Customer Invoices

Depending on the operation you carry out and the module you employ, Odoo17 offers a

variety of techniques for automating the generation of customer invoices. The

administration of bills was covered during our discussion of the Sales module.

In Odoo17, you will receive a draft customer invoice after you confirm a sales order.

Just verify the draft invoices before sending them to the appropriate clients. All of

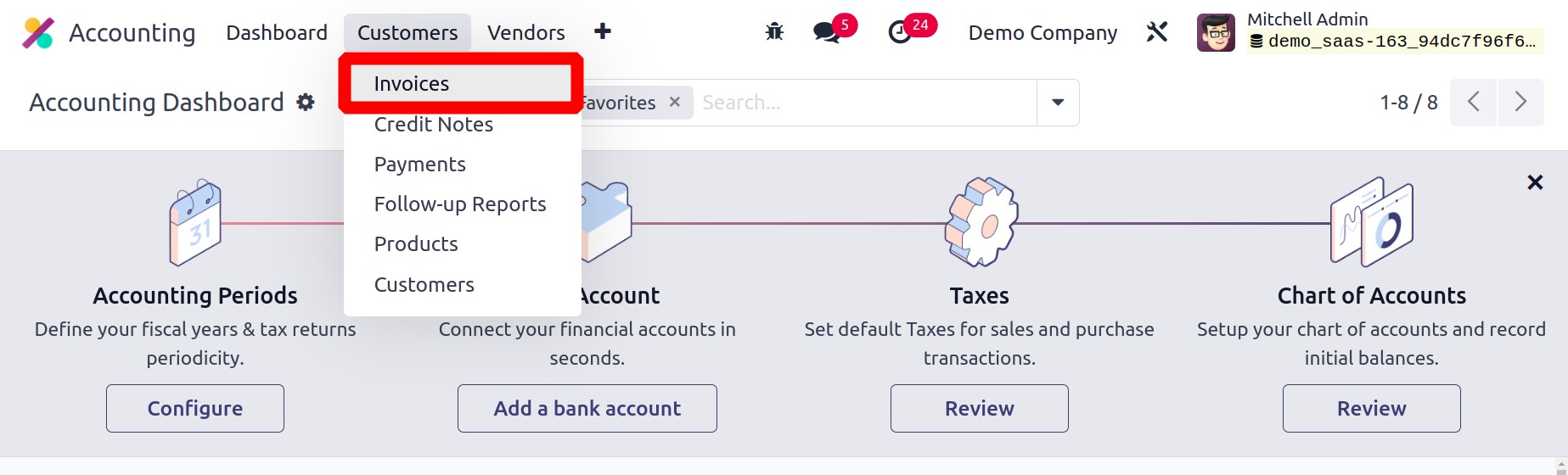

these automatic invoices will be tracked and controlled in the Accounting module's

Customer menu's Invoices platform. You can manually produce invoices on

this platform as well.

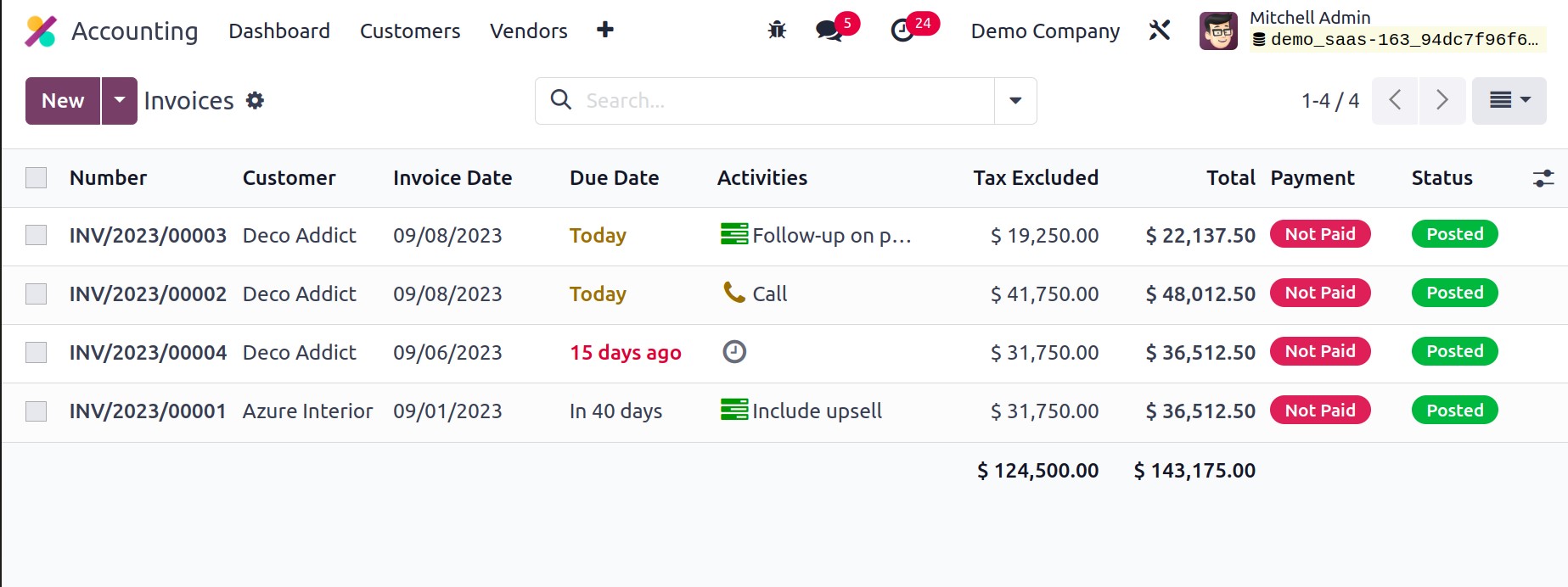

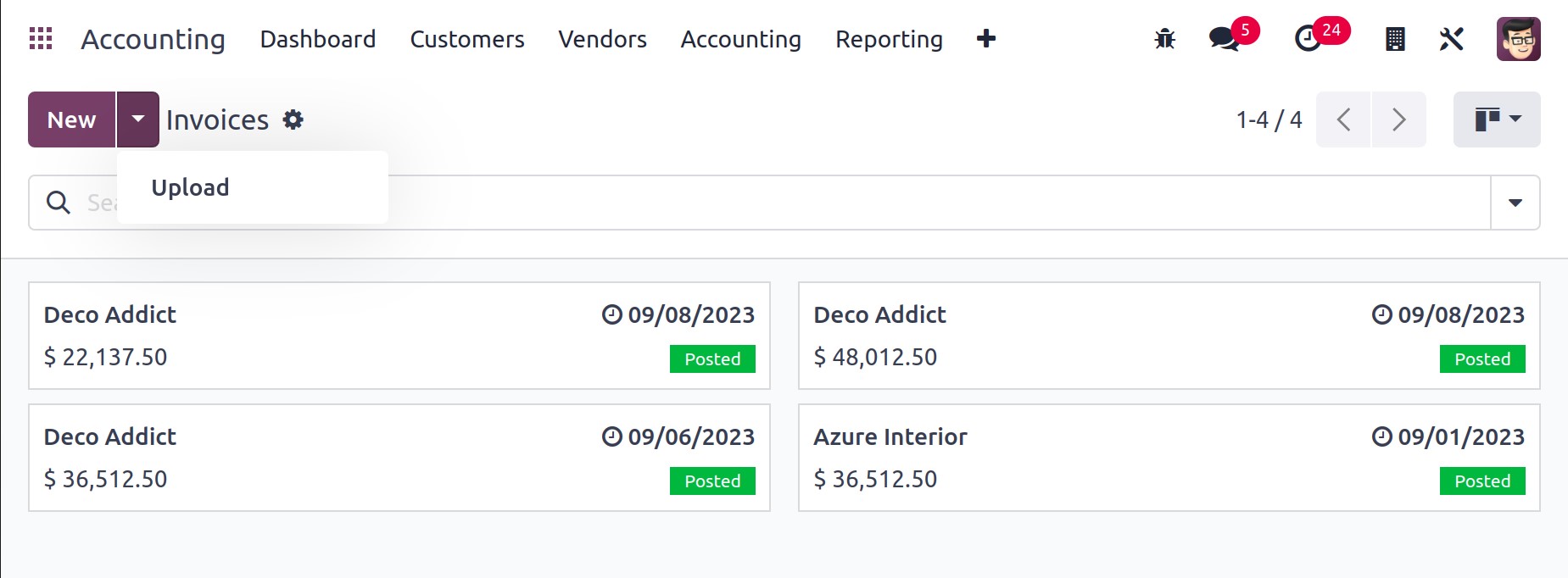

Below is a list of all the invoices that were recorded in the Accounting module. Details

about Number, Customer, Invoice Date, Due Date, Activities, Tax Excluded, Total, Total

in Currency, Payment Status, and Status are provided in the list view. The list view can

be made larger by including more information about the customer invoice. Use the tiny

icon next to the Status field, which is highlighted in the image below, to accomplish

this.

