The Accounting module in Odoo 18 makes managing company assets straightforward and efficient. The platform allows users to create and validate assets with ease, either manually or through its enhanced automation features. These improvements make asset management faster and reduce errors in financial records.

In this blog, we’ll explore how asset management works in Odoo 18 and how the automation capabilities can help you manage your company's assets more effectively.

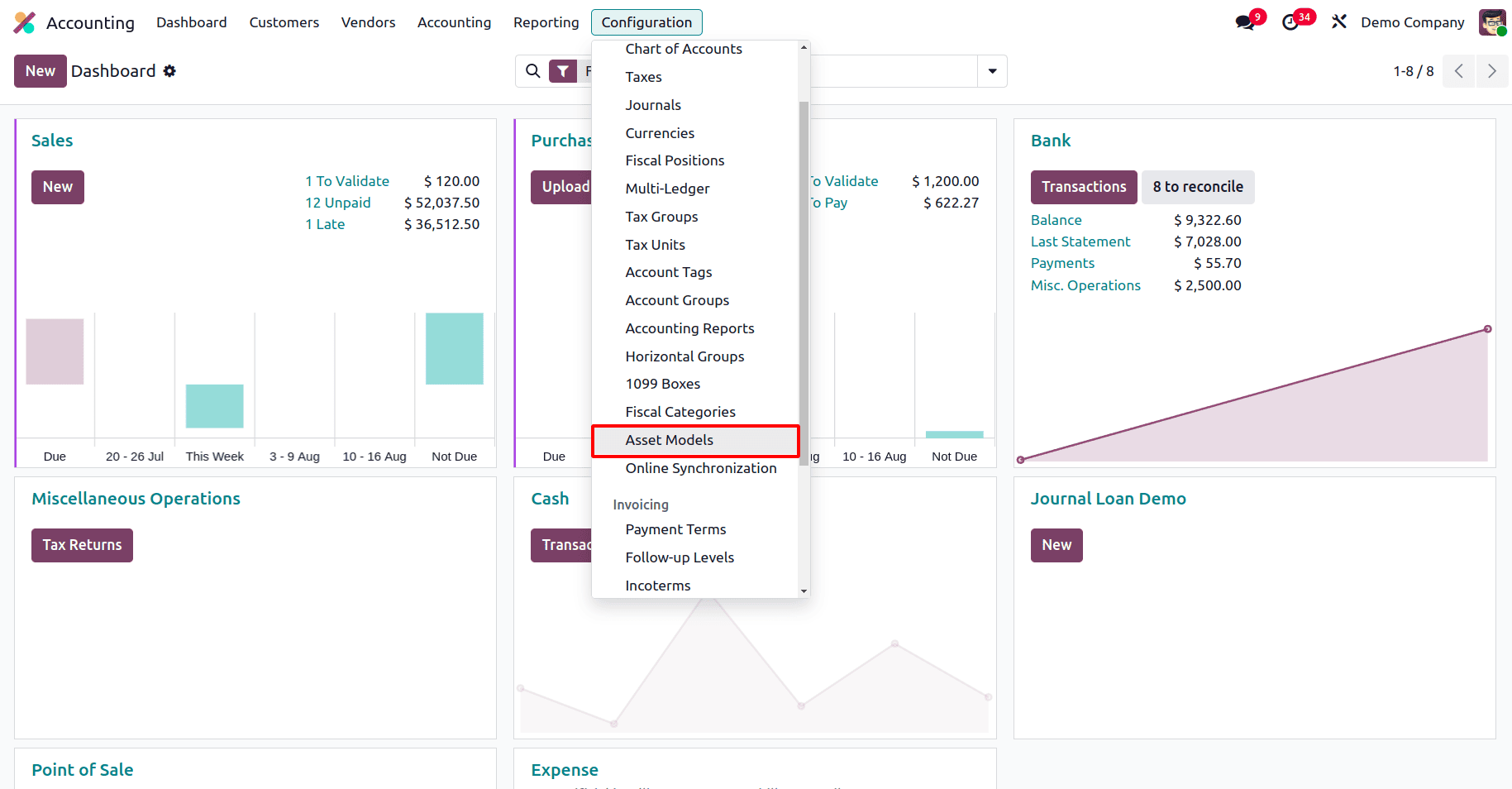

Before we alter the company's assets, let's understand how to develop an appropriate asset model. You may access the Accounting module from the Odoo Dashboard. We can now create a new asset model in the Accounting module by selecting the Asset Models option from the configuration menu.

Go to Accounting > Configuration > Asset Models.

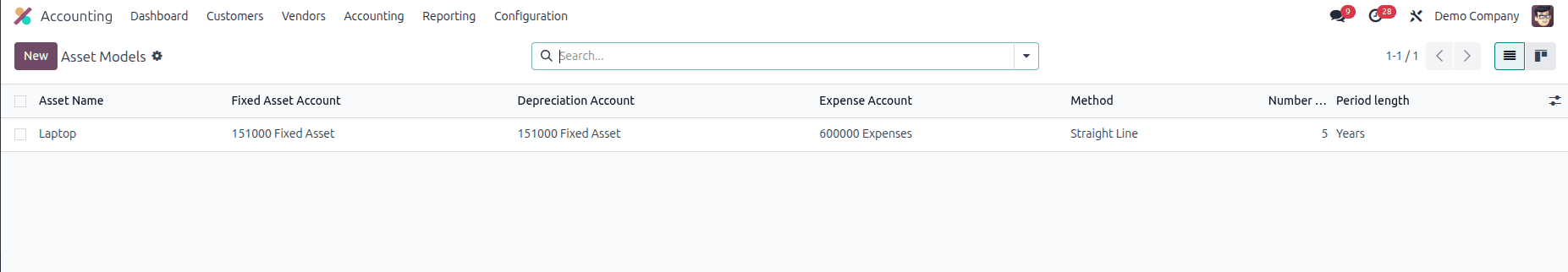

When we select the Asset Models option, Odoo will open a new window with a list view of the asset models that are already configured. The asset name, fixed asset account, depreciation account, method, number of depreciations, and period length are all part of the list preview, as depicted in the image below.

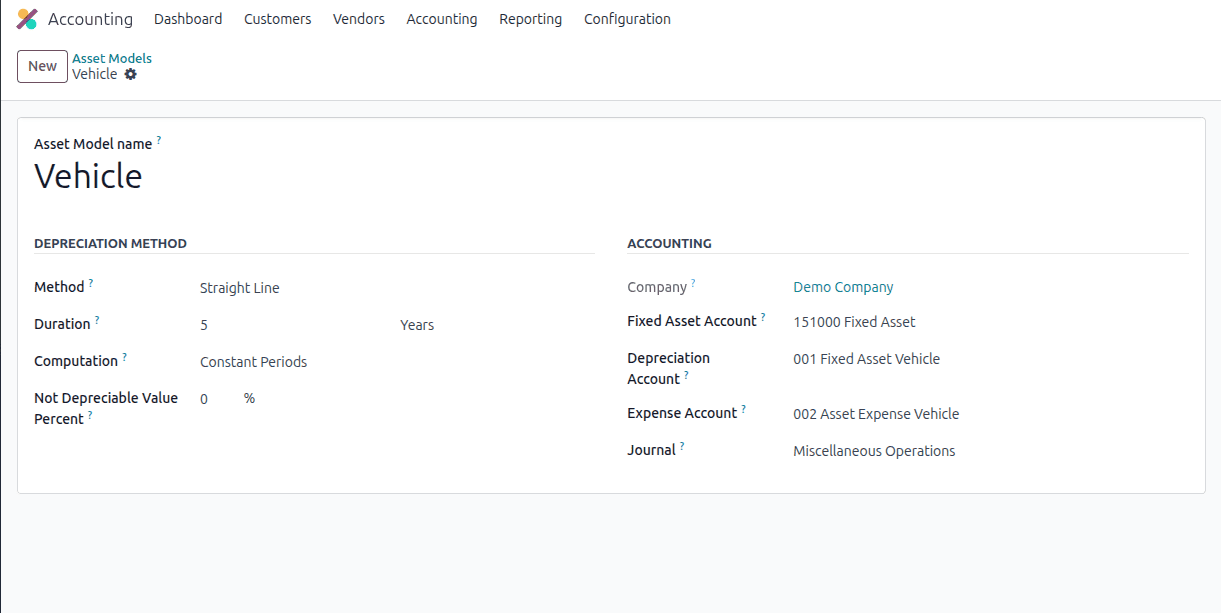

The New button will help us create a new Asset Model. As can be seen below, pressing this button will launch the new form view.

We can enter the asset model's name in the Asset Model name column. The depreciation method will determine how the depreciation of the asset is calculated. Straight Line, Declining, or Declining then Straight Line are the three possible configurations for the approach.

- Straight Line: It is the most common method and is easier to calculate than the other two. If we divide the gross or total value of the asset by the duration of the asset, we obtain the depreciation value.

- Declining: We can define the declining factor, which is then multiplied by residual value to obtain the depreciation value.

- Declining then Straight Line: Declining and Straight line are mixed in this one.

You can enter the amount of time or duration of depreciation needed to depreciate your asset in the Duration area. The duration could be expressed in months or years.

We can specify the duration on which the depreciation will be calculated using the techniques in the computation column. The computation methods could be set up as No Pro rata, Constant Period, and Based on days per period.

- No Pro rata: In no pro rata, depreciation starts at the beginning of the fiscal year, even though some months have elapsed.

- Constant Period: In this instance, the asset's date of acquisition is when depreciation begins. It depreciates only the value from the current period and offers proportionate value for the entire year, even if some months have already passed.

- Based on days per period: The depreciation starts on the given date and is split evenly for every day until the end of the depreciation period.

We can define the salvage value of the asset by setting the Not depreciable value percent.

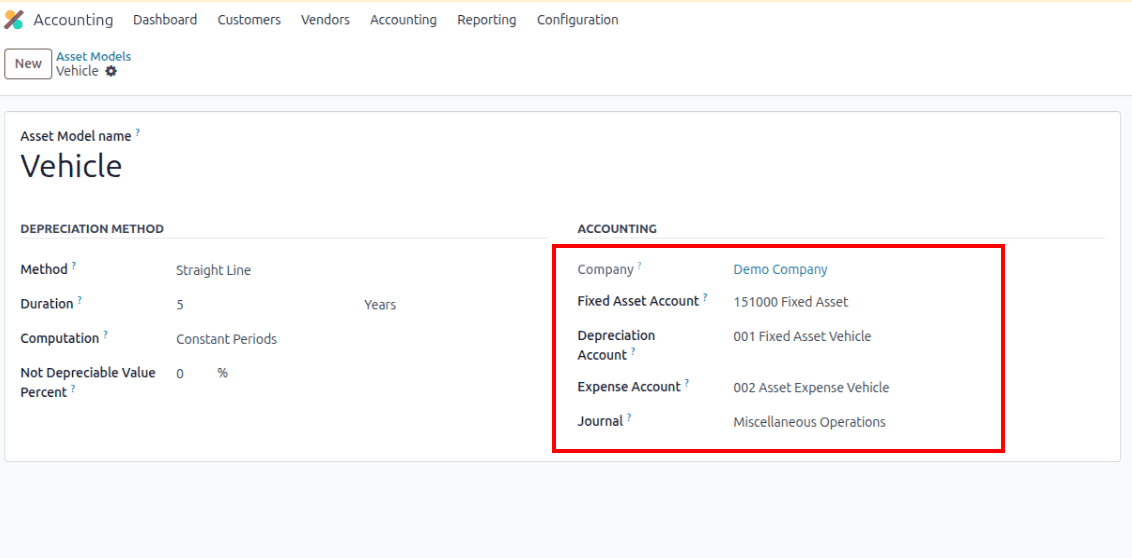

The Fixed Asset Account enables you to define the account that will be applied to capture the purchase and initial cost of the asset. You can designate the account that is used in the depreciation entries to reduce the asset value in the Depreciation Account field. In the Depreciation Account settings, we have the option to automate asset management. We can modify the setup by using the internal link that is provided here. Alternatively, once you have developed the asset model, you may alter the configuration by selecting the right depreciation account from Odoo's Chart of Accounts.

