In any retail business, tax management is a vital part of smooth operations. Odoo 18 Point of Sale (POS) provides a simple yet powerful way to handle taxes. By default, you can configure standard tax rates that automatically apply to products during sales. This ensures accuracy in billing and compliance with tax regulations, especially for businesses that only deal with a single jurisdiction or a fixed rate.

This blog will cover both Default Taxes and Flexible Taxes in POS.

- Default Taxes are the standard tax rates that automatically apply to products during sales.

- Flexible Taxes allow you to dynamically remap or adjust tax rates based on fiscal positions and business requirements.

By understanding both, businesses can manage simple fixed-rate scenarios as well as more complex tax structures with ease.

Default Taxes

Odoo allows you to configure a Default Sales Tax that applies across products in the POS. This tax will be added automatically when a product is sold, unless a different tax is manually assigned at the product level.

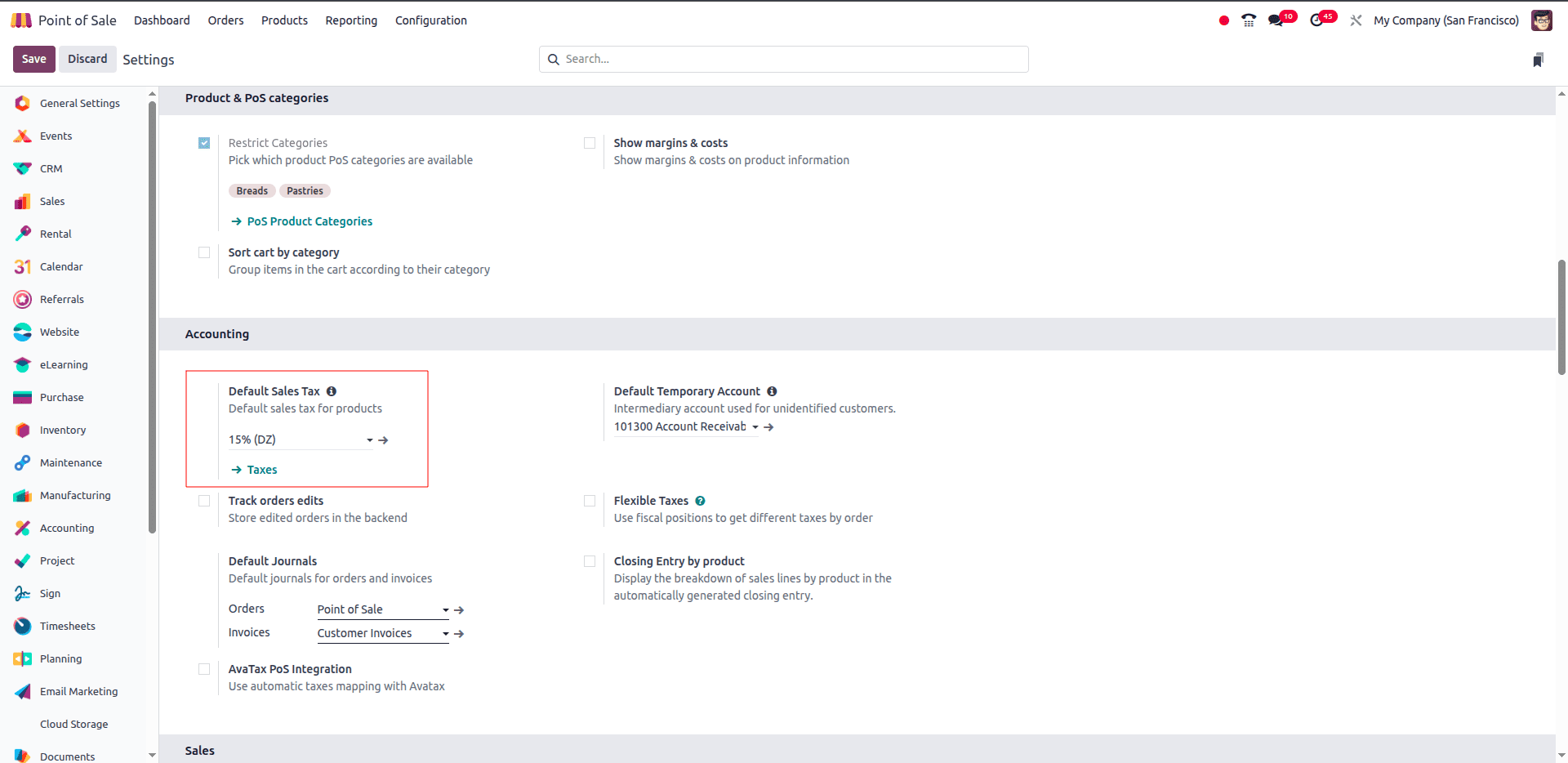

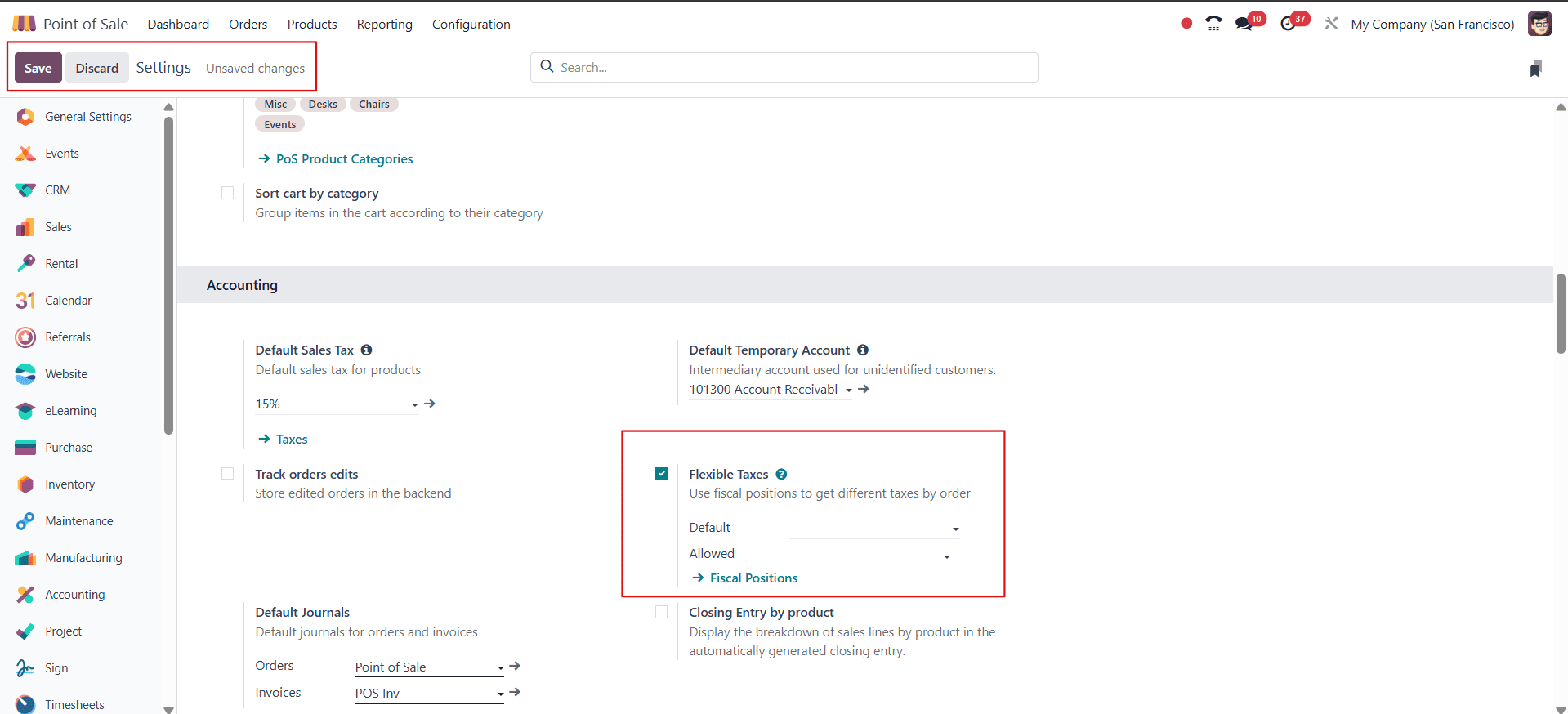

In the Point of Sale > Settings > Accounting section, you can configure the Default Sales Tax for all products.

For example, in the example above, the default tax has been set to 15% (DZ). This means that whenever a product is sold through the POS, a 15% tax will automatically be applied unless specified otherwise.

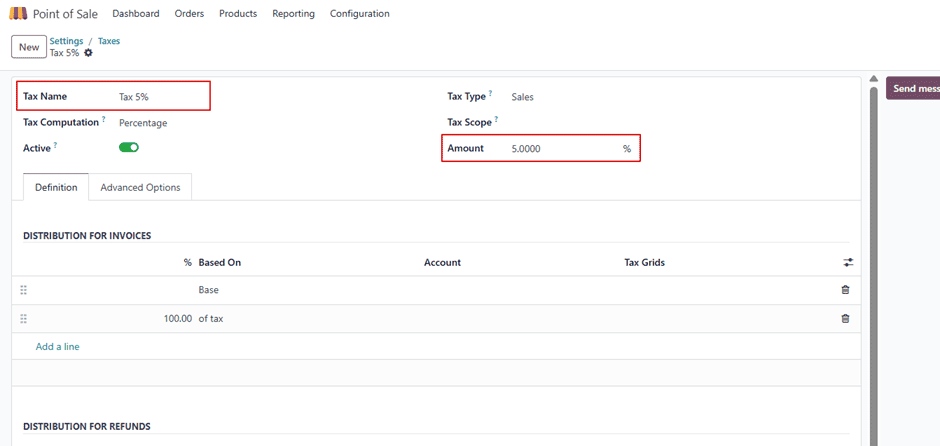

If you want to define a new tax rate, click on the Taxes and click New. Here, you can:

- Enter the Tax Name (e.g., Tax 5%).

- Select the Tax Type as Sales.

- Define the Amount (e.g., 5%).