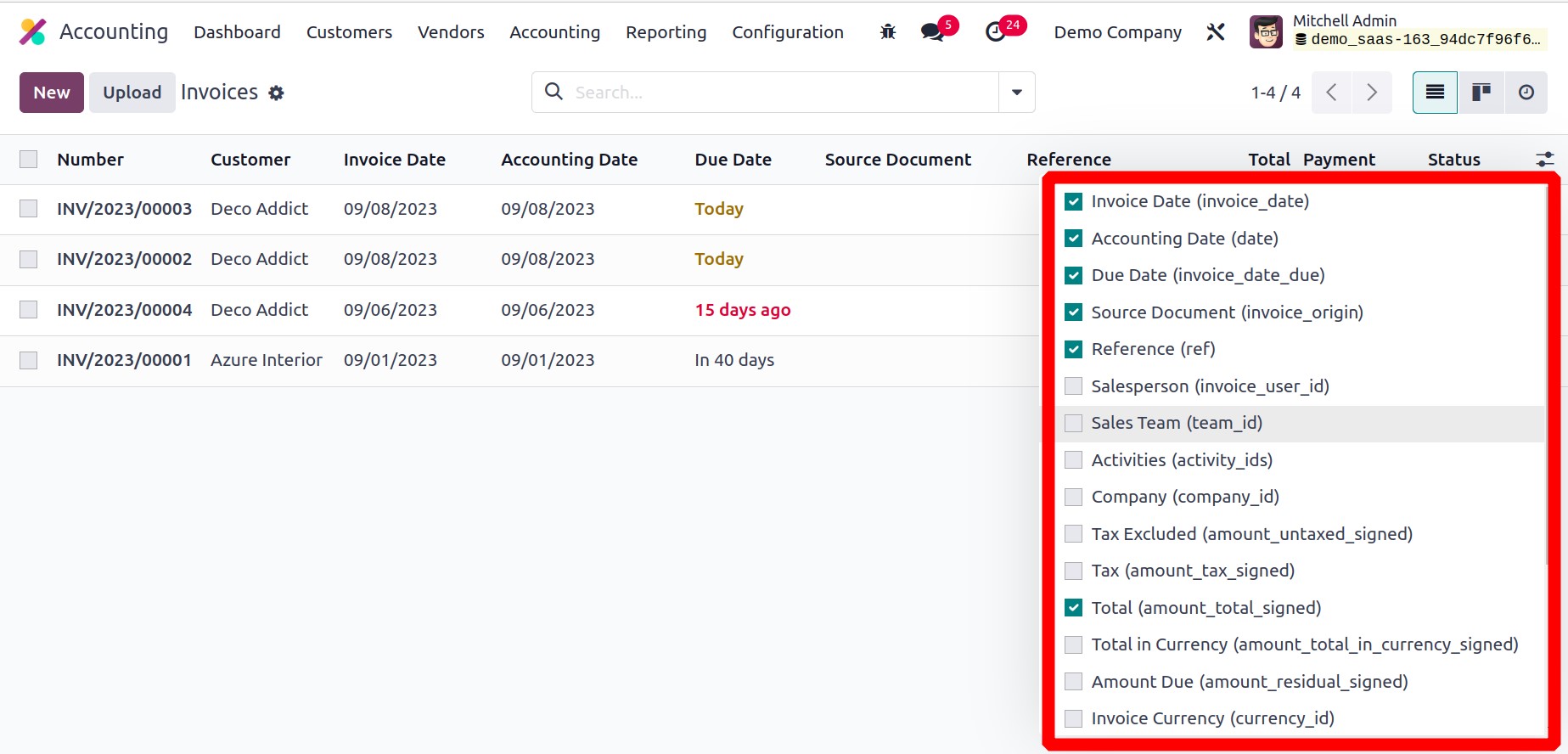

You can enable or disable the needed fields for the customer invoice's list view using

this option. Invoice Date, Due Date, Source Document, Reference, Salesperson, Sales

Team, Activities, Company, Tax Excluded, Tax, Total, Total in Currency, Amount Due,

Invoice Currency, To Check, Payment Status, Electronic Invoicing, and Status are all

included.

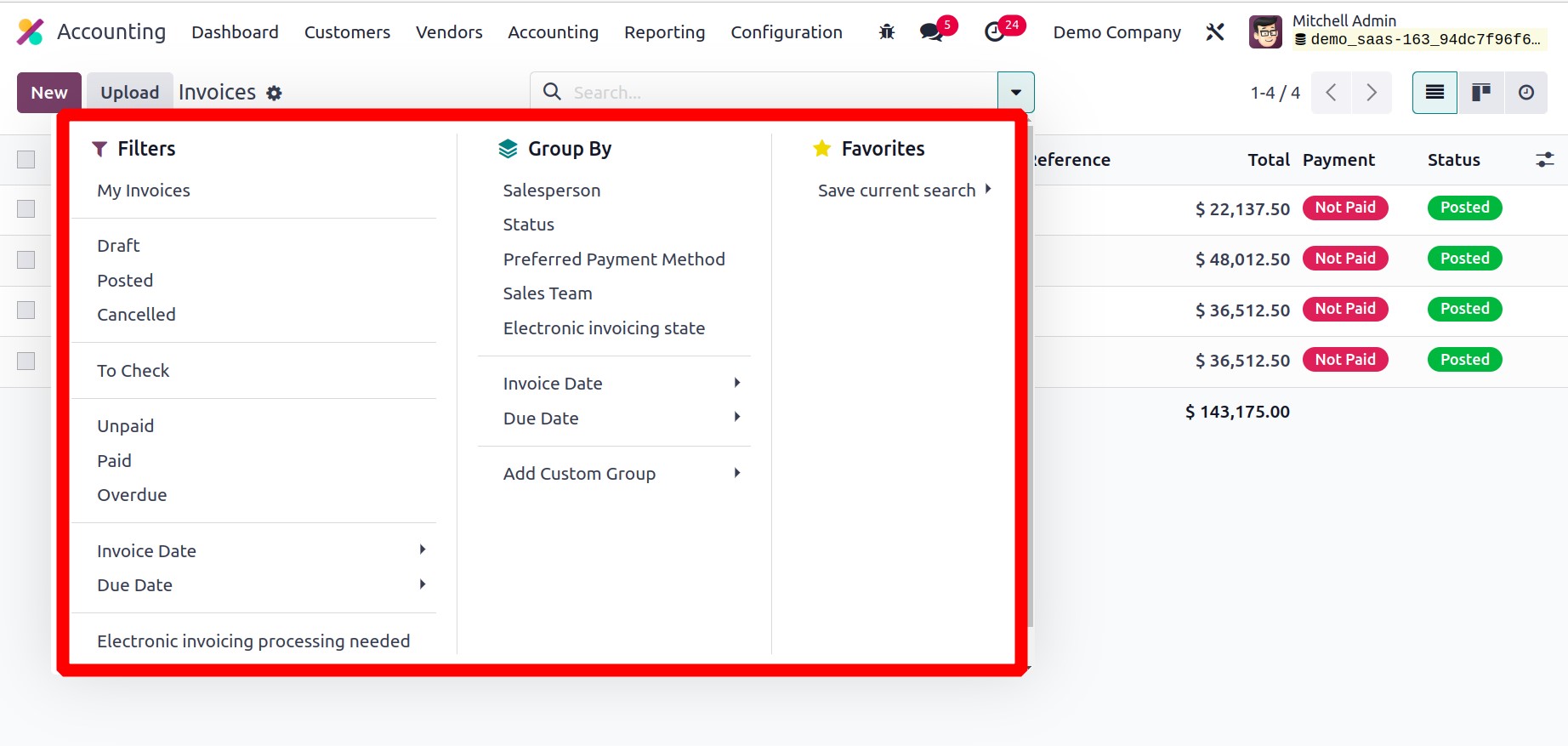

You can sort the bills based on My Bills, Draft, Posted, Canceled, To Check, Unpaid,

Paid, Overdue, Invoice Date, and Due Date using the default Filters. Using the Add

Custom Filter option, you may design your own invoicing filters.

