Any business's accounting process must include managing bank accounts, and Odoo 18 keeps making this process better with a more user-friendly interface and more adaptable automation features. Whether you prefer manual statement imports or wish to connect your bank for live transaction syncing, Odoo makes it easy to set up your banking environment effectively. In this blog, we’ll walk you through creating a bank in Odoo 18, configuring the bank journal, linking the account, setting up bank feeds, and importing bank statements—while explaining every key field along the way.

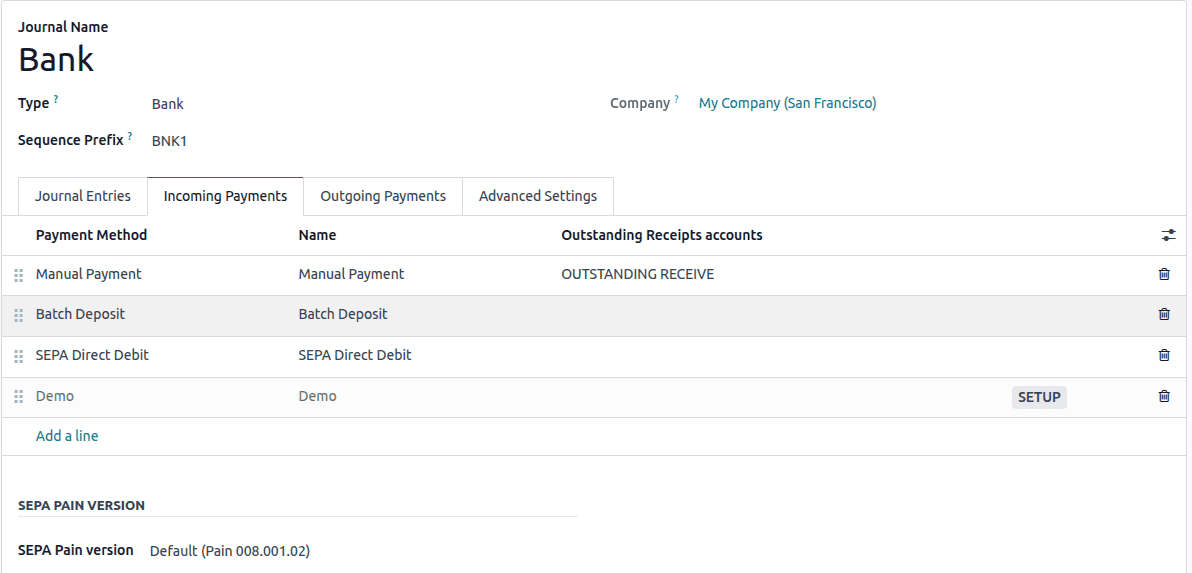

Setting Up the Bank Journal

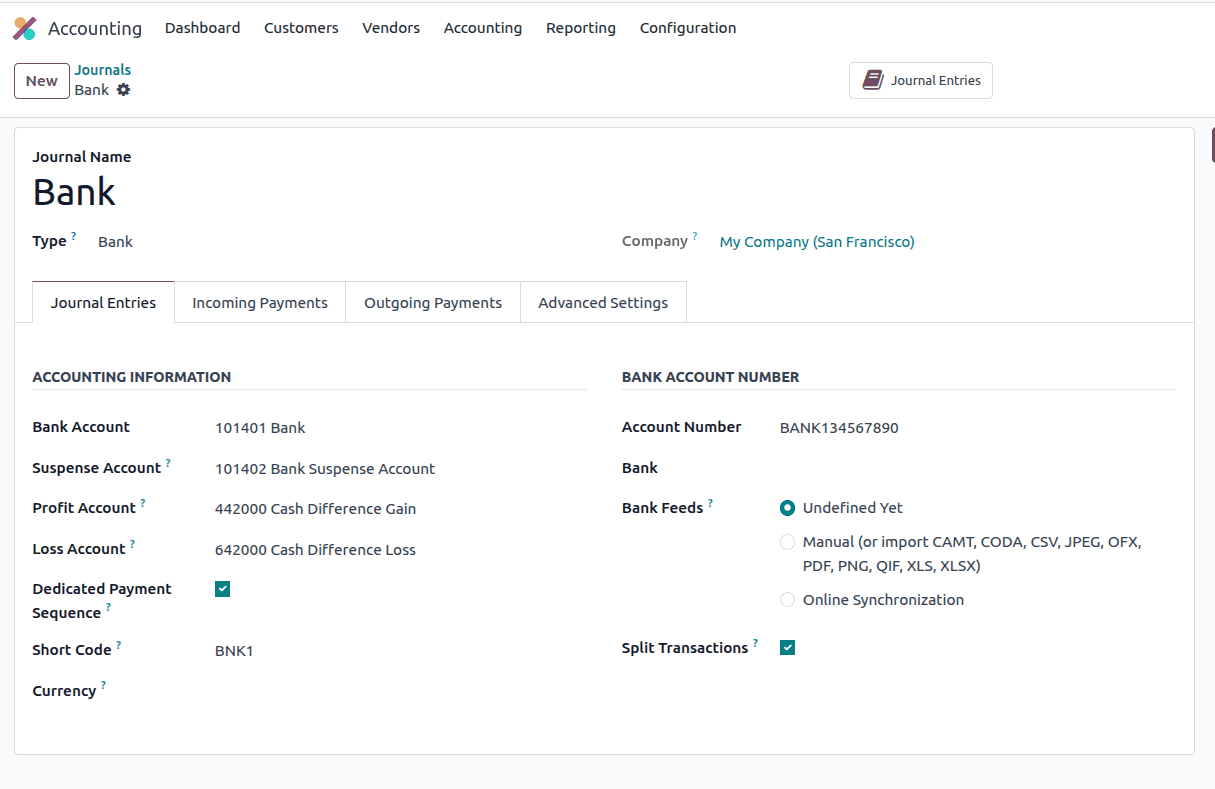

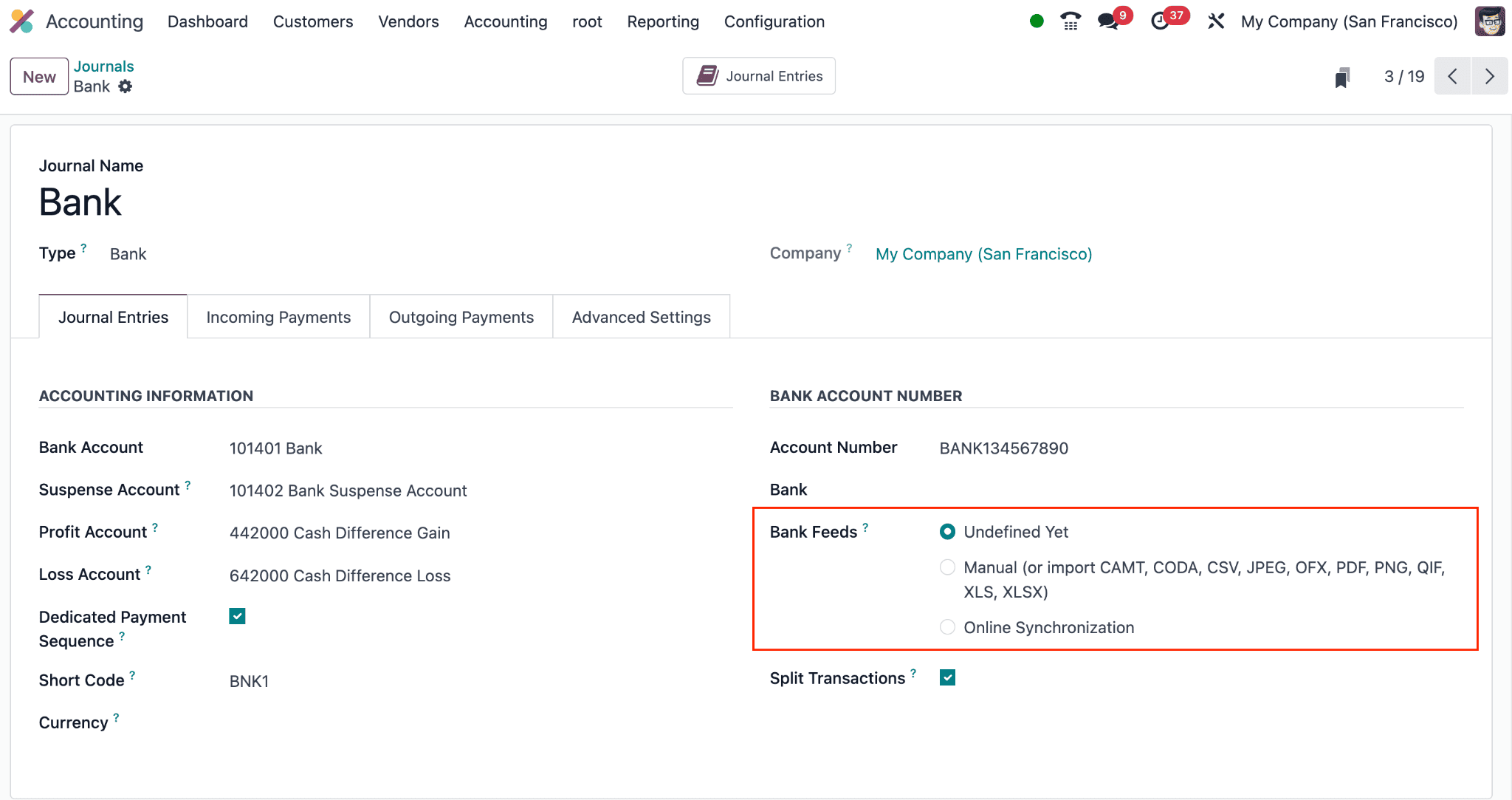

Now, configure a Bank Journal. Journals in Odoo are used to record various financial transactions, and a bank journal is essential for processing payments, receipts, and reconciliations. Go to Accounting ? Configuration ? Journals and click New. Type in a meaningful journal name, like "Company Checking Account" or "Main USD Bank." For easy access, enter a Short Code (such as "BNK1") and set the Type to "Bank." See the screenshot below.

