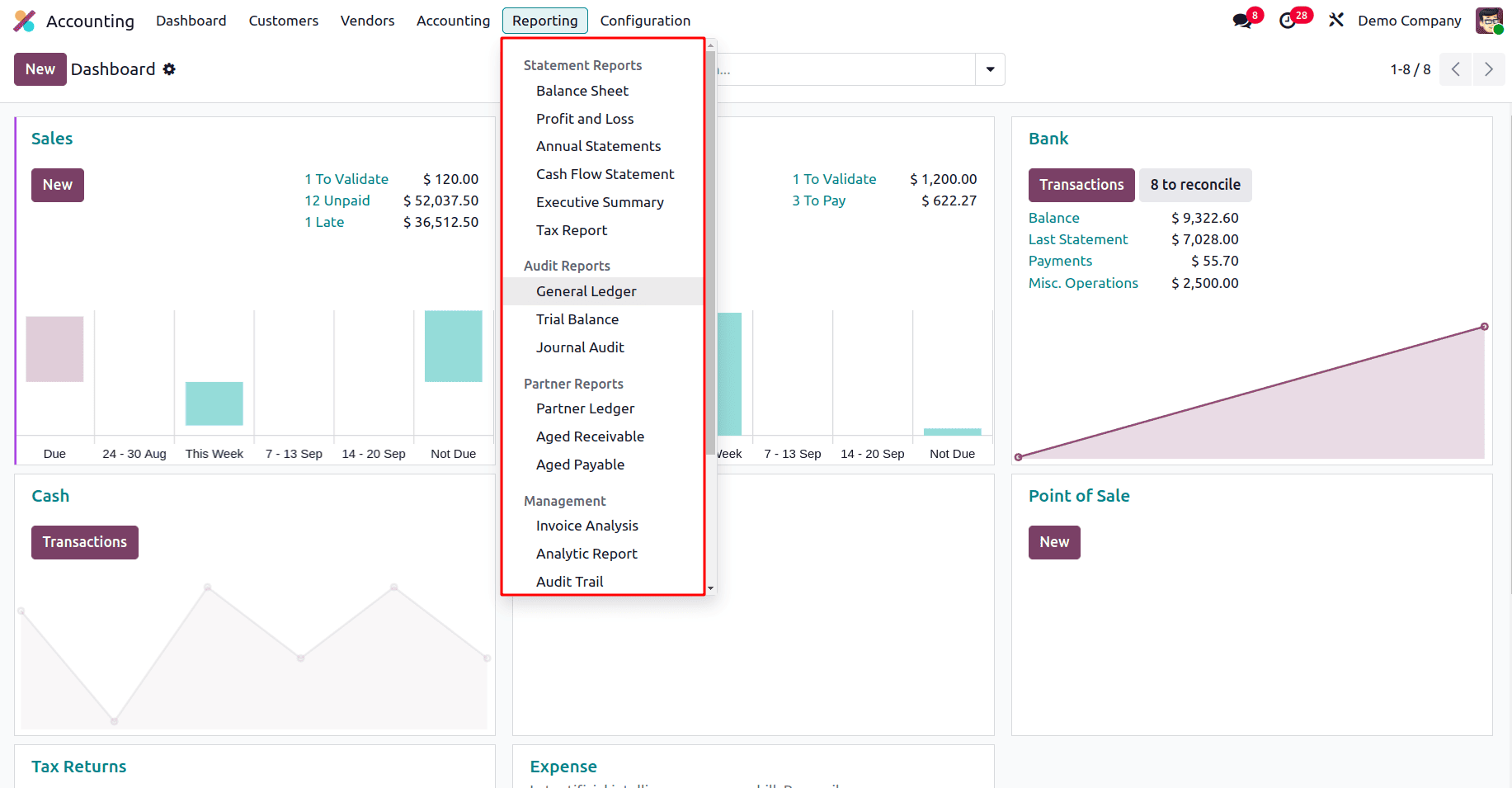

Reports are essential for any firm to monitor work processes and understand how things are progressing. Having a clear and organized reporting system makes it easier to analyze information and make smart decisions, especially in stressful situations. Reports are also essential for monitoring a business's financial situation in real time. In this section, we’ll take a closer look at the different reporting features available in the Odoo 18 Accounting module.

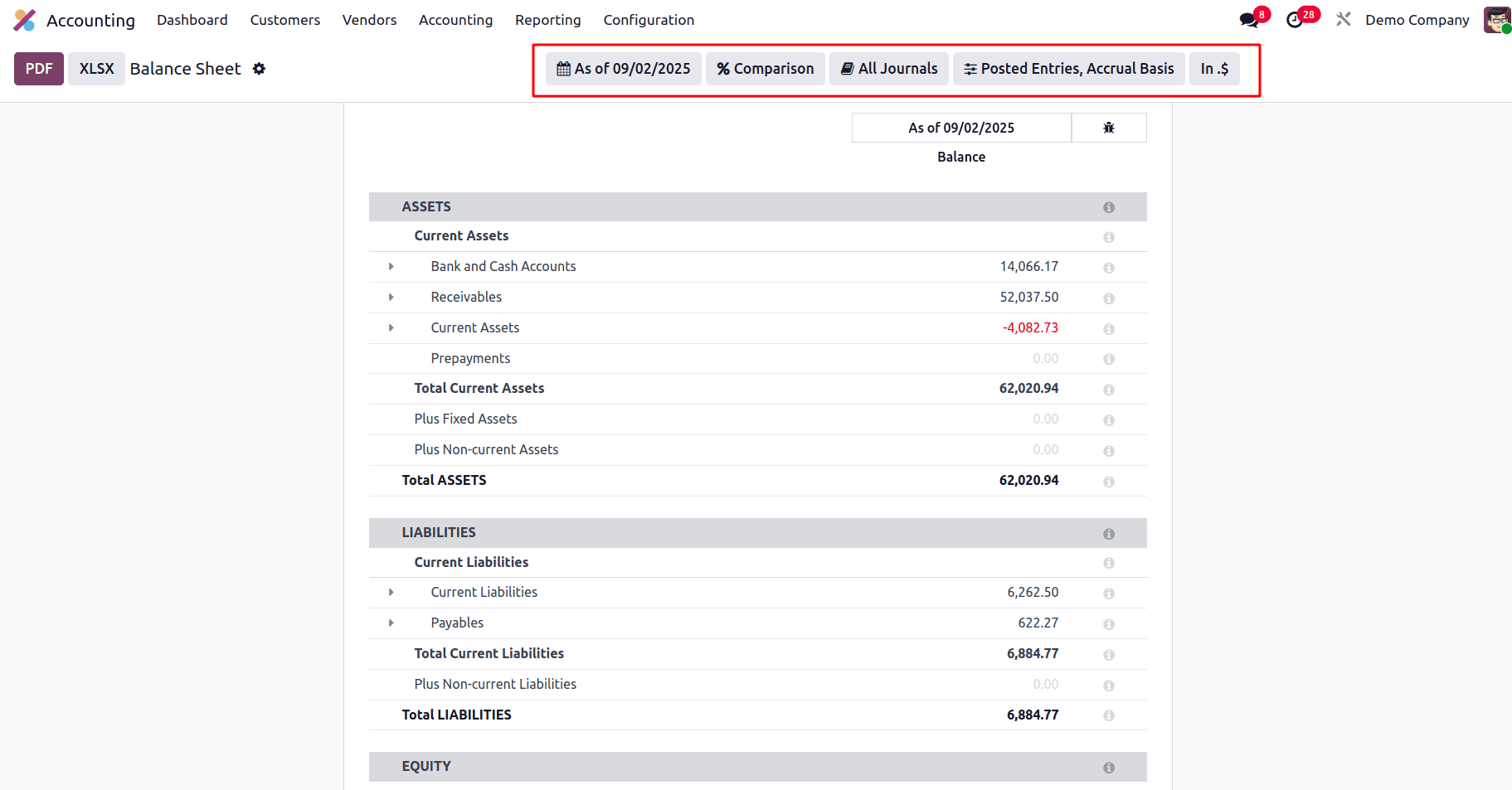

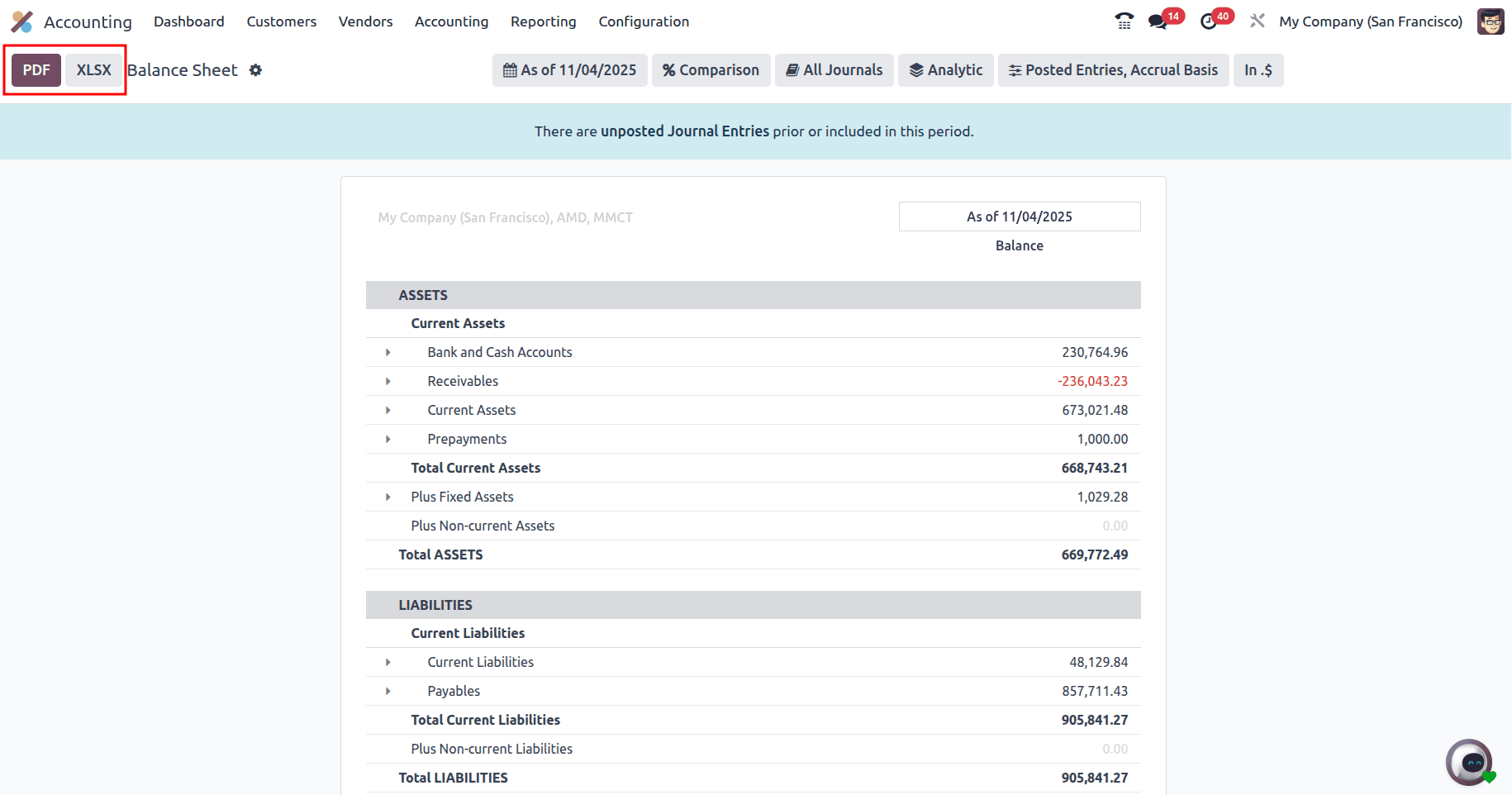

Balance Sheet

The Balance Sheet report provides a snapshot of an organization’s Assets, Liabilities, and Equity at a specific point in time. Odoo 18 also offers extra features that allow users to customize these reports as needed. The balance sheet for that day can be generated by clicking the calendar icon on the screen and choosing a date.

The Comparison tool lets you compare reports with a previous time period. If you want to view the balance sheet for a specific journal, you can select it using the journals option. Odoo 18 also provides advanced filters to help you sort and display data based on your preferences. Any report lines with a value of zero can be hidden using the Hide lines at '0' filter.

The 'i' button appears at the end of each reporting line once developer mode is enabled. Clicking this button shows the formula used to calculate that specific line.

You can also export the report by selecting PDF or XLSX. The settings Icon contains an option for Copy To Documents. A pop-up window similar to the one below will appear when you click on it.

In the Export to section, you can choose the document format for the file. XLSX or PDF are both acceptable. The name of the generated document will appear in the window. Click the Export button after choosing the destination folder for this document file.

