An important tool for maintaining transparency and accountability in financial operations is an accounting audit trail. They enable auditors to follow and verify the accuracy of entries by providing them with a comprehensive, chronological record of all financial transactions. By spotting errors, fraud, or discrepancies this promotes financial integrity and regulatory compliance. Additionally, audit trails increase the accuracy of financial statements by providing a comprehensive record of all operations that can be reviewed and modified as necessary. Ultimately, accounting's use of audit trails ensures a strong foundation that encourages stakeholders' confidence and facilitates effective financial management.

One essential component of Odoo Accounting that guarantees accountability, transparency, and adherence to financial regulations is the Audit Trail. It keeps a running log of every operation, modification, and transaction made within the accounting system. For businesses who have to follow stringent auditing standards or regulatory regulations, this function is extremely crucial.

Odoo Accounting's Audit Trail function aids in preserving the traceability and transparency of all financial transactions. It supports financial integrity and adherence to

auditing requirements by making sure that any modifications made to accounting records are monitored. Monitoring all financial transactions and changes made inside the accounting module is the primary goal of the audit trail. It guarantees that any modifications to financial data may be linked to the accountable user by giving a clear history of who did what and when. This aids in error detection, fraud prevention, and internal and external audit support.

Monitoring Changes: Odoo keeps track of all modifications made to journal entries, invoices, and other financial documents when the audit trail is activated. This covers the time, what was altered, and who made the modification. Both external audits and internal assessments require this kind of tracking.

Legal and Regulatory Compliance: In order for firms to abide by financial regulations and tax laws, audit trails are essential. This feature facilitates appropriate documentation and legal defense during audits in areas where auditability is required, such as the US or the EU.

Security and Accountability: The audit trail enhances accountability within the accounting department by putting users in charge of particular modifications. Additionally, it lowers the possibility of fraud or illegal changes to financial documents.

Integration with User Access Controls: Odoo makes sure that only authorized users are able to carry out sensitive operations by combining the audit trail with access control settings. Faster resolutions are possible since any anomalies or questionable activity can be linked to the accountable party.