Suspense account

Bank statement transactions are posted to the suspense account until they are reconciled. At any time, the suspense account balance in the general ledger reflects the total of unreconciled transactions.

Profit and loss accounts

If the final cash register balance doesn’t match the system’s calculated amount, any profit is posted to the profit account, and any loss is posted to the loss account.

You may optionally designate a currency if this journal is to be used for international transactions. The diary is prepared to be connected to your bank account when it has been saved.

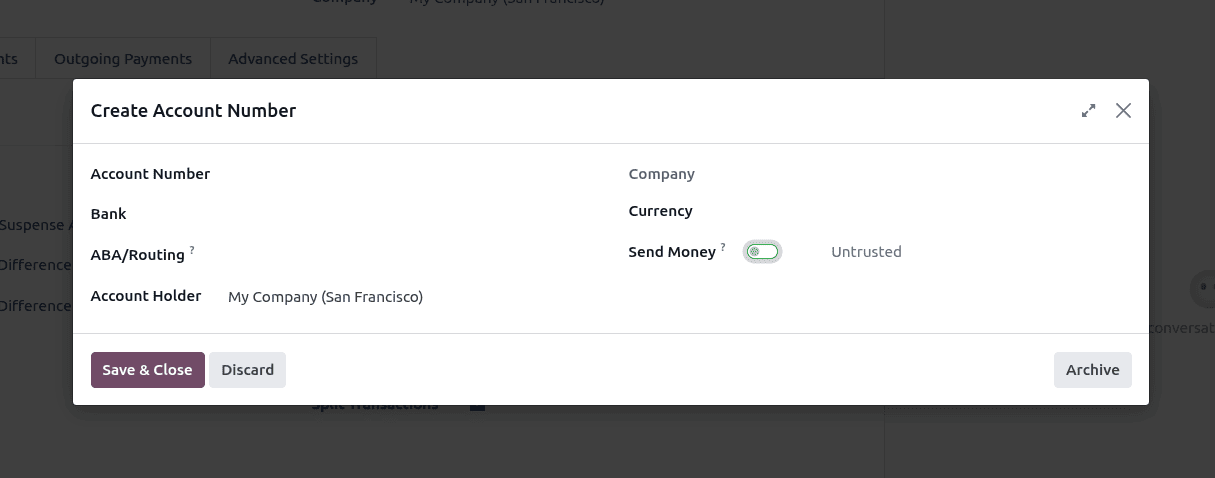

Under the Bank Account Number section, there is a field to add the Account Number where account number can be added. From that point on, when we select Search More from the dropdown menu, a new wizard is launched where we can generate an account number.

- Enter the Account Holder Name (usually your company’s name).

- Enter your bank's account number, often known as the IBAN.

- Choose the Bank that you previously established.

- To link the account to the Journal, select it.

- If the currency differs from your company’s base currency, make sure to set it accordingly.

- Select the Company if operating in a multi-company environment.

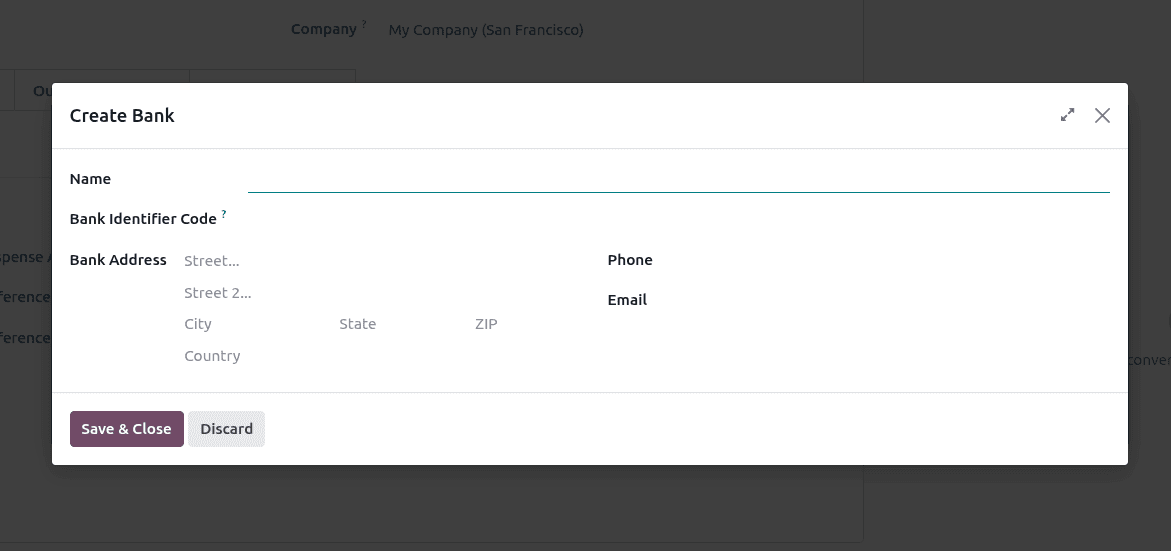

After that, enter the name of the bank in the Bank field. Additionally, when you select the "Search more" drop-down menu, a "New" button will show up. Clicking this button will launch a wizard that allows you to form a bank.