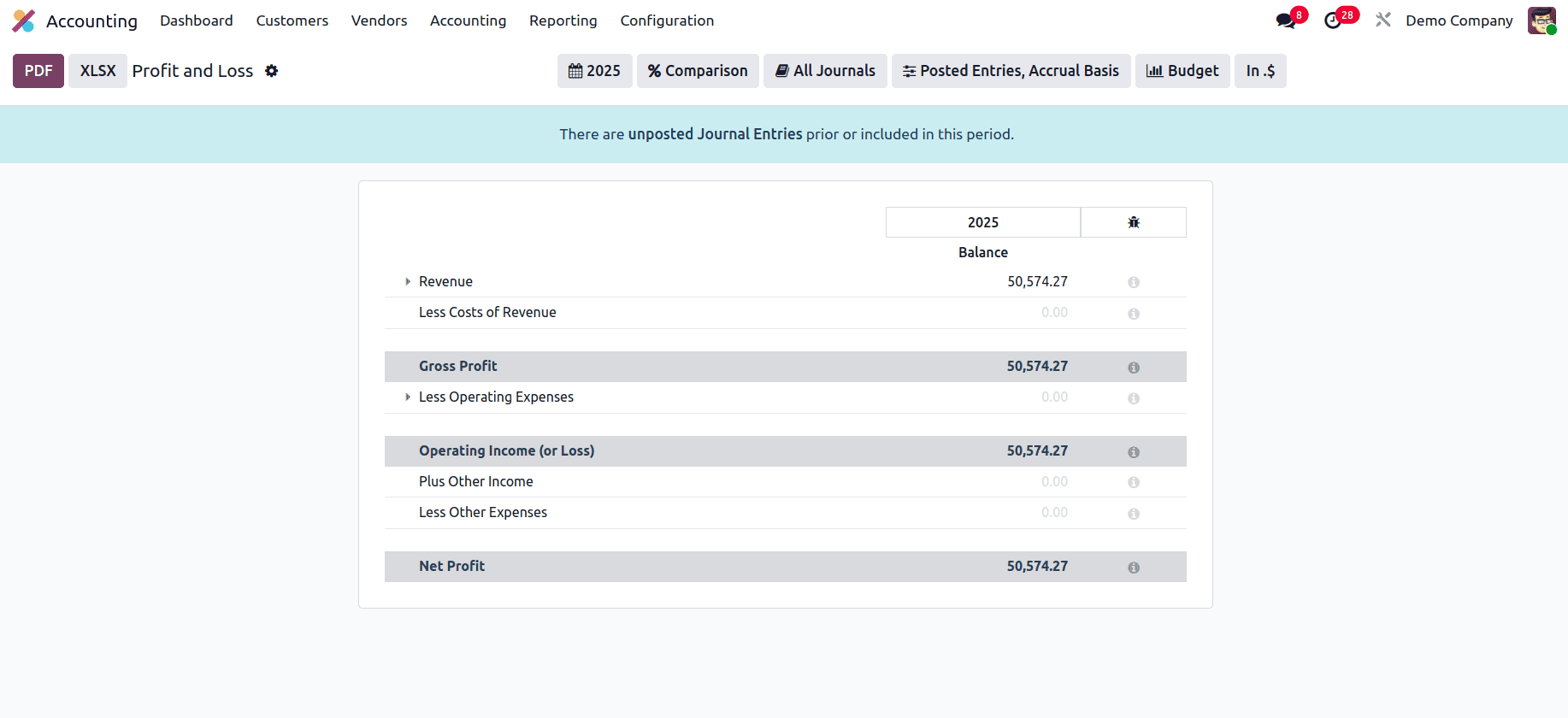

Profit & Loss

One of the most important parts of financial reporting is the Income Statement. In the Profit & Loss report, you can see the organization's Revenue, Expenses, Profit, and Loss for a specific time period. Unlike the Balance Sheet, the ending balance from a Profit & Loss report does not carry over to the next accounting period.

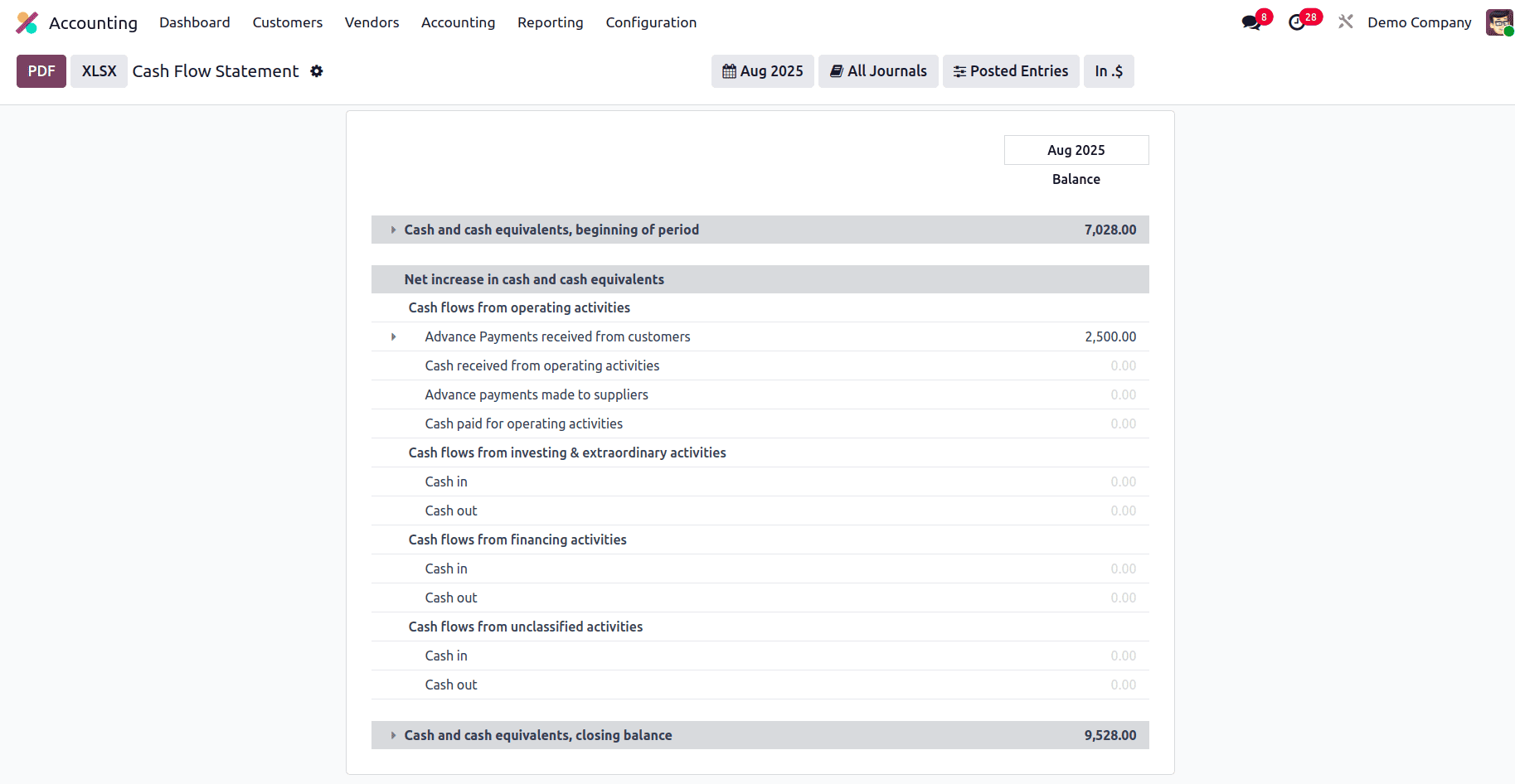

Cash Flow Statement

The Cash Flow Statement provides a report of all cash inflows and outflows within the organization. These reports are generated based on the accounts you've configured for the cash flow statement. The statement breaks down cash movements into three main categories: operating activities, investing activities, financing activities and unclassified activities.

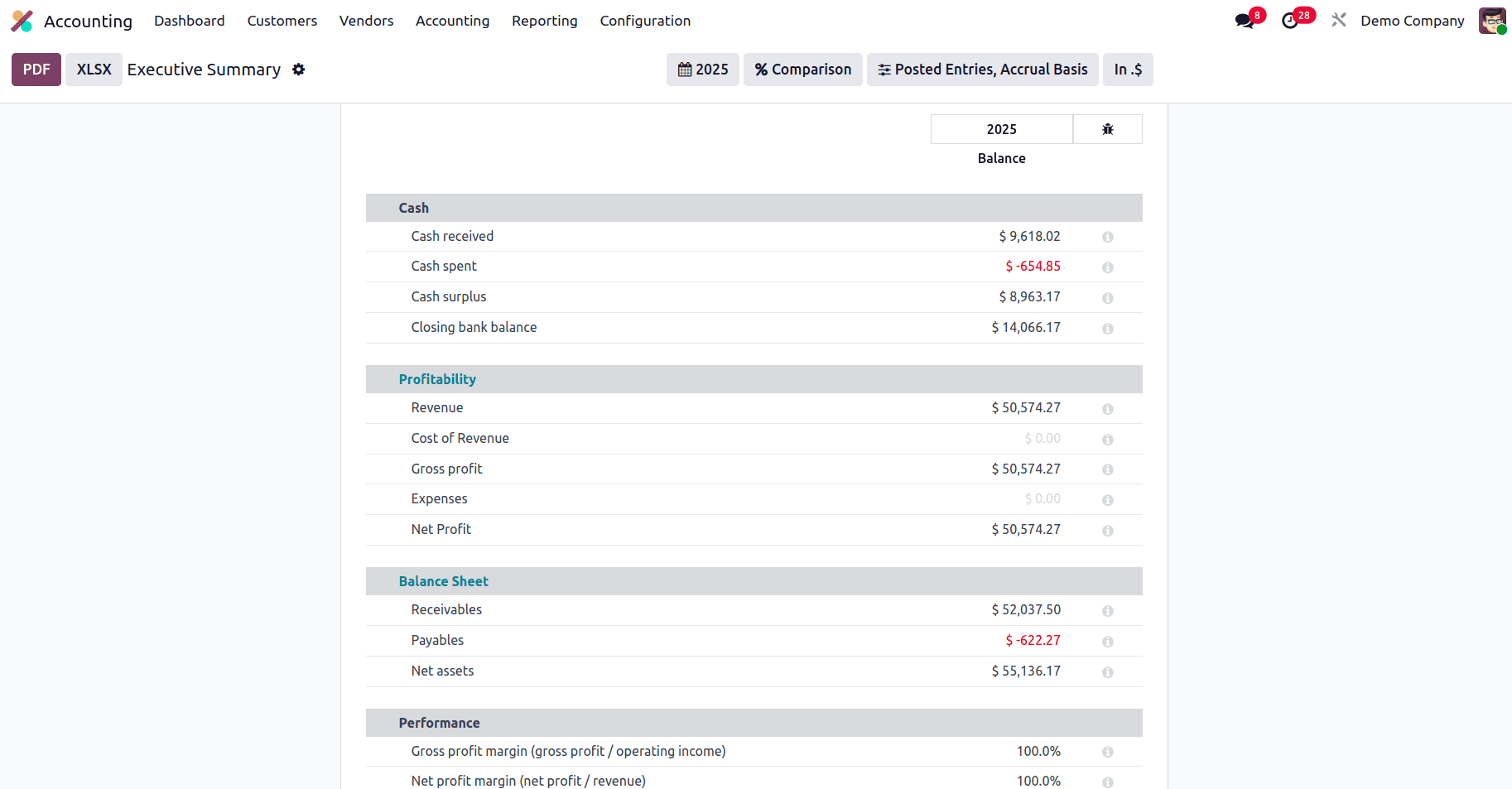

Executive Summary

The Executive Summary, available under the Reporting menu, gives a concise overview of cash flow, profitability, and balance sheet reports for a selected time period. Important measures like Return on Investment, Gross Profit Margin, and Net Profit Margin are included under the Performance tab. In the Position tab, you can find details like Average Debtor Days, Average Creditor Days, Short-Term Cash Forecast, and the ratio of Current Assets to Liabilities.