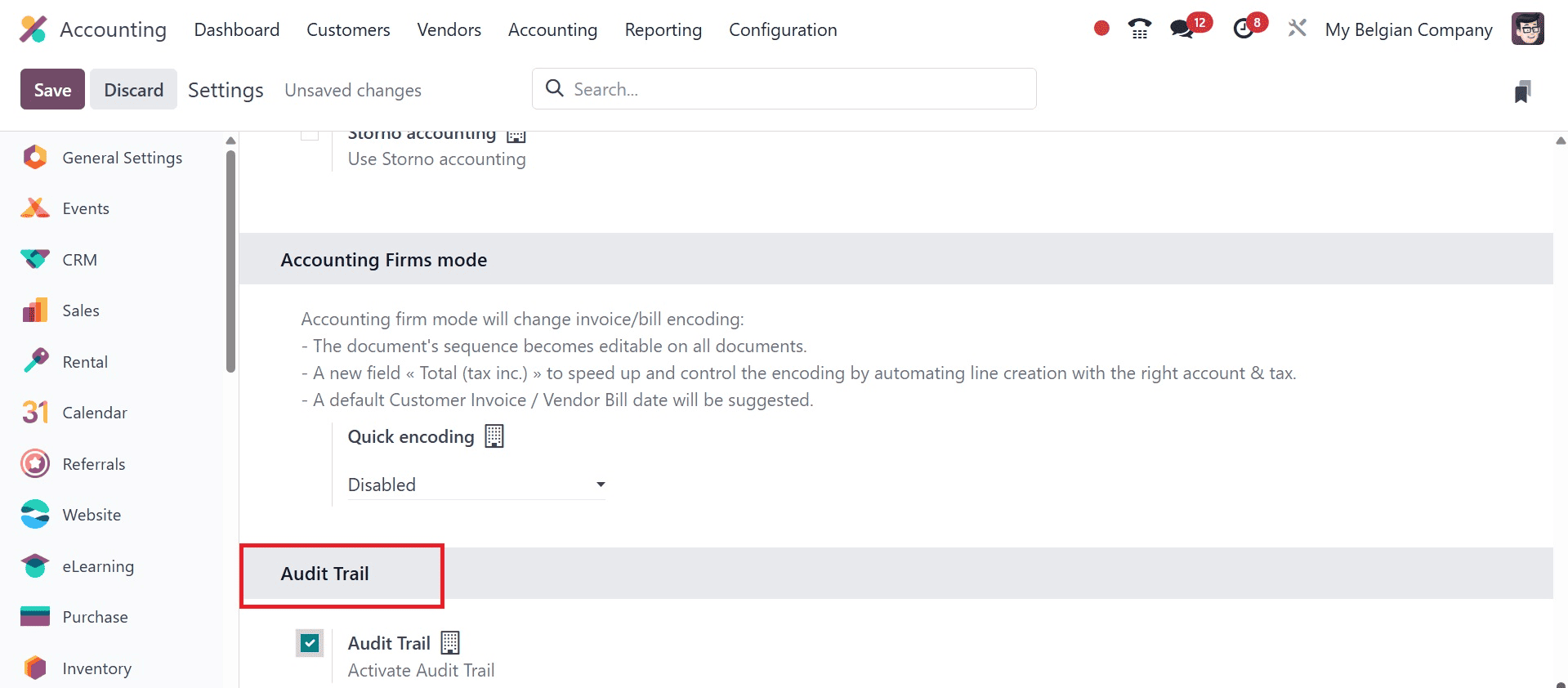

As a result, the Audit Trail option appears in the accounting module's Settings in Odoo 18. Try the option to activate the audit trail.