You can account for a part of the asset as an expense by entering the account utilized in the periodic entries in the Expense Account field. The setting for the new asset model is complete once you set the Journal used to document the accounting entries for this asset model.

Let’s see how we can automate asset management.

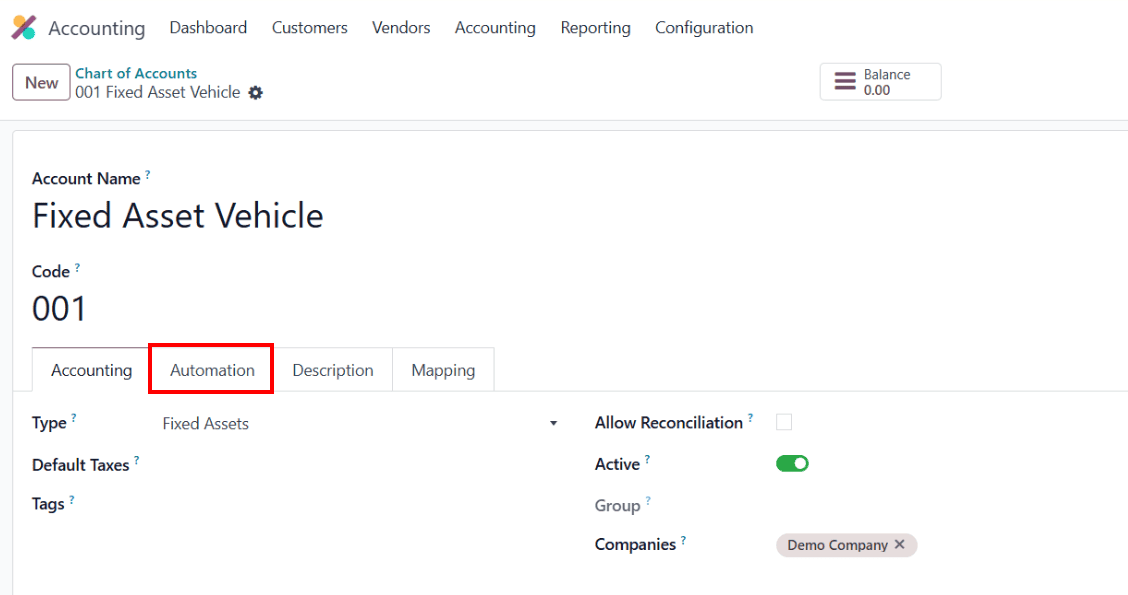

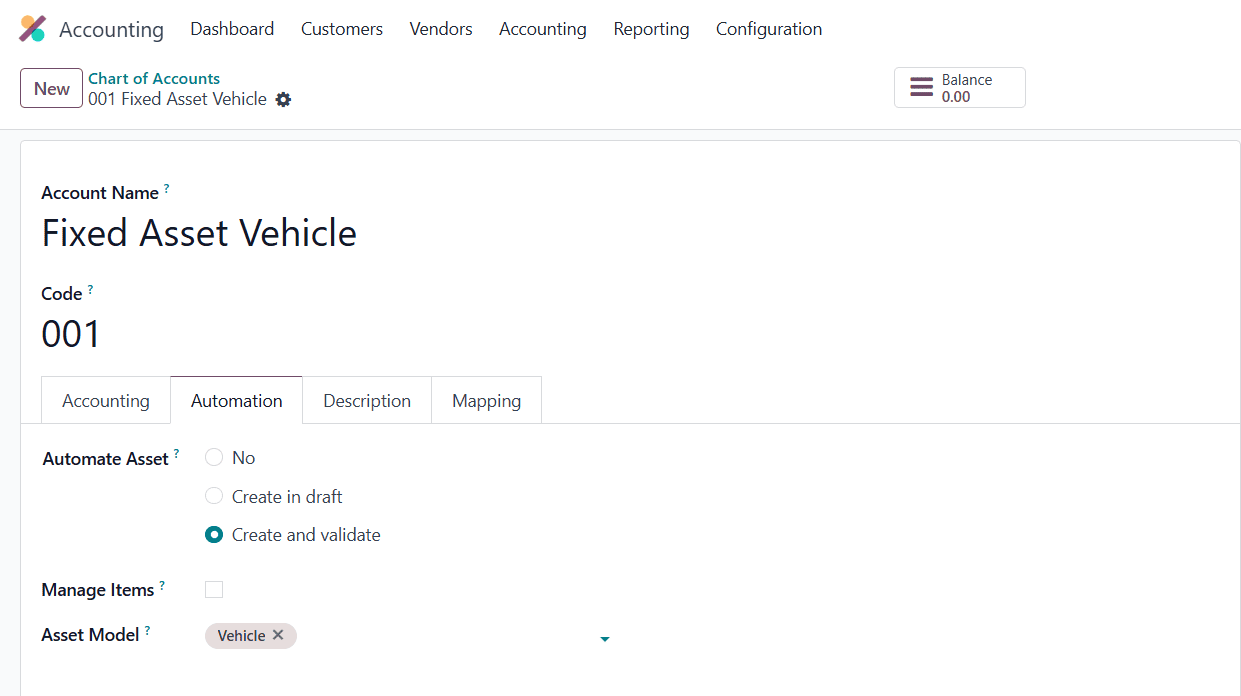

For that you can either go to the internal link of the depreciation account or view the account under the chart of accounts from configuration. We can see the asset automation options under the automation tab inside the account.

If we do not want assets to be created and validated automatically, you can set it to No. The moment we confirm the bill, a draft asset will be automatically created if we select the Create in Draft option. We can manually confirm the draft asset later. Odoo 18 will automatically create and verify assets if we choose the Create and Validate option. The asset is operational as soon as the bill is verified. By turning on the handle Items functionality, we are able to process large quantities of assets simultaneously. The selected Asset Model will be available in the respective field.

Here, we have set the asset model that we created and chosen the Create and Validate option from the Automate Asset box. Now, let's observe the process of how Odoo creates and validates assets automatically.

In this case, we chose the Automate Asset field's Create and Validate option and set the Asset model that we created. Now let’s see how Odoo generates and verifies assets automatically.

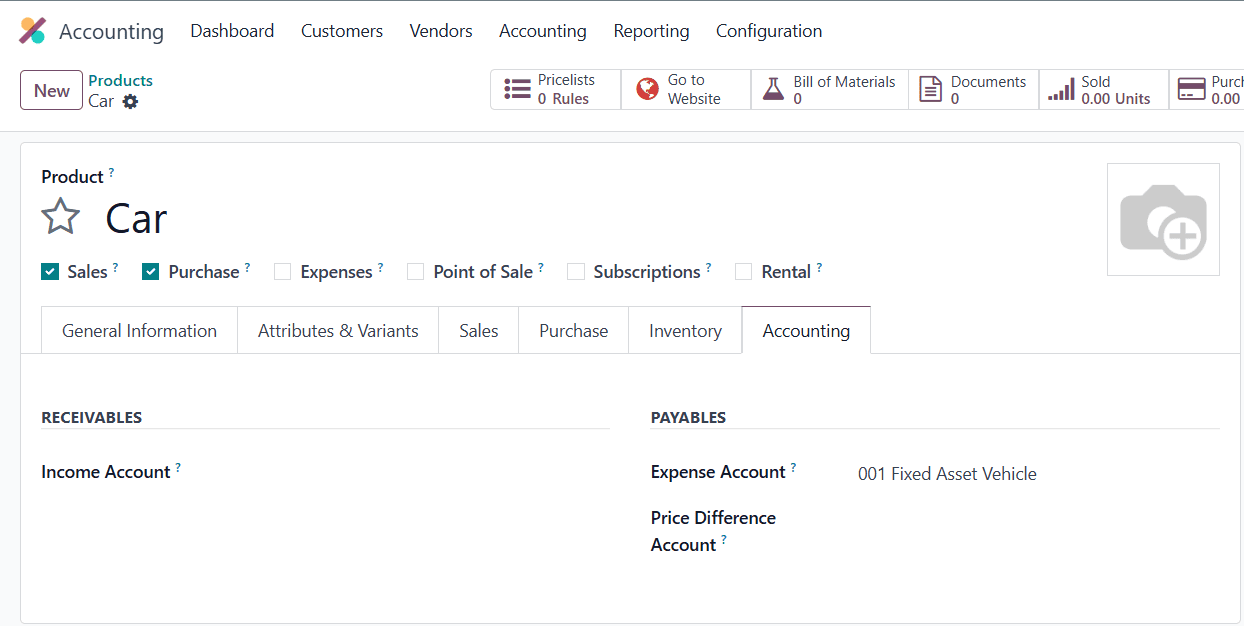

We can do it by introducing a new product called Car. We must have the same asset account for the product in order to force Odoo to create the asset. We can change the depreciation account to the expense account by selecting the accounting tab. In the general information tab, we can make the cost of the asset.

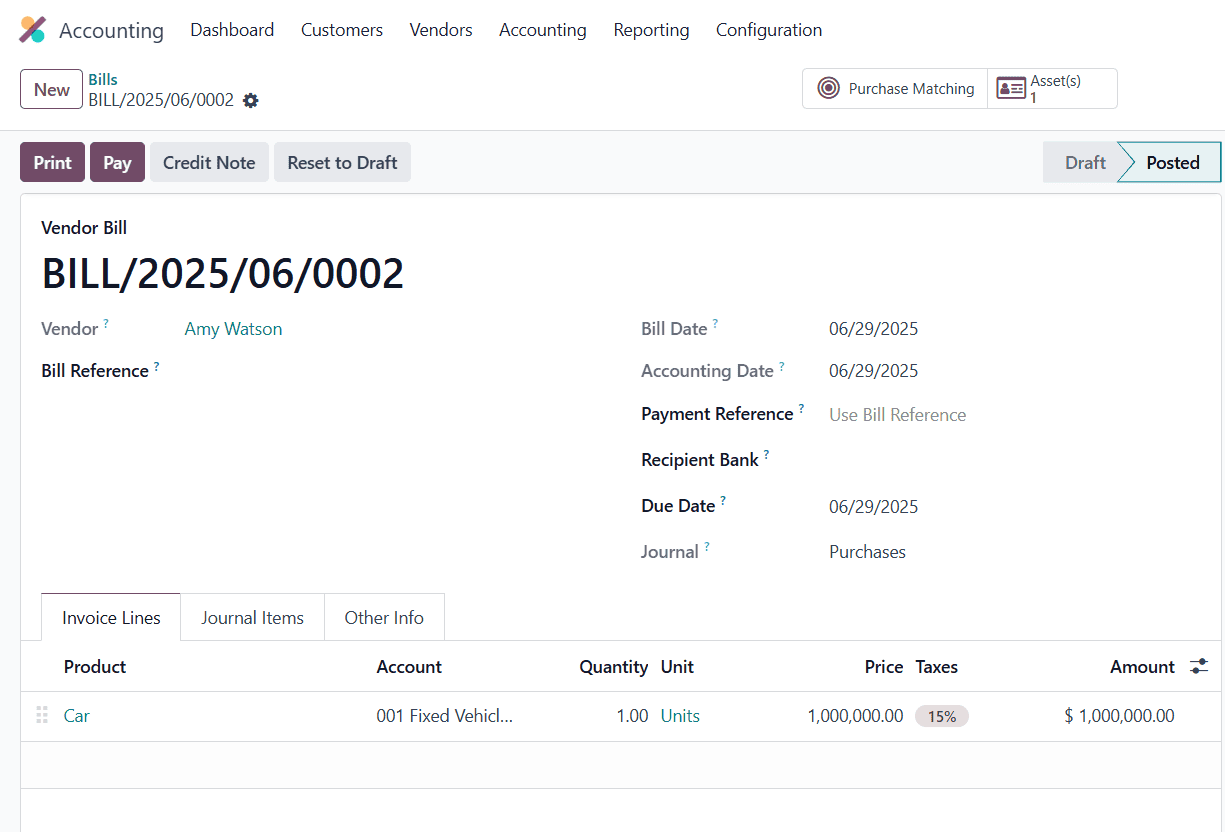

Then generate a new Vendor bill. Insert the Vendor information initially, followed by inserting the product Car under the Invoice line with price.