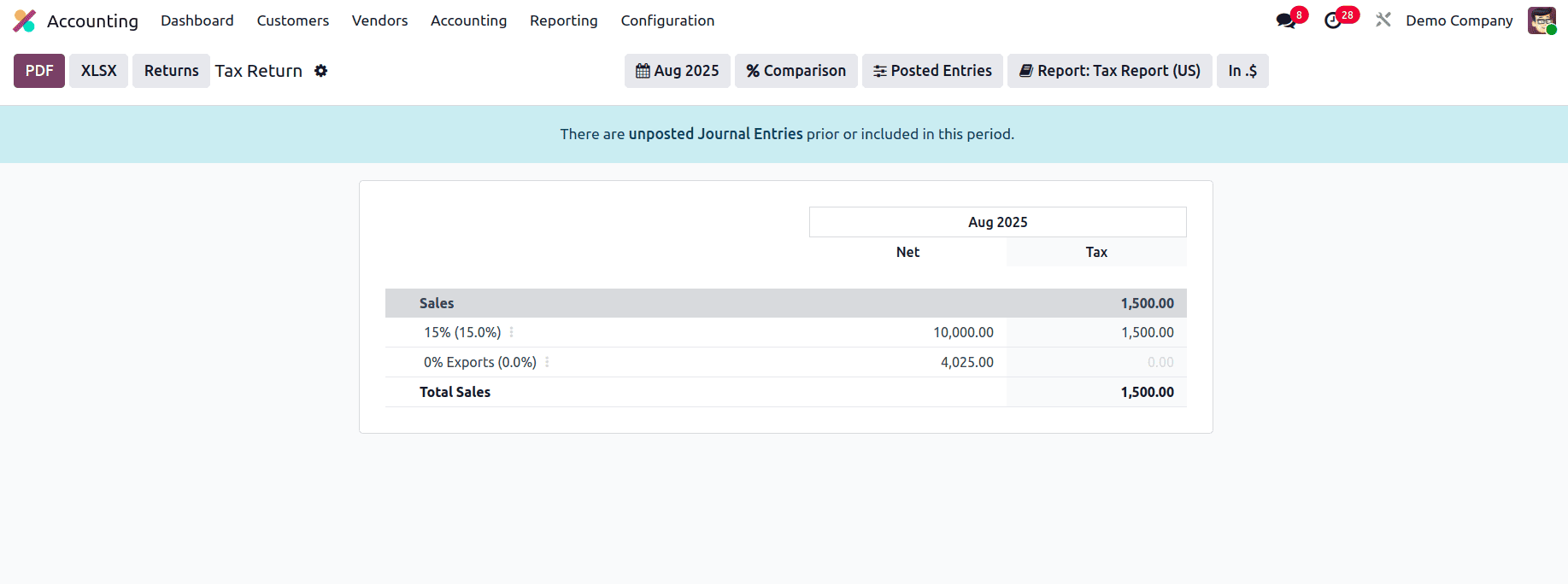

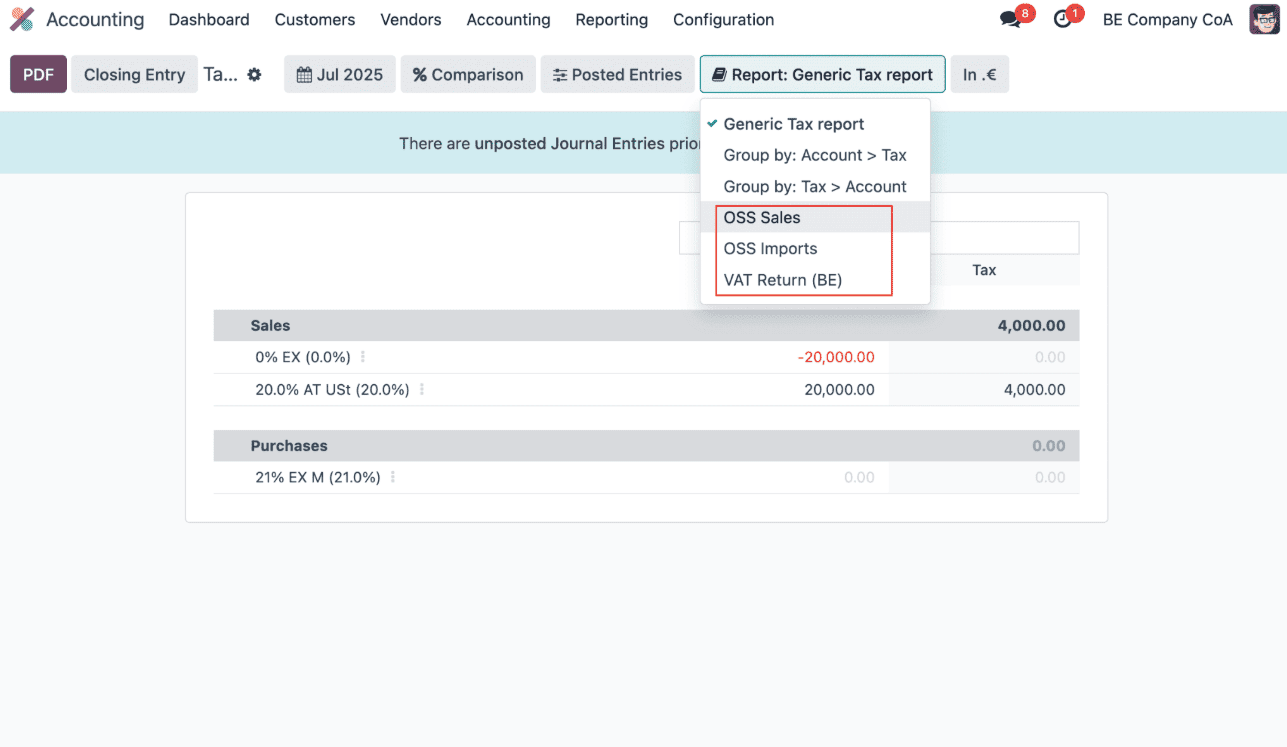

Tax Returns

The Tax Reports section, found under the Reporting menu, allows you to generate detailed reports on both sales and purchase taxes. Additionally, it allows you to submit tax returns for the chosen time frame.

EC Sales List

The EC Sales List report provides details of goods and services sold to VAT-registered customers within the European Union. Submitting this report to HMRC is required for all sales transactions made to EU customers who are registered for VAT.

The total, country code, VAT number, and amount associated with the EC Sales are provided in the report.

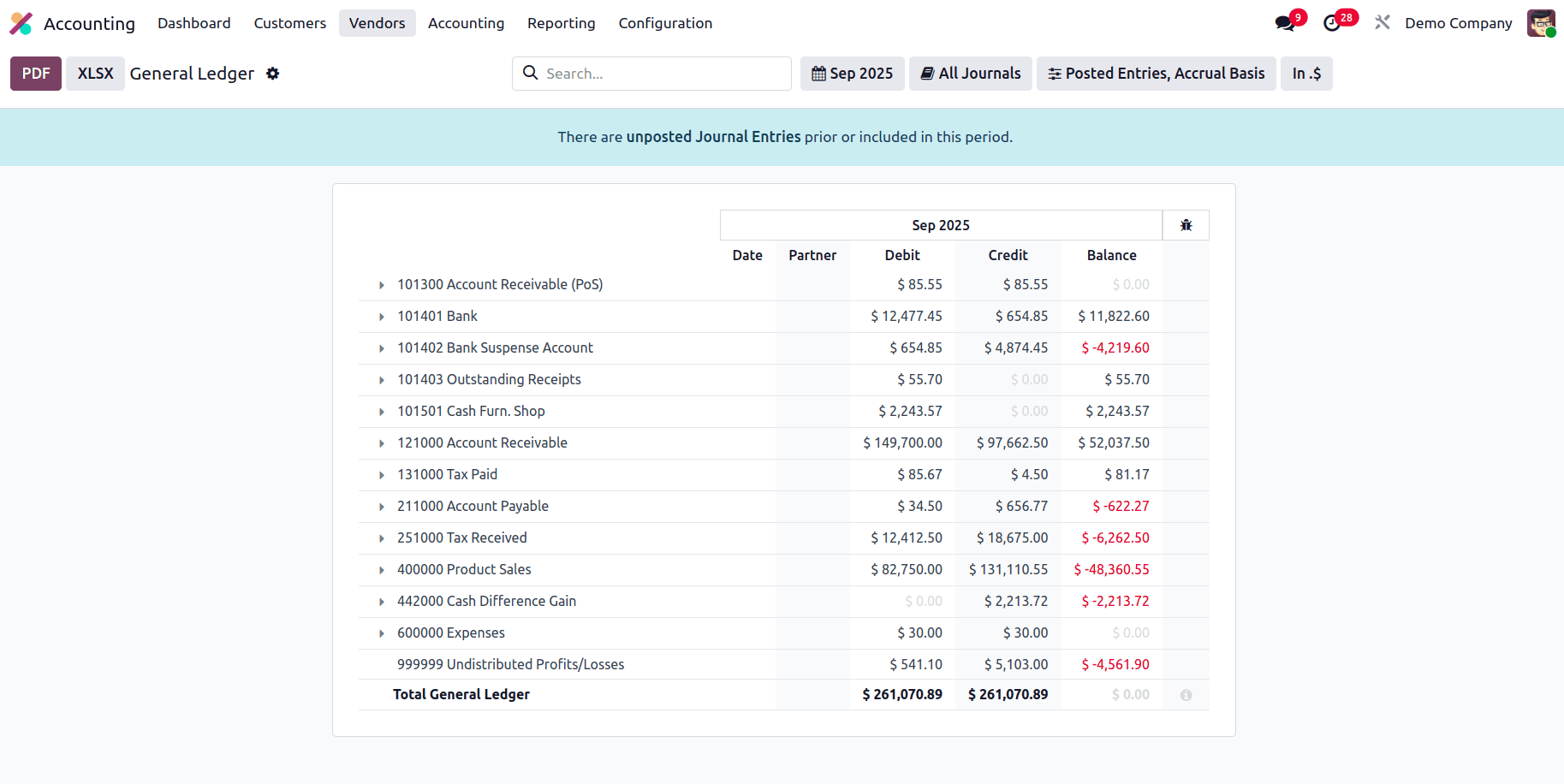

General Ledger

For a chosen time period, the General Ledger report offers a comprehensive record of all transactions from each account set up in your system. Details like Date, Description, Partner, Currency, Debit, Credit, and Balance are all viewable for each account. It serves as a comprehensive record of your organization’s financial activities throughout the fiscal year.

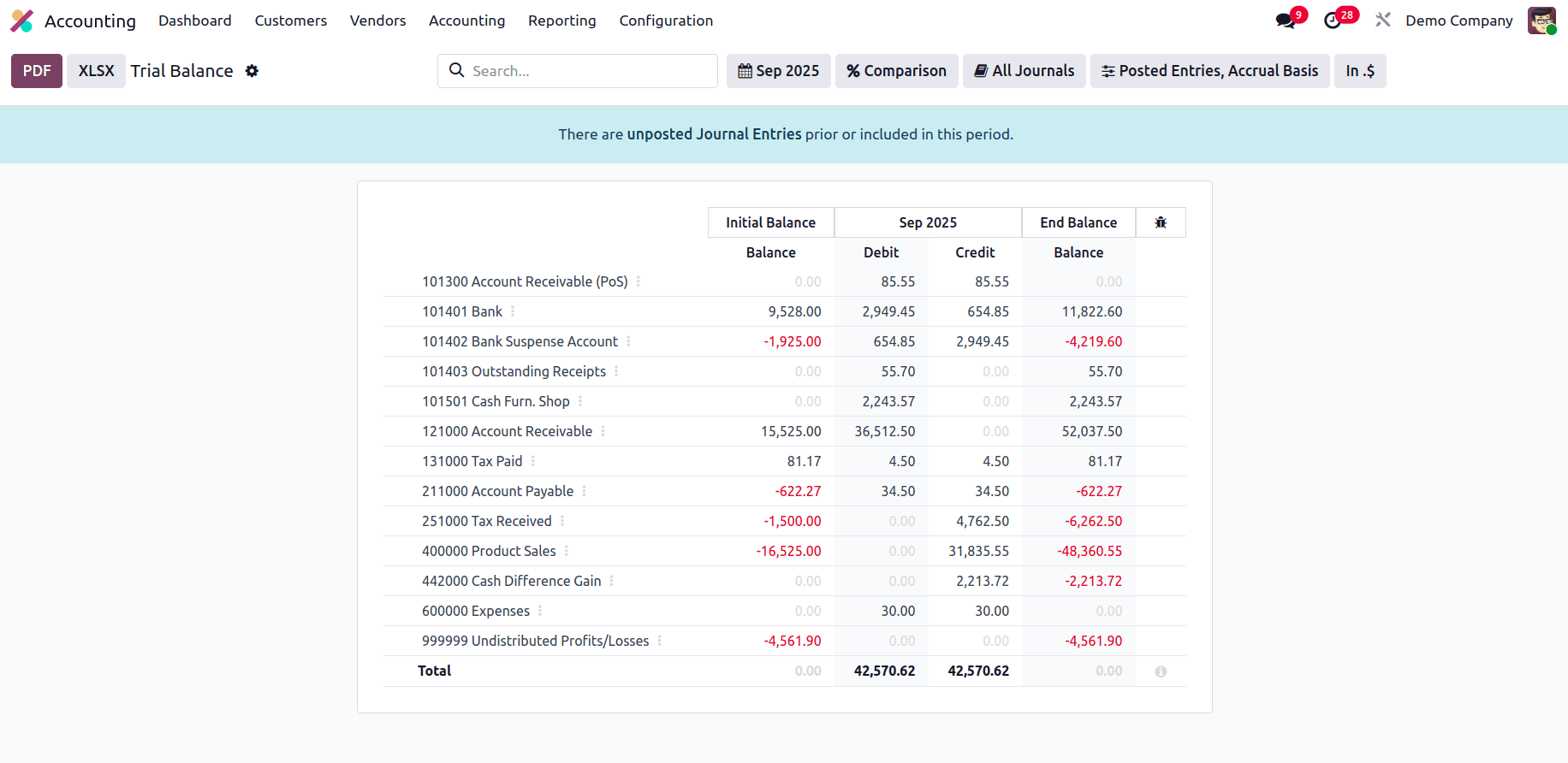

Trial Balance

A trial balance is an accounting report that summarizes the results of all journal entries recorded across various journals. It is essential to the auditing procedure. The initial balance, transactions for the chosen month or year, and closing balance are among the debit and credit data included in the report.