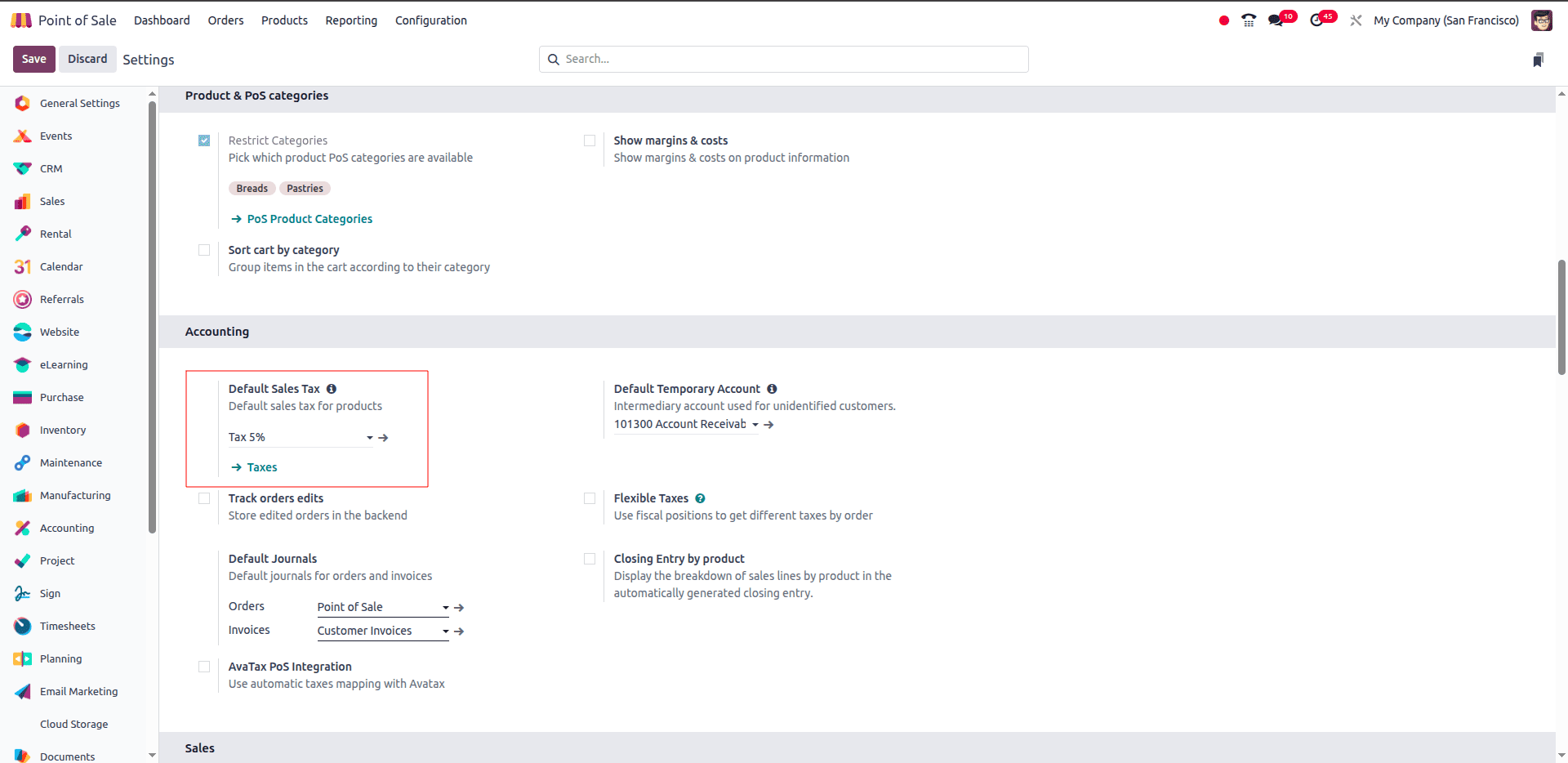

Once you have created the required tax, you can assign it as the default in the POS Settings > Default Sales Tax section.

For example, the example below shows Tax 5% selected as the default sales tax.

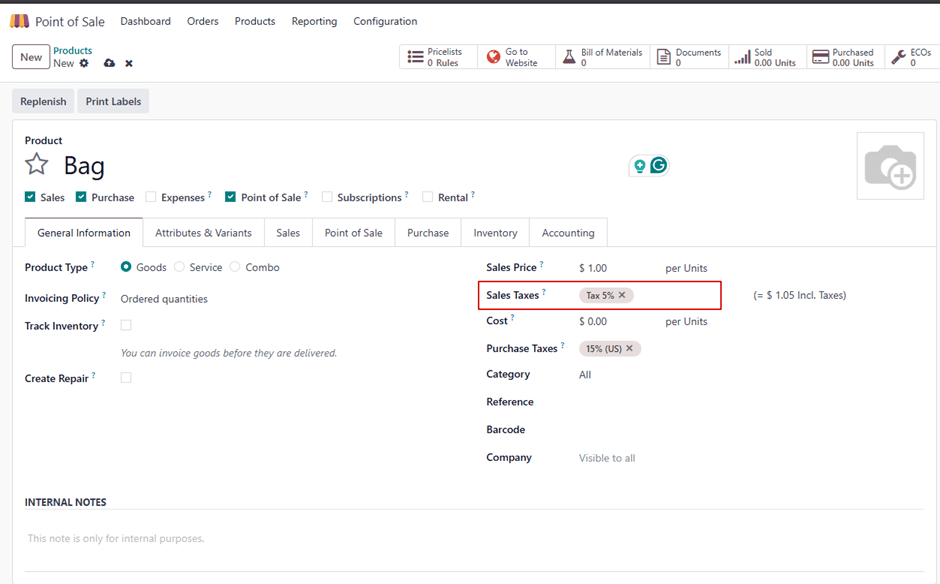

Now, let’s create a product, and we can observe how the default sales tax is being set.

As you can see in the example above, when we are creating a new product, the sales tax is being set as the new tax we have given in the default sales tax section, which is Tax 5%.

Flexible Taxes

Flexible Taxes in Odoo 18 enable you to set up multiple tax mappings and apply them to various scenarios. Instead of having a single fixed tax rate on products, you may change the tax regulations directly in the POS interface based on customer needs or regulatory duties. This is especially useful for businesses operating in areas with different tax rates or serving consumers from numerous jurisdictions.

For example:

- A product may carry a 15% sales tax by default.

- If a different fiscal position is applied (say, for a region with a higher rate), the system can automatically replace the 15% with a 25% tax.