In order to confirm the vendor bill, click the Confirm button. The moment you authenticate the bill, a new smart button named Assets will be visible on the screen. The smart button will show the assets per each amount separately if the bill was generated for more than one quantity.

Pressing the Asset Smart button opens a new window with the automatically generated assets.

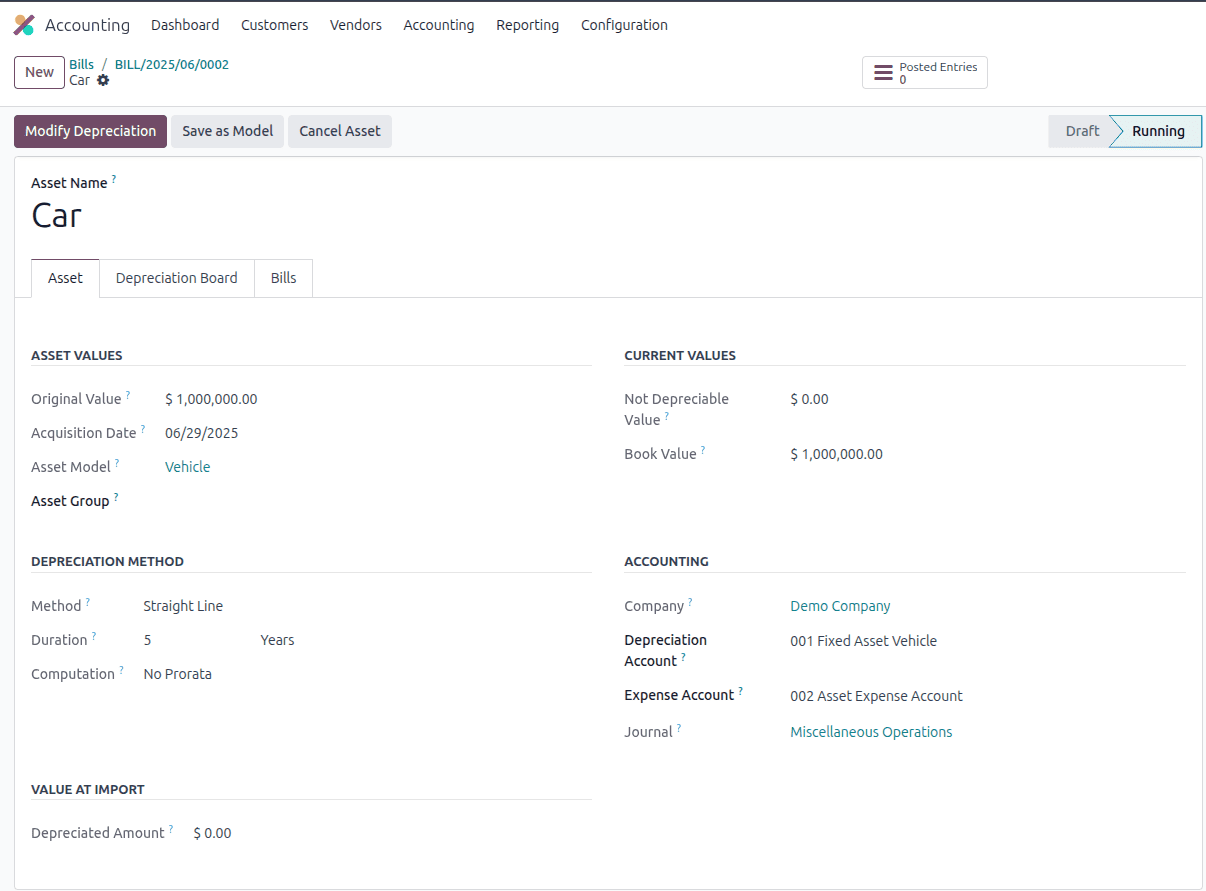

We can view the fundamental information of the asset we have established, such as the acquisition date (date on which the asset was established). We can also establish an asset group for comparison purposes of various assets and loans of similar groups. Both the accounts that the asset will affect and the depreciation mechanism we set up in the asset model are visible.

When an already depreciated item is imported into the company, we can place the current depreciated value of the asset under the depreciated amount section in value at import.

We can modify or edit the current depreciation by clicking Modify Depreciation.

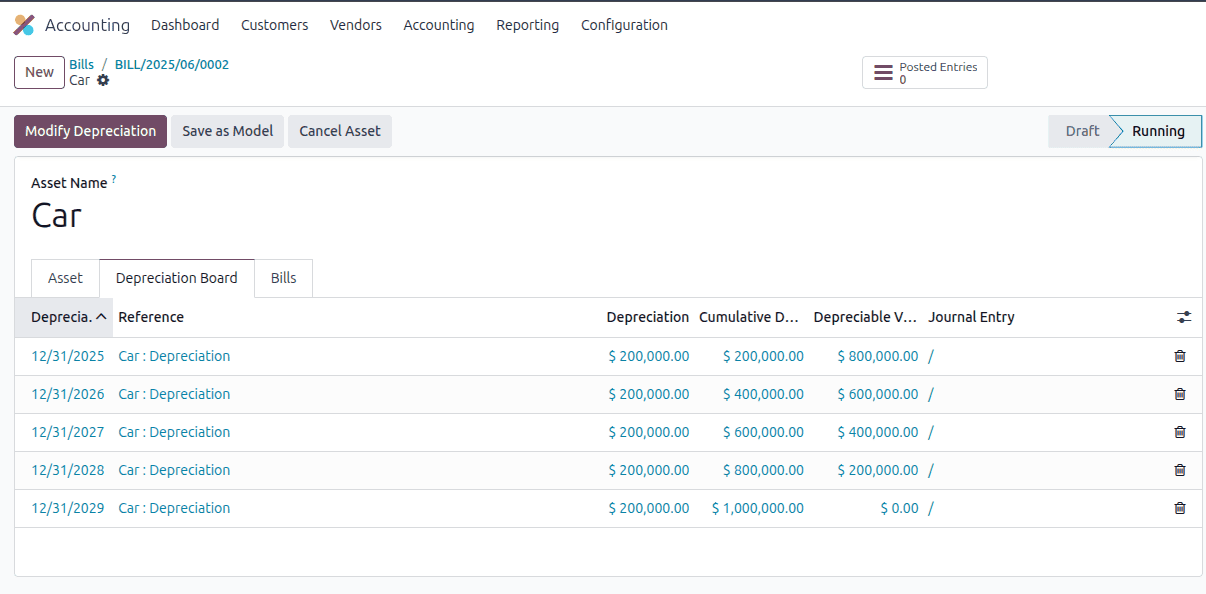

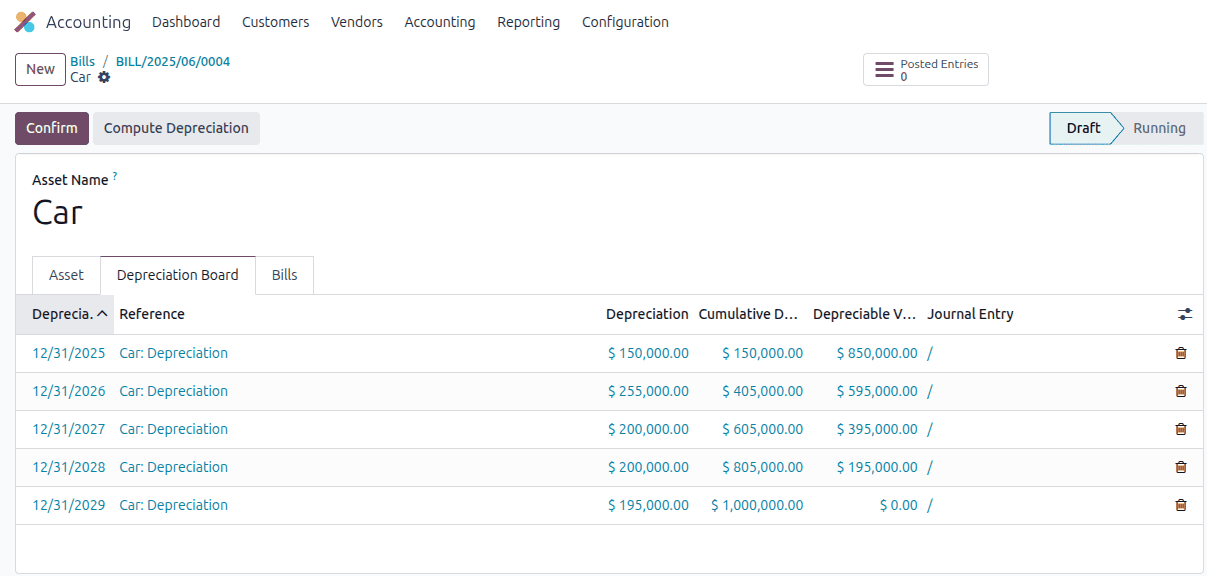

By selecting the depreciation board tab, we can see the asset's depreciation.

Here, the computation method is Straight Line with No Pro rata. The bill amount or the Book Value is $1000000. The duration period is 5 years. Thus the depreciation value of one year is (1000000/5 = 20000.00).

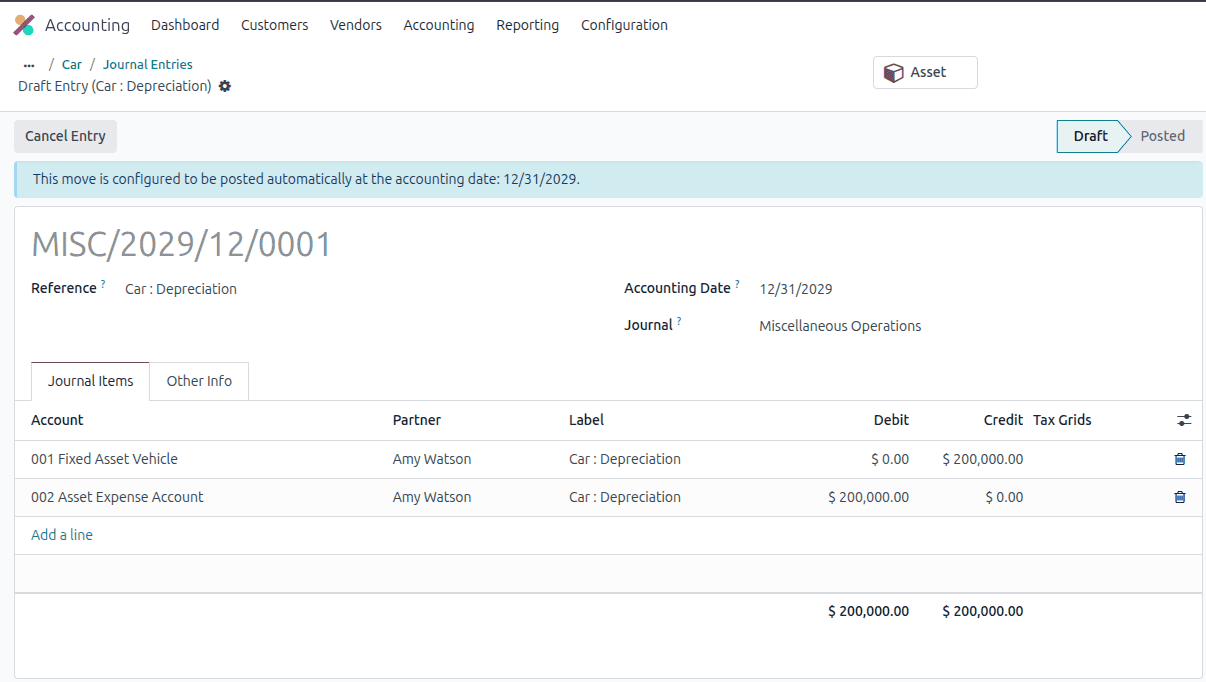

In order to see the journal entries, click on the posted entries smart tab. Let us see one journal entry.