Closing Balance = (Debit - Credit) + Opening Balance

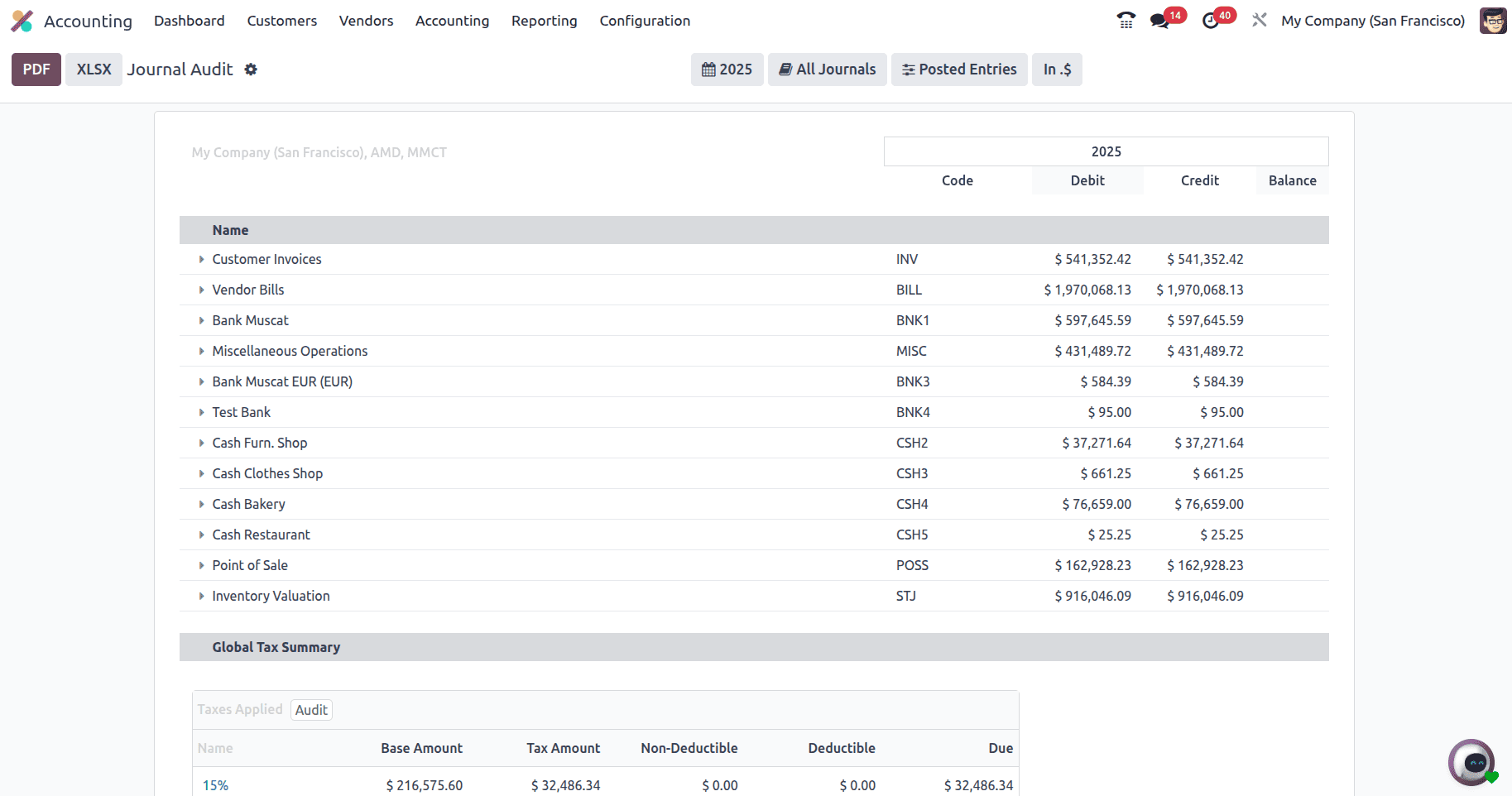

Journal Audit

The Journal Reports platform allows you to generate accounting reports for the various journals set up within your Accounting module. A report of Global Tax Summary provides the report of available taxes of the provided period.

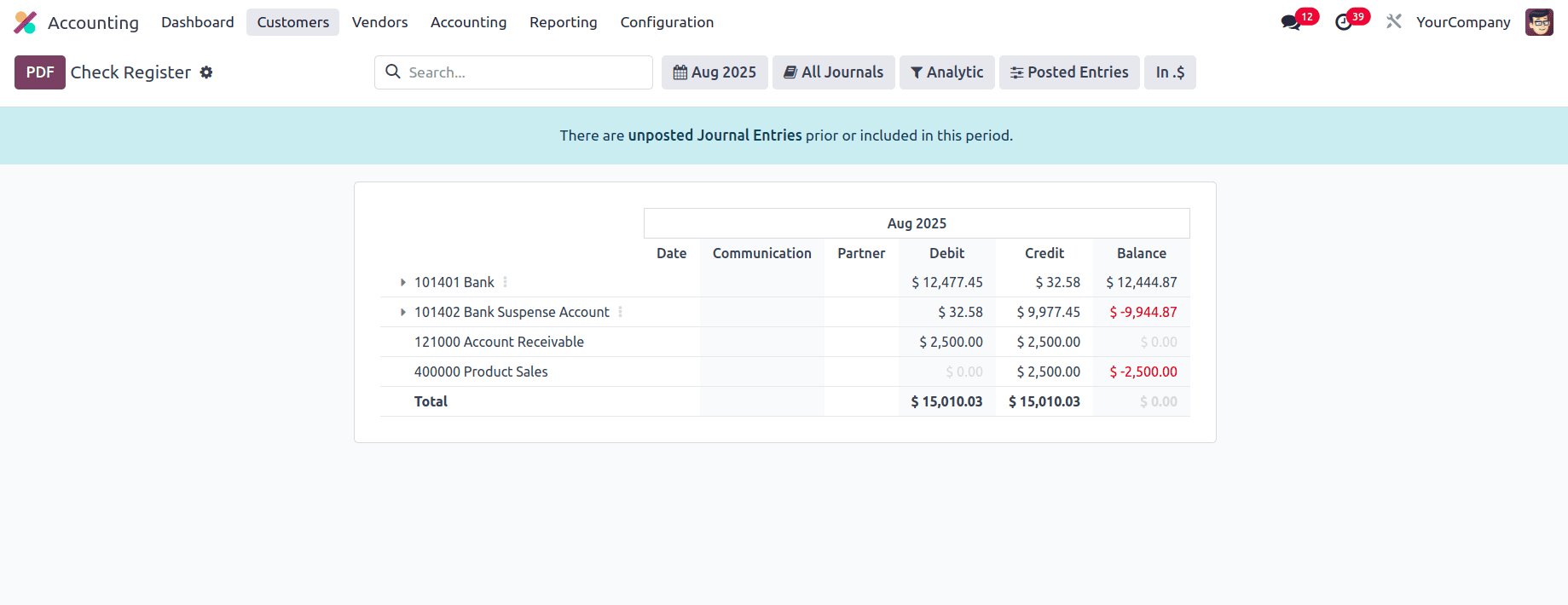

Check Register

This report details all debit and credit transactions across relevant accounts for the provided period. Each line reflects movements associated with checks, transfers, income, expenses, or adjustments.

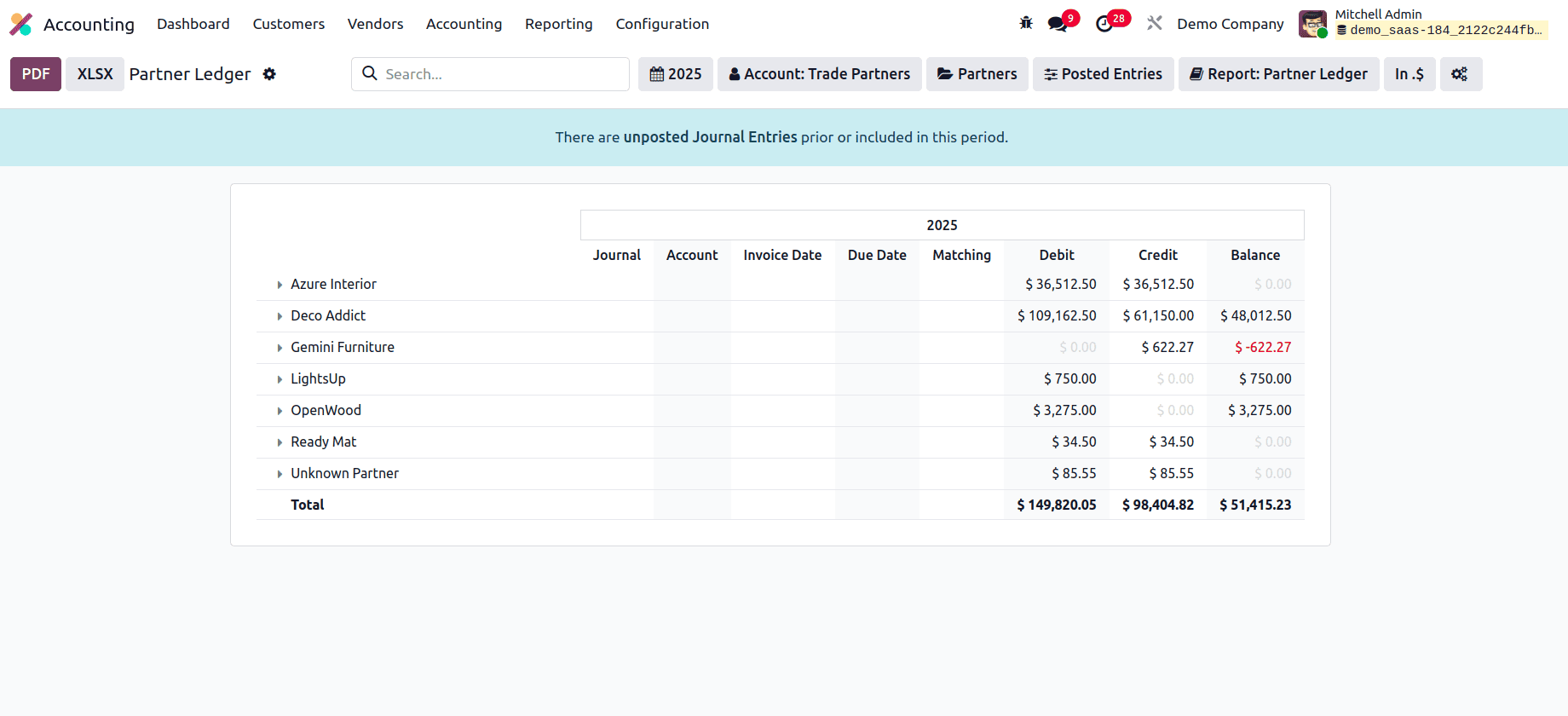

Partner Ledger

The Partner Ledger report shows partners’ receivable and payable journal entries for a selected period, including details like journal, account, reference, due date, matching number, debit, credit, amount, currency, and balance.

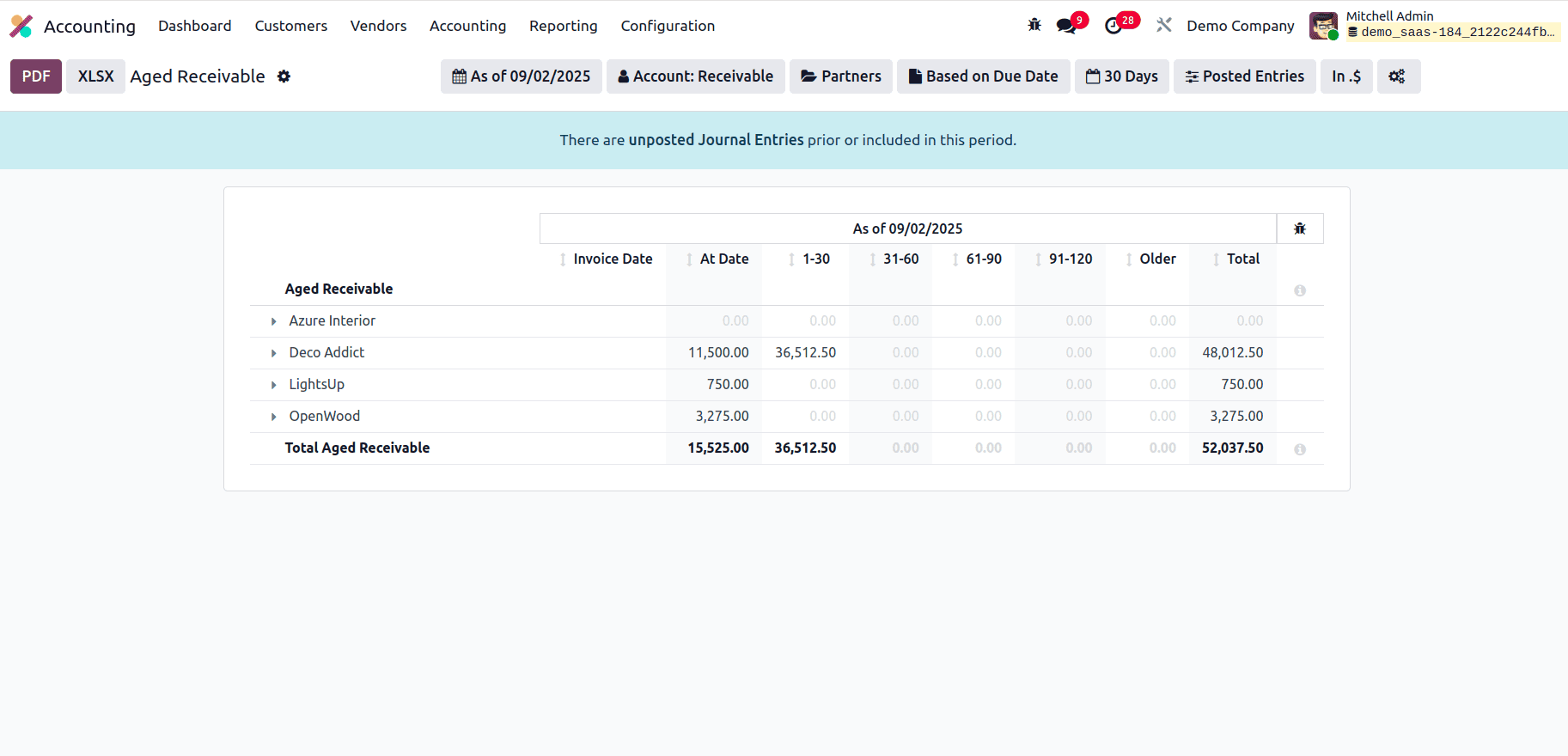

Aged Receivable

The Aged Receivable report shows outstanding customer invoices as of a particular period. If payments exceed the due date per terms, they appear here. The report includes invoice date, aging details, and total. Here we can see the 1- 30, 31- 60, 61 - 30 at the top in each column we can see the amount that has been due in the given number of days.