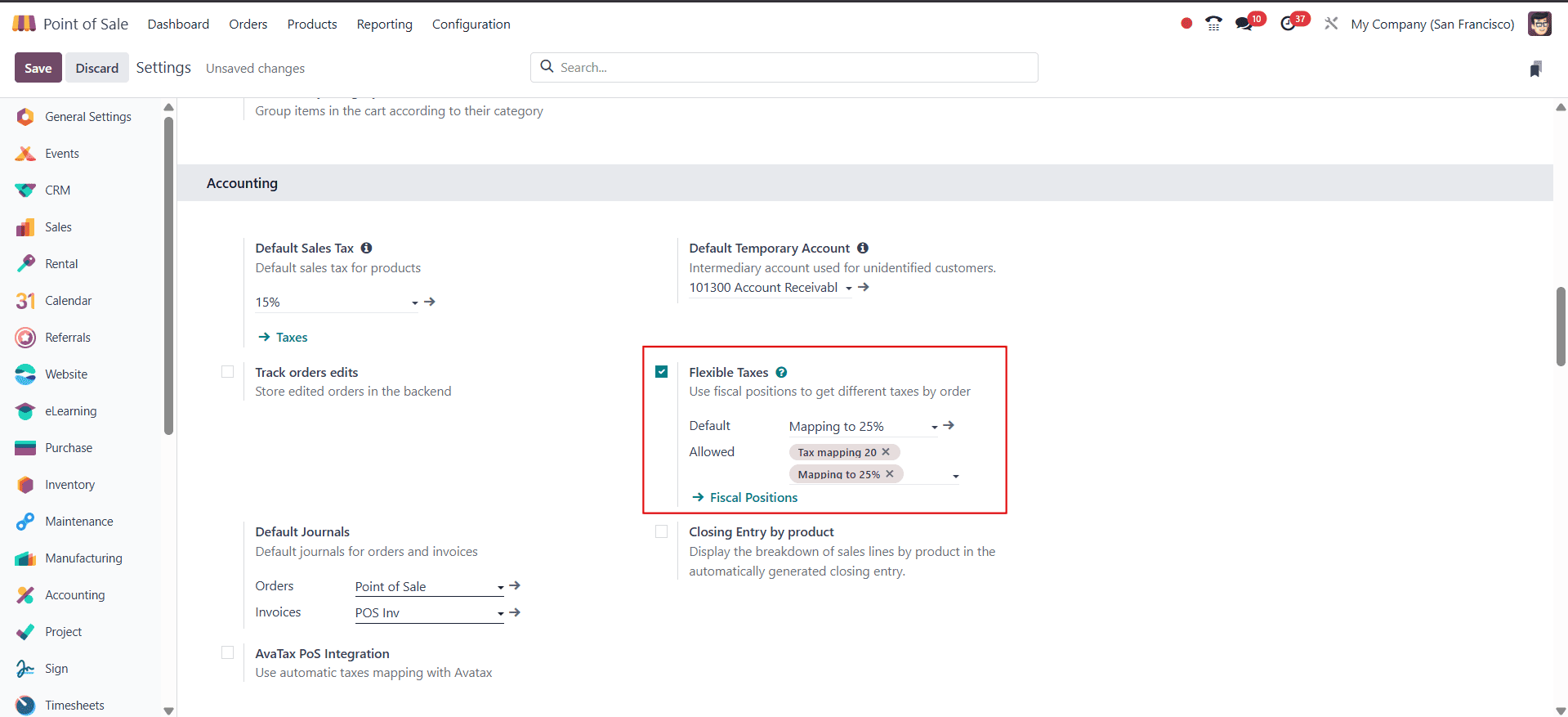

To get started, navigate to Point of Sale > Settings, scroll down to the Accounting section, and enable the Flexible Taxes option and save.

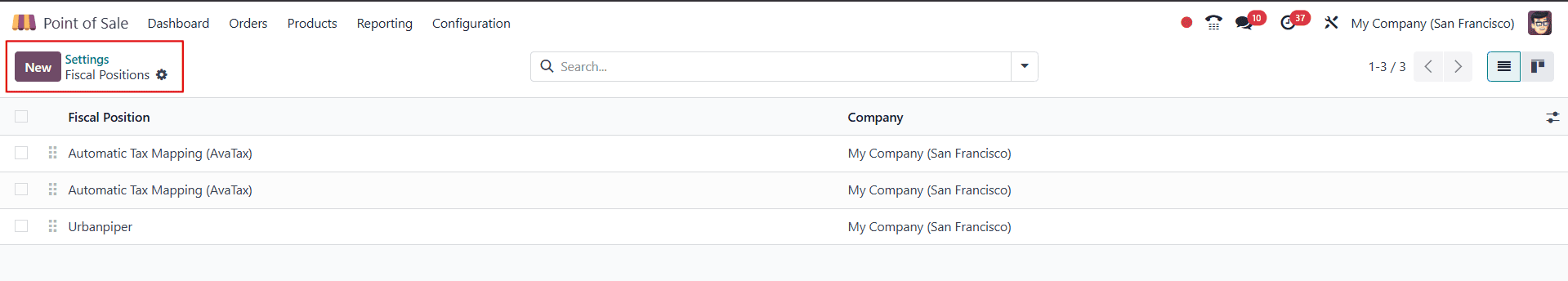

Then click on the fiscal position to configure a new fiscal position.

From here, we can configure a new fiscal position by clicking on the new button.

