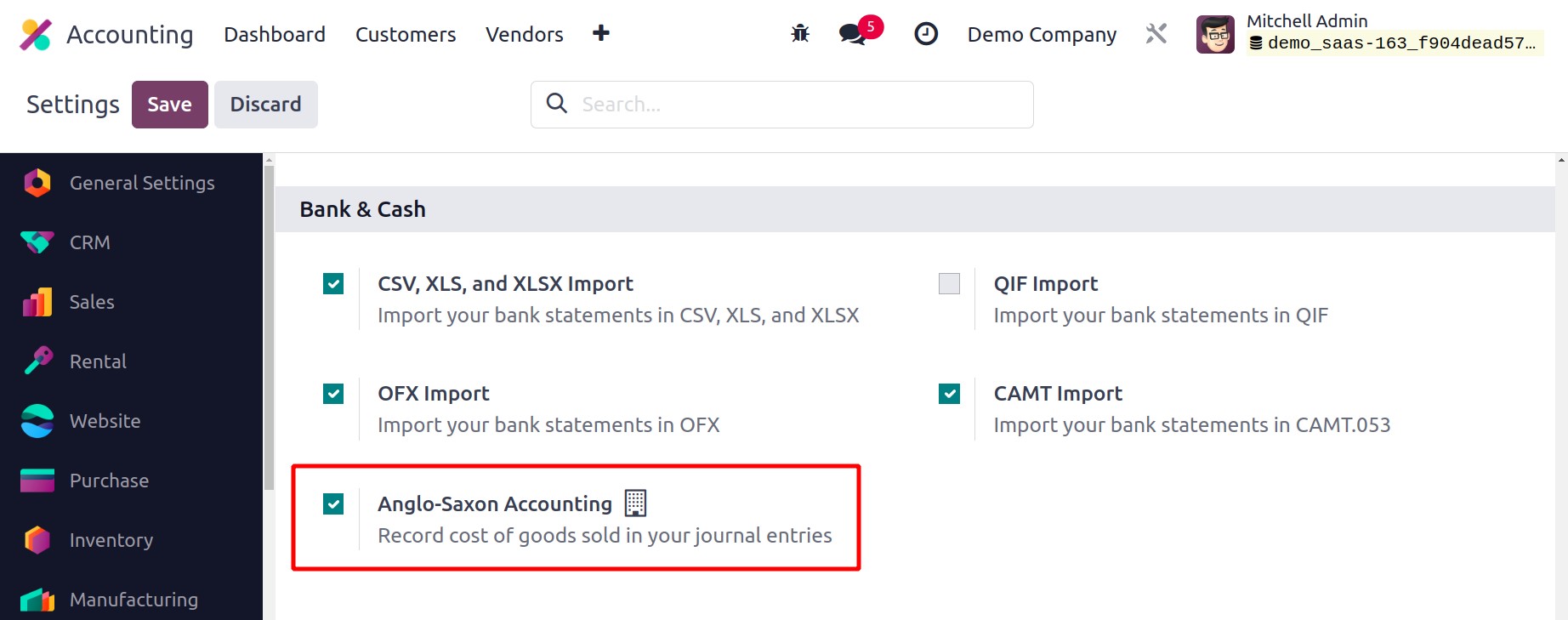

Anglo - Saxon Accounting

The two main forms of accounting practices that are commonly employed around the world

are Continental Accounting and Anglo-Saxon Accounting. Small communities

prefer the Anglo Saxon accounting approach, which is included in Odoo17's enterprise

edition. Following the activation of the developer mode as seen in the figure below, you

can access this function from the Settings menu of the Accounting module.

This style of accounting is widely used by many nations to manage their accounting

functions. The costs of sold products are only recognized in Anglo-Saxon accounting once

they have been sold or delivered to the appropriate consumer. However, the expenses of

the goods will be considered in Continental Accounting as soon as they are received in

the firm's stock.