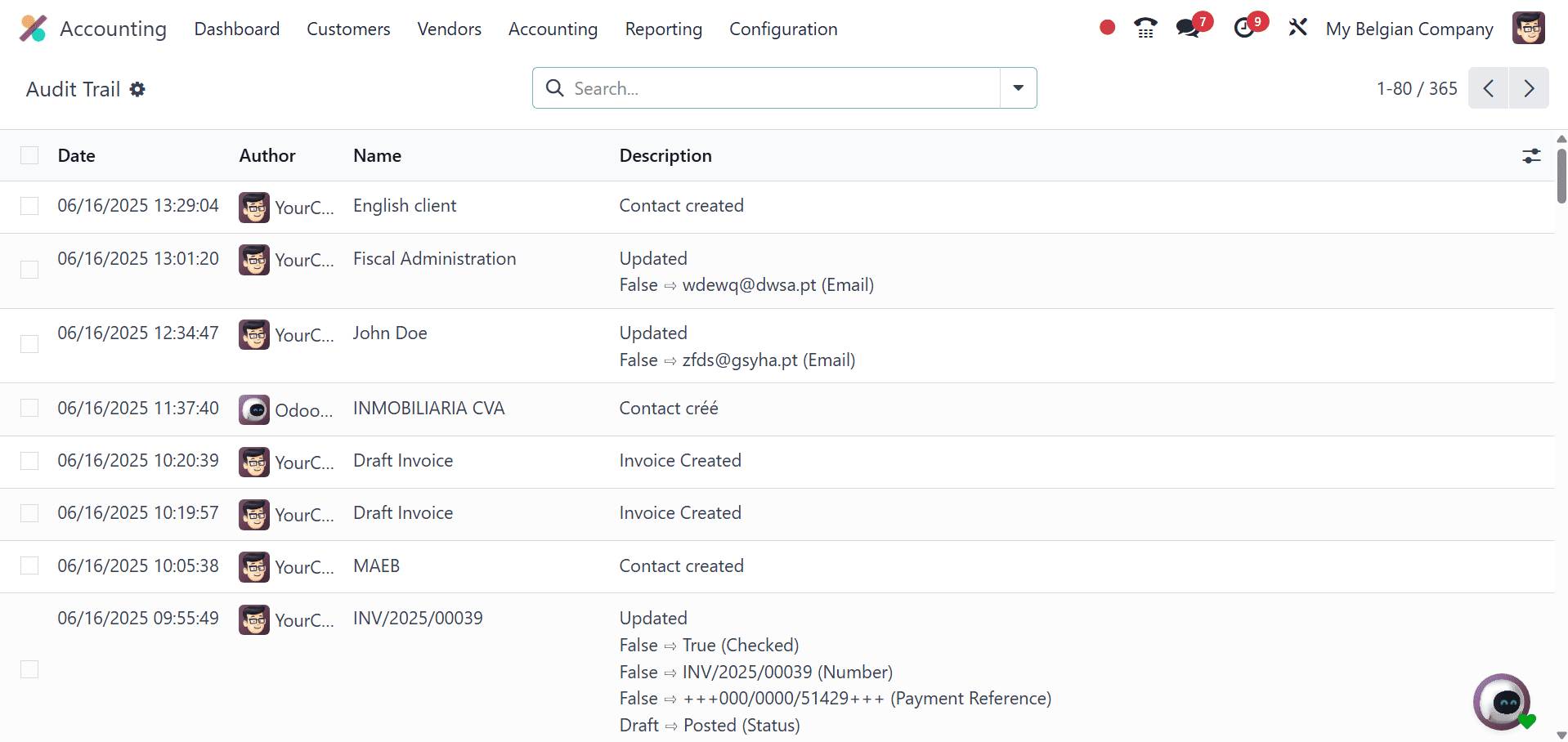

This audit trail will document any changes made by users to an invoice. so that each invoice's changes and amendments are simple for the auditor to understand. By choosing the Go to Audit Trail option, you can access this.