The available invoices can be sorted by salesperson, status, sales team, electronic

invoicing state, preferred payment method, invoice date, due date, and referrer using

the Group By option. You can add custom group choices with the aid of the Add Custom

Group button.

The invoice platform's Kanban view is depicted in the image above. An invoice can be

uploaded to the database using the Upload button. Clicking the New button will

take you to the invoice creation box, which is seen below, where you can manually create

an invoice.

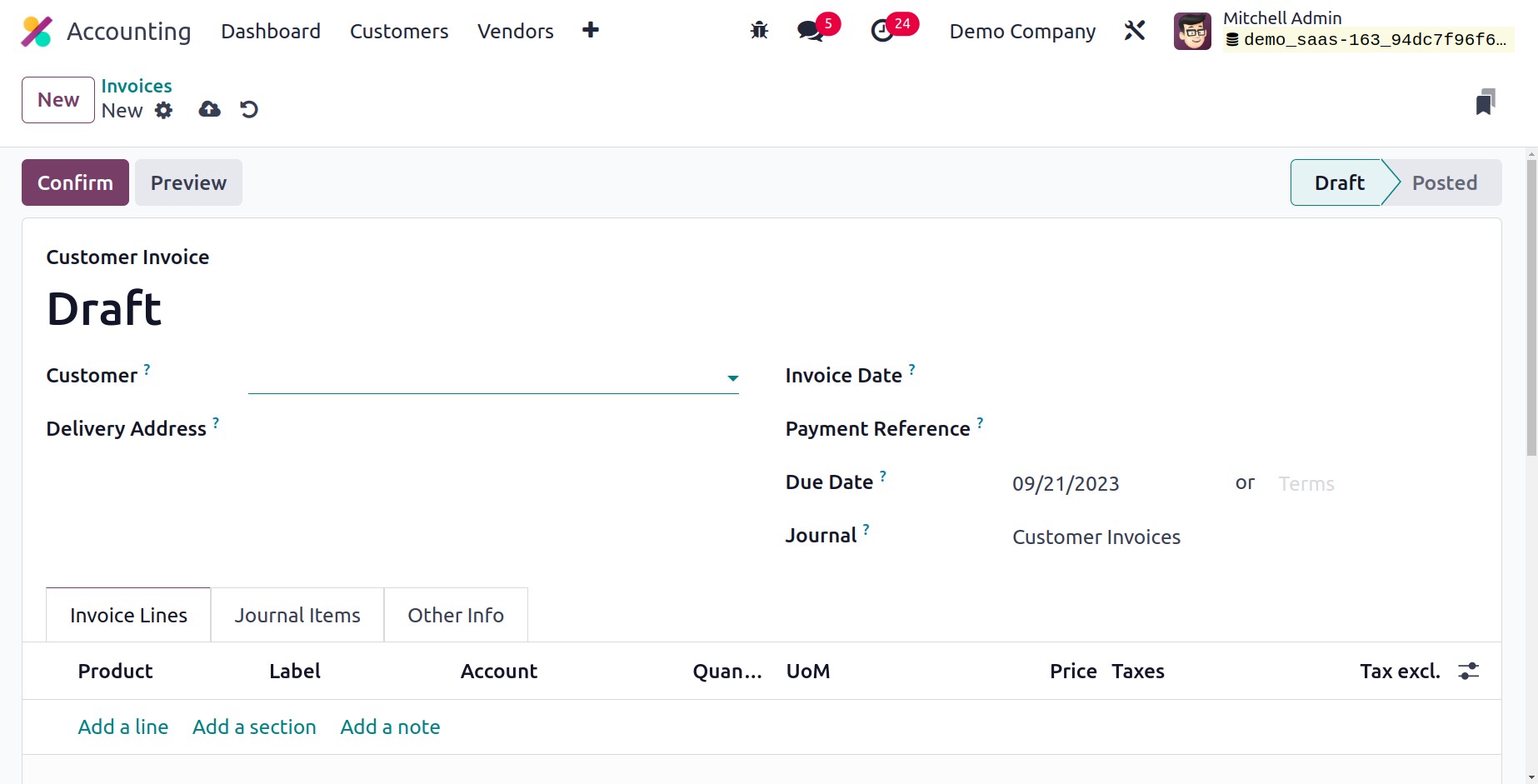

We're going to draft an invoice right now. In the Customer area, you may write the

customer's ID, and in the Delivery Address field, you can write the customer's current

delivery address. In the relevant fields, provide the invoice date and payment reference

for the journal items. The appropriate Payment Term will immediately display on

the invoice once you provide the customer ID in the relevant field in accordance with

the configuration. If not, you can specify a Due Date for the invoice by which the buyer

must pay it. Choose an appropriate Journal for the invoice.