Enter the Bank Name, such as “Bank of America” or “HSBC.” Fill in the Bank Identifier Code (BIC/SWIFT) for international payments, and provide the Address to specify the bank’s physical location. This helps maintain detailed records, especially when managing multiple banks or branches.

After saving, the bank account is now active and can be used for payment operations and reconciliation.

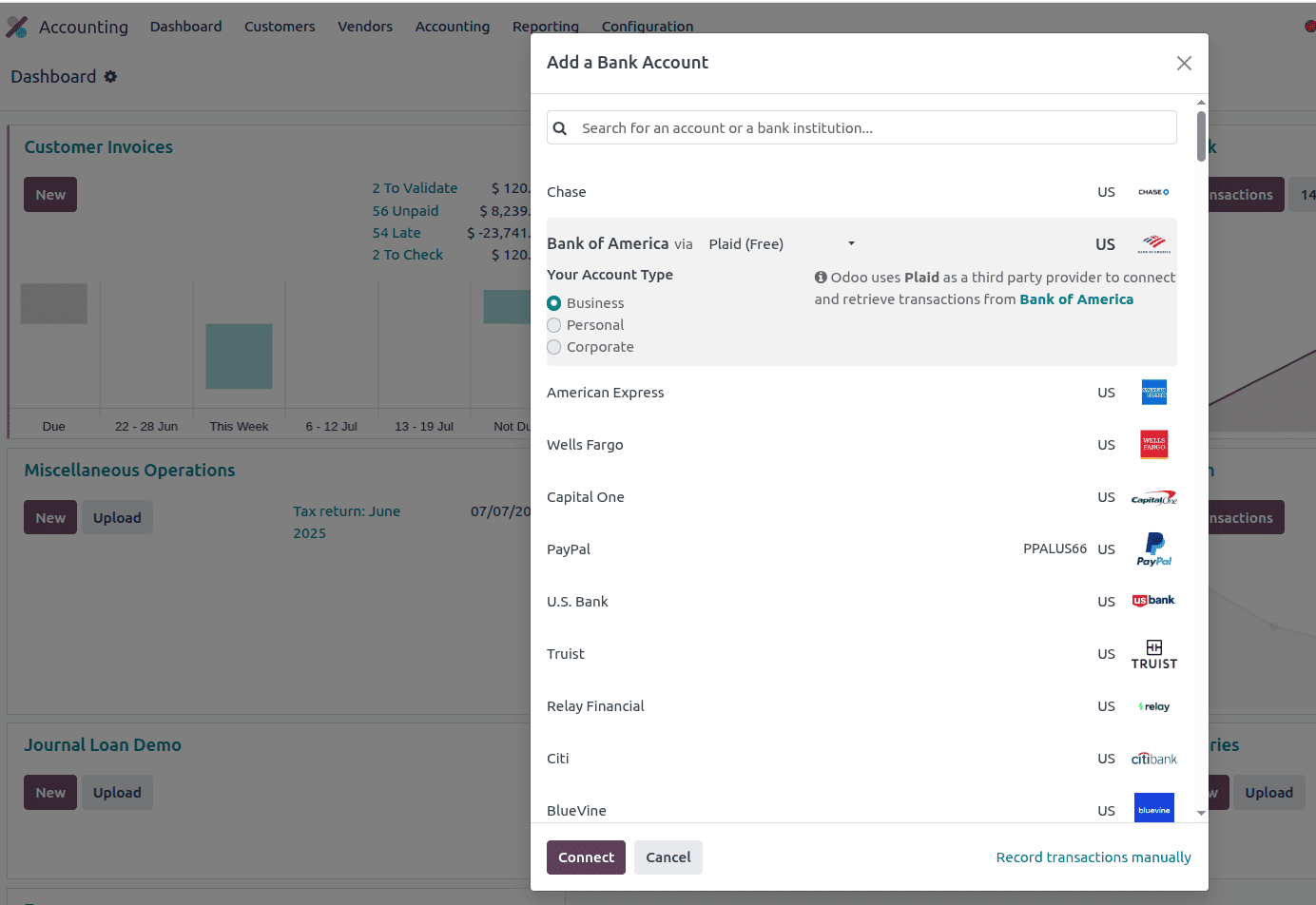

Connecting Live Bank Feeds

Depending on your location, Odoo 18 enables direct bank connections using feeds from other suppliers such as Salt Edge, Plaid, or Yodlee. Click Connect after opening the newly formed bank account. After choosing a provider, log in to your online banking account to complete secure authentication. Select a Start Date for transaction imports and decide which bank accounts to use.

After the connection is complete, transactions will sync automatically and appear in the accounting dashboard. Note: This feature is only available in the Enterprise edition and might require a subscription with the provider.

