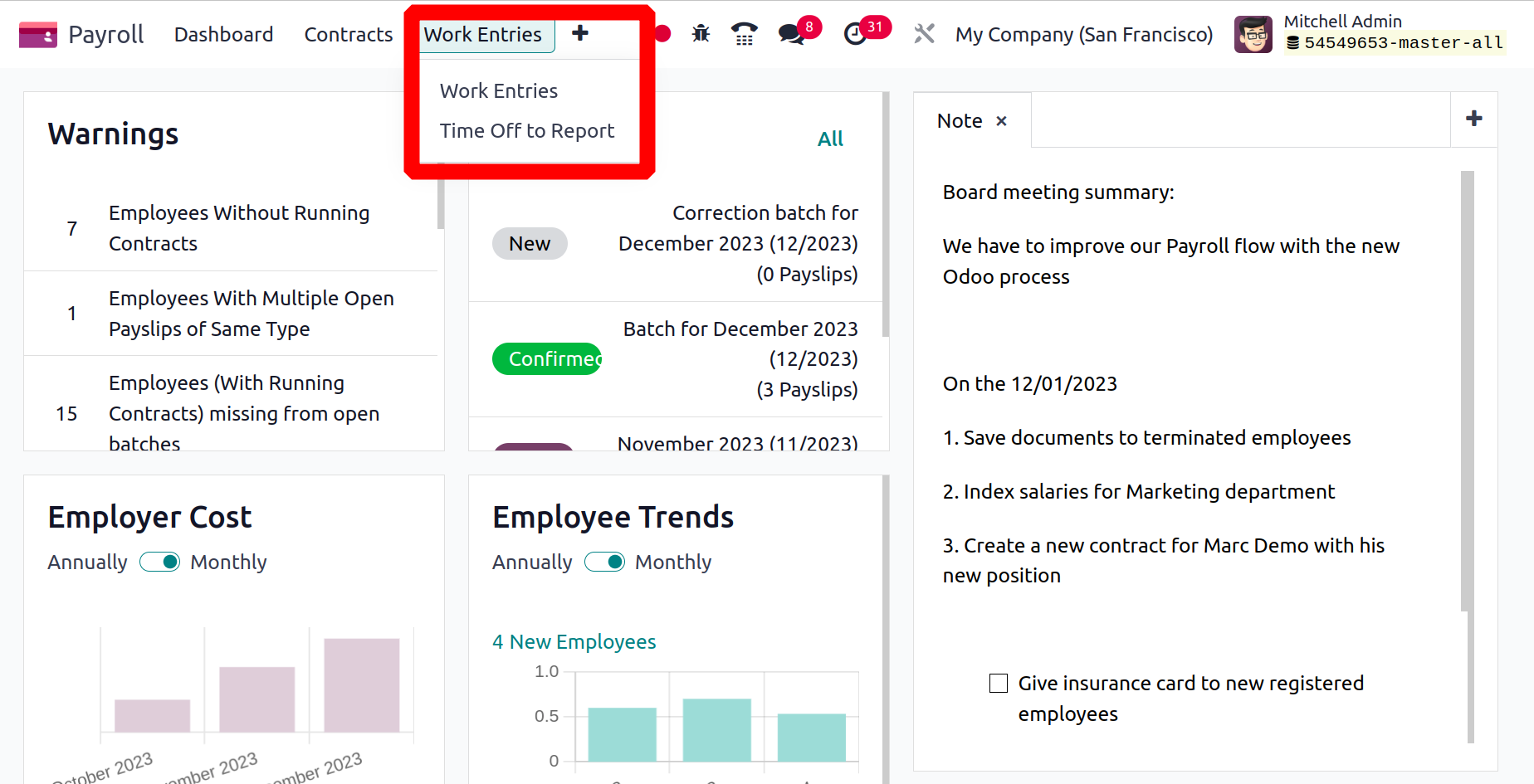

Work Entries

To monitor and manage real-time data within an organization, work entries are required. It serves as a record of the employees' previously scheduled working hours. The choices that are accessible beneath the Work Entries tab are Work Entries and Time Off to Report.

Under the Work Entries tab, we can manage each employee's conflicts, time off requests, and work entries. Let's define each menu in Odoo 17 Payroll's Work Entries tab now.

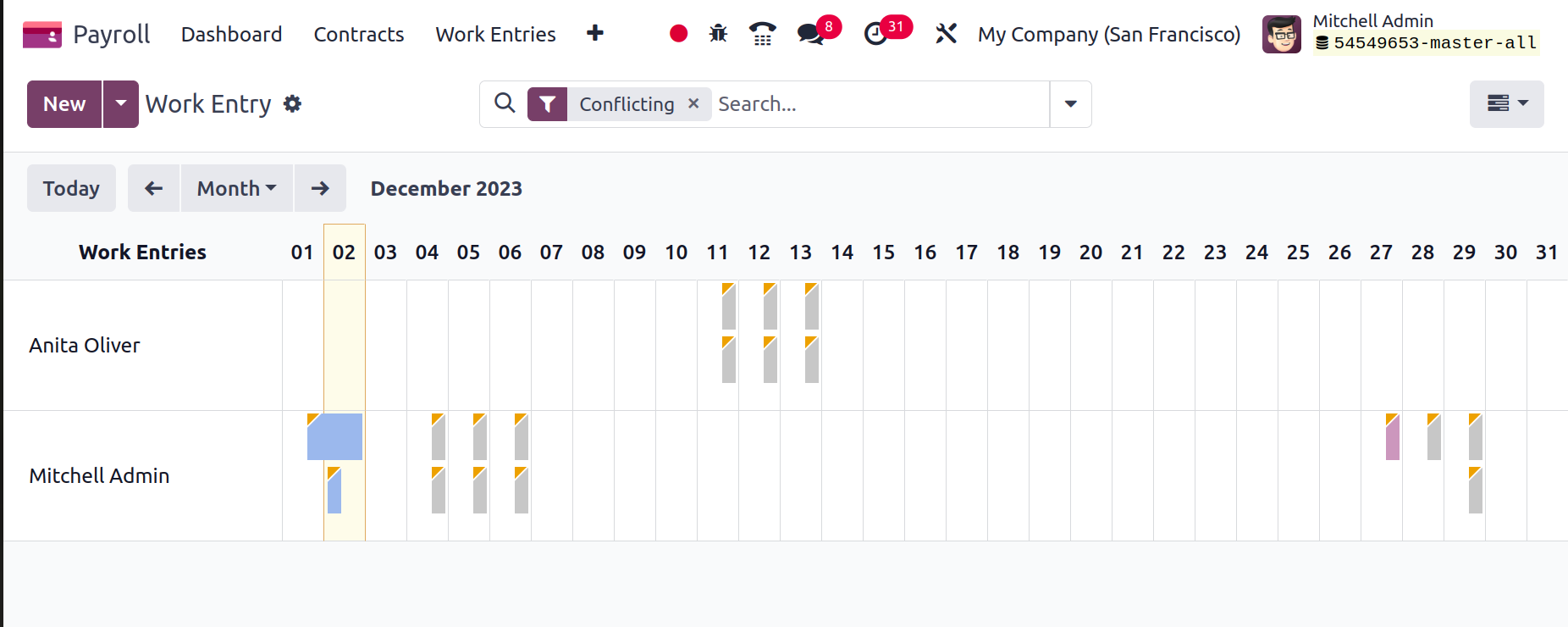

Work Entries

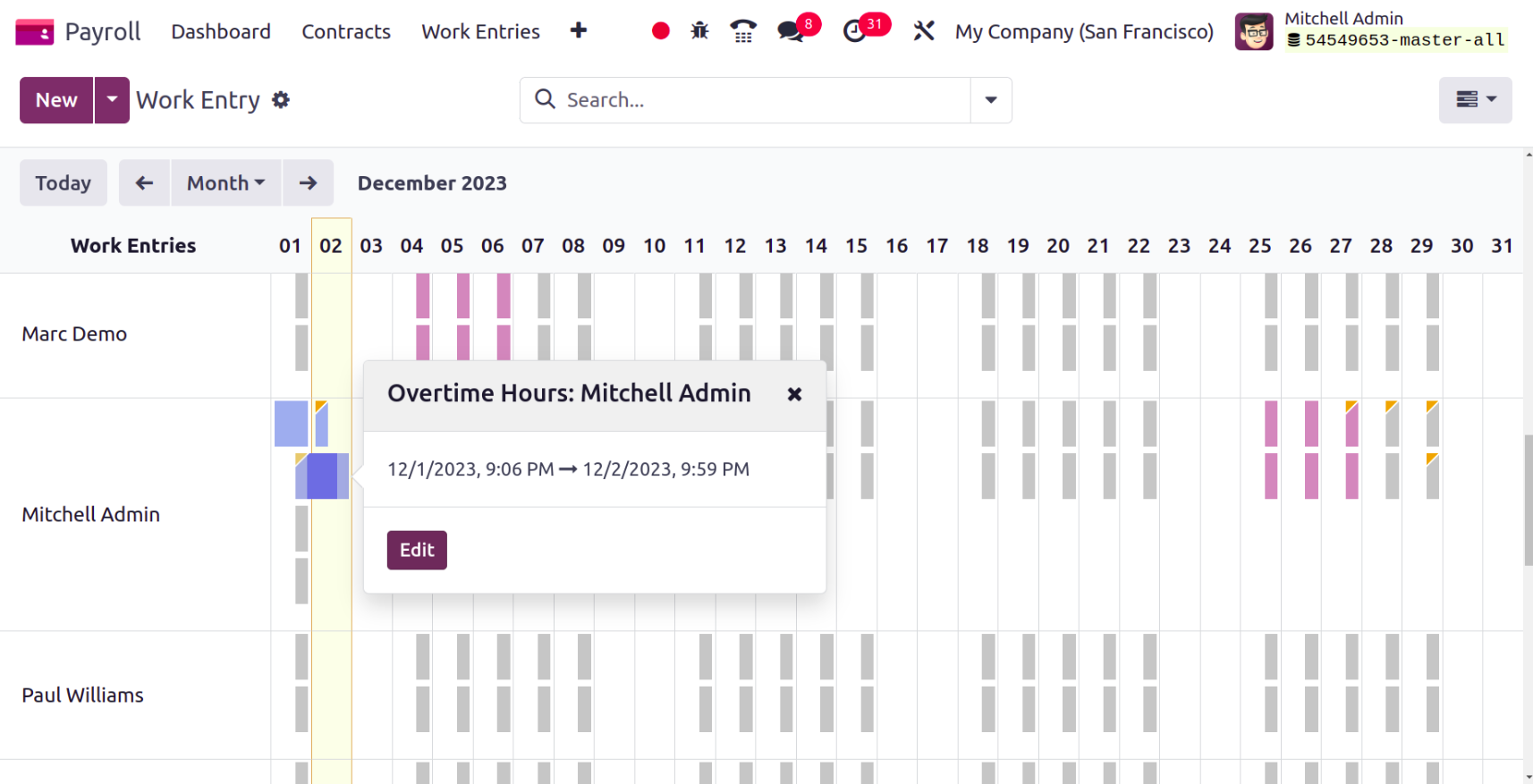

Once the Work Entries option is selected from the Work Entries tab, each employee's work entry may be controlled rapidly. Odoo 17 by default, grouped every conflict into work entries here. The employee name and any incompatible work entries are listed in the Work Entry pane. The user can see undefined and invalidated work entries in the Work Entry window of the Gantt view.

In the Gantt view, we can see a summary of each employee's work entries for a specific month. The employee job input can be sorted based on DAY, MONTH, and WEEK. The employee's overtime is indicated by the color blue. Moreover, the standard entries are displayed in grayscale.

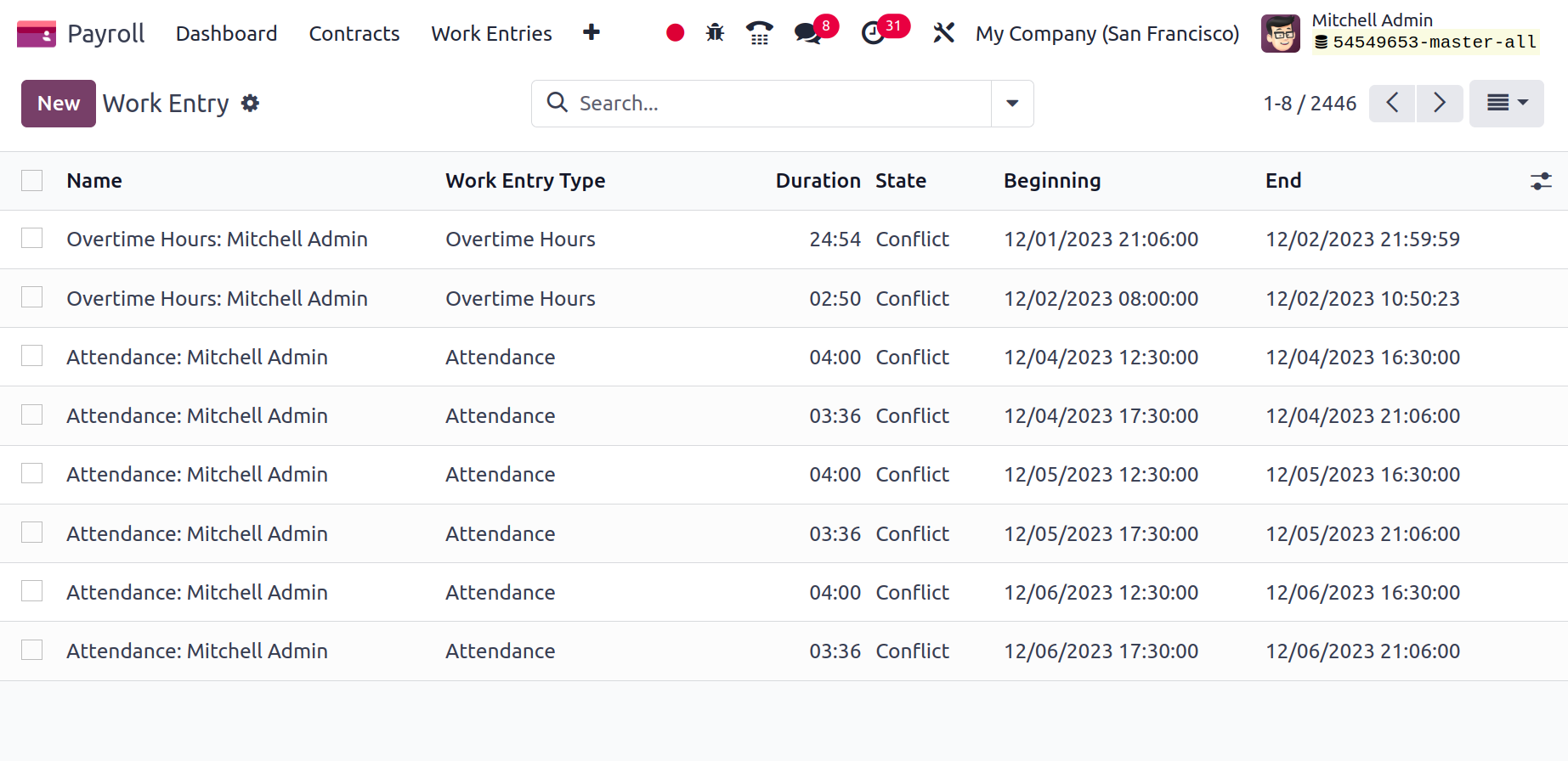

We may view each employee's individual work entry in the List view, together with information like the Name, Work Entry type, Duration, State, Beginning, End, etc.

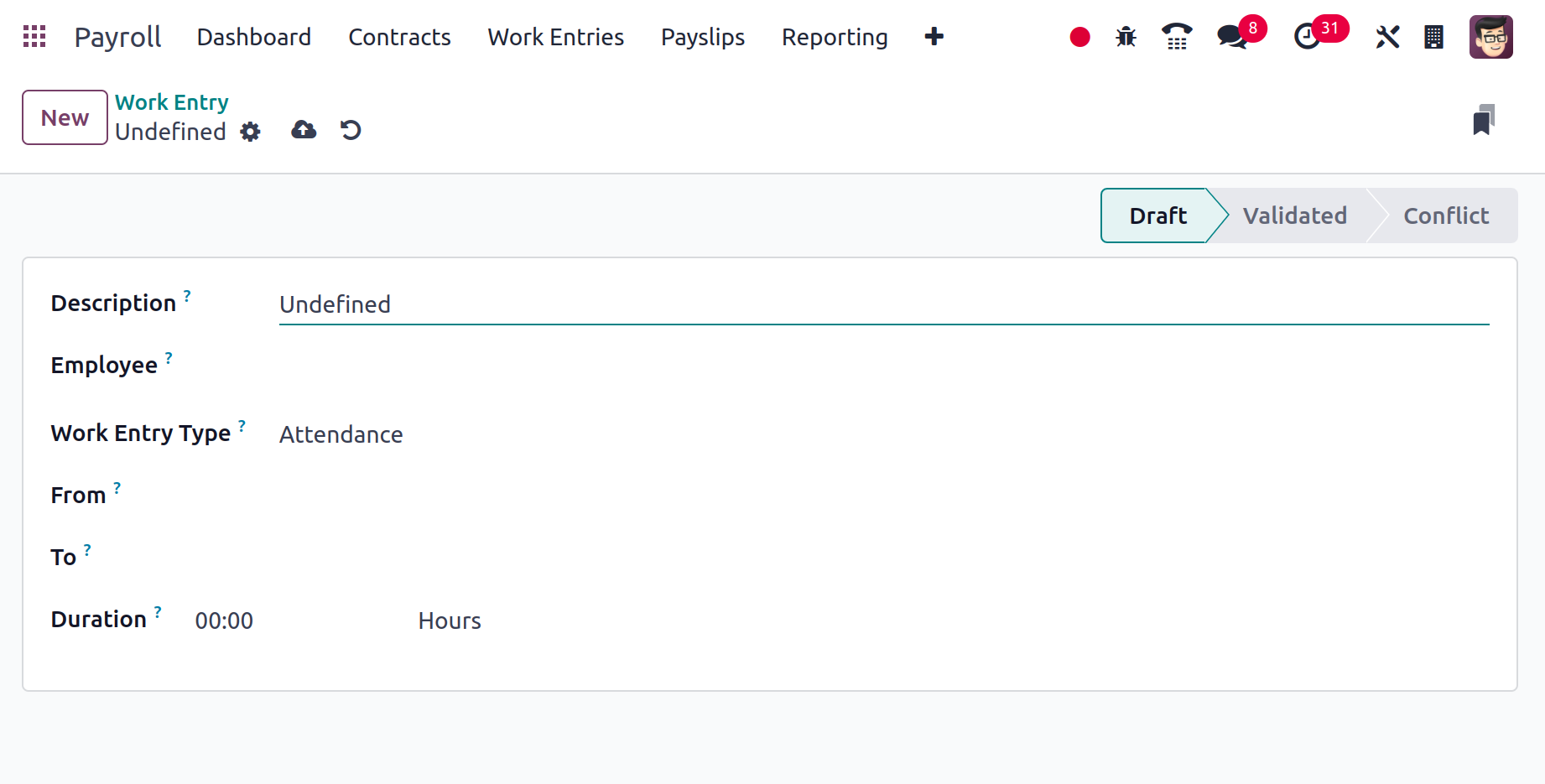

By selecting the New button, we may create a brand-new employee job entry. Apply the work entry type name and choose your employee on the open screen. Later, you can choose the Work Entry Type from options like Attendance, Sick Time off, and Extra Hours. The From and To dates of an employee's work entry can be specified.

Each piece of information is readily saved in the Work Entry box when all the data has been added.

Time Off to Report

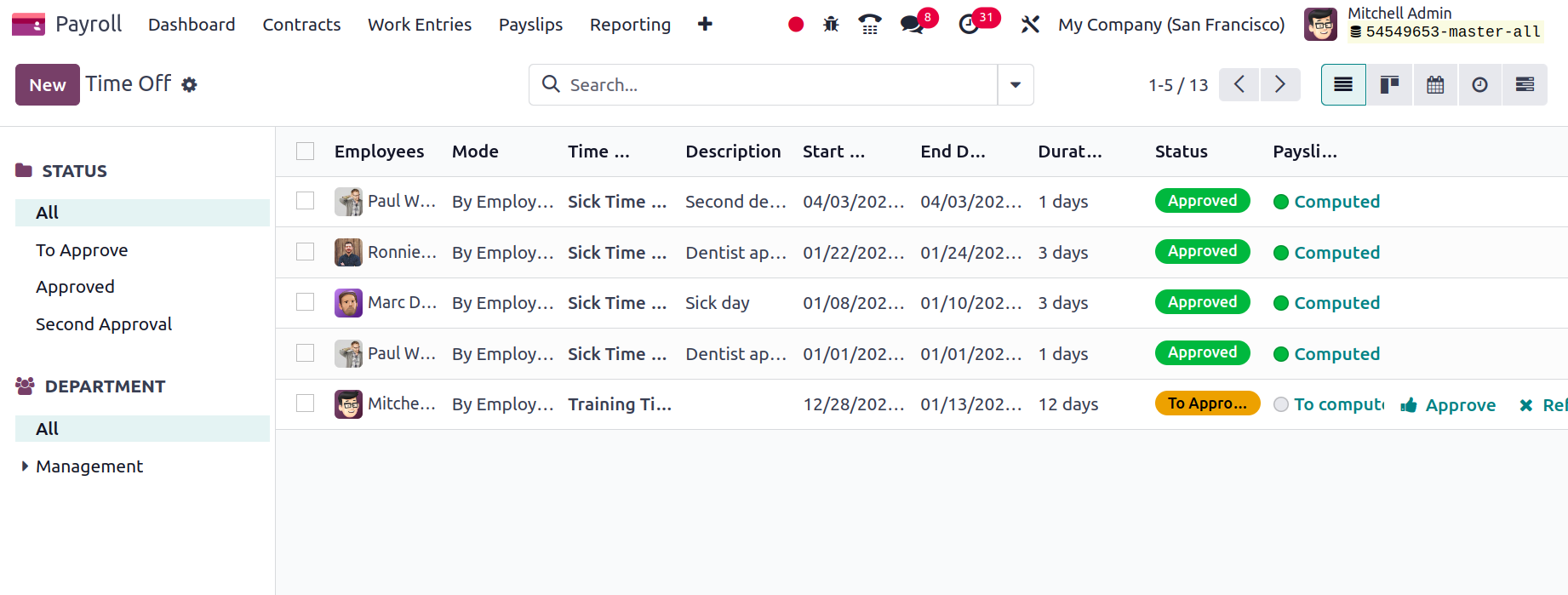

A user can access each employee's time off information by selecting the Time Off to Report option from the Work Entries tab. You may view the specifics of each employee's time off in the Time Off window's List view, including the Start Date, Duration, Payslip State, Time Off Type, End Date, etc. Additionally, the STATUS and DEPARTMENT portions are shown individually on the left side of the window. On the Time Off pane, you may view the corresponding modifications and sort the time off based on approved or unapproved.

The Time Off window is accessible to users in a variety of forms, including Kanban, Activity, Gantt, Calendar, List, etc. Choose the New button on the Time Off screen to create a new Time off report for an employee.

Let's go to the Odoo 17 Payroll Configuration tab now.

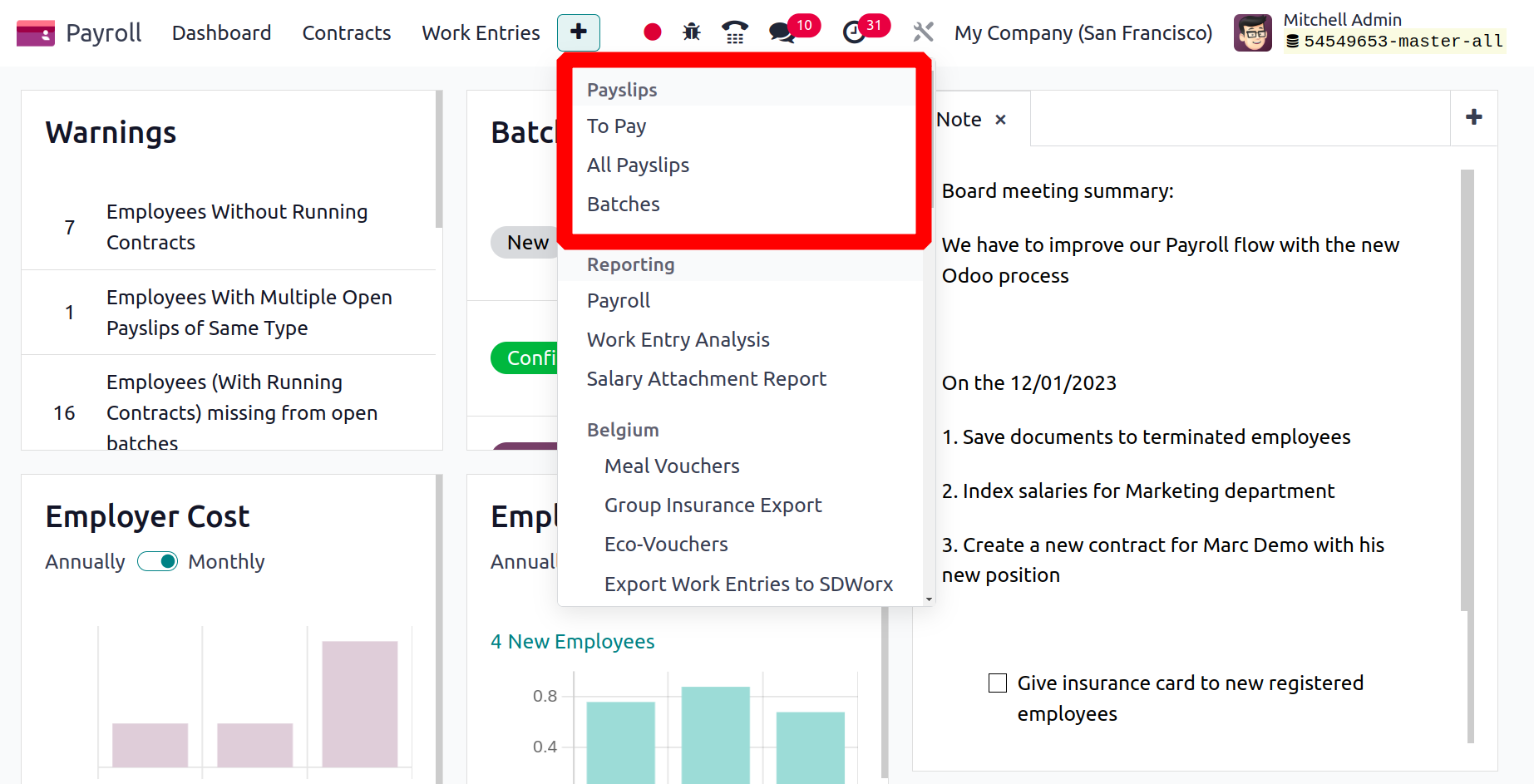

Payslips

The Odoo17 system effectively controls a company's whole payroll application. After specifying employee payslips, you may write a contract with a salary structure.