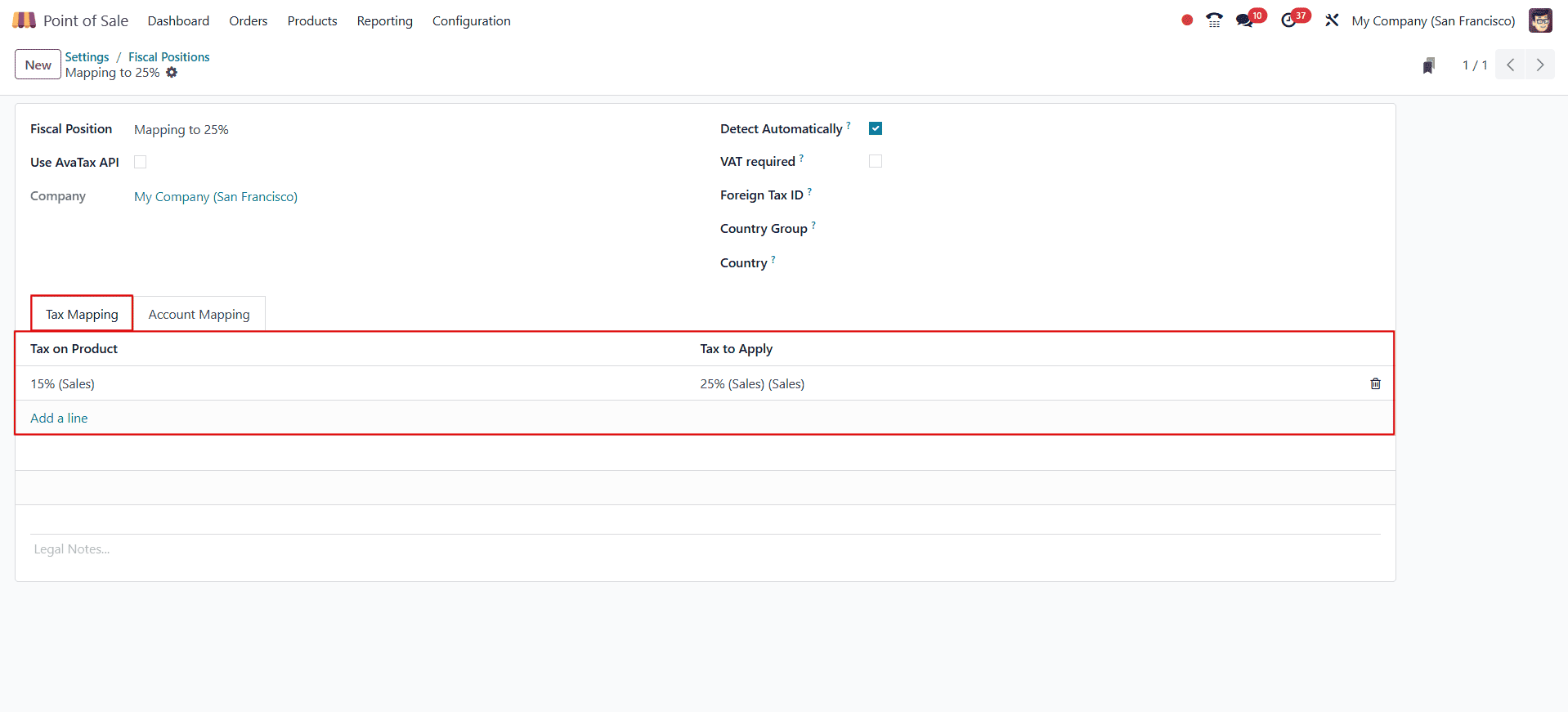

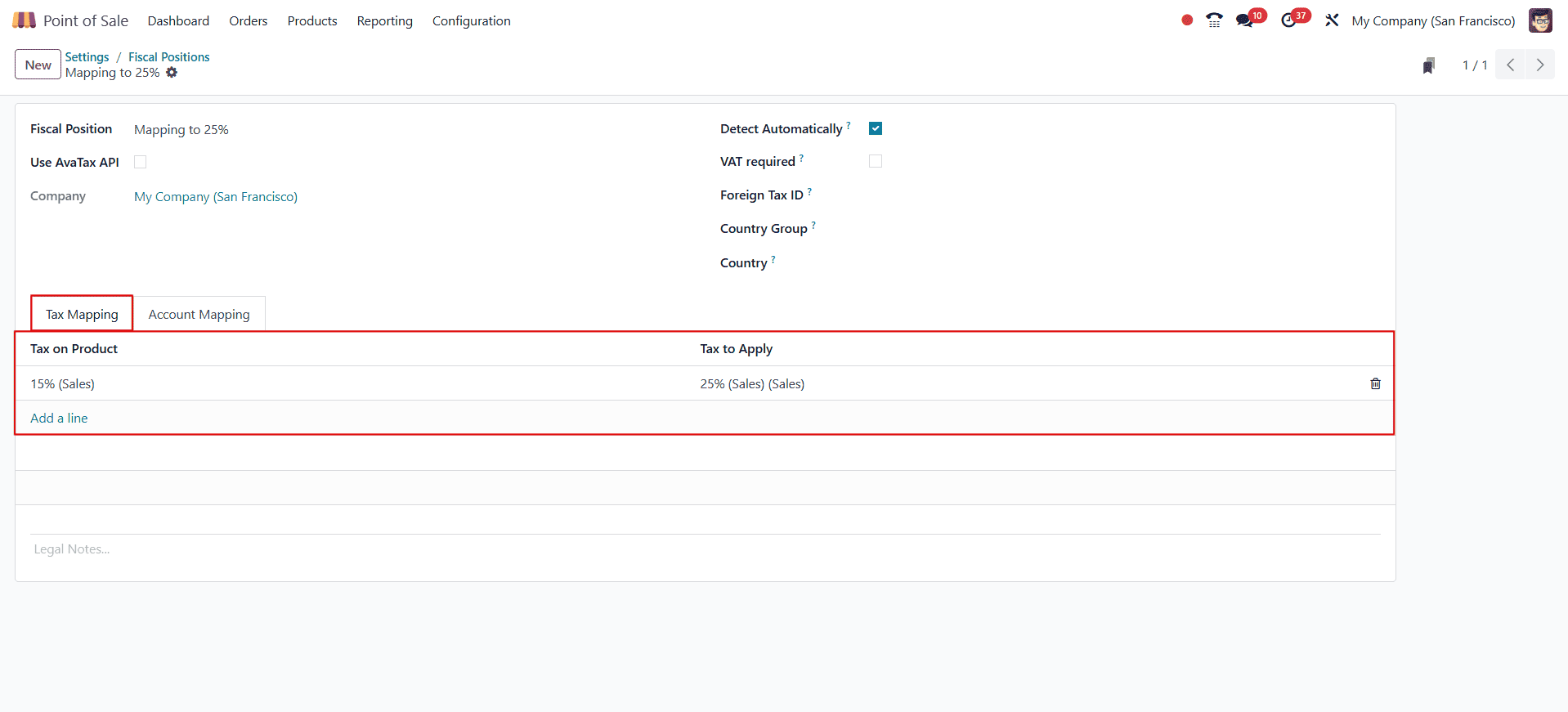

- Fiscal Position - Give the name of the fiscal position (e.g., "Mapping to 25%").

- Use AvaTax API - Sale orders and invoices can incorporate the Avatax fiscal situation through the Avatax connection.

- Company - The company name will be auto-generated.-

- Detect Automatically - When the relevant VAT and country option conditions are satisfied, the feature enables automatic tax and mapping applications.

- Foreign Tax ID - Foreign Tax ID of your company’s country region.

- Country - Name the country groups that are covered by this tax mapping.

Here, we can use the fiscal position to set the tax that needs to be applied on the product when a particular product is chosen.