Even if you create a bill in Anglo-Saxon accounting or receive goods, the expense

account won't be impacted. Only until the goods are billed to the end client will it be

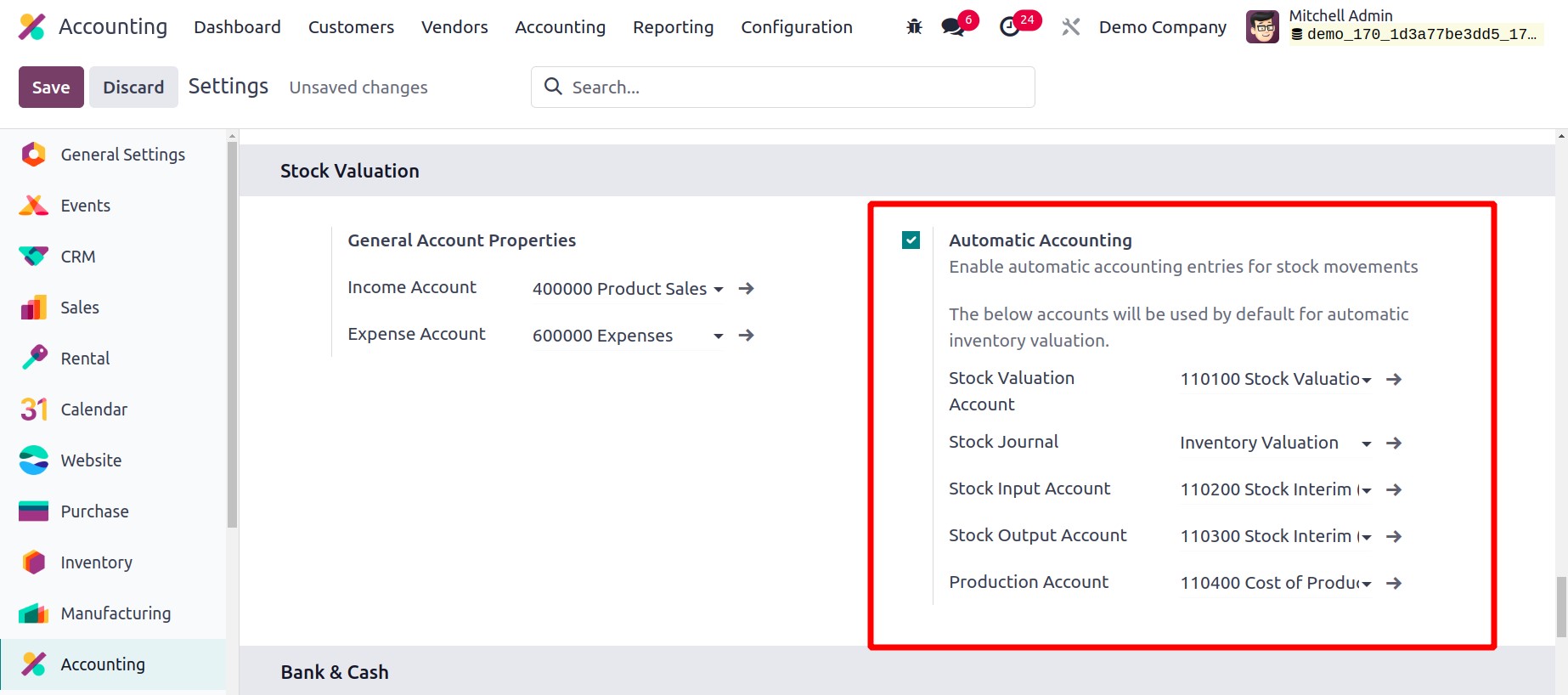

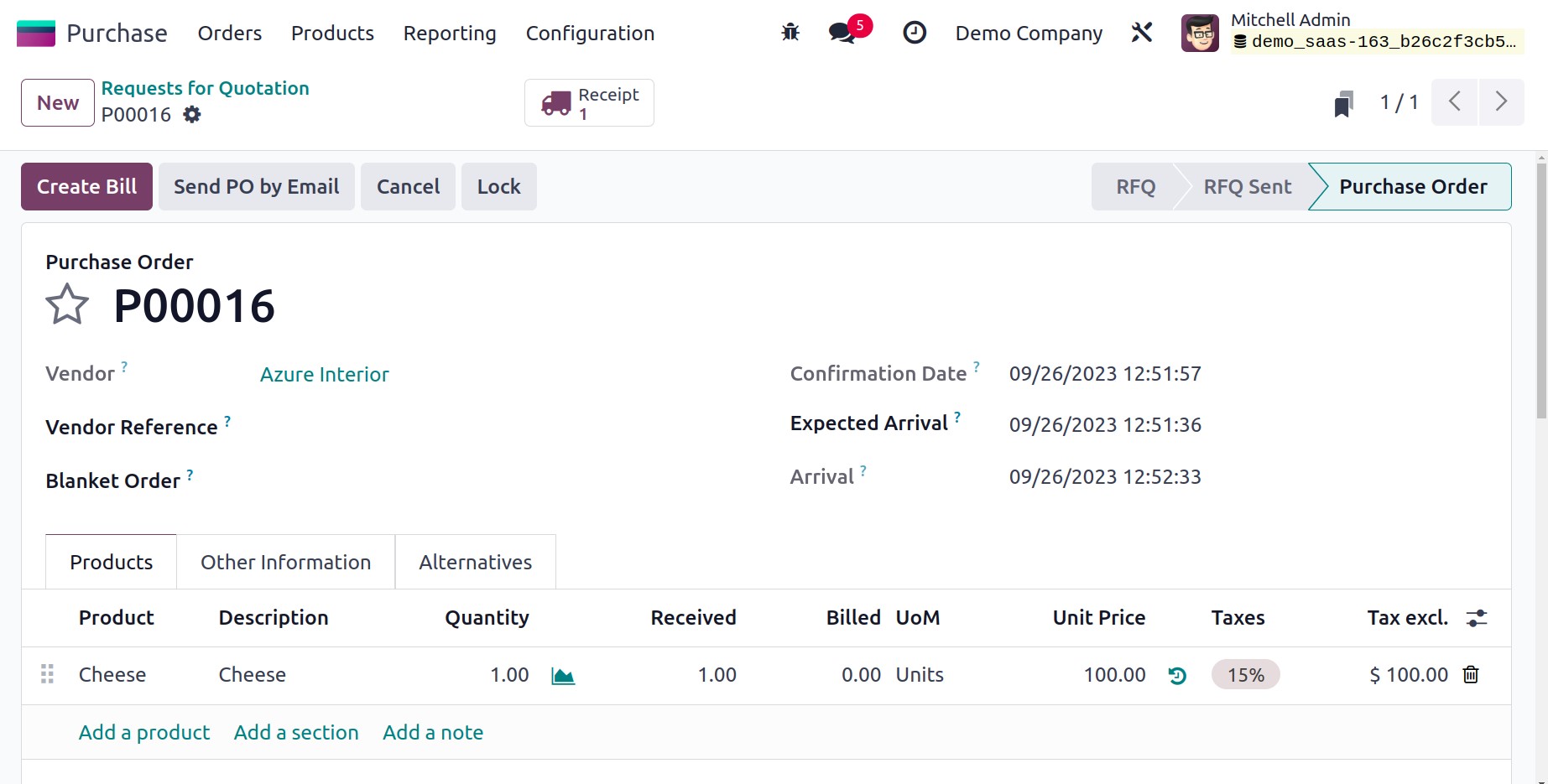

impacted. To automatically record the accounting entries, create a purchase order for

the product and set its inventory valuation to Automated.

You may now use the Configuration Settings to activate automatic accounting

entries for stock movements.