Importing Bank Feeds and Statements in Odoo 18 Accounting

Odoo 18 Accounting offers an advanced and intuitive system for importing bank feeds and statements into your database. With improved synchronisation features and support for numerous file types, Odoo 18 guarantees smooth financial administration. Managing several bank accounts and related transactions in a single database has never been easier.

One of the core aspects of financial reconciliation is ensuring that payments recorded in your system match your actual bank transactions. Bank statements must be imported into Odoo for this to happen, and Odoo 18 offers several bank feed options. The bank feeds option defines how bank statements are registered.

Importing your bank statements into Odoo is crucial for keeping precise and up-to-date financial information. This makes audits and reporting easier, in addition to ensuring consistency between your accounting ledger and actual bank activity. Odoo's Bank Synchronisation tool can automate this process, reducing the likelihood of manual effort and human error.

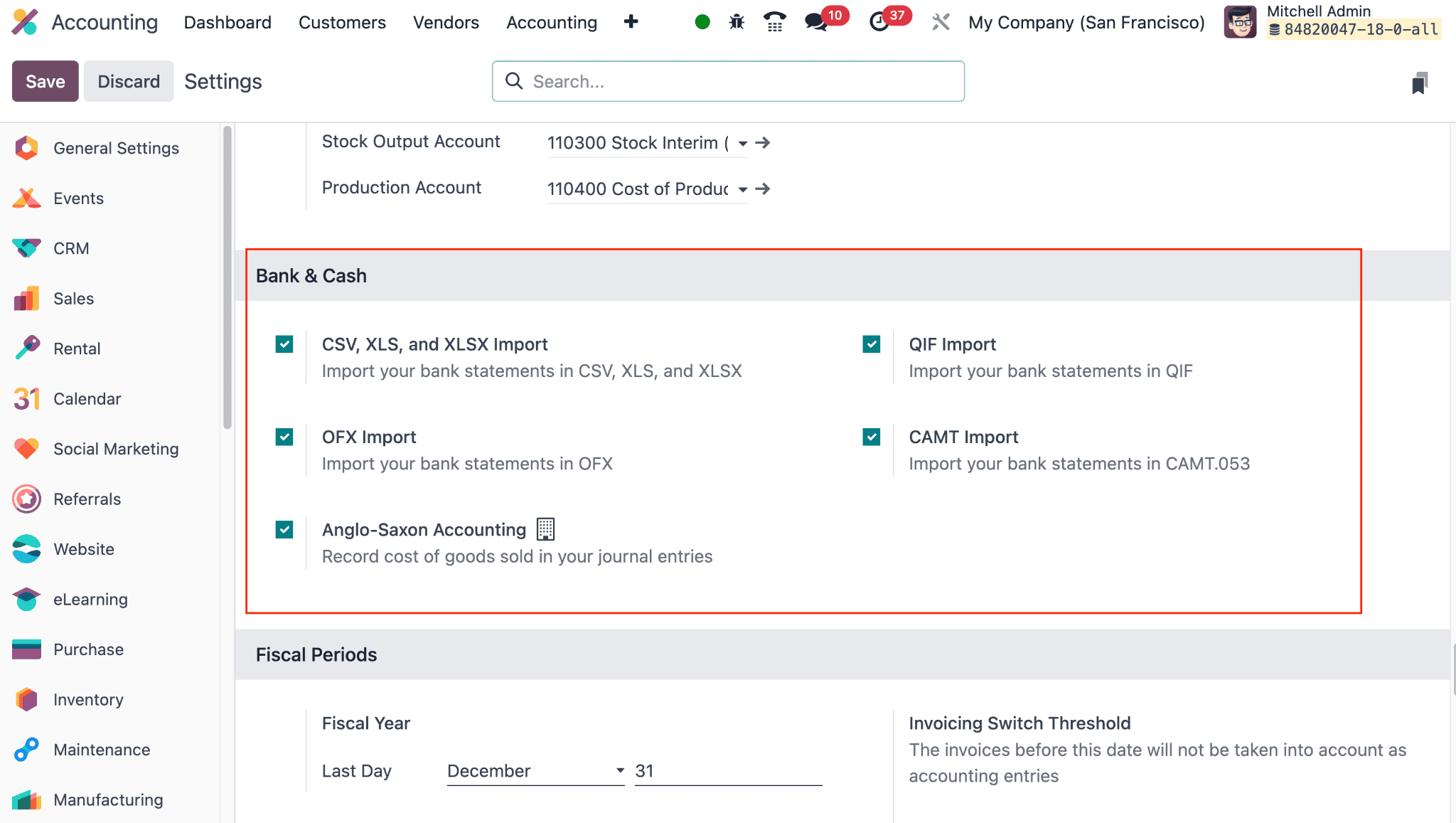

If synchronisation is not possible or desired, you can still manually enter or upload statements in Odoo 18 using supported formats such as OFX, QIF, CSV, and more.