Here, I have set the tax on product as 15%(Sales) and the tax to apply is 25%(Sales) in the Tax Mapping tab. Here, we can also add other taxes if we want to map them to any other taxes. According to the taxes I set here the products with 15%(Sales) will be mapped to 25%(Sales).

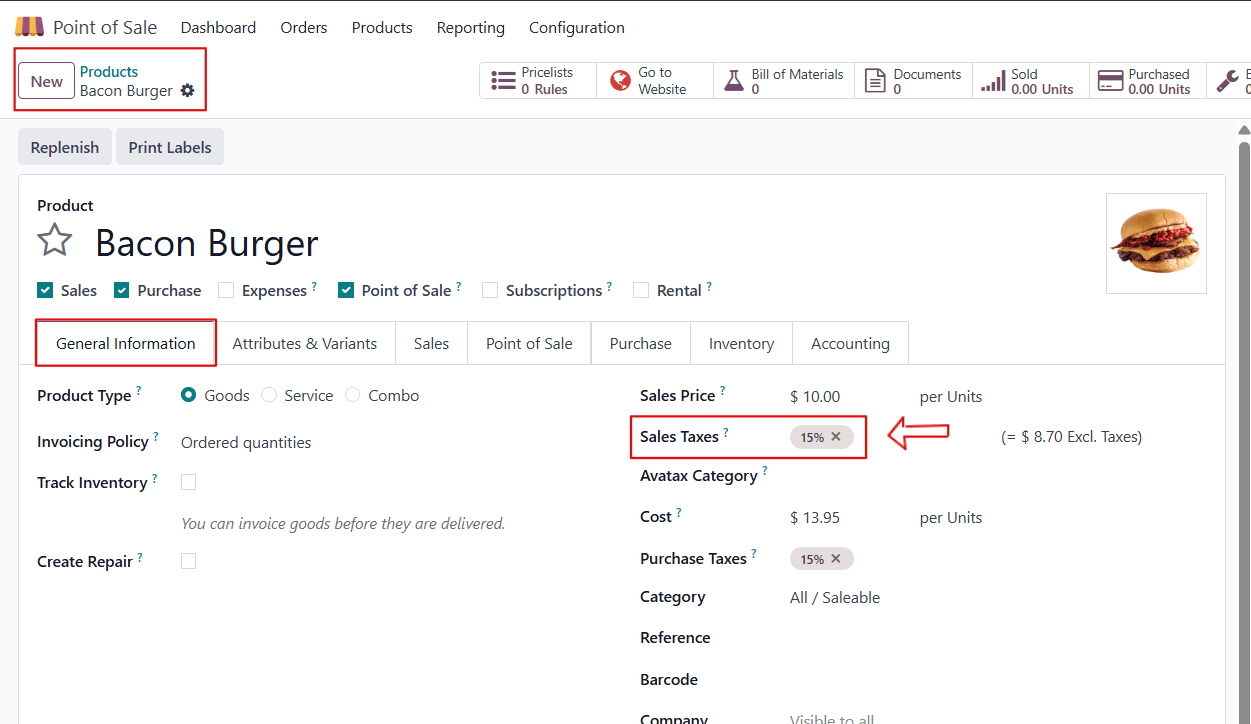

Then, let us choose a product or we can create one. Set it with Sales Taxes as 15%(Sales)

Now, we can set the Default and Allowed fiscal position in the Point of Sale(POS) settings as given below in the image.

Here, I have set the Default as the Mapping to 25% and the Tax mapping 25% and the Mapping to 25% as allowed.