If a payslip was created, Odoo 17 helps you export it as a PDF. Journal entries on accounts can also be explained in Odoo 17. Managing batches, payments, and all payslips is simple.

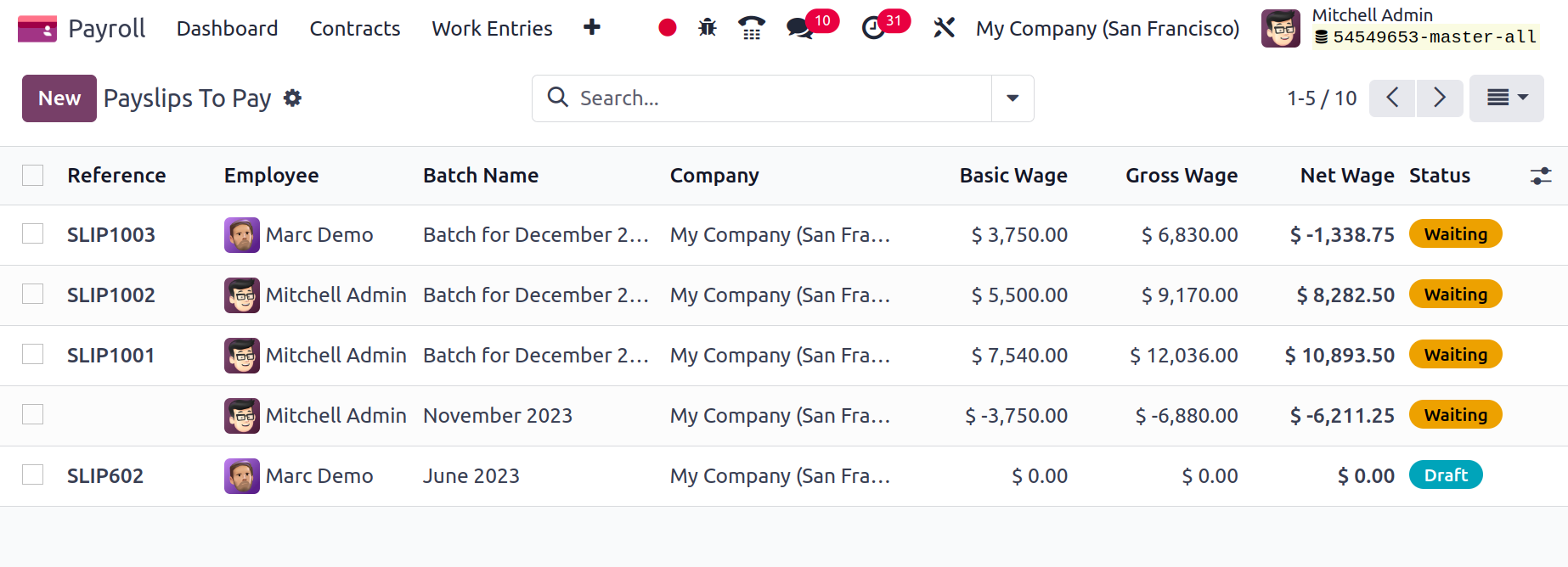

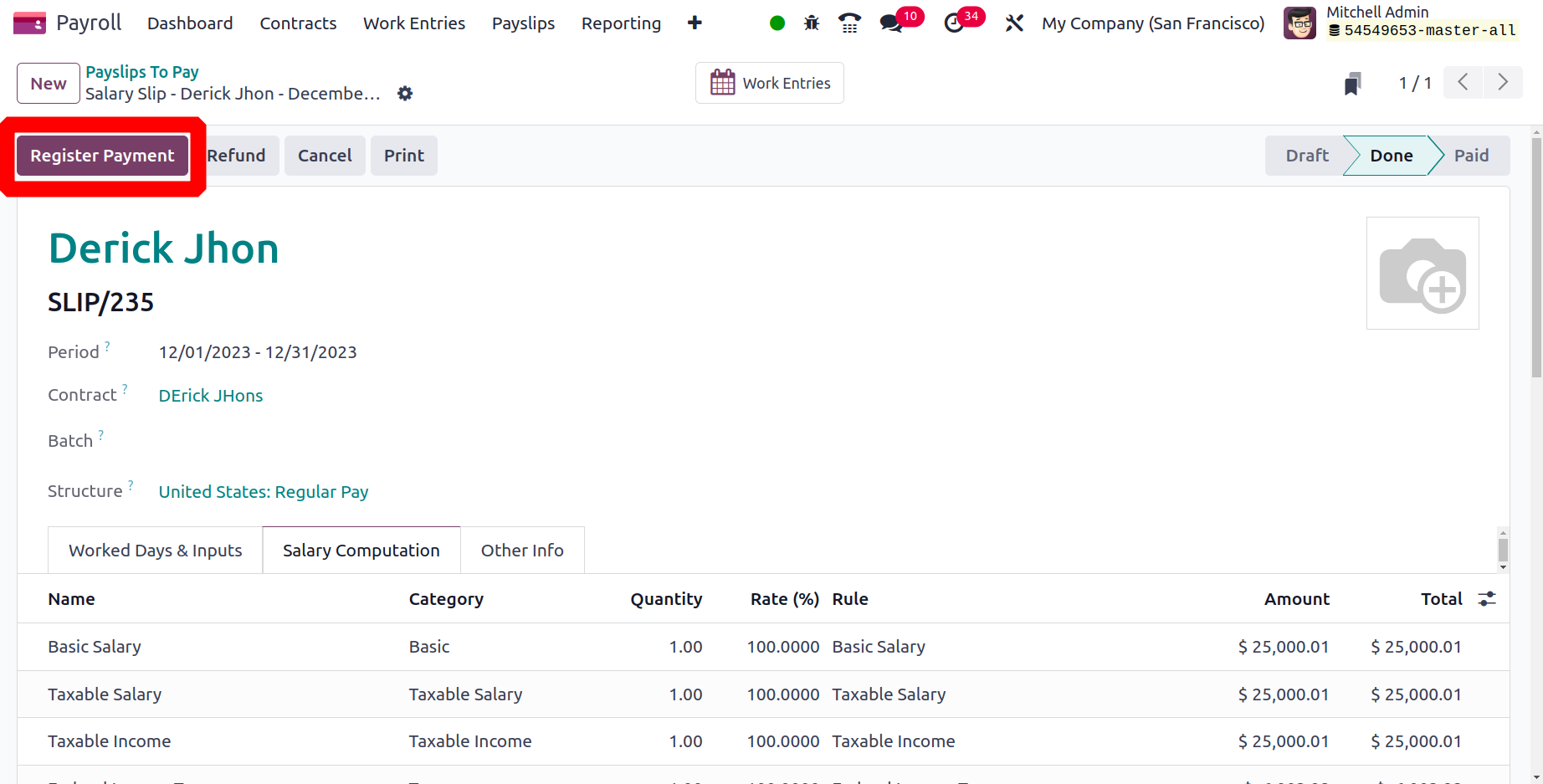

To Pay

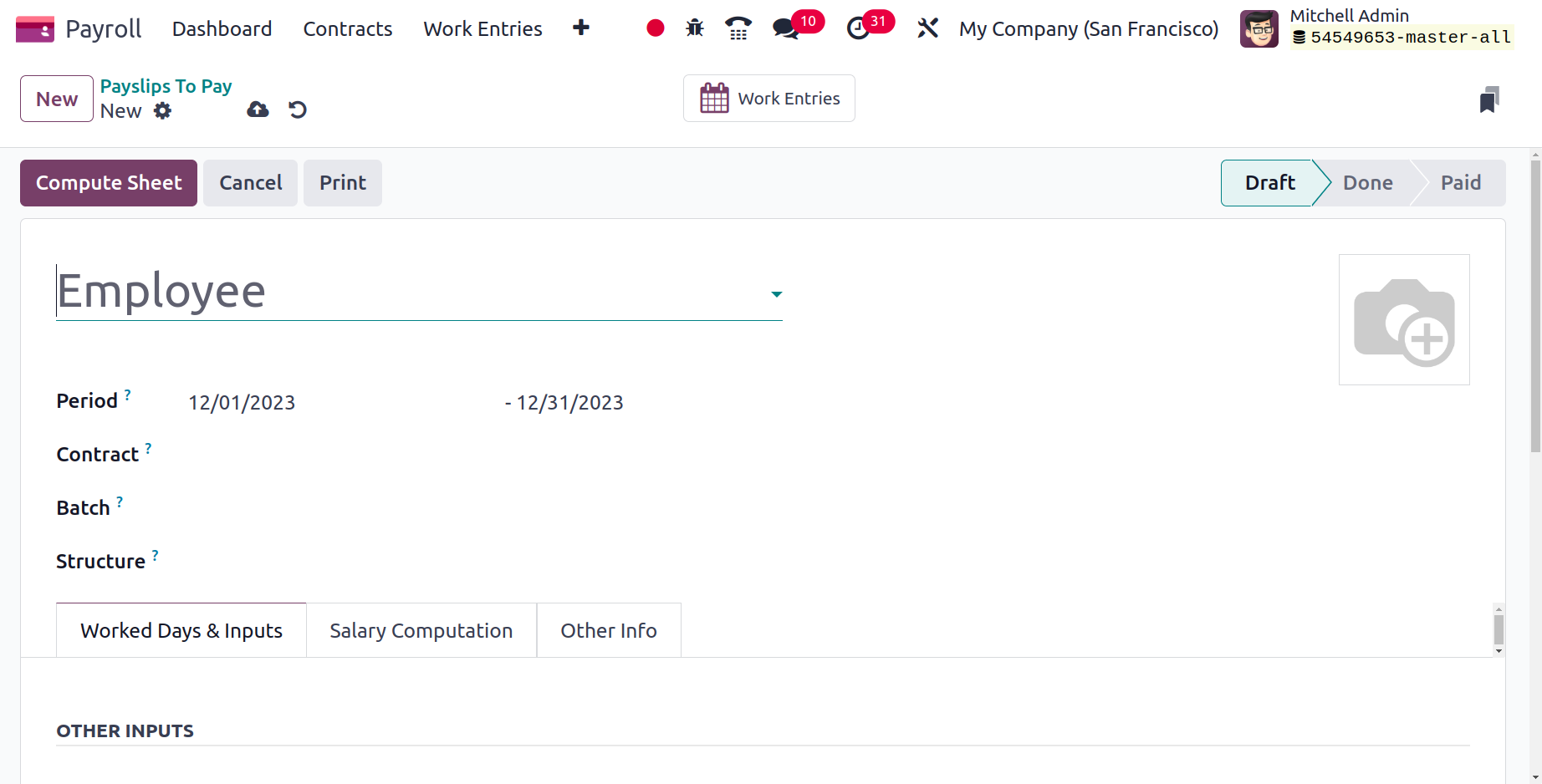

We can access a list of all created payslips to pay by choosing the To Pay menu in Payslips. A user has access to each payslip's data, including Reference, Batch Name, Basic Wage, Status, and more. After clicking the New button, you can generate a new payslip for payment.

In the Payslips to Pay window, users can enter the Employee Name required to generate payslips. The employee payslip's start and end dates can then be entered in the Period section. You can also choose the Contract and Batch for the payment of payslips. Within the Structure section, users can specify rules that apply to a payslip.

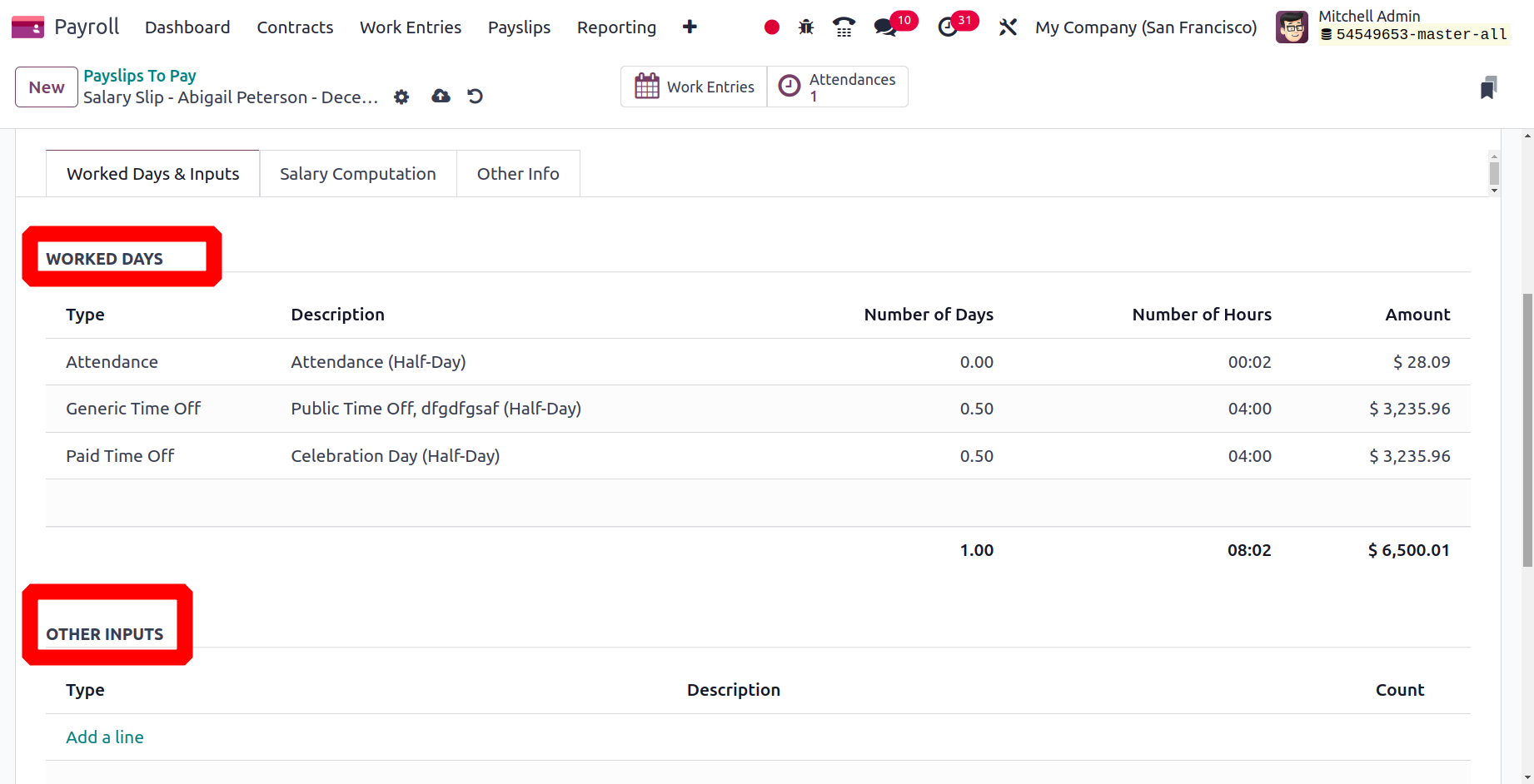

Worked Days & Inputs, Other Info, and Salary Computation are the three tabs that can be seen in the Payslips to Pay window.

We may handle WORKED DAYS and OTHER INPUTS below the Worked Days & Inputs tab. We can customize Type, Number of Days, Amount, Description, and other options under the WORKED DAYS area. On the other hand, you can specify the input type and any necessary descriptions within the area for OTHER INPUTS.

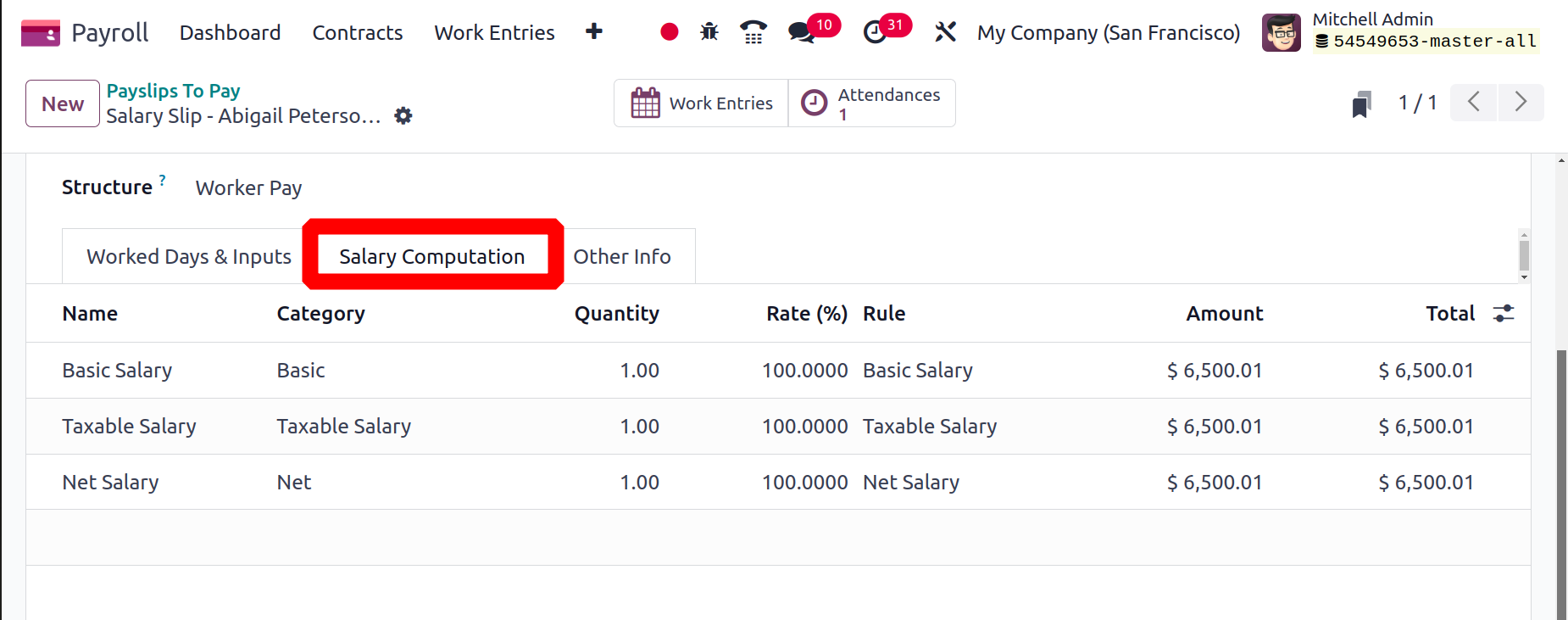

The Salary Computation tab allows us to list salary computation that takes place in payslips in accordance with the salary rule and structure established by employees. The Salary Computation tab contains information such as Name, Quantity, Amount, and more.

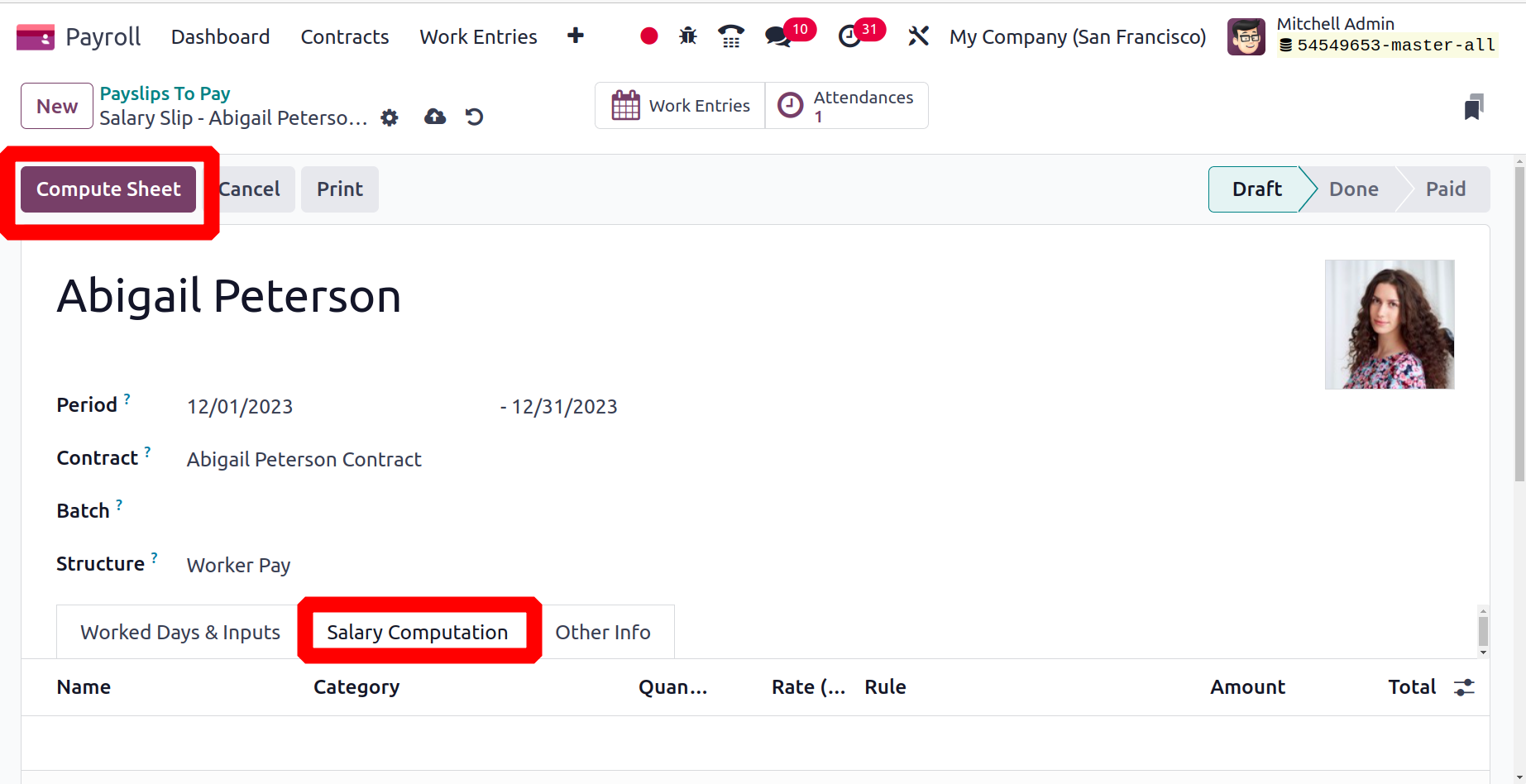

After selecting the employee, contract, and relevant structure, click the Compute Sheet button. Then employee salary computation data are displayed below the Salary Computation field.

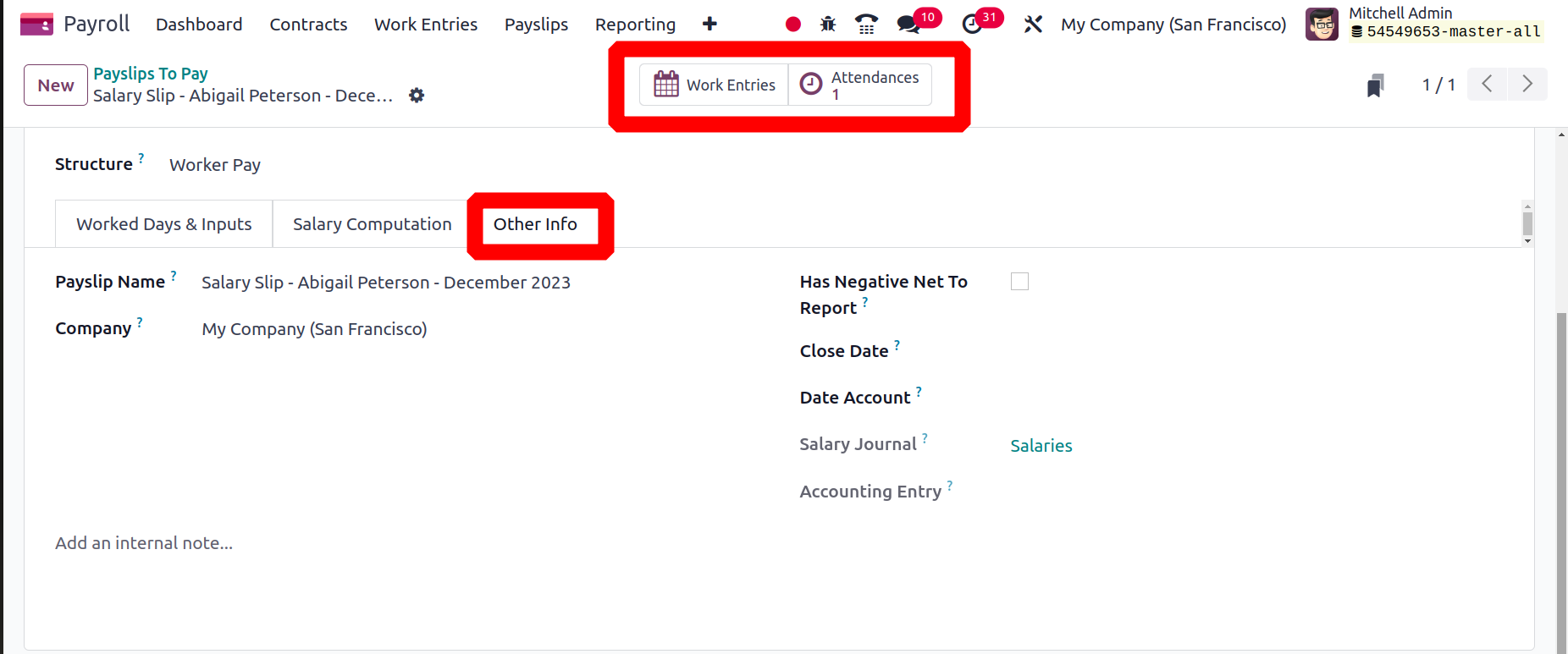

In the Other Info tab, users can describe the Company, Payslip Name, and other information about payslips to pay. Keep the Date Account column unfilled to capture the period of the payslip validation date. Close Date is the day the customer receives their money.