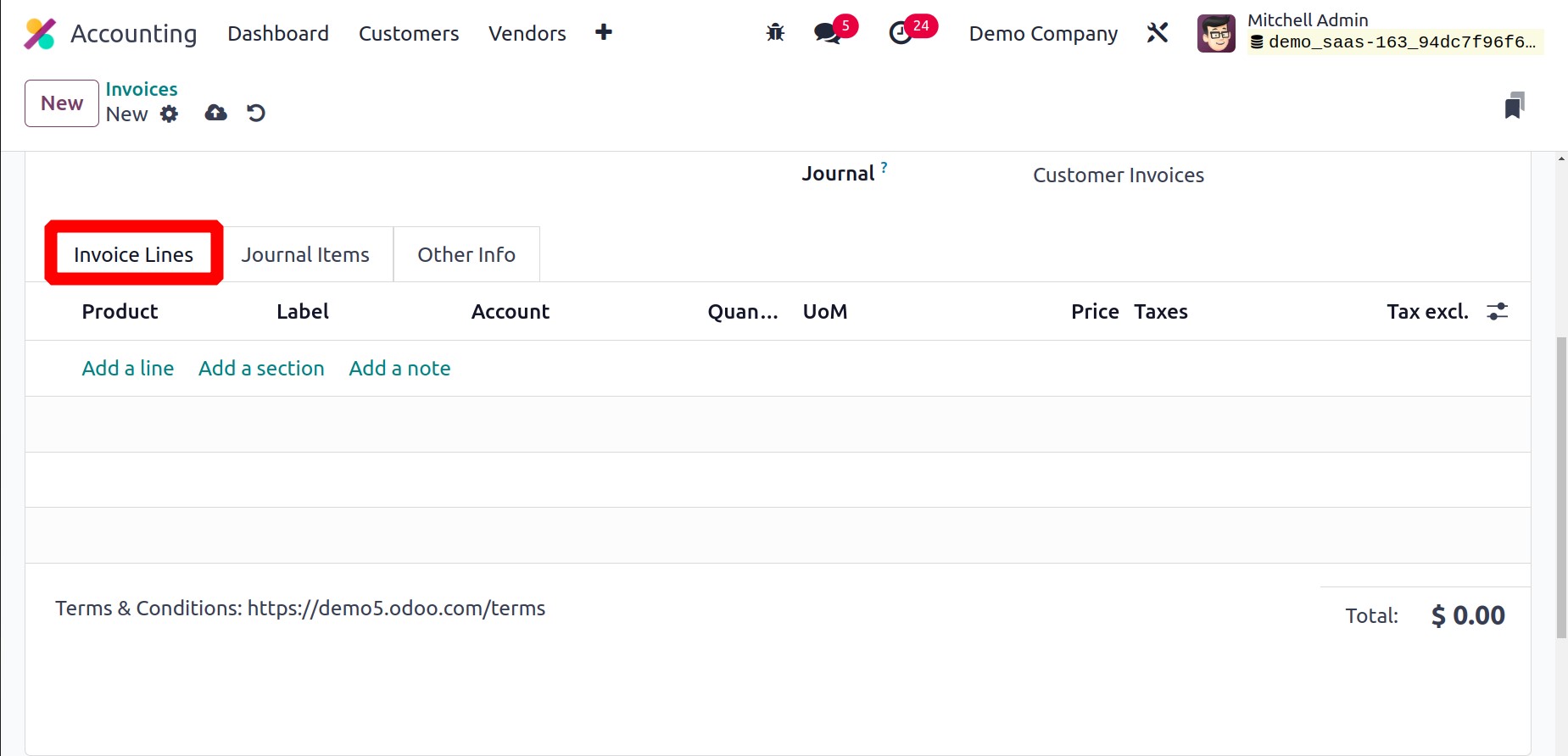

Three more tabs, including Invoice Line, Journal Item, and Other Info, are

displayed on the invoice screen for completion. Using the Add a Line button found under

the Invoice Lines tab, you may individually mention each item on the list of products.

Product, Label, Account, Analytic, Quantity, UoM, Price, Taxes, and Subtotal data are

all included. The products that are listed in the sales order's order line will appear

in the invoice's invoice line if it was created from a sales order. To add a section and

a remark to the invoice, respectively, use the Add a Section and Add a

Note button. The Untaxed Amount, Taxes, and Total of the invoice are visible

after adding products under the Invoice Line.

The Journal Items page displays relevant journal entries with the data of the Account,

Label, Origin, Reference, Analytic, Debit, Credit, and Tax Grids in accordance with the

products you put into the invoice line.

You may use the delete icon to remove any of these diary entries and the Add a Line

button to add a new one.

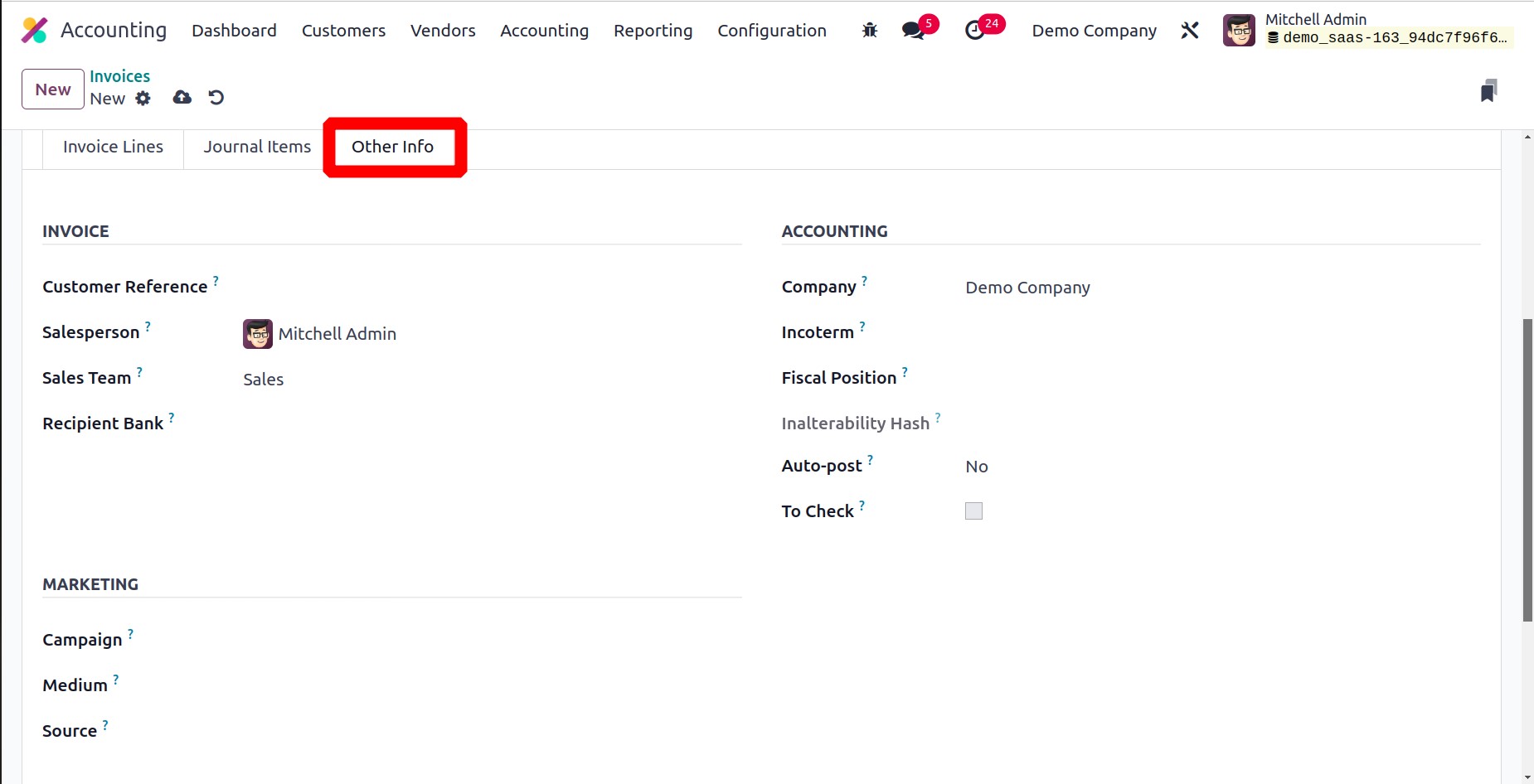

The Invoice, Accounting, and Marketing information of an invoice are mentioned in the

Other Info tab. You can include the Customer Reference beneath the Invoice field.

By entering their IDs in the designated places, this invoice can be assigned to a

specific salesperson and sales team. The Recipient Bank section

allows you to specify the bank account number that will receive payment for the invoice.

You can provide a referrer's ID in the Referrer section if you have one for this

sale.

To indicate the Campaign, Medium, and Source of this invoice, use the

Marketing field. You can provide your company identification number in the Accounting

Section’s Company field. Enter the Incoterms, Fiscal Position, Intrastat Country

(Arrival Country), and Inalterability Hash in the appropriate fields to adjust taxes and

accounts for specific customers or sales orders/invoices.

When creating an invoice, if there is any information about which you are unsure, you may

turn on the To Check field. This field must be enabled if the move needs to be

checked again.