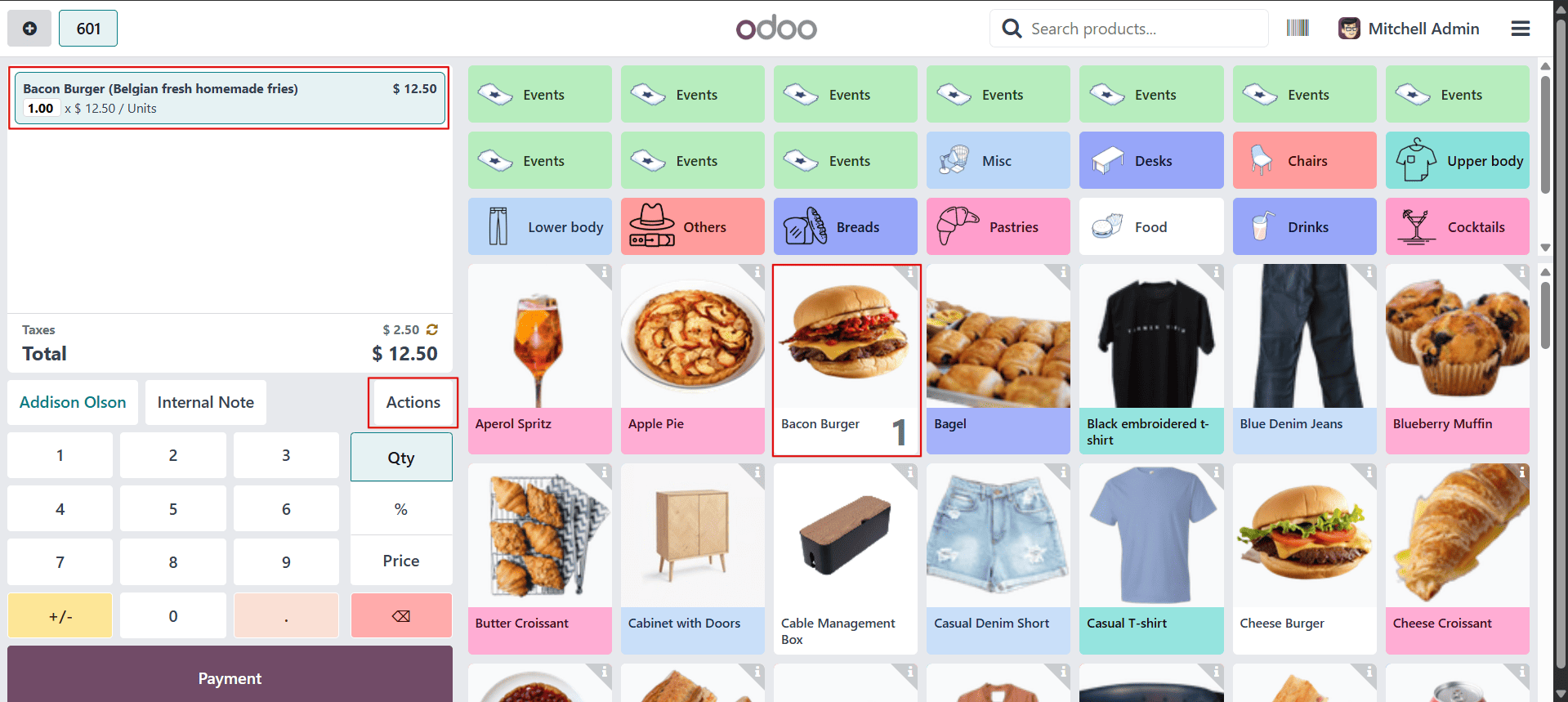

Then, we can now create an order from the PoS session and observe the tax mapping being applied to the product. Now choose a product from the sales section.