Additionally, the Work Entries smart button allows us to access all work entries pertaining to payslips that an employee must pay.

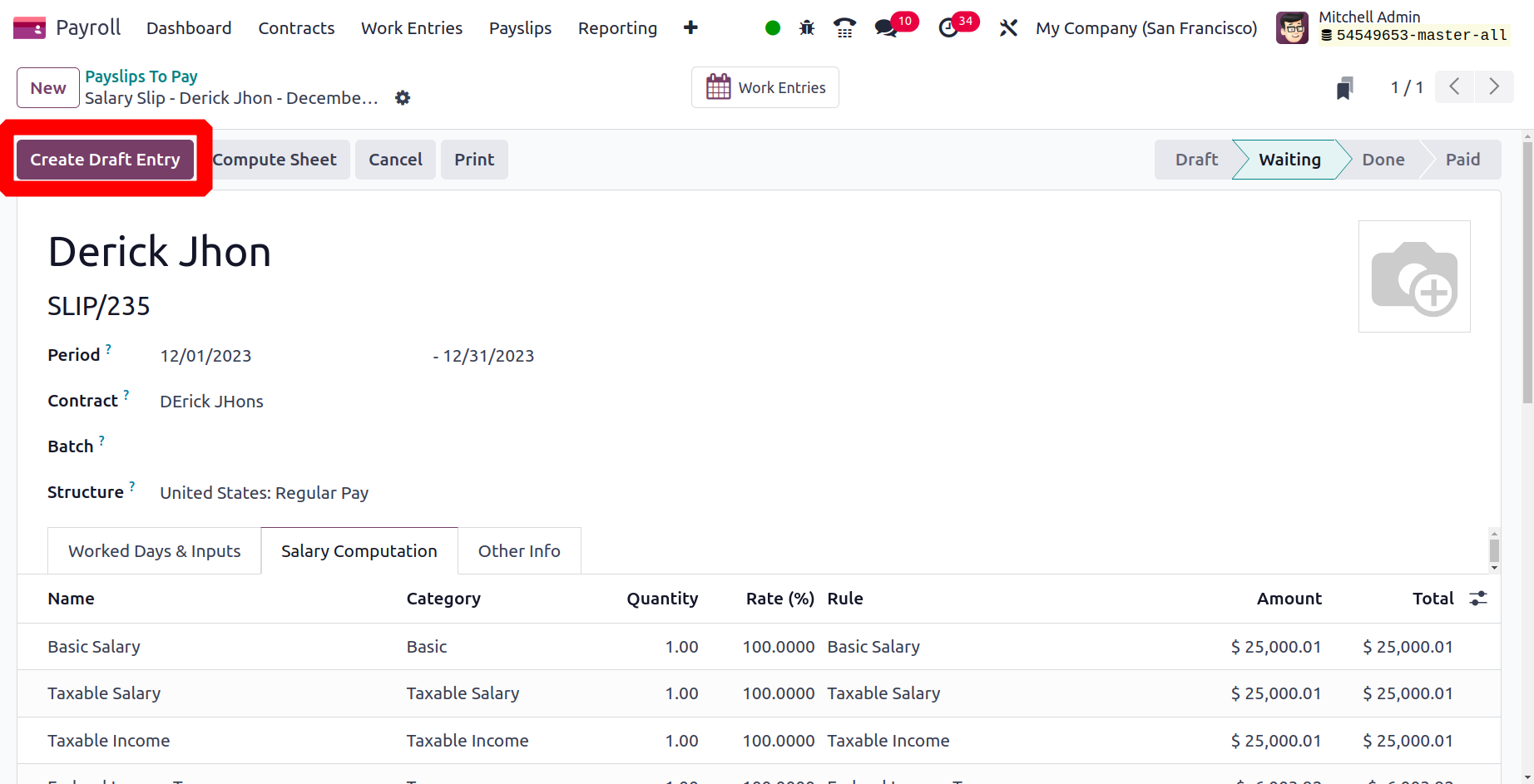

Next, select the Create Draft Entry button to start creating a draft entry.

Then the payslip stage changes to Done and the user can give salary to the employe by using the Register Payment button.

Now with Odoo 17, it is allowed to use the manual payment method to make payment.

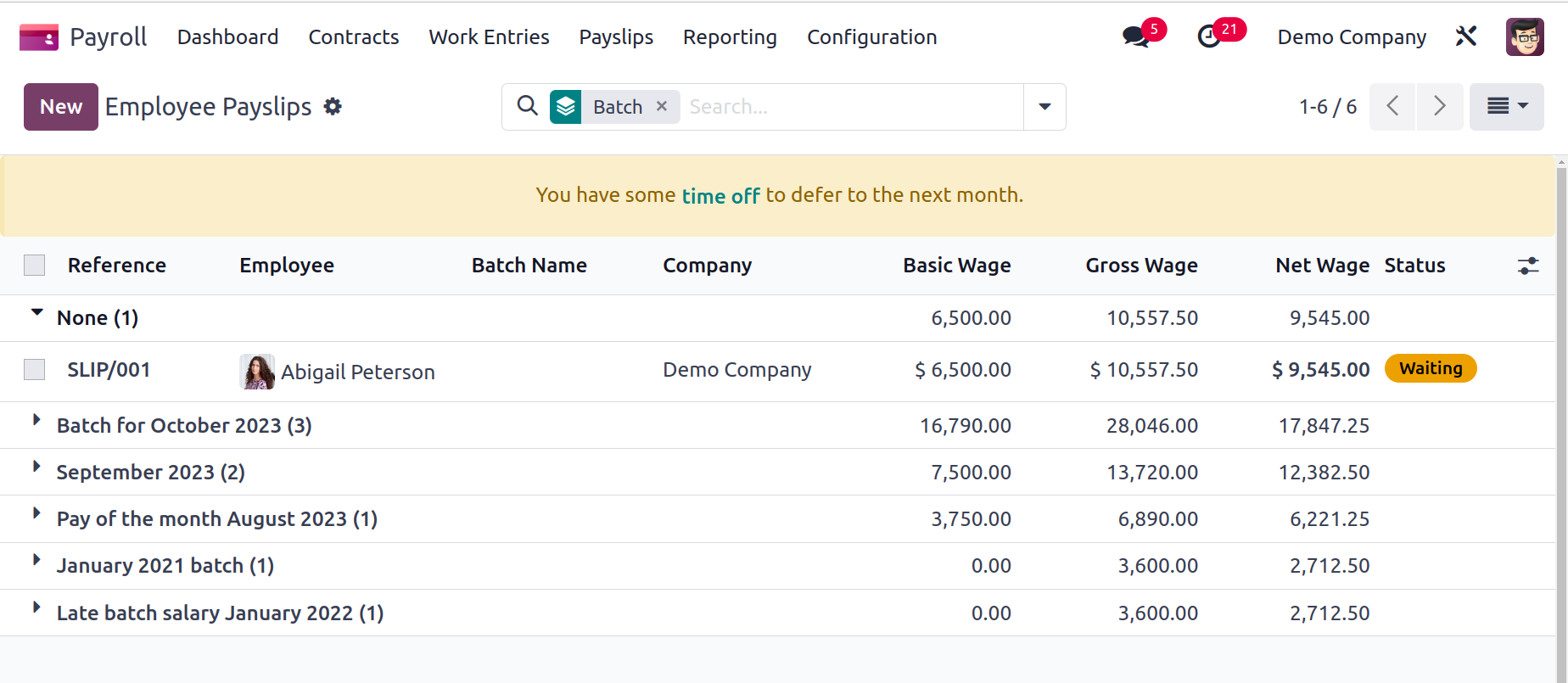

All Payslips

The All Payslips window provides access to data on payslips generated for all employees. You must do so by selecting the All Payslips menu from the Payslips tab. In the List view, you can receive data concerning employee payslips such as Reference, Batch Name, Basic wage, status, and more. We can quickly define new paystubs for employees by selecting the New icon.

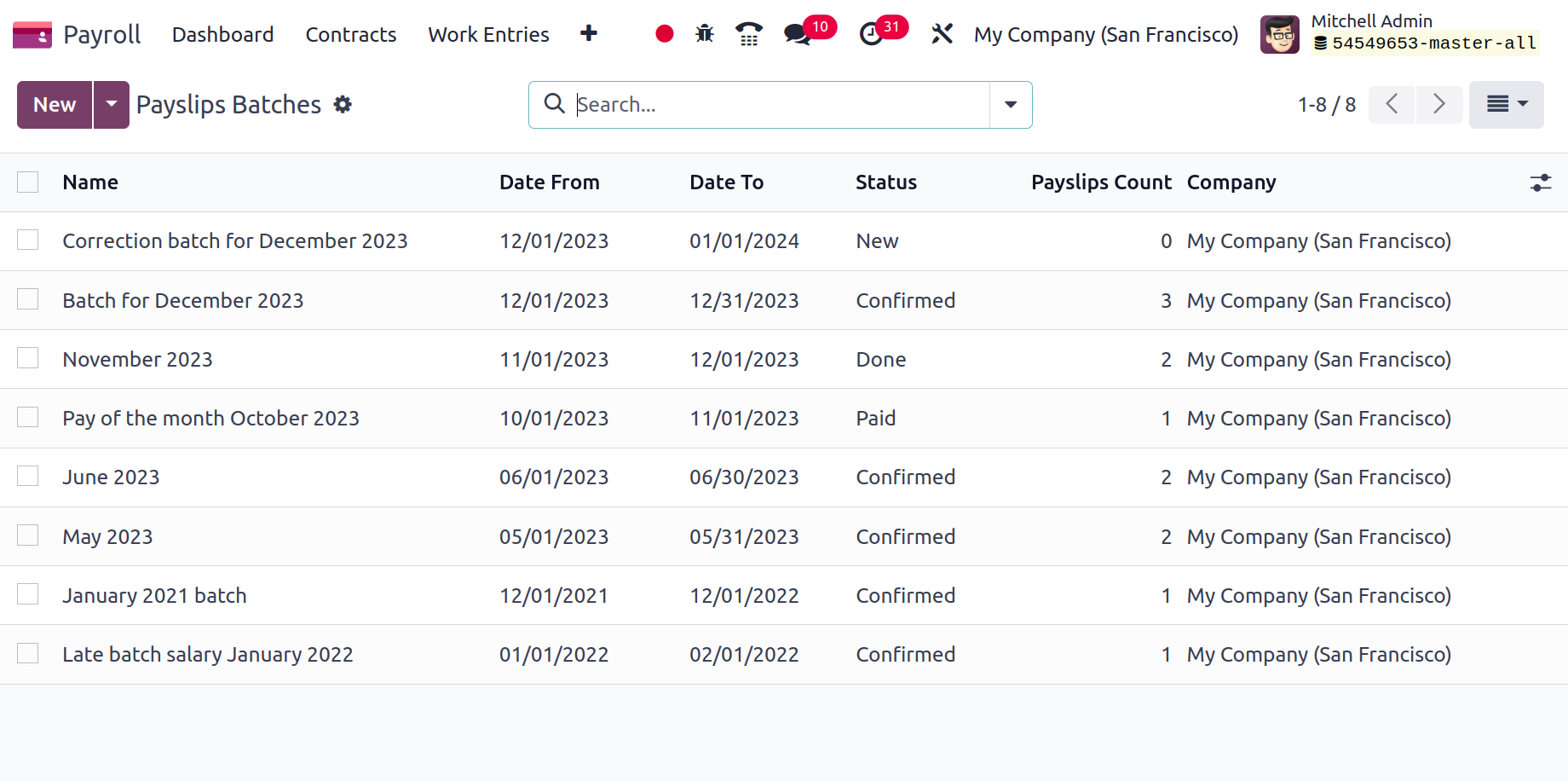

Batches

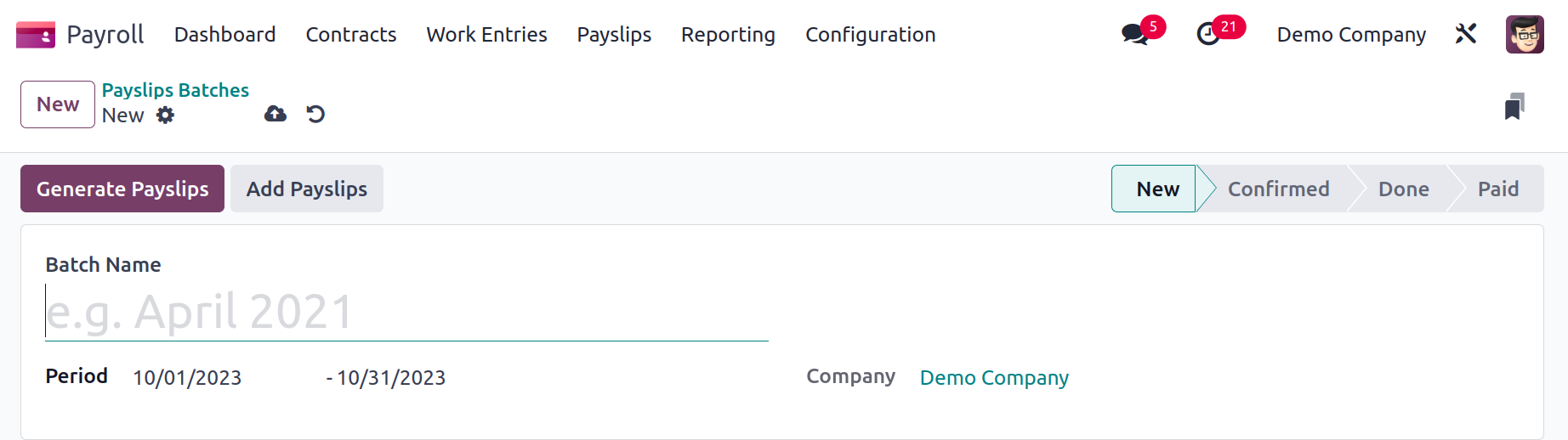

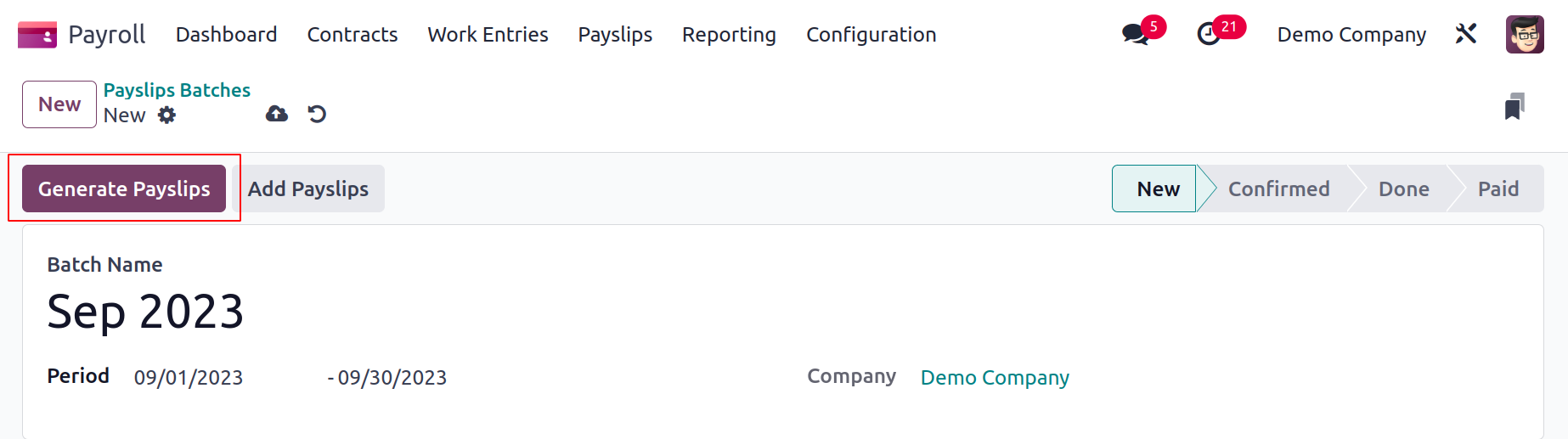

The Payslips tab's Batches menu can be used to create payslips for employee batches. Data about each batch is defined in the Payslip Batches window. This data includes Name, Date To, Company, Date From, Status, and more. We can supply a new payslip batch of data after selecting New.

Mention your individual batch's batch name and time in the Period section of the new screen. In the Period option, users can enter the start and end dates of a batch. Additionally, if you type in the Company name, all detail is instantly recorded.

The payslip batch can be placed at each stage depending on the next steps. After entering the necessary information, you can pick several employees by clicking Generate Payslips.

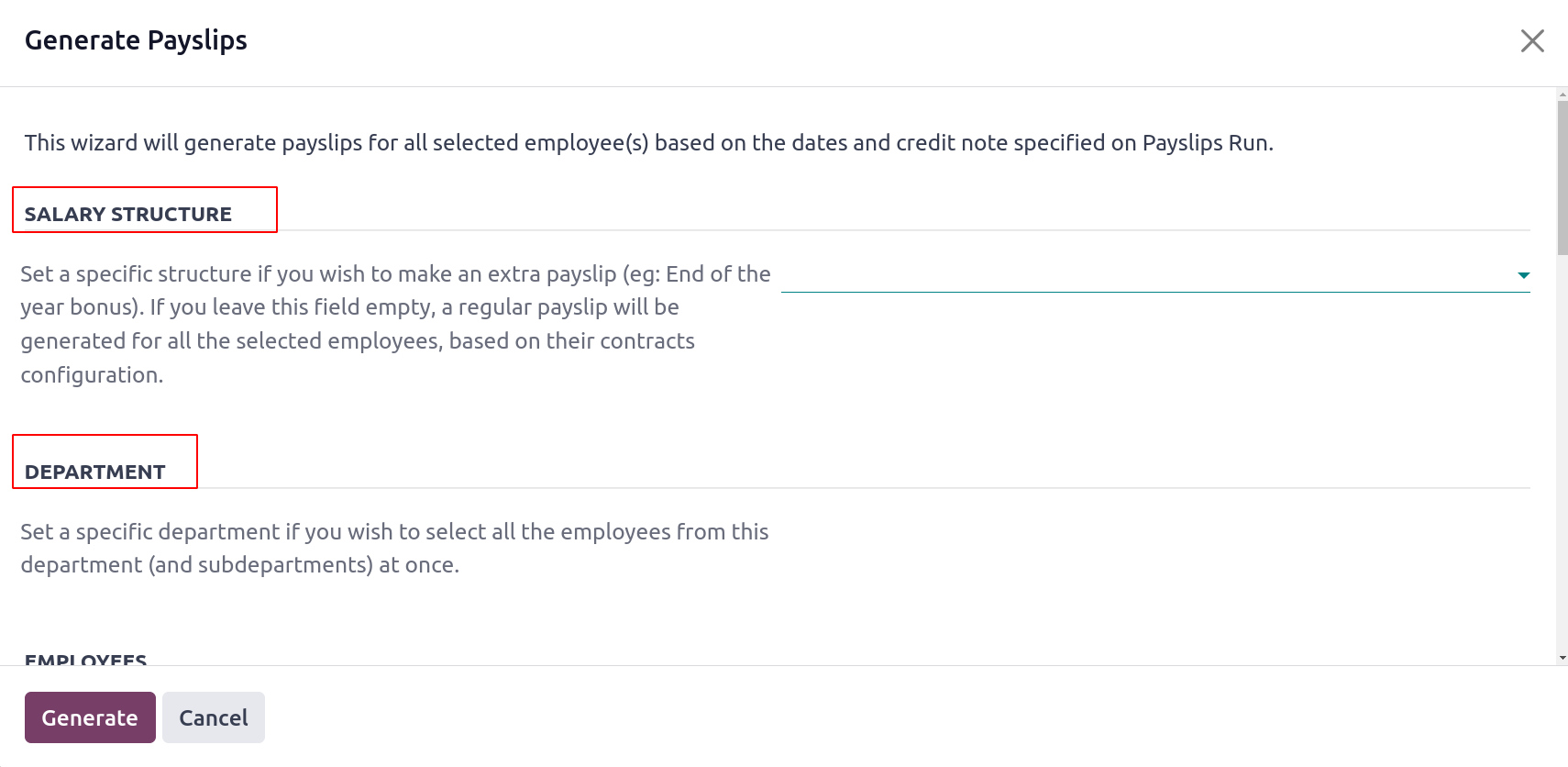

The user can add a specific structure, such as Worker Pay, Regular Pay, and more, underneath the SALARY STRUCTURE area of the Generate Payslips window. If we leave the field empty, a standard payslip is generated based on employee configuration. In a similar manner, you can specify a specific department when selecting personnel inside the DEPARTMENT area.

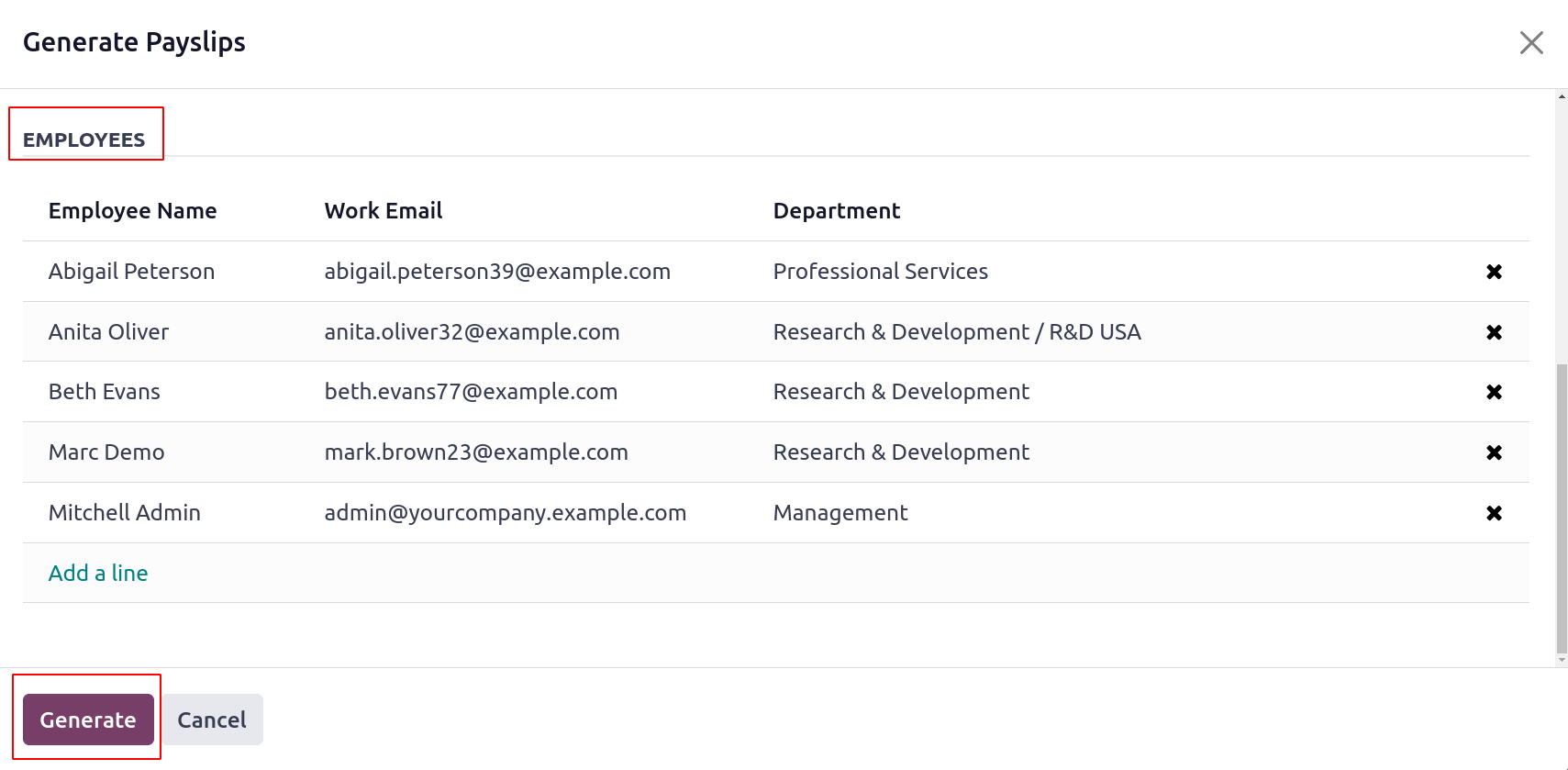

After choosing the Add a line option under the EMPLOYEES tab, we may specify an employee's name. Select the Generate symbol after entering each piece of data.

Therefore, creating employee payslips based on batches is simple.

Configuration

You may manage the salary package configurator, job entries, and employee salary data in Odoo 17 Payroll by using the Configuration tab. Now let's look at the main configuration features.

Template

The Template option under the Configuration menu provides access to the contract templates. Click the New button to add a new one. The form creation view is comparable to the topics we covered in the contract.