Here, we can see that the Depreciation account is credited with the amount, as it is a fixed asset account; the asset is reduced, and the Expense account is debited, as it is an expense account; the expense increases.

For manual asset creation, we can include the product bill in the Bill tab of the asset and assign depreciation for the product.

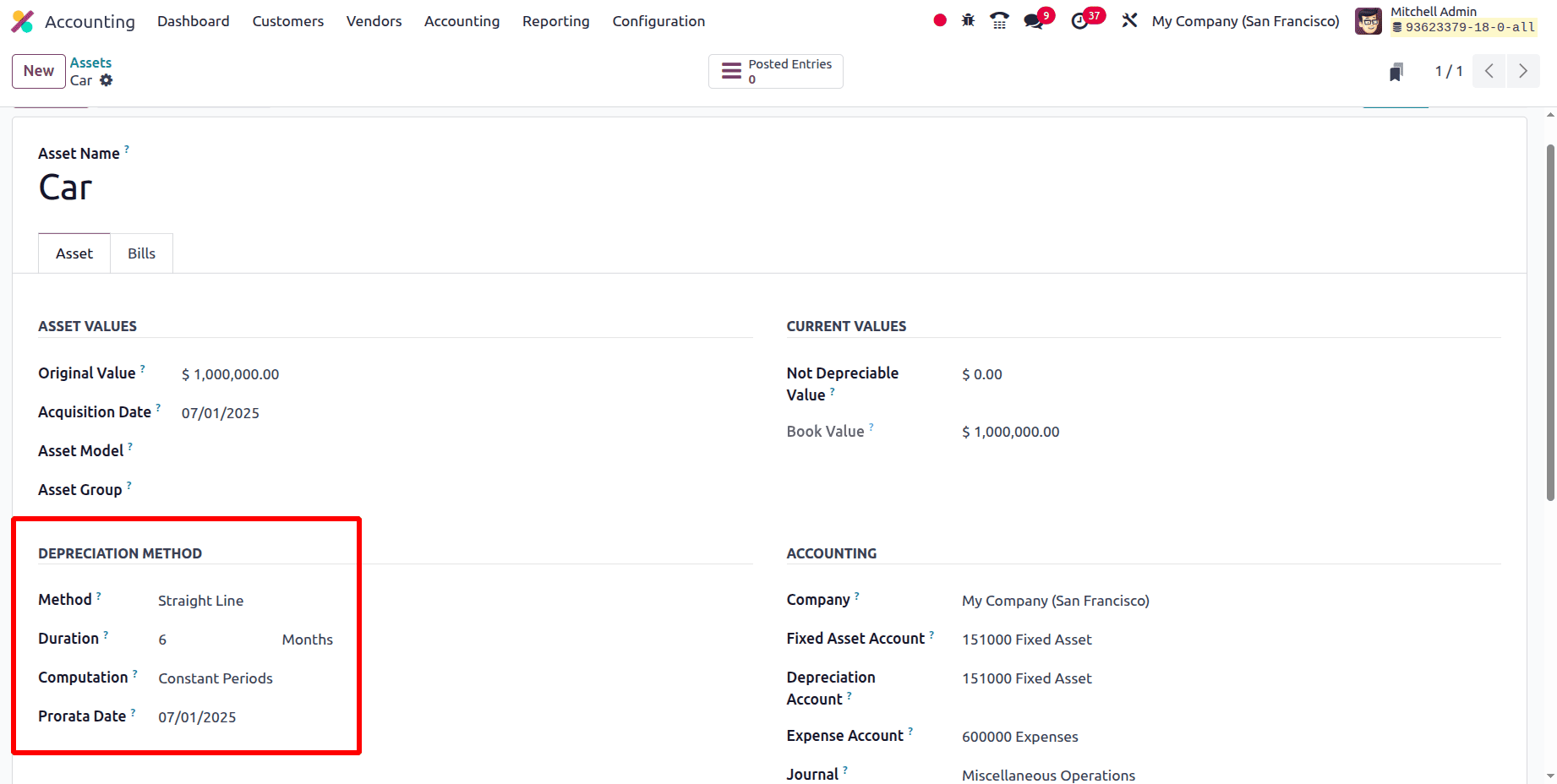

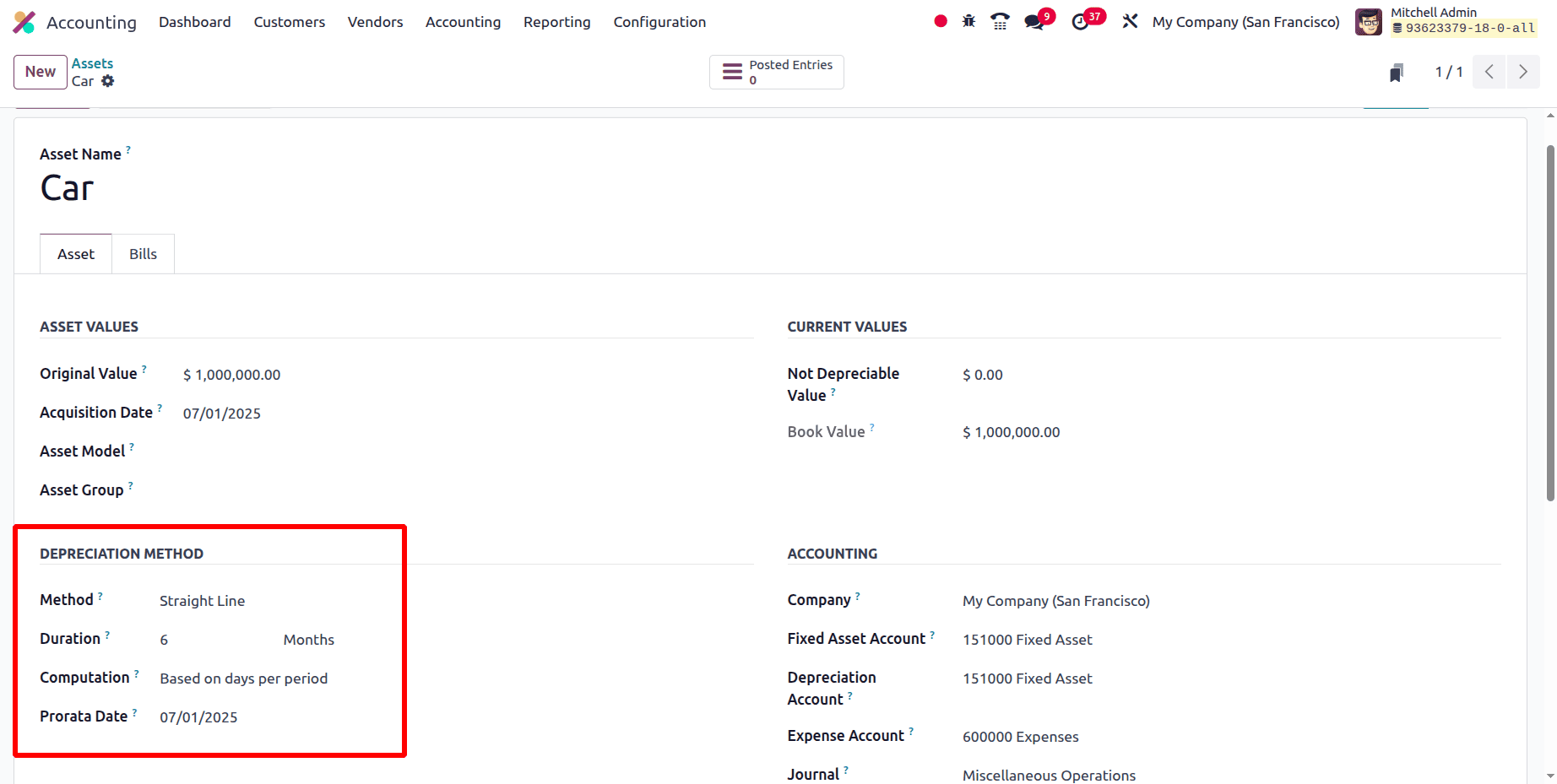

Now, let us see the different computation methods. Since we have already completed the straight line with non pro rata, let us check the straight line with constant period. The pro rata date, or the beginning date for calculating the asset, can be set when we set this computation.

Let's examine the computation after setting July 1st as the pro rata date.

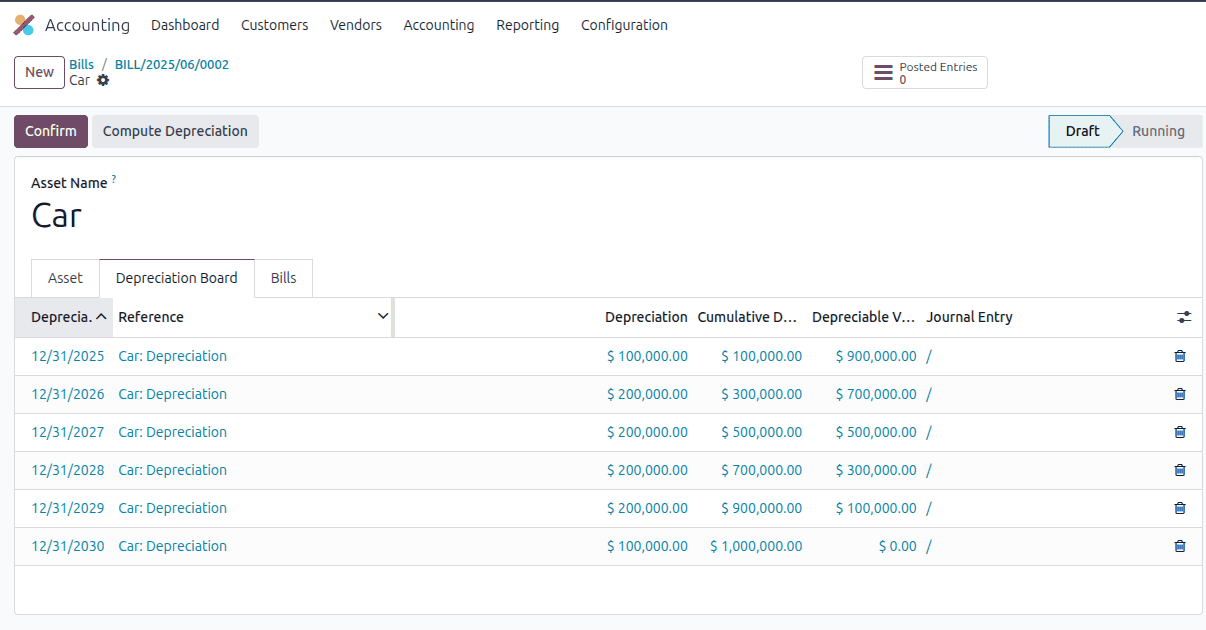

Here, the product book value is $ 1,000,000.00, and the time is 5 years. So for every year, it is $ 200,000.00. As the depreciation period starts from July 1st, we have only 6 months remaining in this year. So for 6 months the depreciation value will be $100,000.00 (200,000.00/12 for every month, multiplied by 6 we get for 6 months).