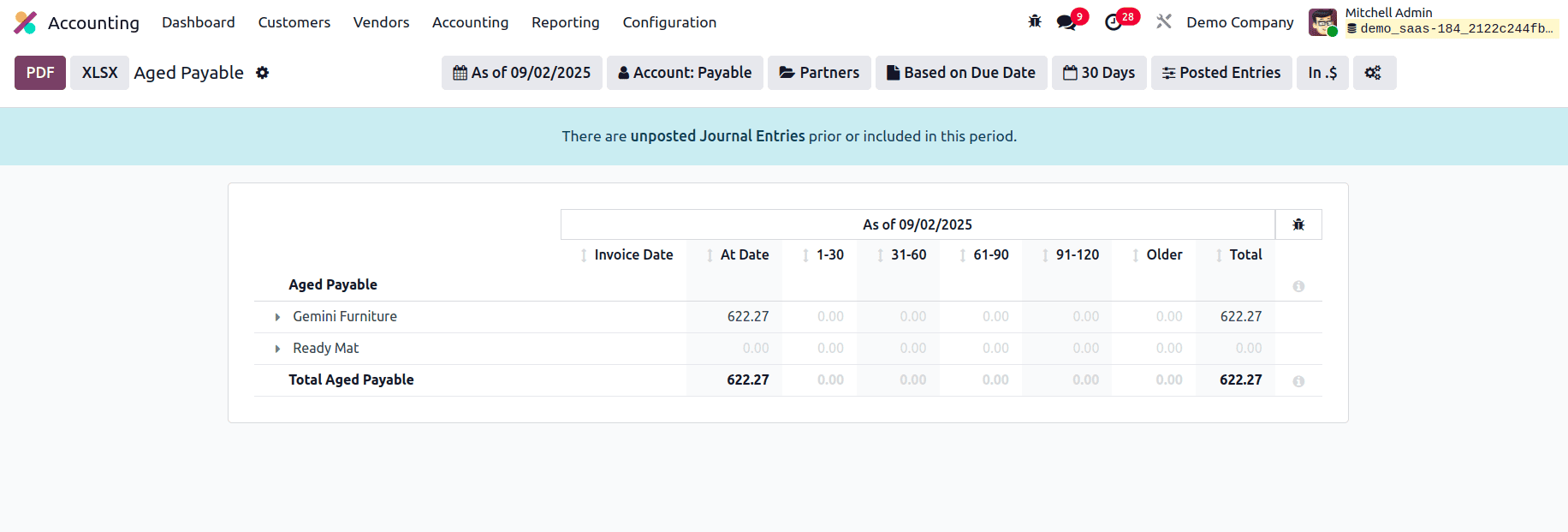

Aged Payable

The Aged payable report shows outstanding vendor bills as of a particular period. If payments exceed the due date per terms, they appear here. The report is the same as the receivables. Similarly, for the payables, we can see the 1- 30, 31- 60, 61 - 30 at the top in each column we can see the amount that has been due to be paid in the given number of days.

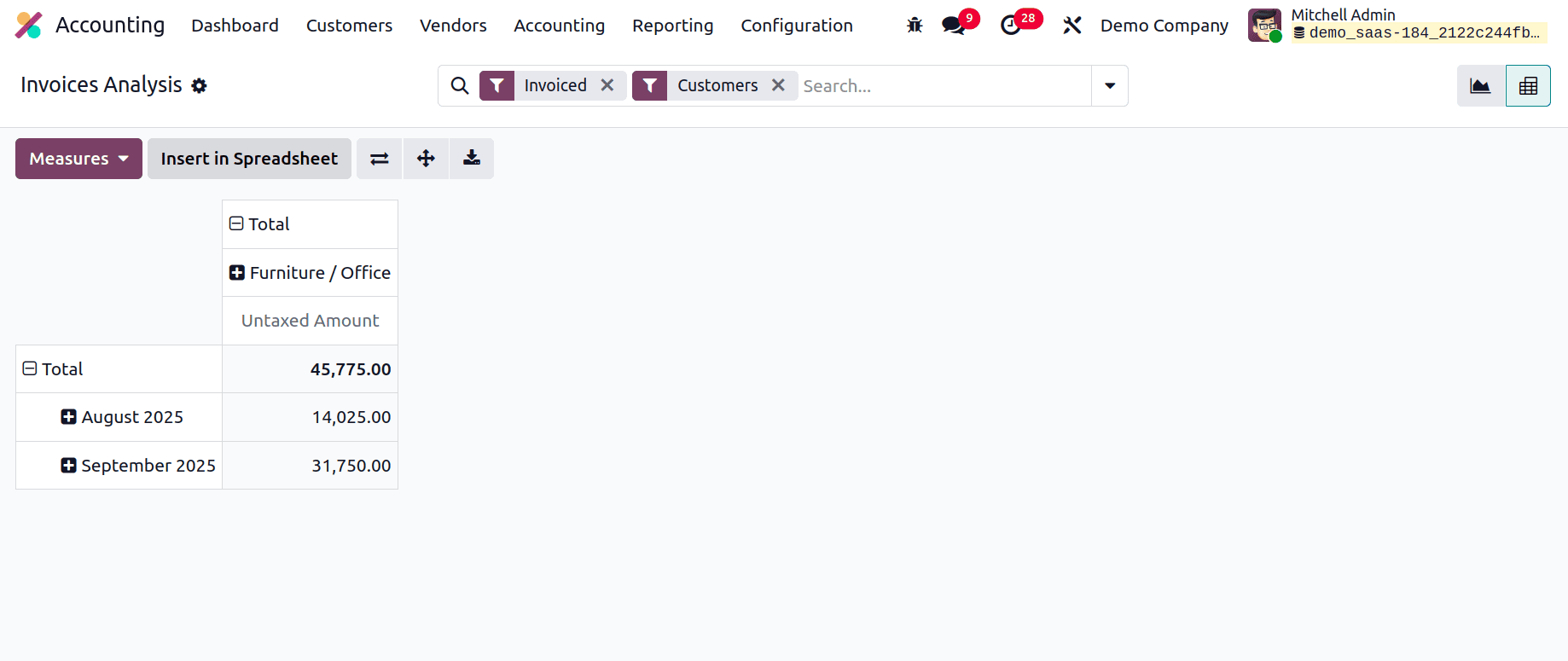

Invoice Analysis

The Invoice Analysis report, accessible from the Reporting menu, provides invoice data for a selected accounting period in either graph or pivot table format. It displays key measures like Average Price, Product Quantity, Total, Untaxed Total, and Count. Built-in filters include My Invoice, To Invoice, Customer/Vendor, Invoice Type, Invoice Date, and Due Date. You can also create custom filters and group data by salesperson, sales team, partner, product category, status, company, and dates for detailed analysis.

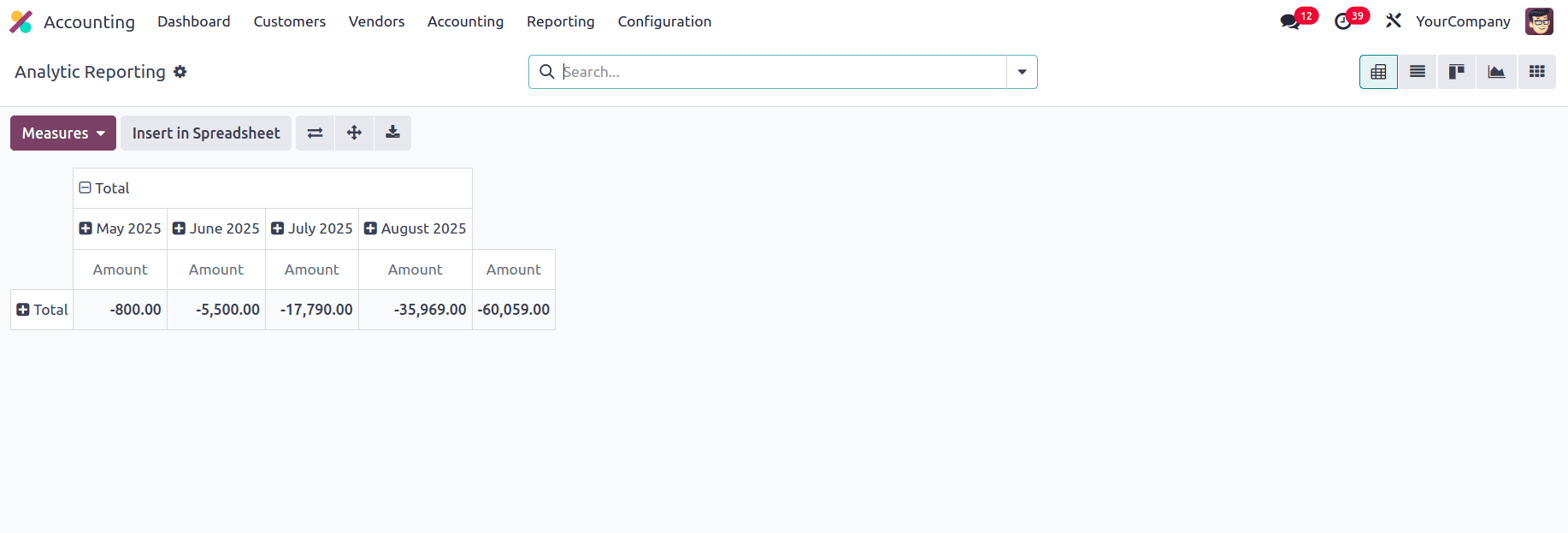

Analytic Report

An analytical accounting report helps analyze, interpret, and generate reports based on the company's Analytic account. It supports reinvoicing and provides cost management insights using the chart of accounts.

You can have reports based on various parameters. Click on ‘+’ near the total in order to get a dropdown menu and select the parameters based on it.

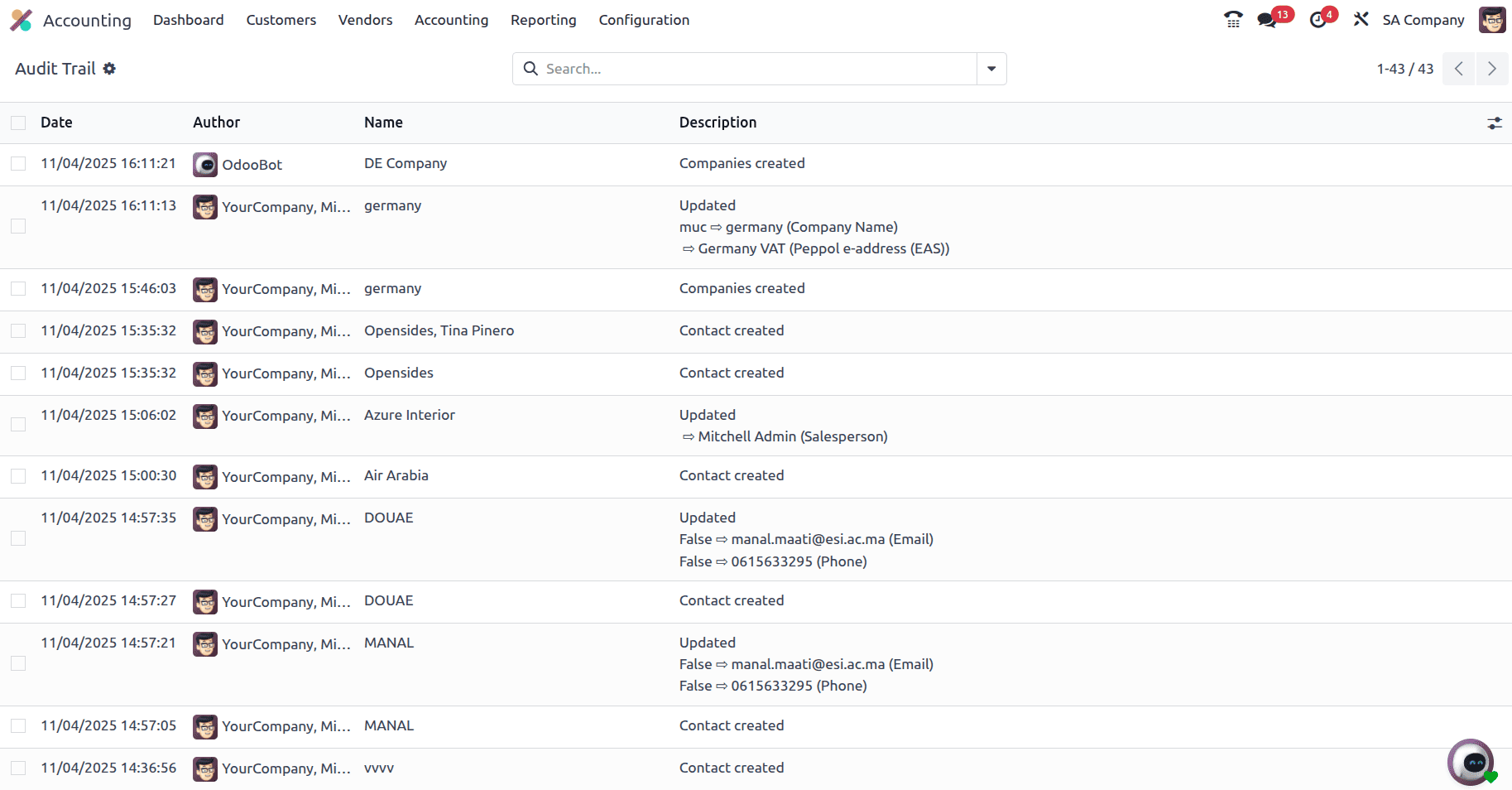

Audit Trail

In Odoo 18, an audit trail tracks changes to important records, showing who made changes, what was changed, and when. It helps ensure data integrity and supports accountability and compliance.