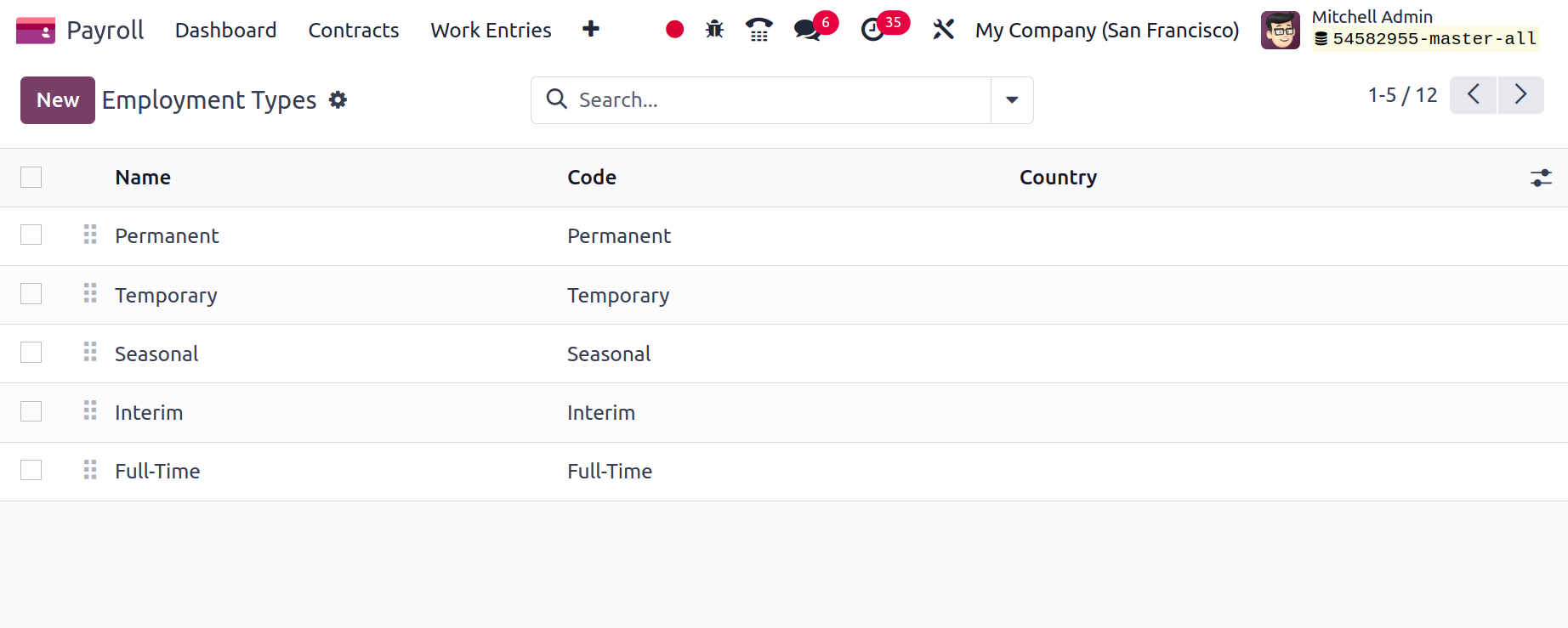

Employment Types

There are various sorts of employees in a company, such as trainees, permanent employees, and temporary employees, and each of them has a separate compensation plan. Under the Configuration option, these employee kinds can be set up as Employment types.

Name, code, and nation are included in the list. Click the New button to add a new one, and a new line will appear beneath the list.

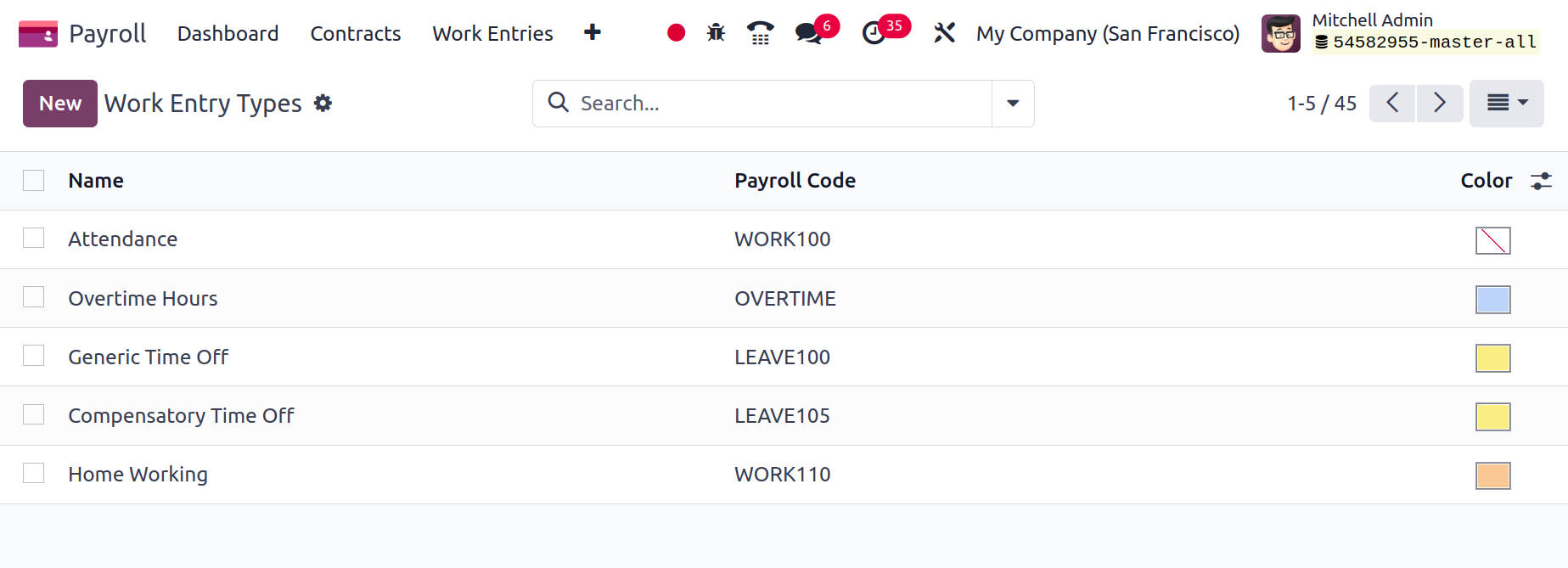

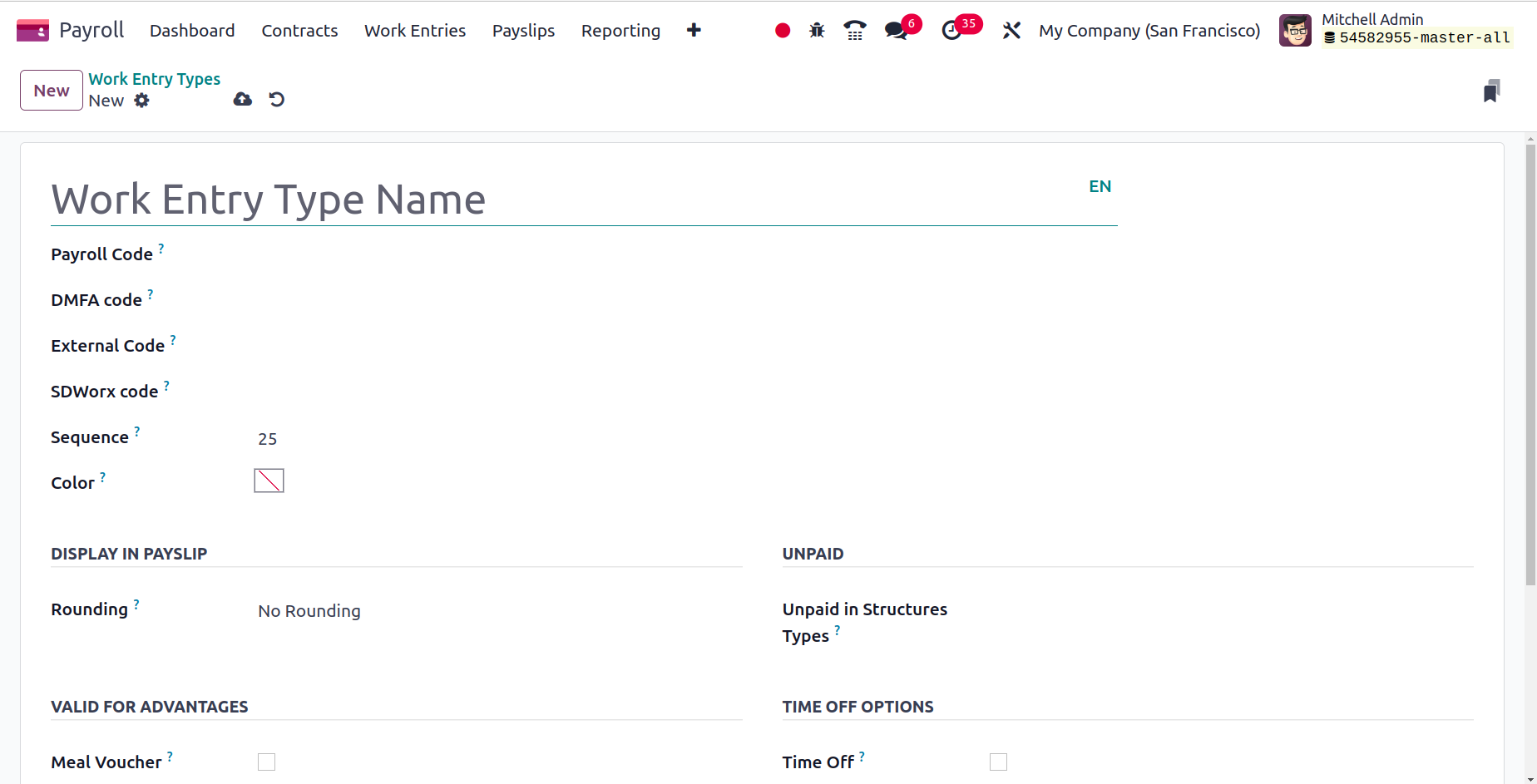

Work Entry Type

The list of work entry kinds can now be found in the Configuration menu. The list displays the Name, Payroll Code, and Color. A new work entry type can be added by using the New button.

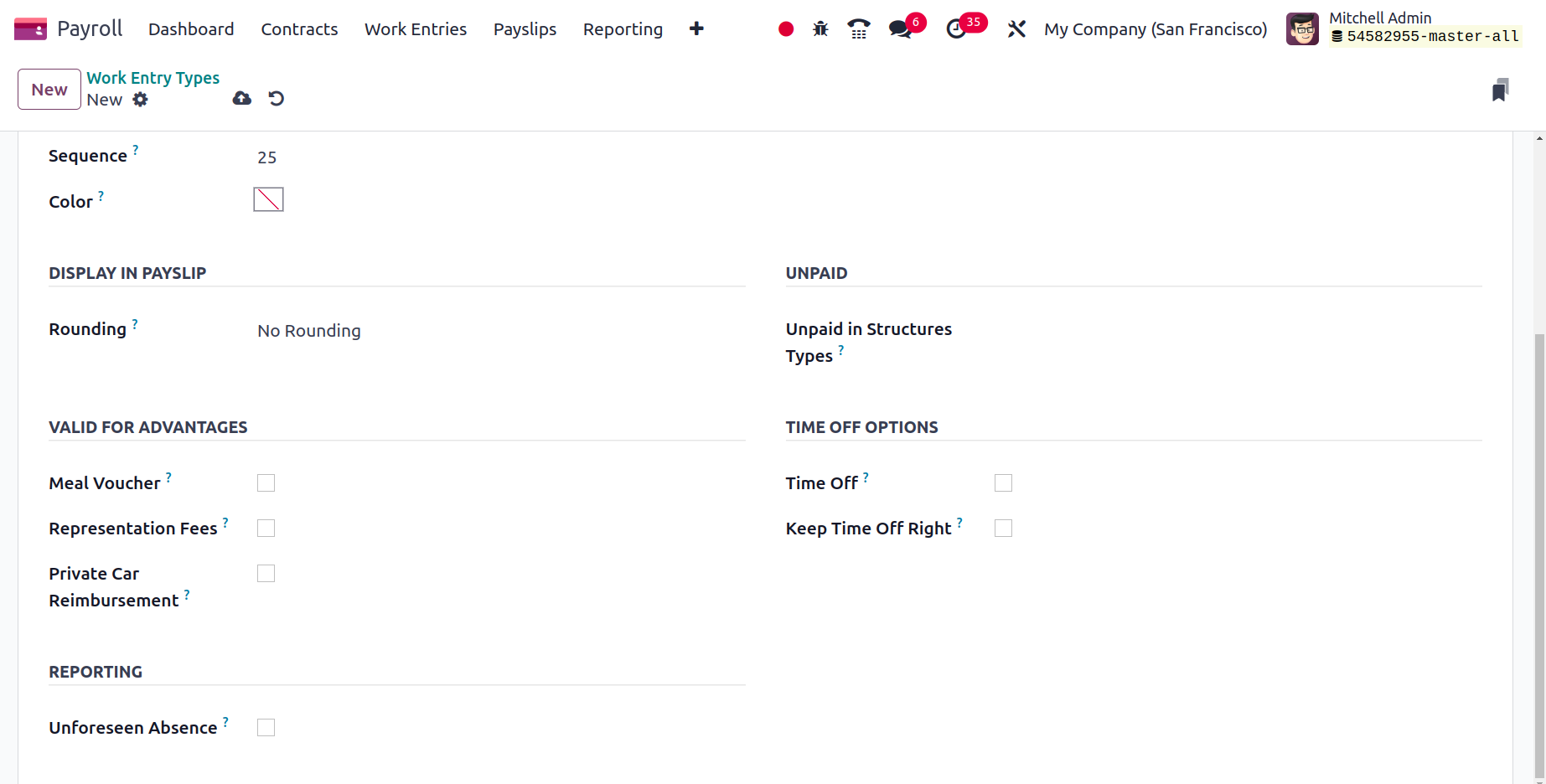

Put the Payroll Code and Workentry Type Name in there. The work entry in the DMFA report is identified by its DMFA Code. The External Code that exported the information to an outside source. The value is rounded using the added rounding method when the entry appears on the payslip. The Unpaid Structure Types benefit the worker and do not grant the employee access to their payslip.

Then, under the VALID FOR ADVANTAGES section, check boxes can be enabled. By checking each box, the work entries count for reimbursement for private car expenses, representation fees, and food vouchers, among other things.

The work entry type can be linked to time off kinds by turning on the Time Off. Keep Time Off Right permits work entry to be included towards future years' vacation time. Unforeseen Absence will be included in the absenteeism at work report if the job entry has Unforeseen Absence enabled.

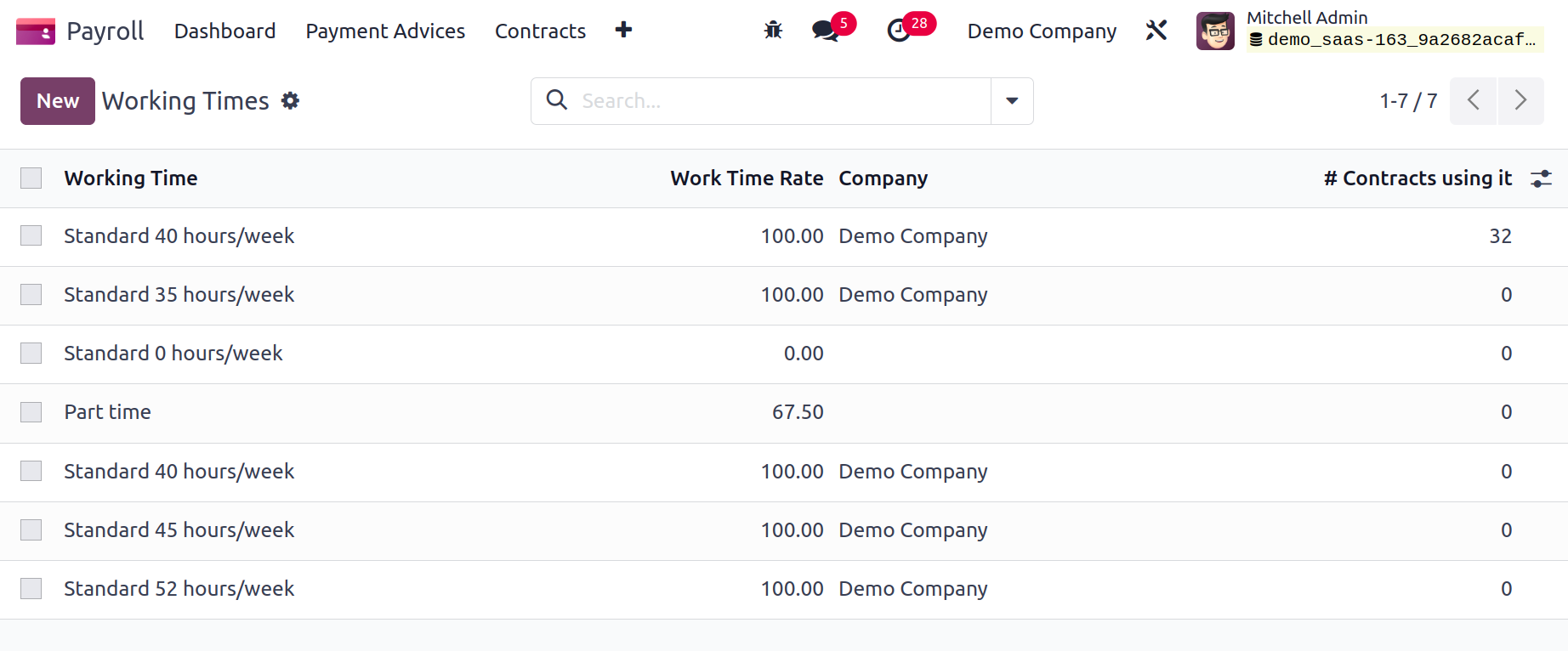

Working Schedules

Within the Odoo 17 Payroll module, users may easily manage their working hours. You can increase organizational productivity with its aid. Flexibility is provided for both employees and employers to reach their full potential. Select the Working Time menu in Odoo 17 Payroll's Configuration tab. We may view information like Work Time Rate, Contracts using it, Working Time, and Company in the Working Times box. You can create a new employee work schedule by selecting the New icon.

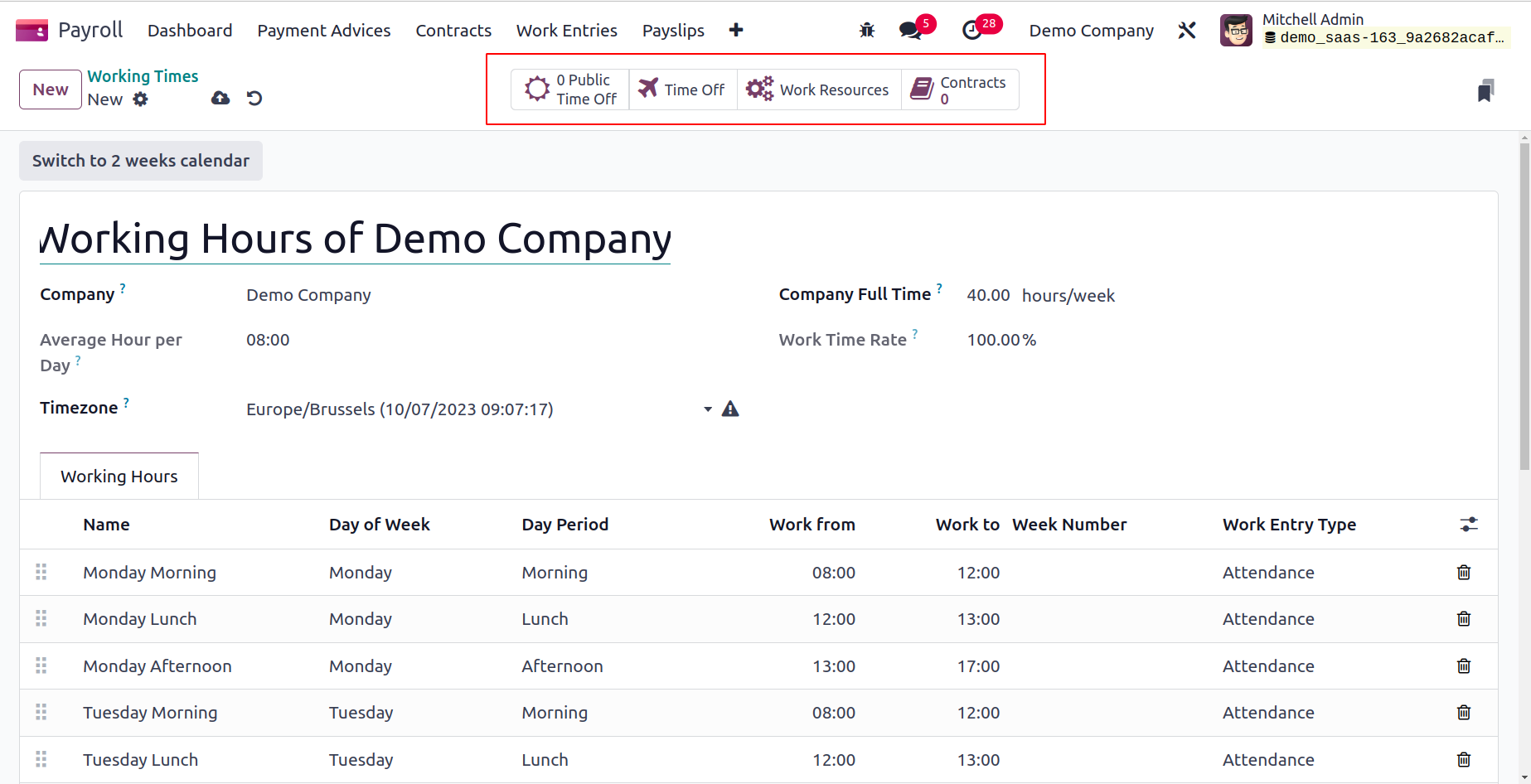

The user can apply the Company, Full Time, Average Hour per Day, and Timezone data in the Working Times window once it has been launched. The Working Times pane contains several smart buttons, including Work Resources, Contracts, and Public Time Off.

By selecting Add a line under the Working Hours tab, the user can add a new working hour for an employee. Under the Working Hours area, the user can specify the Name, Day period, Work Entry Type, Day of the Week, Work from, etc.

We can specify salary structures and salary rules in the Configuration tab's Salary section. Rules, Other Input kinds, Structure kinds, Rule parameters, Rules, etc. are only a few of the options that are accessible within the Salary section. We may now talk about each of them independently.

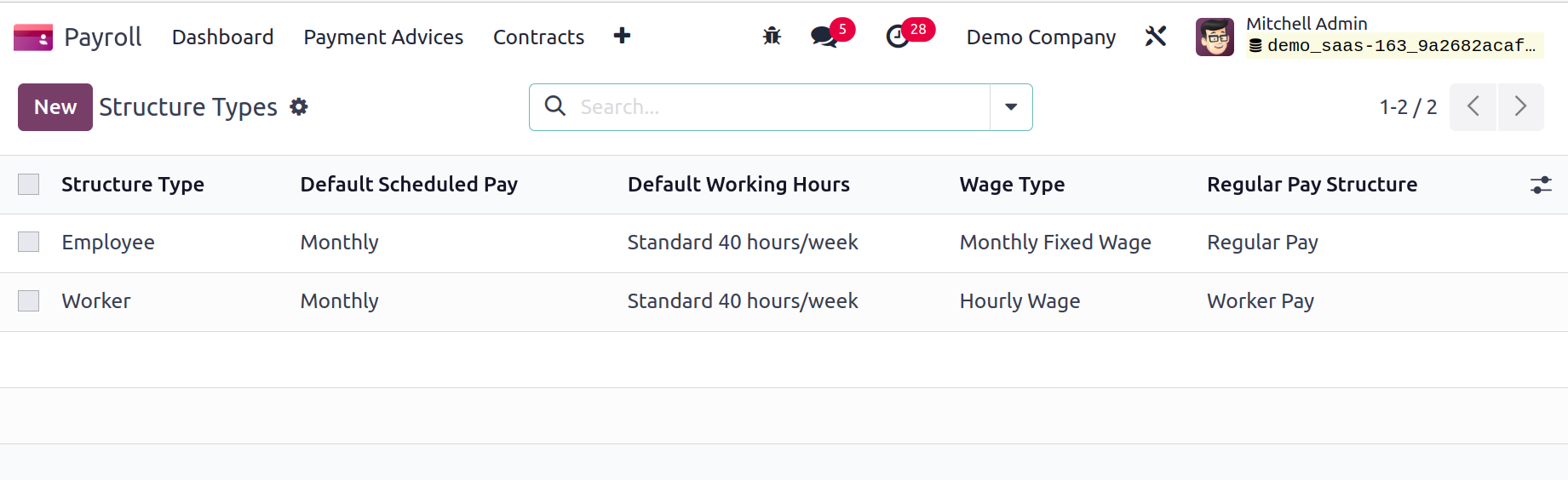

Structure Types

Within the Odoo 17 Payroll, new salary structure types can be configured. Users can specify salary structures for trainees, employees, and workers within the Odoo17 Payroll system after outlining the various wage types on a monthly, hourly/weekly basis. After selecting the Salary Structures menu on the Configuration tab, users may specify the pay scales for their employees. We may find information on Wage Type, Default Scheduled Pay, Structure Type, Regular Pay Structure, and more in the Structure Types box. In Odoo 17, by selecting the New button, we may create new structure kinds.

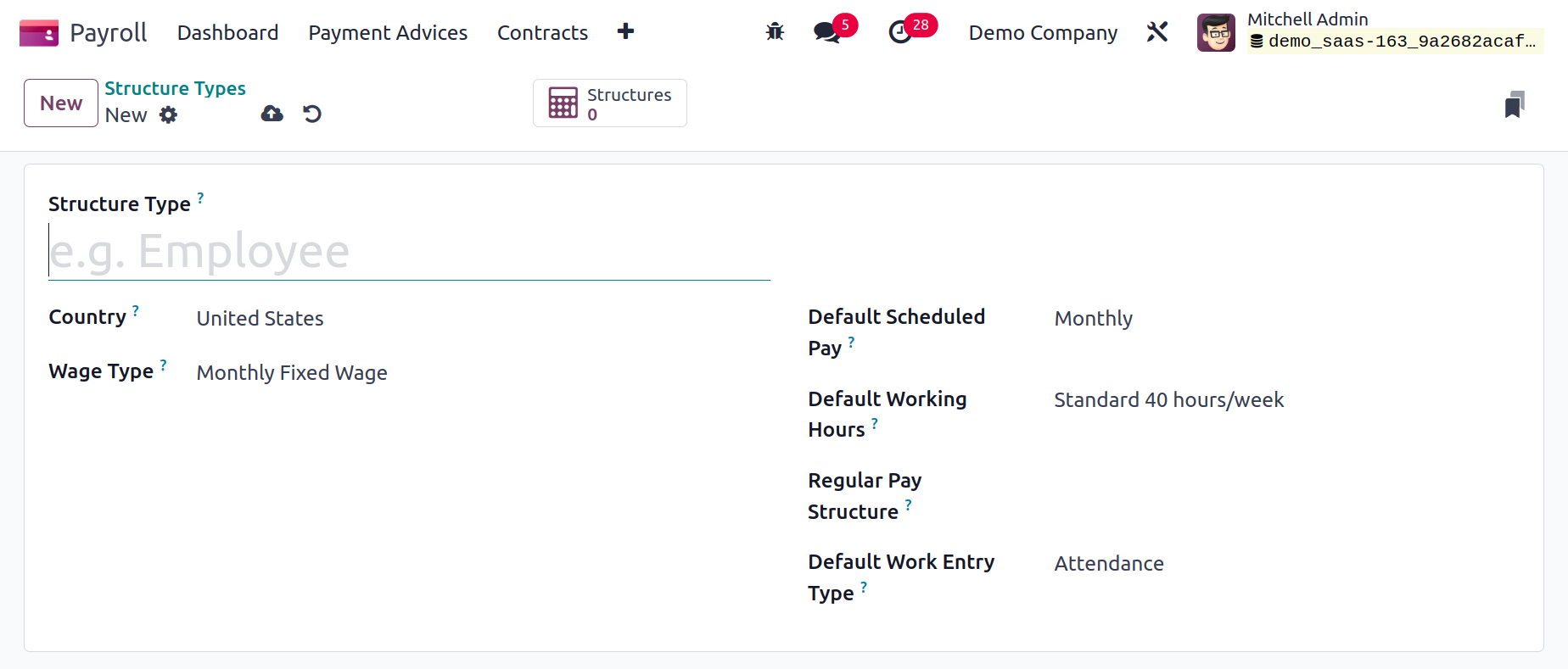

Enter the name of the structure type and your country in the open box. Setting the Wage Type to Hourly Wage and Monthly Fixed Wage is simple.