And the remaining balance ($ 100,000.00) for year one gets added to the 6th year, which finishes the 5-year period from July.

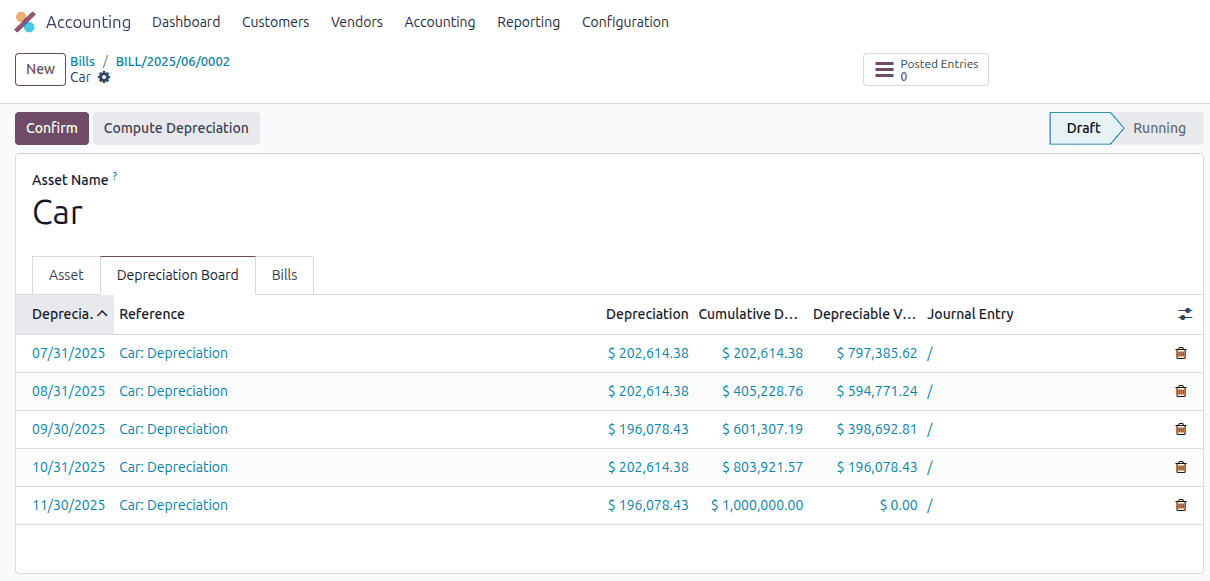

We can use July 1st as the pro rata date and six months as the duration for the days-per-period computation.

Here we can observe the value for 6 months. The number of days in this time frame will be 184 days. So if we divide the book value by 184 we get $ 5434.78 per day. So for July, we have 31 days. 31 times 5434.82 will be $ 202,614.38. Likewise, we can calculate the value for other months.