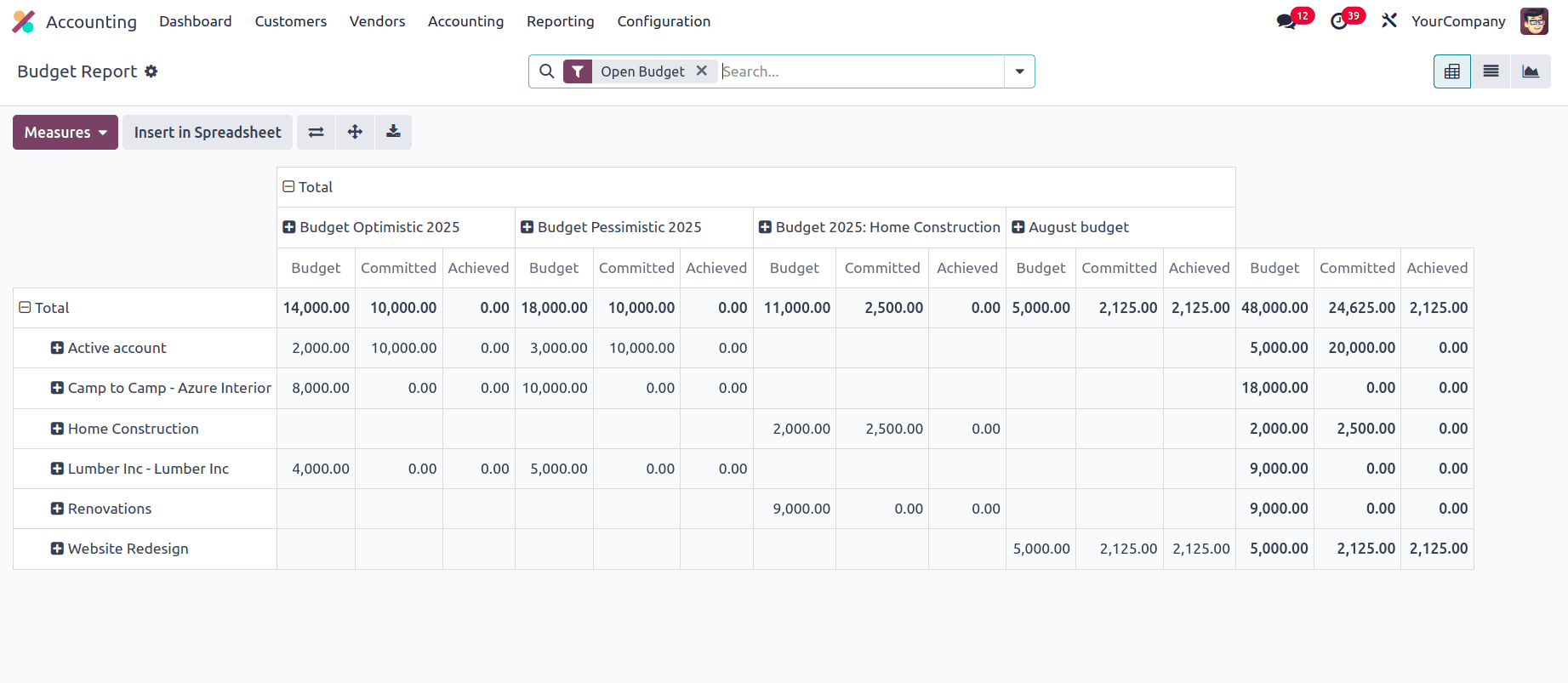

Budget Report

In Odoo 18, the Budget Report offers a comprehensive overview of all created analytic budgets. Displays key details such as Budgeted, Achieved, and Committed amounts for each budget. You can further customize the report by selecting Total on the left side of the table and adjusting metrics using the Measures box at the top.

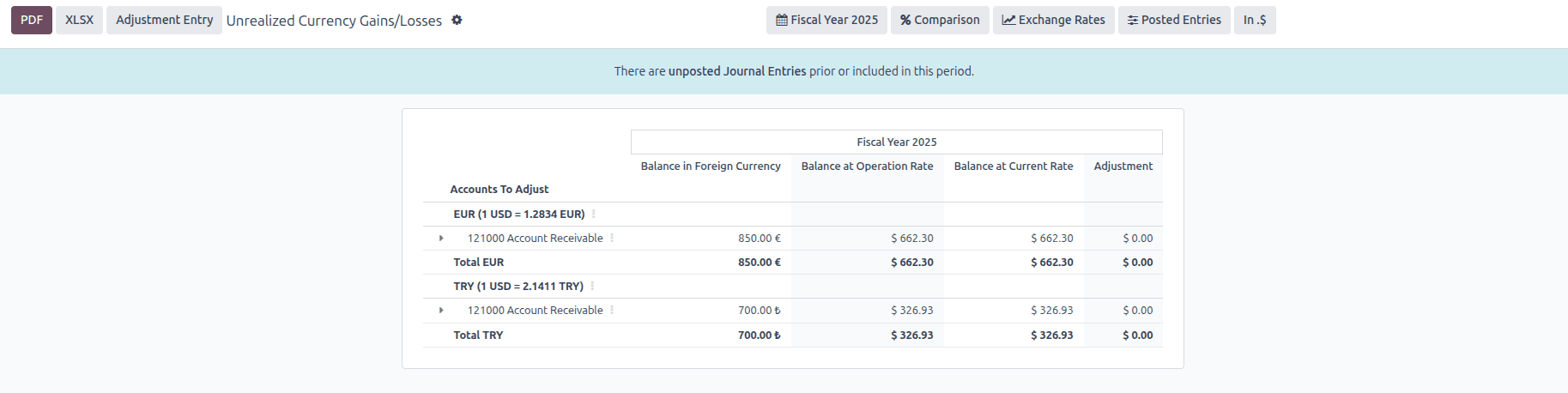

Unrealized Currency Gains/Loss

In the Unrealized Currency Gains/Losses section under the Reporting menu in Odoo 18, you can view a report of all foreign currency that was used to purchase/sell. The report is organized by the currency used and displays key details such as the Balance in Foreign Currency, Balance at Operation Rate, Balance at Current Rate, and the resulting Adjustment. You can apply the necessary adjustments directly by clicking the Adjustment Entry button.

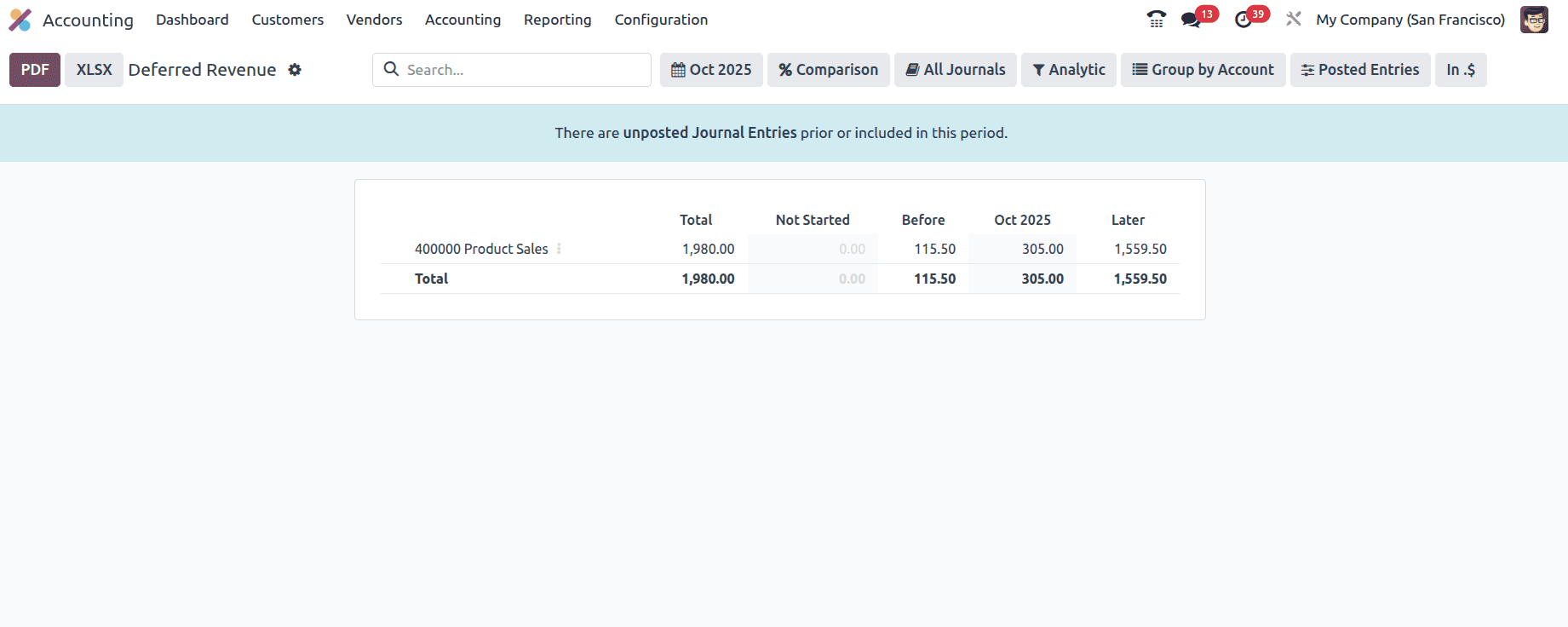

Deferred Revenue

In Odoo 18, the Deferred Revenue report tracks income that has been invoiced but not yet earned, spreading it over future periods. It ensures accurate revenue recognition according to accounting standards. It contains Total, the invoice to be received in the particular month, the amount received before, the amount to be received later. The recognized amount is the total amount received till that month.

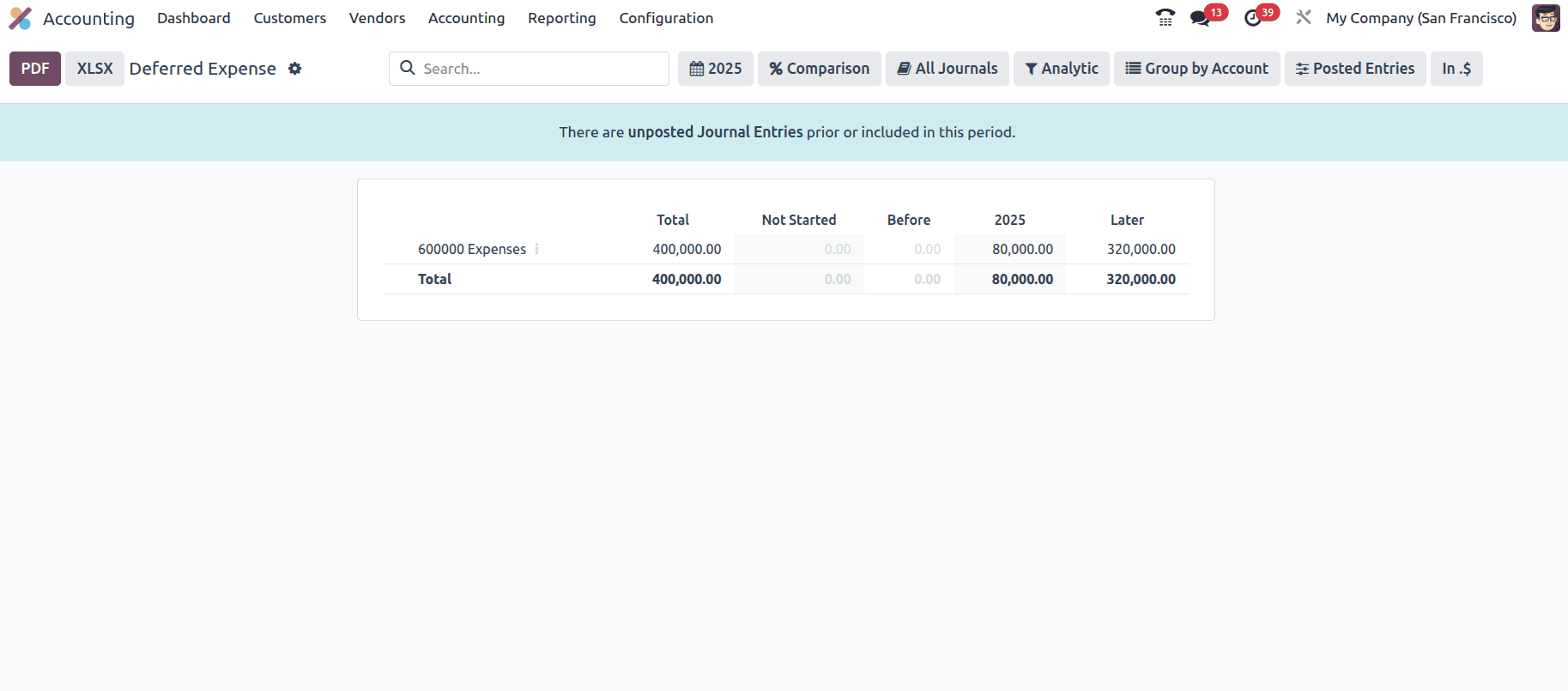

Deferred Expense

The report contents are similar to deferred revenue. It basically shows the income that has to be given to the vendors, spreading it over future periods.