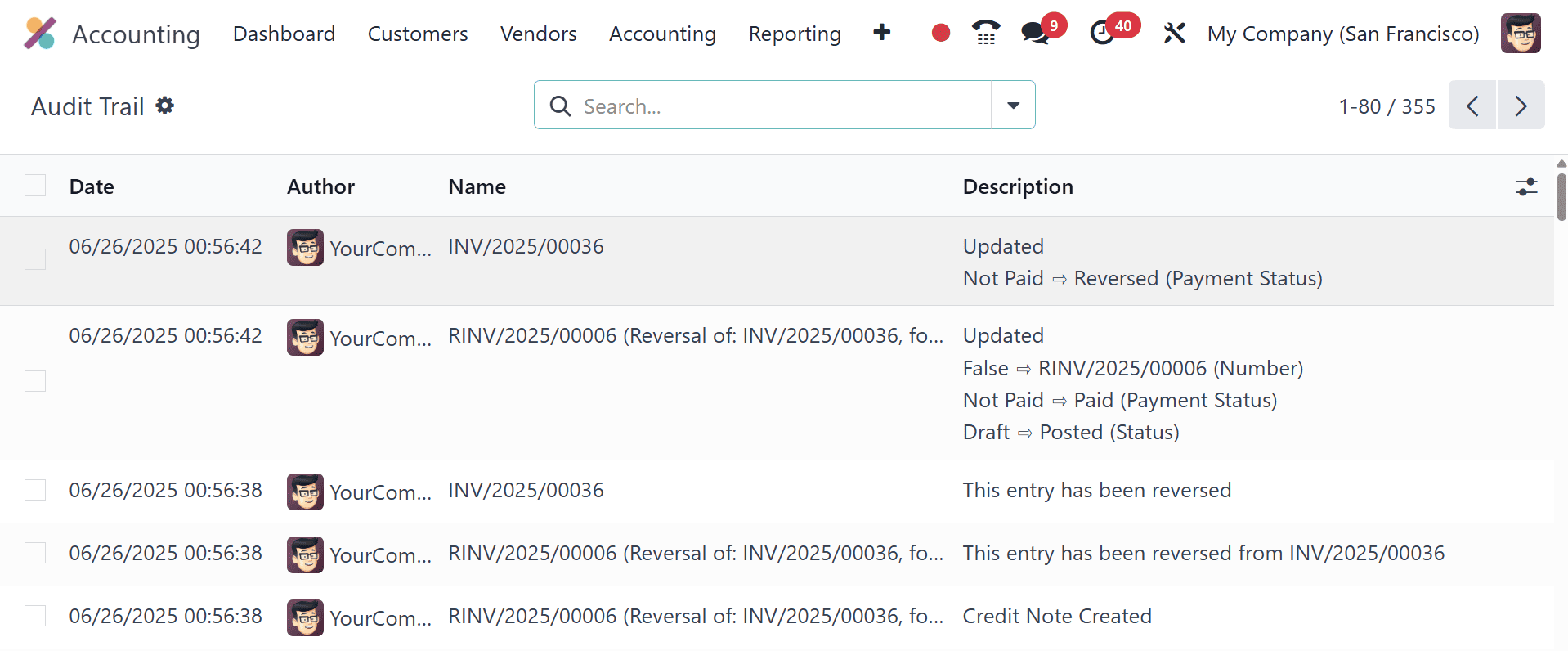

The date, author, journal entry, and description are available here, as may be seen in the above image.

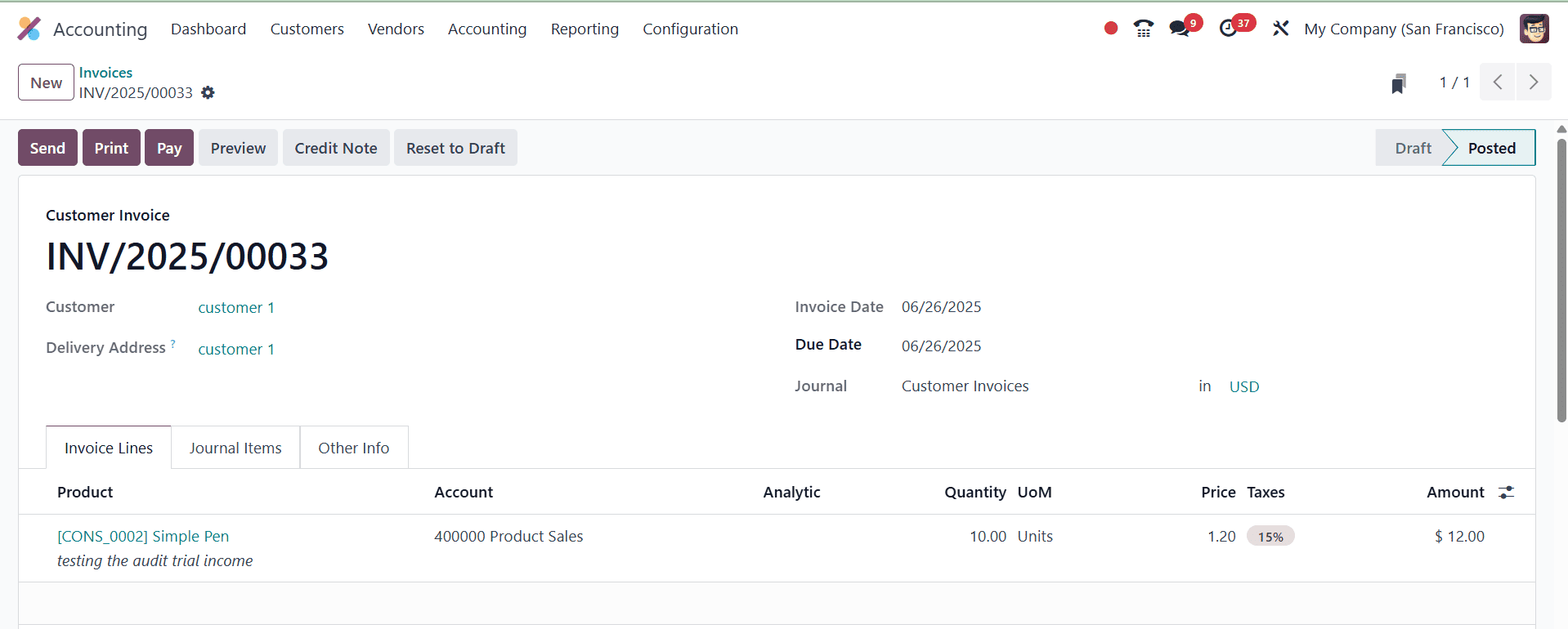

Now, let us look at an example for an audit trial report generation. For that, go for the Invoice option, and create a new invoice, as in the image below.