Methods for Importing Bank Statements in Odoo 18

There are two main ways to import and manage bank statements in Odoo 18:

1. Importing automatically through bank synchronisation

Through approved providers or secure APIs, you can establish a direct connection between Odoo and your bank.

Once connected, Odoo will automatically fetch your bank statements at regular intervals and create matching journal entries in the Accounting > Bank Journal.

To enable automatic synchronization:

- Navigate to the Accounting app.

- To connect to an account, open its Bank Journal.

- For online synchronisation, click.

- Just follow the directions to link your bank account using the manual API credentials or the supported provider.

- Following the configuration, bank statements will be automatically retrieved and compared to the transactions you have already made.

- This method saves time and ensures greater accuracy because it requires less manual data entry.

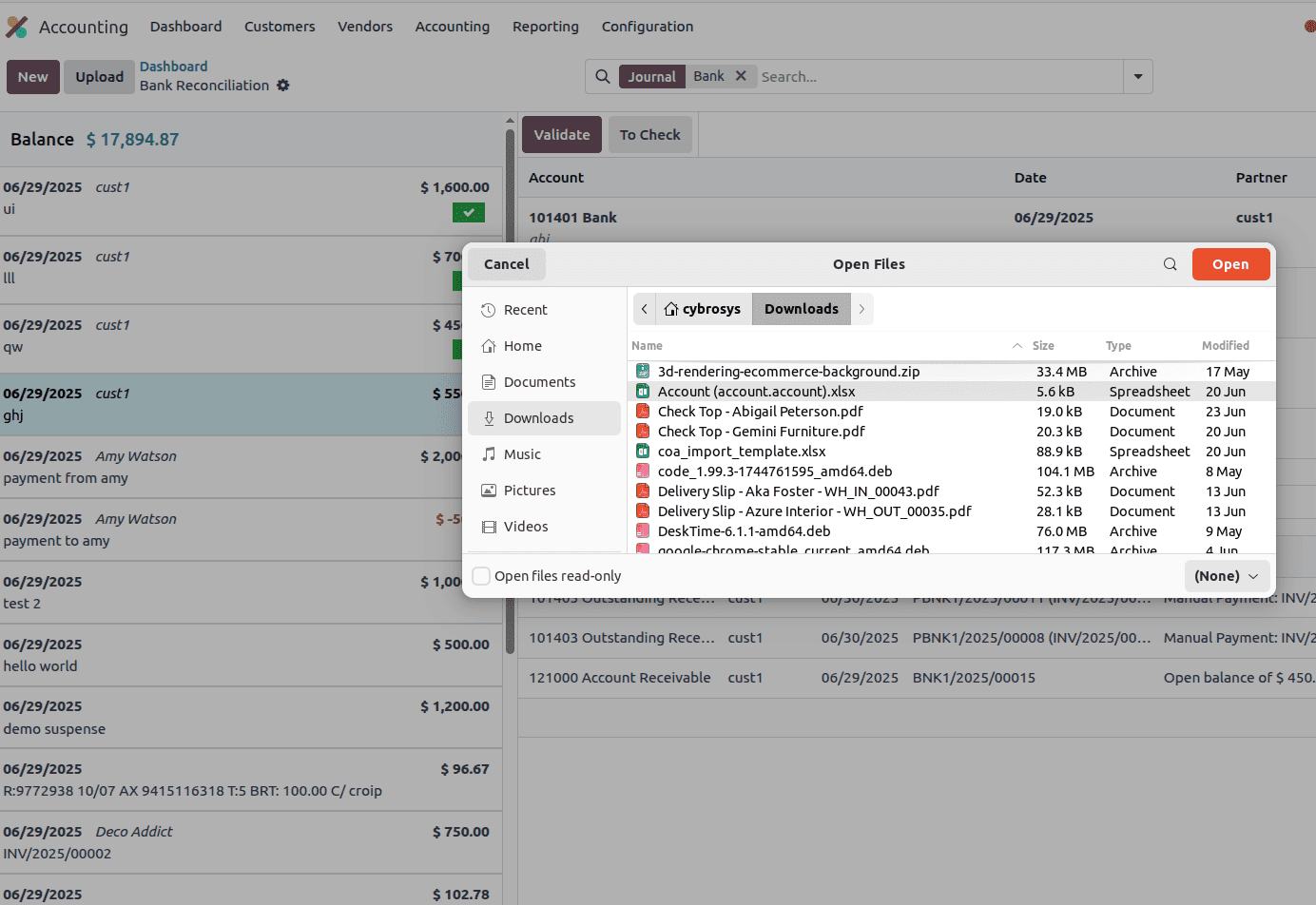

2. Bank Statements Are Manually Imported

- You can manually import bank statements if you prefer to be in charge of the procedure or if your bank forbids internet synchronization.

- To do this, choose the Bank Journal from the Accounting menu. Press "Upload" to begin.

- Choose your file (formats like CSV, OFX, QIF, CAMT.053 are supported).

- Map the fields where they belong, and once you're ready, go ahead and confirm the import.