Declining Method

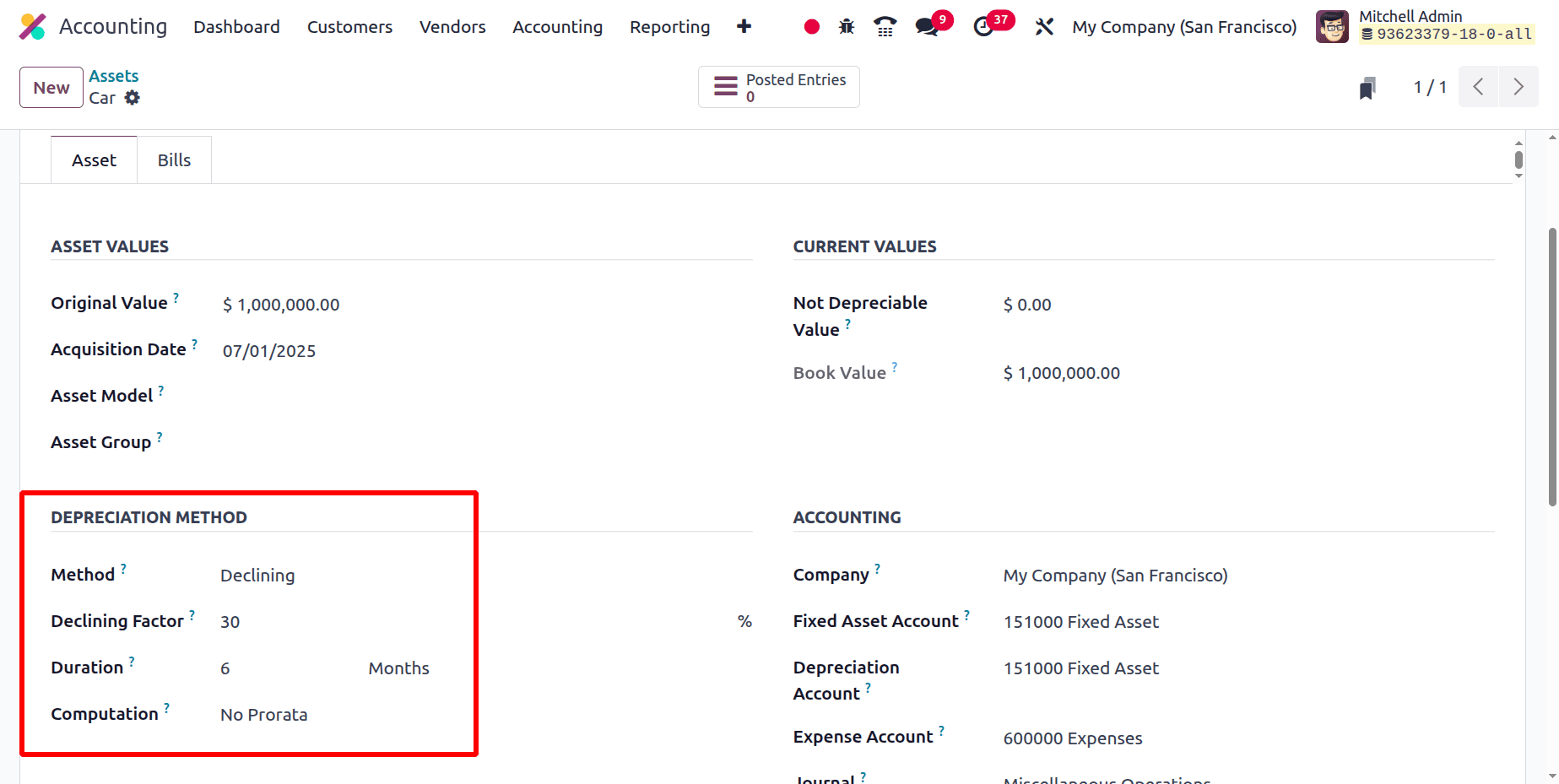

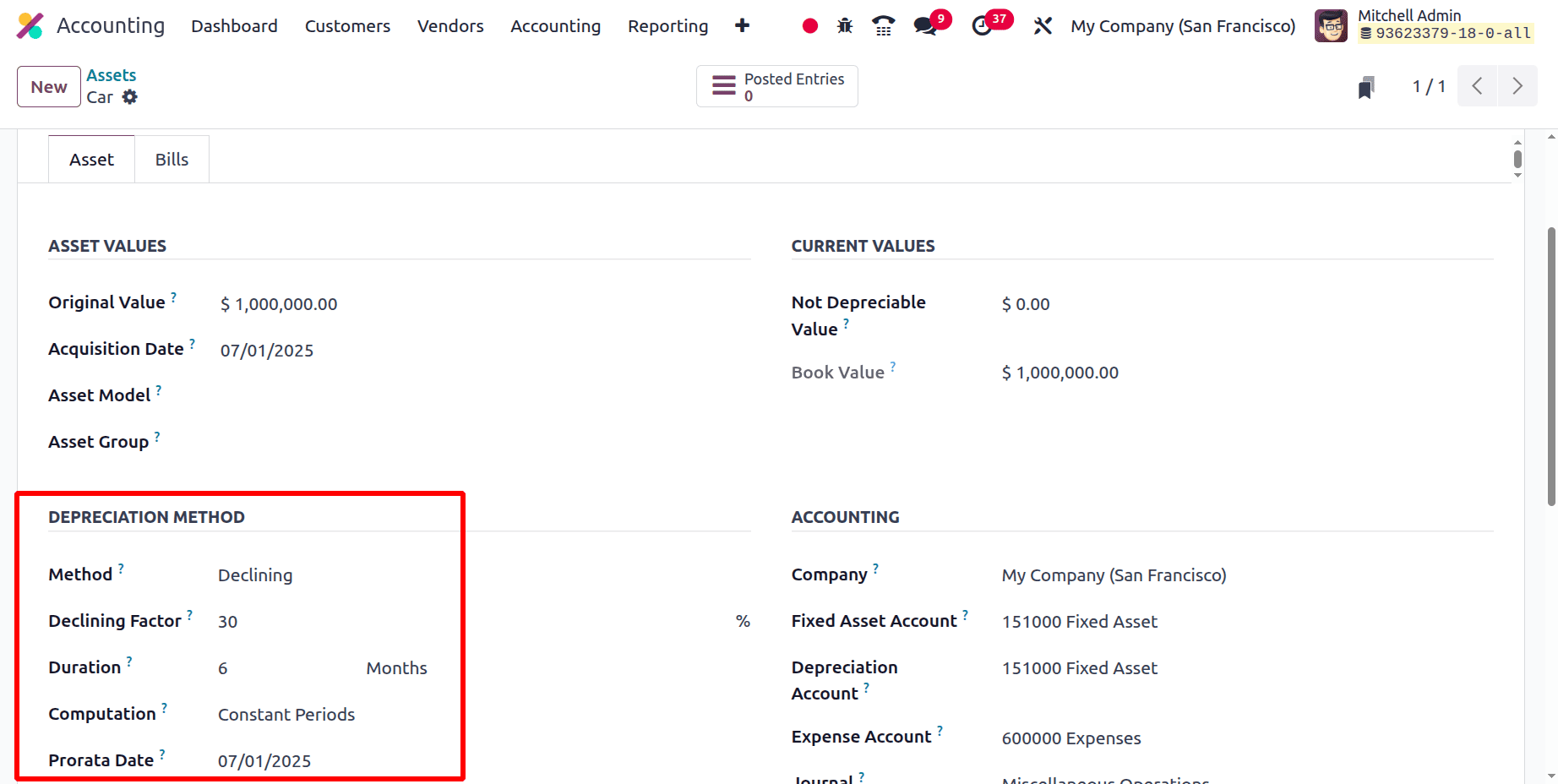

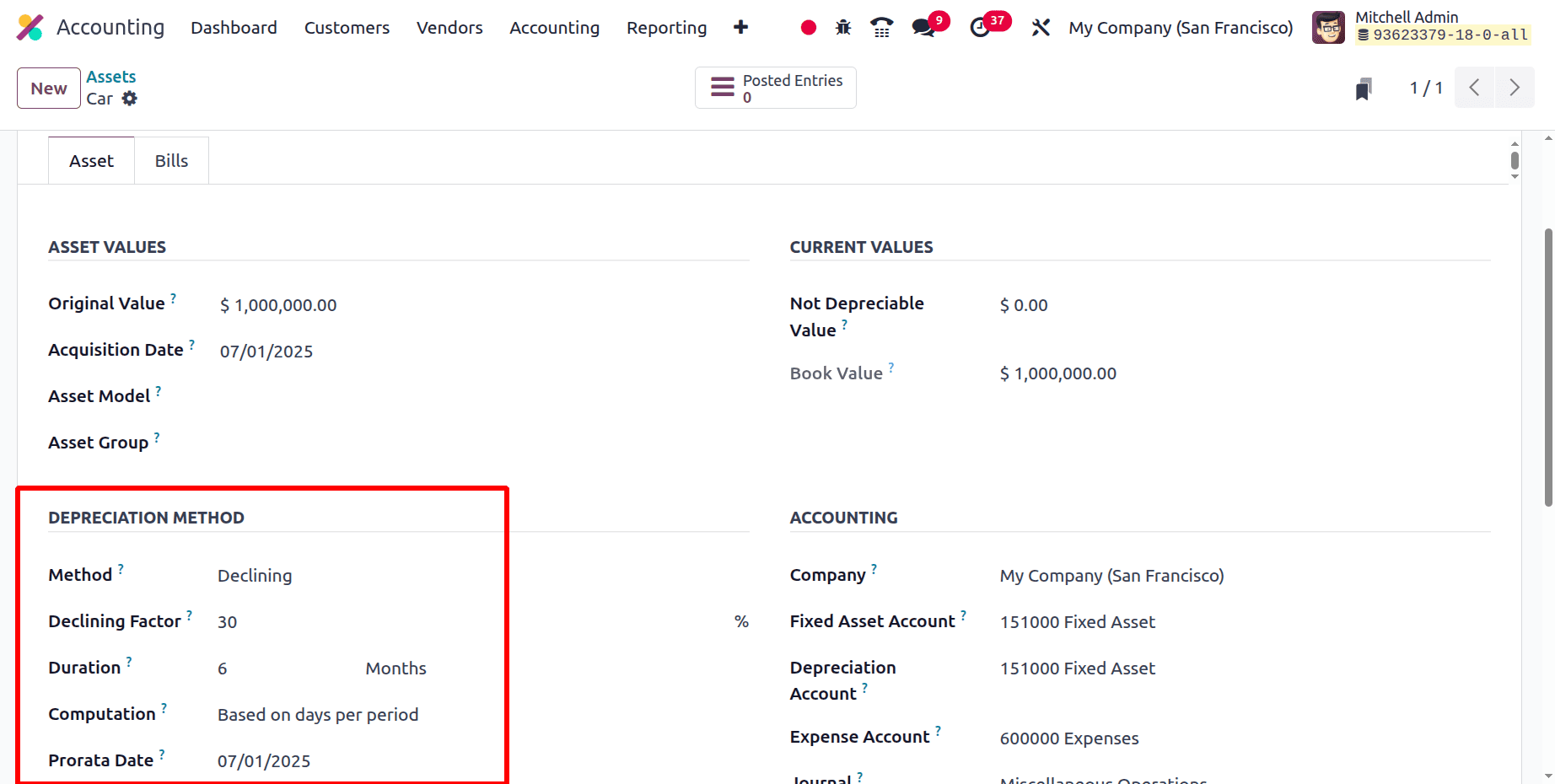

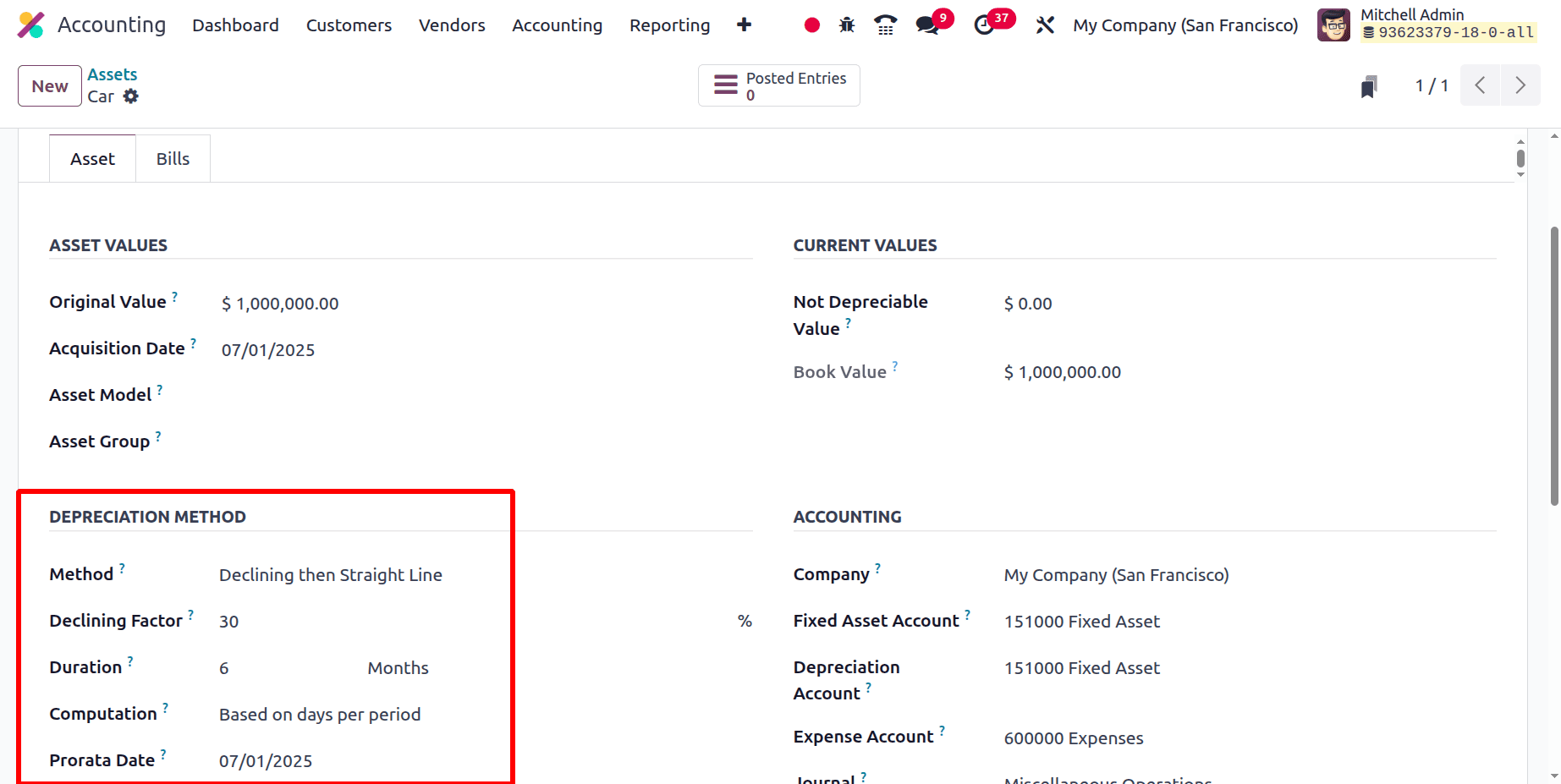

Then we can verify the calculation using the declining method. For the declining method, we can specify a declining factor for the asset. The proportion of the dropping factor in each period reduces the residual value. For the time being, we put the decline factor at 30%.

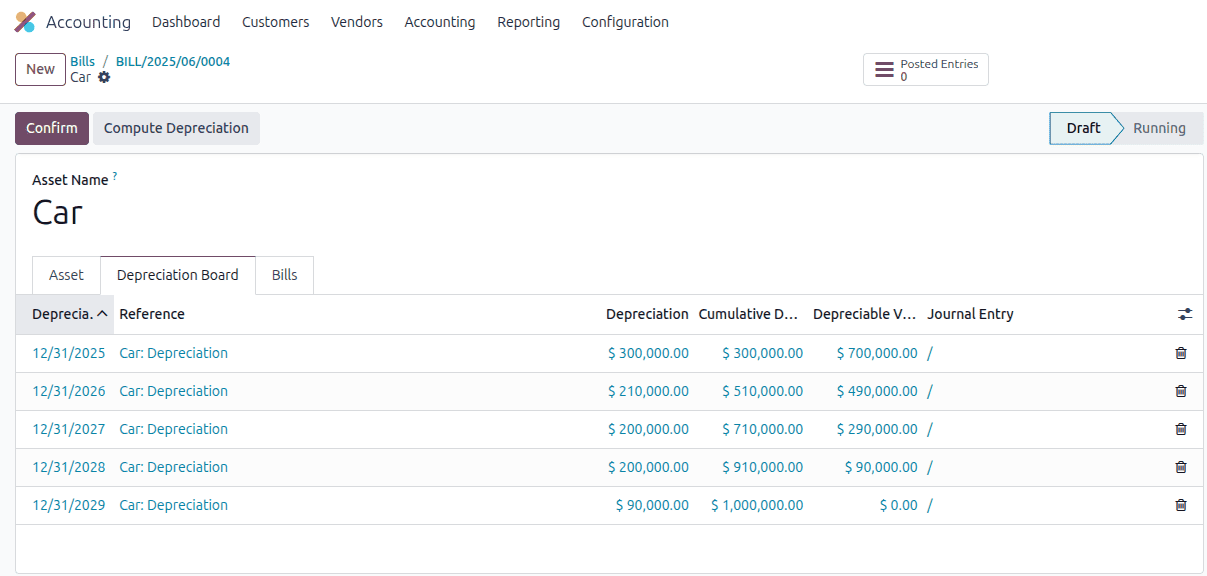

Since in No pro rata the whole year is considered, let us calculate. In the first year 30% of book value, i.e., 30% of $ 1,000,000.00 ($ 300,000.00) is charged off. And in the subsequent year, 30% of the residual value, i.e., 30% of $ 700,000.00 ($ 210,000.00) is charged off, and so on.