In the Default Scheduled Pay area, afterwards, include the frequency of wage payments. The user can then specify the salary structure type's default working hours. In the Structure Type area, we can describe the normal pay structure for employees. In the Default Work Entry Type section, you can also state the work entry type pertaining to regular attendance.

Once the user clicks the Structures smart button, they can view each structure within each of the structure kinds.

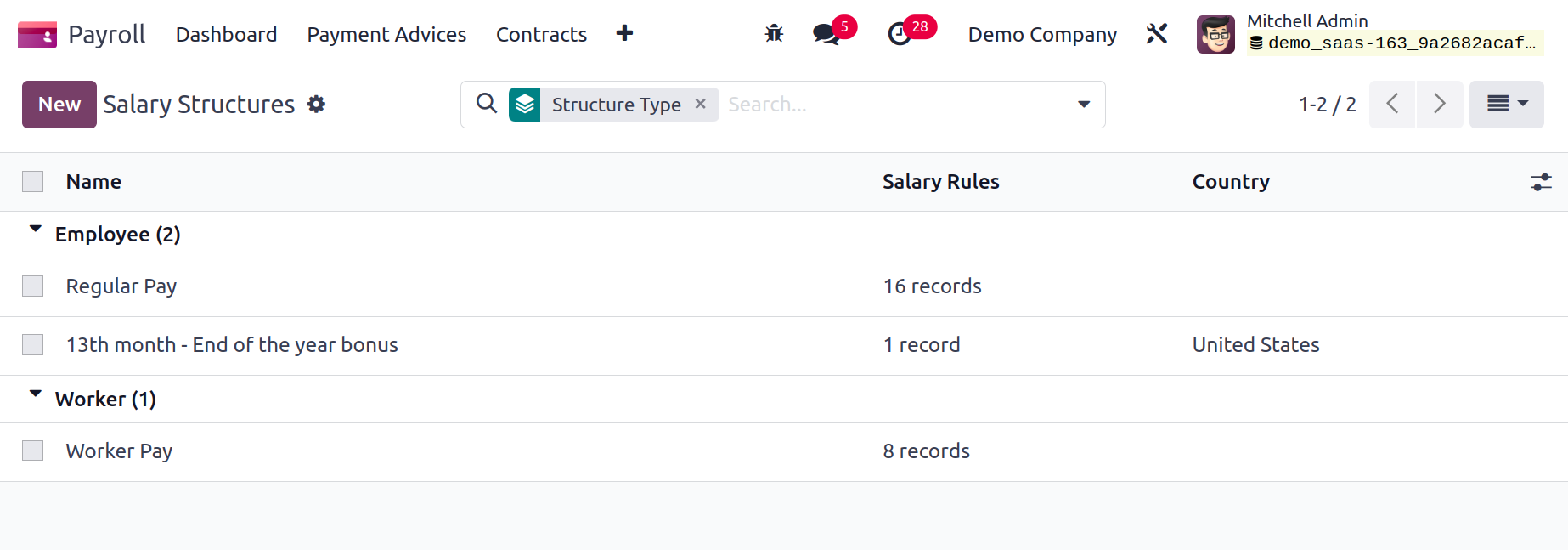

Salary Structures

Within the wage structures, we are able to calculate employee salaries in accordance with job postings and provide payslips for payroll. A wage structure allows you to specify a number of rules that are helpful for calculating payslips. There is a single wage system used by the entire department or group. As soon as they select the Structures menu in Configuration, users can describe a new salary structure. You can obtain the individual wage structures for Employees and Workers on the open window. Each employee's name, country, and wage rules are clearly visible, as is the employee salary structure. Select the New icon in the wage Structures box to enter a new wage structure's description.

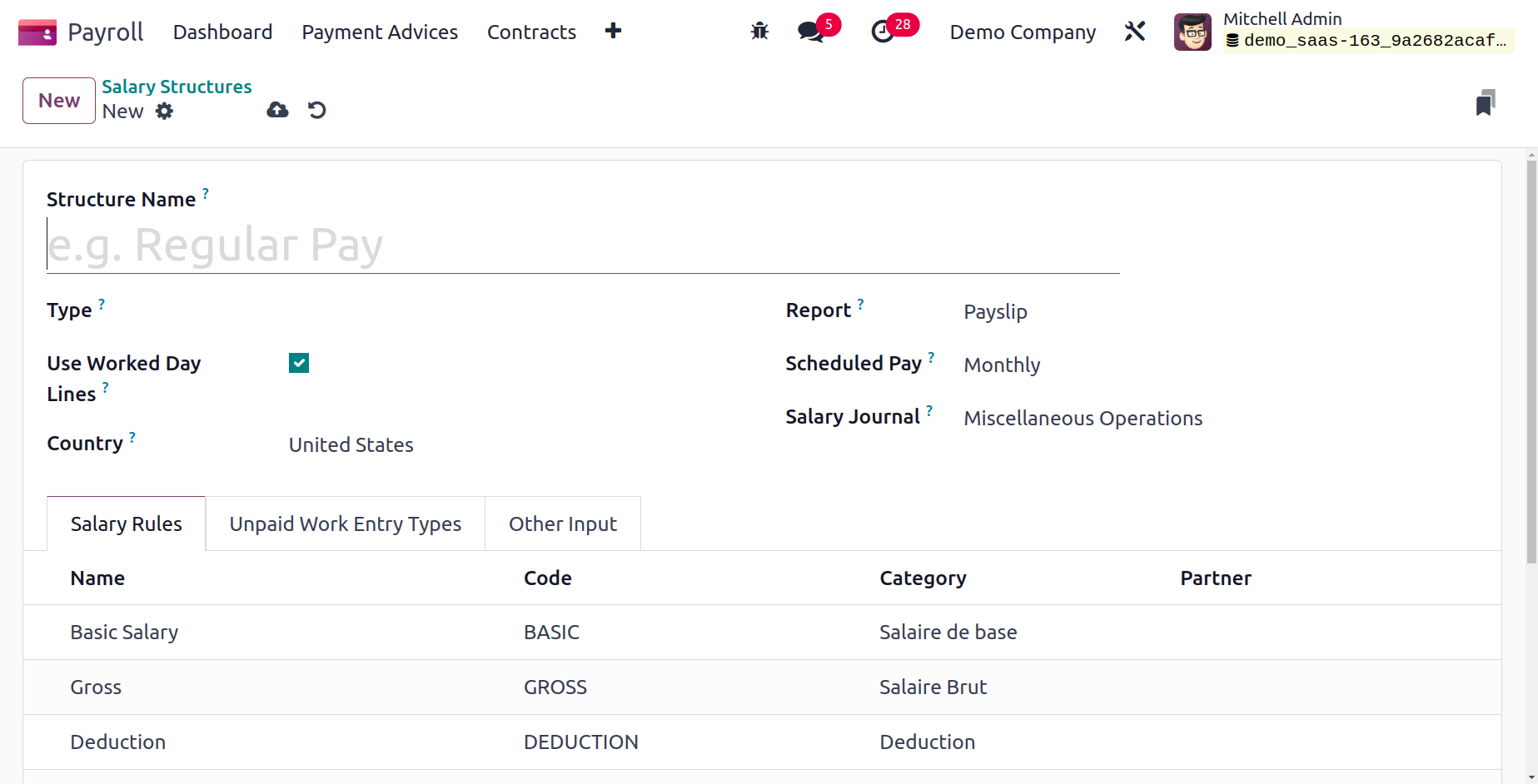

You must input the Structure Name and the Type field in the new screen as Employee/Worker for the category of the structure type. Activate the Use Worked Day Lines option to display worked days in the employee payslip. Include the country when referring to the employee compensation plan.

Users have a variety of reports to choose from, including those on pay stubs, terminations, and more. In the Scheduled Pay section, you can also set the wage payment as Weekly, Annually, Monthly, and more. Regarding the pay system, we can also select a certain salary journal.

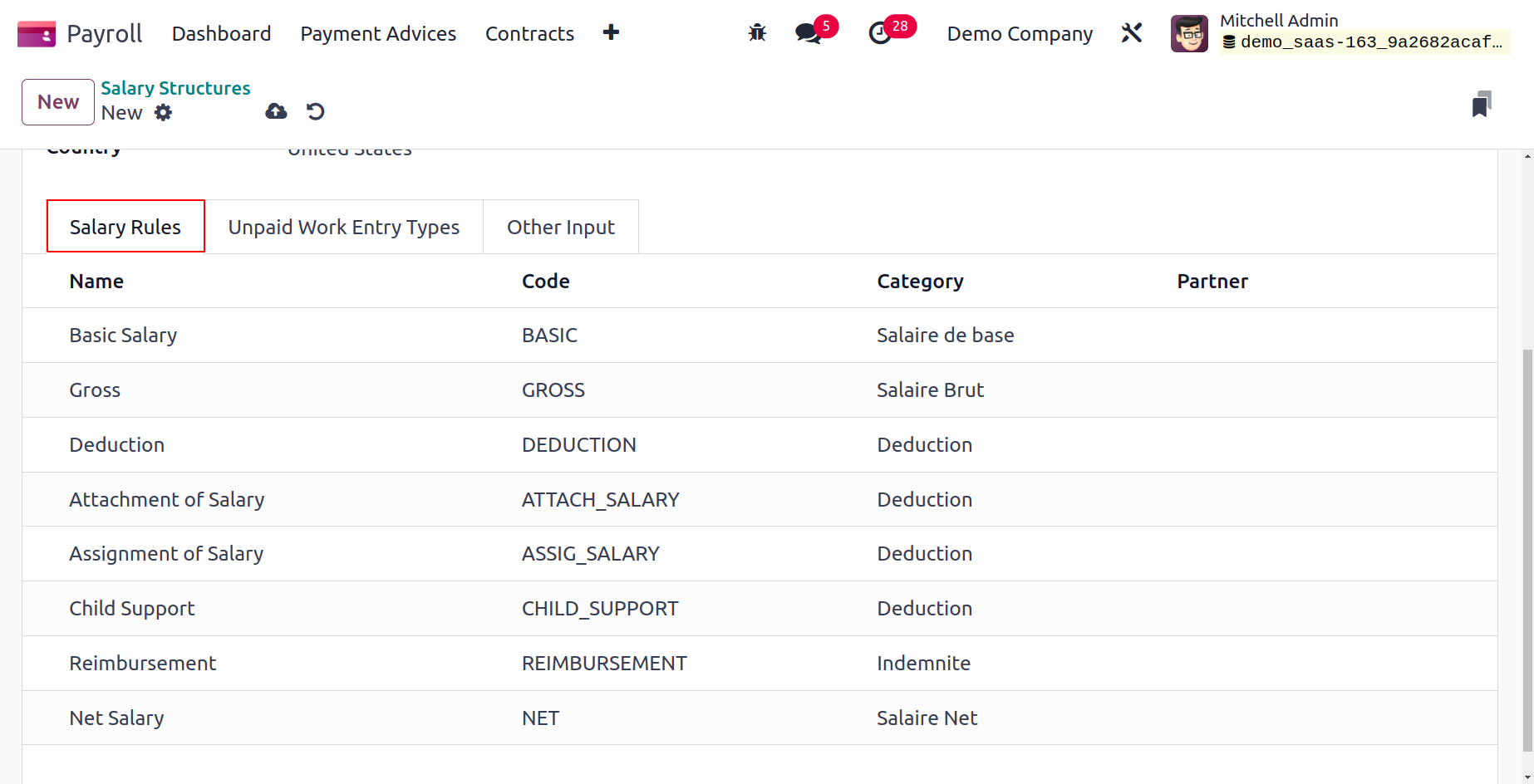

It is possible to implement particular employee wage Structure Rules. To accomplish this, select Add a line from the Salary Rules tab and specify the requirements for your employee salary structure. Each salary rule's Category, Name, Partner, and Code can be mentioned.

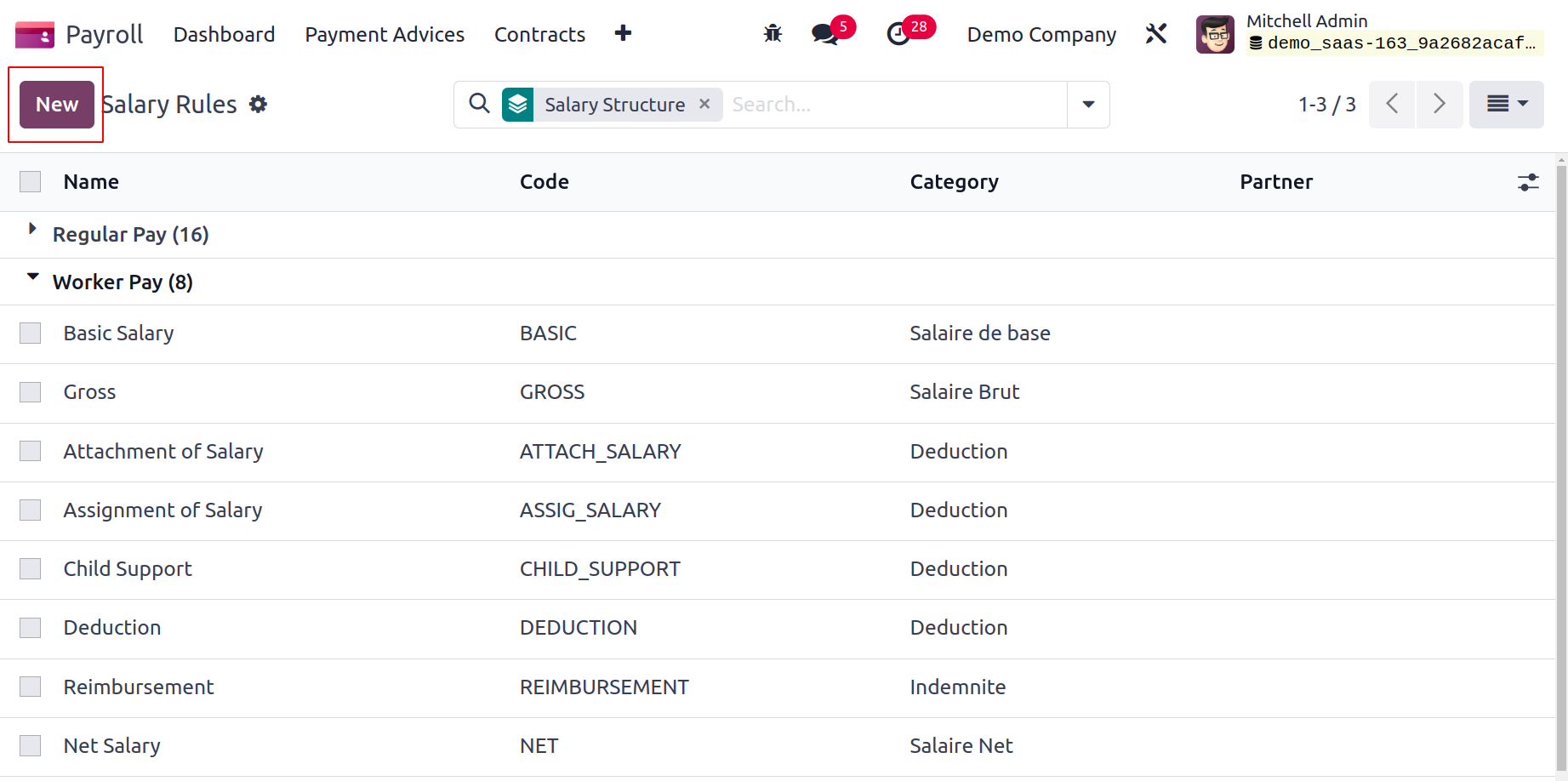

Salary Rules

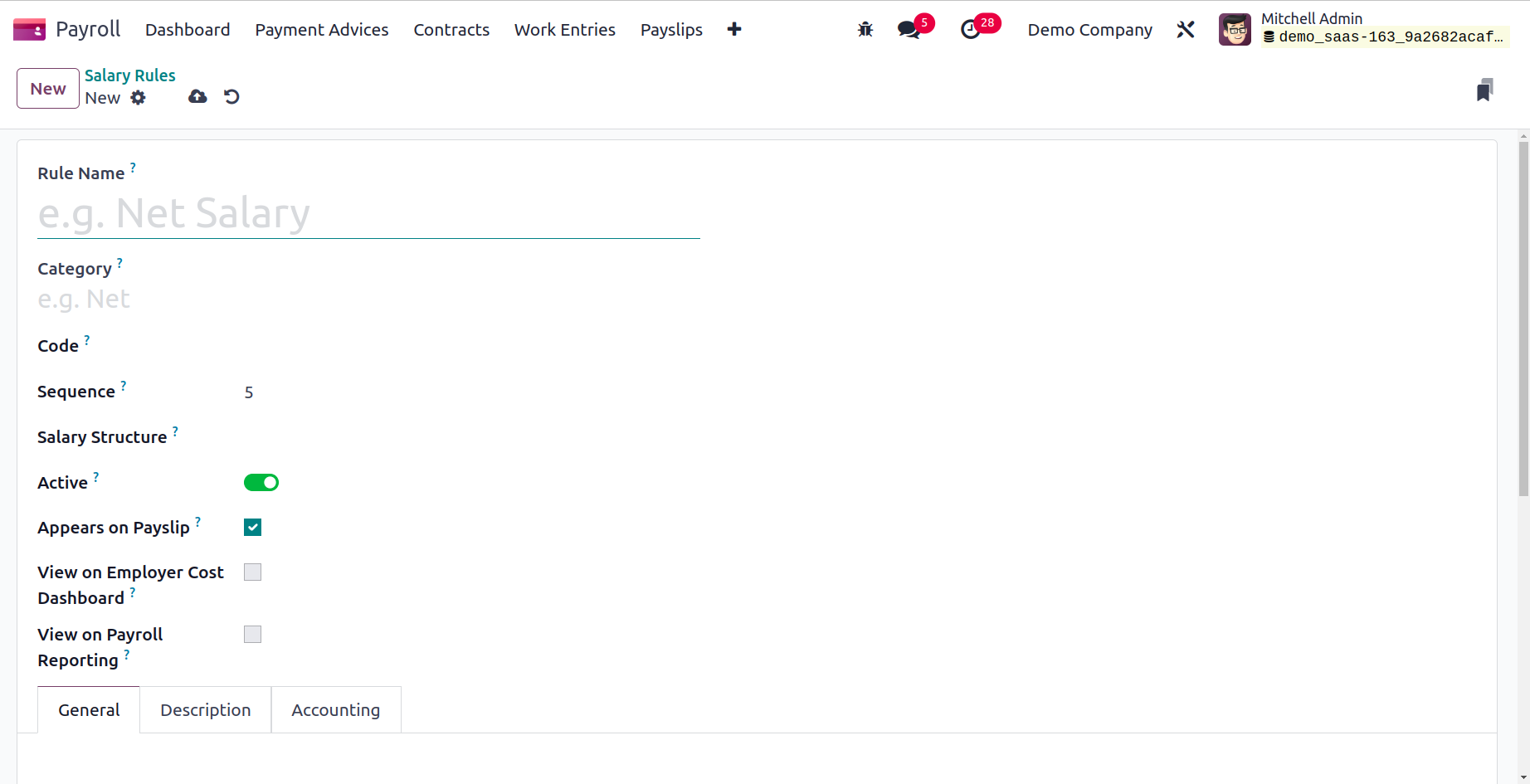

The creation and upkeep of a sound wage structure inside the firm is a critical component of any corporation. Making guidelines, determining trustworthy compensation, and making plans ahead of time are a few things that contribute to efficient administration in a business. These regulations guarantee that you can choose how to calculate salary amounts for different groups. You may reach the Salary Rules window in Configuration by selecting the Rules menu option. Users can access all salary rules established in Odoo 17. The user can view the salary structures for each salary rule, which include information like Name, Category, Code, and Partner. In Odoo 17, we may create a salary rule by selecting the New button.

Add Rule Name to the screen that appears, then select Category based on the Rule Name you just added. Users can provide a code to quickly identify the rule. Additionally, remember to include a serial number to facilitate sequence calculation.

We can observe the salary rule inside a payslip by turning on the Appears on Payslip option. We may display the employer cost value in the dashboard after activating the View on Employer Cost Dashboard. Activate the View on Payroll Reporting field in the Salary Rules window to set the salary rule for payroll reporting.

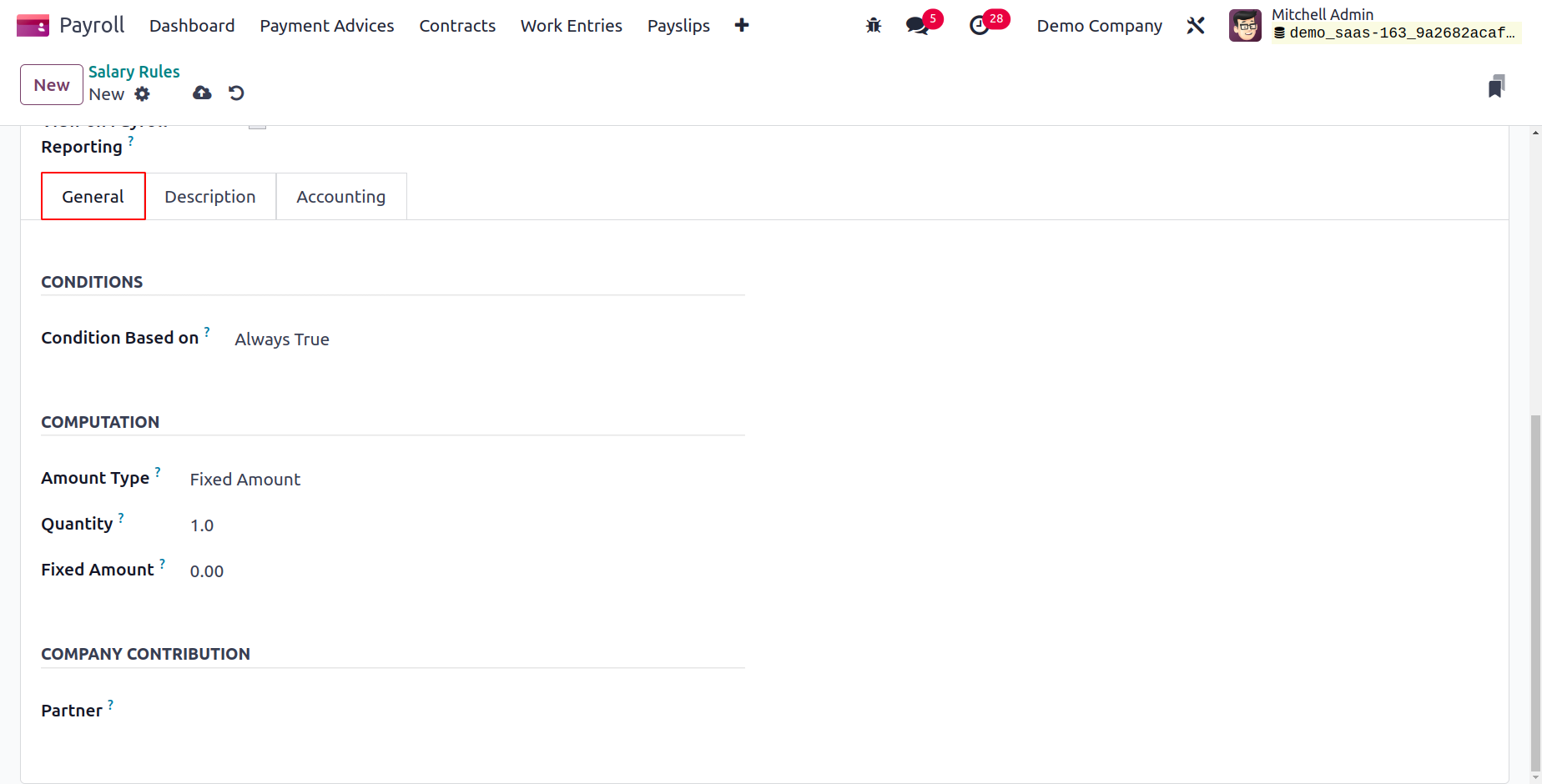

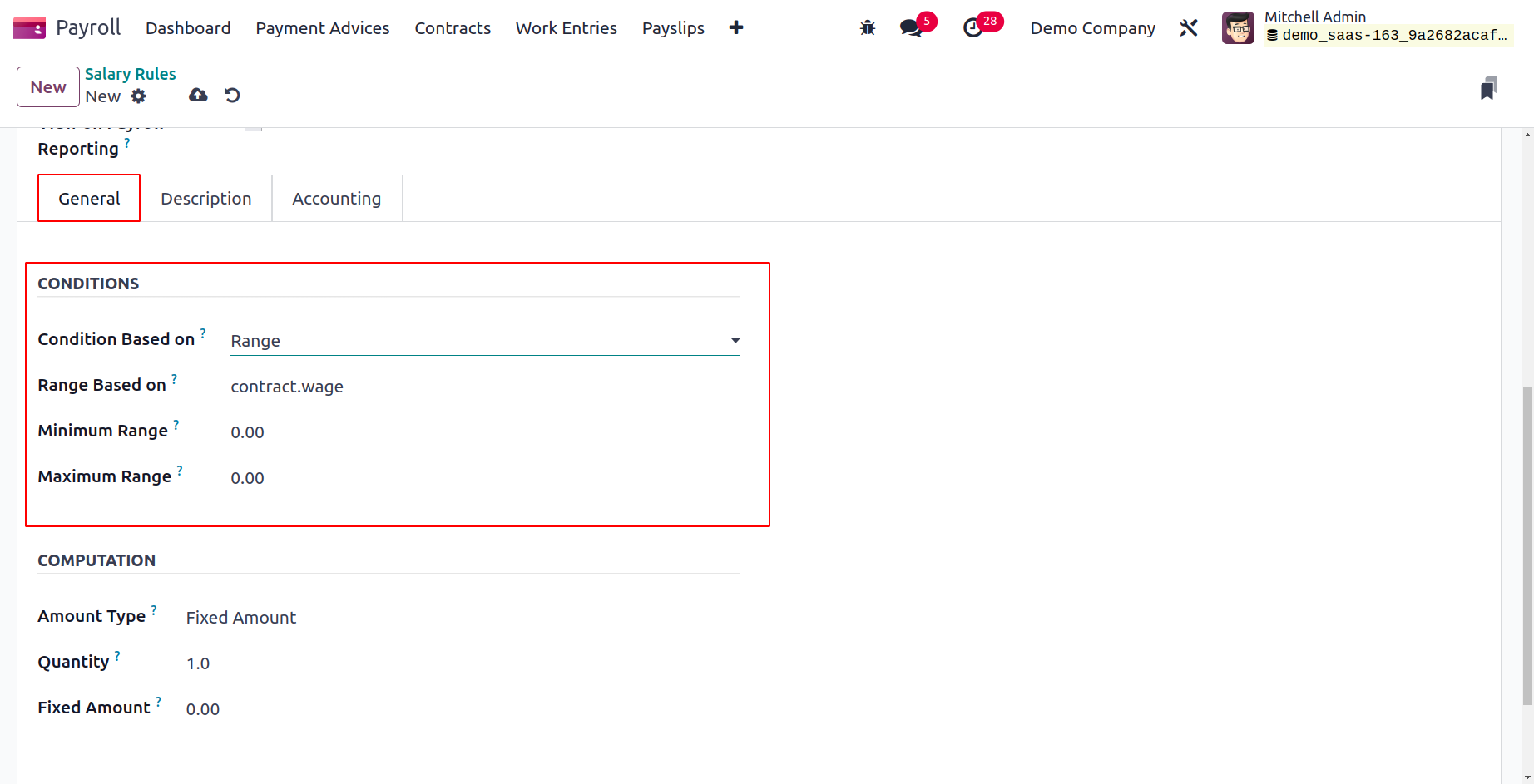

We have control over the computation, terms, and corporate contribution below the General tab. Include the salary rule's condition as Range, Always True, and Python Condition in the ‘Condition Based on’ field. By selecting the Always True option, the necessary wage rule for salary computation can be readily configured. Following your selection of the Range option, you must enter information for the Maximum Range, Range dependent on, and Minimum Range. Field values are computed automatically using the ‘Range’ Based option.