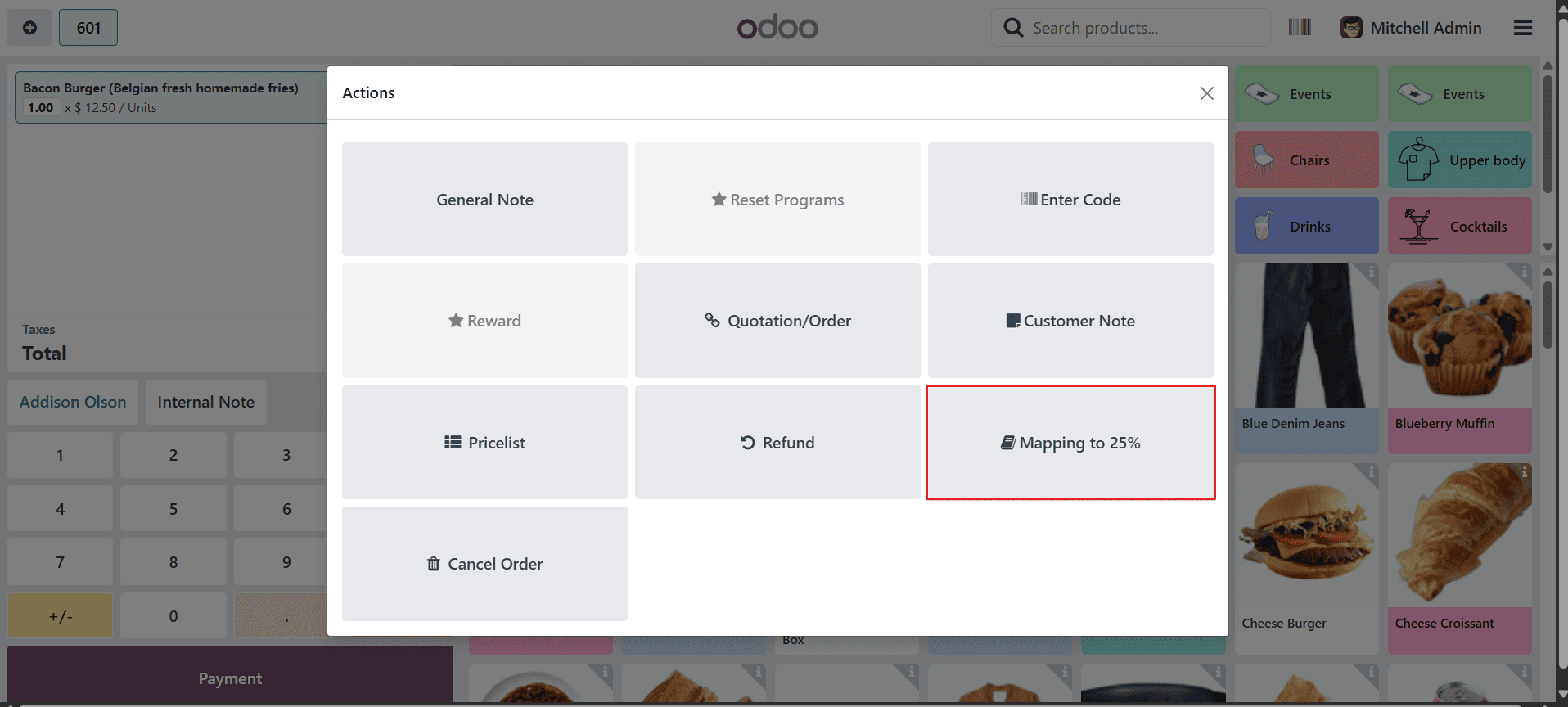

Here, the tax on the product is applied as 25% instead of the 15% originally set on the product. This happens because the default fiscal position has been configured as Mapping to 25%, which remaps the tax automatically. If needed, the fiscal position can be changed at any time by clicking on the Action button and selecting a different option.

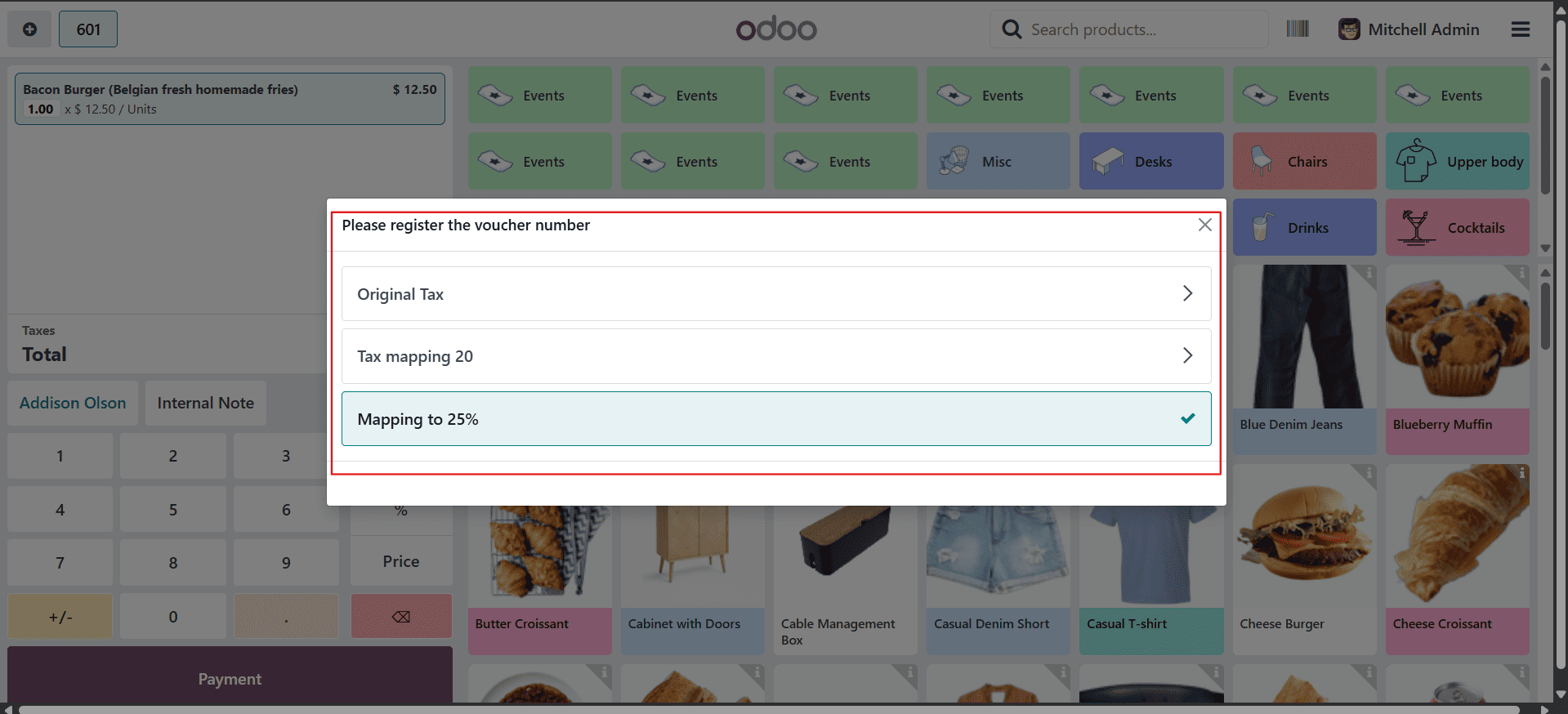

By clicking on the Mapping to 25% button, we can access a list of configured fiscal positions we can apply.

After that, we can complete the PoS sale order and the payment.

Odoo 18's Flexible Taxes functionality in Point of Sale enables firms to meet complex tax regulations without slowing down sales processes. Businesses that configure fiscal positions and enable tax translations can stay compliant, enhance efficiency, and give customers smoother checkout experiences.

Flexible Taxes in Odoo 18 POS is a great way to make tax management smarter and easier, whether you own a restaurant, a store, or a business that works in more than one area.

To read more about How to Configure Taxes in Odoo 17 POS, refer to our blog How to Configure Taxes in Odoo 17 POS.