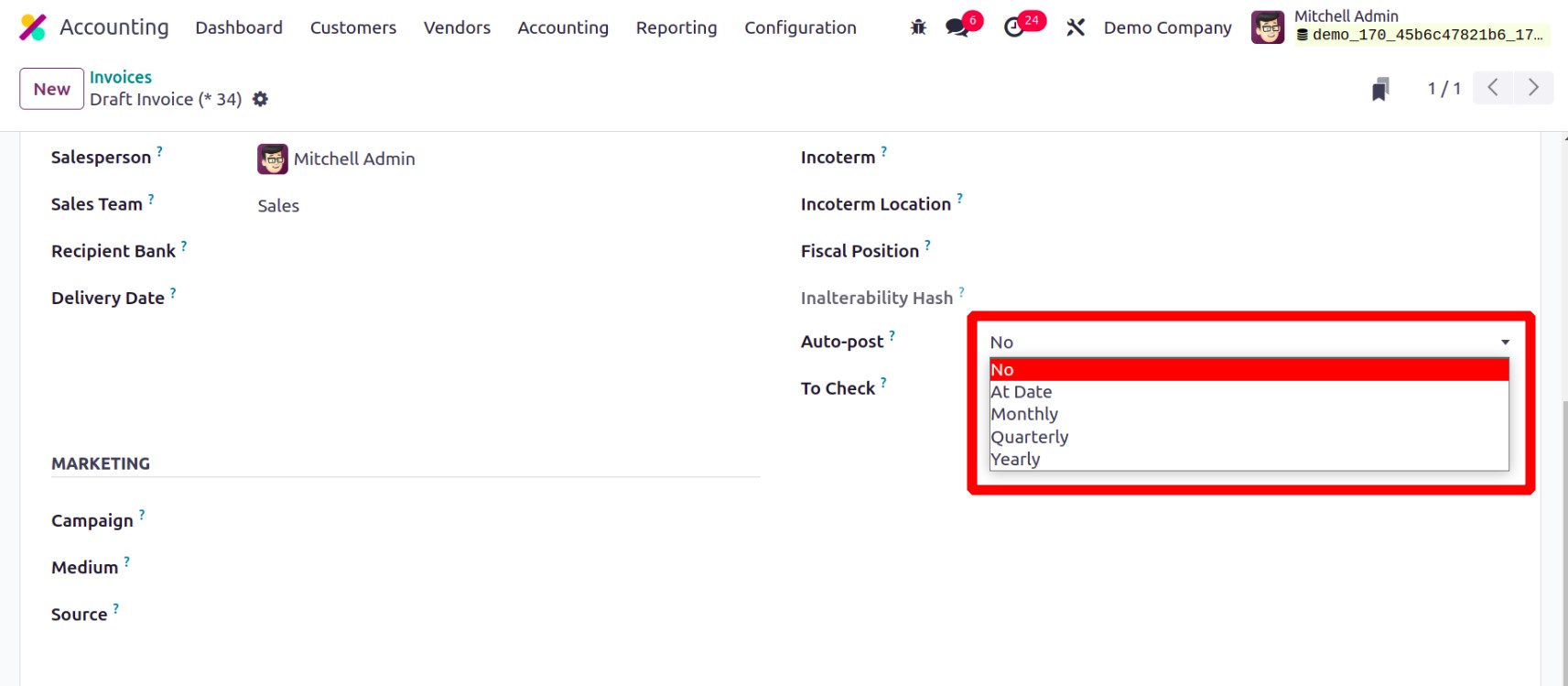

By choosing the appropriate time frame from the Auto Post area, you may

automatically post this entry. You can specify a date in the Auto Post Until section

that will determine how long this repeating move will be posted. Now it's possible to

choose Monthly, Quarterly, or Yearly auto posting. You can choose No from the Auto Post

section if you wish to do it manually.

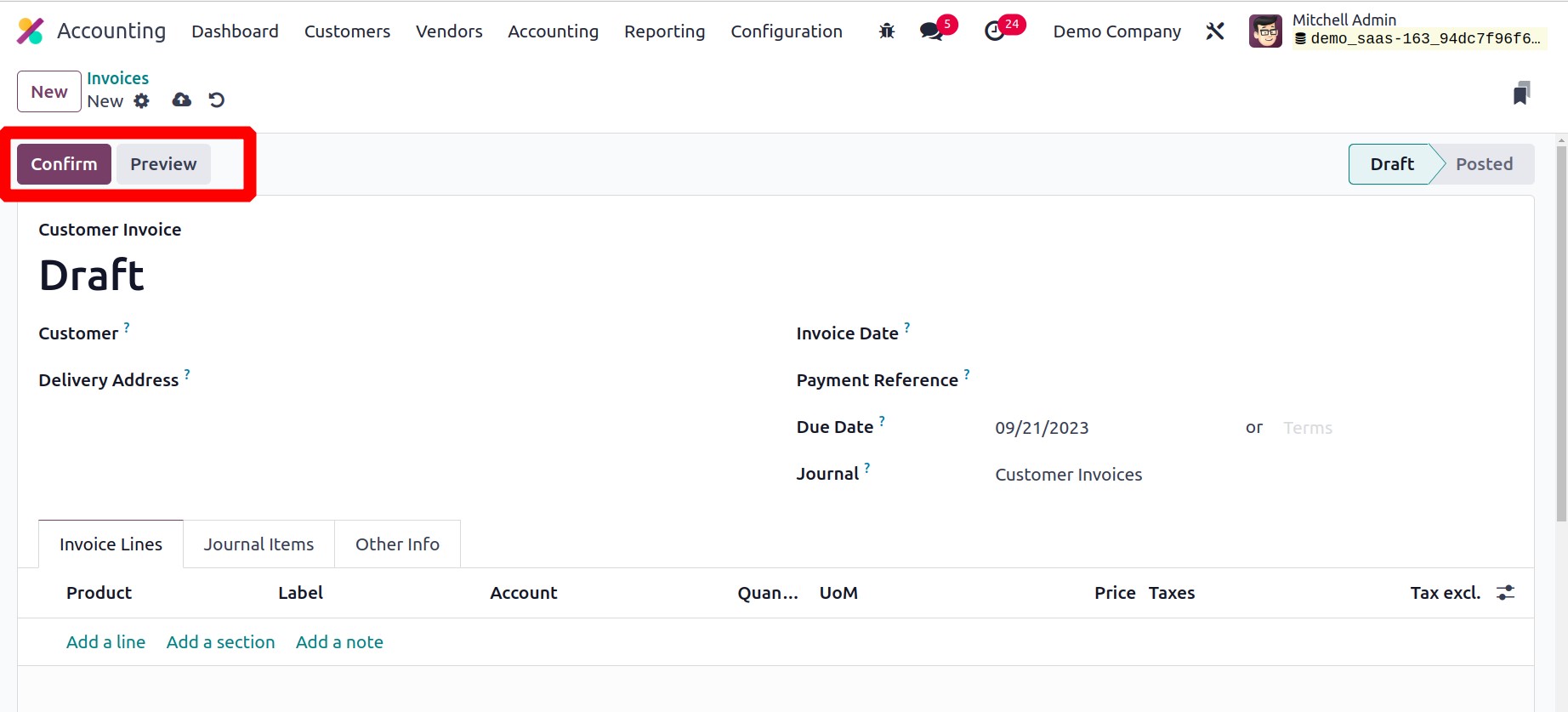

The draft invoice is now complete. When you confirm this invoice, the status will change

from Draft to Posted once you click the Confirm button.