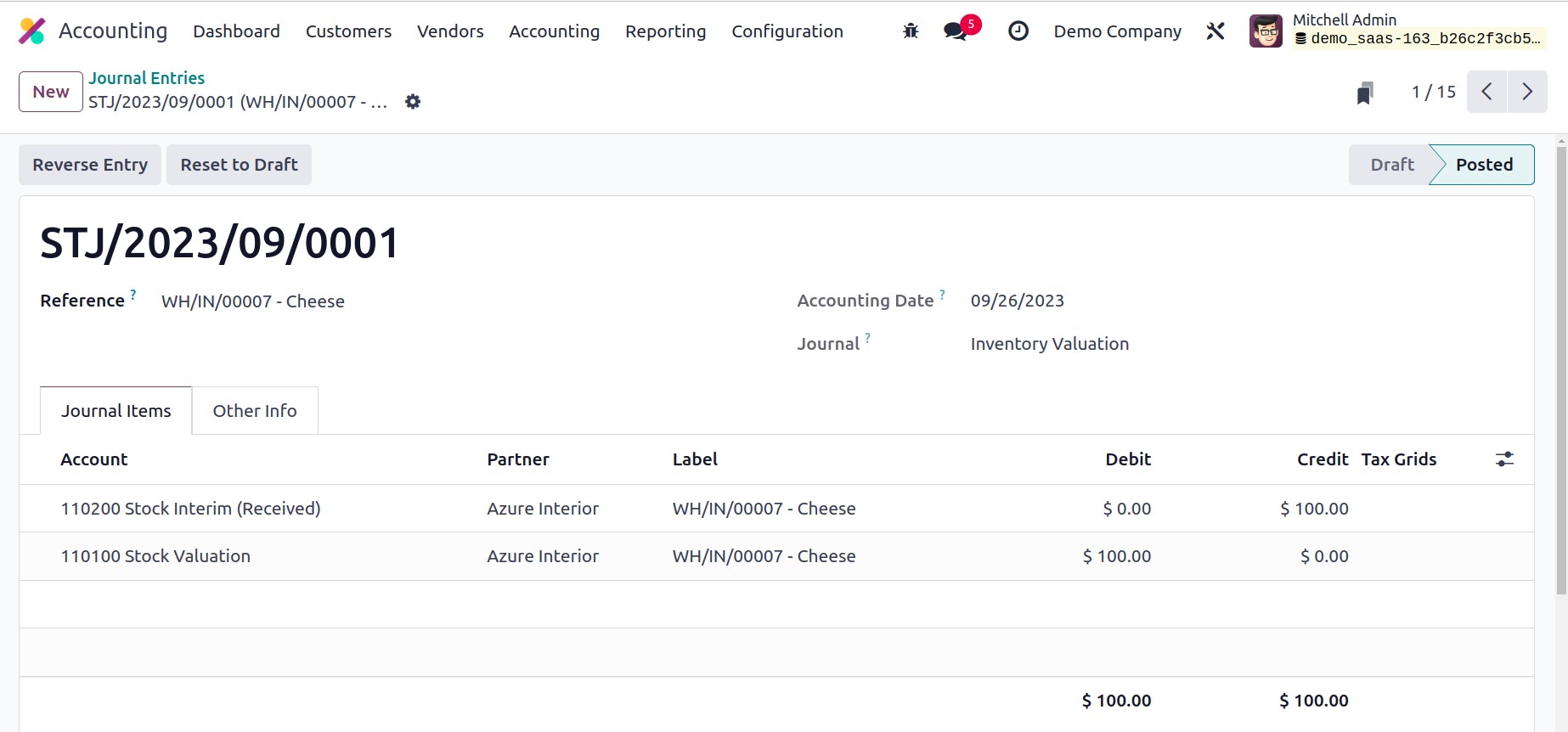

You can accept the product and verify the transfer after creating the purchase order.