Now, on opening the audit trial option, you can see the record created here, and what was the last updated details as well. Then, let us reverse the payment by returning some products for some reason.

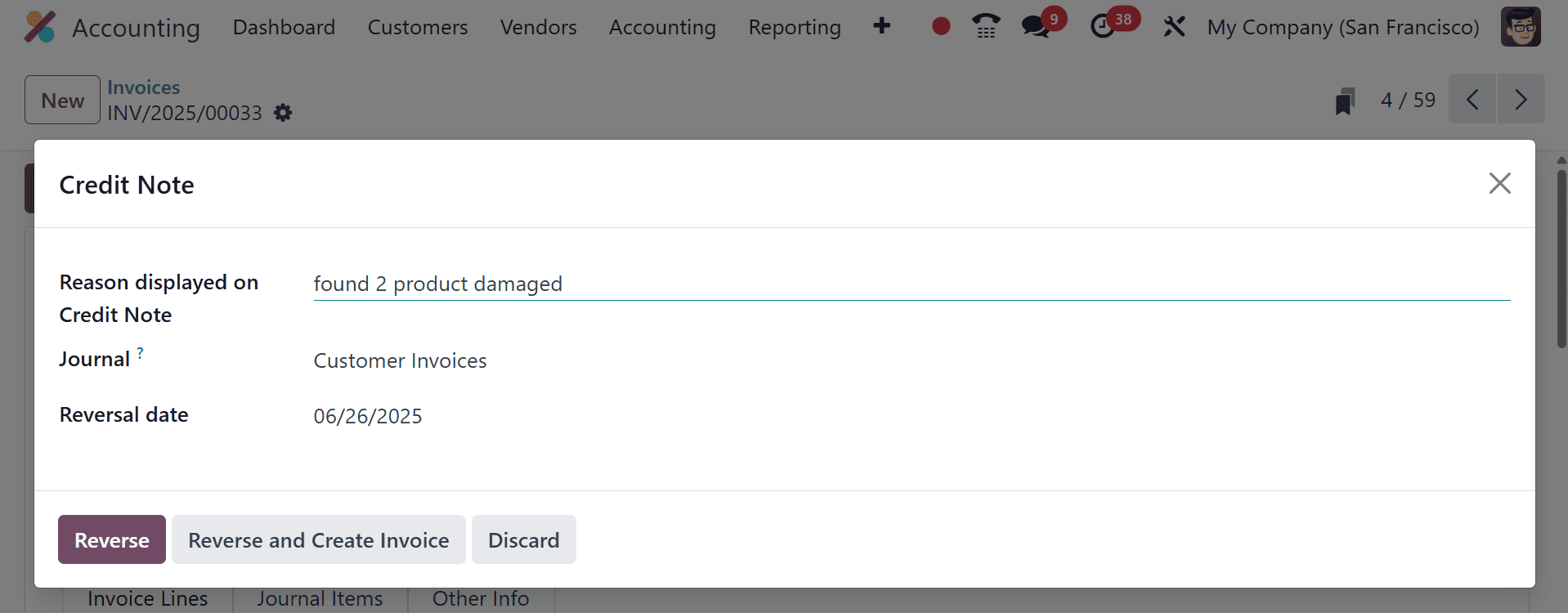

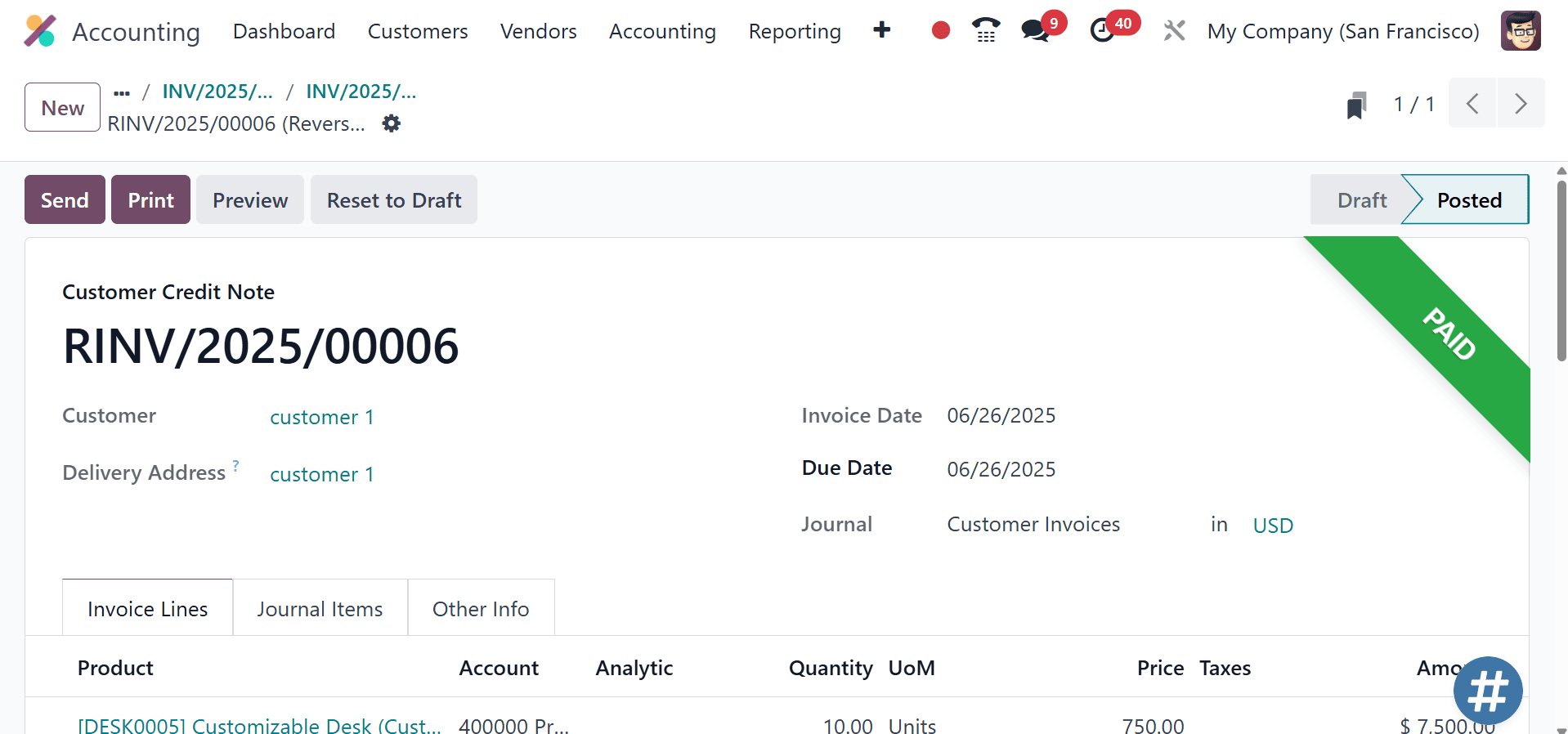

Click on the Reverse icon, and see the change in the invoice.

Now, you can see the invoice got reversed. Then, move to the audit trial option again, and see the updates found there.

Starting with specialized tools and solution providers that will open the door for the company's financial management efficiency, the Odoo Accounting module will function as the solution provider for an organization's business operations management tasks. All of the configuration options, including Accounting configurations, Payment Options, Management Options, Analytical Accounting, Configuring Invoicing, and Configuring Bank Payments, offer insight into how the Odoo configuration tools can be set up to best suit your needs.

In general, the need for functional reference materials for the Odoo Accounting module was filled by the Odoo Accounting module, which filled a gap in the Odoo resource. By providing complete transparency of accounting operations, Odoo Accounting's audit trail enhances financial control. It facilitates the auditing process, increases stakeholder trust, and aids companies in adhering to financial and regulatory requirements. Because of this, it is an essential part of every business using Odoo to manage its finances.

To read more about How the Opening Balance is Added in Odoo 18 Accounting, refer to our blog How the Opening Balance is Added in Odoo 18 Accounting.