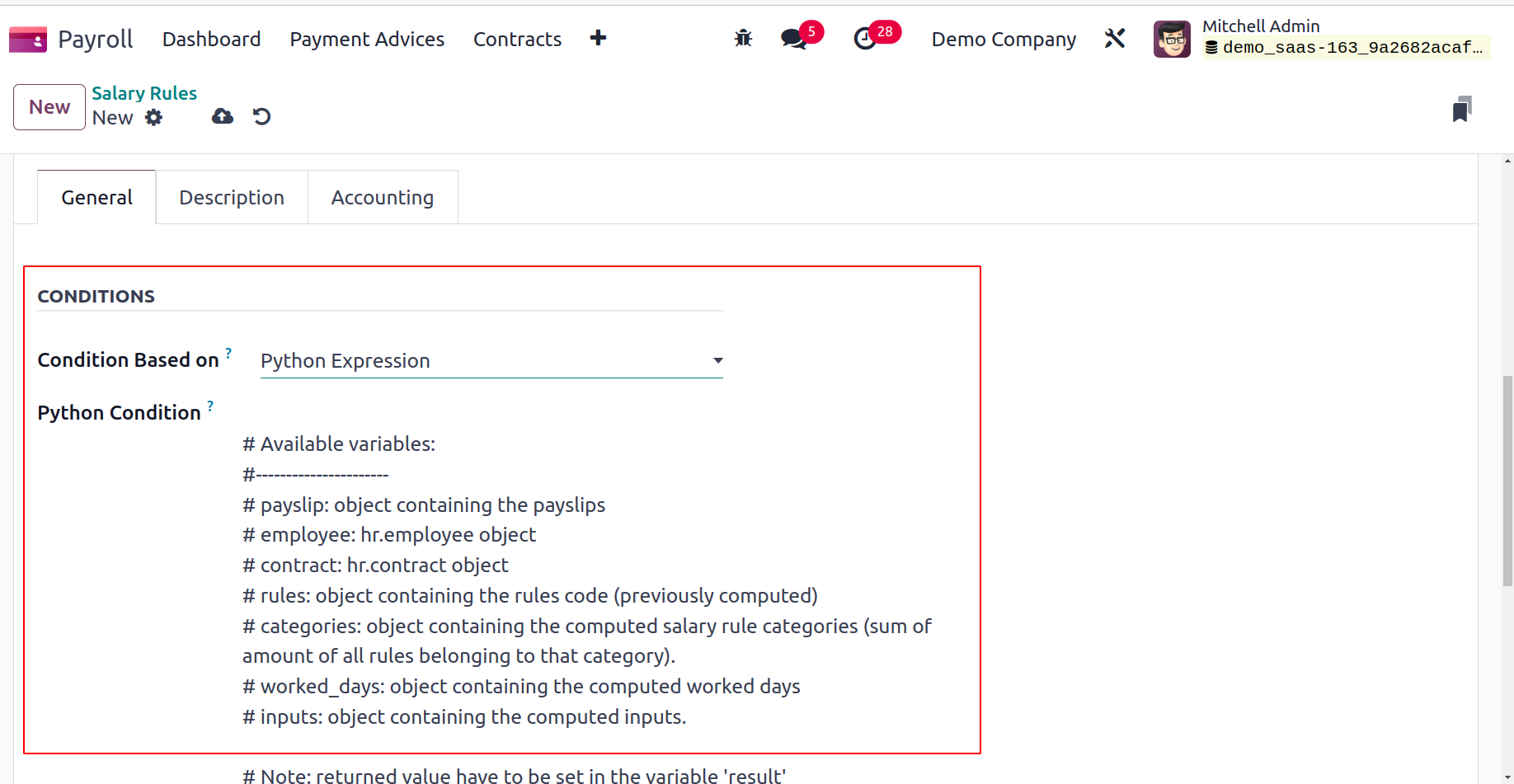

When we select Python Expression in the Condition Based on field, Odoo17 formulates equations in the default fashion.

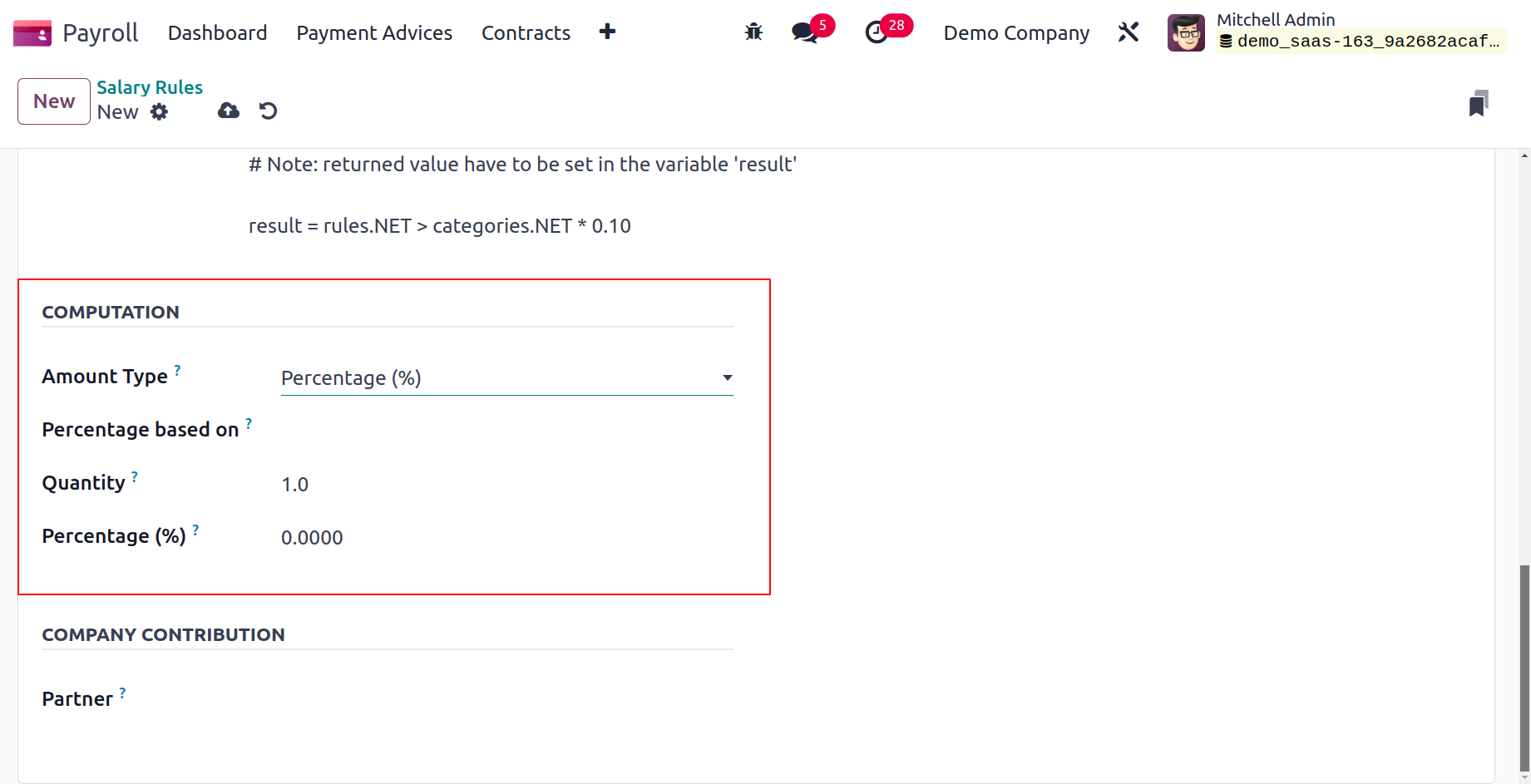

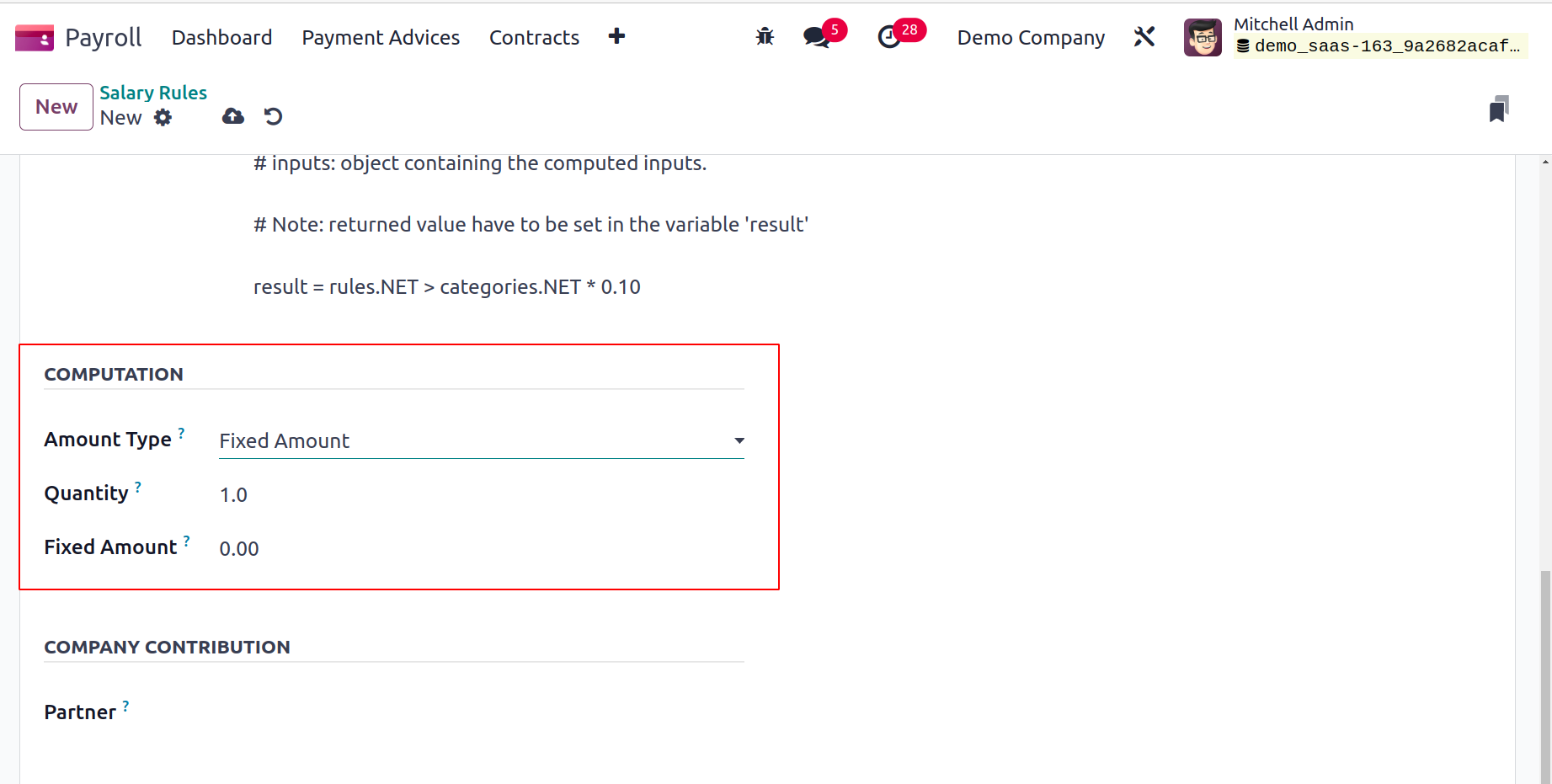

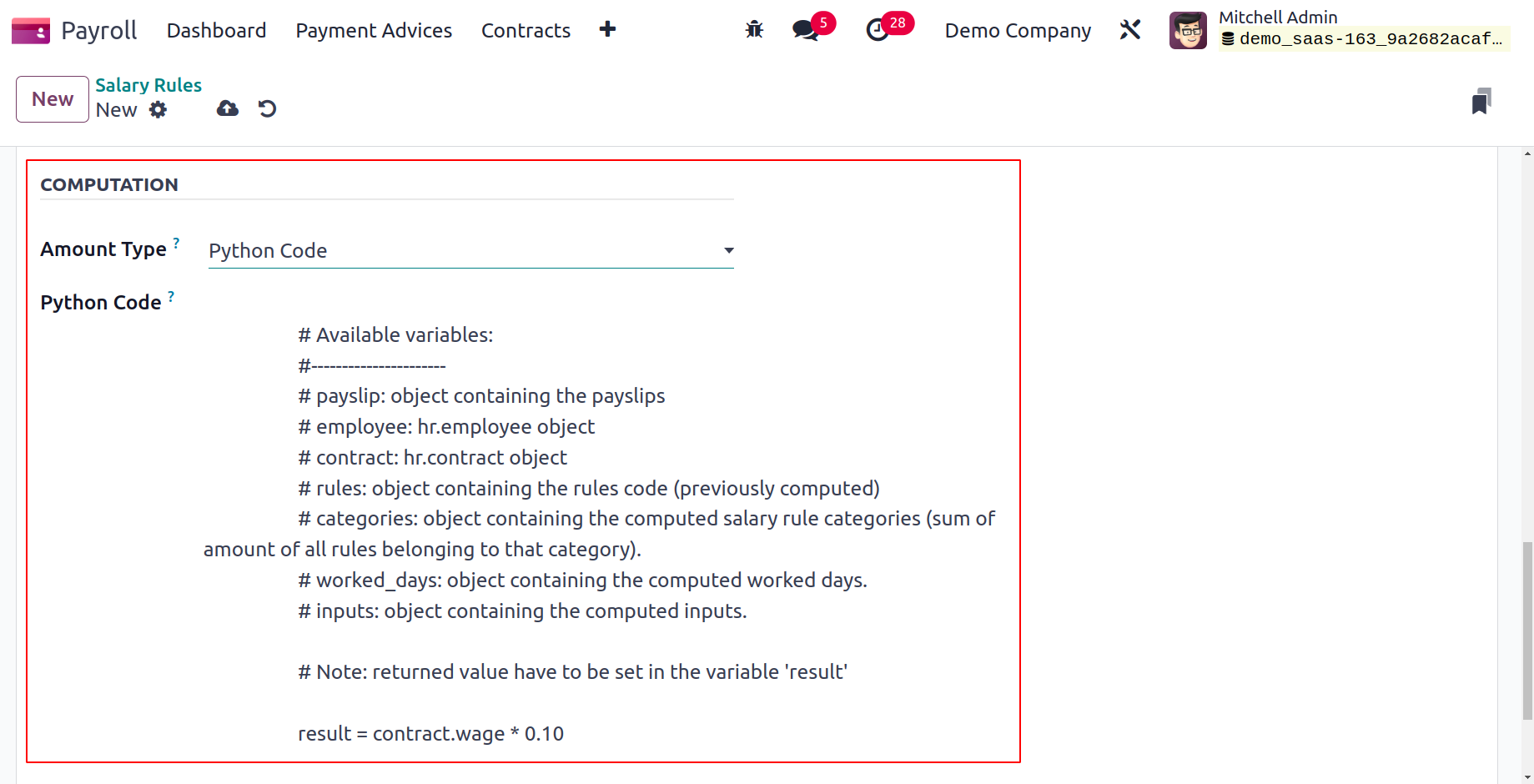

Under COMPUTATION, we may calculate the salary guidelines. The user can choose between percentage (%), Python Code, and Fixed Amount as the computation method in the Amount Type box to accomplish this.

Once we choose percentage as the amount type, we may calculate the amount based on the percentage. We can create a fixed amount by selecting the Fixed Amount option in the Amount Type column. You can choose the quantity and fixed amount of the salary rule after choosing Fixed Amount.

The salary rule can also be calculated by users using Python code. Add Python code to the Amount Type field to accomplish it. You can define the Python code later in accordance with the Python attributes.

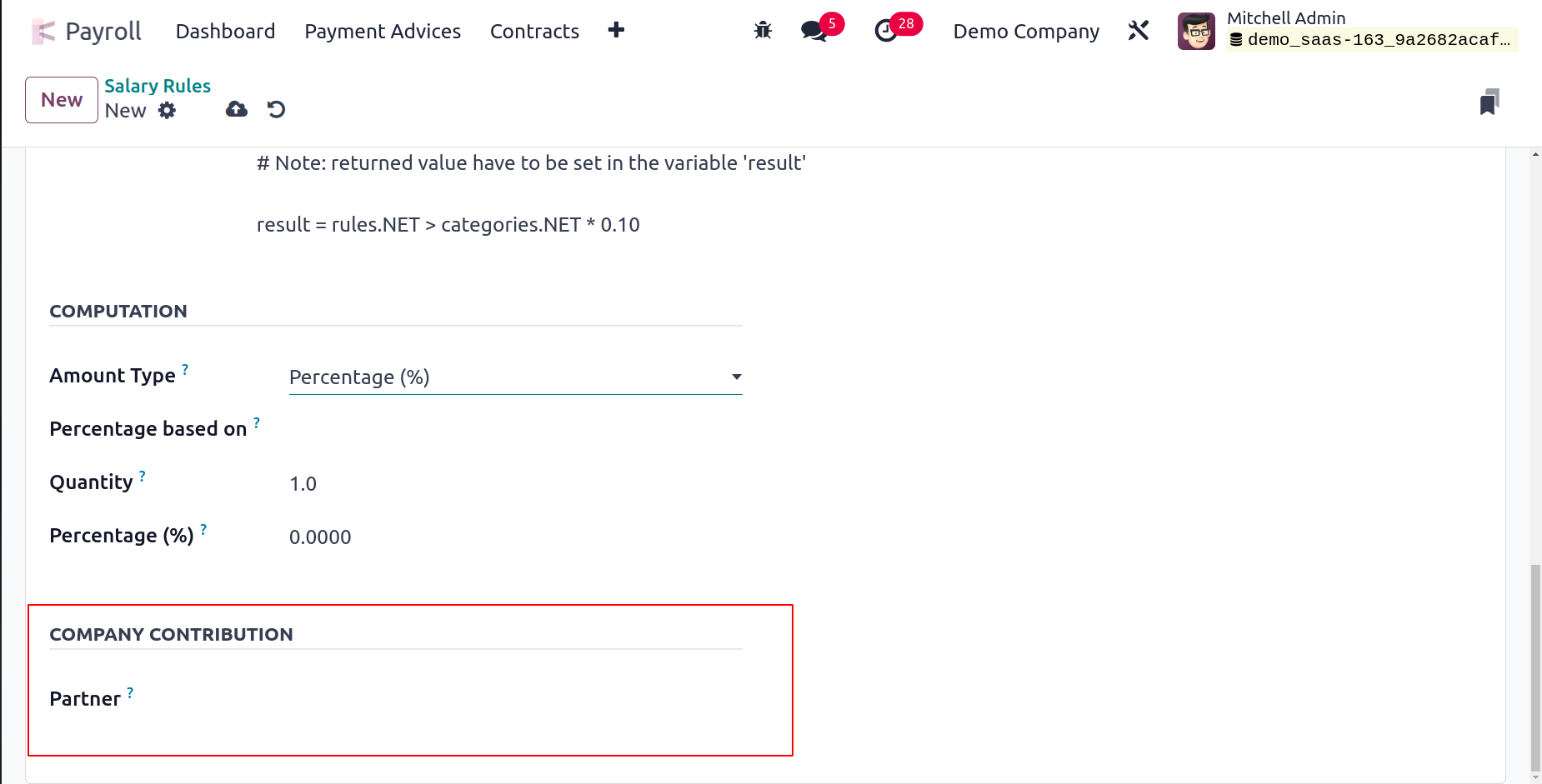

We can define the third party participating in employee salary payments in the COMPANY CONTRIBUTION section.

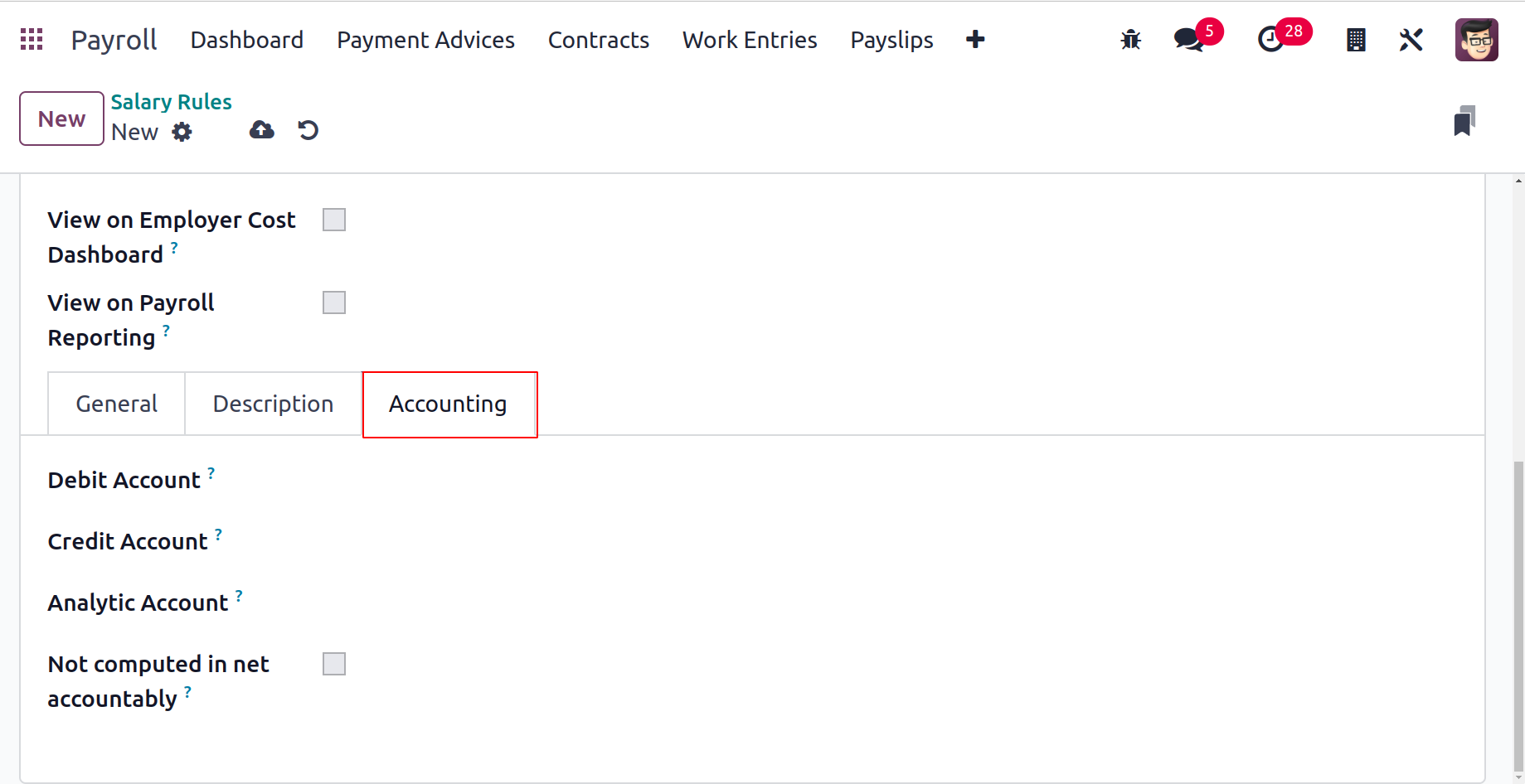

You can put the notice about the salary rule underneath the Description tab. You can provide specifics for Analytic Account, Debit Account, and Credit Account under the Accounting tab. After enabling the Not Computed in net accountability option in the Accounting section, you may remove the net salary rule value.