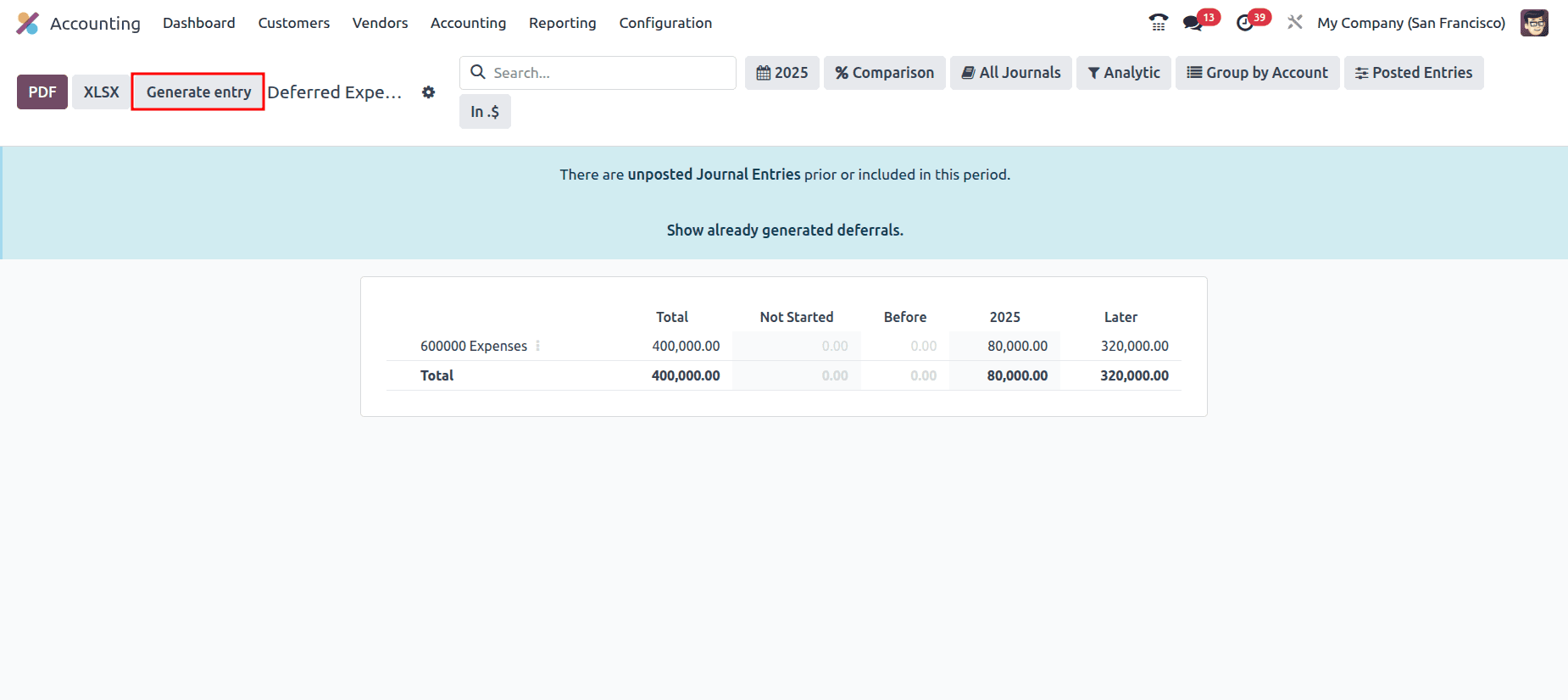

On setting the Generate Entries to Manually & Grouped in the settings menu. A Generate Entry tab appears, which on clicking would create the report manually.

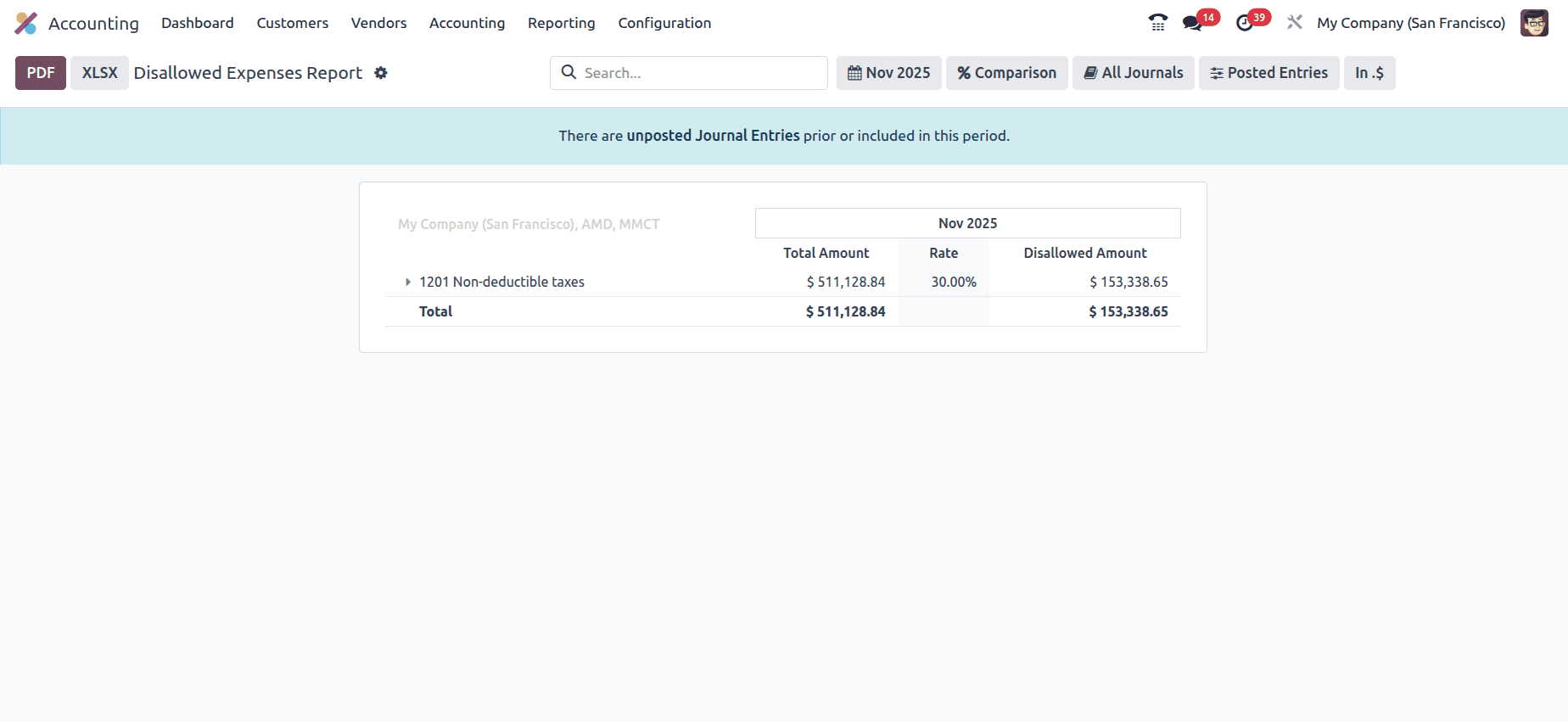

Disallowed Expense

In Odoo 18, the Disallowed Expense Report identifies expenses that are partially or fully non-deductible for tax purposes. It shows the total amount, disallowed rate, deductible amount, and helps ensure compliance with tax regulations by separating allowable and non-allowable expenses.

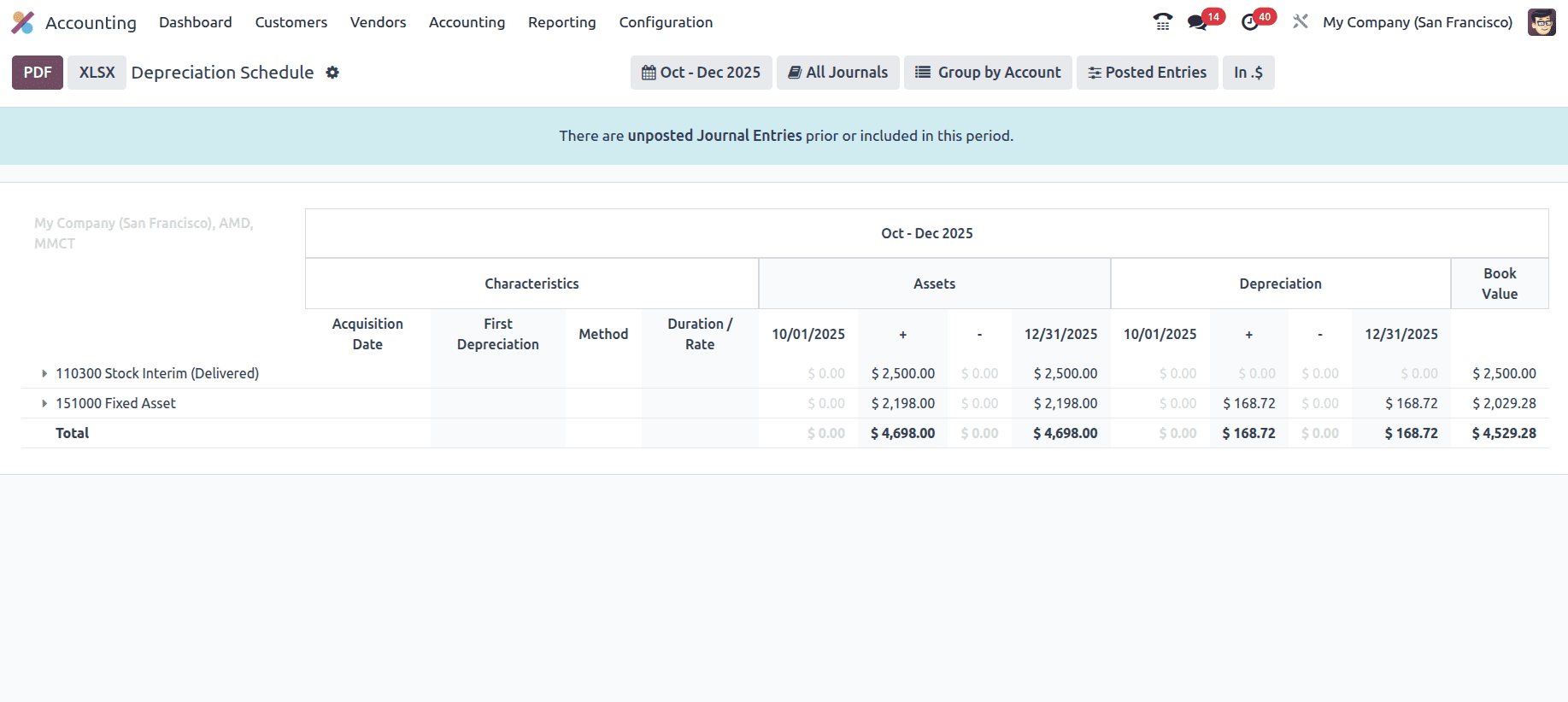

Depreciation Schedule

In Odoo 18, the Depreciation Schedule tracks how fixed assets lose value over time. It shows key details like acquisition date, depreciation method, duration, monthly depreciation entries, and the remaining book value, ensuring accurate asset accounting and compliance.

Characteristics refers to the asset’s details like acquisition date (when it was purchased), depreciation method, and duration/rate (over how many years it will depreciate).

Assets show the value of assets added or removed during the period.

Depreciation displays the decrease in asset value for the month, but since the asset was added late, no depreciation has occurred yet.