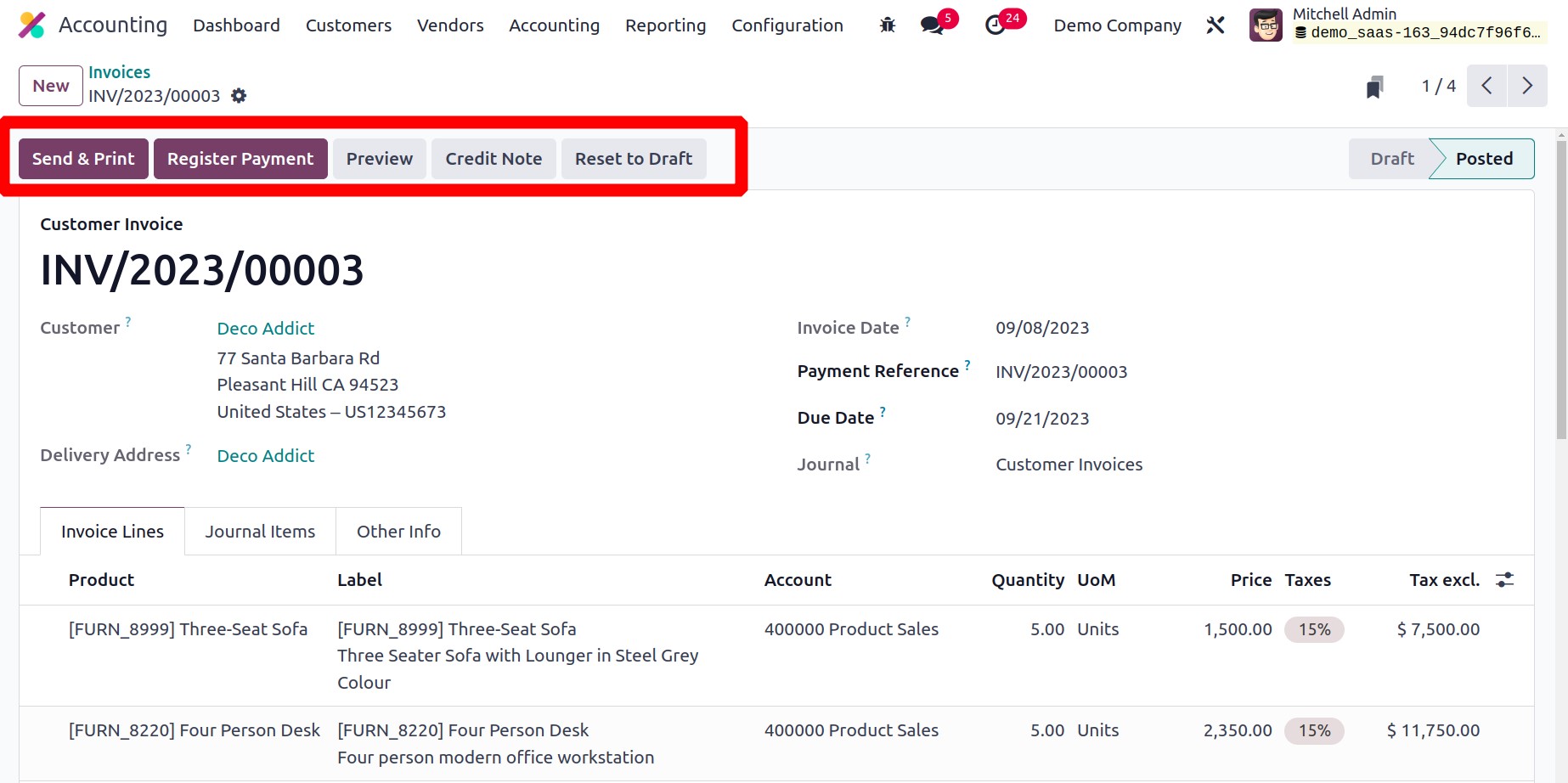

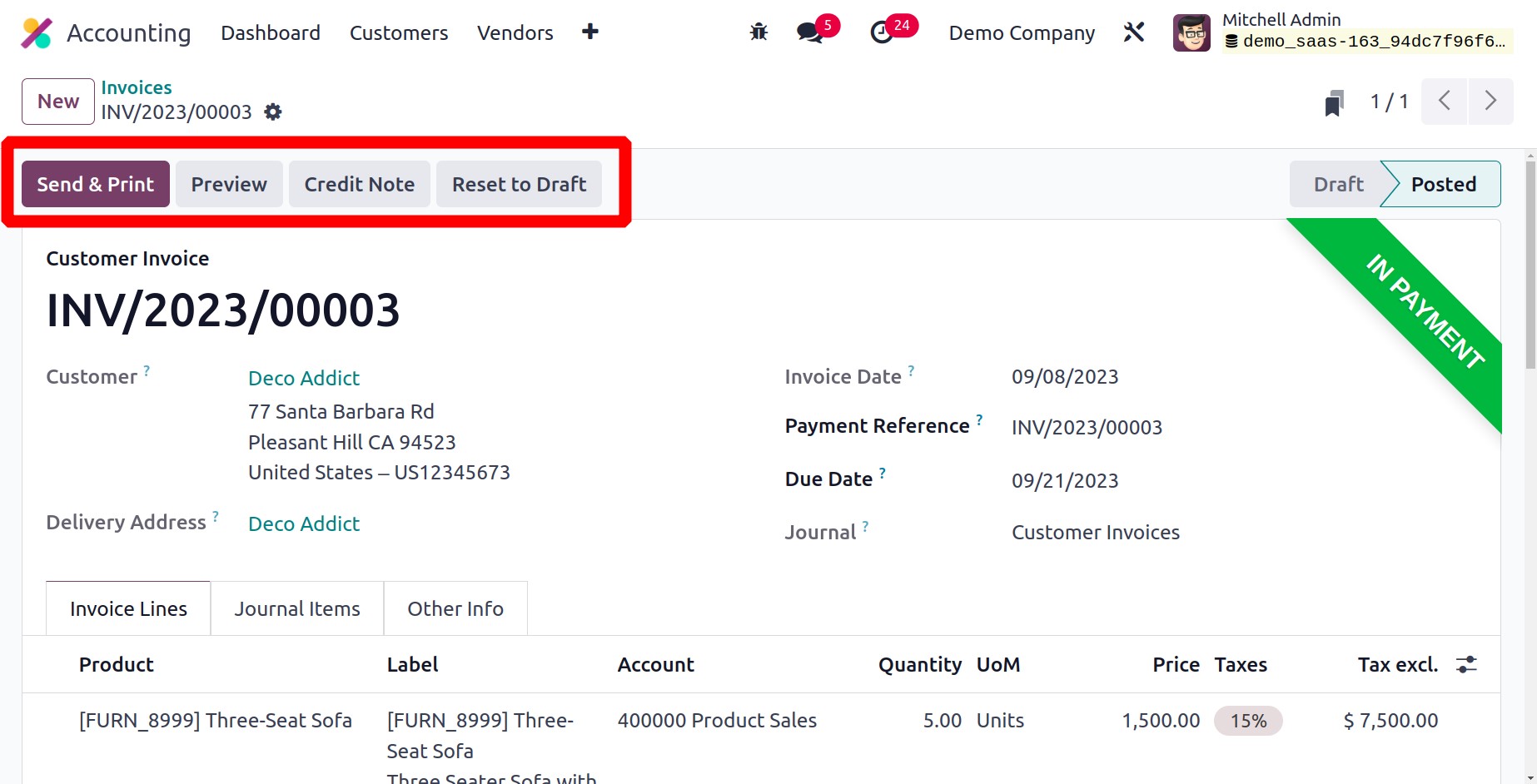

A validated invoice sample is displayed in the screenshot. Using the Reset To

Draft button, you can return a confirmed invoice to drought status. Use the

Preview button to show the invoice to the customer in advance.