The Odoo 17 Payroll manually saves each of the details.

Salary Rule Parameters

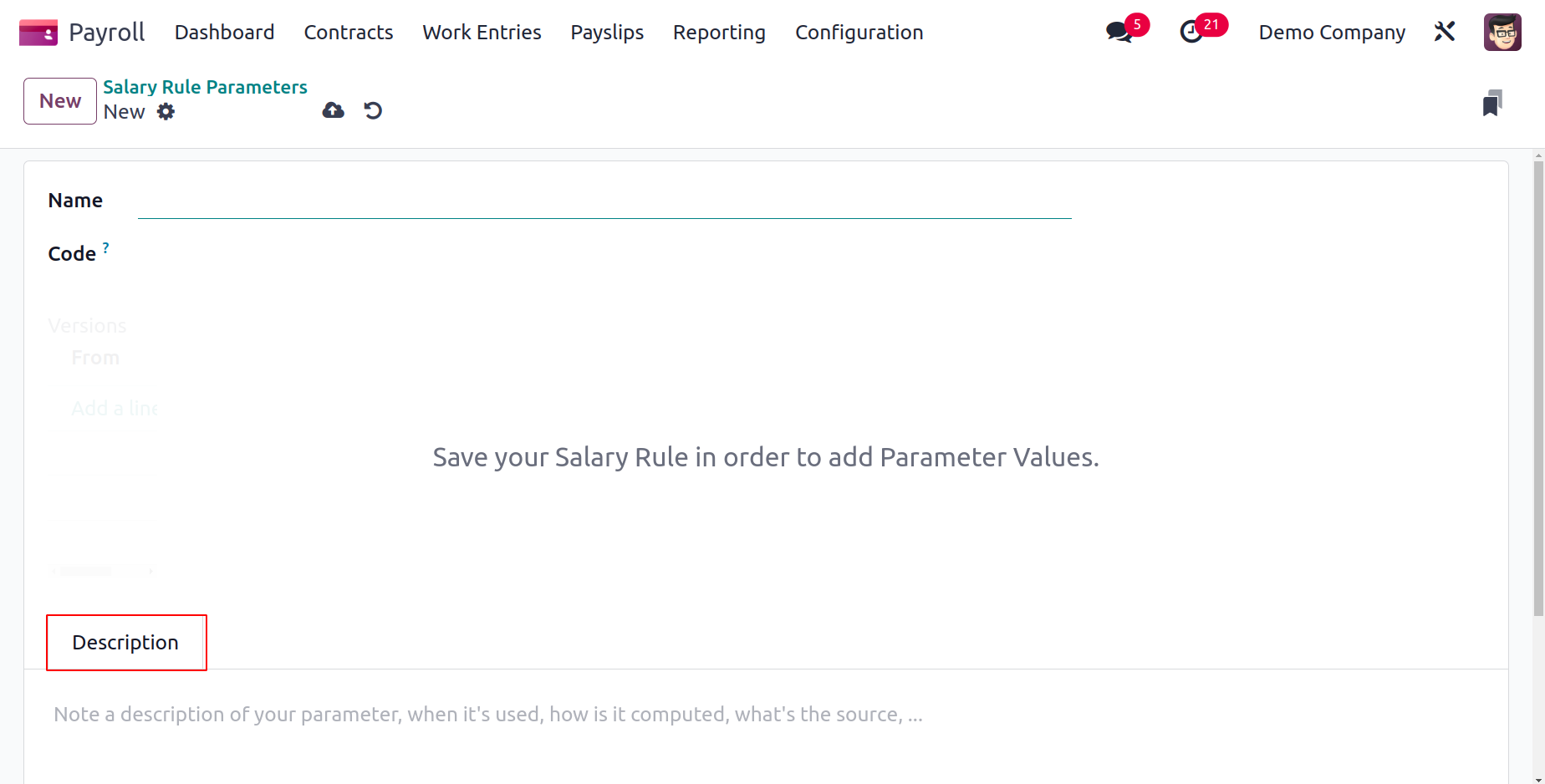

To manage various rule parameters, click the Configuration tab and select the Rule Parameters option. You can find the Code and Name of each salary rule parameter in the Salary Rule Parameters box. Click the New icon on the Salary Rule Parameters page to define a new rule parameter.

Apply the rule parameter's title to the Name option on the open screen. To mention the salary parameter, add code to the salary rule. Following the definition of these specifics, you may provide more details about the salary rule parameter in the Description tab.

Other Input Types

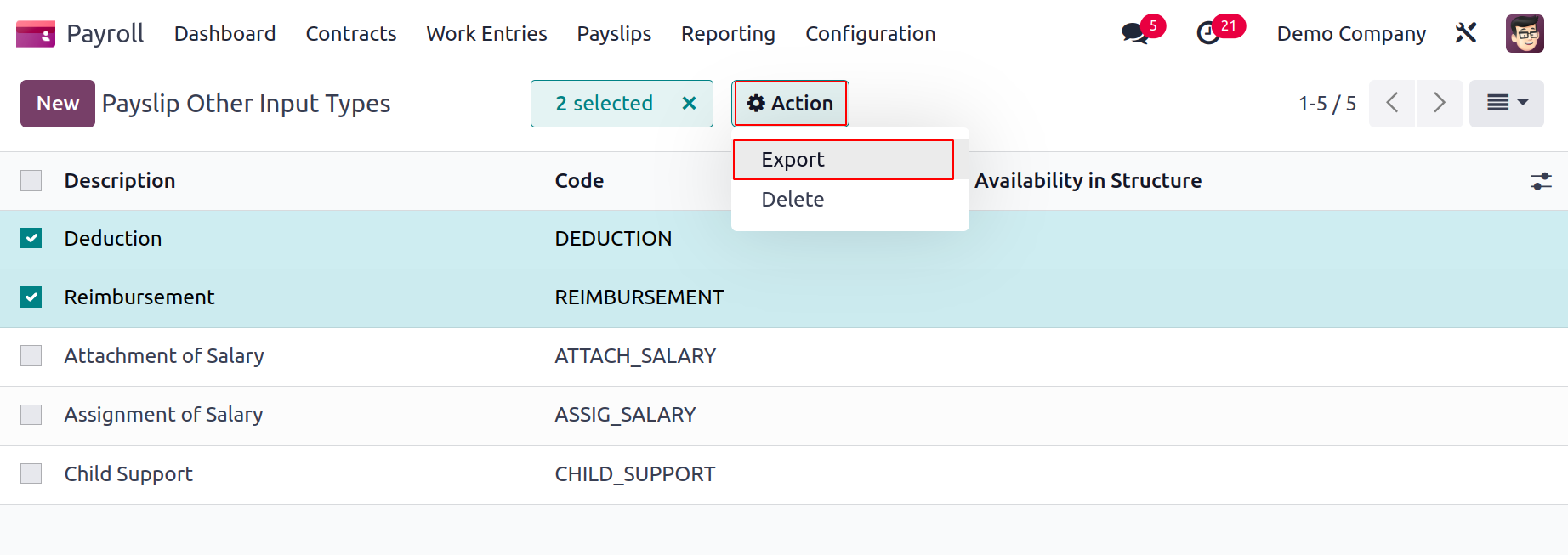

Users can define a payslip input type by accessing the Other Input Types menu, which is located under Configuration. The Code, Description, and Availability in Structure can be seen independently in the Payslip Other Input Types window's List view. Select your chosen input types and click the Action icon if you need to export the payslip input type. After selecting the required input types in Action, you can select the Export menu.

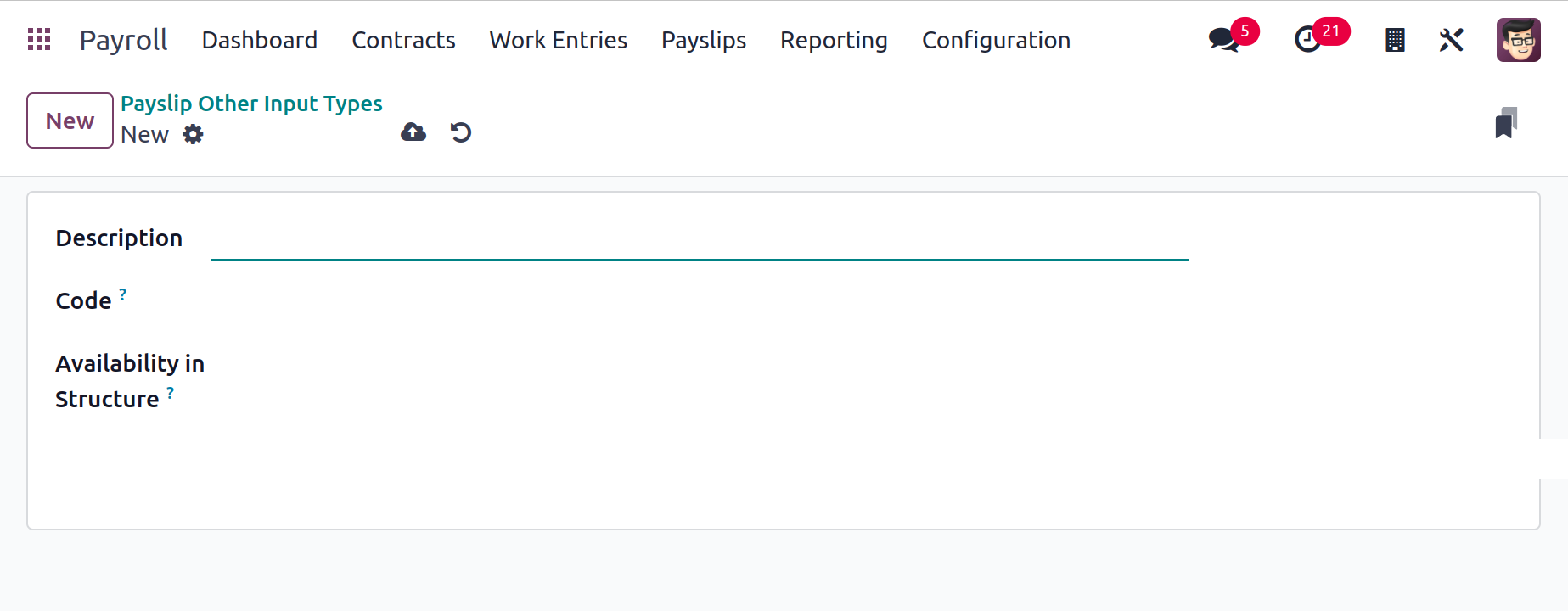

The New button allows us to create a new payslip with several input types. Mention the Code and Description used for the salary regulation.

If you configure the Availability in Structure, the input is accessible in all structures. If you leave the field blank, it will be seen on every payslip.

Salary Package Configurator

In the Configuration page, below the Salary Package Configurator, we may manage the résumé, benefits, and personal information. Let's now go over each detail individually.

Benefits

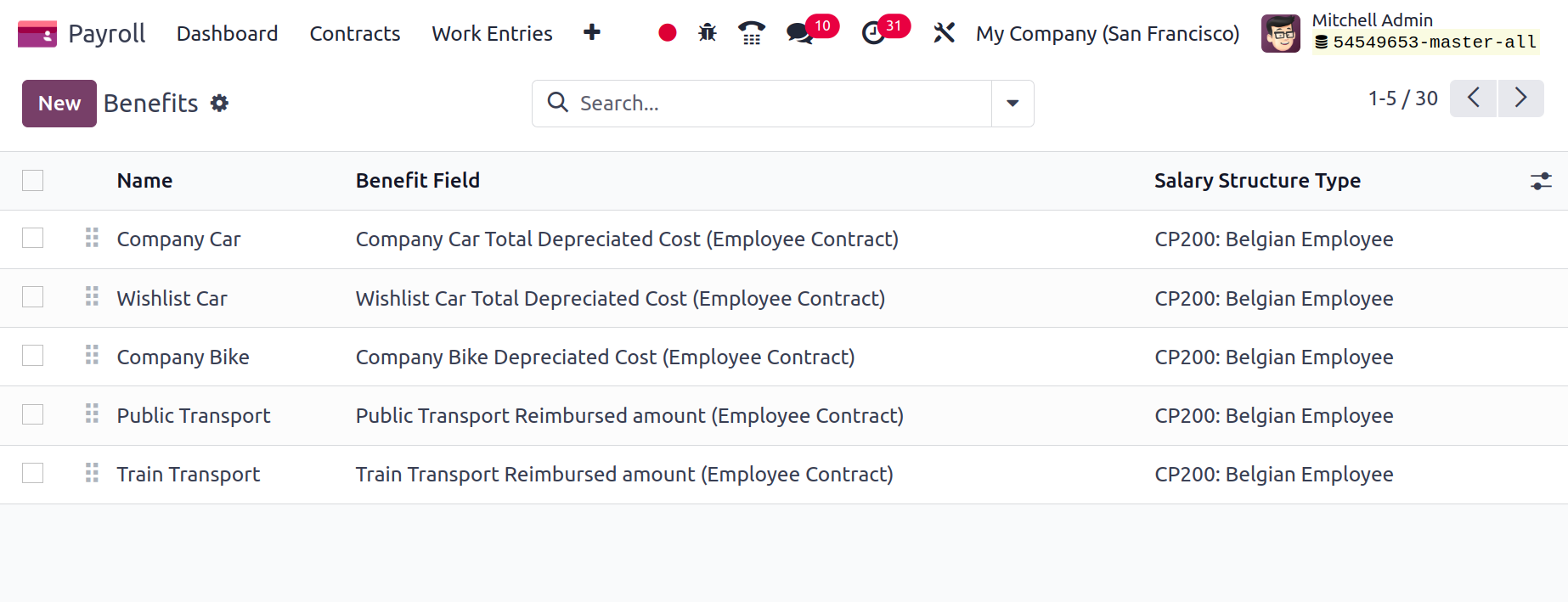

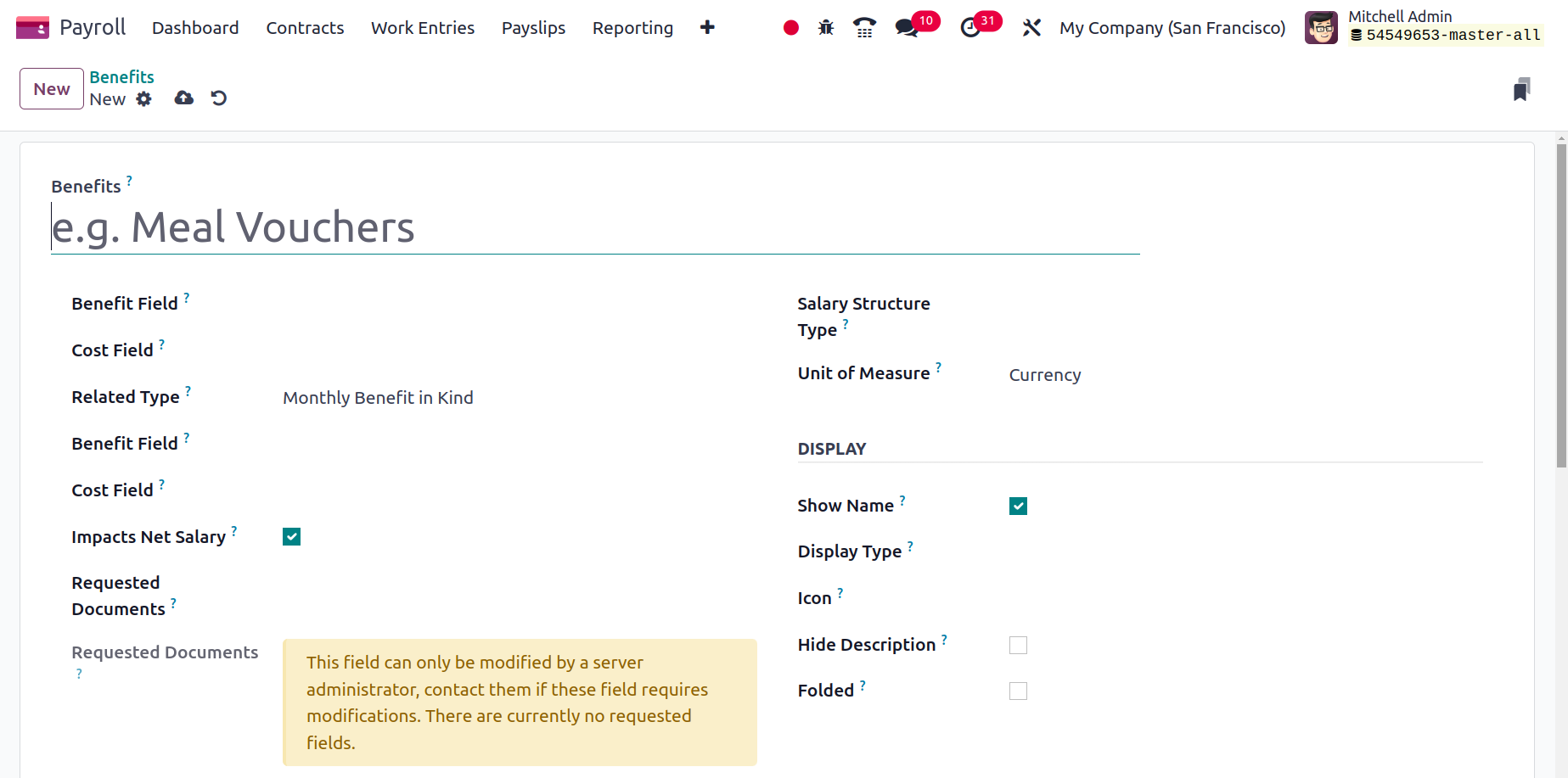

The Salary Package Configuration section of Configuration contains the Benefits menu. In the Benefits panel, you can configure additional compensation perks. The Name, Benefits field and Salary Structure Type are among the details of configured advantages. We can define a new benefit by clicking the New icon.

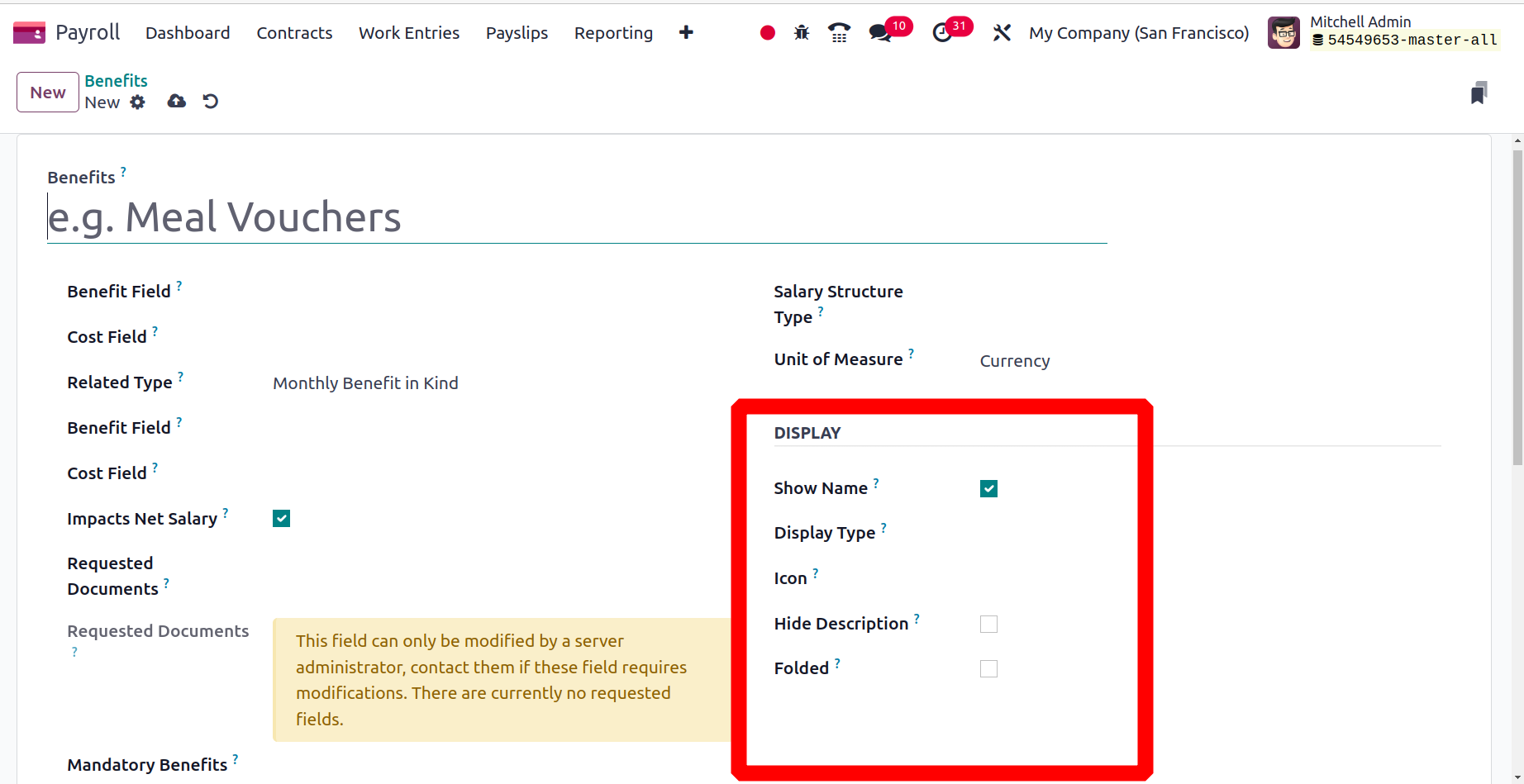

You need to enter the Benefits Name in the visible window. Mention the contract field related to an advantage's cost in the Cost field and the contract field connected to an advantage's advantage. You can also choose from a variety of advantage types, including monthly cash benefits, non-financial benefits, monthly benefits in kind, and more.

Next, we can select either Employee or Worker as the Salary Structure Type. After applying the type, you must give the benefit an icon. You must turn on the Impacts Net Salary option in order to obtain the net salary. Later, we can define Currency, Days, and Percentage as the units of measurement for advantage.

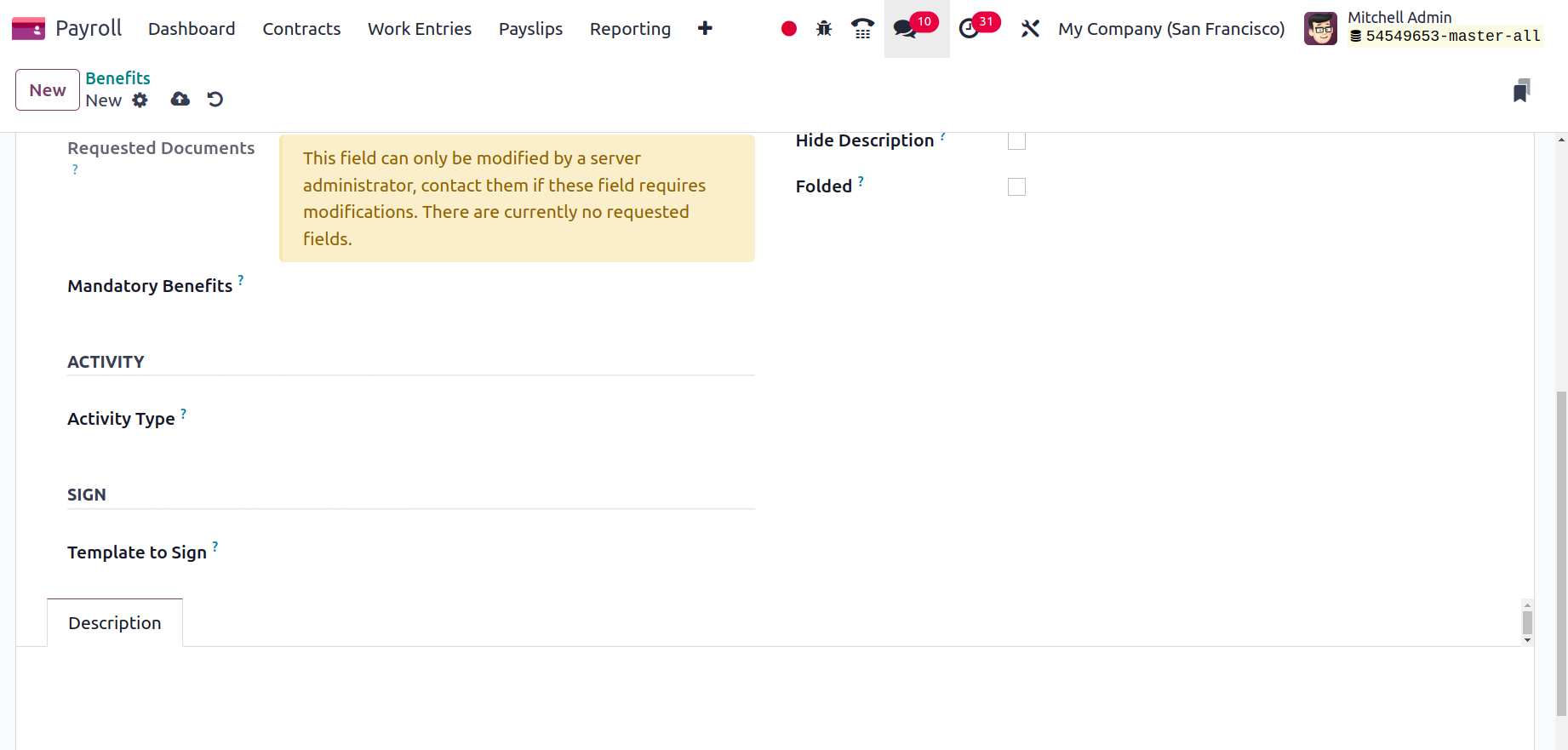

An activity kind of advantage can be specified to be one of Email, Meeting, Notification, Call, etc. Following the employee's selection of the benefit, the activity type will be generated automatically. In the Description field, we may provide further advantages-related information. When the advantage is not utilized after using the Hide Description area, you can hide the description.

Within the Folded field, users can disable or allow beneficial criteria. Additionally, include options for display types like Text, Slider, Dropdown, and more. For added benefit, you can add necessary papers to the area for requested documents. Users can also choose a template to sign the employee benefit.

The Odoo 17 Payroll automatically saves each of these facts.