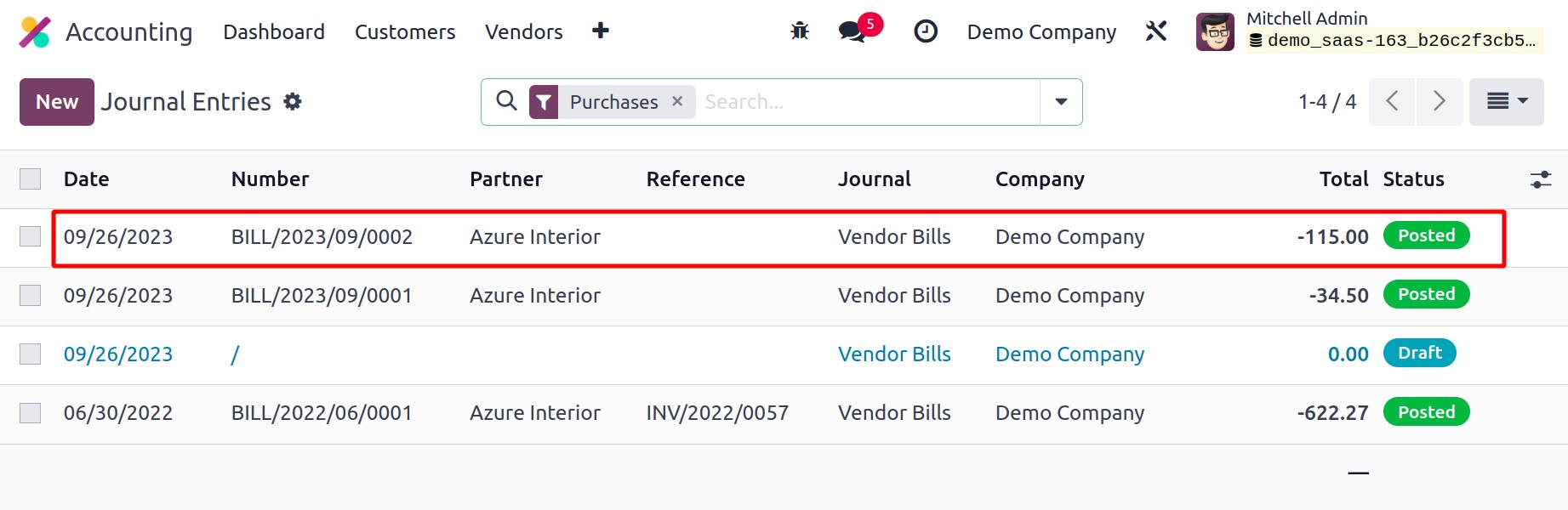

Return to the Accounting module now, where you may find the journal items for the

associated entry by checking the Journal Entries.

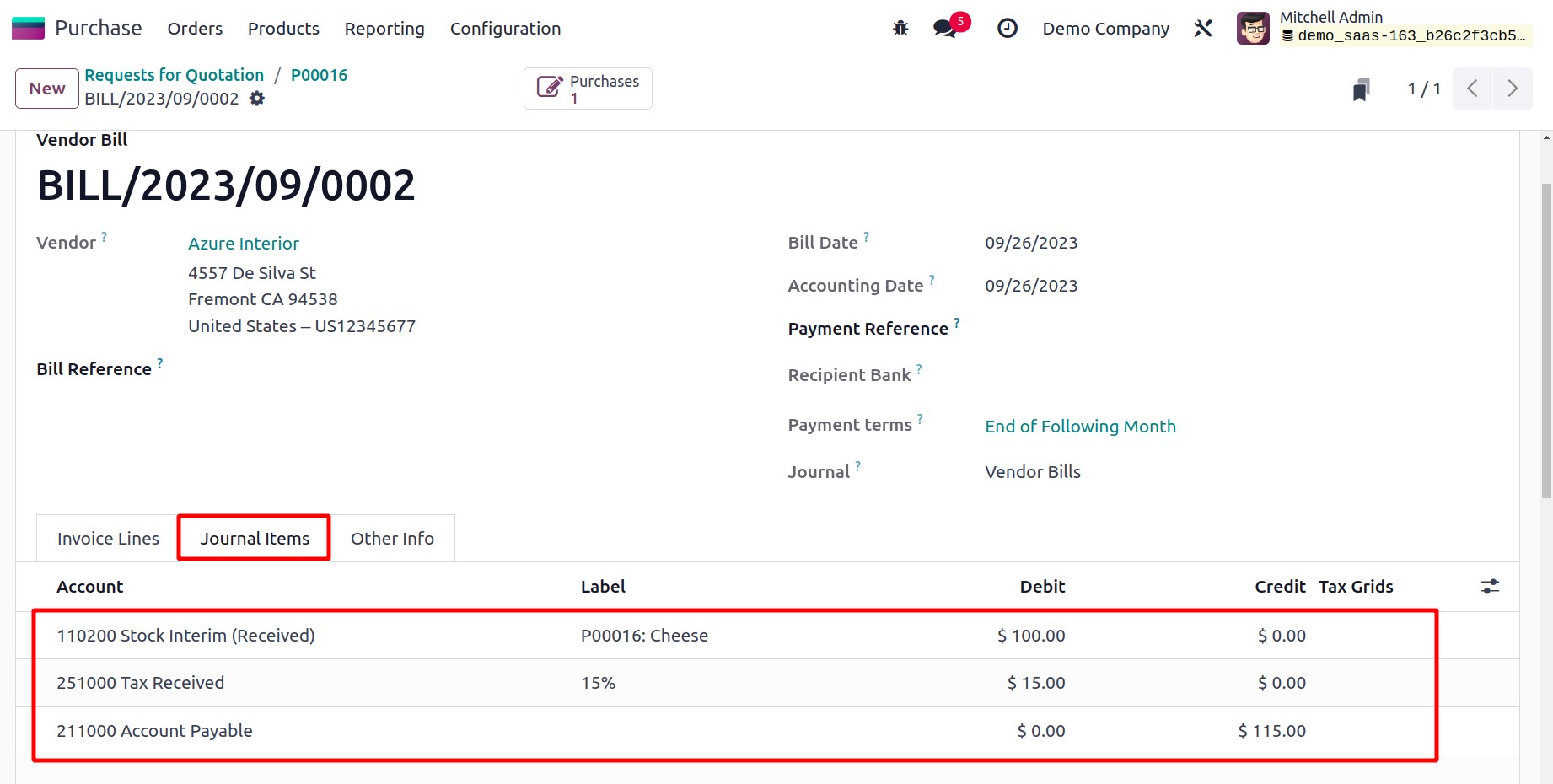

You can confirm the purchase and produce a bill for it. As soon as you approve the