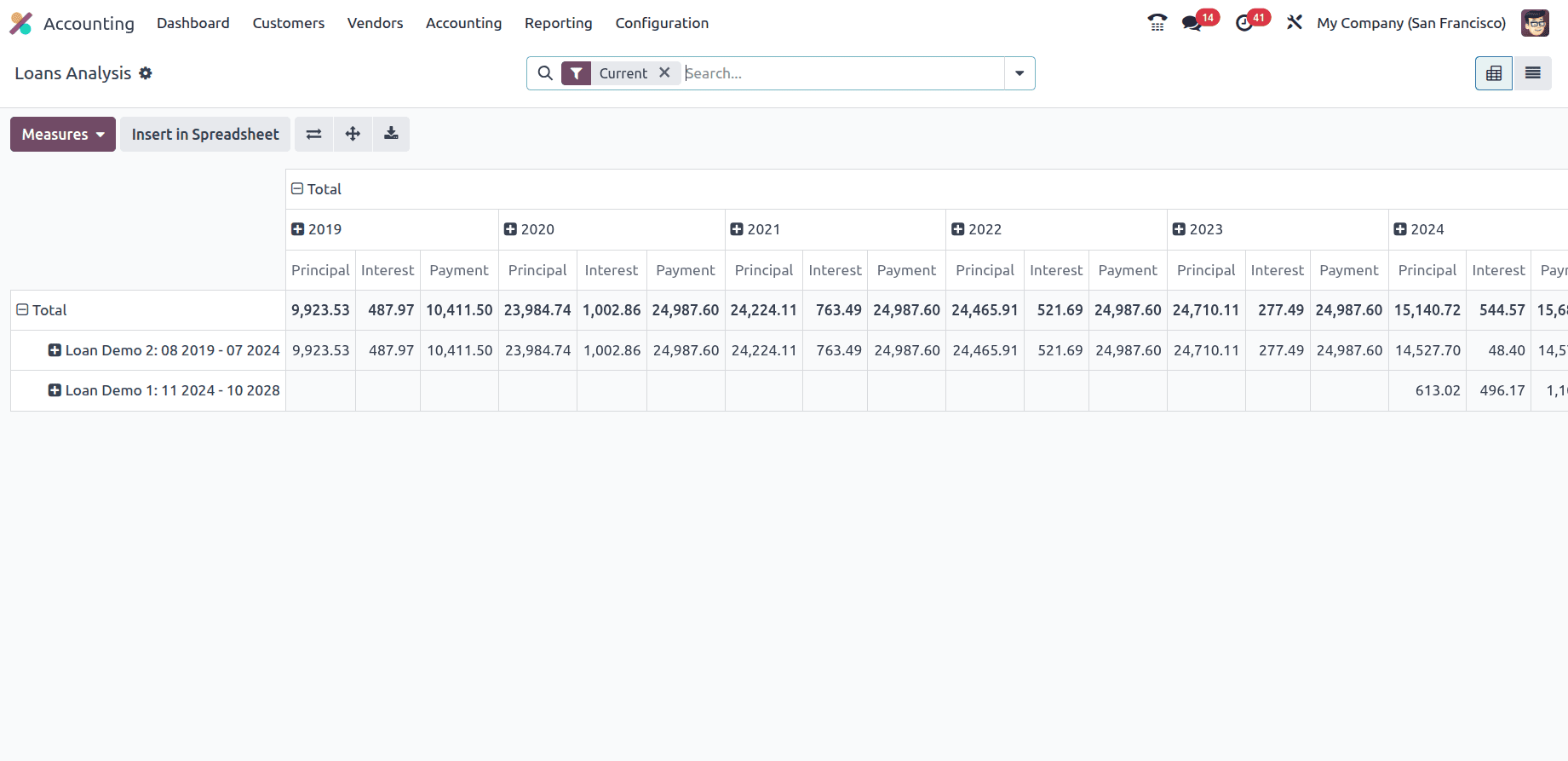

Loans Analysis

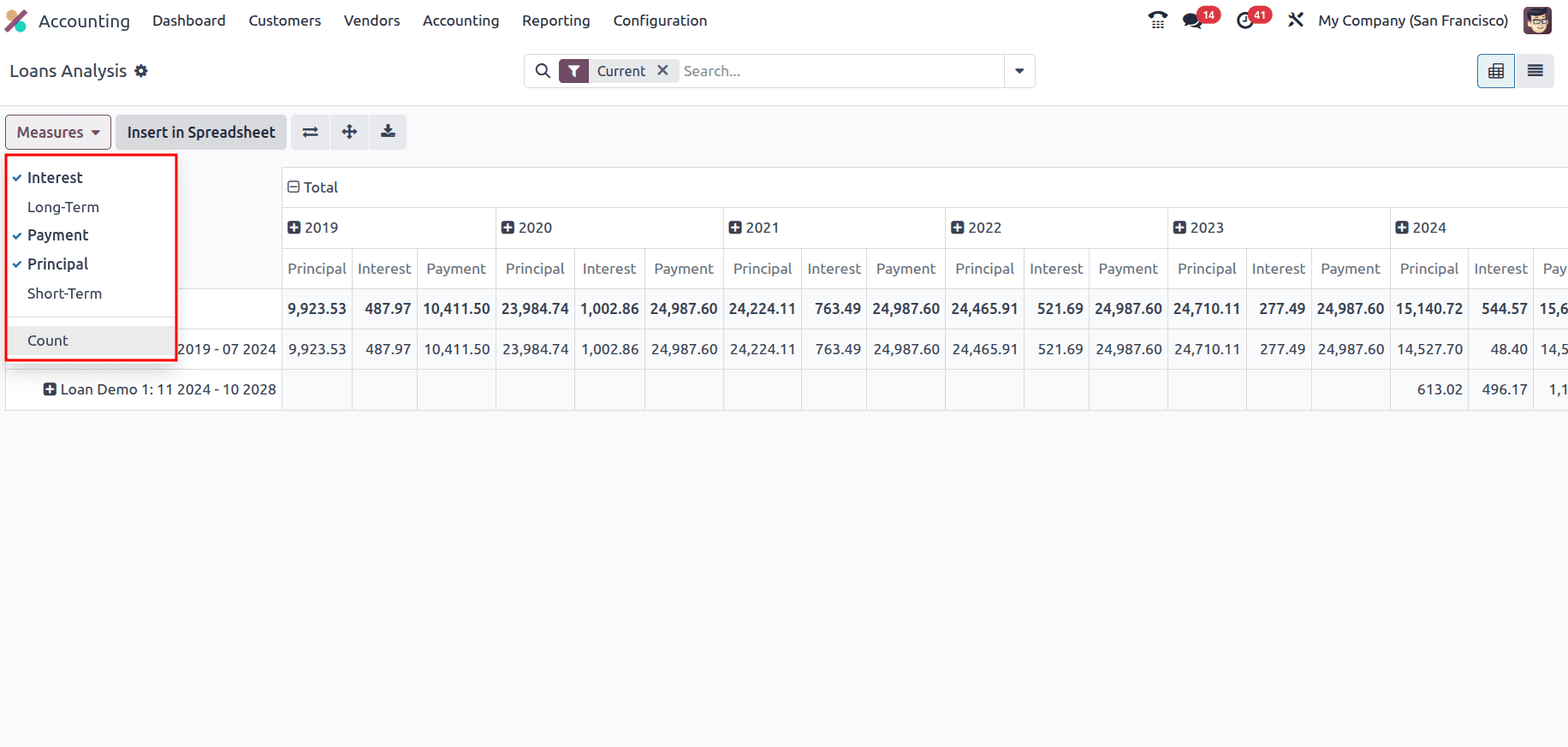

In Odoo 18, the Loans Analysis report provides a detailed view of all active employee or company loans, including Principal amount, Interest, Payment. It helps the accounting teams monitor and maintain financial accuracy.

You can add more parameters by clicking the Measures Tab.

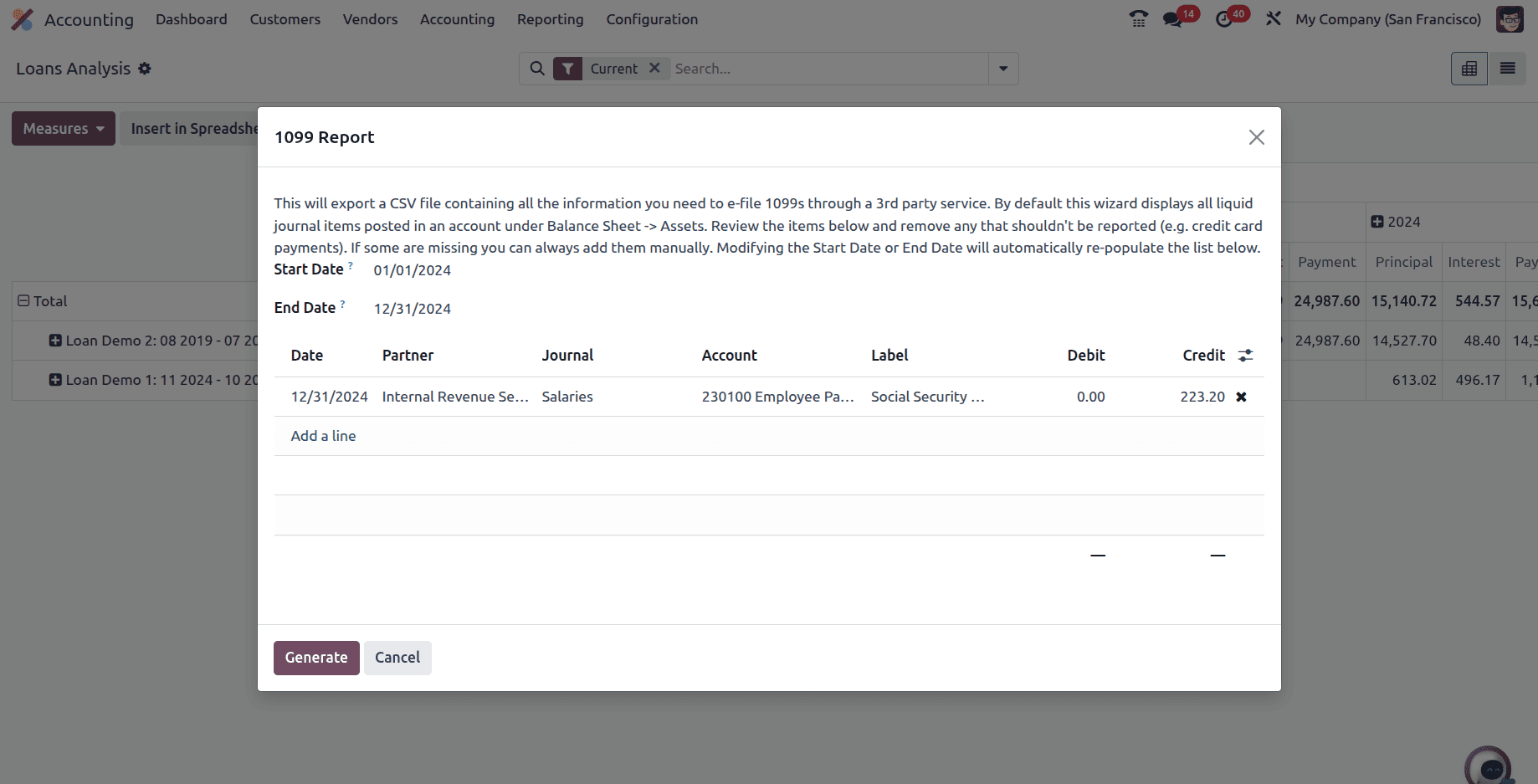

1099 Reports

In odoo 18, 1099 Reports creates a CSV file that contains all the required information for e-filing through a third-party provider. By default, a pop-up window appears displaying all liquid journal entries posted under Asset accounts on the balance sheet. You can review the entries in this window, remove any unnecessary ones, and manually add any missing information. To automatically populate the list of journal items, simply enter a Start Date and End Date in the appropriate fields. The list will display details such as Date, Partner, Journal, Account, Label, Debit, and Credit. Clicking the Generate button will produce a CSV file for the 1099 report.

Product Margin

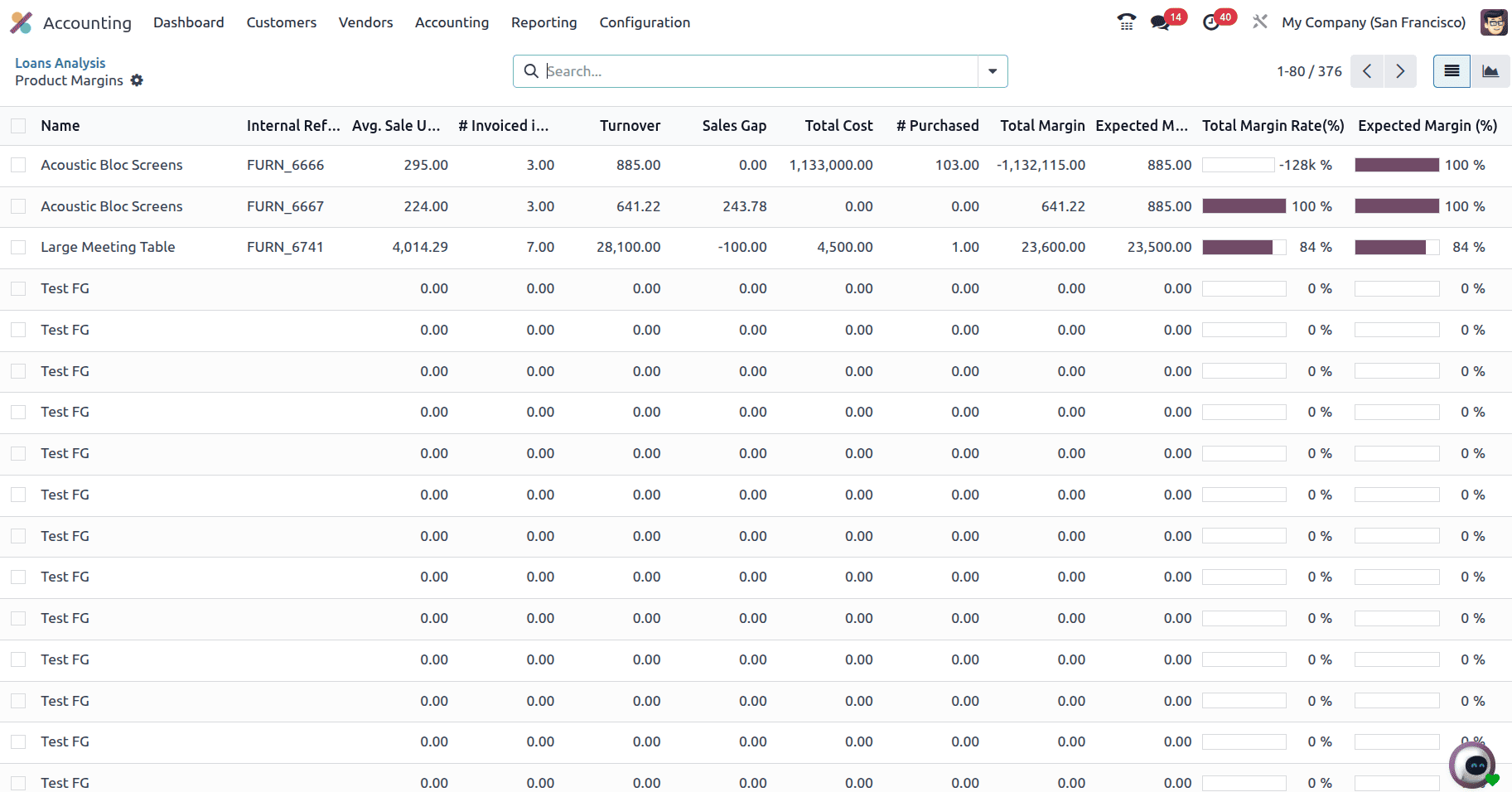

The Product Margin Report allows users to analyze detailed sales product performance. When selecting this report from the Reports menu, a popup window will appear. Users can specify the start and end dates, choose the invoice status for their invoices, and then click on Open Margin to generate the report.

The report will then be generated, displaying details such as the product name, internal reference, average sales, amount invoiced, turnover, sales gap, total cost, amount purchased, total margin, expected margin, total margin rate, and the percentage of expected margin.

The Financial Statement feature in the Odoo 18 Accounting Module provides businesses with a clear and structured view of their financial health. By offering ready-to-use reports such as the Balance Sheet, Profit and Loss, and Cash Flow Statement, Odoo ensures decision-makers have real-time insights into revenues, expenses, assets, and liabilities. Its flexibility to customize reporting layouts, apply filters, and drill down into detailed transactions makes it a powerful tool for both accountants and business owners. With these capabilities, Odoo 18 simplifies compliance, enhances transparency, and empowers organizations to make informed financial decisions with confidence.

To read more about An Overview of Odoo 18 Accounting Reports, refer to our blog An Overview of Odoo 18 Accounting Reports.