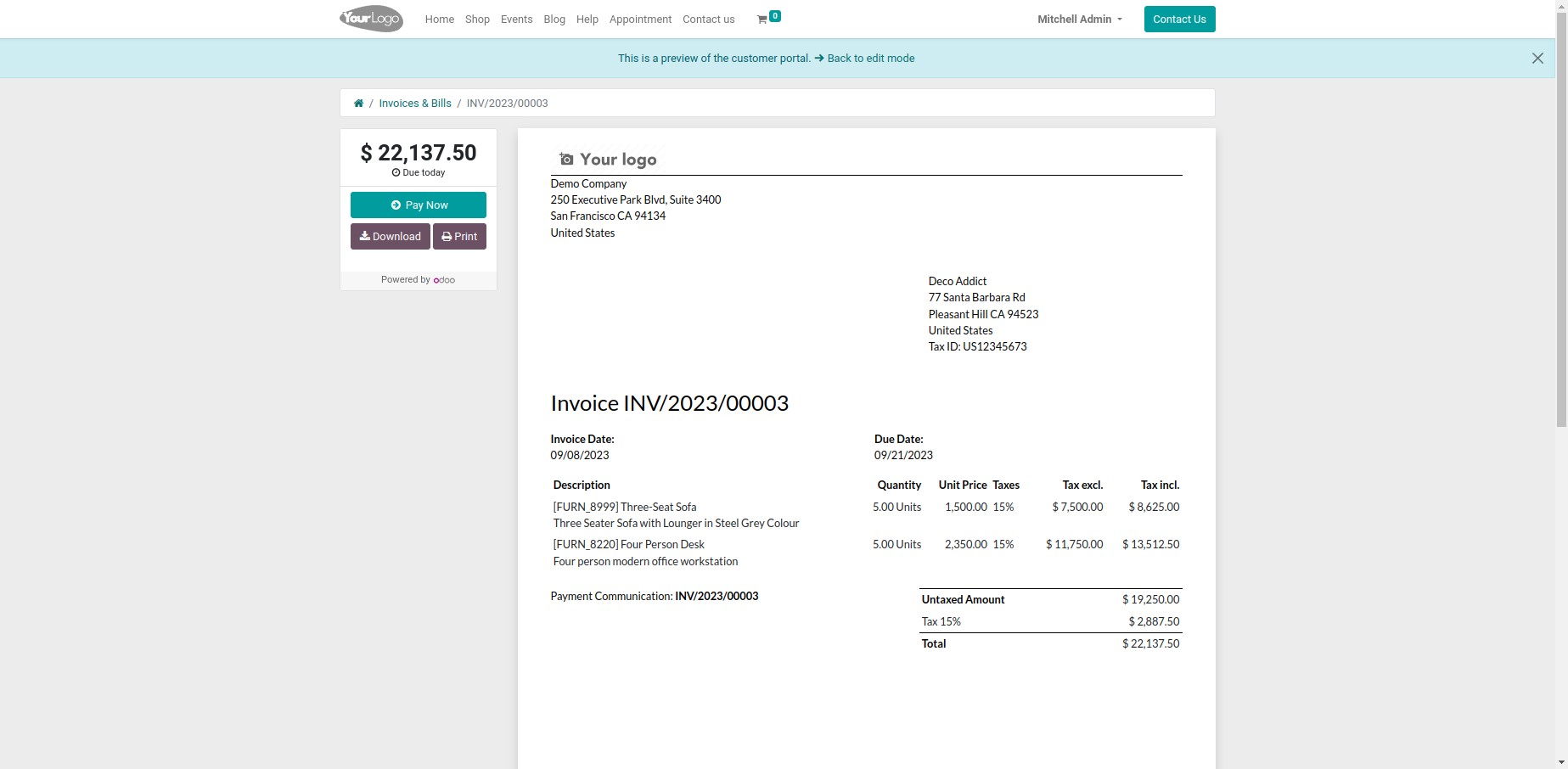

This is the client preview of the invoice from the client site, where the client can

evaluate the invoice and pay the sum using an appropriate payment option. The consumer

will have the ability to send a message to the appropriate salesperson as well as

download and print the invoice.

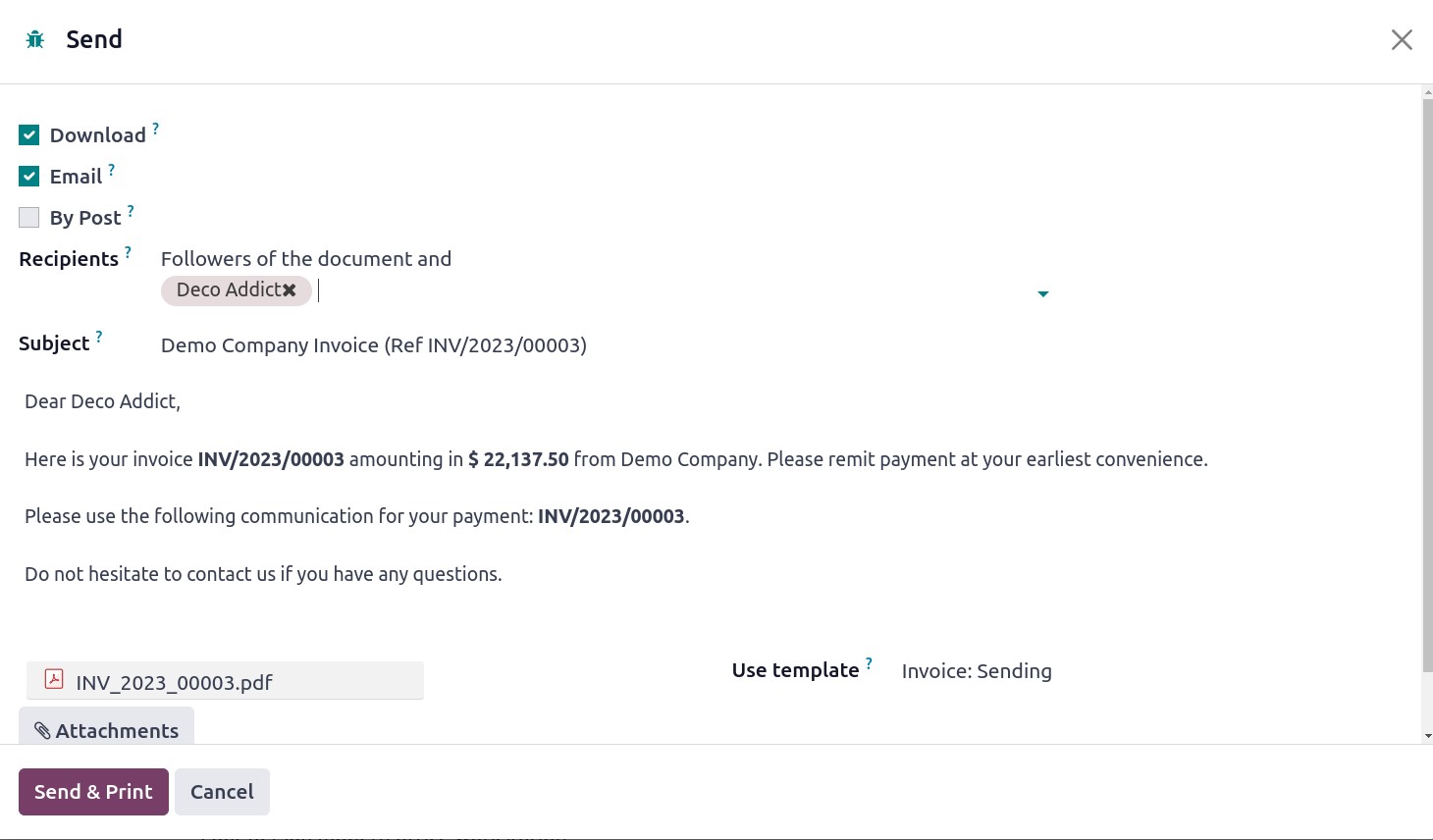

You can mail the invoice to the client by clicking the Send & Print option. A

created automatic email will look like the one below, where you can edit the recipient

list and topic to suit your needs. You can click the Send button once the invoice has

been attached to the email. The consumer can review the contents and submit payment once

they receive this mail.

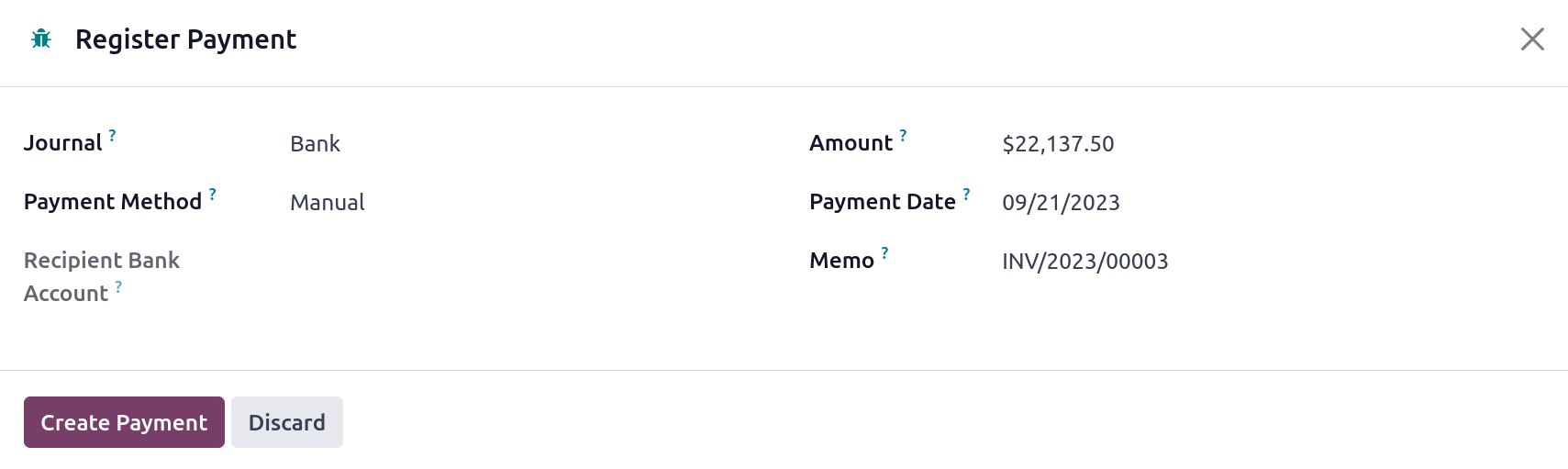

Using the Register Payment option, you can document their payment after the

payment processes are complete. To confirm the information of the payment registration,

Odoo17 creates a pop-up window. As seen in the above image, the window will display the

Journal, Payment Method, Recipient Bank Account, Amount, Payment Date, and Memo. If

necessary, you can alter the details that are already available. Click the Create

Payment button to continue. This step can be used to finish the payment registration.