invoice, the journal entries for the vendor bill will show up like in the illustration

below.

In this case, the expense account is unaffected. You can view the associated data as

displayed below when you check the Purchase Journal Entry.

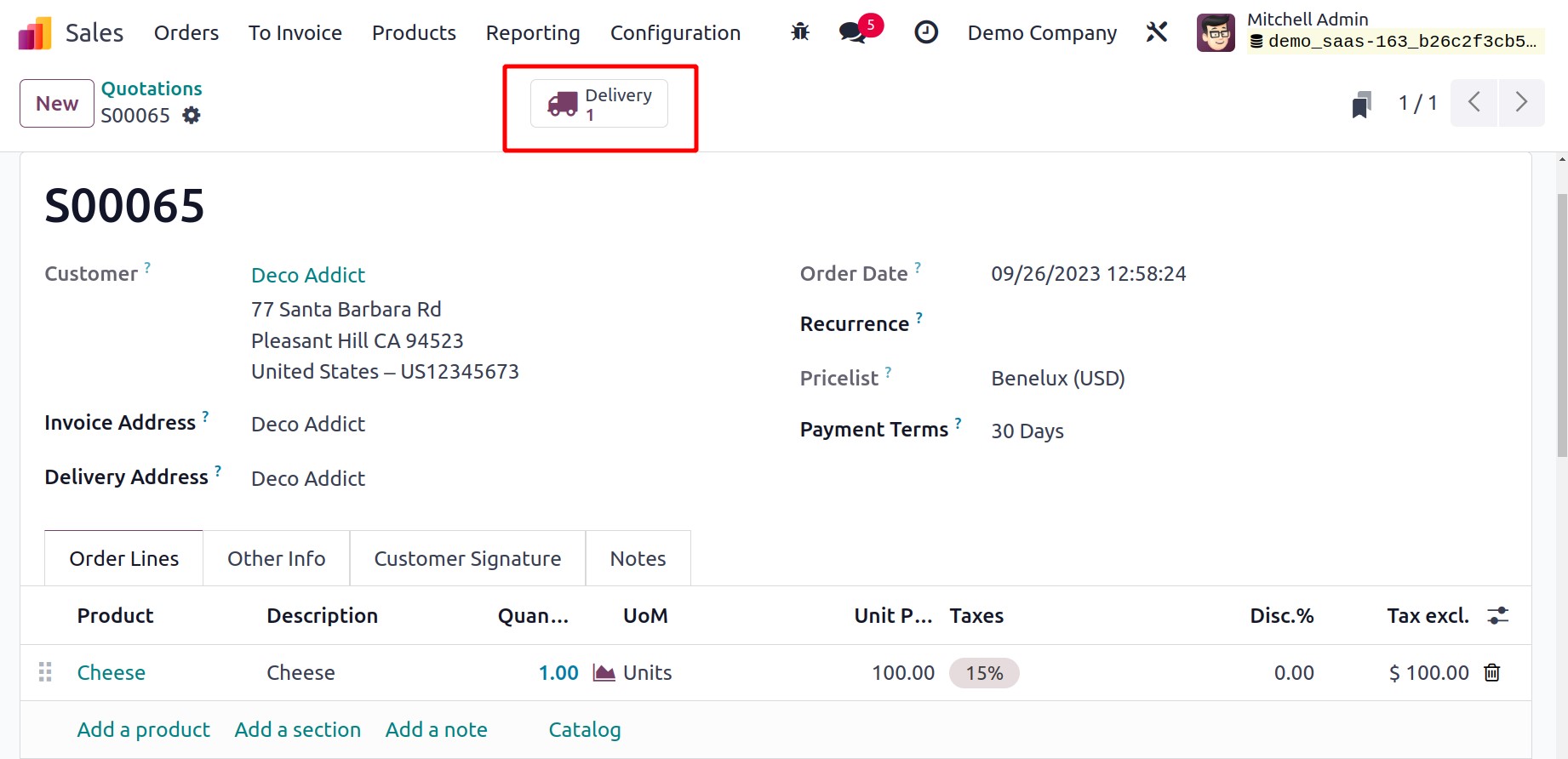

Let's examine how Anglo-Saxon accounting is impacted by the expenditure account. You can

generate and confirm a sales order for a product.