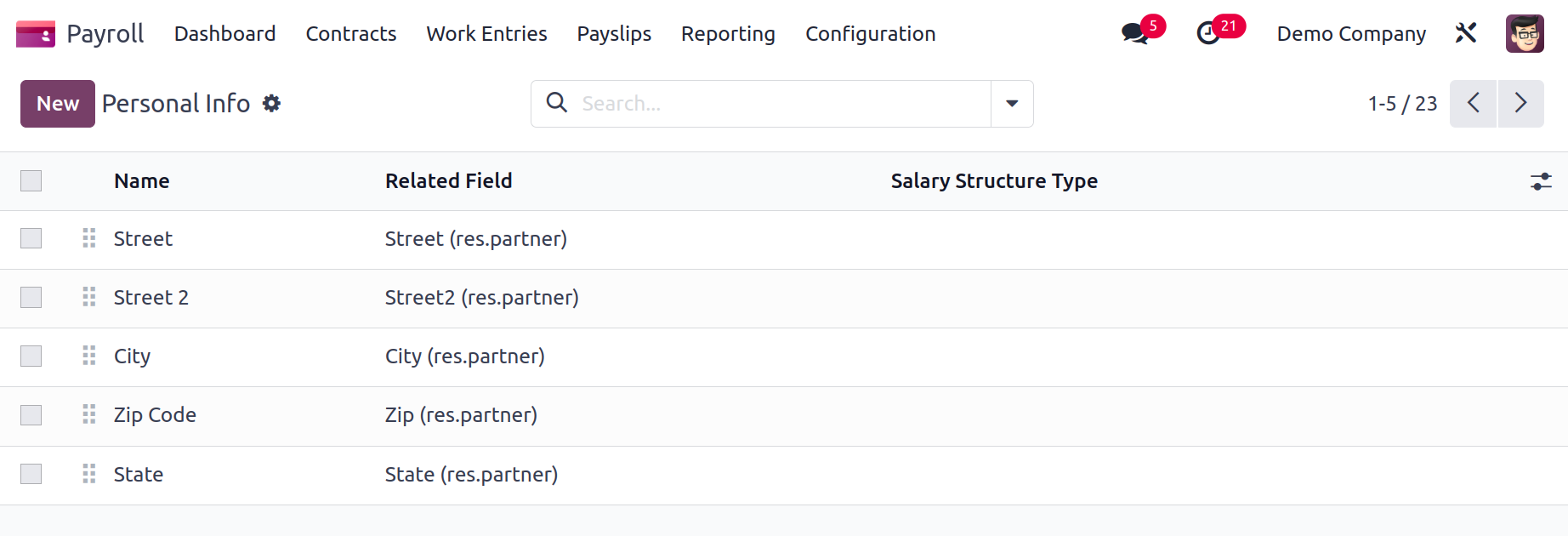

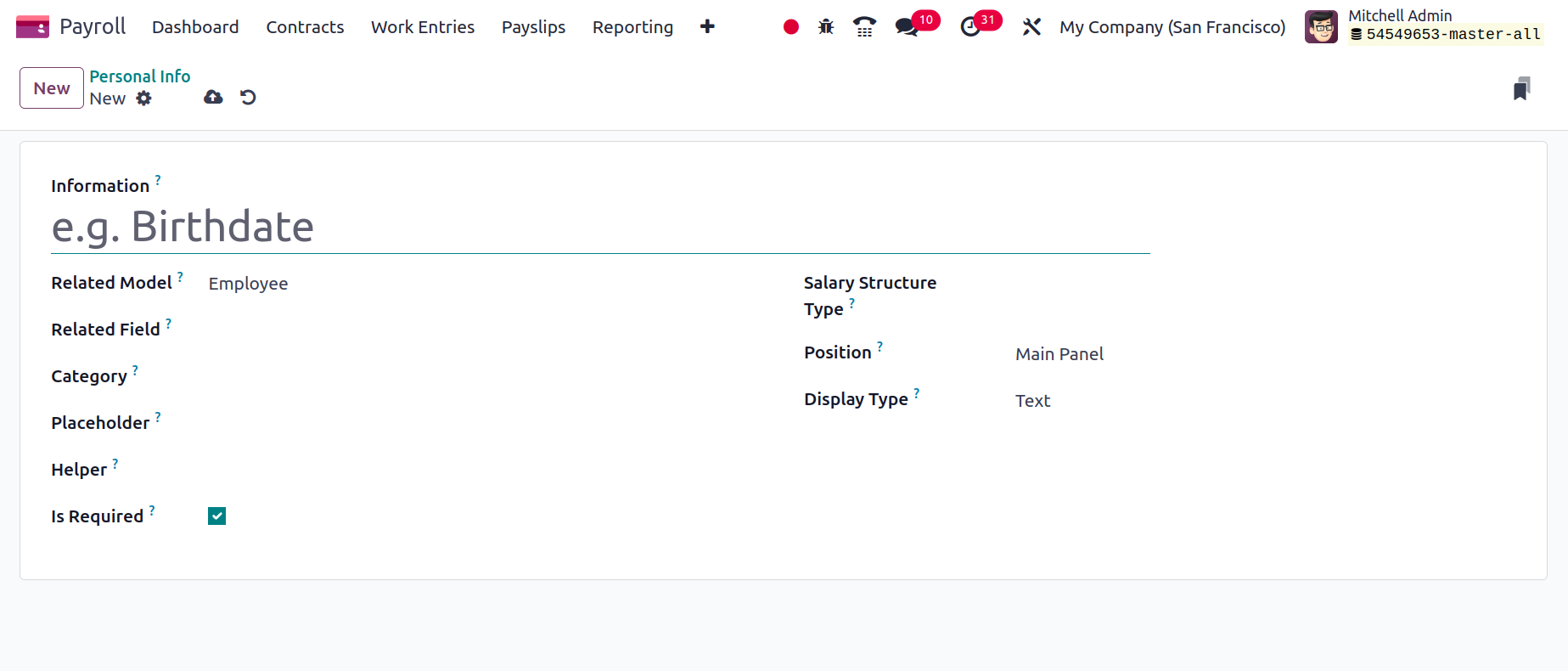

Personal Info

By choosing the Personal Info menu in Configuration, it is simple to understand the personal information related to each employee's payslips. We can individually obtain all preconfigured personal information in the Personal Info box, including Related field, Name, and Salary Structure Type. Once you've clicked the New button, it's simple to describe a new record.

Add personal information and the people it applies for in the open window Applies On field, such as an employee, a bank account, and others. In the Related field, users can additionally define the field name for personal information. You can also enter several types of personal information, such as your address, your personal papers, your circumstances, and more.

Next, select Worker and Employee as the Salary Structure Types for your personal information. Additionally, you can bring up the Placeholder and Helper in relation to employee personal information.

Users can apply for the role of Main Panel or Side Panel for Personal Information. The Display Type can afterward be mentioned as Text, Email, Radio, etc. So, applying personal information data in Odoo 17 is simple.

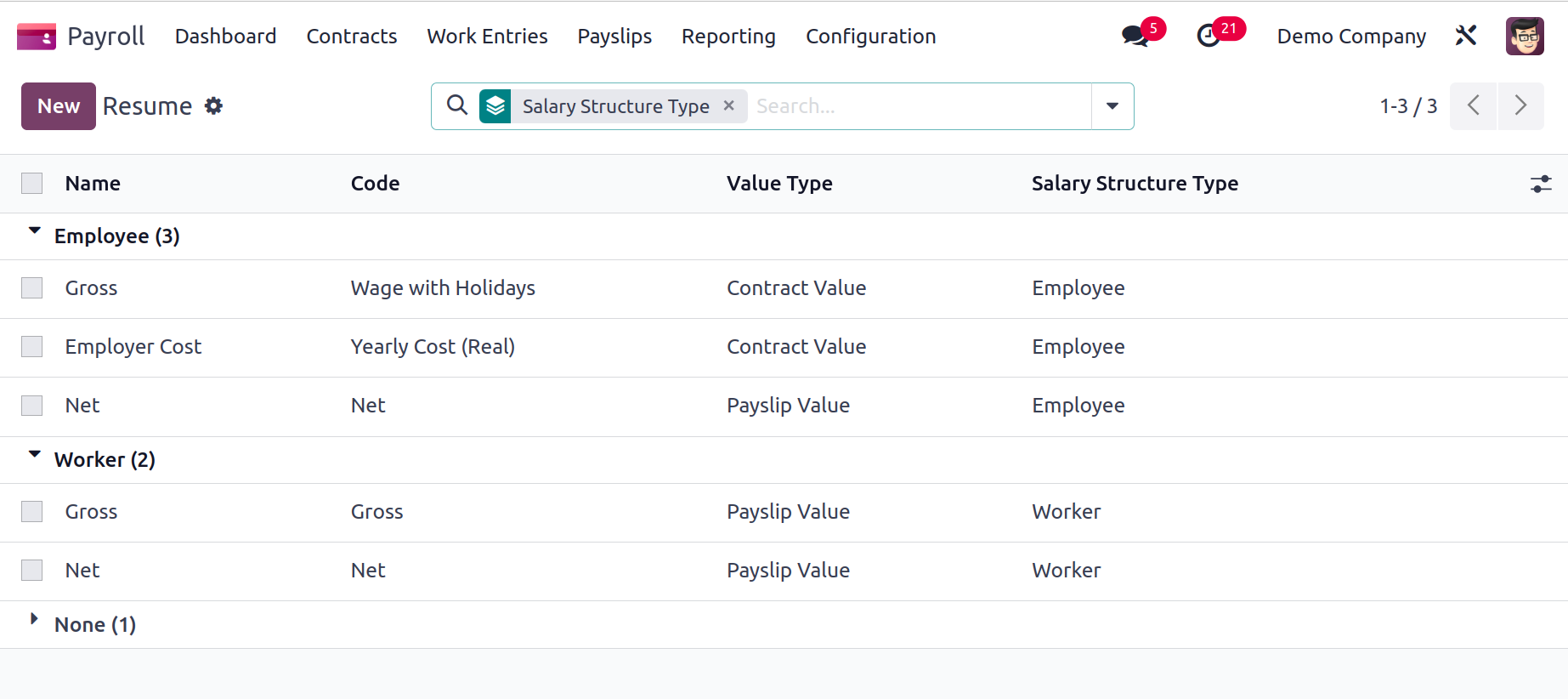

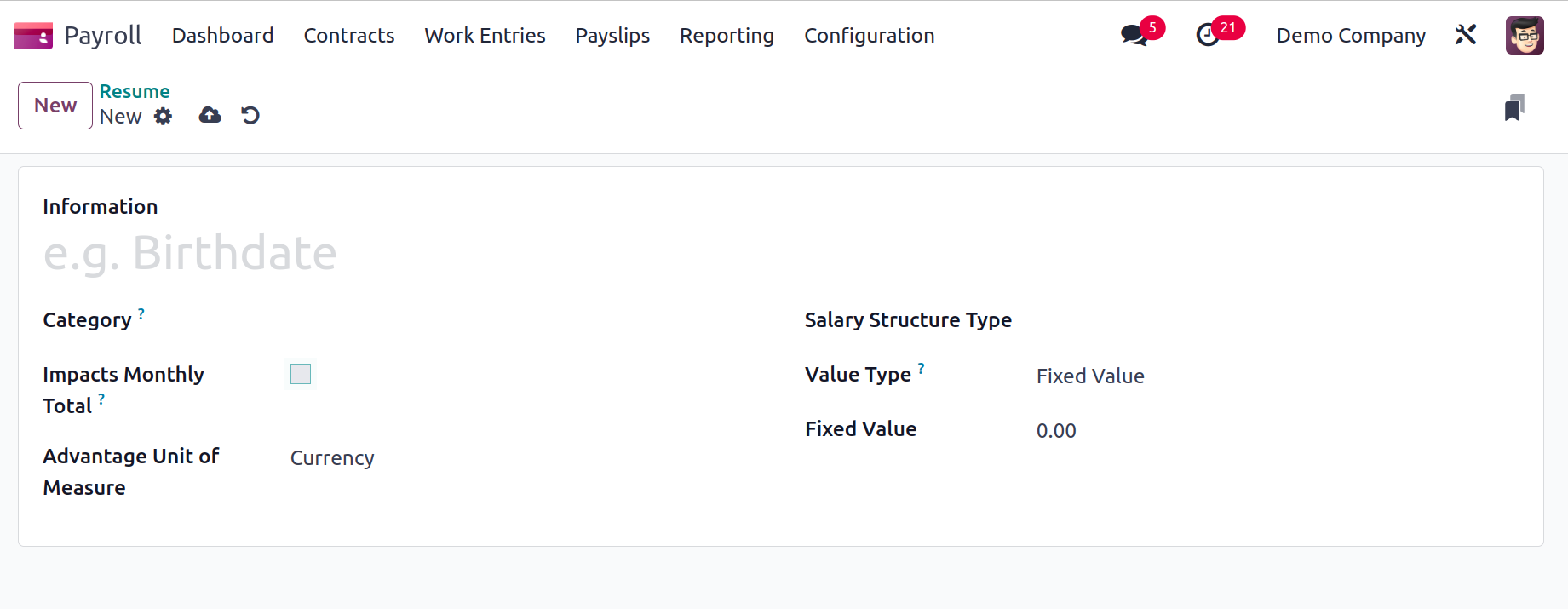

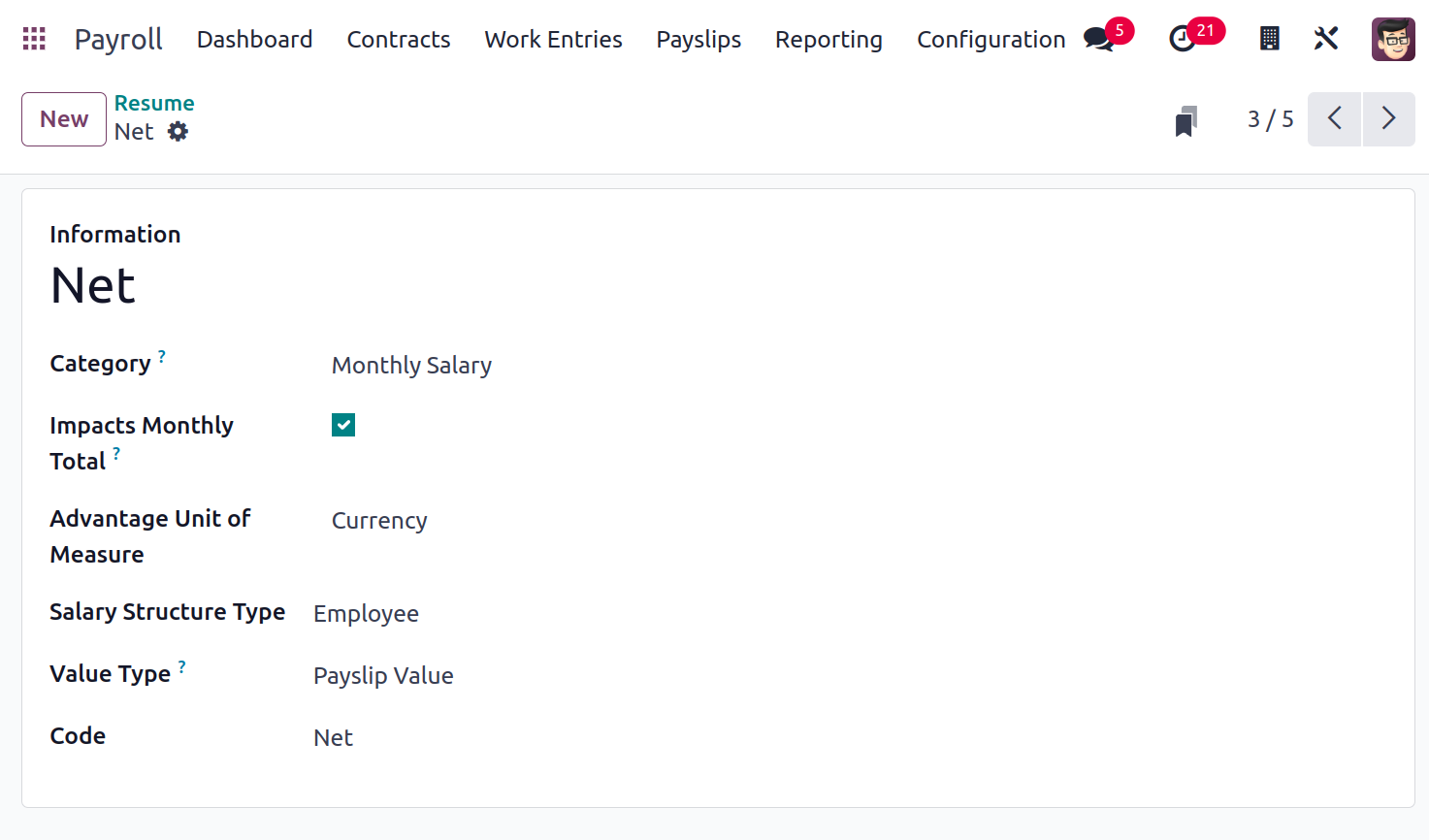

Resume

Following the selection of the Resume option on the Configuration tab, we can specify various resume kinds to a pay structure. All newly constructed resume information, including Name, Value Type, Code, and Salary Structure Type, is defined in the Resume window. We can create a new résumé by selecting the New icon.

Mention the thorough summary in the Information box of the open screen. You must select the Category that best fits your resume, such as Monthly Salary, Annual Benefits, and more. Choose your Salary Structure Type for the resume after that.

Enable the Impacts Monthly Total option to view monthly costs on the resume. Select the Advantage Unit of Measure in the future, such as Percent, Days, etc. Additionally, a value type can be adjusted to be Payslip value, Fixed Value, Monthly Total, and more. The user can add a specific amount based on the value you've chosen after selecting the value type.

These are all related to the Odoo 17 Payroll Configuration feature. Let's now talk about how to create a payslip in Odoo 17.

Reporting

Once users have evaluated the reports, they may manage the payroll expenses. We can assess the payroll, work entry analysis, and salary attachment report. The maintenance of reports at the conclusion of a fiscal year or month in a corporation is simple.

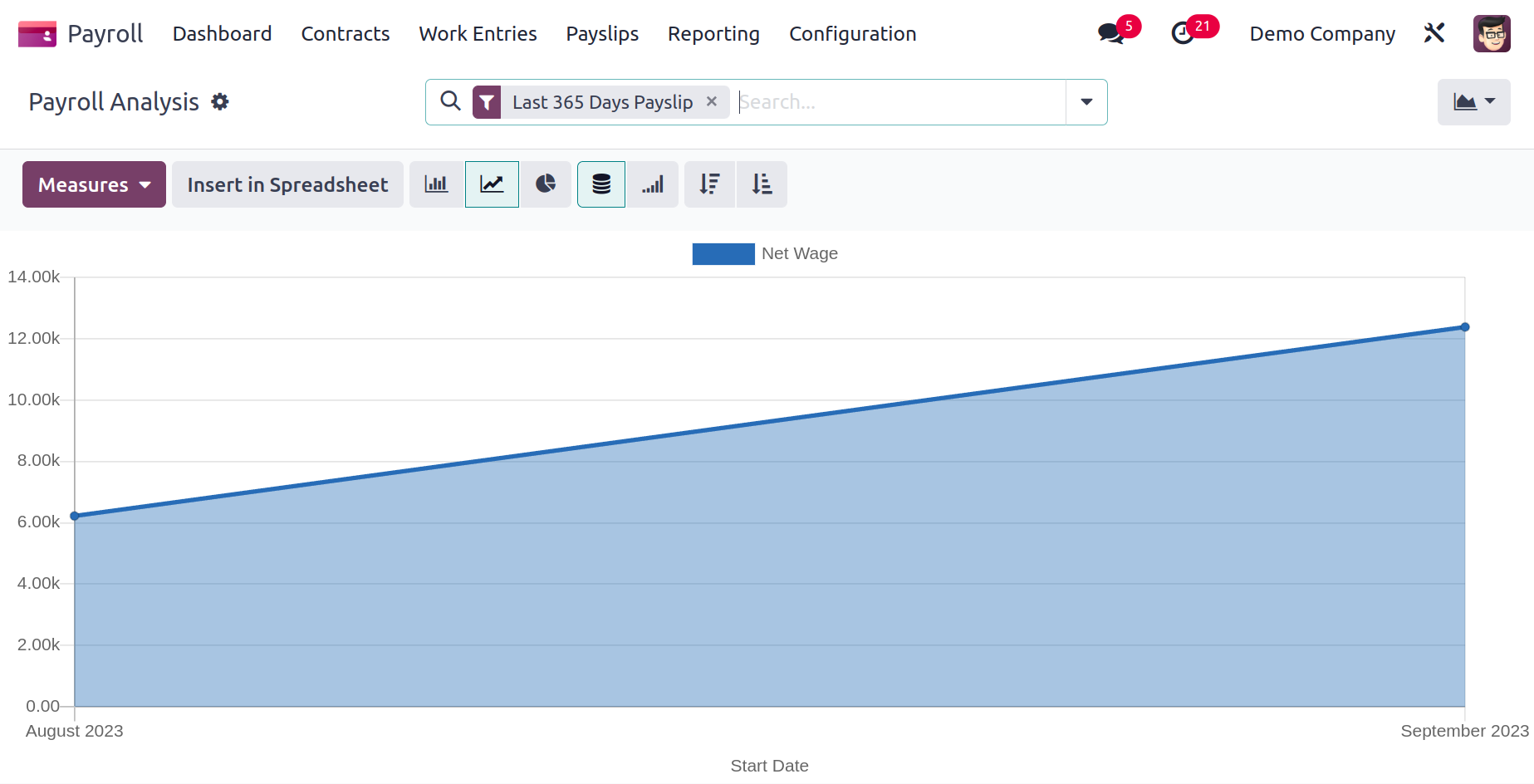

Payroll

After selecting the Payroll menu under the Reporting tab, we can study the corporate payroll data. The Start Date is displayed on the X-axis of the Payroll Analysis window's graph, and the Basic salary is shown on the Y-axis. We can apply different values, such as Gross Wage, Work Days, Number of Hours, Days of Unpaid Time Off, Work Hours, and more, by clicking the Measures icon. The graph is also available in a variety of formats, including pie charts, graph charts, line charts, and more.

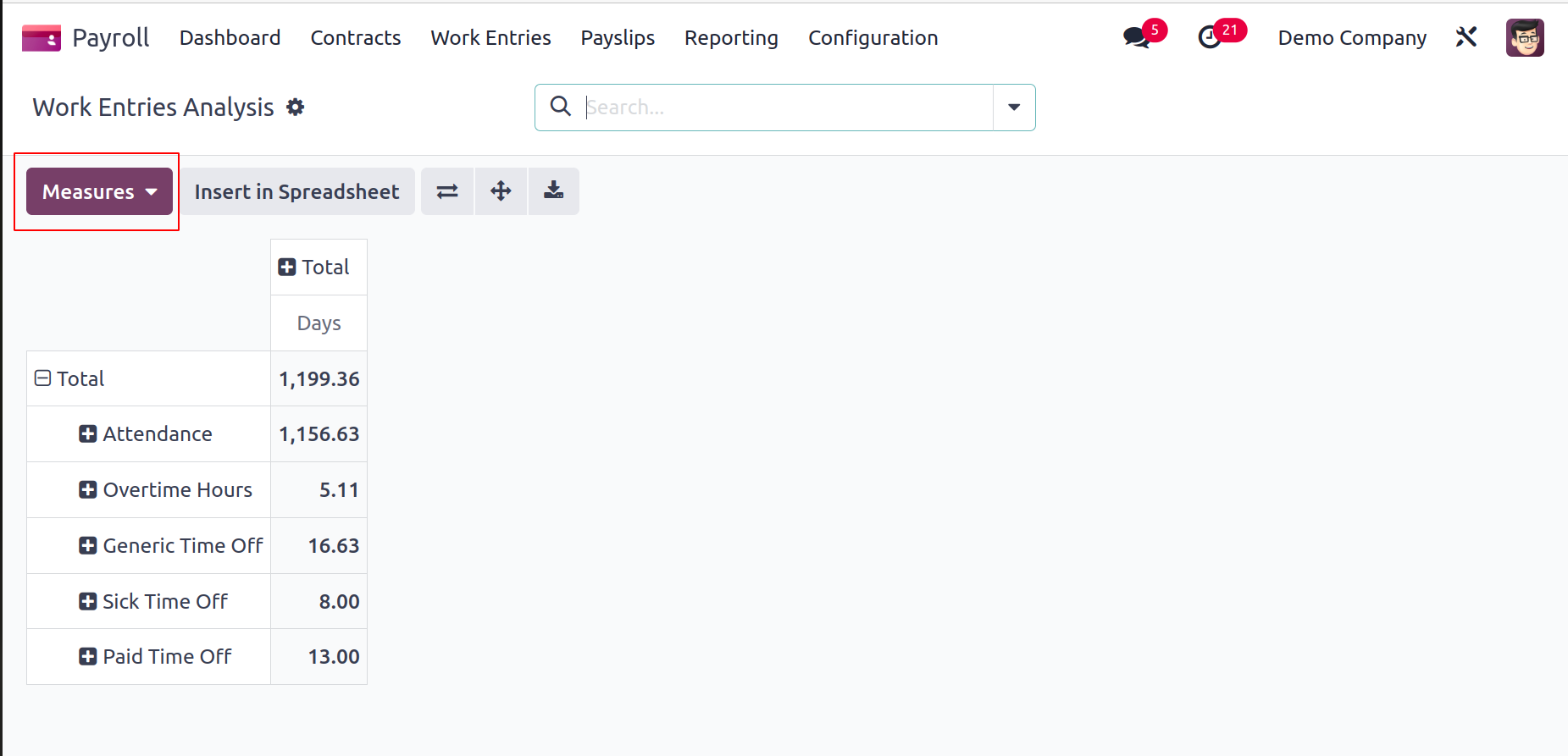

Work Entry Analysis

After choosing the Work Entry Analysis menu from the Reporting tab, a tabular report is made available to the user. You can find work entry analysis based on attendance, sick days, unpaid time off, and more in the pivot table. Using the Measures button, it is simple to assess the job input in terms of measures like a day or count.

Salary Attachment Report

When a user selects the Salary Attachment Report menu item within Reporting, they can view the report regarding employee salary attachment. The Measures tab in the Salary Attachment Report will assist you in managing Child support, Assignment of salary, and Attachment of salary.

So, the Payroll module in Odoo 17 can handle the challenging work of salary management in a company more effectively.