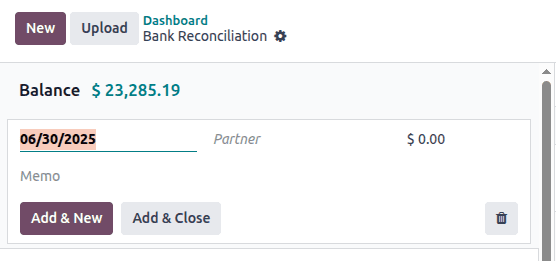

You can also create bank statement lines manually by clicking Create and entering the transaction details directly into the journal.

Importing Bank Statements Manually

For companies not using automated feeds, Odoo supports manual statement imports. Click Import in the bank journal, then upload your file. OFX, QIF, CAMT.053, CAMT.054, CODA, and CSV are among the supported formats.

In Excel or CSV files, map the columns (e.g., Date, Label, Amount, Partner). Following that, the transactions will show up as statement lines and be prepared for reconciliation.

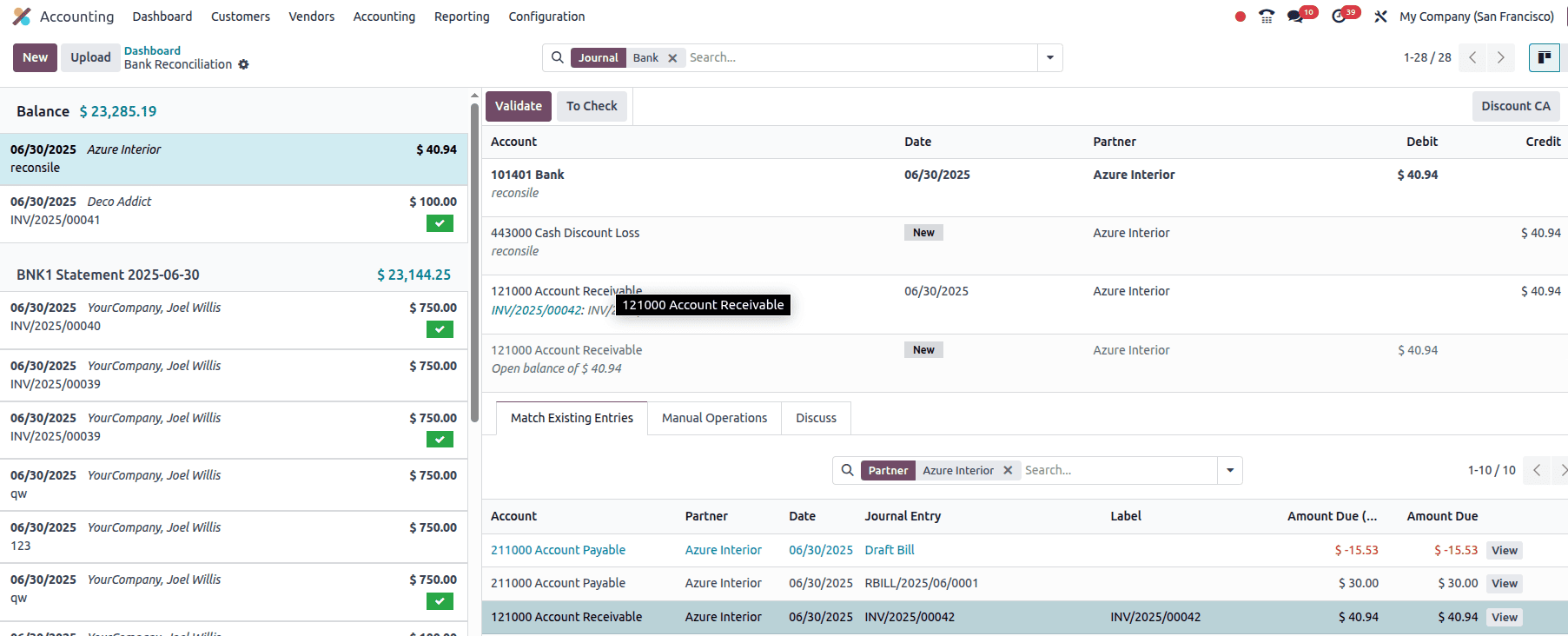

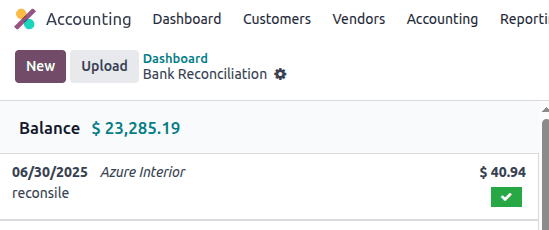

Reconciling Transactions

Whether you're utilising manual imports or live feeds, navigate to the Reconciliation screen in the Accounting module. Odoo makes an effort to link every transaction with previously issued bills, invoices, or payments. To begin, click the 'New' button to create a new bank statement.

If a match is found, it is automatically recommended; if not, either assign the proper counterpart or write a remark in your diary.

And then the entry will be reconciled.