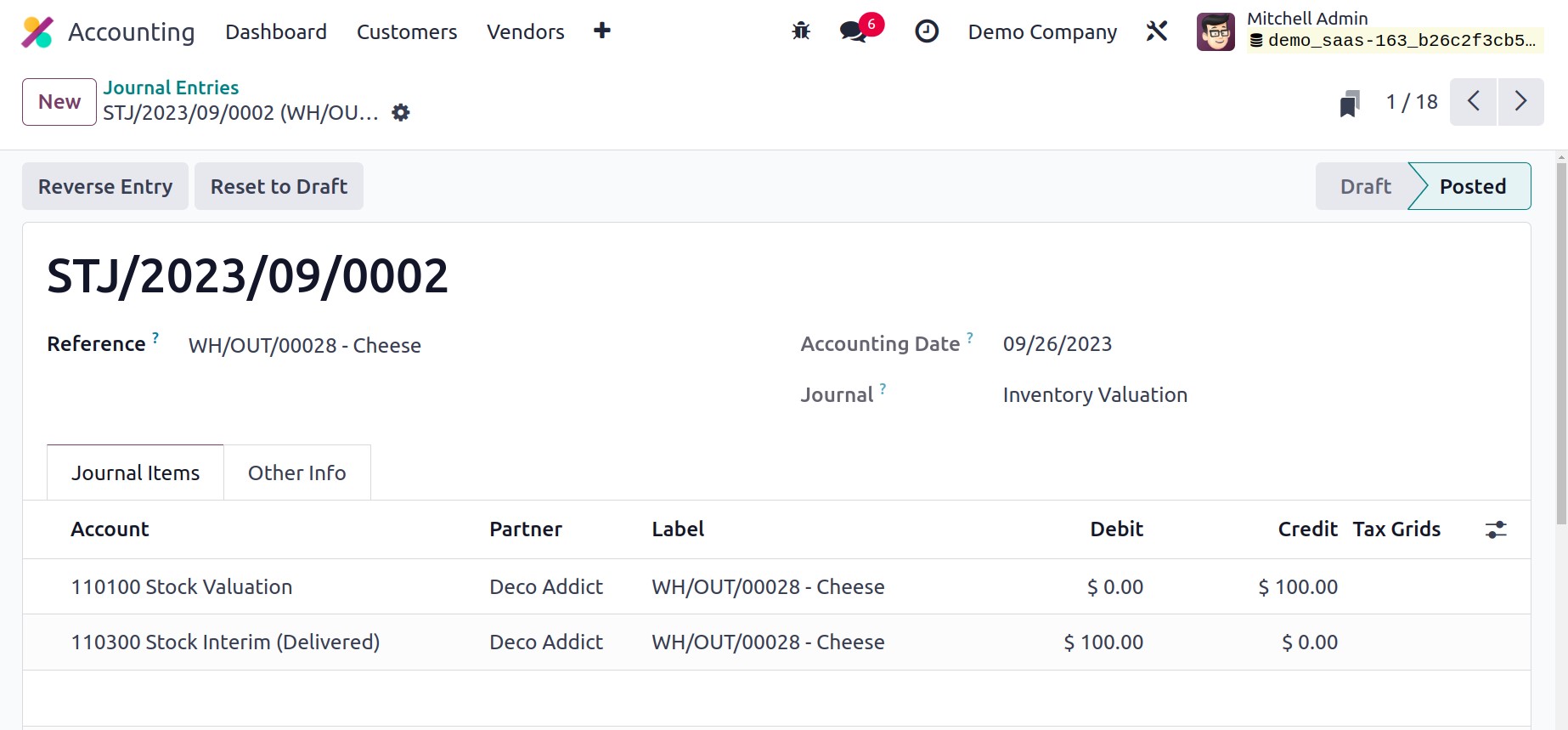

You can validate the delivery after confirming the sales order. You can see the relevant

sales journal record in the Accounting module.