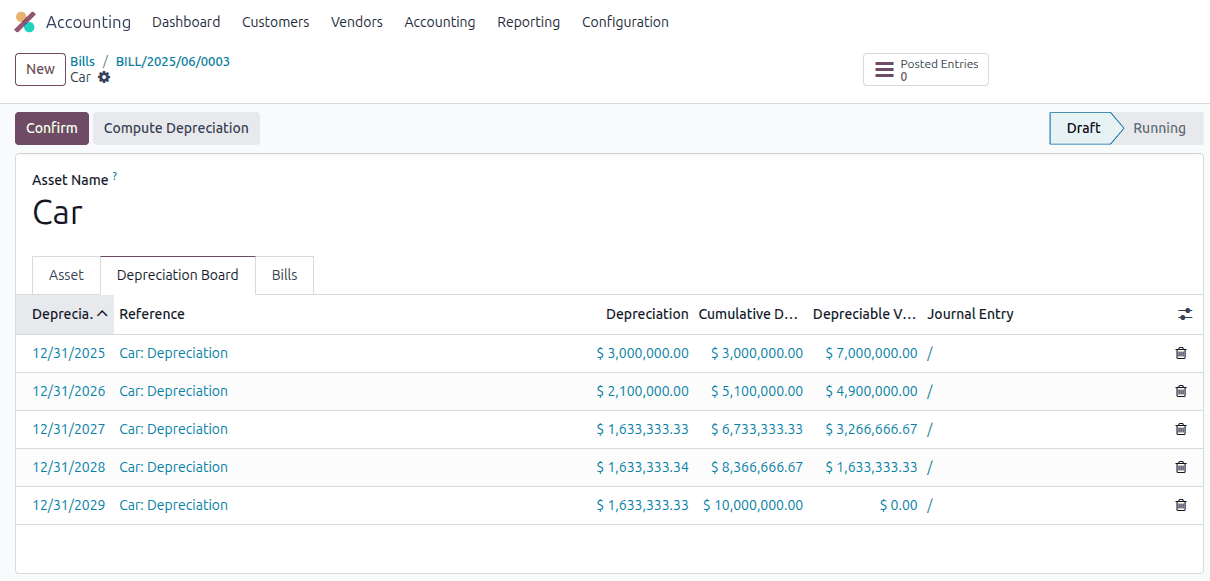

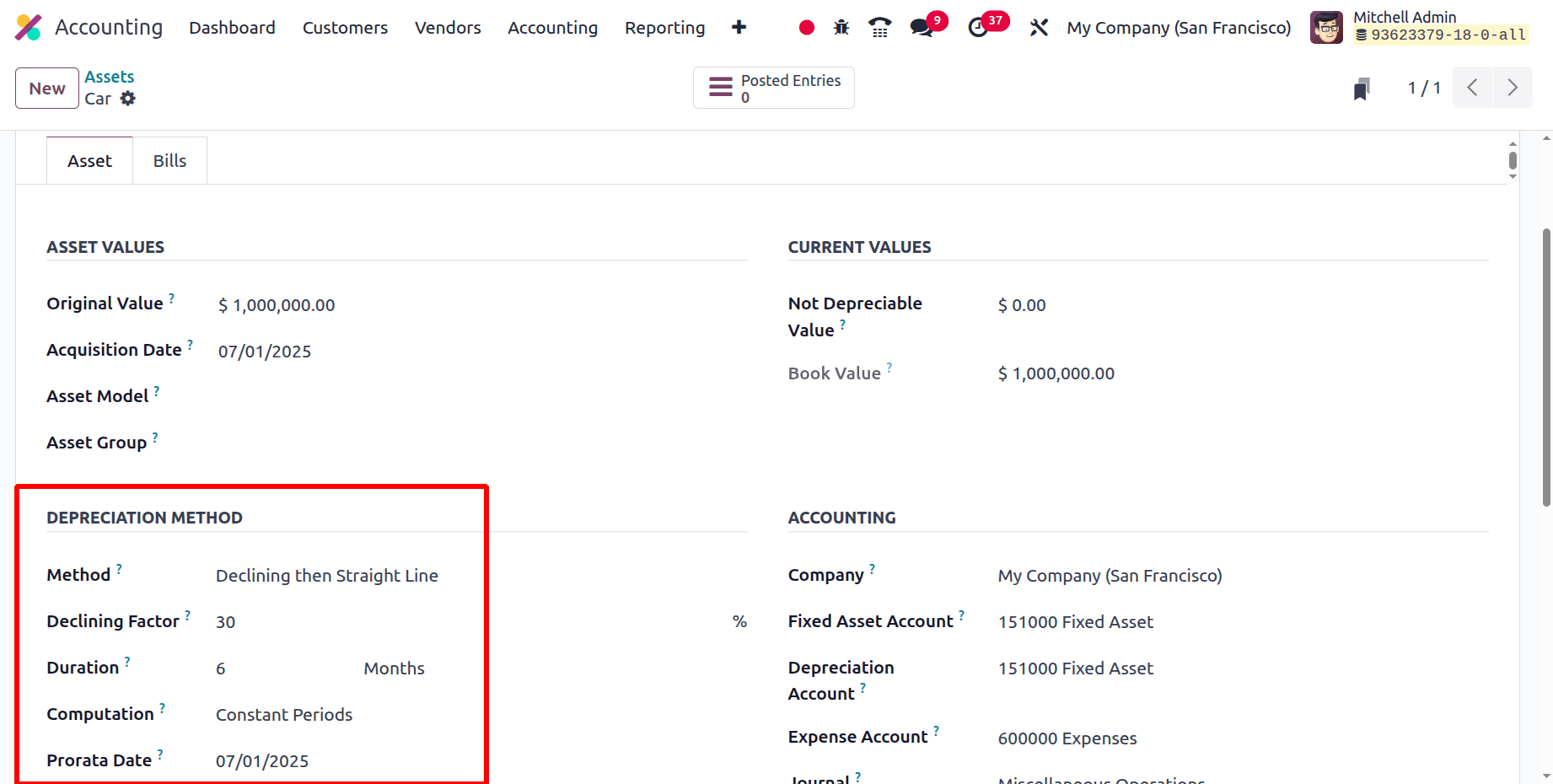

For declining with constant periods, we again place the date on July 1st.

As half a year has passed already and 30% book value is $ 300,000.00, only half of that amount will be depreciable this year. In the sixth year, the leftover sum is depreciated.

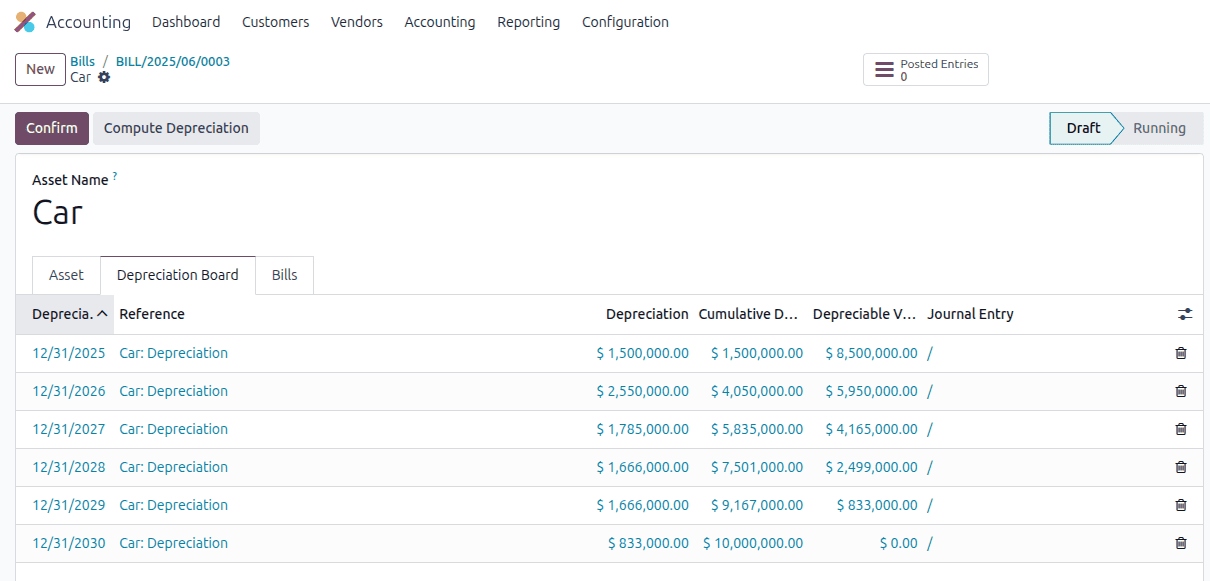

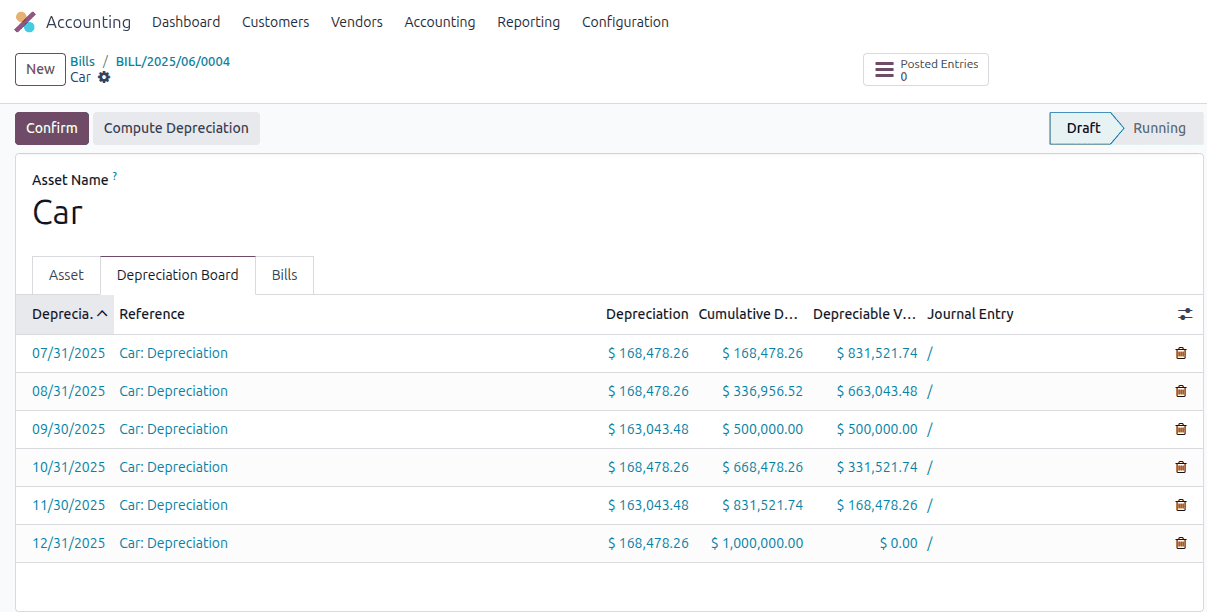

For declining with a basis of days per period, book value is split by the days in the period (184) and computed for each month.

Then click on the Compute button and check the Depreciation Board.

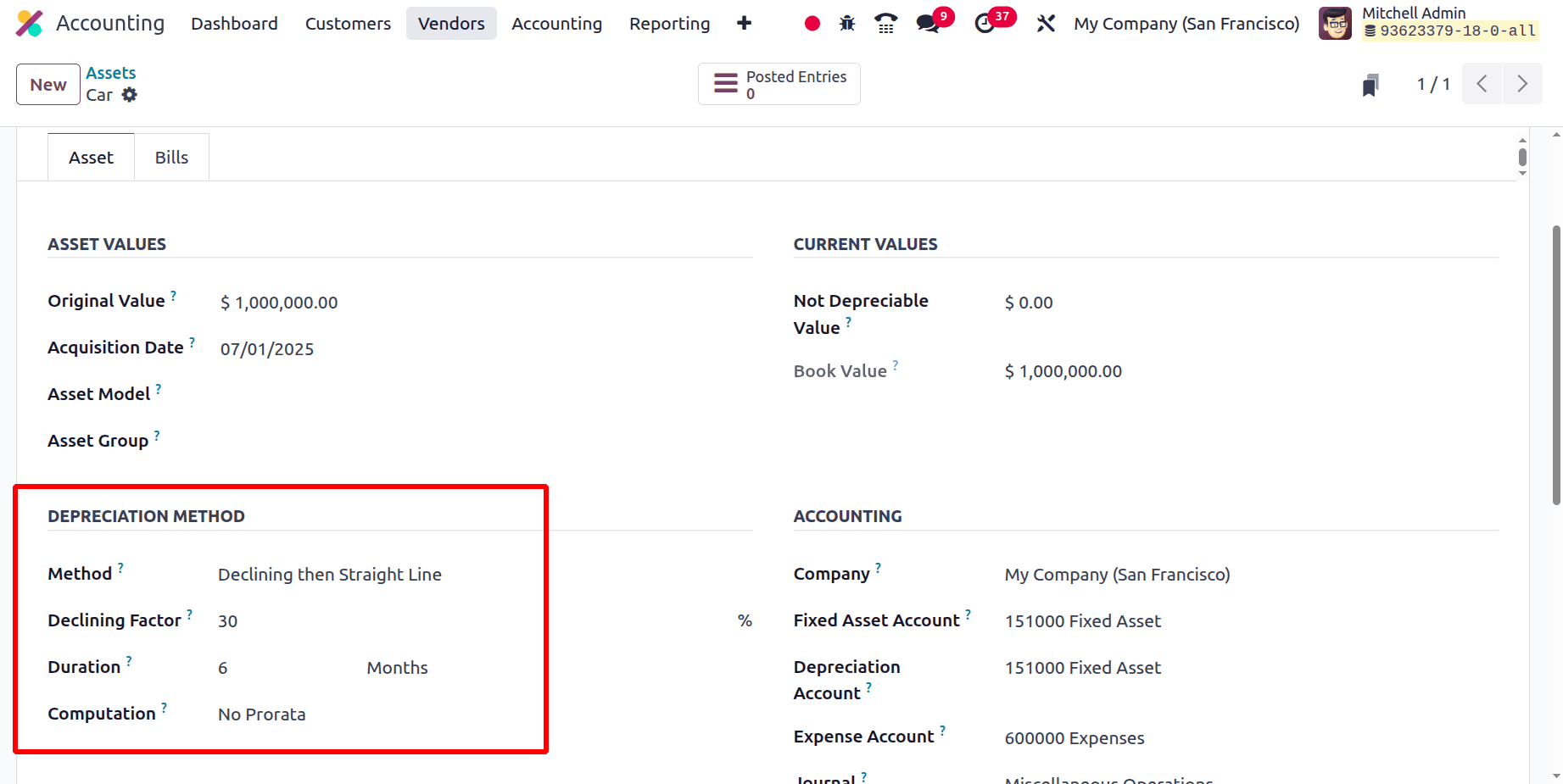

Declining the Straight line Method

In declining the straight line, the reducing factor is first cut from the residual value and then depreciates in the straight line method.