The status of the invoice can be seen as In Payment once the customer has paid

it.

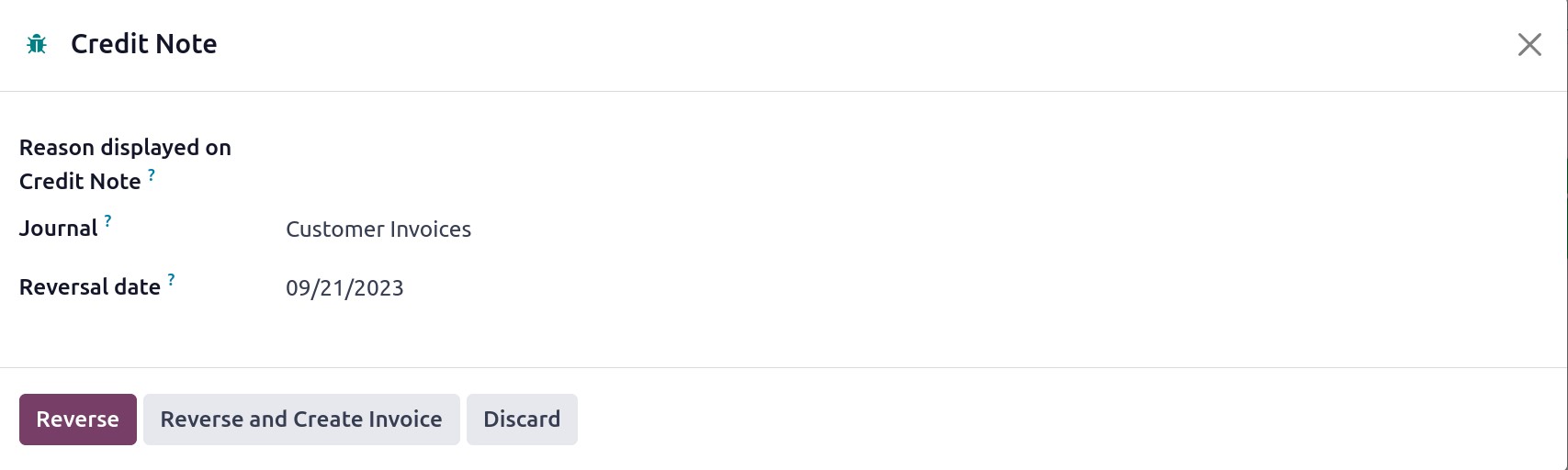

Any errors in the invoice, incorrect product deliveries, damaged items, or service

rejections might result in the issuance of a credit note to the consumer. The Add Credit

Note button can be used to accomplish this. When you click on this option, a new wizard

to define the credit note will emerge.

In the Reason area, you can specify why this credit note was generated. The

Journal Entry Date or a Specific Date can be used to set the Reversal Date. The

Use Specific Journal box allows you to specify the journal entry that will be

used to record the credit note. You can click the Reverse option to reverse the payment

after the Reversal Date appears on the screen.

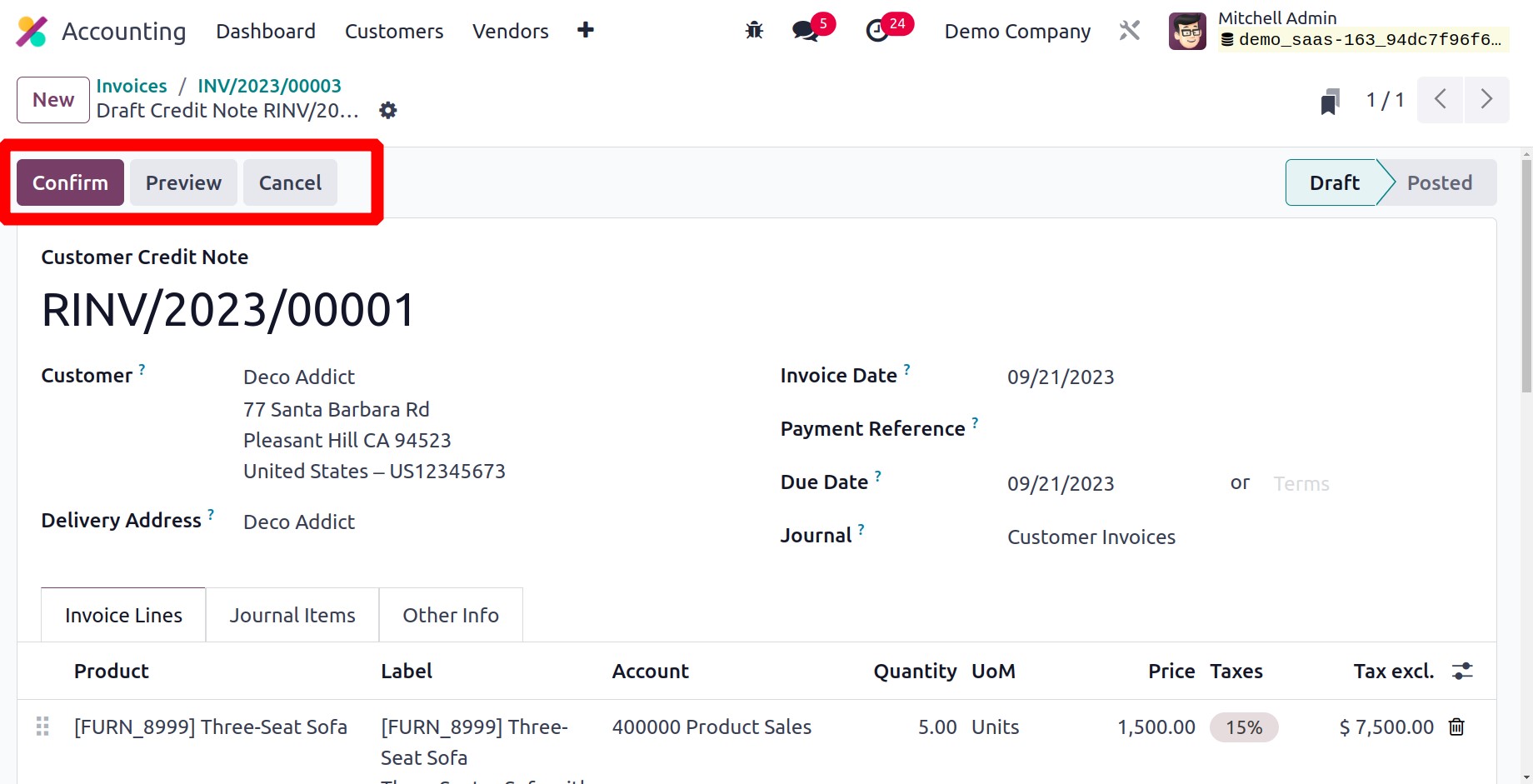

To view the draught customer credit notice, Odoo directs you to a new window. To confirm

the customer credit note, click the Confirm button. The Register Payment

button can be used to record the payment later.

This is how the Accounting module of Odoo17 handles customer invoices. Let's next talk

about the module's Credit Note platform.