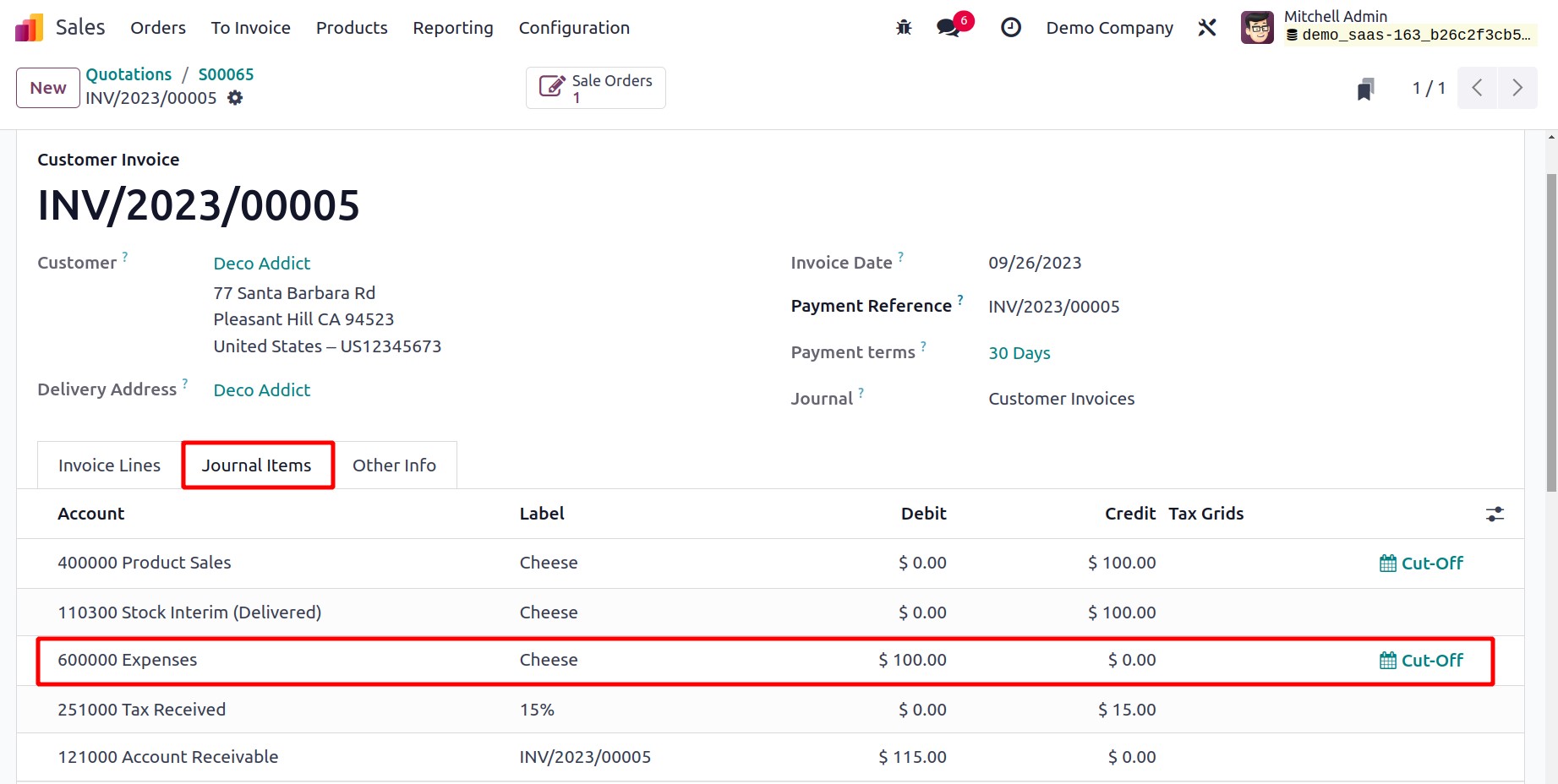

You can now confirm the sales order and produce an invoice for it. The related journal

entries will be displayed as indicated in the illustration below.

You can see by looking at the accompanying journal entries that the spending account is

also impacted in addition to the income account.

The cost of the product is

recorded as an expense in Anglo-Saxon accounting once the product has been sold and an

invoice has been generated.