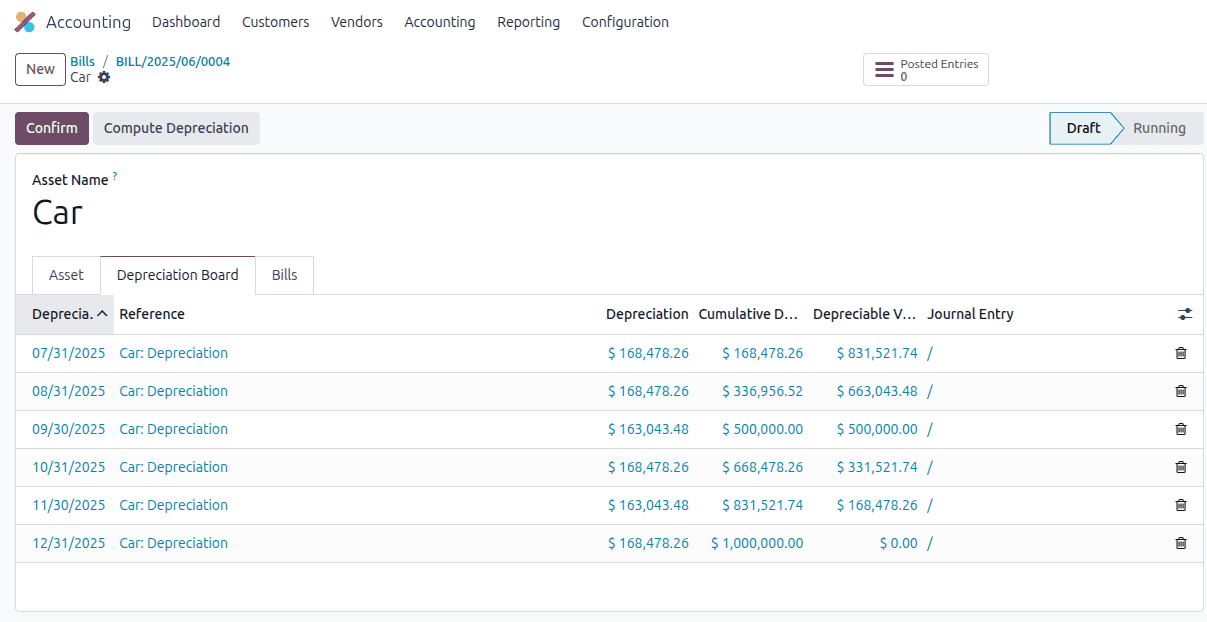

In No pro rata we can observe that for the initial 2 years, it depreciates to a 30 percent value and then a constant straight value.

Because we set the pro rata date, depreciation for the first year of constant periods is only for six months.

Additionally, 30% is depreciated by half. Then it switches to the straight line method.

The value is computed for each month by dividing the book value by the total number of days in each period.

To show the Depreciation Board, click on the Compute Depreciation button.

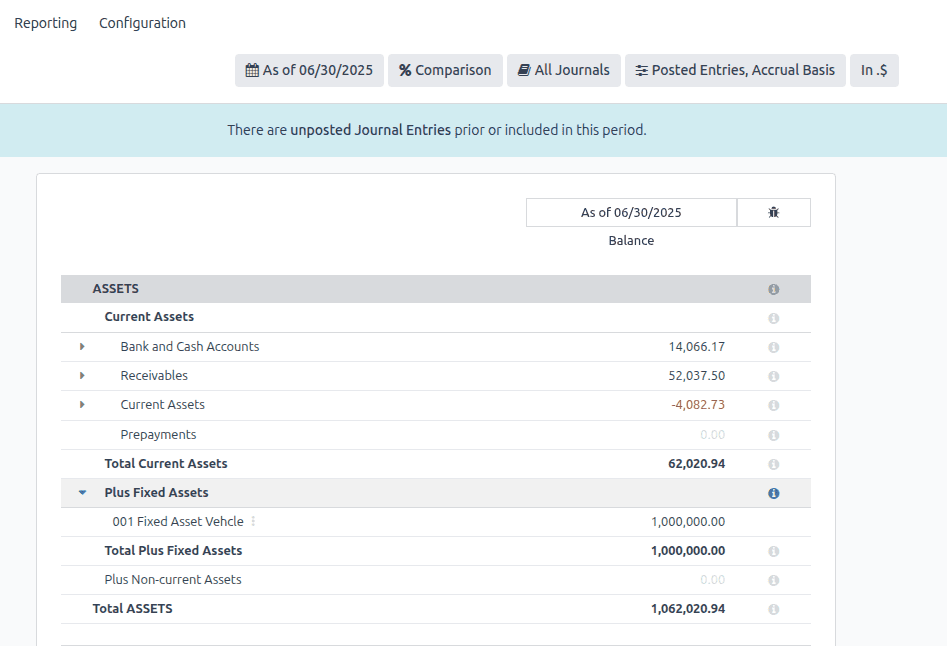

The Balance Sheet report displays the Fixed Asset Vehicle entry.

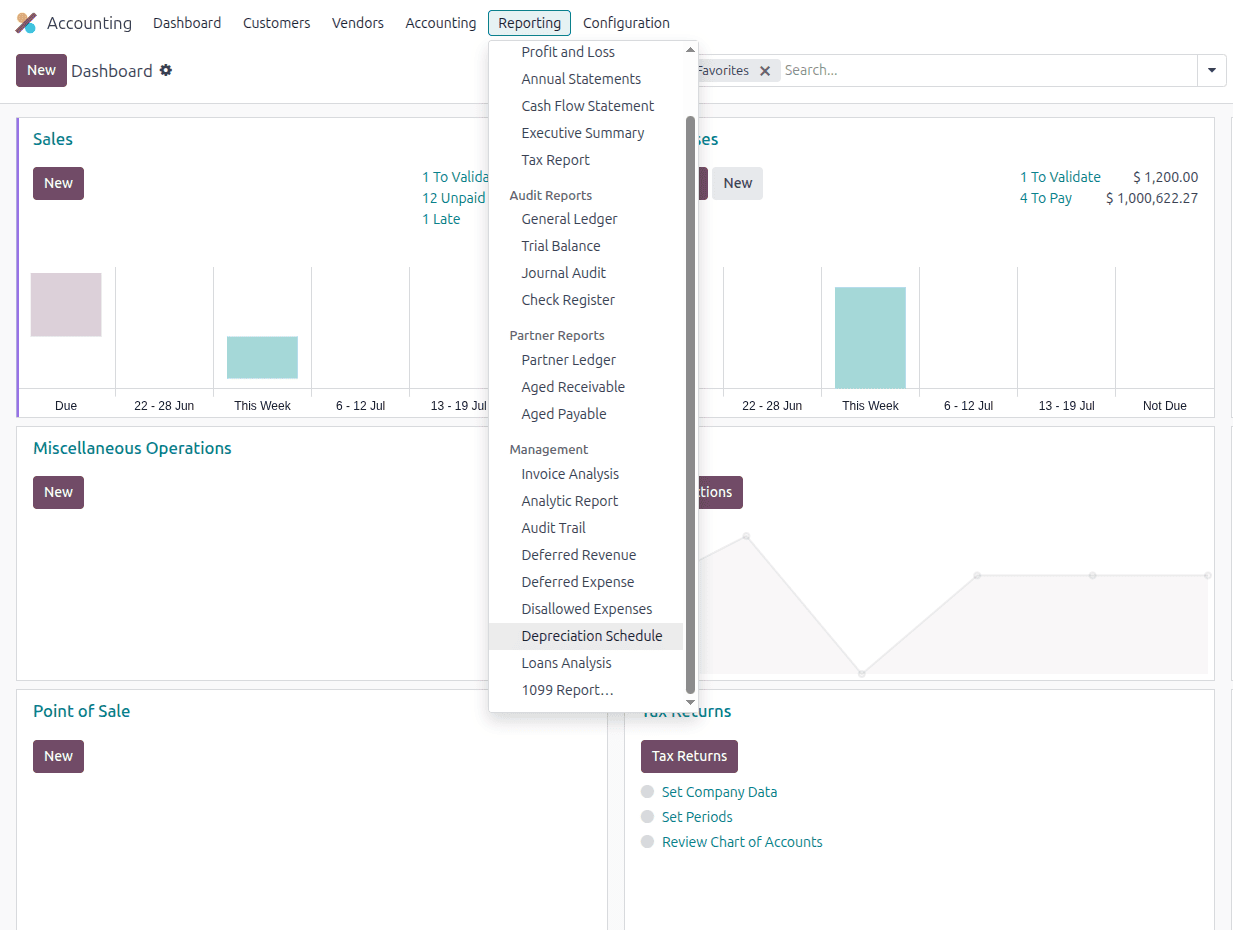

In the Profit and Loss report, we can observe the Asset Expense entry. The asset's depreciation schedule is visible under the Reporting menu.

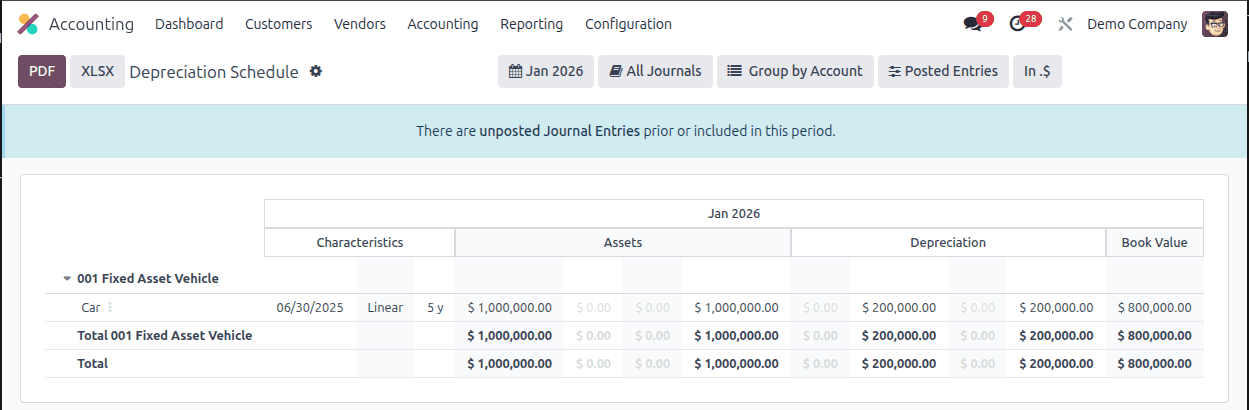

To view the specifics of depreciation, open the Depreciation Schedule.

Here we see the schedule that occurs in January of 2026. Under the Fixed Asset Vehicle account, we can see the product, the acquisition date, the computation method, the duration of the depreciation, the total book value ($ 1,000,000.00), the amount depreciated till January 2026 ($ 200,000.00), and the residual book value on January after depreciation($ 800,000.00).

The new automatic asset creation and validation feature in Odoo 18 Accounting improved the efficiency of the asset management process.

To read more about How to Manage Company Assets & Depreciation in Odoo 17 Accounting, refer to our blog How to Manage Company Assets & Depreciation in Odoo 17 Accounting.