How Reconciliation Works

Odoo automatically attempts to match each bank transaction with an existing record, such as:

- Customer Invoices (Payments Received)

- Vendor Bills (Payments Made)

- Manual Journal Entries

- Outstanding Payments or Receipts

When a match is found, Odoo will:

- Suggest the matching document.

- Highlight any difference in amount or date.

- Before posting, let you verify or modify the transaction.

If a Match Is Found

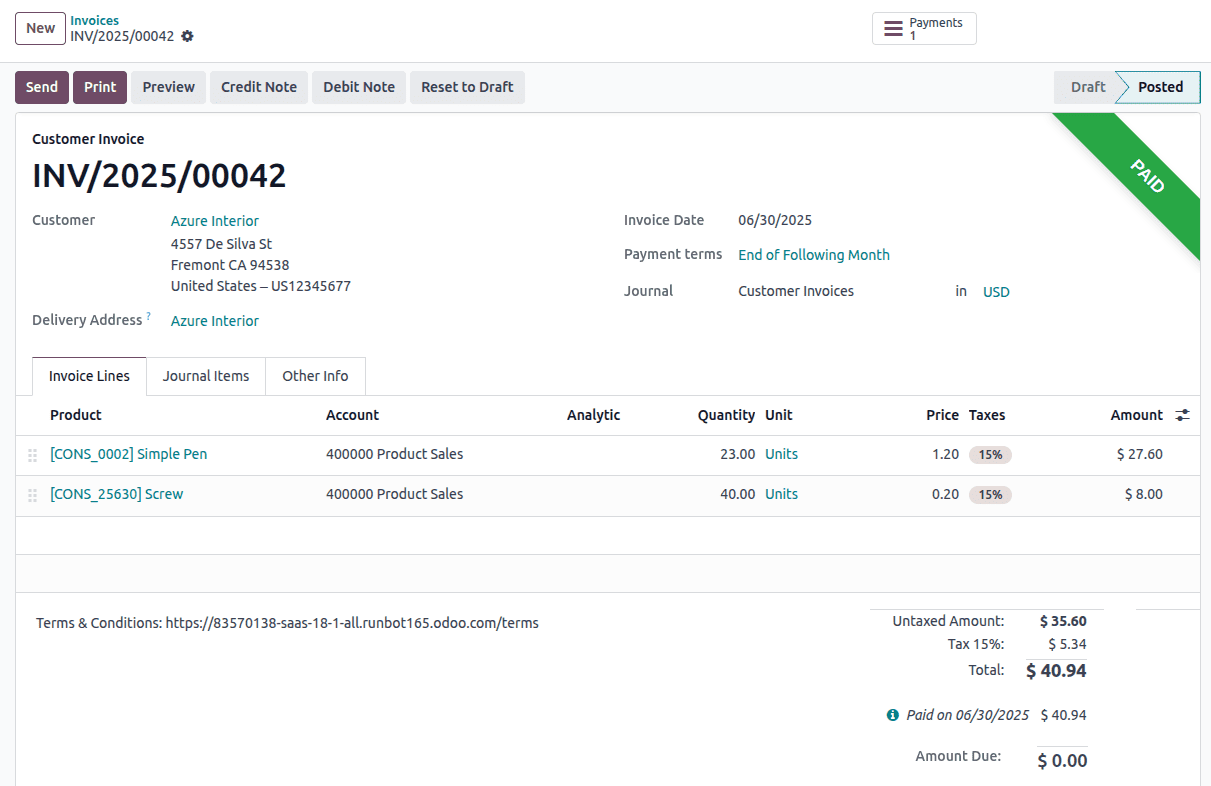

If Odoo detects a matching transaction (e.g., a customer has paid an invoice):

- The matching invoice or payment is displayed.

- To verify and publish the reconciliation, just click Validate.

- Once an entry is marked as reconciled, it is automatically removed from the list of pending items.

1. If There Is No Match

If Odoo is unable to locate a match, you have several choices, such as assigning a Counterpart Account or Assign a suitable expense/income account to document a bank charge, interest income, or refund.

2. Make a Fresh Journal Entry Instantaneously

Use the "Create" option to enter a missing transaction, such as:

- Bank fees

- Loan payments

- Miscellaneous income

3. Match with Multiple Entries

You can manually choose numerous lines to reconcile together if a single payment covers several invoices (or vice versa).

4. Partial Reconciliation

Odoo permits partial reconciliation if only a portion of the sum matches, leaving the remaining portion unresolved.

You can also create Outstanding Payments and Outstanding Receipts accounts in the journal settings to address timing differences between internal postings and bank transactions.

Odoo 18 provides a comprehensive and user-friendly interface for managing bank accounts. The solution guarantees accuracy and efficiency in everything from importing statements and connecting real-time feeds to registering banks and setting up journals. Maintaining accurate financial records and streamlining your business's accounting processes will be made easier if you comprehend each phase and field.

To read more about Overview Of Creating a Bank and Establishing Connection in Odoo 18, refer to our blog Overview Of Creating a Bank and Establishing Connection in Odoo 18